Jan

31

Varieties to species, horses to bicycles to airplanes, and round numbers

January 31, 2025 | Leave a Comment

in reading The Origin of Species yesterday along with Scribners 1895 concerning the evolution of the bicycle industry to cars and airplanes I was struck with how the transformation of industries was similar to the move of varieties to species.

Having always had this mild mania for flying, I was much impressed a few years ago when some one said to me: “If you want to come as near flying as we are likely to get in this generation, learn to ride a pneumatic bicycle.” Then I began for the first time to take a serious interest in the bicycle upon which my eldest boy was so fond of scurrying around the country; and today I am only too willing to say all that I can in its favor. When one begins to tell why the bicycle is one of the great inventions of the century, it is hard to begin, because there is so much to say. A bicycle is better than a horse to ninety-nine men and women out of a hundred, because it costs almost nothing to keep, and it is never tired.

- Philip G. Hubert, Jr., in Scribners 1895.

apparently this subject has been well researched:

The Evolution of Industry 1.0 to 4.0 and Beyond

People have been revolutionizing the production and manufacturing industry for as long as mankind has been around. The changing of items being made and distributed in the home to transitioning to them being mass manufactured and distributed using machines and new technology is what we call the Industrial Revolution. There are four main Industrial Revolutions: coal, gas, electronics and nuclear, and currently the internet and renewable energy. These are also known as Industry 1.0, 2.0, 3.0, and currently 4.0. At the rate technology and knowledge is going though, is an Industry 5.0 soon to follow? If so when and what will that entail? Let’s look into each Industry and see how they have each helped shape and create the next.

the best description I can think of for the way the sp attempted to break the round at 6100 and waited to do so decisively was the way Jimmy Jacobs played handball, waiting 30 shots to hit a killer. can you think of a better example?

Jan

30

New Wiswell proverbs

January 30, 2025 | Leave a Comment

Some recently discovered proverbs of Tom Wiswell that apply to markets:

1. Often by the time the opening is over what is going to happen in the ending is already happening and cannot be reversed.

2. It isn't only the number of games you win that counts. It's the number of drawn games you don't try to win. In short, don't overplay a slight edge.

3. All the wins and draws must be in your head before they can be at your fingertips (or else how can you beat those who beat you to the price and pay 1/10 of commissions as you - VN).

4. Some players study too much and play too little. Unless you are an isolated player in the country, you should play and study in equal parts. Studying is the planning, play is the doing.

5. Games in commerce are usually won or lost in the first 10 minutes (moves). Have a good plan.

6. Take a writing pad with you and record your game. Go over the games - especially the losses - or you'll surely repeat them.

Tom Wiswell says that the greatest influences on his career were having his father reading Tom Sawyer to him.

Here is the DailySpec archive of Wiswell's proverbs.

Jan

29

From the archives: Mind Set! by John Naisbitt, from Steve Ellison

January 29, 2025 | Leave a Comment

Book Review: Mind Set! by John Naisbitt, from Steve Ellison, April, 2007

Some interesting bits:

- One trend is the continuing growth of China, which Mr. Naisbitt points out is quite decentralized: “Beijing pretends to rule, and the provinces pretend to be ruled”.

- While some fear that American culture is obliterating local cultures, Mr. Naisbitt asserts that the world is changing America more than America is changing the world, as more than 1 million legal immigrants per year enter the United States.

- In an intriguing tidbit, Mr. Naisbitt quotes Alan Greenspan as expecting private currencies to return by the end of the 21st century.

Steve Ellison updates:

That book was written in 2004, before bitcoin was invented (speaking of "private currencies"). Mr. Naisbitt is no longer with us, having passed on at age 92. The last thing I noticed him doing, in 2010 or so, was touting the emerging world as the most important story. In my opinion, A LOT has changed since then. We have macro experts on the List who would have much better insight, but I would start with Rocky's accurate prediction in 2016 that the Brexit vote was the canary in the coal mine for the post-Cold War global elite and their policies of globalization, mass immigration, and "cling[ing] to the religion and arrogance of knowing what is best for the common man — and which often also involves rejecting common sense and facts in evidence."

The decentralization of Chinese government finances is today a key reason why a massive economic stimulus from Beijing, as urged by many Western economists, simply cannot happen. The critical mass of government spending is in the provinces, and their governments are starved for revenue after the real estate bust. Christopher Balding writes frequently about all things China on X as @BaldingsWorld.

Jan

28

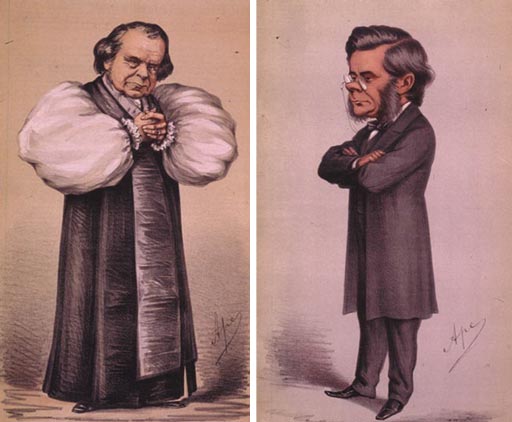

An anecdote which gave me a lot of pleasure

January 28, 2025 | Leave a Comment

An anecdote which gave me a lot of pleasure: Darwin wrote the origin in 1868 and in 1869 there was tremendous fervor and a meeting of 1000 people at the British Museum was called. Huxley as a defender of the evolutionists cause was persuaded to attend. Bishop Wilberforce was there. Professor Henslow was the chairman. The then Admiral Fitz-Roy, still and ardent fundamentalist was there. Darwin was absent. The Bishop spoke for half an hour and ridiculed Darwin and Huxley "but all in such dulcet tones, so persuasive a manner, and in such well-turned periods." However, the bishop showed himself to be quite ignorant of the details of Darwin's book and said, "I should like to ask Prof Huxley, who is sitting by me and is about to tear me to pieces when I have sat down, as to his belief in being descended from an ape. It is on his grandfather's or his grandmother's side that the ape ancestry comes in?"

The bishop concluded with the point that Darwin's ideas ran counter to the revelations of god in the scriptures. Huxley was reluctant to reply but eventually he said, "I am here only in the interest of science and I have not heard anything which can prejudice the case of my august client." He then demonstrated the bishop's poor understanding of Darwin's thesis and concluded with a reference to his descent from a monkey. "I asserted and I repeat that a man has no reason to be ashamed of having an ape for his grandfather. If there were an ancestor whom I should feel shame in recalling, it would be a man, a man of restless and versatile intellect, who not content with an equivocal success in his own sphere of activity, plunges into scientific questions with which he has no real acquaintance, only to obscure them by an aimless rhetoric and distract the attention of his hearers for the real point at issue by eloquent digressions and skilled appeals to religious prejudice."

The Bishop's remarks remind of chronic bear of the stock market and other useful idiots that I have not refrained from quoting.

Jan

26

Terrance Tau does a Bayesian worksheet, from B. Humbert

January 26, 2025 | Leave a Comment

First, Prof. Tau on the Philippines Grand Lotto.

An unusual lottery result made the news recently: on October 1, 2022, the PCSO Grand Lotto in the Philippines, which draws six numbers from {1} to {55} at random, managed to draw the numbers {9, 18, 27, 36, 45, 54} (though the balls were actually drawn in the order {9, 45,36, 27, 18, 54}). In other words, they drew exactly six multiples of nine from {1} to {55}.

Then, Prof. Tau on Bayes.

The Bayesian updating makes me think of predictions for the S&P for 2024 and how one would have updated these as the year progressed.

Asindu Drileba wonders:

Suppose the S&P can only return two values +1% and -1%. If it has returned +1% for day one and -1% for day two. The dataset would day the s&p returns are +1%, -1% so:

- Probability of going up (+1%) is 0.5

- Probability of going down (-1%) is also 0.5

Given the 2 day dataset of +1%, -1%. Now, suppose it is day 3 and the market goes up (+1%). How do we use Bayesian techniques to update the probability? In the ordinary way. The dataset would be (+1%, -1%, +1%). So update probability:

- Probability of going up, 2/3 (0.666..)

- Probability of going down, 1/3 (0.3)

I am not saying this is how Bayesian updates work. I am trying to ask members how it work's given the above toy dataset. There is a related video by Julia Galef called Bayesian thinking.

Khilav Majmudar writes:

I've learnt more about Bayesian probability from these two Tao posts than anything else I've encountered online. Thank you.

George McPherson responds:

I think this falls into the category of the law of small numbers. Relatedly, I just finished reading The Hot Hand by Ben Cohen and enjoyed it very much.

Jan

25

Teller of tales

January 25, 2025 | Leave a Comment

the book Teller of Tales: The Life of Arthur Conan Doyle depicts an energetic man with many talents, many of them shared with Sherlock himself.

This compelling biography examines the extraordinary life and strange contrasts of Sir Arthur Conan Doyle, the struggling provincial doctor who became the most popular storyteller of his age when he created Sherlock Holmes. From his youthful exploits aboard a whaling ship to his often stormy friendships with such figures as Harry Houdini and George Bernard Shaw, Conan Doyle lived a life as gripping as any of his adventures.

Jan

24

The anonymity of limit orders, from Humbert Q.

January 24, 2025 | Leave a Comment

Anonymity, Signaling, and Collusion in Limit Order Books

Álvaro Cartea, University of Oxford; University of Oxford - Oxford-Man Institute of Quantitative Finance

Patrick Chang, University of Oxford - Oxford-Man Institute of Quantitative Finance

Rob Graumans, University of Oxford - Oxford-Man Institute of Quantitative Finance; Autoriteit Financiële Markten (AFM)

Date Written: January 03, 2025

A key feature in the design of a limit order book is the anonymity of limit orders. However, we analyze data with trader identification and find that market makers break the anonymity of limit orders. Market makers use limit orders with large volumes to signal themselves to other market makers to avoid trading with each other and to snipe retail limit orders. We explain the behavior of market makers with a model that considers competitive and collusive equilibria. The model shows that the behavior of market makers we observe in the data is consistent with that in a collusive equilibrium where market makers use signals to avoid sniping each other's limit orders. Signaling enables market makers to share the benign flow from retail limit orders, and to share the additional benign flow from impatient investors who otherwise would have traded with a retail investor’s limit order.

Asindu Drileba writes:

I wonder how the markets would change if order books were opaque.

Jan

23

Biological Evolution

January 23, 2025 | Leave a Comment

Price on evolution is a beautiful informative book that every person interested in markets should read. magnificent summary of the three main stepping stones in Darwin's discovery: Lyell's Geology, voyage of beagle, study of Galápagos.

Here is Price's summary of what Darwin would say: "variation between individuals occurs in all species and is caused by the variability of environments to which a population is exposed - the slight variation that benefits an individual in its struggle for existence enables it to survive longer and reproduce more successfully than others." apply this to markets especially stocks.

Carder Dimitroff writes:

For those interested in historical details, Charles Darwin credited William Charles Wells as one of his precursors in natural selection and biological evolution.

[Wells] distinctly recognises the principle of natural selection, and this is the first recognition which has been indicated.

- Origin of Species, 4th edition

Stefan Jovanovich offers:

Pioneer of Natural Selection: William Charles Wells of Charleston

Jan

22

A Trader in Cotton: Morris Ranger, from Stefan Jovanovich

January 22, 2025 | Leave a Comment

Morris Ranger: The Rise and Fall of the Liverpool Cotton Market’s Greatest Speculator, 1835 to 1887

by Nigel Hall

In the period 1878 to 1883 there was heavy speculation in the Liverpool raw cotton market associated with a trader named Morris Ranger. Little has previously been written about Ranger and his background. Ranger was born in Germany and emigrated to the United States in 1855. He initially traded in tobacco but branched out into cotton during the American Civil War. He settled in Liverpool in 1870. His cotton speculations were enormous, but he fell bankrupt in 1883. The speculations associated with Ranger involved other Liverpool traders and drew heavy criticism from the spinning industry. The speculations played a part in a reorganisation of the Liverpool market and attempts to circumvent it, including the building of the Manchester Ship Canal.

This caught my eye because it was a parallel to what happened in NY during the Crews era with the railroads and the Adams' brothers Chapters of Erie.

In the late 1860s, the spectacular growth of the American economy created an unprecedented concentration of power. The corporate directors that emerged possessed tremendous amounts of economic leverage, and often they flagrantly abused it. The Adams brothers, Charles and Henry, were appalled by this unscrupulous behavior and sought to expose the financial machinations behind it. Charles examined the practices of those running the Erie Railroad while Henry focused on the efforts of Jay Gould and Jim Fisk to corner the gold market. The results of their work are the articles presented in Chapters of Erie. While the term "investigative journalism" did not exist in the Adams brothers' time, their essays show fine examples of it. The Adams brothers' well-researched, perceptive, and sometimes sardonic writing will appeal to anyone interested in the history of big business in the United States and how it affected economics and politics. Students of journalism, especially those with an interest in early muckraking, also will appreciate this groundbreaking work. All readers cannot help but notice a striking similarity between the corporate leaders of the 1860s and the financial power brokers who dominate today's headlines.

Jan

20

Price gouging

January 20, 2025 | Leave a Comment

price gouging - This week’s news affirms earlier reports from all of human history that price controls discourage producers, reduce supply and impose shortages that cause consumer suffering (wsj).

In Praise of Price Gouging

When demand far outstrips supply, unfettered prices are just what we need.

We should praise price gouging, not ban it. Yes, we should pass a new federal price gouging law—one that nullifies the many state laws prohibiting it.

The Problem with Price Gouging Laws

Is optimal pricing during an emergency unethical?

Many people feel price gouging is morally wrong. The remarks of newspaper columnists and state legislators provide ready evidence on this topic. Survey research by Daniel Kahneman, Jack Knetsch, and Richard Thaler, published in the American Economic Review, further establishes this point: most respondents found price increases during difficult times to be unfair, except in cases in which retailers were only passing along cost increases.

More recent research suggests that these unfairness judgments are driven primarily by emotional responses to the price increases. Careful examination of the ethics of price gouging raises questions for these emotion-driven judgments. The ethical case for limiting price gouging is weaker than it may appear.

Jan

19

Some guy built a complete AI-driven hedge fund, from Asindu Drileba

January 19, 2025 | Leave a Comment

Here is the original thread.

All of the agents show their reasoning so you can see how they work.

1 • Market Data Agent: gathers market data like stock prices, fundamentals, etc.

2 • Quant Agent: calculates signals like MACD, RSI, Bollinger Bands, etc.

3 • Fundamentals Agent: analyzes profitability, growth, financial health, and valuation.

4 • Sentiment Agent: looks at insider trades to determine insider sentiment.

5 • Risk Manager: determines risk metrics like volatility, drawdown, and more.

6 • Portfolio Manager: makes final trading decisions and generates orders.

Here is the GitHub repository.

Why would this work or be good at? Why would it not work? I don't think it will work since the same model will be used my many if successful and the gains will be cancelled out.

Larry Williams comments:

Ultimate curve fit - wait a year to know.

Hernan Avella writes:

This is absolutely the way to go, but there’s a bit more to what we get to call “Agent”. Also his quant module is looking at dumb shit.

Julian Rowberry responds:

horses had a good track record before cars. AI is making key opinion leaders redundant too.

Jan

17

Cold outside (and in)

January 17, 2025 | 1 Comment

In Galton's autobiography of 1909 he discussed a time in his Rutland London address when he felt it necessary to wear 15 articles of clothing to keep himself warm as there was no heat in his house. two of his prized monkeys died in that cold.

I had a similar experience in Conn on Thur Jan 16; the temperature dropped to 5 Fahrenheit and I had no heat nor a wife as she was in London. I froze all over. In a similar event in Chicago 65 years ago my pet Macaque died from the cold.

Jan

17

Look into the light, from Humbert Z.

January 17, 2025 | Leave a Comment

Why Scientists Are Linking More Diseases to Light at Night

Glaring headlights, illuminated buildings, blazing billboards, and streetlights fill our urban skies with a glow that even affects rural residents. Inside, since the invention of the light bulb, we’ve kept our homes bright at night. Now, we’ve also added blue light-emitting devices — smartphones, television screens, tablets — which have been linked to sleep problems. But outdoor light may matter for our health, too. “Every photon counts,” Hanifin said.

For one 2024 study, researchers used satellite data to measure light pollution at residential addresses of over 13,000 people. They found that those who lived in places with the brightest skies at night had a 31% higher risk of high blood pressure. Another study out of Hong Kong showed a 29% higher risk of death from coronary heart disease. And yet another found a 17% higher risk of cerebrovascular disease, such as strokes or brain aneurysms.

Nils Poertner comments:

Sleeping in a fully light-blacked-out room is indeed relaxing for the optic nerve and the brain.

That is why expensive hotels have proper curtains and cheap ones often don't. We can't change society but we can make individual adjustments (or at least at home).

Jan

16

Bear hopes, and a good book

January 16, 2025 | Leave a Comment

the hope of the bears was that jan 31 close would be LOWER than dec 31 close of 5935 so they could tout the Jan barometer showing bear and they could attribute it to their feminine champion not being there to raise service rates.

a good book by a good man:

My Years with General Motors, by Alfred P. Sloan, Jr.

My Years with General Motors became an instant best seller when it was first published in 1963. It has since been used as a manual for managers, offering personal glimpses into the practice of the "discipline of management" by the man who perfected it. This is the story no other businessman could tell - a distillation of half a century of intimate leadership experience with a giant industry and an inside look at dramatic events and creative business management.

but how the divisions survived with all those reports and restrictions one doesn't know. perhaps this is why they needed a bailout in 2008.

Jan

15

Maybe relevant to the issue of stops, from Humbert Q.

January 15, 2025 | Leave a Comment

How to Gamble If You Must: Inequalities for Stochastic Processes

This classic of advanced statistics is geared toward graduate-level readers and uses the concepts of gambling to develop important ideas in probability theory…. Following an introductory chapter, the book formulates the gambler's problem and discusses gambling strategies. Succeeding chapters explore the properties associated with casinos and certain measures of subfairness. Concluding chapters relate the scope of the gambler's problems to more general mathematical ideas, including dynamic programming, Bayesian statistics, and stochastic processes.

And a more recent paper:

How to Gamble If You Must

Kyle Siegrist, Department of Mathematical Sciences, University of Alabama - Huntsville

In red and black, a player bets, at even stakes, on a sequence of independent games with success probability p, until she either reaches a fixed goal or is ruined. In this article we explore two strategies: timid play in which the gambler makes the minimum bet on each game, and bold play in which she bets, on each game, her entire fortune or the amount needed to reach the target (whichever is smaller). We study the success probability (the probability of reaching the target) and the expected number of games played, as functions of the initial fortune. The mathematical analysis of bold play leads to some exotic and beautiful results and unexpected connections with dynamical systems. Our exposition (and the title of the article) are based on the classic book Inequalities for Stochastic Processes; How to Gamble if You Must, by Lester E. Dubbins and Leonard J. Savage.

Jeff Watson comments:

Only play cards with suckers, and never try to fill an inside straight. Never sit in a poker game with a guy named Doc. Never lay the points, stay away from sports betting altogether, never be the bank in a casino baccarat style game. Stay away from slots, casino pit games, you will get ground down by the vig.

There are only two bets I can afford in a casino. One is betting the pass/no pass line in craps, the vig on the pass is 1.414% and 1.36% on the no pass. Plus you can get bets behind the line. The other is the banker bet in baccarat where the house has a 1.06% edge. Even with the commission, it’s a good bet. Still, no matter what, play the game long enough and the vig will kill you.

The banker bet can be real good. Playing for an entire session as banker can cause one the embarrassment of losing everything then having the game boss ask very politely, “How do you plan to settle the commission?”

Jan

14

A job that might vanish

January 14, 2025 | Leave a Comment

"i see you referenced technical analyst as a job that might vanish in the next 50 years. How could you say that when Stanley Druckenmiller sold out his longs in Oct 1987 because the months of 1987 were similar to 1929?" and Bill Gross has been bear since 1950 Dow 800.

don quixote part 1, chapter 47: "it is you who are crazy not me for failing to see the value of moving averages and fibonacci series and head and shoulder patterns. even andy lo has found them significant as long as you don't consider the last 10 or 20 prices."

"have you not read Technical Analysis by John Magee? it you had the pleasure of seeing his 20 or so wize old men with slide rules and protractors following the trends and moving averages as I did in 1964 you wouldn't dare to question its staying power."

Mite I suggest that Dr. Magee's former headquarters in springfield mass 1 block away from Pembroke College be named as a National Monument and that he and his band of Brothers be placed in the t.a. Hall of Fame with the full honors that were accorded to Joe Granville.

Jan

13

Assessing causes

January 13, 2025 | Leave a Comment

an excellent study explaining moves of over 2.5% in all markets attributing the moves to monetary factors:

What Triggers Stock Market Jumps?

Scott R. Baker, Nicholas Bloom, Steven J. Davis and Marco Sammond, 9 December 2024

We examine next-day newspaper accounts of large daily jumps in 19 national stock markets to assess their proximate cause, clarity as to cause, and geographic source. Our sample of over 8,000 jumps, reaching back to 1900 for the United States, yields several novel findings. First, news about monetary policy and government spending triggers twice as many upward jumps as downward ones and a highly disproportionate share of all upward jumps. Second, upward jumps due to monetary policy and government spending are much more frequent after a stock market crash. In this sense, the “Fed put” emerged decades before the 1990s, extends to other central banks, and characterizes fiscal policy as well. Third, greater perceived clarity about the reason for a jump foreshadows lower market volatility. Clarity trends up over the past century and is unusually high for jumps triggered by monetary policy. Fourth, leading newspapers attribute 38 percent of jumps in their own national stock markets to US economic and policy developments. The US role in this regard dwarfs that of Europe and China.

daily moves of 2.5% in the HBS study but explanations of reasons for moves are retrospective and can't be objective. its a "monetary" reason rather than ineluctable random reason following a major decline.

one was looking for research on the fate of markets. one believes that underneath the upward drift of 10000 % per 125 years there is a fate factor that brings markets to fates like 100000 in bitcoin and 50000 in dji, 7000 in sp.

Jan

12

Recollections of a Cowpuncher

January 12, 2025 | Leave a Comment

Perhaps the basis for Lonesome Dove:

We Pointed Them North: Recollections of a Cowpuncher

Edward Charles "Teddy Blue" Abbott was born in England in 1860. He came to the United States in 1871, with his parents, settling around Lincoln, Nebraska. Teddy Blue is hailed as one of the greatest of the cowboys who brought herds of Longhorns north from Texas. His charming looks and rebel ways have forever etched him into Montana history.

Gyve Bones offers:

If a storm came along and the cattle started running — you'd hear that low, rumbling noise along the ground and the men on herd wouldn't need to come in and tell you, you'd know — then you'd jump for your horse and get out there in the lead, trying to head them and get them into a mill before they scattered to hell-and-gone [The cowboys would attempt to make the cattle run in an ever-tightening circle until they could no longer move.] It was riding at a dead run in the dark, with cut banks and prairie dog holes all around you in a shallow grave…

One night it come up an awful storm. It took all four of us to hold the cattle and we didn't hold them, and when morning come there was one man missing. We went back to look for him, and we found him among the prairie dog holes, beside his horse. The horse's ribs was scraped bare of hide, and all the rest of the horse and man was mashed into the ground as flat as a pancake. The only thing you could recognize was the handle of his six-shooter. We tried to think the lightning hit him, and that was what we wrote his folks in Henrietta, Texas, but we couldn't really believe it ourselves. I'm afraid it wasn't the lightning. I'm afraid his horse stepped into one of them holes and they both went down before the stampede.

The awful part of it was that we had milled them cattle over him all night, not knowing he was there. That was what we couldn't get out of our minds. And after that, orders were given to sing when you were running with a stampede so the others would know where you were as long as they heard you singing, and if they didn't hear you they would figure something happened. After awhile, this grew to be a custom on the range, but you know, this was still a new business in the seventies and we was learning all the time.

- Teddy Blue Abbott, We Pointed Them North, Recollections of an Old Cowpuncher, 1939

Jan

11

Dimson, Staunton & Marsh: Global Investment Returns, 2024

January 11, 2025 | Leave a Comment

UBS Global Investment Returns Yearbook 2024, Summary Edition

The online version contains the entire Chapter 10 from the full book:

Corporate bonds and the credit premium

Corporate bonds are a major asset class with an outstanding value of some USD 44 trillion, almost half that of the value of global equities. The return to a higher interest rate environment has led many investors to re-consider their merits. This new chapter is thus timely in presenting long run evidence on corporate bonds since the 1860s from both the US and UK. Even very high-quality corporate bonds have offered a significant credit risk premium. The premium from high-yield (or junk) bonds is appreciably higher. Yield spreads of corporate over government bonds incorporate this premium but are not a measure of the expected premium because they also encapsulate expected default losses. This chapter reports on default and recovery rates over the long haul and reviews the determinants of yield spreads and default rates. Finally, it examines whether factors can help boost corporate bond returns and provide positive premia.

Charles Sorkin wonders:

The $44T estimate of the market value of corporate bonds sounds suspect. (To me, at least). I see that UBS cites some SIFMA data to produce a donut chart of US outstanding debt, but one wonders if they are including all manner of dubious Chinese securities that are effectively beyond the scope of most developed market investors.

Jan

10

Energy, from Carder Dimitroff

January 10, 2025 | Leave a Comment

I believe 2024 will be remembered as the year of great awakening. First, the so-called "hydrogen economy," pushed by several administrations and countries, is struggling. Plug Power, Ballard Power, Bloom Energy, and Hyyvia have all experienced losses and related financial challenges. Wood Mackenzie warns that green hydrogen projects are near collapse, with several projects likely to be canceled or deferred (how does it make economic sense to consume electricity to make hydrogen, compress it, move it, store it, and then consume it to make electricity?).

Second, Big Tech is colonizing local power grids at a scale and speed few anticipated. Policymakers are slowly realizing that demand is eclipsing supplies, and at the current rate that demand grows, supplies will quickly be exhausted.

Third, there are unrealistic expectations that the industry can respond in time to avert troubles by increasing supply. Many assume that energy supplies are commodities and can respond to market forces. With new baseload power projects taking at least five years and an average of ten years to initiate and complete, the only realistic option is to manage demand. This conclusion presents significant implications for Big Tech and local consumers.

Like biotech, the electric and gas industries will face an uncertain future in 2025. In the United States, states and Regional Transmission Operators have ultimate control, with the federal government's role limited to providing economic incentives. Consequently, the nation will likely witness various responses depending on local interests.

In any case, Big Tech's demand for power may be severely checked. If investors see unlimited growth in AI and related technologies, they may want to consider the challenges.

The alternative is less pleasant. If Big Tech successfully colonizes the nation's grids to the needed levels, the price of electricity and gas for other industries, commercial properties, and residential consumers will jump, resulting in more inflation.

Either way, the current situation is not sustainable. Solutions will be implemented in 2025 and beyond, but new nuclear power and transmission lines will not be among them for several years.

Remember that there are always winners and losers in energy; there's rarely an easy win-win opportunity. Higher prices produce substantial margins for those previously invested. For cost leaders, supply-demand mismatches present a happy outcome at the bottom line. Even marginal assets, like old nuclear and coal, could become more attractive. However, pipeline capacity issues could create growing challenges for natural gas assets.

The consumer is at risk. Self-generation is attractive to upper-income consumers. Avoiding the purchase of any watt-hours at any time of the day could produce significant savings.

Stefan Jovanovich writes:

The appeal of the income tax was that it promised a tiered system of pricing - i.e. the rich would pay more. There could be an Americans First progressive movement in this century that demanded the same system of pricing for electricity, health care and other services that have become rights. The "average" Americans could pay one rate; the corporations and wealthy users could pay a higher one.

A question for CD. Assuming that politics produces an Americans First tiered system for utility and other pricing where the "average" Americans are guaranteed priority over the large volume consumers, what would the effects be for the utilities? Don't current rate structures give large users a unit discount because they provide so much more demand?

Carder Dimitroff responds:

Remember, a utility's primary mission is/should be to rent its wires or pipes. Every wire and pipe used by utilities in the United States is economically regulated to ensure its owners earn a margin above its levelized costs. Theoretically, utilities' gross margins for wires and pipes are guaranteed no matter how individual tariff books are constructed.

In states where utilities have not deregulated their power plants, utility commissioners may create sophisticated tariffs where utility returns consider the combination of wires, power plants, commodities, and services. If a utility upsets its state commissioners, it could see margins thinned. This frequently happened with nuclear utilities when they delivered new power plants late and over budget. But the penalty is temporary; their full returns were restored later.

Tariffs are [intentionally] complicated. Large power users are frequently offered a break on their energy costs. However, they pay more for services that are not charged to residential consumers. Historically, one hefty example has been the utilities' demand charges, which large consumers hate. Another is for power factor charges, which require large customers to actively manage how they consume energy. In addition, many states require large power users to pay the utility for their capital costs to place transformers on customers' properties and to compensate utilities for stringing high-voltage power cables to those transformers. However, every state is different, and utilities within states negotiate different tariffs.

Big Al adds:

AI Needs So Much Power, It’s Making Yours Worse

AI data centers are multiplying across the US and sucking up huge amounts of power. New evidence shows they may also be distorting the normal flow of electricity for millions of Americans, threatening billions in damage to home appliances and power equipment. 75% of highly-distorted power readings across the country are within 50 miles of significant data center activity.

Jan

9

The Money Masters, from Asindu Drileba

January 9, 2025 | Leave a Comment

The Money Masters by Bill Still

Documentary about the creation and history of the modern central banking system. I learned so much from it. So many interesting reading recommendations, historical insights. It's my exact kind of documentary. Very long (3 hrs +), almost no cliché information & made before the year 2000. It checked all my boxes.

Jan

8

From the Archives: Winning Ugly

January 8, 2025 | Leave a Comment

Winning Ugly, reviewed by Vic

After my recent writings on such things as social insects, evolution, cladification, hydraulics, technology, roulette, marketing, herding, communication theory, herding, piracy, military strategy and opera, I felt it was high time to return to the one thing that I really know about — the lessons from racquet sports. Thus, it was a pleasure to come across the 1993 book on the mental game of tennis, Winning Ugly by Brad Gilbert and Steve Jamison. We all have much to learn from any book by a player who beat Conners and was confronted by him in the locker room afterward in his jockstrap shouting, "You shouldn't be on the same court with me!" and whose victory over McEnroe prompted McEnroe vow to quit the game forever at the age of 27 (and actually do so for six months) or who beat Boris Becker while Becker cursed in German about the humidity and the low-flying planes.

Indeed, the subject of the lessons from games is one of the most valuable for all specinvestors because games are developed to teach us through childhood play the universal things that will help us become competent in our life. To keep it simple, here are 11 useful lessons that I learned from Winning Ugly:

1. Keep the eye on the ball. Gilbert recommends forgetting about the player and following the ball on the serve. I tried it and found that it gives you a split second of extra starting time that is key to proper positioning. I would suggest that this is analogous to watching the open rather than the call. So often , we wait for that great or terrible opening call to be realized, or that terrible reaction to the number that you know should ensue, and miss the trade entirely.

2. Bring proper equipment to the game. Gilbert has a list that for openers includes water, eight rackets (including two with lower and higher tension), energy food, Ibuprofin, Flex-All, chemical ice, towels, sweatbands, extra grips, shoelaces, Band-Aids, cap with visor, dry shirts, socks and sneakers, and pen and notebook. What do you bring as a trader to the opening of the game? Might I suggest that if Gilbert will go all out to win $5,000 in a match, your own efforts to prepare for the trading session might be just as careful? Be prepared with everything you conceivably might need — make up your own list — but strangely, many of the same items that Gilbert mentions might be useful. I would add such things as studies, financial numbers, position sheets, previous games against your trading opponent, a plan for the day, a limit as to how many and where you will trade, alternate communication links, a backup personage for when you leave the room, a phone intercept, music and food.

3. Keep a notebook handy at all times to record your thoughts about your opponent. Gilbert does this during the game, and I would suggest that this would be an excellent thing for specs to do — but your good ideas will come to you at all times. Carrying a notepad has the further advantage of convincing those you have contact with that you are a man of respect.

4. First points are key. Gilbert says that among top players, the person who takes the lead first wins 85% of the time. He believes that an early lead gets the adversary to play defensive and overly pressing tennis. I believe that in trading when you start out with a profit you become much stronger during the rest of the match as you can withstand a greater loss, and the adversary has to extend himself much greater with his mini-booms and busts to squeeze you out.

5. Practice hard before you play. Gilbert has a most unsportsmanlike workout he likes to go through which I deplore, involving getting your opponent to hit it to you first at the net, then hit you lobs and cross-courts and serves so that by the time you play the game you're thoroughly warmed up. I like the idea of preparing everything in advance, even to the extent of entering your orders before the session starts so that you won't, in the heat of the moment, miss the big ones. Certainly you should go over all conceivable contingencies before the game starts.

6. Some points are much more important than others. Gilbert believes that these are the advantage points and the points that lead up to them. My friend Martie Riesman, the champion table tennis player, believes the same thing, and so did Christy Mathewson in Pitching in the Pinch. To me, every point is key, but who am I to argue? Certainly there are key times in the market, I would include the first 20 minutes, the intervals before 11 a.m., and the opening relative to the call as key points here. Also what the market does at the beginning of a period versus the end.

7. Recognize your opportunity. Analyze what's involved, then capitalize on it. That's the Gilbert formula that he applies before, during and after the match. I guess this would be similar to what I consider the key to the spec world: Ask the right questions and then test. But the recognition part, trying to keep an open mind as to when, what and where the questions come from, would augment my guidelines, and it's something that I'll try to improve upon.

8. Be your own doubles partner. Partners in a good doubles team talk to each other about 90 times during a match. Do remind yourself to do the right thing, to prepare for your opponent's strengths, to move to the right position, to give the key points your all during the trading day.

9. Play to your opponent's strengths and weakness. This is key to Gilbert's success. And he has guidelines for playing against the retriever, the player with speed, the attack to your backhand, the good server, the excellent return of serves, the serve volley player, the weak server, the lefty and the heater (the player who makes the point last less than 3 seconds the way they do at Wimbledon). Think of who is on the other side of your trades — is it a dealer or a market maker, a chronic, a charlatrendist? — and act accordingly. Have a plan for dealing with each.

10. Learn from the experts. Gilbert has a chapter on what he learned from Agassiz (hit them on the rise), Lendl (vary the pace), Connors (go for the opponent's weaknesses and return serve properly) Becker (go for the lead and be aggressive). There are many books about how the experts trade. I would think that most of the material in such books is promotional or misinformation, but occasionally in an interview or by analyzing their objective actions, say in the positions of trader's reports, you can glean some information that is not out of date or designed to mislead.

11. Be tournament-tough. Here's a potpourri of catchwords from Gilbert: desire, dedication diligence, mental management, get the early edge, play smart, don't let the other player upset you, have a plan for every aspect of your tennis, mental preparation, stretching warm up, the start of your match, don't rush. All these things are key to success.

Gilbert is to be complimented on a masterful book. Everyone who's seen Gilbert play has the same reaction: "How the Hades did this man win? He hits like a caveman!" I can think of no type of player better to learn from. Anyone who reads Winning Ugly and applies the lessons to his own games and pursuits will find many beautiful outcomes arising from this ugliness.

Jan

7

Tips

January 7, 2025 | Leave a Comment

the sage says don't follow tips, and the palindrome cautioned me not to follow his tips, especially when they were on tv. yet the most successful investor I knew in my 65 year foray into investments followed every one of them very successfully.

i have two tips I received at a recent lunch with a very successful and knowledgeable biotech investor - Crispr and Biomarin - both are down about 1/3 last 12 months.

the worst experience i had on tips came when I was writing for MSN with Miss Kenner. the tip was to buy a company that was a consolidator. their last consolidation involved a garbage disposal company. i posted this in my column. the next day the stock opened -15%.

it turned out the tipster took the occasion to unload his holding of the stock the next day. He had recently recovered from a year in Jail with his only complaints being they didn't serve kosher food. he sensed how easy it was to sucker me.

i used to trade 2000 gold contacts with impunity. the position reached a critical stage in 1981 in the midst of the Polish crisis. fortunately I had as a partner at that time a Prof at Harvard who was very close to the dean who had been an ambassador to Hungary.

My partner transmitted to me that Russia had to combat this insurrection. I sold out my long position based on this tip. the next day Russia didn't go in and gold went up 10%. as this happened some 50 years ago, some of facts may be off but the gist is true.

bring bak to mind the old horse racing tip joke of 78 years ago. it ends with not following a tipster's suggestion that turned out rite 3 times in row. finally he asks me for pop corn and I bring him bak cracker jacks. "you know I cant digest cracker jacks. i have false teeth."

"i thought i should fade you this time"

Jan

6

AI-Powered (Finance) Scholarship, from Humbert X.

January 6, 2025 | Leave a Comment

AI-Powered (Finance) Scholarship

Robert Novy-Marx, Simon Business School, University of Rochester; National Bureau of Economic Research (NBER)

Mihail Velikov, Pennsylvania State University - Smeal College of Business; Pennsylvania State University

Date Written: December 16, 2024

This paper describes a process for automatically generating academic finance papers using large language models (LLMs). It demonstrates the process' efficacy by producing hundreds of complete papers on stock return predictability, a topic particularly well-suited for our illustration. We first mine over 30,000 potential stock return predictor signals from accounting data, and apply the Novy-Marx and Velikov (2024) "Assaying Anomalies" protocol to generate standardized "template reports" for 96 signals that pass the protocol's rigorous criteria. Each report details a signal's performance predicting stock returns using a wide array of tests and benchmarks it to more than 200 other known anomalies. Finally, we use state-of-the-art LLMs to generate three distinct complete versions of academic papers for each signal. The different versions include creative names for the signals, contain custom introductions providing different theoretical justifications for the observed predictability patterns, and incorporate citations to existing (and, on occasion, imagined) literature supporting their respective claims. This experiment illustrates AI's potential for enhancing financial research efficiency, but also serves as a cautionary tale, illustrating how it can be abused to industrialize HARKing (Hypothesizing After Results are Known).

X. Humbert comments:

Jan

5

Two investors

January 5, 2025 | 2 Comments

A very wise investor and an old washed up man

Jan

4

The Influence of Sea Power Upon History

January 4, 2025 | Leave a Comment

Alfred Thayer Mahan: “The Influence of Sea Power Upon History” as Strategy, Grand Strategy, and Polemic, by Thomas Jamison

No book has had greater effect on the composition of and justification for industrial navies than Alfred Thayer Mahan’s 1890 The Influence of Sea Power Upon History, 1660-1783. Indeed, it is likely true that no other piece of “applied history” has been as successful (for better or for worse) in the making and shaping of U.S. national security policy; George F. Kennan’s 1947 “X Article” comes to mind as a comparable example. Written during a period of U.S. naval reform and expansion, Mahan’s research is at once a parochial argument about the need to revitalize U.S. “sea power,” and a broader account of the relationships between the ocean, trade, and national strength. Many critics have read Influence as transparent propaganda for a domestic audience or a set of dated prescriptions about naval strategy. True, the book is both of those things, but Mahan’s account of Atlantic imperial rivalries is also more valuably an “estimate of the effect of sea power upon the course of history and the prosperity of nations.” That form of comparative and nomological history makes Influence a strategic classic of enduring relevance.

This essay leverages Mahan’s personal correspondence, archival sources, and an extensive body of commentary to explore the content, creation, and reception of Influence. In doing so it encourages readers to consider the text through three lenses: polemic, naval strategy, and grand strategy. Like a piece of stained glass held up to the light, the Mahanian concept of “sea power” is many things at once, depending on one’s perspective. In a narrow sense, Influence is a specific argument—a polemic—aimed at fin de siècle “navalists” about the necessity of expanding the United States Navy (USN). As an analysis of purely naval strategy, it is also a thesis emphasizing concentrated battle fleet engagements as a means of achieving command of the sea. Most importantly, however, it is an outline of a grand strategy bound up in a national turn toward the maritime world.

Jan

3

Five-year US load growth forecast, from Carder Dimitroff

January 3, 2025 | Leave a Comment

1 GW = about 1 nuclear power plant

Five-year US load growth forecast [for power] surges to 128 GW

U.S. electricity demand is forecast to increase 15.8% by 2029, according to a new report from Grid Strategies. Six regions of the country are driving the growth

The report's load growth estimates are based on annual planning reports submitted to the Federal Energy Regulatory Commission by electric balancing authorities and updated with additional data from utilities and planning regions.

Consider this question from another list member: What would happen to the grid if Silicon Valley companies found technologies a decade hence that would provide similar server services with less electric power?

Answer 1a: The utility could face stranded assets, including underutilized power plants, transmission lines, substations, and distribution systems. Remember that most utility investments are 30-year-plus assets, are leveraged, and have their levelized costs, plus margin, firmly embedded in utility bills.

Answer 1b: How would investors hedge their position if they considered building a $1 billion gas turbine in states that deregulated their power plants?

David Lillienfeld responds:

Basically, you're going to see a mismatch between where demand from data centers are and where there's generating capacity. You can build demand a lot faster than you can build supply though, and if you get efficiency on the demand end, you have overpriced supply relative to the ability of the region to pay for the power generated. At some point, someone's going broke.

But here's the curious question–how much economic activity can be attributed to a server building? It's like a parking lot for data–nothing more than that. And if there isn't that much taxable revenues that it's generating, what's the appeal to governments–the risk for the electorate of holding the bag at the end of the day is non-trivial it would seem. So what's the appeal?

Henry Gifford writes:

In other industries power saving strategies are known but not adopted yet, but could be at any time without much warning.

Take cars for example. I heard that in about three years the whole car industry in Europe is going to switch from the now-standard twelve volt electrical system (actually about fifteen volts) to seventy-six volts. One advantage of voltage about five times higher is that electric motors can be about one-fifth the size they are now. This includes the starter motor used to start the engine, the motors used to raise and lower the windows, the heating/cooling system’s fan motor, the engine’s cooling fan motor, the alternator (which is basically a motor wired to work in reverse), and others. As motors are made in large part from Copper and rare earth magnets, smaller motors can save a lot of money. Another advantage is that the wires, usually made from Copper, can be about one-fifth the cross sectional area. Another advantage is that some things typically driven directly off the engine by rubber belts, such as the air conditioning system’s refrigerant compressor and the power steering pump can instead be driven by a small electric motor that can be located anyplace the designer chooses, instead of now having to be located in line with a belt wrapped around part of the engine. Shrinking all these things would make the car lighter, saving fuel. Voltages higher than seventy-six would of course extend these advantages in an ever-diminishing way, but be more capable of going through a person’s skin, thus seventy-six is thought to be the best choice.

The problem is, I heard the three year prediction about twenty years ago, and a few times after that, but not more recently than about ten years ago. So maybe it won’t happen anytime soon, or ever, but the technology and advantages are well known and waiting to be used.

Similar changes could gradually or suddenly drop the power used by data centers.

Jan

2

Water Into Wine, from Laurel Kenner

January 2, 2025 | Leave a Comment

Maybe Jesus, in his hidden character as humorist and Zen master, was telling us to savor what’s really good for us.

Read Laurel's full post.

Jan

1

A musical New Year’s card, from Laurel Kenner

January 1, 2025 | Leave a Comment

Laurel’s musical New Year’s card

Laurel Kenner performs 1st movement of Mozart Sonata in F major, KV 332.

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles