Nov

30

Sometimes those elevator door buttons actually work, from Henry Gifford

November 30, 2025 | 1 Comment

Once upon a time I measured how much electricity it takes to ride on an elevator – I measured about 50 elevators – and seem to be the only person who ever measured that and got the results published. Before, there were numerous scholarly papers published on elevator energy use, all guesses or estimates or computer models (same thing), very “scholarly” because they had footnotes referencing other published guesses and because you paid a lot of money for someone to do that “research”. Several multinational elevator companies were selling energy efficient elevators, but none of the companies knew how much energy a ride took – they had “data” on how much their elevator used in one year vs. an ordinary elevator – an unspecified number of rides, unspecified number of stops (floors), unspecified weight in the cab, etc. All just made up “data”. Surprise, none of the manufacturers wanted me to measure their elevator.

Read the full post with additional comments.

Nov

29

American Colossus; “very bull”

November 29, 2025 | Leave a Comment

American Colossus: The Triumph of Capitalism, 1865-1900 summarizes the work of Rockefeller, Carnegie and Morgan in building America and pictures a battle between Adam Smith and Thomas Jefferson.

Also:

Why We Run: A Natural History, by Bernd Heinrich

In Why We Run, Heinrich considers the flight endurance of birds, the antelope's running prowess and limitations, and the ultra-endurance of camels to understand how human physiology can or cannot replicate these adaptations. With his characteristic blend of scientific inquiry and philosophical musings, Heinrich offers an original and provocative work combining the rigors of science with the passion of running.

26 days and 0.50 away from last 20-day high very bull.

Nov

28

Lucky charms, from M. Humbert

November 28, 2025 | Leave a Comment

Anyone have any favorite good luck charms/rituals to help with trading results?

Peter Ringel writes:

some of the old floor traders, we had on this list, reported how superstitious some of the traders were. Cloths, bathroom time…

Asindu Drileba comments:

Lucky charms may sound delusional but they are actually more common than we think. They are more like placebos. I take pill X, my headache goes away. (But pill X is made from wheat flour and a bitter "filler" and has exactly zero pharmaceutical contents, yet it works).

Have you ever pushed the button that opens the door of an elevator? Well, those buttons are completely fake! Elevator doors are pre-programmed to open and close at hard coded intervals. Pushing the button does nothing. They simply exist to give people a sense of control.

Nils Poertner writes:

To have a strong belief one can learn (from mkts or others) is a good start.

ie allowing for mistakes to happen, not fretting them. (many cultures are guilt-ridden, like the German culture on so many fronts. All it takes is sometimes to muster up enough courage and learn from mistakes and don't judge).

Zubin Al Genubi offers:

I'm reading Kidding Ourselves, Hidden Power of Self Deception, by Hallinan, in which he describes real physical and psychological effects of psychosomatic causes such as death, hallucinations. You see what you want to see. You are and become what you believe yourself to be. It affects health, performance, money. He also describes how a feeling of lack of control can be debilitating and even deadly. Some feel a lack of control in that they don't control the market, but one can easily (physically at least) click the keys to buy and sell any time.

From scientific studies: Our results suggest that the activation of a superstition can indeed yield performance-improving effects.

Nov

26

Give Thanks for Pilgrims — and McDonalds, by Victor Niederhoffer and Laurel Kenner

November 26, 2025 | 1 Comment

Thanksgiving is about sharing prosperity, and it's a good time to think about where prosperity comes from. The Pilgrims figured it out in 1623. We'll retell that story as we celebrate the way it lives on in countless U.S. families and companies today. And in particular at one company, McDonald's (MCD, news, msgs), that in its humdrum way beautifully demonstrates the source of prosperity and the American way of life.

Thanksgiving is about sharing prosperity, and it's a good time to think about where prosperity comes from. The Pilgrims figured it out in 1623. We'll retell that story as we celebrate the way it lives on in countless U.S. families and companies today. And in particular at one company, McDonald's (MCD, news, msgs), that in its humdrum way beautifully demonstrates the source of prosperity and the American way of life.

The Pilgrims started with so little. They had to hide in England because the authorities considered them dangerous. They fled to Holland but found themselves compelled to take menial jobs. On the way to America, many of the company died. They lost their way to Virginia and landed in Massachusetts just as winter set in. The Virginia Co., their backers in London, went bankrupt and couldn't send relief supplies.

To cope with want, the Pilgrims made the same mistake that so many countries do even today: They divided all their land, efforts, supplies and produce in common, to each according to his need.

As always in such systems, need surpassed supply.

The Pilgrims spent their first three years in America suffering from hunger, illness, cold and infighting. People stole from the common stores "despite being well whipped," according to William Bradford's "Of Plymouth Plantation."

Bradford, governor of Plymouth Colony, records what happened next: "They began to think how they might raise as much corn as they could, that they might not continue to languish in misery. After much debate, the Governor decided that each settler should plant corn for themselves."

Under the Land Division of 1623, each family received one acre per family member to farm. That year, three times as many acres were planted as the year before. Prosperity was not long in coming.

The Pilgrims turned from their Old World system of common ownership to incentives. They didn't go that way out of ideological conviction, but because they didn't have the luxury of waiting for support to come to them.

How many families in America tell the same tale? "When we came here, we worked hard and our lives were better."

But that wasn't the end of the story. Before the switch to incentives, the hungry settlers were at each other's throats. Hard workers resented receiving the same portions of food as those who were not able to do even a quarter of the work they did. Young men resented having to work without compensation to feed other men's wives and children. Mature men resented receiving the same allotments as did the younger and meaner sort. Women resented being forced to do laundry and other chores for men other than their husbands. Many people felt too sick to work.

But when they were allowed to farm their own plots, the most amazing thing happened. Everybody — the sick, the women and even the children — went out willingly into the fields to work. People started to respect and like one another again. It wasn't that they were bad people, Bradford explained; it's just human nature. Adam Smith came to the same conclusion later, and Friedrich Hayek updated Smith's ideas for the 20th century. But we don't need to go back to New England for understanding. Similar outcomes can be seen at McDonald's every day.

For centuries, people on the lower rungs of the social ladder weren't able to eat meat. They ate grains and beans. But people like beef. And chicken.

When McDonald's started popping up in every neighborhood, all of a sudden there was an affordable place for families to eat. Previously, one of the main differences between the upper and lower classes was that the rich could eat out. Even if the poor could afford the tab, they couldn't hire baby sitters, and they couldn't bring their kids to the elegant establishments designed for the rich because they would have disturbed the other diners.

Most kids don't like fancy restaurants anyway. They want fries, not polenta with wild mushrooms. They want fried codfish, not turbot. They want burgers, not lamb chops.

How many people has McDonald's made happy? How many families has it brought together? How many Happy Meals have been eaten there? How many kids have enjoyed the playgrounds? How many tired workers have been able to catch a quick meal? How many women are able to pursue careers and other productive activities and dreams because McDonald's has freed them from the task of having to cook every night?

The Pilgrims might have served 200 or 300 American Indians at their Thanksgiving feast. McDonald's serves 26 million customers a day at 13,700 U.S. restaurants.

For the traveler, McDonald's is a home away from home, offering so much for so little. The restrooms are clean. And McDonald's serves hot strong organic coffee in smooth cups of some wonderful material that keeps liquids hot without burning the hand, shaped to fit into the cup holders that just happen to be in your car, with carefully designed tops that permit just the right amount to be sipped.

No regulator, no fascist dictator, no socialist planner decreed sip tops or cup holders. But how many late-night drivers have died for the lack of a good cup of coffee? What could be more munificent than saving lives?

And the story doesn't end there. Consider the employees of McDonald's. How many people have worked there and learned the most important lesson in America: The customer is always right?

The anti-this-and-that people who demonstrate against profit incentives and free markets like to single out McDonald's as a symbol of modern capitalism. (They don't mean that in a nice way.) As the McLibel Support Campaign puts it: "(McDonald's) has pioneered many business practices that have been taken up by others, and have come to represent a symbol of the way that society is going –'McDonaldization.'" But when have you ever seen an unhappy customer at McDonald's? There couldn't be too many of them, because about 10% of America eats there each day. Given the choice of cooking at home or going to other restaurants — and competition ensures that there are other restaurants — people go to McDonald's because they trust they'll find good food, quick service and value for money. What could be more munificent, more representative of sharing the fruits of hard work than McDonald's?

McDonald's and the Pilgrims are the essence of America. The people work hard, motivated by the chance for profits. They provide a welcome to others, whether to Indians joining in harvest celebrations, or to customers looking to satisfy their hunger. Their work results in high quality, low costs and family togetherness.

Those humdrum, everyday attributes are what makes America great. That's what we should be celebrating. It's the source of all our munificence, from the first Thanksgiving to today.

Nov

26

Speculator & Son

November 26, 2025 | 3 Comments

Nov

25

Book recommendation from Zubin Al Genubi

November 25, 2025 | Leave a Comment

Zapped: From Infrared to X-rays, the Curious History of Invisible Light

From beloved popular science writer Bob Berman, ZAPPED tells the story of all the light we cannot see, tracing infrared, microwaves, ultraviolet, X-rays, gamma rays, radio waves and other forms of radiation from their historic, world-altering discoveries in the 19th century to their central role in our modern way of life, setting the record straight on health costs (and benefits) and exploring the consequences of our newest technologies.

Nils Poertner suggests:

The HoHo Dojo, by Billy Strean.

Laughter and humor are therapeutic allies in healing.

Nov

24

The world in your breakfast

November 24, 2025 | Leave a Comment

An earlier and more illuminating version of I, Pencil from The Marvels of Modern Industry by William Norman Mitchell 1940:

Have you ever thought of all the work and plans and endless pains in far distant places which were necessary to supply so simple a thing as your breakfast? If you have, you doubtless found that even to enumerate these services constituted a lesson in world geography. There were, perhaps, grapefruit from Texas, sugar from Cuba, syrup from Vermont, toast made from flour milled in Buffalo, possibly from wheat from the valley of the Red River of the North. Butter and cream came from Wisconsin farms, bacon from Iowa, and coffee from distant Brazil. If you looked farther you may have found that this simple meal was served with plates of Bavarian make, on a cloth which was the product of Belgian skill, covering a table fashioned in Carolina hills from Honduras wood, with varnished finish made from gum brought from Algiers. Fork and spoon came from New England where they were fashioned from silver from Nevada's mines, while the knife blade possibly was made of Sheffield steel from iron ore mined in Sweden or war-torn Spain, and by its silvery and stainless sheen indicated that it had drawn upon the nickel from Canadian mines and the chromites of Rhodesian Veldts. And so on, in ever widening spread, until the whole world is drawn into a tangled web and bound on the common mission of serving you your breakfast!

Nov

23

Suprises, from Nils Poertner

November 23, 2025 | Leave a Comment

Whether it is the "Mambani win", Brexit, Covid, Ukraine war, whatever - had someone told me 6 months before that this could happen - the answer would have been "no-way…" whereas in 20-20 hindsight - it is always like "oh yes, there were obvious signs."

Zubin Al Genubi responds:

History is made on the edges by outliers which shifts the averages way over in its direction.

Nov

22

Getting back to normal with Jobs data, from Bill Rafter

November 22, 2025 | Leave a Comment

Chart: Full-time vs, Part-time Employment Growth Rates

Nov

22

Thanksgiving soon

November 22, 2025 | Leave a Comment

a little thankagiving treat coming shortly. dog stole a bone and hiding it over weekend.

OIL AT $58. don't have necessary data for inflation numbers. an appropriate vestige of remainng use for input-output but on prices not output.

Nov

21

VIX Intraday Range, from Cagdas Tuna

November 21, 2025 | 1 Comment

Yesterday's range in VIX was one of the widest & wildest one I have seen in a very long time that happened without any major news. Wednesday close to Thursday low 18% decline followed by 46% rally to the day's high. Is there anyone who can check the occurrences in the past and how SPX traded in the following days of such a massive range explosion?

Asindu Drileba responds:

The Chairman's book, Practical Speculation, has a detailed analysis of the multivariate relationship between the VIX and the SPY. Unfortunately I forgot the page, and I am currently not close to my copy. [see pages 107-110] But it has something to do with how the fluctuations around the average of the VIX affects the SPY.

Paolo Pezzutti does some counting:

#VIX +11.71% at 26.43

Highest close since 24 April

Since 2020 VIX>26 has occurred 290 times.

After 4 days the Emini S&P Futures:

+27.01 pts Mean, 63.4% Wins, 1.63 Profit Factor

Larry Williams cuts to the chase:

Vix goes up when stocks go down they are inverse of each other—no magic there are all.

Nov

21

Sheep shearing, Humbert Q.

November 21, 2025 | Leave a Comment

Sheep needs to be regularly sheared to take off some extra wool- it is actually good for them- healthy!

Henry Gifford adds:

Back in the day sheep didn’t have people handy to shear them. A farmer told me that over the past few hundred years sheep have been bred to grow more wool, thus they need people now, but before that change the sheep didn’t grow as much wool.

Steve Ellison writes:

The S&P 500 reaching its lower 50-day Bollinger band on Thursday might indeed indicate some modicum of panic, as might VIX being well above its upper 50-day Bollinger band.

I have thought sentiment was quite restrained this year given that the S&P 500 was at a record high as recently as October 28. Bears have outnumbered bulls in the AAII survey for the past two weeks. And the publishing of a book titled 1929 was very well publicized. I perceive that out in the general population there is a lot of fear about AI; lots of scaremongering about AI eliminating nearly all white collar jobs.

Cagdas Tuna comments:

Many years ago when I was a teenager, I heard this from the head of top brokerage firm in Turkiye and he said "It is not news until it matters." Circle funding of AI companies and its effect on jobs have been long discussed at least by the people I follow on social media but it has had no impact until yesterday. So can we say it has become news now?

Nov

20

That’s enough

November 20, 2025 | Leave a Comment

that's enuf lobagolaing at 6542

Mixed Identity : LoBagola, the Black-Jewish African Prince

An African savage’s own story chronicles the adventures of LoBagola, a self-proclaimed “Black-Jewish Prince,” as he traveled from his pretended “African birth place” to Great Britain and America.

LoBagola was, in truth, the alter ego of the Baltimore-born African-American, Joseph Howard Lee, who grew up in a life of poverty and deep racial discrimination. In response, Lee fabricated much of this autobiography, initially published as authentic by the leading New York publishing house of Knopf.

Gemini:

In the lore of investors, a LoBagola refers to a market pattern observed by famed speculator Victor Niederhoffer. It is likened to an elephant stampede: the market surges in one direction and then quickly returns along the same path, moving "back and forth".

Nov

20

Following the Equator

November 20, 2025 | Leave a Comment

Following the Equator has a good chapter on thugism and thugee is still part of culture i've found.

Thugee became known to the British authorities in India about 1810, but its wide prevalence was not suspected; it was not regarded as a serious matter, and no systematic measures were taken for its suppression until about 1830. About that time Major Sleeman captured Eugene Sue's Thug-chief, "Feringhea," and got him to turn King's evidence. The revelations were so stupefying that Sleeman was not able to believe them. Sleeman thought he knew every criminal within his jurisdiction, and that the worst of them were merely thieves ; but Feringhea told him that he was in reality living in the midst of a swarm of professional murderers ; that they had been all about him for many years, and that they buried their dead close by. These seemed insane tales; but Feringhea said come and see — and he took him to a grave and dug up a hundred bodies, and told him all the circumstances of the killings, and named the Thugs who had done the work. It was a staggering business.

Nov

19

A good time to buy

November 19, 2025 | Leave a Comment

a good time to buy. gentlemen haven't liked stocks now at 6630.

just getting started at 6650.

Nov

19

Market lesson, from Jeff Watson

November 19, 2025 | 1 Comment

Ben Mallah is a real player in the real estate market and offers a palate cleanser that applies to any market.

Ben Mallah puts a recently renovated house up for auction. The video documents the preparation and the auction process itself, including discussions with the auctioneer and potential buyers. Viewers will see the property's features and the bidding unfold.

Nov

17

Corporate earnings, from Zubin Al Genubi

November 17, 2025 | Leave a Comment

I see they are down [at least through Q2]:

FRED: Corporate Profits After Tax (without IVA and CCAdj)

Steve Ellison responds:

Interesting. S&P 500 earnings per share were up both year to date and year over year. And Q3 so far looks better than Q2.

S&P source spreadsheet: Click link to download file: S&P 500 Earnings.

Big Al wonders:

So maybe the big firms are doing better than the smaller ones?

Nils Poertner remembers:

Investment Bank earnings 2007…My very cerebral friend Maurice at the time: "IBs are cheap - look at their PE ratios."

Nov

15

Tax receipts, from Larry Williams

November 15, 2025 | Leave a Comment

Federal government current tax receipts: Taxes on production and imports: Customs duties

Asindu Drileba writes:

I remember when Trump spoke at a recent market open. (NYSE market opens at around 4:30pm in Uganda). Crypto closed very bullish on that day. Every time he mentioned "Tax Cuts" the market blipped some more. Laffer Curve at work?

Rich Bubb adds:

I was idea hunting and found Wisdom from Larry Williams:

Larry Williams: Why Gold, Bitcoin, and Stocks Are Flashing Warning Signs

Nov

13

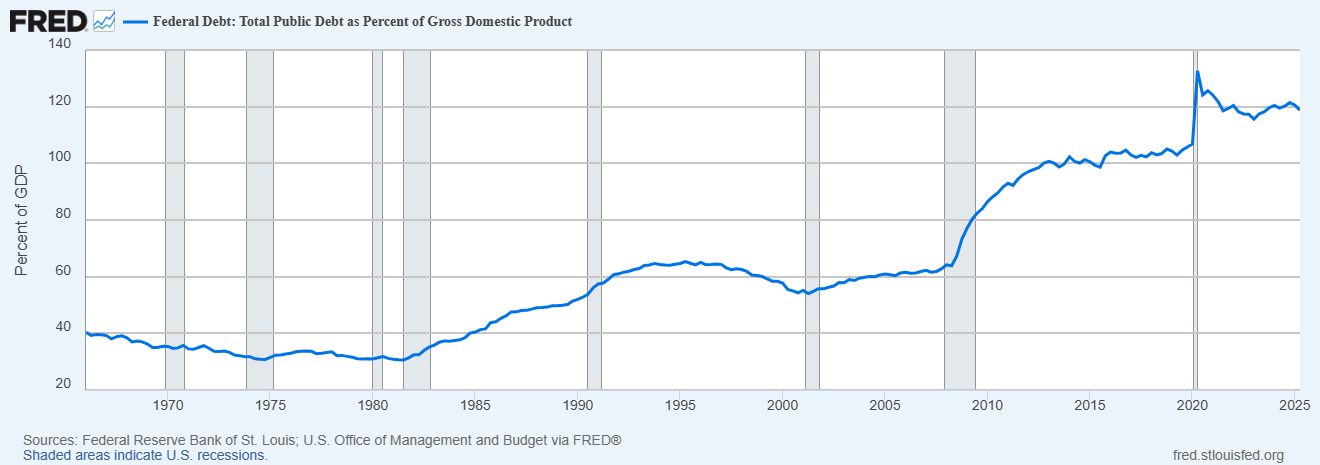

The $38 Trillion Question, from Humbert X.

November 13, 2025 | Leave a Comment

The $38 Trillion Question: An Interview with Stanford Professor Hanno Lustig

Hanno Lustig: I started thinking about the valuation of government debt by looking at the valuation of all Treasuries. What do we have to believe to get to a number like $38 trillion? You must believe there will be a huge fiscal correction, because ultimately the value of debt should be backed by future primary government surpluses. When you do the numbers, you realize that either bond investors are pricing in a huge fiscal correction that seems impossible, or Treasuries are significantly overpriced.

Carder Dimitroff notes:

The interest on debt is approaching $1 trillion per year and continues to compound. Interest costs currently exceed Department of Defense spending.

Larry Williams disagrees:

Meaningless measure look at debt vs gdp

Carder Dimitroff responds:

Yes, that makes sense. However, from a different perspective, it becomes meaningful under the One Beautiful Budget Bill when automatic sequestrations are implemented. Unless new legislation is passed, sequestrations will result in Medicare cuts and other reductions in expenditures. Current projections suggest sequestration will present in early 2026.

Big Al checks with FRED:

Nils Poertner writes:

recession + zero short term rates + lots of QE ….leading to a lot more public debt

maybe that is more likely path.

Stefan Jovanovich offers some history:

This chart shows the solvency ratios that can be found from the Census and other data [by decade 1880 to 2020] - how much "we the people" have in money divided by how much the American governments promise to pay.

Nov

12

David Hand’s probability lever, from Nils Poertner

November 12, 2025 | Leave a Comment

intellectual support / motivation to look at more extreme scenarios from time to time (extreme only appearing in the moment of course).

Hand writing: The Improbability Principle

The law of the probability lever is to do with choosing models. With poor assumptions even highly likely events can seem very improbable. Small changes in initial conditions can have an extremely large effect on outcomes.

Nov

11

Deutsche Bank sums it up, from Humbertus B.

November 11, 2025 | Leave a Comment

Long-Term Asset Return Study - The Ultimate Guide to Long-Term Investing

This study examines how asset classes have performed across a wide range of macroeconomic, policy, and valuation environments. Drawing on data that in some cases stretches back to the 18th century, we analyse both nominal and real returns to understand how different assets have behaved under varying conditions. We explore correlations with key drivers such as real and nominal GDP growth, inflation, interest rates, bond yields, debt and deficit levels, and more — with the goal of helping investors tilt the odds in their favour.

Nov

10

Best indicators for inflation, from Asindu Drileba

November 10, 2025 | Leave a Comment

The more goods cost, the more money visa makes since the fees they charge Issuing banks & acquiring banks are based on a percentage basis. So, higher prices (inflation) –> better predicted revenues for Visa? Inspired by a nice documentary on the history of VISA.

I wonder what the best indicator for inflation would be for testing this? CPI? Oil?

Cagdas Tuna writes:

I was thinking as to find a similar indicator for economic slow turn, spending cuts. It came to my mind to follow sales slips. I live in Malta which is a very tech friendly country for spending habits such as Apple/Google Pay availabilities, many digital banks access etc. I often asked if I need a receipt that I usually don’t. It depends for every country but if there is a rule for stores/restaurants to keep at least a copy for each transaction then it might be the indicator to follow. It might be used for inflation as well but of course needs detailed information.

Pamela Van Giessen comments:

To the best of my knowledge, merchants are not required to keep receipts. We track each sale but it will be the credit card processor or platform such as Square that holds the credit card or Apple or Google pay receipts. I can’t imagine that merchants would be willing to share their sales data. I know I wouldn’t.

Visa doesn’t care how much goods cost. They get their nearly 3% processing fee (+ .10 or .15 per transaction) whether there are 20 transactions for $100/ea or 40 transactions for $50/ea. In fact, they make more $ on a higher volume of transactions.

I don’t think tracking Visa or MC, etc could be a meaningful prediction of inflation as all the credit card companies continuously fight for market share. Note that they all send out multiple credit card offers to everyone all the time. Then, you have a store like Costco that only accepts their credit card (Citibank).

Additionally, there are people who use primarily cash. Those $ would be left out. You may say that cash use is low, and maybe it is. What I can tell you is that today at a market 80% of my sales were cash and that was likely the case for all the other merchants at this market. Older people especially use cash a lot. Just like drug dealers.

I have a theory that the cash economy is much bigger than everyone thinks. Insight into that might be more interesting.

Carder Dimitroff responds:

After considering Panela's cash sales point, I remembered that several companies required customers to switch from credit card payments to bank transfers. Additionally, several small establishments offer incentives for customers to pay in cash. They may be attempting to simplify their accounting and tax reporting. I do know that the federal government has immediate access to individual credit card transactions.

Pamela Van Giessen adds:

I thought it was the Fed that used to report on aggregated credit card data.

The other challenge with using credit card financials is that the credit card processors raise their % cut all the time. This is not due to actual inflation; it is due to them having a government protected moat that allows them to take more and more whenever they want because merchants are stuck with the whole system and consumers don’t realize that they will pay for the service — in increased prices. Every time Square, PayPal, etc., send me notices that they will be increasing fees, I increase my prices. I guess that is a kind of proxy for inflation but it’s a lousy sort of financial market induced inflation not based on anything more than their desire for more profits. I am all about free markets but the credit card processing biz is not even close to a free market.

The government using credit card processing to surveil us may be one reason I see more and more people using cash.

Larry Williams suggests:

Stock market is good predictor of inflation.

Nov

9

Prestigious consulting firm, from Nils Poertner

November 9, 2025 | Leave a Comment

Came to our financial firm 2007 and gave a 100 page presentation full of bullet points and cartesian logic (why housing boom will last). Either 3,5, or 9 bullet points per page.

At the end of the presentation I was tempted to go over to the presenter and ask him "why do you love your wife? (I didn't). The answer might have been bullet points.

Pamela Van Giessen writes:

Michael Korda tells in his memoir, Another Life, of the time that Simon & Schuster hired probably the same prestigious consulting firm to study how to improve revenues/profitability. Prestigious consulting firm (after taking the prestigious consulting firm fee) told the publishing company that they should publish more bestsellers.

Laurel Kenner comments:

I bet the prestigious firm concluded with ‘Key Takeaways’ as a final insult to the intelligence of the client.

Asindu Drileba writes:

I heard that people pay consultancy firms not for their knowledge, but for the fact that executives use them as a scape goat. If an executive wants to pursue policy X. They simply hire a consultancy to recommend policy X. If policy X ends up as a disaster (legally, morally or financially). They can simply say "Policy X was an idea from XYZ consultancy", we had nothing to do with it.

Peter Ringel adds:

a variation of this are fighting owners/ partners about policy. If decision pipelines are blocked, external council is used. Like a neutral arbitrator. I think, these are the main situations externals are used. Usually a good reason to short the entity, especially outside of markets. If they don't have the capability to decide and act on strategy in-house, it‘s a red flag.

Henry Gifford responds:

Even better is hiring a licensed engineer to instruct everyone to do something stupid that they know won’t work, so everyone who did as the engineer decided is blameless.

Jeff Watson offers:

A consultant is a person who knows 1000 ways to make love to a woman…..but he doesn’t know any women.

Nov

8

Tevye the Dairy Man

November 8, 2025 | Leave a Comment

"Tevye the Dairy Man" - one of my favs in High school.

In those days I was not the same person I am now. That is, I was the same Tevye, but different. As they say, the same old woman but under a different veil was then - may this never happen to you - as poor as poor can be, although, to tell the truth, I am by far no rich man today. You and I together should this summer earn what I would need to be as rich as Brodsky, but as compared to those days I am today a well-to-do man with my own horse and wagon, with a couple of, knock on wood, milch cows and another cow that is due to calve any day now. It would be a sin to complain, we have cheese and butter and fresh cream every day, all earned with our own labor, we all work, nobody is idle. My wife, bless her, milks the cows, the children carry the jugs and churn the butter, while I myself, as you see, drive to the market early every morning and call at every Boiberik dacha. I get to meet this person, that person, all the important people from Yehupetz, I chat a while with them and this makes me feel that I am also worth something in the world, that I am, as they say, no "lame tailor".

Tevye the Dairyman and the Other Stories, by Sholom Aleichem.

Nov

7

Ten days since an ATH

November 7, 2025 | Leave a Comment

10 days since all-time high. very bullish.

Steve Ellison comments on CAPE:

[Click chart for original post on X.]

6637-6660 is an important level for the ES December contract; not breaching this level (yet) in today's selloff is short-term bullish in my opinion, but the second highest valuation in history means the longer-term risk is high.

And I'm not sure exactly what the "rolling historical average" is, but by my calculation, the 30-year average CAPE is 28, which might make 40 somewhat less overvalued.

Nov

6

Percentages versus discrete values, from Duncan Coker

November 6, 2025 | 1 Comment

I notice how journalist select for stories to use percentages versus discrete values to server their own interests and the "public" is easily confused. Today, they pick the number nearing 1T to describe Mr. Tesla's pay which seems high. But they could have framed the story as he could be raising his ownership to 12% to 25% of a company he founded. Not much of a story there. Other places like crime statistics they usually go with the %. As in violent crime has risen 100%, this could mean 1 homicide to 2. Without the data with percent's the conclusions are obfuscatory. Percents can never go down more than 99.9%, but they can rise by an infinite amount. This fact also leaves much room for spurious selection.

Nov

4

Edmund Clarence Stedman, from Stefan Jovanovich

November 4, 2025 | Leave a Comment

Edmund Clarence Stedman was the editor of this history, The New York Stock Exchange, quoted below on this site.

From Grok:

Edmund Clarence Stedman (1833–1908) was a prominent American poet, literary critic, and essayist, often dubbed the "Bard of Wall Street" for his successful dual career in literature and finance. Born in Hartford, Connecticut, on October 8, 1833, he was orphaned young after his father's death from tuberculosis and raised by relatives. He briefly attended Yale University (expelled after two years but later honored with a degree) before launching into journalism in the 1850s, working for outlets like the New York Tribune and New York World, including as a Civil War correspondent. He studied law and briefly served as private secretary to U.S. Attorney General Edward Bates.

Connection to the New York Stock Exchange

Stedman's ties to the New York Stock Exchange (NYSE) spanned over three decades, from 1865 to 1900, where he worked as a banker and stockbroker on Wall Street. This financial role provided stability amid his literary endeavors, allowing him to support his family while pursuing poetry and criticism. After retiring from the Exchange in 1900, he remained deeply involved in its institutional history. In 1905, at age 71, he served as editor of the landmark publication The New York Stock Exchange: Its History, Its Contribution to National Prosperity, and Its Relation to American Finance at the Outset of the Twentieth Century, a comprehensive two-volume work commissioned by the Stock Exchange Historical Company. Co-edited with Alexander N. Easton and others, it chronicled the NYSE's evolution from its founding in 1792 under the Buttonwood Agreement through its role in American economic growth. The book, limited to 3,000 copies (with a rare signed edition of 50 for select members), is a key historical resource on early 20th-century finance.

Literary and Other Achievements

Parallel to his NYSE career, Stedman produced influential works like Poems, Lyrical and Idyllic (1860), Victorian Poets (1875), and massive anthologies such as A Library of American Literature (1888–1890, 11 volumes) and An American Anthology (1900). He also dabbled in science, proposing an early rigid airship design in 1879. Elected to the American Academy of Arts and Letters in 1904, he died in New York City on January 18, 1908, from heart disease, survived by two sons.

Nov

2

Optimism fulfilled

November 2, 2025 | Leave a Comment

The New York Stock Exchange

Its history, its contribution to national prosperity, and its relation to American finance at the outset of the twentieth century

Edmund Clarence Stedman, Editor

Stock Exchange Historical Company

New York, 1905

From the preface:

The present writer remembers the impression left upon an educated Englishman, a well-known publicist, who made a visit to Wall Street some eighteen years ago. He had been taken through the largest commercial structures in the vicinity, and even to the Stock Exchange itself, without giving expression to unusual interest. But on returning to his friend's offices, upon the upper floor of a building in the rear of the Exchange, he saw a sight that instantly gave him a realization of the extent of our peopled territory, and of the meaning of the Stock Exchange as the focus to which all currents of American purpose and energy converge. It was shortly before the time when the wires of New York's electric system were buried, by enactment, out of sight. Through the air, over New Street, hundreds, seemingly thousands, of these wires stretched toward the Exchange. No bird could fly through their network, a man could almost walk upon them; in fact, they darkened the street and the windows below their level. The visitor's host suggested that those going north, west, south were carrying messages to and from scores of inland cities and towns — financial ganglia of this land of national wealth and effort — names of which were mentioned. Certain wires were transcontinental, communicating with the towns of the Pacific States. Others served the uses of Montreal, Toronto and kindred points in the Great Dominion. Finally, the competing ocean cables were of course laden with incessant "arbitrage" and other messages to and from London, Paris and Berlin. This ocular demonstration of the relations of the New York Exchange to the Republic in its entirety, and even to the world overseas, proved almost startling to the English traveller. He asserted that within this central field of financial energy and intercommunication it was impossible not to have the imagination aroused, and the reason convinced of the enormous interests of which Wall Street, through its representative Exchange, is the ceaseless regulator. With philosophic impartiality, he predicted the time when even the largest money centres of the old world would become more or less subsidiary to this dominant market of the Western hemisphere.

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles