Jul

29

Latam equity, from Nils Poertner

July 29, 2023 | Leave a Comment

I see in media and real life so many people from Latam trying to get to the US (or Turkey to Europe). that said, local stocks indices and currencies of those regions perhaps present the better options than the US or European mkts? Check out some of the Brazilian stocks yielding up 20pc and lowly valued (trap?) - also Brazilian Real vs USD (or Turkish Lira vs Euro). Just an idea could be half-baked at this stage.

Hernan Avella responds:

Right now Latam represents a minuscule portion of the market cap of international markets, which itself is about 40% of world equities (float adjusted).

Chile .2%

Mexico .8%

Brasil 1.5%

This becomes a highly idiosyncratic bet, mostly on the currency. Unless you have some special edge, it's not a risk you are compensated for.

Nils Poertner replies:

maybe some of the indices can be looked at, and over time one can develop a bit of expertise, too. I kind of like the idea that Latam as a whole remains in a sort of chaotic state. unpredictable and a bit dangerous too. it works a bit as an entry barrier (not for all, but for some).

William Huggins offers:

jacob shapiro of cognitive investments does a good job following latam markets, which could help build some of that expertise over time. they have a free geopolitical newsletter each week with a macro edge to it. he used to have a latam focused newsletter but there wasn't enough uptake apparently.

sample of recent newsletter:

Brazil’s lower house approved a proposal to overhaul the country’s tax rules. Lawmakers voted 375-113 to advance the bill in a second round of voting. The plan still has many hurdles to clear. As a proposed constitutional amendment, it must win two votes in the Senate, and may have to return to the lower house in the second half of the year if senators make changes to the bill, as Speaker Arthur Lira expects. We expect it will happen. Indeed, I can safely say that we are the only geopolitical and macro sources I know of that has been talking about the importance of Brazilian tax reform — both to Brazilian voters and to the trajectory of the Brazilian economy — with such depth and passion. All credit to @Rob Larity here who has been on this from the beginning. De Gaulle was purported to have said, “Brazil is the country of the future…and always will be.” It’s not clear he ever said exactly that, but more important is that the future looks like it is finally here.

John Floyd comments:

Valuations in equity, Valuations in FX, Idiosyncratic commodity drivers, Brazil softs, etc. Political slide left all around, Monetary cycle was first mover up and now first mover down is a tailwind, reshoring FDI flows in Mexico (I know NA and not LatAm). Low index weights does indeed limit some larger flows.

A few liquid country ETF’s or ADR or local expressions of views available. Always the episodic risk both ways. lets see how Argentina may play out next 6-24 months for example.

Nils Poertner writes:

In a way, those countries are good to study for a number reasons. in a way they remind me of the future of US and Europe (money printing, elites playing ever more shenanigans, ordinary people not sitting in their own seats, completely hypnotized what is front of them, endless distractions). re investing/trading- yes, ever-changing cycles - I agree.

Jul

28

Notes, from Hernan Avella

July 28, 2023 | Leave a Comment

1. While individuals in this list may prefer chess or checkers, it is the game of Go that best mirrors the seemingly infinite combinatorial power of market moves. Let's set poker aside for now.

2. "The turn," rather than the tick, is the fundamental unit of market analysis.

3. There's an elegant interplay between Jeffersonian and Hamiltonian stocks. However, to capture it, an expert model seems more appropriate than the usual regularities work.

4. An additional reason to consider playing the long side on equities is this: when the market rises and volatility is low, you fare well. And even when the market declines and volatility increases, the numerous rebounds still position you advantageously. It's never wise to become enamored with the short side, as I did in 2008-2009. I made a considerable profit, but it took over two years to rid myself of the bearish bias.

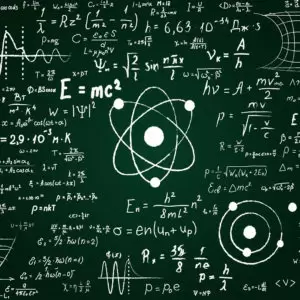

5. Physicist Sean Carroll conducted an insightful interview with David Krakauer of SFIan insightful interview with David Krakauer of SFI. The topic of complexity is very relevant for traders, yet only those with strong fundamental technical skills can fully appreciate it.

6. Cattle Kingdom is a compelling book to listen to, replete with fascinating stories about the boom and bust cycles of the cattle business, which underscore the basic structure common to all cycles in the US. We have a knack for creating bubbles, and overall, this is a positive aspect that should be safeguarded.

7. Does anyone have a comparison of the fundamentals between the peak in January 2022 and now? The current prices in relation to interest rates appear somewhat unusual. However, we need to examine the situation more closely.

8. 10 years later, but here's the python version of An Introduction to Statistical Learning. I'm glad that when I had to choose between R and Python, I chose the latter.

Jul

28

Science and Social Science, from Stefan Jovanovich

July 28, 2023 | 1 Comment

Scientists stand on the shoulders of giants and knowledge advances. Economists on the other hand keep stepping on the same rake. @GrantsPub

Bud Conrad writes:

The underlying science for Economics is not agreed upon, and so predictions are as often wrong as they are right. Economists spend lots of time criticizing each other. The different names for schools of economics are debated. No one debates what school of Algebra of Chemistry is right.

I spent quite a bit of time trying to fit data to the IS/LM model that is the bedrock of first year Macro Economics, and found it flawed. The most used book was by John Taylor (the Taylor Rule and one time assistant Secretary of the Treasury), and Robert Hall (NABE, and Stanford professor). I showed my analysis to Hall, who agreed that the model didn't work.

So it is not a joke about stepping on a rake. It is fundamentally an unsound intellectual base, that is the cause.

H. Humbert adds:

FWIW, even scientists don't agree when it comes to quantum mechanics. The 2022 Nobel Prize in Physics has been awarded to three scientists for their contributions to understanding quantum entanglement and advancing the field of quantum information. The existence of quantum entanglement proves Einstein wrong. If you care what that means, you can read the following. But I guess most on this list won't give a damn about quantum mechanics and not to mention quantum entanglement.

How Einstein challenged quantum mechanics and lost

Stefan Jovanovich comments:

Thx to KKL for making the point BC and I are sharing. The simple test of science is that its rules can predict the future successfully. We all accept the quantum theory's ability to predict motions in time and space so that GPS in our phones continues to work. Einstein was not "wrong"; his ideas "failed" to be a completely successful predictive model for everything we want to know. Economics has no successful predictive models about anything. If it did, our silk tie Marxist and others would make far less money as croupiers in the finance casino.

Peter Grieve writes:

Newton was the last alchemist. Einstein was the last classical physicist. He was wrong about a few quantum things, but right about so much.

In physics we talk about "background". Background is something that affects the world, but is not affected by it. The background is not a dynamical variable. God is background in most modern religions. A set of non-accelerating frames is background in Newtonian physics, along with a Pythagorean method for measuring distances ( "metric"). Einstein reduced the background by making the two things above (really just one thing) into dynamical variables. He also found a revolutionary new symmetry of the world, called Lorentz symmetry. This is everywhere, including in quantum theories.

I forgive him for being wrong about some quantum stuff. I share his distaste for certain aspects, but the mathematics of quantum theory is so beautiful. I don't think quantum mechanics can be a final theory. There will have to be something much different, and much better, still to come. Of course I'm speaking a bit loosely in the above.

Stefan Jovanovich asks:

Question for PG: What do you think of Dirac's criticism that normalization is "wrong" because it is ugly?

Peter Grieve replies:

I agree with Dirac. Feynman thought that the renormalization series actually diverged! The Hamiltonian diverges too, but physicists don't mind, because it works. Quantum field theory has a lot of ad hoc features.

The French mathematician Michel Talagrand often jokes about this sort of thing. He mentions "…the physicists' fairyland, where they discuss mathematical objects that don't exist, and even prove theorems about them!"

My wife's specialty is nonlinear differential equations. She uses the first few terms of divergent series also, and gets good approximations. Renormalization is ugly, but the rest is gorgeous.

Nils Poertner asks:

do you have any example/application for trading/investing - so there is benefit for a wider audience?

Peter Grieve answers:

Unfortunately, I don't. Perhaps someone at the dinner party might be stimulated by this thread, and further the discussion. Free range conversation sometimes has this effect.

Zubin Al Genubi comments:

Science is not what people agree on, it is only what can be disproven as random.

Kim Zussman writes:

What about quantum economics? Predictions are validated by going backwards in time.

H. Humbert responds:

If one is looking for short term trades related to quantum science, the short answer is No. If one is looking for emerging technologies that will give birth to new technology industries, there are indeed something there depending on the time horizon. You often see the average Wall Street analysts on CNBC throwing jargons like quantum computing around as if they know something. I can tell you they don't know squat.

If anyone is interested in where this technology is heading, you can perhaps watch this long video which is approved for public release.

Peter Grieve writes:

I recently learned that a derogatory graffito about my student residence at Caltech is written on the Moon. I lived in Dabney House, and at least in the 50s through the 80s the graffito "DEI" was everywhere. It stood for "Dabney Eats It". Apparently, residents of our house liked a food service item that other students found unpalatable.

Anyway, the astronaut Harrison Schmitt was also a Dabney House guy (before my time), and while he was on the Moon during Apollo 17 he scratched DEI into the Lunar surface.

There is also a story that DEI is inscribed on the back of the plaque on the Pioneer 10 or 11 mission. These plaques were intended to be a possible first written communication with alien life.

Christopher Cooper adds:

And as I recall, “Eats it Raw” was the follow-up phrase. Or, at least it was when heard in my House, Fleming (next door to Dabney).

Jul

25

Moves and the mare

July 25, 2023 | Leave a Comment

there are about 50 market-moving announcements a month. 45 of them have no meaning on prices. but the reactions are designed like the 3-zero roulette wheel to create wrong moves and many transactions and vig.

the blistering reactions are submerged by the increase in prob of winning of the old gray mare. i would like to post a picture of me without shirt on beach chair with Ray-Bans, but i need Aubrey to do it. i have 2-digit grandchildren and I would augment the picture by holding hands with some of them.

when a player or team is behind during the late stages of a match, they try increasingly risky and non-percentage shots. but old gray mare keeps increasing and no need to cure cancer and old age.

Jul

22

The mare and capture

July 22, 2023 | Leave a Comment

the gentlemen don't like the old gray mare's resilience but it is bullish:

you have to hand it to the old gray mare and the market. July seems to be what Martie Riesmann would call a key month. it's been up 12 times since 1996 and down 12 times. of the 12 times it was up, 11 of 12 advanced to end of year. approximate rise 150 big S&P points.

on qualitative basis, consider July's move extraordinarily bullish. the old gray mare was subject to the most withering evidence of corruption imaginable. but he maintained his win prob of 33%. reg capture joy from the powers that be is at a max. the three letter agencies, etc.

Let’s Not Forget George Stigler’s Lessons about Regulatory Capture

George Stigler’s theory of economic regulation opened our eyes to the rent-seeking that undermines the public interest. Yet many in positions to influence policy today do not appreciate the beneficial innovation and increased consumer choice that economic deregulation and competition brought.

as evidence of the lackadaisical response to the corruption news, Fox leads off with an article on backlash against NYC congestion pricing.

sign of our times: the old grey lady has not one single article or mention of the revelations and developments of the old grey mare in its Saturday July 26 edition. how bullish can you get?

Jul

17

A Message From My Son

July 17, 2023 | 2 Comments

this is a message from Aubrey about his very exciting business:

As some of you may have heard, I am developing a startup recruitment agency called Amalgam Talent in the country of Swaziland / eSwatini. We have grown far more sophisticated, and we are now employing wide-reaching recruitment strategies to attract the most talented people in Swaziland. We have hired over 20 remotely working employees to US companies now, and we are extremely excited by how well they are performing. I'll be travelling to Swaziland in a few weeks to meet with his business partners and develop the business further.

We currently have some really exciting people available with AI / machine learning and data analytics experience. If any of you quants happen to be hiring, please contact me via my LinkedIn page or leave a note in the comments here on Daily Speculations.

Best regards, and I hope to hear from some of you soon,

Aubrey

Jul

14

Bonds, from Nils Poertner

July 14, 2023 | Leave a Comment

like Sidney Homer used to say- "sooner or later every generation is shocked by the behaviour of interest rates."

Hernan Avella disagrees:

I don't think many people can be shocked, given the data we have from the 80's. Most asset holders are older folks anyways, that have the memories of the Volker era deep in their heads.

Stefan Jovanovich offers:

Edward Chancellor interview

High Interest Rates To “Slay” Zombified Companies | Edward Chancellor & Joseph Wang

Kim Zussman adds:

America’s Retirees Are Investing More Like 30-Year-Olds

At Vanguard, one-fifth of taxable brokerage account investors aged 85 or older have nearly all their money in stocks

William Huggins responds:

i suspect a good part of that boils down to how one's asset portfolio is defined. most studies of brokerage accounts don't account (haha) for the real estate, pension, insurance, or physical assets of those being studied. if most of my income is derived from a secure pension, its (mathematically) a pretty good approximation to drawing the yield from a large investment grade bond portfolio (less the liquidity). owning your home (usual by 85) would similarly constitute a "housing cost equivalent" yield, as would any reliable health benefits being drawn. seen in that way, one's discretionary funds being kept in equities would be quite reasonable.

Zubin Al Genubi reminisces:

Sure would have been nice to own 17% bonds. 5% not too bad though.

Nils Poertner offers:

Big investors rush into bonds after ‘cataclysmic’ year

Capital Group predicts $1tn will flow into debt markets in next few years as investors move to lock in higher yields

Henry Gifford writes:

In the 1970s my father bought some New York City municipal bonds. At the time there were rumors that the city government was going to go broke. I heard my father say “How can the government go broke? When they want money all they have to do is send people bills.”

The city government defaulted on the bonds. It was widely reported in the news as a disaster, with various solutions to the terrible problem proposed. I was only a teenager, but didn’t see a problem with the government not being able to borrow money any more. I still think it would be great. But, most people believed it was a terrible problem, with disaster looming.

My father reacted by buying more of the bonds – “default” meant they mailed his checks one week late. The bonds were triple tax free: no federal income taxes, no NY State income taxes, and no NY City income taxes. The bonds paid 28%. It was the only time in my father’s life that he borrowed money – to buy more of those 28% bonds. I have no idea for how many years he was collecting 28%.

I started buying apartment houses in Manhattan when I was 20. It was normal to pay 12% interest. One time I bought a small building – only four families – with the goal of replacing the 12% seller-financed loan with an 8% bank loan on an owner-occupied property. I moved into the building, fixed it up, but never managed to get a city inspector to come inspect and remove all the violations without inventing some new ones, as I never bribed an inspector. But for a long time I dreamed of refinancing a little bit of my real estate at 8%.

Nils Poertner responds:

tangentially speaking . we would need to have experience from bond traders of the 1970s and 1980s, today is more leverage though and we have more complex system so not sure how much that would really help. collective mind has been in a long mental bear mkts as well. we need nerves of steel in coming yrs and imagination.

Jul

12

ATH and three zeroes

July 12, 2023 | 1 Comment

you keep hitting it to the opponent's weak backhand, but despite the good strategy, the opponent is near match point. the zeal with which the opposition is gloating over the fissures in the opponent is belied by the score.

despite the best efforts of truly knowledgable bettors like mad dog, they can't surmount the 52% hurdle.

Steve Ellison adds:

Most casinos in Vegas have now added triple zero to their roulette wheels, so even more gamblers will lose more than they have a right to. 7.7% house edge??

Vic continues:

in line with the roulette wheels with 3 zeros, on my platform is a prominent command: 'flatten everything'. one is waiting for a command flatten and reverse everything.

One hasn't heard from the chronic bears lately making fun of me as to when the S&P will make an all-time high. it appears that in Nov 2021, the S&P index was in the 4600-4700 handle and futures were in 4700 handle.

Steve Ellison comments:

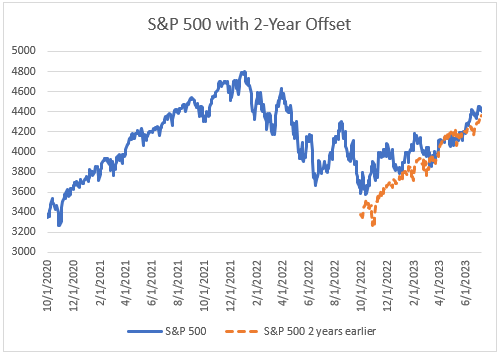

The S&P 500 looks very much like it is making a Lobagola along its 2021 price trajectory (orange line). If this pattern continues, the new all time high should arrive by December. I don't know how to test this hypothesis, so for the moment it remains a conjecture.

Vic continues:

thus we are about 5% away form ATH at 4700. if the devoted father increases his prob of winning to old, we should surmount. let all S&P bulls hope for more news of cog decline and hand in till.

Mr. Wonderful's utterances are the perfect example of a distraction display used by so many animals in nature.

at 4500 S&P, we are 5% away from ATH. where are we going? europeans have finally caught up with July, up a few months in a row. S&P should close at ATH. also depends on reg capture.

Jul

9

Markets and books

July 9, 2023 | 1 Comment

a passage in Ed Spec points out that my dad learned to make friends with the referee. he bought Sam Silver some moo goo gai pan. several successful traders indeed apparently the most successful ones are at one with the exchanges.

is is a shibboleth that it pays to bet against the team that was able to squeak out a win or benefited form an error of the other side or won by corruption of some kind. we should realize the same thing applies to politics viz a viz the perfect father - incredible that he leads.

nice drop of S&P of 40 pts on unemployment from 1:30 to close — greatest drop on unemployment ever.

some books read over weekend: The Smiling Country, by Elmer Kelton; Wealth, War, and Wisdom, by Barton Biggs; The Hidden Life of Trees, Peter Wohlleben; Bird Life, by by Frank Michler Chapman and Julie Zickefoose.

and always the first 80 pages of Fifty Years in Wall Street. where are the greats of the 19th century and why did they succumb? the reason that oak trees are crowded out by beech trees, the beech trees shade out the oak trees to cause the oak trees death:

Root competition between beech and oak: A hypothesis

with bonds in the 123 handle lowest in 10 years, agrarians galore should be on guard that further declines don't hurt their man.

Jul

6

The Chair poses a question

July 6, 2023 | Leave a Comment

how has the evolution of regularities in markets made it much harder to beat the 52% accuracy that no sports better can achieve to break even? one way is the ever changing relation between bonds and stocks between years. what else?

Larry Williams writes:

Crude's influence on stocks [has changed over time]

Alex Castaldo offers:

The Great Financial Crisis of 2007 and 2008 revealed a number of regularities that (I believed) would be very profitable in the future, but careful monitoring of them after their discovery proved very disappointing to me. For example, trend following that would have gotten you out of stocks and back in during that decade did not work well in the Covid crisis with a faster decline and faster recovery.

Nils Poertner comments:

a mystery indeed - some folks have lousy accuracies (say sub 25pc) and still do well - since a few things they do on top turn out great, eg, the lousy equity trader who got into ethereum early enough (and out when others got into it).

Kim Zussman adds:

Yield curve inversion from 3 months and 500 points ago:

Hernan Avella comments:

Like sports, the evolution of markets is guided by the fitness of the players. We are not competing against prospective cab drivers trading in the pits anymore. But armies of highly talented people that invest thoughtfully and systematically in every step of the process: Infrastructure, trading business practices, research, execution, recruiting. I have a friend working in one of these highly capable groups. Around 70 people. All markets 24 hours, every single approach possible.

Very few of us from the old days survive. The Chair might be the oldest and longest lasting point and click trader. Such a great competitor!!! Ray Cahnman, founder of Transmarket Group is up there as well.

Vic replies:

the point-and-click survivor owes it all to Lorie and Dimson who taught there is a drift. also one learned not to succumb to conspiracies to margin one out.

Jared Albert writes:

Modern technology, particularly around real time customer segmentation and portfolio correlation, squeezed more value from the 'customer as the product' than before.

Jul

4

Evolution of excellence

July 4, 2023 | 1 Comment

how now the S&P in next periods given a big rise until 30 June? a dipsy doodle with 12 of 14 up next two months, then a decline in September with a fine bull close to end of year.

bribery during 1865-1870. nothing has changed.

the evolution of athletic excellence continues apace. and one can predict that pickle ball will soon advance the way handball did so that all good players have a natural left and hit ambidextrous. i can hit my left as well as my right. what other sports have evolved to excel?

James Sogi replies:

Downwind foil surfing was only invented a few years ago. Now people foil 200 kilometers flying over ocean waves.

Vic continues:

in the 1950's only one handball player Vic Herskowitz had a natural left. now every player hits from both sides with power and natural swing. the same in baseball pitching where 100 mph is de rigueur. what other sports have evolved to greatness?

the monstrous plastic pickle ball makes it much easier than paddle tennis to switch hand with alacrity and effectiveness.

A twitter asks:

Is that good or bad?

Vic replies:

as Sholem Aleichem would say, "it's both good and bad", but regardless we will soon see ambidextrous pickle players winning all tourneys. i would be such if I didn't have stroke.

notice how weak the backhand of best player Ben Johns is:

Ben Johns Backhand Pickleball Highlight

how has the evolution of regularities in markets made it much harder to beat the 52% accuracy that no sports better can achieve to break even? one way is the ever changing relation between bonds and stocks between years. what else?

one sport that has shown no improvement over the years is handball. the players of 100 years ago would beat the present crop with their baby overhand serves 21-5. why?

Athletic performance has been improving steadily for decades - the evolution of sports shows how it keeps getting more difficult to win. how have markets become more difficult?

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles