Feb

11

New Fed Chair Not So Bearish, from Jeffrey Hirsch

February 11, 2026 | Leave a Comment

…we present the S&P 500’s performance following a change in leadership at the Fed. Historically, performance is not all that bearish. Aside from the 3 months later interval, all other interval’s frequency of advance (% Higher) are above our standard 60% bullish threshold and average performance is positive.

Going one additional step, let’s say Eugene Meyer was not responsible for the Great Depression and Alan Greenspan probably did not cause the market’s crash in 1987. Bad timing, perhaps? Removing them from the data essentially removes the most bearish data. Average performance across all intervals goes up and is positive while frequency of gains also improves noticeably and performance 1-year later jumps to an average gain of 12.7%, with the S&P 500 higher 90% of the time.

Feb

1

Does January predict the next 11 months?, from Big Al

February 1, 2026 | Leave a Comment

In this quick study the answer is no.

Jeffrey Hirsch has a different take:

From my newsletter issue published last night:

Jan

18

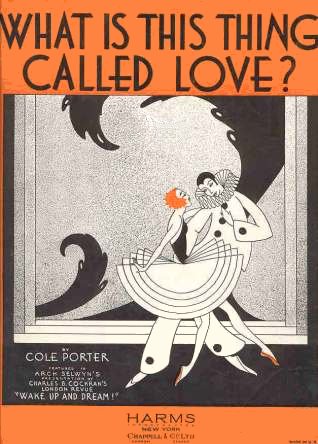

Traders and Art/Music, from N. Humbert

January 18, 2026 | Leave a Comment

Noticed many of my trading friends have an affinity for either ART or MUSIC or both (active or passive) It occurred to me the other day, that both offer ways to somewhat stay sane, it allows the adult to play and have some fun /relax.

Because society as a whole has something matrix like (going to school, learn about consensus reality, fill out the forms, get a BS job, keep up with the JONES, feel empty..) and this is a nice way to see beyond it and feel a bit at ease. That is all.

Here is a lovely Schubert piece. enjoy

Schubert, Trio No. 2, Op. 100, Andante con moto | Ambroise Aubrun, Maëlle Vilbert, Julien Hanck

Asindu Drileba responds:

Narrator: "Fate had already determined that he will die childless and penniless."

Epilogue: "It was in the reign of George III that the aforesaid personages lived and quarreled; good or bad, handsome or ugly, rich or poor, they are all equal now."

Whenever I hear that piece, I think of those words from Barry Lyndon. It was such a good "slice of life" type film.

Jeffrey Hirsch recalls:

Yale was quite a composer. I tried to produce the musical he wrote about the Elephant Man called Merrick & Melissa. But he was a better composer than I was a producer.

Sep

23

Health care costs, from Nils Poertner

September 23, 2025 | Leave a Comment

health care costs, our Achilles heel.

Health Insurance Costs for Businesses to Rise by Most in 15 Years

Insurers say that the rising premiums are driven by growing healthcare costs

(on a personal note: no-one is really fully healthy, not even kids normally! science uses a lot of Aristotelian logic (which is an either/or logic) but there are limits to it - and we take it way beyond its usefulness. Nature does not have those clear mental compartments - it is way more fluid /dynamic).

Steve Ellison writes:

Until the public announcement that Warren Buffett had bought shares in UnitedHealth, health care was by far the worst performing of the 11 S&P 500 sectors in 2025.

Nils Poertner responds:

Yes, the whole sector / subindex looks bullish (XLV). (the type of logic in the West (logic from Aristoteles) that dominates MODERN SCIENCE cripples our society. Why? Because in many cases, whatever the doctor says, "it is not" - it is only an image of something abstract (like the apple painting by Rene Magritte).

Pamela Van Giessen comments:

We overconsume healthcare because we pay so much for insurance and/or our employers give it to us in lieu of salary so we want to get all we can for “free.” We’ve been conditioned to believe that if we visit doctors (though now we see PAs) and get “check ups” and “tests” regularly and take pills to manage our bodies and minds in perpetuity that we won’t get seriously ill. Has got to be the biggest subscription scam ever perpetuated on a society.

Perhaps some spec would like to pull out the data and do some forensic financial analysis of all those hospital system balance sheets. I think that fully 1/3rd or more of hospital systems are owned by private equity firms and the bulk of non-profit hospital systems are extracting meaningful sums from the business regardless of how “healthy” their margins look on their financial statements. From an equity perspective the biz may have looked lousy but I can promise that it is extraordinarily profitable for the inside players.

Jeffrey Hirsch adds:

Not only is it a total scam, but it gets in the way of real needed pharmaceutical/medical care and completely ignores metabolic healthcare via lifestyle and diet changes.

Too bad RFK is all wrapped up in his vaccine crusade to focus on the real USA health crisis with obesity and metabolic health, which causes diabetes, heart disease, cancer and cognitive decline. I think the covid vax is total BS as are others. But MMR and most childhood vaccines save lives. We had a measles outbreak in Rockland County a few years back because some communities did not vaccinate.

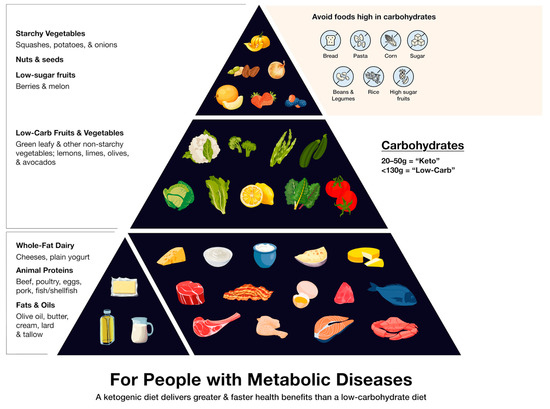

We should also flip the old USDA Food upside down. The chart is from my Doc’s paper. And my doc's site is Dr. Tro Kalayjian).

May

13

A call for great new books, from Jeffrey Hirsch

May 13, 2025 | Leave a Comment

I am putting together a list of the Best Investments Books of the Year. I am not seeing many great books on trading, investing, finance, markets, crypto, options, futures, cycles, etc. I would love to hear if you folks know of any great books out in the past 6 months or so or coming soon.

Matthew Gasda is justifiably proud:

Big Al offers:

This is high-level quant stuff - ie, over my head, and despite "Elements" in the title - but a fun stretch:

The Elements of Quantitative Investing (Wiley Finance) 1st Edition, by Giuseppe A. Paleologo

His more basic 2021 book is "Advanced":

Advanced Portfolio Management: A Quant's Guide for Fundamental Investors, by Giuseppe A. Paleologo

Carder Dimitroff suggests:

This book is about historical finance and may not be a direct response to the question.

Empire, Incorporated: The Corporations That Built British Colonialism, by Philip J. Stern

William Huggins responds:

on a similar (historical) note, one of my students just recommended this title to me. looking forward to cracking it later this month:

Ages of American Capitalism: A History of the United States, by Jonathan Levy

Asindu Drileba adds:

If you would regard a speculator/investor as someone who also builds businesses:

Never Enough: From Barista to Billionaire, by Andrew Wilkinson

Andrew is building Tiny. His intention is to build the Berkshire Hathaway of Tech and software. He is inspired by Monish Pabrai (The Dhando Investor). So he is more in the "Value investing" camp not really quantitative.

Mar

20

Shoeshine boy, from P. Humbert (Updated)

March 20, 2025 | 1 Comment

I had a reverse shoe shine boy moment to day. A friend, who shouldn't talk to me about markets, talked to me: "Your boy Trump is crashing the markets. My portfolio …." I take such data points serious - in combinations.

Steve Ellison responds:

Similarly, my sister in October 2008 was getting 150 calls per day from clients asking, "Should I sell?" She worked at an insurance company that also offered investment services. My reaction at the time was, "Isn't anybody calling to ask, 'Should I buy?'"

Jeffrey Hirsch writes:

Still hearing a lot of “Should I buy?” Two weekends ago was asked if would come on cable biz Monday 2/24 to say I was buying mega cap tech. I declined and said I did not think is was time. Posted this that day.

Updates:

Nils Poertner writes:

valid observations here. good to pay attention to odd moves, anything strange (eg like bund move recently) - as there may be more odd things coming!! in other words, be like Alexander Fleming - who stumbled on penicillin by chance - and didn't bin the sample as he wasnt looking for it.

Adam Grimes comments:

I obviously understand the shoe shine boy/taxi driver point here, but it's worth considering that market psychology is not asymmetrical.

P. Humbert responds:

Hi Adam. there is high risk, that I initially heard about the old masters from your writings. I agree, that it probably has more weight for tops. I think, that is where you are pointing to? My friend has quite a good performance in being wrong. He called the the Bitcoin top being bullish and some more. He is a nice guy, just not for markets.

Adam Grimes agrees:

Yeah that's always been my thinking–a little more actionable with exuberance at tops. Bottoms tend to overshoot a bit more, on balance, so I think the shoe shine boy cries uncle a bit too soon.

Nils Poertner adds:

sometimes the crowd is right or they have a hunch but they don't connect the dots yet

eg. "a bit of subprime" in early 2008 - as sort of consensus view among your typical investor back them it was high time to position extra cautious.

Bill Rafter comments:

The “crowd” is mostly right, but the problem is that there are usually several crowds, and of course the composition of the crowds change. If you’re lucky, there will only be two crowds, the knowledgeable ones, and those “asleep at the switch”. The trading rule is simple: follow the informed ones, particularly if the uninformed ones are 180 degrees away. A classic example of this is the Commitment of Traders Report. Ideally the reporting specs will be one way, with the non-reporters the other way (and preferably short). Without the benefit of COT, you can identify best- and worst-informed with regression.

Feb

21

Spec sampler

February 21, 2025 | Leave a Comment

Asindu Drileba recommends:

The Count of Monte Cristo was my favourite movie of 2024. I would recommend it to specs as it has a very interesting stock market trading segment. The stock trading segment was brilliant in that it incorporated ideas from poker (previously discussed in this list). It's also a good demonstration Howard Mark's "Second level thinking", and the use of deception in the market.

Also, the best description of the Fourier transform I have seen so far.

Jeffrey Hirsch is on IBD:

How To Trade Trump 2.0 And Why DeepSeek Is Not The End Of The AI World | Investing With IBD

Big Al offers:

Humorous and with many lessons:

How I Helped to Make Fischer Black Wealthier

Jay R. Ritter, Cordell Professor of Finance at the University of Florida

Hillary Clinton wasn't the only person who made money speculating in the futures market during the late 1970s and early 1980s. A lot of finance professors did, including me. However, I used a different strategy than Hillary. Following the advent of stock index futures trading in 1982, many finance professors started playing the turn-of-the-year effect. The most popular approach was to buy the Value Line futures and short the S&P 500 futures. This is what I did. Of course, if there is easy money to be made, prices should adjust as the market learns, and a perpetual money machine will cease to exist. But I figured out a way to still make money. Or so I thought. Unfortunately, there was an unexpected danger in my strategy. In 1986, Fischer Black of Goldman Sachs figured it out and took me to the cleaners.

Nov

30

Productivity and AI, from David Lillienfeld

November 30, 2024 | 1 Comment

When do we start seeing the effects of AI show up in national economic data? If you had invested $5K in a laptop and a word processing program, you could replace a secretary at multiples of the cost. When the web came in, there was Amazon squeezing out the costs of the middlemen.

But I don't see the savings for AI. I see lots of talk, some free programs, but in terms of real productivity, not so much. I'm also told that it's early days and I'm asking for too much in posing such a question, but I think we're now getting far enough into AI that it's not an unreasonable matter to bring up.

One thing that's clear is that AI isn't going to generate employment the way the last tech push did. But if it's going to really change the world as its advocates suggest that it will, those productivity gains should be apparent by now.

M. Humbert writes:

However AI productivity gains are measured, it’ll have to account for the productivity loss due to its high energy consumption. For the Austrian economics fans here. I’ve found Copilot to be a helpful time saving tool, so others probably do as well, so time savings definitely are occurring from AI use today.

Laurence Glazier responds:

Using it all the time, huge experiential benefit. Chatting to GPT every morning while reading Thoreau. Instant context. The other big breakthrough is spatial computing. All in the service of art.

Asindu Drileba comments:

From my experience, co-pilot and other LLMs, have not solved anything that could not already be done via ordinary Googling. Looking up solutions to code issues on stack overflow is no different from LLMs. And stack overflow is still better for some tasks (fringe computer languages like APL for example). LLMs are impressive, but are mostly just gimmicks. The only thing it has actually saved me time on is generating copyrighter material and filler text.

Jeffrey Hirsch adds:

Just had that discussion today about ordinary google still being even better than LLM Ais in finding info. Had some fun with AI editing and embellishing copy.

Asindu Drileba adds:

I suspect that the bad SWE job market is due to high interest rates, no AI. The SWE job market is enriched mostly by VC money. And VC money dried up when LPs withdraw to earn risk free money in treasuries instead of betting on start-ups whose success is on probability. I expect it to recover if interest rates come down to previous levels.

I think the LLM narrative was just something that tech executives parroted to show they had an LLM strategy. It's, Like how in 2018/2017 every executive had a "Blockchain" strategy. A lot of businesses assumed that LLMs would replace simple customer support jobs but they just saw their tickets pile up. Even the $2B valued, Peter Thiel financed, code assistant that would make you money on Up work as you sleep turned out to be a blatant scam.

Steve Ellison writes:

I don't have an answer for Dr. Lilienfeld's question about when AI effects will show up in productivity statistics. But I do hear anecdotally through my professional networks that AI projects are adding real value.

At the same time, Asindu is correct that the bad job market for techies, myself included, is more a consequence of rising interest rates–and I would add overhiring during the pandemic–than positions being replaced by AI. As Phyl Terry put it, "But this company [that announced layoffs] wants to go public so the better story is 'we are smart leaders using AI to become more efficient and profitable' vs 'we were idiots during the pandemic and have to lay off some people because we messed up.'"

Gyve Bones writes:

I find that the AI's ability to interpret my request and put together a coherent synthesis of several sources to be very helpful. Grok is nice because it provides a set of links to sources relevant to the prompt, and to related ??-posts and threads.

Laurence Glazier asks:

I usually have audio conversations with GPT rather than the older typed-in input/output. I just subscribed to X Premium to get access to Grok. Any good links for learning good usage? How nice Musk names it from the Heinlein novel.

Gyve Bones responds:

Check out the sample prompts Grok supplies on the [ / ] section in ??. The news analysis prompts for trending items is pretty cool.

Bill Rafter writes:

My business partner and I are in the process of marketing a new software application. Although we are rather literate, we have been running all of our marketing materials through Copilot, and we are amazed at the improvements Copilot makes to our text. It results not only in improved communication, but is a real time-saver. We even asked it to write a business plan, and it came back with a better one than our original.

Peter Penha offers:

I have not (yet) been on Grok but have found that the prompts do not differ very much across LLMs:

A Primer on Prompting Techniques, June 2024.

Prompt engineering is an increasingly important skill set needed to converse effectively with large language models (LLMs), such as ChatGPT. Prompts are instructions given to an LLM to enforce rules, automate processes, and ensure specific qualities (and quantities) of generated output. Prompts are also a form of programming that can customize the outputs and interactions with an LLM. This paper describes a catalog of prompt engineering techniques presented in pattern form that have been applied to solve common problems when conversing with LLMs. Prompt patterns are a knowledge transfer method analogous to software patterns since they provide reusable solutions to common problems faced in a particular context, i.e., output generation and interaction when working with LLMs. This paper provides the following contributions to research on prompt engineering that apply LLMs to automate software development tasks. First, it provides a framework for documenting patterns for structuring prompts to solve a range of problems so that they can be adapted to different domains. Second, it presents a catalog of patterns that have been applied successfully to improve the outputs of LLM conversations. Third, it explains how prompts can be built from multiple patterns and illustrates prompt patterns that benefit from combination with other prompt patterns.

This is earlier/shorter February 2023 paper - I am also a fan/follower of Prof. Jules White’s classes on Coursera why I flag the shorter/earlier paper as well.

Separate on the subject of AI - Eric Schmidt has a new book Genesis with Dr. Kissinger as a co-author (his last work before his passing) but Schmidt did a Prof G Pod Conversation released Nov 21st - in the podcast Schmidt goes over the threat from LLMs that are unleashed and noted that China in his view has open sourced an LLM equal to Llama 3 and that China instead of a being three years behind the USA on LLMs is a year behind. That China comment can be found here at 26:30.

Finally if anyone wants a great book I have read, on the history of the race to AGI going back to 2009: the Parmy Olsen book Supremacy on the histories of Sam Altman and Demis Hassabis is a wonderful read. Also breaks the world down between the AI accelerationists and the AI armaggedonists.

Big Al adds:

I do use Bard to learn or refresh my memory with R. For example, I am trying to use the "tidyverse" set of packages, and Bard is very useful when asked to write code for some task specifically using, say, tidyquant. The code almost never works first time cut & paste, but I can see how things are done differently and figure out what needs fixing. And I get answers to simpler problems faster than on Stack Exchange which is better for more complicated issues.

Laurence Glazier comments:

It's an inverted Turing test situation. The things that AI can't do help identify our humanity, our birthright.

Aug

23

Counting is one thing, statistics is another, from Carder Dimitroff

August 23, 2024 | Leave a Comment

Today, the U.S. Energy Information Administration (EIA) is counting how many power plants were added in the first half of 2024 and projecting how many will be added in the last half.

It's all wonderful news. About 20.2 GW (the equivalent of about 18 nuclear power plants) were added. By the end of the year, EIA expects about 62 GW of new capacity. About 95 percent of these additions are intermittent sources (wind, solar, batteries).

Offsetting this new capacity are retirements. Utilities plan to retire 7.6 GW, all of which use coal, natural gas, and petroleum as fuel. They are likely being retired because they are uneconomic and rarely dispatched. Their levelized costs exceed revenues, and investors want to tidy up their books.

Statistics unearth a problem that counting hides. The problem is not on the supply side; it's on the demand side. Specifically, counting 24/7 demand reveals tremendous growth (e.g., baseload). It appears there's a hidden mismatch between supply and demand. While there will be hours on most days when the grid is flooded with cheap power, there will also be hours on other days when there will not be enough supply to serve all loads.

Retail prices will jump. In fact, they already have. PJM is the Regional Transmission Organization (RTO) that manages bulk power markets for the mid-Atlantic region. It's one of the largest of the nation's ten RTOs. In addition to transmission line responsibilities, PJM manages energy and capacity auctions for power plant production.

PJM conducts an auction for capacity each year. Power plant asset owners may enter the auction and offer their prices. Owners are paid a daily rate for each megawatt if their bids clear. Auction results:

2024/2025

$28.92 / MW-day

2025/2026

$269.92 / MW-day

Next year, a 1,000 MW power plant can earn $269,920 daily compared to $28,920 this year. These payments are in addition to any revenues earned from energy auctions.

While these auctions seem arcane to the average consumer, they will feel it in their pocketbooks—and not just in one part of the country—it's everywhere. All these costs will flow to the consumer, who will have only the choice of paying or reducing consumption.

Two options may become quickly viable. One is to build gas turbines as fast as possible. To attract investors, capacity payments have to be attractive. But starting new projects today may be too late.

The other option is "demand-response," where consumers are enticed to reduce demand for a price. Demand response is in place today but has yet to be aggressively implemented. It appears grid operators like PJM (not the government) will be forced to become aggressive and offer lucrative demand-response programs.

Lastly, those who invest in "behind-the-meter" assets like their own renewable energy sources, including geothermal, will avoid some of these accelerating costs. Those who have already invested will likely experience returns higher than expected.

The roots of this problem germinated decades ago. That is its own story for another time.

Kim Zussman wonders:

XLU?

Big Al observes:

XLU up 25% from Feb low.

Jeffrey Hirsch was there before us:

Our recommendation at the outset of XLU/Utes seasonal bullish March-Oct period.

Humbert H. writes:

Nuclear is clearly the real solution as the current generation of nuclear reactors are pretty much (we hope) not vulnerable to meltdowns. But as the situation stands, battery technology is likely to receive an ever-increasing amount of investment, and also reused old EV batteries will be more and more prevalent as storage banks for solar and wind. Intermittent sources = more and more need for battery capacity.

William Huggins offers:

one possible solution to transmission problems is to use rail-bound batteries.

Jul

9

Floored, from Jeff Watson

July 9, 2024 | 1 Comment

I’ve posted a link to this documentary before but feel compelled to post it again for all of the newcomers to the list. It’s a great weekend flick, and covers a period when we used to do our business in the pits. There was nothing like it.

Floored - The Complete Documentary Film

Floored is a 2009 documentary film about the people and business of the Chicago trading floors. The film focuses specifically on several Chicago floor traders who have been impacted by the electronic trading revolution and whose jobs have been threatened by the use of computers in the trading world. Directed by James Allen Smith, the film runs for 77 minutes.

Jeffrey Hirsch writes:

Thanks Jeff. Just sent it to my 18yo son who has been getting into the markets and trading.

Nils Poertner asks:

Were you a floor trader, Jeff, and if so, what lessons did you learn that helped you in trading electronically?

Jeff Watson replies:

Yes I was. The most important lesson I learned was to not overtrade.

Humbert H. comments:

Asking Jeff is he was a floor trader is like asking Paganini if he ever played the violin, asking Taylor Swift if she ever thought of making a living as a pop singer, or LeBron James if he ever heard of a game named "basketball". But what I really want to know Jeff is if you like to surf?

Jeff Watson answers:

I would love to surf, but my health won't allow it. We’re still a surfing family, but I just don’t surf anymore and am relegated to taking pictures from the beach.

Jun

11

Recession of recession indicator, from Kim Zussman

June 11, 2024 | Leave a Comment

Wall Street’s Favorite Recession Indicator Is in a Slump of Its Own

Treasury yields have been inverted for the longest stretch on record

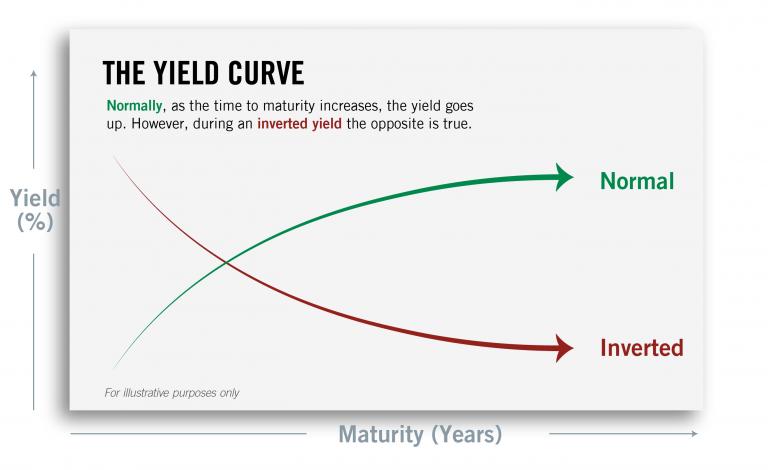

One of Wall Street’s favorite recession indicators looks broken. An anomaly known as an inverted yield curve, in which yields on short-term Treasurys exceed those of longer-term government debt, has long been taken as a nearly surefire signal that an economic pullback looms. In each of the previous eight U.S. downturns, that has happened before the economy sputtered. There haven’t been any glaring false alarms.

Now, though, that streak is threatened. The yield curve has been inverted for a record stretch—around 400 trading sessions or more by some measures—with no signs of a major slowdown. U.S. employers added a solid 175,000 jobs last month, and economic growth this quarter is expected to pick up from earlier in the year.

Big Al snarks:

If a recession doesn’t materialize soon, it could do lasting damage to the yield curve’s status as a warning system.

I'd hate to have to spend my day thinking up stuff like that.

Larry Williams writes:

A close up study of it shows it has often been way wrong—this is just one more time.

Nils Poertner comments:

As those "indicators" lose their importance, the more ppl (and WSJ and FT in particular!!) talk about it. "get the joke" Lack would have said.

Jeffrey Hirsch responds:

NBER that said 2020 was a recession. Fed started cutting rates in 2019 and the curve inverted then.

The recession lasted two months, which makes it the shortest US recession on record.

It is just a shame bond market traders didn’t tell the rest of us that covid was coming. And what about the 2 back-to-back negative quarters of GDP in Q1&2 of 2022? That looked like a recession as well IMHO.

Big Al adds:

The Fed (from before the GFC) says levels matter, too:

The Yield Curve and Predicting Recessions

Jonathan H. Wright, Federal Reserve Board, Washington DC

February 2006

Abstract:

The slope of the Treasury yield curve has often been cited as a leading economic indicator, with inversion of the curve being thought of as a harbinger of a recession. In this paper, I consider a number of probit models using the yield curve to forecast recessions. Models that use both the level of the federal funds rate and the term spread give better in-sample fit, and better out-of-sample predictive performance, than models with the term spread alone. There is some evidence that controlling for a term premium proxy as well may also help. I discuss the implications of the current shape of the yield curve in the light of these results, and report results of some tests for structural stability and an evaluation of out-of-sample predictive performance.

May

4

The Doctor Is In. And He’s an Orangutan.

For the first time, researchers have seen a wild animal treat an open wound with a medicinal plant. After getting injured—probably in a brawl with another male—a wild Sumatran orangutan chewed the stems and leaves of a vine humans use to treat wounds and ailments such as dysentery, diabetes and malaria. The orangutan then repeatedly smeared the makeshift salve on an open gash on its cheek until it was fully covered. After the treatment, scientists saw no signs of infection. The wound closed within five days. And it healed within a month.

Jeffrey Hirsch is enthusiastic:

This is awesome! An good friend of mine spent several years in Borneo working with Orangutans under Birute Galdikas’ program. They are super crafty and smart. Don’t doubt this.

Humbert H. writes:

And nobody can explain how they know to do this in these situations. There is obviously a lot of learning apes can acquire from others, but this? There is also no way the current understanding of how genetic information is passed on that can explain this. There is something very mysterious about the mind and animals doing non-obvious things is the best example, this is not a simple biological phenomenon.

Asindu Drileba comments:

One of the things I hear in the AI research community in the pursuit of of AGI (Artificial General Intelligence) is people thinking of intelligence as something hierarchical like height.

In The Singularity is Near Raymond Kurzweil makes a plot of Computers approaching AGI. He puts insects at the bottom and manuals later then humans at the top. You often hear some people say that "We haven't yet reached dog level AI, so we can't say we can reach human level AI soon." That statement makes the assumption that A humans intelligence is more than that of a dog. But it has been reported in some cases a dog's sense of smell can be 100,000 more acute than that of a human being! And not just that it can tell time just by smelling what's around. Another example is also how birds can sense magnetic fields and use them like a compass.

Anyway my point is that just by the (limited) way humans perceive reality we have access to some secrets we can't pass to animals. My suspicion is that animals also have their own secrets that they cannot pass to us.

Humbert H. adds:

They have recently discovered that some insects are self-aware. The test that's used for animals is that they recognize their reflection in the mirror as themselves judging by their reaction. Usually only dolphins, apes, and some corvids (crows) pass the test.

But more importantly, what I meant was that animals seem to "know" how to do things that no current scientific understanding can explain. This means we don't understand basic things about animal (and human) mind. AI is a machine function: an algorithm using some data provides some outputs in response to inputs. A mind is like that too, except we really don't understand the nature of self-awareness, nor do we understand how animals just "know" things. Sometimes they call it "instinct" but there is no real science behind that word. And in this case it's not even that, apes have no "instinct" to cure wounds with specific processed plant material.

Jeff Watson writes:

Here is an interview with cognitive psychologist, Donald Hoffman. Some find him brilliant, some a flake. His ideas are unconventional to say the least, but the questions that come to mind out of his interview will break one’s brain. Many moments in the video, I pause and ask myself how this applies to markets.

Stefan Jovanovich gets philosophical:

The wheel of time turns on the axle of our self-awareness: Transcendentalism.

Mar

2

ATH, from Zubin Al Genubi

March 2, 2024 | Leave a Comment

While S&P 500’s Friday [23 Feb] gain was only 0.03%, it was enough to propel it to another all-time high (13th record close this year); in years when S&P 500 did hit an all-time high, it did so 29 times on average since inception of modern version of index in 1957.

-Liz Ann Sonders

Here's #14 this year as we close up [1 Mar].

Peter Ringel asks:

How & why should one exit any equity longs [given the market advance of the last 10 years]? Not a trivial question to me.

Zubin Al Genubi responds:

Trade your system expectation time. Develop systems that can capture a trend. (Good luck with that.) (Or at least allow re entries, break outs.) Use appropriate money management and the geometric returns over time and increase net wealth. Trading in a nutshell.

Peter Ringel continues:

what if buy & hold is the best system in your arsenal - not annualized systems, but realized systems and normalized for risk? (though normalized for risk & leverage might be a debate.)

Let's say I have an uber-bullish setup: enter on 5th trading day of year and hold 5 days (not a real one). I can annualize it to compare it to other systems, but really it is just one trade, just a little slice of the year. In this case and current drift - an exit on day 5 is not justified, holding forever is.

Zubin Al Genubi sums it up:

Hard to beat buy and hold, but the drawdowns are hard to handle. Define your risk tolerance and design system around money management. As long as the system is positive it doesn't really matter how good because all returns were in the past. If you mean by "annualize" compounded annual geometric returns, that is the right way to compare systems, but also include the money management in the comparison. That is critical part many leave out.

Jeffrey Hirsch writes:

Today’s post RE ATH:

Ex-2020 S&P 500 Flatter Election Year March

But after 4 months of solid gains the market is poised for a modest pullback of maybe 3-6%.

S&P 500 Support: 4800 old ATH.

Steve Ellison comments:

A decade or so ago, I studied the 4-year presidential cycle and concluded that the pattern in annual returns had been very pronounced from 1948 to 1980. After 1980, maybe as a result of the pattern becoming widely known, later results were much more mixed and fell below statistical significance.

That said, for the past two years beginning with bearish midterm election year 2022, the major market averages have closely followed the classic presidential cycle playbook. I assume that, like the uptrend in NVDA, it will continue to work until it doesn't.

Dec

31

A diet shock Bill Gates does not mention, from Larry Williams

December 31, 2023 | Leave a Comment

Mr Fake Meats does not support is own research:

Findings: In 2017, 11 million (95% uncertainty interval [UI] 10-12) deaths and 255 million (234-274) DALYs were attributable to dietary risk factors. High intake of sodium (3 million [1-5] deaths and 70 million [34-118] DALYs), low intake of whole grains (3 million [2-4] deaths and 82 million [59-109] DALYs), and low intake of fruits (2 million [1-4] deaths and 65 million [41-92] DALYs) were the leading dietary risk factors for deaths and DALYs globally and in many countries. Dietary data were from mixed sources and were not available for all countries, increasing the statistical uncertainty of our estimates. [Funding: Bill & Melinda Gates Foundation.]

Note meat does not pop up in this data.

Jeffrey Hirsch writes:

Lot’s of meat works for me. Keto, exercise and sleep. I’m down 50lbs. Skipping the Booze was a big help.

Pamela Van Giessen comments:

Virtually all nutrition studies are pretty meaningless because it is almost impossible to confine study to one food to the exclusion of all else (do people who eat red meat also not drink and exercise regularly; do people who eat low grain diets also eat a lot of processed food and lack exercise, and so on).

Maybe you can hack your health and longevity with diet. Maybe not. I’d err on the maybe not side and get a lot of good exercise (mix of cardio and strength training), dial back the alcohol and soft drinks, drink a goodly amount of water, eat everything in moderation but be sure to get good protein, green veggies, and fruit, especially as you age. But know that your diet is meaningless without the exercise, good mental health, and purpose in life — whatever it may be for you.

Pretty much what my grandmother, born in 1901, used to say. Except I also drink a glass of athletic greens every morning. Can’t hurt. And stretch and do planks/core work. Both are super important to maintaining balance and agility. More ill health and deaths start with falls than anything else.

K. K. Law wonders:

No argument about the benefit of exercising. But a simple and cursory inspection of the regional maps of (a) and (b) show the people in the regions highlighted by red ellipses appear to have lowest death rates. Do they have something in common in their diets that lead to longer lives?

Pamela Van Giessen responds:

Shouldn’t the question be to first isolate commonalities in everything among the people in those regions as opposed to assuming it is solely a food such as fatty fish? Is it just omega 3 or do peoples in those areas also have lower obesity rates, for instance? If they have lower obesity rates (and where there are lower obesity rates, there are routinely lower premature death rates), how come? What are they doing? Is it all diet or are there other variables?

That said, I try to eat fish at least twice a week. Fortunately I have a neighbor who likes to fish but he doesn’t like to eat fish. So we have a steady stream of fresh Montana trout. And elk. Elk meat is fantastic.

Kim Zussman adds:

Genes are a big factor in longevity, likely the biggest factor (besides distance from windows in Moscow). Could explain regional performance since primates primarily mate locally. The best tactic is to choose your parents carefully.

H. Humbert writes:

The media story on how the 100 yr old lived that long because he had one shot of whiskey per day or ate French fries three times a week always crack me up. I’m not saying nutrition (and exercise) do not matter, but of course their longevity is most likely because they won the gene pool lotto and not because of whatever quirky dietary habit they had.

“Virtually all nutrition studies are pretty meaningless”. This comment always cracks me up. It is untrue. Of course epidemiological and observational studies (observation) have value, even if they are not double blind placebo. For example, if you observe four people eat strychnine and die, would you not conclude that it might be dangerous? Would you stay in line to be the fifth person, even though you have merely done an observational study, and strictly speaking causation is unproven by a scientific study? If your answer is “no” then you must believe that epidemiological and observational studies have some value. Otherwise, you would be “blinded by science” (and dead).

Humbert H. responds:

Of course simple studies, like is strychnine dangerous, are useful. However, studies of subtle effects are generally useless, because of the various biases involved. It is to this day not possible to know if Ivermectin helps fight Covid, or if so, to what degree. Partly is because people are invested in the outcome and the set up of the studies appears suspect, and partly is because the effect is seemingly not overwhelming. Hearing about various "Coffee is good/bad for your health" through the years is a more common example.

Big Al adds:

Another issue with broader studies is that we are learning more about how different individuals with different genetics respond differently to coffee or salt or red wine or a high-fat diet. It becomes more difficult to make conclusions like "coffee is good/bad for you".

Humbert H. replies:

I agree completely. Coffee, if I drink it for a week and than stop, gives me terrible, incapacitating headaches, and if I keep drinking it, eventually I will get the same headaches. I don't know anyone else who has the same side effects, but I can only drink it once in a while. So all the recent studies I've read about the positive effects of its consistent use are of no use to me.

H. Humbert agrees:

Yes, this is absolutely true. And the genes may respond differently to foods over time, as other lifestyle factors change. Epigenetics.

Big Al offers:

An interesting show to watch:

Live to 100: Secrets of the Blue Zones

Though thinking about the stats, you would assume there would be pockets of longevity around the world just by chance. Also stat-wise, he claims there is a correlation in Corsica between the longevity of people in towns with the steepness of the streets in the town (steeper = longer lived). Haven't seen the data, but that's an interesting one on an intuitive basis. Maybe you could compare NYC residents on the first floor vs those on the fourth floor of a walkup building. ![]()

Peter Saint-Andre is skeptical:

That Blue Zone hypothesis is somewhat questionable. Here's one critique.

My impression from previous reading is that in some of these remote and frankly somewhat backward areas (e.g., Sardinia, Ikaria), the original cohort of centenarians contained a large number of people who faked their ages (e.g., to obtain government benefits), which they could do because they were born before birth certificates were common. The centenarian numbers didn't hold up in cohorts born after documentation of birth dates kicked in.

Pamela Van Giessen maintains:

The comment is true. Nutrition studies are meaningless. It’s a backward science in crisis with a host of issues starting with what gets published (and then reported) to garbage analytical studies on the same data sets, most of which have null results (but don’t get published) done from a laptop in about an hour.

Until people spend some time learning how “science” gets funded and what gets published, and demanding change, our knowledge will remain more antiquated than my grandmother’s guidance which was at least practical and based on real world experience.

John McPhee wrote about the funding problem in geology in Annals of the Former World. His observations apply to most fields. In short, what gets funded is what is trendy until it is not and then the new trend gets funded. This process takes about 100 yrs. In nutrition it may be worse. Vinay Prasad does a nice recap of the problems.

Sep

6

Markets and recessions, from Yelena Sennett

September 6, 2023 | 1 Comment

Do markets lead recessions or do recessions cause markets to drop? I think Larry had a chart on this. Consumer is going to be spending less on discretionary spending. Retailers have already warned us of this.

- Student loan payments are due starting September

- Savings rates are down

- Employment situation is weakening a bit

- Consumer credit is slowing

- Interest payments rates are up on credit cards, cars, homes, etc.

Jeffrey Hirsch responds:

We had our U.S. recession on 2022 with back to back negative quarters of GDP Q1-Q2 2022. "They" changes the rules during Covid. Generally, markets lead recessions. This last time they ran concurrently.

Larry Williams comments:

No recession in sight with the indicators I keep…

Yelena Sennett asks:

thank you Larry, in sight means a few months or so? or a few quarters?

Larry Williams answers:

A year or so I would say.

Hernan Avella writes:

When was the last time the yield curve inversion (with the specific configuration by Campbell Harvey at Duke) didn't precede a recession in the out of sample period? It's a 8 out of 8 record I believe. While one would be foolish to act solely on this, this might be the best of all the bad recession indicators we have. Especially because it was conceived in 1986, has some rationale and we are experiencing the out of sample, Unlike Larry's drawings that are constantly overfitted to the data.

Larry Williams responds:

Me overfit data? Try my best not to but you Y-curvers refuse to acknowledge times of negative curve and massive stock rallies. Here is just one DJIA in red:

Hernan Avella replies:

But Larry, kindly stop straw-manning. The gist of the yc indicator, is the out of sample track record of preceding 8 out of the last 8 recessions. There's no controversy about this. Nobody serious has related this to stock returns. So you are trying to disprove a point that nobody is making.

Larry Williams writes:

Two points: (1) To say the curve has accurately predicted recessions you have to acknowledge it as often lead by 2 years. Wowsa!! Now there’s a real helpful tool. Gee those negative readings are not so precise. but maybe you are happy with that I am not. especially when there are so many better tools. (2) And if the YC and recessions don’t mean much to stocks, why would I care?

Hernan Avella responds:

Who said “predicted”. You keep making stuff up!. I can’t find the source, but the lag for the indicator is 12 or 18 months after 2 consecutive quarters of inversion of 3m-10y. Ignore it if you want. Just don’t straw-man the thing.

Larry Williams responds:

No straw man here—just look a the data its very poor indication recession is coming. now what did I make up???????

Hernan Avella states:

I don’t get it. 8 out of 8 within 18 months after 2 consecutive quarters of inversion….it could be luck, but let it at least fail once. Go to the source: Harvey’s 86’ dissertation.

Larry Williams says:

Curve went negative last April. you are the end of the time zone…better get ready for the sky to fall!

Michael Brush writes:

Yardeni charts yield curve inversion against stock returns. It has a good record but not quite as good as forecasting recessions. Agree no recession in sight.

Gary Phillips writes:

Not every yield curve inversion has been followed by a recession; however, every recession has been preceded by a yield curve inversion.

Larry Williams replies:

Agree but with a massive lead time. I want/need more precise timing and then—its not always market relevant.

Gary Phillips responds:

The clock doesn’t start ticking from the inception of the inversion, rather than when the curve begins to re-steepen.

Larry Williams offers:

Sure just like this:

Yelena Sennett writes:

Thank you for sharing your graphs and your concise points. “And if the YC and recessions don’t mean much to stocks why would I care?” Indeed, YC and recessions don’t seem to be very helpful or timely tools.

Peter Ringel comments:

highly subjective: the last break since July did not felt overly bearish. Low volume , a little deeper than I would like yes, but no gusto. Maybe a big range is developing, but more likely the drift kicks in and carries us higher. The AI - story is alive.

H. Humbert adds:

I agree with Larry that this time the YC inversion will not have forecasted a recession. It usually sparks a credit crisis which then causes recession, the normal procession of events. This time it seems to have only sparked the mini bank crisis which seems to have wound down. Of course we do not know if there will be another crisis that gets sparked. But so far, no, and to Larry’s point it has been quite some time now.

May

10

Sell in May and go away, from Big Al

May 10, 2023 | Leave a Comment

Lately I have seen a lot of "sell in May" analysis with this being a good example:

Chart of the Day: Sell in May S&P 500

So I looked at all SPY years and calculated the returns for two periods: (1) "summer", end of May to end of October, and (2) "winter", end of October to end of May:

For owning "summer", $100 became $186.

For owning "winter", $100 became $790.

Seems like a clear victory for "sell in May", except for what they always leave out: buy and hold over the whole period turns $100 into $1474.

H. Humbert adds:

It's obviously a much more ridiculous idea if you consider capital gains taxes, which would be short-term if you truly buy and sell for the winter.

Jeffrey Hirsch replies:

Issued my Best Six Months MACD Sell Signal on April 25 for Dow and S&P. Everyone gets so hyper focused on "sell in May", they forget to "buy in October and get themselves sober," as I like to say.

Larry Williams provides perspective:

Never forget: Prior to 1950's best was to buy in may to make some hay….Long gone but once in the data.

Jeffrey Hirsch responds:

Thanks for the Reminder Larry! So true. Here's the chart I use to make that point:

Steve Ellison writes:

For any seasonal pattern, I ask, "Who is the sucker at the table who will buy too high at one time and sell too low at a different time?" And do said suckers have a reason to continue their behavior into the future? The late Mr. E said that a lot of money flows into the stock market at the beginning of a new calendar year as, for example, high-income people who maxed out their 401(k) contributions the previous year can resume.

There was an annual cycle of profitability at the multinational technology company where I worked for 20 years; conveniently, their fiscal year end of October 31 aligned exactly with the Best/Worst 6 months thesis. First quarter, ending in January, was usually strong as it included both the Christmas season and the end-of-year "budget flush" in which corporate managers had to spend any surplus lest their budgets be cut the next year. Second quarter, ending in April, was also usually strong.

Third quarter, ending in July, tended to be a bit weaker as summer started. Fourth quarter, ending in October, was a mixed bag as back-to-school selling season was offset by European businesses mostly shutting down in August. But with commissions and bonuses on the line, the sales force would work 24/7 in the second half of October to close deals and bring in a strong quarter.

Additionally, with third quarter results being reported in mid-August while Wall Street was in the summer doldrums, the company was disproportionately likely to report any major writeoffs or other bad news in the third quarter.

Mar

24

Book recommendation, from Zubin Al Genubi

March 24, 2023 | Leave a Comment

Pirate Latitudes, by Michael Crichton. Aubriesque tale of privateers and Spanish Galleons.

As the SPEC list is about books, as well as markets, counting, and barbeque.

William Huggins adds:

single best book on the history of finance that i've come across is William Goetzmann's Money Changes Everything. He's a Yale finance prof with a background in art history and archeology and its shows throughout the book as he looks at the roots of our toolkit (sumerian word for "baby cow" is the same word they used for "interest", etc). a very good description of the 1720 bubble with the hypothesis that the bubble was a reasonable reaction to the shifting expectations around insurance companies and the lines of risk they could cover. he also suggests that Venetian gov debt (1172) snowballed into the creation of western capital markets, which in turn propelled the west ahead of "the rest" (to steal a ferguson quote). three solid chapters on the tools imperial China used to increase its "span of control" over its rugged territory. 10/10.

(I used to use it as the required reading in my history course until I realized too many were balking at its size)

Jeffrey Hirsch responds:

Appreciate the reco Mr. Sogi. Almost done with Pam V’s reco on Keith Richard’s autobiography, Life, which is far out. Here’s one from me, The Immortal Irishman, by Timothy Egan. Irish revolutionary becomes a Civil War general. Adventurous tale across many continents.

Laurel Kenner writes:

I offer Harpo Speaks, the autobiography of Harpo Marx, the silent brother. Plenty of poker, speculation, and spectacular success, including an account of his Soviet tour, to entertain this List well.

Pamela Van Giessen responds:

Harpo Speaks is fantastic. For a meditative introspective read on things out of our control and how the body copes A Match to the Heart, by Gretel Ehrlich.

Big Al suggests:

I will recommend The Biggest Bluff: How I Learned to Pay Attention, Master Myself, and Win, by Maria Konnikova.

First of all, it's just an entertaining, well-written story. But in her study of poker and portrait of one of the best professional players, Eric Seidel, there are many lessons for traders.

Penny Brown writes:

I recently re-read the cult classic, The Moviegoer, by Walker Percy. It has nothing to do with trading but the main character is a stockbroker. Read it for the wonderful prose and the delineation of Southern characters with great dialogue.

Also, re-read A Fan's Notes, Fredrick Exley's memoir of growing up under shadow of his father's football fame in Watertown. It's amazing that this book even got written since Exley makes three trips to mental institutions where he undergoes electro-shock and insulin therapy and was an inveterate alcoholic for his entire life. You can see the influence of Nabokov and Edmund Wilson (among his favorite writers) in his prose style.

And then I read Embrace the Suck - a book I literally found at my feet on the sidewalk - hey, the price was right - and I assumed it had a special message for me. It certainly did. It describes the training undergone to become a Navy SEAL including the infamously horrid "Hell Week" that resulted in the death of one participant. It has lots of lessons for traders as it extols the virtues of discipline, focus, planning and most of all, a willingness to embrace suffering, as a means of moving beyond mediocrity.

One guy's way of shaping up for the ordeal of SEAL training was to run the Badlands Ultramarathon - a little 100 mile race through the desert at temperatures over 110.

Okay, I'm not going to try that - never could have even in my prime. But it got me out of my chair committed to doing a full set of Bikram's yoga postures including the ones I hate because I can't do it - Salabhsana - or hate because it hurts - Supta-Vajrasana. As the author says, "you've got to embrace the suck everyday."

Gary Boddicker adds:

I recently read Mule Trader: Ray Lum’s Tales of Horses, Mules, and Men. I originally picked it up for the regional interest. Ray was based about 60 miles down Hwy 61 from me in Vicksburg, and traded mules and livestock throughout the Mississippi Delta…but, it turns out a few of the Chair’s favorite writers, Dr.Ben Green and Elmer Kelton, were running buddies of Ray and are mentioned and vouch for his character in the book. Many tales of trades, moving the herds as the tractors slowly replaced them from California to the Delta. In one case, he bought 80,000 horses in South Dakota, and arb’d them to where they could be used. The book rambles a bit, as it is essentially an oral history, but many lessons within.

It brought to mind a discussion I had years ago over dinner with an buddy of mine who farms about 20,000 acres in NE Louisiana. “Gary, there is isn’t a real farmer in Louisiana who picks up that government agricultural census and doesn’t mark down that he owns at least one mule. We are damn slow to admit we gave ‘em up.” I haven’t fact checked him, but a betting man says the mule census is Louisiana is overstated.

Gyve Bones responds:

I have two copies of that book… one autographed by the re-publishing editor. It’s a great book.

Oct

25

The Trader and the Professor

October 25, 2022 | Leave a Comment

professor and I meet as S&P crosses 3800 amid Bloomberg warning on Friday oct 21 that an armageddon in the market seems likely.

at the turn of the century, it was common practice of Gould and Drew to spread rumors of a catastrophe on the market before buying with abandon to cover their shorts. thus the advice when the papers and brokers were most negative to buy . As I was out visiting children on Oct 21 and Oct 24 and the only contact I had with market was the bearish news and data source, i thought back to the days of the manipulators memorialized so well by Lefevre.

Bejan's latest book will be on evolutionary design (e.d.). we discussed the e.d. in the market over the last hundred years. commissions have gone from 10% a trade to zero, but the rake and vig and the chances of making a profit with short term trading has remained near zero.

it is instructive to realize that Livermore went bankrupt 5 times by not realizing the inevitability of the rake and the vig (bid-asked and commissions) to lead to bankruptcy and in his case suicide. The thing I loathe the most is when some well meaning personage says that two favorite books are Reminiscences and Education of a Spec.

guaranteed to happen: the powers that be make sure that, before an election, good news is rampant and reduction of service revenues is off the table forever.

Steve Ellison adds:

Remembering that the upside down man and his successor are often quoted as being bearish about the stock market, and remembering that they were bond salesmen whose best interest might not be served by clients buying stocks, I recall the fear, uncertainty, and doubt (FUD) technique that the 1980s IBM sales force was known for.

My first job out of college was assembly language programming on IBM mainframe computers that were the standard for large corporations. IBM essentially had a monopoly in this market from the 1960s on, but by the time I started in the 1980s, competitors such as Amdahl were nibbling around the edges of the market by offering "clones" of IBM systems for lower prices.

The IBM sales force's primary technique if they were worried a customer might buy from a different vendor was FUD. The IBM sales guys would come in and cast as much fear, uncertainty, and doubt on competitor products as possible. Other technology sales forces adopted the technique, too. In one example I was involved with while working at a technology company, a competitor's sales person told a customer that our product could not be programmed in Kanji. Kanji is not a programming language at all; it's a writing system for Japanese.

One ought to keep this history in mind when evaluating bearish statements about the stock market by bond fund managers.

Jeffrey Hirsch replies:

Appreciate the reminder, Steve and Vic. Been observing Goldman and other firms doing this in recent years.

Jun

14

If Thursday, Friday, and Monday are all down, what is Tuesday? from Big Al

June 14, 2022 | Leave a Comment

For SPY since inception (1993):

observations: 127

positive: 79

% positive: 62.2%

mean move: 0.37%

sd: 1.61%

z vs all SPY days: 3.19

Jeffrey Hirsch comments:

Filtering for magnitude might be instructive.

Michael Brush suggests:

Would it need to be Thurs Fri Mon down ahead of a Wed Fed meeting? That seems to be the salient factor. For months markets have been weak in the days leading up to a Fed meeting, and then…

Kim Zussman adds:

There may also be a size effect, i.e., not just down, but down small vs big %.

May

4

This is the most positive and heart warming thing I’ve seen in months. This guy’s spirit is noteworthy.

100-year-old NJ native and WWII veteran runs in Penn Relays

Jeffrey Hirsch responds:

Amazing!

Paul O'Leary concurs:

Indeed. Looking forward to Larry’s victory in the early 2040’s!

Apr

13

Tax day effect, from Zubin Al Genubi

April 13, 2022 | Leave a Comment

I recall a study we did years ago on April 15 effect of everyone cashing in to pay the tax bill.

Jeffrey Hirsch responds:

No effect anymore from our studies.

"The first half of April used to outperform the second half, but since 1994 that has no longer been the case. The effect of April 15 Tax Deadline (April 18 for 2022) appears to be diminished with numerous bullish days present on either side of the day. Traders and investors are clearly focused on first quarter earnings and guidance during April. With conflict in eastern Europe and the Fed raising rates, companies may lean conservative with guidance during this upcoming earnings season."

From my blog and newsletter.

Jan

30

Loving and Loathing Kenny G

January 30, 2022 | Leave a Comment

Penny Lane on Loving and Loathing Kenny G

Love it or hate it, but you've definitely heard it: the so-called "smooth jazz" of saxophonist Kenny G. Filmmaker Penny Lane talks about her documentary, Listening to Kenny G, with EconTalk host Russ Roberts. They discuss the pursuit of perfection, the power of vulnerability in art, and why Kenny G is loved by the people and reviled by the critics.

Here is the trailer for the documentary.

Jeff Watson comments:

If I was forced to listen to Kenny G, I would welcome an increase in the rate of my deafness, in fact deafness would be my safe space.

Zubin Al Genubi writes:

In contrast to Kenny G I've really been into John Coltrane. Took a number of years to truly appreciate his music.

Adam Grimes adds:

I absolutely loathe smooth jazz and New Age music (Einaudi, et. al.). I'm not completely sure why, but I've always had a very strong visceral reaction to music like this. And I DO embrace a lot of simplicity and minimalism… so it's not that… Perhaps it's music that is obviously intended to be trivial.

James Lackey writes:

Well joy! Who loves listening to the same key trillion not low tech music? Kenny G blah blah blah. Charlie Parker on a 50s Miles album. If the ever frustrates me is because I can’t play it. Branford Marcellus probably the best ripper sax ever but whatever. Some may think taking pop tunes re sketch them into EDM is silly or lazy. It’s not hard but it’s hard to do and who wants women to dance anyways.

The point was Kenny G hit a note and held it then. Did not hit a note a rest then hit a note on same scale coming from and angle and your eyebrows raised. Damn!

And guys the emotional response to music rests rhythmic beats to each his own. Like the markets please remember the scientific evidence. Down 20% is always going to be emotional. The first 10, I’m not sure if any of us should lift a brow.

Jeffrey Hirsch writes:

I get into some of that old jazz from time to time. But I am a rocker at heart. Recent highlights:

Grateful Dead in Honolulu Jan 23, 1970, with Pig Pen and an extended Turn On Your Lovelight. It's on Dicks Picks.

Little Feat - Electric Lycanthrope – recent release of a live studio performance in 1974

Laurel Kenner responds:

I'm with Adam — I hate the phony sentimentalism/exhibitionism.

Antonio Porres Miranda suggests:

I end up always defaulting to what ever has to do with Antonio Carlos Jobim.

Laurel Kenner approves:

Jobim is impeccable — good choice!

Vic offers:

i always and continuously listen to Verdi. every aria is a perfect blend of instrumental music and singing. each aria is designed to please. and he's very innovative in his orchestration, sometimes 7 basses, other times 4 clarinets. beautiful augmentation of life for me, heartily recommend it.

Maria Callas - Early Verdi arias

Jan

24

Jeremy Grantham says the end of ‘bubble extravaganza’ is coming, from Kora Reddy

January 24, 2022 | Leave a Comment

1) Search results for "Grantham" on CNBC

2) of the 118 results , the below 7 more caught my attention

3) assuming a hypothetical 1k USD investment on those 7 occasions

Jeffrey Hirsch comments:

Nicely done Kora. Perhaps it’s just a marketing campaign. Fear sells you know.

Duncan Coker responds:

Consider the source. Grantham's contrarian flagship fund GBMFX total return since 2003 when it launched is 30.5% ( that's total not annual compounded) and that included 2 bear markets. SPY over the same period 488%.

Andy Aiken writes:

Back in the late 90s, I had a few $ in David Tice's Prudent Bear Fund, which was, essentially, short stocks and long PMs. Entered in 1999, got out in 2002 at a very small gain. Gold & silver dropped along with other risk assets during that time, killing returns. If I'm going to short, I'll do it myself now…

Jan

19

Rate hikes and stock market returns, from Zubin Al Genubi

January 19, 2022 | Leave a Comment

From Marketwatch.

As it turns out, during so-called rate-hike cycles, which we seem set to enter into as early as March, the market tends to perform strongly, not poorly.

In fact, during a Fed rate-hike cycle the average return for the Dow Jones Industrial Average DJIA is nearly 55%, that of the S&P 500 SPX is a gain of 62.9% and the Nasdaq Composite COMP has averaged a positive return of 102.7%, according to Dow Jones, using data going back to 1989 (see attached table). Fed interest rate cuts, perhaps unsurprisingly, also yield strong gains, with the Dow up 23%, the S&P 500 gaining 21% and the Nasdaq rising 32%, on average during a Fed rate hike cycle.

Penny Brown wonders:

Very surprising. I am wondering why there is a mantra: "don't fight the fed." And "three hikes and a stumble."

Vic adds:

not mentioned is that the average fed rate increase cycle lasts 5 years. there have only been 13 of them since the fed was founded in 1910. usually these is a run of 15 increases once they turn from red to black.

i believe that the fed will not raise until the S&P is much stronger. a very nice close today (18 Jan.)

Nils Poertner comments:

the more talk about rising rates (and neg impact on stocks) the better it is for stocks. to a point of course.

everything is taking to the extreme these days. said to my cousin "eating apples is good for health" - and he replied "eating 10 apples isn't." of course not, but for now it seems so wrt rates.

Paolo Pezzutti writes:

Over the next few days option expiration this month can be an issue for stocks in terms of volatility. Not rising rates in my humble view.

Jeffrey Hirsch agrees:

Performance during January’s option expiration week

Big Al writes:

The Fed has never been sitting on a balance sheet like this, along with the other major CB's. Plus, the aggregate amount of debt is quite high after all these years of ZIRP. This will not be a "normal" rate-hiking cycle.

Jun

8

Holiday

June 8, 2021 | Leave a Comment

https://jeffhirsch.tumblr.com/post/652443080575909888/days-after-memorial-day-improving

Sep

4

Go Make

September 4, 2020 | Leave a Comment

“The hubris of the defeated” “The game is flawed”

A Beautiful Mind - "The Challenge" - A Game of Go

https://www.youtube.com/watch?v=GmlSSSN7C78

Aug

14

Sanitizers and Masks

August 14, 2020 | Leave a Comment

Stefan Jovanovich writes:

Although mechanistic studies support the potential effect of hand hygiene or face masks, evidence from 14 randomized controlled trials of these measures did not support a substantial effect on transmission of laboratory-confirmed influenza. We similarly found limited evidence on the effectiveness of improved hygiene and environmental cleaning. We identified several major knowledge gaps requiring further research, most fundamentally an improved characterization of the modes of person-to-person transmission.

https://wwwnc.cdc.gov/eid/article/26/5/19-0994_article

Jeffrey Hirsch writes:

Wow! So then what was responsible for flattening the curves or slowing the spread? Nothing? Time?

Stefan Jovanovich writes:

JH: The answers that the mask and shield-wearing medico who earns here daily bread by examining and diagnosing people at non-social distances offers are these: (1) no one knows exactly how viral infections "spread", (2) no one knows how or why they grow and then decline among populations, (3) people with poor health suffer more than people with good health, but, as with lung cancer and heart disease (to take the 2 most common examples), some people escape the likely consequences of their bad profiles and others who should be fine sicken and die, (4) exchanging the air and scrubbing it with filters AND requiring both patients and medical personnel, including office workers, offers the best odds of reducing general risks of infection because it increases the oxygen levels and reduces the "carbon" levels and that, in almost all situations, helps us human air-handling machines. But the masks need to be changed almost as frequently as surgical gloves to be effective; wearing the same mask for hours at a stretch has zero likelihood of restricting any kind of airborne infection and is guaranteed to have the same kinds of adverse consequences that people get from not changing their water filters within the time limits of their functional capacities.

What she and her Dad think was and is monumentally stupid is to have shut down and continued to reduce access to doctors and medical treatment in the name of keeping emergency rooms free. That is what we have decided to call General Staff thinking of the first order - the same kind that discouraged the development of automatic weapons for soldiers on the grounds that they would "waste" the ammunition.

Henry Gifford writes:

Part 4, about “exchanging” the air and scrubbing it with filters and increasing Oxygen levels and decreasing “Carbon” levels sounds flawed to me.

Most modern commercial buildings in North America, including office buildings and hospitals, typically have systems that gather air from many rooms and put it into a common tube (“duct”) from where it goes through a filter and then a fan and then something to heat or cool the air, and maybe mix in a small % of outdoor air, then return it to all the rooms the air was removed from. Described another way, any airborne viruses in one room will be distributed to all the rooms served by that system, with a small % sent outdoors. Just how many people get sick this way is something that is politically incorrect to discuss or research in the buildings or building design industries, as these systems are the most expensive and profitable to design and install.

Even the fanciest filters have only a small chance of trapping something as small as a virus. People’s respiratory systems expel viruses coated with some water and other materials, in droplets of widely varying sizes, some of which fancier filters can catch, many of which even the best filters will unlikely catch. And retrofitting the fancy filters requires greatly increasing the size of the fan and the motor and the wires that supply electricity to the fan, which almost never happens. A normal air filter is there mainly to keep the equipment free from clogging by relatively large dust particles.

As for adding Oxygen and removing “Carbon,” (Carbon Dioxide exhaled by people), normal leaks in a building provide sufficient Oxygen replacement and Carbon Dioxide removal. Actual ventilation is beneficial for other reasons, but is not necessary for adding Oxygen or (generally) removing Carbon Dioxide. Submarines in WW2 had zero ventilation when submerged, yet running out of Oxygen was never a problem – poisoning with Carbon Dioxide was a problem long before Oxygen deprivation. Absorbent chemicals were used to absorb Carbon Dioxide. Some research in modern buildings has advocated higher ventilation rates as a result of supposedly finding correlation between higher Carbon Dioxide levels (>1,000 PPM) and lower worker performance, but I haven’t heard any talk about adverse health implications at Carbon Dioxide levels found in buildings.

Systems do exist that provide 100% outdoor air to buildings of any type and size, but these systems use very little energy and save space and are quieter, but are inexpensive and simple to design and install and maintain, thus they are not very popular. Even with all the talk about ventilation now, nobody seems to distinguish between “exchanging” used air or new outdoor air – not even a part of the conversation so far.

Mar

7

Power Law Function, from Zubin Al Genubi

March 7, 2020 | Leave a Comment

Victor Niederhoffer writes:

But this is a statistical thing and not predictive other than randomness at any time of day for subsequent movements. There are reasons to hold till end of day relating to vig and margin calls but nothing relates to arc sign law.

Larry Williams writes:

Large range days—up or down–are most apt top close at the extreme of the range. A good reason to hold to the close.

Jeffrey Hirsch writes:

Super helpful today in the fund, Larry.

Larry Williams writes:

Glad an old man can still be of assistance!

Jul

9

Big Moves, from Victor Niederhoffer

July 9, 2019 | Leave a Comment

In checking the old saw that a big rise through the first 6 or 9 months of the year is bull for the remainder of the year, I find an inverse relation i.e. the bigger the rise in the first 6 months the more bear it is. Conversely when big declines the first 6 or 9 months it's very bull for the remainder of the year. Of course there have been only 1 or 2 declines in the first 6 months during the last 20 years… would someone check the relation going back 75 or so years. Of course for once, you will probably see % changes rather than algebraic changes.

Jeffrey Hirsch writes:

I ran the numbers on this for the blog.

Here's the copy. Check the tables on the link.

The market just put on its best first half performance for the Dow since 1999, the S&P 500 since 1997 and NASDAQ since 2003 – and that's a pretty decent omen that market will tack on additional gains. Performance below following first-half Dow and S&P 500 gains greater than 7% and NASDAQ Composite gains greater than 10% shows a solid history of gains for the second half – after a tepid market action in Q3.

Modest gains of about 1% continue into July, but gains little ground during the rest of Q3, which should come as no surprise given the infamous negative history of August and September. On average the market was unable to match first half gains during the second, though the across-the-board 7+% gains over from July to December is still solid. The Dow's second half win ratio following jumbo gains like 2019 is a rather impressive 85.3% – S&P's win ration is 80.0%, NAS 73.9%. Full-year gains are virtual lock.

But The Chair has a point the biggest gains – the handful or so larger than this year had rough second halves.

Mar

9

Good Advice to Follow, from Victor Niederhoffer

March 9, 2019 | Leave a Comment

"In life the intelligent man looks beyond the immediate effect he desired to produce to the more and more results that are likely to follow and studies them calmly and dispassionately" -Ben Boland, Famous Positions in the Game of Checkers.

Very good advice for the market in establishing a position. What if things go wrong and you are cornered. The roach motel, etc.

Jeff Hirsch writes:

"Moses Shapiro (of General Instrument) told me: "Son, this is Talmudic wisdom. Always ask the question 'If not?' Few people have good strategies for when their assumptions are wrong." That's the best business advice I ever got."

- John C. Malone (Liberty Media, TCI, Fortune, 2/16/98)

Jun

15

DJIA Down 24 of Last 28 Weeks after June Option Expiration, from Jeff Hirsch

June 15, 2018 | Leave a Comment

From my blog today:

Historically, next week has been horrendous for DJIA, S&P 500 and to a slightly lesser degree NASDAQ. DJIA has dropped 24 times in 28 years during the week after June option expiration. DJIA's average loss is 1.06%. S&P 500 is somewhat better with 20 losses and an average loss of 0.73%. NASDAQ has the best record since 1990 and yet still has 15 loses since 1990 and its average performance is -0.21%.

Oct

3

African Proverbs with Market Import, from Victor Niederhoffer

October 3, 2017 | 1 Comment

1. The moon moves slowly but it crosses the town

1. The moon moves slowly but it crosses the town

2. By the time the fool has learned the game, the players have dispersed

3. It is the calm and silent waters that drown you

4. The fools sheep break loose twice

5. Don't test the depth of water with both feet

6. You cannot build a house with last year's summer

7. Around a flowering tree one finds many insects

8. A white dog does not bite another white dog

9. If a dead tree falls it carries with it a live one

10. There is no cure that does not cost

11. An eel that was not caught is as big as your thigh

12. Cross the river in a crowd and the crocodiles won't eat you

13. He who wishes to barter does not like his own property

14. A wealthy man will always have followers

15. If you run from the white ant you may stumble upon the stinging ant

16. When the mouse laughs at a cat, there is a hole near by

17. If you rise too early the dew will wet you

18. If you climb up a tree you must climb down the same tree

19. Events follow one another like the days of a week

20. Everything has an end

21. Darkness conceals the hippopotamus

All from African Proverbs compiled by Charlotte and Wolf Leslau

Jefferey Hirsch writes:

When an old man dies, a library burns down. — African proverb

This is one of my favs. Wish I knew if it was from Kenya or Congo or Sudan or Somalia, but I don't.

Jul

12

What is This Thing Called Vig? from Victor Niederhoffer

July 12, 2017 | 1 Comment

What is this thing called vig? See old man vig from Mr. Grain.

What is this thing called vig? See old man vig from Mr. Grain.

"Bored Traders on Tinder Are a Symptom of Wall Street Revenue"

By Laura J. Keller (Bloomberg)