Dec

27

Recession Can’t Come Soon Enough, from Gary Phillips

December 27, 2022 | 1 Comment

The market has always been a discursive struggle between the bulls and the bears. A system of oppositions that one might think, would logically or functionally negate each other. Of course, the relationship never stays linear for long and the inevitable convexity leads to a Hegelian resolution of thesis and antithesis.

The dialectical tension between an "impending" (but reluctant to manifest) recession (inverted yield curve) and a resilient economy (Q3 GDP +3.2) and labor market (unemployment 3.7%) underscores the struggle between the "higher for longer" bears, and the bulls who believe in the equivocation of "pause" with "pivot."

A reactive Fed will continue to focus on a strong jobs market and keep its tightening bias, which WILL inevitably cause a deep recession; however, the recession won't come "soon enough" for the Fed to save the day. And, the seemingly gradual descent into negative growth, will allow the recession trade to dominate its opposition.

Larry Williams responds:

The actual economy down but not out or negative:

Gary Phillips replies:

i get what you're saying. (perhaps the economy is strong enough we never have to endure a recession in 2023.)

but, methinks you're missing MY point: the longer the economy "holds on", and the longer it takes for a recession to rear its ugly head, the longer the Fed continues QT ( good news is very bad news). on the other hand, if there was an impulsive and deep, drop in growth, (bad news would be welcomed with open arms) the Fed would be more inclined to pause or pivot sooner (de facto put).

Read the full discussion here with additional contributors and charts.

Dec

22

SPY from 6 trading days left for the year, to t+5, since 1993, from Kora Reddy

December 22, 2022 | 1 Comment

Click the chart for full view:

Larry Williams responds:

Or this:

Jim Cramer breaks down fresh charts analysis from the legendary Larry Williams

Dec

22

Mr. Wonderful

December 22, 2022 | 1 Comment

correct me if I'm wrong : Mr. Wonderful received 15 million to promote SBF + 3.6 million to cover his taxes: he invested 15 million in crypto and makes a big deal about losing 15 million against 18.6 received. amount of money that was lost by those who were influenced by him is staggering.

somehow Mr. O'Leary should not be on the committee to uncover missing money for those who list billions.

thinking of O'Leary vehement defense, i compare it to Stockholm syndrome, "he doth protest too much, put a thief on a horse and he'll gallop." this picture it best: Willie Sutton disguised as policeman in front of bank he robbed. "how could you ask an officer to violate law."

Dec

14

The pleasure of reading (or listening)

December 14, 2022 | 1 Comment

i have had the pleasure of reading or listening to 1 book a day for the last 4 years. here are the books i find the most educational or enjoyable that i listen to about once a week.

The Time It Never Rained

Don Quixote

On the Origin of Species

Master and Commander

Americana: A 400-Year History of American Capitalism

American Dispatches from the New Frontier

Infrastructure: A Guide to the Industrial Landscape

Benjamin Franklin: An American Life

Heroes: The Greek Myths Reimagined

The Art Of Travel: Or Shifts And Contrivances Available In Wild Countries

all these books are highly recommended and great for education and mollifying anxieties. All i listened to on Audible (i have 470 books ordered from them) except for Origin, Benjamin Franklin, Art of Travel and Infrastructure.

Dec

14

Revelations from start to finish

December 14, 2022 | Leave a Comment

revelations from start to finish and duration of many years:

Crypto Critics Corner: Sam Bankman-Fried Arrested

as mentioned family frauds are the most difficult to unravel. query: why is quickbooks considered an inappropriate accounting system to a company? it seems very useful to me.

Dec

11

Fish in the sea

December 11, 2022 | Leave a Comment

thanks to all who wished me happy birthday.

Someone in a Tree - Stereo - Pacific Overtures - Original Broadway Cast

there are so many fish in the sea. five declines in row, followed by a rise, decline. 22-day low since nov 8. in honor of my 80th birthday, 2 patterns both very bullish, t's of 4 five days later. program originally written by Sue and me in 1979. "i was younger then." still here.

fish in the sea. last 2 FOMC meetings witnessed S&P down more than 100 big sp each— the serial correlation is 0. on a favorable note the Ray-Ban bicyclist is up to 23% prob of winning versus 12% 2 weeks ago.

Dec

11

A most demoralizing fraud

December 11, 2022 | Leave a Comment

the most demoralizing recent fraud I was victimized by was particularly disturbing as it involved my books which is a tribute to my parents who had a library of books even bigger than mine since my father was paid by all the publishers to thro books in the river but he saved them.

the fraud inflicted on me was a big con. (1) i received a call out of the blue: a book seller told me that I was buying lots of his books so would i mind if he came over to look at my collection. (2) he recommended that I sell my books at a well known dealer out of state.

(3) the book seller i had done business with but she was in mourning — a friend was very sick. she sent me one of her most trusted lieutenants to go thru my collection. (4) the lieutenant told me my books had mold and that i should send them to her principal so that they could be restored and evaluated.

(5) the new book seller in a nice touch told me not to worry too much about it as the mold was not particularly damaging. he also sent me a video of his father who was a very venerable professor like my father. i took aubrey to visit the old book seller.

(6) i received an offer for my books for about 1/5 of what I paid for them (i had held them for an average of 20 years). seeing all my books presumably with mold and taking account of the tragic situation of my book seller i accepted the offer in haste.

(7) on the train home i began to rethink the situation. (8) i met the new bookseller on the train and asked him why he was at the meeting. he said how was he going to get paid if he wasn't involved?

(9)the next day i called and offered 25% more than the accepted price to cancel. the old book seller (he or she) said that they couldn't accept my cancel and offer since the books were already in play. (10) there were some other turns in the big con. they offered to send me half the books back for a price. so I would be assuaged. but they were the remnant.

i cried about my idiocy for several weeks and haven't gone back to my library in 2 years as it's too painful.

one lesson for the current excitement about crypto is never to let your goods out of your possession. also never accept a recommendation from a celebrity or friend without asking what their piece of the deal was.

Dec

7

Timing, from Nils Poertner

December 7, 2022 | Leave a Comment

If Timing in mkts is everything - I mean everything - how can one improve it?

Few yrs ago, there was this mixed martial arts boxer called Chuck Liddell. He had amazing timing like no other one else had - and was mostly a counter-boxer. Eventually others figured him out but he has his run. He observed his opponents carefully- - and in the right moment broke the pattern and leaped forward when his opponent didn't expect it. Same parallels to trading mkts perhaps?

a - observe everything

b - develop a bit of courage for the leap (but only after a and plenty of practice)

c - practice.

William Huggins responds:

reminds me of Miyamoto Musashi's exhortation to his students that breaking the opponent's rhythm was the most important part of competition. He suggested a number of techniques (fight with the sun behind you, chase opponent onto uneven ground, stab at the face, etc) but I wonder if those are of limited applicability when squaring off against faceless (and innumerable) market-based opponents simultaneously.

his Book of Five Rings is hundreds of years old and thus free everywhere.

John Floyd writes:

Extending on your martial arts analogy….and bringing in the law of everchanging markets…timing is improved in terms of outcome and consistency if one recognizes and can adapt to prevailing conditions, using experience and intuition, and what tools to pull out of the quiver and employ.

This article from one of my teachers talking about my esteemed dojo mate Paul Williams is a worthy read on an application of timing.

Zubin Al Genubi adds:

One of Miyamoto's strategies was run, then suddenly turn and attack while fleeing. I've found it a useful trading strategy. He would also arrive to a duel early, or late, throwing off the opponent's timing.

Paolo Pezzutti comments:

Intermarket relationships can provide good timing. For example when bonds print a new 20-day it is quite bullish for stocks over the next days. Buy signal last Friday at the close. Since Mar 20 holding 3-5 days T-score up to 4. Last 10 trades after 5 days all positive. (Chart on TWTR.)

Dec

7

Trial and error, from Big Al

December 7, 2022 | Leave a Comment

Watching Victoria via PBS Masterpiece sub, and it's shown that, during the 19th century, one treatment for syphilis was basically a mercury sauna, inhaling the vapors - yikes!

The history of syphilis is an interesting case for seeing how quack medical treatments, such as mercury, were applied and killed people even more quickly. Of course, one shouldn't judge too harshly as they were treating things of which they had no understanding.

The relevance to trading is that humans have an impulse, when confronted with challenges they don't understand, to resort to superstition and to believe anything that is claimed with great confidence.

Penny Brown notes:

Flaubert took the mercury treatment for syphilis and as a result his tongue turned blue.

Laurel Kenner adds:

Qin Shi Huang, first emperor of China, drank mercury-infused wine to attain eternal life. Rivers of mercury surrounded his burial chamber, a depiction of China. Qin died at 49.

Gyve Bones writes:

We saw examples of that in the recent pandemic. At first "masks don't work. Don't wear masks." then… "Everyone must wear a mask at all times, even alone outside or in a car." Then "The virus stops dead in the vaccinated person, who will not get Covid, and won't spread it to others." then… "Anthony Fauci contracts COVID three times, but is certain it would have been worse had he not been quad-jabbed."

Now there's this disturbing study which shows the effects on infant cord blood and their immune systems from mothers who have been infected with COVID.

Henry Gifford comments:

The early instruction for people to not wear masks was so that security cameras could see people’s faces. The police seem to really love security cameras with an enthusiasm that strikes me as going above and beyond any usefulness to “fight crime”.

There was the time a landlord in NYC put a camera outside a tenant’s door to prove if the tenant was using the apartment as a “primary residence”, and would therefore still be entitled to rent protection or not. The tenant’s boyfriend put bubble gum on the lens and was promptly hunted down and arrested and charged with every crime the cops could think of, with an enthusiasm certainly not caused by anyone’s love for a NYC landlord.

Not being seen clearly on security cameras was, if I remember correctly, sometimes even stated as the reason to not wear masks, which made me wonder – if they think masks work, more people dying is OK as long as people can be seen on cameras?

Pamela Van Giessen responds:

Henry — There exists decades of research that show that masks do not reduce transmission. I have yet to see meaningful evidence (research or real world) that shows that they do work. The current situation in China would seem real world validation of the lack of mask effectiveness. Lockdowns don’t seem to work much either. Most people don’t die from covid either. They don’t even get very sick.

Henry Gifford writes:

I tend to believe things if they can be measured, if the measurements can be repeated by others, and if they can be explained by the laws of physics. I tend to not believe anything not meeting these three criteria. As the owner and fairly regular user of over fifty measuring instruments, the measuring part often means measured by me.

Dec

4

A scholar asks; plus market moves, and FTX

December 4, 2022 | Leave a Comment

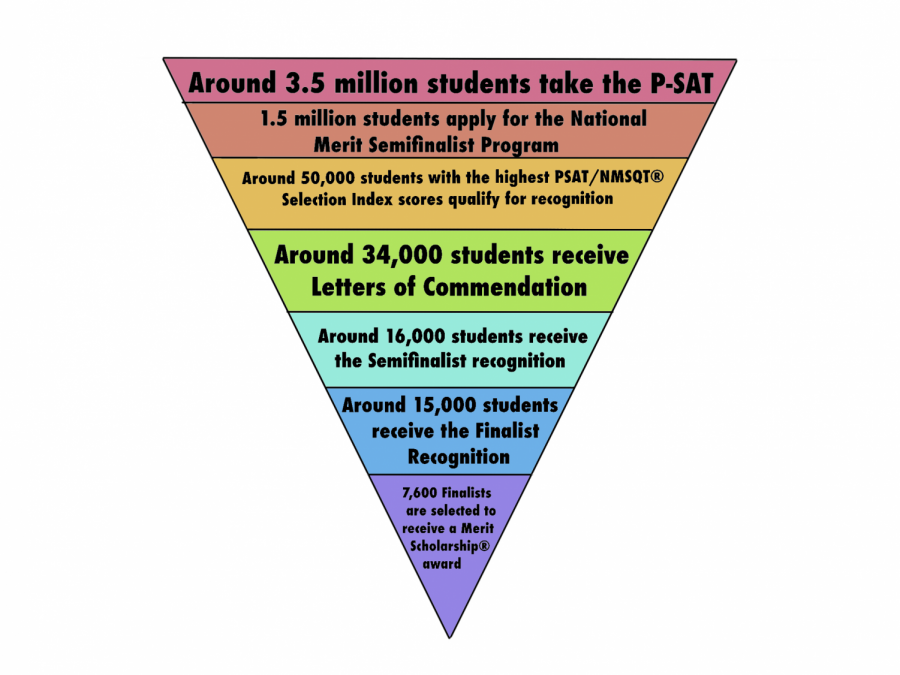

that third person - who asked re SBF, "why aren't you in jail you piece of —" - just won national merit scholar. one is very proud. i've known that 3rd person for a major portion of his life.

why do prices fluctuate so much? to give speculators hope and make them trade excessively.

seems to be sapient piece except for refusal to acknowledge that 90% of spending actual or promised was to bicyclist — which is expected on mayor's site:

11 Hours With Sam Bankman-Fried: Inside the Bahamian Penthouse After FTX’s Fall

also the secret back door exempting Alameda from margin requirements that others had, and fact that FTX invested more in venture capital firms than they invested in him. but mostly how is a person left with only $100,000 if his parents and friends took 87 million from co?

guess they're saving the reduced employment for close to elections. the 44 strategy.

calling out to Mr. E who always lives even when feet first, who always said that he spoke to the then Pres and he was saving the employment numbers for the coming election. we miss him greatly. the Falstaff and always ready to take care of the woke.

finally verification that FTX gave comparable money to R's as D when he gave 10 million to 46 campaign and promised 1 billion more. he said he gave dark money to R's but was it comparable to "second biggest donor to d's next to palindrome"?

here's a pretty kettle of fish: two small daily declines but from a big x-day high but last small decline had a tremendous rise from 9:30. like everything it has happened before but let's say 5 times in last 11 years.

where's it going. not much to make the professor happy. to add to kettle we have bonds at big y-day high putting them all together into kettle — only happened once in last 10 years.

Dec

1

Questions that lead to excuses

December 1, 2022 | Leave a Comment

DealBook to ask SBF "tough questions". perhaps 1 million investors and their counselors who have lost (10 billion?) will be not as forbearing? i would ask verification of his interview that he gave as much to both sides of the aisle. apparently according to interview with Asian reporter he gave money to other side darkly so that he wouldn't be ridiculed by agrarian sources. either way it's deception like the angler fish. i'd also ask him to expatiate on his statement that he doesn't read books.

Mr. Gitarts or Mr. Aiken who knows infinitely more about the crypto than I: "what questions would you ask SBF at end of deal book conference?" to the observer he seems to be the Houdini and the spider of deception.

a third person who knows as much about crypto as anyone answers my query, "why aren't you in jail you piece of — ?"

Barry Gitarts writes:

Yes, SBF was an outright fraud, but there are other things brewing in the space that have been banned a long time ago in traditional markets but have emerged again in crypto.

Remember the bucket shop? Well it's back as a crypto protocol. It pools investors money and will offer a trader a slippage free trade, the trader gets to choose when they enter and exit, however the pool charges 10BPS on the way in and on the way out, they charge double digit interest rates on the position even unlevered and offer up to 150x leverage which of course leads to liquidations.

So how has it done? Since inception in 2021, traders have lost $40m to this pool, and that is not counting interest, trading and liquidation fees. The pool currently holds $375m in assets, one year ago it had $100M in assets.

One would think traders would leave the venue after consistently losing, but trading volume recently hit a new high of $1B notional traded in a day.

Big Al adds:

The question I would ask is, "Who got those billions that SBF lost?" Mr. Gitarts comments may be a trailhead.

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles