Jul

31

Art Shay: Through the Lens and On the Page

July 31, 2025 | Leave a Comment

Art Shay: Through the Lens and On the Page: The Autobiography of an American Eye

by Art Shay with Bo ‘Grandpa AI’ and ChatGPT

Chapter 1: The Negative That Developed Me

I was born in the Bronx in 1922, the son of Jewish immigrants who wanted me to become a doctor, or a lawyer—anything but a guy with a camera in his hand and his head in the clouds. But it was the darkroom, not the courtroom, that called me. I can still smell the developer and fixer the first time I saw a photo appear like a ghost in the chemical tray. It felt like conjuring, like magic. Hell, maybe it was.

I didn’t start out with a Leica in my pocket. I started out with nothing. Nothing but a war, a nose for stories, and a restless need to see. After flying fifty-something bomber missions in WWII, you get used to looking down at the world. But it was only when I got back on foot, on the streets, that I really started seeing it.

Download the full bio (.docx file).

Jul

30

Keeping up with Dr. Brett

July 30, 2025 | Leave a Comment

The problem with tilt is not an excess of emotion. The problem is a lack of brain fitness: poor cognitive endurance and poor capacity for recovery. This is a game changer for trading psychology.

Jul

29

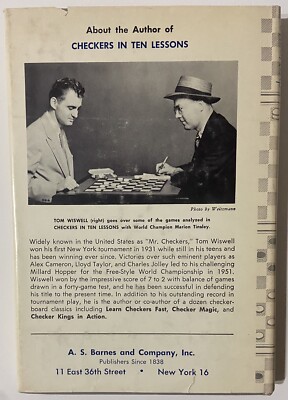

Wiswell’s Way: A Life on the Squares and Between the Lines

By Tom Wiswell (with a little help from Bo Keely and AI)

Chapter One: Brooklyn Beginnings

It all began at the corner of Atlantic and Nostrand, Brooklyn, 1917. A working-class neighborhood, a Jewish family, and a boy who would grow up to be, among other odd things, a world checker champion. Yes—checkers, the game you played at your grandfather’s kitchen table, which I turned into a lifelong study, an art form, and eventually, a philosophy.

I wasn’t born into greatness or madness. Just into a world that still had trolleys clanking down the street and fathers who worked with their hands. Mine owned a small shop and taught me the first lessons of trade, thrift, and tact. My mother taught me patience. The combination, it turned out, is what you need to master any board game—and life itself.

Download the full bio (.docx file)

Jul

28

Tufte fail, from Humbert X.

July 28, 2025 | Leave a Comment

Specs have been posting about copper, and I happened across this act of chartcrime.

Steve Ellison comments:

Wow, I don't think the software I used to generate Sankey charts in a previous career analyzing a petabyte-sized data lake to surface key insights for one of the big 3 personal computer companies would have allowed me to just start a new stream in the middle ("Imports of Refined Copper"). Anyway wouldn't it make more sense to join "Concentrate Net Exports" and "Scrap Net Exports" on the right side of the chart, and then put "Imports of Refined Copper" downstream of that junction?

I was using D3 in those days; now that I am much more experienced with Python, maybe I should search for a Sankey charting library in Python.

On the subject of copper, I perceive a macro trend that the US has geopolitical risk because too much domestic mining and basic material production was shut down, partly in order to export environmental impacts to less developed countries. Lithium and steel are in similar situations.

Peter Ringel writes:

"Sankey" that is a nice search term. I had it on my list to research. These guys use it a lot..

One finds several sankey libraries in Python on Github, such as this one.

Jul

27

The finest man of Westport

July 27, 2025 | Leave a Comment

Tommy had the best way of starting a meeting or conversation: "tell me a story - or teach me something." try it sometime on a first date or meeting.

Where Westport meets the world: Tommy Ghianuly

Friday Flashback #131

Posted on March 1, 2019

When Tommy Ghianuly died last month, Westport lost more than a great barber and good friend.We lost a man who loved local history — and made his Compo Shopping Center business a shrine to it.

The walls of Tommy’s barber shop are filled with vintage photos. Most customers see them in the mirror as they get their hair cut. Sometimes, someone glances a bit more closely at one or two.

Each of them has a story. Tommy knew them all.

Video: Compo Barber Shop and Thomas Ghianuly

In 2001, Dr. Phil Woodruff approached me to help work on video project for the Westport Historical Society. One of the project ideas he wanted to explore involved the Compo Barber shop and its owner Tom Ghianuly. Tom had over the years decorated the barber shop with historically significant photos of Westport. Dr. Woodruff wanted me to help him create a video about the barber shop, Tom Ghianuly, and all of the photos on his walls.

Jul

26

Dispersion, from Big Al

July 26, 2025 | Leave a Comment

There is a debate over the effects of passive investing, eg, whether it causes all stocks to be more correlated in their movements, makes markets less efficient, etc. Here's an interesting take:

Index Investing Makes Markets and Economies More Efficient.

I’m going to argue that the trend towards passive management is not only sustainable, but that it actually increases the accuracy of market prices. It does so by preferentially removing lower-skilled investors from the market fray, thus increasing the average skill level of those investors that remain. It also makes economies more efficient, because it reduces the labor and capital input used in the process of price discovery, without appreciably impairing the price signal.

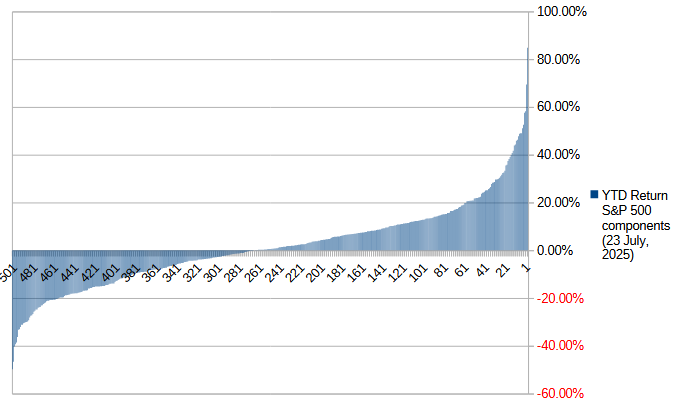

As for the correlation issue, one can still see dispersion. Here are the S&P components sorted by YTD % return as of 23 July (data source), with stocks such as PLTR, NRG and NEM on the right (+) end, and UNH, LULU, ENPH and DECK on the left (-) end:

Jul

24

The Penobscot Expedition, from Stefan Jovanovich

July 24, 2025 | Leave a Comment

Today is the 246th anniversary of the foreign war excursion that would result in 2nd worst naval disaster in American history.

On July 24, 1779, the naval expeditionary force commissioned by the Massachusetts General Assembly departed Boothbay, Maine for Castine on the Penobscot peninsula where the British had a 750-man garrison. The expedition had 19 warships, 24 transport ships and more than 1,000 militiamen under the command of Commodore Dudley Saltonstall, Adjutant General Peleg Wadsworth, Brigadier General Solomon Lovell and Lieutenant Colonel Paul Revere.

On August 13th 7 British ships arrived to reinforce the Castine garrison. The response of Commodore Saltonstall was to burn his ships and lose 470 men by death and capture to the British, who were led by Sir George Collier. Collier would lose 13 men.

Saltonstall and Paul Revere later faced court martial because of the fiasco. Saltonstall would lose his commission, but Revere won acquittal.

The Penobscot Expedition would rank #1 in American nautical fiascos until 1941 when the Japanese Navy would visit Pearl Harbor.

Jul

24

A nice example of economy

July 24, 2025 | Leave a Comment

a nice example of economy in the 1800's. a colleague tells him to get out of the rain but finds him a hour later drenched. what's the explanation? he was waiting the one penny bus not the two penny.

George Peabody never quite escaped the marks of his boyhood poverty. He routinely worked 10-hour days, every day of the week, and during one 12-year stretch he never took off three consecutive days. More visibly, he was frugal to the point of absurdity. His partner, Junius Morgan (father of J. Pierpont Morgan, who began his distinguished career in finance at the New York office of George Peabody), once found him standing in a drenching London rain. Morgan realized that Peabody had left the office 20 minutes earlier. Ron Chernow recounts their exchange: “’Mr. Peabody, I thought you were going home,’ the younger man said. ‘Well, I am, Morgan,’ Peabody replied, ‘but there’s only been a twopenny bus come along as yet and I am waiting for a penny one.’” At the time, Peabody had more than £1 million to his name.

Jul

23

Entry or exit opportunity, from Nils Poertner

July 23, 2025 | Leave a Comment

Donald Trump set to open US retirement market to crypto investments

President preparing executive order to allow 401k plans to tap broad pool of alternative assets

Hm. Entry for ordinary folks or a sneak way / exit for established players? Have a got a picture of the angel fish in my office, to remind me of the deceptive nature of markets. Angler fish are those ambush predator fish living in deep sea, that can illuminate poles in front of their jaws….to catch smaller fish.

William Huggins writes:

am reading Gustavus Myers' History of Great American Fortunes (1907) at the moment and just absorbed 300 pages of railroad fraud perpetrated by those who got their hands on the "mcguffin" asset and then sold it off only once they had successfully looted the value. the same sort of economic transfer happens for early crypto adopters - those trillions of market cap are "paper only" until some rubes can be fleeced of their efforts for the worthless securities foisted upon them.

Stefan Jovanovich comments:

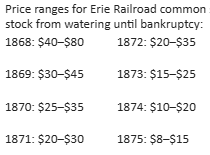

I hope this comment will not be read as argument or rebuttal but only as a factual footnote to Myers' work. The 50,000 shares issued by Fiske et. al. were "legal" in the same way that carried interest is "legal". They were allowed by New York State law in 1868.

The primary limitation on the issue of new shares of common stock for the Erie was its corporate charter. The board only had authority to issue $30 million in capital stock. Any issues above that amount required amendment of the corporate charter by the legislature and majority shareholder approval. The additional 50K of stock issued, at its par value, did not increase the total capitalization above the $30 million limit.

NY State law in 1868 allowed non-cash consideration. The contracts that the Erie board accepted as payment for the new shares were, in nominal dollars, fully equal to the par value of the shares issued. Shareholders had the right to challenge that claim; they were, as litigant frequently are, disappointed by the rejection of their challenge. The result was a situation that can be politely described as "judicial uncertainty" - i.e. a battle of conflicting injunctions.

Jul

22

Smörgåsbord

July 22, 2025 | Leave a Comment

Big Al offers:

Very nice Veritasium vid on randomness and information:

Asindu Drileba likes a new interview:

I learned about Gappy Paleologo from this list. He has a new interview on a Bloomberg podcast. In it, he talks about:

- Why he suspects Astrophysicists make good quants

- Why AI can't fully take over trader's jobs (in principle)

- What makes a "good quant"

Jeff Watson is following the floor traders last stand:

Old-School Floor Traders Finally Get Their Day in Court Against CME

Trial opens in the Chicago plaintiffs’ long-running lawsuit claiming harm from the launch of electronic markets

The plaintiffs, who estimate that they are owed about $2 billion in damages plus interest, say the company broke its promises to them when it opened a data center for electronic trading that effectively doomed the old trading floors. CME has called the lawsuit baseless.

A spokeswoman for CME declined to comment. The company repeatedly tried to get the suit thrown out, but failed each time.

The lawsuit, filed in 2014, has dragged on so long that one of the original plaintiffs has died. Hundreds of former floor traders could be affected by the outcome. The trial, being held at a county courthouse in downtown Chicago, kicked off Monday with jury selection. It is expected to last several weeks.

Jul

21

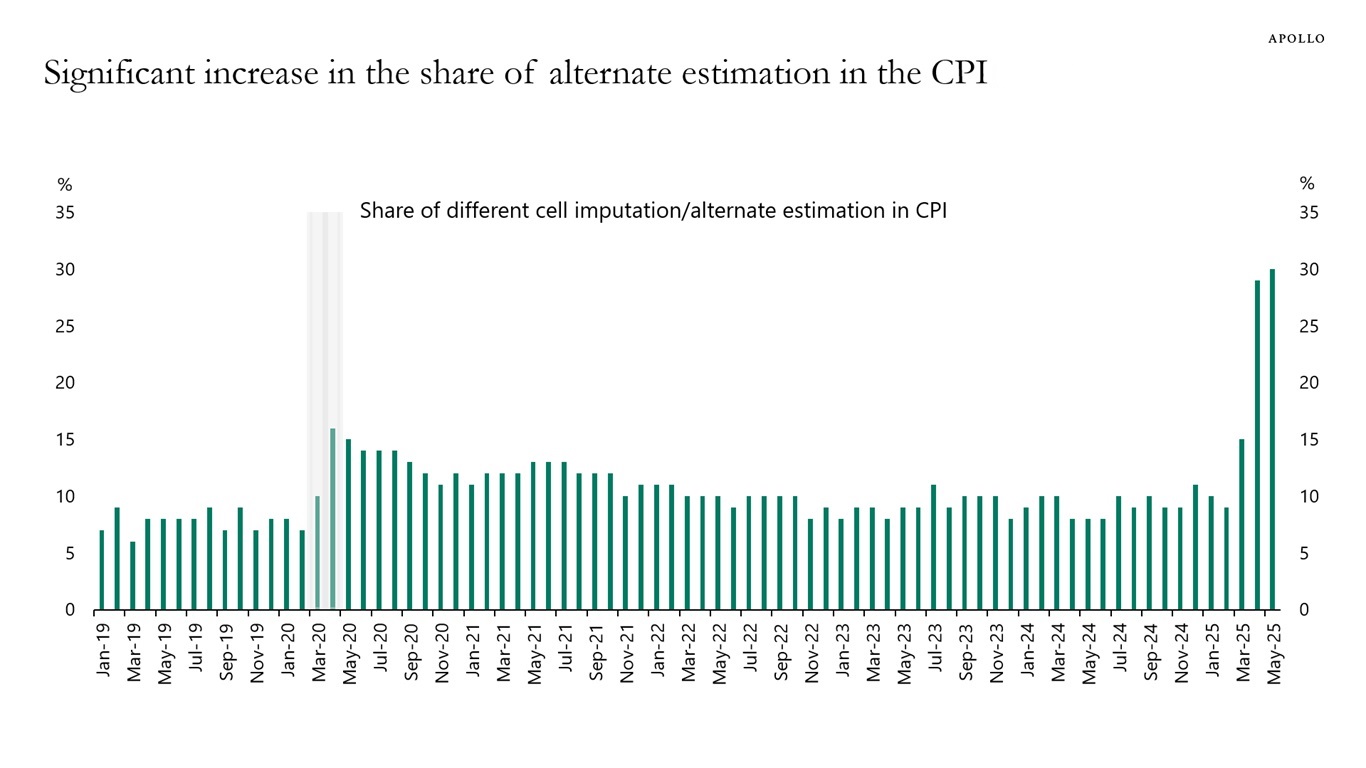

CPI Data Quality Declining

July 21, 2025 | Leave a Comment

CPI Data Quality Declining

June 20, 2025

Torsten Sløk

Apollo Chief Economist

To calculate CPI inflation, BLS teams collect about 90,000 price quotes every month covering 200 different item categories, and there are several hundred field collectors active across 75 urban areas.

When data is not available, BLS staff typically develop estimates for approximately 10% of the cells in the CPI calculation. However, in May, the share of data in the CPI that is estimated increased to 30%, see chart below.

In other words, almost a third of the prices going into the CPI at the moment are guesses based on other data collections in the CPI.

Bill Rafter writes:

Would anyone in the data business be surprised by this? I’m not.

Peter Ringel wonders:

Doge related?

Big Al offers:

US Labor Department reducing CPI collection sample amid hiring freeze

By Reuters

June 4, 2025

The U.S. Labor Department's economic statistics arm said on Wednesday it was reducing the Consumer Price Index collection sample in areas across the country due to resource constraints, but the move should have "minimal impact" on the overall CPI data.

Jul

19

Big Mac Index, from Jeff Watson

July 19, 2025 | Leave a Comment

For those who study such data, here’s the 2025 Big Mac index.

The Big Mac Index, a real and recognized metric developed by The Economist magazine in 1986, initially served as a light-hearted tool to measure purchasing power parity between countries. Today, it has evolved into a significant indicator of the global economy and currency valuation. This index compares the price of Big Macs in various countries to the price in the United States, offering insights into economic conditions.

Steve Ellison writes:

I love the Big Mac Index. But inquiring minds want to know, what about the eurozone, conspicuously missing from the article? The Big Mac Index judges the euro to be 15.2% overvalued, so this year's runup in EUR/USD appears not to be supported by burger fundamentals.

Jul

18

C & I loans, Large v. Small banks, from Bill Rafter

July 18, 2025 | Leave a Comment

In the July 14 Wall Street Journal, an article argued that smaller banks—by virtue of their loan portfolios—are better positioned than larger banks to gauge the nation’s economic health. Intrigued, I tested that claim using Federal Reserve weekly data on Commercial & Industrial loans for both large and small banks going back to 1984.

As expected, small-bank lending proved more volatile, but it was consistently less “correct” than large-bank lending. Whether measured by simple rates of change or by shifts in their 12-month trends, large banks outperformed small banks in accuracy. This analysis does not include loan-performance metrics (delinquency or charge-off rates broken out by bank size), which — unsurprisingly — tend to peak during or immediately after recessions.

Jul

17

Your Favorite Chicken Sandwich Shows How Markets Iterate, by Dr. Peter C. Earle

July 17, 2025 | Leave a Comment

Your Favorite Chicken Sandwich Shows How Markets Iterate

Critics often scoff at the market economists’ claim that competition fosters relentless innovation. A recent meme points to the ubiquity of chicken sandwiches across major fast food chains as supposed evidence of stagnation in capitalism. If twelve top firms offer a similar product, the argument goes, how innovative can an economic system truly be?

But that line of reasoning badly misrepresents both the nature of competition and the role of iterative improvement in markets. The explosion of chicken sandwich options is not a sign of creative bankruptcy — it’s a case study in product refinement, branding evolution, and consumer-focused differentiation. Far from signaling sameness, the chicken sandwich wars reveal how even within a narrow category, firms continuously jockey to win customer loyalty, and with it, market share.

Jul

16

The Most Useful Thing AI Has Ever Done, by Veritasium

The biggest problems in the world might be solved by tiny molecules unlocked using AI. A huge thank you to John Jumper and Kathryn Tunyasuvunakool at Google Deepmind; and to David Baker and the Institute for Protein Design at the University of Washington for their invaluable expertise and explanations.

Overview: Alphafold

AlphaFold is an artificial intelligence (AI) program developed by DeepMind, a subsidiary of Alphabet, which performs predictions of protein structure. It is designed using deep learning techniques.

DeepMind site: AlphaFold: Accelerating breakthroughs in biology with AI

Jul

15

July, 1798 - John Adams Starts the first Loser War of the United States, from Stefan Jovanovich

July 15, 2025 | Leave a Comment

The rules for American warfare are painfully simple: we win the ones that other people start, and we lose the ones that we start. Today is the formal anniversary of the first loser war by the American Republic. Congress, at the urging of President Adams and his Secretary of the Navy, Benjamin Stoddert, revokes its treaty with France. Because the revocation put the country in a state of war with France but is not a formal declaration by Congress, our history books call it a "Quasi-War". Conventional history does its best to pretend that this was a success. History Today tells us "the Navy gained respect as a powerful force. It grew from a mere six vessels to about 30 commissioned ships. American warships captured more than 80 French vessels during the Quasi-War."

U.S. launches the Quasi-War with France, the first conflict since the Revolution

Total tonnage of ships captured during the Quasi-War

(the figures given are a range because the sizes of the individual ships captured have to be estimated; there are not enough surviving records to know how large each ship was.)

• American ships captured by French Navy: 200,050–400,100 tons

• French ships captured by U.S. Navy: 5,200–10,000 tons

We have better numbers for the the number of ships captured:

• American ships captured by French Navy: roughly 2,000

• French ships captured by U.S. Navy: 85-86

The American records are much more precise because the captures had to be valued; prize money was the incentive pay for the officers and sailors.

Steve Ellison writes:

Paul Johnson, in A History of the American People, wrote that Thomas Jefferson during his two terms as president was endlessly vexed by the depredations of both the British and French navies on American shipping. One wonders why we start any wars if we are guaranteed to lose.

Stefan Jovanovich responds:

The data for the war that the Democrat-Republicans (Jefferson and Madison) wanted and formally declared - the one that started in 1812 and is still looking for a name:

• U.S. Captures: 44,412–63,912 tons (200–250 vessels)

• U.K. Captures: 144,799–424,799 tons (1,406 vessels)

Jul

14

Forest for the trees, from Humbert Y.

July 14, 2025 | Leave a Comment

Selection of videos:

How can we make young forests “old-growthier?”

Forest management is hard to understand

Ecological Forestry: The Agony and the Ecstasy of “Messiness”

Five Things You Can Do to Help Forests — In 5 Minutes

And the book:

How to Love a Forest: The Bittersweet Work of Tending a Changing World

By Ethan Tapper

Proffering a more complex vision, Tapper argues that the actions we must take to protect ecosystems are often counterintuitive, uncomfortable, even heartbreaking. With striking prose, he shows how bittersweet acts—like loving deer and hunting them, loving trees and felling them—can be expressions of compassion. Tapper weaves a new land ethic for the modern world, reminding us that what is simple is rarely true, and what is necessary is rarely easy.

Jul

12

The case for free trade

July 12, 2025 | Leave a Comment

The Case for Free Trade

By Milton Friedman, Rose D. Friedman

Thursday, October 30, 1997

For example, the supporters of tariffs treat it as self evident that the creation of jobs is a desirable end, in and of itself, regardless of what the persons employed do. That is clearly wrong. If all we want are jobs, we can create any number–for example, have people dig holes and then fill them up again or perform other useless tasks. Work is sometimes its own reward. Mostly, however, it is the price we pay to get the things we want. Our real objective is not just jobs but productive jobs–jobs that will mean more goods and services to consume.

How Trade Agreements Have Enhanced the Freedom and Prosperity of Americans

By Daniel Griswold and Clark Packard

The most straightforward and preferable path to trade liberalization for any country is the unilateral reduction of trade barriers without regard for other countries’ trade policies. Unilateral liberalization allows a country to realize the gains from openness—mainly lower prices for consumers, lower-cost inputs for businesses, and a more favorable exchange rate for exporters—without the need for complicated negotiations with other countries. Many nations have followed this route with success, from Great Britain in the mid–19th century to China and India and other emerging economies since the 1980s.

Recommended Readings on Free Trade Versus Protectionism

By Williamson M. Evers

Economists, going back to Adam Smith and David Ricardo, are virtually unanimous that free trade benefits consumers and the overall economy. But there exist special interests who would gain in the short run from protectionist barriers. And there is a large segment of the public that doesn’t understand the arguments for free trade. Not surprisingly, there are politicians who are all too willing to gain votes by catering to protectionist interests.

'Ulysses Grant' comments:

"Free trade" was the English rebuttal to the ungrateful Americans who decided in 1789 that they would pay for the national government with tariffs. The intellectual debate only began in the United States a generation later; but, even then, it was only about how much harm Congress would do to libertarian beliefs in order to pay the bills. "True" freedom would only come much later, with the income tax - which has none of the defects that make tariffs so inherently immoral.

Jul

11

Spectacular reported profits

July 11, 2025 | Leave a Comment

To what extent are all the spectacular reported profits of short term traders due to specialized lower commissions and preferred access to the bid-ask spread, especially but not limited to the openings?

Jul

10

Retail Trading in Options and the Rise of the Big Three Wholesalers, from B. Humbert

July 10, 2025 | Leave a Comment

Retail Trading in Options and the Rise of the Big Three Wholesalers

Svetlana Bryzgalova, Anna Pavlova, Taisiya Sikorskaya (London Business School)

First published: 02 October 2023

We document a rapid increase in retail trading in options in the United States. Facilitated by payment for order flow (PFOF) from wholesalers executing retail orders, retail trading recently reached over 60% of total market volume. Nearly 90% of PFOF comes from three wholesalers. Exploiting new flags in transaction-level data, we isolate wholesaler trades and build a novel measure of retail options trading. Our measure comoves with equity-based retail activity proxies and drops significantly during U.S. brokerage platform outages and trading restrictions. Retail investors prefer cheaper, weekly options with average bid-ask spread of 12.6%, and lose money on average.

We start by documenting the stylized fact that, although only a fraction of investors trade options, most of the PFOF received by retail brokerages comes from options, not equities. For example, in 2021, U.S. brokerages received $2.4 billion in PFOF for options and only $1.3 billion for equities. The lion's share of PFOF for options came from only three wholesalers: Citadel, Susquehanna, and Wolverine.

Jul

9

Free trade is a good thing

July 9, 2025 | Leave a Comment

Terms of Trade and the Gains from Trade | AP Macroeconomics | Khan Academy

The Benefits of Free Trade: Addressing Key Myths

By Donald J. Boudreau and Nita Ghei

The growing rhetoric about imposing tariffs and limiting freedom to trade internationally reflects a resurgence of old arguments that stay alive in large part because the benefits of free international trade are often diffuse and hard to see, while the benefits of shielding specific groups from foreign competition are often immediate and visible. This illusion fuels the common perception that free trade is detrimental to the American economy. It also tips the scales in favor of special interests seeking protection from foreign competition. As a result, the federal government currently imposes thousands of tariffs, quotas, and other barriers to trade.

Jul

8

Two Petawatts for 25 quintillionths of a second at Michigan, from Carder Dimitroff

July 8, 2025 | Leave a Comment

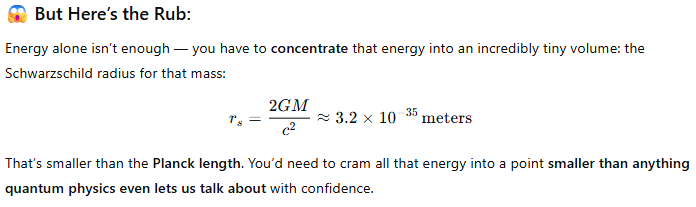

The NSF-funded ZEUS Laser Facility at the University of Michigan produced more than 100 times the global electricity power output (2 petawatts) for a duration of 25 quintillionths of a second.

The US has a new most powerful laser

Hitting 2 petawatts, the NSF-funded ZEUS facility at U-M enables research that could improve medicine, national security, materials science and more.

The ZEUS laser facility at the University of Michigan has roughly doubled the peak power of any other laser in the U.S. with its first official experiment at 2 petawatts (2 quadrillion watts).

Jeff Watson responds:

Those are black hole creation numbers (from chatgpt):

Jul

7

A loitering rogue

July 7, 2025 | Leave a Comment

Lytton Strachey, in Biographical Essays, writes about David Hume:

Not long before he died he amused himself by writing his autobiography — a model of pointed brevity. In one of his last conversations — it was with Adam Smith — he composed an imaginary conversation between himself and Charon, after the manner of Lucian: "Have a little patience, good Charon, I have been endeavouring to open the eyes of the Public. If I live a few years longer, I may have the satisfaction of seeing the downfall of some of the prevailing systems of superstition." But Charon would then lose all temper and decency. "You loitering rogue, that will not happen these many hundred years. Do you fancy I will grant you a lease for so long a term? Get into the boat this instant, you lazy, loitering rogue."

Jul

6

William Slim, from Stefan Jovanovich

July 6, 2025 | Leave a Comment

As officers, you will neither eat, nor drink, nor sleep, nor smoke, nor even sit down until you have personally seen that your men have done those things. If you will do this for them, they will follow you to the end of the world. And if you do not, I will break you.

– Field Marshal William Slim, British Army

Bud Conrad is skeptical:

Of course, they all SAY things like that. But they have their own Officers' Quarters, that "Rank has privilege" and fat retirement on the boards of suppliers. Is there a specific application you're trying to comment on with this quote?

Stefan Jovanovich responds:

At age 16 Slim went to work as a clerk for Stewarts & Lloyds, a supplier of metal tubes. (Slim was able to get the job because he had grown up in the business; his father was an ironmonger.) In 1910, at age 19 he enlisted in the University of Birmingham Officer Training Corps. Because he had the money to buy a regular commission, he was given a temporary rank with the Royal Warwickshire Regiment in 1914. He served in Turkey (Gallipoli), Mesopotamia (Iraq) and France, was wounded twice and earned the Military Cross in 1916. In 1919 he was transferred to the Gurkha Rifles of the British Indian Army and served in the Northwest Frontier (Afghanistan). He was able to attend the Camberley Staff College in 1926; despite his inferior social background, he was invited to stay on and become an instructor. He returned to India in the 1930s and became commander of the 2nd Battalion, 7th Gurkha Rifles. After a year at the Imperial Defence College, he was promoted to brigadier and led the 10th Indian Brigade. In 1940 he was promoted to major general to command the 10th Indian Infantry Division, which operated in Iraq, Syria and Iran in 1940-1941. In March 1942 Slim was appointed commander of the Burma Corps. He led them in a 900-mile retreat from Rangoon to India. In May 1942 the Burma Corps was reorganized into XV Corps of the Eastern Army and Slim as appointed lieutenant general. In October 1943 Slim became commander of the Fourteenth Army.

The rest of the story is easy. The 14th (which became known as the Forgotten Army because they were last in the supply chain for everything) would defeat the Japanese 15th Army at Imphal and Kohima in 1944 and reconquer Burma in 1945. The Japanese would suffer 180,000 casualties; the 14th 24,000.

Slim suffered from the effects of malaria throughout his life; his nickname among the troops was "Uncle Bill".

Jul

5

DailySpeculations calendar colors, from Big Al

July 5, 2025 | Leave a Comment

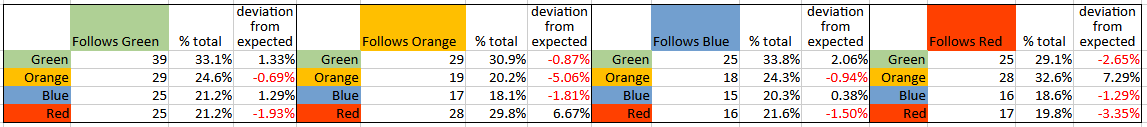

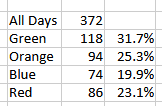

The calendar here at Daily Speculations puts market days into four groups, based on the daily changes in S&P futures and bond futures:

Green = Stocks Up, Bonds Up

Orange = Up, Down

Blue = Down, Up

Red = Down, Down

Using daily data for the S&P and for TLT, from 2 January, 2024, to 28 June, 2025, I determined which color each day is, and then did the count for each color, and what % that color day is of all days:

Then I counted what follows each day, i.e., a Green day could be followed by another Green day, or an Orange, or Blue, or Red day. With a random distribution of days, you would expect random following days, i.e., if 40% of days are Green, and 30% are Orange, then you would expect any given day to be followed by a Green day ~40% of the time and an Orange day ~30% of the time. You could then look at deviations, e.g., Blue days followed by Orange days only 25% of the time could be counted as -5%-point deviation.

So I did this kind of counting with the calendar days, with these results, where you see, for example, the number of times a Green day follows a Green day (39), what % of the time this represents (33.1%), and the deviation from expected, measured in % points (1.33%).

• What follows Green days looks random (i.e., the numbers in the deviation column are close to zero percent).

• Orange days are somewhat more likely to be followed by Red days and less likely by another Orange day.

• Blue days look random.

• Red days are more likely to be followed by Orange days.

I keep thinking I should study Markov processes, especially "Hidden". I don't know if this kind of counting is a simple version of a Markov process, and if there is more that could be done.

Jul

4

Dollar’s Decline Meets Rising Dedollarization, from Dr. Peter C. Earle

July 4, 2025 | Leave a Comment

Dollar’s Decline Meets Rising Dedollarization: The Threat Comes from Within

The Bloomberg Dollar Index has fallen nearly 8.5 percent, its steepest drop since the 1980s. Elsewhere, incremental signs point to emerging alternatives.

Peter C. Earle

June 23, 2025

The recent weakness in the US dollar has reignited the debate over the durability of the dollar’s dominance in global finance. Over the first half of the year, the Bloomberg Dollar Index has fallen nearly 8.5 percent, marking one of the sharpest declines since the mid-1980s. Yet while this drawdown has fueled widespread commentary about de-dollarization, it is important to distinguish between dollar weakness — a familiar, cyclical phenomenon — and the far more consequential and complex issue of de-dollarization, which concerns the dollar’s standing as the world’s primary reserve currency and medium of international exchange.

Rich Bubb writes:

A thought I had was that many/all future currency/ies might eventually only be crypto based. How that develops is an interesting (read: slightly frightening, for me) scenario. And I think the exchange rates would be a tough hurdle to deal with. Unless there'd be a worldwide cryptocurrency system. Then there's the point that must be solved, specifically that quantum computers of 'bad actors' might be able to hack/crack cryptos' security. Maybe crypto security protocols could be quantum-based, run by quantum computers?

Another point might be powering those Q-computers (electricity) constantly. Obviously without constant power any computer is a nice pile of parts. Furthermore, any significant programming errors could 'delete' trillions worldwide before any human could intervene.

Jul

3

Sports $$$, from Big Al

July 3, 2025 | Leave a Comment

The news is the Buss family selling the Lakers (and the online discussion whether the Lakers were a better investment over time than, say, the S&P).

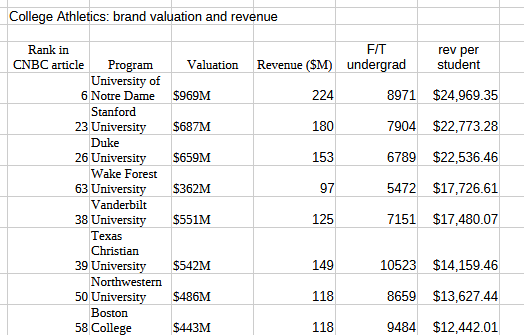

I wanted to look at the value of college athletics and found this page:

What the top 75 college sports programs are worth

Then I used Perplexity and elbow (or mouse finger) grease to build this table showing revenue per student, sorted high-to-low. There are many possible errors in this data but it's just for fun and seems intuitively roughly correct.

Below is the top set of rows - click here for the full sheet (all 75 schools) which will appear zoomed out - click on it to zoom in.

Jul

2

Gem from Operations Research, from Asindu Drileba

July 2, 2025 | Leave a Comment

I recently came to the conclusion that a lot of quants come from the field of Operations Research. I noticed a paper of MFM Osbourne was also published in an Operations Research Journal. After a bit of research with in this space I came across an approach called "Metaheuristics."

I think its very relevant to this list. Mr. Jim Sogi once described The Chair's approach to thinking as "Neiderhoffian thought." E. O Wilson called it "Consilience." "Metaheuristics", "Neiderhoffian Thought" and "Consilience" are all related, in that, they champion the idea that we can come across novel solutions via thinking in analogies & metaphors.

There is a table of curated Metaheuristics. It has algorithms inspired by Ants, Buffaloes, Rivers, Art (yes, like paintings), Squirrels, Wasps and Korean TV Shows (Squid Game Optimizer).

The gem I am talking about is a book called Advanced Optimization by Nature-Inspired Algorithms, by Omid Bozorg-Haddad. The book has 15 Algorithms. Notable mentions are:

- League Championship Algorithm (Inspired by sports)

- Shark Smell Optimisation (Inspired by how sharks use their sense of smell to find prey)

- Ant Lion Optimizer (Inspired by how larvae of Antlions entrap prey)

I consider the book well written. Each of the 15 algorithms are described in 4 ways. For example, the Ant Lion Optimiser algorithm:

1) It's done in plain English to give you a verbal understanding of what the algorithm does.

2) It's done in mathematics so you can know how to better understand the algorithm in math notation.

Example of math description of ant-lion algorithm

3) It's described using flow charts.

4) It's described in pseudocode so you can better know how to code the algorithms up.

All the 15 algorithms are described in this way. This was something I appreciated so much.

Jul

1

The A B C of Stock Speculation

By S. A. Nelson

16 Park Place New York

Copyright, 1902.

pp 28-29:

The elder Rothschilds are said to have acted on the principle that it was well to buy a property of known value when others wanted to sell and to sell when others wanted to buy. There is a great deal of sound wisdom in this. The public, as a whole, buys at the wrong time and sells at the wrong time. The reason is that markets are made in part by manipulation and the public buys on manipulated advances and after they are well along. Hence it buys at the time when manipulators wish to sell and sells when manipulators wish to buy.

In some commission offices, there are traders who, as a rule, go against whatever the outside customers of the house are doing. When members of the firm say, "all our customers are getting long of stocks," these traders sell out; but they buy when the firm says, "the customers are all short." There are of course, exceptions to this rule. If there were no exceptions, the keepers of bucket shops would all get rich. When the market has an extraordinary rise, the public makes money, in spite of beginning its purchases at what would ordinarily be the wrong time, and this is when the bucket shops either lose their money or close out in order to keep such money of customers as they have in hand.

All this points to the soundness of the Rothschild principle of buying a property of known value when the public generally is disposed to sell; or of selling it when the general public thinks it a time to buy.

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles