Feb

15

A Nice Story, by Victor Niederhoffer

February 15, 2007 | Leave a Comment

There is a nice story in Newsweek , 2/19, page E4, that describes an entrepreneur who started a business selling unicycles by web, and then guitars, his two life passions, with 700 dollars. Now he has franchises in several countries and unicycles are making a profit for him and getting people some great exercise. This is a typical story of the entrepreneurial drive that's behind the some 50% of all people that, according to old data from Wilenski, have, are, or will start a business. It's the main reason, that returns of 10% a year, the drift will continue, along with science and trade.

Feb

14

For Love Of Money: Casanova And The Speculators, by Victor Niederhoffer and Laurel Kenner

February 14, 2007 | 1 Comment

Valentine's Day, a chance encounter on a busy street — and the start of something big. Plus: Vic's V-Day market pattern.

Not only did he never hesitate, but he never imagined that he could hesitate. — Albert de Musset, reviewing Casanova's memoirs.

I first met him around Valentine's Day 1999. He was limping across an intersection in midtown Manhattan, near where I worked. In one hand he grasped a sheaf of computer outputs that flapped in the breeze, and in the other was an ancient copy of Casanova's memoirs. He carried a cane under his arm. It was the dead of winter, but he wore a blue-and-white cotton seersucker suit.

I first met him around Valentine's Day 1999. He was limping across an intersection in midtown Manhattan, near where I worked. In one hand he grasped a sheaf of computer outputs that flapped in the breeze, and in the other was an ancient copy of Casanova's memoirs. He carried a cane under his arm. It was the dead of winter, but he wore a blue-and-white cotton seersucker suit.

"May I help you across the street?" I said. "Your papers look like they're going to blow away in the wind." And you do, too, I thought to myself.

"Yes," he said. "If you promise me one thing. I've often admired your sweetness, wit and bearing on television, and I've read your columns on the wire. Please don't unload any untested stuff about moving averages or buying on up-volume on me."

"I won't," I promised.

"In that case, as Casanova said, 'Opportunity is like fortune — one must seize it or it will run away and not return.' Would you consider it overly presumptuous if I suggested we leaven the quantitative analysis of the predictive properties of interactions between stock prices with a bit of food?" he said, allowing me to take his papers. "I guarantee that it will not be entirely without profit to you."

"I don't even know who you are," I said.

"I'm just a speculator," he said. He handed me a card. Revolutions fomented, it said. Damsels rescued. Ballyhoo deflated.

Something clicked. I had seen this man on a book cover playing checkers.

"Do you fancy yourself a Casanova with damsels?" I asked.

"I admire Casanova for many things," he replied. "He was a great speculator, a gifted gambler and mathematician, and translated many of the great French masterpieces into Italian. He was the first to design a derivatives product in the fixed-income market, and created the first French lottery. His memoirs provide the best depiction of 18th century European life. His escape from prison in Venice is one of the great flight stories of all time, and we all could learn from the careful attention to detail that led to its success. Regrettably, I lack Casanova's aptitude in the romantic arts he is so well known for."

"What's the cane for?" I said, curiously. He had a lurching gait, but he wasn't using the cane.

"I always carry a cane after the S&P 500 ($INX) has declined more than 4% in the past week," he replied. "That's how the old-time speculators made all their money. When panic came to Wall Street, they'd buy to the full extent of their bank balances. Casanova, for example, often profited from buying stocks during panics and was quite generous with the proceeds in his chivalrous adventures.

"Cane investing still works," he added. "Over the past six years, there were 64 weeks when the S&P fell more than 4%, and the average change during the next seven trading days was a 3% rise."

"That seems rather humdrum."

"Well, the numbers can be fascinating. If you come tonight, I will show you a special Valentine's Day pattern. Will you come?"

"Mind if I take my laptop?"

He started laughing. He said that reminded him of the scene in "The Fountainhead" where Gail Wynand comes back from a publishers' convention all ready for a private evening with Dominique Francon and she tells him to get dressed because they're going to see a play, "No Skin Off Your Nose."

He said it would be ideal if I brought my laptop. The salad bar at a certain nearby restaurant had some great imitation crab, he said, as well as an electrical outlet by the soft-drink machine for my computer. "I will await your arrival with zeal, young damsel."

I surmised that my new friend's interest in Casanova may have been strengthened by the latter's frequent speculative losses in foreign markets and subsequent struggles back to prosperity in the derivatives markets. It seemed entirely possible that similar misfortunes were forcing him to entertain at the local deli.

I handed him back his papers and told him I had an appointment with a value manager. This seemed to greatly agitate him. Casanova, he said, often found that the best antidote to waiting was a little speculation, and accordingly he planned to do a little speculation of his own while I was away. He appeared somewhat mollified when I told him that the manager just wanted me to hype his stocks, and that I would be careful.

First, Some Necessary Diversions

The value manager was waiting for me when I arrived at the bar of the St. Regis. I swung into the booth. "So, Alan. Tell me what you've been buying."

"I picked up some Bethlehem Steel (BS, news, msgs) the other day," the man said. "P/E of 5."

I couldn't help yawning. "Yeah, and sales are growing at about 7%. The stock has been going down for 20 years."

"My screens say that the stock is a great pick," the man said, a little huffily. "Why, it was a member of the Dow Industrials ($INDU) just a couple of years ago. We're also recommending Carmike Cinemas (CKECQ, news, msgs)," he said. "It trades at 1.7 times book value. By contrast, the rest of the market is trading at more than six times book."

That doesn't mean Carmike won't go to 0.08 times book, I thought to myself. I escaped after three-quarters of an hour and went on to my next appointment. Jack Flanders was a famous technical analyst, and I wanted to persuade him to send his updates to us before he gave them to Brand X. Jack needed no prompting to talk.

"I have spent over 10 years developing a technical indicator, the Guaranteed Known Thing (GKT), using number sequences that occur throughout nature," he said. "It has made me a fortune. The GKT is based on the work of two famous mathematicians, Johann Heinrich Lambert (1728-1777) and Leonardo Pisano Fibonacci (1170-1250).

"Lambert is renowned among physicists as the founder of the theory of light measurement, and his Cosmological Letters are famous among astronomers. Lambert attempted to explain the structure of the universe in these writings. My GKT uses Lambert's series of color-triangles, which proceed from 45 hues built from yellow, cinnabar and azurite to smaller, brighter triangles with hues numbering 28, 15, 10, 6, 3 and finally 1, a total of 108.

"I check the entire universe of stocks for action around the 45- and 108-day moving averages, then look for golden-hued crosses at the moving averages corresponding to the hues in Lambert's other triangles. I then screen the surviving stocks for Fibonacci Fan and Arc intersections. So powerful is this analysis that I caught the start, top and bottom of the entire Internet move.

"But I am not greedy, and have decided to divulge the stocks picked by the GKT indicator on my new hotline, the King's Ransom. You can be my first subscriber."

"Have you back-tested it?" I asked.

"That would be difficult," he said. "But it works."

"Do you give complimentary subscriptions to the media?" I asked. "Since you've done so well…."

"Sorry, gorgeous. Can't do it. What will you have to drink?"

I don't drink the hard stuff, but at that point I might gladly have tossed back a double Scotch. Instead, I politely excused myself and slipped out through the glass doors, winking at the doorman. What a bunch of mumbo jumbo, I thought.

The Romance of Stocks

Finally it was time to see the speculator. As I walked the few blocks to the deli, I realized that I had been thinking about him all evening. Somebody had already claimed the table by the soft-drink machine. I sat down and took out my laptop anyway and was scrutinizing the latest earnings reports when he suddenly appeared at my side. I hadn't realized how tall he was. His blue eyes alight with amusement, he handed me a plastic container of imitation fish. I opened it and stuck a plastic fork into the red-and-white contents, hoping he would be satisfied with a gesture of polite intent.

"What do you do when you're not playing checkers?" I said.

"I conduct experiments."

"What kind?"

"I look for patterns that investors haven't seen yet. That's why I came to you. I saw those stories you wrote about how 'Moby Dick' and the All-Star break are related to the market. That kind of writing gives your readers a meal for a lifetime. Much better than the usual stuff that reporters write, quoting tired advisers with mediocre records hyping the stocks they finished buying a few days or weeks ago, or back-patting themselves with reports of their timely sales."

He put his computer outputs on the table. "If it's knowledge, it's quantifiable," he told me. "For example, I've noticed a special Valentine's Day pattern. The V. It happens when the S&P falls more than 10 one day and then rises more than 10 the next day."

"Anything significant?"

"Quite. It will make you about 1%, on average, by buying at the close of the rising day. And as Casanova said, 'Money can buy the same degree of happiness whether in Italy or France.'"

We talked about the market all evening. My companion told one fascinating story after another.

"Do your patterns work with individual stocks?" I asked.

"I don't trade them," he said. "Futures are more liquid."

"But you're missing half the fun and romance, Vic. Individual stocks have stories. The great entrepreneurial themes are like instruments in the market orchestra."

"Perhaps we could hoist our sails together," he said, looking at me with interest. "I understand there's a good port in Seattle that's open to this sort of union. You could help me with the stories, Laurel, and I could help you with the numbers."

And that, dear reader, is how this site began.

P.S. One of the gravest errors in the area of testing and counting is the assumption that if something is statistically significant in one period it will be predictive in the next (in markets or life). Oh, how many fortunes and dreams have been, and will be lost because of this error. In the above article, which was written on 02/14/01, we look at a Valentines pattern, that was statistically significant — It was bullish and frequent and significant in the five years ending in 01. Regrettably it has hardly ever has happened since. I asked Doc. Castaldo to update the study for the prospective period, the out of sample period, or the period within which the pattern would have been approved by the old duck hunters club et al. … An excerpt of his report follows:

"Regrettably…. the effect has completely disappeared. From 1996 to 2/15/2001 buying the S&P after it was down more than 10 points one day, up more than 10 the next, gave profits of 5.5 S&P points for the following day, statistically significant, z=2.2. After the publication of the article, that is from 2/15/2005 to 1/30/2007, the profit was 0.6 S&P points, statistically indistinguishable from zero." What seasonal studies have stopped working, what fixed systems have gone from black to red, because of the crucial neglected factor?"

Feb

14

A Word on Triumph of the Optimists, from Hanny Saad

February 14, 2007 | Leave a Comment

Triumph of the Optimists: 101 Years of Global Investment Returns, by Elroy Dimson, Paul Marsh, and Mike Staunton, is considered by many to be the best book written about markets and in so many ways it actually is. The authors went to great lengths to collect the most accurate data available from sources including century-old newspapers and dusty books from university libraries among others. Their efforts were very rewarding in the sense that their findings debunked some mainstream beliefs.

Triumph of the Optimists: 101 Years of Global Investment Returns, by Elroy Dimson, Paul Marsh, and Mike Staunton, is considered by many to be the best book written about markets and in so many ways it actually is. The authors went to great lengths to collect the most accurate data available from sources including century-old newspapers and dusty books from university libraries among others. Their efforts were very rewarding in the sense that their findings debunked some mainstream beliefs.

In general, this is an outstanding work and one of the best-researched books on markets to date. It suffers none of the biases that previous research by Fama and French or Malkiel and O'Shaugnessy were guilty of, namely the easy data bias: the bias from incorrect rights-issue adjustment, bias of hindsight choice of companies, bias of hindsight choice of sector, and survivorship bias. All these biases are so well covered in the book that there is no need for me to repeat or explain them here. In this sense, the book is exemplary research and the authors deserve to be applauded for their efforts.

The book was recommended first by Victor Niederhoffer in his posts to the list and in his book as the best book written about markets. And in terms of data accuracy and elimination of biases I have to agree with Victor. No other book I am aware of before the trio came close to offering such a comprehensive study of markets with this impeccable accuracy, even uncovering the beauty of ever-changing cycles in some cases, as with the small cap out performance that stopped working once widely discovered, and its return in 2000 and so forth.

But (didn't you see this coming?), there is some critical observation I have about the trio's great research. In the few cases the authors gave their personal opinions and played the forecaster's role, they failed miserably as there was no empirical support whatsoever.

One notable example in one of the most crucial segments of the first part of the book, The Conclusion, the authors mention that an optimist as stated by Archy the cockroach is a guy that has never had much experience, and in this spirit they state, "statistical logic tells us that future expectations must lie below today's optimists' dreams. We cannot expect the optimists to triumph in the future. Future returns from equities are likely to be lower. As Archy the cockroach warned us, experience should teach us realism not optimism.

How deflating. After reading this conclusion I felt as if I had such a build up of pleasure with the great data provided, but failed to climax reading the conclusion. Isn't 101 years of data over 16 countries a sufficient dose of realism? Didn't their own research show how the stock market outperformed through two world wars, a Wall Street crash and Great depression, hyperinflationary and economic turmoil?

Yet the authors don't expect the future to be as rosy and they call it realism. I believe the authors' opinions were influenced by the tech sector crash prior to the book's publication. Other examples include their conclusion about value versus growth.

This is a great book only if you can skip the authors' opinions and concentrate on the data. I may well be the guy who has never had much experience. As in Archy the cockroach, the authors referred to but failed to provide me with empirical reasons not to be the optimist as opposed to realist according to their definition above. In fact, their research and data make me believe that, if anything, the next hundred years should even be better that the past, given the overall political stability (please don't thow at me the war in Iraq or the Israeli-Palestinian conflict, since they fade in compared to two world wars). The great technological advances are the universal availability of information for executives to make more informed decisions.

From Steve Ellison:

In one important respect, the 21st century has a head start on the 20th century: the number of people engaged in trade. Thomas P. M. Barnett, in The Pentagon's New Map, identified three periods of globalization.

The first was "proto-globalization" from 1871 to 1914 involving Western Europe, the United States, and Canada. After the two world wars came "Globalization I," involving approximately the same countries plus Japan. "Globalization II," since 1980, has brought China, Korea, India, Russia, and Brazil, among others, into the global economy. One would expect the trend of increasing international trade, if not reversed, to increase wealth creation and opportunities for profit.

From Stefan Jovanovich:

Dr. Barnett is the perfect theorist for an age when no one knows any history. Free trade had its most dramatic worldwide expansion in the period from the abolition of the Corn Laws to the adoption of Imperial Preference. The period of "proto-globalization" that Barnett refers to was precisely the period when the clear advantages of open economic exchange began to be overridden by the kind of awful grandiose geopolitical doodling that led to WWI and is still the essence of all "strategic planning." Barnett's popularity is, alas, one of those terrible hints that the anarchy of growing international trade is once again about to be brought to heel by the superior wisdom of the people who have seen the latest Power Point presentation.

Feb

14

Costs of Advertising, by Jim Sogi

February 14, 2007 | Leave a Comment

Sometimes it costs some money to make money. You have your advertising. You have your expenses and normal overhead. Sometimes you have to fix up the merchandise to make it look good. You have to pay off your shills. You have to paint up them horses so they look nice to the buyers. Sometimes you have to give a bit on some inventory to get the action going, get the customers interested.

Hopefully the costs won't exceed the ultimate rake in, but you've got to spend a little hopefully to make a little. I'm not a gambler, but I guess you have to get the mark interested in the game by giving him a few pots before the rake. The problem is, I can never tell who the sucker is at the table when I play. Hmmm.

Hopefully the costs won't exceed the ultimate rake in, but you've got to spend a little hopefully to make a little. I'm not a gambler, but I guess you have to get the mark interested in the game by giving him a few pots before the rake. The problem is, I can never tell who the sucker is at the table when I play. Hmmm.

Feb

14

Writing of Love, from Jay Pasch

February 14, 2007 | Leave a Comment

In keeping with the tradition of honoring St.Valentine, a few readings are offered here:

In keeping with the tradition of honoring St.Valentine, a few readings are offered here:

Kaballah, A Love Story, by Rabbi Lawrence Kushner:

This is a unique and very well written amalgamation of Hebrew mysticism, Kabbalist theosophy, the Zorah, cosmology, and human love. The novel prompts the reader to ponder the odds of how a group of Dusty Ones, from a time before written language, could have randomly developed the conscious thought of the universe's creation from a single father spark, the Botzina d'qardinuta, that is only now being affirmed as a leading theory of the universe's creation through the use of our present-day tools of advanced mathematics, astrophysics, cosmology, and astronomy, allowing us to reach back in time nearly to the event horizon of the universe's origin.

Darwin's Wink, A Novel of Nature and Love, by Allison Anderson:

True to the interests of Speclist, Darwin's Wink is a compelling story that weaves the emotional explorations of love, fertility, evolution, and survival, against an exotic and lush island setting.

Essential Manners For Men, by Peter Post:

The great-grandson of Emily post offers the male gender guidance on proper form, etiquette, and manners, on what to do, when to do it, and why, in the areas of daily life, out on the town, on the job, sharing a habitat, meeting and greeting, dating, and flirting.

Feb

14

Background on Dutch Flower Auctions, from Ryan Carlson

February 14, 2007 | Leave a Comment

The function of auctions is to concentrate offer and demand. Everyday approximately 10,000 specialized breeders deliver their products to the auction. From that offer, approximately 5000 buyers make their choice. An important instrument is the auction clock, by which batches or individual units of products are sold by Dutch auction to the customer that first causes the clock to stand still. Handling approximately 100,000 transactions each day, the auctions distribute a vast, homogenous offer among a large number of different parties. The auctions work as an international marketplace.

Initially, the auctions handled only sales by local breeders and later by regional breeders. Nowadays, however, members of other auctions can offer their products as well. Towards the end of the 1970s it was decided that the auctions would also admit products from abroad. At this time imports constitute approximately 15% of the offer for the clock. The principal countries for import are Kenya, Israel and Zimbabwe. In this way, approximately 60% of the international cut flower trade is handled by auctions in the Netherlands, which thus have a pivotal role in the international trade of flowers and plants.

For traders the auction provides a virtually complete, deep and wide, range of 16,000 floricultural products on a single site. For producers, the auction guarantees their daily sales and the payment for them. The auction also offers a transparent market and an objective operation of the price mechanism. A minimum price is set for each product. It a batch is not sold, it is withdrawn (and destroyed). This leads to a stable pricing system, which in turn promotes a stable offer and stable demand.

Not all products are sold for the clock. In recent years direct sales between sellers and buyers, breeders and traders have become increasingly important. For houseplants and garden plants, approximately 50% of sales are realized through direct sales, almost always under forward contracts. For cut flowers, a day-fresh product, direct sales have no more than a marginal role at present. More than 90% of cut flowers are still auctioned.

Feb

14

Conservation of Money, from Philip McDonnell

February 14, 2007 | Leave a Comment

Two summers ago, at the Spec Party in Central Park, Victor said something to me which was at once profound yet seemingly too simple. "There is only so much money." To someone who did not understand,it would seem rather sophomoric, or even downright cryptic. But it was all he needed to say because I had read his books.

The statement referred to a simple conservation law much like the conservation laws of physics. In physics, energy and mass are the most significant variables in most mechanical systems. So we have laws such as Conservation of Energy, Conservation of Mass and Conservation of Momentum. In financial markets a similar law applies. Money is conserved. At any given time there is only so much money.

Let us imagine an island economy where there are only two stocks, X and Y. There is only so much money on the island. When the traders on the island decide they want to invest in X they need to figure out how to pay for the purchase. The only liquid source of money is stock Y. So they sell Y. The price of X goes up and Y goes down.

Let us draw this on an X-Y coordinate plot and assign some real numbers to it. The relationship between X and Y would show up as a line from high up on the Y axis sloping downward to some point of a large X value. Suppose the amount of money was $100. If everyone wanted to own Y and no one wanted X then we would have Y=100, X=0.

Conversely if everyone wanted X and not Y then Y=0 and X=100. We can think of the distance of the current market valuations as the distance from the origin which is equal to the buying power of the money. It is a simple conservation law on our island. The $100 defines a radius from the origin. It therefore defines a circle. It is easy to draw on a 2D chart or even in 3D. Drawing a 5000 dimensional sphere for the 5000 actively traded stocks is a project still in progress.

Feb

14

Ninety Minutes, from Scott Brooks

February 14, 2007 | 1 Comment

I have a business partner in another venture who sleeps only between 2 a.m. and 5 a.m., sometimes less.

I have a business partner in another venture who sleeps only between 2 a.m. and 5 a.m., sometimes less.

He's been involved in several sleep studies and has taught me a few things about sleep. One is that humans go through 90 minute sleep cycles. If you're awakened during a sleep cycle, you are groggy and have less energy during the day.

The key to good sleep is to arrange to sleep in 90 minute increments (sleep an amount of time that is evenly divisible by 90).

Therefore, don't sleep for eight hours. You are better off sleeping for 7.5 hours or nine hours than for eight.

I've tried it and found that I am much more alert and productive with this methodology. I used to suffer from terrible insomnia, but it hardly affects me anymore.

I've also gone from needing eight hours of sleep down to sleeping only six. My goal is to work myself down to needing only 4.5 hours.

Each of us needs different amounts of sleep. And each of our "sleep cycles" is slightly different, but 90 minutes is pretty much on the money for the majority of people. Try experimenting and finding what is right for you.

It will take at least 20 - 30 days to get into a pattern. But once you do, you'll be glad you did it.

It has helped me out a lot.

Feb

14

Into the Vacuum, from Tom Ryan

February 14, 2007 | Leave a Comment

One of the 10 million things that the Specs have said either on Daily Spec or to me personally in the past five years that made complete sense is how the first priority for the evildoers is to get you to question not your facts or even your beliefs but your own version of reality.

One of the 10 million things that the Specs have said either on Daily Spec or to me personally in the past five years that made complete sense is how the first priority for the evildoers is to get you to question not your facts or even your beliefs but your own version of reality.

They do this by attacking you on a very personal level such that you begin to question your own ability to think clearly about an issue, to use your abilities to reason. This is accomplished generally by intimidation, by peer pressure, or by insinuating that they have access to knowledge that you don't, thereby denigrating your intellect. Then into that vacuum of logic they can insert their own ideology.

J. T. Holley adds:

A very good example of this is shown in the movie, "A Bug's Life," by Disney via Pixar. The following is the logline from Yahoo! Movies:

A very good example of this is shown in the movie, "A Bug's Life," by Disney via Pixar. The following is the logline from Yahoo! Movies:

"A colony of ants is threatened by a gang of grasshoppers led by the evil Hopper. Flik, a common ant and a misfit, has an uncommon vision when he tries to rise to heroic proportions by enlisting a band of circus fleas to help him defend his colony from the grasshoppers."

The amazing story is how the libertarian heroic Flik utilizes individualism and technology to bring about change in the ant colony and helps them realize they have the strength and the numbers to stand up against the evil Hopper and his grasshoppers. Up until then the way the psychological edge was maintained by Hopper and Tom's "questioning your own ability" was wonderfully demonstrated. No one single ant ever challenged Hopper due to this very thing.

Nice to see Heroes and Individualism rising above "Colonies" thoughts and overcomes in the end and is a great lesson for children! That is one movie my kids love to watch over and over!

Incredibles! is another also Pixar! I know Jobs is high up the food chain there at Pixar, but there has to be some other Libertarian, Rand-loving someone who keeps cranking these brilliant movies out every five years? Anyone know who?

Tons of hypothesis and good speculating questions are espoused during the film as well by the way.

Ken Smith adds:

Propaganda is the mechanism of the market also. Money seeping away from investors at a higher rate than should occur is the consequence of the media's flooding the public mind with anodyne.

Investors can ameliorate the losing process by cancelling the Wall Street Journal, Financial Times, Money Magazine, and so on; additionally cancelling all subscriptions to advisory letters.

What's more put a block on emails from services that recommend stock picks, ETFs, puts and calls, and those that promote trading platforms such as Metastock and Tradestation.

Feb

14

A Gem, Noticed by Brett Steenbarger

February 14, 2007 | 1 Comment

A gem, noticed by Brett Steenbarger:

Henry Carstens's latest article, Introduction To Testing Trading Ideas, is a gem. It walks traders through the process of historical testing, significance testing, and portfolio allocation.

From Yishen Kuik:

I've found this other "how-to" guide to testing informative as well.

The market is jai alai.

Feb

14

Beating an Index, by Bill Rafter

February 14, 2007 | 3 Comments

Dr. Bruno had posed the idea of beating an index by deleting the worst performers. This is an area in which we have done considerable work. Please note that we do not consider this trend following. The assets are not charted, just ranked.

Dr. Bruno had posed the idea of beating an index by deleting the worst performers. This is an area in which we have done considerable work. Please note that we do not consider this trend following. The assets are not charted, just ranked.

Let us imagine an investor who is savvy enough to identify what is strong about an economy and invest in sectors representative of those areas, while avoiding sectors representing the weaker areas of the economy. Note that we are not requiring our investor to be prescient. She does not need to see what will be strong tomorrow, just what is strong and weak now, measured by performance over a recent period.

What is a market sector? Standard & Poors does that work for us, and breaks down the overall market (that is, the S&P500) into 10 Sectors. They then further break it down into 24 Industry Groups, and further still into 60-plus Industries and 140-plus Sub-Industries. The number of the various groups and their constituents change from time to time as the economy evolves, but essentially the 500 stocks can be grouped in a variety of ways, depending on the degree of focus desired. Some of the groupings are so narrow that only one company represents that group.

Our investor starts out looking at the 10 Sectors and ranks them according to their performance (such as their quarterly rate of change). She then invests in those ranked first through fourth (25 percent in each), and maintains those holdings until the rankings change. How does she do? Not bad, it turns out.

www.mathinvestdecisions.com/Best_4_of_10.gif

From 1990 through 2006, which encompasses several types of market conditions, the overall market managed an eight percent compound annual rate of return. Our savvy investor achieved 10.77%. A less savvy investor who had the bad fortune to pick the worst six groups would have earned 7.23%. Those results are below. (Note, for comparison purposes, all results excluded dividends.)

www.mathinvestdecisions.com/Worst_6_of_10.gif

How can our savvy investor do better? By simply sharpening focus, major improvements can be achieved. If instead of ranking the top four of 10 Sectors, our savvy investor invests in a similar number (say the top 4, 5, or 6) of the 24 Industry Groups, she achieves a 13.12% compounded annual rate of return over the same period. Note that the same stocks are represented in the 10 Sectors and the 24 Industry Groups. At no time did she have to be prescient.

www.mathinvestdecisions.com/Going_to_24_groups.gif

One thing you will notice from the graphs above is that the equity curves of our savvy and unlucky investors mimic the rises and declines of the market index itself. Being savvy makes money but it does not insulate one from overall bad markets because the Sectors and even the Industry Groups are not significantly diversified from the overall market.

Why not keep going further out and rank all stocks individually? That clearly results in superior returns, but the volume of trading is such that it can only be accomplished effectively in a fund structure - not by the individual. And even ranking thousands of stocks will not insulate an investor from an overall market decline, if she is only invested in equities. The answer of course is diversification.

It is possible to rank debt and alternative investment sectors alongside equities, in the hope of letting their performances dictate what the investor should own. However, the debt and commodities markets have different volatilities than the equities markets. Anyone ranking them must make adjustments for their inherent differences. That is, when ranking really diverse assets, one must rank them on a risk-adjusted basis for it to be a true comparison. But if we make those adjustments and rank treasury bonds (debt) against our 24 Industry Groups (equity) we can avoid some of the overall equity declines. We refer to this as a Strategic Overlay:

www.mathinvestdecisions.com/Strategic_diversification.gif

Adding this Strategic Overlay increases the returns slightly, but more important, it diversifies the investor away from some periods of total equity market decline. We are not talking of a policy of running for cover every time the equities markets stall. In the long run, the investor must be in equities.

Invariably in ranking diverse assets such as equities, debt, and commodities, our investor will be faced with a decision that she should be completely out of equities. It is likely that will occur during a period of high volatility for equities, but one that has also experienced great returns. Thus our investor would be abandoning equities when her recent experience would suggest otherwise. And since timing can never be perfect, it is further likely that the equities she abandons will continue to outperform for some period. On an absolute basis, equities may rank best, but on a risk-adjusted basis, they may not. It is not uncommon for investors to ignore risk in such a situation, to their subsequent regret.

Ranking is not without its problems. For example, if you are selecting the top four groups of whatever category, there is a fair chance that at some time the assets ranked 4 and 5 will change places back and forth on a daily basis. This "flutter" can be easily solved by providing those who make the cut with a subsequent incumbency advantage. For a newcomer to replace a list member, it then must outrank the current assets on the selected list by the incumbency advantage. This is very similar to the manner in which thermostats work. We have found adding an incumbency advantage to be a profitable improvement without considering transactions costs. When one also considers the reduced transaction costs, the benefits increase even more.

Another important consideration is the "lookback" period. Above we used the example of our savvy investor ranking assets on the basis of their quarterly growth. Not surprising, the choice of lookback period can have an effect on profitability. Since markets tend to fall more abruptly than they rise, lookback periods that perform best during rising markets are markedly different from those that perform best during falling markets. Determining whether a market is rising or falling can be problematic, as it can only be done with certainty in retrospect. However, another key factor influencing the choice of lookback period is volatility, which can be determined concurrently. Thus an optimal lookback period can be automatically determined based on volatility.

There is certainly no question that a diligent investor can outperform the market. By outperforming the market we mean that she will achieve a greater average rate of return than the market, while limiting the maximum drawdown (or percentage equity decline) to less than that experienced by the market. But the average investor is generally not up to the diligence or persistence required.

In the research work illustrated above, all transactions were executed on the close of the day following a decision being made. Thus the strategy illustrated is certainly executable. Nothing required a forecast; all that was required was for the investor to recognize concurrently which assets have performed well over a recent period. It is not difficult, but requires daily monitoring.

Feb

14

Book Review: Adventures of a Red Sea Smuggler, from Craig Cuyler

February 14, 2007 | 1 Comment

Adventures of a Red Sea Smuggler, by Henry De Monfreid.

I came across this great book a while ago and for all those who enjoy books like horse-trading, this is a winner. There are more than the obvious analogies to speculation. The book is set in a world where the price of goods, like mother of pearl, can crash from 7500 francs to 1500 and then climb back again.

I came across this great book a while ago and for all those who enjoy books like horse-trading, this is a winner. There are more than the obvious analogies to speculation. The book is set in a world where the price of goods, like mother of pearl, can crash from 7500 francs to 1500 and then climb back again.

I loved his quotes about human nature, gems like, "I dared not be happy; for all my life I have had to pay with sorrow for every bit of happiness I have ever known. That is the fundamental law of the destiny of man." Also, "There was no use worrying about the possible difficulties to come, they always loom very large and terrible in the distance, but when one arrives at the foot of a wall there is always some foothold that enables one to climb it."

This book is about a bored French farmer who decides to embark on a life of smuggling in search for meaning in his life. It is set in the 1920s in, as the cover says, a world populated by Chinese hermits, Greek priest smugglers, Arab robber barons and Bedouins. A classic written by a guy who ended up living well into his 90s and writing over 40 volumes of his adventures.

Feb

14

The Best Benchmark, from Bill Rafter

February 14, 2007 | 1 Comment

I heartily recommend the use of the compounded value of cash as a multidimensional tool. That is, one takes the daily 3-month bill rate and compounds it. (If you are looking at market days, it is the cumulative product of the 252nd root of 1 + the rate.)

I heartily recommend the use of the compounded value of cash as a multidimensional tool. That is, one takes the daily 3-month bill rate and compounds it. (If you are looking at market days, it is the cumulative product of the 252nd root of 1 + the rate.)

I had previously illustrated how year-on-year changes of that data are an excellent indicator as to whether Fed policy is accommodative or restrictive. Now I recommend comparing that data as a benchmark to whatever else you are trading. The point is obvious: If whatever you are trading does not outperform cash (i.e., 3-month bills), then don't own it at that time; it's a dog!

Consider the broad market. Compare a buy-and-hold S&P to the strategy of switching to cash if the yearly growth (252 market days) of the cash is less than that of the S&P. Results of that daily strategy (4300+ days since 1989) are illustrated here:

www.mathinvestdecisions.com/cash_comp_v_tr_spx.gif

This is not difficult, and the savings for the investor can be substantial. Ranking your other assets versus cash can be even more rewarding.

Feb

13

Game Theories, by Nigel Davies

February 13, 2007 | 1 Comment

Some time back I mentioned the book Gm-Ram: Essential Grandmaster Chess Knowledge , by Rashid Ziyatdinov, and ordered a copy for review. It is a chess book with little text, no notes to the games and no solutions to the 256 positions…

Some time back I mentioned the book Gm-Ram: Essential Grandmaster Chess Knowledge , by Rashid Ziyatdinov, and ordered a copy for review. It is a chess book with little text, no notes to the games and no solutions to the 256 positions…

Alan Millhone writes:

But few of us are in that 'elite' category that we need neither instruction nor guidance. As an average checker player I look for books that are well annotated and full of diagrams and solutions towards the back of the book.

Every checker book in my library would be the opposite of his book on chess. The late English Grand Master Derek Oldbury once wrote a book called Move Over, but it is written in non-checker notation and most difficult to follow. Our current 3-Move World Checker Champion recently wrote a book he calls Sixth, and it is well annotated and full of diagrams. It is as if Alex is talking to you in the first person all the way through … Ah, my kind of book.

Nigel Davies adds:

Yes, but the problem is that your understanding will tend to be 'second hand' rather than unique and cutting edge. My best results always came after individual creative work where I went my own way. I might end up agreeing via a roundabout route, but my agreement would carry much greater depth.

Alan Millhone replies:

But keep something in mind: I am just an average tournament checker player. The skill levels of someone like Alexander Mosieyev or Suki King of Barbados, and myself, are miles apart. Perhaps someday I can hammer out my own individual lines of play. Most top players study the greats in our game then try to improve on those tried-and-true lines of defense and attack. I am not at that level yet, may never be, but I love to compete!

Nigel Davies writes:

But what comes first, the chicken or the egg? Do you not try to forge your own lines because you are an average tournament player, or are you average because you are not doing this work?

But what comes first, the chicken or the egg? Do you not try to forge your own lines because you are an average tournament player, or are you average because you are not doing this work?

I believe that one of the major problems 'late improvers' face is in changing their attitudes and habits. Teenagers are notoriously disrespectful, and this allows them to challenge everything. So those who were full-timers as teenagers developed the habit to challenge, whilst hobby players developed the habit to accept.

I think it's good to find just one thing at which you can be the best, but being the best necessarily involves refutation of the old.

Feb

13

Buy the Rat; Sell the Koala, by Nigel Davies

February 13, 2007 | 1 Comment

Cuddly rats seem to be on offer in Ikea right now. I got a junior one for just GBP 1.99, rats probably being heavily discounted because they weren't selling well. Here in the West we think of them as plague carriers and vermin, but in China rats are considered to be enterprising and courageous little fellows. I shouldn't include all Westerners. Gunter Grass wrote a novel entitled The Rat, written from the rat's perspective.

Cuddly rats seem to be on offer in Ikea right now. I got a junior one for just GBP 1.99, rats probably being heavily discounted because they weren't selling well. Here in the West we think of them as plague carriers and vermin, but in China rats are considered to be enterprising and courageous little fellows. I shouldn't include all Westerners. Gunter Grass wrote a novel entitled The Rat, written from the rat's perspective.

I believe there are many good lessons here. There is a lesson in prejudice, the rat being hated despite its good qualities, whilst lazy koalas are loved despite sleeping 23 hours a day (apologies to all koalas and their federations if I have this figure wrong). Once rats are recognized as being lovable, more people will jump on the bandwagon. Woes betide anyone who castigates them as lazy, useless bastards.

There is a lesson in value, my immediate thought being to buy a shipment of rats from Ikea and sell them to China in exchange for some cuddly koalas. If I get four koalas for each rat and sell the koalas at four times what I got the rats for, that's a 16x profit potential, excluding costs.

There's also a lesson in objectivity. Why should it be that koalas are so highly valued? Nobody speaks admiringly of your child's rat, and I can speak with authority on the matter having road tested the situation in town this morning. You may hear people say "What a cute koala," but the words "What a cute rat" never seem to occur to them. There were a few wry smiles and one "Is that a rat?"

Last but not least there seems to be a lesson in speculation. Where do people's sympathies lie and do these really make sense? It seems to me that this is the essence of trading, buy the rat and sell the koala.

Feb

13

“Living Old,” from Craig Mee

February 13, 2007 | Leave a Comment

Here are a few interesting points on the upcoming TV program, Living Old.

Here are a few interesting points on the upcoming TV program, Living Old.

"The bad news is the price that they will be paying for the extra decade of healthy longevity, is up to a decade of anything but healthy longevity."

Within the next 25 years, the number of Americans 85 yrs of age and older will reach 60 million.

A few rough calculations have me assuming that this is currently the amount of people in the U.S. 65 and over. I realize we have spoken about health care as being a future booming sector, but 20% of the current U.S. population being 85 and over is astounding.

One key point: of all the elderly people interviewed, the lady who looked the "most with it" was a 94-year-old stockbroker, still belting orders down the phone, and yelling at her broker not to chase it…superb!

Feb

13

Excalibur, by Gordon Haave

February 13, 2007 | Leave a Comment

"I dreamt of the dragon."

"I dreamt of the dragon."

"I have awoken him."

"Can't you see all around you the dragon's breath?"

From one of the greatest movies of all time.

I watched the director's cut of Blade Runner, which is fantastic, and finally in this cut it becomes apparent that Deckard himself is a replicant.

Now, I am watching the movie with the above lines, where, interestingly, Patrick Stewart plays a role.

Feb

12

A Down Home Approach To Markets, by Victor Niederhoffer

February 12, 2007 | 2 Comments

We are accustomed to reading short stories like Aces Up, or Inside Straight, where the action somehow relates to the sequence of bidding and uncertainty in various card games. Yes, life often imitates the bluffing, counting, bidding, random elements, path dependence, money management, reading, and choice inherent in a good poker game. And, of course, it will be no surprise to say that in many ways the market is like a poker game, with some of the cards hidden, some showing, and random factors to come.

We are accustomed to reading short stories like Aces Up, or Inside Straight, where the action somehow relates to the sequence of bidding and uncertainty in various card games. Yes, life often imitates the bluffing, counting, bidding, random elements, path dependence, money management, reading, and choice inherent in a good poker game. And, of course, it will be no surprise to say that in many ways the market is like a poker game, with some of the cards hidden, some showing, and random factors to come.

Indeed, I have a dozen pages in Ed Spec on it (the most worthless in the book in my opinion) mainly because I am not an educated poker player, and all I've done is read books on how much I didn't know when I did play. Another approach to poker is to think of the cards coming into your hand, say on first, second, and third street, etc., in a five card stud hi-lo game with bidding after each card, as similar to the market moves each of the 5 days of the week. When should you bid, call, fold, or cash in?

Cashing in is always possible with the market mistress. Still, like the "doing business" which characterizes many such card games, the opponent may exercise a high price if you fold. Rite now the market has dealt three of a kind, with three down days in a row. Should you hold, raise, or fold? Readers of this humble site will know the Scarnesque, Malmudesque answer already and always have their canes at hand for such a deal.

If you are long, another player has the trips, and if you are short, you're holding them. Other common hands the market might deal you are the four card outside straight, if you're holding to Thursday, for example, and are long a call at 1450 with the options expiry on Friday, and the market now at 1439. Should you draw to that straight or 3 card flush or not?

Indeed, this seems to me a rather fruitful way of looking at things. On first, second, and third street, all the way up, a good card player knows what the correct play is depending on the cards that he is dealt and whether he's playing for low or high. Do market players have similar guidelines as to how to play the hand after sequential cards are dealt to all the players? We can answer such questions for many hands that the player is dealt during the week.

For example, after you've put up a big ante it might make sense to wait around for the big announcement that's going to cause great uncertainty, like the Humphrey Hawkins testimony on Wednesday. Or at least you shouldn't have called in the first place if you weren't ready to stay in, because you knew there would be a big raise after third street that you'd have to meet.

The question emerges as to what is the best way to simulate a 52-card deck with 13 numerical and face cards, and four suits. This will enable you to come up with rules of thumb as to when it pays to go for it based on expectations at various stages.

I would again propose using the five-card high-low as an analogy that, depending on whether you're long, short or straddling, you divide up the cards.

Since I know even less about poker than I know about trees or electronics or most of the other things I write about, besides the defunct game of hard ball squash, I had better leave this as an exercise for the reader. I'm not hubristic enough to give my own solution now knowing that so many better ones will come to the table. Subject to my admission of ignorance, however, if none comes I'll take a crack at it.

Steve Leslie adds:

There was a time, when hold 'em was not the game of choice in poker rooms around America. In fact, if you were to speak to the old timers, many were totally unfamiliar with the game. It has only recently become a phenomenon, brought on by the technology of the 21st century and the ability to see the players' hole cards. Along with television came the great exposure of the World Series and as a result the game of choice today is no limit tournament style hold 'em.

There was a time, when hold 'em was not the game of choice in poker rooms around America. In fact, if you were to speak to the old timers, many were totally unfamiliar with the game. It has only recently become a phenomenon, brought on by the technology of the 21st century and the ability to see the players' hole cards. Along with television came the great exposure of the World Series and as a result the game of choice today is no limit tournament style hold 'em.

Although the game is termed the Cadillac of poker, in the 90s the game I played was 7-card stud, or eight or better. I played this game for three years or so and I can honestly say that I consider myself to be one of the best stud players around. It plays into my skills very nicely as it is the most statistical of poker games. It also has the most information available as you get to see most of the cards. Players with have photographic memories and those who can think quickly have a great advantage.

This is a variation of the traditional 7-card stud, where the high hand and the low hand split the pot. In order to win the low hand, however, you have to have five cards out of seven that are no higher than an eight and the best possible hand is A, 2, 3, 4, 5. This is called a wheel. Straights and flushes do not count toward the low hand but they do for the high hand. Therefore, you can win both the low hand and the high hand at the same time.

Other than that 7-card stud, eight or better is very straightforward and there is very little bluffing. The true objective of the game is extreme patience and waiting for a starting hand that gives you the highest probability of success.

Here is the great secret to playing 7-card stud, 8 or better. Start out by playing only toward a low hand with an objective of also filling out your hand and winning both the high and the low. This is called sweeping the pot. In order to be profitable in this game you want to win one big pot an hour and sweeping is the best way to do so.

Therefore, you start out with three cards, two down and one up. The best starting hands are three cards that are in a row and of the same suit. A 3, 4, and 5, of spades for example. This constitutes the first round of betting. After that there will be four rounds remaining and one card at a time will be dealt to you and the last card will be dealt down.

If your first four cards are eight or less, then the likelihood that you will make a low is 80%. If you have four cards to a low after the fifth card is dealt, then your chance of success is 50%. There are two critical decisions that the stud player makes in the game. That is after third street and after fifth street. If by fifth street you don't have four low cards, you give up the hand. If you have four to a low by fifth street, you are committed to seeing it all the way to the end. It is really that simple. Properly played it is just beautiful. Poorly played it is absolutely brutal.

People get into trouble by playing high hands. The worst thing to have happen is to play a high hand only and come in second. This is very expensive, especially if someone makes her low and starts raising the pots as she should. And if the low also makes a high then the high is swimming against the current along the way.

The corollaries to a 5-day trading week are self evident. With respect to stocks, using William O'Neill's approach, your highest probability of success is by selecting stocks that have an eps rating of 80 or better and a Relative Share rating of 80 or better and investing in those. This will be your starting hand of three. If the stocks go down seven percent or more after investing in them, you let them go. This is the same as letting your hand go after 5th street as it just did not fill out as you have would liked.

Now I don't necessarily espouse the theory of the 7% rule, as I deem it as too tight for my tastes. It does not give the story time to play out. I rather have a more flexible stop loss level and do not overplay my hand. That is to say I do not chase cards. I do not commit too much of my capital to any one stock either. And if I feel I have a winning stock with good earnings, good relative strength, and in a good group, then I am willing to play it out to the end. Eventually, it will be recognized for its value. If I have an accommodating market on top of those variables chances increase to where I can get both the high and the low. This is where the great reward comes in. Once again, patience is the key. And having the earnings and the relative strength on you side helps provide the patience.

I hope this illustration is helpful. For a more in-depth discussion of the study of 7-card stud, eight or better see me offline.

Larry Williams writes:

"[R]esearch on strategic behavior in economic games has identified a wide range of situations in which thinking one step ahead of an opponent provides a decisive advantage. Research on behavior in markets shows that failing to think carefully about other participants' likely actions leads to adverse consequences, such as the ‘winner's curse’ (the tendency for auction winners to pay too much)."

From On Making the Right Choice : The Deliberation-Without-Attention Effect, by Ap Dijksterhuis, Maarten W. Bos, Loran F. Nordgren and Rick B. van Baaren Department of Psychology, University of Amsterdam

Feb

12

A Travel Suggestion, from Marion Dreyfus

February 12, 2007 | 1 Comment

Tel Aviv had ignored its amazing seacoast for decades. Then real estaters suddenly realized the city faced away from the coast, and poof, the construction was on, redirecting the direction of the entire coastal area, and making a tasty spot for coffee during the day, and romance at night. Nice hotels. The most literate crowd in the region — 98% literacy, more than the US, actually.

Tel Aviv had ignored its amazing seacoast for decades. Then real estaters suddenly realized the city faced away from the coast, and poof, the construction was on, redirecting the direction of the entire coastal area, and making a tasty spot for coffee during the day, and romance at night. Nice hotels. The most literate crowd in the region — 98% literacy, more than the US, actually.

Ari Oliver adds:

I was in Tel Aviv about two years ago. I was amazed at the number of second hand bookstores. It seemed like they were on every second block. It's amazing what books you can get. Obviously it is indicative of a strong intellectual climate.

J. P. Highland writes:

I'm currently in Israel, where I plan to stay for the next two weeks. This morning while visiting the Western Wall I heard a blast and screaming coming from the other side of the wall where the mosque is located. Everyone ran to take cover while I found a safe spot next to the CNN crew.

Israelis are digging next to a mosque and some Muslims are convinced that this is a plan to destroy their sacred place. Now everything seems to be OK. Fortunately, my hotel is next to the U.S. Consulate in case things go terribly wrong.

I've been in Israel for only 24 hours but I'm highly impressed with the country. Infrastructure in Tel Aviv is impressive, people are nice and well-educated and food is great. A lot of construction seems to be taking place.

Marion Dreyfus replies:

Israel has the highest per capita literacy level, much higher, in fact, than that of the U.S. Large clumps of the U.S. have little truck with book-learning, whereas in Israel, few can be so far from civilization that books are not a really proximal commodity, and preferred in many instances to the next choice. The Israel Philharmonic is, this week, 70 years old, which — doing the math –pre-existed the very birth of the State of Israel. Theatre and music are also highly attended, democratically priced and appreciated.

It is a truism that Israel is technologically advanced far beyond its age and size. In a recent science exposition I attended at the Science & Industry Library in NYC, there was a globe with countries represented in proportion to the patents sought and achieved. Israel was as large as Germany and Japan on this 'globe' of science interest. To some extent, Israel has no choice. Lacking easy access to raw materials, Israel thrives on intellect, or perishes.

Feb

11

Fundamental Laws, by Victor Niederhoffer

February 11, 2007 | 2 Comments

The moves in markets often seem to imitate the kinds of things we see in nature: in gas; in water; and in electricity. For example, the gentle back and forth of the stock market last week, gradually building up pressure and then exploding on the downside, is like a cork bursting from a bottle of champagne, or a volcano erupting.

The moves in markets often seem to imitate the kinds of things we see in nature: in gas; in water; and in electricity. For example, the gentle back and forth of the stock market last week, gradually building up pressure and then exploding on the downside, is like a cork bursting from a bottle of champagne, or a volcano erupting.

In electronic circuits we often see a signal gently oscillating between set points, then gathering a slight bit of amplitude on one side or the other, and finally tripping the set point thereby triggering a major change in the output. In capacitor resistor circuits, we find the same buildup of charge, with little change in the output until the time constant of the capacitor is fulfilled and the output suddenly and dramatically changes.

The reason for these similarities is they are all results of various energy conservation laws. Energy coming into a system cannot just disappear. One major conservation law in electronics is Kirchoff's Current law. It holds that current going into the confluence of two wires equals the current coming out. Another major law is Kirchoff's voltage law. It states the voltage that's input to a closed circuit is equal to all the voltage used up in work in the circuit.

I find the major applications of conservation laws in markets relating to some input from outside a system. Usually, some information or money flow gets distributed to the various components, companies, and markets of the system. A major merger announcement affects not just one company but all companies related to it. An increase in liquidity in the system gets distributed according to market's laws similar to Kirchoff's laws in electronics.

Click here for information on Kirchoff's laws.

To be continued.

Philip McDonnell adds:

Two summers ago, in Central Park, the Chair said something to me which was at once profound yet seemingly too simple. "There is only so much money." That was all that he said. To someone who did not understand, it would seem rather sophomoric or even downright cryptic. But it was all he needed to say because I had read his books.

Two summers ago, in Central Park, the Chair said something to me which was at once profound yet seemingly too simple. "There is only so much money." That was all that he said. To someone who did not understand, it would seem rather sophomoric or even downright cryptic. But it was all he needed to say because I had read his books.

The statement referred to a simple conservation law much like the conservation laws of physics. In physics energy and mass are the most significant variables in most mechanical systems. So we have laws such as the Conservation of Energy, Conservation of Mass and Conservation of Momentum. In financial markets a similar law applies. Money is conserved. At any given time 'there is only so much money'.

Let us imagine an island economy where there are only two stocks X and Y. There is only so much money on the island. When the traders on the island decide they want to invest in X they need to figure out how to pay for the purchase. The only liquid source of money is stock Y. So they sell Y. The price of X goes up and Y goes down.

Let us draw this on an X-Y coordinate plot and assign some real numbers to it. The relationship between X and Y would show up as a line from high up on the Y axis sloping downward to some point of a large X value. Suppose the amount of money were $100. If everyone wanted to own Y and no one wanted X then we would have Y=100, X=0. Conversely if everyone wanted X and not Y then Y=0 and X=100.

We can think of the distance of the current market valuations as the distance from the origin that is equal to the buying power of the money. It is a simple conservation law on our island. The $100 defines a radius from the origin. It thus defines a circle. It is easy to draw on a two-dimensional chart or even in 3D. Drawing a 5000 dimensional sphere for the 5000 actively traded stocks is a project still in progress.

Charles Sorkin adds:

Is it not the beauty of Eurodollars that since there is no reserve requirement (being out of the country and not under the auspices of the Fed), foreign banks can create and loan as many dollars as they want?

Gregory van Kipnis adds:

Not quite. After the Eurodollar blew up in 1974, central bankers convened at the behest of the Bank of England to put a lid on the runaway growth of the Eurodollar market. It was agreed that each CB would be responsible for defaults of the banks they regulate even if the default were in the Eurodollar market. Following that, each foreign CB put reserve requirements on Eurodollar deposits.

From: George R. Zachar:

Not quite. After the eurodollar blow up in 1974 of Bank Herstadt, central bankers convened at the behest of the Bank of England to put a lid on the runaway growth of the eurodollar market. It was agreed that each CB would be responsible for defaults of the banks they regulate even if the default were in the eurodollar market. Following that, each foreign CB put reserve requirements on eurodollar deposits. /Gregory van Kipnis/

Given

1) That central banks are increasingly players themselves,

2) The clubby incestuous relationships within the govt/bank community in places like Italy,

3) The fact that one major central bank has had a high official murdered by someone he regulated (Russia),

4) The asset explosion in nations whose financial infrastructure hasn't been tested (the Gulf States),

5) The nil possibility that govt bankers grok the array and scope of derivatives…

I would not assume the central banking clerisy is on top of things. They might be, but there's reason for doubt.

Easan Katir writes:

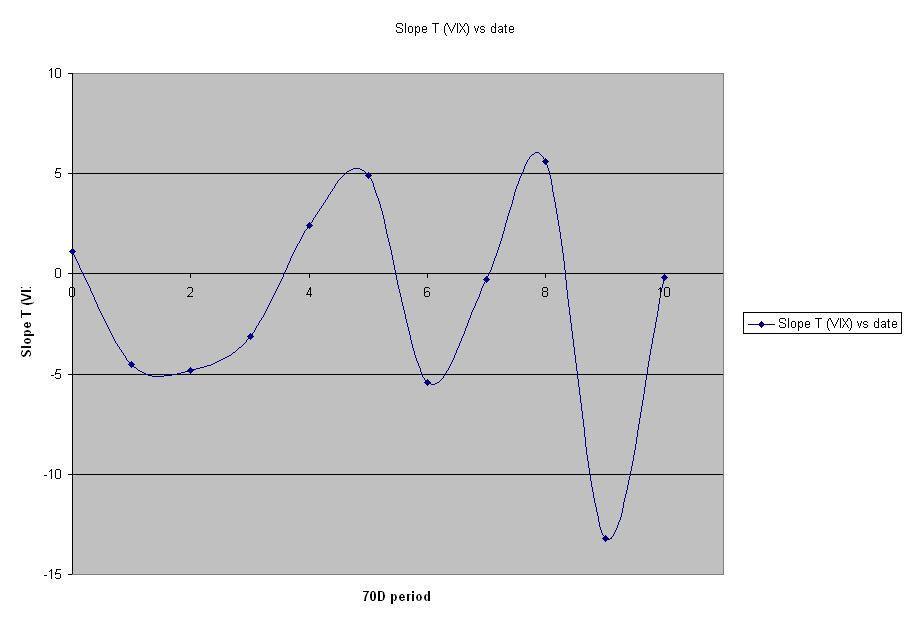

The moves in markets often seem to imitate the kinds of things we see in nature… VN

To continue the Chair's analogy, it would seem the next practical question is how do we predictively discover the impedance of that market capacitor which discharged on February 8, provided the "3 of a kind," then tripped another point of capacitance and surged in the opposite direction for the past 4 days? What voltmeter can we use to measure the current passing through?

To continue the Chair's analogy, it would seem the next practical question is how do we predictively discover the impedance of that market capacitor which discharged on February 8, provided the "3 of a kind," then tripped another point of capacitance and surged in the opposite direction for the past 4 days? What voltmeter can we use to measure the current passing through?

Or is this market more like a big kid bouncing on a "40-day moving average" trampoline for the past seven months?

Feb

11

Gold and The Dollar, by Craig Mee

February 11, 2007 | Leave a Comment

It appears to me that gold and the dollar index had a ambiguous correlation in the past, but all this has changed recently. Through the last month, gold has put on 8.3% (+55.9), while the dollar index has actually added .03% (basically flat).

I believe the Chair has shown in the past that relying on these inter-market relationships will lead to a diet of two-minute noodles. It looks like another one, at least for the moment, joins the graveyard.

Feb

11

“There Is Beauty In The Lashing Of The Tail,” by Victor Niederhoffer

February 11, 2007 | Leave a Comment

The market's decline of 1% on Friday, from March Futures of 1456.8 which was a 6½ year high in the S&P Index, was beautiful on many different levels.

The market's decline of 1% on Friday, from March Futures of 1456.8 which was a 6½ year high in the S&P Index, was beautiful on many different levels.

There was the beauty of covering 31 points on a one box continuation, one box reversal point, and figure basis, versus an average of 10 the previous five days, the startling move after the narrowest five non-holidays in history.

There was the beauty of two declines in a row to get the reversal boys leaning on the wrong foot. There was the beauty of one of the all-time highs in futures volume with 1.41 million contracts traded, the highest except for the January 25 volume of 1.42 million contracts in three months. There was the beauty of crashing below the key level boys stop points at 1448 where three previous one-day lows hit, the general beauty of a completely unexpected extraordinarily volatile day after such a lull with VIX moving from below 10 the previous Friday to above 11 on February 9, and the beauty of it going down on interest rate woes during the week while bond prices were actually up a half point on the week after setting a one month high on Thursday, February 8.

It brings to mind the Duet from he Mikado:

There is beauty in the bellow of the blast,

There is grandeur in the growling of the gale,

There is eloquent outpouring when the lion is a-roaring,

And the tiger is a-lashing of his tail.

Daily Speculations is very fortunate to have as its cofounder a collaboratrix who in my opinion is the world's greatest lyricist (her lyrics to a number of spec songs appear on Google). I have no doubt that she will put this, as well as the beautiful idea of the market's going down, on Fed Speak, about how vigilant they are about inflation.

Feb

11

Google’s Book Project, from Alston Mabry

February 11, 2007 | Leave a Comment

Just discovering Google's book project. They're scanning in books from various libraries and have an ambitious plan to scan every book ever published (New Yorker article by Toobin).

Just discovering Google's book project. They're scanning in books from various libraries and have an ambitious plan to scan every book ever published (New Yorker article by Toobin).

A search for "speculator" brings up these full, searchable texts (among many others):

Arthur Crump: The Theory of Stock Exchange Speculation; London, 1874, John Hill, Jr. (of the Chicago Board of Trade).

Gold Bricks of Speculation; Chicago, 1904, A Study of Speculation and Its Counterfeits, and an exposé of the methods of bucketshop, and "get-rich-quick" swindles.

Harrison H. Brace: The Value of Organized Speculation; New York, 1913. A prize-winning essay from a contest run by Chicago, Columbia, Michigan, NYU, and Harvard, and sponsored by, "…Hart, Schaffner & Marx, of Chicago, who have shown a special interest in trying to draw the attention of American youth to the study of economic and commercial subjects."

Jim Sogi writes:

Thanks to Alston Mabry for pulling this one up. It will surely be a favorite of the Chair.

Thanks to Alston Mabry for pulling this one up. It will surely be a favorite of the Chair.

Arthur Crump appears to talk about the English markets, but the lessons are the same. Crump charges out of the gate with some great formulas for risk, such as, "…the sum risked must be only such proportion of the possible gain as the mathematical probability of gaining it is of unity." This is brilliant. "A man should not hazard his all on any terms."

Imagine this quantitative risk measurement in the 19th century. Closer to current one-day drops he speaks of typical drops of 2-3% a day with very gradual gains, familiar scenario indeed.

Crump identifies the pitfalls that await the unwary.

A typical reason many beginners convince themselves speculation is simple is they say to themselves the market can only go up or down and his chances are at least 50-50. Their mistake is overlooking path dependency in calculating the odds, thinking reversing position might have avoided losses.

"The outsider's stakes are too large a proportion of their means."

"Multiply each gain or loss by the probability of the event on which it depends; compare the total result of the gains with that of the losses. The balance is the average required and is known by the name of mathematical expectation."

It follows from this that the player must be able to stand a number of plays to realize the expectation. Furthermore, the gains must be greater than the expenses.

"Those whose only business it is to be in the stock markets must of course know that the outside public are always dropping their money."

"If a speculator has not learnt the alphabet of recurring intervals, he has not learned the alphabet of his business."

More later, but this is fun and good book in nice quaint old print.

More Crump Quotes from Jim Sogi:

"Any jackass can take a profit, but it requires a devilish clever fellow to cut a loss. After he has once realized the importance of having his accounts open and ready for the periodic haves to carry him in and land his profit, the difficulty is to get him to realize the importance of keeping out while the water weeps back, carrying with it the gray speculators who were not content to take their profits"

Good advise these last few days.

"It is as necessary to the success of his operation that he posses no more regard for the feelings or pockets of other people than a hungry tiger would for him, if he were airing himself unconcernedly in a Bengal jungle. He has a purpose in view, just as a surgeon has when the amputation of a leg has been decided upon."

"Deception in all its form will be found in the armory

of the professional speculator, and the weapons, two-edged, are employed.""Then there is the fatal blunder made by almost every inexperienced speculator, of never being satisfied with a moderate profit. If he buys, and the price rises 1/2, he cannot make up his mind to take it, but must wait for 3/4th. When it has reached that he must have 1 per cent and when that rise has been attained too, he wants another 1/8th to cover the commission. Like a dog in attempting to grasp the shadow of his bone, he loses all."

Feb

11

Characteristics of Successful World Businesses, by Nigel Davies

February 11, 2007 | Leave a Comment

Having returned home from visiting Chessbase in Hamburg yesterday, and having the privilege of being associated with two other successful businesses (Gambit, the World leader in chess book publication plus the Chair's shop), I noticed some similarities that I thought might be worth sharing. Whilst they are reminiscent of one of Jack Aubrey's commands, how many other businesses are there like these, and can it be formulated into an investment strategy? I imagine there are a few software producers and small biotech companies which share these characteristics, but how does one find them for investment purposes?

· Everyone gets on with his job.

· Whilst there are outstanding specialists in

particular fields, there is a certain degree of interchangability between roles.

· There's an absense of office politics and little or no authoritarianism.

· Nobody is counting the hours worked and several people work from home ('Gambit' is entirely virtual).

· The atmosphere is distinctly low key.

Feb

9

Accuracy and Precision, from Gordon Haave

February 9, 2007 | Leave a Comment

Accuracy and precision are conflicting traits in any forecast. Most market forecasters are completely inaccurate, is it because they are trying to be too precise? After all, what kind of forecaster would get paid if he didn't at least try to nail down next year's market return within 5%?

Accuracy and precision are conflicting traits in any forecast. Most market forecasters are completely inaccurate, is it because they are trying to be too precise? After all, what kind of forecaster would get paid if he didn't at least try to nail down next year's market return within 5%?

Perhaps more value can be added by drastically reducing the attempted precision, and so I offer the following:

The market gives 10% per year to those who are willing to freely accept it. This 10% includes big drawdowns such as 2000-2002, and fall 1987.

Therefore, if one could target precision of simply "is there a high chance of a 30% drop in the market", one could add a worthwhile amount of return to the 10% offered by the market.

The P/E ratio is probably the ratio that is most commonly used in inaccurate forecasts, but I give you the following:

I don't know which direction the market is going to go, and I don't know what will happen to corporate earnings.

I do know the following per the graph: Despite the strong bull market since 2003, the PE ratio is exactly where it was at the start of the late 1990's bull market. Combine that with the fact that the Earnings yield on the SPX - the 10 year yield is positive (and it was negative in 2000 and late 1987), we can perhaps safely assume that a negative 30% year is not in the cards, and therefore the expected return on the stock market this year is greater than 10%.

Feb

9

Factoid of the Day, from Sam Humbert

February 9, 2007 | Leave a Comment

From PriorityMagazine.com: "Starbucks spent more money on employee healthcare in 2005 than it did on coffee beans."

From PriorityMagazine.com: "Starbucks spent more money on employee healthcare in 2005 than it did on coffee beans."

Maybe Peter Navarro should write a sequel: "If It's Raining $$$ in Chappaqua, Sell Starbucks."

Feb

9

Depletable Commodities, by Larry Williams

February 9, 2007 | 6 Comments

Perhaps another myth:

Perhaps another myth:

As prices go higher, new materials are used to substitute: fiber optics; plastic for cars rather than iron and steel; etc.

Global warming (if it exists, which I doubt) seems mostly bearish for most agrarian items. This is because it will mean longer growing seasons and production in areas now too cold, hence larger supply.

Reply from George Zachar: