May

21

Ty Cobb as a Trader, from Stefan Jovanovich

May 21, 2025 | Leave a Comment

If Cobb saw a pitcher more than 20 times, he was able to hit better than .300 (the batting average that now gets you into the Baseball HOF). The two exceptions was Red Ruffing and Waite Hoyt.

Once Cobb saw what you had, he owned you; but he had to see what you had. This explains the anomaly of his doing badly against the "pitchers" who were not, in fact, pitchers but field players - Clark Griffith and George Sisler.

David Lillienfeld adds:

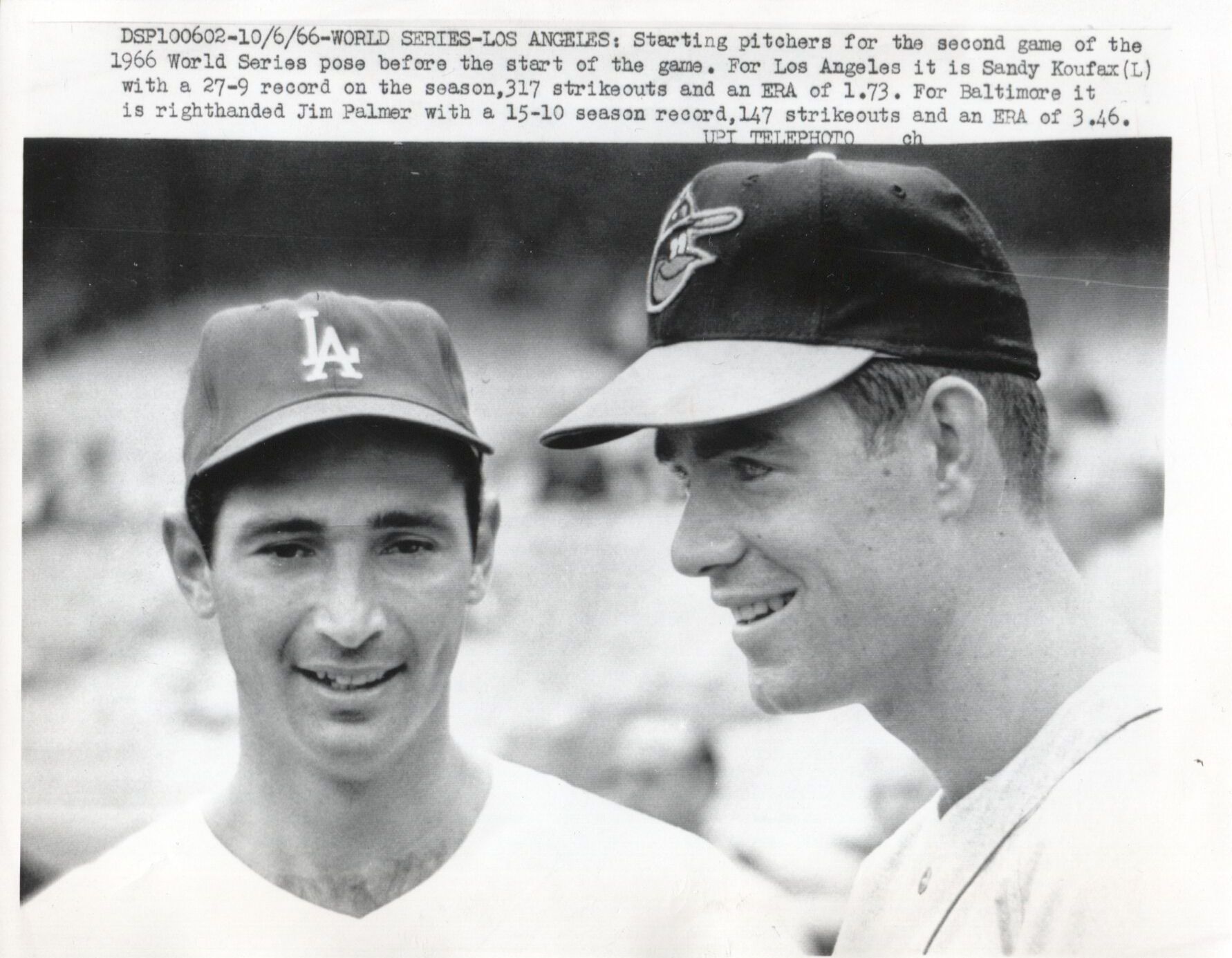

It depends on the pitcher, too, though. Willie Mays commented once that Sandy Koufax would tip off batters all the time as to what pitch he was going to use. A Koufax curve was as wicked as a Koufax fastball to Mays. He said that trying to hit that pitch, even knowing what pitch Koufax had thrown, was "like eating soup with a fork. You just can't do it."

May

15

I went to China recently. What I saw and nearly all the people I talked to were not happy about the economic situation there and almost everyone thinks Xi is stupid.

Humbert A. responds:

This has been the status quo since pre-Covid times imo.

David Lillienfeld writes:

Peter Drucker observed that the problem with totalitarian regimes is that with only one person in charge and no one in a position to offer alternatives/challenge that individual, there is no means of identifying and developing managerial talent in a society and the society inherently slows until the person in charge dies and there is a contest/market for new leadership. There will be problems showing in China soon enough–it has a demographic hurdle coming and it shows no signs of having any idea how to deal with it. It has lots of domestic health issues that will likely cost it considerably within the next decade. Maybe Xi will demonstrate Drucker as being wrong, but I doubt it. Barely three decades ago, the concern in the US was that Japan was about to walk all over the US. It didn't. I'm not sure that China is going to do any better.

Asindu Drileba writes:

This is my exact suspicion.

1950s to Soviet collapse — US Vs Russia (Narrative is Russians will take over USA)

1980s to Asia Currency Crisis — USA Vs Japan (Narrative is Japan will take over USA)

Early 2000s to Present — USA Vs China (Narrative is China will take over USA)

Peter Ringel adds:

There is a perverse stickiness to it. I grew up in one of these shit-holes ( not Japan ! ) - East Germany in my case. All the models and all the data point to implosion. And then it takes decades and centuries and more. And finally, when it collapses everyone is surprised, and no one was expecting it.

Apr

14

Looking back at 2008

April 14, 2025 | 1 Comment

A Few Observations, from Victor Niederhoffer

October 12, 2008

1. Of the 100 biggest markets around the world, almost all are down 40- 60% in dollar terms with the exceptions' being Tunisia and Botswana. The impact of the decline this week, unless rapidly reversed, is going to be very severe on purchases. The previous 20% caused great angst; imagine what this decline will do to those who rely on retirements. The positive feedback of the decline in a negative direction also impacts the election results with every market decline making it more likely the Republicans will be blamed for the situation.

2. The worst aspect of the decline this week from a health point of view was that fixed income around the world cratered, thereby reducing world wealth by a good 15% as opposed to the normal situation where the equities go down 10% and the fixed incomes go up 8% leaving total wealth down only a little. And the people that talked about how bearish it was for stocks because commodities were up would never say that it's bullish now because commodities are down 40% over the past four months.

3. A new word should enter the market vocabulary, a waterboarding decline, being a decline that seems to have a breath of life at the open before going into a death spiral.

4. Because of the decline in all sectors, the wealth/price ratio has stayed relatively constant with corn, copper, soybeans, wheat and oil down 40- 50% since June 30, thereby keeping the number of bushels and barrels we can buy with one DJIA relatively constant, making the number of ounces of gold you can buy with the Dow less than 10 for the first time in a googol, and looking like a bargain for the Dow.

Cagdas Tuna writes:

The plan was to make US assets cheap and make everyone afraid to invest in them(thanks to VIX spike Monday). We all make joke of him but Trump’s post few hours before 90 days pause was the peak. Look at inflation numbers it is officially coming down as most companies were planning this sh*t beforehand. The more we see bad news the bullish stocks are.

David Lillienfeld responds:

You're making the assumption that we're done. I don't know that we are.

Nils Poertner comments:

in any case - def good to watch out for anomalies, or things that shouldn't happen and then they happen - and then there is more of it normally.

Feb

9

A biography of Jay Gould, from David Lillienfeld

February 9, 2025 | Leave a Comment

American Rascal: How Jay Gould Built Wall Street's Biggest Fortune, by Greg Steinmetz

If you needed to pick out major figures of the Gilded Age, such characters as Rockefeller or Carnegie immediately come to mind. If you were in the midwest, you might include Armour in that list. When I was growing up in the 1960s, Jay Gould might have gotten a mention, but chances are good that he certainly wouldn't have been the first to come to mind. This is unfortunate, insofar as Gould was one of the wealthiest Americans of his day, leaving a fortune of some $75+ million in the 1890s. While some like the Vanderbilts (arguably with a greater net worth) succeeded in one major industry in railroading or Carnegie in steel, Gould's success was in multiple industries, including railroading, telecommunications (think Western Union), finance, and fashion (his early success was in leather goods). Gould not only had an impact in these industries, his actions had national impact, triggering panics, new means of communication (not the technology so much as the scale), political scandals (one of the more stark scandals of the Grant Administration, though that's probably subject to some argument), and even the manner in the US financial world grew on the world stage (though surely not at the scale that JP Morgan or Jacob Schiff did). He left an indelible mark on the United States during a crucial time in its immediate post-Civil War period as the industrial revolution was taking hold in the US.

Steinmetz offers a brief, easy-to-read biography of Gould. Some might argue it's a little too easy to read. It is definitely more of an overview than a deep study of the financier that was Gould. Gould was one of the foci around which some of the more colorful scoundrels that defined Wall Street in the post war period assembled. Daniel Drew, for instance, or Jim Fisk as another. The problem with this biography is that it is good only as an overview. And if that's what you seek, it functions perfectly well. But as Steinmetz did with his biography of Fugger (The Richest Man Who Ever Lived), there's just enough meat to do more than whet the appetite.

If you would like to learn more about the Erie War, there's The Scarlet Woman of Wall Street - not light reading but a tad more insightful than Steinmetz. Or the first Black Friday, when in 1869, Gould tried to corner the gold market, and had all the success that the Hunts would later experience in trying to do the same with silver a century or so later. Steinmetz gives just enough to whet one's appetite, but not enough that one is casting about looking for something meatier. Gould was the force behind Western Union's dominance of the telegraph industry, the world's first internet. He was one of the creators of an empire of transcontinental railroads, as well as elevated local train transit in New York City. Any one of these could be the subject of an in-depth study, but Steinmetz doesn't provide enough to forestall someone from having to consult another book or two.

Some might say that Gould epitomized the Robber Barons on the age, but he actually had little use for any sort of cabals. Sure, he appreciated a monopoly as much as any, but like Commodore Vanderbilt, with whom he waged war of a sort during the Erie War, he ran his businesses with a focus on profitability without necessarily having a monopoly or oligopoly. There are some instances where Gould drove the price of the product down, not hiking it. In building his empire, he demonstrated a shrewd sense of timing and of the anticipated direction of human events.

Jeff Watson writes:

I enjoyed that book. Here’s a lagniappe:

Dark Genius of Wall Street, from Jeff Watson

Stefan Jovanovich adds:

People liked him, and he was - until facial neuralgia destroyed his looks and tuberculosis robbed him of his general health - a charmer.

In 1879 Thurlow Weed said this about him: “I am Mr. Gould’s philanthropic adviser. Whenever a really deserving charity is brought to my attention, I explain it to Mr. Gould. He always takes my word as to when and how much to contribute. I have never known him to disregard my advice in such matters. His only condition is that there shall be no public blazonry of his benefactions. He is a constant and liberal giver, but doesn’t let his right hand know what his left hand is doing. Oh, there will be a full page to his credit when the record is opened above.”

Jan

3

Five-year US load growth forecast, from Carder Dimitroff

January 3, 2025 | Leave a Comment

1 GW = about 1 nuclear power plant

Five-year US load growth forecast [for power] surges to 128 GW

U.S. electricity demand is forecast to increase 15.8% by 2029, according to a new report from Grid Strategies. Six regions of the country are driving the growth

The report's load growth estimates are based on annual planning reports submitted to the Federal Energy Regulatory Commission by electric balancing authorities and updated with additional data from utilities and planning regions.

Consider this question from another list member: What would happen to the grid if Silicon Valley companies found technologies a decade hence that would provide similar server services with less electric power?

Answer 1a: The utility could face stranded assets, including underutilized power plants, transmission lines, substations, and distribution systems. Remember that most utility investments are 30-year-plus assets, are leveraged, and have their levelized costs, plus margin, firmly embedded in utility bills.

Answer 1b: How would investors hedge their position if they considered building a $1 billion gas turbine in states that deregulated their power plants?

David Lillienfeld responds:

Basically, you're going to see a mismatch between where demand from data centers are and where there's generating capacity. You can build demand a lot faster than you can build supply though, and if you get efficiency on the demand end, you have overpriced supply relative to the ability of the region to pay for the power generated. At some point, someone's going broke.

But here's the curious question–how much economic activity can be attributed to a server building? It's like a parking lot for data–nothing more than that. And if there isn't that much taxable revenues that it's generating, what's the appeal to governments–the risk for the electorate of holding the bag at the end of the day is non-trivial it would seem. So what's the appeal?

Henry Gifford writes:

In other industries power saving strategies are known but not adopted yet, but could be at any time without much warning.

Take cars for example. I heard that in about three years the whole car industry in Europe is going to switch from the now-standard twelve volt electrical system (actually about fifteen volts) to seventy-six volts. One advantage of voltage about five times higher is that electric motors can be about one-fifth the size they are now. This includes the starter motor used to start the engine, the motors used to raise and lower the windows, the heating/cooling system’s fan motor, the engine’s cooling fan motor, the alternator (which is basically a motor wired to work in reverse), and others. As motors are made in large part from Copper and rare earth magnets, smaller motors can save a lot of money. Another advantage is that the wires, usually made from Copper, can be about one-fifth the cross sectional area. Another advantage is that some things typically driven directly off the engine by rubber belts, such as the air conditioning system’s refrigerant compressor and the power steering pump can instead be driven by a small electric motor that can be located anyplace the designer chooses, instead of now having to be located in line with a belt wrapped around part of the engine. Shrinking all these things would make the car lighter, saving fuel. Voltages higher than seventy-six would of course extend these advantages in an ever-diminishing way, but be more capable of going through a person’s skin, thus seventy-six is thought to be the best choice.

The problem is, I heard the three year prediction about twenty years ago, and a few times after that, but not more recently than about ten years ago. So maybe it won’t happen anytime soon, or ever, but the technology and advantages are well known and waiting to be used.

Similar changes could gradually or suddenly drop the power used by data centers.

Dec

23

Tariffs on Canadian goods, from David Lillienfeld

December 23, 2024 | 1 Comment

So now we're going to get an interesting experiment in what happens when you impose tariffs on your neighbor. To wit:

1. The DEW Line? Probably going to be history very quickly

2. The Keystone Pipeline? The first pipeline to nowhere (why would Canada bother?)

3. Drug interdiction? I doubt the Canadians are interesting in dealing with drug gangs, but they will also have little reason to look kindly on us.

4. NATO? It's a goner already.

I'm not sure that we gain all that much in this tit for tat, but it will be interesting to see what's conjured up.

Carder Dimitroff responds:

It's more than oil from the Keystone Pipeline. As the name suggests, TC Energy (formerly TransCanada) is a Canadian company that exports significant amounts of oil and natural gas to the United States and US natural gas to Canada.

The Keystone Pipelines and the oil they transport are assets owned by Canadian companies rather than US companies. New tariffs on Canadian oil and natural gas traversing TC Energy's pipelines could increase wholesale energy prices within the US. Of course, higher prices help domestic producers.

The US produces more oil and natural gas than it consumes and is a net exporter of natural gas, oil, and byproducts. However, exports could decline if US wholesale feedstock prices increase relative to global markets.

Nov

30

Productivity and AI, from David Lillienfeld

November 30, 2024 | 1 Comment

When do we start seeing the effects of AI show up in national economic data? If you had invested $5K in a laptop and a word processing program, you could replace a secretary at multiples of the cost. When the web came in, there was Amazon squeezing out the costs of the middlemen.

But I don't see the savings for AI. I see lots of talk, some free programs, but in terms of real productivity, not so much. I'm also told that it's early days and I'm asking for too much in posing such a question, but I think we're now getting far enough into AI that it's not an unreasonable matter to bring up.

One thing that's clear is that AI isn't going to generate employment the way the last tech push did. But if it's going to really change the world as its advocates suggest that it will, those productivity gains should be apparent by now.

M. Humbert writes:

However AI productivity gains are measured, it’ll have to account for the productivity loss due to its high energy consumption. For the Austrian economics fans here. I’ve found Copilot to be a helpful time saving tool, so others probably do as well, so time savings definitely are occurring from AI use today.

Laurence Glazier responds:

Using it all the time, huge experiential benefit. Chatting to GPT every morning while reading Thoreau. Instant context. The other big breakthrough is spatial computing. All in the service of art.

Asindu Drileba comments:

From my experience, co-pilot and other LLMs, have not solved anything that could not already be done via ordinary Googling. Looking up solutions to code issues on stack overflow is no different from LLMs. And stack overflow is still better for some tasks (fringe computer languages like APL for example). LLMs are impressive, but are mostly just gimmicks. The only thing it has actually saved me time on is generating copyrighter material and filler text.

Jeffrey Hirsch adds:

Just had that discussion today about ordinary google still being even better than LLM Ais in finding info. Had some fun with AI editing and embellishing copy.

Asindu Drileba adds:

I suspect that the bad SWE job market is due to high interest rates, no AI. The SWE job market is enriched mostly by VC money. And VC money dried up when LPs withdraw to earn risk free money in treasuries instead of betting on start-ups whose success is on probability. I expect it to recover if interest rates come down to previous levels.

I think the LLM narrative was just something that tech executives parroted to show they had an LLM strategy. It's, Like how in 2018/2017 every executive had a "Blockchain" strategy. A lot of businesses assumed that LLMs would replace simple customer support jobs but they just saw their tickets pile up. Even the $2B valued, Peter Thiel financed, code assistant that would make you money on Up work as you sleep turned out to be a blatant scam.

Steve Ellison writes:

I don't have an answer for Dr. Lilienfeld's question about when AI effects will show up in productivity statistics. But I do hear anecdotally through my professional networks that AI projects are adding real value.

At the same time, Asindu is correct that the bad job market for techies, myself included, is more a consequence of rising interest rates–and I would add overhiring during the pandemic–than positions being replaced by AI. As Phyl Terry put it, "But this company [that announced layoffs] wants to go public so the better story is 'we are smart leaders using AI to become more efficient and profitable' vs 'we were idiots during the pandemic and have to lay off some people because we messed up.'"

Gyve Bones writes:

I find that the AI's ability to interpret my request and put together a coherent synthesis of several sources to be very helpful. Grok is nice because it provides a set of links to sources relevant to the prompt, and to related ??-posts and threads.

Laurence Glazier asks:

I usually have audio conversations with GPT rather than the older typed-in input/output. I just subscribed to X Premium to get access to Grok. Any good links for learning good usage? How nice Musk names it from the Heinlein novel.

Gyve Bones responds:

Check out the sample prompts Grok supplies on the [ / ] section in ??. The news analysis prompts for trending items is pretty cool.

Bill Rafter writes:

My business partner and I are in the process of marketing a new software application. Although we are rather literate, we have been running all of our marketing materials through Copilot, and we are amazed at the improvements Copilot makes to our text. It results not only in improved communication, but is a real time-saver. We even asked it to write a business plan, and it came back with a better one than our original.

Peter Penha offers:

I have not (yet) been on Grok but have found that the prompts do not differ very much across LLMs:

A Primer on Prompting Techniques, June 2024.

Prompt engineering is an increasingly important skill set needed to converse effectively with large language models (LLMs), such as ChatGPT. Prompts are instructions given to an LLM to enforce rules, automate processes, and ensure specific qualities (and quantities) of generated output. Prompts are also a form of programming that can customize the outputs and interactions with an LLM. This paper describes a catalog of prompt engineering techniques presented in pattern form that have been applied to solve common problems when conversing with LLMs. Prompt patterns are a knowledge transfer method analogous to software patterns since they provide reusable solutions to common problems faced in a particular context, i.e., output generation and interaction when working with LLMs. This paper provides the following contributions to research on prompt engineering that apply LLMs to automate software development tasks. First, it provides a framework for documenting patterns for structuring prompts to solve a range of problems so that they can be adapted to different domains. Second, it presents a catalog of patterns that have been applied successfully to improve the outputs of LLM conversations. Third, it explains how prompts can be built from multiple patterns and illustrates prompt patterns that benefit from combination with other prompt patterns.

This is earlier/shorter February 2023 paper - I am also a fan/follower of Prof. Jules White’s classes on Coursera why I flag the shorter/earlier paper as well.

Separate on the subject of AI - Eric Schmidt has a new book Genesis with Dr. Kissinger as a co-author (his last work before his passing) but Schmidt did a Prof G Pod Conversation released Nov 21st - in the podcast Schmidt goes over the threat from LLMs that are unleashed and noted that China in his view has open sourced an LLM equal to Llama 3 and that China instead of a being three years behind the USA on LLMs is a year behind. That China comment can be found here at 26:30.

Finally if anyone wants a great book I have read, on the history of the race to AGI going back to 2009: the Parmy Olsen book Supremacy on the histories of Sam Altman and Demis Hassabis is a wonderful read. Also breaks the world down between the AI accelerationists and the AI armaggedonists.

Big Al adds:

I do use Bard to learn or refresh my memory with R. For example, I am trying to use the "tidyverse" set of packages, and Bard is very useful when asked to write code for some task specifically using, say, tidyquant. The code almost never works first time cut & paste, but I can see how things are done differently and figure out what needs fixing. And I get answers to simpler problems faster than on Stack Exchange which is better for more complicated issues.

Laurence Glazier comments:

It's an inverted Turing test situation. The things that AI can't do help identify our humanity, our birthright.

Oct

31

US National Debt possible consequences & hedges, from Asindu Drileba

October 31, 2024 | Leave a Comment

There is a lot of talk about how precarious US Debt situation is. Two questions:

1. What possible disaster may come out of this? I am thinking Zimbabwe type hyper inflation. What other kind of disaster can happen?

2. What can retail level people do to protect themselves from this? Buy Swiss Francs? Gold & Silver? Bitcoin? What?

Larry Williams responds:

Gloom and doomers here is the chart to look at:

Bud Conrad writes:

Gold 1 year is up 24%. Silver 1 year is up 50%. The circumstances today are still very bad for the dollar. (Which is what is actually declining.)

The BRICS+ are meeting in Russia tomorrow Putin, Xi, Modi, Iran, Saudi Arabia (observer only), UAE etc.) to continue de-dollarization with non-dollar-denominated trade through non-SWIFT transactions for international Central Bank settlement. NO body is talking about this, being focused on how much the candidates will print up to bribe us for votes. The $1.1 T for interest on the $35 T of official Government Debt could rise, as the 10 year Treasury rate hit 4.2% while the Fed CUT short-term rate. Including unfunded liabilities for Social Security and Medicare would say the debt obligations are more like $200 T.

This is 10 year Treasury. Red pointer is when Fed Cut short term rate:

There is no way around avoiding the money printing required. Inflation and price rises are inevitable, as foreigners divest their $8 T of Treasury holdings, to avoid US asserting sanctions or seizing assets like the $300B of Russia holdings. They want out of US Hegemony fast, because of 14 rounds of sanctions on Russia.

Oct

24

Spec variety pack

October 24, 2024 | Leave a Comment

Hernan Avella provides a quick book review:

The Biggest Bluff is a decent book, light enough to enjoy in audiobook format. The book follows a simple narrative, weaving decision theory and cognitive biases into the context of the author’s journey learning poker while being mentored by one of the best ever. There are many useful nuggets for the discretionary trader throughout. In today’s markets, where speed and computational power are abundant—much like the solver and GTO approach in poker—the wisdom of the great Eric Seidel can be distilled as follows:

• Focus and pay attention

• Emphasize the decision-making process, iterate, and improve upon it—don’t obsess over results.

• Don’t complain about bad beats; take randomness stoically.

• There’s always something to learn, and always be humble.

David Lillienfeld on GLP-1s and Alzheimer's:

It's rare that one can say much that's definitive about Alzheimer's–other than that we don't know much. However, it seems there's some reason for hope coming from the GLP-1:

Ozempic predecessor suggests potential for GLP-1 drugs in Alzheimer’s in early trial

A small clinical trial suggests that drugs like Ozempic could potentially be used not just for diabetes and weight loss but to protect the brain, slowing the rate at which people with Alzheimer’s disease lose their ability to think clearly, remember things and perform daily activities. The results need to be borne out in larger trials, which are already underway, before the medicines could receive approval for the disease.

Kim Zussman on happiness, money, and "olfactory enrichment":

The Price of Happiness

What is the shape of the relationship between money and happiness, and what are its implications?

People typically think about money in raw units such as dollars. Yet research on money and happiness typically examines the association between happiness and the logarithm of income, or Log(income). This logarithmic association between income and happiness is frequently either overlooked or misunderstood. To help address this, the present report examines this association and makes five key points….

Conclusion: Minimal olfactory enrichment administered at night produces improvements in both cognitive and neural functioning. Thus, olfactory enrichment may provide an effective and low-effort pathway to improved brain health.

Oct

21

Nuclear: Back to the Future, from Carder Dimitroff

October 21, 2024 | Leave a Comment

The media is buzzing about nuclear power as the silver bullet. Two commercial nuclear power plants are in the process of coming out of retirement.

The odds of the two retired nuclear plants successfully navigating their way out of retirement are high. The Michigan unit (Palisades) won a $1.52 billion federal loan guarantee, $300 million from the state, [significant] tax benefits, and bipartisan support from state lawmakers. In addition, Palisades has already signed long-term Power Purchase Agreements for the full power output with rural electric co-ops Wolverine Power Cooperative and Hoosier Energy, which serve rural communities in Michigan, Illinois, and Indiana. DOE will also provide $1.3 billion in funding to two Michigan area power cooperatives to boost power purchases from the Palisades plant.

The Pennsylvania unit (Three Mile Island) is about two years behind Palisades. Their 20-year offtake agreement is with Microsoft. They may decline federal loan guarantees but take advantage of aggressive tax advantages (federal loans have feisty terms).

Both plants will require extensive and high-paying workforces. They will generate significant state and local property taxes and create economic multipliers for local, state, and regional areas.

While each plant may appear old, its components are relatively new. Over the years, each plant has undergone preventive maintenance that required replacing components and maintaining federal safety standards. While each plant is relatively small (under 900 MW), they can safely run for an additional 20 years with routine maintenance.

The validity of the proposed restart schedules is a question. I wonder if they can access new fuel in time because of a rigid queue to support the nation's nuclear fleet. I also question whether there is enough time to overcome the hurdles of the federal regulator (NRC). These are external activities that developers can manage but cannot control.

The natural question is about other nuclear plants. Specifically, how many more retired nuclear plants can be restarted? The answer is that it depends. It depends on how far a plant has been decommissioned, who owns the title, the degree to which the state supports continued operations, whether government incentives can overcome costs, and how desperate consumers are for power.

David Lillienfeld comments:

I find it hard to believe that the community around TMI is going to accept a restart all that easily.

Carder Dimitroff replies:

Thank you. This is an important point. TMI has two nuclear power plants (two reactors and two generators). Only one unit was involved in the TMI incident. Until it retired in late 2019, the other had operated reliably for 40 years after the incident. It retired for financial reasons, and local property taxes jumped when it did.

Not all, but most communities hosting nuclear power plants appreciated the employment, economic, and tax benefits the facility provided. When plants approached retirement age, community leaders sought opportunities to extend or replace the facility.

With one operating unit, TMI was the biggest employer in the county, with nearly 700 high-paying workers. Local businesses depended on the plant for their economic success. In addition, schools and other government departments enjoyed robust budgets while average homeowners' property taxes remained relatively low.

For these reasons, most communities would likely support continued operations. As always, some will want to see the asset permanently decommissioned. While there are no public safety issues that differ from those of any other nuclear plant, those most concerned about TMI would have moved years ago.

David Lillienfeld responds:

There was a documentary about TMI made in the last decade (I think). There were a lot of local residents who registered anger that the reactors had been built there in the first place. I'm not so confident that they would have moved by now. That said, your comments about the economics make a strong case for moving forward with a restart. I guess the big winners are Microsoft shareholders.

Oct

13

FL insurance markets, from David Lillienfeld

October 13, 2024 | 1 Comment

Milton's travel through Florida had the eye wall intact straight through until it got to the Atlantic. Strong storm. Among the 4 strongest in the history of the Atlantic. One thing is clear though: There's a lot of destruction from this storm.

Hence, I have to wonder if there are going to be any insurers left in the Florida market, and if there are any left, which ones? I'm not sure that those insurers still there will make for good investment, but maybe they'll be able to survive in that market. It just seems unlikely.

Art Cooper responds:

There will certainly be private P&C insurers (in addition to state-created Citizens Property Insurance Company) continuing to do business in FL after Milton, but I strongly suspect they will continue to increase their restrictions on coverage. I understand that many victims of Hurricane Helene who thought they had coverage for its damage are being shocked to find out they either didn't, or did not to the extent to which they'd believed.

Historically, the aftermath of an event causing massive insurance claims is an opportune time to invest in carriers doing a lot of business in the affected area, because marginal carriers cease writing policies, thereby minimizing competition, and the event provides cover for dramatic rate increases. (Buy when there's "blood in the streets".) If you're bullish on the P&C sector, wait till after billions of dollars of claims are made, then try to buy at support levels.

I don't have any numbers on net migration out of FL, but I can attest anecdotally that the pandemic-induced flood into the state has ended. Bear in mind, however, that migration to FL has been characterized by wild swings for the past 100 years, and I'm confident it will continue to be volatile. Weather events such as Helene and Milton, and more importantly the greatly increased cost of homeowner's insurance, will of course be inhibiting factors going forward.

Carder Dimitroff writes:

I understand why some would consider NEE for short positions. I can see why the market might ping them. If the price sinks and the value is right for you, consider buying NEE as others sell.

Why? NEE Florida's assets are regulated. Within the state, they operate on a cost-plus-a-margin basis. They have a good relationship with the state's regulators (the state needs them). Their power plants and wires may be damaged, but the state's ratepayers will likely cover all their losses. There may be a temporary cash flow issue, but even those costs will be covered. For traders, it might take a year for NEE to recover financially.

Oct

12

Asking for recommendations, from Steve Ellison

October 12, 2024 | Leave a Comment

Recommendations for an intro to multivariate statistics?

Bill Egan replies:

Here are four excellent multivariate statistics books I have used for many years. I suggest tackling them in this order.

1. Jerrold Zar - Biostatistical Analysis, 5th ed. (this is half univariate and half multivariate)

2. Neter, Kutner, Wasserman, Nachtsheim - Applied Linear Statistical Models, 4th ed (there is now a 5th ed and you can find the pdf by googling)

3. Alvin Rencher - Methods of Multivariate Analysis (there is now a 3rd ed.)

4. Mardia, Kent, Bibby - Multivariate Analysis (there is now a 2nd ed.)

You need to understand linear algebra to do this, e.g., at the level of Strang's Introduction to Linear Algebra, 6th ed. (his lectures are on MIT's opencourse website). Rencher, Neter, and Mardia all use that notation extensively. You also need to understand and be able to do univariate stats at the level of:

• Snedecor and Cochran - Statistical Methods, 8th ed.

• Riffenburgh and Gillen - Statistics in Medicine, 4th ed.

You will really learn multivariate methods only if you code them. Matlab is the best (Matlab Home is cheap), and yes, I coded everything in these books and a lot more work of my own invention in Matlab.

David Lillienfeld adds:

Snedecor and Cochran is the grand old lady of texts. Neter et al is still pretty popular on campuses.

Asindu Drileba asks:

Concerning statistical packages. I often hear some data science communities complain about how there are simply too many bugs & wrong implementations in the Python space. Maybe this is why you are recommending MATLAB? What do think of R or Julia?

Bill Egan responds:

I have used Matlab since 1993 for many things - research, papers, patents, commercial scientific software products. Matlab stands for matrix laboratory. The original data structure was scalar, vector, matrix. If you like to work in matrix/linear algebra notation, or need to, Matlab is the program to use. Other data structures have been added on, such as tables for mixed data types, but like al ladd-ons, this does not always work well. Quality control of the software is great. Very widely used by engineers. Very high level language, so you can see the algorithm without getting lost in the details like you do in C++.

R is not so good for linear algebra because the original data structure is a table for mixed data types. Matrix work is more difficult. Quality control of core R and major packages is good despite R being open source (although it has license restrictions) because it is used by many academic statisticians. I used R for analysis for a couple of years. Fairly high level language. Better for classical stats work where you make a table out of the data and have mixed data types.

Python is completely open source and the people who created and use it most have no knowledge of statistics and that shows. We used it primarily as a scripting/control language inside one of my software products. Available packages do have bugs/errors or are missing methods for stats. We tested them and could not use them; I had my guys code any stats related stuff from scratch. It is not as high level a language as R or Matlab, so you have to do more work. Do not recommend it.

I have no experience with Julia.

Oct

7

What some Specs are keeping an eye on

October 7, 2024 | Leave a Comment

From Carder Dimitroff:

Note: 1 GW = about 1 nuclear power plant.

US DOE/EIA: Batteries are a fast-growing secondary electricity source for the grid.

Utility-scale battery energy storage systems have been growing quickly as a source of electric power capacity in the United States in recent years. In the first seven months of 2024, operators added 5 gigawatts (GW) of capacity to the U.S. electric power grid, according to data in our July 2024 electric generator inventory. In 2010, only 4 megawatts (MW) of utility-scale battery energy storage was added in the United States. In July 2024, more than 20.7 GW of battery energy storage capacity was available in the United States.

From Kim Zussman:

Argentina Scrapped Its Rent Controls. Now the Market Is Thriving.

For years, Argentina imposed one of the world’s strictest rent-control laws. It was meant to keep homes such as the stately belle epoque apartments of Buenos Aires affordable, but instead, officials here say, rents soared.

Now, the country’s new president, Javier Milei, has scrapped the rental law, along with most government price controls, in a fiscal experiment that he is conducting to revive South America’s second-biggest economy.

The result: The Argentine capital is undergoing a rental-market boom. Landlords are rushing to put their properties back on the market, with Buenos Aires rental supplies increasing by over 170%. While rents are still up in nominal terms, many renters are getting better deals than ever, with a 40% decline in the real price of rental properties when adjusted for inflation since last October, said Federico González Rouco, an economist at Buenos Aires-based Empiria Consultores.

From Asindu Drileba:

Charles Piller and the team here at Science dropped a big story yesterday morning, and if you haven't read it yet, you should. It's about Eliezer Masliah, who since 2016 has been the head of the Division of Neuroscience in the National Institute on Aging (NIA), and whose scientific publication record over at least the past 25 years shows multiple, widespread, blatant instances of fraud. There it is in about as few words as possible.

It turns out that alot of FDA drug approvals where based on this guy's research (a few listed in the article). I wonder what effect it may have on pharmaceutical businesses based off his research. Imagine spending decades & billions on a drug whose prior research turn's out to be completely forged (photoshopped images). This looks really bad for the Alzheimer's drug focused pharmaceutical industry.

From David Lillienfeld:

This is a comparison of international drug prices. U.S. gross prices are higher than those in comparison countries for all drugs and for brand-name originator drugs but lower for unbranded generic drugs.

Sep

28

What is in Brooklyn?, from Asindu Drileba

September 28, 2024 | Leave a Comment

Lana Del Rey — My boyfriends really cool, but he is not as cool as me. Cause I'm a Brooklyn Baby. An interview recently posted here with The Chair — "I attribute your being humble to being from Brooklyn" (interviewer referring to The Chair). Another person I listen to - Such mistakes can only be made by people who have not spent a lot of time in Brooklyn. Brooklyn comes up so many times. What's is there to know about it? Of course I have heard of people talking about other cities.

But people that talk about Brooklyn always say it like there is something they know which others don't know. What is in Brooklyn? What does it do to people?

David Lillienfeld adds:

In the epidemiology world, when one of the organizations meets in Manhattan, inevitably someone will suggest to the younger members to go across the Brooklyn Bridge and experience Brooklyn. There is definitely something about Brooklyn that focuses one's thoughts.

Steve Ellison offers:

The Chair wrote a whole chapter on this topic, the first chapter of Education of a Speculator, titled Brighton Beach Training.

Laurel Kenner suggests:

Survivors go there when they get to America.

Alex Castaldo responds:

Agreed, immigrants from Central and Eastern Europe often arrived in Brooklyn as a first step towards success and acceptance in America.

H. Humbert writes:

There is a hierarchy among the real estate developers of New York. Those who develop real estate (especially large commercial buildings) in the central area (the island of Manhattan, also known as New York County) consider themselves socially above the multimillionaires who develop property in the boroughs of Brooklyn, Queens, Bronx and Staten Island. They refer to Manhattan as simply "the City" and seldom go to the other boroughs (other than to take an airplane at LGA or JFK airports, which are in Queens).

Donald Trump's father was a developer of large number of properties all of which were in Queens and Brooklyn and he considered Manhattan development too financially risky. He was quite wealthy but in view of the above was not considered a "major New York developer", like Roth, Reichmann and other well known names.

His son Donald was very ambitious and wanted to move up in society. Contrary to his father's policy he took a gamble and decided to put up a large building, the Grand Hyatt Hotel on 42d street in Manhattan. The project was completed in 1978 and Donald Trump joined the ranks of major NY real estate developers. (What the other developers thought of his operation is another subject and requires a separate article). Even if he wasn't fully accepted by all, when his daughter married a member of the Kushner family, another prominent Manhattan developer, a few years later, it confirmed that the Trump family had reached the first rank among New York's wealthy families. But Donald Trump, having overcome his Queens handicap and shown that he could do better than his father, was not quite satisfied and he decided to enter national politics.

In summary, there is a slight prejudice against people from Queens and Brooklyn, which sometimes causes people to be even more motivated to succeed and be accepted.

In addition Brooklyn has its own distinct accent, which causes the prejudice to be slightly greater. If you would like to know what a Brooklyn accent sounds like you can listen to any speech by Janet Yellen. When she was in line for a top job in Washington, a previous Treasury secretary (probably hoping to get the job himself) mentioned her accent as a reason she should not be appointed. She got the job anyway. Another success for Brooklyn.

Jeff Watson gets musical:

Steely Dan nailed it.

Sep

25

Smörgåsbord

September 25, 2024 | Leave a Comment

Jeff Watson likes info on the softs:

Here’s a copy of a magazine that offers a high level view of all things agricultural:

Carder Dimitroff is watching lithium batteries:

Utility Dive: Lithium battery oversupply, low prices seen through 2028

Despite falling raw material costs and U.S. policy support, North American battery suppliers are delaying or canceling planned capacity investments

Bloomberg: Why Public EV Chargers Almost Never Work as Fast as Promised

Most public machines in the US average about half their maximum speed, a gap that risks hindering further adoption of electric cars.

David Lillienfeld follows pharma:

Immuno-oncology drugs have changed oncology and required rewriting of many sections of medical texts. They have created a revolution. That doesn't mean they are without downsides.

A decade of cancer immunotherapy: Keytruda, Opdivo and the drugs that changed oncology

Medicines that can rev up the immune system against tumors have reshaped expectations of what cancer treatment can accomplish. Their success has hit limits, however.

Jan

30

Sad News from the Diamond, from David Lillienfeld

January 30, 2019 | Leave a Comment

For those who did not live in Baltimore in the 1960s, it is difficult to adequately explain the significance of Frank Robinson's arrival in Charm City in 1966. Sure, Brooks Robinson, in his MVP season practically carried the Orioles into the post-season, before the Yanks saw fit to destroy that dream in the 1964 season. The Colts were the sports team of Baltimore. They were one of the powers of the NFL. Johnny Unitas was so revered by boys under 13 that half of them sported the same crew cut that Unitas wore. The Colts were in. The Orioles? Well, it was a fun afternoon with your dad in the bleachers.

For those who did not live in Baltimore in the 1960s, it is difficult to adequately explain the significance of Frank Robinson's arrival in Charm City in 1966. Sure, Brooks Robinson, in his MVP season practically carried the Orioles into the post-season, before the Yanks saw fit to destroy that dream in the 1964 season. The Colts were the sports team of Baltimore. They were one of the powers of the NFL. Johnny Unitas was so revered by boys under 13 that half of them sported the same crew cut that Unitas wore. The Colts were in. The Orioles? Well, it was a fun afternoon with your dad in the bleachers.

Frank changed that. He taught the Birds how to win. The clubhouse loosened up as the 31 year old would demonstrate that he wasn't over the hill, that the Reds made what may have been the second worst trade in baseball history. The 1966 season put his talents—defensive as well as offensive—on display. Back when the Grey Lady on 33rd Street was still standing, aka Memorial Stadium, there was a pennant on the outer rim of the building somewhere just behind about the middle of left field, flapping in the breeze. It was black, and on it was "HERE" in orange. That's all it said. Nothing about the 586 feet shot that Frank hit clear out of the park—the only ball ever hit outside of the Stadium.

Robinson's career was tied up with the Orioles well beyond his playing days. He was the Bird's manager during one of the worst season starts in baseball history. He also did much in fostering the desegregation of Baltimore.

It seems that Frank Robinson, one of the great competitors of baseball through the ages, is ailing. The specifics are not, as yet, known. Let's hope that this baseball GOAT is still with us for many years to come.15 days until Orioles pitchers and catchers report.

Play ball!

Dec

25

Contrarian Indicator, from David Lillienfeld

December 25, 2018 | Leave a Comment

If there were ever a contrarian indicator of a down market in 2019, this may be it. The number of analysts predicting a down market in 2019: zero. (From Twitter)

If there were ever a contrarian indicator of a down market in 2019, this may be it. The number of analysts predicting a down market in 2019: zero. (From Twitter)

Ralph Vince writes:

My numbers call for at LEAST a 40% move from here (closer to 50% really, but even that sounds crazy to me), and no prospect of a recession until at least 2021 more likely at least 2022 at this point.

David Lillienfeld writes:

With a tightening Fed (not the discount rate, the inventory)?

Stefan Jovanovich writes:

Yes.

Sentiment, by any measure I keep, is as bad if not more so than it was in 08 — but the backdrop, not just in the credit markets but in terms of energy, corporate profits, etc., profoundly different than 08, and the drop is minor by comparison. Further, unlike '08, earnings continue to grow, even over this past week.

Capital must find a home, must seek a return. Cash is a temporary placeholder, cover for the rainstorm, and for liability-driven fiduciaries, a very temporary one when you have >4% annual liabilities. How would you manage a pension in Germany or Japan? The US capital markets, with our rich return on treasuries across the maturity spectrum and equities markets that have increasing earnings are the most viable place on the planet.

And all this has come about as QE has ended, ZIRP has snuck out of it's hole to viable, st rates, and a divided congress, who needs to spend and screech like a middle-aged woman who is about to cough up her gizzard, will only find common ground on a pending transportation bill (think QE4), so "yes," to your question.

Sep

7

Letter from Union Street, from David Lillienfeld

September 7, 2018 | Leave a Comment

Today is my (our, I guess) 29th anniversary. To celebrate, we decided to go the day before up to San Francisco. Sunday rather than Monday since the parking is better. One of the first places in San Francisco we went when we first met and came out west to visit friends was Union Street. It's a nice shopping district. Lots of nice cafes. Perfect for a Sunday. (Granted, it's summer, so the city was a tad cold, and the stiff breeze didn't help, but still, it's San Francisco. The place of lonely hearts (well, they're out on a hill, so they must be lonely. Or at least alone.)

Something seemed strange to me though. In 5 blocks, I counted 12 stores available for lease and 5 available for sale. Empty stores. That's unusual for this street. Three years ago, it was bustling. Today , not so much. Not many people walking on the street either. Schools reopened a couple of weeks ago, but maybe everyone is coincidentally taking off at the same time. Probably not, though.

I made a similar observation in May on upper Madison Avenue in Manhattan. Both are places where traditionally, it's been pretty easy to fill an empty store. Sure, those are places that are a bit expensive, but in San Francisco at least, there's lots of money floating around the city. That money is going somewhere. It's not all for 80 inch monitors. Union Street tended to get its "fair share" in the past. Consumer confidence is at record highs. I know that Amazon and the rest of the net has taken over much of retailing, but there's still a need for neighborhood shops for impulse purchases—as in, " forgot it's our anniversary." Or "If I don't do something for her birthday, it'll be a week of sleeping on the couch."

I have to wonder, then, as the Fed drones on about the need to hike, if the economy really is as healthy as many suggest. After all, 20 years ago, when the same measures used today were in use, it wasn't a gig economy. The Fed may have hiked, but it wasn't concurrently selling off its portfolio of debt instruments. And while there are lots of "for hire" signs out, the wages of a given job may not be what they once were. Just some observations and speculations.

Peter Drucker used to note that if what you see doesn't agree with the data at hand, maybe the data at hand are misleading. I have to wonder if the same thing is going on here. The numbers look good, but is the economy really as good as the numbers suggest? If it is, why are the shops now empty? 6 mos to a year ago they weren't. Did Amazon move that fast? Maybe, but somehow, that just seems unlikely. The disruption in retail has already hit the bricks and mortar stores. Except for Sears, which seems to have missed the memo.

Or is the Fed really justified in raising rates, as it did in 2007 and 2000 and 1990?

Mr. Isomorphisms writes:

Low interest rates benefit only those who have access to them (established firms). Another decade of QE wouldn't help America's poor; only change can do that.

Alan Wolfe, in "the seamy side of democracy", argues that the USA is a story of conflict between stability and freedom–and that stability has always taken precedence. This was 1973.

Yes, people can and do take dogsh__ companies public (doesn't make their bonds good), but that's still different from healthy capitalism. Dynamism requires failure. With regard to everything being expensive but empty, I posted a note about Al Jazeera east 101's takes on paper holdings of China's million millionaires. As a simplistic story, ask yourself where the USA's lost manufacturing wealth 1980-2010 went. Then ask where they park their money. Vancouver is one answer for Chinese wealth. London/NYC are an answer for Saudi money. Qatar had the good sense to make their own BBC, investing in people instead of buildings.

Then turn in your copy of Sidney Homer's history of interest rates to the part where a Swede buys California ranching property based on figures, with no knowledge of how to run the thing.

anonymous writes:

It is easy to get caught in the echo chambers of the two coasts. I've often heard, but only recently, recently how "nice" people are in the Midwest and South. Foreigners here in Los Angeles are frequently replacing locals who are leaving for many reasons. My town's Chinese population has jumped dramatically in the last 18 months.

Stefan Jovanovich writes:

Data from IHL: "Grocery, drug stores, mass merchants/supercenters, and convenience stores are adding a net 2,694 stores in 2018 on top of 3,115 net new stores in 2017. Department stores, specialty soft goods (apparel, shoes), and specialty hardgoods (DIY, electronics, sporting goods, books, furniture) are closing a net 682 stores in 2018 on top of 2,557 net closings in 2017."

Henry Gifford writes:

High end retail areas in New York City, such as Madison Avenue (as mentioned on this site a couple of days ago) have higher vacancy rates than last year. But, retail rents outside of the 6 or 8 fanciest areas went up since a year ago, and vacancies remain fairly low.

All I've written above is to be taken with a grain of salt, however, as nobody really knows what retail rents go for, and even vacancies are hard to track with the increasing popularity of temporary (pop-up) stores. Apartment rents are easy to track, but retail leases usually include the building owner spending some money on repairs/buildout, and the owner usually gives some months of free rent. Owners used to bring electricity and water and sewer into retail spaces, and maybe nothing else, but now more and more owners pay large sums of money toward the cost of building out a space.

The reason is that the more money the owner pays, the higher the rent will be, and thus the larger the mortgage the owner can get on the building - based on the reported rent. If/when mortgage rates change, or mortgage availability changes, owners will pay more or less toward buildouts, and the retail rents will change accordingly, making any effort to track retail rents very difficult.

Aug

19

The Hapless 2018 Baltimore Orioles, from David Lillienfeld

August 19, 2018 | 1 Comment

/cdn.vox-cdn.com/uploads/chorus_image/image/59049391/856025960.jpg.0.jpg) For those on the list following the Birds, they are finally above .333 on their win-loss percentage. But I have great faith in these boys of 2018, and if they make an effort at it, I'm sure they will continue to pursue and exceed the 1962 Mets record for the most losses in a season (at least I think it's the Mets). After all, those arms are only going to get weaker with the further along we go in the season. Not that they were ever strong to begin with. Actually, pretty weak to begin with.

For those on the list following the Birds, they are finally above .333 on their win-loss percentage. But I have great faith in these boys of 2018, and if they make an effort at it, I'm sure they will continue to pursue and exceed the 1962 Mets record for the most losses in a season (at least I think it's the Mets). After all, those arms are only going to get weaker with the further along we go in the season. Not that they were ever strong to begin with. Actually, pretty weak to begin with.

There is one upside to this season of ignomy: It is almost impossible (though I'm sure there may be only a non-zero (read: epsilon) chance) to imagine the GM Danny Duquette surviving into next year. Even Peter Angelos will be hard pressed to excuse the miserable team that goes under the name of the Baltimore Orioles.

And when the end of the season comes and the Os have successfully displaced the 1962 Mets, I suggest noting the epicenter of the strongest earthquake experienced on the East Coast of the United States in millennia. It will be at Earl Weaver's grave.

Mar

17

Theranos, from Garrett Baldwin

March 17, 2018 | Leave a Comment

This IBD article proves how easy it is to manipulate the press with hyperbole and misdirection.

"Theranos Founder Known as Next Steve Jobs' Pays $500,000 to Settle 'Massive Fraud Charges'"

"The next Steve Jobs"

Uh huh.

One should be less biblical in their retorts when another person questions the next tech craze or the sanity of capital pouring into an idea that is too good to be true on the surface, and transparency issues around data make it impossible to reach a solid conclusion.

I find this one especially close to another big name in the tech space whose promises continue to under deliver… yet his moonshot ideas allow him to burn through other peoples money…

Thanks, CNBC.

Henry Gifford writes:

I don't think Theranos is a scam.

As soon as I heard about the company's plans to sell blood tests that are much less expensive, and easier to do, and maybe better in other ways, I thought about all the companies that would be hurt by them, and how heavily regulated those companies are, and how hard those companies will fight back, presumably using regulations as part of their defense.

Then I looked and saw the founder has three strikes against her: she's female, she's good looking, she's young. This shouldn't make any difference, but when combined with being an industry outsider, the jealousy factor can be expected to go up, and the ease with which entrenched companies can create doubt and negative publicity is I think greatly increased.

An early battle the company lost was when the regulators declared that the small container they collect blood samples in is a "medical device," and therefore subject to all sorts of regulations, thus they are not allowed to use it. Sure smells to me like regulators looking for something to start a fight about – how many years could the regulators cut off the company's cash flow while they consider the regulatory merits of a small plastic container which will not contact the body? I didn't hear anything about blood collection containers having previously been regulated, so this is extra perfect – it will take a few years to write the regulations….

When the gloves came off and the regulators cut the company down to being allowed to sell one test only – for herpes – I thought that was perfect – the company from Stanford and Palo Alto with the young founder is now associated with a sexually transmitted disease, but barred from testing for glucose, etc.

Looking at the recent press gives me many reasons to be skeptical that the recent reports of fraud are accurate, or have any merit at all.

One article entitled something like "Patients get different test results with Theranos vs. hospital labs" quoted one patient as claiming a potassium test was about 11.3 with Theranos and 9.6 (or so, as far as I remember) with a hospital lab (implied as being the gold standard). Nothing about what they normal variation is, which I understand is significant, or what period of time elapsed between tests, or what the results might have been with 10 or 100 tests done with each technology. The other patient quoted said she got a glucose reading of 103 in a hospital, and 96 (or 99?) from Theranos. Glucose levels in blood can be expected to change by at least that much after a patent walks across a parking lot, even if every test was going to give the same result every time. No article I saw had any other "bad" numbers quoted, but they still made this sound horrible.

The actions of the regulators were described in one article as "State and federal authorities started investigations into the accuracy of the company's blood testing work. In 2016 the Centers for Medicare and Medicaid Services, which oversees blood testing labs in the U.S., banned Holmes from operating a lab and revoked Theranos' blood testing licence." The first sentence describes the beginning of the process, and the second sentence described the end of the process. There was no mention of anything in the middle – did they find anything? If so, what did they find? Was the suspension of the blood testing license related to anything they found other than non-compliance with the declaration that the sample container was a medical device that should be regulated? If they found anything wrong, why was this not mentioned in this article or any other I've seen?

The company, in their defense, claimed to have offered to demonstrate the machine in the offices of The Wall Street Journal, and provided or offered to provide thousands of test results and etc. evidence that their technology worked, but reportedly got no response.

Most recent articles quoted several people as not having been able to find out anything about how their new machine works. Neither journalists at The Wall Street Journal nor anyplace else could find out anything, or find anyone who knew anything. This is consistent with the box the company came up with being a hollow cardboard box, or some other fraud. But, I know how to find out what is inside the box, and what is inside the company's labs. With a quick search I found about 190 patents assigned to Theranos, all for technologies related to what they claim they are doing. I know a thing or two about patents, and a couple of years ago I read some of the patents assigned to Theranos, including some whose inventor was the company founder (there are many of those). The patents are complex but I think mostly well written – this I think says a lot in a field where I think most patents are so poorly written they are worthless. Theranos hired an expensive law firm that specializes in bio patents – a good sign. The US Patent and Trademark Office makes about as many mistakes as any other large organization, but probably not more, and is not quick to grant patents that do not meet the standards, including not being anticipated by prior art – someone else's idea that came first. Getting patents means they probably came up with something. The patents are mostly different enough from each other to not be minor variations on the same theme. Getting about 190 patents, a huge number, means they are apparently working hard and really coming up with things. Many things, probably very valuable. But, most importantly, anyone who works in bio or writes regularly about bio and claims they have no idea what Theranos is doing, and has no way of finding out what Theranos is doing, is not making any mistake – they are lying. They are surely lying because bio is a field that is very dependent on patents. All the articles I've read are consistent with 100% of the people quoted knowing the company has many patents in their core area, but playing dumb and lying by claiming to have no idea what is going on. The existence of the patents means that if they are good patents, which I expect they are, Theranos really has a lock on much better blood tests for years to come. I think it is quite possible that Theranos came up with much, much better blood tests, so much better that they could dominate the field for decades to come (as old patents expire then-current and evolving technologies are covered by newer patents). All evidence I have seen points to this being possible, and not unlikely. If this is the case, then the real story is as follows:

Young dropout comes up with much better blood testing methods, gets strong patents, raises money and actually brings the technology to market fairly quickly – patents, company, and sales, the unusual dream come true, actually done at lightning speed in an industry where patents are almost expired when products come to market (drugs, frequently). Founder stacks the board with powerful people that are not industry insiders, to help defend against the inevitable attacks from the entrenched competitors. Regulators and competitors in one of the most regulated industries can't find any real problem, so they invent a technicality related to exactly what makes the company special – the small collection container. Then they allow the company to test only for a sexually transmitted disease. Fill in the details after this.

Then they find the founder guilty of fraud – but no news reports explain the nature of the fraud, or mention any law or regulation that was broken. Perhaps the fraud was using the small sample container without approval before the approval was required?

I don't know the real story, but none of the stores I've read ring true.

I suspect the real fraud is what the regulators have done, and what the competitors continue to sell while better technologies exist.

anonymous writes:

I always love a good contrarian position, so thanks for posting yours. Here is what I don't get:

She wasn't doing this on a shoestring budget. She has hundreds of millions.

If the thing works, couldn't she just show the world?

If the thing works, wouldn't Walgreens be out there saying "no wait, this thing works everybody, we of course tested it before we entered into an agreement with Theranos"?

David Lillienfeld writes:

I'll go beyond that: Not everyone in the valley was pushing to get into the company. There were many who weren't. That's in contrast to, say, 23andme a decade ago or Gilead a couple of decades ago.

The first BoD was stocked with major names in American politics–with absolutely little if any healthcare expertise. Maybe that makes sense to some, it doesn't to me. George Schultz may have been a great SecState, but I fail to see the value add for healthcare. Maybe because it's simply not there. It's not always a matter of hearing the right answer as even knowing what are the right questions to ask.

As for shoestring budget, the office bldg. (I pass it every day) sits on a commanding bluff on Page Mill and Porter. It's hardly low-cost. The company may not have spent like drunken sailors, but low budget doesn't seem to have been its thing either. Not Brooks Brothers, not Jos A Banks, maybe Paul Stuart. I guess the finance people could be grateful it wasn't Savile Row.

Now, let's look at the founder. She has little knowledge of the deeply regulated environment that is healthcare in the US. Rage against those regulations all you want, they define much of the marketplace. Her age means she hasn't lived through the inevitable crises in the healthcare world, for which knowledge of FDA, EMA, ECs, IRBs, etc is invaluable. Think it's an accident that there are very few young CEOs in the biotech world–start-ups or otherwise?

Think surgeons. Do you want the surgeon who just finished her training to do your Whipple procedure, or the chief of surgery? I'll take the latter, just as I'd prefer the former for my appendectomy. Theranos was a Whipple–high risk, big potential reward. Age wasn't in her favor. Enough said.

I'll leave aside the scientific basis for Theranos's products–it simply wasn't there.

As I put it to someone else on the list who asked me for an evaluation of Theranos a few years back when this person had been approached about making an investment in the company, if something looks too good to be true, it probably is.

Dec

7

Bugs and a Bad Cancer, from Kim Zussman

December 7, 2017 | Leave a Comment

"Researchers find bacteria tied to esophageal cancer"

December 1, 2017

David Lillienfeld writes:

There was a Nobel award in the early part of last century for the discovery of the bacterial cause of cancer. The work was subsequently found to be deficient.

anonymous writes:

If they give Nobel Prizes for common sene then my Grandfather should receive one. As a nine year old boy I was heartbroken when my Granddad told me that our black Lab Duke was sick and not going to get better. I asked him what was wrong and he told me he had cancer, a sickness where the body turns against itself with healthy tissue being taken over by the disease. "Why? What causes this?" I asked. "Well it was probably from his food (diet) or on the instructions he got from his mom and dad since he was a puppy (ie. Genes)".

So why do humans get cancer? Same reason: our diet and our genes. Why do elephants not get cancer? Going out on a limb here… their diet and their genes.

The highest rates of cancer outside of humans in higher order species are the very ones in which we human control the diet: livestock and pets. Given that dog's frequently consume the scraps of their human family's meals one would EXPECT to see a significant correlation to diet induced disease. Veterinarians note that cancer has become much more prevalent in man's best friend in the last half century and again–Captain Obvious–it has also increased discernably in man.

Nov

6

The Silence is Deafening, from Tim Melvin

November 6, 2017 | 3 Comments

Do you hear that?

This new and sudden silence is deafening.

No crack of the bat. No slap of the mitt. No murmur in the stands. No roar of the crowd. No police whistles as they break up a fight at Citifield. No melodious tones of the announcers as they describe how the pitcher overcame juvenile explosive diarrhea to attain Major League success. Hell, I would go even put up with Joe Bucks annoying cadence and nonsense of the would turn the lights back on and open the turnstiles once more. But it is not to be. The 2017 baseball season is gone now. It had a good, exciting long life-extending as far as the rules allow but it has left the world leaving us only memories of its glory and grandeur. Spring training is 100 days away, and the silence is deafening.

Gone are the bright colors and melodic songs of the Blue Jays. Cardinals and Orioles. The Marlins and Rays scamper among the waves no longer. The Padres and Mariners have both ended their voyages for now. Though they are champions only memories of the Astros light the night sky now. The Rangers and Indians alike have retreated from the plains. The delights of spring and summer are gone once again along with the extreme passion and grand intensity of October.

Ahead lies only winter with Timberwolves, Grizzlies, Warriors, and Raptors to hold our attention to any degree. They won't work for me as I find most NBA basketball to be absolutely unwatchable on TV. One can almost succumb to tears comparing Havlicek, Monroe, West, Frazier, Bird, and Magic to the run and slam version of the game played today. I must confess I do watch the highlights most nights but a whole game would be too much for me.

I have pondered my loss of interest in the NFL a great deal. Part of it is the fact that the game is shit. The referees seem to be determined to have more airtime than the two starting quarterbacks and flags fly out more consistency that many airlines have ever shown. While I am a fan of celebrating achievements watching some idiot do a victory dance because he sacked the quarterback while his team is losing 31-7 late in the 4th quarter disgusts me. If we are honest, it is just not a very good game anymore.

Part of it I think is social. Football is an excuse for the single, or no kids crowd to head to the bar at noon on Sunday and avoid the emptiness of an apartment on Sunday with no work or events to distract you. It is something to do when the snow is up to the low edge of your ass, and the idea of venturing outside is about as welcome as inviting a politician to dinner. It helps pass the winter and gives you something to think about besides frozen pipes salted driveways.

I am now married these past seven years and live in Florida. I am not a big fan of day drinking unless I can get a nap before dinner, so I don't head out to the sports bars much anymore. There is always something to do in Florida and weather that allows you to do things.

I am sure it is a combination of things, but the NFL just does not hold my interest. I follow and watch Notre Dame and Navy at the college level but have no interest in the pro version of the game. No, baseball is the game for me. An evening with a book, while the games played on the TV, has been the preferred activity of many of the last 249 days. Checking the MLB app on a regular basis when the wife wants to watch something else has also been a significant part of my life. Games on the radio version of the app while running around town doing errands while engaging in Florida things has also been a regular activity. Now, that's over. One catch, one toss from Altuve to first base and baseball is over. No more home runs, double plays, dumb baserunning, brilliant pitches, astounding catches, stretching a single or stealing a base. No more second-guessing the manager, yelling at umpires encased in my flat screen or wondering how in the hell Chris Davis could let that pitch go by without swinging. No more box score searching, mathematical determinations of how we can catch the division leaders with a little run of luck. There will be the hot stove league, trades and all sorts of managerial stuff going on all winter to follow. I will probably go sit at the bar during the Winter meetings next weekend to get a little fix. But none of it will enough.

The silence is deafening.

Stefan Jovanovich writes:

There is the NHL - where all the fans and players stand for 2 national anthems whenever American and Canadian franchises compete and they know the words to both. It is the only team sport other than baseball where 1 player–pitcher, goalie–can single handedly lead a weaker team to victory–something neither Michael Jordan nor Barry Sanders could do.

Tim Melvin writes:

I have gone to some minor league hockey games and enjoyed them…but find the sport unwatchable on TV. The only ice I want to see most of the time is my glass. While I am watching a baseball game.

Oct

13

From Our SF Bay Area Correspondent, from David Lillienfeld

October 13, 2017 | Leave a Comment

Here in Shangri-La, aka the SF Bay area, the air is full of the smell of oak. Burned oak. What you might smell if you're downwind of your neighbor burning oak logs in the fireplace to warm a house in winter (the few times one needs to do so in these environs) as I do. It can be a pleasant enough smell. Except in this instance, it's the smell of communities dying. Or at least undergoing significant body blows. The concentration of particulates in the air south of San Francisco is high—among the highest recorded in the SF Bay area. Ever. My wife tells me that trying to run in it is at best challenging. She gave up after a half mile. I don't run, but I can attest to the effects based on how sore my eyes have felt when I've been outside for more than an incidental period for the better part of the week.

Here in Shangri-La, aka the SF Bay area, the air is full of the smell of oak. Burned oak. What you might smell if you're downwind of your neighbor burning oak logs in the fireplace to warm a house in winter (the few times one needs to do so in these environs) as I do. It can be a pleasant enough smell. Except in this instance, it's the smell of communities dying. Or at least undergoing significant body blows. The concentration of particulates in the air south of San Francisco is high—among the highest recorded in the SF Bay area. Ever. My wife tells me that trying to run in it is at best challenging. She gave up after a half mile. I don't run, but I can attest to the effects based on how sore my eyes have felt when I've been outside for more than an incidental period for the better part of the week.

This invasion of particulates has its origins in the North Bay, with those particulates noted (and impactful) 80-90 miles to the south in the South Bay. In the North Bay, the area is known as Wine Country. One of the tourist Meccas of California. Fire. Lots of fire. We have such fires on a regular basis across the state. When I lived in San Diego a few years back, we had such fires just northeast of the city. At their height, the fires were moving a football field every 5-10 minutes. We were about 7-8 miles from them—you could smell the burning wood but no vision of the fire. That didn't mean there wasn't concern. Sometime one afternoon, the local authorities concluded that with the breezes would push the flames across I-15, where a last ditch effort was being mounted to staunch the spread of the burn. Evacuations were ordered.

It's one thing to see an evacuation like that in New Orleans in the wake of Katrina. It's another to be part of one. In this case, 750,000 plus persons evacuated. Going up I-5 near Camp Pendleton. Something I can't recommend as one of those life experiences to be savored.