Jan

31

The benefits of small business

January 31, 2024 | Leave a Comment

in book 1 of Les Miserables there is a resonant section as to how Jean Valjean, now Mssr. Madeleine, has invented a new way of making "English jet and the black glass trinkets", and his factories have uplifted all in the Town. it is the story I have seen with hundreds of small companies that have invented a new product or manufacturing technique and have created jobs and prosperity for their workers and town. It is strangely omitted from all the summaries of the book and could have been applied to Musk, Bezos and the Fad 5 in our current generation. every kid should read the chapter and reflect on what good business does.

I take my hat off to Norman Tyler of Tyco, and Harvey Sellers of Hi-Flier Kites, and Arthur Bernard of Bernard Welding, and Baron Coleman or Hospital Affiliates - the first 3 companies (out of eventually 100's) that I sold in my merger bus and I shall revere their memory.

"Unlike this judge, Elon Musk has actually contributed to the American People in the form of thousands of good paying jobs, innovative products and less expensive access to space." out of Les Miserables. Including significant ROI for those that supported Tesla.

Toward the close of 1815, a man, a stranger, had settled in the town, and had the idea of substituting in this trade gum lac for rosin, and in bracelets particularly, scraps of bent plate for welded plate. This slight change was a revolution: it prodigiously reduced the cost of the material, which, in the first place, allowed the wages to be raised, a benefit for the town; secondly, improved the manufacture, an advantage for the consumer; and, thirdly, allowed the goods to be sold cheap, while tripling them the profit, an advantage for the manufacturer.

- from book 5 chapter 1 of Les Miserables (a la Musk).

Jan

28

Revelations of The Prisoners Dilemma, from Asindu Drileba

January 28, 2024 | Leave a Comment

This is my favourite channel an YouTube. And I liked this particular episode so much it may be my favourite so far:

What The Prisoner's Dilemma Reveals About Life, The Universe, and Everything

The prisoners dilemma is a choice participants need to make that are as follows:

1. If both participants cooperate, they both get $10 each.

2. If only one of the participants cooperate, the defector gets $1, and the one trying to cooperate (be honest) gets $0.

3. If both participants defect (both are dishonest to each other), they both get $1, which is way less than the $10 they would each get by both cooperating.

These are the only four possible states or outcomes of the game. The objective is simple, if the game is repeated for several rounds, under different environments (varying ratio of cooperators & defectors). What strategy should one choose to make the most money? Several agents choose independent strategies and play against each other with whatever strategy they have chosen. All with the aim of making the most money. It turns out that the best strategy for this game amongst different agents is one they call "Tit for Tat". It can be summarised as, "Be Nice, Try to forgive, But don't be a doormat/push over."

Stefan Jovanovich writes:

Pinched from a Stanford course catalog from 1998/9: Axelrod's Tournament:

In 1980, Robert Axelrod, professor of political science at the University of Michigan, held a tournament of various strategies for the prisoner's dilemma. He invited a number of well-known game theorists to submit strategies to be run by computers. In the tournament, programs played games against each other and themselves repeatedly. Each strategy specified whether to cooperate or defect based on the previous moves of both the strategy and its opponent.

Big Al adds:

The Evolution of Cooperation, by Robert Axelrod

We assume that, in a world ruled by natural selection, selfishness pays. So why cooperate? In The Evolution of Cooperation, political scientist Robert Axelrod seeks to answer this question. In 1980, he organized the famed Computer Prisoners Dilemma Tournament, which sought to find the optimal strategy for survival in a particular game. Over and over, the simplest strategy, a cooperative program called Tit for Tat, shut out the competition. In other words, cooperation, not unfettered competition, turns out to be our best chance for survival.

Kim Zussman gets biological:

Cooperation and Darwin:

Humbert H. comments:

The original prisoner’s dilemma was about literal prisoners who didn’t get to play even twice with the same “partners”. There are a lot of situations in the real world that map to the prisoner’s dilemma, but a lot fewer that map to playing the same game with the same partners who are rational and capable of learning.

Big Al appends:

Yale Game Theory Course (24 videos), with Dr. Benjamin Polak.

Peter Grieve goes deep:

I am convinced that the principal functions of a healthy society are (1) to get to the good payoff of the Prisoner's Dilemma, and (2) to find an acceptable solution for the Trolley Problem.

Jan

27

Bitcoin forecast, from Larry Williams

January 27, 2024 | Leave a Comment

Asindu Drileba writes:

A lot of Bitcoiners are expecting a crazy bull run incoming. Their conjecture is that after the halvening, a shock of supply in BTC will cause the price to sky rocket. Previous bull runs have followed this halvening event. It is very refreshing to see a completely different original opinion.

Sam Johnson asks:

You certainly don't need to reveal the source or methodology of the red line data from your timely bitcoin forecast if you don't wish. But when choosing cycles to forecast markets, is there consistency in the order in which you approach finding good cyclical indicators? Do you begin by "chart matching" or finding a leading indicator that visually/numerically correlates well and front-runs certain markets, or do you start with a hypothesis, testing, and then using or discarding such forecasting cycles?

Larry answers:

The forecast here is really simple: it’s just the longer-term cycle forecast for GBTC. I arrive at it by doing a complete cycle search the meld together the 3 with the highest fit.

Andy Aiken asks:

How do you account for the fact that GBTC was a closed-end fund trading at a discount for the past several years, but the discount closed prior to it recharacterizing as an ETF on Jan. 11? This is a one-time event specific to GBTC, not subject to a cycle. What is the significance for bitcoin?

Larry answers (again):

I just use the back-adjusted data as provided.

Andy Aiken adds:

Speaking of mining rewards, the next halving (in which future mining rewards are cut in half, resulting in less reward from mining as well as less inventory to be sold by miners interested only in cash flow), is in about 100 days. This has been historically a (bullish) tailwind.

But with GBTC being converted to a spot ETF, several bankrupt entities are selling their inventory. FTX is now finished selling about $1B in GBTC since Jan. 11, but 3AC has yet to start selling, and that firm had more on its books than FTX. While I am more bullish than your projection, it's interestingly contrarian and would screw with traders' heads as markets like to do.

Jan

27

An inspiring passage

January 27, 2024 | Leave a Comment

An inspiring passage from In the Kingdom of Ice: The Grand and Terrible Polar Voyage of the USS Jeannette: "The polar regions were far safer than the Dark Continent. For decades our explorers, one after the other, have let themselves be slaughtered in the interiors of the most dangerous continents, especially Africa, perhaps by fanatical inhabitants, perhaps by the deadly climate, while such dangers and sacrifice occur with Arctic expeditions, at the most, only as rare exceptions.

The Hampton Sides story of De Long and Bennett inspires one to reach for the 5000 level in the S&P and further.

Jan

26

Variance swap, from Zubin Al Genubi

January 26, 2024 | Leave a Comment

Daily sd's 1 (1,1,1,1,1,0,0) mean variation .71 PL 2

Daily sd's 2 (0,0,0,0,0,0,5) mean variation .71 PL -18

Correct forecast, but went bust anyway, due to lumping of volatility.

Asindu Drileba asks:

What would be the best strategy to capture the return of this distribution? How would the position size be computed? Say you have $10.

Zubin Al Genubi replies:

OTM option? Don't know which direction so maybe a strangle? Its an example of a fat tail event surprising someone expecting a certain variance. Like the LTCM guys. $.20? 2%? As a hedge. Depends if its hedge or a trade.

William Huggins comments:

what you're picking up on is that variance alone doesn't describe non-normal distributions very well - you need additional tools like skewness (possibly kurtosis) to pick up on those differences. despite having a better description though, there is the presumption that the data generating process is stable across the sample period, and going forward. I've generally found (despite my poor timing record) that money is to be made when the distribution is changing, not stable (the computers rule those waves imo) so detecting breaks may be more valuable than fixed descriptions.

Peter Ringel writes:

I can confirm this from the math-undereducated trading side. Stability is boring, and boredom can lead to undisciplined trades. Shocks and short-term exaggerations are great.

Art Cooper points out:

Stability is boring, and boredom can lead to undisciplined trades. It's Minsky's Theory when this becomes widespread.

Zubin Al Genubi responds:

Thank you Dr Huggins. That is indeed the point that variance, regression, sd, means, should be used with power law distributions with extreme caution or not at all.

Hernan Avella questions:

Why is all that mumbo necessary when all you need is good entries and good stops? The house never closes and there are so many opportunities ahead. f you need that big of a stop, or it gets triggered so frequent that ruins the profits, your system sucks! It’s not a stop-loss problem.

H. Humbert comments:

I think he is saying the system did suck because it relied on improper statistical analysis, using gaussian distributions for prediction when it should have used a more sophisticated statistical analysis that doesn't make such assumption. If you know of good entries reliably without using statistics, more power to you! And maybe he needs volatility swaps in addition to variance swaps and then his system will be A-OK because that could be a simple way to hedge the fat tails. Since I don't trade, I'm just trying to interpret what's flying by.

Humbert H. writes:

Var swap vs. vol swap would be the purest expression. You could also buy a call on realized variance, by buying an uncapped variance swap and selling a capped variance swap (for historical reasons, the cap is struck at 2.5x the variance swap strike, the cap level acting as your effective call strike).

For 100k vega notional and uncapped strike at 22, and capped strike at 20, and realized vol over the period of 80:

100,000/(2*strike) = var notional = 2,272.72 var units uncapped, 2500 var units capped

Pnl uncapped 13.4mm

Pnl capped -4.1mm

Net 9.3mm for ~0.2m cost, not bad (approx (22-20) * vega not).

Some payouts were on the order of 2000:1 during March 2020. Pre 2020 you had some active sellers:

‘Amateurish’ Trades Blew Up AIMCo’s Volatility Program, Experts Say

H. Humbert responds:

Interesting. And an interesting article. You'd think that after LTCM people would realize that 100 year floods are just named that for convenience. That's why I never buy stocks in insurance companies. He whose name shouldn't be mentioned (not the fractalist but the Middle Eastern guy) always advocated buying black swan options, but I think the Chair didn't think he made money on this.

Kim Zussman links:

Jan

26

With direct applications to markets

January 26, 2024 | Leave a Comment

two excellent books with direct applications to markets:

Regression: Linear Models in Statistics, by Bingham and Fry.

Event History Analysis: Statistical theory and Application in the Social Sciences, by Blossfeld, Hamerle, and Mayer.

both highlly recommended

Zubin Al Genubi adds:

Previously recommended by Vic:

Event History and Survival Analysis: Regression for Longitudinal Event Data

I've used survival statistics for studying survival time between crashes, x-day highs/lows, ATH, bear markets. Poisson distributions are the distribution for time occurrences as well.

Big Al offers:

Free online book using R language:

Statistical Modeling: Regression, Survival Analysis, and Time Series Analysis, by Lawrence Leemis, William & Mary.

Jan

25

David Deutsch on Bayesianism, from Asindu Drileba

January 25, 2024 | Leave a Comment

People have said that the reason fundamental physics has slowed down is that we have picked all the lower-hanging fruit, but that's not true. There is more lower-hanging fruit than ever before, it's just that picking it is stigmatized.

- David Deutsch

The full podcast is here.

This reminds me of what Brian Arthur insinuated in his book, The Nature of Technology. Brian Arthur describes technology as a combination of other technologies. An example is smart phone being a combination of battery technology, wireless communication technology, a microprocessor technology etc. A common statement I hear often is that we will not see much more technological progress because all the lower hanging fruit (or important things to be invented) are gone. Brian Arthur in his book asserts that if technology is a combination of other technologies, then the invention of new technology should increase the possible space of new technologies that can be invented. For example an AI breakthrough (the invention of the Transformers Model that underlies ChatGPT) will make it easier to invent new products, discover new phenomena which will also make it easier to produce even newer technology. Could this insight be a a good conjecture for always being long technology companies, since we expected technology to grow almost boundlessly if this is true?

Peter Saint-Andre comments:

Although it's seemingly true that technology always grows, that doesn't necessarily mean that technology companies are always a good investment. Various technology industries (crypto, Internet, semiconductors, chemicals, automobiles, radio, railroads, etc.) have experienced cycles of over-investment and hype. I worked in Internet tech companies from 1996 through 2022, and plenty of the companies I worked at either went bust (returning nothing to the investors or employee stockholders) or never approached their former highs (can you say Cisco?). It's not clear to me that, on balance, technology companies provide above average returns. But my perspective is qualitative, not quantitative.

Zubin Al Genubi responds:

That is the Lucretius Fallacy. Thinking the prior highest or best is the top. There will always be something new, bigger, better. That is why NQ is good over time. The old fades out and the new rises ever higher.

Asindu Drileba replies:

It is true that most tech companies actually fail without ever yielding a profit. How ever if your are diversified i.e have a very broad portfolio of investments. You don't have to be successful very many times. You can do very well with a 90% failure rate. Fred Wilson (of Union Square Ventures) claims that half of all VCs beat "The Stock Market" (I am assuming he means the S&P 500).

Big Al writes:

Important, too, to notice the improvements in ordinary things we might otherwise take for granted. A lot of this progress happens in basic materials. A quick search produces:

9 Material Discoveries that Could Transform Manufacturing

During Covid, our dishwasher broke. It was at least 35 years old and possibly older (amazing the use we got from it!). Because seemingly everybody was remodeling while they were stuck at home, it took us 3 months to get a new Bosch (during which time I washed a *lot* of dishes). But I was amazed at what an improvement the new Bosch machine was: it's so much more efficient, with energy and water, and effective, as well as quiet and very smart. That experience woke me up a bit to how much things get improved, and without any central planning authority being responsible for it.

Hernan Avella warns:

Yet, the new Bosch won't last 1/2 of the old one.

Jan

24

For the Darwin fans, from Peter Saint-Andre

January 24, 2024 | Leave a Comment

I just posted the Voyage of the Beagle at my website for public domain books (optimized for reading on phone or tablet).

I'd previously also posted Darwin's Autobiography.

Jan

22

The Poisson Process and Poisson Distribution, from Asindu Drileba

January 22, 2024 | Leave a Comment

This is the best explanation I have seen so far concerning the Poisson Process & Poisson Distribution. It has clearly defined math variables (something explanations involving maths seldom do) & very clear practical examples. I wish more people describing math concepts wrote like this.

A Poisson process is a model for a series of discrete events where the average time between events is known, but the exact timing of events is random. The arrival of an event is independent of the event before (waiting time between events is memoryless).

Zubin Al Genubi comments:

Seems useful to study occurrences of crash or bear market.

Big Al offers:

3Blue1Brown does some great math videos, eg:

Binomial distributions | Probabilities of probabilities, part 1

H. Humbert is skeptical:

It's hard to know without a lot of study whether this is useful for any real-world applications. This distribution has been used in network traffic modeling since the advent of networks because networks have packets and packets have rates that COULD be pretty stable over the period of interest. It worked pretty well for legacy telephone networks, but not so much as computer networks become more and more complex. People still like it because it's a relatively simple formula where if you know the lambda you know everything, and it has no memory of the past so you don't need to store the past, but it doesn't really work well. It doesn't even work that well for predicting meteor showers because the rate itself is subject to change, so can it really work well as a predictive tool for the markets?

Andrew Moe writes:

Poisson has shown to be useful in predicting soccer and hockey scores. In the markets, one test might be to model uncorrelated markets against each other in a double Poisson, like the soccer quants do. Offense and defense, up markets and down.

Jan

21

Wall Street And The Wilds

January 21, 2024 | 1 Comment

great book: Wall Street And The Wilds (Internet Archive version), by Anthony Weston Dimock. 1915. invented a very good gold system. competed with the Commodore in steam ship lines and railroads. touched every area of gilded age business. was great naturalist and photographer.

Also: Dick In the Everglades

Jan

20

Useful bears

January 20, 2024 | Leave a Comment

El-Erian Says Markets Have Overpriced Speed, Depth of Fed Cuts

• I wouldn’t be surprised if cuts only start in summer: El-Erian

• Markets are underestimating stubborn service-sector inflation

Jan

19

Numberphile interview with Jim Simons, from Big Al

January 19, 2024 | Leave a Comment

Interesting in many ways:

James Simons (full length interview) - Numberphile

He worked a lot on differential geometry which would seem to be the area of Ralph Vince's manifolds.

Zubin Al Genubi writes:

Differential geometry would be good for Ralph Vince's optimal f portfolio calculation finding the peak "hump" in the multidimensional surface. Can anyone recommend a good entry level book?

Big Al offers:

Possible: The Leverage Space Trading Model: Reconciling Portfolio Management Strategies and Economic Theory by Ralph Vince.

Also a list of Ralph's publications.

Zubin Al Genubi comments:

An interesting aspect of Vince's optimal f calc for a portfolio is that it solved by iteration. The idea of iteration is interesting in finding optimal values in functions. Also, graphing is an important tool to find maxima, and inflection points in curved functions.

Big Al adds:

Newton's method in optimization

Jan

17

The sin-eater

January 17, 2024 | Leave a Comment

the joy of set pieces in O'Brian and Conan Doyle. the Hoodoo.

'I have a curious case in the sick-bay,' he said to James, as they sat digesting figgy-dowdy with the help of a glass of port. 'He is dying of inanition; or will, unless I can stir his torpor.'

'What is his name?'

'Cheslin: he has a hare lip.'

'I know him. A waister—starboard watch—no good to man or beast.'

'Ah? Yet he has been of singular service to men and women, in his time.'

'In what way?'

'He was a sin-eater.'

'Christ.'

'You have spilt your port.'

'Will you tell me about him?' asked James, mopping at the stream of wine.

'Why, it was much the same as with us. When a man died Cheslin would be sent for; there would be a piece of bread on the dead man's breast; he would eat it, taking the sins upon himself. Then they would push a silver piece into his hand and thrust him out of the house, spitting on him and throwing stones as he ran away.'

'I thought it was only a tale, nowadays,' said James.

[More on sin-eaters.]

Jan

17

Statistical Consequences of Fat Tails, from Zubin Al Genubi

January 17, 2024 | Leave a Comment

Statistical Consequences of Fat Tails

Taleb discusses how fat tails can affect probabilities. Is a 10 sigma event an outlier or is it part of a different power law distribution. How slowly does the Central limit theorem conform say Student T distribution to normal (need n>120) for proper confidence levels. Learned about Pareto and other power law distributions. Book suffered from poor editing, missing color references, and Taleb's abrasive pedantics. Recommended nonetheless.

Asindu Drileba writes:

I have learned a lot from both Vic & Taleb. Vic introduced me to obscure trading psychology & insights. Via his books, interviews and books recommended (Horse Trading, Secrets of Professional Turf Betting etc). At first these recommendations seemed strange. But after watching this video by D. E Shaw, it finally made sense because Shaw hints that successful models are built often via thinking in terms of analogies. So, reading Vic's own books, book reccomdations and thinking in terms of analogies can allow you to develop new insights into the market.

Taleb introduced me to the complexity theorists (Didier Sornette, Ole Peters, Mandelbrot etc). He also actually introduced me to Vic's work. Education of a Speculator is praised & highly recommend in Taleb's Fooled by Randomness. I also like Taleb, because he simplifies his concepts in to plain English. So a lay man like me can easily understand what he is trying to say. For instance majority of a statistical consequences of fat tails is summarized in Extreme events and how to live with them- The Darwin College Lecture. In plain English.

Zubin Al Genubi reponds:

The gist of the papers is that use of Gaussian underestimates tail events. Its a good point. Since so many do, it opens good trading opportunity. I've found several which is left as an exercise for the reader and explained in the references here.

Jan

16

IID, from Zubin Al Genubi

January 16, 2024 | Leave a Comment

One main assumption in statistics is that samples are independent and not correlated. However, it seems apparent to almost every trader that the outcome for one day is related to yesterdays price action.

Andrew McCauley writes:

Your comments reminded me of something that Benoit Mandelbrot mentioned in his book The (Mis)Behavior of Markets: A Fractal View of Financial Turbulence:

Speaking mathematically, markets can exhibit dependence without correlation. The key to this paradox lies in the distinction between the size and the direction of price changes. Suppose that the direction is uncorrelated with the past: The fact that prices fell yesterday does not make them more likely to fall today. It remains possible for the absolute changes to be dependent: A 10 percent fall yesterday may well increase the odds of another 10 percent move today—but provide no advance way of telling whether it will be up or down. If so, the correlation vanishes, in spite of the strong dependence. Large price changes tend to be followed by more large changes, positive or negative. Small changes tend to be followed by more small changes. Volatility clusters.

Big Al offers:

Just felt like doing some tinkering, so here is a chart with two series: The upper series is the moving 20-day C-C % return of SPY adj, calibrated by the right hand axis. The lower series (left hand axis) is the 20-day rolling sum of the absolute value of the daily % changes. As expected, the lower, vol series tends to peak when the upper series is spiking downward, but the chart could provide some interesting trailheads for further research.

Jan

14

The Wisdom of Rationals, from Asindu Drileba

January 14, 2024 | Leave a Comment

I have an interest in prediction markets (also known as information markets or idea futures), such as election betting odds, that allows people to place bets on who they think will be the next president. I wrote an article on my blog some time back (2020) describing the phenomena referred to as the "wisdom of the crowds" that makes these prediction markets possible:

For years now I have been fascinated by prediction markets. The source of excitement is the idea is that you can use financial markets to do inference — just like machine learning. A famous example of such prediction markets are the orange futures. The orange futures market is one that allows entities to buy oranges in advance. How it works, is that one can pay $1,000 to receive 1,000 oranges that will be delivered next year. An interesting side effect of this orange futures market is how it accurately predicts temperatures in certain locations more specifically, the temperature of the locations where the oranges are from.

Peter Ringel writes:

this is a clever thought, and also a terrible situation. I too noticed that it seems - in places - to be easier to predict pockets of the real economy with the financial markets. Of course, traders like it the other way around. Mkts got so efficient. The outside world has way more inefficiency left. (Also enjoyed your mention of "J" language - never heard about it before.) the source of excitement is the idea is that you can use financial markets to do inference.

Zubin Al Genubi comments:

The difference between prediction markets and financial markets is that prediction markets are binary outcomes and markets have non binary outcomes. The distributions are different.

Larry Williams responds:

What a great point. That’s a massive difference….then add in position size.

H. Humbert writes:

An option price seems awfully similar to a prediction market price: both deal with a discrete event at a particular time in the future (or at least close enough for most prediction markets), and right before expiration both, in a way, create a binary choice. I don't trade options, but that's what it appears like.

Zubin Al Genubi replies:

One big difference is options are subject to arbitrage. The prediction markets are not and get wildly inaccurate swings.

Big Al offers:

Binary Option

Superforecasting: The Art and Science of Prediction

Brier scores

From an interview with Michael Mauboussin:

…when you have an investment thesis to buy or sell something, that means you believe you're going to generate an excess return, or there's a mispricing in the market. And…that thesis should have sub-components to it that will allow us to create a scoring system. The most common of these or known of these is called a Brier Score….To have a Brier score you only need three things. You need an outcome that we can agree upon, within a time period that we are finite, with some probability….And so my argument is break down your thesis and put it into some Brier score ready predictions…what I find is the very discipline of writing those things down will force you or compel you to think more…deeply about them. For example, if you're assigning probabilities, you're going to immediately start searching for base rates.

Jan

12

On sizing and return

January 12, 2024 | Leave a Comment

Mauboussin re Druckenmiller and Soros:

There's one other thing [Druckenmiller] talked about and it was about position sizing. Broadly speaking, when you're trying to maximize your returns, you need two things. One is you need some sort of an edge….The second thing is how much you can bet on that when you have that advantage. And the intuition is quite straightforward. If you had perfect information, you knew your bet was going to make you money. You would bet everything you could, right?…He has this sort of zinger, where he says, people said, what did you learn from Soros? And he said, the main thing that he learned from Soros was that position sizing was 70 to 80% of the game. The reason that struck me is because, first of all, purportedly George Soros made money on fewer than 30% of his trades. And that alone is worth letting settle in a bit….It means that he made a lot of investments that lost money. They probably did not lose much money. And when he did make money, he made a lot of money, both by betting a lot of money and by letting it run simultaneously. That I thought was a really interesting lesson.

H. Humbert responds:

Imagine that you have this ability to make win enough on 30% of your trades, and the edge is enough to compensate for the losses on the other 70%. If you take lots and lots of time to study and prepare for your positions or you must have only 1 or 2 at any one time for any reason, it makes sense that position size becomes a very important consideration. But what if you don't spend a lot of time? Or what if you can easily have 200 (or whatever, but a large number compared to 20) positions? Than it would seem that having a very large number of positions makes sense and position size is not an important consideration.

Jan

11

NVDA up 6% on Monday, from Steve Ellison

January 11, 2024 | Leave a Comment

Looking at 5-day forward returns after one-day net changes of 5% or more, the expectation for NVDA stock is negative based on the period back to 2015, but if I shrink the study period to only the past 2 years, results are consistent with randomness with a t score of -0.60.

Output of my Python code:

The sample mean log return is 0.0019077453098868752

The population mean log return is 0.005224266059430747

Backtest sample statistics (log returns):

Mean: 0.0019077453098868752

Standard deviation: 0.03251087812071903

N: 35

t: -0.6035149614769291

I put my code on Github.

Last 10 results:

Jan

10

Mises Stationarity Index, from Zubin Al Genubi

January 10, 2024 | Leave a Comment

Buy S&P when MS in lowest quartile. Hold bonds in highest quartile. Beats S&P buy hold by 2%. Per Spitznagel.

James Goldcamp responds:

Is the quartile a rolling or calculated over the entire history, a fixed lookback, etc? (I have this book I think somewhere I guess I could find it myself). The graph would suggest, if using "max quartiles", it stays a buy or hold (bonds) for long periods. I feel like that would also generate many flat periods if you are in bonds in the highest and wait until it drops to lowest to get back into the market.

My interpretation could be totally wrong (above) , so apologies if I'm grossly misrepresenting, but I've always been nervous with very long term timing mechanisms because you may miss good investing years before you know the model is flawed. Of course you might say the same for "long only" domestic investors in Japan investing in the 80s. But it's always nice when flawed ideas fail fast non-catastrophically.

This does bring up fond memories of watching a presentation of various long term timing models of the late Nelson Freeburg in Orlando in 1998 (I think) - I believe one was called "Competitive Returns" that compared equities and bonds and may have been originally attributable to Ned Davis. He reviewed several that day (one may have been a Zweig timing mechanism). I always liked Nelson's newsletter which he graciously sent to our office for many years.

Big Al offers:

The Single Greatest Predictor of Future Stock Market Returns

And the current version on FRED.

Jan

9

John Floyd on the Biggest Trades and Risks for 2024

Peter Ringel writes:

regarding the other topic on win rate: In this interview, John too mentioned (as an FX macro trend trader) a win rate below 50%. "I am more wrong than right." Of course, this gets rectified by larger wins than losses and the resulting expectancy.

Zubin Al Genubi adds:

My biggest take aways were that volatility will be higher next year and Japan will do better than it has been.

Jan

9

Art for sale

January 9, 2024 | Leave a Comment

art for sale I own. any ideas as to best way to sell it?

Jan

9

Books, from Zubin Al Genubi

January 9, 2024 | Leave a Comment

Option Volatility and Pricing: Advanced Trading Strategies and Techniques, Sheldon by Natenberg. Recommended in by Ralph Vince.

The Dao of Capital: Austrian Investing in a Distorted World, by Mark Spitznagel and Ron Paul.

This is a magnificent, scintillating book that I will read over and over again. It provides a theoretic and practical framework for understanding the insights of all the greats that a student of markets will encounter—Soros, Baldwin, Klipp, Buffett, Cooperman (albeit these greats might not realize or acknowledge it). It teaches you things about war, trees, martial arts, opera, baseball, board games. Every page is eye-opening, with numerous areas for testing and profits in every chapter. I will share the book with all my traders, friends, and circles of influence. Here’s an unqualified, total, heartfelt recommendation, which coming from me is a rarity, and possibly unique.

- Victor Niederhoffer (from inside cover)

Quite exciting tale of 1939 failed Russian invasion of Finland:

A Frozen Hell: The Russo-Finnish Winter War of 1939-1940

And a classic from Ralph Vince:

The Mathematics of Money Management: Risk Analysis Techniques for Traders

Martin Lindkvist writes:

Many years ago in 2006 I had a heated discussion on this list with Stefan J about the Finnish winter war as well as WW2 and what conclusions could be drawn from them about Sweden's position. Suffice to say that we both thought we won and still left the argument amicably.

There is a very good film from 2017 as well as a Netflix series about the "Continuation War" called Tuntematon Sotilas/Unknown Soldier. This war was from 1941-1944 and started after Germany used Finnish territory for part of Operation Barbarossa, and as the Soviets started to bomb Finland, they seized the opportunity to try to take back lost territory from the Winter war.

Stefan Jovanovich replies:

Martin won. He was then, as now, gracious to a fault. These links provide some background:

[Also of interest: The Winter War (Talvisota) DVD - Uncut (70 min. longer than U.S release) -Ed.]

Jan

8

Futures beat forex again, from Larry Williams

January 8, 2024 | Leave a Comment

Year in and year out the winners of trading contests do better in futures than FOREX yet forex has better margins. Big lesson here.

Martin Lindkvist comments:

Interesting, Serghey Magala is on both lists. Anybody knows him? Might be good addition to this board.

And I note Robert Miner (Dynamic Trader) is on the Forex list. Another trading expert (apart from the Senator) that actually trades, and trades well it seems.

Jan

7

Lee Stern: legendary trader, from Jeff Watson

January 7, 2024 | Leave a Comment

December 27th was the 97th birthday for Lee Stern, the oldest and longest-standing member of the CBOT. Lee is a legendary trader and one of the most respected members of the exchange. He’s the guy that took the 9 million dollar hit when a fake trader scammed the bond pit. He’s also a spreader which explains his longevity in the business.

Here’s the story of the scammer which is a compelling read on it’s own.

Jan

7

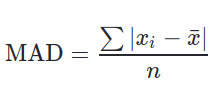

Mean Absolute Deviation, from Zubin Al Genubi

January 7, 2024 | Leave a Comment

Consider using Mean Absolute Deviation, arithmetic Average of absolute returns, in lieu of standard deviation. This is often done in finance unintentionally. Cant remember which understates variance. Easier to compute.

William Huggins writes:

The problem with MAD in finance is that it is not continuously differentiable, making it hard to include in optimization calculations. Also, variances are additive but MSDs are not (handy for portfolio math). (A student asked me this question last semester and I had to spend some time sorting out the answer for him. As a single stock measure of dispersion, it's fine but its hell in portfolio math.)

Peter Ringel asks:

Isn't MAD or better MAD/median ratio a good non-parametric metric? I use it for range & volatility comparison over different timeframes. I don't trust Stdev in markets. (my ignorance will be exposed very quickly here - Just trying to apply, what I learn from list and it's members.)

William Huggins responds:

it's totally fine for one-to-one comparisons but can't be used to find out what the MAD of a portfolio of two stocks would be without redoing all the math. for stdev, you square it up to variance, add them, then root back to stdev. optimization of portfolios relies on calculus to find the weights that result in minimum variance but you can't differentiate MAD in the same way. so it can be used for a side-by-side comparison, but MADs don't play well when you mix them. (strictly speaking, what I wrote is good for independent stocks - if they are correlated, and they all are - you need to account for their covariance. there is no co-MAD to include in equivalent calculations.)

Bill Egan comments:

One outlier is sufficient to distort the mean and thus the std. Median absolute deviation (MAD) avoids this, being resistant to up to 50% outliers (which ought not happen in price data).

Robust Standard deviation = 1.4826*MAD

Huggins is correct - derivative based optimization methods blow up when you use MAD or similar methods. Simplex or genetic algorithms work for optimization in that case. For estimated covariance, you can try replacing mean with median in the covariance formula.

William Huggins adds:

I last applied MAD, while I was trying to understand better, why markets ( NQ, Spoo) are so absurdly homogeneous with their ranges for different intraday time-frames. And if some time-frames are less efficient than others. And I believe some are. During the last summer market it was very noticeable.

Jan

7

Height, weight, are distributed normally. Once an infinite variable like wealth is introduced, the distribution is no longer normal and can't be regressed. Lots of implications including convexity here.

Past extremes are not good predictors of future extremes. (The Lucretius Fallacy) Simple proof is that the last biggest was bigger than the one before.

Nils Poertner writes:

markets sometimes go from one extreme to another, they tend to overshoot like a novice at the sailing boat - always over-steering the boat. great for us as trader/investor.

William Huggins comments:

They can be regressed but only after an appropriate transform (log, ln, etc). The key is transform in reverse before interpreting outcomes.

If the data is time series though, you'll find that exponential growth (organic) results in "exploding variance' that makes the coefficient estimates less reliable (larger standard errors). Feasible generalized least squares maybe more practical than OLS in such cases.

Zubin Al Genubi responds:

A transform is the standard work around but you can't transform an infinite variable into CLT compliance without losing so much important information to make it dangerous. Its a different distribution. That's my point.

Jan

1

Quant ballyhoo, from Zubin Al Genubi

January 1, 2024 | Leave a Comment

A main goal of the spec list is discrediting ballyhoo: Many so-called quant this quant that show the arithmetic capital appreciation and a fixed bet creating an artificially inaccurate accumulation. Some show the max loss, but due to volatility drag (33% needed to recover 25% drawdown) the growth will not be as their charts show. Instead of $100,000 bet every trade, after a 25% loss the fund is under water.

On the upside geometric returns will rapidly outpace the arithmetic returns due to compounding rather than a fixed trade amount but they don't use that either. So the quant charts twitter charts are wrong in 2 of the most important aspects.

Larry Williams:

What I have come to believe and practice that in money management is all that matters is the trade I’m in right now. The past numbers of the strategy have no bearing on what I will do. Why? Its like a gunfight —you will kill or killed. The trade I am in now will lose or win. There are no other options. That is the hard reality I deal with and protect myself accordingly.

Jeff Watson agrees:

Bingo!

H. Humbert asks:

So are you all saying you literally have to create a new strategy or a version of the old strategy from scratch in every single trade, without regard for the past. This can't be right, can it?

Larry Williams replies:

Oh no, not at all each trade offers the same odds of winning, 50/50, so ‘bet’ accordingly.

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles