Feb

18

Vol in percent versus dollars, from Zubin Al Genubi

February 18, 2026 | Leave a Comment

More on the points vs % argument. % vol or Vix is misleading and inaccurate measurement of vol. A better measure is abs vol in points/$ because we live and measure ultimately in dollars.

Accordingly at 7000 abs vol is 350% of what is was a few years ago at 2000. Trading has to adjust accordingly to maintain the same portfolio volatility of returns. Thus leverage, targets, systems, time have to adjust to match.

Adam Grimes disagrees:

because we live and measure ultimately in dollars

This does not strike me as coherent. Returns are the only reasonable way to understand market movements. Just imagine a portfolio of two assets, one at $1 and the other at $100,000 (or other arbitrarily wide handles). The only way to think about those is to normalize for price via %, so it follows that volatility would be equally incoherent measured in points. (Sorry for the Finance 001 example, but I think 'Explain It Like I'm Five Years Old' cuts through a lot of confusion.)

% and vol measured as vol of %'s (i.e., returns) is the only thing that makes actual sense here unless I'm misunderstanding the argument. What am I missing?

Accordingly at 7000 abs vol is 350% of what is was a few years ago at 2000.

Scratching my head here. "So what?" and "of course" are the only things I could manage to say here.

I'm probably missing something, though. What is it? (btw VIX sucks as much as any other clunky measurement of implied vol. I'll agree with you on that one, but I don't think that's your point.)

Zubin Al Genubi responds:

1 ES contract used to move 7 points as an average range 20 years ago. You made or lost $350. 1 contract now moves 50 or 100 points a day, same percentage, but your account is up or down $5000. The volatility in your account in dollars is higher than 20 years ago. If you lost 1% in 2000, its $600, but 1% now is $3500 per contact. You don't see too many 2% days like before. Abs vol is up while Vix or % vol is down. Its apples and oranges.

The trading style, research should change. Straight percentages for expectations, returns, targets don't work like they used to, especially using historical data. Silver now has micro contract because $5000 a dollar too is high volatility in dollars with $20 or more ranges. I guess I'm suggesting using abs vol as a better measure of vol.

Appropriate here, Feynman in 6 Not so easy pieces, cites Wyle on symmetry, "Suppose we build a certain piece of apparatus, and then build another apparatus five times bigger in every part, will it work exactly the same way? The answer is, in this case, no!" My point is the market does not the same way as it did 25 years ago in large part because it is bigger. The fact that the laws of physics are not unchanged under a change of scale was discovered by Galileo. He realized that the strengths of materials were not in exactly the right proportion to their sizes. [Ibid]

Adam Grimes writes:

I'm sorry, but I still find these points trivially obvious. Of course nominal price swings are bigger because price levels are higher, so of course holding a single contract would result in larger dollar swings. Who's holding a single contract? Position size takes care of all of this.

And I don't think the physical analogs add anything beyond confusion. Physical properties scale differently. For instance volume scales as cube and surface area as square. This is why we could not have a science fiction 100 ft tall lobster in reality…because of material constraints. There's no market analog to this. A 1% move is a 1% move. There's no hidden non linearity there.

If your claim is that markets don't move the same they did 25 years ago I would challenge that claim. What's the evidence for this? Statistically there's always the issue of non-stationarity but it seems to me you're claiming there's something more meaningful here. What am I missing?

Asindu Drileba comments:

I think Zubin is simply trying to say that he had found measuring volume in dollar terms (absolute terms) more relevant than measuring it in percentage terms.

Richard Hamming has an interesting talk, You get what you measure

Here us a good summary:

You may think that the title means if you measure accurately you will get an accurate measurement, and if not then not; it refers to a much more subtle thing - the way you choose to measure things controls to a large extent what happens. I repeat the story Eddington told about the fisherman who went fishing with a net. They examined the size of the fish they caught and concluded there was a minimum size to the fish in the sea. The instrument you use clearly affects what you see.

I for example, completely stopped measuring market returns in percentage terms a few years ago. I now exclusively use log returns. Why did I stop using percentages? The problem with percentages is that they are not equal to each other (ignoring the negative sign). (a 50% move) + ( a -50% move ) does not give you 0 in dollar terms. But what you get is 0% in percentage terms. Percentages are not symmetrical. Does this mean they don't measure growth? They actually do. But they simply should not be compared. As the absolute values may mean something different.

- A 0% return percentage may (erroneously)

indicate that you have broken even.

- The same 0% percent return may also show that you are actually loosing money in absolute (dollar) terms

Adam Grimes writes:

Of course log returns are well known, and this is more finance 101. There are several qualities that make them more attractive for some analyses. (just dont mix percents and log returns!)

But that's not the same as measuring market movements in raw dollars (which is the only reasonable companion to volatility measured in absolute dollars (or points).

And as for measuring what you see, methodology (and perhaps even experimenter expectations) greatly affecting outcomes and conclusions, we're on the same page there. This is fascinating territory for discussion and I'd welcome it.

But his point about volatility only extends to someone trading a single contract in 2001 and also trading a single contract today. That is irrelevant.

If there's something at work here and legitimately some way the market "doesn't move the same way" it did decades ago… I'm all ears and very interested. Always looking to learn more about what I don't know or might be missing.

Zubin Al Genubi does some counting:

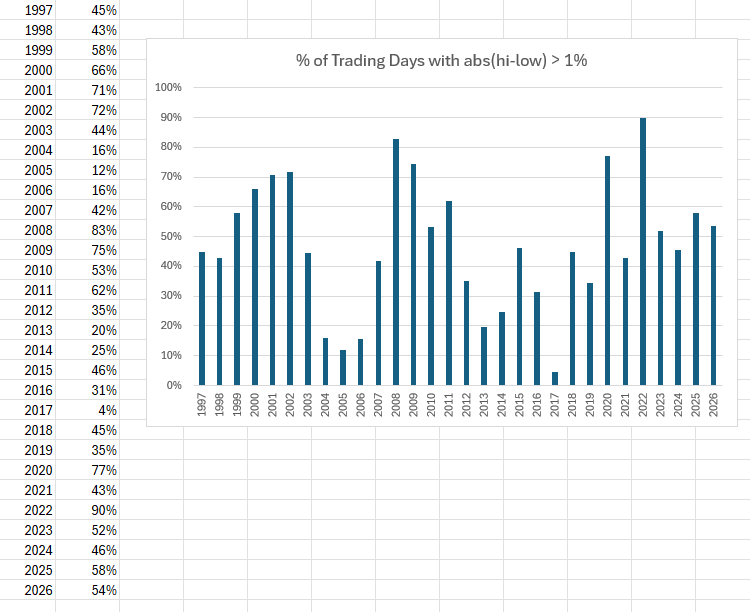

There were 31 days in 2006 and 67 days in the last year with percent moves >1%. This is due to Big Tech being 32% of ES with higher beta and the speed and intraday persistence of algorithmic trading. Lastly, it 'feels' different. A 120 point drop trades different than a 13 point drop in 2002.

Stated quantitatively, now nearly half of our trading days have abs vol hi-lo >1% while in 2006 only a quarter of days had abs vol >1%. That is a big difference and clearly explains why trading is different (better) now. Today is just 1 of the many such days.

Cagdas Tuna adds:

All futures contracts of index products have adjusted to gross notional value of underlying stocks. At the same time VIX contract specifications and notional value it can represent almost remain unchanged. Although calculation method of VIX is the same, the number of futures contracts hedgers need to cover notional values they trade in underlying assets are totally different.

Adam Grimes writes:

Stated quantitatively, now nearly half of our trading days have abs vol hi-lo >1% while in 2006 only a quarter of days had abs vol >1%.

I'm sorry but I have to be direct. I find this annoying. You have moved the goalposts and are now making a completely different argument. You began advocating for measuring volatility in absolute dollars and now you are using a percentage measure. You are literally using the metric you said was wrong to support your argument that the metric is wrong.

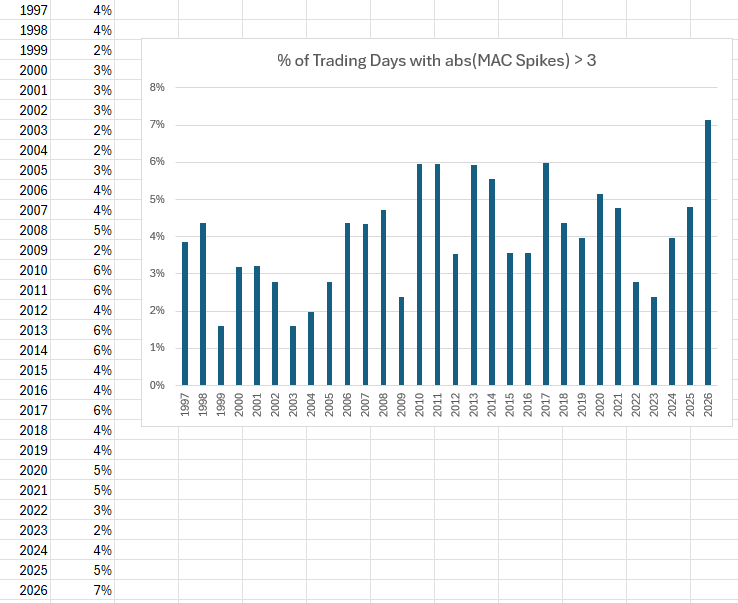

Furthermore, your data are bad. It's simply a volatile measure. Volatility is volatile. Here's a look at the FULL history of the ES futures [first chart] (back-adjusted so this may not be fully accurate, but I think the % adjustment fixes the back-adjustment distortion) counting the number of trading days in each calendar year that had abs(high-low) / close > 1%. It's simply an unstable measure and I don't know what is to be drawn from this.

If your argument is that there are more days with "surprise" distortions, this is maybe nominally true, but better measured with better tools. I use a tool that expresses each day in terms of the mean average absolute closing difference [second chart]. Taking an arbitrary bound of 3 for that, the argument that this year is on track to show more surprise shocks than usual is true (but also reflective of a generally lower baseline).

You've flipped to percentage measures and we're left with hand waving "it feels different now." That's a different claim and it's qualitative, perhaps has value, but not in supporting your original claim.

I'll reiterate my position: percentage measures are the only thing that make sense. Point values are arbitrary and can be easily handled via position sizing (within the limits of granularity of instruments vs account size.) I don't think this is revolutionary or controversial. This is truly finance 101.

Feb

15

6950, from Ani Sachdev [Updated]

February 15, 2026 | 1 Comment

I counted the number of crossings of the ES future past 6950. I counted the using the nearest expiry future. I counted using 30 min increments. Since October 29, 2025:

ES crossed from close to close across 6950, 78 times. 39 times up, 39 times down - true Logbola.

ES traded through and touched 6950 at any time at least 154 times (counted when there was low < 6950 < high).

Curious if any specs have used data like this to predict future prices.

Zubin Al writes:

14 hourly crosses night and open [Friday, 13 Feb.].

Cagdas Tuna comments:

I find the fact that whether call it NY Fed or Blackrock or other main street banks whoever single handedly controls and manage to keep VIX below 20 that is ultimate power controls the US stock market.

Larry Williams responds:

No one is holding anything down—or up—my vix fix is essentially same as $vix it cannot be controlled.

Cagdas Tuna is skeptical:

Yes, nothing is controlled!

Zubin Al Genubi prefers market dynamics:

Vix suppression is caused by: 1) heavy ODTE trade, while VIX is calculated on options 23-37 days out; 2) dispersion in SP index (dispersion meaning Mag 7 vs other 493; see RTY almost up 2%); 3) Big fund/ETF imbalances balancing deltas; 4) mean reversion of VIX/and buy the dip, which can break down at some point.

Larry Williams gets cosmic:

The universe is always expanding, Hawking proved. Stocks are part of that.

Feb

5

6 new lows, from Zubin Al Genubi

February 5, 2026 | Leave a Comment

The last few down swings each had 6 new lows before a bottom. Today, marking a new low for this swing after hours will end up a new low number 5 by the end of tomorrow.

Steve Ellison writes:

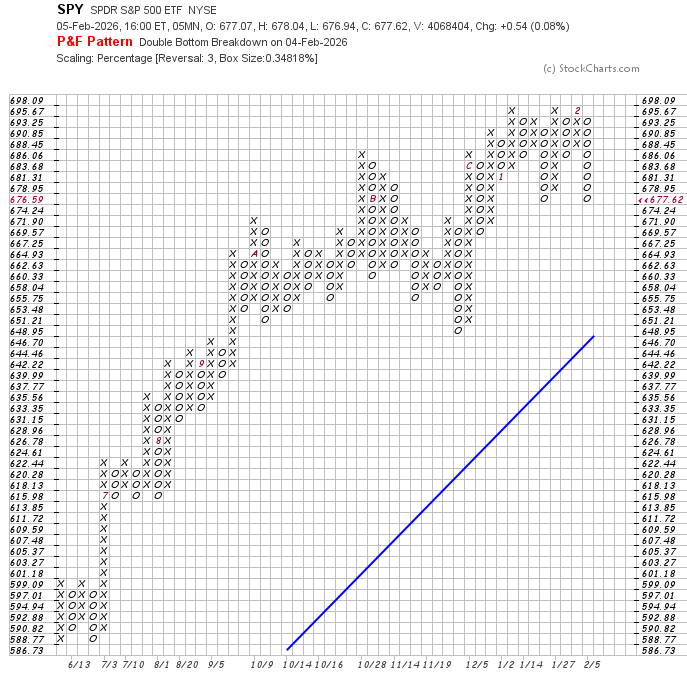

Interesting. I have been experimenting with multi-level point and figure charts. Using a box size of 1.4% (a long-term average true daily range) and a 3-box reversal, SPY is still within 4.2% of its all-time high and hence in an uptrend. Drill down with smaller box sizes and shorter time intervals, and interesting price structures appear. At a 1/4 ATR box size, today's close was at a similar level to the Jan. 20 low.

Lots of sector rotation under the surface. If 2025 was the year of the magnificent 7 and the flatlining 493, this year may be the opposite. While technology was getting beaten down this week, the Industrial, Materials, Consumer Staples, and Energy sector ETFs all made new highs.

Zubin Al Genubi adds:

Lots of late night shenanigans going on. Asian markets trading open in late thin US futures creating imbalances. Price action appears algo driven.

Nils Poertner comments:

I like the pattern with 6 new lows. Well spotted. Otoh, if the pattern does not repeat the surprise for mkts is bigger. nature offers "patterns" and "break of patterns" and both are relevant - else it would be a museum.

Cagdas Tuna predicts:

Then it is going to be a rough year for market cap weighted indices in US.

Peter Ringel writes:

While I would always give a study, like Big Al‘s more weight to remove opinion. I wonder, if there is a January effect regarding regime type or sector or general trading type. Not necessary % performance. Will the rest if the year trade like January? Would give a 2015 type year.

Nils Poertner responds:

yes. for practical purpose, it may be easier to trade mkts which receive less attention by the wider financial community /media.

Feb

4

2026 Bullish Confirmation, from Larry Williams

February 4, 2026 | Leave a Comment

Yale Hirsch and his son Jeff have shown that a positive change, from the last trading day of the year to the 5th trading day of the new year, portends a bullish year (positive first 5-day percent change).*

Consider this … in the last 76 years of trading, the S&P 500 has declined for the year 20 times or 26% of the time. In other words, 74% of the time, there has been a yearly gain.

Jeff’s numbers show that in those last 76 years, 49 years showed a positive first 5-day percent change. Only 8 of those years went on to close down for the year. That’s an 84% bias for the year to close higher when we have a positive first 5-day percent change.

My add-on to Yale’s and Jeff’s work was to look at the years that gained 1.2% or more in the first 5 days of trading. There were 28 such years. Of those years, only 2 were down for the year. That’s a 93% bias for the year to close higher. What an improvement from the average 74%!

In 2026, the first 5-day** change for the Dow Jones 30 was +3%.

In 2026, the first 5-day** change for the S&P 500 was +1.6%.

Those 28 years had an average annual return of 14%. The remaining years had an annual gain of 5.3%. I see this as excellent confirmation of the bullishness of my Forecast 2026 Report.

Cagdas Tuna writes:

There is no need for a statistical analysis to assume any given year will be positive for US indices. It is almost guaranteed to be positive every year. No offense to any list member.

Larry Williams responds:

Wrong 24% of time we close down for the year.

Michael Brush is surprised:

Wow did not know it was that high.

Larry Williams agrees:

I was taken back by it as well.

Asindu Drileba asks:

2026 is bullish? But Senator, you said you expect a recession in 2026 with 100% certainty. Is this a contradiction? Or maybe its possible for the market to be bullish even during a recession?

Larry Williams answers:

Yes, there was a projection made a year ago for a 2026 sell off —in the last 12 months data changed—large improvements in fundamentals and hopefully I got a little better understanding of long term cycles. New Data matters.

Nils Poertner writes:

Asindu- there would be simply too many variables out to make that statement with such a certainty in advance. Just impossible. It remains a probability game. Used to subscribe to some cycle research that claimed to have things figured out yrs in advance. quite pricey subscription. it was HOOK, LINE and SINKER (for me).

Denise Shull comments:

New Data matters.

Indeed it does. Wonder why it’s challenging for many to incorporate?

Nils Poertner responds:

Good question. On this note… (Pure) data analysts believe pattern matching on large datasets will solve our problems. But what if the really vital information isn't being collected? What if it's invisible to our trained systems?

Jan

6

Leather jacket indicator, from Cagdas Tuna

January 6, 2026 | Leave a Comment

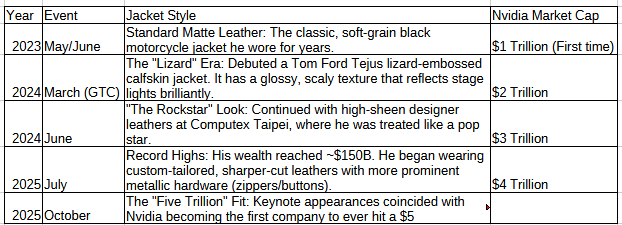

I asked Gemini if the Nvdia stock price milestone dates associated with Jensen Huang's famous leather jackets. Here is the timeline of Jensen's jacket evolution alongside Nvidia’s stock milestones:

The one that caught my attention is Lizard Era in March 2024. At that time Nvdia price was around $100 and after Jensen's Lizard Jacket appearance Nvdia stock fell 20-25%. And here is Jensen while debuting new chips last night. We will learn soon if the Lizard Jacket is a helpful tool for front running Nvdia stock!

Steve Ellison likes the idea:

Very unique and insightful analysis. My wife read a biography of Mr. Huang. When he was growing up in Oregon, his immigrant relatives wanted to put him in a private school, but the school they enrolled him in was a reformatory. After that life experience, I am pretty sure that Mr. Huang can't be intimidated by Donald Trump or Xi Jinping.

Peter Ringel adds:

agree. probably useful insights can come from seemingly absurd corners. Like the weather of sports teams in NYC.

Jan

5

Oil, from Cagdas Tuna

January 5, 2026 | Leave a Comment

So where lies the thin line between liberating Venezuela and putting world into oil supply based recession?

Larry Williams comments:

The quality of their crude is a different issue we use to refine it here; sour, full of gravel etc.

Stefan Jovanovich writes:

Historically, before full sanctions in 2019, the US imported over 600,000 barrels per day (bpd) of Venezuelan crude, with refiners like Citgo (PDVSA-owned), Valero, Chevron, and Phillips 66 as top recipients.

More recently (post-2023 relief), Valero accounted for 44% of imports, Chevron 32%, and Phillips 66 10%.

Carder Dimitroff writes:

IMO, it's not about oil. The US is a net exporter. They're doing just fine without Venezuela. If heavy oil is desired for refining optimization, as some claim, there's a direct pipeline from Canada.

Stefan Jovanovich responds:

It would help if Carder focused on the use of heavy oil for marine diesel and bunker oil for steam turbines. Those are the essential propulsion fuels for China's Navy; hence, Hegseth's comment today assuring China that it would continue to receive its share of Venezuela's output.

Carder Dimitroff expands:

Globally, three major regions produce heavy crude: Russia, Canada, and Venezuela. Downstream, “heavy oil” or “heavy fuel oil” usually means the residual, high-boiling product left after lighter fractions (gasoline, diesel, kerosene, etc.) are distilled from crude. As Stefan suggests, heavy oil and bunker oil are growing markets, not only in China but also elsewhere.

In my opinion, the administration's interests in Venezuela reflect several interests. High on my list are Venezuela's untapped rare-earth elements (about 300,000 metric tons).

Pamela Van Giessen offers:

Interesting analysis here:

The Real Reason the Pentagon Approved Venezuela: Critical Minerals and Adversary Expulsion

The Department of War has allocated $7.5 billion under the One Big Beautiful Bill Act specifically for critical minerals, with $1 billion already deployed to stockpile antimony, bismuth, cobalt, indium, scandium, and tantalum. This is not economic policy. This is national security infrastructure. The United States is 100% import reliant for 12 critical minerals and over 50% reliant for 28 of the 50 minerals classified as essential to national security. These materials are not interchangeable. They cannot be substituted. They form the irreducible foundation of modern weapons systems.

Boris Simonder questions the thesis:

What rare earth does Venezuela hold that is proven and confirmed? Based on USGS Mineral Commodity Summaries 2025 and other sources like CSIS reports, Venezuela has no significant cobalt production or reserves listed. Antimony deposits exist but are small and underdeveloped, with declining output due to infrastructure issues.

Dec

22

Bitcoin Historical Drawdowns, from Cagdas Tuna

December 22, 2025 | 1 Comment

It will be the first time mainstream institutions, such as ETFs, banks etc. are so heavily involved with this asset class if it is repeating the historical pattern.

Cycle 1 (2010 - 2013)

• Peak: December 2013

• Drawdown: 93% from ATH

Cycle 2 (2014 to 2017)

• Peak: December 2017

• Drawdown: ~86-87% from ATH

Cycle 3 (2018 to 2021)

• Peak: November 2021

• Drawdown: ~75-77% from ATH

Cycle 4 (2025 to ???)

• Peak: October

• Drawdown: 30% from ATH for now

If 70-80% drawdown repeats, Bitcoin will be below 40000 and Crypto Treasury geniuses will be meeting with Trump for a bailout! But Who will bailout Trump?

Nov

21

VIX Intraday Range, from Cagdas Tuna

November 21, 2025 | 1 Comment

Yesterday's range in VIX was one of the widest & wildest one I have seen in a very long time that happened without any major news. Wednesday close to Thursday low 18% decline followed by 46% rally to the day's high. Is there anyone who can check the occurrences in the past and how SPX traded in the following days of such a massive range explosion?

Asindu Drileba responds:

The Chairman's book, Practical Speculation, has a detailed analysis of the multivariate relationship between the VIX and the SPY. Unfortunately I forgot the page, and I am currently not close to my copy. [see pages 107-110] But it has something to do with how the fluctuations around the average of the VIX affects the SPY.

Paolo Pezzutti does some counting:

#VIX +11.71% at 26.43

Highest close since 24 April

Since 2020 VIX>26 has occurred 290 times.

After 4 days the Emini S&P Futures:

+27.01 pts Mean, 63.4% Wins, 1.63 Profit Factor

Larry Williams cuts to the chase:

Vix goes up when stocks go down they are inverse of each other—no magic there are all.

Nov

21

Sheep shearing, Humbert Q.

November 21, 2025 | Leave a Comment

Sheep needs to be regularly sheared to take off some extra wool- it is actually good for them- healthy!

Henry Gifford adds:

Back in the day sheep didn’t have people handy to shear them. A farmer told me that over the past few hundred years sheep have been bred to grow more wool, thus they need people now, but before that change the sheep didn’t grow as much wool.

Steve Ellison writes:

The S&P 500 reaching its lower 50-day Bollinger band on Thursday might indeed indicate some modicum of panic, as might VIX being well above its upper 50-day Bollinger band.

I have thought sentiment was quite restrained this year given that the S&P 500 was at a record high as recently as October 28. Bears have outnumbered bulls in the AAII survey for the past two weeks. And the publishing of a book titled 1929 was very well publicized. I perceive that out in the general population there is a lot of fear about AI; lots of scaremongering about AI eliminating nearly all white collar jobs.

Cagdas Tuna comments:

Many years ago when I was a teenager, I heard this from the head of top brokerage firm in Turkiye and he said "It is not news until it matters." Circle funding of AI companies and its effect on jobs have been long discussed at least by the people I follow on social media but it has had no impact until yesterday. So can we say it has become news now?

Nov

10

Best indicators for inflation, from Asindu Drileba

November 10, 2025 | Leave a Comment

The more goods cost, the more money visa makes since the fees they charge Issuing banks & acquiring banks are based on a percentage basis. So, higher prices (inflation) –> better predicted revenues for Visa? Inspired by a nice documentary on the history of VISA.

I wonder what the best indicator for inflation would be for testing this? CPI? Oil?

Cagdas Tuna writes:

I was thinking as to find a similar indicator for economic slow turn, spending cuts. It came to my mind to follow sales slips. I live in Malta which is a very tech friendly country for spending habits such as Apple/Google Pay availabilities, many digital banks access etc. I often asked if I need a receipt that I usually don’t. It depends for every country but if there is a rule for stores/restaurants to keep at least a copy for each transaction then it might be the indicator to follow. It might be used for inflation as well but of course needs detailed information.

Pamela Van Giessen comments:

To the best of my knowledge, merchants are not required to keep receipts. We track each sale but it will be the credit card processor or platform such as Square that holds the credit card or Apple or Google pay receipts. I can’t imagine that merchants would be willing to share their sales data. I know I wouldn’t.

Visa doesn’t care how much goods cost. They get their nearly 3% processing fee (+ .10 or .15 per transaction) whether there are 20 transactions for $100/ea or 40 transactions for $50/ea. In fact, they make more $ on a higher volume of transactions.

I don’t think tracking Visa or MC, etc could be a meaningful prediction of inflation as all the credit card companies continuously fight for market share. Note that they all send out multiple credit card offers to everyone all the time. Then, you have a store like Costco that only accepts their credit card (Citibank).

Additionally, there are people who use primarily cash. Those $ would be left out. You may say that cash use is low, and maybe it is. What I can tell you is that today at a market 80% of my sales were cash and that was likely the case for all the other merchants at this market. Older people especially use cash a lot. Just like drug dealers.

I have a theory that the cash economy is much bigger than everyone thinks. Insight into that might be more interesting.

Carder Dimitroff responds:

After considering Panela's cash sales point, I remembered that several companies required customers to switch from credit card payments to bank transfers. Additionally, several small establishments offer incentives for customers to pay in cash. They may be attempting to simplify their accounting and tax reporting. I do know that the federal government has immediate access to individual credit card transactions.

Pamela Van Giessen adds:

I thought it was the Fed that used to report on aggregated credit card data.

The other challenge with using credit card financials is that the credit card processors raise their % cut all the time. This is not due to actual inflation; it is due to them having a government protected moat that allows them to take more and more whenever they want because merchants are stuck with the whole system and consumers don’t realize that they will pay for the service — in increased prices. Every time Square, PayPal, etc., send me notices that they will be increasing fees, I increase my prices. I guess that is a kind of proxy for inflation but it’s a lousy sort of financial market induced inflation not based on anything more than their desire for more profits. I am all about free markets but the credit card processing biz is not even close to a free market.

The government using credit card processing to surveil us may be one reason I see more and more people using cash.

Larry Williams suggests:

Stock market is good predictor of inflation.

Oct

23

Regional US banks, from Nils Poertner

October 23, 2025 | Leave a Comment

As a European, I am asking: Are US regional banks in trouble (maybe even some larger banks - incl Investment banks). Dodgy consumer loans, then those silly "AI-related" loans? Am agnostic here - I suspect the typical analyst from JPM down the road won't enlighten us here.

Paul O'Leary comments:

No. Looks like over-reaction to a couple credit blips. Then algos pile on and observers who don’t follow the sector conjure up doom scenarios. Zion Bancorp - the main sinner, lost $1B in market cap for a $50mm write down.

Nils Poertner responds:

Hear you, Paul. If enough people would start to worry now, I would worry less (let us see).

Cagdas Tuna adds:

We are at a level any reaction will be exaggerated. If market adds $200bln to NVDA market cap with additional $1blnn revenue then $50m loss will have the same effect on a smaller company's share.

Oct

22

Government shutdown question, from Cagdas Tuna

October 22, 2025 | Leave a Comment

Are the furloughed government employees going to be counted as unemployed? I believe they will be which will be considered as a huge green light for 50bps rate cut in the December FOMC. This shutdown is the perfect storm for Trump’s “Fire Powell and get rates to 0%” scenario.

Bill Rafter responds:

The requirements for being “Unemployed” are that (a) the person is not working , and (b) that person is “looking for work”. I believe the latter qualification would disqualify those furloughed from being considered as unemployed. Not only the shutdown [will delay BLS releases], but the recently nominated BLS head, E.J. Antoni has withdrawn his name from nomination. So BLS is headless.

Alex Castaldo comments:

That is good news for all statisticians, I am sure he is a wonderful guy but he had a reputation for mistakes in calculations.

Oct

21

Trading the transition to AV1, from Asindu Drileba

October 21, 2025 | Leave a Comment

AV1 is a new video compression format that may reduce the size of a video file by up to 50%. The big advantage is that videos will be up to half the size, with the exact same image and audio quality.

Two big consequences may ensue (when AV1 is fully adopted):

- Internet bills for streaming Netflix will reduce.

A 2 GB movie will only cost 1 GB from the perspective of a customer paying their Internet Service Provider. So more frequent subscriptions?

- Netflix will cut its bandwidth costs by 50%. So the profit margin (respective to bandwidth costs) will go up by 50% if users fully adopt AV1?

Currently, AV1 is only available on select hardware chips (listed table on Wikipedia) Maybe as users get new devices, use of AV1 will grow. This will likely happen gradually over several years (maybe half a decade). But an obvious winner would be Netflix & YouTube (Google Stock). Maybe bandwidth is so cheap it won't make a dent in the business revenues? But all major companies seem very enthusiastic about implementing AV1. Maybe bandwidth has it's (less talked about) variant of Moore's law. Where after a few years it gets easier to move stuff around the internet.

Cagdas Tuna wonders:

How many nuclear plants we need to feed that endless “technology”?

Nils Poertner asks:

How would you express this into a trade idea, Asindu? I find it easy to put ideas into a trade - it encourages deeper thinking and gives a feedback when wrong. eg, I was bullish housing London property 2007, but short-term it didn't really work out at all! longerterm yes. it was fuzzy thinking of my behalf.

Asindu Drileba answers:

Going long $NFLX since the business is largely about streaming video. The same pattern occurred in Tesla when the cost of efficient batteries dropped by like 90%. So margins automatically go up. (in theory) Tesla could have still gone under due to debt or something else. So, of course it may may fail (most likely)

Another big draw back is that such "qualitative" insights cannot be tested in the past. Maybe a good analogy would be to go long Starbucks $SBUX if you think the price of coffee wil drop the next 5 years by 50%.

So the ideas may be generalized to:

- Find key Ingredient company X uses in thier products

- Find out if the drop in key ingredient's price over 5 years improves profit margin over X years -> positively impacts stock prices.

This general idea, may then be tested across several industries for example:

- MacDonalds (drop in price of beef)

- TSMC, ASML, INTEL, NVDA (drop price of silver) as silver is very essential in chip manufacturing.

Hopefully testing this across multiple industries on different historical accounts may yield some consistent patterns.

Nils Poertner responds:

Good to write it down in a trading journal and look in a few months what happened. Started writing hand-written letters to friends now. In our digital age, everyone incl me, is going for speed, but deeper thinking - also quality in thinking /research is underrated. Intuitively speaking - we are prob getting some unexpected moves coming, as well.

Oct

19

Le Chiffre attacks, from Asindu Drileba

October 19, 2025 | Leave a Comment

In Casino Royal (2006) there is a speculator called Le Chiffre. He would manage money for war lords & other "underground" clients. He would take positions in markets, and then "manipulate them". For example in this clip, he takes a short position in an airlines company, then later bombs a plane belonging to it.

This year, I am starting to think that Le Chiffre is real. Someone opened a crypto account on Hyperliquid (decentralized exchange) and made an $88m profit from short positions that very day.

Cagdas Tuna responds:

Good catch! I have been reading these whales news since March-April 2025 mostly tied to Trump’s policy shifts. It is not difficult to guess who those Le Chiffres might be related to!

Peter Ringel writes:

I wanted to place 1 Nov in my calendar - as a new Mkt Risk date based on Trumps post. Only to realize, I placed this date regarding tariffs before. This makes this old news to some degree. And all of this is potentially an overreaction / a play.

Ed. - lagniappe: Forget Sean Connery, Watch James Bond Make His Real Debut on TV

Before Connery registered his license to kill in the 1962 hit Dr. No, millions of viewers were introduced to Barry Nelson’s “Bond, Jimmy Bond” in a 1954 episode of the CBS anthology series Climax! The show’s producers secured the rights to adapt Ian Fleming’s just-published debut Bond novel, Casino Royale, during their first season.

Since the Climax! version of Casino Royale is only 50 minutes, the plot has obviously been shortened considerably. And yet, if you’ve read the book or, more likely, seen the 2006 movie version that launched Craig’s Bond career, you’ll recognize the basic narrative, even though none of the familiar 007 flourishes are in place. In fact, Nelson doesn’t enjoy “00” status at all — he’s merely identified as a “Combined Intelligence” agent who is tasked with competing head-to-head against the mysterious Le Chiffre (Peter Lorre) in a rousing game of baccarat.

Jeff Watson does some research:

James Bond, the complete list…there are more than you think:

Please list every James Bond on film, TV, and radio. Grok: Alright, here goes-starting with the big-screen Bonds: Sean Connery, George Lazenby, Roger Moore, Timothy Dalton, Pierce Brosnan, Daniel Craig. Then David Niven in the 1967 spoof Casino Royale. On TV, there's Barry Nelson from a 1954 Climax! episode of Casino Royale. Radio Bonds? Bob Holness in a 1956 BBC Casino Royale adaptation, Tom Hiddleston in a 2014 Heart of the Matter series, and Toby Stephens in various BBC radio dramas.

Apr

14

Looking back at 2008

April 14, 2025 | 1 Comment

A Few Observations, from Victor Niederhoffer

October 12, 2008

1. Of the 100 biggest markets around the world, almost all are down 40- 60% in dollar terms with the exceptions' being Tunisia and Botswana. The impact of the decline this week, unless rapidly reversed, is going to be very severe on purchases. The previous 20% caused great angst; imagine what this decline will do to those who rely on retirements. The positive feedback of the decline in a negative direction also impacts the election results with every market decline making it more likely the Republicans will be blamed for the situation.

2. The worst aspect of the decline this week from a health point of view was that fixed income around the world cratered, thereby reducing world wealth by a good 15% as opposed to the normal situation where the equities go down 10% and the fixed incomes go up 8% leaving total wealth down only a little. And the people that talked about how bearish it was for stocks because commodities were up would never say that it's bullish now because commodities are down 40% over the past four months.

3. A new word should enter the market vocabulary, a waterboarding decline, being a decline that seems to have a breath of life at the open before going into a death spiral.

4. Because of the decline in all sectors, the wealth/price ratio has stayed relatively constant with corn, copper, soybeans, wheat and oil down 40- 50% since June 30, thereby keeping the number of bushels and barrels we can buy with one DJIA relatively constant, making the number of ounces of gold you can buy with the Dow less than 10 for the first time in a googol, and looking like a bargain for the Dow.

Cagdas Tuna writes:

The plan was to make US assets cheap and make everyone afraid to invest in them(thanks to VIX spike Monday). We all make joke of him but Trump’s post few hours before 90 days pause was the peak. Look at inflation numbers it is officially coming down as most companies were planning this sh*t beforehand. The more we see bad news the bullish stocks are.

David Lillienfeld responds:

You're making the assumption that we're done. I don't know that we are.

Nils Poertner comments:

in any case - def good to watch out for anomalies, or things that shouldn't happen and then they happen - and then there is more of it normally.

Feb

7

Nvidia $200 Billion in 3 Days, from Cagdas Tuna

February 7, 2024 | Leave a Comment

It is not hard to see this is very late stages of speculative madness but I really would like to know how the risk management teams approve buying Nvidia stock here after adding $200 billion to market cap in 3 days?

Larry Williams offers:

Maybe my cycle forecast for NVDA would help:

Asindu Drileba writes:

I don't know why people are still buying Nvidia. But this is what I personally think of the stock. Nvidia has an 80% market share in the Graphics Card business. Their bread and butter used to be video gaming, 3d animation, video editing, later crypto mining, AI (computer vision), AI (Large Language Models), AI (Image generation) possible new advances may occur in Molecular Dynamics, Self driving cars etc. The CEO had an interesting interview where he talked about possible areas Nvidia may venture into.

But here is one strange thing about high performance computing (Nvidia's Niche): We would think that the better (higher performing) their products are, the less people would buy because people would do more with less right? It's actually the opposite.

— In gaming for example, when graphics cards improved people moved to less polygon looking characters and wanted more details like finer hair & plants. From there they even went to more computationally intensive algorithms like ray tracing that mimic real world scattering of light. Requiring even more compute in subsequent algorithmic advances.

— In Bitcoin, many people using Nvidia GPUs made it more difficult to earn money from crypto mining. Which requires people to have even more Nvidia GPUs just to continue earning the same income.

— In AI, when ever a new breakthrough was made, researchers often trained models with larger datasets, using more & more GPUs. Chat GPT for example was trained on 1 Trillion corpus of text.

So if they do maintain this 80% market share and these underlying industries continue to grow (and make new break throughs). It makes sense that Nvidia will be very valuable in the near or distant future. Buying now (at all time highs) is definitely dangerous but, even if the bubble pops, the underlying industries it facilitates will still be present. And if more breakthroughs in these industries are made, it makes sense that Nvidia still has some value left in it.

Cagdas Tuna responds:

Good fundamental points and there I have 2 counter outlook:

-Gaming industry; I almost everyday play an online game called Destiny 2, and their developer Bungie has reduced workforce around 10%. I know many other gaming companies are reducing/reduced workforce which doesn't give too much optimism in that area.

-Bitcoin mining; there is halving in a few weeks and this will require more powerful computers but it will also increase the cost which in the end will end up new miners losing money in most cases. Only way to maintain gains in mining is Bitcoin price to double or triple in a year.

Even on the best possible scenario it will not add 200 billion dollars worth growth in many many years.

Steve Ellison comments:

Words of wisdom from Rocky's Ghost, posted in the Spec List on April 4, 2017. And yes, I am long NVDA. I believe this is the study Rocky referred to.

Soros and I share very little. However, I have come to agree with him that the right position is to be long "bubble" (however defined). I used to subscribe to Anatoly's view and to be bearish during bubbled but I discovered that from a risk-adjusted-return perspective, it's better to be right "today" than right "tomorrow." Along this point, I read a study that shows a substantial percentage of stock returns occur during the last surge in a "bull market". If you miss this surge, it's very difficult to keep up with the indices in the short term. And in the long term, we're all dead.

Asindu Drileba replies:

Gaming Revenue was about $142B just in 2022. If cloud gaming, something Nvidia is planning todo is successful, I expect this to jump by several multipliers. I expect Cloud gaming to be a bigger business than say AWS. Gaming is really big, I believe you have heard about gaming being bigger than movies & music combined.

The Crypto market cap is $1.6T, a lot of these Crypto currencies use graphics cards to mine their currencies. So I don't think $200B is too much. For Nvidia which is well positioned in these industries, i.e., owning 80% of that market.

Humbert H. adds:

One fundamental point about predicting the future of NVIDIA. It's a complete accident (lucky for NVIDIA) that the hardware optimized matrix multiplication used for 3D graphics pipelines was also useful for AI.

K. K. Law riffs on The Great One:

Confirmation bias. And this is where the AI computation puck is at of course.

Cagdas Tuna realizes:

Now I see why everyone chasing this momentum with FOMO as all assumptions based on Nvidia will get all of the cake in the market!

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles