Aug

31

George Pólya, from N. Humbert

August 31, 2025 | Leave a Comment

George Pólya came up with the term Inventor Paradox.

Basically, if one thinks about a problem more deeply, something else may open up. And one can achieve extraordinary results! Plenty of examples in finance, engineering, medicine.

Steve Ellison writes:

From the Wikipedia link about the inventor's paradox:

When solving a problem, the natural inclination typically is to remove as much excessive variability and produce limitations on the subject at hand as possible. Doing this can create unforeseen and intrinsically awkward parameters.

Very interesting idea with applications in many fields. As one example, I recently told my daughter, who is a partner at Boston Consulting, that I was reading a book about strategy by a professor at Harvard Business School. She told me, "Boston Consulting literally wrote the book on strategy": Your Strategy Needs a Strategy.

I ordered that book and so far have read the first chapter. One of the key questions is how predictable the business environment is. Another is, how much can you influence the environment? "Classical strategy" as taught in business schools generally assumes that the environment can be forecast and that the company has very limited influence over it. A case study was the Mars candy bar company.

But if you cannot forecast the environment, a very different approach is called for, with heavy emphasis on learning and iterating. And if you can in fact shape the business environment, you might want to find some partners and create an ecosystem.

As a footnote, the book I was originally reading, which I also found informative, was by Richard Rumelt: Good Strategy, Bad Strategy.

Asindu Drileba offers:

Optimize the Overall System Not the Individual Components, interview given by Edwards Deming. Excerpts:

The results of a system must be managed by paying attention to the entire system. When we optimize sub-components of the system we don’t necessarily optimize the overall system.

Optimizing the results for one process is not the same as operating that process in the way that leads to the most benefit for the overall system.

Applied to markets:

- It's easier to do well on the S&P 500 index (the general market), than do well in a single stock (picking).

- Attributed Mark Spitznagel, we should judge the buying of far OTM puts based on how they help the entire portfolio. Not the individual PnLs of buying the far OTM puts.

- Attributed to Roy Niederhoffer, many traders turn off trading strategies once they start loosing money, but different trading strategies make money at different times.

Aug

29

What we don’t trade, but study for warnings about what the 19th Century called “slumps”, from Stefan Jovanovich

August 29, 2025 | Leave a Comment

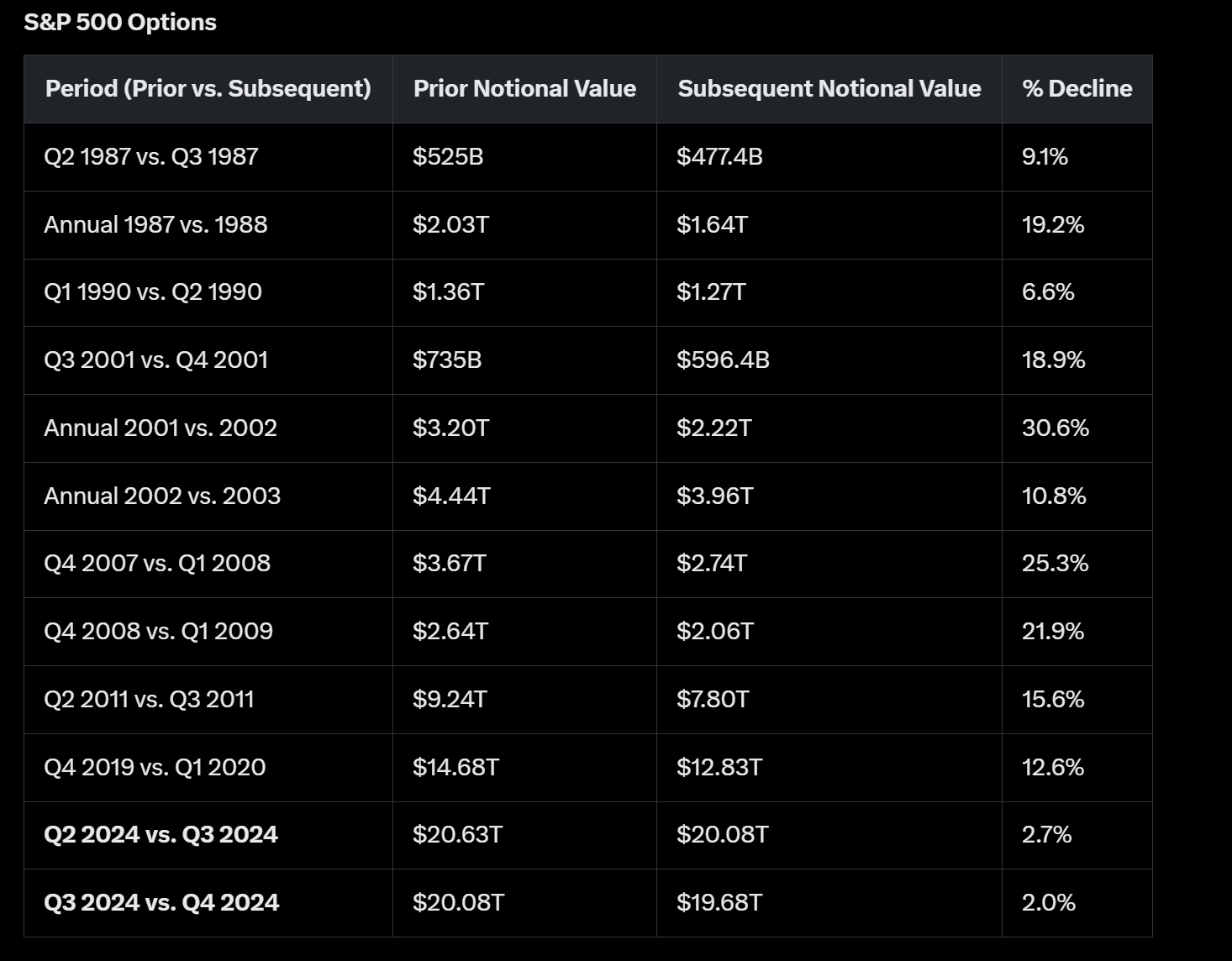

Our FO has been using Grok3 to build tables of the historical declines for financial assets. I have been doing the typing of the queries, Grok has done the thinking and the other members of the FO have set the definition for the market measure they want to use for timing. The measure is what our most smart ass member calls the Louis L'Amour "herd size" - the notional value of the assets wandering around the range.

Here is the data for the 10 worst quarter-to-quarter/year-to-year period slumps in the S&P 500 options herd size for which Grok was able to retrieve reported data.

Aug

28

If man were to disappear

August 28, 2025 | Leave a Comment

below from my favorite and most highly recommended Western book, The Time It Never Rained, by Elmer Kelton:

He had often thought that if man were to disappear, the domesticated livestock would not long survive. Fences would sag and rust away. The artificial watering places would go to dust, forcing livestock to the natural creeks and rivers.

There, in time, the sheep and goats would fall to the bobcats and coyotes. Perhaps even the lean gray wolf- so long gone from here- would return to hunt and howl at the moon. The land would go back to those creatures which impartial Nature had found fittest by ruthless selection.

Aug

27

Suppliers vs providers, from Stefan Jovanovich

August 27, 2025 | Leave a Comment

The opportunity lies with the supplier, not the providers of AI.

Larry Williams asks:

Who are the suppliers?

Stefan Jovanovich answers:

Nvidia. My 19th century brain thinks of NVDA as a supplier of the stuff the people selling information tickets will use to build their 21st century railroads.

Easan Katir writes:

Agree. Those creating the AI platforms won't generally be good investments, imho. Why? They lack one thing needed: scarcity. Any intelligent person can feed his/her data into an LLM and create their own AI for $20 / month or less. China's DeepSeek is free, I've read. Hard to make a profit when competing with free.

Last month I had lunch with an author cousin who lives in Tehama Carmel Valley. She uploaded all her books into an LLM, cloned her voice with another AI service, connected that to her voicemail. Now her clients can call her number and her cloned voice answers all their questions based on the knowledge in her books. All while she's having lunch.

AI + robotics will be a theme, such as Elon's Optimus and robo-taxis, yes? Investing in the suppliers is mostly done, isn't it? NVDA being the most obvious. Along with LW, other inquiring minds wonder which companies you have in mind.

William Huggins responds:

don't forget the coal and iron mines, those essential input assets that 19th century railroad magnates knew could be pilfered via land "grants". i think the equivalent is looking at the companies involved in the chip etching (who makes the lasers, etc).

Henry Gifford comments:

FRED says that Railroad stock prices weighted by number of shares went up x7 over 70 years [to 1929]. Nice, but not fantastic, but weighing by number of shares could be misleading because of reverse splits, shares of a new company replacing a larger number of shares of the old company in a buyout, survivorship bias when a company goes bankrupt, etc.

% of market cap can I think also be misleading because of people pouring huge amounts of money into companies with no revenue in the hope of future returns, adding to market cap.

Stefan Jovanovich responds:

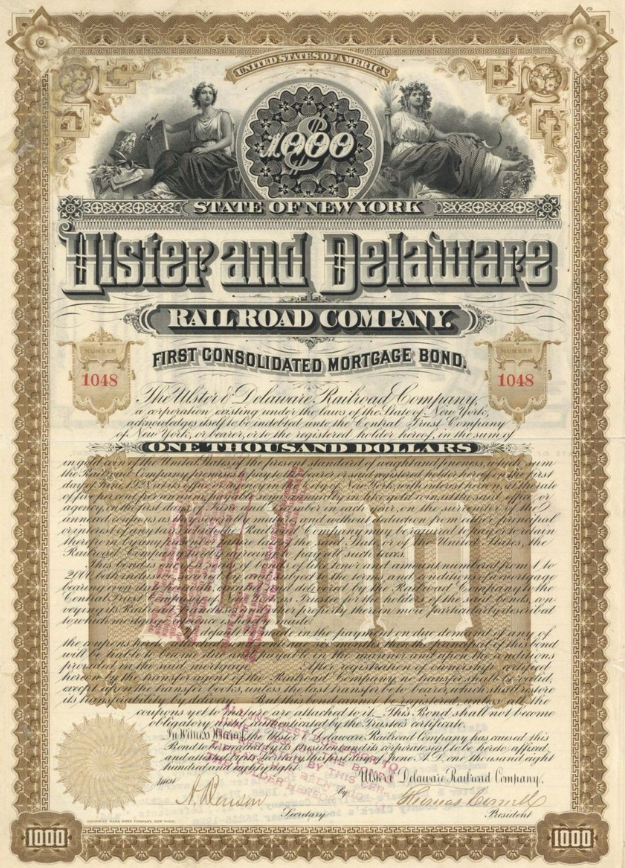

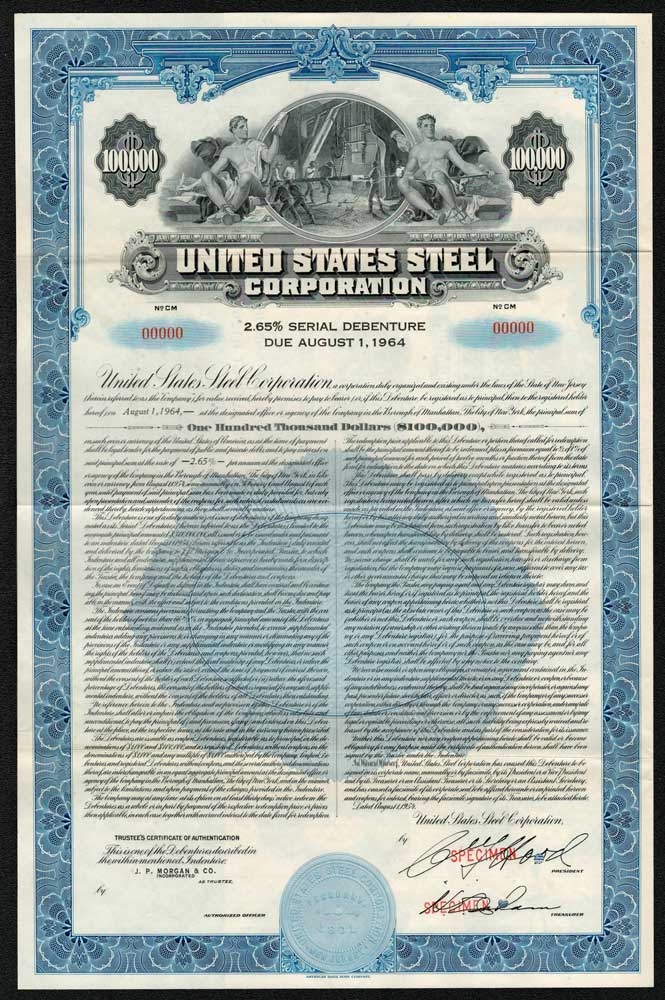

In the last third of the 19th century, the money made in railroad investing was in the bonds, not the stocks. That was the recital of the FRED data that some found so surprising. For this 19th century mind those results are not surprising because the one President in the century who could do the math killed the speculation in international money.

Aug

26

0DTE & Volatility, from Peter Ringel

August 26, 2025 | Leave a Comment

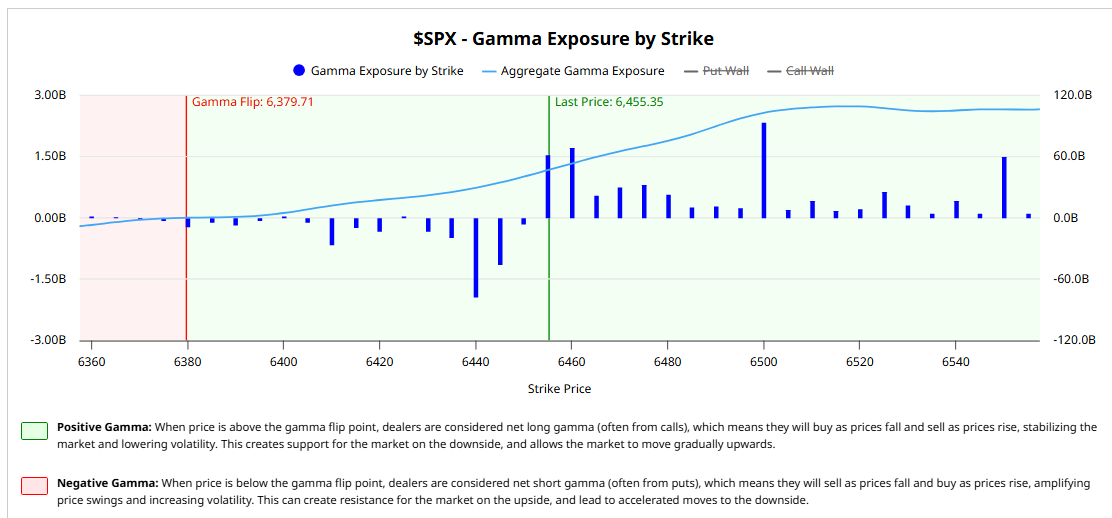

The abysmal Volatility last Monday, 18 August, and the dead stop last Tuesday, EOD, were attributed by some to 0DTE. A little back on Spec List, papers were posted, showing this Volatility suppression effect by 0DTE options and their market makers.

I know it is just the latest holy grail traders flog to. Quite a few websites are offering subscriptions for the data. So, I was surprised to find it for free on Barcharts – the EOD version:

Steve Ellison adds:

Important information, thanks. Jeff Clark said on a podcast that 68% of all S&P 500 option contracts are 0DTE.

Aug

25

Robert Z. Aliber, 1930-2025, from Alex Castaldo

August 25, 2025 | Leave a Comment

Friend of the Chair, Robert Z Aliber, a professor of International Economics and Finance at the University of Chicago, died in June 2025, I recently found out.

Just before the Financial Crisis (I don't remember the exact date) he sent a prescient Email to the Chair, arguing that problems caused by carelessly underwritten mortgages would soon cause a recession in the US. At the time I was not really aware of what was going in in the field of mortgage securitization, so I found the information surprising and was impressed later when it was confirmed by subsequent events.

Big Al adds:

Robert Z. Aliber on "The Next Financial Crisis?"

The University of Chicago

Apr 24, 2013

In 1982, 1997, 2003, and 2008, Asia and the world were rocked by major financial crises. Robert Z. Aliber discusses past crises and the possible trajectory of the next one. Where is the next major crisis likely to begin? How will its impact compare to previous crises? Aliber, a regular speaker for Chicago Booth, co-authored Manias, Panics, and Crashes: A History of Financial Crises.

Aug

24

Recent research on credit rating changes, from Humbert A.

August 24, 2025 | Leave a Comment

This research implies less-than-ethical behavior by some analysts!

What moves stock prices around credit rating changes?

Omri Even-Tov, Haas School of Business, University of California, Berkeley

Naim Bugra Ozel, N. Jindal School of Management, University of Texas at Dallas, The Wharton School, University of Pennsylvania (Visiting)

Published: 07 January 2021

Using monthly and multi-day return windows, research shows that credit rating downgrades often reveal new information and lead to significant stock price reactions but that upgrades do not. Using intraday data, we revisit these findings and extend them by examining the possibility of informed trading ahead of the announcement of credit rating changes. Credit rating agencies delay public announcements of rating changes to provide issuers with time to review and respond to rating reports, which opens the door for informed trading in advance of credit rating changes. Using data on rating changes from S&P, Moody’s, and Fitch, we find a more modest price reaction to rating downgrades than documented elsewhere and show that stock prices respond to changes in long-term issuer ratings but not to changes in ratings of a single instrument or a subset of instruments. Most interestingly, we find that prices start moving before a downgrade announcement, controlling for other news and investor anticipation. These pre-announcement movements are concentrated among observations where credit analysts are motivated to disclose private information to advance their careers. The beneficiaries of these disclosures appear to be institutional investors.

Aug

23

Carpet bombing and the death of General Lesley McNair, from Humbert X.

August 23, 2025 | Leave a Comment

In July 1944, McNair was in France to observe troops in action during Operation Cobra, and add to the FUSAG deception by making the Germans believe he was in France to exercise command. He was killed near Saint-Lô on 25 July when errant bombs of the Eighth Air Force fell on the positions of 2nd Battalion, 120th Infantry, where McNair was observing the fighting. In one of the first Allied efforts to use heavy bombers in support of ground combat troops, several planes dropped their bombs short of their targets. Over 100 U.S. soldiers were killed, and nearly 500 wounded.

Stefan Jovanovich recalls:

My favorite Audie Murphy bit of history (which can be verified by recollections but not by any published anecdotes) is that Murphy met Omar Bradley in Hollywood in July 1951 when Bradley was Chairman of the Joint Chiefs of Staff. The Red Badge of Courage had been released and Murphy was a "star"; Bradley was on his way to and from Japan and South Korea to talk to Matthew Ridgway (MacArthur's successor) about how the war was going. Someone had the bright idea to bring favorable publicity to the war effort that was so unpopular that it would elect a Republican as President for the first time in a quarter century by having a photo shoot of Bradley, a 5-star general, and Murphy, the most decorated "common" American soldier. The story is that they met with Bradley in his full dress uniform and Murphy in a suit and tie and, with the cameras rolling, everyone got ready for Murphy to come to attention and salute. He just stood there opposite Bradley and his entourage. Finally, with teeth clenched and skin reddening, Bradley raised his right hand and placed it diagonally across his right cheek. The rule was and still is that everyone in uniform regardless of rank salutes the holder of the Medal of Honor first.

I like to think that Murphy enjoyed the moment as a tiny bit of revenge for the stupidities of Bradley, who, along with Carl Spaatz, made Murphy's and his fellow soldiers lives much, much harder with their belief in bombing from 20,000 feet. The carpet bombing tactic was still very much the Air Force catechism when I was in the Navy on the Mekong River in 1967 and 1968. I was told by the writer who put down the words of Schwarzkopf's memoir that Stormin Normin's happiest fit of temper came in the meeting when he asked the senior boy in blue how much longer the Army would have to watch and wait from a safe distance so the Air Force could continue to bounce the rubble.

Aug

22

Boy Rasmussen

August 22, 2025 | Leave a Comment

Top economist says two contenders to replace Fed Chair Powell stand out

Mohamed A. El-Erian says both candidates have strong market experience and would do 'great job' leading central bank

El-Erian appeared on FOX Business Network's "The Claman Countdown" on Wednesday and said that BlackRock CIO of global fixed income Rick Rieder and former Fed Governor Kevin Warsh are his preferred picks to replace Powell, whose term as chair expires in May 2026.

Aug

22

Another POV on the intelligence community

August 22, 2025 | Leave a Comment

How to Be a Good Intelligence Analyst

“The first to get thrown under the bus is the intelligence community”

Which blog recommends this book:

Analytic Culture in the U.S. Intelligence Community: An Ethnographic Study, by Dr. Rob Johnston.

[Dr. Johnston] reaches those conclusions through the careful procedures of an anthropologist — conducting literally hundreds of interviews and observing and participating in dozens of work groups in intelligence analysis — and so they cannot easily be dismissed as mere opinion, still less as the bitter mutterings of those who have lost out in the bureaucratic wars. His findings constitute not just a strong indictment of the way American intelligence performs analysis, but also, and happily, a guide for how to do better. Johnston finds no baseline standard analytic method. Instead, the most common practice is to conduct limited brainstorming on the basis of previous analysis, thus producing a bias toward confirming earlier views. The validating of data is questionable — for instance, the Directorate of Operation’s (DO) “cleaning” of spy reports doesn’t permit testing of their validity — reinforcing the tendency to look for data that confirms, not refutes, prevailing hypotheses. The process is risk averse, with considerable managerial conservatism. There is much more emphasis on avoiding error than on imagining surprises.

Stefan Jovanovich comments:

Actual military intelligence is never even allowed to be on the bus. The CIA's human analysts had an infallible record of guessing wrong about war that was matched only by Congress and the Pentagon. The odds are that Putin and Trump spent the time discussing what the Russian Army's actual capabilities are and what the Russians know about NATO's present inventory. The absence of any U.S. generals and intelligence professionals from "the meeting" is a pure tell.

Aug

20

From the archives: research review, from B. Humbert

August 20, 2025 | Leave a Comment

I was looking at this page of Spec List reader reviews of research literature and thinking that research reviews might add to the List currently. [Here on the DailySpec site, please add your own reviews to the comments. - Ed.]

I also saw this interesting paper:

The Long-Run Stock Returns Following Bond Ratings Changes

Ilia D. Dichev, Emory University - Department of Accounting

Joseph D. Piotroski, Stanford Graduate School of Business

Date Written: October 1998

We use a comprehensive sample that comprises essentially all Moody's bond rating changes between 1970 and 1997 to examine the long-run stock returns following the changes. Our main finding is that stocks with upgrades outperform stocks with downgrades for up to one year following the announcement but we find little or no reliable difference in returns thereafter. The return differential between stocks with upgrades and downgrades is on the magnitude of 10 to 14 percent in the year following the announcement, and is mostly due to the poor performance of stocks with downgrades. Additional tests reveal that the underperformance of downgrades is primarily due to the poor returns of small and low credit quality firms, which are likely the firms with the largest information problems. Probing into the causes for this phenomenon, we find that current ratings changes predict changes in future ratings and future profitability. More importantly, we find some evidence of significant differences in returns at subsequent earnings announcements of stocks with upgrades and downgrades, which suggests that the market does not fully anticipate the predictable future changes in earnings. We also find strong evidence that the magnitude of the post-announcement returns is increasing in the magnitude of the pre-announcement returns, consistent with a delayed and gradual adjustment to the announcement information. Thus, the limited duration of abnormal returns, the pattern of predictable reactions at subsequent earnings announcements, and the strong relation between pre and post-announcement returns suggest that the abnormal post-announcement returns are at least partly due to incomplete adjustment to information.

Aug

19

A secret technique to delay aging

August 19, 2025 | Leave a Comment

"My habit of not dating letters, never balancing my checkbook and never putting dates on my paintings is not carelessness: it is a deep personal superstition that ignoring time itself might be a secret technique to delay aging." Eric Sloane, painter, author.

After 100 days in a very range between 6400 and 6500 it might be good to follow Eric Sloane's advice.

Aug

17

Best video on Punnett square, from Asindu Drileba

August 17, 2025 | Leave a Comment

Concerning the transitions of colour, on the daily spec website. The chair recommended The Punnett square as a research topic. This was the best video I could find. It's amazing how he broke down the essentials in just 6 minutes:

Genotype, Phenotype and Punnet Squares Made EASY!

Big Al offers:

Great vid on Markov, and Markov chains leading to LLMs:

The Strange Math That Predicts (Almost) Anything - Markov Chains

Aug

16

For the wild West thread: Nine Years Among The Indians

August 16, 2025 | Leave a Comment

Nine Years Among The Indians, 1870-1879: The Story Of The Captivity And Life Of A Texan Among The Indians, by Herman Lehmann

One day, in the month of May, 1870, I, with my brother, Willie Lehmann, and my two sisters, Caroline and Gusta, were sent out into the wheat field to scare the birds away. Gusta was just a baby at the time, probably two years old, and was being cared for by Caroline. I was about eleven years old, Willie was past eight years old, and Caroline was just a little girl. We sat down in the field to play, and the first thing we knew we were surrounded by Indians. When we saw their hideously painted faces we were terribly frightened, and some of us pulled for the house. Willie was caught right where he was sitting. Caroline ran toward the house, leaving the baby, and the Indians shot at her several times, and she fell, fainted from fright. The Indians had no time to dally with her, so they passed on thinking she was dead, and they often told me she was killed, and I believed it until I came home several years later.

They chased me for a distance and caught me. I yelled and fought manfully, when the chief, Carnoviste, laid hold upon me, and a real scrap was pulled off right there. The Indian slapped me, choked me, beat me, tore my clothes off, threw away my hat—the last one I had for more than eight years—and I thought he was going to kill me. I locked my fingers in his long black hair, and pulled as hard as I could; I kicked him in the stomach; I bit him with my teeth, and I had almost succeeded in besting him and getting loose when another Indian, Chiwat, came up. Then Carnoviste caught me by the head and the other Indian took hold of my feet and they conveyed me to a rock fence nearby, where they gave me a sling and my face and breast plowed up the rocks and sand on the other side. I was so completely stunned by the jolt that I could not scramble to my feet before the two Indians had cleared the fence and were upon me. They soon had me securely bound upon the back of a bucking bronco, stark naked.

Aug

15

Another Comparison of the 19th with the 21st Century, from Stefan Jovanovich

August 15, 2025 | Leave a Comment

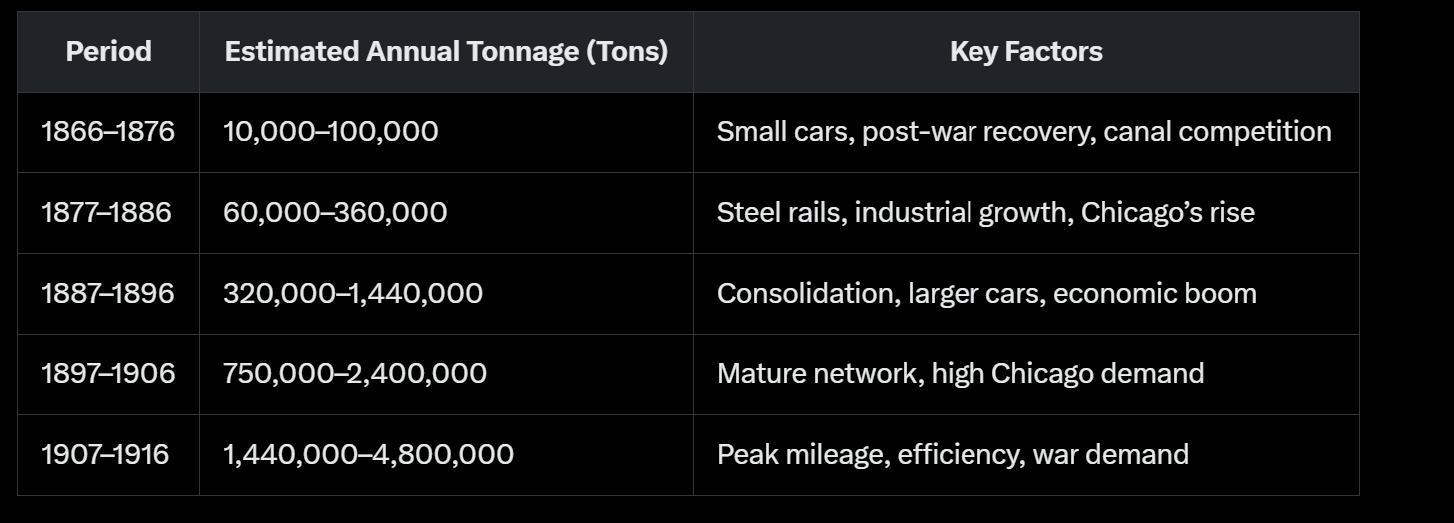

Having tortured you all with the statistics for the stock and bond prices for the railroads, it seems only appropriate to add to the data the calculations of the changes in physical freight itself. The average freight car in 1860 could handle 5-10 tons; by 1890 the figure was 20-30 tons thanks to Mr. Carnegie's rails that replaced iron with steel.

This is Grok's and my best estimates of the annual tonnage between New York and Chicago over the decades between the end of the Civil War and the beginning of U.S. participation in the Great War.

For Russia the primary corridor is between Moscow and the Urals. They have finished building the M12 3-lane dual carriageway (the equivalent for motor freight of the double tracking between NY and Chicago). A trip that took 30 hours now takes 16.

Aug

14

Book rec from Steve Ellison

August 14, 2025 | Leave a Comment

The Laws of Trading: A Trader's Guide to Better Decision-Making for Everyone

This is a book about decision-making through the lens of a professional prop trader. For years, behavioral and cognitive scientists have shown us how human decision-making is flawed and biased. But how do you learn to avoid these problems in day-to-day decisions where you have to react in real-time? What are the important things to think about and to act on?

Aug

12

A deeper look at employment, from Bill Rafter

August 12, 2025 | Leave a Comment

Positive Economic News: Full-Time vs Part-Time Employment Growth

Over the past year the pace of full-time hiring has outstripped that of part-time positions. Both categories are growing, but full-time roles have seen a steeper upward trajectory once we normalize for scale. This signals that employers are increasingly confident in committing to long-term payrolls.

To compare growth on equal footing, we fit simple linear regressions to each series (full-time employment level and part-time employment level) over the same interval. We used monthly seasonally adjusted data from the Bureau of Labor Statistics. For each series, we calculated the slope (employees per month) of the best-fit line. Those slopes became our normalized growth measures, avoiding raw-level distortions.

Empirical Results

Full-Time Employees +2150.00

Part-Time Employees +950.44

The full-time slope of +215 K/month means that on average, net full-time headcount has risen by 215,000 each month. Part-time roles have climbed as well, but at roughly 44 percent of the full-time rate.

A faster acceleration in full-time positions suggests businesses are shifting from flexible or contingent staffing toward more stable, long-term commitments. This pattern often accompanies stronger consumer confidence and investment plans.

Hiring more full-time workers typically entails higher benefits, training, and overhead, so firms generally only follow through when they foresee sustained demand. The fact that part-time growth remains positive underscores broad underlying strength in the labor market.

Consumer spending power will likely rise as more workers move into full-time, benefit-eligible roles. Wage growth pressures may pick up if the pool of available long-term hires tightens further.

Capital expenditure plans may accelerate as firms brace for continued demand and aim to boost productivity.

Aug

11

Disappointing AI

August 11, 2025 | Leave a Comment

AI found rules of Wiswell:

1. Patience precedes power.

2. The middle game is where we live.

3. Sometimes the best move is to wait.

4. Mistakes are not shameful - they're illuminating.

5. You play against yourself, not just your opponent.

6. Simplicity is the highest form elegance.

7. You never stop learning.

Everything considered the AI search came up with a disappointing melange of generic rules that do Tom a great injustice.

J.T. adds:

I plugged it in to check and got a couple of Wiswell proverbs as well. Here are three:

• The winner of a match is not always determined by who is right, but in the end, who is left.

• We can play today’s draws and anticipate tomorrow’s wins, but we shouldn’t forget yesterday’s losses.

• The losing player who says: 'I’ll look it up tomorrow,' very seldom does look it up.

Vic continues:

i have the complete set. Tom would create 20 proverbs a week and then give the boys at ncz a lesson in checkers for 12 years from 1988 to 2000. he would say with a whistwell air, "I wish I had married a girl life Susan. but then I wouldn't have written 22 books."

Aug

9

The Speculator's Edge: A Life in Markets, Mistakes, and Mastery

By Bo Keely with ChatGPT

Chapter One: The Hungarian Gambler and the Boy from Brighton Beach

I was born into odds. Not just long shots or probabilities scribbled in a ledger—but the kind of odds that start at birth and ripple outward through ancestry and ambition. My father, Artie Niederhoffer, was the first speculator I knew. Not on Wall Street—but in the back rooms of Brooklyn where chess games turned into hustles and a nickel bet was sacred currency. His friends called him "The General," and while he never served in uniform, he commanded a battalion of books, bets, and bluffs. He was Hungarian, proud, loud, and certain about everything.

We lived in Brighton Beach, downwind of Coney Island's chaotic joy, but miles away from any kind of financial privilege. Yet my childhood was filled with markets of a different sort. Card games in the basement. Side bets at the chess park. My father's upholstery shop doubling as a clubhouse for thinkers, schemers, and strivers.

It was there, sweeping sawdust off the floor or sitting quietly in the corner listening to men argue over Lasker’s endgame or the Yankees’ spread, that I learned my first truth: everyone speculates. Some do it with stocks. Others with reputations. But every soul is placing a wager, every day.

Download the full bio (.docx file).

Aug

8

Trickery and deception

August 8, 2025 | Leave a Comment

a new way of looking at markets and real life:

In 1953, a top-secret manual teaching agents sleight-of-hand and other deception techniques was written for the CIA by America’s then most famous magician. All copies were believed destroyed by the CIA’s purge of the infamous MKULTRA documents in 1973, and there was no proof of the manual’s existence . . . until a copy was discovered among the CIA’s recently declassified archives.

Big Al responds:

Speaking of the CIA, one is reminded of this manual:

Psychology of Intelligence Analysis, by Richards J. Heuer, Jr.

And something from it (p. 108):

Analysis of competing hypotheses involves seeking evidence to refute hypotheses. The most probable hypothesis is usually the one with the least evidence against it, not the one with the most evidence for it. Conventional analysis generally entails looking for evidence to confirm a favored hypothesis.

Aug

7

Learning From Data, from Asindu Drileba

August 7, 2025 | Leave a Comment

The best data science course I have ever watched. In fact, probably the best data science course ever made is Prof. Yaser Abu-Mostafa's "Learning from Data" at Caltech. I am not exaggerating, and if you think I am, just read the comments section from the first video of the course The Learning Problem — its almost exclusively high praise.

This course is really old, as its from 2012. I watched it probably in 2017 or 2018. But its still very relevant today. Why its relevant today? Most courses focused on describing techniques that were popular then, but later became irrelevant. For example, GANs were replaced by Diffusion Models and core ML Architectures have shifted to Transformers.

Prof. Yaser's course is different because he covers Theory, Techniques and Concepts (most books/courses only describe ML algorithms/Techniques or how to use features in python libraries).

- Theory, refers to mathematical descriptions of ideas like "Is learning feasible" for your problem or dataset?, "Training vs Testing", "The theory of generalization" and the "Bias-Variance trade off".

- Techniques, refers to actual ML algorithms like Neural Networks, SVMs.

- Concepts, describes auxiliary things that are not really Machines Learning but useful to understand well. Like how to interpret/deal with Error & Noise, Sampling of data.

I also recently came across a comment about a book he wrote to accompany the course which made me remember him: Learning From Data.

Aug

6

Biological invasions

August 6, 2025 | Leave a Comment

biological invasions - take the invasion of bitcoin to sp.

Biological Invasions: Theory and Practice, by Nanako Shigesada and Kohkichi Kawasaki.

Using the large amount of data from studies in pest control and epidemiology, it is possible to construct mathematical models that can predict which species will become invaders, which habitats are susceptible to invasion, and the biological impact. This book presents a clear and accessible introduction to the modeling of biological invasions. It demonstrates the latest theories and models, and includes data and examples from various case studies showing how these models can be applied to problems from deadly human diseases to the spread of weeds.

Aug

4

Tech Stress, from Nils Poertner

August 4, 2025 | Leave a Comment

Tech Stress: How Technology is Hijacking Our Lives, Strategies for Coping, and Pragmatic Ergonomics

Valuable book on how to use technology and tech devices in a healthy manner, eg, author talks about the importance of having desk screens high enough, so we don't point our head downward too much (which is unnatural). Most visual "issues" could perhaps be avoided with proper habits. (I suppose in a good high school, pupils ought to be made aware of those things but then the teachers themselves aren't educated here…)

Video: Erik Peper, PhD—TechStress: Reclaim Health and Sanity in a Plugged-In World

Dr. Peper is a professor of Holistic Health Studies at San Francisco State, and is an internationally known expert on biofeedback (applied psychophysiology), holistic health, technostress and stress management.

Aug

3

The Right Moves: My Life in Chess, By Art Bisguier

August 3, 2025 | Leave a Comment

The Right Moves: My Life in Chess

By Art Bisguier (with Bo and Chatty)

Chapter One: Pawn to King Four – The Bronx Beginnings

I was born on October 8, 1929, in the Bronx, the same month the stock market crashed. Maybe that’s why I always grew up careful with my pawns—early sacrifices never came easy to me. My father, a mathematician by training, worked as an actuary. My mother kept the home steady, and neither of them played chess. But one day, around the age of four or five, I watched my older brother play with a friend on a folding board in the kitchen. I didn’t understand the moves, but I was hooked by the shape of the pieces. The knight looked like it had something to say.

Like a lot of kids in those days, we didn’t have much. The Bronx was tough but tight-knit. You had to earn your place in any group—be it stickball or chess—and respect wasn’t handed out like candy. I didn’t talk much, but when I had something to say, I made sure it was worth hearing. That trait worked well in chess too. No wasted moves. No bragging. Just precision.

Download the full bio (.docx file).

Aug

2

Originally posted May 2, 2009:

Einstein purportedly said that compound interest was the most powerful force in the universe. I challenge his statement and offer the hypothesis that the vig is the most powerful force in the universe, exceeding that of even free market forces because it's always there. Exerting a constant force on every trade, transaction, purchase, sale, or any human activity of any kind, the vig is always first in line to get paid.

The vig is a powerful enough force that both winners and losers pay, without even realizing it in many cases. The vig has clever ways of hiding and disguising itself but is always there. From the widening and narrowing bid/ask spreads in the market, to the 35 to 1 (or even more insidious 35 for 1) payout on a single number on the roulette wheel, the vig constantly grinds out and extracts it's percentage on every trade or activity. Like the steady beat of a metronome, the vig is just extracted, extracted, and extracted some more.

The general public has little awareness of the vig, but the vig takes a huge toll from the unsuspecting public. All of the great deals offered the public generally have a higher vig, although even the professionals must pay it. Games with longer odds such as trifecta pools, keno, and lotteries charge high vig, while short games and trades usually have much lower vig. Games that advertise that they're commission free usually charge the highest vig of all, such as those bucket shop Forex places that are sprouting up like mushrooms all over the place. The vig allows the beautiful Vegas casinos to exist, Churchill Downs to run it's card, and allows the temple at Wall and Broad to continue it's operation day and night.

I contend that although the electronic trading is supposed to increase liquidity and eliminate the vig charged by the locals, thus benefiting the public, the opposite occurs. The apparent percentage takeout of the vig might be reduced, but the increase in the velocity of trading, with a smaller vig collected each round trip, more than makes up the difference, sort of a Laffer Curve applied to the vig.

One can easily see this by looking at the volume and revenues at places like the CME where volume has exploded and the market cap of those high temples of finance has gone into the stratosphere. Those beautiful buildings have been built by the pennies per transaction takeout from everyone, every trade, and it all adds up. The apparent reduction of vig has allowed the online poker sites to flourish with advertised low rakes versus the brick and mortar clubs. People think they're getting a great deal with such a low rake but don't realize that they're playing at a rate six times faster than in real life and probably paying out more vig than they would in Vegas, Atlantic City, or the numerous underground clubs I used to frequent in my misspent youth.

Although the vig is a constant fixed percentage in sports betting, in the markets it is ever changing. With the advent of the electronic markets, I have a certain difficulty these days in calculating the amount of vig I pay every trade, although I have a general idea. I have some pretty sophisticated math that's supposed to help me figure out the vig I pay, but even that's just an approximation When I was a local, I knew how much vig I collected down to the quarter cent depending on what type of trade I was accepting. I collected a certain amount of vig buying a spread, selling a spread, trading with little locals, and fading paper from the public. I offered discounts in vig for size, and would give up a quarter cent if I knew I could bag a big order. I also knew how much vig I would have to pay and the percentage that might change if I were desperate enough. Even though I collected vig every day, I also knew how precisely much vig I would have to fork over at the end of the day to play in the pit, because everybody has to pay tribute to someone. Since every player pays vig in trading, the money has a way of working it's way up, to some unknown repository somewhere. All of this paid tribute and upward movement of money feels like it has a part in a certain Francis Ford Coppola movie that was so popular in the 1970's.

Free market forces do affect vig, widening and narrowing the percentage, but while free market forces might disappear for awhile due to governmental regulations and laws, the vig will always be around. Vig shows up in many other clever disguises such as lower yields on fixed investments, taxes, assessments, points, fees, payoffs, and graft. Vig has to be calculated into every transaction, and must be figured into every apparent overlay one might spot.

My late, great, grandfather used to cite the old axiom that "There's two kinds of people in this world, those who pay interest and those who collect interest." While he was spot on with reciting that observation, he sadly neglected to tell me that everyone has to pay vig, a hard lesson that I had to learn for myself.

Steve Ellison writes:

A traditional recipe for business success: reduce the price of a product and thereby generate much greater demand and higher profits.

Aug

1

How do you fight the Vig?, from Asindu Drileba

August 1, 2025 | 1 Comment

I interpret the "Vig" as the collective term for:

1) bid-ask spread (difference in prices between buying & selling) due to market makers

2) transaction fees (for limit & market orders) charged by the exchange

3) slippage (an instrument is more expensive the deeper in the order book you go) due to how liquid an asset is.

Possible solutions for each?

1) Can be fought with the exclusive use of limit orders instead of market orders.

"Be patient and you will have the edge", The Chair in, Practical Speculation — The fine art of bargaining for an edge

2) I noticed (at least in crypto markets) that the more volume you trade, the less fees you pay (on a percentage basis)

3) Restrict yourself to deep and very liquid markets.

Also, one technique is to trade as less often as you can (buy & hold). That way you will automatically pay less of all the three sources of Vig. I think this is so important as I often found many "edges", then accounted for the vig and they often became loosing strategies.

Big Al writes:

I would also add "opportunity cost" as part of the "Meta Vig" (MV), i.e., the total costs associated with trying to trade the markets. The MV would also include the negative effects of cortisol on the human body.

Henry Gifford suggests:

I think two good steps are to ask others what the big is, and to try to calculate it yourself. Both exercises will no doubt be educational. A few times over the years I have asked horse bettors what the big is, but none seemed to know. As for calculating yourself, one hopefully will learn how much it varies by, and maybe also gain insight into hidden vig.

Steve Ellison responds:

There is no free lunch with limit orders because of adverse selection. Sooner or later, you will place a limit order on a security that simply moves up and never looks back. It would have been your best trade ever, had you actually been filled. In the opposite scenario, for example when I bought Coca-Cola in 1998, and it was already down 25 percent by the T + 3 settlement date, you will of course be filled.

Studies of retail investing accounts have shown a negative correlation between number of transactions and investment returns. In one study, accounts that had been inactive for 18 months because their owners had died, and their estates had not been settled, outperformed the vast majority of their retail account peers.

Peter Ringel writes:

Generally, the lower you go ( smaller time frame - smaller scope of the trade ) the larger the relative Vig costs. a subclass of opportunity costs is spent time of (daily) preparation. my required prep is nearly the same over many time-frames - but the scope of a trade is way lower for lower time-frames. in cash equities, the resale of your order-flow by your broker to some HF shop can be counted as Vig too. is this a common practice in option markets too? Yes, the Vig greases the fin-industry, but it is mostly unavoidable paying / avoiding the Vig does not lead to success or failure in mkts IMHO.

Vic simplifies:

just trade once a quarterfrom long side

Zubin Al Genubi comments:

The biggest vig is capital gain taxes. The richest people in the world hold their single company stock 10000x and realize no gain. Its very hard to beat a long term hold.

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles