Dec

20

Another amazing measurement: LIGO, from Alston Mabry

December 20, 2025 | Leave a Comment

The Absurdity of Detecting Gravitational Waves

The LIGO site.

May

18

RIP “macher”, from Big Al

May 18, 2023 | 1 Comment

Many meals for a lifetime in this long interview with Sam Zell, which starts at about the 7:35 mark.

Many meals for a lifetime in this long interview with Sam Zell, which starts at about the 7:35 mark.

Historical insight: His father and mother escaped from Poland to Lithuania as the Germans were invading in 1939.

His father had been getting ready to leave because he saw what was coming and he tried to convince his extended family to leave, too, but their view was that life had been better under the Germans in WWI than it had been under the Poles, so it would be better to stay.

Zell's father had been paying attention to what had been happening in Germany, but he couldn't get them to join him.

Sep

27

Paying the vig in the Royal Navy, from Alston Mabry

September 27, 2022 | Leave a Comment

The historical moment is France's declaration of war against England and Holland in 1793. From Cochrane: Britannia's Last Sea King, by Donald Thomas, p. 37:

However, a young officer in Cochrane's position, joining the navy with a hope of enriching himself with prizes, faced a more powerful enemy than France or Spain, and one whose weapons were a good deal more sophisticated: the Admiralty and its prize courts. In the view of many serving officers, these courts were at best unsympathetic and, all too often, cynically corrupt. It was relatively common for a hopeful young commander and his men to find that, after a hard-won capture, the Admiralty proposed to appropriate the entire value of the prize. It was always open to the heroes to fight for their claim in the prize court. But even if they won the case, they might hear that the cost of the proceedings had swallowed up more than the sum due to them, so that they were now in debt to the court as well as having been robbed of the proceeds of their valour.

A man might complain publicly or privately against the prize system. But before he set himself up as a "sea lawyer", he was well advised to remember that this very employment, let alone his promotion, lay in the hands of the Admiralty itself. In consequence, there was a good deal of private grumbling and very little public campaigning.

Vic writes:

very much like the market where often the only way to receive or fight back is to sign away your rights in a preliminary hearing or arb.

Sep

16

Federer adieu, from Duncan Coker

September 16, 2022 | Leave a Comment

Market declining in sympathy with announced retirement. I was lucky to see him play on several occasions. A great player and a great gentleman to the game. What a backhand, and what a forehand, serve, volley, footwork, strategy and touch.

Alston Mabry adds:

Farewell address, very classy.

Bud Conrad agrees:

Yes. Classy.

Laurel Kenner recalls:

My tennis teacher knew him and said he never swore.

Sep

3

Tiger Management founder Julian Robertson dies at 90, from Nils Poertner

September 3, 2022 | Leave a Comment

Tiger Management founder Julian Robertson dies at 90

I enjoy reading obituaries because there is a series of events that we use to describe a person - at the same time there is this internal rollercoaster of emotions going on - which we never know.

Alston Mabry adds:

From the NYT obit:

“I had become convinced that the hedge fund was the way to invest,” he

recalled, and that short-selling was “a license to steal.”Mr. Robertson prospered, but in the mid-1990s his performance grew

ragged amid the mania for untested dot-com stocks. Investors withdrew,

and in 2000 a baffled Mr. Robertson, his strategy no longer working,

closed shop.“There is no point in subjecting our investors to risk in a market

which I frankly do not understand,” he told investors.In a 2004 biography, “Julian Robertson: A Tiger in the Land of Bulls

and Bears,” Daniel A. Strachman quoted Mr. Robertson as saying, “The

mistake that we made was that we got too big.” This meant, he added,

that “to make it meaningful we had to buy a huge amount of a company’s

stock, and there were only a few companies” where that was an option.

Easan Katir remembers:

While on a road show pitching a private equity deal in 1989 I recall a rendezvous Dean Witter had arranged at Tiger Management. I briefly chatted with Julian. He handed us off to a few of his cubs for the meeting. RIP, Julian.

Sep

3

Reading upside down, from Zubin Al Genubi

September 3, 2022 | Leave a Comment

I was reading upside down to a grandkid today. Its an interesting exercise. Requires a mental readjustment. I recall some people looking at charts upside down. They are not the same. The Beatles and Jimi Hendrix used to play recordings of guitar played backwards. Bach used palindromic music. Also an interesting effect requiring a mental shift. This kind of exercise is good for the mind.

Alston Mabry responds:

In learning science this is called "disfluency." If one group reads some material normally, and a second group reads it upside down, the second group will have significantly better retention of the material over any given time frame. It's been done with things like normal type vs funky, hard-to-read type, as well as clear type versus fuzzy type. The group that struggles more mentally to read the material demonstrates greater retention.

Zubin Al Genubi adds:

In the book Why We Sleep he says a full night's sleep after learning helps retention by over 40% over all night crammers.

Nils Poertner writes:

reading a text upside down can have other positive effects, eg:

1. pay attention to the white between the black ink letters,

2. then turn it right again and read the text

3 reading is then typically easier

we all learn to read letter by letter. "w" "e", too, but overtime we tend to rush things and want to grasps whole words and lines but vision is all about habits and a lot more than reading a text.

smart phones support bad visual habits , as one is tricked to look at the whole text at once - but we need to practice the art of looking at details -at least from time to time, too, and to remember it. we got to remember things- memorize - that gives us the speed later. and first, we got to relax the visual field /brain (looking at white spaces is just one way to achieve it- there is a lot more one could say - see Bates method uses micro print for visual relaxation- yes micro print).

Easan suggests:

The advent of inverse ETFs helps look at charts upside down, doesn't it?

Jul

17

The marvels of human achievement, from Gary Boddicker

July 17, 2022 | Leave a Comment

Always progressing. Meals for a lifetime can be found in this story of a mathematician. Not settling. Changing in midstream. Not accepting norms. Intense focus. Then passing it on to the next generation.

Alston Mabry adds:

A trader should enjoy numbers:

A Solver of the Hardest Easy Problems About Prime Numbers

On his way to winning a Fields Medal, James Maynard has cut a path through simple-sounding questions about prime numbers that have stumped mathematicians for centuries.

Dec

12

Arrival of the Queen of Sheba - G.F. Händel, from Nils Poertner

December 12, 2021 | Leave a Comment

A music piece by Händel - the Arrival of the Queen of Sheba. One could tell that the organ player is enjoying himself.

So many of us finance do terribly well - financially speaking. But then we see it as toil. Some go to the theater or listen to concert in the eve- but perhaps we got it all backward then?

Laurence Glazier writes:

Let’s remember that Handel was enjoying himself too.

Nils Poertner replies:

Wasn't he a pretty good investor as well?

Most (good) musicians experience life in greater fullness than ordinary folks (like us) and express it via their music, eg, the late US singer Johnny Cash…same thing with him. also good lyric with toil and feeling depressed and the sun comforting him etc. some of my more narrow minded friends are like: "I am rich, I can buy happiness." No, you can't. It is an illusion.

Vic adds:

i listen to verdi whenever i need cheer. every one of his arias and chorus pieces is bite sized to enjoy. verdi was a genius in all things like mozart and brahms. a great investor also was about the richest man in Italy when he passed. maintained amazing secrecy about his mistresses also.

Jeff Watson offers:

Whenever I need cheering up, I listen to Steve Fromholz sing his epic Texas Trilogy, and his Man With a Big Hat. (If that one doesn’t bring a tear to your eye, have someone check you for a pulse.)Beautiful music that celebrates real men, freedom, and the open range.

Adam Grimes writes:

Thank you for the share, Nils. This is a fun piece… I've played arrangements of it literally hundreds of times in church services and weddings, etc.

By the way, if any of you play piano, Handel's keyboard music is vastly underrated. Almost all of it is super accessible and a real joy to play. Worth checking out!

I've been more successful in the past few years finding a balance between my artistic, creative life as a musician and the markets. It's a terribly hard balance to maintain and I haven't quite got it right yet.

James Lackey writes:

The Blues Travelers Run Around, the blues brothers and the prison movies Shawshank Redemption, Clint Eastwood Alcatraz always cheer me.

Verdi is fantastic for its simple yet full and rich chord structure and the similar movie sound tracks. Or how about that chord and crescendo on the TDX patented movie surround sound vrrrrmph there is nothing like the sounds of a properly tuned full blown racing engine at idle then a single thump of the throttle and shut it down to silence.

Simon and Garfunkel the sound of silence is wonderful with the remakes of recent rockers.

The sound of silence trading is one thing, like sunshine itself that is either one of the most beautiful things a day or annoying. The sounds of a single fan on in a room across the hall, a car door, mumbled sounds of laughter on the next block. In a panic as your fingers cut plastic keyboard buttons and you search for an honorable retreat. A big rally, the escape with a proper reduction, back to even you laugh as your holding what you’ve got for the duration as we mumble we should have had the balls to hold all to close.

Then like the sun rising over a few covered manicured field of dreams. You whisper, Put some music on brother…Why is it so quiet in here?

Life without music is death.

Laurence Glazier responds:

Nicely put, Lack, with a great rhythm and turn of phrase. Music is a force of nature we cannot tame, but we can be its instrument.

A quote from the painter David Hockney's latest book, Spring Cannot Be Cancelled:

I intend to carry on with my work, which I now see as very important. We have lost touch with nature, rather foolishly as are a part of it, not outside it. This will in time be over and then what? What have we learned? I am almost 83 years old, I will die. The cause of death is birth. The only real things in life are food and love, in that order, just like our little dog Ruby, I really believe this and the source of art is love. I love life.

Larry Williams suggests:

Food and love?? How about air? How about something to be passionate about—like trading or whatever turns you on.

James Lackey :

Larry as you know "trading for a living" opens up self - I we me - to the world in a very simple output PnL and you can not fake it for long. To complete on the worlds stage full time is to immerse yourself. If you give the market 80% effort perhaps you’ll end up with a 20% loss. Give it 98% maybe you’ll get a 2% profit after expenses and paying yourself a working wage. Go all in and it’s literally limitless. All the money fame fortune a many can ever want.

Take back 2% of your time? The mistress of the market is a very jealous person. If she doesn’t kill you your cohorts running at 100% will.

Trading is one of the best things that has ever consumed me and mine. Yet it consumes me.

Laurence Glazier comments:

Better the passion is in the art than the artist.

Nils Poertner writes:

well said. there is nothing wrong with some healthy ego. but the ego that modern man (modern woman) has formed is perhaps way too narcissistic. We are co-creators in fife and that spirit is encapsulated in many religious books- even by Ralph Walter Emerson. one has to feel it - it has nothing to do with IQ.

In The Gospel of Emerson, Ralph Waldo Emerson is quoted as saying:

"There is a principle which is the basis of things . . . a simple, quiet, undescribed, indescribable presence, dwelling very peacefully in us . . . we are not to do, but to let do; not to work, but to be worked upon."

James Lackey adds:

The gist of whatever m saying comes from my dad and army guys and y’all:

Give a smart man time he finds problems.

Give a real smart guy time he finds solutions.

Give a genius time they find the right questions.

With leadership all 3!work together and create the undiscovered unlimited human potential. Alone without leadership and a dose of pain you get what my dad called "lost souls". Time is the 21st century issue most have too much time to think of problems. Those with solutions have no voice as they live in fear. The genius sit alone talking to the connections.

The genius around the globe never before without a middle man or government wishing some one would take charge and get it done. What is it? That list is now so long it’s an infinity symbol. No begging. No end.

Alston Mabry suggest:

Speaking of music, the Fresh Air podcast has a 3-part Sondheim

retrospective. It's really interesting to hear somebody at that level

talk about his work.

Nov

20

Nancy Lazar: “Middle America is my favorite emerging market.”

November 20, 2021 | Leave a Comment

Alston Mabry notes:

Some TLDR:

- The US will lead the post-covid recovery, not EM.

- Goods-producing jobs are back which will have a multiplier effect.

- Capex will lead in the US, and total capex is 4x stock buybacks.

- China unlikely ever to exceed US economy. China much more like

Japan since the 90s.

- She likes innovation and recommends ARKK.

Wealthtrack: U.S. MANUFACTURING RESURGENCE

November 12, 2021

Be prepared to question many of the negative assumptions you have been hearing and listen to some other data that shines a different light on the outlook. Our guest is a highly respected economist who is no pollyanna. She is just a top economist who looks at data many others miss.

Nancy Lazar is Partner and Chief Economist of Cornerstone Macro. Lazar and her team are challenging the assumptions that higher inflation is here to stay, that interest rates have to go higher and that emerging markets will be the driver of global growth post-pandemic.

K. K. Law comments:

China could be much worse than Japan in the '90s.

Sarah comments:

Is she assuming all manufacturers/categories operate the same way? As much as I would love for this to be the case, there appears to be an oversimplified view of manufacturing that stems from the en vogue ecommerce B2C who typically have less operational personnel, strategic planning, etc. Sales and marketing teams are out in full force to convince manufacturers to buy their products, but many B2B who are currently better positioned and quieter could be the slowest to change.

Nov

8

J. S. Bach, from Nils Poertner

November 8, 2021 | Leave a Comment

JS Bach was once asked why he wrote so much music.

His answer:

1. "To the glory of God" (not sure whether he meant it, nevermind)

2. To amuse himself.

Maybe some like this piece here as well:

Bach - Concerto in D minor BWV 596 - Van Doeselaar | Netherlands Bach Society

In the first notes of the Concerto in D minor, performed by Leo van Doeselaar for All of Bach, it is immediately clear that this is not the usual Bach. This piece is an organ version of a concerto for two violins and orchestra from Antonio Vivaldi’s L’Estro Armonico. Vivaldi’s music was popular throughout Europe and Germany was no exception. During his years at the court in Weimar, Bach made a series of arrangements of Italian concerto music for organ and harpsichord, including six concertos by Vivaldi.

Gyve Bones adds:

From 20 arguments for the existence of God, from Prof. Peter Kreeft, Department of Philosophy, Boston College:

17. The Argument from Aesthetic Experience

There is the music of Johann Sebastian Bach.

Therefore there must be a God.

You either see this one or you don't.

Alston Mabry writes:

There is a scene in Professor T (Antwerp version) where T is talking to his cellmate and says very sadly something like, "Is there a God?". And his cellmate says something like, "There is Bach. Bach is God." And T smiles and says "Yes, Bach is God."

Peter Saint-Andre offers:

A quote from Pablo Casals:

For the past eighty years I have started each day in the same manner. It is not a mechanical routine but something essential to my daily life. I go to the piano, and I play two preludes and fugues of Bach. I cannot think of doing otherwise. It is a sort of benediction on the house. But that is not its only meaning for me. It is a rediscovery of the world of which I have the joy of being a part. It fills me with awareness of the wonder of life, with a feeling of the incredible marvel of being a human being. The music is never the same for me, never. Each day it is something new, fantastic and unbelievable. That is Bach, like nature, a miracle!

Nils Poertner responds:

that's great. I always try to listen in the moment - whatever works for ppl - life works a bit by invitation anyway. one can't force stuff. a basic sense of joy and harmony is certainly missing in our era (the media, the drama etc outside).

Jeffrey Hirsch recalls:

An English professor whose class I was in asked the question why people write poetry. Answer: Because they have to. Similar reason why Bach wrote so much music. Because he had to.

Richard Owen wonders:

Does Bach have an Onlyfans? I can't see it in the search.

Laurence Glazier suggests:

There are free versions of Sibelius. May I recommend the pleasures of composing now available to all?

Richard Owen admits:

Thank you Laurence, an answer from a real musician of note I think? I should therefore disclose, because you are a decent and proper individual of good character and standing… my question was touched with satire. Google Onlyfans via google news, and you might learn something about the debasement of our culture.

Nils Poertner makes a connection:

btw…I always wondered whether one could re-train a musician becoming good trader? Why? Coz good musicians (of any style) tend to enjoy the process of learning - and are the complete opposite of end-gainers. perhaps they are not interested in financial markets enough- otherwise it would be an interesting project. any idea?

Duncan Coker writes:

I am not in the class or universe of LG in terms of composing, but I do write country songs as a hobby. One thing I have found useful is, often I have to throw something away that I thought was good, a melody, a lyric and start from scratch. The more easily and quickly I scrap an idea, the easier it is to start over. You can't force it. This is true for trading.

James Lackey expands:

Dunc is not gonna get mad at me because we never argue. However sure we can force it and to add to the comment of "those people". As if a career makes a man!?)@“”

Anyways path dependence omg I sound like the geek I am. Ok in a sport or music the pleasure has to be the process of practicing or doing it every damn day. As parents we teach this as in brush your hair teeth good girl boy kiddo! The pleasure of rewriting written words must be higher than start from scratch or least effort kicks in no?

I do not care if she likes my poems. I love them. I’m not sure if it’s a coin toss but I can’t fathom whether I like the poems I wrote in one blast or over 6 hours weeks days or? Good is good and great is better than 6 years ago and awesome is when she says so.

I wrote an awful poem once. Many bad but awful because you can hear the blood hit the floor. I gave it to a song writer buddy and he said damn that’s awesome. I said write a song. He said no man you never write over another mans blood sweat or tears.

In trading the get the joke one liners or 5 lots are cute and won’t hurt anyone much can’t kill you but will never inspire romance. The all in big line can and will get you the one, the forever girl or death one way or the other every 7 years death to the marriage of business and of the romantic life.

They say you’ll get what you need out of trading the market. I think perhaps that’s what separates us from the other guys. We need we want we just can’t help ourselves, we need everything. We want it all!

Adams Grimes writes:

I do think there are some fairly intense connections between music and successful trading/investing. There are the obvious issues of "sticktuitiveness" and grit… I'm currently working my way through one of the Bach Partitas and spent about 4 hours yesterday on 2 measures of music. (For reference that's probably 4-6 seconds, when performed). That degree of focus on detail is absolutely normal for musicians, but is not normal for most peoples' experience, at least in the modern world.

In markets, we get kicked in the head (if we're lucky) or the balls (or, more likely, both) on a regular basis. Some degree of stubbornness and a willingness to just not give up.

I think there are also some profound tie-ins in terms of pattern recognition. For me, I think this worked both ways… after taking a decade away from music I discovered my "musical brain" and compositional skills were probably better than they were, in some ways, when I was focusing my life around music. (My keyboard technique emphatically DID NOT improve, as that's something that does take a fair amount of maintenance.)

Serious, important, and maybe even interesting epistemological questions lurk here.

It's hard to have a favorite Bach piece… his works are surprisingly even in quality across his output, but let me share one that is at the top of my list. This has always been one of my favorites:

Bach: Trio Sonata in G major BWV 530 - I. Vivace - Koopman

(And, for sounding so simple and transparent, it's a nasty little nightmare to perform!)

Gyve Bones harmonizes:

I first heard this performed in the 1970s by Walter/Wendy Carlos on the “Switched-On Bach” on Moog synthesizer, and it has remained a favorite piece of music since then. There are various settings of the piece for guitar and piano as well. Here is a full symphony rendition… It is a song of gratitude to God for his many blessings.

Bach - Sinfonia from Cantata BWV 29 | Netherlands Bach Society

Peter Saint-Andre responds:

I had a similar experience with one of the Bach Cello Suites last night. There is much effort (both time and concentration) involved in learning these pieces. And he probably just dashed them off!

BTW, many years ago there was a software company that specifically recruited music majors because they were highly trainable for programming. And music majors also scored quite high on the even older IBM Programmer's Aptitude Test.

Adam Grimes comments:

And he probably just dashed them off!

This, for me, is one of the biggest and probably eternally unanswerable questions in music history. I suspect our performance standards today are probably far higher than they were historically. It's possible we have an army of at least highly technically competent instrumentalists who've devoted more time to, say, the Chopin scherzi than he ever did himself. We know that Beethoven's playing of his own pieces was, according to contemporary accounts, thrilling but filled with mistakes. When Czerny (a student of Beethoven) proposed playing Beethoven's pieces from memory, Beethoven replied that it was impossible to get all the details without looking at the score… and then admitted he was incorrect on that assumption.

Reading between the lines of what CPE Bach wrote (the Essay on the True Art… is a must-read) I suspect contemporary performance practice was much more improvisatory and perhaps less detail-oriented than we'd expect. We know many of these Bach cantatas were written, rehearsed, and performed in a week. These performers were not super human… the only thing that makes sense to me is that our performance standards and expectations (which approach technical perfection, due to the advent and growth of recording) might be much higher than in past ages.

But perhaps I'm wrong on that.

Interesting on the programming front. I would think those are two quite different modes of thinking (and knowing the expertise is domain-specific in many cases), but I'm a far better programmer than I should be given my level of actual training in the discipline. Maybe there's something to that.

Peter Saint-Andre writes:

In his book "Baroque Music Today", Nikolaus Harnoncourt notes that before music was recorded, people most likely heard any given piece of music only once and didn't want to keep listening to the same music over and over as we do but instead continually sought out whatever was new. Perhaps there was a sense of discovery as composers explored the potentials of the tonal system; once those potentials were exhausted and composers started to produce extremely chromatic or even atonal music in the 20th century, listeners were turned off by the new and sought refuge in the old (thus Western art music ceased to be a living tradition for most listeners). Thankfully composers like Adam Grimes and Laurence Glazier are bucking that trend!

Laurence Glazier writes:

One would expect coding and music skills to be correlated. A symphony is partly an encoded instruction set, whether performed by a computer or an orchestra. The conductor is the "crystal", the timer that pumps the flow. But oh, so much more, than that.

It would be very hard to combine the music and trading fields. To be attentive to the Muse and the S&P at the same time? Surely both are all-consuming. But trading, with its psychological dimension, of self-awareness and development, is a fine path. Alexander Borodin managed to combine composing with a distinguished career in science, as did Charles Ives in insurance.

Oct

28

Supply, from Duncan Coker

October 28, 2021 | Leave a Comment

Yes, it is a different mind set and self fulfilling. I am thinking about replacing some wood flooring and got a quote and now makes me think better do it now before the wood becomes less available and/or more expensive. Meanwhile cash is losing 5% this year. Multiply this mindset x 100m people and you get some inflation. Fed won't raise rates, wages won't keep up, but assets should do well until the yield curve is so steep that rates have to go up, which is the big unknown. Who will be our Volcker of 2020s? Does this not make the case for all the supply-siders. You can demand all you want, but someone has to make the stuff.

Steve Ellison adds:

I worked in technology supply chain management in a previous career and have been thinking about a scenario called the "dreaded diamond".

Technology part shortages occurred with some frequency as the transition from designing a next-generation product to ramping up production did not always go smoothly. And even before covid, accidents happened; some years ago, a factory in Japan caught fire. Many specialized components have only one supplier.

What typically happened in shortage situations was that the supplier would allocate the limited supply among the buyers. The buyers would try to game the system by placing 3x to 5x their normal orders, hoping that would increase their share of the allocation. Meanwhile, executives would want daily updates on the situation: how many units were delivered, and what the likely delivery schedule was.

This situation might continue for some months, with buyers continuing to place inflated orders, and the apparent shortage stretching out longer into the future with the higher orders.

As actual deliveries increased, one day, all of a sudden, the buyer would cancel all the excess orders. As other buyers did the same, the demand on the supplier would crash to near zero. This phenomenon of illusory orders that would vanish later was called the "dreaded diamond". A few quarters later, there would be big inventory write-downs because technology products lose value fast as they age.

Maybe some variation of this scenario could occur in the general economy as some of the shortages are alleviated in the course of time. We might find out the shortages have been exaggerated by purchasers trying to maximize their own supply.

Alston Mabry offers:

The Odd Lots podcast (BBG) had a recent episode about the chip shortage, and the guest described this exact scenario, where a customer orders 10x chips and is told by the supplier, "We can deliver 1x chips now, and the rest within 50 weeks." So the customer then orders 100x chips, hoping to get a 10x allotment, after which they cancel the rest of the order. But suppliers must be catching on.

A reader comments:

Sounds like how the Street allocates hot deals. The “pad-my-order-by-a-factor-of-10” move can’t help but to attract attention on the syndicate desk… and the result rarely benefits the customer.

A reader adds:

This has been my base case for some time. Interestingly, I get the sense that complacency is increasing lately, which us odd.

I expect a deflationary shock from overproduction within 24 months, globally synchronized. The delay us from supply chain snafu’s continuing for about another 18 months.

The difference between this and the diamond is deliveries being made and a simultaneous demand drop (ie they get their increased orders).

Hybrid system in time models are rolling out still.

Pamela Van Giessen writes:

This is not rocket science or even dismal science.

Quit testing healthy people for covid so companies that engage in non-Zoom activities can work at capacity and people aren’t "scared" to be around other people. We are still testing well over 1M and sometimes 2M people daily. ~2.5M people were unable to work between June-Sept because of covid. Since there weren’t that many sick people the bulk of them were out of work due to covid related quarantines. And I can promise you they weren’t the zoom class. Supply issues and inflation last as long as covid is a 24/7 threat that "must be conquered."

Our World in Data: Daily COVID-19 tests: USA

Yes, hoarding makes the problem worse but that will evaporate in 2 seconds once we have reliable supply.

Last week I saw a man on a bike wearing a mask in Park County MT where we have nearly 3000 sq mi and a population of ~16k. No helmet but he had a mask on. I should have snapped a pic as it was a perfect illustration of the brainwashing insanity that plagues our economy and health right now. The vaccines may prevent serious illness/death from covid but they don’t seem to be good for much else be it the supply of canola oil, engines, or other health conditions/injuries, etc.

Duncan Coker writes:

The reformers always make the assumption that supply will just naturally bubble forth like a spring constant and unaffected by the world around, be it for labor, capital, services, products. It is assumed no incentives apply and the curve is a vertical line stretching to the the outer limits of the universe. However, this assumption is always wrong and being tested right now.

Aug

24

Wondering why the FTSE has lagged, from James Lackey

August 24, 2021 | Leave a Comment

One of the things that make me a poor manager but perhaps a leader mindset is to me pointing out problems with out a proper solution seems, well, silly.

At the trading desk here in Weston with Mr Vic, the one thing that caught my eye quickly was the FTSE and it's low prices. I have no clue so google landed the link below. any ideas?

Has the FTSE 100 really performed as badly this century as it appears?

Nils Poertner muses:

good spot - many other indices are rich (and firms, too, eg. Apple)?

long FTSE is probably the next big thing for Cathy Woods - am mentioning her name since she gets a lot of bad press in Europe but her calls have been quite good in last few yrs.

Paul O'Leary is skeptical:

FTSE an unlikely place for Cathie Wood to find the hyper growth she looks for.

A reader offers a critique:

The author shoots himself in the foot when he says if you bought all the companies in FTSE 100 in 2001 this is what you would have got…the constituents have changed. I skimmed the rest because it was clear the author didn't really know what was going on.

James Lackey clarifies:

Thank you paul, my apologies to all. My better question is what is wrong with English stocks or is that a bad question, i.e., nothing is wrong? I've lost so much money buying laggards and value, specs forgive me.

Big Al theorizes:

Here's a theory: The Digital Revolution has been one of the greatest expansions of human activity/productivity/wealth in history and it has been centered in the US, as have the stocks of the companies surviving the competition for doing the revolutionizing. The winners have been added to indices, and the losers dropped. This equity/index mechanism has far outperformed all others.

James Lackey responds:

Big, that is what I needed! I was lost (did not get the joke) and as usual was the last to know.

Stefan Jovanovich provides an historical perspective:

Big Al nails it, once again. The British invention of industrial production achieved the same startling results; within a third of a century, the center of the world's low-cost production of fabrics shifted from the hand-looms of India to the "infernal machinery" of the Midlands.

Jul

11

And Here I Thought Prediction Markets Were a Modern Invention, shared by Alston Mabry

July 11, 2020 | Leave a Comment

HISTORICAL POLITICAL FUTURES MARKETS: AN INTERNATIONAL PERSPECTIVE

Paul W. Rhode, Koleman Strumpf

ABSTRACT Political future markets, in which investors bet on election outcomes, are often thought a recent invention. Such markets in fact have a long history in many Western countries. This paper traces the operation of political futures markets back to 16th Century Italy, 18th Century Britain, and 19th Century United States. In the United States, election betting was a common part of political campaigns in the antebellum period, but became increasingly concentrated in the organized futures markets in New York City over the postbellum period.

Jul

10

An Interview with Ken French, shared by Alston Mabry

July 10, 2020 | Leave a Comment

A very interesting interview with Ken French.

May 28, 2020

Episode 100

Prof. Kenneth French:

Apr

20

Price Gouger Confiscation, from Alston Mabry

April 20, 2020 | Leave a Comment

Victor Niederhoffer writes:

The speculator as hero. The siege of Antwerp.

Rudolf Hauser writes:

For the private sector to inventory supplies, etc. for potential future periods of shortages requires a return for their investment and the risk that such shortages will never happen. Someone or some organization should be able to charge higher prices during such a shortage so that they precautionary investment will be rewarded. That will encourage such future behavior to be warranted. There also is a worthwhile function when someone buys large amounts in areas with adequate supply in order to make then available in areas of shortages.

From a demand standpoint, pricing insures that those who get the most value from a scarce product will be buyers when it comes to most goods and services.

But things are different when after a crisis is clearly at hand, someone purchases large amounts with the intention of cornering a market and selling at inflated prices. Nor is price a fair distribution mechanism when it is a matter of life and death and it would have maximum utility for all and the ability to purchase is limited by the means to pay at one's disposal. The most basic human right is the right to survival in oth non-human animal world and in the human world. Any enforcement against price gouging should be limited to such agents, not those who purchased before a crisis situation was well known. Nor should agents who purchased before a crisis be forced to sell at any point in time. It is in their advantage to sell when the shortage is greater. If they hold off selling, it may be because they see an even greater need in the future, and they might just be right. In that case society would be better off if they hold off selling. When the future is so uncertain, better more judgements than fewer making such decisions.

Apr

20

COVID and Age Demographics, from Alston Mabry

April 20, 2020 | Leave a Comment

Sort by over 65 here and see that Italy is second only to Japan. The same sort puts most African countries at the bottom of the sort.

Demographic science aids in understanding the spread and fatality rates of COVID-19

Governments around the world must rapidly mobilize and make difficult policy decisions to mitigate the coronavirus disease 2019 (COVID-19) pandemic. Because deaths have been concentrated at older ages, we highlight the important role of demography, particularly, how the age structure of a population may help explain differences in fatality rates across countries and how transmission unfolds. We examine the role of age structure in deaths thus far in Italy and South Korea and illustrate how the pandemic could unfold in populations with similar population sizes but different age structures, showing a dramatically higher burden of mortality in countries with older versus younger populations. This powerful interaction of demography and current age-specific mortality for COVID-19 suggests that social distancing and other policies to slow transmission should consider the age composition of local and national contexts as well as intergenerational interactions. We also call for countries to provide case and fatality data disaggregated by age and sex to improve real-time targeted forecasting of hospitalization and critical care needs.

Apr

20

Subways Seeded the Massive Coronavirus Epidemic, shared by Alston Mabry

April 20, 2020 | Leave a Comment

Some nice maps:

The Subways Seeded the Massive Coronavirus Epidemic in New York City

Jeffrey E. Harris

NBER Working Paper No. 27021

Issued in April 2020 NBER Program(s):Health Economics

New York City's multitentacled subway system was a major disseminator – if not the principal transmission vehicle – of coronavirus infection during the initial takeoff of the massive epidemic that became evident throughout the city during March 2020. The near shutoff of subway ridership in Manhattan – down by over 90 percent at the end of March – correlates strongly with the substantial increase in the doubling time of new cases in this borough. Maps of subway station turnstile entries, superimposed upon zip code-level maps of reported coronavirus incidence, are strongly consistent with subway-facilitated disease propagation. Local train lines appear to have a higher propensity to transmit infection than express lines. Reciprocal seeding of infection appears to be the best explanation for the emergence of a single hotspot in Midtown West in Manhattan. Bus hubs may have served as secondary transmission routes out to the periphery of the city.

Mar

22

Long Anticipated, from Alston Mabry

March 22, 2020 | 1 Comment

The presence of a large reservoir of SARS-CoV-like viruses in horseshoe bats, together with the culture of eating exotic mammals in southern China, is a time bomb. The possibility of the reemergence of SARS and other novel viruses from animals or laboratories and therefore the need for preparedness should not be ignored.

Severe Acute Respiratory Syndrome Coronavirus as an Agent of Emerging and Reemerging Infection Vincent C. C. Cheng, Susanna K. P. Lau, Patrick C. Y. Woo, and Kwok Yung Yuen

* State Key Laboratory of Emerging Infectious Diseases, Department of Microbiology, Research Centre of Infection and Immunology, The University of Hong Kong, Hong Kong Special Administrative Region, China

Mar

12

Futures, from Victor Niederhoffer

March 12, 2020 | Leave a Comment

Futures close 30 points below s index close at 24 80… reminiscent of Feb 2018 when sp index declined 150 points.

Alston Mabry writes:

Lots of stocks catching up in after-hours trading…

LMT

311.38 -45.55 (-12.76%)

At close: 4:06PM EDT

301.50 -9.88 (-3.17%)

After hours: 7:00PM EDT

Mar

12

Richard Davies on Extreme Economies:

Economist and author Richard Davies talks about his book Extreme Economies with EconTalk host Russ Roberts. The conversation explores economic life in extreme situations. Examples discussed are the Angola State Penitentiary in Louisiana, two Syrian refugee camps in Jordan, the rain forest in the Darien Gap in Panama, and Kinshasa, the largest city in the Democratic Republic of Congo. This is an economic and journalistic tour de force as Davies shares insights from his encounters with people around the world struggling to trade and prosper in extreme environments.

Feb

18

She’s Been Reading Stefan’s Posts, from Alston Mabry

February 18, 2020 | Leave a Comment

An Unsettling New Theory: There Is No Swing Voter

Rachel Bitecofer's radical new theory predicted the midterms spot-on. So who's going to win 2020?

Bitecofer's theory, when you boil it down, is that modern American elections are rarely shaped by voters changing their minds, but rather by shifts in who decides to vote in the first place. To her critics, she's an extreme apostle of the old saw that "turnout explains everything," taking a long victory lap after getting lucky one time. She sees things slightly differently: That the last few elections show that American politics really has changed, and other experts have been slow to process what it means.

Stefan Jovanovich writes:

Only half of them. Bitecofer has no respect for the notion that people's partisan loyalties shift because of their changed views of their interests. She thinks there is a permanent division between leftist Geulphs and tightest Ghibbelines, and elections are entirely a function of which side sends more soldiers to the battlefield. She is convinced that the Children's Climate Crusade will triumph because they will show up to protest Trump's love of carbon. She could be right. But the evidence is against her. The Democrats won the House in 2018 because the power of incumbency was nil, and the Democrat candidates were the new faces. They lost in the Senate for the same reason. Even the new Democrat faces were old ones in terms of media exposure. Candidates do matter. So do interests. I am increasingly confident the Trump Republicans will run the table because the Trump brand is now JFK liberalism with debt doesn't matter Galbraith economics. There is nothing in Trump's labor policy that George Meany could object to, and the "fiscal conservatives" are all gone. It is guns and butter, preserve Social Security and Medicare and bring the troops home. Against that you have what - abortion rights and gun control and debt forgiveness for graduate students? Really?

anonymous writes:

Oh, but it's much more than abortion rights and gun control and debt forgiveness for graduate students! Bernie promises to double union membership in his first term, switch to 100% renewable energy, impose national rent control, guarantee everyone a job, provide free high-speed internet for all, give prisoners the right to vote, rebuild Puerto Rico, turn the post office into a bank, and so much more.

Feb

18

A Historical Lagniappe, from Alston Mabry

February 18, 2020 | Leave a Comment

Simple Principles of Investment, 1919 by Thomas Gibson

In chapter XI "Industrial Stocks" (p. 125) the author states that the large industrials "decline to issue full and frequent reports as to their condition and earnings".

"The very worst feature of this state of affairs is that a few 'insiders' are at all times in possession of the facts and are able to act upon them marketwise. No one who has observed the stock markets, even in a perfunctory way, has failed to note instances of vigorous advances or declines in certain stocks, wholly unexplained to the bewildered public owner."

Feb

2

Math Oddity/Euro Stoxx, from Alston Mabry

February 2, 2020 | Leave a Comment

Just for comparison, FEZ closed Friday at 39.10, and the 2022 39 calls (farthest out available) show a closing ask of 3.05, which is 7.8%.

Cagdas Tuna writes:

It must be due to pricing. Dax, Eurostoxx futures priced in Euro while ETF priced in USD.

Jan

22

Article of the Day, from Alston Mabry

January 22, 2020 | Leave a Comment

"An algorithm that learns through rewards may show how our brain does too"

Zubin Al Genubi writes:

You can shape a child's behavior through positive reinforcement of successive approximations of the desired behavior. Attention is the greatest re-enforcer. Unwittingly parents shape bad behavior by paying attention to bad behavior. "Now Johnny, don't hit your sister, that is not nice" is reinforcing.

Jan

12

Sports Statistics, from Victor Niederhoffer

January 12, 2020 | Leave a Comment

Sports statistics all show that you should go for it on fourth and short but going for it three times led to the Ravens loss. It provides a caution to those who follow market regularities religiously. There is a good thread on this at VicNiederhoffer@twitter.com.

Sports statistics all show that you should go for it on fourth and short but going for it three times led to the Ravens loss. It provides a caution to those who follow market regularities religiously. There is a good thread on this at VicNiederhoffer@twitter.com.

Ralph Vince writes:

Football is peculiarly about making the wrong mathematical decisions. I'm not sure why it is, but I suspect the rapid turnover in coaches and the fact that there is an unavoidable second-guessing in the press and by fans, helps coerce these mistakes.

The most glaring example of this is the (lack of) 2 pt conversions. Mathematically, there are a host of times where this should be taken though you'll never see it. When was the last time a tea in the lead ever took one in the first half?

Russ Sears writes:

Besides second guessing by the press and the fans there's second guessing by their own teammates. The defensive team doesn't like the offense to take risk because they feel they could have stopped the other teams offense given the chance. It's like couples deferring to their partner's lack of risk tolerance.

Ralph Vince writes:

Team sports, by our definition, should ipso facto be more inherently risk-averse than individual sports.

Alston Mabry writes:

Just re the NFL, I was listening to a roundtable interview with players, and the question was, "What's harder to play, offense or defense?" And I was surprised when the unanimous verdict was defense. The explanation was that the offense knows what's going to happen, whereas the defense doesn't, which adds an extra level of stress and is one reason why you hear about the defense "getting tired" by the 4th quarter but you never hear that about the offense.

Ralph Vince writes:

In terms of expected yards per play, because players at the pro level are so good, it;s hard to argue against the fastest receivers getting out ahead of of coverage, and not throwing the ball short; the potential interference call makes the average yards per play considerably higher.

In football gambling, it is ALL about average yards per play.

Jan

4

Article of the Day, from Alston Mabry

January 4, 2020 | Leave a Comment

Today the life expectancy, healthcare, nutrition, available resources, and standards of living in the world's poorest countries largely exceeds that of the world's wealthiest countries at the onset of the Industrial Revolution. On the morning of January 1, 1800 in Britain, life expectancy was 36.6 years and GDP was just $3,430 per capita. Today, life expectancy in Zambia, one of the world's poorest countries, exceeds 50 years, and GDP per capita is greater than $3,800.

Dec

10

Grant, Lincoln, Race and Heritage, from Alston Mabry

December 10, 2019 | Leave a Comment

One of the great history 'what ifs' is what Reconstruction would have been like if Lincoln hadn't been assassinated.

Dec

5

S&P Outperformance, from Alston Mabry

December 5, 2019 | Leave a Comment

At the March '09 low, the S&P total market cap was about $5.3T (if I'm doing the math right).

Since then, according to Yardeni, the S&P has returned about >$4T to investors via buybacks and dividends.

Zubin al Genubi writes:

Bonds moving with equity rather than opposite.

Nov

21

Article of the Day, from Alston Mabry

November 21, 2019 | Leave a Comment

Oct

21

The Battle of Mohács, from Alston Mabry

October 21, 2019 | Leave a Comment

"…free trade is something of a historical aberration…"

Oct

16

Excellent, Very Optimistic EconTalk, from Alston Mabry

October 16, 2019 | Leave a Comment

Andrew McAfee on More from Less:

Andrew McAfee on More from Less:

Andrew McAfee of MIT's Sloan School of Management talks about his book, More from Less, with EconTalk host Russ Roberts. McAfee argues that technology is helping developed nations use fewer resources in producing higher levels of economic output. The improvement is not just a reduction in energy per dollar of GDP but less energy in total as economic growth progresses. This "dematerialization" portends a future that was unimaginable to the economists and pundits of the past. McAfee discusses the potential for dealing with climate change in a dematerialized world, the non-material aspects of economic progress, and the political repercussions of the current distribution of economic progress.

Oct

2

Collectivist Math Practices, from Anonymous

October 2, 2019 | 1 Comment

Math Ethnic Studies Framework (20.08.2019)

Can you suggest resolutions to oppressive mathematical practices? How can we change mathematics from individualistic to collectivist thinking?

Russ Sears writes:

I shared responsibility of teaching Algebra 2 with a lady that let the kids do homework in groups of 3 Of course only 1/3 the kids in her class passed the final and 30% of her kids passed the state test. She got the smartest kids too. As she had an honors class which was about 30% of her students. One of her regular classes only had one student pass.

Sep

13

Rafa, from Alston Mabry

September 13, 2019 | Leave a Comment

Tennis is so interesting. One player can be so good on one surface that the best players in the world can't even take him to five sets.

"Rafael Nadal Takes Another Step Towards Tennis History"

By winning the final grand-slam tournament of the season, Nadal brought himself within one title of Roger Federer's record for the most slams ever won by a male player. Barring a catastrophic injury along the lines of a ruptured Achilles tendon or torn ACL, Nadal seems more likely to surpass his great rival in that category. He's almost five years younger, and while Federer's longevity in tennis is approximate to Tom Brady's in football, Federer will likely retire before Nadal, meaning that Nadal will have more opportunities to collect grand-slam hardware. Just as important, Nadal is still the best clay-court player in the world by an almost unfathomable margin. He has won the past three French Opens without once being pushed to five sets. He will remain the prohibitive favorite at that tournament until another player proves a worthy adversary.

Sep

6

Below the Surface, from Pitt T. Maner III

September 6, 2019 | Leave a Comment

An interesting article with a hint (energy/nutrient flow) of the Dailyspec's recommended book, "The Way Life Works" (Hoagland and Dodson) is this: "Soil's Microbial Market SHows the Ruthless Side of Forests".

An interesting article with a hint (energy/nutrient flow) of the Dailyspec's recommended book, "The Way Life Works" (Hoagland and Dodson) is this: "Soil's Microbial Market SHows the Ruthless Side of Forests".

It should be noted, however, that interactions seen in a petri dish are not always representative of what happens in a living system– in fact, there are antibiotics that are being revisited because they are much more effective in the complexities of the human body than once thought based on petri dish performance.

The cooperative vs. " cutthroat" views of nature are being tested.

Some quotes follow:

"Toby Kiers, an evolutionary biologist at VU University Amsterdam, finds that the interactions among plants and their fungal symbiotes resemble a cutthroat marketplace in which the species negotiate their exchanges of nutrients ruthlessly."

And

"Based on observations of the free-market system, Kiers suspects that what has stabilized plant-fungal mutualisms for at least 470 million years is not that individual organisms are committed to the good of the community, but rather that, in most cases, both plants and fungi benefit more from trading with each other than from keeping resources to themselves."

Alston Mabry writes:

One thing I notice is people talking about competition and cooperation as if they are equal concepts on the same level biologically, rather than seeing cooperation as one strategy inside a framework of competition.

Aug

9

Current Learning Science, from Alston Mabry

August 9, 2019 | Leave a Comment

I happen to be working in this area the last few years, and I am sold on the insights from current learning science.

I happen to be working in this area the last few years, and I am sold on the insights from current learning science.

Very useful and practical.

This book is an excellent summary by some of the leading researchers:

"Make it Stick: The Science of Successful Learning"

Leo Jia writes:

Spaced repetition of concepts from both directions are the most efficient way to me for learning new things.

I wonder what more he offers with a full book.

Aug

9

Once Upon a Time in Hollywood, from Alston Mabry

August 9, 2019 | Leave a Comment

"Actor Bryan Cranston Reveals His Creepy Encounter with Charles Manson"

Jul

17

Propagation of Error: Approving Citations to Problematic Research, shared by Alston Mabry

July 17, 2019 | Leave a Comment

"Propagation of Error: Approving Citations to Problematic Research":

Abstract

Many claims in a scientific article rest on research done by others. But when the claims are based on flawed research, scientific articles potentially spread misinformation. To shed light on how often scientists base their claims on problematic research, we exploit data on cases where problems with research are broadly publicized. Using data from over 3,000 retracted articles and over 74,000 citations to these articles, we find that at least 31.2% of the citations to retracted articles happen a year after they have been retracted. And that 91.4% of the post-retraction citations are approving—note no concern with the cited article. We augment the analysis with data from an article published in Nature Neuroscience highlighting a serious statistical error in articles published in prominent journals. Data suggest that problematic research was approvingly cited more frequently after the problem was publicized. Our results have implications for the design of scholarship discovery systems and scientific practice more generally.

Jul

9

With 16 Months to go, Negative Partisanship Predicts the 2020 Presidential Election, from Alston Mabry

July 9, 2019 | Leave a Comment

"With 16 Months to go, Negative Partisanship Predicts the 2020 Presidential Election"

On whether the D side can find a candidate that will actually stimulate the turnout required:

The potential advantage they have is a long primary process, during which they hope a clearly strong candidate will emerge. And they will figure out what messages to focus on to get that turnout.

What 45 will do is try to time a great trade breakthrough with China so that it gives him max boost going into the election. That timing should be a tradeable opp.

Jun

13

Adventure Book Recommendations, from Alston Mabry

June 13, 2019 | 1 Comment

The Best Books by Adventurers recommended by Alastair Humphreys

The Best Books by Adventurers recommended by Alastair Humphreys

Alastair Humphreys is a British adventurer, author and blogger. He spent over 4 years cycling round the world, a journey of 46,000 miles through 60 countries and 5 continents. More recently Alastair has walked across southern India, rowed across the Atlantic Ocean, run six marathons through the Sahara desert, completed a crossing of Iceland, busked through Spain and participated in an expedition in the Arctic, close to the magnetic North Pole. He has trekked 1000 miles across the Empty Quarter desert and 120 miles round the M25—one of his pioneering microadventures. He was named as one of National Geographic's Adventurers of the Year for 2012.

The best books on Victorian Adventures (though the selections may seem to stray) recommended by Stephen Evans

The Best Travel Books recommended by Paul Theroux

The best books on India, Ancient and Modern recommended by William Dalrymple

The award-winning writer selects five books on India and says that the Mahabharata, eight times the length of the Bible, is one of the great works of literature of mankind - and every bit as good as it's made out to be.

Jun

2

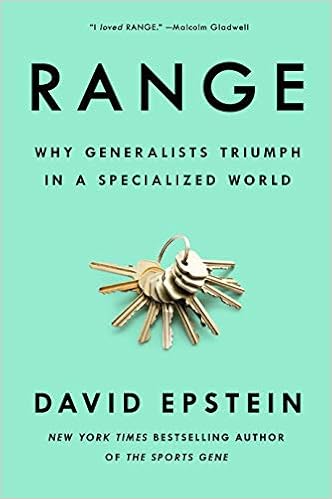

“Range” by David Epstein, from Alston Mabry

June 2, 2019 | Leave a Comment

David Epstein is a writer who had a NYT bestseller in 2014 called The Sports Gene.

David Epstein is a writer who had a NYT bestseller in 2014 called The Sports Gene.

His new book is called Range.

In this podcast interview, Epstein discusses the book.

Lots of interesting topics, including some nice statistical points, and also a few lagniappes for Gladwell h8rs:

Epstein mentions this online discussion between him and Gladwell.

May

31

Interesting Graphic, from Alston Mabry

May 31, 2019 | Leave a Comment

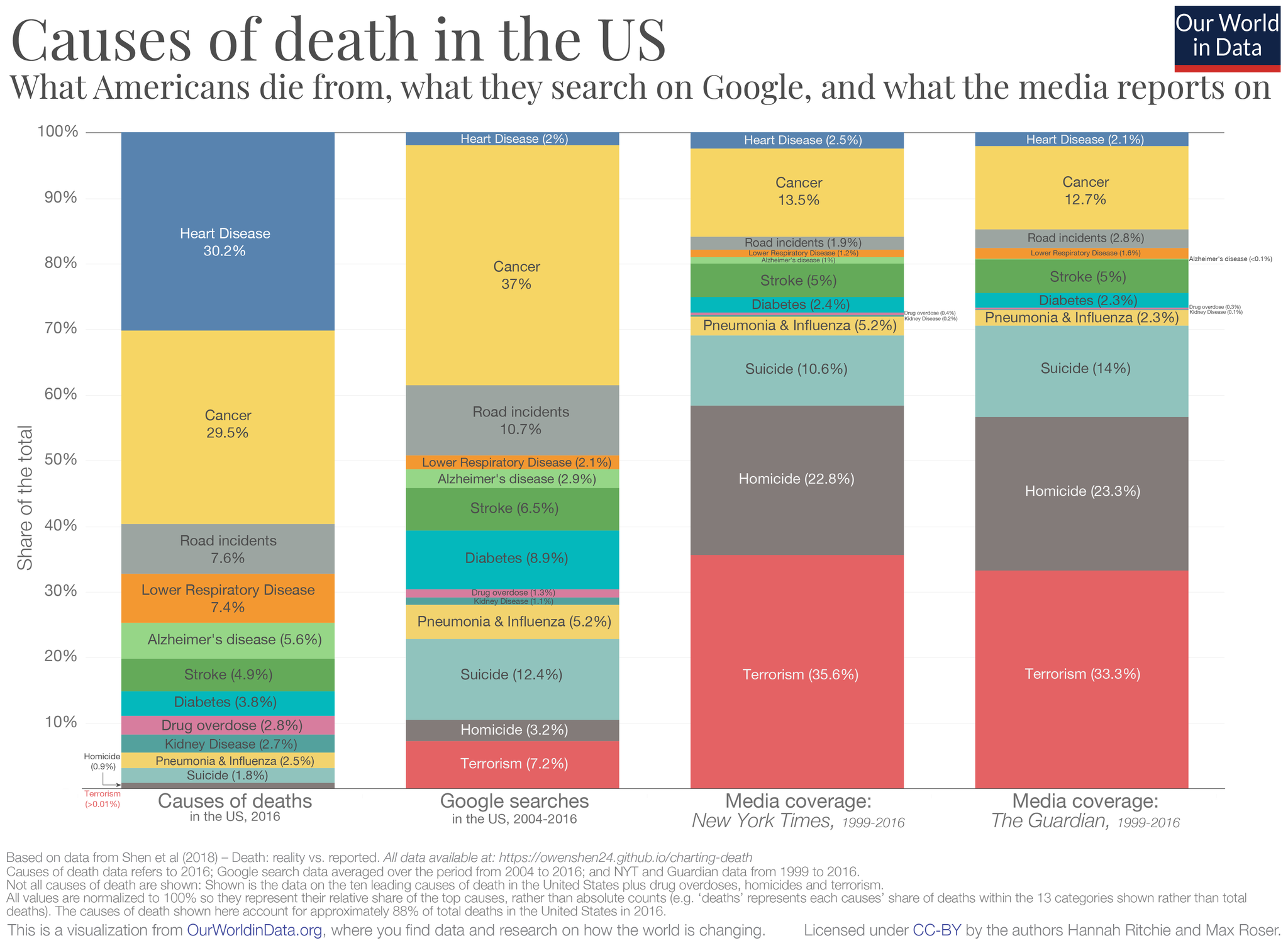

Causes of death versus media coverage of the same.

Causes of death versus media coverage of the same.

Presumably they're trying to show that media over-emphasizes terrorism and murder, and that we worry about the wrong things.

But the vast majority of medical mortality is not caused by others, and to a large extent is, at least eventually, unavoidable.

You have to die from something, and the two most common things are cardiovascular disease and cancer.

Actually, that would have been an excellent title for it:

"You have to die from something"

May

28

Correlations for the S&P Quarterly, from Alston Mabry

May 28, 2019 | 1 Comment

Just to scratch a quantitative itch, here are correlations for the S&P quarterly.

Just to scratch a quantitative itch, here are correlations for the S&P quarterly.

One hopes it's clear as presented.

Slightly larger magnitudes in bottom 2 rows one assumes is mostly from smaller sample sizes.

And btw, the Q on Q R, or autocorrelation, is +0.07.

May

20

A sign hangs in prolific romance novelist Danielle Steel's office:

"There are no miracles. There is only discipline."

Interestingly, Steel has 9 children.

Apr

22

The Road to Crony Capitalism, from Alston Mabry

April 22, 2019 | Leave a Comment

A lagniappe on socialism vs capitalism:

A lagniappe on socialism vs capitalism:

"Why the U.S. Should Adopt the Nordic Approach to Private Roads"

Many view the United States as a free market capitalist state and Nordic countries such as Sweden and Finland as socialist due to their extensive welfare system. Yet, in the United States, most roads, highways, and other transportation infrastructure are publicly owned and operated. Meanwhile, the vast majority of roads in Sweden and Finland are operated by the private sector and maintained by local communities. Examining Sweden and Finland's public-private road model may give us insight into how private roads can operate in the United States.

Feb

26

EU Data Law, from Alston Mabry

February 26, 2019 | Leave a Comment

"Federal Trade Comission Oversight and the Need for Online Consumer Privacy Legislation"

However, if the idea is that "harder regulation" will somehow tame the big Silicon Valley platforms, the opposite has happened. The EU's General Data Protection Regulation (GDPR), along with similarly heavy-handed regimes such as California's Consumer Privacy Act, entrenches established platforms that have the resources to meet their onerous compliance requirements. Since the GDPR's implementation in May, the rank and market share of small- and medium-sized ad tech companies has declined by 18 to 32 percent in the EU, while these measures have increased for Google, Facebook, and Amazon. My new paper, "What the GDPR really does and how the US can chart a better course," documents these unintended consequences and argues for an innovation-based approach to data privacy and protection along with consumer education.

anonymous writes:

Thank you, Mr. Mabry, for sharing this fitting analysis of the EU Data law.

Regulation is always institutionalized corruption, collusion and state-sanctioned monopolization against small enterprises and citizens.

It is very hard not to rant about this topic; Hey Europe I recommend burning books next–surely books are more dangerous than allowing us to read American newspapers!

Feb

26

Two Fun Things, from Alston Mabry

February 26, 2019 | 1 Comment

Something with market implications: Significant Wave Height

Something with market implications: Significant Wave Height

And an interesting bio: Walter Munk

Jim Sogi writes:

As a surfer, I expect at least one wave on any given day to be 10x the size of the smaller sized waves. The idea of the "rogue" wave is also misguided since in the open ocean there will be waves, 10x the smaller sized wave on any given day. We call it the wave of the day. Lucky is the guy who waits for it and doesn't get caught inside and thrashed and can ride the crest to the inside.

It's the holes created in the water, not just the peaks, that can be as dangerous as the breaking crest. I've been in rough water when the boat just drops below the surface in a terrifying moment as the water sucks out under the boat. Not intuitive at all. These can be terrifying market moments when it happens, but it's definitely part of the ocean and market physics.

Jan

27

Hagfish Slime, from Alston Mabry

January 27, 2019 | Leave a Comment

"No One Is Prepared for Hagfish Slime" is a fascinating article you might want to take a look at.

"No One Is Prepared for Hagfish Slime" is a fascinating article you might want to take a look at.

It expands by 10,000 times in a fraction of a second, it's 100,000 times softer than Jell-O, and it fends off sharks and Priuses alike.

Here is a direct link to the video from the article, showing hagfish using their slime for both defense and offense.

Jan

26

DeepMind AI AlphaStar Goes 10-1 Against Top ‘StarCraft II’ Pros, from Alston Mabry

January 26, 2019 | Leave a Comment

"AlphaStar won the games unfairly via unit control & mechanical actions with suprahuman actions per minute & vision of the battlefield."

-"DeepMind AI AlphaStar goes 10-1 against top 'StarCraft II' pros"

I wouldn't call it unfair, but I agree that this is a different class of game, where physical response time is an issue and an area where computers plugged directly into the game have a clear advantage. I always wondered what kind of advantage Watson had with button response time, playing Jeopardy.

Jan

16

An Education Lagniappe, from Alston Mabry

January 16, 2019 | Leave a Comment

400 free Ivy League university courses you can take online in 2019.

I sometimes explore online courses looking for interesting lecture videos that I can either watch or convert to mp3's and use as podcasts.

Mr. Isomorphisms writes:

Their list doesn't have a couple of my favourites. Aiken's compilers course at Stanford and MIT's xv6 lions commentary on unix.

Recent mathematical finds:

-a locus with 25920 linear transformations by H F Baker (archive.org)

-ikosahedron by Felix Klein (archive.org)

-slodowy: platonic solids, kleinian singularities, and lie groups

-Elie Cartan: theory of spinors (more readable than you might think; written in the autumn of his life)

-Park & Yang: yang-baxter equations. (on arXiv, written for an encyclopedia)

The A-D-E stuff is probably the most interesting mathematics ever found. (Mathematicians get to leverage the enormous and relatively obvious differences between platonic solids to make inferences about other structures.)

I'll say this, MIT OCW (started ~2002, no productivity gains so far) is higher quality than Sam's Teach Yourself C++ at Barnes & Noble.

Competition in general has benefits, but 30 cold medicines yet none of them work is just more confusing things to try. Speaking of cold medicines that don't work and competition/markets, I would contrast Guatemala to the U.S. in this way. Guatemala has genuine markets–small merchants who will negotiate on price–whereas the U.S. has CVS (posted-offer, negotiations behind the scenes by eg Procter & Gamble vis-a-vis CVS). CVS will carry fewer cold medicines but they will work.

Back to education and MOOC's: delivery of a higher-quality product happens online than Barnes & Noble (or public library), with youtube (Federico Ardila), PDF's hosted on someone's site (Andrew Ranicki), or Rails/post-Rails MOOC's. More people know about more stuff because of youtube documentaries; that's already happened. It just won't improve work output, other than–we've yet to see how this pans out–millennials deciding that programming is the only decent career, and that they can teach themselves (including 25-year-olds who have held 1-9 jobs teaching for General Assembly).

Jan

7

Free Course Recommendations, from Alston Mabry

January 7, 2019 | Leave a Comment

There are 400 free Ivy League university courses you can take online in 2019

I sometimes explore online courses looking for interesting lecture videos that I can either watch or convert to mp3s and use as podcasts.

Mr. Isomorphisms writes:

Their list doesn’t have a couple of my favorites, including Aiken’s compilers course at Stanford and MIT’s xv6 lions commentary on unix.

Recent mathematical finds:

-A locus with 25920 linear transformations by H F Baker (archive.org)

-Ikosahedron by Felix Klein (archive.org)

-Slodowy: platonic solids, kleinian singularities, and lie groups

-Elie Cartan: theory of spinors (more readable than you might think; written in the autumn of his life)

-Park & Yang: Yang-Baxter equations (on arXiv, written for an encyclopedia)

The A-D-E stuff is probably the most interesting mathematics ever found. (Mathematicians get to leverage the enormous and relatively obvious differences between platonic solids to make inferences about other structures.)

Dec

26

Libratus Presentation from Carnegie Mellon, from Alston Mabry

December 26, 2018 | Leave a Comment

Here’s a holiday gift, an hour-plus presentation from Carnegie Mellon on Libratus:

Superhuman AI for heads-up no-limit poker: Libratus beats top professionals

Wiki on Libratus

One interesting thing that is clear from human vs computer poker is that a key advantage the computer has is lack of emotional response to risk, i.e., the computer never goes on tilt.

Dec

18

Australia, from Alston Mabry

December 18, 2018 | Leave a Comment

India, Australia, Canada, Italy and France (and their banks) are coming off their rails:

"Australian House Prices Fall Most Since Global Financial Crisis"

Sydney's property downturn accelerated in November, propelling nationwide house prices to the biggest monthly drop since the global financial crisis, as credit curbs and buyer nerves continue to bite.

Nationwide home values fell 0.7 percent last month, led by a 1.4 percent drop in Sydney and 1 percent in Melbourne, according to CoreLogic Inc. data released Monday.

The drop takes the total decline in Sydney since the July 2017 peak to

9.5 percent, on the cusp of overtaking the 9.6 percent top-to-bottom decline recorded during the last recession 27 years ago. This decline is even steeper than the 1989-91 fall, showing how quickly sentiment has flipped.

Stefan Jovanovich comments:

The declines in the gold currency prices of wheat, coal, rail and water-born freight and lumber that were the "deflation" of the growth explosion of the 19th century came to be seen as "normal". They became so obviously the way things are that rising prices seemed not only the exception but also the product of conspiracy. How can urban land prices keep increasing–despite their recurring temporary panics–if it is not some kind of manipulation, asked Henry George. Even the prices of luxuries like diamonds (thank you, Mr. Rhodes) keep falling.

We are in an age in which credit has seen the same explosion of volumes that the steel industry saw with Carnegie and Krupp. The presumption has been that these loans were prudent for the same reason expansions in industrial capacity were willingly financed at fixed rates for as much as half a century. What called those industrial loans into question was the collapse in foreign exchange that was the financial carnage of WW 1. My presumption is that this crisis is not about the collapse in FX; Germans and Chinese will be able to pay for imports in 2019 in a way neither was able to do in 1919. But, what will collapse are the expected incomes of the civil service and other government pensioners (other than Social Security recipients) and their ability to borrow against their houses. It will be like the farming crisis of the industrial age–a devastation to the small holders that was unable to be softened because the political majorities would not pay for the bailout.

Dec

14

Is this Useless S%*# Index Signaling S&P Declines? from Alston Mabry

December 14, 2018 | Leave a Comment

I received a correspondence from a friend entitled "is this useless shit index signaling S&P declines?"

It prompted me to try to count something I had been wondering about:

1940: $284

2000: $602

Annualized rate of inc: 1.26%

2000: $602

2017: $982

Annualized rate of inc: 2.93%

(Data sources)

Dec

9

History Lagniappe: Deception, from Alston Mabry

December 9, 2018 | Leave a Comment

I recommend the Pbs documentary The Ghost Army

I recommend the Pbs documentary The Ghost Army

War, deception, art and glory come together in the documentary film "The Ghost Army," the astonishing true story of American G.I.s — many of whom would later have illustrious careers in art, design and fashion — who tricked the enemy with rubber tanks, sound effects and carefully crafted illusions during WWII. Filmmaker Rick Beyer tells a remarkable story of a top-secret mission that was at once absurd, deadly and amazingly effective.

I'm particularly fascinated by the game of traffic analysis.

NSA article on traffic analysis in WW1.

Dec

5

A 4 Hour Mini Series: The Circus, from Alston Mabry

December 5, 2018 | Leave a Comment

This is very nicely done and I wish it were even longer, like a Ken-Burns-style series:

This is very nicely done and I wish it were even longer, like a Ken-Burns-style series:

This four-hour mini-series tells the story of one of the most popular and influential forms of entertainment in American history. Through the intertwined stories of several of the most innovative and influential impresarios of the late nineteenth century, this series reveals the circus was a uniquely American entertainment created by a rapidly expanding and industrializing nation; that it embraced and was made possible by Western imperialism; that its history was shaped by a tension between its unconventional entertainments and prevailing standards of respectability; and that its promise for ordinary people was the possibility for personal reinvention. For many Americans, the circus embodied the improbable and the impossible, the exotic and the spectacular. Drawing upon a vast and richly visual archive and featuring a host of performers, historians and aficionados, The Circus follows the rise and fall of the gigantic, traveling tented railroad circus and brings to life an era when Circus Day would shut down a town and its stars were among the most famous people in the country.

Sep

16

Prediction Update, from Alston Mabry

September 16, 2018 | Leave a Comment

538 version:

HOR: 5 in 6 the D side wins control

Senate: 2 in 3 the R side maintains control

Stefan Jovanovich writes:

538 offers us their assurance of the accuracy of their 3-headed model by telling us how successful it has been. After all, their accuracy score in actual election predictions has been between 95.7% and 96.9%. Or, to put is another way, their inaccuracy score has been between 3.1% and 4.3%; on average, they have been wrong in only 3.7% of their predictions.

That looks wonderfully impressive until you remember that, in House of Representative elections in the United States, you have to look through the small end of the telescope. Since the passage of the Permanent Apportionment Act in 1929, only 22 of the 44 elections have seen a change in either party's seats that was greater than 538's strikeout average.

If you limit the sample to the current period in which the House changed hands between the two major parties - i.e. 1994-present, there have been only 4 elections out of the 12 that have seen a change greater than 3.7%.

Their astounding "accuracy" is built into the game. Since 1929 the mean change in the number of seats has been 1 (.2%) and the median change has been 3 (.6%). Even when you look only at the "wave" elections - those whose changes are greater than 538's inaccuracy percentage, the mean change has been 44 seats (10.2%), the median gain by the Democrats has been 37 seats (8.5%) and the median gain by the Republicans has been 46 seats (10.6%).

I trust Big Al's and others' math more than my own; but these spreadsheet calculations suggest to me that we are playing the 95% confidence interval game.

In any case, this seems to me a bit like forecasting the pennant based on teams' records in spring training. The primaries are only now ended and even "well-informed" citizens barely recognize the names of the candidates the parties have chosen. The one survey that no political polling firm will ever take is the name recognition one where citizens are asked to match their local candidates with their party affiliations; even among likely voters the results are wonderfully bad. It will not be until 4 weeks before election day that a majority of them will be able to guess the names of the people on whom the fate of the Republic depends.

At that time guessing about the likely results becomes less like propaganda and more like the speculation that we all enjoy.

Back on October 9th.

Sep

1

Global Cap Over Product, from Alston Mabry

September 1, 2018 | Leave a Comment

Steve Ellison writes:

This indicator was also mentioned in Mark Hulbert's article in the Wall Street Journal on Sunday. People who cite it as an indicator usually implicitly assume that the aggregate value of the stock market should grow at the same pace as GDP over the long term.

I believe this assumption is flawed for two reasons. Privately held companies are not counted, so changes in the relative percentages of public and private companies affect the ratio. More importantly, the traditional capital structure of 50% debt and 50% equity, in which all upside value goes to equity holders, is a good reason why stock valuations should increase faster than GDP, especially over very long periods. Indeed the inflation-adjusted compound annual growth rate in the S&P 500 between the generational lows of 1982 and 2009 was 4.4%, significantly more than GDP growth during the same period. So I don't lose any sleep over this ratio being higher now than in 1929.

Stefan Jovanovich writes:

In a recent speech Jorg Meuthen made a simple point: GDP calculations assume that civil servants are somehow as magically "productive" as the people who have to do work for a living and successfully sell their work for cash.

No one in the "mainstream" (sic) wants to do calculations that remove all the recipients of government payments from political economic calculation. It is, from the point of view of modern economics, heresy.

I took Big Al's elegant calculation and found its "private sector" derivative.