Jun

30

Daily Spec Calendar Transitions

June 30, 2025 | Leave a Comment

sp and bonds 1-day changes similar to Mendel's independent moves to next generation. when an event occurs that throws one of pair of bond or sp off, treat it as a mutation.

The Punnett square is a square diagram that is used to predict the genotypes of a particular cross or breeding experiment. It is named after Reginald C. Punnett, who devised the approach in 1905. The diagram is used by biologists to determine the probability of an offspring having a particular genotype. The Punnett square is a tabular summary of possible combinations of maternal alleles with paternal alleles. These tables can be used to examine the genotypical outcome probabilities of the offspring of a single trait (allele), or when crossing multiple traits from the parents.

Asindu Drileba writes:

Orange (S&P Up, Bonds Down) and Green (S&P Up, Bonds Up)

Orange appeared 4 times. In 3/4 times, Orange transitioned to Green with an average point gain of 35.4 in the SPY.How long will this continue? I noticed the pattern last month, unfortunately I didn't "count" it. Was it around for longer periods of time?

Jun

29

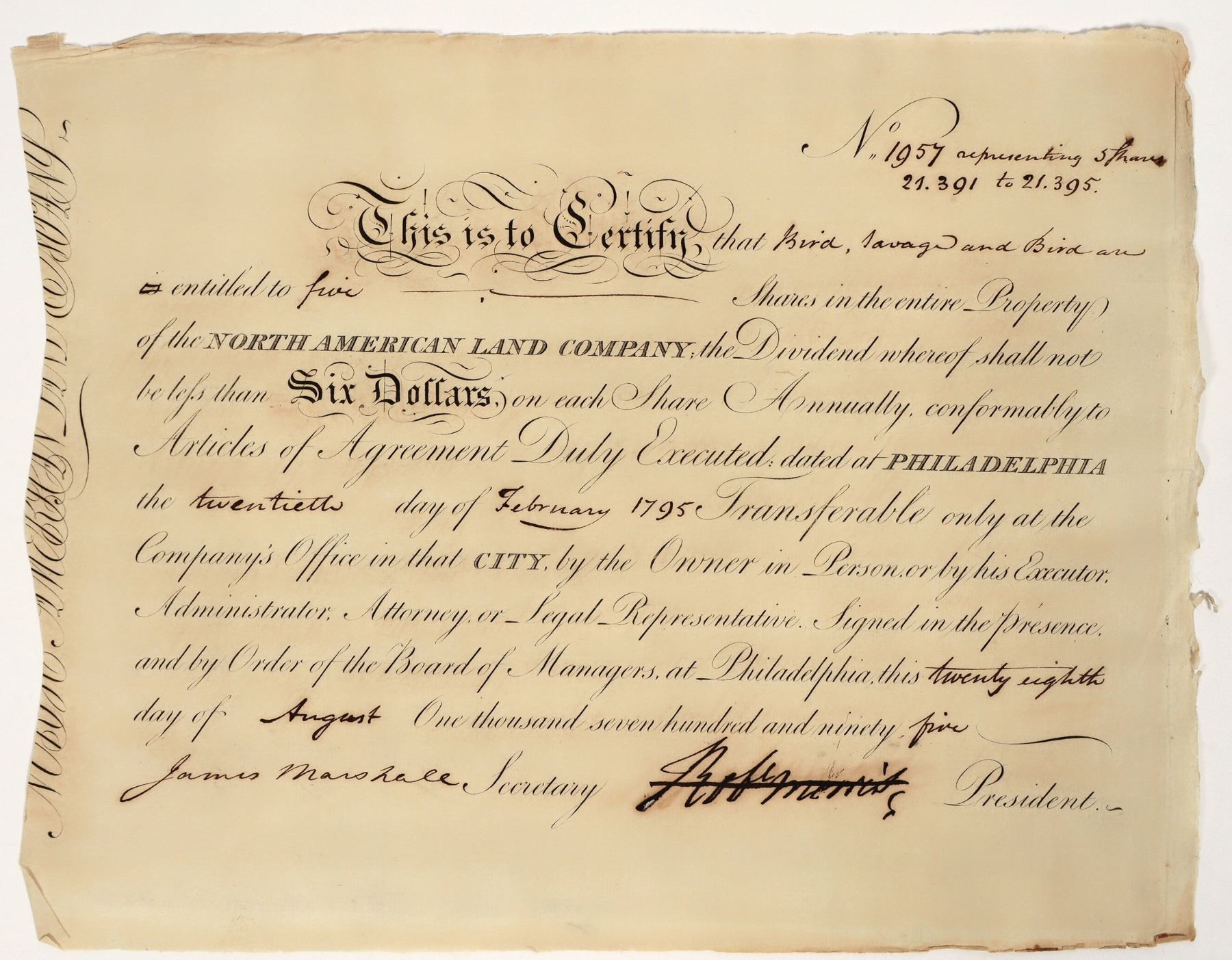

We know that Morris had at least £11,250 sterling in January 1784 when Congress ratified the Treaty of Paris. That was the sum Morris contributed, as lead manager, to a subscription for “a vessel for the China trade”. The Empress of China venture would raise £27,000 – Morris’ £11,250, £6,750 from Daniel Parker, a New York merchant, £4,500 from John Holker, the French consul in Philadelphia, and £4,500 from other individual investors. The partners would buy a 360-ton, 18-gun sloop that had been built in Baltimore in 1783 as a privateer, convert it into a merchantman and load cargo in Philadelphia and New York: 30 tons of ginseng, 2,600 beaver and other furs, Spanish silver dollars, lead, pepper and naval stores (turpentine). The captain would be John Green. Green had served as captain of the Pennsylvania Navy sloop Aetna in 1776; in 1778 he had been captain of the brig Hope which is recorded as having captured £1,000 in prizes under its privateering commission. The Supercargo would be Samuel Shaw. Shaw had enlisted as an Ensign in the 3rd Massachusetts Regiment in 1775 after the Battles of Lexington and Concord. As Lieutenant, the Captain and then Major Shaw would serve under General Henry Knox as an artillery officer, then aide-de-camp and deputy adjutant general.

The Empress of China sailed from New York on February 22, 1784 with a crew of 34 (Green, Shaw, 2nd supercargo Thomas Randall, 2 carpenters, a barrel-maker and “several boys”). It would stop at the Cape Verde Islands for provisions in April, round the Cape of Good Hope, pass through the Sunda Strait (where it narrowly avoided a collision according to Green's logbook), and anchor at Whampoa on August 28, 1784. 1 of the crew would die in Canton of “illness”, and the ship would have £500 of repairs done while in port. Shaw would present a letter from Congress to the Chinese officials, and the Canton merchants would give Captain Green a painted fan with a portrait of the ship (the only image of the Empress of China that survives). Shaw’s September-December 1784 journal would record payments of £1,500 in duties and £500 for an interpreter. He and Randall would sell the ginseng for £6,000 and the furs for £4,000; they would buy 800 chests of tea (£15,000), 20,000 pairs of cotton trousers from Nanjing (£3,000), 64 tons of porcelain (£2,000), and silk fabrics (£1,500). The ship would weigh anchor at Whampoa on December 28 “with a fair wind”. They would sail around the Straits of Malacca, across the Indian Ocean, around the Cape of Good Hope and anchor at St. Helena on March 10 to take on water (£100). The carpenters would spend £50 in materials to repair minor leaks. According to Shaw’s logbook, the ship “Made land at New York, May 11, 1785, to great acclaim.” The cargo would be sold in Boston, New York and Philadelphia. Morris’ papers record a net profit of £6,250. What is puzzling is his calculation that this was only a 25% return on his investment of £11,250. What makes things curiouser and curiouser is that Daniel Parker will write to Morris that the venture has provided him with a “satisfactory return” and then flee to Britain 2 months later, leaving debts of £20,000 and the Empress of China put up for sale, advertised in the New York Packet as “copper-bottomed, scarcely two years old, fit for Indian with small expense.”

In 1785 he would purchase 100,000 acres in western Pennsylvania for £5000 and then sell half his holding in 1787 for the same amount. In 1786 he would invest £3,000 in the privateering schooner Dolphin; the following year the ship would record the sale of £3,000 in goods captured. In 1788 Morris' own balance sheet would show his liquid net assets at £20-30,000.

By 1790 Morris would purchase the Genesee Tract from the State of Massachusetts -1.5 million acres in the Genessee region of New York, paying £22,500. In 1791 he would buy the city block in Philadelphia (Chestnut-Walnut, Seventh-Eighth Streets) for £22,500. That same year Morris would launch the Delaware and Schuylkill Canal Company. Of its total £45,000 capital Morris would contribute £11,250. In 1793 he would sell 1 million acres of the Genesee Tract to the Holland Land Company for £75,000 and buy shares in the Bank of Pennsylvania (£4,500). In 1794 the work would begin on the Chestnut Street mansion, with Pierre Charles L’Enfant being paid £2,000 for design and supervision and £6,138 being spent that year on construction.

1795 would be the year of the very big deal. Morris, James Greenleaf and John Nicholson would form the North American Land Company; each would own 10,000 shares, and the venture would be capitalized at £675,000. It would own 6 million acres. Within 2 years (1797) Greenleaf and Nicholson would be in Prune Street Prison for bankruptcy. Morris would arrive there the following year (1798). Their collective unpaid debts would be in excess of £1,000,000.

Jun

28

Trade negotiations, from Dr. Peter C. Earle

June 28, 2025 | Leave a Comment

Trade Negotiations aren’t Chess, Poker, or Go. They’re Bridge.

Chess is zero-sum and strictly competitive. Trade is collaborative; its foundational principles are voluntary exchange and mutual advantage.

Peter C. Earle, Subiksha Ramakrishnan

May 22, 2025

Trade negotiations are often mischaracterized as adversarial contests akin to warfare or chess. (The latter is increasingly invoked in varying degrees: 3d, 4d, and nth degree). Headlines speak of countries “battling” over tariffs or “outmaneuvering” each other in the global marketplace. But while those analogies may be emotionally satisfying and undergird ideological fervor, they fundamentally misunderstand and distort the nature of trade itself.

Unlike war, trade is not about conquest; it’s about cooperation under constraints. While no analogies are perfect, within the gaming milieu, a better model is to be found in contract bridge, where strategy, communication, and shared outcomes dominate the pursuit of mutual gain.

Jun

27

General semantics, from Nils Poertner

June 27, 2025 | Leave a Comment

Drive Yourself Sane: Using the Uncommon Sense of General Semantics, by Susan Presby Kodish

GS is based on a careful study of human behavior and scientific problem-solving, bridging applied psychology and practical philosophy. Drive Yourself Sane provides time-tested methods for critical and creative thinking and constructive communicating with a variety of problem-solving applications for mental hygiene, personal development, education, business, etc.

Easy to read book about Global Semantics. Why relevant? Because we often confuse the image of something with reality. And that is recipe for insanity. eg. Dalio has this "machine" analogy for mkts and the econ. Fair enough. But the econ and markets are much more: Living organism etc (good to use "etc" as it reminds oneself that it is a lot more…) There is a famous picture that shows an "apple" and underneath the painter wrote: "This is not an Apple."

Humbert G. comments:

Image v. Reality. Dialio is the perfect example. What’s with all the gloomy billionaires?

Larry Williams writes:

Dalio sure looks like a loser always bemoaning the world same as Cooperman how did these guys rise so far?? Then I have been accused of not being smart enough to put my feet on the ground if it weren’t for gravity.

Rich Bubb ponders:

I've been thinking that Dalio is using historical events to try to not repeat AVOIDABLE/PREVENTABLE mistakes. Yet the rhyming of those events is intriguing. Especially the given nature of Nature, current hot wars, insane debt levels, growing militarization actions, natural resource over usage/abuse, wealth distribution, Us vs. Them polarizations, etc. Yep, gloomy.

His 'machine' concept of the Markets & Economics is an "approximation of a likely future" (my words). The coincidences of the factors Dalio describes at some pressure point will often start Change Cycles. We've witnessed this in our own short-lived & humble lifetimes.

The problem is that 'history' will not exactly repeat in some-yet-unknown terms but might rhyme in concept. The timeline/s of historical examples Dalio uses for large changes is/are very long. And the salient concepts, e.g., reserve currency, debt irrationality, Dalio's Big Cycle (some spanning decades or longer), "Dynastic Cycles' Stages", etc., are historically documented and presented in "The Changing World Order" (2021). The tables and 'chartwork' are visual reinforcements throughout, yet intriguing patterns do persistently re-occur.

My takeaway is generally that Major Powers' (Markets, Econ, military conflicts, extinction-level weapons/WMD^6, etc.) either don't see the cliff they are eventually going to go over, or those major powers refuse to find solutions to the recurring Root Causes that Dalio writes about.

I'm not finished with his 'Changing World Order' book. From what I have read, Dalio seems to try to codify history into significantly huge cycles, leading to changes in the World's Order. IMO, given the current situation (in our time, i.e., now) it isn't too difficult to extrapolate what's ahead… gloomy indeed. Maybe Dalio is "gloomy" for one or more reason/s.

Jun

26

Increase in yields, from Jeff Watson

June 26, 2025 | Leave a Comment

Adam Grimes comments:

Cool chart. Interesting data. We have some farmers in the family but I would not have expected such a big difference.

Peter Ringel writes:

I think, this productivity boost shows Norman Borlaug‘s Green Revolution. There would be no India or China as we know it . And in the West too. The topic seems close to not being politically correct in our upside-down world.

Michael Ott brings expertise:

The Y axis is Mg/hectare, which is a different way to measure weight per unit area. Technically, a bushel is a unit of volume (8 gallons) that is understood to be equivalent to 56 pounds of corn or 60 pounds of soybeans. Most US farmers measure in bushels per acre, which is a different way to express weight per unit area.

The major increase in corn came from breeding AND fertilization. GMO corn was introduced in 1996 and reached 50% market share around 2001, which is pretty fast adoption for agriculture. Biotech traits certainly help with yield, but more so prevent disasters from insects and weeds, which harm yields.

Big Al finds another chart interesting:

Jun

25

Fate again, but called Destiny

June 25, 2025 | Leave a Comment

Henry Siddons Mowbray was an American artist. He executed various painting commissions for J.P. Morgan, F.W. Vanderbilt, and other clients.

Destiny (1896) - Henry Siddons Mowbray (1858–1928), oil on canvas, Museum of Fine Arts, Boston, MA:

Jun

24

Forces of fate

June 24, 2025 | Leave a Comment

the forces of fate. finally a new all-time high. previous all-time high: 23 January, 2025, S&P 6123.

The Hallé - Verdi: The Force of Destiny Overture

Over the years La forza has acquired a reputation for being cursed, following some unfortunate incidents. In 1960 at the Metropolitan Opera, the noted baritone Leonard Warren collapsed and died during a performance of the opera. The supposed curse reportedly kept Luciano Pavarotti from ever performing the opera, and the tenor Franco Corelli used to follow small rituals during performances to avoid bad luck.

Jun

24

Excellent version of Clews, from Laurel Kenner

June 24, 2025 | Leave a Comment

The Wiley edition of Henry Clews, Fifty Years in Wall Street, has annotations by Jon Markman - the editor for Vic and me when we wrote a biweekly column for MSN Money - and a foreword by the Chair.

Henry Clews was a giant figure in finance at that time, and his firsthand account brings this colorful era to life like never before. He reveals shocking stories of political and economic manipulation and how he helped bring down the mighty Boss Tweed. He writes eloquently about the madness of the markets and how the era's greatest speculators amassed their fortunes. This book provides an expansive view of Wall Street in an era of little regulation, rampant political corruption, and rapid financial change.

Henry Clews was born in England in 1836 and emigrated to the United States in 1850. In 1859, he cofounded what became the second largest marketer of federal bonds during the Civil War. Later, he organized the "Committee of 70," which deposed the corrupt Tweed Ring in New York City, and served as an economic consultant to President Ulysses Grant.

Jun

23

Jarisch–Herxheimer reaction, from Nils Poertner

June 23, 2025 | Leave a Comment

Jarisch-Herxheimer reaction in medicine: A sudden and typically transient reaction (eg fever) that may occur within 24 hours of being administered antibiotics for an infection such as syphilis.

Application in financial markets? eg when a troubled stock sells off briefly after a new strategy or management is announced but the stock recovers after some 24-48 h carnage.

Asindu Drileba writes:

In The Education of a Speculator, Chapter 14, "Music & Counting":

Another frequent work I hear in the market is Haydn's Symphony No. 94 ("The Surprise"). The surprise is a simple fortissimo chord in the second movement, designed "to make the women jump." In a contemporaneous review of the work, a lyrical critic wrote:

The surprise might be likened to the situation of a beautiful Shepherdess who, lulled to sleep by the murmur of a distant Waterfall, starts alarmed by the unexpected firing of a fowling-piece.'

Two examples from currency markets:

1) Asia Currency crisis: When the Asian currency crisis of the 1990s was starting to manifest, IMF provided a loan to "stabilize" the economy. The currencies were stable for some time (the lull to sleep), then dropped by up to 80% in some Asian countries (the jump).

2) The Lebanese pound: The Lebanese pound remained very stable. Close to a flat line for 13 years (the lull to sleep), Then in Jan 2023 it dropped by 90% (the jump).

Equity Markets: "The best predictor that a company will go bankrupt, is stable income" — Nassim Taleb. Unfortunately its hard for me to get data on delisted (bankrupt) stocks so I can't test this. But the logic behind this reasoning is that, to provide stable income, corporations often optimise via unhealthy accumulation of debt, relying on a single supply chain (Apple & China), relying on a few big enterprise customers (Palantir & US Government).

While this optimisation makes it easier to milk profits that make a corporation look "stable" (the lull to sleep), it makes them more prone to catastrophic failure (the jump). A single customer canceling your service, trump tariffs on a single supply chain partner or debt unable to be paid may lead serious issues.

Jun

22

Classic research on volatility

June 22, 2025 | Leave a Comment

Converting 1-Day Volatility to h-Day Volatility: Scaling by sqrt(h) is Worse than You Think

Francis X. Diebold, Atsushi Inoue - University of Pennsylvania

Andrew Hickman, Til Schuermann - Oliver, Wyman and Company

We show that the common practice of converting 1-day volatility estimates to h day estimates by scaling by sqrt(h) is inappropriate and produces overestimates of the variability of long-horizon volatility. We conclude that volatility models are best tailored to tasks: if interest centers on long-horizon volatility, then a long-horizon volatility model should be used. Economic considerations, however, confound even that prescription and point to important directions for future research.

Jun

21

Anyone who appreciates the scientific study of finance will recognize the name of MFM Osborne as a pioneer, visionary, and creator of our field. He was the first to discover Brownian Motion in Stock Prices, the first to study technical analysis scientifically, the first to note the lognormal nature of prices, the first econophysicist, the creator of automated market making algorithms 50 years before they became common place, the creator of market microstructure, and the discoverer of clustering of prices among other things.

They might also know that he was an eminent physicist whose work on sound and electricity led to his discoveries in finance. Yet despite his renown, he is somewhat of an unsung hero having done his work mainly in the 1960s when our field was in its infancy and many of his contributions have languished in such journals as Econometrics, Operations Research and Journal of the American Statistical Association from that period.

I had the pleasure of knowing him fairly well during the 1960s when he did much of his work in finance. And indeed we collaborated on some papers, we had an extensive correspondence, and he served as one of the original directors of my firm Niederhoffer, Cross and Zeckhauser, Inc., the original name of the current firm of Manchester, Inc. I also had the pleasure of meeting and befriending one of his astronomical colleagues, Harold Weaver at the Univ of Cal, Berkeley, who audited my classes there, and we exchanged many a story about the astounding trajectory of Osborne's scientific career.

During the time I knew Osborne, I was aware that he was the most creative and competent eye in the world of finance, far surpassing in that respect all my teachers at the University of Chicago, of that period, many of whom are widely known, revered, and honored. And I always wondered, where did it all come from, how did a man of such genius arise, and how did his scientific work in physics, astronomy, entomology and oceanography lead to his contributions to finance.

Out of the clear blue sky, I recently found the book "Autobiographical Recollections of M.F Maury Osborne", transcribed by Melita Osborne Carter from a series of cassette recordings in 1987. Attached to the autobiography was a hand written note from MFM Osborne: "You have often asked about the path I took in life. Well here it is. And as you can see my upbringing and path was diametrically different from yours."

It is a pleasure, honor and duty to review this book, as I believe we can all learn from it. And a man of such great accomplishment should receive his due. The book reminds me of what Tom Sawyer would have been like if Tom had trained to be a scientist rather than a detective, and if he had been raised by genteel Southern Scientists rather than a house aunt. It's divided into 34 sections: Early Childhood, Mrs. John's School, Public School, Games and Other Activities, Kites and Model Airplanes, The effects of Personal experience, My House on Westoer Wenue, Summer Camp, Scouts High School, Eoodberry Forest, Mother's Influence, Incidents in Norfolk, University of Virginia Sophomore Year, With Hrdicka in the Aleutions, University of Virginia Other Activities, Mrs. Rose's Farm, American Student Union, Jail– Right and Wrong, University of Cal at Berkley, Lick Observatory, Student of Oppenheimer, Operations of the Naval Research Laboratory, Life in Forest Heights, Non-nrl Research Eddington Studies.

Maury was born on December 1916 and passed away in early 2003 at the age of 86. He has two daughters and two sons. During his life he published 47 scientific papers, received his PhD from the University of Maryland in biology in 1952, served as the Mayor of Forest Heights, and was a gadfly for all the physicists working in the fields of relativity, and all the early believers in the random walk theory.

Like most greats, his life was shaped by a combination of inheritance from eminent predecessors and a fortunate environment that enabled his inherited talents to prosper. He was the proud great grandson of Matthew Fontaine Maury, a famed astronomer, oceanographer and meteorologist who was known as the Pathfinder of the Seas and the Scientist of the Seas "because of his seminal work" The Physical Geography of the Seas, 1855. After great efforts to eradicate slavery in the South, as a proud resident of Virginia, Maury resigned his commission as Superintendent of the US Naval Observatory and joined the confederacy.

He then devoted a good deal of the remainder of his life to the commercial possibilities of discovering and extracting minerals in the South as a way of rebuilding the fortunes of Southerners. MFM Osborne was very proud of his heritage from Matthew Fontaine Maury and followed in many ways in the highways and byways of his grandfather's career.

It was always hilarious to read in the autobiography that despite MFM Osborne's positions in highly classified government research, he always refused to sign any loyalty oaths because he would have had to deny that he was descended from a grandfather who had sworn to overthrow the US government with the outbreak of the civil war.

Here comes the scientist, MFM Osborne. What was his life like? What were the major influences on him? The significant events? How did he reproduce and eat? To get a flavor for his ecology, let's consider several of the typical events described in his autobiography. Osborne never accepted anything without proof. When he found an error in some respected authorities work he liked to say something like, "Someone's going to eat crow, raw squawking and fully feathered, by the time I correct his errors." He applied the same approach to life situations. He noted many people being sent to jail. But why were they sent? The answer would teach him what a society regarded as right and wrong. "No one is surprised if people want for no other reason than to explore mountain tops or caves or jungles. Well, the same is true in society. There are segments of society that one layer does not know anything about or very little about, and you can explore it with the idea of learning about it or improving it." So Osborne decided to spend a few months of his summer vacation from the University of Virginia in jail. He went about it by hoboing across the country until he was picked up by a plain clothes sheriff in Vanceburg, Kentucky. The Jail was a pre-Civil War masonry cell with two rooms with a cage on the outside with masonry walls three feet thick with 30 people inside. What did he conclude from his months in jail? "These people were not bad so much as they were just amoral in just the same way as primitive societies… Looking back I can say it enlightened me as to what constitutes right and wrong. Very much depends on arbitrary standards which change with time." He applied these insights into his study of the Constitution, the Bible, and his scientific pursuits. "It contributed to my understandings of the limitations of truth and falsity — of right and wrong. My experiences in Vanceburg, Kentucky were consonant ultimately with what I learned in many other parts of my life, and in many other circumstances." He applied this learning to question and correct the conclusions of science in many fields, particularly astronomy where he concluded that the errors of measurement were so great that separate investigators were liable to come to completely different conclusions concerning such fundamental questions as the truth of Einstein's hypotheses about the movements of the planets and satellites during eclipses, to the world of finance where he concluded that the students of the random walk were completely on the wrong track because they didn't take account of the influence of the bid asked spread, and the relation between volume and price.

It should be mentioned here that Osborne was a can do person. He was a boy scout and a fix it person. He built model airplanes, boats and kites while in his teens. "If you flew one of these airplanes at night and hung on it a thin wire in which there was a rubber band attached hanging down below the airplane, and the put a match to the rubber band, the rubber band would burn and melt and drop little flaming balls"— The unsympathetic police soon put a stop to that. "I told my children that I had taken a trash can and made a huge catapult out of old inner tubes and shot one of the smallest boys in the neighborhood in the trash can as a space capsule". He liked to hobo and hitchhike across America. He took a year off from school to work on a farm to improve his physical conditioning. He enjoyed pushing a wheelbarrow around, and hauling dirt and using a shovel. Eventually he used these skills to become the main hand on an archeological expedition with Professor Hrdlicka to explore the antiquity of man.

Time and again he used the knowledge he gained of how to get and improve his bearings to get out of life threatening experiences. On one of them however, hauling a car up to the observatory in Mr. Lick while he was studying at Berkeley, he managed to fall off a cliff and spent 1 month prostrate on his back in a hospital which time, he characteristically used to improve his knowledge of tensor calculus.

One of his typical chores there was to rake manure. He used his experiences there to come up with his solution to the problem of why the bee can fly or some insects can travel at 500 miles per hour, or how salmon can swim upstream 500 miles without eating. His conclusion: "Salmon are more efficient than the most efficient rigid body boat that humans can devise because they seek out and gain energy from the varying velocities of water that they navigate." When he performed archeological work, he had no compunction of diving 50 feet under water without deep sea equipment to recover a rake.

Another example of the Osborne way came when he was made mayor of Forest Heights. It was the first city outside of the city limits of Virginia. Anyone who moved tended to allow their dogs to run free. The dogs ran in packs and terrorized all the people of Forest Heights. Osborne concluded the solution was to have a dog day where every stray dog not on a leash that day would be shot. He became world infamous for that solution and received many a threat that he would be killed if he implemented it.

The path and conclusions of many of his scientific discoveries in astronomy, biology, entomology, finance, physics, optics, sound and especially Eddington's theory of relativity are detailed in the autobiography. His schooling at the University of Virginia, Berkeley, and Harvard provides a great window on the process of scientific education and discovery during the first half of the 20th century. His work at the Naval Research Laboratory provides insights into how large research institutions work, and the ins and outs of the bureaucratic process. His experiences with Oppenheimer, Feynman, and other great geniuses of physics and astronomy as well as the hum drum day to day of the kind of instruction provide a great foundation for the way science was carried out in practice rather than theory.

In view of the importance of Osborne's contributions to the world of finance and science, and the intrinsic interest of his autobiographical notes, his daughter Melita Osborne has prepared a biographical document that is available here [MS word .docx file, approx 300 Kb].

Jun

20

AQR looks at trend following, from Y. Humbert

June 20, 2025 | Leave a Comment

A Century of Evidence on Trend-Following Investing

November 1, 2017 - Brian K. Hurst, Yao Hua Ooi, Lasse H. Pedersen

As an investment style, trend following has existed for a very long time. Some 200 years ago, the classical economist David Ricardo’s imperative to “cut short your losses” and “let your profits run on” suggests an attention to trends. Early in the last century, the legendary trader Jesse Livermore stated explicitly that the “big money was not in the individual fluctuations but in…sizing up the entire market and its trend.”

The most basic trend-following strategy is time series momentum — going long markets with recent positive returns and shorting those with recent negative returns. Time series momentum has been profitable on average since 1985 for nearly all equity index futures, fixed income futures, commodity futures and currency forwards (Moskowitz, Ooi and Pedersen (2012)). The strategy explains the strong performance of managed futures funds from the late 1980s, when fund returns and index data first becomes available.

This paper seeks to establish whether the strong performance of trend following is a statistical fluke of the last few decades or a more robust phenomenon that exists over a wide range of economic conditions. Using historical data from a number of sources, we construct a time series momentum strategy back to 1880 and find that the strategy was consistently profitable over the next 110 years.

Jun

19

Robert Morris, financier, from Larry Williams

June 19, 2025 | Leave a Comment

North American Land Co. stock issued to Bird Savage & Bird of London in 1795. Signed by Robert Morris as president and James Marshall as secretary. Morris' signature is pen cancelled. 9.75 x 12" Robert Morris was the financier of the American Revolution, and one of only two Founding Fathers to sign all three key American documents: The Declaration of Independence, the Constitution, and the Articles of Confederation. Morris was the first to use the dollar sign in official documents. The financial Panic of 1796 led to his financial ruin and he was incarcerated for debt in the Prune Street Prison. Date: 1795

Stefan Jovanovich writes:

Morris was the intern/apprentice to Charles Willing (Thomas Willing's father). When Charles died in 1754, Morris became a partner; he became a name partner in Willing, Morris & Co. by 1757. There was no formal registration of businesses in the Province of Philadelphia. "Firms" were known by usage as either individuals or partnerships. We know that the firm existed because its name appears in the Customs records as owners of the brig Nancy and on a bill of exchange for 500 pounds in 1757. The firm "dissolved" in 1783; in March 1784 Thomas Willing wrote a letter to a fellow merchant referring to "our late firm".

By 1781 Morris had left doing any of the daily the business of the firm because of his duties as a public official. On February 20, 1781 Congress appointed Morris Superintendent of Finance; and in September Morris became Agent of Marine - i.e. Secretary of the Navy. On December 31, 1781 Congress chartered the Bank of North America and Thomas Willing was named as its President.

The mixture of finance, merchant business and government was complete. Willing, Morris & Co. supplied muskets, gunpowder and food to the Continental Army. The Bank of America and Willing, Morris & Co. secured $5.4 million in loans ($4 million from France, $1.4 million from the Netherlands) and also made loans directly to Congress. When Congress did an audit in 1783 they found that the discrepancies in the accounting were for money that had flowed to the government, not from it. Willing & Morris had paid $100,000 in Treasury debts.

How Morris went on the become the richest man in the country, owner of "Morris's Folly" and the most famous bankrupt is Part 2 of the story. How Willing (not Alexander Hamilton) became the "founder" of the American system of finance is a whole new volume.

Jun

18

Win rate, from Francesco Sabella

June 18, 2025 | Leave a Comment

What exactly means this quote? I read of it years ago on a book about Medallion Fund but never understood if I got the meaning correctly.

We're right 50.75% of the time…but we're 100 % right 50.75% of the time. You can make billions that way.

- Robert Mercer

Peter Ringel responds:

my guess: trend following systems can have 40% win rate and lower. Yet via expectancy these sys can be very profitable. Medallion though, would do HF stuff, less MoMo.

Michael Chekalin comments:

Mercer refers to the consistency of Medallion. In other words, they are “consistently” profitable in the 50% area, which through proper money management, risk/reward, etc, can be extremely profitable.

Asindu Drileba writes:

I think its a reference to the "law of large numbers." Suppose you noticed the market goes up 51% of the time on Thursday. (for the 100 Thursdays in your sample dataset) This means that you will also loose 49% of the time. If you decide for example to only place bets for the first 20 days, you might have a win rate of 0%. All bets of the first 20 days can fail.

But the model will still be correct since you can make money for the subsequent 51 days and the lose money for the next 29 days — thus playing the market for all the 100 days (20 + 51 + 29). So your win rate will converge to 51/100 which is the same 51% you identified in your sample. You have therefore acquired 100% of the edge. I think that is what he means when he says "we are 100% right 50.75% of the time."

Nils Poertner adds:

Some specs have a 10pc win rate and do really well. Friend of mine was early investor in ETH in size- but all other of his ideas didn't work out. His nick name was "Harbinger of Failure." Kind of like the joke: "I told my friends I want to become a comedian - and they all laughed. And then I became a comedian and no-one laughed anymore." I often think about him now.

Jun

17

Bullish timing

June 17, 2025 | Leave a Comment

max without all time high currently >250 days very bullish. what else in timing is bullish?

"Time schedule are most strict for flowering and fruiting," says Heinrich. "I can make observations and then speculate about these schedules on the assumption that they came into being, and persisted because they uniquely served the tree of each species to reproduce itself better in the particular environment that it grows in." - The Trees in My Forest

Seasonal timing on a cyclical Earth: Towards a theoretical framework for the evolution of phenology

Phenology refers to the seasonal timing patterns commonly exhibited by life on Earth, from blooming flowers to breeding birds to human agriculture. Climate change is altering abiotic seasonality (e.g., longer summers) and in turn, phenological patterns contained within. However, how phenology should evolve is still an unsolved problem. This problem lies at the crux of predicting future phenological changes that will likely have substantial ecosystem consequences, and more fundamentally, of understanding an undeniably global phenomenon. Most studies have associated proximate environmental variables with phenological responses in case-specific ways, making it difficult to contextualize observations within a general evolutionary framework. We outline the complex but universal ways in which seasonal timing maps onto evolutionary fitness. We borrow lessons from life history theory and evolutionary demography that have benefited from a first principles-based theoretical scaffold. Lastly, we identify key questions for theorists and empiricists to help advance our general understanding of phenology.

Jun

16

GridFree AI: Data centers to bypass utilities, from Carder Dimitroff

June 16, 2025 | Leave a Comment

From: Axios Generate (2 June 2025):

The startup GridFree AI, born in "electron economy" incubator Montauk Climate, emerges from stealth today with $5 million led by Giant Ventures.

It's modular, off-grid "power foundry" concept integrates gas power, battery storage, and cooling with computing infrastructure.

It's "systematic, repeatable, and becomes a manufacturing process, not a stick-built process," GridFree AI co-founder and executive chairman Ralph Alexander said.

It converts gas into electricity and cooling with 90% efficiency and ensures more power is used for the actual data center IT and processing units, which means much lower CO2, it said."

The efficiency of the overall solution enables a 50% increase in available power for IT loads," the announcement states.

This is a good idea. It utilizes an older concept called cogeneration, which has been widely employed in municipalities and on private campuses. This structure's capital and operating costs are significantly lower. Owners bypass onerous ISO, transmission, distribution, and utility charges. Their presence has no impact on LMPS (local wholesale power prices). Additionally, owners capture the turbine's waste heat and convert it into cooling, which data centers require.

With minimal barriers to entry, expect more data centers to capitalize on these opportunities, particularly near fuel sources (e.g., Pennsylvania, Louisiana, and Texas).

Jun

15

Gregariousness, glory, and memorable experience

June 15, 2025 | Leave a Comment

gregariousness. in bison, locusts, passenger pigeons. what insights does this have for markets?

listening to now:

The Glory of Their Times: The Story of the Early Days of Baseball Told by the Men Who Played It

one of the most memorable and saddest experiences of my life was visiting with Larry Ritter as he was dying at Roosevelt hospital. i had befriended Larry 10 years ago and found him equally knowledgeable about finance and old time and Negro Baseball. He traveled in a Yankees bus.

while visiting him on his last days a big curmudgeon walked in. we discussed Glory and I mentioned that the spoken words of it was just as good as the book. the curmudgeon said he never listened to radio, tv, computers or anything else. he didn't believe in any of the modern.

I was not surprised when he tried to ruin the US economy shortly thereafter. Paul Volcker was proud to be wrecker. The curmudgeon was a colleague of Larry's at NYU.

Jun

13

Alasdair MacIntyre (1929-2025), from Alex Castaldo

June 13, 2025 | Leave a Comment

A few weeks ago I read about the death of Alasdair MacIntyre, described in Wikipedia as a Scottish American philosopher. And in some obituaries as "one of the great moral philosophers of the 20th century".

I heard his name here on the SpecList about 10 years ago when someone (sorry, I do not remember who, maybe GB?) recommended his book After Virtue, saying that it described how philosophy has gone wrong in the 20th century and how to correct it.

Intrigued, I bought the book, but like many things on SpecList, it was harder to understand than I expected. I think I read the 1st chapter or so, but I guess my knowledge of Aristotelian philosophy was not adequate and I could not make much progress. So the book sat on my shelf until now. I also did not quite grasp what Aristotle got right that later philosophers missed or what going back to Aristotle's views would mean in practice. The whole idea of reviving an earlier tradition seemed odd to me, I guess.

But still I am glad Daily Speculations made me a better person, at least judging by the books I claim to have (partially) read. Maybe someone else can explain it in terms I would understand.

Jun

12

From the archives: 10 Things I’ve Learned About Markets, from Victor Niederhoffer

June 12, 2025 | Leave a Comment

Posted on April 20, 2011:

1. "There is no such thing as easy money"

2. Events that you think are affected by cardinal announcements like the employment numbers at 8:30 am on Friday are often known to many participants before the announcement

[An example supplied on April 18 by Mr. Rogan: "The Reason For Geithner's Weekend Media Whirlwind Tour: White House Learned About S&P Downgrade On Friday" (zerohedge )]

3. It's bad to try to make money the same way several days in a row

4. Markets that have little liquidity are almost impossible to profit from.

5. When the stock market is way down, policy makers take notice and do what they can to remedy the situation.

6. The market puts infinitely more emphasis on ephemeral announcements that it should.

7. It is good to go against the trend followers after they have become committed.

8. The one constant, is that the less you pay in commissions, and bid asked spread, the more money you'll end up with at end of day. Too often, a trader makes a fortune on the prices showing when he makes a trade, and ends up losing everything in the rake and grind above.

9. It is good to take out the canes and hobble down to wall street at the close of days when there is a panic.

10. A meme about the relation between today's events and those of x years ago is totally random but it is best not to stand in the way of it until it is realized by the majorit of susceptibles

11. All higher forms of math and statistics are useless in uncovering regularities.

Read the full post with additional comments.

Jun

11

One must admire the first guy to introduce Brownian Motion into a theory about speculation.

Louis Bachelier's Theory of Speculation: The Origins of Modern Finance

Asindu Drileba wrires:

If you like that, you may find Louis Bachelier's other book Sketches in Quantitative Finance interesting. It's very accessible as it has no complex math and describes many concepts in probability/statistics in a very straightforward way. In it, he say's for example that despite Martingale strategies looking lucrative, "no one has gotten rich by using this method."

Jun

10

Trees, instinct, octets

June 10, 2025 | Leave a Comment

The Trees in My Forest by Bernd Heinrich is one of the best books about nature that I have ever read. theme of the book is, 'Trees exist as parts of an unfathomably complex web where each species is linked to others in growth, reproduction, sex'.

Each chapter teaches me big things about markets. (1) evolution of small versus big. (2) construction for strength. (3) Tree geometry. (4) time for a tree. (5) sex in a tree. (6) seeds and seedlings. (7) ants and trees.

The Homing Instinct by Bernd Heinrich is a great companion piece. Much detail about Lobagola in many migratory species.

the inexorable fate of round numbers: Octet Rule

Jun

9

Analyzing Employment Trends: Full-Time vs. Part-Time Work, from Bill Rafter

June 9, 2025 | Leave a Comment

Within the Non-Farm Payrolls (NFP) Report, two key employment categories—full-time employment and part-time employment for economic reasons—offer valuable insight into the state of the labor market. By analyzing their respective growth trends and comparing their slopes, we can better understand shifts in employer confidence and economic stability. Historically, economic downturns have occurred when part-time job growth surpasses full-time employment growth, reflecting caution among employers hesitant to commit to permanent positions. Conversely, economic recovery typically begins when full-time employment accelerates faster than part-time hiring, signaling renewed confidence in long-term business prospects.

Full-time employment has been growing steadily for the past six months and increasing consistently for 11 consecutive months. Part-time job growth, though still exceeding full-time growth, has declined over the last two months. This shift suggests a potential turning point in labor market trends. While employers have not fully transitioned to long-term hiring, the upward momentum in full-time job growth indicates gradual economic stabilization.

If this pattern continues, we may see full-time employment overtaking part-time growth, solidifying economic recovery. Monitoring sector-specific hiring trends—such as whether certain industries are driving full-time job gains—can provide additional insight into the strength of this shift. Wage growth and labor force participation are also critical factors to watch.

Jun

8

A trading game, from Humbert Z.

June 8, 2025 | Leave a Comment

Here is the trading game used by the authors of this paper:

When a Crystal Ball Isn’t Enough to Make You Rich, by Victor Haghani and James White, of Elm Partners, September 23, 2024

The authors called the experiment “The Crystal Ball challenge.” They gave 118 young adults trained in finance $50 each and the opportunity to grow that stake by trading in the S&P 500 index and 30-year US Treasury bonds with the information on the front page of the Wall Street Journal (WSJ) one day in advance, but with stock and bond price data blacked out. The game covered 15 days, one day for each year from 2008 to 2022. In sum, the players did not do very well.

To gain further understanding, the authors invited five experienced macro traders - four men, one woman - to play the game, with markedly better results. The group of five consisted of a head of trading at a top-five US bank, a founder of top-ten macro hedge fund, a senior trader at top-ten macro fund, a former senior government bond trader at top-three US primary dealer, and a former senior Jane Street trader. These players all finished with gains. On average, they grew their starting wealth by 130%, with a median gain of 60%. All of the players were selective and highly variable in their trade sizing. These veteran traders predicted the direction of the markets significantly better than the 118 younger, less experienced participants (63% vs 51.5%), but mostly the authors ascribe the dramatically different results to the much more sensible trade sizing displayed by the experienced traders.

I played the game and got this result first (and only) time. The result is largely an accident as I wasn't paying attention to the rules or the sliders and so was taking far more risk than I realized. But maybe there is a lesson there.

Jun

6

On a recent tour

June 6, 2025 | Leave a Comment

books read on recent tour of California, Japan, Thailand, Singapore and Hong Kong with Aubrey and his good friend:

Singapore: A Biography, by Mark Ravinder Frost and Yu-Mei Balasingamchow

The Trees in My Forest, by Bernd Heinrich

The Birth of the Modern: World Society 1815-1830, by Paul Johnson

And for music: La Divina - the Best of Maria Callas Compilation

Also, a great book about 200 years of peace and harmony in Japan, The Fantastic Edo Era, but a completely opposite take by Paul Johnson in The Birth of the Modern.

also one terrible book, Every Man a Speculator, by Steve Fraser. the author hates speculation in all forms and writes 800 pages of selected anecdotes with thousands of footnotes to support his biased and hateful review.

Gavan Tredoux comments:

Paul Johnson is not a careful writer, makes too many factual mistakes, often accepts received wisdom uncritically. He writes well, as a journalist would, but I wouldn't trust anything he produced.

Jun

5

Aubrey and Vic in Thailand last week

June 5, 2025 | 1 Comment

back from a few weeks tour of Asia with many books read and museums visited and zoos and botanical gardens and aquariums, and much abalone from many great restaurants. will provide reviews shortly.

Jun

4

A very healthy day

June 4, 2025 | Leave a Comment

today (Wed, 4 June) a very healthy day for sp.

Jun

4

Big round numbers

June 4, 2025 | Leave a Comment

round # of 6000 approaching, sp now at 5973. the octet rule in chemistry: the concentration of stops at rounds. what else causes inordinate concentration? limit orders tend to be concentrated at round numbers. many compounds lose electrons to reach a stable, nonreactive 8. tests show that when a stock breaks thru a round number, it is bullish.

The Octet Rule: Help, Definition, and Exceptions

The Octet Rule is a general rule that is used to describe chemical bonding and draw Lewis Structures. The rule states that Main Group elements form bonds in a manner that results in each atom having eight valence electrons in the highest energy level (sometimes called outer shell). This results in each atom having the same electronic configuration as a noble gas.

Jun

3

Books again, from Asindu Drileba

June 3, 2025 | Leave a Comment

I can't find any books from the 1700s. Big events like the Mississippi Scheme and the South Sea Bubble happened in that period. But I can't find literature from the 1700s of people describing markets then. Maybe they had PTSD from having their fingers burnt? I heard Newton never wanted anyone to mention "South Sea" around him. (he lost his pile in the investment)

Stefan Jovanovich responds:

Essai sur la Nature du Commerce en Général, by Richard Cantillon (1680s–1734)

During 1719 Cantillon sold Mississippi Company shares in Amsterdam and used the proceeds to buy them in Paris. Mississippi Company shares surged from 500 livres in January 1719 to 10,000 livres by December 1719; during the same period the prices in Amsterdam went from 400 to 7,000. The daily average spread is calculated to have been between 20% and 40%.

Carder Dimitroff suggests:

Empire Incorporated — The Corporations that Built British Colonialism, by Philip J. Stern

The book provides historical perspectives about British markets and corporate financing. It's not an easy read, but it is fascinating.

William Huggins writes:

there is a collection of "things written afterwards" about 1720 called The Great Mirror of Folly but its mostly moralizing tracts than a steely-eyed review of what went down. keep in mind the experience (a bubble in uk-fr-nl, all at the same time) had profound effects on the market for almost a century afterwards with the fr retreating from paper money and the british passing the bubble act which made it waaaay harder for anyone to raise capital. trading stock largely returned to being an insiders game until the 1800s. GMoF was recently published along with a pile of other primary docs by Yale U press:

The Great Mirror of Folly: Finance, Culture, and the Crash of 1720

I like the goetzmann treatment of 1720 from Money Changes Everything personally. He's got a couple of good recorded talks on it too. for those interested in institutional developments around markets and financial institutions in north america, I strongly recommend Kobrak and Martin's "Wall Street to Bay Street."

Steve Ellison offers:

Extraordinary Popular Delusions and the Madness of Crowds was written in 1841 by Charles Mackay. The first three chapters are devoted to the Tulip Mania, the South Sea Bubble, and the Mississippi scheme. The remainder of the book is about non-financial episodes of irrationality, including a chapter about plagues that I re-read closely in March 2020.

Jun

1

A book rec, from Big Al

June 1, 2025 | Leave a Comment

The World for Sale: Money, Power and the Traders Who Barter the Earth’s Resources, by Javier Blas and Jack Farchy

In The World for Sale, two leading journalists lift the lid on one of the least scrutinised corners of the economy: the workings of the billionaire commodity traders who buy, hoard and sell the earth's resources. It is the story of how a handful of swashbuckling businessmen became indispensable cogs in global markets: enabling an enormous expansion in international trade, and connecting resource-rich countries - no matter how corrupt or war-torn - with the world's financial centres.

Interview with the authors:

The Most Powerful People You’ve Never Heard Of

Just beneath the surface of the global economy, there is a hidden layer of dealmakers for whom war, chaos, and sanctions can be a great business opportunity. Javier Blas and Jack Farchy, the authors of The World for Sale, help us shine a light on the shadowy realm of commodity traders.

Michael Ott agrees:

I read The World for Sale about a year ago and wholeheartedly recommended.

Francesco Sabella recommends:

Many interdisciplinary insights and very elegant clarity:

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles

.jpg!Large.jpg)