Jan

22

The Engineering Rules that Trade, Stefan Jovanovich

January 22, 2026 | Leave a Comment

If a design takes too long to execute, it fails.

Never fall for sunk costs; the current tally does not know what you paid.

Avoid the Optimizing trap: do not develop system for a market that does not actually trade

Leave school early. In classes you come in first by getting the correct answer to every question on the test. In markets the winners ask the right questions and accept the risks that come from being wrong.

Carder Dimitroff writes:

Never fall for sunk costs; the current tally does not know what you paid.

The real story behind commercial nuclear power.

Vic approves:

a sparkling and useful post

Jan

5

Oil, from Cagdas Tuna

January 5, 2026 | Leave a Comment

So where lies the thin line between liberating Venezuela and putting world into oil supply based recession?

Larry Williams comments:

The quality of their crude is a different issue we use to refine it here; sour, full of gravel etc.

Stefan Jovanovich writes:

Historically, before full sanctions in 2019, the US imported over 600,000 barrels per day (bpd) of Venezuelan crude, with refiners like Citgo (PDVSA-owned), Valero, Chevron, and Phillips 66 as top recipients.

More recently (post-2023 relief), Valero accounted for 44% of imports, Chevron 32%, and Phillips 66 10%.

Carder Dimitroff writes:

IMO, it's not about oil. The US is a net exporter. They're doing just fine without Venezuela. If heavy oil is desired for refining optimization, as some claim, there's a direct pipeline from Canada.

Stefan Jovanovich responds:

It would help if Carder focused on the use of heavy oil for marine diesel and bunker oil for steam turbines. Those are the essential propulsion fuels for China's Navy; hence, Hegseth's comment today assuring China that it would continue to receive its share of Venezuela's output.

Carder Dimitroff expands:

Globally, three major regions produce heavy crude: Russia, Canada, and Venezuela. Downstream, “heavy oil” or “heavy fuel oil” usually means the residual, high-boiling product left after lighter fractions (gasoline, diesel, kerosene, etc.) are distilled from crude. As Stefan suggests, heavy oil and bunker oil are growing markets, not only in China but also elsewhere.

In my opinion, the administration's interests in Venezuela reflect several interests. High on my list are Venezuela's untapped rare-earth elements (about 300,000 metric tons).

Pamela Van Giessen offers:

Interesting analysis here:

The Real Reason the Pentagon Approved Venezuela: Critical Minerals and Adversary Expulsion

The Department of War has allocated $7.5 billion under the One Big Beautiful Bill Act specifically for critical minerals, with $1 billion already deployed to stockpile antimony, bismuth, cobalt, indium, scandium, and tantalum. This is not economic policy. This is national security infrastructure. The United States is 100% import reliant for 12 critical minerals and over 50% reliant for 28 of the 50 minerals classified as essential to national security. These materials are not interchangeable. They cannot be substituted. They form the irreducible foundation of modern weapons systems.

Boris Simonder questions the thesis:

What rare earth does Venezuela hold that is proven and confirmed? Based on USGS Mineral Commodity Summaries 2025 and other sources like CSIS reports, Venezuela has no significant cobalt production or reserves listed. Antimony deposits exist but are small and underdeveloped, with declining output due to infrastructure issues.

Dec

21

Study of ancient languages. from Nils Poertner

December 21, 2025 | Leave a Comment

Idea for younger Specs: In School, some of us studied old languages, Latin, ancient Greek, one had to sit 1 hour to figure out what individual words could mean. And then put it all together. One could have the same approach for reading modern newspaper articles now. like this WSJ article here (I know that ppl can read "English" - I meant in a more reflective way. "Get the joke")

Five Reasons Investors Are Feeling Good About Stocks Again

and then check /study with "expected" vs "actual" in 1 week, 1 month, 1 quarter etc,

on a rolling basis to hone intuition /train memory.

Stefan Jovanovich recalls:

Arthur Sullivan - "no, I am not a descendant of the composer, whom none of you dunces will have heard of. He was English; I am Irish." - remains my favorite of all teachers. He lasted 1 year at Hackley - then a borstal boarding school for children who had to be warehoused, now a respectable Westchester County day school. He taught 9th grade Latin and turned it into a lesson in military tactics and strategy. The little Latin and less Greek are long gone, but I can still see his face and those of my classmates the day he explained to us how Caesar used a company of archers to conduct reconnaissance by fire.

Dec

17

John Freeborn, from Stefan Jovanovich

December 17, 2025 | Leave a Comment

His book Tiger Cub: The Story of John Freeborn DFC* is the best writing about the RAF in WW 2.

The facts are from Grok; the comments are mine.

John Connell Freeborn, DFC & Bar (1 December 1919 – 28 August 2010), was a distinguished British fighter pilot and flying ace in the Royal Air Force (RAF) during the Second World War. He was kicked out of Leeds Grammar School at 16 for fighting and found his calling when he joined the RAF 3 years later under a short service commission. After 4 hours and 20 minutes of flight time, he was allowed to solo. In 3 months he went from trainee to pilot officer.

During the Battle of Britain (July–October 1940) Freeborn flew more operational hours than any other RAF pilot—over 300 sorties. He is credit with 5 confirmed kills (Messerschmitt Bf 109s) and 3 shared kills.

Freeborn served as RAF liaison and test pilot in the United States (January–December 1942), commanded No. 118 Squadron (June 1943–January 1944), was wing commander of 286 Wing in Italy (1944–1945). He quit the RAF in 1946; it was, he said, "run by nincompoops".

Dec

14

Ever Changing Cycles in the NBA, from Andrew Moe

December 14, 2025 | Leave a Comment

Wonderful example of ever changing cycles in the NBA vis a vis the post up play which went dramatically out of favor when analytics reshaped the game into a three point shooting contest but now has come back into favor due to the spacing afforded by all those three point shooters.

How post-ups became the NBA's most efficient play

Stefan Jovanovich comments:

Steve Ellison is wistful:

Might one dare to hope that actually putting the ball in play for fielders might once again gain favor in baseball?

Dec

12

Comments on free trade, from Stefan Jovanovich

December 12, 2025 | Leave a Comment

"Free trade" never loses an argument; it is like being in favor of virtue. Even the worst sinner knows that vice is not to be publicly defended. The difficult for those of us in the bleachers is that we have never been able to avoid asking the follow-on question: if you don't like tariffs as taxes, what do you want to have instead? Adam Smith's answers were (1) domestic excises - the sugar is allowed to arrive untaxed and then have a tax levied when it is sold and (2) occupancy taxes - to be measured by how many windows a building had. What is never mentioned, of course, is that Smith was completely in support of the navigation acts; Britain would have "free trade" but only on cargoes carried on British ships that traveled directly to British ports. His specific comment on that question was: “Defense is of much more importance than opulence.”

William Huggins writes:

i'm all ears to hear what national security threat the us is responding to with their 50% tariff on aluminum processed where there is an abundance of clean energy to do so and (until recently) all but perfectly aligned nat sec interests with the processor?

Stefan Jovanovich responds:

The answer offered by the authors and voters who made the Constitution the national law was "protection". I offer this only as an historical explanation, not advocacy, since those of us who live on popcorn and waiting from spring (what Rogers Hornsby said he did after the baseball season ended) have abandoned all attempts to understand what is called "policy", whether monetary or otherwise.

Art Cooper asks:

May I have your thoughts on Henry George's advocacy for the replacement of all other taxes by a land value tax?

Henry Gifford comments:

I think Henry George’s idea has a lot of merit, and not just because I heard that my father once taught at The Henry George School of Economics.

More than one calculation has shown that the cost of complying with tax laws in the US is about equal to the amount of taxes paid. If a land value tax eliminated all other taxes, almost all that cost would be saved. But, this would disadvantage the government because vague and complicated laws can be used by the strong against the weak, something not many in government want to see the end of.

Then there is the issue of jobs. The existing tax systems create a huge number of jobs, most of which would go away with a greatly simplified tax. Sure, those people could find more useful endeavors, increasing wealth for all, but if politicians started talking like that a lot of other things would be seen as folly.

Disagreements about the value of land could be handled like the ancient Greeks did – anyone claiming a lower value for their property can be challenged to sell it at that lower price.

A similar situation exists with the part of building design laws that regulate the energy efficiency of new buildings that get built. Now the laws run to hundreds of pages, which makes them very difficult to enforce. The vagueness gives the government people more power, as they interpret the laws as they see fit, or as they are paid under the table to do. For a time I was advocating a simple energy code: limit the size of the heating and cooling systems installed per the size of the building (you-tube: “The Perfect Energy Code”). Governments around the US were loathe to adopt a simplified energy code, because then jobs would be “lost” and the power to make arbitrary decisions would be reduced and the laws would actually be enforceable. A simplified tax collecting system will probably always be unpopular for similar reasons, despite what I think is a lot to recommend it.

Stefan Jovanovich responds:

Smith agreed with Henry George. He thought a land tax had all the attributes of a good tax, unlike income and employment taxes, which were the worst possible ones. Even tariffs had some virtues compared to those that required citizens to tell the state everything.

Nov

13

The $38 Trillion Question, from Humbert X.

November 13, 2025 | Leave a Comment

The $38 Trillion Question: An Interview with Stanford Professor Hanno Lustig

Hanno Lustig: I started thinking about the valuation of government debt by looking at the valuation of all Treasuries. What do we have to believe to get to a number like $38 trillion? You must believe there will be a huge fiscal correction, because ultimately the value of debt should be backed by future primary government surpluses. When you do the numbers, you realize that either bond investors are pricing in a huge fiscal correction that seems impossible, or Treasuries are significantly overpriced.

Carder Dimitroff notes:

The interest on debt is approaching $1 trillion per year and continues to compound. Interest costs currently exceed Department of Defense spending.

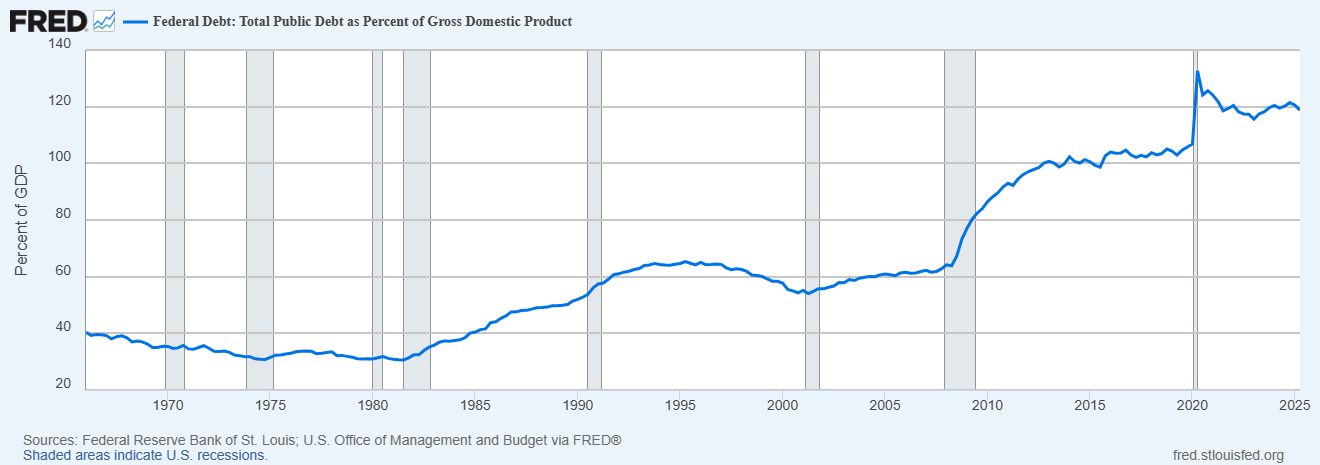

Larry Williams disagrees:

Meaningless measure look at debt vs gdp

Carder Dimitroff responds:

Yes, that makes sense. However, from a different perspective, it becomes meaningful under the One Beautiful Budget Bill when automatic sequestrations are implemented. Unless new legislation is passed, sequestrations will result in Medicare cuts and other reductions in expenditures. Current projections suggest sequestration will present in early 2026.

Big Al checks with FRED:

Nils Poertner writes:

recession + zero short term rates + lots of QE ….leading to a lot more public debt

maybe that is more likely path.

Stefan Jovanovich offers some history:

This chart shows the solvency ratios that can be found from the Census and other data [by decade 1880 to 2020] - how much "we the people" have in money divided by how much the American governments promise to pay.

Nov

4

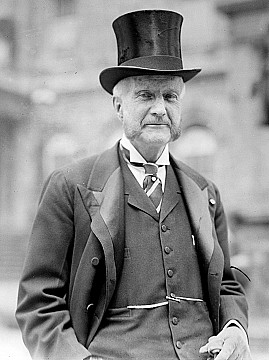

Edmund Clarence Stedman, from Stefan Jovanovich

November 4, 2025 | Leave a Comment

Edmund Clarence Stedman was the editor of this history, The New York Stock Exchange, quoted below on this site.

From Grok:

Edmund Clarence Stedman (1833–1908) was a prominent American poet, literary critic, and essayist, often dubbed the "Bard of Wall Street" for his successful dual career in literature and finance. Born in Hartford, Connecticut, on October 8, 1833, he was orphaned young after his father's death from tuberculosis and raised by relatives. He briefly attended Yale University (expelled after two years but later honored with a degree) before launching into journalism in the 1850s, working for outlets like the New York Tribune and New York World, including as a Civil War correspondent. He studied law and briefly served as private secretary to U.S. Attorney General Edward Bates.

Connection to the New York Stock Exchange

Stedman's ties to the New York Stock Exchange (NYSE) spanned over three decades, from 1865 to 1900, where he worked as a banker and stockbroker on Wall Street. This financial role provided stability amid his literary endeavors, allowing him to support his family while pursuing poetry and criticism. After retiring from the Exchange in 1900, he remained deeply involved in its institutional history. In 1905, at age 71, he served as editor of the landmark publication The New York Stock Exchange: Its History, Its Contribution to National Prosperity, and Its Relation to American Finance at the Outset of the Twentieth Century, a comprehensive two-volume work commissioned by the Stock Exchange Historical Company. Co-edited with Alexander N. Easton and others, it chronicled the NYSE's evolution from its founding in 1792 under the Buttonwood Agreement through its role in American economic growth. The book, limited to 3,000 copies (with a rare signed edition of 50 for select members), is a key historical resource on early 20th-century finance.

Literary and Other Achievements

Parallel to his NYSE career, Stedman produced influential works like Poems, Lyrical and Idyllic (1860), Victorian Poets (1875), and massive anthologies such as A Library of American Literature (1888–1890, 11 volumes) and An American Anthology (1900). He also dabbled in science, proposing an early rigid airship design in 1879. Elected to the American Academy of Arts and Letters in 1904, he died in New York City on January 18, 1908, from heart disease, survived by two sons.

Oct

26

The forgotten janitor who discovered the logic of the mind, from B. Humbert

October 26, 2025 | Leave a Comment

AI relevant:

Finding Peter Putnam

The forgotten janitor who discovered the logic of the mind

Every game needs a goal. In a Turing machine, goals are imposed from the outside. For true induction, the process itself should create its own goals. And there was a key constraint: Putnam realized that the dynamics he had in mind would only work mathematically if the system had just one goal governing all its behavior.

That’s when it hit him: The goal is to repeat. Repetition isn’t a goal that has to be programmed in from the outside; it’s baked into the very nature of things—to exist from one moment to the next is to repeat your existence. “This goal function,” Putnam wrote, “appears pre-encoded in the nature of being itself.”

Stefan Jovanovich offers, with a bit of irony:

From Grok:

Peter Putnam (1927–1987) was an American physicist and theoretical neuroscientist whose work anticipated many modern concepts in cognitive science, artificial intelligence, and philosophy of mind. He studied under prominent figures like Albert Einstein, Niels Bohr, and John Archibald Wheeler, and his ideas influenced early developments in computational theory of mind, though he remained largely unpublished and obscure during his lifetime. Putnam's writings, now digitized and discussed in recent scholarship (particularly following the 2025 rediscovery and publication of his papers), propose a functional model of the nervous system that integrates physics, game theory, and neuropsychology. His theory emphasizes how the brain achieves order and learning through mechanisms like Hebbian plasticity, distributed neural networks, and conflict resolution—ideas that predate similar concepts in predictive processing and reinforcement learning. Putnam's work is not a single, neatly packaged "theory of repetition" but rather a core principle woven throughout his model of cognition and behavior. Repetition serves as a foundational "goal function" for existence, learning, and induction (the process of generalizing from specific experiences).

Oct

24

Another Historical Analogy, from Stefan Jovanovich

October 24, 2025 | Leave a Comment

Grok and I have produced this summary of the growth of the electric utilities industry in the United States from 1910 to 1930. [Click on chart for full view.]

Bud Conrad comments:

Not sure what you take from this data. Electrification was probably more important than AI. Its growth rate was big at first in %, but slowed. Recessions were big downturns. What do you apply to today?

Steve Ellison writes:

My grandmother was a telephone operator in the 1920s. It was a high-tech industry at the time.

Carder Dimitroff clarifies:

The definition of an "electric utility" changed over time.

Big Al suggests:

An excellent series available on Prime:

Shock and Awe: The Story of Electricity

Professor Jim Al-Khalili tells the electrifying story of our quest to master nature's most mysterious force: electricity.

Books I haven't read yet, which get lots of stars:

The Power Makers: Steam, Electricity, and the Men Who Invented Modern America

The power revolution is not a tale of machines, however, but of men: inventors such as James Watt, Elihu Thomson, and Nikola Tesla; entrepreneurs such as George Westinghouse; savvy businessmen such as J.P. Morgan, Samuel Insull, and Charles Coffin of General Electric. Striding among them like a colossus is the figure of Thomas Edison, who was creative genius and business visionary at once.

Empires of Light: Edison, Tesla, Westinghouse, and the Race to Electrify the World

In the final decades of the nineteenth century, three brilliant and visionary titans of America’s Gilded Age—Thomas Edison, Nikola Tesla, and George Westinghouse—battled bitterly as each vied to create a vast and powerful electrical empire. In Empires of Light, historian Jill Jonnes portrays this extraordinary trio and their riveting and ruthless world of cutting-edge science, invention, intrigue, money, death, and hard-eyed Wall Street millionaires.

Oct

1

Lebanon, from Nils Poertner

October 1, 2025 | Leave a Comment

Lebanese traders from the 1980s tell me how chaotic that decade was - high vol ever day - for yrs. Survival was key! Started reading every bit about it in the last few weeks. (The thing that Stefan is right about is that the self-image we have in West and realtiy - there is a huge gap for sure!! Am not speaking about military though - I meant anything else)

The Lebanese Economic Crisis: How It Happened; the Challenges that Lie Ahead

September 27, 2021

Lebanon is experiencing one of the worst economic collapses in recent history. The currency has lost more than 90 percent of its value; an estimated three in four Lebanese citizens are now below the poverty line, and the country is beset by food, gas, and medical shortages. The power grid can barely maintain electricity for cities, with frequent blackouts occurring. Finally, the country had to default on its debt payment, launching its debt crisis. The debt crisis didn’t come suddenly, but was building up over time due to economic decisions made by previous governments. To understand how this crisis came to be, an examination of Lebanon’s modern history is in order, starting with the civil war in 1975.

Larry Williams writes:

Chaotic? In 1973 Shearson AmEx had me go there to lecture an teach trading - some high flyer commodity mooches had come in and lost lots of $$ for some locals who did not understand margin calls. The high flyers from Chicago were found gutted on a barb wire fence out in the country! The war broke out we could not get out for about a week so hung low then finally bribed our way home.

Nils Poertner responds:

my 2 cents are on Larry and all savvy Lebanese traders going forward. Good idea to live in more rural areas in the US, UK etc to see things unfolding as well. And keeping the internal chatter to a minimum (as always).

Stefan Jovanovich analogizes:

If LW disagrees, he will, I hope, correct this latest folly from the List's history channel wannabe. The reason the Oregon Trail came first was that it was the one safe destination for the missionaries. The Indians of the rain forest coastal Northwest were the tribes with no history of revolt against the Brits, Russians and Americans. The wars on the Plains started when some smart money decided that they could colonize the spaces between Council Bluffs and the Dalles. That analogy comes to mind every time I look at the modern history of the adventures of the Americans in Lebanon.

Larry Williams offers:

My brother on law who is better read than I am an a deeper thinker says this is a good read on the western adventure:

The Undiscovered Country: Triumph, Tragedy, and the Shaping of the American West

Sep

28

Scaling problems in ship design, from Nils Poertner

September 28, 2025 | Leave a Comment

Scale effects and full-scale ship hydrodynamics: A review

Scaling problems in ship design refer to the difficulties of translating performance data from a small-scale model to a full-scale ship, as physical forces like viscosity and wave drag do not scale proportionally with size.

Crypto space here? Trading strategies that work in niche mkts or early on, may not work when they are larger /more mature etc.

Henry Gifford writes:

The problems with water include the size of water droplets – they won’t form larger than a certain size – and Reynolds Number, which has to do with viscosity (mentioned below), and how to calculate it. Basically, a certain flow velocity in a small pipe (or river) will be turbulent, while in a larger pipe it might not.

Movies that use models of ships to show dramatic events with ships always show water droplets that are way, way too large, making it obvious to those who notice that they are looking at a model.

Nils Poertner responds:

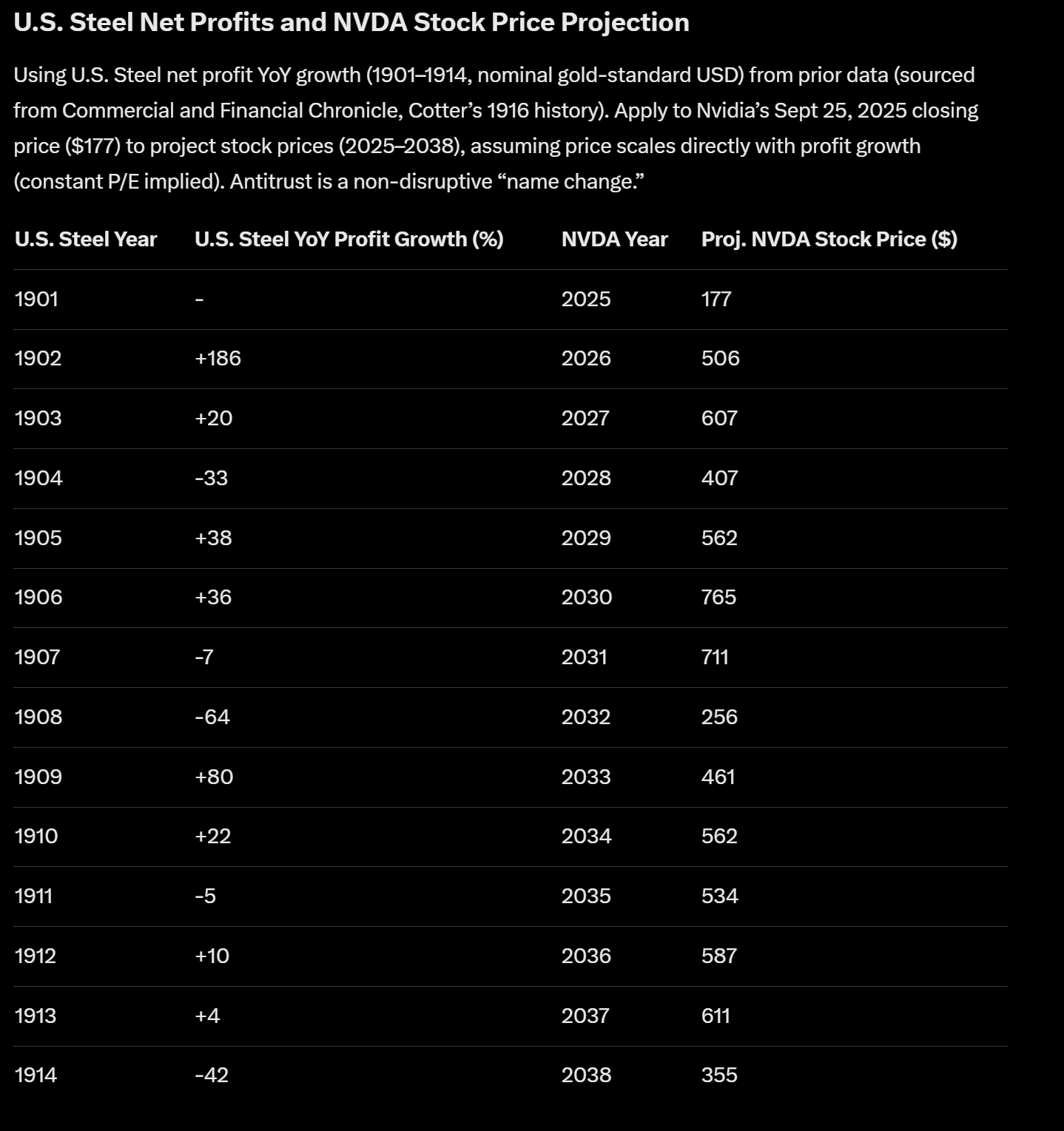

Makes a lot of sense, Henry, thanks! (Equity sell-side analysts love to scale things (to the point it makes no sense anymore). Wile E. Coyote moment for NVDA et al coming soon perhaps.

Stefan Jovanovich predicts:

Grok - our FO's new member (he/she/it works for free like Harry Potter's Dobby) - thinks the moment will be 2031-32. [Click on chart at right.] We take the current AI events as a direct comparison to the creation of U.S. Steel.

Sep

16

Happy Yeltsin Supermarket Day

September 16, 2025 | Leave a Comment

Thirty-five years ago today, Boris Yeltsin, then a newly elected member of the Supreme Soviet of the Soviet Union, visited NASA’s Johnson Space Center in Houston, Texas, where he toured the US government facility and the various technologies therein. But it was a brief, impromptu visit to a nearby grocery store that may well have changed world history.

Yeltsin, who’d two years later become the first freely elected leader of Russia, roamed the aisles of the relatively small Randall’s market that day and was astonished at the variety and affordability of the products on display. According to various reports, this visit — not the one to NASA — catalyzed Yeltsin’s exit from the Communist Party and his abandonment of the Soviet economic model.

Stefan Jovanovich comments:

The supermarket is innocent.

When Yeltsin visited the Johnson Space Center in September, it was two months after he had announced Soviet withdrawals of its Red Army garrisons from East Germany, Hungary, Poland and Czechoslovakia. Boris Yeltsin was first elected to office in the Soviet Union on March 26, 1989, as a deputy to the Congress of People's Deputies of the Soviet Union, representing Moscow’s 1st District. He won 89.6% of the vote (5,118,745 votes) in a multi-candidate election, defeating Yevgeny Brakov, a pro-CPSU candidate. The CPD was the equivalent of what the members of the more numerous branches of the State legislatures were in the 19th century; they elected members of the Supreme Soviet just as American State legislatures elected members of the U.S. Senate. He became the first President of the Russian Soviet Federative Socialist Republic (RSFSR) on May 29, 1990. The CPSU’s assets were seized, and its activities were suspended. A successor party, the Communist Party of the Russian Federation (CPRF), was formed on February 14, 1993, led by Gennady Zyuganov. The CPRF is an active political party in Russia, participating in elections and holding seats in the State Duma. As of the September 8, 2024, regional elections, the CPRF holds 57 seats in the State Duma (out of 450).

Sep

6

The Evolution of Infantry War-Fighting, from Stefan Jovanovich

September 6, 2025 | Leave a Comment

The greatest single success of the Japanese Army in WW 2 - the capture of Singapore - came directly from the use of bicycles as the primary means of troop transport.

From the Army and Navy Journal of 1896

BICYCLE “CORPS,” 25TH Inf

2d Lieut. James A. Moss, U.S.A., Commanding

The Bicycle Corps of the 25th. U.S. Inf., under the command of 2d Lieut. James. A. Moss, appears to have had a very successful, but very fatiguing, trial in their recent expedition from Fort Missoula, Mont., to test the bicycle for military purposes.

The corps left Fort Missoula Aug. 15 with rations, rifles, cooking utensils, shelter tents, ammunition, extra bicycle parts, repair material, etc., etc. They reached Fort Harrison on the 17th, having covered 132 miles in 22 hours of actual travel. They got new rations at Harrison and left for Yellowstone at noon Aug. 19, reaching Mammoth Springs, Wyo., at 1:30 Aug. 23. The distance of 101 miles was made in 31 hours of actual traveling. So far they had traveled in 53 hours of actual traveling, 323 miles of the hilliest and rockiest roads in the United States, fording streams, going through sand, mud, over road ruts, etc. Every day, except only one, they had wind against them. Aug. 25 the corps left for a days’ trip through the park.

When they left Fort Missoula, their lightest wheel [i.e., bicycle] packed, weighed 64 pounds, the heaviest 84 pounds, an average of 77½ pounds; the lightest wheel with rider, weighed 205 pounds, the heaviest, 272 pounds. The wheel used was the 26-pound Spalding bicycle, geared to 66½. The weights of the members of Bicycle Corps were as follows: Lieut. Moss, 135 pounds; Corp. Williams, 153½; Musician Brown, 145½; Pvt. Proctor, 152; Pvt. Findley, 183½; Pvt. Foreman, 160; Pvt. Haynes, 160; Pvt. Johnson, 151½.

Previous to making this trip, Lieut. Moss made a preliminary excursion to Lake McDonald, leaving Fort Missoula at 6:20 A.M., Aug. 6 and reaching there on return at 1:30 P.M., Aug. 9, having ridden and walked 126 miles in 24 hours of actual traveling under most adverse circumstances. They were delayed quite a number of times in tightening nuts, adjusting handle bars, etc. The wheels were not spared in the least, and did the work extraordinarily well. On their trip the men found the roads muddy from recent rain, and were impeded by the clay-mud sticking to the tires of their bicycles. They had to dismount frequently to scale heights, and over six miles of road they dismounted twenty times on account of mud puddles and fallen trees. While crossing Finley Creek on wheels two men fell in the stream. Part of the journey was made in a driving rain, which covered the wheels with mud and filled the shoes of the riders with water, making it difficult for them to keep their feet. on the muddy pedals. [Another creek] was forded through three feet of swift water, each wheel being carried across on a pole suspended from the shoulders of two soldiers. "Had the devil himself," says Lieut. Moss, “conspired against us, we would have had little more to contend with.”

The party attracted great attention along the way from the inhabitants, and their dogs and cattle. Dogs ran after them, cattle away from. them, and residents stopped work and stood in open-mouthed wonder as they passed. Every once in a while they would strike an Indian cabin and the dogs barking would announce their approach, while the occupants would stand in the door and gaze at them. Every other soldier carried a complete Spalding repair kit. The large tin [water] case (carrying about 11 gallons) was attached to the front of bicycles on a frame and strapped to the handle bars. The men wore the heavy marching uniform, and every other soldier was armed with a rifle and 30 rounds ammunition. The rifles were strapped horizontally on the top side of the side of the bicycles with the bolt on top. Those not so armed carried revolvers on belt with 30 cartridges.

Big Al adds:

More detail:

The Twenty-Fifth Infantry Bicycle Corps

On June 12, 1894, James A. Moss graduated from the United States Military Academy at West Point. Moss was assigned to the all-Black Twenty-Fifth Infantry, headquartered at Fort Missoula, Montana. It was one of four all-Black regiments in the Army at the time, nicknamed the Buffalo Soldiers.

Aug

29

What we don’t trade, but study for warnings about what the 19th Century called “slumps”, from Stefan Jovanovich

August 29, 2025 | Leave a Comment

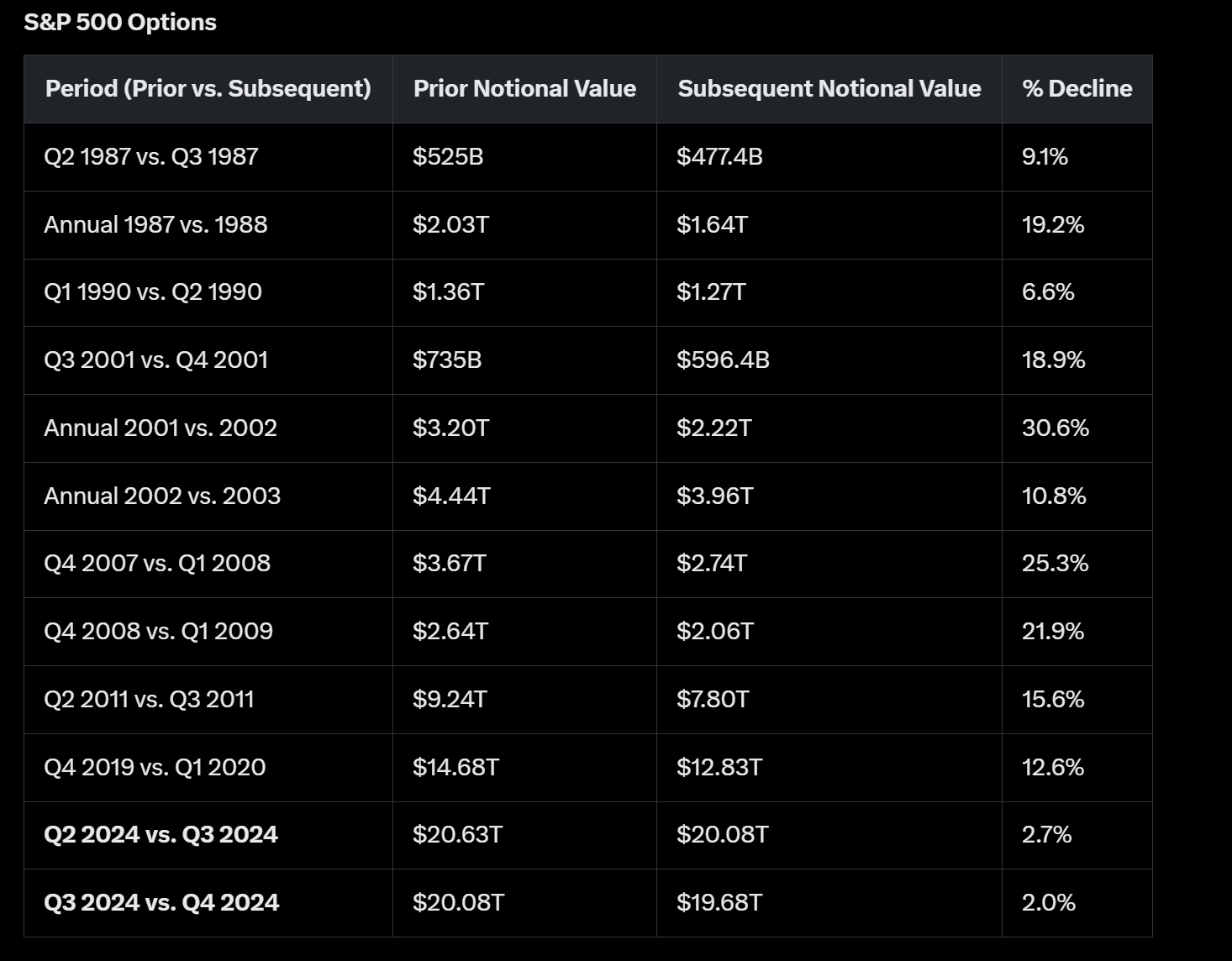

Our FO has been using Grok3 to build tables of the historical declines for financial assets. I have been doing the typing of the queries, Grok has done the thinking and the other members of the FO have set the definition for the market measure they want to use for timing. The measure is what our most smart ass member calls the Louis L'Amour "herd size" - the notional value of the assets wandering around the range.

Here is the data for the 10 worst quarter-to-quarter/year-to-year period slumps in the S&P 500 options herd size for which Grok was able to retrieve reported data.

Aug

27

Suppliers vs providers, from Stefan Jovanovich

August 27, 2025 | Leave a Comment

The opportunity lies with the supplier, not the providers of AI.

Larry Williams asks:

Who are the suppliers?

Stefan Jovanovich answers:

Nvidia. My 19th century brain thinks of NVDA as a supplier of the stuff the people selling information tickets will use to build their 21st century railroads.

Easan Katir writes:

Agree. Those creating the AI platforms won't generally be good investments, imho. Why? They lack one thing needed: scarcity. Any intelligent person can feed his/her data into an LLM and create their own AI for $20 / month or less. China's DeepSeek is free, I've read. Hard to make a profit when competing with free.

Last month I had lunch with an author cousin who lives in Tehama Carmel Valley. She uploaded all her books into an LLM, cloned her voice with another AI service, connected that to her voicemail. Now her clients can call her number and her cloned voice answers all their questions based on the knowledge in her books. All while she's having lunch.

AI + robotics will be a theme, such as Elon's Optimus and robo-taxis, yes? Investing in the suppliers is mostly done, isn't it? NVDA being the most obvious. Along with LW, other inquiring minds wonder which companies you have in mind.

William Huggins responds:

don't forget the coal and iron mines, those essential input assets that 19th century railroad magnates knew could be pilfered via land "grants". i think the equivalent is looking at the companies involved in the chip etching (who makes the lasers, etc).

Henry Gifford comments:

FRED says that Railroad stock prices weighted by number of shares went up x7 over 70 years [to 1929]. Nice, but not fantastic, but weighing by number of shares could be misleading because of reverse splits, shares of a new company replacing a larger number of shares of the old company in a buyout, survivorship bias when a company goes bankrupt, etc.

% of market cap can I think also be misleading because of people pouring huge amounts of money into companies with no revenue in the hope of future returns, adding to market cap.

Stefan Jovanovich responds:

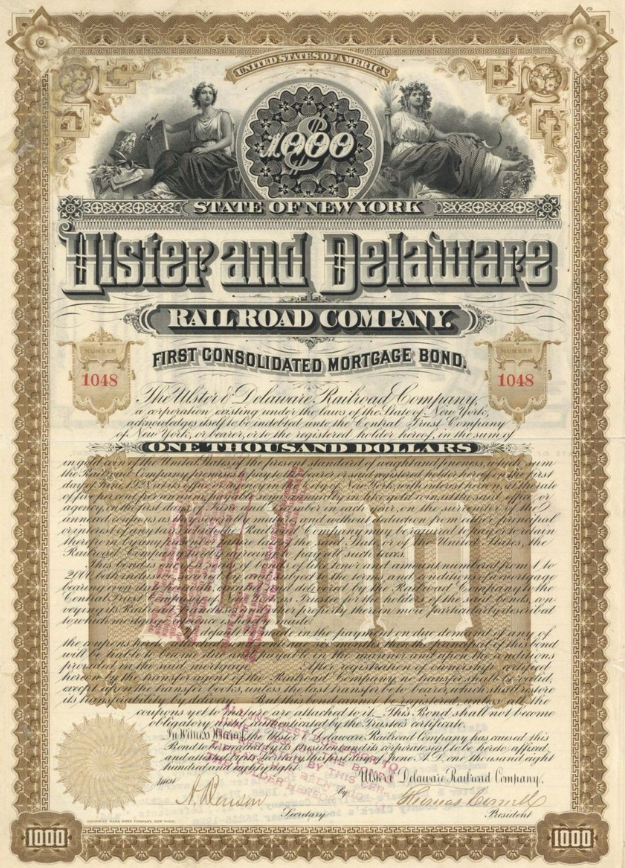

In the last third of the 19th century, the money made in railroad investing was in the bonds, not the stocks. That was the recital of the FRED data that some found so surprising. For this 19th century mind those results are not surprising because the one President in the century who could do the math killed the speculation in international money.

Aug

23

Carpet bombing and the death of General Lesley McNair, from Humbert X.

August 23, 2025 | Leave a Comment

In July 1944, McNair was in France to observe troops in action during Operation Cobra, and add to the FUSAG deception by making the Germans believe he was in France to exercise command. He was killed near Saint-Lô on 25 July when errant bombs of the Eighth Air Force fell on the positions of 2nd Battalion, 120th Infantry, where McNair was observing the fighting. In one of the first Allied efforts to use heavy bombers in support of ground combat troops, several planes dropped their bombs short of their targets. Over 100 U.S. soldiers were killed, and nearly 500 wounded.

Stefan Jovanovich recalls:

My favorite Audie Murphy bit of history (which can be verified by recollections but not by any published anecdotes) is that Murphy met Omar Bradley in Hollywood in July 1951 when Bradley was Chairman of the Joint Chiefs of Staff. The Red Badge of Courage had been released and Murphy was a "star"; Bradley was on his way to and from Japan and South Korea to talk to Matthew Ridgway (MacArthur's successor) about how the war was going. Someone had the bright idea to bring favorable publicity to the war effort that was so unpopular that it would elect a Republican as President for the first time in a quarter century by having a photo shoot of Bradley, a 5-star general, and Murphy, the most decorated "common" American soldier. The story is that they met with Bradley in his full dress uniform and Murphy in a suit and tie and, with the cameras rolling, everyone got ready for Murphy to come to attention and salute. He just stood there opposite Bradley and his entourage. Finally, with teeth clenched and skin reddening, Bradley raised his right hand and placed it diagonally across his right cheek. The rule was and still is that everyone in uniform regardless of rank salutes the holder of the Medal of Honor first.

I like to think that Murphy enjoyed the moment as a tiny bit of revenge for the stupidities of Bradley, who, along with Carl Spaatz, made Murphy's and his fellow soldiers lives much, much harder with their belief in bombing from 20,000 feet. The carpet bombing tactic was still very much the Air Force catechism when I was in the Navy on the Mekong River in 1967 and 1968. I was told by the writer who put down the words of Schwarzkopf's memoir that Stormin Normin's happiest fit of temper came in the meeting when he asked the senior boy in blue how much longer the Army would have to watch and wait from a safe distance so the Air Force could continue to bounce the rubble.

Aug

22

Another POV on the intelligence community

August 22, 2025 | Leave a Comment

How to Be a Good Intelligence Analyst

“The first to get thrown under the bus is the intelligence community”

Which blog recommends this book:

Analytic Culture in the U.S. Intelligence Community: An Ethnographic Study, by Dr. Rob Johnston.

[Dr. Johnston] reaches those conclusions through the careful procedures of an anthropologist — conducting literally hundreds of interviews and observing and participating in dozens of work groups in intelligence analysis — and so they cannot easily be dismissed as mere opinion, still less as the bitter mutterings of those who have lost out in the bureaucratic wars. His findings constitute not just a strong indictment of the way American intelligence performs analysis, but also, and happily, a guide for how to do better. Johnston finds no baseline standard analytic method. Instead, the most common practice is to conduct limited brainstorming on the basis of previous analysis, thus producing a bias toward confirming earlier views. The validating of data is questionable — for instance, the Directorate of Operation’s (DO) “cleaning” of spy reports doesn’t permit testing of their validity — reinforcing the tendency to look for data that confirms, not refutes, prevailing hypotheses. The process is risk averse, with considerable managerial conservatism. There is much more emphasis on avoiding error than on imagining surprises.

Stefan Jovanovich comments:

Actual military intelligence is never even allowed to be on the bus. The CIA's human analysts had an infallible record of guessing wrong about war that was matched only by Congress and the Pentagon. The odds are that Putin and Trump spent the time discussing what the Russian Army's actual capabilities are and what the Russians know about NATO's present inventory. The absence of any U.S. generals and intelligence professionals from "the meeting" is a pure tell.

Aug

15

Another Comparison of the 19th with the 21st Century, from Stefan Jovanovich

August 15, 2025 | Leave a Comment

Having tortured you all with the statistics for the stock and bond prices for the railroads, it seems only appropriate to add to the data the calculations of the changes in physical freight itself. The average freight car in 1860 could handle 5-10 tons; by 1890 the figure was 20-30 tons thanks to Mr. Carnegie's rails that replaced iron with steel.

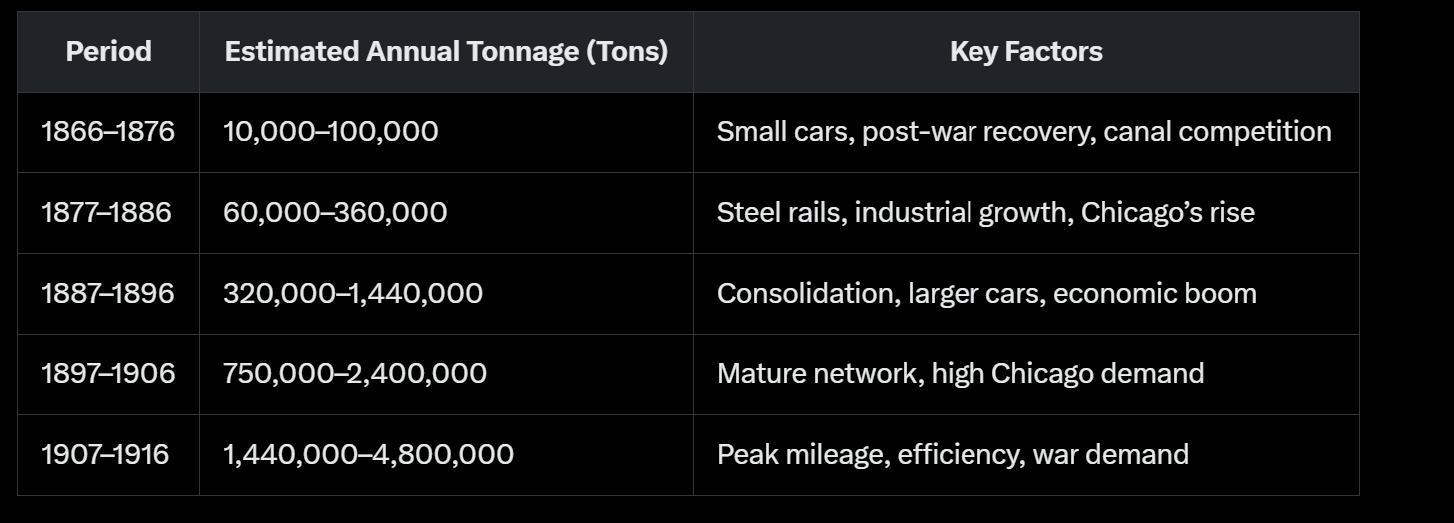

This is Grok's and my best estimates of the annual tonnage between New York and Chicago over the decades between the end of the Civil War and the beginning of U.S. participation in the Great War.

For Russia the primary corridor is between Moscow and the Urals. They have finished building the M12 3-lane dual carriageway (the equivalent for motor freight of the double tracking between NY and Chicago). A trip that took 30 hours now takes 16.

Jul

24

The Penobscot Expedition, from Stefan Jovanovich

July 24, 2025 | Leave a Comment

Today is the 246th anniversary of the foreign war excursion that would result in 2nd worst naval disaster in American history.

On July 24, 1779, the naval expeditionary force commissioned by the Massachusetts General Assembly departed Boothbay, Maine for Castine on the Penobscot peninsula where the British had a 750-man garrison. The expedition had 19 warships, 24 transport ships and more than 1,000 militiamen under the command of Commodore Dudley Saltonstall, Adjutant General Peleg Wadsworth, Brigadier General Solomon Lovell and Lieutenant Colonel Paul Revere.

On August 13th 7 British ships arrived to reinforce the Castine garrison. The response of Commodore Saltonstall was to burn his ships and lose 470 men by death and capture to the British, who were led by Sir George Collier. Collier would lose 13 men.

Saltonstall and Paul Revere later faced court martial because of the fiasco. Saltonstall would lose his commission, but Revere won acquittal.

The Penobscot Expedition would rank #1 in American nautical fiascos until 1941 when the Japanese Navy would visit Pearl Harbor.

Jul

23

Entry or exit opportunity, from Nils Poertner

July 23, 2025 | Leave a Comment

Donald Trump set to open US retirement market to crypto investments

President preparing executive order to allow 401k plans to tap broad pool of alternative assets

Hm. Entry for ordinary folks or a sneak way / exit for established players? Have a got a picture of the angel fish in my office, to remind me of the deceptive nature of markets. Angler fish are those ambush predator fish living in deep sea, that can illuminate poles in front of their jaws….to catch smaller fish.

William Huggins writes:

am reading Gustavus Myers' History of Great American Fortunes (1907) at the moment and just absorbed 300 pages of railroad fraud perpetrated by those who got their hands on the "mcguffin" asset and then sold it off only once they had successfully looted the value. the same sort of economic transfer happens for early crypto adopters - those trillions of market cap are "paper only" until some rubes can be fleeced of their efforts for the worthless securities foisted upon them.

Stefan Jovanovich comments:

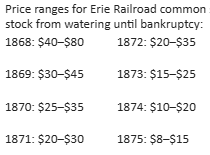

I hope this comment will not be read as argument or rebuttal but only as a factual footnote to Myers' work. The 50,000 shares issued by Fiske et. al. were "legal" in the same way that carried interest is "legal". They were allowed by New York State law in 1868.

The primary limitation on the issue of new shares of common stock for the Erie was its corporate charter. The board only had authority to issue $30 million in capital stock. Any issues above that amount required amendment of the corporate charter by the legislature and majority shareholder approval. The additional 50K of stock issued, at its par value, did not increase the total capitalization above the $30 million limit.

NY State law in 1868 allowed non-cash consideration. The contracts that the Erie board accepted as payment for the new shares were, in nominal dollars, fully equal to the par value of the shares issued. Shareholders had the right to challenge that claim; they were, as litigant frequently are, disappointed by the rejection of their challenge. The result was a situation that can be politely described as "judicial uncertainty" - i.e. a battle of conflicting injunctions.

Jul

15

July, 1798 - John Adams Starts the first Loser War of the United States, from Stefan Jovanovich

July 15, 2025 | Leave a Comment

The rules for American warfare are painfully simple: we win the ones that other people start, and we lose the ones that we start. Today is the formal anniversary of the first loser war by the American Republic. Congress, at the urging of President Adams and his Secretary of the Navy, Benjamin Stoddert, revokes its treaty with France. Because the revocation put the country in a state of war with France but is not a formal declaration by Congress, our history books call it a "Quasi-War". Conventional history does its best to pretend that this was a success. History Today tells us "the Navy gained respect as a powerful force. It grew from a mere six vessels to about 30 commissioned ships. American warships captured more than 80 French vessels during the Quasi-War."

U.S. launches the Quasi-War with France, the first conflict since the Revolution

Total tonnage of ships captured during the Quasi-War

(the figures given are a range because the sizes of the individual ships captured have to be estimated; there are not enough surviving records to know how large each ship was.)

• American ships captured by French Navy: 200,050–400,100 tons

• French ships captured by U.S. Navy: 5,200–10,000 tons

We have better numbers for the the number of ships captured:

• American ships captured by French Navy: roughly 2,000

• French ships captured by U.S. Navy: 85-86

The American records are much more precise because the captures had to be valued; prize money was the incentive pay for the officers and sailors.

Steve Ellison writes:

Paul Johnson, in A History of the American People, wrote that Thomas Jefferson during his two terms as president was endlessly vexed by the depredations of both the British and French navies on American shipping. One wonders why we start any wars if we are guaranteed to lose.

Stefan Jovanovich responds:

The data for the war that the Democrat-Republicans (Jefferson and Madison) wanted and formally declared - the one that started in 1812 and is still looking for a name:

• U.S. Captures: 44,412–63,912 tons (200–250 vessels)

• U.K. Captures: 144,799–424,799 tons (1,406 vessels)

Jul

6

William Slim, from Stefan Jovanovich

July 6, 2025 | Leave a Comment

As officers, you will neither eat, nor drink, nor sleep, nor smoke, nor even sit down until you have personally seen that your men have done those things. If you will do this for them, they will follow you to the end of the world. And if you do not, I will break you.

– Field Marshal William Slim, British Army

Bud Conrad is skeptical:

Of course, they all SAY things like that. But they have their own Officers' Quarters, that "Rank has privilege" and fat retirement on the boards of suppliers. Is there a specific application you're trying to comment on with this quote?

Stefan Jovanovich responds:

At age 16 Slim went to work as a clerk for Stewarts & Lloyds, a supplier of metal tubes. (Slim was able to get the job because he had grown up in the business; his father was an ironmonger.) In 1910, at age 19 he enlisted in the University of Birmingham Officer Training Corps. Because he had the money to buy a regular commission, he was given a temporary rank with the Royal Warwickshire Regiment in 1914. He served in Turkey (Gallipoli), Mesopotamia (Iraq) and France, was wounded twice and earned the Military Cross in 1916. In 1919 he was transferred to the Gurkha Rifles of the British Indian Army and served in the Northwest Frontier (Afghanistan). He was able to attend the Camberley Staff College in 1926; despite his inferior social background, he was invited to stay on and become an instructor. He returned to India in the 1930s and became commander of the 2nd Battalion, 7th Gurkha Rifles. After a year at the Imperial Defence College, he was promoted to brigadier and led the 10th Indian Brigade. In 1940 he was promoted to major general to command the 10th Indian Infantry Division, which operated in Iraq, Syria and Iran in 1940-1941. In March 1942 Slim was appointed commander of the Burma Corps. He led them in a 900-mile retreat from Rangoon to India. In May 1942 the Burma Corps was reorganized into XV Corps of the Eastern Army and Slim as appointed lieutenant general. In October 1943 Slim became commander of the Fourteenth Army.

The rest of the story is easy. The 14th (which became known as the Forgotten Army because they were last in the supply chain for everything) would defeat the Japanese 15th Army at Imphal and Kohima in 1944 and reconquer Burma in 1945. The Japanese would suffer 180,000 casualties; the 14th 24,000.

Slim suffered from the effects of malaria throughout his life; his nickname among the troops was "Uncle Bill".

Jun

29

We know that Morris had at least £11,250 sterling in January 1784 when Congress ratified the Treaty of Paris. That was the sum Morris contributed, as lead manager, to a subscription for “a vessel for the China trade”. The Empress of China venture would raise £27,000 – Morris’ £11,250, £6,750 from Daniel Parker, a New York merchant, £4,500 from John Holker, the French consul in Philadelphia, and £4,500 from other individual investors. The partners would buy a 360-ton, 18-gun sloop that had been built in Baltimore in 1783 as a privateer, convert it into a merchantman and load cargo in Philadelphia and New York: 30 tons of ginseng, 2,600 beaver and other furs, Spanish silver dollars, lead, pepper and naval stores (turpentine). The captain would be John Green. Green had served as captain of the Pennsylvania Navy sloop Aetna in 1776; in 1778 he had been captain of the brig Hope which is recorded as having captured £1,000 in prizes under its privateering commission. The Supercargo would be Samuel Shaw. Shaw had enlisted as an Ensign in the 3rd Massachusetts Regiment in 1775 after the Battles of Lexington and Concord. As Lieutenant, the Captain and then Major Shaw would serve under General Henry Knox as an artillery officer, then aide-de-camp and deputy adjutant general.

The Empress of China sailed from New York on February 22, 1784 with a crew of 34 (Green, Shaw, 2nd supercargo Thomas Randall, 2 carpenters, a barrel-maker and “several boys”). It would stop at the Cape Verde Islands for provisions in April, round the Cape of Good Hope, pass through the Sunda Strait (where it narrowly avoided a collision according to Green's logbook), and anchor at Whampoa on August 28, 1784. 1 of the crew would die in Canton of “illness”, and the ship would have £500 of repairs done while in port. Shaw would present a letter from Congress to the Chinese officials, and the Canton merchants would give Captain Green a painted fan with a portrait of the ship (the only image of the Empress of China that survives). Shaw’s September-December 1784 journal would record payments of £1,500 in duties and £500 for an interpreter. He and Randall would sell the ginseng for £6,000 and the furs for £4,000; they would buy 800 chests of tea (£15,000), 20,000 pairs of cotton trousers from Nanjing (£3,000), 64 tons of porcelain (£2,000), and silk fabrics (£1,500). The ship would weigh anchor at Whampoa on December 28 “with a fair wind”. They would sail around the Straits of Malacca, across the Indian Ocean, around the Cape of Good Hope and anchor at St. Helena on March 10 to take on water (£100). The carpenters would spend £50 in materials to repair minor leaks. According to Shaw’s logbook, the ship “Made land at New York, May 11, 1785, to great acclaim.” The cargo would be sold in Boston, New York and Philadelphia. Morris’ papers record a net profit of £6,250. What is puzzling is his calculation that this was only a 25% return on his investment of £11,250. What makes things curiouser and curiouser is that Daniel Parker will write to Morris that the venture has provided him with a “satisfactory return” and then flee to Britain 2 months later, leaving debts of £20,000 and the Empress of China put up for sale, advertised in the New York Packet as “copper-bottomed, scarcely two years old, fit for Indian with small expense.”

In 1785 he would purchase 100,000 acres in western Pennsylvania for £5000 and then sell half his holding in 1787 for the same amount. In 1786 he would invest £3,000 in the privateering schooner Dolphin; the following year the ship would record the sale of £3,000 in goods captured. In 1788 Morris' own balance sheet would show his liquid net assets at £20-30,000.

By 1790 Morris would purchase the Genesee Tract from the State of Massachusetts -1.5 million acres in the Genessee region of New York, paying £22,500. In 1791 he would buy the city block in Philadelphia (Chestnut-Walnut, Seventh-Eighth Streets) for £22,500. That same year Morris would launch the Delaware and Schuylkill Canal Company. Of its total £45,000 capital Morris would contribute £11,250. In 1793 he would sell 1 million acres of the Genesee Tract to the Holland Land Company for £75,000 and buy shares in the Bank of Pennsylvania (£4,500). In 1794 the work would begin on the Chestnut Street mansion, with Pierre Charles L’Enfant being paid £2,000 for design and supervision and £6,138 being spent that year on construction.

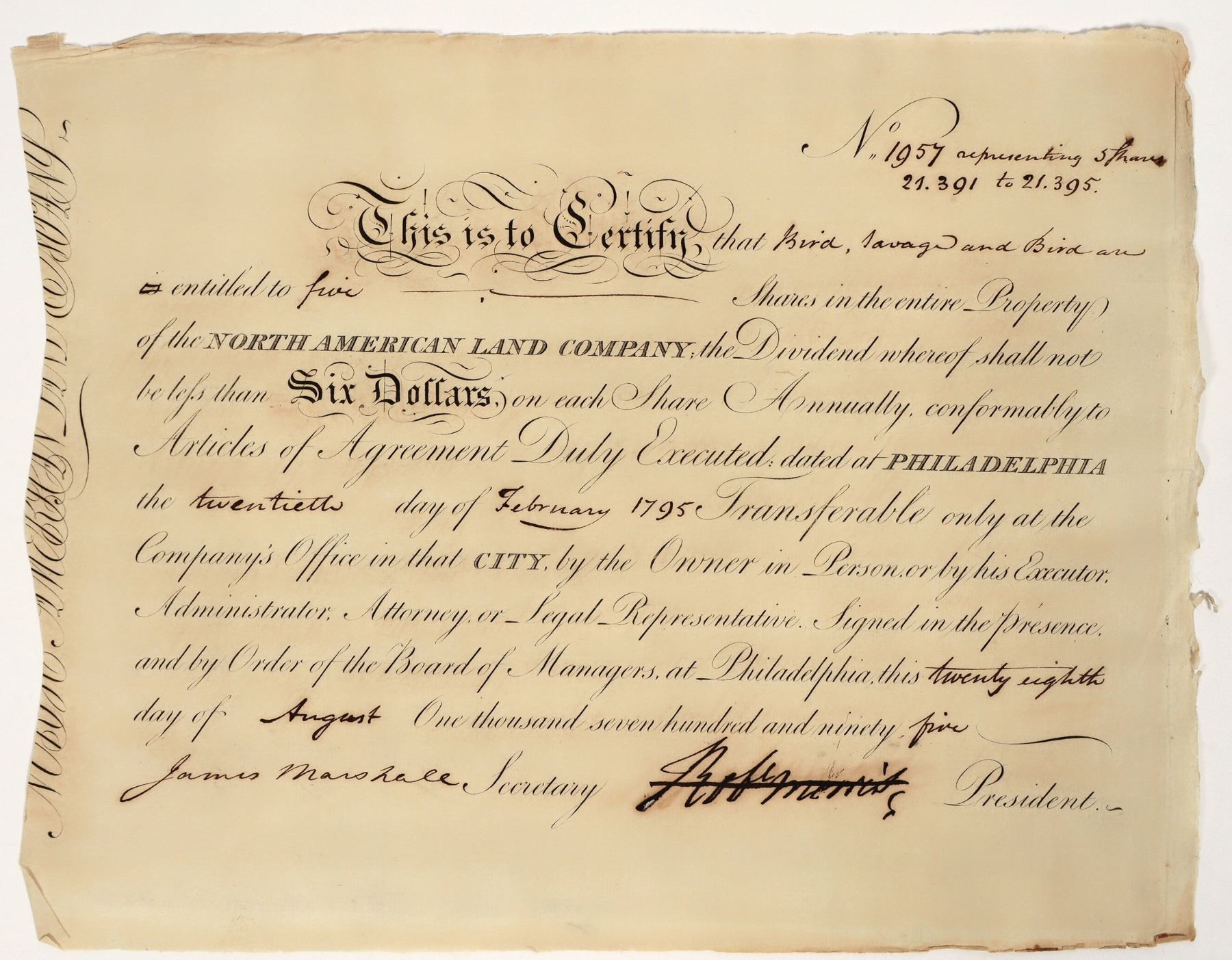

1795 would be the year of the very big deal. Morris, James Greenleaf and John Nicholson would form the North American Land Company; each would own 10,000 shares, and the venture would be capitalized at £675,000. It would own 6 million acres. Within 2 years (1797) Greenleaf and Nicholson would be in Prune Street Prison for bankruptcy. Morris would arrive there the following year (1798). Their collective unpaid debts would be in excess of £1,000,000.

Jun

19

Robert Morris, financier, from Larry Williams

June 19, 2025 | Leave a Comment

North American Land Co. stock issued to Bird Savage & Bird of London in 1795. Signed by Robert Morris as president and James Marshall as secretary. Morris' signature is pen cancelled. 9.75 x 12" Robert Morris was the financier of the American Revolution, and one of only two Founding Fathers to sign all three key American documents: The Declaration of Independence, the Constitution, and the Articles of Confederation. Morris was the first to use the dollar sign in official documents. The financial Panic of 1796 led to his financial ruin and he was incarcerated for debt in the Prune Street Prison. Date: 1795

Stefan Jovanovich writes:

Morris was the intern/apprentice to Charles Willing (Thomas Willing's father). When Charles died in 1754, Morris became a partner; he became a name partner in Willing, Morris & Co. by 1757. There was no formal registration of businesses in the Province of Philadelphia. "Firms" were known by usage as either individuals or partnerships. We know that the firm existed because its name appears in the Customs records as owners of the brig Nancy and on a bill of exchange for 500 pounds in 1757. The firm "dissolved" in 1783; in March 1784 Thomas Willing wrote a letter to a fellow merchant referring to "our late firm".

By 1781 Morris had left doing any of the daily the business of the firm because of his duties as a public official. On February 20, 1781 Congress appointed Morris Superintendent of Finance; and in September Morris became Agent of Marine - i.e. Secretary of the Navy. On December 31, 1781 Congress chartered the Bank of North America and Thomas Willing was named as its President.

The mixture of finance, merchant business and government was complete. Willing, Morris & Co. supplied muskets, gunpowder and food to the Continental Army. The Bank of America and Willing, Morris & Co. secured $5.4 million in loans ($4 million from France, $1.4 million from the Netherlands) and also made loans directly to Congress. When Congress did an audit in 1783 they found that the discrepancies in the accounting were for money that had flowed to the government, not from it. Willing & Morris had paid $100,000 in Treasury debts.

How Morris went on the become the richest man in the country, owner of "Morris's Folly" and the most famous bankrupt is Part 2 of the story. How Willing (not Alexander Hamilton) became the "founder" of the American system of finance is a whole new volume.

Jun

3

Books again, from Asindu Drileba

June 3, 2025 | Leave a Comment

I can't find any books from the 1700s. Big events like the Mississippi Scheme and the South Sea Bubble happened in that period. But I can't find literature from the 1700s of people describing markets then. Maybe they had PTSD from having their fingers burnt? I heard Newton never wanted anyone to mention "South Sea" around him. (he lost his pile in the investment)

Stefan Jovanovich responds:

Essai sur la Nature du Commerce en Général, by Richard Cantillon (1680s–1734)

During 1719 Cantillon sold Mississippi Company shares in Amsterdam and used the proceeds to buy them in Paris. Mississippi Company shares surged from 500 livres in January 1719 to 10,000 livres by December 1719; during the same period the prices in Amsterdam went from 400 to 7,000. The daily average spread is calculated to have been between 20% and 40%.

Carder Dimitroff suggests:

Empire Incorporated — The Corporations that Built British Colonialism, by Philip J. Stern

The book provides historical perspectives about British markets and corporate financing. It's not an easy read, but it is fascinating.

William Huggins writes:

there is a collection of "things written afterwards" about 1720 called The Great Mirror of Folly but its mostly moralizing tracts than a steely-eyed review of what went down. keep in mind the experience (a bubble in uk-fr-nl, all at the same time) had profound effects on the market for almost a century afterwards with the fr retreating from paper money and the british passing the bubble act which made it waaaay harder for anyone to raise capital. trading stock largely returned to being an insiders game until the 1800s. GMoF was recently published along with a pile of other primary docs by Yale U press:

The Great Mirror of Folly: Finance, Culture, and the Crash of 1720

I like the goetzmann treatment of 1720 from Money Changes Everything personally. He's got a couple of good recorded talks on it too. for those interested in institutional developments around markets and financial institutions in north america, I strongly recommend Kobrak and Martin's "Wall Street to Bay Street."

Steve Ellison offers:

Extraordinary Popular Delusions and the Madness of Crowds was written in 1841 by Charles Mackay. The first three chapters are devoted to the Tulip Mania, the South Sea Bubble, and the Mississippi scheme. The remainder of the book is about non-financial episodes of irrationality, including a chapter about plagues that I re-read closely in March 2020.

May

22

Books on markets before 1900, from Asindu Drileba

May 22, 2025 | Leave a Comment

I noticed that I know of very few books on the stock market before 1900. I only know of:

Confusion of Confusions, by Joseph De La Vega (1688)

The Art of Investing, by John F Hume (1888)

Are there any books about the market before 1900 that can help me grow this list?

Big Al replies:

Lombard Street: A Description of the Money Market, by Walter Bagehot

Fifty Years in Wall street, Henry Clews

Francesco Sabella suggests:

The Stock Exchange: A Short Study of Investment and Speculation, by Francis W. Hirst

Stefan Jovanovich offers:

The Stock Exchange from Within, by Van Antwerp, William Clarkson

Martin’s Boston Stock Market, by Joseph Gregory Martin

Wall Street in History, by Martha J. Lamb

May

21

Ty Cobb as a Trader, from Stefan Jovanovich

May 21, 2025 | Leave a Comment

If Cobb saw a pitcher more than 20 times, he was able to hit better than .300 (the batting average that now gets you into the Baseball HOF). The two exceptions was Red Ruffing and Waite Hoyt.

Once Cobb saw what you had, he owned you; but he had to see what you had. This explains the anomaly of his doing badly against the "pitchers" who were not, in fact, pitchers but field players - Clark Griffith and George Sisler.

David Lillienfeld adds:

It depends on the pitcher, too, though. Willie Mays commented once that Sandy Koufax would tip off batters all the time as to what pitch he was going to use. A Koufax curve was as wicked as a Koufax fastball to Mays. He said that trying to hit that pitch, even knowing what pitch Koufax had thrown, was "like eating soup with a fork. You just can't do it."

May

5

TSLA Stock, from Francesco Sabella

May 5, 2025 | Leave a Comment

Fundamentally one thing i like of Tesla its the self driving technology, even if proper implementation is probably years ahead, maybe even more. And this extraordinary technology was funded thanks to Tesla high stock price. With the high stock price it strenghtned the fundamentals which fueled funding for innovation creating a virtuous cycle.

Thanks to this Elon could borrow easier and invest more and more… i waited to see if sentiment flipped on its favor again, but it didn't, so the same dynamics that made him so successful in the past will now (not now actually, as its months already) work against him can help deteriorate the fundamentals even faster.

I do not forget about the exceptional ability of american companies into adapting to different economic environments, but i have a lot of confidence on this trade. Plus all the reputational risks of Elon with his political activity and its exposure. Again, Elon's exposure is what helped a lot TSLA growing so big, but now that exposure is working again him unless he recognizes the mistake is doing and change the way he deals with his public image, which he won't.

In Q1 2025, Tesla's net income dropped an incredible 71%, to just 409 mln , compared to the same quarter in the previous year. This dramatic decline signals serious trouble in maintaining profitability, especially when you consider that without 595 mln from selling zero-emissions tax credits, Tesla would have actually posted a loss. This reliance on external credits to stay in the black is a grim indicator of weakness in its core operations. Operating margin is Operating Margin is at 2.1%, which is below industry.

And, in my opinion one of the most bad-looking things is the warranty liabilities, which is out of control. Let’s assume they hit $3.5 billion, up from, say, $2.5 billion in Q1 2024—a 40% jump in one year. Compare that to their $409 million net income in Q1 2025, and you’re looking at a liability that’s 8.5 times their quarterly earnings which will drain cash and destroy profitability.

If this trend holds, which very likely will given the self reinforcing behavior of the stock, tesla will need to raise prices of the car to cover the costs shutting demand even more,cut research and innovation and raise capital.

And most don’t realize how much Tesla’s battery production hinges on cobalt from politically unstable regions and a conflict or export ban could choke their supply chain overnight, spiking costs or halting production. It’s a hidden risk, that can cause serious problems, without adding the macroeconomic current environment which you are probably aware of.

Elon's bold announcements worked very well in the past because it was unexpected, now he lost that power. He has no power to influence his stock if not for a day or two, those especially retails who bought the dip in the past, made a lot of money and will do it again more and more forgetting about Robert Bacon ever changing cycles and the market can only come down when nobody expects it.

Henry Gifford writes:

A few days ago I attended a reunion of my grade school class. Guys I haven't spoken to in decades were commenting on how the rush to all-electric for cars and buildings strikes them as insane.

For seven years I taught about energy efficiency at the graduate level in an architecture college. One assignment was to compare the energy used by a gasoline powered car to an electric car, including the energy required to make the electricity to charge the batteries. No student over those years argued that electric cars saved any energy at all when the energy needed to make the electricity was included. In the later years more students refused to do the assignment, and instead take a D, as the assignment became more politically incorrect as the years went by.

I imagine fewer students would do that assignment these days, but sooner or later those who don't believe electric cars save energy, or reduce burning of fossil fuels, will get even more tired of keeping quiet to avoid being seen as an outcast. Remember, it was a kid who pointed out that the emperor was naked - no adult dared say that. But sooner or later, something along these lines will have a large effect on TSLA stock. Or, there simply won't be enough electricity around, and/or the price will be so high people will not want to buy the electricity and stop buying TSLA cars.

Without the backstory that TSLA is good for the environment, or saving the planet, it wouldn't be much more than a cool looking, inconvenient car that will need a very expensive battery replacement long before a gas engine needs replacement.

Sam Johnson responds:

Electric cars seem the best optimized for full self driving (individual tire motor control, acceleration/deceleration). They will take over in most climates for this reason alone. Everyone will want the tech, even if "less green."

Stefan Jovanovich comments:

The point of Tesla from its inventor's point of view was that it would provide ideal learning curves for (1) advanced fabrication and (2) autonomous machine thinking. If you were going to visit Mars in your lifetime, you had to have a rocket and a planetary construction technology that used (1) and (2). The instinctive mistrust of Elon Musk by short sellers and Democrats has not been misplaced; he is the consummate hustler. Since we (the BW and I) never trade or speculate, we have never once been tempted to go long or short on TSLA.

For us the connection there is an unavoidable connection between TSLA and NVDA; and we have, as a family, been long on NVDA for a dozen years now. We had no choice; our one and only child chose one of its engineers for her true love, and he chose her. We had to study Nvidia as a business because we were financially married to it. What we found is that rare company that can have repeated growth spurts like a child's - where everything financial - revenues, earnings, cash flows - increases 10 times faster than the financial world around it while its "bad" years never see declines any greater than the figures that Wall Street considers normal for a "recession". It did this without ever once getting the permanent subsidy that Musk had to depend on for TSLA.

I agree with HG about TSLA's technology; he is confirming Carroll Shelby's prediction that, in the end, hybrids would be the best engineering solution to the question of how you match electrical motor drives to automobiles.

TSLA as a car brand can disappear, and Musk will not care; he will have acquired the knowledge needed to build rockets at scale. Given his wonderful abilities as a financial hustler - PayPal remains to this day a wonderful invention of something no one needed but everyone bought into, Musk may find a way to get others to buy him out (has anyone ever actually made money in Ford after it went public?).

Update to earlier Idiot advice about common stocks: NVDA and PHM are now Owns, not Buys. TOL is the one company we are still punching on the Buffett bus ticket. We will continue to be married to NVDA financially because its climb to vertical integration is only half-way done. I asked the SIL if there was any comparison between Carnegie's acquiring the coal, iron ore, clay and earth metals that his mills used and Nvidia's "investment" in America. He wisely deferred to offer any opinion since that would be, in the small minds of SEC lawyers, "inside" information. He did offer a general comment: for the world of ICs and their users, the vertical integration is already happening; it is AI.

Apr

17

The Theory Of Societal Stupidity, from Jeff Watson

April 17, 2025 | Leave a Comment

Any market parallels?

The Theory Of Societal Stupidity

by Dietrich Bonhoeffer

Dietrich Bonhoeffer (4 February 1906 – 9 April 1945) was a German Lutheran pastor, neo-orthodox theologian and anti-Nazi dissident who was a key founding member of the Confessing Church. His writings on Christianity's role in the secular world have become widely influential; his 1937 book The Cost of Discipleship is described as a modern classic. Apart from his theological writings, Bonhoeffer was known for his staunch resistance to the Nazi dictatorship, including vocal opposition to Nazi euthanasia program and genocidal persecution of Jews.

Stefan Jovanovich asks:

Why do we need a theory?

Steve Ellison adds:

Gustave Le Bon in his 1895 book The Crowd noted that the intellect of any crowd was far lower than that of any of its members. And he considered all political parties to be crowds.

Apr

16

The Invisible Gorilla in the Room, from Stefan Jovanovich

April 16, 2025 | Leave a Comment

That is the creature Hugh Hendry - the Acid Capitalist - says we have to find in order to profit from our speculations.

The events in Ukraine are that gorilla. They are predicting the likelihood that Trump, Putin and the Muslim oil producers will establish a Drill, Baby, Drill world of orderly energy production and supply priced in U.S. $. The effects on the European and Asian consumers will be comparable to what happened to the German-speaking world and its silver standard when the French fulfilled the terms of the Treaty of Frankfurt by paying their reparations in gold.

Big Al needs some help:

Perplexity answers the question, "What happened to the German-speaking world and its silver standard when the French fulfilled the terms of the Treaty of Frankfurt by paying their reparations in gold?"

Stefan Jovanovich answers:

They = "events, dear boy". The prediction is that the new cartel of oil and gas exporters will establish "orderly production" that manages the risks of overproduction in the same artful manner that OPEC once operated before the invention of fracking.

William Huggins responds:

So you are suggesting us producers will submit to directives from moscow or Riyadh to limit their production? No evidence of anything but predation among those players but somehow trump purs them all on the same page? I have a bridge for sale….

Apr

12

Bessent 's most recent public comments about Treasuries seem to me the best answer to the suggestion that "they" want to debase the dollar:

In his remarks to the American Bankers Association on April 9, 2025, Bessent criticized the current regulatory framework, noting that leverage capital restrictions, such as the Supplementary Leverage Ratio (SLR), can become overly restrictive. He pointed out that these rules sometimes treat Treasuries—the safest assets—as if they carry significant risk, requiring banks to hold additional capital against them. Bessent suggested that regulators should reconsider this approach, hinting at reforms that could allow banks to hold Treasuries with less punitive capital requirements. He emphasized the need for a regulatory system that supports economic growth and questioned why "the safest asset in the country" faces such constraints under current leverage rules.

The question to be asked about "the dollar" is the one Hamilton and Willing tried to answer: who will own the Treasuries IOUs? Since the Americans had no savings, Hamilton thought the answer would have to be foreigners. Willing was clever enough to realize that Treasuries could become the savings if banks gave up the fantasy that deposits could be lent. The banks had to be discounters of each others' notes and dealers in personal loans/commercial paper. They could accumulate Treasuries as capital and leave leveraging to private capital (Astor became, by far, the richest man in the country by being Fannie and Freddie for his own and others' properties).

I doubt that Bessent, of all people, has any plan for the exchange price for the dollar any more than Willing had any belief that the BUS (which owned half the capital of the entire country) could set the discount rate. As he said yesterday, “Up 10 down 5 is not a bad reaction.”

Apr

5

Time for the canes?, from Doug Martin (Updated)

April 5, 2025 | Leave a Comment

I'm liking the look of that huge spike down in ES, out of my euro and sterling, that was a crazy move too. Technically it's nice looking low, from a chart perspective. I'm liking the low interest rate and commodity softening posture, I'm pretty damn bullish on equities.

William Huggins responds:

the shock moment is not when the canes come out - those metaphorically come out when the bulls have given up. those are generational moments related to the culling of new speculators who have only known rising markets (ie, anyone who joined robin hood with their stimulus checks in hand). as long as there are people willing to pay x60-100 earnings for hype, i don't think its quite time for a shift in strategic allocation.

this is simply the first serious wakeup call for anyone who thought this administration is doing anything remotely like macroeconomic analysis when it sets policy. according to the executive, there will be more such shocks to come so as many were fond of suggesting in mid-november "buckle up" (your 401k, and the usd, have both been liberated from gravity!)

Steve Ellison comments:

The S&P 500 has not even gone off the bottom of my hand-drawn chart. The move down since yesterday strikes me as more an efficient market repricing of reduced economic prospects than an emotional panic or forced selling.

By contrast, my hand-drawn chart on February 28, 2020.

Adam Grimes states:

Canes? Nowhere close, in my opinion. And the fact that many people think this is a crash is just a lack of perspective (and a misunderstanding of potential.) Again, all in my opinion, which may change with any tick.

UPDATE: Stefan Jovanovich has a shopping list:

The idiot list is the catalog of companies that our model collects on the presumption that their common stocks will be worth more in 5 years than they are now. I publish it when we guess that our stupidity is within the 25% range - i.e. we won't lose more than $1 out of every $4 we invest in those companies if they liquidate. Thanks to the List and others, we have learned not to trade so the publication is, in no sense, a "Buy"; it is simply an indication that prices have gotten low enough that the list has more than 10 companies on it. (A month ago it had 5.)

Mar

1

Sampler

March 1, 2025 | Leave a Comment

Carder Dimitroff points to:

Michigan’s Palisades nuclear plant nearing reopening

Michigan’s Palisades Nuclear Generating Station is one step closer to becoming the first nuclear power plant in the United States to reopen. After closing in 2022, the company that was set to decommission the plant has changed course, aided by a $1.5 billion loan from the U.S. Department of Energy to restart operations.

And a new SMR will be added on the same property in about 2030:

Michigan: First nuclear re-start is scheduled for this August

FWIW, the federal regulator (NRC) may be immune from budget cuts. Their licensing and regulatory activities are funded by the industry, not taxpayers.

Asindu Drileba suggests:

Great podcast on LLMs:

What kind of Intelligence is an LLM

[Part 3 of a 6-part series on intelligence in the Complexity podcast series by the Santa Fe Institute.]

Stefan Jovanovich finds:

The best underdog story in professional baseball in US:

The Best Underdog Story of 2025

Payton Eeles #11

St. Paul Saints

Minnesota Twins

Triple-A Affiliate

2BB/T: L/R5' 5"/180Age: 25

Feb

13

Silver, from Anatoly Veltman

February 13, 2025 | Leave a Comment

I paused Asindu-posted link at time-stamp 1.33.30, to turn your attention to 150 years ago - when Silver first got demonetized:

The Money Masters - The Rise Of The Bankers

Below is where we are this decade, at the 90:1 Gold/Silver ounce/ounce price ratio (click to expand):

Silver has a special place in my conscience, since I lost my first million on April 28th, 1987 - having misjudged the magnitude potential of COMMODITY EXCHANGE floor shenanigans, which cost me that much in mere minutes (of failed calendar spread execution) between the Limit-up lock and the Limit-Down lock in the May contract. I then managed to recoup, and by the end of 1989 achieved my goal of heading a COMEX member firm. Memoirs aside: the above Bullish-projecting chart is nailing the fate of Silver - as one of industrial metals of today. Take the above as note of importance to listers in the commodities space.

Stefan Jovanovich gets into the history:

Silver was not demonetized in 1873. Coin continued to be minted in record volumes and used for the China trade. Grant ended the wonderful arbitrage that had made the Treasury everyone's bitch by limiting the amount of metal that the Mint had to accept for exchange. So, no more bringing silver and asking for gold when the market had taken silver lower than the ratio set by the Coinage Act and no more bringing gold and selling it to the Mint to buy China dollars when the ratio was the opposite. The ability of the Congress to issue money was voided by ending all presumption that Federal debt could be legal tender. Greenbacks had to be exchanged for coin whenever presented to the Treasury.

Those remained the rules until 1914 when the Treasury and the Federal Reserve agreed that European central bank IOUs dud not have to be cleared in coin or specie.

Peter Penha writes:

My favorite metal Silver (at these prices) and relative to Gold both for the Gold/Silver ratio long term and in Ag's natural occurring parts per million of ore in mining vs Au. Stefan’s comment about changing les règles du jeu is a reminder that it will happen again as it always does to try to hold things together.

The US Government is adding to our debt at $1 trillion every 90 days. Gold mined annually ~3000 tonnes (~1.9% of above ground reserves) * 31500 ounces * $3000 = $ 283 billion dollars worth - I trust that more than 1/2 of that gold that is mined cannot ever come to market as taken directly by the Chinese government & other central banks directly now to offset that very US treasury printing press. The silver market is 25000 tonnes a pittance in terms of nominal value of $24 billion at $30 an ounce - this is added to our national debt every 2 1/2 days.

I understand the debasement of our national currency is the upside drift in markets this list teaches as the key thing to take advantage of long term via the s&p 500 and equities, but things do sometimes get out of line on a relative value basis.

The world’s 3rd largest producer of Silver is Peru (after Mexico and China) and iI read somewhere as part of a let’s move off the USD for trading commodities, that Peru as part of the construction of the giant deep water port north of Lima built by China/COSCO (with it's potential dual military/commercial use) has agreed to send all its physical silver output to China for processing.

Stefan Jovanovich comments: