Dec

29

Chance, luck, and ignorance: how to put our uncertainty into numbers

December 29, 2024 | Leave a Comment

Chance, luck, and ignorance: how to put our uncertainty into numbers - David Spiegelhalter, Oxford Mathematics

We all have to live with uncertainty. We attribute good and bad events as ‘due to chance’, label people as ‘lucky’, and (sometimes) admit our ignorance. In this Oxford Mathematics Public Lecture David shows how to use the theory of probability to take apart all these ideas, and demonstrate how you can put numbers on your ignorance, and then measure how good those numbers are.

Coffee cup he got from MI5 showing verbal-numerical scale they use.

Also: The Art of Statistics

William Huggins offers:

i like to give this guide to my students for whom English is a 2nd/3rd (sometimes 4th+ language).

Kim Zussman is unimpressed:

David Spiegelhalter was Cambridge University's first Winton Professor of the Public Understanding of Risk.

Translation: He is the most qualified of the vast array of those who don't know WTF they are talking about, but are knighted to tell us.

Peter Grieve responds:

I heard a story a decade ago about one of the big decision theorists, I think it was a Harvard professor. He was offered a position somewhere else, and was agonizing about whether to accept it. A colleague suggested he use his decision theory, and he said "Come on! This is serious!" I've no idea about the veracity of the story, or who was involved.

Alex Castaldo clarifies:

You are talking about Howard Raiffa. The story was told by another professor, although apparently Raiffa later denied that he had said it.

Dec

20

On your last leg, from Kim Zussman

December 20, 2024 | Leave a Comment

How Old Are You? Stand on One Leg and I'll Tell You

I’m always interested in ways to quantify how my body is aging, independent of how many birthdays I have passed. And, according to a new study, there’s actually a really easy way to do this: Just stand on one leg.

Pamela Van Giessen writes:

I slipped on black ice a few years ago and broke my wrist. It was awful and I exclaimed that I would do everything possible to avoid that happening again. I have never had great balance to begin with. I started doing lots of planks. Minor improvement. This year I started running and walking backwards for ~10 mins/day (and I increased the planks to 4 mins). I have been doing this at least 5 days/week since January. I also do about 3 mins/day (7 days/week) sideways leg lifts (one leg at a time and then alternating) with my eyes closed.

HUGE improvement. On recent hikes I was able to rock hop over creeks without my usual falling on my rear and walked several round tree trunks over creeks (like a balance beam) successfully. Two yrs ago I would have had to scootch over those tree trunks on my butt.

Falls are one of the leading causes of mortality as we age because when people fall and hurt themselves it takes longer to recover and they get really nervous about it happening again so they become more sedentary. Peter Attia spends a lot of time discussing this in his book and podcast.

Larry Williams offers:

I had this in my February letter:

We are all aware of how dangerous falls can be for older people. I did not realize it was this dangerous; “The mortality rate for falls increases dramatically with age in both sexes and in all racial and ethnic groups, with falls accounting for 70 percent of accidental deaths in persons 75 years of age and older.” Am Fam Physician.

Most say older people fall because they lose their balance, surely that is part of it. But, there’s another part you can start working on now that costs nothing.

When you start to lose your balance, your body immediately corrects it with how you are standing. Weak ankles, as I see it, are the problem. I first realized this when training for the Sr Olympics. Faster sprinters have stronger ankles. Weak ankles mean you can’t “catch yourself” as you start to fall. To strengthen your ankles, walk barefoot. Walk on your toes, then walk on your heels (careful) to build up these muscles and protect you from falling. Lots of YouTube videos on this as well. Strong people fall less. Muscle loss and ankle strength will keep you upright.

A good exercise is to rock back on your heels, may want to hold on to something, to develop balance and strength

Andrew Moe adds:

Walking backwards uphill, dragging a big weight sled backwards and doing squats on an incline board are all favorites of the Knees Over Toes guy. He's an innovator who believes in building strength from the ground up. Also combines strength and flexibility. Worked for me and is now part of my regular exercise.

Dec

12

Positively aging, from Kim Zussman

December 12, 2024 | Leave a Comment

Want to Live a Long and Fulfilling Life? Change How You Think About Getting Old

Research consistently shows our attitudes and beliefs influence our health and longevity.

Data is mounting, much of it from research by Yale epidemiologist Becca Levy, about the impact our attitudes and beliefs have on our health and longevity. Levy’s interest in the connection began in the 1990s, when she traveled to Japan to try to understand why the Japanese had the longest lifespan in the world. She was familiar with explanations that attributed this longevity to diet—Japanese people consume less meat, dairy products, sugar and potatoes than other wealthy countries. But what stood out to her was how the culture respected and celebrated older people.

“It struck me as very different to what I had observed in the U.S.,” she told me. “So I began to wonder if these positive age beliefs could contribute to the longer lifespan in Japan.”

Nils Poertner writes:

Psychology plays a huge role here - eg. excessive nostalgia means one does not appreciate the moment - in my view it is also linked to far-sightedness (went farsighted at the age of 15! which is rare and then recovered). there is somewhat a placebo in life - and the joke is on us really.

Big Al comments:

There are maybe complicated issues around causality, e.g., do people with a positive attitude live longer and better, or do people with underlying factors that promote health and longevity tend to have a positive attitude? But I will stipulate that we might as well try it. Which leads to the issue of people feeling like they have failed if they *don't* have a positive attitude. Perhaps as a way of avoiding this pitfall, we could be given information on how to *practice* a positive attitude. Then, over time and with practice, we might see a benefit.

Nov

25

From the archives: How To Become a Professional Con Artist

November 25, 2024 | Leave a Comment

Book Review: How To Become a Professional Con Artist

3/25/2005

Dennis Marlock opens his "How To" book with a testimonial:

As a law professor, I have read countless books, articles, and dissertations on fraud and deception. This, however, is the first time I have elected to endorse any author's work. The book is indeed an academic gem worthy of inclusion in university curriculums throughout the nation.

The beautiful thing about the professor's testimonial and the related, "I first bought the book hoping to discover why a cop would tell people how to commit fraud. Having read the book, I must now ask why he didn't write it sooner" is that they were both short cons written by the author.

The book lacks the scholarship, timelessness, humor and general principles of David Maurer's classic The Big Con, which I would recommend as one of the seven best books for market practitioners right after Ben Green's Horse Trading. Nevertheless, it is replete with cons and techniques we are exposed to in our day-to-day work in the market. The most relevant topic is chapter 4, "Tools of the Trade," which lists such essentials as "How to Talk Without Saying Anything." An example of this would be market talk such as "1040 is a key level." Yes, if it turns at that level and goes up it was key, and if it hits that level and goes below, why that proves that it didn't hold. A variant of this is the "the market is good as long as stays in the 1025-1075 range."

An important sub-technique is to "use abstract and otherwise equivocal and meaningless rhetoric." I have already written about this, and California Phil's precis of the earthquake "professor" is a classic here. But the market confidence man in general does always frame his thoughts in ways that cannot be disproved or refuted.

One loves the discussions of power laws in this context, as there's no way to differentiate a normal distribution from a power law with any degree of confidence for any samples involving 750 observations or less, and by then the situation has changed so much that one can always rely on Oct 19, 1987.

One must always appear confident as a confidence man and "I am completely confident that you will be totally satisfied with this necklace" is a phrase that the confidence man uses often. This is even more effective when you receive this assurance from a friend of the confidence man. I recently read an interview about a large man who has lost billions of dollars for his investors in publicly reported funds, yet the interviewer refers to the millions he has made the 30% a year internal rates of return, and the nine-figure amount that his followers made applying the techniques that the large man proudly boasts he took the lions share of , and the amazing returns he himself is making at the very present time, despite the difficulties he apparently has in making money for customers.

One of my favorite passages in "How to Become a Professional Con Artist" is the depiction of the big businessman as the ideal mark. "They're cows waiting to be milked," Marlock writes. "They are in abundance, they don't complain when being milked, they provide useful products, and they are used and abused by almost everyone. They are abused daily by employees, lawyers, stockholders, customers, suppliers, lenders, accountants, partners, tax collectors, and competitors. except for the stiff competition, bus schemes are the easiest, safest, and most profitable.

Nov

14

Crypto and the money supply, from Bill Rafter

November 14, 2024 | Leave a Comment

Should the market cap of crypto currencies be included in money supply for macroeconomic purposes?

William Huggins replies:

I'd you cant use it to pay taxes it doesn't count (just another asset, like a stamp).

Kim Zussman asks:

Why not? They add because if you pay taxes with fiat you can buy merch with crypto.

William Huggins responds:

you can barter wine or chocolate for a ton of things online too but we don't count those either. if money is "anything taken as payment" then we have to get very serious about "degrees of moneyness" (hence m0,m1,etc). in that spectrum, its pretty clear that the only things on the list are legal tender so unless you live in the land of bukele, it doesn't count (also, whose money supply does crypto count as exactly?)

Peter Penha:

I will volunteer that there is no moneyness to crypto as it was determined a 100% haircut asset by the DTC.

I think this leaves Blackrock and other crypto ETF managers in the interesting position that they cannot include crypto ETFs in one of their asset allocation funds or a target date fund, etc - inclusion would pollute.

Crypto in the USA appears to be a walled garden - the only contagion I can see to the financial world would be to holders of Micro Strategy Convertible Debt.

Stefan Jovanovich writes:

The question you all are raising here has a history - how far can "the law" go to monetize promises to pay? Originally, the answer was not one step. The Constitution says that legal tender can only be Coin. Article I, Section 8.

The lawyers have been working around that limitation ever since. Their greatest difficulty has been getting around the literalist non-lawyer Presidents who keep following the actual instructions the People established by vote as "the law".

Success came with the Aldrich-Vreeland Act which authorized banks with Federal charters to form "currency associations". Those were given authority to issue emergency currency could be backed by securities other than U.S. bonds, including commercial paper, state and local bonds, and other miscellaneous securities.

Section 18 of the Act: "The Secretary of the Treasury may, in his discretion, extend from time to time the benefits of this Act to all qualified State banks and trust companies, which have joined the Federal reserve system, or which may contract to join within fifteen days after the passage of this Act: Provided, That such State banks and trust companies shall be subject to the same regulations and restrictions as are national banks under this Act: And provided further, That the circulating notes issued under this Act shall be lawful money and a legal tender in payment of all debts, public and private, within the United States."

Everything since 1908 has been a variation on that theme - "lawful money" can be whatever Congress says it is.

Bill Rafter comments:

I started this question because I am working on a slight variation of digitally quantifying inflation. With the loose definition of inflation being “too much money chasing too few goods”, then the “money” part should include all that can conceivably buy the “goods”. Since one can increasingly buy a whole lot of stuff with crypto, then crypto deserves inclusion. If one were to fast-forward to a time of massive currency instability (this is just a thought experiment), having included the cryptocurrency might have facilitated greater forecasting.

Stefan Jovanovich adds:

For me the paradox of Bitcoin is that it has been a spectacularly successful asset - like a share of Berkshire Hathaway stock bought in the days before Buffett even went public - but it has never been a money. If I had Bill's brain and cleverness, I would try to include in the calculations the sum of personal and corporate credit that the lenders cannot easily pull away from the table (the potential moneyness supply) and the amount of credit actually used; and then seek the correlations to the fluctuations in that spread. In the days before central banking, speculators watched the net supply of commercial paper as such an indicator.

Oct

31

US National Debt possible consequences & hedges, from Asindu Drileba

October 31, 2024 | Leave a Comment

There is a lot of talk about how precarious US Debt situation is. Two questions:

1. What possible disaster may come out of this? I am thinking Zimbabwe type hyper inflation. What other kind of disaster can happen?

2. What can retail level people do to protect themselves from this? Buy Swiss Francs? Gold & Silver? Bitcoin? What?

Larry Williams responds:

Gloom and doomers here is the chart to look at:

Bud Conrad writes:

Gold 1 year is up 24%. Silver 1 year is up 50%. The circumstances today are still very bad for the dollar. (Which is what is actually declining.)

The BRICS+ are meeting in Russia tomorrow Putin, Xi, Modi, Iran, Saudi Arabia (observer only), UAE etc.) to continue de-dollarization with non-dollar-denominated trade through non-SWIFT transactions for international Central Bank settlement. NO body is talking about this, being focused on how much the candidates will print up to bribe us for votes. The $1.1 T for interest on the $35 T of official Government Debt could rise, as the 10 year Treasury rate hit 4.2% while the Fed CUT short-term rate. Including unfunded liabilities for Social Security and Medicare would say the debt obligations are more like $200 T.

This is 10 year Treasury. Red pointer is when Fed Cut short term rate:

There is no way around avoiding the money printing required. Inflation and price rises are inevitable, as foreigners divest their $8 T of Treasury holdings, to avoid US asserting sanctions or seizing assets like the $300B of Russia holdings. They want out of US Hegemony fast, because of 14 rounds of sanctions on Russia.

Oct

24

Spec variety pack

October 24, 2024 | Leave a Comment

Hernan Avella provides a quick book review:

The Biggest Bluff is a decent book, light enough to enjoy in audiobook format. The book follows a simple narrative, weaving decision theory and cognitive biases into the context of the author’s journey learning poker while being mentored by one of the best ever. There are many useful nuggets for the discretionary trader throughout. In today’s markets, where speed and computational power are abundant—much like the solver and GTO approach in poker—the wisdom of the great Eric Seidel can be distilled as follows:

• Focus and pay attention

• Emphasize the decision-making process, iterate, and improve upon it—don’t obsess over results.

• Don’t complain about bad beats; take randomness stoically.

• There’s always something to learn, and always be humble.

David Lillienfeld on GLP-1s and Alzheimer's:

It's rare that one can say much that's definitive about Alzheimer's–other than that we don't know much. However, it seems there's some reason for hope coming from the GLP-1:

Ozempic predecessor suggests potential for GLP-1 drugs in Alzheimer’s in early trial

A small clinical trial suggests that drugs like Ozempic could potentially be used not just for diabetes and weight loss but to protect the brain, slowing the rate at which people with Alzheimer’s disease lose their ability to think clearly, remember things and perform daily activities. The results need to be borne out in larger trials, which are already underway, before the medicines could receive approval for the disease.

Kim Zussman on happiness, money, and "olfactory enrichment":

The Price of Happiness

What is the shape of the relationship between money and happiness, and what are its implications?

People typically think about money in raw units such as dollars. Yet research on money and happiness typically examines the association between happiness and the logarithm of income, or Log(income). This logarithmic association between income and happiness is frequently either overlooked or misunderstood. To help address this, the present report examines this association and makes five key points….

Conclusion: Minimal olfactory enrichment administered at night produces improvements in both cognitive and neural functioning. Thus, olfactory enrichment may provide an effective and low-effort pathway to improved brain health.

Oct

19

Basic counting, applied to the healthcare system, from Big Al

October 19, 2024 | Leave a Comment

In 1973, when John Wennberg published his first journal article on unwarranted variations in the delivery of healthcare, he was largely ignored. But over the past 40 years, Wennberg—the founder of the Dartmouth Atlas Project and the Peggy Y. Thomson Professor Emeritus in the Evaluative Clinical Sciences at Geisel—has helped to change the way physicians and patients approach medical decision making and shaped efforts to reform the nation's health-care system.

Over the course of two days at Dartmouth, Jack and his colleagues laid out the content of their work—leaving me to sort out its revolutionary implications. Elliott Fisher, David Goodman, and H. Gilbert Welch, all physicians, showed me data suggesting that in regions of the country and at individual hospitals that delivered the most medical services—as measured by days in the hospital, tests, procedures, and visits from multiple specialists—patients did not, on average, live longer. It also did not appear that regions whose patients were the sickest on average—and therefore potentially most in need of more treatment—were the ones where the most care was delivered. Jack and the others went on to show me that many patients were unwittingly getting elective surgeries (including cardiac bypass, mastectomy, and prostate surgery) that could cause side effects that patients did not know about or fully understand, raising the question of whether they would have wanted the surgeries had the pros and cons been explained to them in a way they could grasp.

Tracking Medicine: A Researcher's Quest to Understand Health Care, by John E. Wennberg.

Kim Zussman adds:

There are financial incentives to do procedures (both for drs and hospitals), creating moral hazard. I.e., it is more likely for an interventional cardiologist to recommend an angiogram than it is for a non-interventional to do so. Note the income difference in the table. Click on the image for full view or go to the article:

Cardiology salaries on the rise, how does yours compare?

According to Modern Healthcare’s 2017-2018 By the Numbers report, most physician specialties have seen an increase in average salary since 2015-2016. Interventional and non-invasive cardiology are no exception.

Oct

10

Red state:blue state / In state:out state, from Kim Zussman

October 10, 2024 | Leave a Comment

Discussions on Florida prompted another look at domestic migration (one state to another, from 2020-2023) by presidential vote in the 2020 election. Using Wiki data on net migration and 2020 results*, here is a table of the top and bottom 10 in-migration states, on a per-capita basis, with voting colors**.

6/10 top in-migration states were Red, but only 2/10 top out-migration states were Red. Also of note is the out-migration raw numbers for CA and NY.

* List of U.S. states and territories by net migration

** Red = Trump, Blue = Biden, lighter colors were close to tied.

Oct

7

What some Specs are keeping an eye on

October 7, 2024 | Leave a Comment

From Carder Dimitroff:

Note: 1 GW = about 1 nuclear power plant.

US DOE/EIA: Batteries are a fast-growing secondary electricity source for the grid.

Utility-scale battery energy storage systems have been growing quickly as a source of electric power capacity in the United States in recent years. In the first seven months of 2024, operators added 5 gigawatts (GW) of capacity to the U.S. electric power grid, according to data in our July 2024 electric generator inventory. In 2010, only 4 megawatts (MW) of utility-scale battery energy storage was added in the United States. In July 2024, more than 20.7 GW of battery energy storage capacity was available in the United States.

From Kim Zussman:

Argentina Scrapped Its Rent Controls. Now the Market Is Thriving.

For years, Argentina imposed one of the world’s strictest rent-control laws. It was meant to keep homes such as the stately belle epoque apartments of Buenos Aires affordable, but instead, officials here say, rents soared.

Now, the country’s new president, Javier Milei, has scrapped the rental law, along with most government price controls, in a fiscal experiment that he is conducting to revive South America’s second-biggest economy.

The result: The Argentine capital is undergoing a rental-market boom. Landlords are rushing to put their properties back on the market, with Buenos Aires rental supplies increasing by over 170%. While rents are still up in nominal terms, many renters are getting better deals than ever, with a 40% decline in the real price of rental properties when adjusted for inflation since last October, said Federico González Rouco, an economist at Buenos Aires-based Empiria Consultores.

From Asindu Drileba:

Charles Piller and the team here at Science dropped a big story yesterday morning, and if you haven't read it yet, you should. It's about Eliezer Masliah, who since 2016 has been the head of the Division of Neuroscience in the National Institute on Aging (NIA), and whose scientific publication record over at least the past 25 years shows multiple, widespread, blatant instances of fraud. There it is in about as few words as possible.

It turns out that alot of FDA drug approvals where based on this guy's research (a few listed in the article). I wonder what effect it may have on pharmaceutical businesses based off his research. Imagine spending decades & billions on a drug whose prior research turn's out to be completely forged (photoshopped images). This looks really bad for the Alzheimer's drug focused pharmaceutical industry.

From David Lillienfeld:

This is a comparison of international drug prices. U.S. gross prices are higher than those in comparison countries for all drugs and for brand-name originator drugs but lower for unbranded generic drugs.

Oct

5

Larry Williams comments:

Yield curve is very bullish at this time - it is so misunderstood.

Peter Ringel does some counting:

I found a FED Cut gives some bear pressure on SPY 5, 10 days after. Then it goes into meaningless regarding SPY.

only T+5 , T+10 are probably significant. We just crossed the end of that bearish pressure.

T+1 10000 reshuffled - Observed difference: -0.03, Bootstrap p-value: 0.8573

T+5 10000 reshuffled - Observed difference: -0.96, Bootstrap p-value: 0.0206

T+10 10000 reshuffled - Observed difference: -1.13, Bootstrap p-value: 0.0514

T+20 10000 reshuffled - Observed difference: -0.88, Bootstrap p-value: 0.2829

(a work in progress)

Oct

2

Maybe G*d plays dice after all, from Kim Zussman

October 2, 2024 | Leave a Comment

Anyone else sick of the idea that gamblers are best at financial markets? Why aren't the champion players the richest in the world? Would you hire a gambler to manage your life savings? Don't gamblers (Livermore, etc) die broke?

Why This Wall Street Firm Wants Its Traders to Play Poker

Young traders who join the trading giant Susquehanna International spend at least 100 hours playing cards during a 10-week training program. When the stock market closes at 4 p.m., they often head straight from the trading floor to a dedicated poker room at the firm’s headquarters in the Philadelphia suburbs.

Jeff Yass, Susquehanna’s co-founder, sometimes joins in, scrutinizing hands new hires play and gauging how effectively they bluff. Thousands of employees, from traders to technologists, participate in the firm’s annual poker tournament. At least three have notched wins at the World Series of Poker in Las Vegas.

Big Al offers:

Peter Ringel writes:

I agree to all the points from the trading side. I know the basics of poker, but not a skilled player. Not even a novice. It makes sense to use the filter "skilled poker player" for manager selection. But how to become a skilled player ? Is it easier to become skilled in poker vs a skilled trader? I suspect it is a similar hard battle.

Asindu Drileba comments:

The problem with "skill level" is that they kind of translate differently. Warren Buffet for example is a Bridge addict. (Bridge is also a game of chance like poker) He (Buffet) is definitely an "above average skill player", but nit amongst the top 20 in the world. In investing however, Buffet may be regarded as part of the top 5.

The same goes for other financiers. Sam Altman (top VC in Silicon Valley), Jason Calcanis (Top VC in Silicon Valley), Charlie Munger were probably above average poker players but their edges were stronger in the finance & investing world — but all these attribute poker to their success.

Big Al writes:

1. Poker is very different from other casino games. There is a lot of skill involved, a lot of math (at the higher levels), a deep understanding of game theory (at the very high levels), and there are many more decisions to be made in poker compared to, say, roulette. Most poker pros probably wouldn't call poker "gambling", though some are degen gamblers when they walk away from the poker table.

2. Poker is a lot like the other casino games in that, for most people, the best decision is not to play. Like in markets, where the best decision for most is not to trade but just buy a diversified portfolio and hold it for a long time.

3. But firms like Susquehanna are not advising "most people" and they're not buying and holding SPY. For them, poker is a good way to assess and develop various skills that are relevant to hacking the market and making big bets. Poker is a great laboratory for testing "risk tolerance".

4. The poker "ecosystem" is a lot like the trading market in that there is a need to keep getting new suckers to enter at the bottom level and convince them they can win.

Aug

29

Speaking of efficient buildings, from Kim Zussman

August 29, 2024 | Leave a Comment

How Big Data Centers Are Slowing the Shift to Clean Energy

In Virginia’s data-center alley, rising power demand means more fossil fuels

An explosion of so-called hyperscale data centers in places such as Northern Virginia has upended plans by electric utilities to cut the use of fossil fuels. In some areas, that means burning coal for longer than planned.

These giant data centers will provide computing power needed for artificial intelligence. They are setting off a four-way battle among electric utilities trying to keep the lights on, tech companies that like to tout their climate credentials, consumers angry at rising electricity prices and regulators overseeing investments in the grid and trying to turn it green.

Ground zero for the fight is Northern Virginia’s “Data Center Alley.” About 70% of global internet traffic passes through the area’s data centers. A spider web of power lines connecting data centers to the grid crisscross neighborhoods and parks. More are coming.

Henry Gifford provides some analysis:

There are about three laws of thermodynamics, the first says that energy cannot be destroyed or created.

I’ve seen photos of data centers that allegedly use huge amounts of electricity. If that is true, all that energy enters the building as electricity and somehow has to leave as heat. I saw one photo of part of a building that looked like it had cooling equipment, but mostly I just see ominous looking buildings – maybe the photos are darkened in photoshop. If the building does not have a huge cooling system, such as a large row of large cooling towers – those machines on the roof that evaporate water, putting off a cloud of visible water droplets – or some other large cooling system - then either they don’t use much energy or the buildings are cooled by politics or magic or etc.

No, they can’t use geothermal cooling systems, those systems that put the heat into the soil under the building, because very soon that soil would heat up, rendering the cooling system inoperable. That works for a single-family house, especially if they take heat back out of the ground to heat the building during the winter, but a large building that dumps heat into the ground all year long? No, it doesn’t work.

Yes, liquid cooling is part of the picture; the liquid takes the heat from the computers, then the liquid gets pumped to something to cool the liquid. Cooling towers are a common way to cool the liquid - this is how office buildings are usually cooled. Geothermal uses the ground as a heat sink to cool the liquid. The heat goes from the computers to the liquid and then to someplace else.

Given the enormous amounts of electricity data centers are typically described as using, the someplace the heat goes cannot be very small - that something must be large.

Aug

23

Counting is one thing, statistics is another, from Carder Dimitroff

August 23, 2024 | Leave a Comment

Today, the U.S. Energy Information Administration (EIA) is counting how many power plants were added in the first half of 2024 and projecting how many will be added in the last half.

It's all wonderful news. About 20.2 GW (the equivalent of about 18 nuclear power plants) were added. By the end of the year, EIA expects about 62 GW of new capacity. About 95 percent of these additions are intermittent sources (wind, solar, batteries).

Offsetting this new capacity are retirements. Utilities plan to retire 7.6 GW, all of which use coal, natural gas, and petroleum as fuel. They are likely being retired because they are uneconomic and rarely dispatched. Their levelized costs exceed revenues, and investors want to tidy up their books.

Statistics unearth a problem that counting hides. The problem is not on the supply side; it's on the demand side. Specifically, counting 24/7 demand reveals tremendous growth (e.g., baseload). It appears there's a hidden mismatch between supply and demand. While there will be hours on most days when the grid is flooded with cheap power, there will also be hours on other days when there will not be enough supply to serve all loads.

Retail prices will jump. In fact, they already have. PJM is the Regional Transmission Organization (RTO) that manages bulk power markets for the mid-Atlantic region. It's one of the largest of the nation's ten RTOs. In addition to transmission line responsibilities, PJM manages energy and capacity auctions for power plant production.

PJM conducts an auction for capacity each year. Power plant asset owners may enter the auction and offer their prices. Owners are paid a daily rate for each megawatt if their bids clear. Auction results:

2024/2025

$28.92 / MW-day

2025/2026

$269.92 / MW-day

Next year, a 1,000 MW power plant can earn $269,920 daily compared to $28,920 this year. These payments are in addition to any revenues earned from energy auctions.

While these auctions seem arcane to the average consumer, they will feel it in their pocketbooks—and not just in one part of the country—it's everywhere. All these costs will flow to the consumer, who will have only the choice of paying or reducing consumption.

Two options may become quickly viable. One is to build gas turbines as fast as possible. To attract investors, capacity payments have to be attractive. But starting new projects today may be too late.

The other option is "demand-response," where consumers are enticed to reduce demand for a price. Demand response is in place today but has yet to be aggressively implemented. It appears grid operators like PJM (not the government) will be forced to become aggressive and offer lucrative demand-response programs.

Lastly, those who invest in "behind-the-meter" assets like their own renewable energy sources, including geothermal, will avoid some of these accelerating costs. Those who have already invested will likely experience returns higher than expected.

The roots of this problem germinated decades ago. That is its own story for another time.

Kim Zussman wonders:

XLU?

Big Al observes:

XLU up 25% from Feb low.

Jeffrey Hirsch was there before us:

Our recommendation at the outset of XLU/Utes seasonal bullish March-Oct period.

Humbert H. writes:

Nuclear is clearly the real solution as the current generation of nuclear reactors are pretty much (we hope) not vulnerable to meltdowns. But as the situation stands, battery technology is likely to receive an ever-increasing amount of investment, and also reused old EV batteries will be more and more prevalent as storage banks for solar and wind. Intermittent sources = more and more need for battery capacity.

William Huggins offers:

one possible solution to transmission problems is to use rail-bound batteries.

Aug

21

Creative destruction, primordial edition, from Kim Zussman

August 21, 2024 | Leave a Comment

Financial Statement Analysis with Large Language Models

Chicago Booth Research Paper

Fama-Miller Working Paper

54 Pages Posted: 21 May 2024

Alex Kim, Maximilian Muhn, Valeri V. Nikolaev

University of Chicago Booth School of Business

We investigate whether an LLM can successfully perform financial statement analysis in a way similar to a professional human analyst. We provide standardized and anonymous financial statements to GPT4 and instruct the model to analyze them to determine the direction of future earnings. Even without any narrative or industry-specific information, the LLM outperforms financial analysts in its ability to predict earnings changes. The LLM exhibits a relative advantage over human analysts in situations when the analysts tend to struggle. Furthermore, we find that the prediction accuracy of the LLM is on par with the performance of a narrowly trained state-of-the-art ML model. LLM prediction does not stem from its training memory. Instead, we find that the LLM generates useful narrative insights about a company's future performance. Lastly, our trading strategies based on GPT's predictions yield a higher Sharpe ratio and alphas than strategies based on other models. Taken together, our results suggest that LLMs may take a central role in decision-making.

Aug

17

Index of stocks nixed from indexes, from Kim Zussman

August 17, 2024 | Leave a Comment

Wall Street’s Trash Contains Buried Treasure

Investors buying index-fund castoffs could have made 74 times their money since 1991

Rebound relationships are best avoided, but maybe not in the stock market.

In a paper that starts out by stating that “no one enjoys getting dumped,” two investing quants reveal some surprising, and potentially lucrative, traits of companies that have really let themselves go. With about half of the money invested in American stocks now sitting in index funds, and many active managers holding portfolios that resemble them — just try beating the market these days without “Magnificent 7” stocks such as Nvidia or Microsoft — index castoffs have a hard time meeting someone new.

That is when investors should pounce, says Rob Arnott, chairman of advisory firm Research Affiliates, with colleague Forrest Henslee. This week they are unveiling a stock index named NIXT that would have earned investors about 74 times their money since 1991 by buying stocks kicked out of indexes.

Big Al links:

The Disappearing Index Effect

Robin Greenwood & Marco Sammon, Harvard Business School

Revised, November 2023

The abnormal return associated with a stock being added to the S&P 500 has fallen from an average of 7.4% in the 1990s to 0.3% over the past decade. This has occurred despite a significant increase in the share of stock market assets linked to the index. A similar pattern has occurred for index deletions, with large negative abnormal returns during the 1990s, but only 0.1% between 2010 and 2020. We investigate the drivers of this surprising phenomenon and discuss implications for market efficiency. Finally, we document a similar decline in the index effect among other families of indices.

Aug

10

Grip strength, chair rise-time, one-legged balance predict life expectancy, Kim Zussman

August 10, 2024 | Leave a Comment

Physical capability in mid-life and survival over 13 years of follow-up: British birth cohort study

Grip strength was measured isometrically with an electronic handgrip dynamometer. The dynamometers were calibrated at the start of testing by using a back-loading rig and are accurate, linear, and stable to within 0.5 kg. The retest variability within individual participants for maximal voluntary tests of strength in those unused to such measurements is about 9%. Two values were recorded for each hand and the highest used in analyses. Chair rise time was measured with a stopwatch as the time taken to rise from a sitting to a standing position with straight back and legs and then to sit down again 10 complete times as fast as possible. For high scores to indicate good performance, we calculated chair rise speed by dividing the number of rises (that is, 10) by the time taken to complete 10 rises (in minutes). Standing balance time was measured, using a stopwatch, as the longest time, up to a maximum of 30 seconds, participants could maintain a one-legged stance in a standard position with their eyes closed.

Big Al lists:

I've been doing balance exercises with a stopwatch, but mostly eyes-open. With eyes closed, I've only gotten up to 12 seconds.

Humbert H. comments:

It seems the article deliberately stayed away from remedies. It noted that certain things (most of which I have seen before in similar contexts, so this isn't entirely new) are associated with increased mortality. Exercise is universally recognized as positive, but there wasn't even a hint that doing anything specific about any of the indicators reduces mortality. Causation and what to do about any of these need a lot more research, it seems.

Big Al responds:

Yes. Causation arrow pointing one way: Eyes-closed balance measures some more complex internal state of health that predicts longevity. Flip the arrow: I practice balance exercises to improve my balance and thus reduce the chance of falling which is a major cause of hospitalization and death in older cohorts.

Humbert H. agrees:

Excellent point, that can be generalized as follows: when you don't understand the root cause of the problem, limiting its negative effects is always the right strategy.

James Goldcamp writes:

The eyes closed one leg stand is exceptionally hard.

I used to measure grip strength and own a hand dynameter. I found grip strength could vary/range as much 145 lbs to 177 lbs in the same month based on rest and recovery state.

Since these are all basically a function of power and strength (standing up and rate), and neurological efficiency (grip/ balance) unilateral leg strengthening (e.g. pistols to a chair of suitable height) and carrying objects (walk around room it yard with a dumbbell or kettlebell within ones level of strength) would be the obvious activities. Another challenge as we age is doing any resistance activity for power (vs strength)since the obvious choices carry injury risk (sprinting, box jumping, Olympic lifts, med ball throwing).

However, I believe its less a matter of training to these qualities than these measurements select for people who have maintained power/strength generally (strength trumps muscle for longevity though they obviously overlap).and are thus less susceptible to falls and things like hip fractures that cascade people downwards. It would be interesting to know how much of the longevity is predicated on fall reduction and or recovery after.

Aug

1

AI wins silver, from Kim Zussman

August 1, 2024 | Leave a Comment

Google DeepMind’s new AI systems can now solve complex math problems

AlphaProof and AlphaGeometry 2 are steps toward building systems that can reason, which could unlock exciting new capabilities.

Google DeepMind says it has trained two specialized AI systems to solve complex math problems involving advanced reasoning. The systems—called AlphaProof and AlphaGeometry 2—worked together to successfully solve four out of six problems from this year’s International Mathematical Olympiad (IMO), a prestigious competition for high school students. They won the equivalent of a silver medal.

To test the systems’ capabilities, Google DeepMind researchers tasked them with solving the six problems given to humans competing in this year’s IMO and proving that the answers were correct. AlphaProof solved two algebra problems and one number theory problem, one of which was the competition’s hardest. AlphaGeometry 2 successfully solved a geometry question, but two questions on combinatorics (an area of math focused on counting and arranging objects) were left unsolved.

Download the 2024 International Mathematical Olympiad problems

Jul

30

Intermittent fasting and your noodle, from Kim Zussman

July 30, 2024 | 1 Comment

Two Diets Linked to Improved Cognition, Slowed Brain Aging

An intermittent fasting (IF) diet and a standard healthy living (HL) diet focused on healthy foods both lead to weight loss, reduced insulin resistance (IR), and slowed brain aging in older overweight adults with IR, new research showed. However, neither diet has an effect on Alzheimer's disease (AD) biomarkers.

Although investigators found both diets were beneficial, some outcomes were more robust with the IF diet.

Larry Williams adds:

A “dry” fast loses weight more than wet fast.

Big Al writes:

Sergei's AI says:

The main difference between dry fasting and wet fasting, also known as water fasting, is whether you consume liquids:

Dry fasting: Restricts both food and liquids, including water, broth, and tea. It can be done as part of intermittent fasting, which cycles between eating and fasting. For example, you might restrict food for 16 hours and eat during an 8-hour window. Wet fasting: Allows you to drink water, and sometimes certain teas.

Dry fasting can be dangerous, especially for long periods of time. Some potential side effects include: Dehydration, Nutrient deficiencies, Urinary problems, Kidney issues, Heat injury, and Swollen or ruptured cells.

Jul

26

Precedent weather-change responses, from Kim Zussman

July 26, 2024 | Leave a Comment

A mass sacrifice of children and camelids at the Huanchaquito-Las Llamas site, Moche Valley, Peru

Here we report the results of excavation and interdisciplinary study of the largest child and camelid sacrifice known from the New World. Stratigraphy, associated artifacts, and radiocarbon dating indicate that it was a single mass killing of more than 140 children and over 200 camelids directed by the Chimú state, c. AD 1450. Preliminary DNA analysis indicates that both boys and girls were chosen for sacrifice. Variability in forms of cranial modification (head shaping) and stable isotope analysis of carbon and nitrogen suggest that the children were a heterogeneous sample drawn from multiple regions and ethnic groups throughout the Chimú state. The Huanchaquito-Las Llamas mass sacrifice opens a new window on a previously unknown sacrificial ritual from fifteenth century northern coastal Peru. While the motivation for such a massive sacrifice is a subject for further research, there is archaeological evidence that it was associated with a climatic event (heavy rainfall and flooding) that could have impacted the economic, political and ideological stability of one of the most powerful states in the New World during the fifteenth century A.D.

Laurel Kenner comments:

In Lessons from History, the Durants write that Peru was a happy socialist state until the arrival of the conquistadors in the 16C.

Bo Keely reports:

Iquitos, Peru at the headwaters of the Amazon Rio is the only of two places I've lived in the past 20 years. The other is here in Slab City. I had a trip planned to Peru this month but got a desert skin infection that the jungle would have ravaged. As such, i've lived in the Peruvian Amazon a half-dozen times for months at a stint, all in the jungle hiking and hitchhiking banana boats. The proposed postponed trip was to hitch the rios again doing magic tricks for the natives in putting together a photo-essay. The Peruvian Amazon is my haunt because the people operate very low on the brainstem. Cannibalism and malaria make them perhaps the greatest evolved and toughest humans on the planet. Put succinctly, if one is invited to dinner make sure the host isn't licking his chops. I'll go back, and escape again with magic.

Asindu Drileba is concerned:

Put succinctly, if one is invited to dinner make sure the host isn't licking his chops. I'll go back, and escape again with magic.

You have unlocked a whole new level to what I consider a set of risks people take. Please don't do that again.

Jul

24

Mega-Tinderbox buy-and-hold, from Kim Zussman

July 24, 2024 | Leave a Comment

‘Greatest Bubble’ Nearing Its Peak, Says Black Swan Manager

Universa’s Mark Spitznagel, who has made billions from past crashes, sees last hurrah for stocks before severe reckoning

Humbert H. asks:

His job is to make money on black swans, not to predict black swans. What kind of black swan is it if it can be predicted?

Asindu Drileba writes:

Black Swans are relative. If you have tail risk protection it means you are aware of tail risk. If you don't have tail risk protection, the notion of a "surprise" when it happens means you encounter a black swan. So Mark may be speaking form the perspective of those that actually don't think they will encounter a black swan.

Humbert H. responds:

Is there anyone who invests in the magnificent seven and NVDA in particular who isn't aware of their elevated valuations, possible bubble formation, and the risk of a major decline? There's some level of obviousness to warning people of this possibility. It's like he is suddenly preaching "past performance is no guarantee of future results" or "correlation does not equal causation". Is he doing this to help humanity? Someone will make more money and someone will make less money if they act on his warning, and there will be bagholders either way, so humanity will not benefit as a whole.

Asindu Drileba adds:

I think for his case, he is just marketing his fund.

Zubin Al Genubi observes:

Cheap Deep OTM puts are up 45% on a 3% decline showing exponential gearing in place from ATH as a directional trade or as a hedge. Surprisingly unidirectional.

Asindu Drileba expands:

His philosophy is more like that of "insurance" for stocks. I think Uncle Roy also has the same philosophy. I remember his describing portfolio protection akin to having fire insurance for your house. To benefit from fire insurance on your house, you don't need to predict when it will burn down. Just make sure you always have coverage for it. So most of the time, percentage wise, your predictions of having a fire are going to be wrong. He mostly advocates that everyone should have "fire insurance" for your portfolio.

To learn more about Mark's strategy:

1) A section called "The Forest In the Pine Cone" inside his book The Dao of Capital

2) His solution to the "narrow framing" problem

3) How he sizes his positions

Nils Poertner comments:

good to be open minded. that said: the more stories (like this one) we can read in mass financial media (FT, WSJ, etc) - the less likely this is going to play out anytime soon. "get the joke"

Humbert H. writes:

I don't think it makes any difference unless "everybody" has the opposite view of the future from what the market is doing. Every single day multiple people prognosticate both doom and gloom and full steam ahead. Since the motivation for this warning is clearly suspect this is white noise. But if his prediction comes true soon which it obviously has a reasonable chance of doing he'll be venerated for decades as the great prophet. This guy is clearly a disciple of Taleb, and they even collaborated in the past. Victor's take would be interesting.

Jun

25

Bendopnea, from Kim Zussman

June 25, 2024 | Leave a Comment

Why This Simple Heart Failure Symptom Is So Easy to Ignore

Patients with decompensated heart failure who have bendopnea on discharge from hospital appear to be at significantly increased risk for all-cause mortality within 2 years, reported investigators.

The research, presented here at the Heart Failure Association of the European Society of Cardiology (HFA-ESC) 2024 and published in the European Journal of Preventive Cardiology, found that across two study cohorts, the risk for all-cause mortality was at least doubled among patients with shortness of breath when bending forward.

"Bendopnea can be assessed through a simple and noninvasive examination," said lead researcher Taisuke Nakade, MD, from the Department of Cardiovascular Biology and Medicine, Juntendo University Graduate School of Medicine in Tokyo, who pointed out that the association with mortality is "independent of other known prognostic factors."

Jun

11

Recession of recession indicator, from Kim Zussman

June 11, 2024 | Leave a Comment

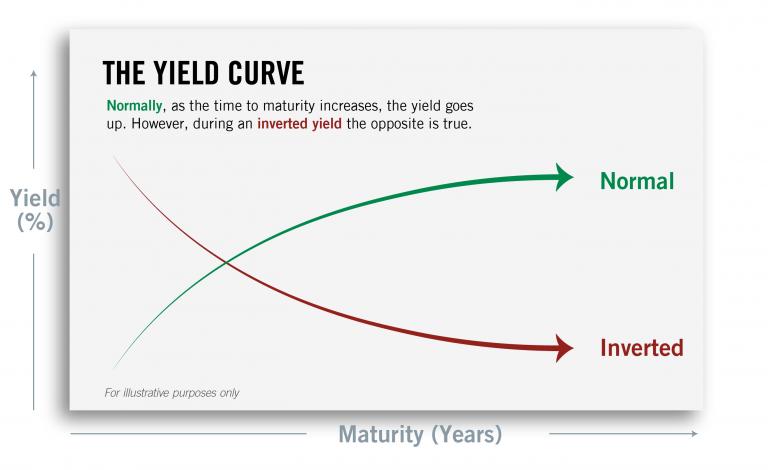

Wall Street’s Favorite Recession Indicator Is in a Slump of Its Own

Treasury yields have been inverted for the longest stretch on record

One of Wall Street’s favorite recession indicators looks broken. An anomaly known as an inverted yield curve, in which yields on short-term Treasurys exceed those of longer-term government debt, has long been taken as a nearly surefire signal that an economic pullback looms. In each of the previous eight U.S. downturns, that has happened before the economy sputtered. There haven’t been any glaring false alarms.

Now, though, that streak is threatened. The yield curve has been inverted for a record stretch—around 400 trading sessions or more by some measures—with no signs of a major slowdown. U.S. employers added a solid 175,000 jobs last month, and economic growth this quarter is expected to pick up from earlier in the year.

Big Al snarks:

If a recession doesn’t materialize soon, it could do lasting damage to the yield curve’s status as a warning system.

I'd hate to have to spend my day thinking up stuff like that.

Larry Williams writes:

A close up study of it shows it has often been way wrong—this is just one more time.

Nils Poertner comments:

As those "indicators" lose their importance, the more ppl (and WSJ and FT in particular!!) talk about it. "get the joke" Lack would have said.

Jeffrey Hirsch responds:

NBER that said 2020 was a recession. Fed started cutting rates in 2019 and the curve inverted then.

The recession lasted two months, which makes it the shortest US recession on record.

It is just a shame bond market traders didn’t tell the rest of us that covid was coming. And what about the 2 back-to-back negative quarters of GDP in Q1&2 of 2022? That looked like a recession as well IMHO.

Big Al adds:

The Fed (from before the GFC) says levels matter, too:

The Yield Curve and Predicting Recessions

Jonathan H. Wright, Federal Reserve Board, Washington DC

February 2006

Abstract:

The slope of the Treasury yield curve has often been cited as a leading economic indicator, with inversion of the curve being thought of as a harbinger of a recession. In this paper, I consider a number of probit models using the yield curve to forecast recessions. Models that use both the level of the federal funds rate and the term spread give better in-sample fit, and better out-of-sample predictive performance, than models with the term spread alone. There is some evidence that controlling for a term premium proxy as well may also help. I discuss the implications of the current shape of the yield curve in the light of these results, and report results of some tests for structural stability and an evaluation of out-of-sample predictive performance.

Jun

1

Demonstration of Non-linear Effects Using Volumes of Cones, Asindu Drileba

June 1, 2024 | Leave a Comment

Numberphile Video demonstrating that a cone that is 80% full in height is actually 50% full in volume. You will also know if your getting scammed in a bar.

Cones are MESSED UP - Numberphile

Zubin Al Genubi writes:

This is why convexity, compounding, and geometric or exponential growth are hard to comprehend.

Kim Zussman comments:

Geometric returns are important when assessing performance. From an investor's perspective, average returns underweight when a manager loses everything (because it is sum-based), but geometric returns don't (because it is a product).

May

19

Apropos worry wall:

- Unprecedented US debt

- Presidential candidates to debate from jail cell vs hospital room

- Democracy in decline

Humbert H. writes:

Sooner or later, everyone is right.

Larry Williams responds:

Bob Prechter would like to hear that!

Steve Ellison adds:

My pinned tweet documents 53 bricks in a 53-year wall of worry. But Venita Van Caspel made the original chart in her 1983 book The Power of Money Dynamics. I just added 40 years of additional worries.

May

16

“Index young man, index!”, from Kim Zussman

May 16, 2024 | Leave a Comment

Wealth Creation in the U.S. Public Stock Markets 1926 to 2019

Hendrik Bessembinder, W.P. Carey School of Business

Last revised: 12 Nov 2020

Date Written: February 13, 2020

Abstract

This report quantifies long-run stock market outcomes in terms of the increases or decreases (relative to a Treasury bill benchmark) in shareholder wealth, when considering the full history of both net cash distributions and capital appreciation. The study includes all of the 26,168 firms with publicly-traded U.S. common stock since 1926. Despite the fact that investments in the majority (57.8%) of stocks led to reduced rather than increased shareholder wealth, U.S. stock market investments on net increased shareholder wealth by $47.4 trillion between 1926 and 2019. Technology firms accounted for the largest share, $9.0 trillion, of the total, but Telecommunications, Energy, and Healthcare/ Pharmaceutical stocks created wealth disproportionate to the numbers of firms in the industries. The degree to which stock market wealth creation is concentrated in a few top-performing firms has increased over time, and was particularly strong during the most recent three years, when five firms accounted for 22% of net wealth creation. These results should be of interest to any long-term investor assessing the relative merits of broad diversification vs. narrow portfolio selection.

May

4

The Doctor Is In. And He’s an Orangutan.

For the first time, researchers have seen a wild animal treat an open wound with a medicinal plant. After getting injured—probably in a brawl with another male—a wild Sumatran orangutan chewed the stems and leaves of a vine humans use to treat wounds and ailments such as dysentery, diabetes and malaria. The orangutan then repeatedly smeared the makeshift salve on an open gash on its cheek until it was fully covered. After the treatment, scientists saw no signs of infection. The wound closed within five days. And it healed within a month.

Jeffrey Hirsch is enthusiastic:

This is awesome! An good friend of mine spent several years in Borneo working with Orangutans under Birute Galdikas’ program. They are super crafty and smart. Don’t doubt this.

Humbert H. writes:

And nobody can explain how they know to do this in these situations. There is obviously a lot of learning apes can acquire from others, but this? There is also no way the current understanding of how genetic information is passed on that can explain this. There is something very mysterious about the mind and animals doing non-obvious things is the best example, this is not a simple biological phenomenon.

Asindu Drileba comments:

One of the things I hear in the AI research community in the pursuit of of AGI (Artificial General Intelligence) is people thinking of intelligence as something hierarchical like height.

In The Singularity is Near Raymond Kurzweil makes a plot of Computers approaching AGI. He puts insects at the bottom and manuals later then humans at the top. You often hear some people say that "We haven't yet reached dog level AI, so we can't say we can reach human level AI soon." That statement makes the assumption that A humans intelligence is more than that of a dog. But it has been reported in some cases a dog's sense of smell can be 100,000 more acute than that of a human being! And not just that it can tell time just by smelling what's around. Another example is also how birds can sense magnetic fields and use them like a compass.

Anyway my point is that just by the (limited) way humans perceive reality we have access to some secrets we can't pass to animals. My suspicion is that animals also have their own secrets that they cannot pass to us.

Humbert H. adds:

They have recently discovered that some insects are self-aware. The test that's used for animals is that they recognize their reflection in the mirror as themselves judging by their reaction. Usually only dolphins, apes, and some corvids (crows) pass the test.

But more importantly, what I meant was that animals seem to "know" how to do things that no current scientific understanding can explain. This means we don't understand basic things about animal (and human) mind. AI is a machine function: an algorithm using some data provides some outputs in response to inputs. A mind is like that too, except we really don't understand the nature of self-awareness, nor do we understand how animals just "know" things. Sometimes they call it "instinct" but there is no real science behind that word. And in this case it's not even that, apes have no "instinct" to cure wounds with specific processed plant material.

Jeff Watson writes:

Here is an interview with cognitive psychologist, Donald Hoffman. Some find him brilliant, some a flake. His ideas are unconventional to say the least, but the questions that come to mind out of his interview will break one’s brain. Many moments in the video, I pause and ask myself how this applies to markets.

Stefan Jovanovich gets philosophical:

The wheel of time turns on the axle of our self-awareness: Transcendentalism.

Apr

25

FTC Announces Rule Banning Noncompetes, from Big Al

April 25, 2024 | Leave a Comment

FTC Announces Rule Banning Noncompetes

Today, the Federal Trade Commission issued a final rule to promote competition by banning noncompetes nationwide, protecting the fundamental freedom of workers to change jobs, increasing innovation, and fostering new business formation.

“Noncompete clauses keep wages low, suppress new ideas, and rob the American economy of dynamism, including from the more than 8,500 new startups that would be created a year once noncompetes are banned,” said FTC Chair Lina M. Khan. “The FTC’s final rule to ban noncompetes will ensure Americans have the freedom to pursue a new job, start a new business, or bring a new idea to market.”

Kim Zussman writes:

This will also help knock down the value of businesses. Mike sells his business to Mary. One week later Mike opens the same kind of business one block away, and contacts all his old customers. How much should Mary pay to buy Mike's business?

H. Humbert comments:

Certainly has more merit than trying to destroy Amazon or preventing Kroger from buying Alberson's, her two other favorite busybody activities. Not a very libertarian thing to do, but noncompetes are often used against many powerless people as a nakedly aggressive move.

The argument she uses is that Silicon Valley where noncompetes are illegal beat out Boston Route 128, and is doing just fine in terms of starting new businesses. Whether it's due to noncompetes or the weather is anybody's guess. The other argument is that noncompetes are used to restrain security guards or sandwich shop workers from getting employment across the street, cases where intellectual property or customer lists are clearly not involved.

Pamela Van Giessen adds:

There is another downside to this. When companies lay off people, especially middle and senior management, they give them attractive parting gifts that are contingent on non-compete agreements. E.g, ABC co lays off senior manager, pays them up to 1 yr salary plus health benefits, etc. but the caveat is that former senior manager doesn’t work for a competitor for x period of time. These workers already have the right to decline the parting gifts if they don’t want to sign the non-compete. Now there is almost no incentive for companies to provide compensation to the people they lay off since they can’t bargain for a non compete. That sucks for employees who can now be laid off with pretty much nothing. I’d say this is a loss for employees and a win for big companies. Thank you to Joe Biden & co.

William Huggins responds:

let's not oversell this - firms seek out non-compete agreements for THEIR benefit, not that of employees. strange that an erosion of their position would somehow strengthen them but war is peace and ignorance strength?

Apr

17

Bits and pieces

April 17, 2024 | Leave a Comment

Zubin Al Genubi on market prices:

Twenty S&P points used to be a good trading day. It still is, but now 50 points is the new normal. Need to recalibrate mentally and recalibrate old systems. It's a dichotomy between points and percentages as the prior Rocky/Vic argument discussed. The higher price has resulted in a stealth increase in leverage. Announcements widen spreads and create great small entry points. The FED speak traders are always wrong and offer great opportunity. Why are they wrong? Bad news is not good news.

I've read that the current market price is always right. I disagree. The market price is set at the margin by a few, maybe several hundred participants with a variety of reasons for transacting. The reasons are often wrong and the price is wrong at that moment. This can be used to advantage either in patterns prospectively, or in the case of liquidity holes on the fly.

Big Al suggests:

Daniel Kahneman on Cutting Through the Noise | Conversations with Tyler

Andre Agassi tennis hack against Boris Becker

Nils Poertner on effortless learning:

When learning a foreign language, we learn the best when being PRESENT and don't fret to get it right all the time. This being right puts a huge amount of unnecessary stress on the student. To some extent it seems the same in trading: we don't need to know everything in advance - far more important is to be PRESENT.

Easan Katir on an old book:

NHK offers a sensitive review of In Praise of Shadows. The book is by Juni'chiro Tanizaki, one of Japan's eminent novelists. Market relevance? One can muse on how much of market activity takes place in the shadows, the dark pools, the anonymous orders whizzing by on level 2… is there a shadowy level 3, 4, 5 where identities are revealed?

Kim Zussman responds:

Relatedly to spec interests, A Taxing Woman, a nice film about Yazuka/tax evasion at Nippon ATH ca late 80s.

Apr

7

Interesting research

April 7, 2024 | Leave a Comment

Kim Zussman is optimistic:

Age and High-Growth Entrepreneurship

Pierre Azoulay, Benjamin F. Jones, J. Daniel Kim, and Javier Miranda

American Economic Review: Insights

Vol. 2, No. 1, March 2020

Abstract

Many observers, and many investors, believe that young people are especially likely to produce the most successful new firms. Integrating administrative data on firms, workers, and owners, we study start-ups systematically in the United States and find that successful entrepreneurs are middle-aged, not young. The mean age at founding for the 1-in-1,000 fastest growing new ventures is 45.0. The findings are similar when considering high-technology sectors, entrepreneurial hubs, and successful firm exits. Prior experience in the specific industry predicts much greater rates of entrepreneurial success. These findings strongly reject common hypotheses that emphasize youth as a key trait of successful entrepreneurs.

Asindu Drileba adds:

This infographic is really good.

Big Al finds value in experience:

Neoclassical Theory Versus Prospect Theory: Evidence from the Marketplace

John A. List

ISSUE DATE June 2003

Abstract

Neoclassical theory postulates that preferences between two goods are independent of the consumer's current entitlements. Several experimental studies have recently provided strong evidence that this basic independence assumption, which is used in most theoretical and applied economic models to assess the operation of markets, is rarely appropriate. These results, which clearly contradict closely held economic doctrines, have led some influential commentators to call for an entirely new economic paradigm to displace conventional neoclassical theory e.g., prospect theory, which invokes psychological effects. This paper pits neoclassical theory against prospect theory by investigating three clean tests of the competing hypotheses. In all three cases, the data, which are drawn from nearly 500 subjects actively participating in a well-functioning marketplace, suggest that prospect theory adequately organizes behavior among inexperienced consumers, whereas consumers with intense market experience behave largely in accordance with neoclassical predictions. The pattern of results indicates that learning primarily occurs on the sell side of the market: agents with intense market experience are more willing to part with their entitlements than lesser-experienced agents.

Apr

2

Unintended (intended) consequences, from Kim Zussman

April 2, 2024 | Leave a Comment

California Restaurants Cut Jobs as Fast-Food Wages Set to Rise

Chains lay off workers, shave hours ahead of state minimum-wage increase

Big Al suggests:

Jacob Vigdor on the Seattle Minimum Wage, Mar 4 2019

Jacob Vigdor of the University of Washington talks with EconTalk host Russ Roberts about the impact of Seattle's minimum wage increases in recent years. Vigdor along with others from the Evans School of Public Policy and Governance have tried to measure the change in employment, hours worked, and wages for low-skilled workers in Seattle. He summarizes those results here arguing that while some workers earned higher wages, some or all of the gains were offset by reductions in hours worked and a reduction in the rate of job creation especially for low-skilled workers.

Mar

30

From The Mind of Bill JamesThe Mind of Bill James by Scott Gray, which I've been reading:

All things in baseball tend to return to their previous form. A team whose record improves one year will tend to decline the following year, and vice versa. In 1980, for example, only five of the twenty-six teams moved in the same direction in which they moved in 1979. It also applies to individual players. Bill found a way to express not merely the statistical principle of regression to the mean, but also what he called the 70/50 rule. Seventy percent of teams that decline in one year will improve the next; 70 percent of teams that improve will decline; and in all cases the amount of rise or fall is about 50 percent, so that a team twenty games over .500 one year would be ten games over .500 the next. (The percentages are much different for very big or very small improvements and declines.) “These were not things that I had expected to find,” Bill wrote. “Weaned on the notion of ‘momentum’ since childhood, I had expected a team which won eighty-three games one year and eighty-seven the next to continue to improve, to move on to ninety; instead, they consistently relapsed. Half-expecting to find that the rich grow richer and the poor grow poorer, I found instead that the rich and the poor converged on a common target at an alarming rate of speed.

It also applies to individual players. Bill found a way to express not merely the statistical principle of regression to the mean, but also what he called the 70/50 rule. Seventy percent of teams that decline in one year will improve the next; 70 percent of teams that improve will decline; and in all cases the amount of rise or fall is about 50.

Steve Ellison writes:

From my experience, I think the S&P 500 is less mean reverting in 1- to 2-week timeframes now than it was in the mid-2010s. On the other hand, the presidential election cycle pattern has been spot on since the beginning of bearish midterm election year 2022.

Eric Lindell comments:

These data pertain to relative performance — eg, a team's record relative to other teams. For absolute gauges — like how much I weigh on a diet, there's no such reversion to mean.

Kim Zussman responds:

Funny stuff! For asset managers everything is relative. For their customers (without yachts), it is absolutely absolute.

Where Are the Customers' Yachts?: or A Good Hard Look at Wall Street

Humbert H. agrees:

And that’s why people should not entrust their assets to asset managers, unless these people suffer from some sort of emotional instability and can’t handle losses without some stranger pretending to care.

Mar

24

An alternate understanding of a market being at all time high (market reaching new prices it has never encountered) is this: "Everyone that has ever bought that stock or instrument is now in profit". What might be the psychological implications of this?

Kim Zussman comments:

It is possible (and probable) to buy, then sell after a decline and stay out only to see it reverse and go up further. This (timing) is one reason it is so much easier to do better with B/H than trading.

Big Al adds:

The other advantage to B&H is that the opportunity cost viz time/attention required is basically zero. I have looked at various index timing approaches and have not found anything that beats B&H, especially when considering the vig and opportunity cost. However, should one need to scratch the itch, timing strategies may work better with individual stocks. But again, opportunity cost.

Humbert H. writes:

I've always been believer in B&H vs. trading. But even in B&H the debate between indexing and individual stock selection never dies. I don't like indexing, but I don't have a mathematical basis for that. It's a fundamental belief that buying things without any regard to their economic value has to fail in time, at least relative to paying some attention to it.

Zubin Al Genubi adds more:

Another aspect of buy and hold that Rocky pointed out is the capital gain tax severely eats into returns. The richest guys hold for years and have only unrealized untaxable gains.

Art Cooper agrees:

There was an excellent article in the Jan 7, 2017 issue of Barron's by Leslie P. Norton on VERY long-lived closed end mutual funds which have surpassed the S&P's performance. They have all followed buy and hold strategies.

Michael Brush offers:

Far more money has been lost by investors in preparing for corrections, or anticipating corrections, than has been lost in the corrections themselves.

- Peter Lynch

Steve Ellison brings up an important point:

And yet trading is one of the focal points of this list. The way I square this circle is to keep most of my trading account in an equity index fund at all times. When I think I have an edge, I make trades using margin.

Larry Williams writes:

B&H is the keys to the kingdom, but…the massive fortunes of Livermore were short term trades despite his comment about sitting on your hands. Even the current high performers, Cohen, Dalio, Tudor etc use market timing. When I won world cup trading $10,000 to $1,100,000, it was all about timing and wild crazy money management. One approach wins big the other wins fast. A point to ponder.

Bill Rafter writes:

What we found in studying only the SPX/SPY is that in the long run a buy-and-hold yielded 9.5 percent compounded annually. That was from 1972 to recent. Our argument is that studies before 1972 are flawed. That 9.5 was great considering there were several collapses of ~50 percent. However if you could just eliminate the collapses you could raise the return to 13.5 percent compounded annually.

Eliminating the down moves did not involve prescience. You did not need to forecast recessions, only identify them when you were in one. That was not difficult, and timing was not a critical as one might think. We identified several algos that worked well.

When you were out of equities, you could either simply hold cash, or go long the 10-year ETF. The bonds were better, but not by much. Interestingly, long term holding of bond ETFs yielded low single-digit returns. Best avoided. Which also means that the Markowitz 60/40 strategy was a sub-performer.

Taxes are investor/vehicle specific. For example, if you use a no-tax vehicle, there are no taxes. Regarding turnover, there are very few transactions, as there are very few recessions. The strategy is basically B&H, but with holidays.

Asindu Drileba has concerns:

My problem with buy & hold Is that it has no risk management strategy. If you bought the S&P 500 in 1929 for example during the wrong month. It took you 25 years i.e until 1954 not even to make profit, but just to break even. The real question is, how do you know your not investing in a market path that will take 25 years just to break even?

Humbert H. responds:

That’s why, dollar cost averaging. I don’t think anyone thinks buy once in your lifetime and never interact with the stock market ever again. I think if you had averaged in monthly or quarterly from the summer 1929 through summer 1959 and then held and lived off dividends or cashed out/interest in retirement, you did well.

Art Cooper adds:

The year 1954 is almost universally given as the "break-even" year to recoup losses for buy & hold investors who bought at the 1929 peak. It's wrong to do so. First, it ignores dividends. Had dividends been re-invested the recovery year would have been much earlier. Second, it ignores the deflation which occurred during the Great Depression. In this column Mark Hulbert argues that someone who invested a lump sum at the 1929 peak would have recovered in real economic terms by late 1936.

I'm not arguing against dollar-cost averaging, merely pointing out a historical falsehood.

Hernan Avella writes:

What people should do while they are young and have human capital left is to leverage!

Life-Cycle Investing and Leverage: Buying Stock on Margin Can Reduce Retirement Risk

The most robust research, incorporating lifecycle patterns and relevant time horizons for long term investors tells us that the optimal allocation is 50/50 all equities, domestic and international. But most ppl don’t have the gumption to be 100% on equities.

Feb

29

A +1 for the inspiring story, from Kim Zussman

February 29, 2024 | Leave a Comment

Nvidia Hits $2 Trillion Valuation on Insatiable AI Chip Demand

The chips are so valuable that they are delivered to the networking company Cisco Systems by armored car, said Fletcher Previn, Cisco’s chief information officer, at The Wall Street Journal’s CIO Network Summit this month.

H. Humbert is skeptical: