Jan

22

The Engineering Rules that Trade, Stefan Jovanovich

January 22, 2026 | Leave a Comment

If a design takes too long to execute, it fails.

Never fall for sunk costs; the current tally does not know what you paid.

Avoid the Optimizing trap: do not develop system for a market that does not actually trade

Leave school early. In classes you come in first by getting the correct answer to every question on the test. In markets the winners ask the right questions and accept the risks that come from being wrong.

Carder Dimitroff writes:

Never fall for sunk costs; the current tally does not know what you paid.

The real story behind commercial nuclear power.

Vic approves:

a sparkling and useful post

Jan

5

Oil, from Cagdas Tuna

January 5, 2026 | Leave a Comment

So where lies the thin line between liberating Venezuela and putting world into oil supply based recession?

Larry Williams comments:

The quality of their crude is a different issue we use to refine it here; sour, full of gravel etc.

Stefan Jovanovich writes:

Historically, before full sanctions in 2019, the US imported over 600,000 barrels per day (bpd) of Venezuelan crude, with refiners like Citgo (PDVSA-owned), Valero, Chevron, and Phillips 66 as top recipients.

More recently (post-2023 relief), Valero accounted for 44% of imports, Chevron 32%, and Phillips 66 10%.

Carder Dimitroff writes:

IMO, it's not about oil. The US is a net exporter. They're doing just fine without Venezuela. If heavy oil is desired for refining optimization, as some claim, there's a direct pipeline from Canada.

Stefan Jovanovich responds:

It would help if Carder focused on the use of heavy oil for marine diesel and bunker oil for steam turbines. Those are the essential propulsion fuels for China's Navy; hence, Hegseth's comment today assuring China that it would continue to receive its share of Venezuela's output.

Carder Dimitroff expands:

Globally, three major regions produce heavy crude: Russia, Canada, and Venezuela. Downstream, “heavy oil” or “heavy fuel oil” usually means the residual, high-boiling product left after lighter fractions (gasoline, diesel, kerosene, etc.) are distilled from crude. As Stefan suggests, heavy oil and bunker oil are growing markets, not only in China but also elsewhere.

In my opinion, the administration's interests in Venezuela reflect several interests. High on my list are Venezuela's untapped rare-earth elements (about 300,000 metric tons).

Pamela Van Giessen offers:

Interesting analysis here:

The Real Reason the Pentagon Approved Venezuela: Critical Minerals and Adversary Expulsion

The Department of War has allocated $7.5 billion under the One Big Beautiful Bill Act specifically for critical minerals, with $1 billion already deployed to stockpile antimony, bismuth, cobalt, indium, scandium, and tantalum. This is not economic policy. This is national security infrastructure. The United States is 100% import reliant for 12 critical minerals and over 50% reliant for 28 of the 50 minerals classified as essential to national security. These materials are not interchangeable. They cannot be substituted. They form the irreducible foundation of modern weapons systems.

Boris Simonder questions the thesis:

What rare earth does Venezuela hold that is proven and confirmed? Based on USGS Mineral Commodity Summaries 2025 and other sources like CSIS reports, Venezuela has no significant cobalt production or reserves listed. Antimony deposits exist but are small and underdeveloped, with declining output due to infrastructure issues.

Jan

4

Natural Gas, from Nils Poertner [Update]

January 4, 2026 | Leave a Comment

European Natural gas - not that far to test 2024 lows, and perhaps even pre-Ukraine-war levels eventually? Peace coming (?) Or general decline in Gas prices (US natty has gone the other direction for a while).

"Price move first - fundamentals later." When something moves (even though I don't trade it - or have expertise in it yet), I often look at it and wonder what it could mean. Mass financial media hasn't picked up on this theme either (much) - another reason to consider what it means…

Carder Dimitroff comments:

For me, this is an important observation. EU-US fundamentals have changed. The current US administration "encouraged" the EU to accept US LNG imports. At the same time, US LNG export capacity has increased. For Europe, the supply-demand dynamics changed. In the next several months, it will continue to change:

• 14.49 Bcfd US LNG export capacity - current.

• 21.81 Bcfd US LNG export capacity - under construction.

• 13.24 Bcfd US LNG export capacity - approved but not under construction.

• 12.49 Bcfd US LNG export capacity - proposed and seeking approval.

Most of this LNG use capacity uses, and will use, Texas/Louisiana natural gas as its feedstock. Feedstock and LNG prices will likely be correlated with Henry Hub prices. If most of this capacity is built, the following trends are likely to emerge:

• US citygate (NG) average prices will float higher.

• US LMP (electric) average prices will float higher.

• US NGL average prices will sink.

• EU NG average NG and LMP prices will stabilize.

More importantly, global LNG markets are changing and will continue to change. Keep in mind:

• Global LNG capacity is expanding

• The US is not the LNG cost leader and never can be.

• As the US dominates EU imports, global markets adjusted accordingly.

Of course, traders should be indifferent about these long-term fundamentals. But long-term investors might consider options.

Stefan Jovanovich asks:

Follow-up question for Carder and others: "What do you think about the Doombird thesis that the Permian drillers and the mid-stream connectors will shift to have natural gas be the hydrocarbon asset that they look to make money from and oil will be the secondary source of income?"

Carder Dimitroff replies:

If the question concerns long-term prospects, global demand for diesel, jet fuel, plastics, and related products is expected to grow. Gasoline consumption may be slowing, but it is not crashing. But who knows where the economy is headed?

For the US, natural gas as a bridging fuel makes sense if it can reach consumers. In the US, domestic delivery is a problem. Globally, LNG delivery is also a problem, but for different reasons. Because they deliver to Henry Hub, producers should be indifferent between the two markets. Beyond Henry, LNG is becoming increasingly accessible, whereas citygates will continue to struggle.

The US is also a net exporter of oil and oil products. Again, the product supports two separate markets.

Most Permian wells produce oil and associated gas (and they are getting gassier). It's not a choice. They get both.

For me, the short-term challenge is global overproduction. Geopolitical considerations rather than economic factors drive the decision to overproduce and erode margins. It will end, and the markets will revert. Until then, it will be difficult for American producers to finance new wells.

Dec

29

A curious case of silver, from Anatoly Veltman

December 29, 2025 | Leave a Comment

So as Silver trades yet another stratospheric (psychological) target, there are a few questions. On commercial side, both Demand and Supply are price-inelastic. Whatever industrial uses are, Silver is hardly substitutable, especially at the time when other metals are just as pricey. And on new Supply side, much Silver gets out of the ground as a by-product from mines not primarily operating as "a Silver mine". So, again, Silver production can't be easily jacked up during Silver's rise.

On non-commercial side, however, it's the opposite. Supply/Demand balance works as it should. $77 (or $100 lol) market would cause Buyers to be abandoning bids; while grandmas might start dusting silverware off and storming pawnshops. Any other considerations?

Peter Penha responds:

Exactly - if you look at the Silver Institute Supply / Demand models it shows we have been in several years of deficits (still in deficit of course this year and next) - Mine supply peaked a decade ago

If you add up all the non industrial uses of silver (Jewelry, Photography+film (Chris Nolan & IMAX), and all silverware) they do not make up the deficit.

So in the Silver Institute model and I am talking 2023 $28 silver price we have some 20% of total ounces that need to be divested every year to maintain supply/demand.

60% of uses are industrial - solar is the future everywhere now….for those missing the US battery trade —> the Biden era tax credits for solar are now Trump credits for solar+batteries & the AI data centers are now going to be Bring Your Own Capacity and storage & connect to the grid.

Read the full post with additional comments.

Dec

23

Low status jobs becoming high status, from Nils Poertner

December 23, 2025 | Leave a Comment

Fascinating to watch how former low status jobs, like cybersecurity, have become high status now. Same is true the other way around as well (eg (male) technician at the London tube system who makes a quarter of his wife who is in real estate - although that is changing now). Wondering what low type jobs / or ppl are on the fringes today will be in high demand in coming years.

Carder Dimitroff responds:

Try these:

Any of the crafts. Specifically, licensed electricians, plumbers, and HVAC techs. Many make more than engineers.

Public response teams. Specifically, firefighters, EMTs, and law enforcement. Many make more than lawyers, particularly when pensions are considered.

Career military. Specifically, for those with 20 years of service. Lifetime benefits are incredible (free college, unlimited grad schools, pensions w/colas, lifetime medical insurance, VA benefits, hiring preferences).

Pamela Van Giessen suggests:

Car mechanics

Henry Gifford writes:

My friend who fixed boilers said to his sophisticated, suit-and-tie, well educated in-laws “I’m not the smartest guy around. I’ve only read two or three books in my life. I don’t think I’m smart enough to come up with a sophisticated investment plan (nods all around the room at this point). So I just buy one piece of New York City real estate each year and hope for the best”. No more nodding at that point.

Guess what blue collar people who don’t have vices do with their money? They buy property. Who is better suited to own real estate? People who fix things and have friends who fix things, or lawyers?

And what nobody mentions is that some people are much better at those sorts of work than others. Simply finding someone to show up and try to do those things is hard. Someone who is good at one of those trades is in even higher demand.

Those fantastic benefits for former military people are not limited to the military – all federal employees get all those benefits after twenty years of work. If someone joins the military at 18, and gets out at 38, or gets out sooner and then works in the post office or etc. until they “get their twenty”, they get full salary with increases for life. Income that will survive any lawsuit, even the IRS can’t take it all. They maybe collect a total of three years of salary for every year worked.

Nils Poertner responds:

Certainly good to encourage young men (or women) to follow a path that interests them - and not just follow a path that is currently "high status". This "Yousef" guy who was my IT guy at Bankers Trust decades ago (low status in my eyes back then) became a cyberpunk in 2008…you get the idea. That said, it is a power game outside. young men need wives etc.

Henry Gifford adds:

I judge the level of a single woman’s interest in me by counting the seconds until she says “what do you do?”.

No woman has ever asked me if I like what I do, or am good at what I do – not important.

Many men have a choice between coming home miserable to a wife, or coming home happy to an empty house. Age old dilemma, no known fix, as all our DNA has evolved to enhance survival, which for a woman over the millennia has meant marrying the chief’s son, or someone else with high status.

Larry Williams recalls:

When I was dating all women ever asked me is your place or mine. Must have been doing something wrong.

Michael Brush is curious:

Do you have a cycle chart for that?

Larry Williams clarifies:

Yes but there are not enough examples to draw a conclusion.

Dec

9

Interesting AI read, from Big Al

December 9, 2025 | Leave a Comment

The Structural Collapse: How Google’s Integrated Stack Is Dismantling the OpenAI Thesis

Shanaka Anslem Perera

Nov 22, 2025

A leaked internal memo reveals the tectonic shift reshaping artificial intelligence, where platform economics are defeating venture-backed innovation at the exact moment markets assumed the opposite.

Carder Dimitroff writes:

My Australian daughter is a Google employee. She recently completed Google's 3-month AI training program in the US. From what I understand, Google's AI capabilities are big. When demonstrated to Google's large-cap clients, they were surprised.

Based on her comments, I've concluded that AI technologies will displace accountants, engineers, lawyers, financial analysts, medical staff, educators, sales, and more.

Obviously, leaders in those disciplines will continue to do well. While most normal positions can be eliminated, there must be a human somewhere in the mix. There's an ongoing need to manage the architecture of the questions and review AI responses. Anyone who wants to remain in the game may wish to develop expertise in leadership, program management, systems management, and communication.

Then again, there will be an ongoing need for the crafts. They will reap while others weep.

Musk is right. Work will become optional. But he was not the first.

Nov

13

The $38 Trillion Question, from Humbert X.

November 13, 2025 | Leave a Comment

The $38 Trillion Question: An Interview with Stanford Professor Hanno Lustig

Hanno Lustig: I started thinking about the valuation of government debt by looking at the valuation of all Treasuries. What do we have to believe to get to a number like $38 trillion? You must believe there will be a huge fiscal correction, because ultimately the value of debt should be backed by future primary government surpluses. When you do the numbers, you realize that either bond investors are pricing in a huge fiscal correction that seems impossible, or Treasuries are significantly overpriced.

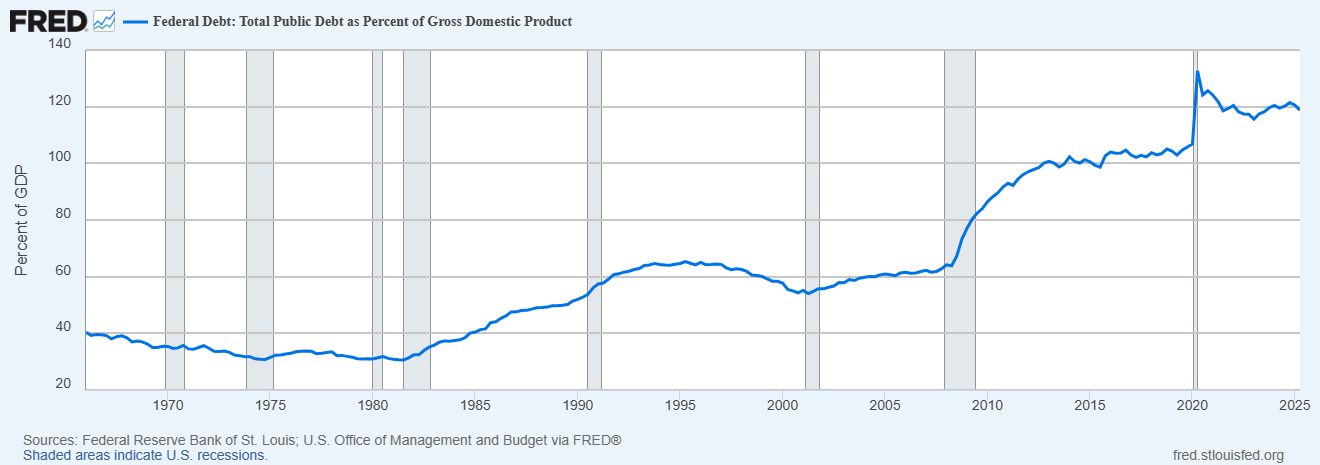

Carder Dimitroff notes:

The interest on debt is approaching $1 trillion per year and continues to compound. Interest costs currently exceed Department of Defense spending.

Larry Williams disagrees:

Meaningless measure look at debt vs gdp

Carder Dimitroff responds:

Yes, that makes sense. However, from a different perspective, it becomes meaningful under the One Beautiful Budget Bill when automatic sequestrations are implemented. Unless new legislation is passed, sequestrations will result in Medicare cuts and other reductions in expenditures. Current projections suggest sequestration will present in early 2026.

Big Al checks with FRED:

Nils Poertner writes:

recession + zero short term rates + lots of QE ….leading to a lot more public debt

maybe that is more likely path.

Stefan Jovanovich offers some history:

This chart shows the solvency ratios that can be found from the Census and other data [by decade 1880 to 2020] - how much "we the people" have in money divided by how much the American governments promise to pay.

Nov

10

Best indicators for inflation, from Asindu Drileba

November 10, 2025 | Leave a Comment

The more goods cost, the more money visa makes since the fees they charge Issuing banks & acquiring banks are based on a percentage basis. So, higher prices (inflation) –> better predicted revenues for Visa? Inspired by a nice documentary on the history of VISA.

I wonder what the best indicator for inflation would be for testing this? CPI? Oil?

Cagdas Tuna writes:

I was thinking as to find a similar indicator for economic slow turn, spending cuts. It came to my mind to follow sales slips. I live in Malta which is a very tech friendly country for spending habits such as Apple/Google Pay availabilities, many digital banks access etc. I often asked if I need a receipt that I usually don’t. It depends for every country but if there is a rule for stores/restaurants to keep at least a copy for each transaction then it might be the indicator to follow. It might be used for inflation as well but of course needs detailed information.

Pamela Van Giessen comments:

To the best of my knowledge, merchants are not required to keep receipts. We track each sale but it will be the credit card processor or platform such as Square that holds the credit card or Apple or Google pay receipts. I can’t imagine that merchants would be willing to share their sales data. I know I wouldn’t.

Visa doesn’t care how much goods cost. They get their nearly 3% processing fee (+ .10 or .15 per transaction) whether there are 20 transactions for $100/ea or 40 transactions for $50/ea. In fact, they make more $ on a higher volume of transactions.

I don’t think tracking Visa or MC, etc could be a meaningful prediction of inflation as all the credit card companies continuously fight for market share. Note that they all send out multiple credit card offers to everyone all the time. Then, you have a store like Costco that only accepts their credit card (Citibank).

Additionally, there are people who use primarily cash. Those $ would be left out. You may say that cash use is low, and maybe it is. What I can tell you is that today at a market 80% of my sales were cash and that was likely the case for all the other merchants at this market. Older people especially use cash a lot. Just like drug dealers.

I have a theory that the cash economy is much bigger than everyone thinks. Insight into that might be more interesting.

Carder Dimitroff responds:

After considering Panela's cash sales point, I remembered that several companies required customers to switch from credit card payments to bank transfers. Additionally, several small establishments offer incentives for customers to pay in cash. They may be attempting to simplify their accounting and tax reporting. I do know that the federal government has immediate access to individual credit card transactions.

Pamela Van Giessen adds:

I thought it was the Fed that used to report on aggregated credit card data.

The other challenge with using credit card financials is that the credit card processors raise their % cut all the time. This is not due to actual inflation; it is due to them having a government protected moat that allows them to take more and more whenever they want because merchants are stuck with the whole system and consumers don’t realize that they will pay for the service — in increased prices. Every time Square, PayPal, etc., send me notices that they will be increasing fees, I increase my prices. I guess that is a kind of proxy for inflation but it’s a lousy sort of financial market induced inflation not based on anything more than their desire for more profits. I am all about free markets but the credit card processing biz is not even close to a free market.

The government using credit card processing to surveil us may be one reason I see more and more people using cash.

Larry Williams suggests:

Stock market is good predictor of inflation.

Oct

30

Demand, Supply, and Electricity Prices, from Carder Dimitroff

October 30, 2025 | Leave a Comment

Funded by the U.S. Department of Energy, five scientists associated with California's Lawrence Berkeley National Laboratory claim that data centers are not a significant cause of retail electricity price increases. Counterintuitively, they suggest that data centers could have a beneficial effect in lowering costs. But more research is needed.

Factors influencing recent trends in retail electricity prices in the United States

Summarizing their "Ten Key Findings":

4.1. National-average retail electricity prices have tracked inflation in recent years.

4.2. State-level retail electricity price trends vary widely.

4.3. Residential customers and investor-owned utilities experienced greater increases.

4.4. Load growth has tended to depress retail electricity prices in recent years.

4.5. Behind-the-meter solar was associated with higher prices.

4.6. Utility-scale wind and solar are not—alone—broadly related to recent price increases.

4.7. State renewables portfolio standards are associated with recent price increases.

4.8. Exposure to natural gas price risk increases electricity prices when gas prices rise.

4.9. Hurricanes, storms, and wildfires have increased retail prices.

4.10. Several other variables appear to have limited statistical explanatory power.

Oct

24

Another Historical Analogy, from Stefan Jovanovich

October 24, 2025 | Leave a Comment

Grok and I have produced this summary of the growth of the electric utilities industry in the United States from 1910 to 1930. [Click on chart for full view.]

Bud Conrad comments:

Not sure what you take from this data. Electrification was probably more important than AI. Its growth rate was big at first in %, but slowed. Recessions were big downturns. What do you apply to today?

Steve Ellison writes:

My grandmother was a telephone operator in the 1920s. It was a high-tech industry at the time.

Carder Dimitroff clarifies:

The definition of an "electric utility" changed over time.

Big Al suggests:

An excellent series available on Prime:

Shock and Awe: The Story of Electricity

Professor Jim Al-Khalili tells the electrifying story of our quest to master nature's most mysterious force: electricity.

Books I haven't read yet, which get lots of stars:

The Power Makers: Steam, Electricity, and the Men Who Invented Modern America

The power revolution is not a tale of machines, however, but of men: inventors such as James Watt, Elihu Thomson, and Nikola Tesla; entrepreneurs such as George Westinghouse; savvy businessmen such as J.P. Morgan, Samuel Insull, and Charles Coffin of General Electric. Striding among them like a colossus is the figure of Thomas Edison, who was creative genius and business visionary at once.

Empires of Light: Edison, Tesla, Westinghouse, and the Race to Electrify the World

In the final decades of the nineteenth century, three brilliant and visionary titans of America’s Gilded Age—Thomas Edison, Nikola Tesla, and George Westinghouse—battled bitterly as each vied to create a vast and powerful electrical empire. In Empires of Light, historian Jill Jonnes portrays this extraordinary trio and their riveting and ruthless world of cutting-edge science, invention, intrigue, money, death, and hard-eyed Wall Street millionaires.

Sep

22

Get ready to rumble, from Carder Dimitroff

September 22, 2025 | Leave a Comment

Holtec is thinking about restarting the Indian Point Nuclear Power Station. It is located on the Hudson River, about 30 miles north of Manhattan.

Holtec eyes restarting another nuclear plant – this time in New York

Although the company has not made any major moves yet, Holtec International is eyeing the restart of the Indian Point Energy Center in New Jersey, a 2,000 MW nuclear plant that ceased operations in 2021 and is currently being decommissioned.

Several groups will likely oppose Indian Point. Several others will be in favor.

Sep

3

Data centers and power demand, from Big Al

September 3, 2025 | Leave a Comment

I post these wondering what Carder D thinks:

Big Tech’s A.I. Data Centers Are Driving Up Electricity Bills for Everyone

Electricity rates for individuals and small businesses could rise

sharply as Amazon, Google, Microsoft and other technology companies

build data centers and expand into the energy business.

14 August, 2025

AI Boom Reshapes Power Landscape as Data Centers Drive Historic Demand Growth

Monday, March 3, 2025

The power industry was once considered slow-moving and perhaps even boring. That is no longer the case as technology has expanded and power demand projections skyrocket. New reports released by analysts at Enverus and Deloitte are examined to provide insight on what’s likely to evolve in the power industry over the coming year and beyond.

Carder Dimitroff responds:

I believe these articles present several issues that could benefit investors:

1) Transformers (not pole transformers). The queue for new transformers is long, and about half are manufactured offshore. Data centers need transformers as do new power sources.

2) Gas turbines. Same situation as transformers. For efficient turbines, the queue is about 5 years.

3) Solar panels. Those who previously invested in solar will see their ROIs grow faster than they expected.

4) Retail consumers. They will see their gas and electric utility bills grow as they pay for higher costs of energy and subsidize infrastructure costs to support new loads.

5) New manufacturing. Several geographical options will present better opportunities than others, as the cost of power is regional and seasonal.

6) Forget new nuclear as a near-term solution.

Asindu Drileba asks:

What do you think about nuclear fusion? Is it really close? The joke is that nuclear fusion has always been ready in 5 years for many decades. But I recently heard Chris Sacca (one of the best VCs ever, made over 250x for his entire fund), mention it is genuinely close and that his new fund, Lower Carbon existing partly to capture the incoming advancements in nuclear fusion.

Carder Dimitroff replies:

Today, nuclear fusion is a science project. Keep in mind that fusion requires operating temperatures of over 100 million degrees (at this level, the distinction between Fahrenheit and Celsius is irrelevant). Producing bulk power from this technology is more than ten years away. At these temperatures, it's unlikely they will be operating near population centers.

Jun

16

GridFree AI: Data centers to bypass utilities, from Carder Dimitroff

June 16, 2025 | Leave a Comment

From: Axios Generate (2 June 2025):

The startup GridFree AI, born in "electron economy" incubator Montauk Climate, emerges from stealth today with $5 million led by Giant Ventures.

It's modular, off-grid "power foundry" concept integrates gas power, battery storage, and cooling with computing infrastructure.

It's "systematic, repeatable, and becomes a manufacturing process, not a stick-built process," GridFree AI co-founder and executive chairman Ralph Alexander said.

It converts gas into electricity and cooling with 90% efficiency and ensures more power is used for the actual data center IT and processing units, which means much lower CO2, it said."

The efficiency of the overall solution enables a 50% increase in available power for IT loads," the announcement states.

This is a good idea. It utilizes an older concept called cogeneration, which has been widely employed in municipalities and on private campuses. This structure's capital and operating costs are significantly lower. Owners bypass onerous ISO, transmission, distribution, and utility charges. Their presence has no impact on LMPS (local wholesale power prices). Additionally, owners capture the turbine's waste heat and convert it into cooling, which data centers require.

With minimal barriers to entry, expect more data centers to capitalize on these opportunities, particularly near fuel sources (e.g., Pennsylvania, Louisiana, and Texas).

Jun

3

Books again, from Asindu Drileba

June 3, 2025 | Leave a Comment

I can't find any books from the 1700s. Big events like the Mississippi Scheme and the South Sea Bubble happened in that period. But I can't find literature from the 1700s of people describing markets then. Maybe they had PTSD from having their fingers burnt? I heard Newton never wanted anyone to mention "South Sea" around him. (he lost his pile in the investment)

Stefan Jovanovich responds:

Essai sur la Nature du Commerce en Général, by Richard Cantillon (1680s–1734)

During 1719 Cantillon sold Mississippi Company shares in Amsterdam and used the proceeds to buy them in Paris. Mississippi Company shares surged from 500 livres in January 1719 to 10,000 livres by December 1719; during the same period the prices in Amsterdam went from 400 to 7,000. The daily average spread is calculated to have been between 20% and 40%.

Carder Dimitroff suggests:

Empire Incorporated — The Corporations that Built British Colonialism, by Philip J. Stern

The book provides historical perspectives about British markets and corporate financing. It's not an easy read, but it is fascinating.

William Huggins writes:

there is a collection of "things written afterwards" about 1720 called The Great Mirror of Folly but its mostly moralizing tracts than a steely-eyed review of what went down. keep in mind the experience (a bubble in uk-fr-nl, all at the same time) had profound effects on the market for almost a century afterwards with the fr retreating from paper money and the british passing the bubble act which made it waaaay harder for anyone to raise capital. trading stock largely returned to being an insiders game until the 1800s. GMoF was recently published along with a pile of other primary docs by Yale U press:

The Great Mirror of Folly: Finance, Culture, and the Crash of 1720

I like the goetzmann treatment of 1720 from Money Changes Everything personally. He's got a couple of good recorded talks on it too. for those interested in institutional developments around markets and financial institutions in north america, I strongly recommend Kobrak and Martin's "Wall Street to Bay Street."

Steve Ellison offers:

Extraordinary Popular Delusions and the Madness of Crowds was written in 1841 by Charles Mackay. The first three chapters are devoted to the Tulip Mania, the South Sea Bubble, and the Mississippi scheme. The remainder of the book is about non-financial episodes of irrationality, including a chapter about plagues that I re-read closely in March 2020.

May

25

Atlas Shrugged, from Francesco Sabella

May 25, 2025 | 1 Comment

This morning I finished rereading the classic Atlas Shrugged of Ayn Rand and every time I learn something new; her thought is monumental. I don’t agree with a lot of her ideas and I fully agree with others, but I’ve always found this book to be an impressive catalyst for thought; this is in my opinion her power: the ability in sparking debate.

Rich Bubb comments:

Atlas Shrugged is also available as a 3-part movie. I think the book was better.

Adam Grimes writes:

My opinion on her work has shifted over the years, in a strongly negative direction. Too much of my experience contradicts her metaphysics and epistemology, particularly the rigidity of her rational materialism, and, as someone who treasures the craft of writing, much of her prose lands as clunky and overly didactic. I'm also now unconvinced on the primacy and sufficiency of rational self-interest… but, as you said, perhaps her greatest value is in creating discussion.

Asindu Drileba adds:

Ayn Rand had a reading group called the "Ayn Rand Collective" — Which Alan Greenspan was part of. They [Greenspan, Rand and a "professor"] would meet at Rand's apartment to read every new chapter of her new book. She (Ayn Rand) then fell in love with the professor and they started dating.

After sometime, the "professor" encountered a pretty young student in his own class and he "fell in love with her". The professor told Rand about the affair, but Rand begged the professor to cancel it. The professor then said that he would dump Ayn Rand, and then exclusively date the young pretty student. He said that this was the right thing to do since he was following his "rational self-interest". Ayn Rand got angry, slapped the professor in the face twice and kicked him out of her reading group.

This was a good illustration of cognitive dissonance. Rand thought her readers should practice "rational-self interest" towards everyone else, except her.

Francesco Sabella met a girl:

I was very fascinated to meet a girl times ago who I knew for her philanthropic activities and for her ideas being the exact opposite of Rand; and I was surprised to see her carrying an Ayn Rand book and she told me she didn’t like at all her; it made me think of her ability in creating debates.

Victor Niederhoffer responds:

i would always marry a girl who admired the book. susan introduced me to it and i knew then i had to marry her. it was very good choice.

May

13

A call for great new books, from Jeffrey Hirsch

May 13, 2025 | Leave a Comment

I am putting together a list of the Best Investments Books of the Year. I am not seeing many great books on trading, investing, finance, markets, crypto, options, futures, cycles, etc. I would love to hear if you folks know of any great books out in the past 6 months or so or coming soon.

Matthew Gasda is justifiably proud:

Big Al offers:

This is high-level quant stuff - ie, over my head, and despite "Elements" in the title - but a fun stretch:

The Elements of Quantitative Investing (Wiley Finance) 1st Edition, by Giuseppe A. Paleologo

His more basic 2021 book is "Advanced":

Advanced Portfolio Management: A Quant's Guide for Fundamental Investors, by Giuseppe A. Paleologo

Carder Dimitroff suggests:

This book is about historical finance and may not be a direct response to the question.

Empire, Incorporated: The Corporations That Built British Colonialism, by Philip J. Stern

William Huggins responds:

on a similar (historical) note, one of my students just recommended this title to me. looking forward to cracking it later this month:

Ages of American Capitalism: A History of the United States, by Jonathan Levy

Asindu Drileba adds:

If you would regard a speculator/investor as someone who also builds businesses:

Never Enough: From Barista to Billionaire, by Andrew Wilkinson

Andrew is building Tiny. His intention is to build the Berkshire Hathaway of Tech and software. He is inspired by Monish Pabrai (The Dhando Investor). So he is more in the "Value investing" camp not really quantitative.

May

2

Working thorium reactor, from Asindu Drileba

May 2, 2025 | Leave a Comment

:max_bytes(150000):strip_icc()/GettyImages-465426935-edcdf31401e94eb3a3df656656509326.jpg)

I wanted to ask Carder's opinion on this article that I came across titled:

China builds world’s first working thorium reactor using declassified US documents

It uses molten salt to carry the fuel and manage heat, while thorium serves as the radioactive fuel source. Experts have long viewed thorium reactors as the next leap in energy innovation. Some scientists estimate that a single thorium-rich mine in Inner Mongolia could theoretically supply China’s energy needs for tens of thousands of years with far less radioactive waste than current uranium-based reactors.

Carder Dimitroff responds:

Thorium is a fuel that is currently used in some commercial reactors. Canadian reactors can accept thorium and other nuclear materials in their CANDU reactors. (Read more: We can use thorium.)

One reason that the US, EU, and other reactors do not use thorium is that their reactors and related supply lines were not designed to accept that type of fuel. In US PWRs and BWRs, the reactor relies on precise fuel physics to achieve optimal performance. Changing the type of fuel would present a tough, if not impossible, outcome in terms of performance, let alone capital and operating costs.

When compared to a plant's production costs, nuclear fuel is surprisingly inexpensive, including the cost of disposal. Most of its energy is wasted. Consequently, there is little motivation to change the nuclear fuel's value chain.

Molten salt reactors are not new. In 1959, the US built the "Sodium Reactor Experiment" in California. Since then, several other countries have improved the design. Today, it is a viable technology, particularly in the Small Module Reactor (SMR) market. One example is TerraPower's Natrium Project (Bill Gates). They are currently testing the liquid sodium fuels for their Small Modular Reactor (SMR) product. (Read more: Terrapower: Natrium)

Apr

20

An interesting article that is making me think its mostly IP theft:

An image of an archeologist adventurer who wears a hat and uses a bullwhip

One of the internet-est things to come out of the most recent update to GPT image generation is the Studio Ghibli-zation of everything - another reminder of how OpenAI (and everyone else) trains on images that are very obviously someone else’s work.

Carder Dimitroff adds:

It's also an energy thief. Some data center owners are trying to get ratepayers to cover infrastructure costs through the state ratemaking process. On top of the capital costs, ratepayers are also expected to pay elevated marginal power costs. It's not just power. It's also natural gas:

This proposed gas plant to power a data center campus is massive

The soaring power needs of data centers continue to raise eyebrows, and nowhere is this more evident than at one Pennsylvania project, where a massive proposed natural gas plant would replace a legacy coal facility.

Pamela Van Giessen responds:

Thanks for sharing this. Every publishing/media legal department should read this, along with all artist guilds. And then they should do their own tests. AI was always theft.

Asindu Drileba offers:

There is a developing case NYT vs OpenAI:

Judge explains order for New York Times in OpenAI copyright case

April 4 (Reuters) - The New York Times made its case, for now, that OpenAI and its most prominent financial backer, Microsoft, were responsible for inducing users to infringe its copyrights, a New York federal judge said in a court opinion on Friday explaining an order from March 26.

Ars Technica did a more comprehensive article about it a year ago.

Apr

16

The Invisible Gorilla in the Room, from Stefan Jovanovich

April 16, 2025 | Leave a Comment

That is the creature Hugh Hendry - the Acid Capitalist - says we have to find in order to profit from our speculations.

The events in Ukraine are that gorilla. They are predicting the likelihood that Trump, Putin and the Muslim oil producers will establish a Drill, Baby, Drill world of orderly energy production and supply priced in U.S. $. The effects on the European and Asian consumers will be comparable to what happened to the German-speaking world and its silver standard when the French fulfilled the terms of the Treaty of Frankfurt by paying their reparations in gold.

Big Al needs some help:

Perplexity answers the question, "What happened to the German-speaking world and its silver standard when the French fulfilled the terms of the Treaty of Frankfurt by paying their reparations in gold?"

Stefan Jovanovich answers:

They = "events, dear boy". The prediction is that the new cartel of oil and gas exporters will establish "orderly production" that manages the risks of overproduction in the same artful manner that OPEC once operated before the invention of fracking.

William Huggins responds:

So you are suggesting us producers will submit to directives from moscow or Riyadh to limit their production? No evidence of anything but predation among those players but somehow trump purs them all on the same page? I have a bridge for sale….

Mar

5

If your company is a domestic power generator like Constellation (CEG) or Calpine (CPN), the proposed Trump Administration tariffs at the Canadian and Mexican borders could help elevate gross margins. If Canada cuts off electricity altogether, additional margins may become available. While generators may benefit, US consumers will be harmed.

Uncertainty clouds northern US grids amid Canada tariff threat

Canadian premier says he will cut off electricity exports to US ‘with a smile on my face’

M. Humbert writes:

It’s my understanding that utilities are generally regulated to provide a steady ROA based return. If so, I don’t believe that they can raise their prices and increase their gross margins, as that would raise their ROA. They can raise their prices though if their costs go up (to maintain their ROA). It’s been a while since I last looked at utilities though. Am I mistaken about this?

Carder Dimitroff responds:

Yes, regulated utilities generally provide steady ROAs. However, some states fully regulate their electric utilities. Other states deregulated bulk power (wholesale power) and the generators that supply bulk power. Most population centers in the US are in deregulated states.

In the deregulated states, the title to bulk power passes to regulated distribution utilities at substations adjacent to transmission lines. Specifically, titles pass to distribution utilities at substations' step-down transformers.

Ontario supplies bulk power to unregulated states (Minnesota, Michigan, and New York). Quebec supplies bulk power to New York and New England. New Brunswick also supplies New England. All three provinces own and operate nuclear power plants. While Canadian transmission lines feed power directly to specific locations within those states, imbalances propagate to other states.

Ontario updated its strategy. They now plan to tax Ontario power exports at 25%.

Steve Ellison writes:

In this video Peter Zeihan says that a hurdle to green energy is that essentially all cost is up front, unlike natural gas plants in which only 20% of the lifetime cost is in construction, and 80% is in fuel costs over the life of the plant. So even when total lifetime cost of green energy is less than that from a natural gas plant, the higher upfront costs make financing more difficult. If true, I would guess cost recovery of the upfront expenses is also more risky in a deregulated market.

Mar

1

Sampler

March 1, 2025 | Leave a Comment

Carder Dimitroff points to:

Michigan’s Palisades nuclear plant nearing reopening

Michigan’s Palisades Nuclear Generating Station is one step closer to becoming the first nuclear power plant in the United States to reopen. After closing in 2022, the company that was set to decommission the plant has changed course, aided by a $1.5 billion loan from the U.S. Department of Energy to restart operations.

And a new SMR will be added on the same property in about 2030:

Michigan: First nuclear re-start is scheduled for this August

FWIW, the federal regulator (NRC) may be immune from budget cuts. Their licensing and regulatory activities are funded by the industry, not taxpayers.

Asindu Drileba suggests:

Great podcast on LLMs:

What kind of Intelligence is an LLM

[Part 3 of a 6-part series on intelligence in the Complexity podcast series by the Santa Fe Institute.]

Stefan Jovanovich finds:

The best underdog story in professional baseball in US:

The Best Underdog Story of 2025

Payton Eeles #11

St. Paul Saints

Minnesota Twins

Triple-A Affiliate

2BB/T: L/R5' 5"/180Age: 25

Jan

10

Energy, from Carder Dimitroff

January 10, 2025 | Leave a Comment

I believe 2024 will be remembered as the year of great awakening. First, the so-called "hydrogen economy," pushed by several administrations and countries, is struggling. Plug Power, Ballard Power, Bloom Energy, and Hyyvia have all experienced losses and related financial challenges. Wood Mackenzie warns that green hydrogen projects are near collapse, with several projects likely to be canceled or deferred (how does it make economic sense to consume electricity to make hydrogen, compress it, move it, store it, and then consume it to make electricity?).

Second, Big Tech is colonizing local power grids at a scale and speed few anticipated. Policymakers are slowly realizing that demand is eclipsing supplies, and at the current rate that demand grows, supplies will quickly be exhausted.

Third, there are unrealistic expectations that the industry can respond in time to avert troubles by increasing supply. Many assume that energy supplies are commodities and can respond to market forces. With new baseload power projects taking at least five years and an average of ten years to initiate and complete, the only realistic option is to manage demand. This conclusion presents significant implications for Big Tech and local consumers.

Like biotech, the electric and gas industries will face an uncertain future in 2025. In the United States, states and Regional Transmission Operators have ultimate control, with the federal government's role limited to providing economic incentives. Consequently, the nation will likely witness various responses depending on local interests.

In any case, Big Tech's demand for power may be severely checked. If investors see unlimited growth in AI and related technologies, they may want to consider the challenges.

The alternative is less pleasant. If Big Tech successfully colonizes the nation's grids to the needed levels, the price of electricity and gas for other industries, commercial properties, and residential consumers will jump, resulting in more inflation.

Either way, the current situation is not sustainable. Solutions will be implemented in 2025 and beyond, but new nuclear power and transmission lines will not be among them for several years.

Remember that there are always winners and losers in energy; there's rarely an easy win-win opportunity. Higher prices produce substantial margins for those previously invested. For cost leaders, supply-demand mismatches present a happy outcome at the bottom line. Even marginal assets, like old nuclear and coal, could become more attractive. However, pipeline capacity issues could create growing challenges for natural gas assets.

The consumer is at risk. Self-generation is attractive to upper-income consumers. Avoiding the purchase of any watt-hours at any time of the day could produce significant savings.

Stefan Jovanovich writes:

The appeal of the income tax was that it promised a tiered system of pricing - i.e. the rich would pay more. There could be an Americans First progressive movement in this century that demanded the same system of pricing for electricity, health care and other services that have become rights. The "average" Americans could pay one rate; the corporations and wealthy users could pay a higher one.

A question for CD. Assuming that politics produces an Americans First tiered system for utility and other pricing where the "average" Americans are guaranteed priority over the large volume consumers, what would the effects be for the utilities? Don't current rate structures give large users a unit discount because they provide so much more demand?

Carder Dimitroff responds:

Remember, a utility's primary mission is/should be to rent its wires or pipes. Every wire and pipe used by utilities in the United States is economically regulated to ensure its owners earn a margin above its levelized costs. Theoretically, utilities' gross margins for wires and pipes are guaranteed no matter how individual tariff books are constructed.

In states where utilities have not deregulated their power plants, utility commissioners may create sophisticated tariffs where utility returns consider the combination of wires, power plants, commodities, and services. If a utility upsets its state commissioners, it could see margins thinned. This frequently happened with nuclear utilities when they delivered new power plants late and over budget. But the penalty is temporary; their full returns were restored later.

Tariffs are [intentionally] complicated. Large power users are frequently offered a break on their energy costs. However, they pay more for services that are not charged to residential consumers. Historically, one hefty example has been the utilities' demand charges, which large consumers hate. Another is for power factor charges, which require large customers to actively manage how they consume energy. In addition, many states require large power users to pay the utility for their capital costs to place transformers on customers' properties and to compensate utilities for stringing high-voltage power cables to those transformers. However, every state is different, and utilities within states negotiate different tariffs.

Big Al adds:

AI Needs So Much Power, It’s Making Yours Worse

AI data centers are multiplying across the US and sucking up huge amounts of power. New evidence shows they may also be distorting the normal flow of electricity for millions of Americans, threatening billions in damage to home appliances and power equipment. 75% of highly-distorted power readings across the country are within 50 miles of significant data center activity.

Jan

3

Five-year US load growth forecast, from Carder Dimitroff

January 3, 2025 | Leave a Comment

1 GW = about 1 nuclear power plant

Five-year US load growth forecast [for power] surges to 128 GW

U.S. electricity demand is forecast to increase 15.8% by 2029, according to a new report from Grid Strategies. Six regions of the country are driving the growth

The report's load growth estimates are based on annual planning reports submitted to the Federal Energy Regulatory Commission by electric balancing authorities and updated with additional data from utilities and planning regions.

Consider this question from another list member: What would happen to the grid if Silicon Valley companies found technologies a decade hence that would provide similar server services with less electric power?

Answer 1a: The utility could face stranded assets, including underutilized power plants, transmission lines, substations, and distribution systems. Remember that most utility investments are 30-year-plus assets, are leveraged, and have their levelized costs, plus margin, firmly embedded in utility bills.

Answer 1b: How would investors hedge their position if they considered building a $1 billion gas turbine in states that deregulated their power plants?

David Lillienfeld responds:

Basically, you're going to see a mismatch between where demand from data centers are and where there's generating capacity. You can build demand a lot faster than you can build supply though, and if you get efficiency on the demand end, you have overpriced supply relative to the ability of the region to pay for the power generated. At some point, someone's going broke.

But here's the curious question–how much economic activity can be attributed to a server building? It's like a parking lot for data–nothing more than that. And if there isn't that much taxable revenues that it's generating, what's the appeal to governments–the risk for the electorate of holding the bag at the end of the day is non-trivial it would seem. So what's the appeal?

Henry Gifford writes:

In other industries power saving strategies are known but not adopted yet, but could be at any time without much warning.

Take cars for example. I heard that in about three years the whole car industry in Europe is going to switch from the now-standard twelve volt electrical system (actually about fifteen volts) to seventy-six volts. One advantage of voltage about five times higher is that electric motors can be about one-fifth the size they are now. This includes the starter motor used to start the engine, the motors used to raise and lower the windows, the heating/cooling system’s fan motor, the engine’s cooling fan motor, the alternator (which is basically a motor wired to work in reverse), and others. As motors are made in large part from Copper and rare earth magnets, smaller motors can save a lot of money. Another advantage is that the wires, usually made from Copper, can be about one-fifth the cross sectional area. Another advantage is that some things typically driven directly off the engine by rubber belts, such as the air conditioning system’s refrigerant compressor and the power steering pump can instead be driven by a small electric motor that can be located anyplace the designer chooses, instead of now having to be located in line with a belt wrapped around part of the engine. Shrinking all these things would make the car lighter, saving fuel. Voltages higher than seventy-six would of course extend these advantages in an ever-diminishing way, but be more capable of going through a person’s skin, thus seventy-six is thought to be the best choice.

The problem is, I heard the three year prediction about twenty years ago, and a few times after that, but not more recently than about ten years ago. So maybe it won’t happen anytime soon, or ever, but the technology and advantages are well known and waiting to be used.

Similar changes could gradually or suddenly drop the power used by data centers.

Dec

23

Tariffs on Canadian goods, from David Lillienfeld

December 23, 2024 | 1 Comment

So now we're going to get an interesting experiment in what happens when you impose tariffs on your neighbor. To wit:

1. The DEW Line? Probably going to be history very quickly

2. The Keystone Pipeline? The first pipeline to nowhere (why would Canada bother?)

3. Drug interdiction? I doubt the Canadians are interesting in dealing with drug gangs, but they will also have little reason to look kindly on us.

4. NATO? It's a goner already.

I'm not sure that we gain all that much in this tit for tat, but it will be interesting to see what's conjured up.

Carder Dimitroff responds:

It's more than oil from the Keystone Pipeline. As the name suggests, TC Energy (formerly TransCanada) is a Canadian company that exports significant amounts of oil and natural gas to the United States and US natural gas to Canada.

The Keystone Pipelines and the oil they transport are assets owned by Canadian companies rather than US companies. New tariffs on Canadian oil and natural gas traversing TC Energy's pipelines could increase wholesale energy prices within the US. Of course, higher prices help domestic producers.

The US produces more oil and natural gas than it consumes and is a net exporter of natural gas, oil, and byproducts. However, exports could decline if US wholesale feedstock prices increase relative to global markets.

Dec

15

LNG: different perspectives, from Carder Dimitroff

December 15, 2024 | Leave a Comment

Whither the weather: predicting weather patterns helps predict LNG demand and prices.

Asia and Europe in a contest to attract LNG cargoes:

US LNG exports to Europe surge in November on higher prices

U.S. LNG exports to Europe surged in November as the world's largest producer of the superchilled gas sent more cargoes to the continent and fewer to Asia and Latin America, according to preliminary data from financial firm LSEG. European natural gas prices climbed in November to their highest levels in two years on fears remaining Russian pipeline supplies to Europe will be halted or face further curtailment.

LNG tankers divert to Europe from Asia after Russia halts supplies to Austria's OMV

LNG traders divert cargoes from Europe to Asia as eastern demand strengthens

Meanwhile:

U.S. inventories enter the winter with the most natural gas since 2016

Rising LNG terminal costs to make new US projects less competitive

FYI, U.S. LNG producers must buy natural gas at market prices. Many competitors pay only lifting costs.

Oct

21

Nuclear: Back to the Future, from Carder Dimitroff

October 21, 2024 | Leave a Comment

The media is buzzing about nuclear power as the silver bullet. Two commercial nuclear power plants are in the process of coming out of retirement.

The odds of the two retired nuclear plants successfully navigating their way out of retirement are high. The Michigan unit (Palisades) won a $1.52 billion federal loan guarantee, $300 million from the state, [significant] tax benefits, and bipartisan support from state lawmakers. In addition, Palisades has already signed long-term Power Purchase Agreements for the full power output with rural electric co-ops Wolverine Power Cooperative and Hoosier Energy, which serve rural communities in Michigan, Illinois, and Indiana. DOE will also provide $1.3 billion in funding to two Michigan area power cooperatives to boost power purchases from the Palisades plant.

The Pennsylvania unit (Three Mile Island) is about two years behind Palisades. Their 20-year offtake agreement is with Microsoft. They may decline federal loan guarantees but take advantage of aggressive tax advantages (federal loans have feisty terms).

Both plants will require extensive and high-paying workforces. They will generate significant state and local property taxes and create economic multipliers for local, state, and regional areas.

While each plant may appear old, its components are relatively new. Over the years, each plant has undergone preventive maintenance that required replacing components and maintaining federal safety standards. While each plant is relatively small (under 900 MW), they can safely run for an additional 20 years with routine maintenance.

The validity of the proposed restart schedules is a question. I wonder if they can access new fuel in time because of a rigid queue to support the nation's nuclear fleet. I also question whether there is enough time to overcome the hurdles of the federal regulator (NRC). These are external activities that developers can manage but cannot control.

The natural question is about other nuclear plants. Specifically, how many more retired nuclear plants can be restarted? The answer is that it depends. It depends on how far a plant has been decommissioned, who owns the title, the degree to which the state supports continued operations, whether government incentives can overcome costs, and how desperate consumers are for power.

David Lillienfeld comments:

I find it hard to believe that the community around TMI is going to accept a restart all that easily.

Carder Dimitroff replies:

Thank you. This is an important point. TMI has two nuclear power plants (two reactors and two generators). Only one unit was involved in the TMI incident. Until it retired in late 2019, the other had operated reliably for 40 years after the incident. It retired for financial reasons, and local property taxes jumped when it did.

Not all, but most communities hosting nuclear power plants appreciated the employment, economic, and tax benefits the facility provided. When plants approached retirement age, community leaders sought opportunities to extend or replace the facility.

With one operating unit, TMI was the biggest employer in the county, with nearly 700 high-paying workers. Local businesses depended on the plant for their economic success. In addition, schools and other government departments enjoyed robust budgets while average homeowners' property taxes remained relatively low.

For these reasons, most communities would likely support continued operations. As always, some will want to see the asset permanently decommissioned. While there are no public safety issues that differ from those of any other nuclear plant, those most concerned about TMI would have moved years ago.

David Lillienfeld responds:

There was a documentary about TMI made in the last decade (I think). There were a lot of local residents who registered anger that the reactors had been built there in the first place. I'm not so confident that they would have moved by now. That said, your comments about the economics make a strong case for moving forward with a restart. I guess the big winners are Microsoft shareholders.

Oct

20

Nuclear restart: Murphy strikes, from Carder Dimitroff

October 20, 2024 | Leave a Comment

Whenever there's a home project, it usually requires three visits to the hardware store. Murphy's Law prevails as "anything that can go wrong will go wrong." The same is true in the nuclear world. But in this case, Murphy was an optimist:

Corrosion exceeds estimates at Michigan nuclear plant US wants to restart.

Steam generators are radiators. They transfer heat from inside the reactor building to outside the building without mixing fluids that move the heat. They have a simple job but rely on complex metallurgy. It's common practice to replace steam generators from time to time. So, this news is not a surprise, but it will delay the expected restart and increase costs.

In general, nuclear power plants come in two flavors. One uses steam generators that isolate the reactor's primary loop from the turbine's secondary loop. The other has only one loop directly connecting the reactor to the turbine without steam generators.

The first is a Pressurized Water Reactor (PWR) manufactured mainly by Westinghouse and its technology partners (France, China, and Korea). The second is a Boiling Water Reactor (BWR) manufactured by General Electric and its technology partners.

Both Michigan and Pennsylvania restarts rely on PWR technology.

Oct

13

FL insurance markets, from David Lillienfeld

October 13, 2024 | 1 Comment

Milton's travel through Florida had the eye wall intact straight through until it got to the Atlantic. Strong storm. Among the 4 strongest in the history of the Atlantic. One thing is clear though: There's a lot of destruction from this storm.

Hence, I have to wonder if there are going to be any insurers left in the Florida market, and if there are any left, which ones? I'm not sure that those insurers still there will make for good investment, but maybe they'll be able to survive in that market. It just seems unlikely.

Art Cooper responds:

There will certainly be private P&C insurers (in addition to state-created Citizens Property Insurance Company) continuing to do business in FL after Milton, but I strongly suspect they will continue to increase their restrictions on coverage. I understand that many victims of Hurricane Helene who thought they had coverage for its damage are being shocked to find out they either didn't, or did not to the extent to which they'd believed.

Historically, the aftermath of an event causing massive insurance claims is an opportune time to invest in carriers doing a lot of business in the affected area, because marginal carriers cease writing policies, thereby minimizing competition, and the event provides cover for dramatic rate increases. (Buy when there's "blood in the streets".) If you're bullish on the P&C sector, wait till after billions of dollars of claims are made, then try to buy at support levels.

I don't have any numbers on net migration out of FL, but I can attest anecdotally that the pandemic-induced flood into the state has ended. Bear in mind, however, that migration to FL has been characterized by wild swings for the past 100 years, and I'm confident it will continue to be volatile. Weather events such as Helene and Milton, and more importantly the greatly increased cost of homeowner's insurance, will of course be inhibiting factors going forward.

Carder Dimitroff writes:

I understand why some would consider NEE for short positions. I can see why the market might ping them. If the price sinks and the value is right for you, consider buying NEE as others sell.

Why? NEE Florida's assets are regulated. Within the state, they operate on a cost-plus-a-margin basis. They have a good relationship with the state's regulators (the state needs them). Their power plants and wires may be damaged, but the state's ratepayers will likely cover all their losses. There may be a temporary cash flow issue, but even those costs will be covered. For traders, it might take a year for NEE to recover financially.

Oct

8

Government planning and efficiency, from Big Al

October 8, 2024 | Leave a Comment

Originally, 32 ships were planned, with $9.6 billion research and development costs spread across the class. As costs overran estimates, the number was reduced to 24, then to 7; finally, in July 2008, the Navy requested that Congress stop procuring Zumwalts and revert to building more Arleigh Burke destroyers. Only three Zumwalts were ultimately built. The average costs of construction accordingly increased, to $4.24 billion, well exceeding the per-unit cost of a nuclear-powered Virginia-class submarine ($2.688 billion), and with the program's large development costs now attributable to only three ships, rather than the 32 originally planned, the total program cost per ship jumped. In April 2016 the total program cost was $22.5 billion, $7.5 billion per ship.

Henry Gifford disagrees with the implication:

I am no fan of runaway government spending, and waste, and stealing, but I applaud the decision to stop construction of the Zumwalt ships when it became apparent they were not what the navy wanted. It would have been better for the egos and careers of senior Navy officers to make believe the Zumwalt ships were desirable and keep making them, then quietly retiring.

The "peacetime" military has a huge challenge predicting what weapons will work well in the next war. At the same time, the military needs to maintain some shipbuilding capacity in the US, so that ships can be made in the US in the future. Maintaining shipbuilding capacity requires continuously building navy ships, needed or not needed, as the capacity to build ships in the future is critical. I haven't heard about anyone putting numbers on the value of this capacity.

Before WW2 the US has a robust shipbuilding industry that shifted to building navy ships, and ramped up for increased production. In the years since, that industry has gone away, except for a few pleasure boats and for military craft. One version I heard was that the last time ships were manufactured in the US installing a porthole required work by members of thirteen different unions, a problem presumably not faced in the places where the shipbuilding industry is robust today. With no significant shipbuilding industry in the US now, outside of military ships, the navy needs to keep building ships. (I think navy ships don't have many portholes, which probably avoids on of the challenges formerly faced by the commercial shipbuilding industry in the US).

One version of the Zumwalt story I heard is that much of the Zumwalt superstructure was made of Aluminum, to save weight, especially high up where saving weight increases stability and/or frees up capacity for mounting weapons high up, while the lower parts of the structure and hull were made of steel, and the dissimilar metals reacted with each other (happens quickly in the presence of salt water), resulting in terrible corrosion and structural damage. The Aluminum superstructure idea has been tried on naval ships before, but as Aluminum burns in a fire, it is not without risk to crew and ship in battle.

Another version of the story I heard is that the ship was designed for weapons which never materialized, thus the ships were cancelled. It all sounds logical, but somehow doesn't have the ring of truth that the version above has.

I also note that the Zumwalt ships were significantly larger than the Burke class ships made before and after it, and it seems quite believable (to me) that the navy simply wanted a larger number of smaller ships. Once upon a time the larger a battleship was the larger the guns it could carry and thus it had the firepower to shoot further than opponents, which meant it had the capability to maneuver to where an enemy was within range of its guns, while staying out of range of the enemy's guns. This battle-winning capability was worth the cost of huge ships. Now in the age of missiles and radar, the size of a ship is not nearly as relevant. During WW2 German soldiers reportedly said "one of our panzer tanks is worth ten of those American Sherman tanks, but every time we build one panzer they build eleven Shermans". As tank-on-tank battles were not the main, or main intended use of tanks, eleven OK tanks had many, many advantages over one superior tank. The US Navy might have decided that for similar reasons they are much better off with a larger number of smaller ships than a smaller number of Zumwalt ships. I would be surprised if the actual truth about the decision is ever made public, and more surprised if I was ever convinced that I was convinced the real reason(s) was made public.

The math about per-unit cost when development cost is amortized over the number of units produced is, I think, useful, but implies that development cost for something that never saw production or only went into limited production was somehow wasted.

The US navy now has hard data on the seakeeping ability of a full-scale tumblehome hull ship design, which I think nobody had before the Zumwalt actually went to sea. No, testing a scale model is not a robust test because much in fluid dynamics does not scale (google "Reynolds Number"). And if computer modeling alone was good enough nobody would have wind tunnels. The history of airplane development is full of planes that were built and flown in very small numbers, with the data helping to inform future designs. As the Zumwalt was such a radical design, departing so far from normal shipbuilding experience and formulas (google "metacentric height", "center of buoyancy", and "center of gravity"), it, I think, deserves to be thought of in much the same way as plane designs that saw very limited production and saw testing, and informed future designs in a useful way.

The US navy also has hard data on the radar signature of a tumblehome hull design, which nobody else has unless they pointed their radar sets at a Zumwalt class ship while configured for battle. I somehow doubt the US Navy sailed the Zumwalts close to the coast of Russia unless they added radar reflectors to them to mask their actual wartime radar signatures.

Maybe someone on the list developed and tested a trading strategy and found it lacking, then used the insights gained to test another strategy that turned out to be useful. Was the cost of developing and testing the first strategy wasted? I think not.

Carder Dimitroff writes:

Henry, your comment about aluminum reminded me of nuclear power plant design. For the reasons you state, aluminum is not allowed inside the containment (reactor building). Copper and stainless steel are used in place of aluminum. Outside the containment, aluminum is everywhere. I assume the US Navy requires similar standards for their nuclear submarines and aircraft carriers. Many design features in commercial nuclear plants originate from the nuclear navy.

Oct

7

What some Specs are keeping an eye on

October 7, 2024 | Leave a Comment

From Carder Dimitroff:

Note: 1 GW = about 1 nuclear power plant.

US DOE/EIA: Batteries are a fast-growing secondary electricity source for the grid.

Utility-scale battery energy storage systems have been growing quickly as a source of electric power capacity in the United States in recent years. In the first seven months of 2024, operators added 5 gigawatts (GW) of capacity to the U.S. electric power grid, according to data in our July 2024 electric generator inventory. In 2010, only 4 megawatts (MW) of utility-scale battery energy storage was added in the United States. In July 2024, more than 20.7 GW of battery energy storage capacity was available in the United States.

From Kim Zussman:

Argentina Scrapped Its Rent Controls. Now the Market Is Thriving.

For years, Argentina imposed one of the world’s strictest rent-control laws. It was meant to keep homes such as the stately belle epoque apartments of Buenos Aires affordable, but instead, officials here say, rents soared.

Now, the country’s new president, Javier Milei, has scrapped the rental law, along with most government price controls, in a fiscal experiment that he is conducting to revive South America’s second-biggest economy.

The result: The Argentine capital is undergoing a rental-market boom. Landlords are rushing to put their properties back on the market, with Buenos Aires rental supplies increasing by over 170%. While rents are still up in nominal terms, many renters are getting better deals than ever, with a 40% decline in the real price of rental properties when adjusted for inflation since last October, said Federico González Rouco, an economist at Buenos Aires-based Empiria Consultores.

From Asindu Drileba:

Charles Piller and the team here at Science dropped a big story yesterday morning, and if you haven't read it yet, you should. It's about Eliezer Masliah, who since 2016 has been the head of the Division of Neuroscience in the National Institute on Aging (NIA), and whose scientific publication record over at least the past 25 years shows multiple, widespread, blatant instances of fraud. There it is in about as few words as possible.

It turns out that alot of FDA drug approvals where based on this guy's research (a few listed in the article). I wonder what effect it may have on pharmaceutical businesses based off his research. Imagine spending decades & billions on a drug whose prior research turn's out to be completely forged (photoshopped images). This looks really bad for the Alzheimer's drug focused pharmaceutical industry.

From David Lillienfeld:

This is a comparison of international drug prices. U.S. gross prices are higher than those in comparison countries for all drugs and for brand-name originator drugs but lower for unbranded generic drugs.

Oct

1

Book rec, from Carder Dimitroff

October 1, 2024 | Leave a Comment

Empire, Incorporated: The Corporations That Built British Colonialism

Across four centuries, from Ireland to India, the Americas to Africa and Australia, British colonialism was above all the business of corporations. Corporations conceived, promoted, financed, and governed overseas expansion, making claims over territory and peoples while ensuring that British and colonial society were invested, quite literally, in their ventures. Colonial companies were also relentlessly controversial, frequently in debt, and prone to failure. The corporation was well-suited to overseas expansion not because it was an inevitable juggernaut but because, like empire itself, it was an elusive contradiction: public and private; person and society; subordinate and autonomous; centralized and diffuse; immortal and precarious; national and cosmopolitan-a legal fiction with very real power.

Sep

25

Smörgåsbord

September 25, 2024 | Leave a Comment

Jeff Watson likes info on the softs:

Here’s a copy of a magazine that offers a high level view of all things agricultural:

Carder Dimitroff is watching lithium batteries:

Utility Dive: Lithium battery oversupply, low prices seen through 2028

Despite falling raw material costs and U.S. policy support, North American battery suppliers are delaying or canceling planned capacity investments

Bloomberg: Why Public EV Chargers Almost Never Work as Fast as Promised

Most public machines in the US average about half their maximum speed, a gap that risks hindering further adoption of electric cars.

David Lillienfeld follows pharma:

Immuno-oncology drugs have changed oncology and required rewriting of many sections of medical texts. They have created a revolution. That doesn't mean they are without downsides.

A decade of cancer immunotherapy: Keytruda, Opdivo and the drugs that changed oncology

Medicines that can rev up the immune system against tumors have reshaped expectations of what cancer treatment can accomplish. Their success has hit limits, however.

Sep

3

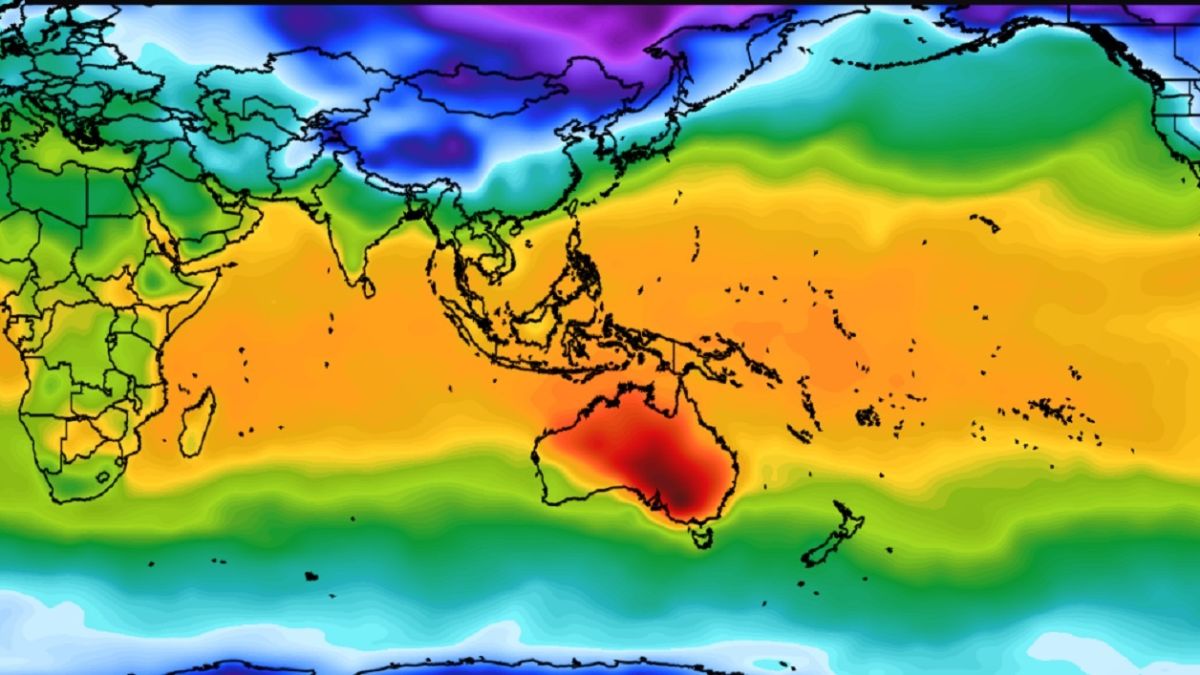

Apparently, it’s not just an American thing - Australia, from Carder Dimitroff

September 3, 2024 | Leave a Comment

Sydney Morning Herald: Three Months to Back Up the Grid as Risk of Summer Blackouts Ramps Up.

Interesting Engineering: Australia Is Generating Too Much Solar Power (12:25).

IMO, expect:

1. volatile wholesale energy prices, including deeply negative prices,

2. forced load shedding and expanding demand-response programs,

3. sudden awareness that infrastructure is needed,

4. growing reliance on natural gas/ LNG, and

5. growing interest in competitive energy contracts

Aug

23

Counting is one thing, statistics is another, from Carder Dimitroff

August 23, 2024 | Leave a Comment

Today, the U.S. Energy Information Administration (EIA) is counting how many power plants were added in the first half of 2024 and projecting how many will be added in the last half.

It's all wonderful news. About 20.2 GW (the equivalent of about 18 nuclear power plants) were added. By the end of the year, EIA expects about 62 GW of new capacity. About 95 percent of these additions are intermittent sources (wind, solar, batteries).

Offsetting this new capacity are retirements. Utilities plan to retire 7.6 GW, all of which use coal, natural gas, and petroleum as fuel. They are likely being retired because they are uneconomic and rarely dispatched. Their levelized costs exceed revenues, and investors want to tidy up their books.

Statistics unearth a problem that counting hides. The problem is not on the supply side; it's on the demand side. Specifically, counting 24/7 demand reveals tremendous growth (e.g., baseload). It appears there's a hidden mismatch between supply and demand. While there will be hours on most days when the grid is flooded with cheap power, there will also be hours on other days when there will not be enough supply to serve all loads.