Nov

22

Markets and sociobiology, from Scott Alexander

November 22, 2022 | 1 Comment

Markets are teaching me that Freud was wrong about the subconscious and sociobiology is right. The subconscious isn't a personal universe of abstract mysteries revealed through metaphors; it's a biological tool for groups to sort out hierarchies. At some point, how much risk you place on a trade is just a test of your place in the hierarchy of the tribe. Just as kids test boundaries to discover the rules of the tribe, adults make decisions to test their place in it. Making a big bet has more to do with acceptance than greed.

Why? Think of it this way: There is no genetic survival at the group level survival without hierarchy because groups wouldn't be able to effectively organize without a clear chain of command. Upsetting the chain of command puts its entire genetic survival at risk. Nothing gets done if nobody is going to do what they're told. Some must lead, most must follow, or we all die.

The subconscious is how we connect mentally with each other without actually hearing each other's thoughts. Through that mental connection, the subconscious will direct the conscious mind to make decisions that test your place in the tribe.

Doing well in anything fundamentally challenges the structure of the tribe. When we move up too quickly, we can reasonably wonder if the ascension was warranted, and cover our denial through arrogance. There will be times the temptation to make bets against our own interest because the tribe is always questioning your rank and right to exist through your subconscious.

The temptation to make a trade against your own personal interest is just the tribe's way of testing if you belong where you are. The market is an ideal forum for reordering or reinforcing the hierarchy. Making any bet that can lower our place in the tribe is an admission that we can't find consistent asymmetrical returns. Nature uses the markets to sort out who belongs where in the tribe.

After actively trading for two years I understand that my subconscious is not my friend. It's a biological tool that evolved to serve the group over myself. Only by consciously choosing facts do I move beyond factional control. But I also understand the meaning of learned helplessness. Sometimes I'm afraid of what I might learn next.

Bo Keely responds:

nice to read these fresh original thoughts. in addition, anything by the father of sociobiology E.O. Wilson is solid. he is the foremost authority on ants, and my Quaker Army Ants are still pulling the wagon of oats to their nest.

Nov

21

Boxwood Butchery, from Laurel Kenner

November 21, 2022 | Leave a Comment

A new post from Laurel Kenner: Annals of Greenwich, Pt. 4: Boxwood Butchery

Nov

20

Mad advice, FTX insight

November 20, 2022 | Leave a Comment

I believe the mad dog and mad money are both in my opinion useless with their predictions but mad dog genuinely likes his viewers while mad money has contempt and arrogence in his seemingly vitriolic opinions. mad money hates his listeners and Wall street unless they are part of his investment club. mad dog is harmonious. it is interesting that mad money berates his listeners for not trading enuf. they're too much buy and hold.

important and informative video about FTX from Patrick Boyle. be sure to check out ncz art (a nyse and shackleton painting behind Patrick Boyle who worked effectively at ncz for 5 years). picture of wood nymph who ran alameda on boyle's video.

Nov

17

Just as destructive to the speculator

November 17, 2022 | Leave a Comment

it is good to realize that just as destructive to the speculator is establishing a position that will not be able to withstand a reasonable fluctuation. take crude down 4.00 to a new 60-day low today. it was a boon to those who don't have to worry about margin. not being able to withstand such a move, which creates tremendous vig for the Bigs, is just as significant a source of loss in magnitude and frequency as the HFT front-running and the big losses with bad fills on the open.

while everyone was watching the finagling in FTX, the infrastructure took the occasion to decimate the longs in crude and S&P with a heads up and minor forced liquidation of the grains.

shades of Alfred Cowles: a reasonably big reversal 4 days in a row with the last down 20 in S&P. the Kona smells so good but just as Sogi brings it to the lips, a ripple knocks it out - temporarily. Sogi's reflexes and surfing is very good since he was an amateur champion and a sports adventurer - so he catches it before it spills into the Pacific.

It is interesting how the two major financial publication don't even mention that SBF was the second major contributor to the D's after Palindrome in their entirely empathetic articles about him. If he hadn't promised a billion more to the D's or if the Good one Forbid he contributed 98% to the Outs instead of 98% to the ins, there would be a diametrically opposed story. we can forgive the Mayor's site because Fellow Travelers congregate there. But why should the WSJ suppress?

Nov

17

Commonalities

November 17, 2022 | Leave a Comment

one thing common to the Madoff situation and FTX was their close relation with their trading firms. in Madoff's case it was the third market operation that was situated one floor up from the "wealth management". many investors assumed that by front running, profits of the "wealth management" were assured. The proximity of FTX and Alameda supposedly with a Chinese wall between them is an eerie similarity. Bernie Cornfeld's operations and interrelations with IOS was similarly "complex".

interesting article in the wsj about SBF:

The Fall of Crypto's Golden Boy

according to article the boys at the firm weren't interested in money. they just wanted to give it all away. Left out in the article are the things about their being the second largest contributor to D's and plans to give 1 billion more.

Mr. Pater Earle says the situation is more like MF Global than Madoff. but the diffidence, the playing of racquetball in the Catskills, the friendly way Madoff took money from a family friend at a funeral a week before the end, the interconnection between the market maker and trader.

Nov

17

FTX surprise

November 17, 2022 | Leave a Comment

H. Humbert writes:

I find it amazing that an exchange with monopolistic market making, and no Manning Rule equivalent can ever lose money. As bad as stealing customer funds to cover trading losses sounds, I wonder if there's even worse to come because it sounds so incompetent. However, once again the value of crypto to nefarious actors is demonstrated by the 'asset classes' anti-fragility. Some flavor of the notion of honor among thieves.

Zubin Al Genubi replies:

Market makers can't handle big fast moves, of which we've seen some breathtaking one recently. I believe they are caused in part by the market makers and the ones who are just a bit slower get eaten by the lion. Of course this is sheer speculation on mu part.

H. Humbert comments:

With respect, your model of what a market maker is hasn't existed for about 15-20 years. Market making today is machine driven, speed of light kind of thing, and balanced/correlated across a firm's book. It is almost touchless for the most part.

So for example, if you are a Manning-Rule-free exchange, and you have your own internal market making operation that sees the flow first, you can, at the speed of light, see the direction of the order flow, front run it, sell into it, take the other side of the stupid trades ie the trades that are 'random' going against the flow that you are seeing, see the limit orders and the stop orders and run those etc etc. You see the flow first and decide how to execute against or with it or pass to the punters on the exchange.

It seems impossible to lose money at this and if you don't believe me, look at how few losing days Virtu and Citadel put up and they only get to see about 90% of just the retail flow in equities and they generally can't front run it. They can only decide if they want to take the other side or pass the order on to the market. Imagine if you had no fiduciary responsibility at all and no any kind of rule of best execution.

Anyway I go on and on, but point is, that FTX's Alameda lost money and a lot of it is very strange. Also, I should add, that I know absolutely nothing about crypto.

I can't help but notice that another of Vic's flags is prominent in this FTX story, and that's all the charity work they were doing. All while seemingly running some crazy embezzling thing to cover what? How were they generating these huge losses?

I knew a living human market maker at Schwab in the dot com era. His boss took and traded a single security(I won't name it) and split the rest of the book up. My living human associate got like m-z or something and one day he's long a zillion XLNX. Supervisor screams at him 'What are you and ANAL-IST?"–meaning what ever you think you know, get back to making markets and leave the positions to the buy side suckers. So maybe the losses are from directional market supporting efforts or some such.

Zubin Al Genubi suggests:

Maybe machine/com speed now determines winners?

William Huggins agrees:

can't see why that wouldn't be the case. on a precisely related note, a friend (ex-mit) gave a talk on algos in finance a decade ago, noting at one point how buildings were then being hollowed out to reduce microseconds of lag (i start the clip where its juicy).

H. Humbert writes:

This is one issue with co-location of servers at the exchanges, why it costs so much, why IEX markets a 200ms 'speedbump' to protect resting orders, why dark pools offer some very strange order types, etc etc but ultimately, the winners and losers imo, are determined by rent seeking in the regulations. Ban payment for order flow and Virtu disappears, ban internalization and Schwab has to charge commission, make best execution mean best possible all in price at the moment the order is received and all brokers will institute intermarket sweeps and order flow will go to exchanges, etc.

Stefan Jovanovich comments:

I hope H. Humbert will agree with this comment from the financial bleachers. The anti-trust laws, including agricultural marketing restrictions, have offered the same opportunities for rent-seeking around regulation without having any of the pushback from innovation - i.e. new and better ways to game the system. So, we have an age of inflation at the same time transaction and carry costs for retail customers have gone steadily down.

Duncan Coker writes:

This is a great description of the rent seeking infrastructure or "top feeders" as vic would say. It is all sell-side as that is where the stable income resides. Still as a lowly buy-sider if my choice is to get fleeced by the exchange/locals or the hft hedge funds I think I would go with the later. At least the hedge funds are competing against one other to steal from me. Don't even get me started with the wirehouses. Used to be 100 bp to execute/clear a trade back in the 80s, off exchange that is.

H. Humbert replies:

In the US equity world, which is the only thing I know anything about, the issue that that the HFT shops segment the order flow into smart and dumb and pay for the dumb order flow, which they get first look at and first dibs on off-exchange - through FINRA, which has it's own rules on order handling.

Segmenting the flow makes the rest of the market(not the internalizes, not the payment for flow(PFOF)), both lit and dark, more toxic in terms of adverse selection to resting quotes. This widens the spread, which makes internalization/PFOF more profitable - virtuous cycle kind of thing and also increases the concentration of who gets to see the flow first and decided where to fill.

Given the midterms, I think Chair Gensler has enough political capital to push through some of the rule changes he's been talking about: “Competition and the Two SECs” Remarks Before the SIFMA Annual Meeting

To me, the most likely significant change to get through easily is SEC's own Best Execution rule(amazing I know that there is none currently) and that could dramatically change where orders get filled. We'll see.

Nov

17

A Trip to the Dump, from Laurel Kenner

November 17, 2022 | Leave a Comment

A new post from Laurel Kenner: Annals of Greenwich, Part 3: A Trip to the Dump

Nov

16

Tells

November 16, 2022 | Leave a Comment

i have been asked what signals Mr. Bankman gave of wrongness. khaki shorts, effective altruism, tremendous gifts to 46 and hope of giving 1 billion more, entire family interconnected in supposedly altruistic causes…virtue signaling - what else?

smartest guy in room, stanford professors in family, lover of video games, naming rites. frequent use of curse words. first name basis with head of sec. wanted to be first trillionaire, use of standard of silicon valley " it sucks" in "heartfelt" apology. walked out of meeting with regulators with one crucial demand " need more ubers".

Mr. Bankman's activities and interconnected firms has been compared to Enron, and Madoff, but I would add it to Bernie Cornfeld at IOS. the only thing missing is sex.

Barry Gitarts writes:

- Renaming Miami stadium to "FTX".

- Running a crypto company but sponsoring anti-crypto legislation.

- Talked about how they made so much money arbitraging the "kimchi premium", when no one else in the industry could get around the capital controls of South Korea.

- Badly out of shape and was always visibly shaking (now known to be a result of strong stimulants).

- Goes to congressional hearings with his shoelaces untied.

- Arrogant against critics online, tweets out: "Sell me all your SOL at $3 than F*CK off" in response to an account that asked him what is going on with the price of Solana which he is a big backer of.

- Only achieved a bronze level after playing the video game League of legends for years.

- Playing the video game he is so bad at while on important calls like trying to raise money from Sequoia capital.

- Claims to be frugal only driving a toyota corolla but lives in a $40M condo.

Big Al adds:

Misleading statements?

FTX US, Four Others Ordered to Correct FDIC Insurance Claims

Agency ramping up efforts to crack down on misleading comments

Follows similar action against bankrupt crypto firm Voyager

The Federal Deposit Insurance Corporation issued letters to five companies, including crypto exchange FTX US, demanding that they take immediate steps to correct “false or misleading statements” about certain products being eligible for insurance protection.

John Floyd asks:

I find it interesting delving into how this can help us become better traders in large part by recognizing the human psychology at play here. Is it as simple as if it looks to good to be true it is? Or a filter on linguistic frequency relative to price movement? Or a filter on price movement relative to one's expectations of prospective fundamentals? I can remember being in a room of 10-20 people in 1998 and saying we all own 85% plus of Russia's local currency debt….is that a bad thing and what can go wrong?

Clearly there were smart and successful investors/traders who waived their usual safeguards….what can we learn from this?

Nils Poertner suggests:

I think every company, every group, etc should have at least one person (better a whole team) which only job is to constantly imagine the complete opposite of what the group is doing or thinking.at the moment…

Big Al again:

It also helps to have experienced people on board:

Ultimate Bet Scandal Lawyer Daniel Friedberg at Centre of FTX Crypto Crash

The poker world was shocked to learn that one of the main players in the FTX crypto crash is none other than Daniel Friedberg, the attorney who was in it up to his neck in the Ultimate Bet and Absolute Poker scandals of the late noughties.

Easan Katir writes:

An anecdotal tell with a sample size of one: When I was managing an emerging markets fund, while doing due diligence on the island of Mauritius I met a young fellow who looked a lot like SBF who was guaranteeing his investors that he would profit 50% each year. I advised him to never guarantee anything, since markets are…well, y'know, fickle. He didn't listen and kept repeating his guarantee, with the predictable result: big losses, angry investors.

What strikes me is the same body type: large round head, gangly, same slightly vacant expression… probably coincidence…

Penny Brown suggests:

All movie stars (Matt Damon) and celebrities (Giselle & Brady, Naomi Osaka) the new shoe shine boys Joe Kennedy warned against?

Nov

15

On virtue signaling, from Henry Gifford

November 15, 2022 | Leave a Comment

While Lance Armstrong was racing he tested positive seven times, but was let off the hook on technicalities, not all valid, each time. This was well known at the time, but few journalists mentioned it. As far as I know, among the few with the courage to mention it, none said “therefore he is cheating” or said “therefore he was cheating”.

During the years Lance and The US Postal Service team were winning The Tour de France year after year it was said that the team specializes in winning the team time trial (race against the clock) events that were part of the tour. As a former racer I wondered how that could be, as that event arguably does not require special skills different from the skills required for other events - probably fewer skills are required. I strongly suspect that they won those events with a lot of help from electric motors hidden in the bicycles, probably within the “disk” (streamlined) rear wheels. Maybe motor doping helped Lance in his other events as well.

Bo Keely adds:

i remember reading & studying something similar from you before. or, it could be that the electric clocks were fixed. a guy with a top hat used to walk through las vegas casinos & a device in the hat triggered jackpots to his associates. lance armstrong was the marty hogan of bicycling. people supported his cheating because they wanted a hero, and because his sponsors had so much invested in him.

Pamela Van Giessen writes:

The human animal craves heroes so we will go to a lot of lengths to support the illusion. Because admitting that heroism is an act, not a personage, is almost like refuting the existence of god.

Good people can do bad things and bad people can do good things. Too bad we have such a hard time wrapping our heads around this.

Laurel Kenner agrees:

Brilliant insight, Pamela. The idea is hard to embrace because it means confronting our own bad deeds. We all want to see ourselves as good people.

Nils Poertner comments:

in Vedic culture there is something like Maya- the fog …that we see through the world - everybody has a fog around him/her so we never meet - we just see through this fog…and some are more caught up in Maya than others.

Nov

15

Falling shoes

November 15, 2022 | Leave a Comment

the shoe keeps falling - use of the word fragility and integrity - admonition never to consider reducing service revenues:

Central Banks Get a Breather But Can’t Afford to Rest

charlatans always use poignant and fructatious words. all that was missing from article above was use of word "risk-on" and appeal to yoga and Taylor Rule and laudatory shout out to tall Paul Volker.

when the good one wishes to destroy the ants, he makes them fly:

The Stadium Branding Curse Hits Miami Heat’s FTX Arena

what market needs to constructal make 4000 is announcement by 45 that he's running again. this will increase the chances of 46 which is good for regulatory capture and buying of votes.

you cant have breakfast all day:

Trial By Jury & H.M.S. Pinafore

it was nice to see the evolution of a big con as described by Laurel in the previous link here on DS. they have evolved to specialization now taking on piano teachers.

mr trump lost in 2020 BEFORE the election. i have listed 50 reasons he lost starting with Pfizer holding back the announcement they had an effective vaccine and running thru the hunter biden suppression, and all the three letter agencies, and Dr. Fauci, and the professional sports leagues trying their hardest to do him in. It is unfortunate that no one told him to concentrate on the forces against him Before rather than After.

Henry George: does his theory that price of real estate lead stock prices down apply to industries? Tech firms also showed a preference for higher-end workspace, a move that they thought helped attract top talent and enable.

One might cite a theoretical speculative operation during the great swing in Bethlehem Steel from below 50 to 700 in the war boom of 1915 and 1916, or during the swing of General Motors stock in 1918 and 1919 from 106.75 to above 400.

– Beating the Stock Market by R.W. McNeel, 1926

Nov

15

Annals of Greenwich: A wedding scam, from Laurel Kenner

November 15, 2022 | Leave a Comment

A new post from Laurel Kenner: Annals of Greenwich: A wedding scam

Nov

13

Holbrook Working on price changes

November 13, 2022 | Leave a Comment

My work has made it clear that changes in a speculative price may profitably be regarded as arising from two classes of influence, namely disturbing influences and changes in price-relevant economic prospects; and that the disturbing influences generate chiefly negative autocorrelations among price changes, while changes in economic prospects generate positively autocorrelated price changes. The negative autocorrelations generated by disturbing influences occur at lags ranging from minutes to at least several days; changes in economic prospects generate positively autocorrelated price changes at lags within that range, and also at much longer lags.

the preceding letter was from Holbrook Working to VN on 4-11-1969. Holbrook Working, along with M. F. M. Osborne, was a giant in the speculative price arena of the 1930-1970 era.

S&P has risen a reasonable amount 6 days in a row and has gained 10% since 11-3-2022, such an event is exceedingly rare. indeed has occurred zero times since 1996. and twice above 10 big a day since 1996 is anything but random. it was slightly bullish in past.

Nov

10

A chart re-enforcing Vic’s #1 lesson, from Larry Williams

November 10, 2022 | Leave a Comment

72 years looks like more green than red to me:

Steve Ellison adds:

I have a similar graph on my Twitter page that I annotated with each year's most convincing reason to be bearish. There is always some plausible-sounding reason why the market should go down, but we see on the Senator's chart how much more green there is than red. I adapted this annotation format from a similar chart in Venita Van Caspel's 1983 book The Power of Money Dynamics.

Nov

10

Elections, big market moves, and fuddy duddies

November 10, 2022 | Leave a Comment

takeaways from the midterm: (1) fortunately for the S&P the senate wasn't reversed. (2) the betting odds were incredibly wrong for the 3rd election in row. (3) the senate probs switched from 75% r to 10% r in an hour. (4) the horse bet wisdom of waiting to bet near post time is shown.

second largest open ever up 120 big pts. only exceeded on 11-9 2020 when it was up 150 big pts at open. (how a little 0.1 change from expectations can create such big change. all we need is the useful idiot saying the fed must be resolute.)

it is fortunate for the outs that the D.O.L. is not responsible for the reporting of the CPI. if they tweaked it last month by 0.1 up, the outs would surely have lost both houses. with every market down about 20% from last month, was the 0.1 decline that surprising?

bonds at 124 at highest level since oct 17,2022. query: did the Commissioners at the fed forecast this and was that why they were adamant that bonds were going higher? stocks still at 20 day hi as 10-28 was 3948.

guaranteed to happen just like in the old days. when the buzz and media are most negative, time to buy, and the opposite. rite out of the books of the corners and propaganda of 50 years ago.

this is the second biggest rise ever in S&P, only 3-13 22 higher up 220 big. seems to be the greatest rise in wealth in one day ever as when bonds up 3 pts or more stocks were never up more than 100 big triumph of the optimists and proof that the market loves agrarian reformers.

alan abelson and the upside down man previously had the record for the worst advice on stocks of all time having lost hundred of billions for their followers. but their losses were over years. the fed people and their followers who have been beating the pessimistic drums. while it was guaranteed to happen, the question arises if they knew that such an increase in wealth was imminent, how many folks were induced to go into cash or reduce exposure to wealth because of their wrongful bearishness.

amazingly crude only up 0.60 after 5% decline in last 3 days. when the sun is shining , the agrarians make hay all around.

its the little things that the 3-letter agencies tweak that make the drift happen and get one off balance.

The Little Things You Do Together

i am thinking of the old fuddy duddies at the Metropolitan Club on 5th avenue who look out the window and cast dark grimaces at the Women with short skits and congratulate themselves on their disapproval and abstinence. The same must be true of all the governors at the Fed who have twisted all the weak longs out of stocks and bonds with their infernal pessimism and wrongful admonitions. Are they congratulating themselves like the boys at the Cosmopolitan?

the final shoe falls: “This time around, the Fed cannot step in and provide stimulus. So I don’t think it’s good news that we’re not going to get anything out of Congress over the next two years,” El-Erian said.

Nov

7

Mid-term election weeks

November 7, 2022 | Leave a Comment

Three predictions around election day: (1) we will hear much more about P. Pelosi after Tuesday. (2) the ray-ban sunglasses will be used much more frequently by the unifier. (3) based on patterns, the move from day of election to 2 days after is up 13 big or about 1.5%.

Last 6 midterm elections S&P 500 average move from open to close:

MON +3.38

TUE +5.70 (election day)

WED +8.95

THU +4.42

FRI -1.45

[Click image to open for full analysis showing S&P futures data for the mid-term election weeks from 1998-2018.]

Nov

3

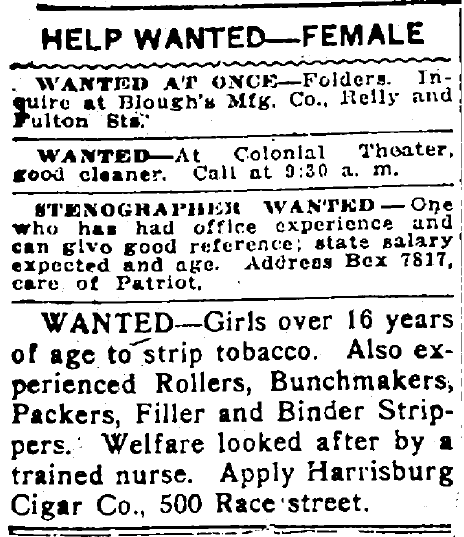

Want-ad indicator, from Henry Gifford

November 3, 2022 | Leave a Comment

The want ads are perhaps the most honest part of a newspaper – the editors have little say in what gets written. The obituaries are interesting to me. I hear they are written years ahead of time, except for the part about how and when the person died.

Bo Keely expands:

it brings out something i didn't know: check various market in the want ads. that's as sure as hobo's checking the 'help wanted' ads when he rolls into town and decides whether or not to stay.

it would seem to me, and i don't have time now or i'd do it, to be simple to study and test a few newspapers' classified ads to find something that correlates either to a specific or the general market. if something were found it would likely be consistent. beats the moon.

Nov

3

Markets, predictions, and announcements

November 3, 2022 | Leave a Comment

very small variations in S&P on Monday oct 31 , 3.5 a half hour versus normal var on 10 a half hour. largest change was 12 pts versus normal largest change of 20 pts. since a major purpose of markets is to move enough to force out weak with big moves that public can't requite. big moves and margin calls will force enuf of them out to feed the top infrastructures. the market will have to make it up with some extraordinary changes next two days [Nov 1-2]. hang on to seat belt.

takeaways from Powell's remarks: inspector general :inflation hurts those in poverty the most: amazing that someone with no economic training can talk such a good game.

"Give a thief enough rope, and he'll hang himself." all the traders that front run the announcement of an easing next month and bought when they got the news release or heard it from their colleagues at the Fed directly or indirectly were caught long and are blowing in wind.

interesting that both the most popular sports commentator and the most popular stock commentator, mad dog russo and mad money cramer, are both proud of their madness and both seem very ethical and both make numerous predictions that are valueless. guaranteed to happen.

nice move from 14:30 on nov 2 at 3899 to nov 3 at 10:00 AM am 3708 - 5% down in blink of eye - thereby making up for the lack of margin calls and volatility in previous days.

Mr. Powell emphasized the integrity of the Federal Reserve in his commentary on wed Nov 2. he spoke of the Inspector General's probity and independence. Will someone please contact the powers that be concerning the 12 pt S&P rise form 13:30 et to 14:00 right before the announcement? it wasn't chance the announcement seemed very bullish and it was obviously leaked. How was it leaked? its inimical to a fair market which is everybody's stated goal. billions were lost and made with the leak.

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles