Jan

10

Original music from Duncan Coker

January 10, 2026 | Leave a Comment

Duncan Coker - Roadside Attractions

Duncan Coker likes to leave a little distance between himself and the characters that narrate his songs. That way he’s free to imagine himself as a long haul trucker, a cowboy or a young singer with dreams of a Nashville music career. He can put himself back a decade, feign an accent or wind up on a different side of the continent. Whatever it takes to move the story forward. What else is songwriting but real feelings channeled through fiction? Every character a sideways version of its author but in another multiverse.

Still, Coker’s songs are true-to-life. He keeps his antenna up, always looking for the signals in the noise. He is a stenographer of the human condition. You might even catch him in the dairy aisle, thumb-typing a phrase he overheard into his phone, destined for a spot in his next verse. Coker’s songs also grapple with the realness of life—the loss of his father or his love for his wife Julie. He enjoys the puzzle of conveying big emotions with a few choice words that rhyme.

Jan

7

News, from Duncan Coker

January 7, 2026 | Leave a Comment

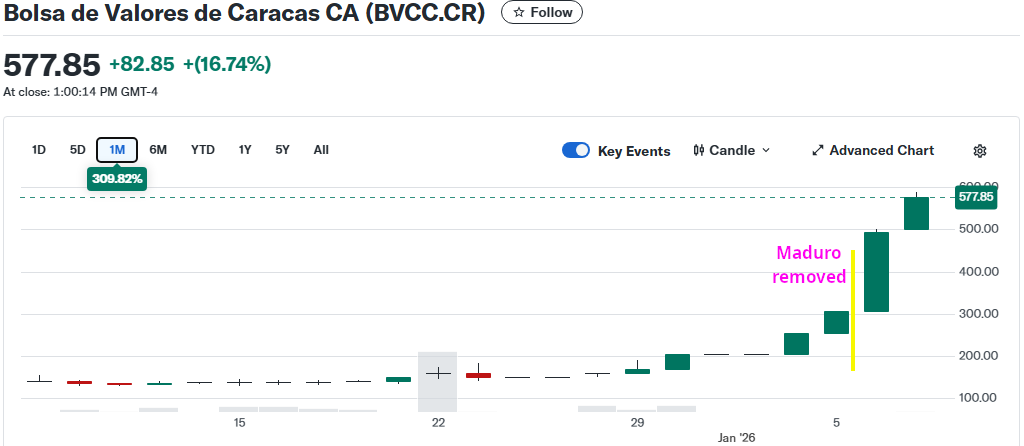

Interesting 40% move in Caracas stocks the days Before the capture. It is as if someone knew about the plans and acted on that information. News follows the markets as Larry has taught us.

Nov

6

Percentages versus discrete values, from Duncan Coker

November 6, 2025 | 1 Comment

I notice how journalist select for stories to use percentages versus discrete values to server their own interests and the "public" is easily confused. Today, they pick the number nearing 1T to describe Mr. Tesla's pay which seems high. But they could have framed the story as he could be raising his ownership to 12% to 25% of a company he founded. Not much of a story there. Other places like crime statistics they usually go with the %. As in violent crime has risen 100%, this could mean 1 homicide to 2. Without the data with percent's the conclusions are obfuscatory. Percents can never go down more than 99.9%, but they can rise by an infinite amount. This fact also leaves much room for spurious selection.

Oct

28

Risk, from Duncan Coker

October 28, 2023 | Leave a Comment

It seems a misnomer to call longs bonds risk free. Indeed the default risk is near zero, but the interest rates risk is wilder than a bronco at Montana rodeo. Credit risk is also a factor with potential downgrades. Which begs the question will risk premiums decrease equity vs bonds. Which asset class is actually carries more "risk"" on an annual basis.

Big Al asks:

Are long bonds (UST 30s) referred to as "risk free"? I think of the "risk-free rate" as Treasury bills. Whereas with bonds, doesn't longer duration equal greater risk?

William Huggins responds:

the risks of a long-term contract are mostly in getting out early at a bad time (and thus having a holding period yield lower than YTM), default, and of course inflation. if you hold to maturity (liability matching for instance) then the first risk vanishes but the last two remain. in gov bonds, the second risk also vanishes but the third becomes all important since a gov can promise to give you 1000 currency units but makes no reps about what that will buy at maturity.

Hernan Avella writes:

Interest rate volatility is only a problem for people who don't know how to immunize the risk. One should always match the investment horizon to the duration of the bond holdings. To quote Campbell and Viceira:

In financial economics a one-period indexed bond is usually thought of as riskless. Over one period, a nominal bond is a good substitute for an indexed bond, and thus by extension the riskless asset is often identified with a short-term nominal asset such as a Treasury bill. In a world with time-varying interest rates, however, only the current short-term real interest rate is riskless; future short term interest rates are uncertain. This makes a one-period bond risky from the perspective of long-horizon investors. For such investors, a more natural definition fo a riskless asset might be a real perpetuity, since this asset pays a fixed coupon of one unit of consumption per period forever.

In practical terms, given that we do live in the most powerful country in the history of the world and this country issues indexed bonds. For a long term investor, a TIPS ladder to finance your long term consumption is the riskless asset. Which should be 100% of the portfolio of the infinitely risk averse investor with zero intertemporal elasticity of substitution.

Kim Zussman reflects:

The most risk-free state is death because nothing worse (or better) can happen to you. Less severely one likes to lay on the floor. The cool hard surface is good for back pain and there is no further to fall.

Aug

20

Serial correlation, from Duncan Coker

August 20, 2023 | Leave a Comment

It would be interesting to look at the daily serial correlation of major markets last few weeks and months. I would posit it has turned positive or more positive than usual. I will take a shot at it. And if positive what does it pose for the coming days.

Zubin Al Genubi adds:

One of the the longest stretch of lower lows consecutive or nearly. 1986 had 8 down days in a row.

Big Al computes:

Rolling 60-tday autocorr for SPY back to 2018:

Looking at the calendar on Daily Spec made me wonder about this: SPY - Rolling count of down days in every 20 trading days:

Mar

6

Term structure 101, from Duncan Coker

March 6, 2023 | Leave a Comment

Futures prices, particularly financial futures like S&P and Bond prices, have a relationship to the cash markets which can be arbitraged. It is a function of cash flows usually interest borrowing costs and dividends, but it depends on being able go short and long the cash/spot markets. My questions is this: seems to not hold in hard assets like crude where there is currently large backwardation. You can buy Dec 24 Crude at a large discount and have been able to do so for some time. Specifically, is it possible to short the spot market for crude? Is there a counterparty that will accept this trade? It seems that for term structures like crude futures, the prices are an actual prediction of supply and demand and not an interest rate arbitrage.

Zubin Al Genubi responds:

With crude, storage (or not to store) is part of the future price. I read there is a lot of Russian crude stored in ships now. I'm not sure how that figures in.

In backwardation (tight market) normally one buys the future waiting for convergence with spot. Selling spot- yes you can, but delivery is an issue.

Big Al ruminates:

Not sure what "shorting the spot price" would even mean, other than Zubin's point where you have to have crude for delivery. Doesn't the concept of shorting a contract inherently involve a future price point? You could have 1-day futures, but then the vig might be far more significant.

If we model it on stocks, then shorting spot crude would involve "borrowing" somebody else's oil and then selling it for delivery. But then you're just back to why futures exist in the first place, aren't you?

But speaking of the term structure of crude, I ran across this:

Forecasting WTI crude oil futures returns: Does the term structure help?

Abstract

Nelson-Siegel (NS) factors extracted from the term structure of WTI oil futures are shown to predict subsequent WTI holding period returns in-sample. This in-sample predictability is not diminished by augmenting with macroeconomic indicators or oil market specific predictors. Allowing the decay factor in the Nelson-Siegel model to vary over time improves in-sample predictions at medium horizon return forecasts. We conduct out-of-sample forecasting exercises on models that use NS factors, such as a simple two factor model that uses a composite leading indicator along with the NS decay factor, and a LASSO model that combines NS factors with macroeconomic indicators and oil market specific predictors. These models significantly reduce forecast errors relative to a no change benchmark across a range of return horizons and futures contract maturities. We also find consistent evidence that models that use the NS factors result in trading strategies with higher Sharpe ratios and better skewness properties than buy and hold strategies and historical mean strategies.

Relatedly, the Nelson-Siegel model.

Nov

17

FTX surprise

November 17, 2022 | Leave a Comment

H. Humbert writes:

I find it amazing that an exchange with monopolistic market making, and no Manning Rule equivalent can ever lose money. As bad as stealing customer funds to cover trading losses sounds, I wonder if there's even worse to come because it sounds so incompetent. However, once again the value of crypto to nefarious actors is demonstrated by the 'asset classes' anti-fragility. Some flavor of the notion of honor among thieves.

Zubin Al Genubi replies:

Market makers can't handle big fast moves, of which we've seen some breathtaking one recently. I believe they are caused in part by the market makers and the ones who are just a bit slower get eaten by the lion. Of course this is sheer speculation on mu part.

H. Humbert comments:

With respect, your model of what a market maker is hasn't existed for about 15-20 years. Market making today is machine driven, speed of light kind of thing, and balanced/correlated across a firm's book. It is almost touchless for the most part.

So for example, if you are a Manning-Rule-free exchange, and you have your own internal market making operation that sees the flow first, you can, at the speed of light, see the direction of the order flow, front run it, sell into it, take the other side of the stupid trades ie the trades that are 'random' going against the flow that you are seeing, see the limit orders and the stop orders and run those etc etc. You see the flow first and decide how to execute against or with it or pass to the punters on the exchange.

It seems impossible to lose money at this and if you don't believe me, look at how few losing days Virtu and Citadel put up and they only get to see about 90% of just the retail flow in equities and they generally can't front run it. They can only decide if they want to take the other side or pass the order on to the market. Imagine if you had no fiduciary responsibility at all and no any kind of rule of best execution.

Anyway I go on and on, but point is, that FTX's Alameda lost money and a lot of it is very strange. Also, I should add, that I know absolutely nothing about crypto.

I can't help but notice that another of Vic's flags is prominent in this FTX story, and that's all the charity work they were doing. All while seemingly running some crazy embezzling thing to cover what? How were they generating these huge losses?

I knew a living human market maker at Schwab in the dot com era. His boss took and traded a single security(I won't name it) and split the rest of the book up. My living human associate got like m-z or something and one day he's long a zillion XLNX. Supervisor screams at him 'What are you and ANAL-IST?"–meaning what ever you think you know, get back to making markets and leave the positions to the buy side suckers. So maybe the losses are from directional market supporting efforts or some such.

Zubin Al Genubi suggests:

Maybe machine/com speed now determines winners?

William Huggins agrees:

can't see why that wouldn't be the case. on a precisely related note, a friend (ex-mit) gave a talk on algos in finance a decade ago, noting at one point how buildings were then being hollowed out to reduce microseconds of lag (i start the clip where its juicy).

H. Humbert writes:

This is one issue with co-location of servers at the exchanges, why it costs so much, why IEX markets a 200ms 'speedbump' to protect resting orders, why dark pools offer some very strange order types, etc etc but ultimately, the winners and losers imo, are determined by rent seeking in the regulations. Ban payment for order flow and Virtu disappears, ban internalization and Schwab has to charge commission, make best execution mean best possible all in price at the moment the order is received and all brokers will institute intermarket sweeps and order flow will go to exchanges, etc.

Stefan Jovanovich comments:

I hope H. Humbert will agree with this comment from the financial bleachers. The anti-trust laws, including agricultural marketing restrictions, have offered the same opportunities for rent-seeking around regulation without having any of the pushback from innovation - i.e. new and better ways to game the system. So, we have an age of inflation at the same time transaction and carry costs for retail customers have gone steadily down.

Duncan Coker writes:

This is a great description of the rent seeking infrastructure or "top feeders" as vic would say. It is all sell-side as that is where the stable income resides. Still as a lowly buy-sider if my choice is to get fleeced by the exchange/locals or the hft hedge funds I think I would go with the later. At least the hedge funds are competing against one other to steal from me. Don't even get me started with the wirehouses. Used to be 100 bp to execute/clear a trade back in the 80s, off exchange that is.

H. Humbert replies:

In the US equity world, which is the only thing I know anything about, the issue that that the HFT shops segment the order flow into smart and dumb and pay for the dumb order flow, which they get first look at and first dibs on off-exchange - through FINRA, which has it's own rules on order handling.

Segmenting the flow makes the rest of the market(not the internalizes, not the payment for flow(PFOF)), both lit and dark, more toxic in terms of adverse selection to resting quotes. This widens the spread, which makes internalization/PFOF more profitable - virtuous cycle kind of thing and also increases the concentration of who gets to see the flow first and decided where to fill.

Given the midterms, I think Chair Gensler has enough political capital to push through some of the rule changes he's been talking about: “Competition and the Two SECs” Remarks Before the SIFMA Annual Meeting

To me, the most likely significant change to get through easily is SEC's own Best Execution rule(amazing I know that there is none currently) and that could dramatically change where orders get filled. We'll see.

Sep

16

Federer adieu, from Duncan Coker

September 16, 2022 | Leave a Comment

Market declining in sympathy with announced retirement. I was lucky to see him play on several occasions. A great player and a great gentleman to the game. What a backhand, and what a forehand, serve, volley, footwork, strategy and touch.

Alston Mabry adds:

Farewell address, very classy.

Bud Conrad agrees:

Yes. Classy.

Laurel Kenner recalls:

My tennis teacher knew him and said he never swore.

Aug

30

Keeping charts by hand, an interview with Helene Meisler

August 30, 2022 | Leave a Comment

Big Al writes:

A fun and interesting interview with Helene Meisler who has been keeping charts by hand since the 80s.

Helene Meisler On What's Going On With the Stock Market Now

The Federal Reserve is in tightening mode. And there's that old adage "don't fight the Fed" which means in theory it's a bad time for stocks. And yet we saw a surprisingly powerful rally off the bottom in June. But now what? Can the market resume its ascent? Or will we return to the lows, or possibly make new lows? On this episode we speak to Helene Meisler, who has been trading stocks for roughly four decades, and who has a unique approach to analyzing the market. She draws stock charts by hand. In our chat, Meisler explains her methodology, and gives her assessment of the market right now.

Jeff Watson comments:

I still keep up my charts by hand, and I know at least 3 others on the list who do the same. Does keeping charts add value for those who partake in the practice?

Duncan Coker responds:

I would posit that the physical act of writing and drawing is beneficial. It improves focus and generates a sense of mastery and accomplishment, however small, both of which are good for trading. This is all in addition to the statistical information garnered.

Aug

30

Practical applications of counting beyond finance /trading, from Nils Poertner

August 30, 2022 | Leave a Comment

1. telling marauding children in back of a car (when on longer trips) to count number of green vehicles….and then red and so on (or let them experience boredom and don't give in and hand over a tablet).

2. for natural vision building -so ppl who lost ability to see far ahead (myopia), they would benefit from counting leaves of a tree or anything they can see - and don't worry if it is still blurry…it is getting better - coz nature rewards those who at least try….but once we believe something (that it can't get better - well, then it won't) - same for presbyopia (start counting tiny letters font size 1 btw).

counting can be wonderful for the brain and the brain is the motor that keeps it all together….millions of other applications. I wish ppl would do more counting - we are just going (as society) in the complete other direction. but the individual can escape that trend.

Vic comments:

very Galtonian who said "always count" and he kept a little pad and pricker with him at all times. counted the number of fidgets in the audience at 90.

Big Al offers:

I practice counting steps to measure distance, say around the park with the dogs, or on a hike. I count only lefts or rights (switching between the two at intervals) so that for me one "pace" is two "steps". I calibrated my pace counting against a wristband GPS and found that a mile is about 1100 paces for me.

Another practice is to count breaths, on the exhale, following the breath with one's attention. It is focusing and relaxing. One can calibrate one's breaths to measure time.

Nils Poertner writes:

love that counting for breathing - it is not that the drama outside does not exist, but in order to see things more realistically and go with probabilities also for trading… one better improve own mental health….. and many people (not just traders) are so fickle.

eg one of my trader friends would call me in the middle of the night and leave a voicemail that this and that is going to happen since he saw it on TV - mostly pictures that have a strong impact on his amygdala…

Zubin Al Genubi adds:

I count breathing 5.5 seconds in, 5.5 second out, 5.5 breaths a minute, and 5.5 liters per breath.

Andrew Moe writes:

I count seconds during cooking, particularly when operating on multiple dishes simultaneously. Also count seconds when trying to squeeze out an extra minute or two in the sauna.

Duncan Coker notes:

Watering the plants with a garden hose. 10 seconds about half gallon with my

sprayer.

Aug

10

The Count, from Duncan Coker

August 10, 2022 | Leave a Comment

Rereading the Count of Monte Cristo with my highs schooler, I am struck by the fact the all the virtuous characters are failures at business (ship owner, tailor, inn owner), while all the evil ones are great financial successes (currency speculators, war profiteers, state bankers). Of course the Count rectifies this. His fortune comes by way of a cardinal in Italy, a secrete cave and 14 years in prison. Perhaps the author's ( Alexandre Dumas) message is that every great fortune has a dark past. Maybe that was true in his day, but ones hopes that is not the case today.

Kim Zussman comments:

Socialism is as old as the bell curve.

Gyve Bones writes:

I'm reading this book too, and have found it really interesting. I picked it up because I'd seen two different film adaptations of the story, one starring James Caviezel, who a year later would portray Jesus Christ in Mel Gibson's "The Passion", and an earlier one from the 1970s. The two were so different in many details that I wanted to see the real story in the book. Both movies were good, each in their own way.

Like Les Miserables, by Victor Hugo, the Dumas story is about French society dealing with the ripple effects of the French Revolution. Both have heroes who are sort of New Christ figures. Both characters are unjustly imprisoned. In the case of Danton, the "Count", it was a case of a corrupt prosecutor during a time much like now, where Napoleon is in exile, and his alleged supporters still in France are being hunted down and imprisoned. It reminds me a lot of this nation, which has sent a former president into exile on an island off the coast of Florida, and there is an official inquisition into his affairs which is imposing punitive political prison sentences on his political supporters, and making it a crime to speak with the former president on the phone, in order to thwart any attempt to organize a campaign to return to office.

There's a point where the Count uses and extols the virtues of hashish which you might want to be prepared to discuss with your teenager.

Project Gutenberg has a very nice illustrated edition of the book available, which is helpful in imagining the scenes described.

I had trouble with the size of the illustrated ePub version for my iOS Books app on my iPad. It's 76 megabytes with the images included and it would crash the app. So as an alternative workaround, I downloaded the image free ePub into the Books app, and keep a web page open on the index of the images, which are named according to the page numbers in the book, and I view them as needed as I'm reading along.

Stefan Jovanovich responds:

Dumas pere was anything but a socialist. He was an aristocrat who was beyond snobbery and sentimentality. Good people regularly get screwed by thieves, frauds and liars; but then, so do the thieves, frauds and liars by each other. That is the "moral" of the novel. The Count succeeds in his quest for revenge by turning the bad guys against one another. He is a truly great figure, and the wiki page does him proper justice.

Dumas was neither a monarchist nor a Bonapartist. He was a republican and a Freemason. The novel makes that very clear; and it got Dumas in real trouble when a second Bonaparte became Fuhrer. Dumas had to flee France for Brussels, which also helped him escape his creditors. Read the wiki page; it is a beautiful exposition of an extraordinary life.

Full disclosure: One of the Stefan's weird (academics don't even want to discuss it) speculations about Ulysses Grant is that he was reading Dumas' novels when he was at West Point when he was supposed to be studying "tactics". Grant did not have a full duplex brain when it came to language and music; he taught himself to read German and French, but he found it impossible to speak or understand the languages when spoken. He loved music, but could not play it or read it as anything but notation (i.e. he could not translate the symbols on the page to sounds in his head). Hence, his joking about himself that he only knew two songs - one was Yankee Doodle Dandy and the other was not. The biographers all assume that because Grant had no verbal fluency, he had not read Jomini. He had; he also knew it was complete crap, but why say so except to start an argument? (Grant definitely did not have the legal mind or temperament).

Gyve Bones counters:

Straw men are easy to knock over. I did not assert Dumas was either a monarchist or a Bonapartist. In the same way, Hugo, son of a mother of the ancien regime and a father who was a Revolutionary, he was a melding of the two, and the novel sort of becomes a Hegelian dialectic about the synthesis which emerges from the thesis (the old order) in conflict with the anti-thesis (the Revolution). Jean Valjean is his synthesis, the New Man, a man of Christian virtues without Christ and the sacraments of the Church He founded.

Steve Ellison adds:

Dumas lived a high life and was chronically in debt despite having a number of bestsellers. I still remember one sentence from the book, "He was denounced as a Bonapartist …" It made me think that the first totalitarian society was Revolutionary France, but I hesitate to make such a sweeping pronunciation in the presence of Mr. Jovanovich. In any case, current efforts to make modern denunciations similarly career-ending are a grave threat to liberty.

Stefan Jovanovich agrees:

Great comment, SE. The French revolution - as an event - has a scale and complexity that can only be matched by the global war that began in Spain in 1936 and China in 1937 and ended in Korea in 1954. What Dumas was describing was its net effect: everyone in France had become so kind of spy and snitch. So, yes, it was the first totalitarian society; but you need to give the Citizen Emperor the same credit that Stalin and Hitler deserve for so thoroughly organizing the tyranny.

Bill Rafter offers:

Pardon me for coming in late to this discussion, but there is a mistake: The tailor was Caderousse, one of the three co-conspirators against young Dantes. That failed tailor then became the owner of the Inn at Beauclaire, who then murdered the jeweler. The Inn itself failed because its location was bypassed by a newly constructed canal. That leaves Mr. Morrel, who failed because he was in a highly speculative business (the hedge fund of its time) and was not diversified. However his successors in the business, Emmanuel and Julie were certainly righteous and successful. They retired to a nice home in Paris.

Stefan Jovanovich writes:

Not mine. Dumas was very much someone who believed that an honorable life was the only one worth living, whatever its financial costs or rewards.

Henry Gifford writes:

When I was growing up in a part of New York City that was populated by about half Christians and half Jewish people, almost none of the Christian adults owned a business – they had jobs. The one Christian adult that I knew owned a business did not attend religious services. All the Jewish adults owned businesses except a few that were involved in organized crime (professional level: state senator, state assembly, etc.).

When I was a child attending a Christian school, they made us sing a song that included the words “oh lord, do until me as you would do unto the least of my brothers”. I didn’t sing it, even though I was required to, as I saw it as a request for the all the worst things that happened to other people to all happen to me. As a child I thought this included blindness, loss of multiple limbs, leprosy, locusts (even though I wasn’t sure what those were) etc.

I have never had a mentor in my life. The closest I came were adults who advised me to “make sure you learn a trade so you will have something to fall back on”, who I made sure to steer clear of after I nodded and smiled and made good my escape. When I was 16 I asked my father what he thought I should do when I grew up. He suggested I go on welfare. I never asked again, or brought up the topic of what I was doing with myself, etc. When I was about ten years into writing a book, I showed the almost-finished version to my parents, figuring they should see it while they were still alive. The only comment they had was a harsh criticism of the grammar on one page, which they insisted I correct. The “incorrect” grammar was part of an insightful and charming passage written by Benjamin Franklin in the 1700s.

A few years ago I was walking past a Jewish community center near where I live in Manhattan. On the bulletin board outside I saw a schedule of upcoming lectures. One was titled “The Five Risks Every Entrepreneur Should Take”. I picture a member of the community that sponsored that lecture stumbling in business a little while being surrounded by people who are supportive, and who applaud the person for trying, and then for getting up and going at it again. I doubt any member of that community would ask the person who stumbled if she or he had made sure to first learn a trade to fall back on, or demand that children sing a song like the one I and my classmates were required to sing.

I still manage to do OK financially. Among other endeavors I own or am part owner of property in nine US states, soon to be ten, all worth much more than I paid (including the properties I am contracted to buy on Monday). And I have never “paid my dues” by spending years doing something I hate, or by gaining all the easily available advantages of being dishonest. But the Christian kids I grew up with? I can’t think of one who owns a business, and I can only think of two who likely have enough investments to carry them for long if they didn’t keep working at their job. And I can’t think of any who seem to enjoy or gain much satisfaction from that which they spend their day doing.

As for the emotional toll religion has taken on people over the centuries, suffice to say that someone once summarized the difference between the emotional state of veterans of the US military during WW2 vs. those who were veterans of the Vietnam War as the emotional state of Vietnam War veterans being the embodiment of the result of one generation of young men being lied to by their father’s generation. Likewise, young people being lied to about what economic decisions they ought to make, meanwhile a different reality is there for the seeing, also has its cost.

When growing up I spent time in Jewish households when I could, as the people there seemed to me to have an upbeat and healthier attitude, compared to the funeral home ambience I sensed in most Christian households. But, of course, most people growing up in the US do not have that opportunity, and fewer take the opportunity if available. Most are simply beaten down by the forces of religious insanity and stay down for life. Just today I was waiting for a train and a person nearby was shouting into her phone on speaker, describing in an upbeat tone her life that struck me as horrible, while she periodically mentioned that “god is good.” Not to her, I think, but I didn’t argue with her.

Bo Keely responds:

henry, this is interesting from our comparative angles. I’ll bet the few kids like u and I would say the same thing. as a child, I also rejected the ‘do unto others…’ because it included negative things.

i also had no mentor throughout life. when I eventually took a teacher test that required answering, ‘describe your first mentor’ I wrote about an admitted imagined mentor.

likewise, when I was sixteen, my mother asked, ‘what do you want to do in life,’ on receiving a selective service notice. It had never donned on me, so I replied, ‘be a veterinarian’ since that was my summer job. that’s how I became a vet.

and, i also have never ‘paid my dues’ to society figuring i never owed any. The only real money I ever made was in rental housing in Lansing, MI with a strategy of buy cheap complexes, fix them up, and rent to tenants receiving monthly checks directly deposited into my account. i still do well financially with 25 published books that sell, on average, one each per month. my financial secret of life is to have negligible expenses. I have gained satisfaction from each of dozens of jobs too, and never lived hand-to-mouth. it’s long-term gratification.

I have reacted to the lies of my father’s generation by retreating from Babylon into an anarchic desert town. each is an independent citizen who thinks god is a stinking mess in the sky, and one should learn in youth to take care of himself.

Kim Zussman adds a coda:

After the revolution apartments and land was confiscated and living arrangements made equitably* by central committees.

Los Angeles voters to decide if hotels will be forced to house the homeless despite safety concerns

*government jobs, military, connections, etc.

Jul

23

Books and BBQ, from Duncan Coker

July 23, 2022 | Leave a Comment

You have to admire a state that distinguishes is BBQ intrastate between eastern and western styles. Ole Time BBQ on Hillsborough in Raleigh serves an excellent example of the former for those in NC. (ie Stefan)

Reading The Boys in the Boat about the 1936 U Washington crew team and their journey to compete in the Berlin Olympics. Some great coaching and lessons from Ulbrickson the Washington coach. The downplaying of expectations before big races, "My boys are not ready for the race but they're the best we got", the quiet in the boatyard before the competitions, the practices at night in brutally cold conditions to avoid observation from competitors. The Stoicism in the face of victory and defeat.

Art Cooper responds:

I enjoyed The Boys of '36 by PBS on their American Experience series very much.

Jeff Watson adds:

I’ve been rereading Finnegan’s Pulitzer-Prize-winning Barbarian Days, arguably one of the best autobiographies I have ever read. The best surfing literature.

Nils Poertner writes:

good to read a book at all. most adults I know, in particular - males, and from a certain age onwards, say 40 - often give up on reading long text. why? hm, I guess visual stress during the day from excessive near vision these days so overwhelming (screen time), and made worse by poor visual habits etc (ppl don't blink enough when they read text etc) maybe other reasons, too. lack of curiosity etc.

May

1

Moral certainty, from Zubin Al Genubi

May 1, 2022 | Leave a Comment

Moral certainty is always a sign of cultural inferiority. The more uncivilized the man, the surer he is that he knows precisely what is right and what is wrong. All human progress, even in morals, has been the work of men who have doubted the current moral values, not of men who have whooped them up and tried to enforce them. The truly civilized man is always skeptical and tolerant, in this field as in all others. His culture is based on “I am not too sure.” - H. L. Mencken

(Quoted in Bejan, Time And Beauty: Why Time Flies And Beauty Never Dies)

Duncan Coker writes:

I recently spent time at a conference on a college campus that included input from many grad and undergrads. I was expecting intolerance towards any but the most agrarian of ideas. I was pleasantly surprised to find more openness, nuance, and free speech that I had anticipated, leading me to change a few my own preconceptions. Point is, it's good to get out in the wild and test long-held beliefs, empirically. The virtual world can become a confirmation bias factory.

Nils Poertner comments:

quite often we just learn things from our ancestors (societal beliefs) which we take for granted - but by closer inspection, they aren't necessarily true and are far more fluid. it seems as if society is run by the lowest common denominator at any point if time (as if we are afraid of ourselves or the greatness of the other human fellow). but perhaps one needs to see "through" this and try solve some of our own little paradoxes and take it easy. see also the early Carlos Castaneda on that - before he experimented with drugs.

Jan

24

Jeremy Grantham says the end of ‘bubble extravaganza’ is coming, from Kora Reddy

January 24, 2022 | Leave a Comment

1) Search results for "Grantham" on CNBC

2) of the 118 results , the below 7 more caught my attention

3) assuming a hypothetical 1k USD investment on those 7 occasions

Jeffrey Hirsch comments:

Nicely done Kora. Perhaps it’s just a marketing campaign. Fear sells you know.

Duncan Coker responds:

Consider the source. Grantham's contrarian flagship fund GBMFX total return since 2003 when it launched is 30.5% ( that's total not annual compounded) and that included 2 bear markets. SPY over the same period 488%.

Andy Aiken writes:

Back in the late 90s, I had a few $ in David Tice's Prudent Bear Fund, which was, essentially, short stocks and long PMs. Entered in 1999, got out in 2002 at a very small gain. Gold & silver dropped along with other risk assets during that time, killing returns. If I'm going to short, I'll do it myself now…

Jan

1

Human error, from Zubin Al Genubi

January 1, 2022 | Leave a Comment

From Human Error, by James Reason:

People often have an overwhelming tendency to verify generalisations rather than falsify them: this is a fundamental attribution error.

Whatever governs general proneness to everyday slips and lapses also appears to contribute to stress because certain styles of cognitive management can lead to both absent-mindedness and to the inappropriate matching of coping strategies to stressful situations.

Predictable potential for error is the inappropriate acceptance of readily available but irrelevant patterns.

Humans, if given a choice, would prefer to act as context-specific pattern recognizers rather than attempting to calculate or optimize.

Nils Poertner agrees:

so true. chess for kids = excellent - they learn to falsify a "winning path" by looking at all possible defenses of opponents. so many good projects now everywhere -eg St Louis Chess club for kids etc - also see Ben Finegold.

Duncan Coker offers:

Read an interesting book called Scatterbrain by Henning Beck. Humans makes tons of mistakes especially in repetitive, mundane tasks or difficult calculations. Computers do that way better. What the brain is quite good at is forming ideas based on connections, patterns, correlations, and intuition. We are also very good at adaptation and learning from mistakes. AI will be much better and grinding through terabytes of data. But human brains better at separating the wheat from the chaff and making sense of it all.

Dec

14

The market goes where it wants

December 14, 2021 | Leave a Comment

the bonds were up as usual on the inflation number, -10 today but up 48 ticks yesterday. but stocks went down on the ppi number which presumably has wholesale prices of 1 month ago. as always the market goes where it wants regardless of the news.

James Lackey writes:

Mr Vic Wrote: "calumniate, traduce - wrongfully accuse." the 6.8% inflation rate announced on the cpi for friday was good enough to raise the S&P futures to an ATH on a 1% rise. as mentioned repeatedly the inflation is not a problem. bonds and mortgages predict a 5 year rate of 1.5%.

what's worse is that the current administration is being wrongfully accused of driving inflation up by miles to this rate. when it comes down as will be seen on all future cpi's and eci, one should not credit with the great miracle of driving it down. its was front page news about the horrible spike. its not the fault of bbb so much, what's wrong with all these programs is the opposite of capitalism (i dare not use the word for fear of total cancelation). in any case a great opportunity to go long sp on future releases like last friday.

There is something I need to say. This statement took 20 years to pass. Guys I have never agreed with Victor Neiderhoffer publicly because I had to or for any other reasons than this one: He’s correct.

If we need a reason inflation isn’t ever a problem outside of the printing press or the rigged short term rates set by the central’s for their 12 and only 12 clients, when businesses are left alone to do their thing it is this one which probably comes from Vics books but the gist is: Business men drive profit to Zero!

If you can’t wrap your head around that one think of Trucks in transportation services. There are times in history where Trucks have lost money. It’s not that truck drivers cost too much or fuel or repairs. It’s the business. A truck will take a lower load vs no load at all dead head.

That’s easy to understand. What is driving me more insane, more crazy or best stated by my bmx racing kids is your crazier than usual Mr Lack. Why do industries as a whole seemingly lose on purpose? An example is BBBY or cars in general like Autonation, Sonic et al? Why would any business not.

Text book "pure competition" was described as agriculture in my old books. Why? How why what in the world are they doing driving profit to zero? Please help with anecdotal evidence and stats if we get them.

Here is why: Covid rigged shortage some of these old line businesses like food service Carz and others are running 10% non levered margin profit or triple of what was stasis and as usual driven to zero.

My hypothesis is men never learn as a people. A person is smart but people can be toxic as hades and let’s not forget Every day is better than the years 1942 to 45 at least for Americans.

Duncan Coker observes:

5-year TIPS yield -1.6%, with 5-year Treasuries yield 1.2%, implies a 2.8% inflation rate over the period. Wake me up when it hits 5%.

Nov

20

Inflation and I Bonds, from Duncan Coker

November 20, 2021 | Leave a Comment

The Fed talks of the transitory nature of inflation and not raising rates, meanwhile Treasury is offering I bonds at 7% yield to small investors. Seems

to be a disconnect.

Peter Penha responds:

I Bonds Purchases are limited to US$10k a person, the extra coupon is indexed to the Urban CPI (why higher - nothing funny or contradictory it is formulaic)…this was all seen in advance by I series holders who track the urban CPI (which if you believe the rent increase stories - should remain high).

The FAQ is here: Series I Savings Bonds FAQs

Separately I do believe everyone should have a treasury direct account (was made a little more difficult to open one during the GFC) but no fees of any kind and you can leave your money as a certificate of indebtedness (C of I) of the US treasury with 24 hour withdrawal/ credit to any banking institution & you jump the queue among indirect/direct bidders on any US treasury auctions and I believe I read years ago that the original legislation (Ron Paul was part of it) guarantees you cannot be issued at a negative interest rate even if rates are negative for financial repression purposes.

Was about putting the little guy/gal first.

Nov

8

J. S. Bach, from Nils Poertner

November 8, 2021 | Leave a Comment

JS Bach was once asked why he wrote so much music.

His answer:

1. "To the glory of God" (not sure whether he meant it, nevermind)

2. To amuse himself.

Maybe some like this piece here as well:

Bach - Concerto in D minor BWV 596 - Van Doeselaar | Netherlands Bach Society

In the first notes of the Concerto in D minor, performed by Leo van Doeselaar for All of Bach, it is immediately clear that this is not the usual Bach. This piece is an organ version of a concerto for two violins and orchestra from Antonio Vivaldi’s L’Estro Armonico. Vivaldi’s music was popular throughout Europe and Germany was no exception. During his years at the court in Weimar, Bach made a series of arrangements of Italian concerto music for organ and harpsichord, including six concertos by Vivaldi.

Gyve Bones adds:

From 20 arguments for the existence of God, from Prof. Peter Kreeft, Department of Philosophy, Boston College:

17. The Argument from Aesthetic Experience

There is the music of Johann Sebastian Bach.

Therefore there must be a God.

You either see this one or you don't.

Alston Mabry writes:

There is a scene in Professor T (Antwerp version) where T is talking to his cellmate and says very sadly something like, "Is there a God?". And his cellmate says something like, "There is Bach. Bach is God." And T smiles and says "Yes, Bach is God."

Peter Saint-Andre offers:

A quote from Pablo Casals:

For the past eighty years I have started each day in the same manner. It is not a mechanical routine but something essential to my daily life. I go to the piano, and I play two preludes and fugues of Bach. I cannot think of doing otherwise. It is a sort of benediction on the house. But that is not its only meaning for me. It is a rediscovery of the world of which I have the joy of being a part. It fills me with awareness of the wonder of life, with a feeling of the incredible marvel of being a human being. The music is never the same for me, never. Each day it is something new, fantastic and unbelievable. That is Bach, like nature, a miracle!

Nils Poertner responds:

that's great. I always try to listen in the moment - whatever works for ppl - life works a bit by invitation anyway. one can't force stuff. a basic sense of joy and harmony is certainly missing in our era (the media, the drama etc outside).

Jeffrey Hirsch recalls:

An English professor whose class I was in asked the question why people write poetry. Answer: Because they have to. Similar reason why Bach wrote so much music. Because he had to.

Richard Owen wonders:

Does Bach have an Onlyfans? I can't see it in the search.

Laurence Glazier suggests:

There are free versions of Sibelius. May I recommend the pleasures of composing now available to all?

Richard Owen admits:

Thank you Laurence, an answer from a real musician of note I think? I should therefore disclose, because you are a decent and proper individual of good character and standing… my question was touched with satire. Google Onlyfans via google news, and you might learn something about the debasement of our culture.

Nils Poertner makes a connection:

btw…I always wondered whether one could re-train a musician becoming good trader? Why? Coz good musicians (of any style) tend to enjoy the process of learning - and are the complete opposite of end-gainers. perhaps they are not interested in financial markets enough- otherwise it would be an interesting project. any idea?

Duncan Coker writes:

I am not in the class or universe of LG in terms of composing, but I do write country songs as a hobby. One thing I have found useful is, often I have to throw something away that I thought was good, a melody, a lyric and start from scratch. The more easily and quickly I scrap an idea, the easier it is to start over. You can't force it. This is true for trading.

James Lackey expands:

Dunc is not gonna get mad at me because we never argue. However sure we can force it and to add to the comment of "those people". As if a career makes a man!?)@“”

Anyways path dependence omg I sound like the geek I am. Ok in a sport or music the pleasure has to be the process of practicing or doing it every damn day. As parents we teach this as in brush your hair teeth good girl boy kiddo! The pleasure of rewriting written words must be higher than start from scratch or least effort kicks in no?

I do not care if she likes my poems. I love them. I’m not sure if it’s a coin toss but I can’t fathom whether I like the poems I wrote in one blast or over 6 hours weeks days or? Good is good and great is better than 6 years ago and awesome is when she says so.

I wrote an awful poem once. Many bad but awful because you can hear the blood hit the floor. I gave it to a song writer buddy and he said damn that’s awesome. I said write a song. He said no man you never write over another mans blood sweat or tears.

In trading the get the joke one liners or 5 lots are cute and won’t hurt anyone much can’t kill you but will never inspire romance. The all in big line can and will get you the one, the forever girl or death one way or the other every 7 years death to the marriage of business and of the romantic life.

They say you’ll get what you need out of trading the market. I think perhaps that’s what separates us from the other guys. We need we want we just can’t help ourselves, we need everything. We want it all!

Adams Grimes writes:

I do think there are some fairly intense connections between music and successful trading/investing. There are the obvious issues of "sticktuitiveness" and grit… I'm currently working my way through one of the Bach Partitas and spent about 4 hours yesterday on 2 measures of music. (For reference that's probably 4-6 seconds, when performed). That degree of focus on detail is absolutely normal for musicians, but is not normal for most peoples' experience, at least in the modern world.

In markets, we get kicked in the head (if we're lucky) or the balls (or, more likely, both) on a regular basis. Some degree of stubbornness and a willingness to just not give up.

I think there are also some profound tie-ins in terms of pattern recognition. For me, I think this worked both ways… after taking a decade away from music I discovered my "musical brain" and compositional skills were probably better than they were, in some ways, when I was focusing my life around music. (My keyboard technique emphatically DID NOT improve, as that's something that does take a fair amount of maintenance.)

Serious, important, and maybe even interesting epistemological questions lurk here.

It's hard to have a favorite Bach piece… his works are surprisingly even in quality across his output, but let me share one that is at the top of my list. This has always been one of my favorites:

Bach: Trio Sonata in G major BWV 530 - I. Vivace - Koopman

(And, for sounding so simple and transparent, it's a nasty little nightmare to perform!)

Gyve Bones harmonizes:

I first heard this performed in the 1970s by Walter/Wendy Carlos on the “Switched-On Bach” on Moog synthesizer, and it has remained a favorite piece of music since then. There are various settings of the piece for guitar and piano as well. Here is a full symphony rendition… It is a song of gratitude to God for his many blessings.

Bach - Sinfonia from Cantata BWV 29 | Netherlands Bach Society

Peter Saint-Andre responds:

I had a similar experience with one of the Bach Cello Suites last night. There is much effort (both time and concentration) involved in learning these pieces. And he probably just dashed them off!

BTW, many years ago there was a software company that specifically recruited music majors because they were highly trainable for programming. And music majors also scored quite high on the even older IBM Programmer's Aptitude Test.

Adam Grimes comments:

And he probably just dashed them off!

This, for me, is one of the biggest and probably eternally unanswerable questions in music history. I suspect our performance standards today are probably far higher than they were historically. It's possible we have an army of at least highly technically competent instrumentalists who've devoted more time to, say, the Chopin scherzi than he ever did himself. We know that Beethoven's playing of his own pieces was, according to contemporary accounts, thrilling but filled with mistakes. When Czerny (a student of Beethoven) proposed playing Beethoven's pieces from memory, Beethoven replied that it was impossible to get all the details without looking at the score… and then admitted he was incorrect on that assumption.

Reading between the lines of what CPE Bach wrote (the Essay on the True Art… is a must-read) I suspect contemporary performance practice was much more improvisatory and perhaps less detail-oriented than we'd expect. We know many of these Bach cantatas were written, rehearsed, and performed in a week. These performers were not super human… the only thing that makes sense to me is that our performance standards and expectations (which approach technical perfection, due to the advent and growth of recording) might be much higher than in past ages.

But perhaps I'm wrong on that.

Interesting on the programming front. I would think those are two quite different modes of thinking (and knowing the expertise is domain-specific in many cases), but I'm a far better programmer than I should be given my level of actual training in the discipline. Maybe there's something to that.

Peter Saint-Andre writes:

In his book "Baroque Music Today", Nikolaus Harnoncourt notes that before music was recorded, people most likely heard any given piece of music only once and didn't want to keep listening to the same music over and over as we do but instead continually sought out whatever was new. Perhaps there was a sense of discovery as composers explored the potentials of the tonal system; once those potentials were exhausted and composers started to produce extremely chromatic or even atonal music in the 20th century, listeners were turned off by the new and sought refuge in the old (thus Western art music ceased to be a living tradition for most listeners). Thankfully composers like Adam Grimes and Laurence Glazier are bucking that trend!

Laurence Glazier writes:

One would expect coding and music skills to be correlated. A symphony is partly an encoded instruction set, whether performed by a computer or an orchestra. The conductor is the "crystal", the timer that pumps the flow. But oh, so much more, than that.

It would be very hard to combine the music and trading fields. To be attentive to the Muse and the S&P at the same time? Surely both are all-consuming. But trading, with its psychological dimension, of self-awareness and development, is a fine path. Alexander Borodin managed to combine composing with a distinguished career in science, as did Charles Ives in insurance.

Oct

28

Supply, from Duncan Coker

October 28, 2021 | Leave a Comment

Yes, it is a different mind set and self fulfilling. I am thinking about replacing some wood flooring and got a quote and now makes me think better do it now before the wood becomes less available and/or more expensive. Meanwhile cash is losing 5% this year. Multiply this mindset x 100m people and you get some inflation. Fed won't raise rates, wages won't keep up, but assets should do well until the yield curve is so steep that rates have to go up, which is the big unknown. Who will be our Volcker of 2020s? Does this not make the case for all the supply-siders. You can demand all you want, but someone has to make the stuff.

Steve Ellison adds:

I worked in technology supply chain management in a previous career and have been thinking about a scenario called the "dreaded diamond".

Technology part shortages occurred with some frequency as the transition from designing a next-generation product to ramping up production did not always go smoothly. And even before covid, accidents happened; some years ago, a factory in Japan caught fire. Many specialized components have only one supplier.

What typically happened in shortage situations was that the supplier would allocate the limited supply among the buyers. The buyers would try to game the system by placing 3x to 5x their normal orders, hoping that would increase their share of the allocation. Meanwhile, executives would want daily updates on the situation: how many units were delivered, and what the likely delivery schedule was.

This situation might continue for some months, with buyers continuing to place inflated orders, and the apparent shortage stretching out longer into the future with the higher orders.

As actual deliveries increased, one day, all of a sudden, the buyer would cancel all the excess orders. As other buyers did the same, the demand on the supplier would crash to near zero. This phenomenon of illusory orders that would vanish later was called the "dreaded diamond". A few quarters later, there would be big inventory write-downs because technology products lose value fast as they age.

Maybe some variation of this scenario could occur in the general economy as some of the shortages are alleviated in the course of time. We might find out the shortages have been exaggerated by purchasers trying to maximize their own supply.

Alston Mabry offers:

The Odd Lots podcast (BBG) had a recent episode about the chip shortage, and the guest described this exact scenario, where a customer orders 10x chips and is told by the supplier, "We can deliver 1x chips now, and the rest within 50 weeks." So the customer then orders 100x chips, hoping to get a 10x allotment, after which they cancel the rest of the order. But suppliers must be catching on.

A reader comments:

Sounds like how the Street allocates hot deals. The “pad-my-order-by-a-factor-of-10” move can’t help but to attract attention on the syndicate desk… and the result rarely benefits the customer.

A reader adds:

This has been my base case for some time. Interestingly, I get the sense that complacency is increasing lately, which us odd.

I expect a deflationary shock from overproduction within 24 months, globally synchronized. The delay us from supply chain snafu’s continuing for about another 18 months.

The difference between this and the diamond is deliveries being made and a simultaneous demand drop (ie they get their increased orders).

Hybrid system in time models are rolling out still.

Pamela Van Giessen writes:

This is not rocket science or even dismal science.

Quit testing healthy people for covid so companies that engage in non-Zoom activities can work at capacity and people aren’t "scared" to be around other people. We are still testing well over 1M and sometimes 2M people daily. ~2.5M people were unable to work between June-Sept because of covid. Since there weren’t that many sick people the bulk of them were out of work due to covid related quarantines. And I can promise you they weren’t the zoom class. Supply issues and inflation last as long as covid is a 24/7 threat that "must be conquered."

Our World in Data: Daily COVID-19 tests: USA

Yes, hoarding makes the problem worse but that will evaporate in 2 seconds once we have reliable supply.

Last week I saw a man on a bike wearing a mask in Park County MT where we have nearly 3000 sq mi and a population of ~16k. No helmet but he had a mask on. I should have snapped a pic as it was a perfect illustration of the brainwashing insanity that plagues our economy and health right now. The vaccines may prevent serious illness/death from covid but they don’t seem to be good for much else be it the supply of canola oil, engines, or other health conditions/injuries, etc.

Duncan Coker writes:

The reformers always make the assumption that supply will just naturally bubble forth like a spring constant and unaffected by the world around, be it for labor, capital, services, products. It is assumed no incentives apply and the curve is a vertical line stretching to the the outer limits of the universe. However, this assumption is always wrong and being tested right now.

Oct

20

Energy - Things that make you go hmmmm, from Zubin Al Genubi

October 20, 2021 | Leave a Comment

The energy crunch in China and Europe may grow into a bigger trend worldwide. Its one of those small line notes you notice and go hmmm. Like the pandemic was in early 2020. Hmmm, shortage of masks. Hmmm, Shortage of gas, coal. Things that make you go hmmm.

Water shortages also coming up. See how this winter is. Reservoirs are quite low. Look at weekly chart of FIW water etf.

Jeff Watson adds:

I’m noticing many holes where product should be on shelving at every retail establishment we patronize. I’ve been waiting on a part for my Jeep that’s been on back order for 6months. Still see little to no ammo in stores. The system is full of hiccups.

Tim Melvin notes:

I saw a lot of empty shelf space at Costco last week. Very unusual.

Pamela Van Giessen writes:

No joke. We have a huge problem. This is what happens when the world gets shut down and everything is all covid fear all the time. No workers. Test school kids constantly and they will end up being sent home and parents won’t be able to work. Then stuff won’t get made or shipped to where it needs to be. Freight train, fully loaded, sat parked in Livingston MT for nearly 2 weeks. Just left the other day.

As someone running a business that relies on actual commodities (flour, sugar, etc) I find myself overbuying out of concern that I will not be able to get basic ingredients. I had a hard time getting boxes about 2 weeks ago. It’s ridiculous.

Laurence Glazier writes:

It’s getting reminiscent or the Atlas Shrugged movie.

Nils Poertner suggests:

UK is worth to watch as most things we are going to see here in Eurozone or you guys in the US are happening a touch earlier over there (UK being such a tiny, little, open, exposed, econ).

Laurence Glazier adds:

Yes, over here in London it's harder to get petrol (i.e. gas) for the car, less things available in online stores.

James Lackey writes:

I can get everything to build a car a bike or a motorcycle and mysteriously no spikes no single bearing or one simple chip - I call BS. This is almost as big as a Vatican scam.

Jeff Rollert adds:

The most common boat engine, the Merc Cruiser, is quoting deliveries of full engines for next summer.

Duncan Coker notes:

Motors being taken out of production. Sounds a lot like a book I know.

Oct

12

Economists win Nobel prize for proving laws of economics don’t exist, from Duncan Coker

October 12, 2021 | Leave a Comment

No it is not the Onion.

3 economists awarded Nobel for work on real-world experiments

"The Royal Swedish Academy of Sciences said that Card's studies from the early 1990s "challenged conventional wisdom." By comparing what happened when New Jersey hiked its minimum wage to labor market conditions in neighboring Pennsylvania, he was able to upend the accepted theory that increasing the minimum wage would lead to fewer jobs."

Peter Saint-Andre adds:

Why don't we raise the minimum wage to $200/hr so everyone can be rich?

James Lackey relates:

True story: What is the probability old lack would sell a unit to University PhDs in Econ in a year? They both asked why I sell Carz. That I blew up again peaked their interest. What they didn’t realize is the Econ profession told me the exact same thing the Law clerks told me: Go trade lack.

Anyhoo they always bring up the big short movie book or some other mumbo story then they quote their book. I exhale and call bs.

I get very upset at men calling me a not ummm honorable man or imply that whether it’s Carz or trading for a living.

I blast them with a 11 minute data dump and why the street works and how and Mr Vics ecology the story of the elephants and like Gresham law they know they never read Albert K Nock and they do implicitly understand the law of least effort. I end my discussion with the same to all business men: It’s the pay plan man!

I’ve been asked to speak at MBA classes and seminars and for sure interviews for their next book. After blow up artist and hour interviews and a one line quote that was actually the get the joke true real deal about Mr Vic "he always found a way for all of us to make money". Which in bmx or drag racing terms means to win! I say no thanks have a nice day.

A year later I see the profs new book at the library. I flip through it and I’ll be damned. Ya can’t make a jackass drink the koolaid.

Henry Gifford comments:

The thing frequently referred to as the Nobel Prize in Economics is misleading, at best.

The original Nobel Prizes were established in 1895, and financed (the word "funded" implies "free" government money in some circles) by Alfred Nobel's will.

The prize in economics was established in 1968 by a donation from Sweden's central bank. Perhaps the central bank has some economic agenda to pursue, but if so, they didn't state that as their goal.

In 1995 the prize in economics was redefined as a prize in social sciences for the stated purpose of widening the field of possible recipients to include people who are not economists.

While the prize in economics is often called "The Nobel Prize in Economics" in the US, that has never been the official translation to English agreed on by the people giving the award. The official English translation of the name has changed eleven times since 1971 - perhaps they are striving for the most confusing and politically correct name possible. The official names in English usually include the words "Memorial" and "Alfred Nobel."

At a minimum, the prize should be referred to with the word "Memorial" in the name, to distinguish it from a genuine "Phone call from Sweden."

Oct

6

Books, from Zubin Al Genubi

October 6, 2021 | Leave a Comment

1. Human Error, James Reason. A rather disappointing academic treatise on cognitive analysis of how humans make errors which is really dragged down by obtuse academia speak. Two major sources of error are lapses and slips, and secondly errors of reason and rules. Slips are when you forget steps, lose your place, get distracted, fall into a habitual practice inappropriate for the situation. Errors of reason are using the wrong rule for the situation, where the plan does not go as expected, or the plan was wrong. When the rule doesn't fit, the expert acts like a novice.

There are the raft of heuristics. One is how humans utilize familiar patterns rather than calculate or optimize a current new situation. It is cognitively difficult to consciously think through a new situation.

An interesting section was about how the brain uses "autodrive" to do many familiar things to make room for conscious thought. I was driving down somewhere thinking, and look up and arriving at my destination, realize that I basically had no recollection of the drive there - just on autopilot. A lot of daily life is on auto pilot thus ripe for error.

It's a difficult read. Better to rent, than buy.

2. The Genetic Lottery: Why DNA Matters for Social Equality, by Kathryn Paige Harden

A flawed book addressing a difficult subject. Galton's biggest failing was his theory on eugenics. One of Harden's main points is to debunk the misconception that the genetics of race has any meaning. Race is close to meaningless in genetics. For example, people with genes from people from Africa have a much larger variation in genes than in all the other races, and the categorization of Black and White becomes meaningless.

Genetics does have an effect on personal traits. It predicts certain diseases. The attempt at connecting genetics with achievement in education, life satisfaction, and wealth, suffers from too many variables to have any use.

Their statistical studies, not disclosed, I think will not be robust.

3. John Steinbeck, Sea of Cortez, recommended by Andrew Moe. A beautifully written book and a joy to read.

4. Yottam Ottolenghi, Plenty More. Highly recommended cook book with smashing recipes for vegetarian dishes with a mideastern influence. He has other cookbooks such as Jerusalem with recipes that are real home runs. I've made a number with great success.

5. Michael Lewis, The Premonition. Excellent book about the sad state of the lack of preparedness for a pandemic in the US. Outlines some of the goings on in California to deal with pandemics and disease. Lewis is a fine writer and easy to read.

Pamela Van Giessen comments:

Lewis is a facile writer who performs a parlor trick by bringing forward, in Vanity Fair like story telling, that which will convince you that his view is the correct view. He will not be remembered 100 yrs from now.

A reader writes:

There are three sentences in the short review of The Genetic Lottery that are utter nonsense:

"Galton's biggest failing was his theory [sic] on eugenics."

"Race is close to meaningless in genetics."

"The attempt at connecting genetics with achievement in education, life satisfaction, and wealth, suffers from too many variables to have any use."

These sentences could probably be accepted in, say, the NY Times given that and other leading publications' denial of much of genetic science, but not on this Spec List.

James Lackey appreciates:

Fantastic report! I dig Lewis because moneyball was a great movie lol but really love him because his Wife is so amazing that he must be a good dude to keep her.

Duncan Coker

Thanks for the list. Has anyone read the latest from Steven Pinker, Rationality? It seems like a more scientific analysis of what Kahneman failed to do. We humans have trouble with advanced probability in every day life, so appear to be irrational, but there is more to the story. Do the shortcuts we use help or hurt. Try doing Bayesian Analysis at the grocery story. I think Pinker is one of the best writers we have at present.

An excerpt from Pinker's latest:

Why You Should Always Switch: The Monty Hall Problem (Finally) Explained

By Steven Pinker

Sep

28

Ken Burns is pessimistic, from Jack Cook

September 28, 2021 | Leave a Comment

Historian and documentary filmmaker Ken Burns said that the present day is one of the worst times in American history.

Burns made the remark while on the “SmartLess” podcast, hosted by Will Arnett, Jason Bateman, and Sean Hayes, comparing current events with the Civil War, the Depression, and World War II.

“It’s really serious. There are three great crises before this: the Civil War, the Depression, and World War II. This is equal to it,” he said on Monday’s episode when asked about the direction the United States was headed.

Peter Saint-Andre offers:

Perhaps he's been reading The Fourth Turning by Strauss & Howe. Highly recommended.

It does strike me that the recent run of presidents rivals the likes of Fillmore, Pierce, and Buchanan. Stefan can provide a more informed perspective for us.

Leo Jia writes:

The Fourth Turning sounds very interesting, thanks for sharing. I had similar senses in recent years, hope I had read it earlier.

According to Wikipedia [Strauss–Howe generational theory], our current turning is crisis starting in 2008 and ending in 2020 (+a couple years perhaps). The last crisis was between 1929 and 1947 (depression and ww2 together for 17 years). The crisis before that was between 1860 and 1865 (civil war for 5 years).

As one turning generally lasts 20-22 years, the current one is coming to the final years.

The next turning following a crisis is termed high. It's like 1946 - 1964, and 1865 - 1886, for which we can be hopeful.

I am not sure if the authors discussed about the not fully synchronous nature of the turnings through the world. For instance, America didn't suffer ww2 so much as Europeans or some Asians. Europe didn't have the depression, though it had ww1 earlier. Also, even in the same crisis turning for instance, different groups or countries can take differently: winners get more benefits than losers for instance.

So the podcaster talks about a worst crisis we are in, well that may be true, but the good news is that not everyone has to suffer.

Vic adds:

presumably that fellow traveler who has never believed in american excetionalim is referring to the negative feelings about president biden which i happen to agree is bearish as the masters 1000 and the big tech and the bilious billionaires will have less chance of capturing the rake from being one with the lokis.

Henri Huws suggests:

If you’re enjoying The Fourth Turning have a look at Decline of the West by Oswald Spengler. He was a history teacher by trade that wrote extensively on the coming decline of the west. Spengler’s cyclical theory on history is very interesting. He famously predicted the fall of the third reich, 9 years before the end of the war. All of his work is fantastic, but has a much longer time horizon than the 4th turning. In vol1 he focuses on how culture in civilisations throughout history changed as their civilisations grew and declined. In vol 2 He puts more emphasis on politics and economics. Its a dense read, but well worth it.

Duncan Coker recommends:

For geopolitics I recommend Peter Zeihan. His latest is due out next year, and the title is provocative: The End of the World is Just the Beginning. It could be taken as negative or positive depending on your time frame. As much as I like Ken, his comparisons to other points in history seem way off the mark.

Stefan Jovanovich

Mr. Burns left out the wow finish with Jesus and George Washington - always Lincoln's favorite bit of stagecraft.

Reason, cold, calculating, unimpassioned reason, must furnish all the materials for our future support and defence.–Let those materials be moulded into general intelligence, sound morality, and in particular, a reverence for the constitution and laws: and, that we improved to the last; that we remained free to the last; that we revered his name to the last; that, during his long sleep, we permitted no hostile foot to pass over or desecrate his resting place; shall be that which to learn the last trump shall awaken our WASHINGTON. Upon these let the proud fabric of freedom rest, as the rock of its basis; and as truly as has been said of the only greater institution, "the gates of hell shall not prevail against it."

Aug

13

Trouble ahead?

August 13, 2021 | Leave a Comment

Jeff Watson writes:

Jeff Watson writes:

The market weathermen, self described sage like realists, always see trouble on the horizon and are compelled to give all knowing, logical reasons the market will get hit. Sometimes even invoking "science." To them the pressure is dropping hard, the seas are building, and we're about to get hit with sustained gale force winds. It's always doom and gloom to them. They want the little guy to get scared, pitch his position and make the broker money, rinse and repeat. Meanwhile, Steve provides some perspective and his chart lists 49 reasons for the market to get hit…while the S&P went up 35X during that time. Unfortunately the brokers don't want their clients looking at charts like this or reading Dimson.

James Lackey agrees:

Jeff says what we all learned the hard way. The market in stocks is an engine designed to go up. Any business decisions based otherwise are in between risk-based conservative - which in most cases is a good thing - and ruinous, as the vigorish will grind you to a long-term guaranteed loser.

Michael Cook responds:

I broadly agree with this but let’s not take it as written on tablets of stone.

One of the nastiest human failings in my opinion is recency bias and for investors in US stocks, an entire career (unless a very seasoned investor indeed) has been a basic bull market tempered by the bear markets of 1997, 2002 and 2008 and whatever the hell March last year qualifies as. Recency bias on steroids.

But it doesn’t mean it must always be like that. Just ask eg the investors in the Japanese stock market 40 years ago who pretty much are still waiting to be making money now…

Leo Jia adds:

Even if there is a sharp drop, it will only be shallow and short term. This is not a big bubble and there is no euphoria yet. If one suspects big money are selling, the question is what is the alternative to the US market. Perhaps the worry will be legitimate when Turkey and China become out of any concerns.

Nils Poertner writes:

what makes the difference between folks who are in the market - and trade successfully in the long-term and those who don't is often the acquisition of implicit knowledge. Things we know are true on some level, and that we need to experience personally many times to know that they are true - not in the absolute sense but more intuitively - and percentage-wise.

we live in a very explicit world now everything needs to be spelled out. but the "absense" of something is a better guide than the appearance of an event.

an example would be that SPX drops by 3pc one one day (after months of overheating) - AND the financial press is somwheat quiet aout the drop. as long as they are loud…one can normally relax a bit more.

not to be confused with long-term investing. eg, some of my English friends who bought prime real estate in the 90s in London, and levered up every year with new flats, are all fabulously rich now. was it being lucky or smart? who knows? implicit knowledge is underrated - was my point to say.

Leo Jia comments:

Even if there is a sharp drop, it will only be shallow and short term. This is not a big bubble and there is no euphoria yet. If one suspects big money are selling, the question is what is the alternative to the US market. Perhaps the worry will be legitimate when Turkey and China become out of any concerns.

Duncan Coker writes:

Agreed, it's worth noting that the 00's were the worst decade since the 30's for stocks. I'd propose there was a bearish recency bias going on during the 2010s.

I liked the video about carnival scams. I recall "winning" an album at age 13 from a darts game on the boardwalk at Asbury Park, NJ. No doubt I overpaid. It was a vinyl from a band I had never heard of at the time called the The Allman Brothers which forever changed my life in music.

Apr

5

Vix

April 5, 2021 | Leave a Comment

Anonymous writes:

Do you mind sharing what's needed to be read inferred in your svxy chart for beginners.

Gary Phillips writes

nothing particularly esoteric here, other than the dotted yellow line is a level that has shown support in the past, and old support may become new resistance. in terms of constructal law it is an area that has evolved over time to allow greater access to the currents that flow through it.

Duncan Coker writes:

Feb of 2018 was quite a move for SVXY, down 90%. SVXY is really a proxy for selling the term structure of VIX which is almost always in contango.(ie sell the distance month, cover after a month, rinse and repeat). Except when the spot and front month explode upward and go into backwardation. I did a study a while back showing backwardation of futures term structure is very bullish for SP500, but not that many trades.

Apr

5

Play Ball

April 5, 2021 | Leave a Comment

Since we are all in the predictions market, any early season baseball

prognostications? Rockies were able to host 21k fans yesterday and win the

opener, and driving around town seeing high school ball in action was a fine

sight.

Jan

22

Inverted Curves

January 22, 2021 | Leave a Comment

Duncan Coker writes: