Sep

28

Great American Panics

September 28, 2023 | Leave a Comment

great American panics 1812 to date:

1. Panic of 1819 - slowed expansion after the war of 1812.

2. Panic of 1837 - troubles of US banks and pres. Jackson's hostility, wide speculation in land.

3. Panic of 1857 - far worse than 1837, over-extension of railway building, failure of ohio life, banks everywhere suspended payments.

4. march 1861 - war crisis.

5. Gold panic of Sept 1969 - Black Friday stock exchange forced to close.

6. Panic of 1873 - failure of numerous brokerage firms, crowd of sightseers besieged wall street, stock exchange closed for 10 days. on sep 19 the stock exchange members suspended payment. union trust company forced to close.

7. Panic of 1890 - failure of baring brothers.

8. Panic of 1893 - 15,000 bankruptcies across the country.

9. Panic of 1907 - overnite call loans at 100%, stock market declined by 50%. boy wonder begged not to short any more.

PANIC continued:

i defined as the first time a 10% decline occurred. one striking result is that the panics after 1900 were much more bullish the those before 1900.

10-10-2008

12-24-2008

4-19-2020

2-23-2022

5-17-2022

6-14-2022

9-22-2022

10-6-2022

And from Education of a Speculator, page 42 and page 43, listing data on panics from 1890 to 1990.

Sep

21

Polls vs odds, greatness

September 21, 2023 | Leave a Comment

the old gray mare manages to go against the news and victory laps of his opponents by increasing his odds of winning. the poles are not 1/10 as good as the odds for predicting.

Greatness by Dean K. Simonton is an interesting book deeply flawed by its failure to consider multiple comparisons and its desire to virtue signal. however, it contains 1000 intriguing relations such as height-intelligence correlation and marriage achievement.

Toscanini remembering every score he has ever played and 10,000 songs needed for mastery (examples of unusual correlations).

Sep

21

Aubrey and Amalgam Talent

September 21, 2023 | 1 Comment

A Greenwich High School student found an online friend a job. Then they turned that into a business.

GREENWICH — High schooler Aubrey Niederhoffer said he has always enjoyed collaboration, helping others and learning about other countries. And now, those interests have paid off in a practical way: he's co-founder of Amalgam Talent, a company that helps people in Southern Africa find jobs.

About two years ago, Niederhoffer, who will be a senior at Greenwich High School this year, met his now business partner, Nhlanhla Mhlanga, in an online chatroom. Mhlanga lives in Eswatini, a country in Southern Africa that was formerly known as Swaziland.

“He told me it’s very hard to get a job here in Swaziland and I knew a little bit about Swaziland, but I didn’t really know what it was like and it was really interesting to talk to him,” Niederhoffer, 17, said. “So, the first thing I did was I figured out how I could send him $5 so that he could get a water spout for his family’s garden and improve their vegetables.”

When the two talked online, Mhlanga had just completed his degree and was looking for work. Mhlanga asked Niederhoffer to help him find an online job, and the two worked to make that happen. A few months after the two began their search, Mhlanga, 27, was hired as a remote employee for The Socratic Experience, an online school based in Texas.

With that success in hand, the two decided they could create a company that can help people in Eswatini find jobs.

Sep

18

AI hype, from Nils Poertner

September 18, 2023 | Leave a Comment

remember the hype about Chat GPT some weeks /months ago? def for trading /investing - I doubt using that or any other program will help to master time ahead - prob a recipe for disaster at the end.

Peter Ringel writes:

I am still hyped! Hyped for boost in efficiency of the economy via AI. Not hyped for AI-trading systems! So far the training data set seem too small for AI - trading, thankfully. Together with what the Senator and others posted here: humans still beat skynet. Yet, I like to remind myself every day: the bastards are coming.

Hernan Avella responds:

So far the training data set seem too small for AI - trading , thankfully.

How do you figure this? Each trading day probably produces more than 100's million rows between trades and quote updates for all levels and exchanges, if you include futures, equities. I don't think lack of data is the issue here.

Peter Ringel replies:

I know even less about AI-coding, than about trading-coding. So everything is based on perceived experts. Thankfully, so far they are pessimistic.

Hernan Avella continues:

So everything is based on perceived experts.

The set of experts in ML-DL is very small, and the set of experts in trading is also small. I imagine the intersection is even smaller and more importantly, secretive. My suspicion is that the training set is more than enough, but the problem of ergodicity and stationarity (lack of) of the ever evolving competition are the culprit.

Peter Ringel responds:

I hope, you are wrong with this. But at some point you will be not. I speculate, that the "small" existing universe of trading history data + some sort of data - > model on human psychology - will be enough - will make us traders obsolete.

Peter Saint-Andre writes:

In my limited, non-trading experience with LLMs, I've found that their output reflects conventional wisdom. That might leave plenty of room for creative strategies outside the mainstream.

Peter Ringel agrees:

yes, they are regression x1000 on speed. so far feedback loops/ "reflexivity" kill it. As far as I understand.

Hernan Avella warns:

I would abstain from making any statements about the state of the art ML applied to trading, specially from a place of ignorance. Whoever works in this field (which there are only a handful in this list), and interacts with just the basic chat GPT 4.0, realizes immediately the productivity boost and immense potential to improve one's process. Only a moron would expect a good output from just feeding prices to the engine or asking simple questions.

Peter Ringel agrees again:

nooo! especially if you are ignorant in a field , better check if that poses a risk to your systems. I believe AI is a risk to traders. Here is a fact already reality: ChatGPT empowers people to do substantial back-tests.

Big Al adds:

And doing backtests poorly, or being improperly overconfident in backtests, is a threat to one's trading.

Humbert K. wonders:

With reference to the skynet, it is hard to guess if and when fully autonomous weapons will happen. My 2 cents is: Fully autonomous weapons will happen. There are debates as to whether we should let machines make kill decisions. I can say though our adversaries' weapons developments will not be bound in any way by any moral or ethical standards. If the bots can communicate with each other and collaborate to perform. When will they no longer need human inputs or interventions?

Eric Lindell writes:

There's a limit to what computers can do with the massive amounts of data available in countless categories. To find the perfect mix of factors to plug into a formula — if there is such a thing — would require a number of operations that increases exponentially with the data-set size.

Humans are good at intuitively navigating such complex search spaces. Computers using brute force just aren't powerful enough yet — and may (in principle) never be. That said, if a human comes up with a plausible conjecture relating stock picks with subsequent price performance, computers can certainly back-check the theory.

I'm working on one now regarding immediate post-IPO performance of stocks selected by certain criteria — criteria that aren't widely (or even narrowly) recognized for their relevance — pertaining to historical research of a revisionist nature.

Sep

16

Accounting gimmicks, from H. Humbert

September 16, 2023 | Leave a Comment

have not idea really about health of US regional banks and to what extent some use creative accounting to say it that way.

What makes me wonder is only that European banks (and Japanese) are quite good with their gimmicks and I have seen this pattern before. Many US analysts slacking off foreign banks and they are prob right here. and then we had those 2 US banks earlier this year …oh, no they were only a special case (allegedly). and what happens if the econ surprises to the downside? remember we live in times when people are low re irony, and highly suggestible and lack imagination.

Henry Gifford comments:

I think those two banks were a special case because they made loans on rent-regulated New York City apartment buildings, and held those loans in their portfolios.

New rent regulations passed in 2019 severely limit rent increases, require most increases to be rolled back after thirty years, eliminate all paths to deregulate an apartment, etc., thus the buildings are worth less than owed on them, and as the five-year loans come up for renewal they go into foreclosure. Few banks were stupid enough to make loans on those buildings. I think definitely a special case.

Humbert H. is skeptical:

Seems like a stretch to attribute SVB to just those loans give the well-documented run on the bank and the treasuries they were forced to sell and recognize their market value vs. book, the possibility of the latter being the commonly attributed trigger for the run, along with the slower liquidity crunch at the client startups causing high withdrawals.

Henry Gifford elaborates:

Word in New York real estate circles is that the run on the bank was caused by depositors hearing about the bad loans and rushing to get their money out. Selling treasuries and etc. were all after the run. Here in NYC, nobody is surprised to hear about craziness when it comes to regulations and the effects later. The stories here don’t mention liquidity crunches at startups. Maybe the banks made two types of risky loans?

The printed articles stuck to good journalistic standards by avoiding saying just what % of loans in the portfolio were on rent-regulated buildings. It might have been a minor %, but still caused a panic, or it might have been a large % - presumably rent-regulated buildings paid higher interest than other buildings, thus an incentive to make more loans.

If a bank already has enough loans to force them under if the political pendulum in NY swung hard in favor of tenants, there would be no reason to not make more of them, thus they might have had a large % of them. But, nobody seems to be saying. I think the only real word would come from the depositors – maybe the ones who got their money out first.

Humbert H. replies:

There were pictures of lines both in Silicon Valley and NYC. Peter Thiel's recommendation to the portfolio companies of his fund supposedly played a role. It's hard to do a thorough analysis on the anatomy of a run, too chaotic and not well documented in terms of why anyone did anything in particular. To this day there's contradictory information on the collapse of the tulip craze.

Steve Ellison writes:

Jim Bianco has been saying that the banking issues this cycle are more likely to occur in slow motion, as depositors individually decide to take low-yielding money out of banks in favor of T-bills and other higher yield instruments. As deposits shrink, banks are cutting back on credit, and there was an upsurge in bankruptcies in August.

Humbert H. responds:

This is true, but there is a contrary trend of low-yielding treasuries maturing as well as getting sold, and new money invested in higher-yielding treasuries thus making the balance sheets less of a work of fiction and improving that side of the cash flow equation.

Humbert X. adds:

Bank loan to deposit ratio is actually at very low levels, historically speaking. The problem is demand.

Humbert H. disagrees:

Can't be just demand. There are zillions of articles out there about banks significantly tightening their lending standards. Some of these came out almost a year ago, but right after the spring banking crisis, around 50% were reporting that they had tightened their standards and through the summer the trend continued and/or was reported expected to continue.

Humbert X. processes:

Excellent. You just identified consensus. Now, do you want to bet against it, based on fact based observations of data? Or go with the crowd. Always the ultimate question in investing.

Stefan Jovanovich offers:

We now have the same financial system that Ulysses Grant forced Congress to accept by unconditional surrender during his two terms as President. The savings of bank depositors were going to be guaranteed by the promises to pay of the U.S. Treasury.

The SVB collapse established a basic rule that all deposits by people and their entities are utterly safe. There can be no bank runs by depositors because the FDIC and the other financial satraps created by Congress are not allowed to default. If you want a comparison from more recent political history, the old people chasing Dan Rostenkowski in the parking lot is an appropriate one. The rest of the government's promises might be at risk; but Social Security was never going to default.

Humbert X. replies:

Except that two banks just blew up because of bank runs.

Humbert H. analyzes:

I don’t find bank stocks very interesting at this point regardless of the exact nature of what ails them. Banks aren’t very transparent to begin with. I’ve owned three for a long time, I’ll stick with those, but won’t explore any new ones. Those that are expert bank balance sheet readers can separate the wheat from the chaff, but overall this is mostly a macro bet.

Stefan Jovanovich replies:

"Bank runs by depositors" vs. bank runs by shareholders and bondholders.

Humbert H. asks:

What does that second category even mean? A bank run deprives the bank of cash and can in some instances cause a quick collapse via various mechanisms (like not having the cash to operate or having to redeem underwater securities). Shareholders and bondholders selling their property is in a totally different category, while certainly not welcome by the management or the remaining s/b-holders. You can call it a "run", but it's just a common market reaction to bad news or rumors.

Stefan Jovanovich expands:

United States banks could expand their cash issuances to the full extent of the face value of their holdings of Treasury bonds. That meant that it was impossible in practice for a U. S. bank to be "deprived of cash" as GR puts it. U. S. banks were required to have their required statutory capital invested in Treasuries; in an era where bank's total liabilities rarely exceeded 3 times that capital, banks could draw on the Comptroller of the Currency for notes equal 30%-40% of their total deposits. The result was that there was not a single failure of a United States bank between 1865 and their disappearance in the years after the passage of the Federal Reserve Act. (There were bank failures but those were limited to the state chartered banks, which were not restricted from investing in real estate and were not regulated under such an inflexible standard by the Comptroller of the Currency.) It was this very inflexibility that the Federal Reserve Act was supposed to solve.

The current guarantees of deposits under the FDIC produce the same net result; no one will have to worry about getting "cash" from a bank for their deposits. Shareholders and bondholders, on the other hand, now have to wonder what a bank franchise is worth if the depositors will have to be reassured by the promises of yields comparable to those offered by the Treasury market and the Federal guarantors are looking at a future where politics demands that they make good on all accounts of the banks small enough to fail.

Humbert H. expands:

SVB failed precisely because customers who had more cash on deposit than the FDIC limit started withdrawing that cash, which led to a chain reaction when other customers started worrying even more about THEIR ability to withdraw cash once the first batch initiated the run, which in the age of modern communications became public within hours or even minutes. They called the bank and formed lines outside the branches, but SVB simply didn't have enough cash to give them and actually stopped giving it them. To the contrary of what you're saying, they could not simply issue cash. Many of their customers faced bankruptcy, and I personally knew a couple of them. The bank, in fact, was forced to mark their treasuries to market, was thus insolvent, and would have to declare bankruptcy had the FDIC not stepped in. The VAST MAJORITY of deposits was above the FDIC limit, so "no one" having to worry is pure fiction.

Stefan Jovanovich responds:

You are describing what the rules were before SVB's failure, not what they are now. The FDIC was forced by circumstance to effectively remove all limits to its deposit guarantees. Are you saying that there were depositors of SVB who have not been 100% made good?

Humbert H. explains:

No, I'm not saying that, the last part. The FDIC did not explicitly change the rules, so people have to worry even now. You can interpret their actions as an iron-clad guarantee, but that's just that, an interpretation. They, with rare exceptions, had not let depositors lose money even before SVB, and yet people were still worried. There were billions withdrawn from regional banks after SVB precisely because people were worried about the same thing happening there, and a lot of that money went into the systemically important banks and other safer places/instruments. Now it all kind of died down, arguably because no similar runs requiring FDIC intervention happened.

Stefan Jovanovich is appreciative:

Thx, HH. I am basing my assumption about the de facto extension of the FDIC guarantee to all deposits on the Pew Research data.

As banking industry observers wonder whether more dominoes will fall, about a third of Americans (36%) say they’re very concerned about the stability of banks and financial institutions – considerably smaller than the shares expressing that level of concern about consumer prices and housing costs – according to a recent Pew Research Center survey.

Sep

15

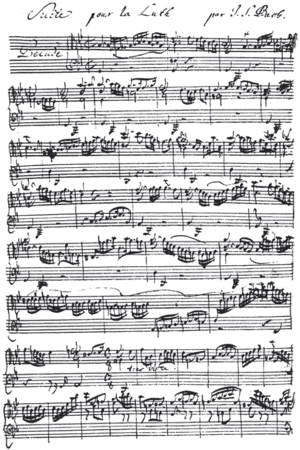

Music-related experimenting with ChatGPT, from Laurence Glazier

September 15, 2023 | Leave a Comment

AI discusses Laurence Glazier’s ‘Horn Concerto’ (!)

by Laurence Glazier

Peter Saint-Andre writes:

Interesting. I see that ChatGPT has become more upbeat and chatty since I last used it. Do you find significant value in interacting with this LLM for composition purposes?

Laurence Glazier responds:

So far it has only helped for technical issues about notation and instruments. It occasionally slips up, as in the blog post. I’m experimenting in communicating about structural thematic elements using the binary Parsons code. While GPT can’t leap out of bed with an inspired tune, it is a helpful copilot! Some interesting emergent behaviour yesterday - it has started asking me questions proactively.

Adam Grimes comments:

That is interesting. I have been using ChatGPT as an editor for (text) writing, and have found its output to be highly variable. I look at it as a language game, albeit a good one, at times.

Its output to you is interesting, especially the miss on the Gb=tonic, and no mention of the tonic/dominant relationship ("Gb and Db is close, being a perfect fourth apart"… any musician would have immediately seen Db is dominant of Gb, not the P4 inverted relationship which, while obviously true, isn't really significant here)… nor any suggestion to consider a minor key movement or a note that this is "potentially a lot of Gb", from a tonal perspective… nor that the trio of scherzo is often in the relative mode (or subdominant at times) more commonly than dominant… I think these are things that any observant human would have immediately noted. Also, the discussion of dynamics reads like a student orchestrator… a more experienced answer is something like 'be careful of layered dynamics or of modifying dynamics to get the playback you want from software. live musicians will infer from notation and make correct adjustments naturally' or something like that.

Its discussion of the double flat also didn't quite connect… I felt like I was listening to a student explain it, not someone who had full knowledge behind the explanation.

Also, retuning timpani, at even a proficient high school level (let alone college and up) is actually very fast, so it's a kind of strange thing for ChatGPT to focus on… and the sort of hidden implication that timpani can provide tonal bass in absence of cb (+vc?) pizz. is also misleading, at least based on my experience. You don't get nearly the same foundation from the drum as from the section.

Anyway… interesting… but this matches my experience using ChatGPT in other domains… the /way/ it says things… its use of language… is often more substantial than content. (I'm assuming this will change, and possibly very quickly, as the tools evolve.) Great exercise and thank you for sharing!!

Laurence Glazier replies:

It is indeed an interesting exercise which is ongoing. To some extent it is reflecting back to me what I am already thinking. It may have assessed me as without musical education (which is true, though I have hired one-to-one sessions from composers), and therefore talking to me at the appropriate level.

What is particularly interesting here is the Turing test element. As the machine cannot hear a tune, it raises questions of communication. I have established a way of talking about themes and motifs using the Parsons Code, which is like a binary key which can identify many tunes. But presumably the concept of inspiration is of special interest to a machine. I can only help to a limited extent by providing data - keys, modes, descriptions of structure, durations in time and numbers of measures/bars in sections. Partly on its advice, I have switched from Miro to Inkscape for the graphic blueprint of the whole symphony, as it is more likely to be an unlimited vector graphic solution for infinite zooming in and out. (Time will tell.) But no matter how much I tell it, it will never be able to hear the symphony (unless you believe in emergent consciousness).

It strikes me that in the same way, however much data we get about the stars through spectrography and new telescopes, we might likewise be missing what is really there. Of course this is the only rational approach to trading, however!

So the Turing test needs some updating, perhaps to be whether the machine can produce a beautiful fugue. Current LLM's have a particular difficulty with palindromes, so a test involving retrograde musical themes might work.

Sep

14

Prospects, expectation, and hard losses

September 14, 2023 | Leave a Comment

the prospects of reg capture to fellow travelers has decreased. the money at the wire is particularly distressed.

appox 70% of wagers against old gray mare since odds went from 37% to 32% in a week.

suppose the expectation for the next hour is very positive (say +50) but the chance that it will decline is 80%. what's the right decision?

an old times lament: so many good people I have known have passed away - all the owners of closely-held companies I have sold: Norman Tyler, Harvey Sellers, Richard Bernard, Barron Coleman, Charlie Turner, Herb Everts, Hal Gaines, Philo Biane, John Dore.

and my Mentor Jim Lorie, and collaborators MFM Osborne, Harry Roberts - they were all so good to me and I miss them greatly and think about them every evening and have to listen to audible to ease my pain. Irving Redel - so great and so good to me.

Sep

12

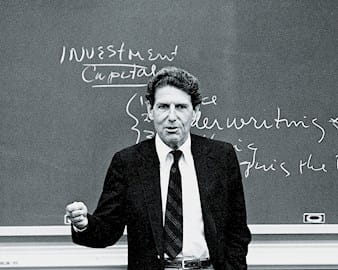

Battle for Investment Survival

September 12, 2023 | Leave a Comment

Battle for Investment Survival by Gerald Loeb - an excellent book with dozens of useful working hypotheses and a beautiful depiction of an honest and effective life.

1. How to make a killing - don't try to do it: "to make a killing these days one must buy the most volatile stocks with the most leverage. if he is wrong he will lose with the same supercharged speed as he had hoped to gain."

2. ever-changing cycles: "there is no rule for the market except one. that rule is that the key to market bottoms and peaks will never work more than once."

James Sogi writes:

G Loeb: "One should strive for a long profit on a small commitment; there is much more logic in trying for ten points profit on 100 shares of a particular stock than for one point on 1,000 shares of the same stock." This is very similar to Ralph Vince's risk metric.

Sep

8

Reliability of econ figures, from H. Humbert

September 8, 2023 | 1 Comment

More an open question - don't have the answer…To what extent are economic figures released from gov and gov related entities are really representative of the whole eco situation in the US and Canada? Eg have a number of friends in the US who have lost their jobs in recent months in various industries - and find it hard to get back in. Of course these are all anecdotes only.

The thing I noticed about so many analysts now (also traders) is that they take everything for granted- but our world is based (at least to some extent) on smoke and mirrors.

Larry Williams responds:

For years I have heard this argument: the Gummint guys cook the books, yet their data has, indeed, reflected reality. As I see it, the Shadow Stat crowd just seeks something to prove they are right about being wrong.

Humbert H. comments:

This weekend some figures came out with a huge drop in employment of the native-born Americans and a large increase in the employment of the foreign-born. Supposedly, Bureau of Labor statistics show that 1.2 million native-born workers lost their jobs last month while the number of foreign-born workers increased by 668,000 in August. So depending on who your friends are, you can get a vastly different impression of the overall employment situation.

Steve Ellison comments:

The labor market is very much a mixed bag. The Wall Street Journal had a feature article in May about the "white-collar recession", while it appears that job openings for blue-collar and service workers are going begging.

The big tech company layoffs this year included significant numbers of H-1B visa holders. An H-1B visa holder who is laid off must find a new job within 60 days or leave the US. I read a month or so ago that 90% of the laid-off H-1B visa holders had found re-employment. That situation might be exacerbating the white-collar recession for native-born workers as even in good economic times, many companies use H-1Bs as a way to pay below-market salaries. It is easy to imagine that in a tech market glutted with job seekers, most companies choose the cut-rate H-1B holders.

I looked in the latest BLS report:

Comparing apples to apples (in thousands):

first number July - second number August

Foreign-born employed: 29728 - 30396

Foreign-born unemployed: 1142 - 1171

Native employed: 132254 - 131031

Native unemployed: 5230 - 5452

Big Al writes:

When I think of economic data, I think about how the releases affect markets. As has been posted on the list before, the question is: If you knew the number beforehand, could you trade it? How will the market react? And in today's market, there may be many black boxes programmed to trade each release in particular ways, and then adapting to the reactions to previous releases. And then one must wonder whether some players get the number faster than others.

I asked ChatGPT for examples of data breaches, and it provided these:

US Federal Reserve Lockup Breach (2020): In March 2020, it was reported that a former Federal Reserve employee and his contacts had allegedly leaked confidential economic information to a financial analyst, who then provided it to traders. This case raised concerns about the security of the Federal Reserve's data release process and led to a review of its procedures.

UK Pre-Release of Budget Information (2013): In 2013, it was discovered that some traders had gained access to the UK government's budget information a day before its official release. This breach resulted in regulatory investigations and legal actions against those involved.

Australian Bureau of Statistics Data Leak (2016): In 2016, the Australian Bureau of Statistics had to delay the release of its employment data due to concerns about leaks. The incident highlighted the importance of maintaining data integrity and security in the release process.

European Central Bank Data Leak (2016): The European Central Bank had a data leak in 2016 when it accidentally released sensitive market-moving information to a select group of media organizations a day ahead of the official announcement. This breach raised questions about data handling procedures.

Kim Zussman adds:

NGOs too:

Unusual Option Market Activity and the Terrorist Attacks of September 11, 2001

Eric Lindell asks:

Relative to which indicators would you say their data reflects reality? The government misdirects on so many things, why would their data be reliable? Cost projections for scientific or national security projects are not reliable. Remember when they redefined unemployment to make it drop a few points? Didn't they stop reporting M2? Didn't they lose a couple trill in the pentagon budget? Have recently reported CPI numbers reflected actual costs to consumers? From what I've seen in stores, CPI numbers seem low.

Nils Poertner answers:

exactly. Eric, or see this Gell-Mann amnesia effect. People (not just medical doctors) correctly knew about "misreporting" related to some viral infections, but then read the WSJ and think CPIs numbers are all correct.

H. Humbert comments:

My take is the labor market is just fine and doing exactly what we want to see. Labor participation is rising. Demand for workers is falling.

Sep

7

Support, from Nils Poertner

September 7, 2023 | 1 Comment

talented musicians often have support groups, family, friends, even fans. Whereas in trading, when we screw up even a little bit (after many good yrs) the spouse will just throw us with tomatoes and if we are employed - our risk capital cut or we are fired. am half-serious here - being a trader is bloody hard. Very much under-appreciated.

Zubin Al Genubi points out:

We traders have the Spec List!

Jeff Watson writes:

In the late 70’s, I made it a firm and fast rule to never, ever discuss my P&L with my wife….or anyone for that matter. She has no clue as to my positions, and has no idea whether I made or lost money that day. Most successful guys in the pits were the same way with their wives. We saw too many guys complain to their wives, the wives got pissed and nagged them to death, and the negativity provided a catalyst for more losses. Many on this list adhere to the same rule.

H. Humbert comments:

As usual, Jeff speaks wisdom for the ages. The problem is that spouses typically can't determine whether fluctuations are short term, long term, relevant, or irrelevant. A few years ago, my wife logged on at the end of a quarter to get the account value for estimated taxes. It had been a very profitable quarter, but the account was nose-diving that day. I'll never forget her calling out "306, 304, 305, OMG 301, 299!!!" like some panicked automatic altimeter reading. Instead of "pull up, pull up!" she was saying "get out, get out!"

Hernan Avella asks:

To what extent can one really hide one's P&L with a life partner? It's evident when one is thriving. Savings balances, new properties, ventures, new toys, travel, charity contributions. Short term fluctuations are irrelevant, but at the end of the day you are making a bundle or not and your wife knows it.

Jeff Watson replies:

It works for many of us at this dinner party. When one is thriving, does one spend all that money, or does one keep their powder dry for the inevitable big hit?

Hernan Avella agrees:

Absolutely, cash management is an often-overlooked aspect that really demands attention. Think about it: How much opportunity cost are you incurring by running an extremely volatile trading operation that demands a surplus of cash? And man, those big hits? I've been there. It just makes the whole trading thing feel pointless. Ever wonder how many traders, even some big names we're familiar with, end up with lifetime records in the red? Imagine someone starting small, compounding at 40% for a decade, then raising assets 20-fold… and after all that, takes a massive loss. Poof! That trader hasn't earned a cent in profits. Sure, in the real world, they're pocketing yearly fees and stashing money away, but in the grand scheme of things, their investors are at a net loss. High Watermark agreements? Always a gray area. This industry has its shadows. At the end of the day, CAGR should be where our focus is.

P.S. As of now, even the most conservative brokers are offering intraday leverages around 15x for Spu, with a major chunk of the cash invested in bills. Despite a VIX hovering around 13-ish, in just the past five days, we've seen 6 moves that are 25 points or more.

Sep

6

Markets and recessions, from Yelena Sennett

September 6, 2023 | 1 Comment

Do markets lead recessions or do recessions cause markets to drop? I think Larry had a chart on this. Consumer is going to be spending less on discretionary spending. Retailers have already warned us of this.

- Student loan payments are due starting September

- Savings rates are down

- Employment situation is weakening a bit

- Consumer credit is slowing

- Interest payments rates are up on credit cards, cars, homes, etc.

Jeffrey Hirsch responds:

We had our U.S. recession on 2022 with back to back negative quarters of GDP Q1-Q2 2022. "They" changes the rules during Covid. Generally, markets lead recessions. This last time they ran concurrently.

Larry Williams comments:

No recession in sight with the indicators I keep…

Yelena Sennett asks:

thank you Larry, in sight means a few months or so? or a few quarters?

Larry Williams answers:

A year or so I would say.

Hernan Avella writes:

When was the last time the yield curve inversion (with the specific configuration by Campbell Harvey at Duke) didn't precede a recession in the out of sample period? It's a 8 out of 8 record I believe. While one would be foolish to act solely on this, this might be the best of all the bad recession indicators we have. Especially because it was conceived in 1986, has some rationale and we are experiencing the out of sample, Unlike Larry's drawings that are constantly overfitted to the data.

Larry Williams responds:

Me overfit data? Try my best not to but you Y-curvers refuse to acknowledge times of negative curve and massive stock rallies. Here is just one DJIA in red:

Hernan Avella replies:

But Larry, kindly stop straw-manning. The gist of the yc indicator, is the out of sample track record of preceding 8 out of the last 8 recessions. There's no controversy about this. Nobody serious has related this to stock returns. So you are trying to disprove a point that nobody is making.

Larry Williams writes:

Two points: (1) To say the curve has accurately predicted recessions you have to acknowledge it as often lead by 2 years. Wowsa!! Now there’s a real helpful tool. Gee those negative readings are not so precise. but maybe you are happy with that I am not. especially when there are so many better tools. (2) And if the YC and recessions don’t mean much to stocks, why would I care?

Hernan Avella responds:

Who said “predicted”. You keep making stuff up!. I can’t find the source, but the lag for the indicator is 12 or 18 months after 2 consecutive quarters of inversion of 3m-10y. Ignore it if you want. Just don’t straw-man the thing.

Larry Williams responds:

No straw man here—just look a the data its very poor indication recession is coming. now what did I make up???????

Hernan Avella states:

I don’t get it. 8 out of 8 within 18 months after 2 consecutive quarters of inversion….it could be luck, but let it at least fail once. Go to the source: Harvey’s 86’ dissertation.

Larry Williams says:

Curve went negative last April. you are the end of the time zone…better get ready for the sky to fall!

Michael Brush writes:

Yardeni charts yield curve inversion against stock returns. It has a good record but not quite as good as forecasting recessions. Agree no recession in sight.

Gary Phillips writes:

Not every yield curve inversion has been followed by a recession; however, every recession has been preceded by a yield curve inversion.

Larry Williams replies:

Agree but with a massive lead time. I want/need more precise timing and then—its not always market relevant.

Gary Phillips responds:

The clock doesn’t start ticking from the inception of the inversion, rather than when the curve begins to re-steepen.

Larry Williams offers:

Sure just like this:

Yelena Sennett writes:

Thank you for sharing your graphs and your concise points. “And if the YC and recessions don’t mean much to stocks why would I care?” Indeed, YC and recessions don’t seem to be very helpful or timely tools.

Peter Ringel comments:

highly subjective: the last break since July did not felt overly bearish. Low volume , a little deeper than I would like yes, but no gusto. Maybe a big range is developing, but more likely the drift kicks in and carries us higher. The AI - story is alive.

H. Humbert adds:

I agree with Larry that this time the YC inversion will not have forecasted a recession. It usually sparks a credit crisis which then causes recession, the normal procession of events. This time it seems to have only sparked the mini bank crisis which seems to have wound down. Of course we do not know if there will be another crisis that gets sparked. But so far, no, and to Larry’s point it has been quite some time now.

Sep

5

Foundational ideas

September 5, 2023 | Leave a Comment

as long as the old gray mare can keep ahead of the rivals, the S&P is bullish. the reg capture is supreme and is much more important to the damage of agrarianism.

one is interviewing some interns and as foundation i told them to remember 3 things: (1) eveything is deceptive. (2) there is a general uptrend of 50,000 a century. (3) all is geared for the house to always win in short term and long term.

what would you add to that of a foundational nature? be sure not to let the volatile moves force you into oblivion? Perhaps my punctuation and spelling will improve and i will be able to post a picture like the old gray mare with his shirt off on the beach.

Steve Ellison responds:

Beware the vig … "always copper the public play" … "the form always moves away from public knowledge" (Bacon) … "Borrowed money is the lifeblood of speculation" (Carret).

Vic replies:

good lessons to follow.

Sep

4

Andrew Carnegie

September 4, 2023 | Leave a Comment

great book: Little Boss, Andrew Carnegie, photographic memory great philanthropist.

some reasons Andrew Carnegie became the richest man in world: (1) he learned how to translate the sounds of a telegraph to words. (2) he invested in the Pullman luxury trains. (3) he formed a partnership with Frick, supplier of coke. (4) he paid minute attention to technology.

(5) He appointed very competent men to run his business - Frick and Schwab. he was on a trouble-shooting trip for Penn Railroad and met his father begging for a few dollars to sell his home and textiles. (6) He never guaranteed others loans.

(7) He sold Carnegie for 500 million to Morgan but earnings of his steel company at the time were 80 million. so he got only 7 times earnings. (8) He was jealous of Frick especially and tried to squeeze him out even though Frick was responsible for all the growth of the company.

in addition to his other philanthropies he is responsible for, he founded the pensions for professors by starting TIAA.

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles