Feb

15

6950, from Ani Sachdev [Updated]

February 15, 2026 | 1 Comment

I counted the number of crossings of the ES future past 6950. I counted the using the nearest expiry future. I counted using 30 min increments. Since October 29, 2025:

ES crossed from close to close across 6950, 78 times. 39 times up, 39 times down - true Logbola.

ES traded through and touched 6950 at any time at least 154 times (counted when there was low < 6950 < high).

Curious if any specs have used data like this to predict future prices.

Zubin Al writes:

14 hourly crosses night and open [Friday, 13 Feb.].

Cagdas Tuna comments:

I find the fact that whether call it NY Fed or Blackrock or other main street banks whoever single handedly controls and manage to keep VIX below 20 that is ultimate power controls the US stock market.

Larry Williams responds:

No one is holding anything down—or up—my vix fix is essentially same as $vix it cannot be controlled.

Cagdas Tuna is skeptical:

Yes, nothing is controlled!

Zubin Al Genubi prefers market dynamics:

Vix suppression is caused by: 1) heavy ODTE trade, while VIX is calculated on options 23-37 days out; 2) dispersion in SP index (dispersion meaning Mag 7 vs other 493; see RTY almost up 2%); 3) Big fund/ETF imbalances balancing deltas; 4) mean reversion of VIX/and buy the dip, which can break down at some point.

Larry Williams gets cosmic:

The universe is always expanding, Hawking proved. Stocks are part of that.

Feb

4

2026 Bullish Confirmation, from Larry Williams

February 4, 2026 | Leave a Comment

Yale Hirsch and his son Jeff have shown that a positive change, from the last trading day of the year to the 5th trading day of the new year, portends a bullish year (positive first 5-day percent change).*

Consider this … in the last 76 years of trading, the S&P 500 has declined for the year 20 times or 26% of the time. In other words, 74% of the time, there has been a yearly gain.

Jeff’s numbers show that in those last 76 years, 49 years showed a positive first 5-day percent change. Only 8 of those years went on to close down for the year. That’s an 84% bias for the year to close higher when we have a positive first 5-day percent change.

My add-on to Yale’s and Jeff’s work was to look at the years that gained 1.2% or more in the first 5 days of trading. There were 28 such years. Of those years, only 2 were down for the year. That’s a 93% bias for the year to close higher. What an improvement from the average 74%!

In 2026, the first 5-day** change for the Dow Jones 30 was +3%.

In 2026, the first 5-day** change for the S&P 500 was +1.6%.

Those 28 years had an average annual return of 14%. The remaining years had an annual gain of 5.3%. I see this as excellent confirmation of the bullishness of my Forecast 2026 Report.

Cagdas Tuna writes:

There is no need for a statistical analysis to assume any given year will be positive for US indices. It is almost guaranteed to be positive every year. No offense to any list member.

Larry Williams responds:

Wrong 24% of time we close down for the year.

Michael Brush is surprised:

Wow did not know it was that high.

Larry Williams agrees:

I was taken back by it as well.

Asindu Drileba asks:

2026 is bullish? But Senator, you said you expect a recession in 2026 with 100% certainty. Is this a contradiction? Or maybe its possible for the market to be bullish even during a recession?

Larry Williams answers:

Yes, there was a projection made a year ago for a 2026 sell off —in the last 12 months data changed—large improvements in fundamentals and hopefully I got a little better understanding of long term cycles. New Data matters.

Nils Poertner writes:

Asindu- there would be simply too many variables out to make that statement with such a certainty in advance. Just impossible. It remains a probability game. Used to subscribe to some cycle research that claimed to have things figured out yrs in advance. quite pricey subscription. it was HOOK, LINE and SINKER (for me).

Denise Shull comments:

New Data matters.

Indeed it does. Wonder why it’s challenging for many to incorporate?

Nils Poertner responds:

Good question. On this note… (Pure) data analysts believe pattern matching on large datasets will solve our problems. But what if the really vital information isn't being collected? What if it's invisible to our trained systems?

Jan

27

Ralph Vince’s latest, from Larry Williams

January 27, 2026 | Leave a Comment

Ralph Vince's newest book. Not about the markets.

The Theology of Lust follows Ricky “Pork Chop” White — a wounded, self-mythologizing erotic savant — as he stumbles through desire, regret, and violent entanglements, trying to turn raw masculinity into something redemptive. It’s a darkly funny, psychologically unfiltered journey where erotic obsession, betrayal, and a lurking murder plot converge on one man’s desperate attempt to find some sort of salvation out of the mess he calls a life.

Asindu Drileba writes:

Nice! I remember Ralph Vince mentioned that one of his favourite books was The Bible. There is a strange relationship between speculation, theology & computers(artificial intelligence) that no one has comprehensively talk about. Hopefully, I will learn more about theology from this book.

Peter Ringel comments:

When I read the senator writing "the greatest project of his life", I immediately feared, that he fell victim to French, Spanish or Portuguese girls. The title seems to confirm this.

Larry Williams responds:

Good guess but not quite Ralph has a new steal proof coin coming out the book is a year old but was just translated to English from French.

Steve Ellison recalls:

We had a long-ago list member who would frequently draw parallels between never-ending market arguments such as fundamental vs. technical analysis and the European religious wars of the 1600s or theological debates such as predestination vs. free will.

Jan

16

Tacit knowledge, life lessons, and roast beef

January 16, 2026 | Leave a Comment

Nils Poertner suggests:

there is a wonderful book by Michael Polanyi - on tacit knowledge (unlike explicit knowledge one has to develop that skill oneself). not trying to proselytize here that is quite good of a book) and worth many gold nuggets

Jeff Watson offers:

There are some great nuggets in this video - 100 quotes, 100 meals for a lifetime:

100 Harsh Life Lessons That Made My Life So Much Better

Larry Williams knows where the beef is:

America's Top Roast Beef Sandwiches, According to Food Critics

Peter Ringel follows up:

Classical Music for When You're in a Food Coma

Jan

12

Zugzwang, from Zubin Al Genubi

January 12, 2026 | 1 Comment

In chess, zugzwang refers to a situation where a player has to move, but every move worsens the player's position. When a portfolio manager's risk limits are hit or losses are thought to be unacceptable, the situation is quite the same. - Hari Krishnan

The Immortal Zugzwang Game is a chess game between Friedrich Sämisch and Aron Nimzowitsch, played in Copenhagen in March 1923. It gained its name because the final position is sometimes considered a rare instance of zugzwang occurring in the middlegame. According to Nimzowitsch, writing in the Wiener Schachzeitung in 1925, this term originated in "Danish chess circles".

Nils Poertner writes:

on this note (lack of imagination), see David Hand's probability lever concept:

The Law of the Probability Lever essentially states that slight changes in the circumstances or assumptions of a statistical model can dramatically change the calculated probabilities of events.

Larry Williams states:

ZUGZWANG The life of a trader in one word—always in too early or out too late, also out too early or too late.

Jan

5

Oil, from Cagdas Tuna

January 5, 2026 | Leave a Comment

So where lies the thin line between liberating Venezuela and putting world into oil supply based recession?

Larry Williams comments:

The quality of their crude is a different issue we use to refine it here; sour, full of gravel etc.

Stefan Jovanovich writes:

Historically, before full sanctions in 2019, the US imported over 600,000 barrels per day (bpd) of Venezuelan crude, with refiners like Citgo (PDVSA-owned), Valero, Chevron, and Phillips 66 as top recipients.

More recently (post-2023 relief), Valero accounted for 44% of imports, Chevron 32%, and Phillips 66 10%.

Carder Dimitroff writes:

IMO, it's not about oil. The US is a net exporter. They're doing just fine without Venezuela. If heavy oil is desired for refining optimization, as some claim, there's a direct pipeline from Canada.

Stefan Jovanovich responds:

It would help if Carder focused on the use of heavy oil for marine diesel and bunker oil for steam turbines. Those are the essential propulsion fuels for China's Navy; hence, Hegseth's comment today assuring China that it would continue to receive its share of Venezuela's output.

Carder Dimitroff expands:

Globally, three major regions produce heavy crude: Russia, Canada, and Venezuela. Downstream, “heavy oil” or “heavy fuel oil” usually means the residual, high-boiling product left after lighter fractions (gasoline, diesel, kerosene, etc.) are distilled from crude. As Stefan suggests, heavy oil and bunker oil are growing markets, not only in China but also elsewhere.

In my opinion, the administration's interests in Venezuela reflect several interests. High on my list are Venezuela's untapped rare-earth elements (about 300,000 metric tons).

Pamela Van Giessen offers:

Interesting analysis here:

The Real Reason the Pentagon Approved Venezuela: Critical Minerals and Adversary Expulsion

The Department of War has allocated $7.5 billion under the One Big Beautiful Bill Act specifically for critical minerals, with $1 billion already deployed to stockpile antimony, bismuth, cobalt, indium, scandium, and tantalum. This is not economic policy. This is national security infrastructure. The United States is 100% import reliant for 12 critical minerals and over 50% reliant for 28 of the 50 minerals classified as essential to national security. These materials are not interchangeable. They cannot be substituted. They form the irreducible foundation of modern weapons systems.

Boris Simonder questions the thesis:

What rare earth does Venezuela hold that is proven and confirmed? Based on USGS Mineral Commodity Summaries 2025 and other sources like CSIS reports, Venezuela has no significant cobalt production or reserves listed. Antimony deposits exist but are small and underdeveloped, with declining output due to infrastructure issues.

Dec

31

There is market manipulation, from Larry Williams

December 31, 2025 | Leave a Comment

Every time I take a position the market manipulates my emotions. Every damn time.

Humbert Y. agrees:

Ha! As always, Larry nails it. This is the only relevant manipulation to be on guard for, and it is not an easy task…

W. Humbert comments:

My entrances are typically during what I perceive as a manipulation, I look for them.

Dec

23

Low status jobs becoming high status, from Nils Poertner

December 23, 2025 | Leave a Comment

Fascinating to watch how former low status jobs, like cybersecurity, have become high status now. Same is true the other way around as well (eg (male) technician at the London tube system who makes a quarter of his wife who is in real estate - although that is changing now). Wondering what low type jobs / or ppl are on the fringes today will be in high demand in coming years.

Carder Dimitroff responds:

Try these:

Any of the crafts. Specifically, licensed electricians, plumbers, and HVAC techs. Many make more than engineers.

Public response teams. Specifically, firefighters, EMTs, and law enforcement. Many make more than lawyers, particularly when pensions are considered.

Career military. Specifically, for those with 20 years of service. Lifetime benefits are incredible (free college, unlimited grad schools, pensions w/colas, lifetime medical insurance, VA benefits, hiring preferences).

Pamela Van Giessen suggests:

Car mechanics

Henry Gifford writes:

My friend who fixed boilers said to his sophisticated, suit-and-tie, well educated in-laws “I’m not the smartest guy around. I’ve only read two or three books in my life. I don’t think I’m smart enough to come up with a sophisticated investment plan (nods all around the room at this point). So I just buy one piece of New York City real estate each year and hope for the best”. No more nodding at that point.

Guess what blue collar people who don’t have vices do with their money? They buy property. Who is better suited to own real estate? People who fix things and have friends who fix things, or lawyers?

And what nobody mentions is that some people are much better at those sorts of work than others. Simply finding someone to show up and try to do those things is hard. Someone who is good at one of those trades is in even higher demand.

Those fantastic benefits for former military people are not limited to the military – all federal employees get all those benefits after twenty years of work. If someone joins the military at 18, and gets out at 38, or gets out sooner and then works in the post office or etc. until they “get their twenty”, they get full salary with increases for life. Income that will survive any lawsuit, even the IRS can’t take it all. They maybe collect a total of three years of salary for every year worked.

Nils Poertner responds:

Certainly good to encourage young men (or women) to follow a path that interests them - and not just follow a path that is currently "high status". This "Yousef" guy who was my IT guy at Bankers Trust decades ago (low status in my eyes back then) became a cyberpunk in 2008…you get the idea. That said, it is a power game outside. young men need wives etc.

Henry Gifford adds:

I judge the level of a single woman’s interest in me by counting the seconds until she says “what do you do?”.

No woman has ever asked me if I like what I do, or am good at what I do – not important.

Many men have a choice between coming home miserable to a wife, or coming home happy to an empty house. Age old dilemma, no known fix, as all our DNA has evolved to enhance survival, which for a woman over the millennia has meant marrying the chief’s son, or someone else with high status.

Larry Williams recalls:

When I was dating all women ever asked me is your place or mine. Must have been doing something wrong.

Michael Brush is curious:

Do you have a cycle chart for that?

Larry Williams clarifies:

Yes but there are not enough examples to draw a conclusion.

Dec

19

Request for “off topic” books on speculation, from Asindu Drileba

December 19, 2025 | Leave a Comment

Often when I listen to specs I hear "off-topic" book recommendations. Examples:

"The most important book to do with trading is Secrets of Professional Turf Betting by Robert Bacon" — The Chair. A book about parimutuel horse betting.

"The most important book to do with the stock market is Horse Trading by Ben Green" — A game theorist & friend of The Chair. A book about selling horses

"I can find new trading strategies on almost every new page (Thinking Fast and Slow by Daniel Khaneman)" — The Chair's Brother (Mr. Roy Niederhoffer). A psychology book

"Our entire investment philosophy is based off this book (Snow Crash by Neal Stephenson) — Fred Wilson of Union Square Ventures, a Tier 1 VC firm. Its a sci-fi book.

"One of the most important things you can learn todo with investing is creative writing" — Jeffrey Hirsch. Not a book but still an off-topic research recommendation.

I have never regretted reading an "off-topic" book. Any more of such recommendations?

Nils Poertner responds:

Coaching Plain & Simple, by P. Szabo, D. Meier (book about learning - how to coach oneself in a way)

Asindu - what books to get rid off, to burn, what is an obstacle in your life is also relevant. Early 2008, I visited a French friend on Lehman trading floor in London. V nice guy, senior analyst for their credit models, high IQ 130 plus, bit gullible though. He was surrounded by over 20 books of advanced math on either side of his desk. I had the urge to get a huge sledgehammer and whack down the books…you know.

Larry Williams suggests:

Zurich axioms. A must read.

Peter Ringel agrees with Larry:

I have them on my wall. Besides some of the lists by Vic, Larry, Adam Grimes and some other. Valuable.

And did you find the Daily Speculations booklist?

Asindu Drileba writes:

Yes. I forgot about Zurich Axioms. Thanks. This Daily Speculations list is good, I actually wasn't aware of it.

Nov

21

VIX Intraday Range, from Cagdas Tuna

November 21, 2025 | 1 Comment

Yesterday's range in VIX was one of the widest & wildest one I have seen in a very long time that happened without any major news. Wednesday close to Thursday low 18% decline followed by 46% rally to the day's high. Is there anyone who can check the occurrences in the past and how SPX traded in the following days of such a massive range explosion?

Asindu Drileba responds:

The Chairman's book, Practical Speculation, has a detailed analysis of the multivariate relationship between the VIX and the SPY. Unfortunately I forgot the page, and I am currently not close to my copy. [see pages 107-110] But it has something to do with how the fluctuations around the average of the VIX affects the SPY.

Paolo Pezzutti does some counting:

#VIX +11.71% at 26.43

Highest close since 24 April

Since 2020 VIX>26 has occurred 290 times.

After 4 days the Emini S&P Futures:

+27.01 pts Mean, 63.4% Wins, 1.63 Profit Factor

Larry Williams cuts to the chase:

Vix goes up when stocks go down they are inverse of each other—no magic there are all.

Nov

15

Tax receipts, from Larry Williams

November 15, 2025 | Leave a Comment

Federal government current tax receipts: Taxes on production and imports: Customs duties

Asindu Drileba writes:

I remember when Trump spoke at a recent market open. (NYSE market opens at around 4:30pm in Uganda). Crypto closed very bullish on that day. Every time he mentioned "Tax Cuts" the market blipped some more. Laffer Curve at work?

Rich Bubb adds:

I was idea hunting and found Wisdom from Larry Williams:

Larry Williams: Why Gold, Bitcoin, and Stocks Are Flashing Warning Signs

Nov

13

The $38 Trillion Question, from Humbert X.

November 13, 2025 | Leave a Comment

The $38 Trillion Question: An Interview with Stanford Professor Hanno Lustig

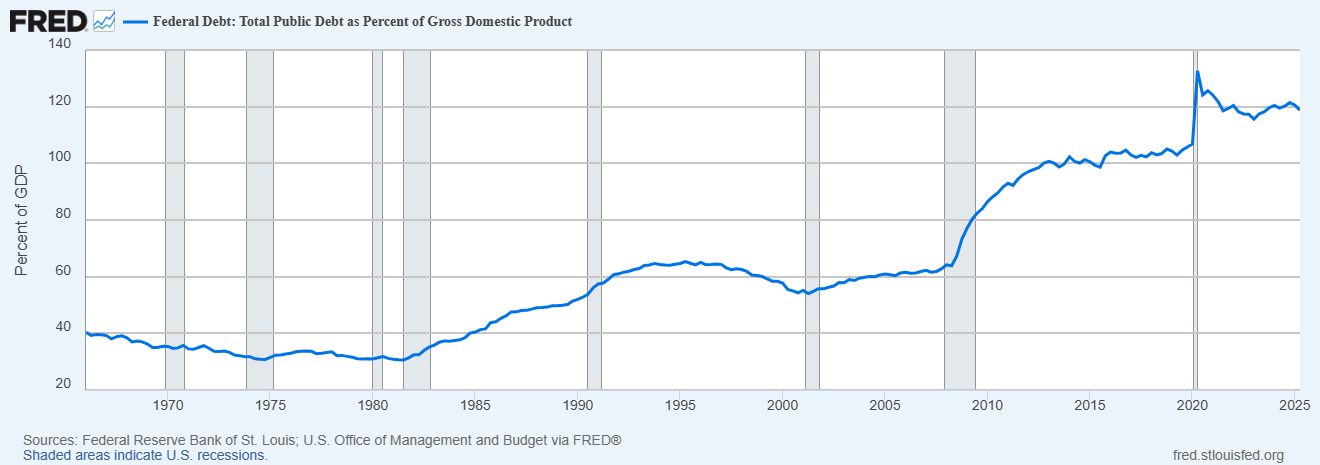

Hanno Lustig: I started thinking about the valuation of government debt by looking at the valuation of all Treasuries. What do we have to believe to get to a number like $38 trillion? You must believe there will be a huge fiscal correction, because ultimately the value of debt should be backed by future primary government surpluses. When you do the numbers, you realize that either bond investors are pricing in a huge fiscal correction that seems impossible, or Treasuries are significantly overpriced.

Carder Dimitroff notes:

The interest on debt is approaching $1 trillion per year and continues to compound. Interest costs currently exceed Department of Defense spending.

Larry Williams disagrees:

Meaningless measure look at debt vs gdp

Carder Dimitroff responds:

Yes, that makes sense. However, from a different perspective, it becomes meaningful under the One Beautiful Budget Bill when automatic sequestrations are implemented. Unless new legislation is passed, sequestrations will result in Medicare cuts and other reductions in expenditures. Current projections suggest sequestration will present in early 2026.

Big Al checks with FRED:

Nils Poertner writes:

recession + zero short term rates + lots of QE ….leading to a lot more public debt

maybe that is more likely path.

Stefan Jovanovich offers some history:

This chart shows the solvency ratios that can be found from the Census and other data [by decade 1880 to 2020] - how much "we the people" have in money divided by how much the American governments promise to pay.

Nov

10

Best indicators for inflation, from Asindu Drileba

November 10, 2025 | Leave a Comment

The more goods cost, the more money visa makes since the fees they charge Issuing banks & acquiring banks are based on a percentage basis. So, higher prices (inflation) –> better predicted revenues for Visa? Inspired by a nice documentary on the history of VISA.

I wonder what the best indicator for inflation would be for testing this? CPI? Oil?

Cagdas Tuna writes:

I was thinking as to find a similar indicator for economic slow turn, spending cuts. It came to my mind to follow sales slips. I live in Malta which is a very tech friendly country for spending habits such as Apple/Google Pay availabilities, many digital banks access etc. I often asked if I need a receipt that I usually don’t. It depends for every country but if there is a rule for stores/restaurants to keep at least a copy for each transaction then it might be the indicator to follow. It might be used for inflation as well but of course needs detailed information.

Pamela Van Giessen comments:

To the best of my knowledge, merchants are not required to keep receipts. We track each sale but it will be the credit card processor or platform such as Square that holds the credit card or Apple or Google pay receipts. I can’t imagine that merchants would be willing to share their sales data. I know I wouldn’t.

Visa doesn’t care how much goods cost. They get their nearly 3% processing fee (+ .10 or .15 per transaction) whether there are 20 transactions for $100/ea or 40 transactions for $50/ea. In fact, they make more $ on a higher volume of transactions.

I don’t think tracking Visa or MC, etc could be a meaningful prediction of inflation as all the credit card companies continuously fight for market share. Note that they all send out multiple credit card offers to everyone all the time. Then, you have a store like Costco that only accepts their credit card (Citibank).

Additionally, there are people who use primarily cash. Those $ would be left out. You may say that cash use is low, and maybe it is. What I can tell you is that today at a market 80% of my sales were cash and that was likely the case for all the other merchants at this market. Older people especially use cash a lot. Just like drug dealers.

I have a theory that the cash economy is much bigger than everyone thinks. Insight into that might be more interesting.

Carder Dimitroff responds:

After considering Panela's cash sales point, I remembered that several companies required customers to switch from credit card payments to bank transfers. Additionally, several small establishments offer incentives for customers to pay in cash. They may be attempting to simplify their accounting and tax reporting. I do know that the federal government has immediate access to individual credit card transactions.

Pamela Van Giessen adds:

I thought it was the Fed that used to report on aggregated credit card data.

The other challenge with using credit card financials is that the credit card processors raise their % cut all the time. This is not due to actual inflation; it is due to them having a government protected moat that allows them to take more and more whenever they want because merchants are stuck with the whole system and consumers don’t realize that they will pay for the service — in increased prices. Every time Square, PayPal, etc., send me notices that they will be increasing fees, I increase my prices. I guess that is a kind of proxy for inflation but it’s a lousy sort of financial market induced inflation not based on anything more than their desire for more profits. I am all about free markets but the credit card processing biz is not even close to a free market.

The government using credit card processing to surveil us may be one reason I see more and more people using cash.

Larry Williams suggests:

Stock market is good predictor of inflation.

Oct

13

Advice from the past, from Humbert X.

October 13, 2025 | Leave a Comment

Stock market advice from 1944 - how would one test it?

This Is the Road to Stock Market Success

Page 30:

If one cannot profit by trading in the highest grade issues — one certainly cannot profit by trading in "cats and dogs". If our industrial giants cannot advance — what prospects arc there in the stability of others? Although this sounds logical there are exceptions, and the "time element" has much to do with the selection.

At the top of a Bull market, when uncertain as to whether the upward movement is exhausting itself or not, it is comparatively safer to have your money in investment, rather than speculative, issues. Of course, it is most advisable to be out of the market entirely at such periods. Investment stocks are not the leader in a Bear movement and, therefore, it is safer to have your money invested in this category — and to watch the market closely. If the speculative and "cheap" stocks begin to decline — you can still dispose of your investment issues without much loss — as they follow rather than lead the Bear movement. Likewise, when you note that investment stocks stand still — and "cats and dogs" or even the better grade issues advance — it should put you on your guard as the market may be "topping" and in line for a good reaction. The 1937 Bear market was foretold by investment stocks in November, 1936. They refused to go higher.

Larry Williams comments:

I learn so much from his writings, such as comparative strength and targets.

[Ed. - Note on the photo:

In 1943, when World War II came, Helen Hanzelin, a Merrill Lynch, Pierce, Fenner, & Beane telephone clerk, became the first woman to work on the NYSE Trading Floor.

Another three dozen women answered the country’s call to duty and filled vacant posts vacated by soldiers sent overseas on the trading floor but were booted out when the war ended, and men returned home.

Women of the New York Stock Exchange ]

Oct

3

Where am i wrong, from Larry Williams

October 3, 2025 | 2 Comments

Zero sum game: for every $ that wins the same amount will be lost. REALLY? you bought at 7 sold to me at 10 I sell at 20 and the contract goes off the board and delivered at 22 who lost? We lost that we could have made more $$ but where is a net loss?

Steve Ellison comments:

Adverse selection can make us all feel like losers. If I sold at 10, I should have held to 22. Or I should have put on more size. If I bought at 7, and it went to 5, that would have been even worse.

Jeff Watson goes literary:

But Yossarian still didn't understand either how Milo could buy eggs in Malta for seven cents apiece and sell them at a profit in Pianosa for five cents.

[ … ]

Milo chortled proudly. "I don't buy eggs from Malta," he confessed… "I buy them in Sicily at one cent apiece and transfer them to Malta secretly at four and a half cents apiece in order to get the price of eggs up to seven cents when people come to Malta looking for them."

"Then you do make a profit for yourself," Yossarian declared.

"Of course I do. But it all goes to the syndicate. And everybody has a share. Don't you understand? It's exactly what happens with those plum tomatoes I sell to Colonel Cathcart."

"Buy," Yossarian corrected him. "You don't sell plum tomatoes to Colonel Cathcart and Colonel Korn. You buy plum tomatoes from them."

"No, sell," Milo corrected Yossarian. "I distribute my plum tomatoes in markets all over Pianosa under an assumed name so that Colonel Cathcart and Colonel Korn can buy them up from me under their assumed names at four cents apiece and sell them back to me the next day at five cents apiece. They make a profit of one cent apiece, I make a profit of three and a half cents apiece, and everybody comes out ahead."

Oct

1

Lebanon, from Nils Poertner

October 1, 2025 | Leave a Comment

Lebanese traders from the 1980s tell me how chaotic that decade was - high vol ever day - for yrs. Survival was key! Started reading every bit about it in the last few weeks. (The thing that Stefan is right about is that the self-image we have in West and realtiy - there is a huge gap for sure!! Am not speaking about military though - I meant anything else)

The Lebanese Economic Crisis: How It Happened; the Challenges that Lie Ahead

September 27, 2021

Lebanon is experiencing one of the worst economic collapses in recent history. The currency has lost more than 90 percent of its value; an estimated three in four Lebanese citizens are now below the poverty line, and the country is beset by food, gas, and medical shortages. The power grid can barely maintain electricity for cities, with frequent blackouts occurring. Finally, the country had to default on its debt payment, launching its debt crisis. The debt crisis didn’t come suddenly, but was building up over time due to economic decisions made by previous governments. To understand how this crisis came to be, an examination of Lebanon’s modern history is in order, starting with the civil war in 1975.

Larry Williams writes:

Chaotic? In 1973 Shearson AmEx had me go there to lecture an teach trading - some high flyer commodity mooches had come in and lost lots of $$ for some locals who did not understand margin calls. The high flyers from Chicago were found gutted on a barb wire fence out in the country! The war broke out we could not get out for about a week so hung low then finally bribed our way home.

Nils Poertner responds:

my 2 cents are on Larry and all savvy Lebanese traders going forward. Good idea to live in more rural areas in the US, UK etc to see things unfolding as well. And keeping the internal chatter to a minimum (as always).

Stefan Jovanovich analogizes:

If LW disagrees, he will, I hope, correct this latest folly from the List's history channel wannabe. The reason the Oregon Trail came first was that it was the one safe destination for the missionaries. The Indians of the rain forest coastal Northwest were the tribes with no history of revolt against the Brits, Russians and Americans. The wars on the Plains started when some smart money decided that they could colonize the spaces between Council Bluffs and the Dalles. That analogy comes to mind every time I look at the modern history of the adventures of the Americans in Lebanon.

Larry Williams offers:

My brother on law who is better read than I am an a deeper thinker says this is a good read on the western adventure:

The Undiscovered Country: Triumph, Tragedy, and the Shaping of the American West

Aug

27

Suppliers vs providers, from Stefan Jovanovich

August 27, 2025 | Leave a Comment

The opportunity lies with the supplier, not the providers of AI.

Larry Williams asks:

Who are the suppliers?

Stefan Jovanovich answers:

Nvidia. My 19th century brain thinks of NVDA as a supplier of the stuff the people selling information tickets will use to build their 21st century railroads.

Easan Katir writes:

Agree. Those creating the AI platforms won't generally be good investments, imho. Why? They lack one thing needed: scarcity. Any intelligent person can feed his/her data into an LLM and create their own AI for $20 / month or less. China's DeepSeek is free, I've read. Hard to make a profit when competing with free.

Last month I had lunch with an author cousin who lives in Tehama Carmel Valley. She uploaded all her books into an LLM, cloned her voice with another AI service, connected that to her voicemail. Now her clients can call her number and her cloned voice answers all their questions based on the knowledge in her books. All while she's having lunch.

AI + robotics will be a theme, such as Elon's Optimus and robo-taxis, yes? Investing in the suppliers is mostly done, isn't it? NVDA being the most obvious. Along with LW, other inquiring minds wonder which companies you have in mind.

William Huggins responds:

don't forget the coal and iron mines, those essential input assets that 19th century railroad magnates knew could be pilfered via land "grants". i think the equivalent is looking at the companies involved in the chip etching (who makes the lasers, etc).

Henry Gifford comments:

FRED says that Railroad stock prices weighted by number of shares went up x7 over 70 years [to 1929]. Nice, but not fantastic, but weighing by number of shares could be misleading because of reverse splits, shares of a new company replacing a larger number of shares of the old company in a buyout, survivorship bias when a company goes bankrupt, etc.

% of market cap can I think also be misleading because of people pouring huge amounts of money into companies with no revenue in the hope of future returns, adding to market cap.

Stefan Jovanovich responds:

In the last third of the 19th century, the money made in railroad investing was in the bonds, not the stocks. That was the recital of the FRED data that some found so surprising. For this 19th century mind those results are not surprising because the one President in the century who could do the math killed the speculation in international money.

Jun

27

General semantics, from Nils Poertner

June 27, 2025 | Leave a Comment

Drive Yourself Sane: Using the Uncommon Sense of General Semantics, by Susan Presby Kodish

GS is based on a careful study of human behavior and scientific problem-solving, bridging applied psychology and practical philosophy. Drive Yourself Sane provides time-tested methods for critical and creative thinking and constructive communicating with a variety of problem-solving applications for mental hygiene, personal development, education, business, etc.

Easy to read book about Global Semantics. Why relevant? Because we often confuse the image of something with reality. And that is recipe for insanity. eg. Dalio has this "machine" analogy for mkts and the econ. Fair enough. But the econ and markets are much more: Living organism etc (good to use "etc" as it reminds oneself that it is a lot more…) There is a famous picture that shows an "apple" and underneath the painter wrote: "This is not an Apple."

Humbert G. comments:

Image v. Reality. Dialio is the perfect example. What’s with all the gloomy billionaires?

Larry Williams writes:

Dalio sure looks like a loser always bemoaning the world same as Cooperman how did these guys rise so far?? Then I have been accused of not being smart enough to put my feet on the ground if it weren’t for gravity.

Rich Bubb ponders:

I've been thinking that Dalio is using historical events to try to not repeat AVOIDABLE/PREVENTABLE mistakes. Yet the rhyming of those events is intriguing. Especially the given nature of Nature, current hot wars, insane debt levels, growing militarization actions, natural resource over usage/abuse, wealth distribution, Us vs. Them polarizations, etc. Yep, gloomy.

His 'machine' concept of the Markets & Economics is an "approximation of a likely future" (my words). The coincidences of the factors Dalio describes at some pressure point will often start Change Cycles. We've witnessed this in our own short-lived & humble lifetimes.

The problem is that 'history' will not exactly repeat in some-yet-unknown terms but might rhyme in concept. The timeline/s of historical examples Dalio uses for large changes is/are very long. And the salient concepts, e.g., reserve currency, debt irrationality, Dalio's Big Cycle (some spanning decades or longer), "Dynastic Cycles' Stages", etc., are historically documented and presented in "The Changing World Order" (2021). The tables and 'chartwork' are visual reinforcements throughout, yet intriguing patterns do persistently re-occur.

My takeaway is generally that Major Powers' (Markets, Econ, military conflicts, extinction-level weapons/WMD^6, etc.) either don't see the cliff they are eventually going to go over, or those major powers refuse to find solutions to the recurring Root Causes that Dalio writes about.

I'm not finished with his 'Changing World Order' book. From what I have read, Dalio seems to try to codify history into significantly huge cycles, leading to changes in the World's Order. IMO, given the current situation (in our time, i.e., now) it isn't too difficult to extrapolate what's ahead… gloomy indeed. Maybe Dalio is "gloomy" for one or more reason/s.

Jun

19

Robert Morris, financier, from Larry Williams

June 19, 2025 | Leave a Comment

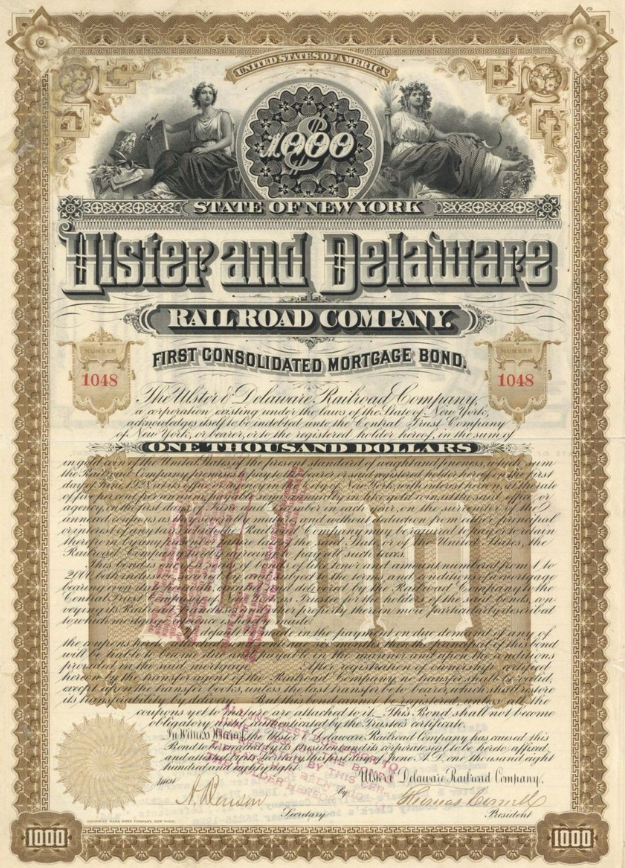

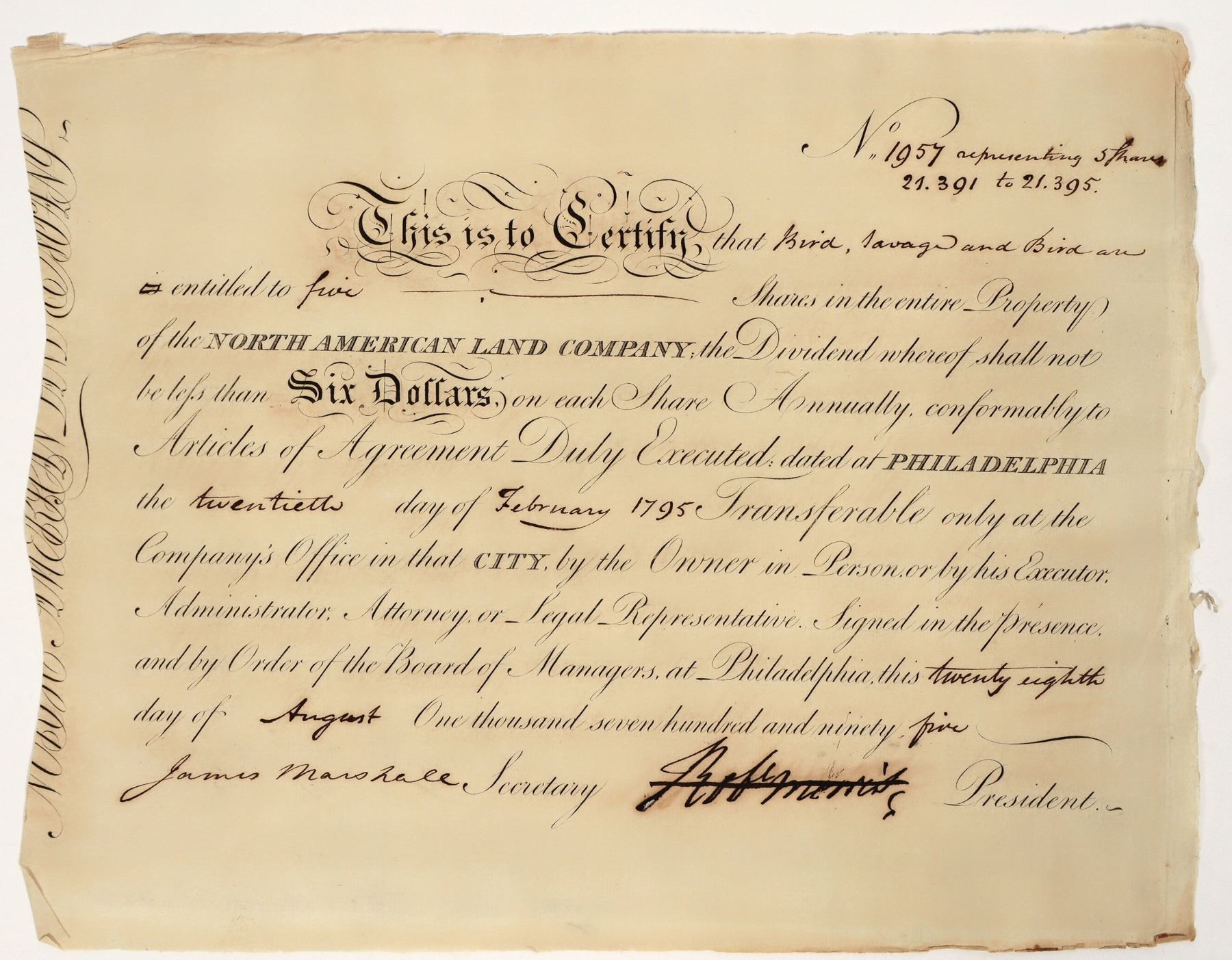

North American Land Co. stock issued to Bird Savage & Bird of London in 1795. Signed by Robert Morris as president and James Marshall as secretary. Morris' signature is pen cancelled. 9.75 x 12" Robert Morris was the financier of the American Revolution, and one of only two Founding Fathers to sign all three key American documents: The Declaration of Independence, the Constitution, and the Articles of Confederation. Morris was the first to use the dollar sign in official documents. The financial Panic of 1796 led to his financial ruin and he was incarcerated for debt in the Prune Street Prison. Date: 1795

Stefan Jovanovich writes:

Morris was the intern/apprentice to Charles Willing (Thomas Willing's father). When Charles died in 1754, Morris became a partner; he became a name partner in Willing, Morris & Co. by 1757. There was no formal registration of businesses in the Province of Philadelphia. "Firms" were known by usage as either individuals or partnerships. We know that the firm existed because its name appears in the Customs records as owners of the brig Nancy and on a bill of exchange for 500 pounds in 1757. The firm "dissolved" in 1783; in March 1784 Thomas Willing wrote a letter to a fellow merchant referring to "our late firm".

By 1781 Morris had left doing any of the daily the business of the firm because of his duties as a public official. On February 20, 1781 Congress appointed Morris Superintendent of Finance; and in September Morris became Agent of Marine - i.e. Secretary of the Navy. On December 31, 1781 Congress chartered the Bank of North America and Thomas Willing was named as its President.

The mixture of finance, merchant business and government was complete. Willing, Morris & Co. supplied muskets, gunpowder and food to the Continental Army. The Bank of America and Willing, Morris & Co. secured $5.4 million in loans ($4 million from France, $1.4 million from the Netherlands) and also made loans directly to Congress. When Congress did an audit in 1783 they found that the discrepancies in the accounting were for money that had flowed to the government, not from it. Willing & Morris had paid $100,000 in Treasury debts.

How Morris went on the become the richest man in the country, owner of "Morris's Folly" and the most famous bankrupt is Part 2 of the story. How Willing (not Alexander Hamilton) became the "founder" of the American system of finance is a whole new volume.

May

31

All higher forms of math and statistics are useless in uncovering regularities, from Asindu Drileba

May 31, 2025 | Leave a Comment

I was browsing the Daily Speculations archive and found this:

10 Things I’ve Learned About Markets, from Victor Niederhoffer

No. 11 is, "All higher forms of math and statistics are useless in uncovering regularities."

Define "higher form". To someone that has just learned basic arithmetic, basic algebra seems "higher form". Does The Chair maybe mean "PhD level" math? Or does he mean that basic "counting" is the only proper way to uncover regularities?

Fazil Ahmed responds:

I think Ralph Vince has explained well, copying from the post:

Certainly in a post-'08 world, quants are out of favor, and for good reason. Most anyone I know who DOES make money in the markets, does so with very simple, robust techniques. Having considered going to quant school, and studied a good deal of it, I finally came to the conclusion that they are simply working with "models." Models of how the world behaves. unlike hard sciences like Physics and such where you can perform a test, come back a year from now, perform it again and get the same results, you don't have this in financial modeling. And I think this is where the quants have fallen short. Models are NOT reality, and they never got down to the bedrock, the reality of what his game is about. Of course it had to fail, and in a large way, at some point. A good rule of thumb is that if I need a computer, if it isn't simple enough to do in my head on the fly in the foxhole after I have been awake for over 100 hours, I can't use it.

Larry Williams comments:

This gets down to there are hard questions: What is the capitol of Montana? Only one answer: Helena.

And soft questions: How many people are in Montana? Varies from hour to hour.

May

30

The problem facing China, from Larry Williams

May 30, 2025 | Leave a Comment

Perplexity says it best:

The U.S. population is projected to keep growing through the end of the century, mainly due to immigration, even as deaths begin to outnumber births after 203325. By 2055, the U.S. is expected to reach 372 million people, with net immigration as the primary driver of growth. In contrast, China faces a rapidly aging population: by 2050, about one-third of its population will be over 65, and the number of elderly will vastly outnumber children, creating an “inverted pyramid” demographic structure. This aging trend is expected to slow China’s growth and strain its social systems, leading some to describe China as “becoming a nursing home” by century’s end. Meanwhile, the U.S., thanks to sustained immigration, will remain younger and larger than it would be from natural increase alone.

Asindu Drileba writes:

Professor Bejan's constructal law guarantee's that China will go bust on a long enough time horizon. I attribute this to China's rigid political system. Like Daenerys Targaryen said, "Those that don't bend, will break." Professor Bejan's TED Talk.

William Huggins responds:

for entirely different reasons, both Daron Acemoglu (econ Nobel 24) and Peter Zeihan are also in the China-bear camp long term - the former due to hitting the limits of "growth under extractive institutions", the latter due largely to demography (even if his tone is alarmist). Dalio's indicators suggest the opposite but all his data comes from a demographic regime of pyramids, not chimneys or inverted pyramids so i'm not sure his forecast will play out.

May

29

The latest from Larry Williams

May 29, 2025 | 1 Comment

Larry Williams on the Fed, Interest Rates & Markets! What’s Next?

Larry Williams breaks down the latest GDP cycles, shares his predictions on the Fed's next move on interest rates, and analyzes TSLA, NVDA, AAPL, and XLP.

May

26

Every trade a loser, from Larry Williams

May 26, 2025 | Leave a Comment

I believe every trade I enter will be a loser–that is my most powerful trading belief. That concept keep me on guard and alert. Emotions are strictly Money Management. If/when you are too emotional, it just means your position size is too big for your emotions.

H. Humbert responds:

The attitude will tend to put you in contrarian positions at the best times, the times of maximum fear in the market or towards a stock. What you said is the same as saying "your best purchases are the ones that are the hardest to make." Of course if you recognize that you are a contrarian, at the same time on some level you have faith that the position will work out. It just depends on what level you want to think about it, emotionally. First derivative second derivative stuff.

The point is, with money in the market based on who is, or who is not, playing tennis (times 10,000 investors with their own 10,000 irrational superstitions), there are bound to be mispriced securities somewhere. Our job is to find them. Despite all their spreadsheets, NPVs, TA, back testing and “counting,” investors remain among the most irrational and emotional creatures on the planet. That is a good thing. That has always created mispricing, and opportunities. In essence, trading is about betting against human nature.

Galen Cawley writes:

I would say that thinking in advance that every trade will be a loser does not provide a positive edge so much as it prevents behavioral errors.

1) If you are a completely algorithmic trader, then the question is largely moot.

2) On the discretionary side, focusing on potential losses prevents unforced errors such as overconfidence manifested in the form of both overtrading (size and frequency).

3) Visualizing worst-case outcomes can prevent you from going on tilt during a crisis or during a string of losses.

Asindu Drileba agrees:

I have this attitude too. I assume every position will be a loss. So practically it helps me size my positions modestly. When I am placing a trade. A position is only in two states: a) I am over betting, in which case I may blow up. b) I am under betting, in which case I won't blow up. The only way to make sure that you are on the side of b) is to: 1) over estimate your losses; and then 2) under estimate your wins.

Another reason for assuming that your position is going to be a loosing one is that you are proactive to your trades, not reactive. Reactive means that you improvise when surprised by how things have gone. Of which you may not be in the right head space to make a decision. Proactive means you already assumed the trade was going to loose, so you had a plan ahead of time (when you were clear headed). I, for example know exactly the maximum I can loose on each trade, and it is always an amount that doesn't make me panic. Do I get Annoyed? Disappointed? Yes. But I never panic.

May

11

Echoes from the past, from Jeff Watson

May 11, 2025 | Leave a Comment

I have heard every single one of these more than once on the floor. This is the G version; the X version would be very inappropriate for this venue.

You’re long hope and short reality.

He couldn’t trade his way out of a wet paper straddle.

You’re bidding like it’s your wife’s money.

His stops have stops.

He buys the high, sells the low, and thinks he’s range trading.

If brains were dynamite, he couldn’t blow his nose.

He's so underwater, Aquaman just waved.

Tighter than a bull’s ass in fly season.

Your size is what we use for toilet paper.

He’s a momentum trader—in reverse.

He couldn’t fill a corn order, let alone an order ticket.

That guy trades like he’s reading Braille.

He thinks ‘limit down’ means he hit the jackpot.

He trades like he’s got a rearview mirror taped to his glasses.

He’s scalping—his own account.

Nice fade. If I ever need a contrary indicator, I’ll call you.

He went from hero to sandwich in one tick.

I’ve seen better risk management at a toddler’s birthday party.

Market’s moving—better go ask your horoscope.

You trading or just making donations today?

He’s got a 30-lot mouth and a 1-lot account.

That guy’s P&L looks like an EKG flatline.

You're not trading—you're gambling, but slower.

He’s so unlucky, he’d lose money in a rigged market where he’s the rigger.

The guy’s charts look like modern art—ugly, meaningless, and overpriced.

He averages losers like he’s building a position in failure.

Don’t worry, he’ll blow up before lunch.

His fills are like Bigfoot—plenty of stories, no proof.

That trade had more slippage than a greased pig at a county fair.

He went full margin—and full stupid.

Asindu Drileba writes:

I watched the documentary "Floored" that was about the extinction of pit traders due to the advent of computer driven traders. A lot of the traders seemed to have their edge in bullying and intimidation that was both physical and psychological.

I made a pit trading playlist that I binged on, and this seemed consistent even to pit traders in the currency pits of London.

One of the pit traders called the computer "The most vile invention ever made." I think he was just sad that his bullying was no longer an advantage. You can't insult a computer, or use your big body to push it away so you can have the edge, or seduce it with good looks.

Michael Brush responds:

Behind every computer, there is a person.

“The offer is $25.”

“But my computer says $45.”

“So sell it to your computer.”

Pamela Van Giessen adds:

For those interested in a biography of a once famous and beloved pit trader, I recommend Charlie D: The Story of the Legendary Bond Trader by William Falloon.

Francesco Sabella adds:

It's an incredible book! I read it years ago, I even saw a 2 hour video of Charlie D. when i was in high school where he gave a lecture on trading on 1989.

Larry Williams writes:

Charly D was one stand up guy. He loved the Bears and suggested a bet with a young lady trader for a nickel on the weekend's game. She said sure…and won. Monday morning Charley D gave her 5 grand (a nickel in betting parlance). She was astounded, told him she meant 5 cents not 5G's. No way could she risk that or take the money. He left it in her hand and walked away.

I was fortunate, thanks to T Demark, to be part of his Vegas support group - he was just amazing to hang with.

Apr

16

The Invisible Gorilla in the Room, from Stefan Jovanovich

April 16, 2025 | Leave a Comment

That is the creature Hugh Hendry - the Acid Capitalist - says we have to find in order to profit from our speculations.

The events in Ukraine are that gorilla. They are predicting the likelihood that Trump, Putin and the Muslim oil producers will establish a Drill, Baby, Drill world of orderly energy production and supply priced in U.S. $. The effects on the European and Asian consumers will be comparable to what happened to the German-speaking world and its silver standard when the French fulfilled the terms of the Treaty of Frankfurt by paying their reparations in gold.

Big Al needs some help:

Perplexity answers the question, "What happened to the German-speaking world and its silver standard when the French fulfilled the terms of the Treaty of Frankfurt by paying their reparations in gold?"

Stefan Jovanovich answers:

They = "events, dear boy". The prediction is that the new cartel of oil and gas exporters will establish "orderly production" that manages the risks of overproduction in the same artful manner that OPEC once operated before the invention of fracking.

William Huggins responds:

So you are suggesting us producers will submit to directives from moscow or Riyadh to limit their production? No evidence of anything but predation among those players but somehow trump purs them all on the same page? I have a bridge for sale….

Feb

19

Strange AI twist, from Larry Williams (updated)

February 19, 2025 | Leave a Comment

We sent my 2025 annual forecast to the Copyright office. They would not copyright it saying, “it was AI generated so could not be copyrighted.” We replied it was not AI, showing why so were finally approved. This raises an unraised question about AI protection. What is/will be the law??

Asindu Drileba comments:

The purpose of AI regulation is just so the big players can build a cartel and lock in the market. This is why people like Sam Altman say they "welcome it".

Big Al gets conspiratorial:

Not to be too conspiratorial, but…

OpenAI whistleblower found dead at 26 in San Francisco apartment

A former OpenAI employee, Suchir Balaji, was recently found dead in his San Francisco apartment, according to the San Francisco Office of the Chief Medical Examiner. In October, the 26-year-old AI researcher raised concerns about OpenAI breaking copyright law when he was interviewed by The New York Times.

Peter Ringel writes:

I always suspected, that the senator is a robot. His performance is inhuman!

Your work is obviously your work. But, what if one uses AI for ones work, creations and everything? It should be still your IP. We have musicians on this list, who use AI for inspirations and research. I constantly lookup code via AI, b/c I am not a good coder. But the final script is mine. I even run AI models locally. The opensource models like Facebook's LAMA. (for an easy install, i can recommend: msty.app)

There is creativity in asking questions, to squeeze the right results out of AI. Prompt engineering is a thing.

Pamela Van Giessen prompts:

No doubt every single publishers’ lawyers are fighting the ability for AI generated anything to be copyrighted because so much AI is taking from existing copyrighted works, usually without permission or payment. Some publishers are feeding into AI programs with permission/payment (I think my previous employer, Wiley, is feeding at least some content into AI, for instance). This is a lousy deal for the authors and artists. The publishers will make vast sums, much like Spotify, and the content creators (I really hate that phrase) will get less than pennies on the dollar.

Liberals have done a great job of deflecting the real problem with platforms (omg, no content moderation or fact checking, TikTok is spying on Americans, the world will end!). The real problem with platforms is that they steal content, outright theft. And where is your government protecting you from this theft? NOWHERE.

Easan Katir relates:

I sent an unpublished manuscript to an Oxford-educated editor, asking her to edit. She asked if any of it was AI. I replied truthfully that I wrote most of it but I asked AI to add some. She declined the job, I guess making a stand: humans vs. AI. Fortunately or not, we know which is going to win.

Peter Ringel offers:

Pamela Van Giessen comments:

I imagine that the courts are going to get involved at some point. Since much AI is from existing copyrighted material, some (most?) used without permission, someone is going to challenge copyrighted AI that is really someone else’s material.

Jordan Low agrees:

precisely. i have been seeing a lot of content creators complain that their work is just automatically reworded into another article without attribution.

Update: Big Al offers an historical lagniappe:

The battle of Cúl Dreimhne (also known as the Battle of the Book) took place in the 6th century in the túath of Cairbre Drom Cliabh (now County Sligo) in northwest Ireland. The exact date for the battle varies from 555 AD to 561 AD. 560 AD is regarded as the most likely by modern scholars. The battle is notable for being possibly one of the earliest conflicts over copyright in the world.

Stefan Jovanovich writes:

The first written mention of the Battle of the Book occurs in the Life of Saint Columba composed by Manus O'Donnell in 1532. Britain did not have a formal copyright law until the passage of the Statute of Anne in 1710; that gave authors their first ownership claim to their writings. Until then the Stationers' Company had an exclusive right to all printing and publishing in Britain. The term "copyright" comes from the right a member of the Stationers' Company had to copy a written manuscript into print after the text had been registered with the Stationers' Company. The charter for the Stationers' Company was granted in 1557 by Queen Mary and King Philip, then confirmed in 1559 by Queen Elizabeth. The Company had the authority to seize "offending books".

Carder Dimitroff adds:

From March's Library: Early printed books were customized with hand-painted illumination for the wealthy.

Feb

3

Inflation and it’s Causes, from Asindu Drileba

February 3, 2025 | Leave a Comment

What causes inflation? Suppose we define inflation simply as the rise in prices of commodities, stocks, real estate etc. What causes it?

1) A generic explanation people offer (acolytes of Milton Friedman & Margaret Thatcher for example) is to blame monetary policy. Simplified as, inflation is caused by "too much money chasing too few goods."

Many people blamed President Trump's COVID stimulus packages for the rise of prices during that period. It seems specs in this list agree upon this when it comes to stock prices, i.e., lower interest rates (higher money supply) -> Higher stock prices (inflated stock prices).

2) An alternative explanation is that higher prices are caused by supply chain issues.

So they would claim that higher commodity prices were so because it was extremely difficult to move them around during lockdowns, let alone processing them in factories. A member also described that egg prices may be going up because of disease (a chink in the supply chain) not necessarily monetary policy. I am thinking that supply chain issues are more important to look at, than monetary policy.

Larry Williams predicts:

Inflation is very, very cyclical so maybe the real cause resides in the human condition and emotions. It will continue to edge lower until 2026.

Yelena Sennett asks:

Larry, can you please elaborate? Do you mean that when people are optimistic about the future, they spend more, demand increases, and prices go up? And then the reverse happens when they’re pessimistic?

Larry Williams responds:

Just that it is very cyclical— as to what drives the cycles I am not wise enough to know…though I suspect…some emotional pattern dwells in the heart and souls of as all that creates human activity—along the lines of Edgar Lawrence Smiths work.

Jan

19

Some guy built a complete AI-driven hedge fund, from Asindu Drileba

January 19, 2025 | Leave a Comment

Here is the original thread.

All of the agents show their reasoning so you can see how they work.

1 • Market Data Agent: gathers market data like stock prices, fundamentals, etc.

2 • Quant Agent: calculates signals like MACD, RSI, Bollinger Bands, etc.

3 • Fundamentals Agent: analyzes profitability, growth, financial health, and valuation.

4 • Sentiment Agent: looks at insider trades to determine insider sentiment.

5 • Risk Manager: determines risk metrics like volatility, drawdown, and more.

6 • Portfolio Manager: makes final trading decisions and generates orders.

Here is the GitHub repository.

Why would this work or be good at? Why would it not work? I don't think it will work since the same model will be used my many if successful and the gains will be cancelled out.

Larry Williams comments:

Ultimate curve fit - wait a year to know.

Hernan Avella writes:

This is absolutely the way to go, but there’s a bit more to what we get to call “Agent”. Also his quant module is looking at dumb shit.

Julian Rowberry responds:

horses had a good track record before cars. AI is making key opinion leaders redundant too.

Dec

27

Slab City photos, from Larry Williams

December 27, 2024 | 1 Comment

50 Photos of The Last Free Place in America

Hidden in Southern California’s desert is a small squatter’s paradise affectionately known as “The Last Free Place in America”.

More on Slab City

Slab City, also called The Slabs, is an unincorporated, off-the-grid alternative lifestyle community consisting largely of snowbirds in the Salton Trough area of the Sonoran Desert, in Imperial County, California. It took its name from concrete slabs that remained after the World War II Marine Corps Camp Dunlap training camp was torn down. Slab City is known for attracting people who want to live outside mainstream society.

Dec

20

On your last leg, from Kim Zussman

December 20, 2024 | Leave a Comment

How Old Are You? Stand on One Leg and I'll Tell You

I’m always interested in ways to quantify how my body is aging, independent of how many birthdays I have passed. And, according to a new study, there’s actually a really easy way to do this: Just stand on one leg.

Pamela Van Giessen writes:

I slipped on black ice a few years ago and broke my wrist. It was awful and I exclaimed that I would do everything possible to avoid that happening again. I have never had great balance to begin with. I started doing lots of planks. Minor improvement. This year I started running and walking backwards for ~10 mins/day (and I increased the planks to 4 mins). I have been doing this at least 5 days/week since January. I also do about 3 mins/day (7 days/week) sideways leg lifts (one leg at a time and then alternating) with my eyes closed.

HUGE improvement. On recent hikes I was able to rock hop over creeks without my usual falling on my rear and walked several round tree trunks over creeks (like a balance beam) successfully. Two yrs ago I would have had to scootch over those tree trunks on my butt.

Falls are one of the leading causes of mortality as we age because when people fall and hurt themselves it takes longer to recover and they get really nervous about it happening again so they become more sedentary. Peter Attia spends a lot of time discussing this in his book and podcast.

Larry Williams offers:

I had this in my February letter:

We are all aware of how dangerous falls can be for older people. I did not realize it was this dangerous; “The mortality rate for falls increases dramatically with age in both sexes and in all racial and ethnic groups, with falls accounting for 70 percent of accidental deaths in persons 75 years of age and older.” Am Fam Physician.

Most say older people fall because they lose their balance, surely that is part of it. But, there’s another part you can start working on now that costs nothing.

When you start to lose your balance, your body immediately corrects it with how you are standing. Weak ankles, as I see it, are the problem. I first realized this when training for the Sr Olympics. Faster sprinters have stronger ankles. Weak ankles mean you can’t “catch yourself” as you start to fall. To strengthen your ankles, walk barefoot. Walk on your toes, then walk on your heels (careful) to build up these muscles and protect you from falling. Lots of YouTube videos on this as well. Strong people fall less. Muscle loss and ankle strength will keep you upright.

A good exercise is to rock back on your heels, may want to hold on to something, to develop balance and strength

Andrew Moe adds:

Walking backwards uphill, dragging a big weight sled backwards and doing squats on an incline board are all favorites of the Knees Over Toes guy. He's an innovator who believes in building strength from the ground up. Also combines strength and flexibility. Worked for me and is now part of my regular exercise.

Nov

24

Stops, from Hernan Avella

November 24, 2024 | Leave a Comment

Contrary to what has often been repeated on this esteemed list over the years, the art and process of trading is fundamentally the art and process of setting the right stops. Simpletons may claim that adding stops to a system (trading ES) reduces profitability, but that's only because the system itself is flawed, with laziness baked into its design. Setting the right stop is an integral process—it involves gauging current and expected volatility, weighing potential paths, and accounting for the bias.

Steve Ellison writes:

One of my best experiences with this list was that at the sparsely attended Spec Party in summer 2009, the 20 or so of us who were there had a very spirited discussion in Victor's living room about whether it was advisable to use stops or not. Many excellent points were made both pro and con.

Speaking for myself, I usually don't enter stop orders because they become part of the market, but I have mental stops. On the rare occasions when I actually have a profit, I am determined to not let it turn into a loss. And if a trade goes against me (by a nontrivial amount), that's new information that apparently my original analysis missed; in that case I am determined not to let a small loss turn into a big loss.

To put it another way, I entered a trade because I thought I had an edge, but the market moved in the wrong direction. Maybe something bigger is going on than, say, my analysis of the last 10 post-options-expiration weeks.

Big Al offers:

Stop Orders in Select Futures Markets

Nicholas Fett and Lihong McPhail

Office of the Chief Economist

Commodity Futures Trading Commission

August 29, 2017

This paper analyzes trade and order book audit trail data to provide a detailed summary of the use of stop orders in select futures markets; specifically E-mini S&P 500 Futures, Ten Year Treasury Note Futures, and WTI Crude Oil Futures. Recent flash rallies and the ever increasing speed of futures markets have called into question the appropriateness of traditional stop order strategies. By utilizing metrics related to both placement of and execution of stop orders, we show that stop orders are being used in these futures contracts with varying frequency and the strategy of stop order placement varies greatly by participant. As expected, trades involving stop orders are found to be highly correlated with intraday price volatility. Existence of stop orders is generally unknown to market participants as stop orders are not visible in the orderbook but must be triggered by a trade in the market at the corresponding price. More importantly, our analysis indicates that many traders are not only using stop orders for hedging purposes but also using them for latency reduction strategies. We provide a background on the usage and depth associated with stop orders in selected futures markets.

Larry Williams responds:

THANKS FOR THE POST. This should dispel the notion "they are going after my stops."

Asindu Drileba writes:

I don't actually use stops at all. My position size is my stop. I only bet a maximum of 3% of my bankroll. I really only get out of the market when I am liquidated. I sleep knowing that if I am to loose, my maximum loss is capped at 3%. I don't even respond to margin call emails. I often want to capture the moves between the daily open and the close. So what happens in between is something I usually ignore.

Nov

10

The Old Right was a principled band of intellectuals and activists, many of them libertarians, who fought the “industrial regimentation” of the New Deal, and were the first to note that, in America, statism and corporatism are inseparable.

Despite some current claims, however, these writers ardently defended capitalism, including big business and corporations, celebrated the profit motive, and took a strict laissez-faire attitude towards international trade. They loathed tariffs, and saw protectionism as a species of socialist planning.

Humbert H. writes:

Current restrictionist trade theories in the conservative movement, therefore, are not those of the Old Right. Their intellectual legacy is more likely British mercantilism.

The British did pretty well under mercantilism. I have always supported free (meaning from both sides) trade with equally situated countries, like US and Canada, but I love restrictionism and tariffs imposed on countries like China. It's crazy, in my opinion, to have "free trade" with a country that can and routinely does restrict imports, has slave labor, no "social safety net", steals intellectual property in a variety of ways, and can chose to focus on any trade area to bankrupt it's counterparts in a "free" country. The ability to produce a variety of goods is fundamental to the strength of the country. In wars, pandemics, and trade wars the other country starts having domestic capabilities is crucial. When this debate was first discussed in France, restricting the imports of oranges from Spain and Portugal into France was used as an example of what not to do, and that's a poor example compared to importing steel and semiconductors.

Larry Williams comments:

Hamilton's use of tariffs made America great.

Stefan Jovanovich writes:

Hamilton made his living as a private attorney in New York representing the marine insurance companies whose policies required shippers to be "woke" - i.e. perfect observers of their policies' neutrality warranties.

Pamela Van Giessen adds:

Silent Cal Coolidge the Vermonter was also good with tariffs and preferred them to income taxes.

Along with Secretary of the Treasury Andrew Mellon, Coolidge won the passage of three major tax cuts. Using powers delegated to him by the 1922 Fordney–McCumber Tariff, Coolidge kept tariff rates high in order to protect American manufacturing profits and high wages. He blocked passage of the McNary–Haugen Farm Relief Bill, which would have involved the federal government in the persistent farm crisis by raising prices paid to farmers for five crops. The strong economy combined with restrained government spending produced consistent government surpluses, and total federal debt shrank by one quarter during Coolidge's presidency.

Michael Brush responds:

Smoot-Hawley worsened the Great Depression.

Humbert H. cautions:

That's not really a fact, it's a debatable point. There's a range of opinions there from "it caused it" to "it did nothing to worsen it". It's one of those things like "what caused the fall of Rome" that can't be decisively proven.

Stefan Jovanovich offers:

Effective date of Smoot-Hawley Tariff: June 17, 1930

Tariff collections:

Fiscal Year 1931: $378,354,005.05

Fiscal Year 1932: $327,754,969.45

Fiscal Year 1933: $250,750,251.27

Total tax collections by Treasury:

Fiscal Year 1931: $2,118,092,899.01

Fiscal Year 1932: $2,118,092,899.01

Fiscal Year 1933: $2,576,530,202.00

Pamela Van Giessen writes:

Amity Shlaes goes into detail about how the depression was extended (or recovery didn’t come) in The Forgotten Man. She attributes the worsening of the depression, especially in the late ‘30s, to a combination of government interventions that included the Smoot-Hawley tariff, government (and union) demands to keep wages high, banking regulation, over-regulation, and FDR’s new deal, among other government interventions. In short, there doesn’t seem to be just one cause though it seems reasonable to blame each of the interventions.

Art Cooper adds:

I also found Murray Rothbard's America's Great Depression to have worthwhile insights.

Oct

31

US National Debt possible consequences & hedges, from Asindu Drileba

October 31, 2024 | Leave a Comment

There is a lot of talk about how precarious US Debt situation is. Two questions:

1. What possible disaster may come out of this? I am thinking Zimbabwe type hyper inflation. What other kind of disaster can happen?

2. What can retail level people do to protect themselves from this? Buy Swiss Francs? Gold & Silver? Bitcoin? What?

Larry Williams responds:

Gloom and doomers here is the chart to look at:

Bud Conrad writes:

Gold 1 year is up 24%. Silver 1 year is up 50%. The circumstances today are still very bad for the dollar. (Which is what is actually declining.)

The BRICS+ are meeting in Russia tomorrow Putin, Xi, Modi, Iran, Saudi Arabia (observer only), UAE etc.) to continue de-dollarization with non-dollar-denominated trade through non-SWIFT transactions for international Central Bank settlement. NO body is talking about this, being focused on how much the candidates will print up to bribe us for votes. The $1.1 T for interest on the $35 T of official Government Debt could rise, as the 10 year Treasury rate hit 4.2% while the Fed CUT short-term rate. Including unfunded liabilities for Social Security and Medicare would say the debt obligations are more like $200 T.

This is 10 year Treasury. Red pointer is when Fed Cut short term rate:

There is no way around avoiding the money printing required. Inflation and price rises are inevitable, as foreigners divest their $8 T of Treasury holdings, to avoid US asserting sanctions or seizing assets like the $300B of Russia holdings. They want out of US Hegemony fast, because of 14 rounds of sanctions on Russia.

Oct

30

For Those of Us Who Are Chronically Late to the Party, from Stefan Jovanovich

October 30, 2024 | Leave a Comment

Larry Williams interview with Jason Shapiro:

Masterclass with Larry Williams: COT, Market Cycles & Trading Secrets Revealed

Join Jason Shapiro, a renowned contrarian trader, as he unravels the complexities of the COT Report with legendary trader Larry Williams in this must-watch deep dive. Discover the market insights and trading strategy secrets that have led to their success, as they discuss everything from the impact of macroeconomics on trading decisions to the nuances of technical and sentiment analysis.

Oct

5

Larry Williams comments:

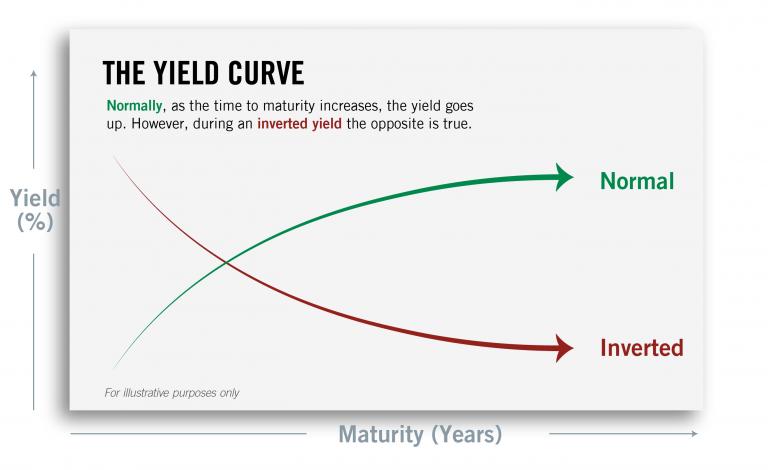

Yield curve is very bullish at this time - it is so misunderstood.

Peter Ringel does some counting:

I found a FED Cut gives some bear pressure on SPY 5, 10 days after. Then it goes into meaningless regarding SPY.

only T+5 , T+10 are probably significant. We just crossed the end of that bearish pressure.

T+1 10000 reshuffled - Observed difference: -0.03, Bootstrap p-value: 0.8573

T+5 10000 reshuffled - Observed difference: -0.96, Bootstrap p-value: 0.0206

T+10 10000 reshuffled - Observed difference: -1.13, Bootstrap p-value: 0.0514

T+20 10000 reshuffled - Observed difference: -0.88, Bootstrap p-value: 0.2829

(a work in progress)

Jul

30

Intermittent fasting and your noodle, from Kim Zussman

July 30, 2024 | 1 Comment

Two Diets Linked to Improved Cognition, Slowed Brain Aging

An intermittent fasting (IF) diet and a standard healthy living (HL) diet focused on healthy foods both lead to weight loss, reduced insulin resistance (IR), and slowed brain aging in older overweight adults with IR, new research showed. However, neither diet has an effect on Alzheimer's disease (AD) biomarkers.

Although investigators found both diets were beneficial, some outcomes were more robust with the IF diet.

Larry Williams adds:

A “dry” fast loses weight more than wet fast.

Big Al writes:

Sergei's AI says:

The main difference between dry fasting and wet fasting, also known as water fasting, is whether you consume liquids:

Dry fasting: Restricts both food and liquids, including water, broth, and tea. It can be done as part of intermittent fasting, which cycles between eating and fasting. For example, you might restrict food for 16 hours and eat during an 8-hour window. Wet fasting: Allows you to drink water, and sometimes certain teas.

Dry fasting can be dangerous, especially for long periods of time. Some potential side effects include: Dehydration, Nutrient deficiencies, Urinary problems, Kidney issues, Heat injury, and Swollen or ruptured cells.

Jul

23

We cheered on Larry who competed in the Big Sky Games, Sunday, July 21.

Big Al adds:

Larry had a great result in the 5k.

Larry Williams writes:

Pam’s donuts, she kindly brought a box to Red Lodge were the most beautiful I have ever seen (cute little ones) and best tasting…well worth a trip to the Home of Dan Bailey.

Big Al is enthusiastic:

Daisy Donuts look great!

Pamela Van Giessen responds:

Not great pic of the mini donuts Larry enjoyed. I should have taken a photo before we left instead of in the car while driving. For anyone venturing to Red Lodge MT, we highly recommend the pig races in Bear Creek. And a nice visit with Larry!

Jun

11

Recession of recession indicator, from Kim Zussman

June 11, 2024 | Leave a Comment

Wall Street’s Favorite Recession Indicator Is in a Slump of Its Own

Treasury yields have been inverted for the longest stretch on record

One of Wall Street’s favorite recession indicators looks broken. An anomaly known as an inverted yield curve, in which yields on short-term Treasurys exceed those of longer-term government debt, has long been taken as a nearly surefire signal that an economic pullback looms. In each of the previous eight U.S. downturns, that has happened before the economy sputtered. There haven’t been any glaring false alarms.

Now, though, that streak is threatened. The yield curve has been inverted for a record stretch—around 400 trading sessions or more by some measures—with no signs of a major slowdown. U.S. employers added a solid 175,000 jobs last month, and economic growth this quarter is expected to pick up from earlier in the year.

Big Al snarks:

If a recession doesn’t materialize soon, it could do lasting damage to the yield curve’s status as a warning system.

I'd hate to have to spend my day thinking up stuff like that.

Larry Williams writes:

A close up study of it shows it has often been way wrong—this is just one more time.

Nils Poertner comments:

As those "indicators" lose their importance, the more ppl (and WSJ and FT in particular!!) talk about it. "get the joke" Lack would have said.

Jeffrey Hirsch responds:

NBER that said 2020 was a recession. Fed started cutting rates in 2019 and the curve inverted then.

The recession lasted two months, which makes it the shortest US recession on record.

It is just a shame bond market traders didn’t tell the rest of us that covid was coming. And what about the 2 back-to-back negative quarters of GDP in Q1&2 of 2022? That looked like a recession as well IMHO.

Big Al adds:

The Fed (from before the GFC) says levels matter, too:

The Yield Curve and Predicting Recessions

Jonathan H. Wright, Federal Reserve Board, Washington DC

February 2006

Abstract: