Jun

30

Grandeur, and a very, very good wife

June 30, 2024 | Leave a Comment

There is grandeur in this view of life, with its several powers, having been originally breathed into a few forms or into one; and that, whilst this planet has gone cycling on according to the fixed law of gravity, from so simple a beginning endless forms most beautiful and most wonderful have been, and are being, evolved.

- Charles Darwin, The Origin of Species

there is grandeur in the inexorable rise in the S&P, documented by Dimson and Lorie.

i am forced to move and my paintings don't have much auction value so i would gladly reveal my methods for 50 million + and throw in a very valuable wife to the bargain.

English Men Once Sold Their Wives Instead of Getting Divorced

Between the 17th and 19th centuries, wife-selling was a weird custom with a practical purpose.

she's a very good one. Tom Wiswell said his one regret in life was that he didn't marry a girl like Susan and since then many visitors have said same. The problem is that she is necessary to take care of me so I believe she could sell me for more than I could get for her. I told her at dinner that I was looking at ways of making money by selling some of our trees. She looked at me and said immediately that she wasn't going to send me the picture of her I asked for.

Jun

29

Canary?, from Zubin Al Genubi

June 29, 2024 | 1 Comment

Seen yesterday in Kona Hawaii, billionaire's playground:

1 private jet at FBO. Very unusual.

25% commercial vacancies in prime retail.

Tourism down 9%

(Galtonesque count)

Stefan Jovanovich comments:

ZAG's reports are a treasure - and a source of future profits.

Nils Poertner wonders:

easier to be bullish on European /UK equities than having bearish view on US stocks?

Jun

26

Bonds, from Hernan Avella

June 26, 2024 | Leave a Comment

Bonds, especially long-term bonds, seem to be the most disliked asset class at the moment. However, they are not only great diversifiers but now might also be an opportune time to start investing in them or increase your current allocation. Here are a few considerations from my perspective:

- Duration Matching: Align the duration of your bonds with your investment horizon. Being relatively young, it makes sense for me to opt for longer durations.

- Capital Efficiency of Futures: Utilizing the capital efficiency of futures can be challenging with current borrowing rates. Nevertheless, if leverage is used productively, it can still yield benefits.

- Inflation Protection: Enhance your fixed income exposure with assets that are protected against inflation.

- 12M Stock-Bond Correlation is at max (as of 17 June):

There's a fourth dimension that complicates implementation. When examining term premiums, such as the spread between 30-year and 5-year yields, the benefits of long-term exposure are minimal—aside from the potential convexity benefits if rates significantly decline.

Furthermore, historical data indicates that long bonds have a lower Sharpe ratio compared to short bonds. However, short bonds lack sufficient volatility to effectively diversify an equity-heavy portfolio. Consider the hypothetical performance of buying short-term (~5 years) versus long-term bonds, adjusted for volatility:

Strategy CAGR Stdev Max DD Sharpe Corr w/ S&P 500

Short-Term Bonds 4.19% 4.81% -14.45% 0.39 -0.06

Long-Term Bonds 4.86% 11.11% -45.29% 0.27 -0.07

Leveraged ST Bonds 6.03% 11.11% -38.11% 0.37 -0.04

The question remains: Is it possible to 'have our cake and eat it too' by leveraging short bonds?

Big Al asks:

In your model, what is the implementation of "Leveraged ST Bonds"?

Hernan Avella answers:

Long VFTIX 2.35x, short 3M Bills as proxy to futures embedding financing costs.

Jun

25

Bendopnea, from Kim Zussman

June 25, 2024 | Leave a Comment

Why This Simple Heart Failure Symptom Is So Easy to Ignore

Patients with decompensated heart failure who have bendopnea on discharge from hospital appear to be at significantly increased risk for all-cause mortality within 2 years, reported investigators.

The research, presented here at the Heart Failure Association of the European Society of Cardiology (HFA-ESC) 2024 and published in the European Journal of Preventive Cardiology, found that across two study cohorts, the risk for all-cause mortality was at least doubled among patients with shortness of breath when bending forward.

"Bendopnea can be assessed through a simple and noninvasive examination," said lead researcher Taisuke Nakade, MD, from the Department of Cardiovascular Biology and Medicine, Juntendo University Graduate School of Medicine in Tokyo, who pointed out that the association with mortality is "independent of other known prognostic factors."

Jun

23

Interview with the Chair from 2020

June 23, 2024 | Leave a Comment

Queued up to the start of the actual interview:

An Education from a Speculator: Interview with Legendary Victor Niederhoffer

Laurel Kenner approves:

One of the best interviews of the Chair. —The Collab

Bo Keely writes:

i like it, a fine reacquaintance.

Peter Ringel responds:

Thank you, watching it now. I also want to highlight the recent mkt calls on Twitter, which worked nicely. This and the wonderful articles about MFM Osborne.

Jun

20

Odds, books, and Wilde in America

June 20, 2024 | Leave a Comment

with odds differential of 20 percentage points a max, how can we expect a change in the numbers announced? i would predict an increase in ppi and cpi.

a sensational phantasmagorical book building up from birth-death processes to the evolutionary theory of markets:

Adaptive Markets: Financial Evolution at the Speed of Thought, by Andrew Lo

Drawing on psychology, evolutionary biology, neuroscience, artificial intelligence, and other fields, Adaptive Markets shows that the theory of market efficiency isn't wrong but merely incomplete. When markets are unstable, investors react instinctively, creating inefficiencies for others to exploit. Lo's new paradigm explains how financial evolution shapes behavior and markets at the speed of thought - a fact revealed by swings between stability and crisis, profit and loss, and innovation and regulation.

given the latitude and longitude of a market, at a time, what do rotational symmetries enable you to predict?

The Force of Symmetry, by Vincent Icke

The Force of Symmetry gives an elementary introduction to the spectacular interplay among the three great themes of contemporary physics: quantum behavior, relativity, and symmetry. In clear, nontechnical language, it explores many fascinating aspects of modern physics, discussing the nature and interaction of force and matter. All these themes are drawn together toward the end of the book to describe the most successful physics theory in history, the "standard model" of subatomic particles. The book is suitable for undergraduate students in physics and mathematics.

D'Oyly Carte arranged for Oscar Wilde to tour U.S. to build up audience for Patience.

Oscar Wilde In America, The Definitive Resource Of Oscar Wilde's Visits To America

These pages document for the first time a detailed, comprehensive, and accurate record of all the dates, venues, and subjects of Oscar Wilde’s 1882 lecture tour of North America. Wilde conducted some 141 lectures over 11 months of 1882 and each has its own page beginning with the first lecture in New York City.

Jun

18

Back to school

June 18, 2024 | Leave a Comment

Aubrey one day before Berkeley. My kids all asked if I would be moving as Beethoven did when Karl left for school.

i cried when he didn't get into Harvard. he tried so hard and did so much. how could someone with 1600, a benevolent business in Eswatini, and 20 straight 5's on AP not get in? i guess his squash was not world caliber, and dei.

he only ran a 4.5 mile. his compatriots said if he knocked 30 seconds off he 'd have a chance. the best i ran was a 7.5 minute mile.

Jun

17

NVDA, from Big Al

June 17, 2024 | Leave a Comment

Yes, the chart looks like a moonshot. Two things:

1. NVDA is selling for about 37x revs, which looks very expensive. But at that P/S ratio, it's selling for only 70x earnings. The reason is that it's a profit monster, with ttm operating income almost 60% of ttm revs.

2. Maybe tech gurus can comment on this: Looking into GPUs, I find they have a limited lifespan, especially if run 24/7 at high workload, which AI seems to demand. Even ignoring upgrades, I'm thinking the chips NVDA is selling today may need to be replaced in as little as 3-4 years. Maybe I'm wrong, but I don't read about this aspect of their business model.

Humbert H. writes:

What matters is whether anyone will catch up. That is truly an open question. They're the leader, but more so due the inertia of their customers and not because nobody can replicate their technology. That's the thing about super-highly valued tech growth stocks, nobody can predict their situation even two years from now. Starting before the dotcom era, Microsoft has been growing forever, Cisco not as much, Nortel even less so, to put it mildly.

High-end AI chips are replaced due to obsolescence much more so that "wearing out". Some will certainly fail, but less so than the graphics card-type GPUs, and that's not the driving force for the replacement cycle. Trying to decide if Nvidia is properly valued is a pointless exercise. There are always people who will know 100x about the situation, and if they could truly value it properly, they'd find a way to follow up.

H. Humbert comments:

I would think as the computing power of the GPU or TPU (tensor processing unit) increases, the communication bandwidth among the chips, server chassis and server racks is the limiting factor that affects the overall computing speed of the entire AI high performance computing center's performance. The latter is a complicated issue, depending on the data center's server connection topology and so forth. I am sure NVDA knows about the issue and they will come up with a solution to resolve some of the speed bottlenecks either organically or by M&A. As a result, they will come up with next-gen solutions and products undoubtedly. There are designed obsolesces built into the products.

There is another issue. The training of the LLMs requires exorbitant amount of energy that it can't be sustained. The energy trajectory is almost exponential. Somehow these issues need to be mitigated. The increasing amount of energy expended also translates to the huge burden of cooling for the data center. So either NVDA or other companies may come up with the solutions to address some or all of the issues. Long story short, the product lifecycle remains relatively short.

The culmination of these issues and hence the potential solutions are of course good business for those who sell the gadgets. Both of the private sectors and the brain trust of the government and the defense departments worldwide are well aware of these issues and have been working hard to come up with some viable solutions.

Asindu Drileba writes:

There are other areas like Gaming, Molecular Dynamics Simulation, 3D Rendering/Computer Graphics, Video Editing, Crypto Mining that are GPU heavy and expected to grow in the future. As for AI, I think Nvidia riding on the AI hype is a bit precarious. Yes. They have mostly "locked in" AI tooling such that it makes no sense to compete with them.

What makes it precarious, is that a single paper that finally describes how to perform current AI applications with very cheap compute i.e CPU compute. Will destroy a lot the stock. As this problem is more of a software problem and not a hardware problem. So I expect it to move & get adopted very fast if it is actually solved. Several companies like Symbolica are working on such a solution.

Dylan Distasio adds:

No comment on the investing angle or future of the industry, but modern day chips are capable of handling pretty high temperatures for a very long time. Running at 24/7 high work load at a stable temp within the safe zone probably would actually result in a longer life than a gamer situation where the chip is stressed/heated and cooled down repeatedly. In any case, I don't think lifespan and failure due to thermal issues (if maintained properly) is a significant concern with GPUs. They'd be replaced due to obsolescence first.

Humbert Humbert writes:

This is a position for electrical interconnect. The current NVDA Blackwell chiplets are connected with very short electrical interconnects which are reaching their speed limits. The speed resolutions are to bring the optical connects closer to the edges of the chips. A few years ago DAPRA has a program called PIPES is to do just that using optical fibers. I don't recall the spec and I believe it has energy spec in terms of how many femtojoules per bit as it have been recognized a number of years ago that the digital switching energy will become an energy burden. But this solution may eventually run into chip edge real estate problem because of the size of the optical fiber core.

There are limits with the current state of the art digital neural network even though it is the hottest subject in town. Analog neural network may have its niche applications that could compute at higher speed and with lower power consumption. The following is one of the many example programs that the DoD is investing in.

Jun

16

Brighton Beach knishes

June 16, 2024 | Leave a Comment

I grew up in Brighton Beach Brooklyn. By far the greatest Knishes of all time. The long gone Mrs Stahls.

Mrs. Stahl’s delicious Brighton Beach knishes

Yonah Schimmel gets credit for inventing the humble knish in 1910 at his still-thriving knishery on East Houston Street.

But knish fiends all over New York still lament the loss of Mrs. Stahl’s Knishes, a dingy place tucked under the elevated train at Brighton Beach Avenue.

The shop served up hand-made cushions of potato, kasha, and cabbage inside flaky baked dough. They were truly legendary.

A recipe: Old Fashioned Potato Knishes

Jun

15

Megacaps in Random Land, from Big Al

June 15, 2024 | Leave a Comment

Lots going around about how NVDA dominates; and MSFT, NVDA and AAPL now account for about 20% of the S&P 500. I was curious to see what happened in a toy index and so did an experiment (using R):

1. Create an index of 500 stocks, each with a starting value of $100.

2. Each year, for 40 years, each stock's value is multiplied by 1 + a value randomly drawn from a normal distribution with mean 8% and sd 15%, roughly what you might see with the S&P 500.

3. The starting value of the index was $50,000. The final value after 40 years was $1,152,446.

4. The final summed value of the largest 10 out of 500 stocks was $142,320, or 12.35% of the 500-stock index.

I was curious to see if megacaps would emerge from a simple toy model. I ran it only once, and they did. For me, this is a comment on the perennial alarm stories about "Only X% of stocks account for Y% of the market!" Even with a simple model, you wind up with something like that.

Adam Grimes agrees:

Can confirm. Have done variations of this test with more sophisticated rules, distribution assumptions, index rebalancing, etc. Get similar results.

Peter Ringel responds:

so we can take this ~12% of the index as a base value, that develops naturally or by chance? Then a clustering of being 20% of a total index (only greater by 8%) does not look so outrageous.

William Huggins is more concerned:

keep in mind it's 10 companies making up 12% (~1.2% each) vs 3 companies making up 20% (8.3% each) - in that sense, the concentration DOES look pretty high. am reminded of when NT was 1/5 of the entire CDN index in 99/00.

Peter Ringel replies:

You are right, I failed to catch this difference of only 3 stocks. In general, I am not so much surprised about the concentration. Money always clusters. Always clusters into the perceived winners of the day. Should they blow up, money flows into the next winner. To me, the base for this is herd mentality.

Adam Grimes comments:

It's Pareto principle at work imo. I'm not making any claims about exact numbers or percents, but as you use more realistic distribution assumptions (e.g., mixture of normals) the clustering becomes more severe. There's nothing in the real data that is a radical departure from what you can tease out of some random walk examples. Winners keep on winning. Wealth concentrates. (As Peter correctly points out.)

Asindu Drileba offers:

Maybe you try replacing the normal distribution of multiples with a distribution of multiples constructed with those historically present in the S&P 500? It may reflect the extreme dominance in the market today.

To me, the base for this is herd mentality.

It is also referred to as preferential attachment:

A preferential attachment process is any of a class of processes in which some quantity, typically some form of wealth or credit, is distributed among a number of individuals or objects according to how much they already have, so that those who are already wealthy receive more than those who are not. "Preferential attachment" is only the most recent of many names that have been given to such processes. They are also referred to under the names Yule process, cumulative advantage, the rich get richer, and the Matthew effect. They are also related to Gibrat's law. The principal reason for scientific interest in preferential attachment is that it can, under suitable circumstances, generate power law distributions.

Zubin Al Genubi writes:

Compounding of winners is also at work and returns will geometrically outdistance other stocks. No magic, just martini glass math.

Anna Korenina asks:

So what are the practical implications of this? Buy or sell them? Anybody in the list still owns nvda here? If you don’t sell it now, when?

Zubin Al Genubi replies:

Agree about indexing. Hold the winners, like Buffet, Amazon, Microsoft, NVDIA. Or hold the index. Compounding takes time. Holding avoids cap gains tax which really drags compounding. (per Rocky) Do I? No, but should. It also works on geometric returns. Avoid big losses.

Humbert H. wonders:

But what about the Nifty Fifty?

Jun

14

Oppenheimer and his students, from M. F. M. Osborne

June 14, 2024 | Leave a Comment

To give you another example of Oppenheimer and the way he acted, and also which illustrates that his bark was worse than his bite, is when I took my prelims, they came in two parts - one in physics and one in astronomy - and he was the sole administrator of the physics prelim, which was an oral. This was probably in the spring of 1941. I am not sure exactly when it was.

He called me into his office and started asking me questions in physics and it was a disconcerting procedure, because he would ask you a question and if you started to answer it and he could see that you did know the answer, he would cut you off without allowing you to answer it as soon as he saw that you knew it or knew enough about it, and move on to something else. Well, pretty soon he found something I did not know and he listened to me flounder for a while and then he said, "Well, you should know that and this is the answer," and he even wrote it down on the board and then he said, "You passed and did very well," which sort of left me gasping.

But it turned out that I do not think my treatment from him was different from other people, in that he really did give a damn about his students and when he found out that I was going to leave Berkeley in 1941 (because the war was on and the draft was on), he wrote letters around to find me employment without my even asking him for it. I mean he assessed me and assessed other students and did things for them.

Another thing which other students pointed out to me was that Oppenheimer really made his contribution through his students. That the number of papers which came out from Berkeley, especially theoretical papers (but others too, in experiments and interpretation) rarely had his name on them, but if you looked at the bottom line at the end you would always see an acknowledgement or very often that great help was provided by, or the problem was suggested by Dr. Oppenheimer, and that is the way he operated.

From his daughter, Melita Osborne's biographical document available here [MS word .docx file, approx 300 Kb].

Jun

12

Capgras delusion

June 12, 2024 | Leave a Comment

when a sizable part of speculators refuses to acknowledge the work of dimson et al and lorie and fisher et al in showing the 1000 fold increase in stocks over the last 100 years, we may attribute it to capgras delusion of imposters within.

Capgras delusion or Capgras syndrome is a psychiatric disorder in which a person holds a delusion that a friend, spouse, parent, another close family member, or pet has been replaced by an identical impostor. It is named after Joseph Capgras (1873–1950), the French psychiatrist who first described the disorder.

odds differential is now max of 17 percentage pts against regulatory capture. need a reduction.

Jun

12

Opposites

June 12, 2024 | Leave a Comment

Gilbert and Sullivan by Hesketh Pearson: sullivan was an inveterate gambler and inventor. personality was opposite to gilbert who was most litigious playwright in history.

From page 195:

Sullivan was at Monte Carlo when this letter arrived. He had recently been staying with the Prince and Princess of Wales at Sandringham, had then accompanied the Prince to the Continent, and was now enjoying princely festivities on the Riviera. His regular visits to the tables were reported in the papers, and he was extremely annoyed when certain English journals commented on his heavy gambling. What with dining among lords and counting his losses, he was in no mood to discuss grand opera with Gilbert. But he wrote again, recapitulating his main objections to Gilbertian comic opera: he was tired of it; his work was too good for it; he did not want to spend the rest of his life in clothing the same old types with music, e.g. "the middle-aged woman with fading charms"; he disliked the inhuman and impossible plots; in fact, the whole business had become distasteful to him.

Hesketh Pearson:

Hesketh Pearson published his first full-length biography, Doctor Darwin, when he was 43. By the time of his death thirty-four years later he had written another eighteen biographies, three travel books (all with Hugh Kingsmill), three books of reminiscences (one written with Malcolm Muggeridge), four collections of brief lives, a collection of short stories and essays, and a book on the craft of biographical writing, as well as numerous articles and talks. In England he was the most popular and successful biographer of his time.

From: Harry Ransom Center at the University of Texas

Jun

11

Recession of recession indicator, from Kim Zussman

June 11, 2024 | Leave a Comment

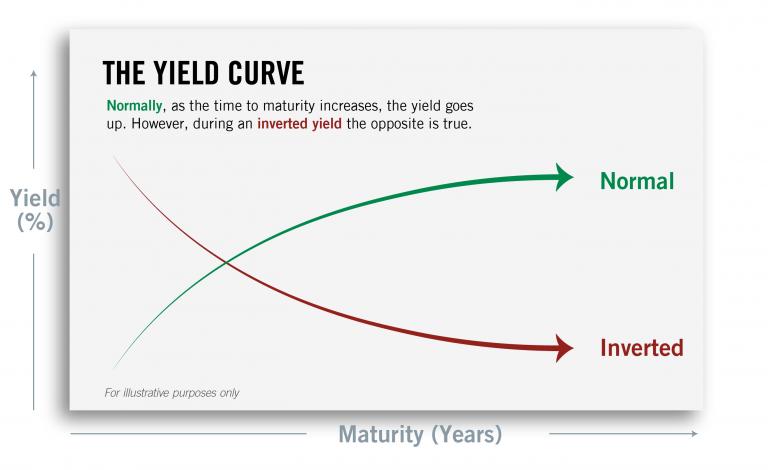

Wall Street’s Favorite Recession Indicator Is in a Slump of Its Own

Treasury yields have been inverted for the longest stretch on record

One of Wall Street’s favorite recession indicators looks broken. An anomaly known as an inverted yield curve, in which yields on short-term Treasurys exceed those of longer-term government debt, has long been taken as a nearly surefire signal that an economic pullback looms. In each of the previous eight U.S. downturns, that has happened before the economy sputtered. There haven’t been any glaring false alarms.

Now, though, that streak is threatened. The yield curve has been inverted for a record stretch—around 400 trading sessions or more by some measures—with no signs of a major slowdown. U.S. employers added a solid 175,000 jobs last month, and economic growth this quarter is expected to pick up from earlier in the year.

Big Al snarks:

If a recession doesn’t materialize soon, it could do lasting damage to the yield curve’s status as a warning system.

I'd hate to have to spend my day thinking up stuff like that.

Larry Williams writes:

A close up study of it shows it has often been way wrong—this is just one more time.

Nils Poertner comments:

As those "indicators" lose their importance, the more ppl (and WSJ and FT in particular!!) talk about it. "get the joke" Lack would have said.

Jeffrey Hirsch responds:

NBER that said 2020 was a recession. Fed started cutting rates in 2019 and the curve inverted then.

The recession lasted two months, which makes it the shortest US recession on record.

It is just a shame bond market traders didn’t tell the rest of us that covid was coming. And what about the 2 back-to-back negative quarters of GDP in Q1&2 of 2022? That looked like a recession as well IMHO.

Big Al adds:

The Fed (from before the GFC) says levels matter, too:

The Yield Curve and Predicting Recessions

Jonathan H. Wright, Federal Reserve Board, Washington DC

February 2006

Abstract:

The slope of the Treasury yield curve has often been cited as a leading economic indicator, with inversion of the curve being thought of as a harbinger of a recession. In this paper, I consider a number of probit models using the yield curve to forecast recessions. Models that use both the level of the federal funds rate and the term spread give better in-sample fit, and better out-of-sample predictive performance, than models with the term spread alone. There is some evidence that controlling for a term premium proxy as well may also help. I discuss the implications of the current shape of the yield curve in the light of these results, and report results of some tests for structural stability and an evaluation of out-of-sample predictive performance.

Jun

10

Stock/Bond ratio, from Hernan Avella

June 10, 2024 | Leave a Comment

I use a slightly modified version, I think is apt to use a rolling vol adjustment. Using VFINX (stocks) Long, VUSTX (long bonds) short. The stock bond ratio is higher than it was in 2000. the chart will show whatever you want; however, if you make the assumption that stocks and bonds have similar RISK ADJUSTED returns, mean reversion should be expected….at some point, but I don't think there's an actionable point here other than stay diversified. Here's a visual:

Stefan Jovanovich writes:

In the 40 years between the return of the dollar to the Constitutional standard (i.e. all paper issued by the Treasury had to be redeemable in coin) and the creation of a central bank that guaranteed that call money would always be available, the returns on the stock and bond markets had similar risk adjusted returns. For investors it was a choice whether to buy the common stocks of railroads with their wonderful but variable dividends or the secured bonds of the same companies.

A reversion to the mean could be a return to a period when cash, bonds and stocks all competed with one another in a connected equilibrium. That world saw creations of extraordinary fortunes; but against the one successful oil trust one had to measure the losses of all the enterprises that were unable to compete with Rockefeller's price-cutting for kerosene. What if AI means that sourcing for semiconductors only needs a few large relentlessly successful companies?

Vic asks:

how about no roll, no averaging on the bonds stock ratio?

Jun

9

M. F. M. Osborne recalls Oppenheimer

June 9, 2024 | Leave a Comment

There was one other pearl of information of a technical sort that I got from Oppenheimer, although it took me about ten or fifteen years to really appreciate it, but it shows how his mind worked. I asked him about two partial differential equations - one the Laplace equation and the other the Wave equation (d'Alembert's equation). The two were almost alike except that one has a plus sign and the other has a minus sign; and the conventional interpretation of the Wave equation is of two waves moving to the right and the left, and this is something you can read in any textbook. And I asked him why one could not have the same kind of an interpretation of the Laplace equation because you could get from the one to the other by changing one of the coordinates from real to imaginary units.

Oppenheimer said without any hesitation that the solution of two waves going in opposite directions didn't tell you a damn thing about the answer, contrary to whatever you read in the textbook. That tells you nothing beyond the continuity of the answer and, in fact, the real interest in those problems is not where the solution exists, but at the boundaries or the initial conditions where the continuity and solution breaks down; and that really controls what the answer is all about. In other words it is not where the equation is satisfied. It is where the equation is not satisfied that really describes a specific problem. The same happens to be true for Laplace's equation; it's the poles and the singularities where the analytic properties break down that really controls what the solution of Laplace's equation is like.

Well, the idea that you understand the theory and how a theory is determined is not the way it works but the way it does not work is a very useful idea. As I said it took me ten or fifteen years to suddenly realize, or gradually realize, that this was a very profound and important piece of mathematical and physical philosophy. You can in a sense relate it to Popper's ideas (that is Karl Popper), that a theory is not a theory unless you can show where it breaks down and then you begin to understand it. It is not where it works but where it does not work that really gives you enlightenment as to what it is all about and, of course, this statement of Oppenheimer's is an example of this. That it is the boundaries and the initial conditions where the equation breaks down that really control what is going on in any particular problem.

From his daughter, Melita Osborne's biographical document available here [MS word .docx file, approx 300 Kb].

Jun

8

Coney Island again

June 8, 2024 | Leave a Comment

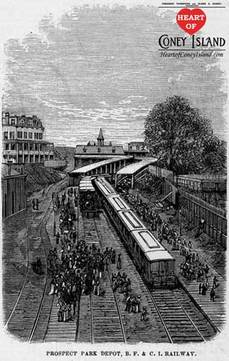

Coney Island History: The Rise and Fall of Engeman's Brighton Beach Resort

This article covers the rise and fall of Brighton Beach as a leading resort between 1870 and 1920. During these years, Brighton Beach competed for supremacy of Coney Island with Manhattan Beach to its east, and West Brighton to its west. Bill Engeman and the Brighton Beach Railroad Company both placed their bets on Brighton Beach and did everything they could to attract visitors to their particular resort. Brighton Beach was home to a beautiful hotel, music hall, and a well-known horse-racing track. When first built, it appealed primarily to the middle and upper-middle classes, while its competitor West Brighton initially appealed to the working and middle classes, and Manhattan Beach to the upper class.

Jun

7

More classic research

June 7, 2024 | Leave a Comment

Market Making and Reversal on the Stock Exchange

Victor Niederhoffer, University of Chicago, and M. F. M. Osborne, Washington, D. C.

Source: Journal of the American Statistical Association, Vol. 61, No. 316, (Dec., 1966), pp. 897-916

The accurate record of stock market ticker prices displays striking properties of dependence. We find for example that after a decline of 1/8 of a point between transactions, an advance on the next transaction is three times as likely as a decline. Further examinations disclose that after two price changes in the same direction, the odds in favor of a continuation in that direction are almost twice as great as after two changes in opposite directions.

Jun

5

M. F. M. Osborne

June 5, 2024 | Leave a Comment

M. F. M. Osborne. works on farm for free. uses his strength to go on anthropological dig. purposely spends 1 month in jail. graduate degree at Lick Obs. in Berkeley. becomes student of Oppenheimer who was smartest man at School. takes job at US Naval Research in sound division. writes scenes from life of the greatest contributor to random walk behavior.

while carrying his bio around, I fell down 7 stairs on my head onto concrete and all pages mixed up.

Brownian Motion in the Stock Market, M. F. M. Osborne.

It is the purpose of this paper to show that the logarithms of common stock prices can be regarded as an ensemble of decisions in a statistical steady state and that this ensemble of logarithms of prices, each varying with the time, has a close analogy with the ensemble of coordinates of a large number of molecules. We wish to show that the methods of statistical mechanics, normally applied to the latter problem , may also be applied to the former.

Jun

4

Top-Level Domains | The Economics of Everyday Things

Those letters at the end of web addresses can mean big bucks — and, for some small countries, a substantial part of the national budget. Zachary Crockett follows the links.

Asindu Drileba writes:

Mali owns the .ml domain for that may do well for Machine Learning. I wonder why they are sleeping on it?

Jun

1

Demonstration of Non-linear Effects Using Volumes of Cones, Asindu Drileba

June 1, 2024 | Leave a Comment

Numberphile Video demonstrating that a cone that is 80% full in height is actually 50% full in volume. You will also know if your getting scammed in a bar.

Cones are MESSED UP - Numberphile

Zubin Al Genubi writes:

This is why convexity, compounding, and geometric or exponential growth are hard to comprehend.

Kim Zussman comments:

Geometric returns are important when assessing performance. From an investor's perspective, average returns underweight when a manager loses everything (because it is sum-based), but geometric returns don't (because it is a product).

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles