May

31

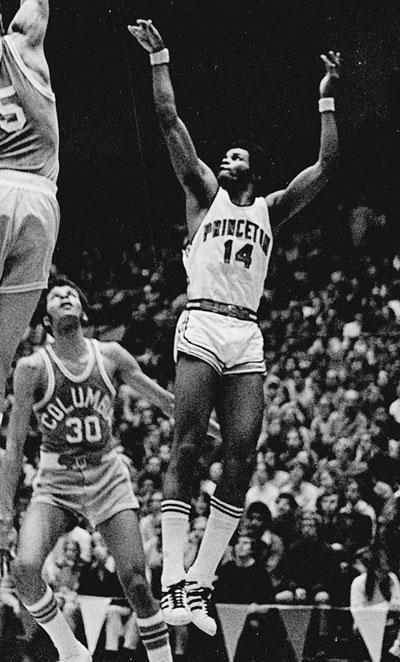

Kings of the Court

May 31, 2024 | Leave a Comment

Kings of the Court: The Story of Lawn Tennis by E. C. Potter, Jr. - the good old days in 1879, the third Wimbledon victory, Hartley got to the finals on Saturday. he had not arranged for anyone to replace him in pulpit. he rushed off the court, took a one-hour trip to Yorkshire, arrived at W. just in time to change his flannels, averted default and won W. those were the days of the identical twin Renshaws and Dohertys. many still rank the Dos in top 5 of all time from 1903. Pim in between the two sets of twins could pull of a let cord whenever he wanted. But he only won W twice because he only cared about perfecting his stoke.

May

30

NYC history lagniappe

May 30, 2024 | Leave a Comment

Coney Island Was Once Full of Dueling, Backstabbing Theme Parks

Come one, come all to the controversial, ugly beginnings of what was once called ‘Sodom by the Sea.’

Coney Island was once a glittering star of the early 1900s. It was the Progressive Era, amusement parks were becoming enormously popular across America, and New York City’s version of roller coasters and carnival games seemed like the epitome of wholesome fun. But the beachy entertainment land was quite different than it is today. Coney Island mainly consisted of three theme parks: Steeplechase Park, Luna Park, and Dreamland. And from 1904 to 1911, all were locked into a perpetual dance of stealing acts, copying rides from each other, and some dirty competition.

Steve Ellison recalls:

We had a big Spec Party event at Coney Island in 2007 when Aubrey was still a toddler.

May

29

A good overview, from Hernan Avella

May 29, 2024 | Leave a Comment

A Fresh Look at the Kalman Filter

In this paper, we discuss the Kalman filter for state estimation in noisy linear discrete-time dynamical systems. We give an overview of its history, its mathematical and statistical formulations, and its use in applications. We describe a novel derivation of the Kalman filter using Newton's method for root finding. This approach is quite general as it can also be used to derive a number of variations of the Kalman filter, including recursive estimators for both prediction and smoothing, estimators with fading memory, and the extended Kalman filter for nonlinear systems.

Big Al adds:

Forecasting with the Kalman Filter

Mike Mull, PyData Chicago 2016

The Kalman filter is a popular tool in control theory and time-series analysis, but it can be a little hard to grasp. This talk will serve as an introduction to the concept, using an example of forecasting an economic indicator with tools from the statsmodels library.

May

28

The Last Bear, from Humbert H.

May 28, 2024 | 1 Comment

The last bear on Wall Street: Why JPMorgan's Marko Kolanovic is sticking by his forecast for a 20% market sell-off

• JPMorgan's Marko Kolanovic sees no reason to turn bullish on the stock market despite record highs.

• In a Monday note, Kolanovic reiterated his view that the S&P 500 could fall 20% to 4,200.

• "We do not see equities as attractive investments at the moment and we don't see a reason to change our stance," Kolanovic said.

Larry Williams responds:

Here is something from what I have been writing:

Led by “Rich Dad, Poor Dad” Robert Kiyosaki’s warning of, “Be careful, it’s the biggest crash in world history,” the bears have come out of their winter caves. “We can’t make it past 2025,” warns Patrick Bet-David. Wells-Fargo is saying it’s recession time. Mark Spitznagel, who serves as chief investment officer of Universa Investments, is predicting “Biggest market crash since 1929."

They always walk among us…if they can only last until late 2025.

May

27

Weekend Reading, from Zubin Al Genubi

May 27, 2024 | Leave a Comment

Right, that Comey, fired as head of the FBI. But the book is a good murder mystery by someone who obviously knows law enforcement and investigation, and has a real nice human touch. Recommended. Also it has a pretty funny dig on the hedgies…right, that Westport.

Westport, by James Comey:

It's been two years since Nora Carleton left the job she loved at the US Attorney's Office to become lead counsel at Saugatuck Associates, the world's largest hedge fund. The career change also meant a change of scenery, relocating her to Westport, Connecticut, fifty miles north of New York City. But it was worth it to get her daughter, Sophie, away from the city. Plus, she likes the people she works with. Especially Helen, who recruited Nora because of her skills as an investigator.

Then, Nora's new life falls apart when a coworker is murdered and she becomes the lead suspect. Nora calls in her old colleagues from the US Attorney's Office, Mafia investigator Benny Dugan and attorney Carmen Garcia. To clear Nora's name, Benny and Carmen hunt for the true killer's motive, but it seems nearly everyone at Saugatuck has secrets worth killing for. As Benny sets out to interrogate her colleagues, Nora examines her history with the company to determine who set her up to take the fall.

May

26

The Oceans and the Stars, from Zubin Al Genubi

May 26, 2024 | Leave a Comment

This modern Jack Aubreyesque story of naval warfare is some of the best fiction I've read recently. Lots of action written in beautiful prose.

The Oceans and the Stars, by Mark Helprin.

A Navy captain near the end of a decorated career, Stephen Rensselaer is disciplined, intelligent, and determined to always do what’s right. In defending the development of a new variant of warship, he makes an enemy of the president of the United States, who assigns him to command the doomed line’s only prototype––Athena, Patrol Coastal 15––with the intent to humiliate a man who should have been an admiral.

Big Al recommends:

Covers key psychological issues around trading, with clear action steps:

The Mental Game of Trading: A System for Solving Problems with Greed, Fear, Anger, Confidence, and Discipline, by Jared Tendler.

Khilav Majmudar is reading:

Models.Behaving.Badly.: Why Confusing Illusion with Reality Can Lead to Disaster, on Wall Street and in Life, by Emanuel Derman.

In this bitterly funny novel by the renowned Polish author Witold Gombrowicz, a writer finds himself tossed into a chaotic world of schoolboys by a diabolical professor who wishes to reduce him to childishness. Originally published in Poland in 1937, Ferdydurke became an instant literary sensation and catapulted the young author to fame. Deemed scandalous and subversive by Nazis, Stalinists, and the Polish Communist regime in turn, the novel (as well as all of Gombrowicz’s other works) was officially banned in Poland for decades. It has nonetheless remained one of the most influential works of twentieth-century European literature.

Vic adds:

The Oceans and the Stars, and The Whole Story: two excellent books that have similar trajectories and conclusions - struggle, with love conquering adversity.

May

25

Looking back at Spec research history

May 25, 2024 | Leave a Comment

The Behavior of Stock Prices on Fridays and Mondays, by Frank Cross

Financial Analysts Journal, November-December 1973

The objective of this article is to document an example of non-random movements in stock prices. Specifically, we shall examine the distribution of price changes on Fridays and Mondays, and the relationship that exists between price changes on those two days. Other researchers have found little or no evidence of dependence in successive daily price changes. Apparently, however, these researchers have not investigated the possibility that dependence might occur on some days of the week but not on others.

Frank Cross is Secretary and Treasurer of Niederhoffer, Cross & Zeckhauser, Inc. The author wishes to express his thanks to Dr. Victor Niederhoffer for his helpful suggestions concerning this paper.

May

24

Slow to adapt, from Big Al

May 24, 2024 | Leave a Comment

It's been 44 years since the introduction of the 3-point line in the NBA. To me, it's a curious case of slow adaptation. Of course, you have new generations of players growing up shooting the 3, but surely players in the early 80s were capable of learning and practicing. The low number of 3s seems like a failure of analysis, failure to understand the impact on points-per-possession, which wasn't much of a moneyball concept yet.

Also, early on it was pretty much just guards who shot the 3 well, with the big exception of Larry Bird. But now, lots of players 6-10 or taller shoot 3s with considerable accuracy. To me, this is more an issue of assumptions, that big men couldn't shoot from long. And then some big men put in more practice and showed they could do it, opening up the possibilities.

Interesting how there are thresholds people believe can't be crossed…until somebody crosses them…and then lots of people are running sub-4-minute miles.

The 3-Point Revolution, by Stephen Shea:

A gimmick? A publicity stunt? That’s what many thought of the 3-point line when the NBA adopted it for the 1979-80 season. Back in 1979, Washington Bullets coach Dick Motta commented, “The three-point field goal will definitely make things interesting.” He meant interesting in the sense that a game that would have been over might now be sent to overtime by a desperation heave. Neither Coach Motta nor anyone else foresaw an NBA game played like it is today.

Five years after its inception, NBA teams were only averaging 2.4 three-point attempts (3PA) per game. This past season, James Harden alone averaged ten. Teams averaged 29.

[ More data on 3-point shooting. ]

Larry Williams comments:

Good point!! …like the 4 minute mile…and we can only beat the averages by a few points…

Vic wonders:

what adjustments have markets been slow to adapt to in last 5 years?

Big Al adds:

An interesting sidebar from 2017:

The Basketball Team That Never Takes a Bad Shot

The NBA’s most efficient offenses seek out layups and threes. A high school in Minnesota takes the idea to the extreme.

By Ben Cohen

PINE CITY, Minn.—Jake Rademacher made a mid-range jumper in a recent high-school basketball game. But as soon as the ball left his hands, even before it banked in, Rademacher knew it was a bad shot. And his team doesn’t take bad shots.

Pine City High School seeks out only the most valuable shots in basketball: from underneath the rim or beyond the 3-point line. They play as if they’re allergic to all the space in between.

May

23

The Whole Story

May 23, 2024 | Leave a Comment

The Whole Story by John Mackey - a story of how an entrepreneur learned about the bourgeois virtues and thanks to his father and his supportive partners, wives, and in spite of the venture capitalists, went from rags to riches.

Whole Foods Market's cofounder and CEO for forty-four years, John Mackey offers an intimate and provocative account of the rise of this iconic company and the personal and spiritual journey that inspired its remarkable impact.

The Whole Story invites listeners on the adventure of building Whole Foods Market: the colorful cast of idealists and foodies who formed the company's DNA, the many breakthroughs and missteps, the camaraderie and the conflict, and the narrowly avoided disasters. Mackey takes us inside some of the most consequential decisions he had to make and honestly shares his regrets looking back.

May

22

AI again: weather forecasting, from Big Al

May 22, 2024 | Leave a Comment

Learning skillful medium-range global weather forecasting, from Google DeepMind:

Global medium-range weather forecasting is critical to decision-making across many social and economic domains. Traditional numerical weather prediction uses increased compute resources to improve forecast accuracy but does not directly use historical weather data to improve the underlying model. Here, we introduce GraphCast, a machine learning–based method trained directly from reanalysis data. It predicts hundreds of weather variables for the next 10 days at 0.25° resolution globally in under 1 minute. GraphCast significantly outperforms the most accurate operational deterministic systems on 90% of 1380 verification targets, and its forecasts support better severe event prediction, including tropical cyclone tracking, atmospheric rivers, and extreme temperatures. GraphCast is a key advance in accurate and efficient weather forecasting and helps realize the promise of machine learning for modeling complex dynamical systems.

Asindu Drileba writes:

I looked and how they split the surface of the earth into tiny meshes in order to form a Graph upon which the rest of the model is built. This technique's description looked familiar to another technique called "Numerical Weather Prediction" or "NWP". The paper by Deep Mind does have several papers referencing "Numerical Weather Prediction" or "NWP".

I learnt about NWP from this PBS Nova documentary, Prediction By The Numbers. The documentary has many descriptions on tools for predicting. Wisdom of the Crowds, Probability Theory, and Numerical Weather Prediction. Meteorologists were interviewed and they showed their NWP programs in action (it is shown how the model generalized with time to predict a more accurate forecast of the in the weather). The meteorologist says it is their best model and also goes ahead to say that "it works so well."

May

21

Last Train to Paradise

May 21, 2024 | Leave a Comment

an excellent bio of the gilded age and a man who loved adventure and created the Florida East railroad and overcame numerous engineering and weather challenges. highly recommended.

The paths of the great American robber barons were paved with riches, and though ordinary citizens paid for them, they also profited. Les Standiford, author of the John Deal thrillers, tells how the man who turned Florida's swamps into the playgrounds of the rich performed the almost superhuman feat of building a railroad from the mainland to Key West at the turn of the century. An extraordinary man and partner of John D. Rockefeller in the Standard Oil Company, Flagler had the vision to build railroads to link this backward territory with the rest of America. Last Train to Paradise shows how he masterminded the nearly impossible engineering feat of spanning more than 100 miles of ocean and islands to reach the southernmost tip of the Eastern seaboard.

May

19

Apropos worry wall:

- Unprecedented US debt

- Presidential candidates to debate from jail cell vs hospital room

- Democracy in decline

Humbert H. writes:

Sooner or later, everyone is right.

Larry Williams responds:

Bob Prechter would like to hear that!

Steve Ellison adds:

My pinned tweet documents 53 bricks in a 53-year wall of worry. But Venita Van Caspel made the original chart in her 1983 book The Power of Money Dynamics. I just added 40 years of additional worries.

May

18

Following the money, from Asindu Drileba

May 18, 2024 | Leave a Comment

Lots More on How CHIPS Act Money Got Awarded

In 2022, Congress passed the CHIPS Act, which set aside tens of billions of dollars in loans and grants in order to encourage companies to build new semiconductor fabs in the United States. We're still very early in the process. It's going to be a long time before we know if the US will become a major player again in the production of advanced chips. But the process is well underway and the bulk of the awards have been officially announced, with much of the money going to Intel, Samsung, TSMC, and others. So how did the grants get allocated — and what's next?

While it is clear that money earning or losing events like quarterly earnings announcements have an impact on the market (stock prices). I am not sure if government subsidies & grants have an impact on stock prices. Is there a tool that can be used to track events related to government subsidies & grants?

Big Al responds:

An interesting question. Probably start here:

USAspending is the official open data source of federal spending information, including information about federal awards such as contracts, grants, and loans.

Also interesting research tracking stock trades by members of the US Congress:

Capitol Trades

Smart Insider

Senate Stockwatcher

May

17

Vienna

May 17, 2024 | Leave a Comment

Vienna: How the City of Ideas Created the Modern World, by Richard Crockett.

Viennese ideas saturate the modern world. From California architecture to Hollywood Westerns, modern advertising to shopping malls, orgasms to gender confirmation surgery, nuclear fission to fitted kitchens—every aspect of our history, science, and culture is in some way shaped by Vienna.

The city of Freud, Wittgenstein, Mahler, and Klimt was the melting pot at the heart of a vast metropolitan empire. But with the Second World War and the rise of fascism, the dazzling coteries of thinkers who squabbled, debated, and called Vienna home dispersed across the world, where their ideas continued to have profound impact.

Humbert H. writes:

When I left the Soviet Union, Vienna was the first western city I saw. It's hard to imagine a bigger contrast. It was like moving from a garbage dump to an immaculately maintained dollhouse. My next stop was Italy, and in spite of being the most beautiful country in the world, IMO, Italy was a letdown after Vienna.

As for it's historical significance, it's huge, but this battle was one of the most important in the history of the world, and that's saying something (there have been a lot of battles).

Laurel Kenner suggests:

For a more detailed overview, I enjoyed The Austrian Mind.

May

16

“Index young man, index!”, from Kim Zussman

May 16, 2024 | Leave a Comment

Wealth Creation in the U.S. Public Stock Markets 1926 to 2019

Hendrik Bessembinder, W.P. Carey School of Business

Last revised: 12 Nov 2020

Date Written: February 13, 2020

Abstract

This report quantifies long-run stock market outcomes in terms of the increases or decreases (relative to a Treasury bill benchmark) in shareholder wealth, when considering the full history of both net cash distributions and capital appreciation. The study includes all of the 26,168 firms with publicly-traded U.S. common stock since 1926. Despite the fact that investments in the majority (57.8%) of stocks led to reduced rather than increased shareholder wealth, U.S. stock market investments on net increased shareholder wealth by $47.4 trillion between 1926 and 2019. Technology firms accounted for the largest share, $9.0 trillion, of the total, but Telecommunications, Energy, and Healthcare/ Pharmaceutical stocks created wealth disproportionate to the numbers of firms in the industries. The degree to which stock market wealth creation is concentrated in a few top-performing firms has increased over time, and was particularly strong during the most recent three years, when five firms accounted for 22% of net wealth creation. These results should be of interest to any long-term investor assessing the relative merits of broad diversification vs. narrow portfolio selection.

May

15

Florence Nightingale, statistician

May 15, 2024 | 1 Comment

Florence Nightingale - Statistics and sanitary reform

Florence Nightingale exhibited a gift for mathematics from an early age and excelled in the subject under the tutelage of her father. Later, Nightingale became a pioneer in the visual presentation of information and statistical graphics. She used methods such as the pie chart, which had first been developed by William Playfair in 1801. While taken for granted now, it was at the time a relatively novel method of presenting data.

The image is an example from the Crimean War by way of The Royal Society.

More from Scientific American:

How Florence Nightingale Changed Data Visualization Forever

In the summer of 1856 Florence Nightingale sailed home from war furious. As the nursing administrator of a sprawling British Army hospital network, she had witnessed thousands of sick soldiers endure agony in filthy wards….Nightingale arrived back in London determined to prevent similar suffering from happening again. It would be an uphill slog. Many government leaders accepted the loss of common soldiers as inevitable….Resolute, Nightingale set out to sway the minds of generals, medical officers and parliamentarians. Their poor data literacy muted statistical arguments that could have oriented them toward the facts. Nightingale, with her quantitative mind, had to persuade people with common understanding but uncommon standing. Her prime target throughout this effort was the head of the British Army, Queen Victoria.

And an expert offers a balanced view:

The real goods and the oversell

To many, Florence Nightingale is a hero. But like all heroes, elements of her story have been exaggerated. Lynn McDonald, editor of Nightingale’s collected works, sorts fact from fiction.

May

13

TLT returns, from Big Al

May 13, 2024 | Leave a Comment

Not sure why I did this, but once I did, I thought it was interesting. This shows the to-date total return of TLT depending on when you bought it. The data is weekly adjusted close (so I'm assuming YHOO got it right, with interest payments correctly included). Some buyers as far back as 2012 are under water, whereas from last October nicely ahead. Speaks to a comment from Dr. Zachar re bonds: "date them but don't marry them."

May

12

Cost of Carry, from Zubin Al Genubi

May 12, 2024 | Leave a Comment

A carry trade is borrowing/buying at low interest and selling/lending at higher interest rates using leverage. Its used in currencies. The authors propose the trade had become systemic including the FED such that the markets have disconnected from fundamentals and are moved by dynamics of the carry/bust pattern. Further that it is the main driver of economic cycles not classic economic supply and demand.

If so, maybe the Fed watch traders are not always wrong as I've stated and the bad news is good news idea has merit under the carry trade.

Humbert H. writes:

Is there anyone who has done this for decades and not blown up, other than maybe Palindrome? Leverage combined with simultaneous forex and interest rate bets seems like it will eventually blow up, unless you always get advance warnings from central bankers.

Jeff Watson expands:

In the grain markets we determine the cost of carry as Futures price = Spot price + carry or carry = Futures price – spot price. Carry consists of storage costs, insurance, and interest. Carry provides the farmer with signals helping with crop marketing decisions while it provides a trader an opportunity to capture the carry. As an aside, here’s a handy dandy little formula to play around with:

F = Se ^ ((r + s - c) x t)

Where:

F = the future price of the commodity

S = the spot price of the commodity

e = the base of natural logs, approximated as 2.718

r = the risk-free interest rate

s = the storage cost, expressed as a percentage of the spot price

c = the convenience yield

t = time to delivery of the contract, expressed as a fraction of one year

Steve Ellison adds:

The US stock market had a carry trade from 2008 to 2018 and again in 2020 and 2021 when zero interest rate policy made it possible for traders to buy stocks with borrowed money, and cover the interest costs using the stock dividends. Philip L. Carret wrote in his 1931 book The Art of Speculation that the best time to buy stocks is in such situations when stocks "carry themselves".

As a quick approximation, the prices of the front-most ES contracts are:

June 5225

September 5282

So the cost of carry at the moment is roughly 47 points per quarter, and the S&P 500 is not carrying itself (if it were, the contracts would be in backwardation).

May

11

Small business, from Laurel Kenner

May 11, 2024 | Leave a Comment

Greetings from Greenwich, Connecticut, one of the nation's wealthiest towns. This year:

1) Steinway closed its piano store and announced that all pianos would be liquidated at steep discounts.

2) Saks Fifth Avenue closed its brand-new (and very good) restaurant after spending $1 million on a remodel. Also closed its retail stores along the main drag.

3) A favorite Chinese restaurant in Old Greenwich closed after serving three generations.

4) A venerable Old Greenwich sit-down cafe with the best fish-and-chips in Connecticut also closed.

5) A good-value nice clothing store on Greenwich's main shopping street closed, just one of several.

It isn't just East Coast. On a UCLA visit with my son, I breakfasted at a landmark, Patrick's Roadhouse in my hometown, Santa Monica Canyon. The week after I left, a friend told me that Patrick's had closed after 52 years. COVID relief had expired. Arnold Schwarzenegger, who has a special throne there that can bear his weight, had bailed it out previously — but hasn't stepped up to the plate. A GoFundMe campaign is attempting to keep Patrick's alive. Fixer-uppers on my old street start at $6 million.

Why is any of this important? When small businesses close, the ordinary people must move on, be they customers or owners. They spend less. The economy reflects their diminished circumstances.

What grinds me the most is the Steinway store's failure. I'm teaching piano now, and I am so tired of seeing my students fail to develop their ears because they can only afford horrible electric keyboards.

Bo Keely responds:

i think it's a local thing. we can't see the world forest for the American trees. i just traveled through Mexico the hard way under a pack and the country bustles, thrives, and has altered the mindset to friendliness to strangers. the best investment is along the Sea of Cortez where, 15 years ago, there was one sleepy fishing village where i couldn't find a meal or bed. i slept in the weeds. now it's the Platinum Coast with twenty miles of high rises. there's a 200-mile new skyscraping powerline to meet electricity demand across the dune capped desert where, as seen yesterday on my throne on La Bestia, the last poles are driven and strung to blow open the coast to investment.

May

10

Same-Weekday Momentum

May 10, 2024 | Leave a Comment

Same-Weekday Momentum

Zhi Da, University of Notre Dame - Mendoza College of Business

Xiao Zhang, University of Maryland - Robert H. Smith School of Business

Apr 24, 2024

A disproportionately large fraction (70%) of stock momentum reflects return continuation on the same weekday (e.g., Mondays to Mondays), or the same-weekday momentum. Even accounting for partial reversals in other weekdays, the same-weekday momentum still contributes to a significant fraction (20% to 60%) of the momentum effect. This pattern is robust to different size filters, weighing schemes, time periods, and sample cuts. The same-weekday momentum is hard to square with traditional momentum theories based on investor mis-reaction. Instead, we provide direct and novel evidence that links it to within-week seasonality and persistence in institutional trading. Overall, our findings highlight institutional trading as an important driver of the stock momentum.

Peter Ringel writes:

I find this a sexy area of research. It also effects the indices. My guess is some sort of behavioral bias among large players plus some technical constraints, how they have to enter complex trades. Why is a certain fund buying the sector every Tuesday at 10:30? I see such regularities pop up, exist for a while - and vanish again.

Big Al does some counting:

Here is a quick, simple study just to kick this can. This is looking at NVDA, days of the week, for about the last year. The z scores show Wednesday being a significantly poor day and Thursday being good (but with a big sd).

I also did a thousand sim runs, resorting the % changes randomly, and pulled out the max-min spread for each sim run. For the actual data, the range is 1.86% points (Thursday mean minus Wednesday mean). Only 2.08% of the sim runs had a wider range. Taking that to a z score table gives the actual range a score of +2.03.

However, here is the correlation for each weekday predicting the next trading day that is the same weekday:

NVDA correlations, weekday to next instance

Mon-Mon 0.06

Tues-Tues 0.04

Wed-Wed 0.03

Thurs-Thurs 0.09

Fri-Fri 0.01

May

9

Teller of tales

May 9, 2024 | Leave a Comment

an excellent bio of a multitalented writer, thinker, and sportsman. a very chivalrous man. the story of Doyle going to a performance of Patience is resonant.

Teller of Tales: The Life of Arthur Conan Doyle

This compelling biography examines the extraordinary life and strange contrasts of Sir Arthur Conan Doyle, the struggling provincial doctor who became the most popular storyteller of his age when he created Sherlock Holmes. From his youthful exploits aboard a whaling ship to his often stormy friendships with such figures as Harry Houdini and George Bernard Shaw, Conan Doyle lived a life as gripping as any of his adventures. Exhaustively researched and elegantly written, Teller of Tales sets aside many myths and misconceptions to present a vivid portrait of the man behind the legend of Baker Street, with a particular emphasis on the Psychic Crusade that dominated his final years, the work that Conan Doyle himself felt to be "the most important thing in the world".

May

8

Commodities voyeurism (and also some ride-hitching for Bo), from Big Al

May 8, 2024 | Leave a Comment

This Sahara Railway Is One of the Most Extreme in the World

Trains on the railway are up to 3 kilometres (1.9 mi) in length, making them among the longest and heaviest in the world. They consist of 3 or 4 diesel-electric EMD locomotives, 200 to 210 cars each carrying up to 84 tons of iron ore, and 2-3 service cars. The total traffic averages 16.6 million tons per year.

And a bit of Oz, with "driverless" thrown in:

The Driverless Iron Ore Trains Of Rio Tinto Australia

May

7

Sogi levels, from Zubin Al Genubi

May 7, 2024 | Leave a Comment

From Market Tremors: Quantifying Structural Risks in Modern Financial Markets, discussing how dealers and market makers need to rebalance delta on their option book with futures causing mean reversion:

We observe that interest tends to be highest for strikes that are a multiple of 50. Investors typically like round numbers.

Hence Sogi levels. Finally, an explanation:

Pinning Arises from Dealer Hedging: Avellaneda and Lipkin (2003)

We propose a model to describe stock pinning on option expiration dates. We argue that if the open interest in a particular contract is unusually large, Delta-hedging in aggregate by floor market-makers can impact the stock price and drive it to the strike price of the option. We derive a stochastic differential equation for the stock price which has a singular drift that accounts for the price-impact of Delta-hedging. According to this model, the stock price has a finite probability of pinning at a strike. We calculate analytically and numerically this probability in terms of the volatility of the stock, the time-to-maturity, the open interest for the option under consideration and a "price-elasticity" constant that models price impact.

Asindu Drileba writes:

I first saw this in Vic's Practical Speculation. I discovered a few edges based on this in the Bitcoin market.

May

6

Thomas Sowell’s personal journey

May 6, 2024 | Leave a Comment

Thomas Sowell's A Personal Odyssey shows him as a Maverick in military, government, foundations and academia. the book follows his path to greatness through 70 years. He shines as a photographer, boxer, thinker, family man. an inspiring bio.

wherever he went, and refused to kowtow, his compatriots would remark "we have another Thomas Sowell in our midst." Reminds one of how Elmer Kelton was called "Doc" 5 years after his father upbraided him for being slow at cowboy things.

May

5

For the O’Brian fans

May 5, 2024 | Leave a Comment

Six Frigates, by Ian W. Toll (2006).

From the NYT review:

This first book by Toll, a former financial analyst and political speechwriter, is a fluent, intelligent history of American military policy from the early 1790s, when Congress commissioned six frigates to fight the Barbary pirates, through the War of 1812. But the book’s real value, and the pleasures it provides, lies in Toll’s grasp of the human dimension of his subject, often obscured in the dry tomes of naval historians. The battle depictions are worthy of Patrick O’Brian (whose fictional hero, Jack Aubrey, he cleverly uses to illustrate a scene in the December 1812 shootout between the American frigate Constitution and the British frigate Java).

Stefan Jovanovich adds:

Here is a discussion with Toll about his book on the last two years of WW 2 in the Pacific.

May

4

The Doctor Is In. And He’s an Orangutan.

For the first time, researchers have seen a wild animal treat an open wound with a medicinal plant. After getting injured—probably in a brawl with another male—a wild Sumatran orangutan chewed the stems and leaves of a vine humans use to treat wounds and ailments such as dysentery, diabetes and malaria. The orangutan then repeatedly smeared the makeshift salve on an open gash on its cheek until it was fully covered. After the treatment, scientists saw no signs of infection. The wound closed within five days. And it healed within a month.

Jeffrey Hirsch is enthusiastic:

This is awesome! An good friend of mine spent several years in Borneo working with Orangutans under Birute Galdikas’ program. They are super crafty and smart. Don’t doubt this.

Humbert H. writes:

And nobody can explain how they know to do this in these situations. There is obviously a lot of learning apes can acquire from others, but this? There is also no way the current understanding of how genetic information is passed on that can explain this. There is something very mysterious about the mind and animals doing non-obvious things is the best example, this is not a simple biological phenomenon.

Asindu Drileba comments:

One of the things I hear in the AI research community in the pursuit of of AGI (Artificial General Intelligence) is people thinking of intelligence as something hierarchical like height.

In The Singularity is Near Raymond Kurzweil makes a plot of Computers approaching AGI. He puts insects at the bottom and manuals later then humans at the top. You often hear some people say that "We haven't yet reached dog level AI, so we can't say we can reach human level AI soon." That statement makes the assumption that A humans intelligence is more than that of a dog. But it has been reported in some cases a dog's sense of smell can be 100,000 more acute than that of a human being! And not just that it can tell time just by smelling what's around. Another example is also how birds can sense magnetic fields and use them like a compass.

Anyway my point is that just by the (limited) way humans perceive reality we have access to some secrets we can't pass to animals. My suspicion is that animals also have their own secrets that they cannot pass to us.

Humbert H. adds:

They have recently discovered that some insects are self-aware. The test that's used for animals is that they recognize their reflection in the mirror as themselves judging by their reaction. Usually only dolphins, apes, and some corvids (crows) pass the test.

But more importantly, what I meant was that animals seem to "know" how to do things that no current scientific understanding can explain. This means we don't understand basic things about animal (and human) mind. AI is a machine function: an algorithm using some data provides some outputs in response to inputs. A mind is like that too, except we really don't understand the nature of self-awareness, nor do we understand how animals just "know" things. Sometimes they call it "instinct" but there is no real science behind that word. And in this case it's not even that, apes have no "instinct" to cure wounds with specific processed plant material.

Jeff Watson writes:

Here is an interview with cognitive psychologist, Donald Hoffman. Some find him brilliant, some a flake. His ideas are unconventional to say the least, but the questions that come to mind out of his interview will break one’s brain. Many moments in the video, I pause and ask myself how this applies to markets.

Stefan Jovanovich gets philosophical:

The wheel of time turns on the axle of our self-awareness: Transcendentalism.

May

3

Odds and highlights

May 3, 2024 | Leave a Comment

change in odds to induce bullish press conference. how's the weather in durham? the next rate cut will depend on the odds, not on the labor market.

The highlight of this week's listening makes me cry about the untimely passing of Artie and Elaine.

Saddle up and come along on a Cowboy Christmas with Marshal Matt Dillon and "King of the Cowboys" Roy Rogers! During the years now known to old-time radio fans as the Golden Age of Radio, listeners could expect to hear special guests and holiday sketches on their favorite programs. Even the Western shows and cowboy stars of the day could be counted on to show the holiday spirit, especially at Christmas time. This Audio Archive presentation showcases two such Christmas episodes from two of radio's most popular Western programs: Gunsmoke and The Roy Rogers Show, both from December 1952.

i listen to The Complete Sherlock Holmes every evening and accompany it with the life and music of Verdi and the life and music of Gilbert and Sullivan - thereby bringing me back to a beautiful and restful Victorian age.

May

2

Smörgåsbord for the beginning of May

May 2, 2024 | Leave a Comment

Smörgåsbord for the beginning of May

Zubin Al Genubi recommends:

Market Tremors: Quantifying Structural Risks in Modern Financial Markets

Clear exploration of potential causes of and prediction of volatility events caused by Dominant Agents. Explores imbalances created by ETFs ETNs Banks, FED Market Makers.

Asindu Drileba suggests chaos:

Doyne Farmer describes the relationship between Roulette Wheels, The Weather, Financial Markets, and Economies as a whole. He thinks companies that don't make the energy transition from fossil fuels will all go bankrupt in the next 5 years. He is also promoting his new book:

Here is the discussion:

Simplifying Complexity: Making sense of chaos with Doyne Farmer

Nils Poertner points to probability:

stochastics is really quite counter-intuitive - it deals with "uncertainty" rather than basic algebra or geometry which one learns in schools. good training ground for learning about markets as well. (always found that stochastics often attracts folks who are a bit off the normal conventions / and have an genuine curiosity in things rather than go with what is fashionable)

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles