Feb

8

CIO predicts 2026, too

February 8, 2026 | Leave a Comment

Expect Equity Markets to Broaden in 2026, Led by Small Caps, International

Both fiscal and monetary stimulus should boost earnings in the U.S. and abroad, with dollar weakness continuing to underpin international stocks.

Nils Poertner comments:

Back in High School, they gave a 1 pager of Latin and we had 1 hour to translate it (since it is an ancient language I was spending a lot of time to see what this all meant.) We all know English more or less. These days, I read a 1 pager in English (like this page) in 1 minute. My modern brain actually agrees with the whole article. Yummy. In reality there are probably a lot of cliches in it….

Zubin Al Genubi writes:

AI is about training data otherwise it gets stale and cliched. Like a person reading the same newspaper every day. Google has lots of data. Musk is merging SpaceX with AI because as internet provider he will have access to unlimited global data. I wonder what their contract disclosures say about data privacy.

Steve Ellison responds:

"Expect"? I have seen the broadening occurring since November. There was an extended non-confirmation of Dow Theory last summer into fall as the Industrials were making new highs, but the Transports remained below their November 2024 high. Not only did the Transports finally make an all time high, now they are making new highs before the Industrials do. Similarly, the equal-weighted S&P 500 ETF RSP, which was badly lagging the cap-weighted SPY in the 2025 rally off the "Liberation Day" tariff lows, made a new high yesterday while the cap-weighted index only partially regained some of its losses from earlier in the week.

I said on X [6 Feb.], "Lots of strength in the broader market. While technology stocks were selling off the last few days, the Industrial, Materials, Consumer Staples, and Energy sector ETFs all made new highs".

Feb

5

6 new lows, from Zubin Al Genubi

February 5, 2026 | Leave a Comment

The last few down swings each had 6 new lows before a bottom. Today, marking a new low for this swing after hours will end up a new low number 5 by the end of tomorrow.

Steve Ellison writes:

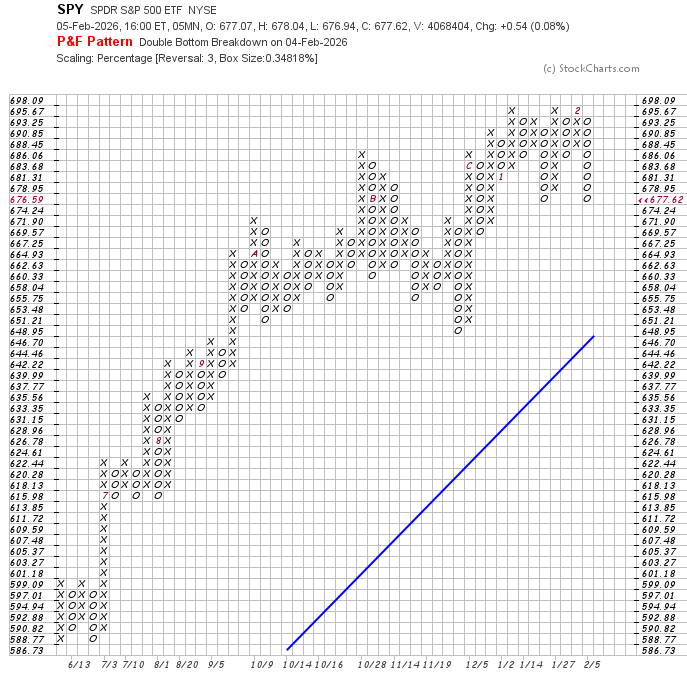

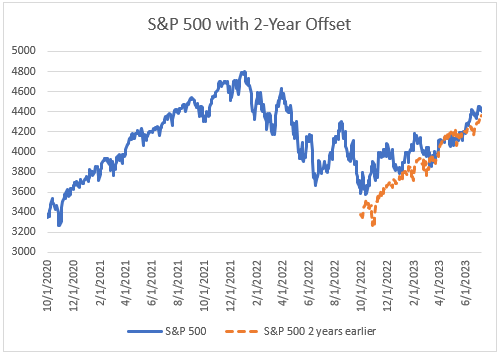

Interesting. I have been experimenting with multi-level point and figure charts. Using a box size of 1.4% (a long-term average true daily range) and a 3-box reversal, SPY is still within 4.2% of its all-time high and hence in an uptrend. Drill down with smaller box sizes and shorter time intervals, and interesting price structures appear. At a 1/4 ATR box size, today's close was at a similar level to the Jan. 20 low.

Lots of sector rotation under the surface. If 2025 was the year of the magnificent 7 and the flatlining 493, this year may be the opposite. While technology was getting beaten down this week, the Industrial, Materials, Consumer Staples, and Energy sector ETFs all made new highs.

Zubin Al Genubi adds:

Lots of late night shenanigans going on. Asian markets trading open in late thin US futures creating imbalances. Price action appears algo driven.

Nils Poertner comments:

I like the pattern with 6 new lows. Well spotted. Otoh, if the pattern does not repeat the surprise for mkts is bigger. nature offers "patterns" and "break of patterns" and both are relevant - else it would be a museum.

Cagdas Tuna predicts:

Then it is going to be a rough year for market cap weighted indices in US.

Peter Ringel writes:

While I would always give a study, like Big Al‘s more weight to remove opinion. I wonder, if there is a January effect regarding regime type or sector or general trading type. Not necessary % performance. Will the rest if the year trade like January? Would give a 2015 type year.

Nils Poertner responds:

yes. for practical purpose, it may be easier to trade mkts which receive less attention by the wider financial community /media.

Jan

27

Ralph Vince’s latest, from Larry Williams

January 27, 2026 | Leave a Comment

Ralph Vince's newest book. Not about the markets.

The Theology of Lust follows Ricky “Pork Chop” White — a wounded, self-mythologizing erotic savant — as he stumbles through desire, regret, and violent entanglements, trying to turn raw masculinity into something redemptive. It’s a darkly funny, psychologically unfiltered journey where erotic obsession, betrayal, and a lurking murder plot converge on one man’s desperate attempt to find some sort of salvation out of the mess he calls a life.

Asindu Drileba writes:

Nice! I remember Ralph Vince mentioned that one of his favourite books was The Bible. There is a strange relationship between speculation, theology & computers(artificial intelligence) that no one has comprehensively talk about. Hopefully, I will learn more about theology from this book.

Peter Ringel comments:

When I read the senator writing "the greatest project of his life", I immediately feared, that he fell victim to French, Spanish or Portuguese girls. The title seems to confirm this.

Larry Williams responds:

Good guess but not quite Ralph has a new steal proof coin coming out the book is a year old but was just translated to English from French.

Steve Ellison recalls:

We had a long-ago list member who would frequently draw parallels between never-ending market arguments such as fundamental vs. technical analysis and the European religious wars of the 1600s or theological debates such as predestination vs. free will.

Jan

21

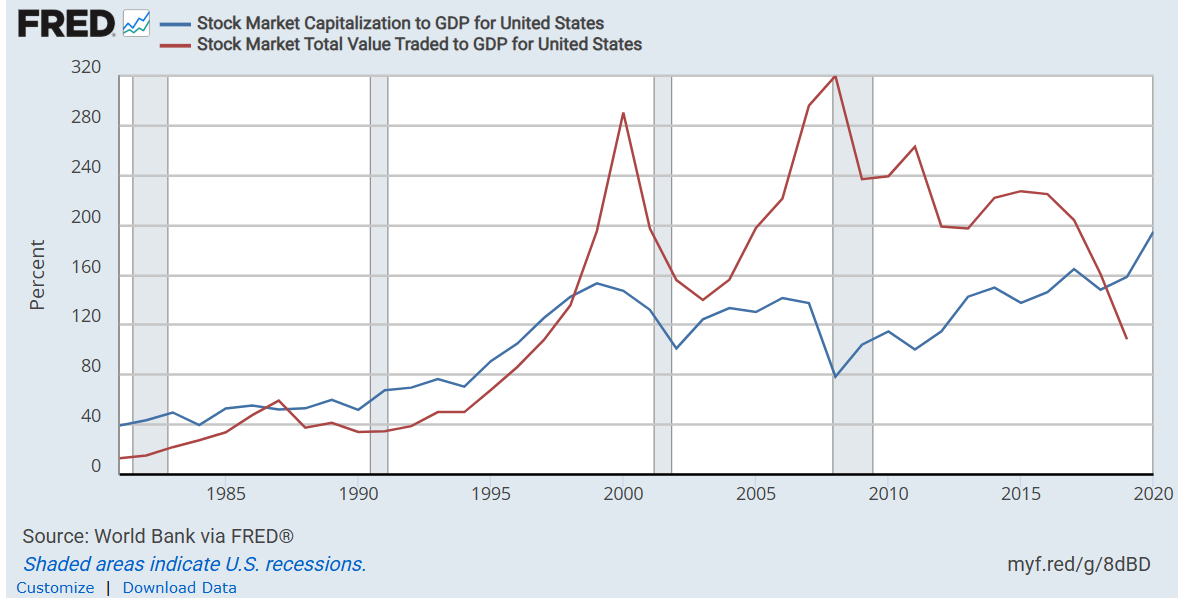

US Stock Mkt Value as pc of GDP (US), from Humbert X.

January 21, 2026 | Leave a Comment

Used to be like sub 50pc in the 1990 and now well over 200pc. Not meant to be of any value for speculation (would have been rubbish in the past and don't think any value for future). but one wonders what it does in terms of tension (internal/ external) as we as shareholders would not like to give back gains so easily (and there is the drift etc). Tricks to be used to keep it up - see v recent events- not judging here.

Larry Williams offers a chart:

Big Al wonders:

I wonder to what extent the decline in "Stock Market Total Value Traded to GDP" reflects a shift to dark-pool/off-exchange trading.

Peter Ringel writes:

TY Larry, great data! looks like we are severely undervalued. A 90s style party is coming.

@BigAl this too is a valid point. If founders don't go the exchanges anymore. Is there data on this off-exchange size? At least for their exit they will most likely show up in equities. Why should early backers not do this in the end? Its too juicy.

related: If off-exchange sector really gets dominant, then FED policy becomes even more toothless.

They have no tools to influence this.

Big Al asks Gemini:

In the US, how much stock trading occurs in dark pools or otherwise off exchanges?

Over 50% of all U.S. stock trading volume now occurs off-exchange, in venues such as dark pools and through internalizers at major firms, exceeding the volume on public exchanges for the first time in early 2025.

Overall Off-Exchange Volume: While dark pools specifically account for a smaller portion of the off-exchange activity (around 13% of consolidated turnover), the overall off-exchange market, including internalizers and bilateral trades, accounts for the majority of U.S. equity trading volume.

Purpose of Dark Pools: Dark pools and other off-exchange venues are primarily used by large institutional investors to execute big orders anonymously, which helps them avoid significant market impact and predatory high-frequency trading (HFT) strategies that can occur on public "lit" exchanges.

Regulatory Oversight: Despite their name, dark pools are regulated as Alternative Trading Systems (ATS) by the SEC and must report executed trades to regulators like the FINRA on a delayed basis.

Market Share Trends: Off-exchange trading share has been on a general upward trend for years, driven by the desire for better execution quality and anonymity. This shift has implications for traditional price discovery on public exchanges.

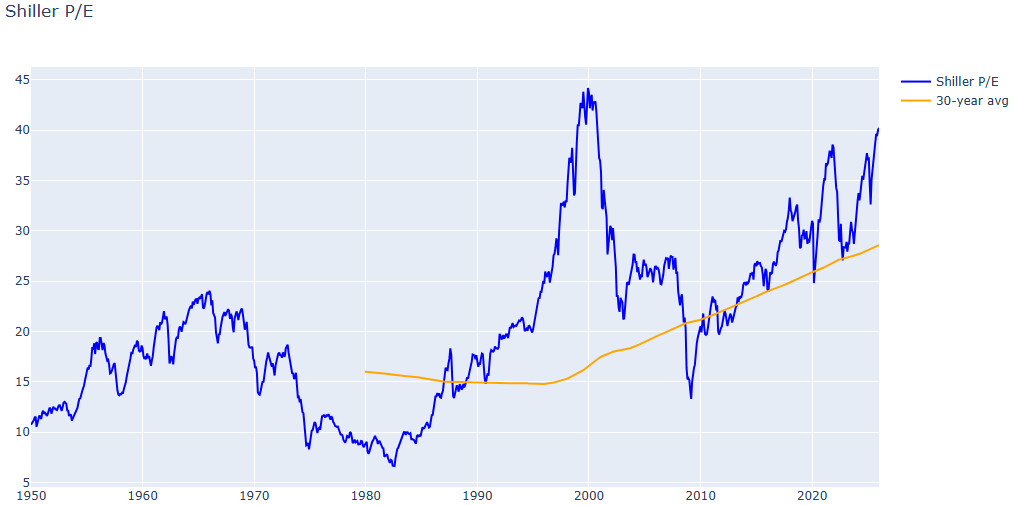

Steve Ellison does some analysis:

The Shiller Cyclically Adjusted Price Earnings (CAPE) ratio is at its second highest level in history, exceeded only in 1999-2000. What I find interesting is that the 30-year moving average of this ratio has nearly doubled since 1990. My theory is that permanently lower interest rates in an aging population support generally higher stock valuations than in past eras when large families were the norm.

And in the spirit of the old Spec List, here is the Python code I used (.text file) to generate this graph.

Big Al adds:

Another issue is the effect of Mag7 stocks which are global in a new way, beyond US GDP.

Jan

6

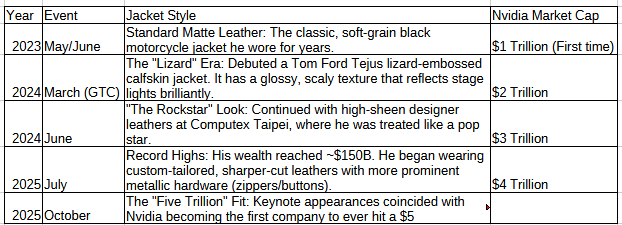

Leather jacket indicator, from Cagdas Tuna

January 6, 2026 | Leave a Comment

I asked Gemini if the Nvdia stock price milestone dates associated with Jensen Huang's famous leather jackets. Here is the timeline of Jensen's jacket evolution alongside Nvidia’s stock milestones:

The one that caught my attention is Lizard Era in March 2024. At that time Nvdia price was around $100 and after Jensen's Lizard Jacket appearance Nvdia stock fell 20-25%. And here is Jensen while debuting new chips last night. We will learn soon if the Lizard Jacket is a helpful tool for front running Nvdia stock!

Steve Ellison likes the idea:

Very unique and insightful analysis. My wife read a biography of Mr. Huang. When he was growing up in Oregon, his immigrant relatives wanted to put him in a private school, but the school they enrolled him in was a reformatory. After that life experience, I am pretty sure that Mr. Huang can't be intimidated by Donald Trump or Xi Jinping.

Peter Ringel adds:

agree. probably useful insights can come from seemingly absurd corners. Like the weather of sports teams in NYC.

Dec

14

Ever Changing Cycles in the NBA, from Andrew Moe

December 14, 2025 | Leave a Comment

Wonderful example of ever changing cycles in the NBA vis a vis the post up play which went dramatically out of favor when analytics reshaped the game into a three point shooting contest but now has come back into favor due to the spacing afforded by all those three point shooters.

How post-ups became the NBA's most efficient play

Stefan Jovanovich comments:

Steve Ellison is wistful:

Might one dare to hope that actually putting the ball in play for fielders might once again gain favor in baseball?

Nov

21

Sheep shearing, Humbert Q.

November 21, 2025 | Leave a Comment

Sheep needs to be regularly sheared to take off some extra wool- it is actually good for them- healthy!

Henry Gifford adds:

Back in the day sheep didn’t have people handy to shear them. A farmer told me that over the past few hundred years sheep have been bred to grow more wool, thus they need people now, but before that change the sheep didn’t grow as much wool.

Steve Ellison writes:

The S&P 500 reaching its lower 50-day Bollinger band on Thursday might indeed indicate some modicum of panic, as might VIX being well above its upper 50-day Bollinger band.

I have thought sentiment was quite restrained this year given that the S&P 500 was at a record high as recently as October 28. Bears have outnumbered bulls in the AAII survey for the past two weeks. And the publishing of a book titled 1929 was very well publicized. I perceive that out in the general population there is a lot of fear about AI; lots of scaremongering about AI eliminating nearly all white collar jobs.

Cagdas Tuna comments:

Many years ago when I was a teenager, I heard this from the head of top brokerage firm in Turkiye and he said "It is not news until it matters." Circle funding of AI companies and its effect on jobs have been long discussed at least by the people I follow on social media but it has had no impact until yesterday. So can we say it has become news now?

Nov

17

Corporate earnings, from Zubin Al Genubi

November 17, 2025 | Leave a Comment

I see they are down [at least through Q2]:

FRED: Corporate Profits After Tax (without IVA and CCAdj)

Steve Ellison responds:

Interesting. S&P 500 earnings per share were up both year to date and year over year. And Q3 so far looks better than Q2.

S&P source spreadsheet: Click link to download file: S&P 500 Earnings.

Big Al wonders:

So maybe the big firms are doing better than the smaller ones?

Nils Poertner remembers:

Investment Bank earnings 2007…My very cerebral friend Maurice at the time: "IBs are cheap - look at their PE ratios."

Nov

7

Ten days since an ATH

November 7, 2025 | Leave a Comment

10 days since all-time high. very bullish.

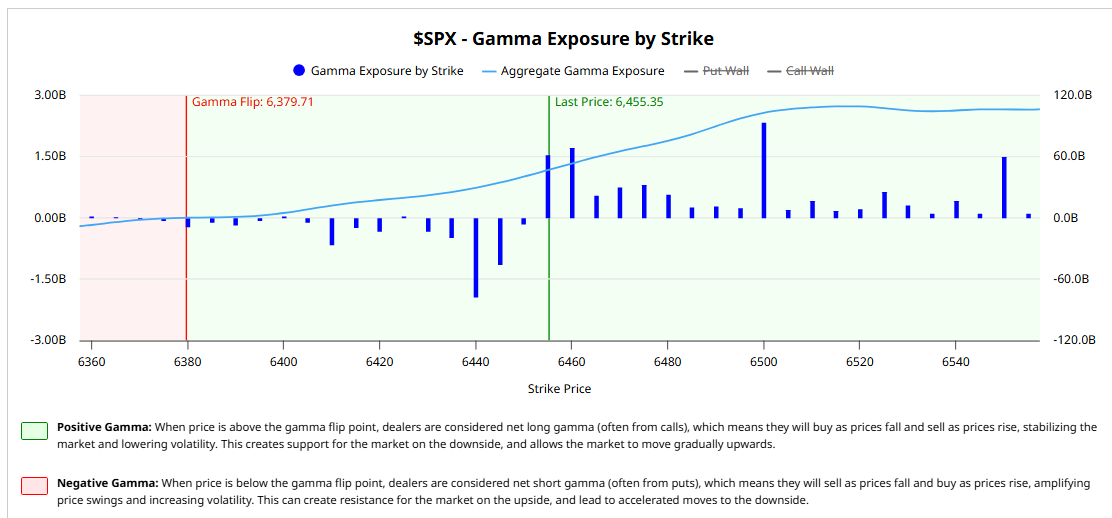

Steve Ellison comments on CAPE:

[Click chart for original post on X.]

6637-6660 is an important level for the ES December contract; not breaching this level (yet) in today's selloff is short-term bullish in my opinion, but the second highest valuation in history means the longer-term risk is high.

And I'm not sure exactly what the "rolling historical average" is, but by my calculation, the 30-year average CAPE is 28, which might make 40 somewhat less overvalued.

Oct

24

Another Historical Analogy, from Stefan Jovanovich

October 24, 2025 | Leave a Comment

Grok and I have produced this summary of the growth of the electric utilities industry in the United States from 1910 to 1930. [Click on chart for full view.]

Bud Conrad comments:

Not sure what you take from this data. Electrification was probably more important than AI. Its growth rate was big at first in %, but slowed. Recessions were big downturns. What do you apply to today?

Steve Ellison writes:

My grandmother was a telephone operator in the 1920s. It was a high-tech industry at the time.

Carder Dimitroff clarifies:

The definition of an "electric utility" changed over time.

Big Al suggests:

An excellent series available on Prime:

Shock and Awe: The Story of Electricity

Professor Jim Al-Khalili tells the electrifying story of our quest to master nature's most mysterious force: electricity.

Books I haven't read yet, which get lots of stars:

The Power Makers: Steam, Electricity, and the Men Who Invented Modern America

The power revolution is not a tale of machines, however, but of men: inventors such as James Watt, Elihu Thomson, and Nikola Tesla; entrepreneurs such as George Westinghouse; savvy businessmen such as J.P. Morgan, Samuel Insull, and Charles Coffin of General Electric. Striding among them like a colossus is the figure of Thomas Edison, who was creative genius and business visionary at once.

Empires of Light: Edison, Tesla, Westinghouse, and the Race to Electrify the World

In the final decades of the nineteenth century, three brilliant and visionary titans of America’s Gilded Age—Thomas Edison, Nikola Tesla, and George Westinghouse—battled bitterly as each vied to create a vast and powerful electrical empire. In Empires of Light, historian Jill Jonnes portrays this extraordinary trio and their riveting and ruthless world of cutting-edge science, invention, intrigue, money, death, and hard-eyed Wall Street millionaires.

Oct

3

Where am i wrong, from Larry Williams

October 3, 2025 | 2 Comments

Zero sum game: for every $ that wins the same amount will be lost. REALLY? you bought at 7 sold to me at 10 I sell at 20 and the contract goes off the board and delivered at 22 who lost? We lost that we could have made more $$ but where is a net loss?

Steve Ellison comments:

Adverse selection can make us all feel like losers. If I sold at 10, I should have held to 22. Or I should have put on more size. If I bought at 7, and it went to 5, that would have been even worse.

Jeff Watson goes literary:

But Yossarian still didn't understand either how Milo could buy eggs in Malta for seven cents apiece and sell them at a profit in Pianosa for five cents.

[ … ]

Milo chortled proudly. "I don't buy eggs from Malta," he confessed… "I buy them in Sicily at one cent apiece and transfer them to Malta secretly at four and a half cents apiece in order to get the price of eggs up to seven cents when people come to Malta looking for them."

"Then you do make a profit for yourself," Yossarian declared.

"Of course I do. But it all goes to the syndicate. And everybody has a share. Don't you understand? It's exactly what happens with those plum tomatoes I sell to Colonel Cathcart."

"Buy," Yossarian corrected him. "You don't sell plum tomatoes to Colonel Cathcart and Colonel Korn. You buy plum tomatoes from them."

"No, sell," Milo corrected Yossarian. "I distribute my plum tomatoes in markets all over Pianosa under an assumed name so that Colonel Cathcart and Colonel Korn can buy them up from me under their assumed names at four cents apiece and sell them back to me the next day at five cents apiece. They make a profit of one cent apiece, I make a profit of three and a half cents apiece, and everybody comes out ahead."

Sep

23

Health care costs, from Nils Poertner

September 23, 2025 | Leave a Comment

health care costs, our Achilles heel.

Health Insurance Costs for Businesses to Rise by Most in 15 Years

Insurers say that the rising premiums are driven by growing healthcare costs

(on a personal note: no-one is really fully healthy, not even kids normally! science uses a lot of Aristotelian logic (which is an either/or logic) but there are limits to it - and we take it way beyond its usefulness. Nature does not have those clear mental compartments - it is way more fluid /dynamic).

Steve Ellison writes:

Until the public announcement that Warren Buffett had bought shares in UnitedHealth, health care was by far the worst performing of the 11 S&P 500 sectors in 2025.

Nils Poertner responds:

Yes, the whole sector / subindex looks bullish (XLV). (the type of logic in the West (logic from Aristoteles) that dominates MODERN SCIENCE cripples our society. Why? Because in many cases, whatever the doctor says, "it is not" - it is only an image of something abstract (like the apple painting by Rene Magritte).

Pamela Van Giessen comments:

We overconsume healthcare because we pay so much for insurance and/or our employers give it to us in lieu of salary so we want to get all we can for “free.” We’ve been conditioned to believe that if we visit doctors (though now we see PAs) and get “check ups” and “tests” regularly and take pills to manage our bodies and minds in perpetuity that we won’t get seriously ill. Has got to be the biggest subscription scam ever perpetuated on a society.

Perhaps some spec would like to pull out the data and do some forensic financial analysis of all those hospital system balance sheets. I think that fully 1/3rd or more of hospital systems are owned by private equity firms and the bulk of non-profit hospital systems are extracting meaningful sums from the business regardless of how “healthy” their margins look on their financial statements. From an equity perspective the biz may have looked lousy but I can promise that it is extraordinarily profitable for the inside players.

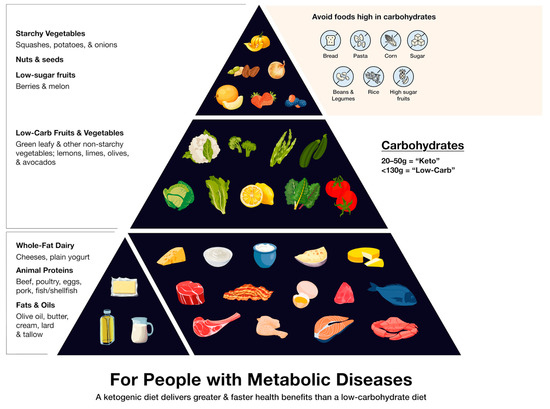

Jeffrey Hirsch adds:

Not only is it a total scam, but it gets in the way of real needed pharmaceutical/medical care and completely ignores metabolic healthcare via lifestyle and diet changes.

Too bad RFK is all wrapped up in his vaccine crusade to focus on the real USA health crisis with obesity and metabolic health, which causes diabetes, heart disease, cancer and cognitive decline. I think the covid vax is total BS as are others. But MMR and most childhood vaccines save lives. We had a measles outbreak in Rockland County a few years back because some communities did not vaccinate.

We should also flip the old USDA Food upside down. The chart is from my Doc’s paper. And my doc's site is Dr. Tro Kalayjian).

Sep

19

Dow theory, from Steve Ellison

September 19, 2025 | 1 Comment

This is a bit disturbing: According to classic Dow Theory, the Transports have not confirmed any new highs in the Industrials since November 25, 2024. If fewer goods are moving, is the economy really growing?

Aug

31

George Pólya, from N. Humbert

August 31, 2025 | Leave a Comment

George Pólya came up with the term Inventor Paradox.

Basically, if one thinks about a problem more deeply, something else may open up. And one can achieve extraordinary results! Plenty of examples in finance, engineering, medicine.

Steve Ellison writes:

From the Wikipedia link about the inventor's paradox:

When solving a problem, the natural inclination typically is to remove as much excessive variability and produce limitations on the subject at hand as possible. Doing this can create unforeseen and intrinsically awkward parameters.

Very interesting idea with applications in many fields. As one example, I recently told my daughter, who is a partner at Boston Consulting, that I was reading a book about strategy by a professor at Harvard Business School. She told me, "Boston Consulting literally wrote the book on strategy": Your Strategy Needs a Strategy.

I ordered that book and so far have read the first chapter. One of the key questions is how predictable the business environment is. Another is, how much can you influence the environment? "Classical strategy" as taught in business schools generally assumes that the environment can be forecast and that the company has very limited influence over it. A case study was the Mars candy bar company.

But if you cannot forecast the environment, a very different approach is called for, with heavy emphasis on learning and iterating. And if you can in fact shape the business environment, you might want to find some partners and create an ecosystem.

As a footnote, the book I was originally reading, which I also found informative, was by Richard Rumelt: Good Strategy, Bad Strategy.

Asindu Drileba offers:

Optimize the Overall System Not the Individual Components, interview given by Edwards Deming. Excerpts:

The results of a system must be managed by paying attention to the entire system. When we optimize sub-components of the system we don’t necessarily optimize the overall system.

Optimizing the results for one process is not the same as operating that process in the way that leads to the most benefit for the overall system.

Applied to markets:

- It's easier to do well on the S&P 500 index (the general market), than do well in a single stock (picking).

- Attributed Mark Spitznagel, we should judge the buying of far OTM puts based on how they help the entire portfolio. Not the individual PnLs of buying the far OTM puts.

- Attributed to Roy Niederhoffer, many traders turn off trading strategies once they start loosing money, but different trading strategies make money at different times.

Aug

26

0DTE & Volatility, from Peter Ringel

August 26, 2025 | Leave a Comment

The abysmal Volatility last Monday, 18 August, and the dead stop last Tuesday, EOD, were attributed by some to 0DTE. A little back on Spec List, papers were posted, showing this Volatility suppression effect by 0DTE options and their market makers.

I know it is just the latest holy grail traders flog to. Quite a few websites are offering subscriptions for the data. So, I was surprised to find it for free on Barcharts – the EOD version:

Steve Ellison adds:

Important information, thanks. Jeff Clark said on a podcast that 68% of all S&P 500 option contracts are 0DTE.

Aug

14

Book rec from Steve Ellison

August 14, 2025 | Leave a Comment

The Laws of Trading: A Trader's Guide to Better Decision-Making for Everyone

This is a book about decision-making through the lens of a professional prop trader. For years, behavioral and cognitive scientists have shown us how human decision-making is flawed and biased. But how do you learn to avoid these problems in day-to-day decisions where you have to react in real-time? What are the important things to think about and to act on?

Aug

2

Originally posted May 2, 2009:

Einstein purportedly said that compound interest was the most powerful force in the universe. I challenge his statement and offer the hypothesis that the vig is the most powerful force in the universe, exceeding that of even free market forces because it's always there. Exerting a constant force on every trade, transaction, purchase, sale, or any human activity of any kind, the vig is always first in line to get paid.

The vig is a powerful enough force that both winners and losers pay, without even realizing it in many cases. The vig has clever ways of hiding and disguising itself but is always there. From the widening and narrowing bid/ask spreads in the market, to the 35 to 1 (or even more insidious 35 for 1) payout on a single number on the roulette wheel, the vig constantly grinds out and extracts it's percentage on every trade or activity. Like the steady beat of a metronome, the vig is just extracted, extracted, and extracted some more.

The general public has little awareness of the vig, but the vig takes a huge toll from the unsuspecting public. All of the great deals offered the public generally have a higher vig, although even the professionals must pay it. Games with longer odds such as trifecta pools, keno, and lotteries charge high vig, while short games and trades usually have much lower vig. Games that advertise that they're commission free usually charge the highest vig of all, such as those bucket shop Forex places that are sprouting up like mushrooms all over the place. The vig allows the beautiful Vegas casinos to exist, Churchill Downs to run it's card, and allows the temple at Wall and Broad to continue it's operation day and night.

I contend that although the electronic trading is supposed to increase liquidity and eliminate the vig charged by the locals, thus benefiting the public, the opposite occurs. The apparent percentage takeout of the vig might be reduced, but the increase in the velocity of trading, with a smaller vig collected each round trip, more than makes up the difference, sort of a Laffer Curve applied to the vig.

One can easily see this by looking at the volume and revenues at places like the CME where volume has exploded and the market cap of those high temples of finance has gone into the stratosphere. Those beautiful buildings have been built by the pennies per transaction takeout from everyone, every trade, and it all adds up. The apparent reduction of vig has allowed the online poker sites to flourish with advertised low rakes versus the brick and mortar clubs. People think they're getting a great deal with such a low rake but don't realize that they're playing at a rate six times faster than in real life and probably paying out more vig than they would in Vegas, Atlantic City, or the numerous underground clubs I used to frequent in my misspent youth.

Although the vig is a constant fixed percentage in sports betting, in the markets it is ever changing. With the advent of the electronic markets, I have a certain difficulty these days in calculating the amount of vig I pay every trade, although I have a general idea. I have some pretty sophisticated math that's supposed to help me figure out the vig I pay, but even that's just an approximation When I was a local, I knew how much vig I collected down to the quarter cent depending on what type of trade I was accepting. I collected a certain amount of vig buying a spread, selling a spread, trading with little locals, and fading paper from the public. I offered discounts in vig for size, and would give up a quarter cent if I knew I could bag a big order. I also knew how much vig I would have to pay and the percentage that might change if I were desperate enough. Even though I collected vig every day, I also knew how precisely much vig I would have to fork over at the end of the day to play in the pit, because everybody has to pay tribute to someone. Since every player pays vig in trading, the money has a way of working it's way up, to some unknown repository somewhere. All of this paid tribute and upward movement of money feels like it has a part in a certain Francis Ford Coppola movie that was so popular in the 1970's.

Free market forces do affect vig, widening and narrowing the percentage, but while free market forces might disappear for awhile due to governmental regulations and laws, the vig will always be around. Vig shows up in many other clever disguises such as lower yields on fixed investments, taxes, assessments, points, fees, payoffs, and graft. Vig has to be calculated into every transaction, and must be figured into every apparent overlay one might spot.

My late, great, grandfather used to cite the old axiom that "There's two kinds of people in this world, those who pay interest and those who collect interest." While he was spot on with reciting that observation, he sadly neglected to tell me that everyone has to pay vig, a hard lesson that I had to learn for myself.

Steve Ellison writes:

A traditional recipe for business success: reduce the price of a product and thereby generate much greater demand and higher profits.

Aug

1

How do you fight the Vig?, from Asindu Drileba

August 1, 2025 | 1 Comment

I interpret the "Vig" as the collective term for:

1) bid-ask spread (difference in prices between buying & selling) due to market makers

2) transaction fees (for limit & market orders) charged by the exchange

3) slippage (an instrument is more expensive the deeper in the order book you go) due to how liquid an asset is.

Possible solutions for each?

1) Can be fought with the exclusive use of limit orders instead of market orders.

"Be patient and you will have the edge", The Chair in, Practical Speculation — The fine art of bargaining for an edge

2) I noticed (at least in crypto markets) that the more volume you trade, the less fees you pay (on a percentage basis)

3) Restrict yourself to deep and very liquid markets.

Also, one technique is to trade as less often as you can (buy & hold). That way you will automatically pay less of all the three sources of Vig. I think this is so important as I often found many "edges", then accounted for the vig and they often became loosing strategies.

Big Al writes:

I would also add "opportunity cost" as part of the "Meta Vig" (MV), i.e., the total costs associated with trying to trade the markets. The MV would also include the negative effects of cortisol on the human body.

Henry Gifford suggests:

I think two good steps are to ask others what the big is, and to try to calculate it yourself. Both exercises will no doubt be educational. A few times over the years I have asked horse bettors what the big is, but none seemed to know. As for calculating yourself, one hopefully will learn how much it varies by, and maybe also gain insight into hidden vig.

Steve Ellison responds:

There is no free lunch with limit orders because of adverse selection. Sooner or later, you will place a limit order on a security that simply moves up and never looks back. It would have been your best trade ever, had you actually been filled. In the opposite scenario, for example when I bought Coca-Cola in 1998, and it was already down 25 percent by the T + 3 settlement date, you will of course be filled.

Studies of retail investing accounts have shown a negative correlation between number of transactions and investment returns. In one study, accounts that had been inactive for 18 months because their owners had died, and their estates had not been settled, outperformed the vast majority of their retail account peers.

Peter Ringel writes:

Generally, the lower you go ( smaller time frame - smaller scope of the trade ) the larger the relative Vig costs. a subclass of opportunity costs is spent time of (daily) preparation. my required prep is nearly the same over many time-frames - but the scope of a trade is way lower for lower time-frames. in cash equities, the resale of your order-flow by your broker to some HF shop can be counted as Vig too. is this a common practice in option markets too? Yes, the Vig greases the fin-industry, but it is mostly unavoidable paying / avoiding the Vig does not lead to success or failure in mkts IMHO.

Vic simplifies:

just trade once a quarterfrom long side

Zubin Al Genubi comments:

The biggest vig is capital gain taxes. The richest people in the world hold their single company stock 10000x and realize no gain. Its very hard to beat a long term hold.

Jul

28

Tufte fail, from Humbert X.

July 28, 2025 | Leave a Comment

Specs have been posting about copper, and I happened across this act of chartcrime.

Steve Ellison comments:

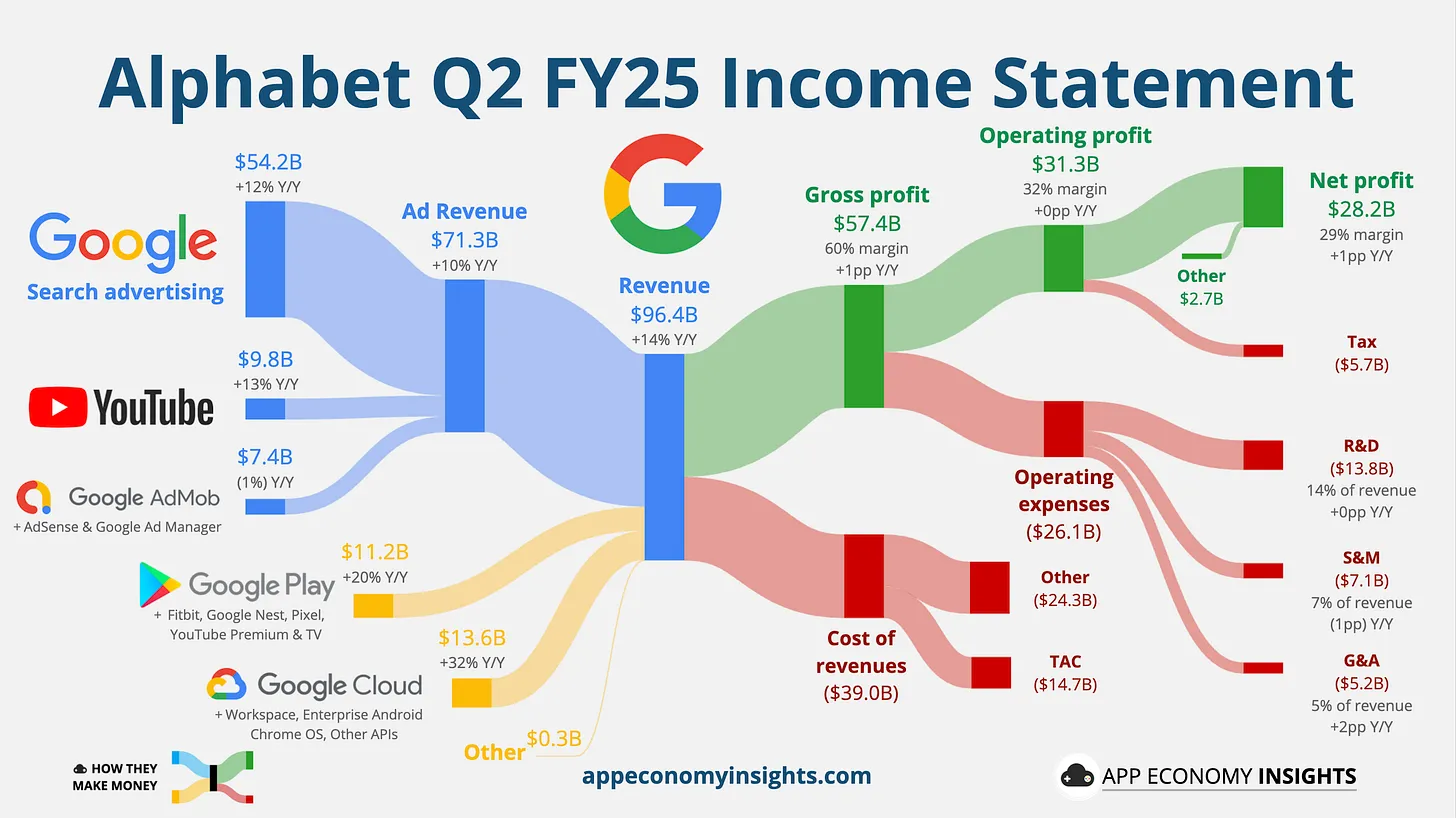

Wow, I don't think the software I used to generate Sankey charts in a previous career analyzing a petabyte-sized data lake to surface key insights for one of the big 3 personal computer companies would have allowed me to just start a new stream in the middle ("Imports of Refined Copper"). Anyway wouldn't it make more sense to join "Concentrate Net Exports" and "Scrap Net Exports" on the right side of the chart, and then put "Imports of Refined Copper" downstream of that junction?

I was using D3 in those days; now that I am much more experienced with Python, maybe I should search for a Sankey charting library in Python.

On the subject of copper, I perceive a macro trend that the US has geopolitical risk because too much domestic mining and basic material production was shut down, partly in order to export environmental impacts to less developed countries. Lithium and steel are in similar situations.

Peter Ringel writes:

"Sankey" that is a nice search term. I had it on my list to research. These guys use it a lot..

One finds several sankey libraries in Python on Github, such as this one.

Jul

19

Big Mac Index, from Jeff Watson

July 19, 2025 | Leave a Comment

For those who study such data, here’s the 2025 Big Mac index.

The Big Mac Index, a real and recognized metric developed by The Economist magazine in 1986, initially served as a light-hearted tool to measure purchasing power parity between countries. Today, it has evolved into a significant indicator of the global economy and currency valuation. This index compares the price of Big Macs in various countries to the price in the United States, offering insights into economic conditions.

Steve Ellison writes:

I love the Big Mac Index. But inquiring minds want to know, what about the eurozone, conspicuously missing from the article? The Big Mac Index judges the euro to be 15.2% overvalued, so this year's runup in EUR/USD appears not to be supported by burger fundamentals.

Jul

15

July, 1798 - John Adams Starts the first Loser War of the United States, from Stefan Jovanovich

July 15, 2025 | Leave a Comment

The rules for American warfare are painfully simple: we win the ones that other people start, and we lose the ones that we start. Today is the formal anniversary of the first loser war by the American Republic. Congress, at the urging of President Adams and his Secretary of the Navy, Benjamin Stoddert, revokes its treaty with France. Because the revocation put the country in a state of war with France but is not a formal declaration by Congress, our history books call it a "Quasi-War". Conventional history does its best to pretend that this was a success. History Today tells us "the Navy gained respect as a powerful force. It grew from a mere six vessels to about 30 commissioned ships. American warships captured more than 80 French vessels during the Quasi-War."

U.S. launches the Quasi-War with France, the first conflict since the Revolution

Total tonnage of ships captured during the Quasi-War

(the figures given are a range because the sizes of the individual ships captured have to be estimated; there are not enough surviving records to know how large each ship was.)

• American ships captured by French Navy: 200,050–400,100 tons

• French ships captured by U.S. Navy: 5,200–10,000 tons

We have better numbers for the the number of ships captured:

• American ships captured by French Navy: roughly 2,000

• French ships captured by U.S. Navy: 85-86

The American records are much more precise because the captures had to be valued; prize money was the incentive pay for the officers and sailors.

Steve Ellison writes:

Paul Johnson, in A History of the American People, wrote that Thomas Jefferson during his two terms as president was endlessly vexed by the depredations of both the British and French navies on American shipping. One wonders why we start any wars if we are guaranteed to lose.

Stefan Jovanovich responds:

The data for the war that the Democrat-Republicans (Jefferson and Madison) wanted and formally declared - the one that started in 1812 and is still looking for a name:

• U.S. Captures: 44,412–63,912 tons (200–250 vessels)

• U.K. Captures: 144,799–424,799 tons (1,406 vessels)

Jun

3

Books again, from Asindu Drileba

June 3, 2025 | Leave a Comment

I can't find any books from the 1700s. Big events like the Mississippi Scheme and the South Sea Bubble happened in that period. But I can't find literature from the 1700s of people describing markets then. Maybe they had PTSD from having their fingers burnt? I heard Newton never wanted anyone to mention "South Sea" around him. (he lost his pile in the investment)

Stefan Jovanovich responds:

Essai sur la Nature du Commerce en Général, by Richard Cantillon (1680s–1734)

During 1719 Cantillon sold Mississippi Company shares in Amsterdam and used the proceeds to buy them in Paris. Mississippi Company shares surged from 500 livres in January 1719 to 10,000 livres by December 1719; during the same period the prices in Amsterdam went from 400 to 7,000. The daily average spread is calculated to have been between 20% and 40%.

Carder Dimitroff suggests:

Empire Incorporated — The Corporations that Built British Colonialism, by Philip J. Stern

The book provides historical perspectives about British markets and corporate financing. It's not an easy read, but it is fascinating.

William Huggins writes:

there is a collection of "things written afterwards" about 1720 called The Great Mirror of Folly but its mostly moralizing tracts than a steely-eyed review of what went down. keep in mind the experience (a bubble in uk-fr-nl, all at the same time) had profound effects on the market for almost a century afterwards with the fr retreating from paper money and the british passing the bubble act which made it waaaay harder for anyone to raise capital. trading stock largely returned to being an insiders game until the 1800s. GMoF was recently published along with a pile of other primary docs by Yale U press:

The Great Mirror of Folly: Finance, Culture, and the Crash of 1720

I like the goetzmann treatment of 1720 from Money Changes Everything personally. He's got a couple of good recorded talks on it too. for those interested in institutional developments around markets and financial institutions in north america, I strongly recommend Kobrak and Martin's "Wall Street to Bay Street."

Steve Ellison offers:

Extraordinary Popular Delusions and the Madness of Crowds was written in 1841 by Charles Mackay. The first three chapters are devoted to the Tulip Mania, the South Sea Bubble, and the Mississippi scheme. The remainder of the book is about non-financial episodes of irrationality, including a chapter about plagues that I re-read closely in March 2020.

May

18

Strategies, from Francesco Sabella

May 18, 2025 | Leave a Comment

With long-term investors, short-term traders, trend-followers, mean-reversion advocates, and buy-low-sell-high activists all confident their strategy is superior and showing market success, is this evidence that all approaches work together, or does survivorship bias and misplaced confidence masks that no single strategy truly dominates in today’s volatile markets?

I’ve always been fascinated by the fact that there are investors holding forever competing with traders who do the complete exact opposite and usually one says the other person is an idiot and the same is the opposite haha. (The only time I think I’ve heard of someone praising another’s way of working which was totally opposite of his in this business, was the yearly speech of Buffett and Munger claiming Jim Simons and his team were very very smart.)

Steve Ellison responds:

There are different ways to find an edge in the market, so market participants behave differently. A market maker who uses order flow information behaves very differently from a fundamental investor who believes a company has value that is unrecognized, but they may both be very good at what they do. Probably neither person could do the other's job. It's a big reason why I heed Livermore's admonition to neither seek out nor act on tips about the market.

My observation having seen multiple market cycles is that bad news spreads fast and is known quickly, while good news often occurs so diffusely and so quietly that it often doesn't even register as "news". I have as my pinned X post a 54-year chart of the S&P 500 that is annotated with the most prominent bad news for each year. Every one of these events seemed at the time to be a reason for stocks to go down (as did many other things that were only the second or third worst news of the year). I adapted this from a similar chart that Venita Van Caspel published in her 1983 book The Power of Money Dynamics.

May

16

Be careful with AI, from Asindu Drileba

May 16, 2025 | Leave a Comment

The chair recently made a tweet about a Galton book he was reading. I could read the text on the image but had to squint. I later took a copy of the image as asked Grok to extract for me the text so I can read it comfortably. Grok could only extract the text "Natural Inheritance."

After that, it didn't tell me it failed to extract the rest. it just made up its own fictional text that sounded plausible. I quickly learned it was just slop since I had already read some of the actual text in the picture.

My worry is that some people are using these LLM tools for medical records, creating legal documents. The latest AI gimmick is the so called "Agents" that will supposedly be used to file tax returns, book flights and do actual tasks on behalf of humans. My opinion would be to completely cut out all AI tools for critical tools.

Steve Ellison responds:

I am very, very careful about what I enter at an AI prompt, especially when doing proprietary or confidential work, lest my ideas become part of the cloud.

Laurence Glazier comments:

For this sort of thing use NotebookLM. Choose your sources for it, it will give you citation and preview.

Apr

27

Age is just a number, from Jeff Watson

April 27, 2025 | Leave a Comment

88 years old and skating. He started skating at age 70.

Octogenarian skateboarder shreds concrete in Spain's Bilbao

"My bones are special," he chuckles between sips on a post-workout glass of white wine at his favourite bar in Bilbao's working-class neighbourhood of Begoña. "Though I touch wood."

Steve Ellison writes:

In only 2 more years, he will be old enough to have "sufficient experience … to command success" in Wall Street, as Clews put it, and know exactly when to skateboard down to lower Manhattan in a panic.

Apr

17

The Theory Of Societal Stupidity, from Jeff Watson

April 17, 2025 | Leave a Comment

Any market parallels?

The Theory Of Societal Stupidity

by Dietrich Bonhoeffer

Dietrich Bonhoeffer (4 February 1906 – 9 April 1945) was a German Lutheran pastor, neo-orthodox theologian and anti-Nazi dissident who was a key founding member of the Confessing Church. His writings on Christianity's role in the secular world have become widely influential; his 1937 book The Cost of Discipleship is described as a modern classic. Apart from his theological writings, Bonhoeffer was known for his staunch resistance to the Nazi dictatorship, including vocal opposition to Nazi euthanasia program and genocidal persecution of Jews.

Stefan Jovanovich asks:

Why do we need a theory?

Steve Ellison adds:

Gustave Le Bon in his 1895 book The Crowd noted that the intellect of any crowd was far lower than that of any of its members. And he considered all political parties to be crowds.

Apr

15

Trade deficits, from Steve Ellison

April 15, 2025 | Leave a Comment

The president seems to believe that trade deficits are evil and must be stamped out. If he ever actually succeeded at meaningfully reducing the trade deficit (so far the reverse is happening), what would be the implications for capital flows into and out of the US, and how might those changes affect markets?

Humbert L. responds:

Finance professor Jeremy Siegal wrote a piece decades ago about how the trade deficit is driven in part to demographics. Currently, the US is consuming more than it can produce, due to baby boomers retiring, no longer working, while still consuming. China is on the other side of the coin, with a younger workforce that is producing more than it's consuming.

Eventually the demographics will reverse, along with the trade deficit. The old folks in the US pass away, along with their consumption, and the US will start producing more than it's consuming, while China's young ones become old, retire, and they start consuming more than they are producing.

Asindu Drileba writes:

This sounds like a very plausible explanation for the phenomenon of "cycles" in the stock market, as described by the senator.

Apr

5

Time for the canes?, from Doug Martin (Updated)

April 5, 2025 | Leave a Comment

I'm liking the look of that huge spike down in ES, out of my euro and sterling, that was a crazy move too. Technically it's nice looking low, from a chart perspective. I'm liking the low interest rate and commodity softening posture, I'm pretty damn bullish on equities.

William Huggins responds:

the shock moment is not when the canes come out - those metaphorically come out when the bulls have given up. those are generational moments related to the culling of new speculators who have only known rising markets (ie, anyone who joined robin hood with their stimulus checks in hand). as long as there are people willing to pay x60-100 earnings for hype, i don't think its quite time for a shift in strategic allocation.

this is simply the first serious wakeup call for anyone who thought this administration is doing anything remotely like macroeconomic analysis when it sets policy. according to the executive, there will be more such shocks to come so as many were fond of suggesting in mid-november "buckle up" (your 401k, and the usd, have both been liberated from gravity!)

Steve Ellison comments:

The S&P 500 has not even gone off the bottom of my hand-drawn chart. The move down since yesterday strikes me as more an efficient market repricing of reduced economic prospects than an emotional panic or forced selling.

By contrast, my hand-drawn chart on February 28, 2020.

Adam Grimes states:

Canes? Nowhere close, in my opinion. And the fact that many people think this is a crash is just a lack of perspective (and a misunderstanding of potential.) Again, all in my opinion, which may change with any tick.

UPDATE: Stefan Jovanovich has a shopping list:

The idiot list is the catalog of companies that our model collects on the presumption that their common stocks will be worth more in 5 years than they are now. I publish it when we guess that our stupidity is within the 25% range - i.e. we won't lose more than $1 out of every $4 we invest in those companies if they liquidate. Thanks to the List and others, we have learned not to trade so the publication is, in no sense, a "Buy"; it is simply an indication that prices have gotten low enough that the list has more than 10 companies on it. (A month ago it had 5.)

Mar

30

The hypothesis is that at the end of a quarter in which bonds are up while stocks are down, institutions need to rebalance their asset allocations by selling bonds and buying stocks.

I found 14 such quarters since 2002, not including the current quarter. In the last 5 trading days of those 14 quarters, SPY was up 8 times and down 6 times, with an average net change of 0.9% with a t score of 0.76–statistically insignificant.

My Python code that I used to obtain the above results.

Big Al responds:

That's an event I hadn't thought about in a long time. It's hard to imagine a lot of big institutions running a simple strategy like that these days, which doubt your study would appear to support. But it does make me wonder if there are other, more complex balances or relationships that big players do manage on a calendar basis.

Alex Castaldo comments:

The general idea of trying to take advantage of "fixed behavior" by others is a good one IMO.

Paolo Pezzutti agrees:

It's like finding regularities end of month or Holiday's behavior or several others. I think there may be many still uncovered. Steve on Github has made public a number of Python notebooks. Very nice work to stimulate curiosity in searching patterns. It's not rocket science based on Artificial Intelligence, but I think this methodology has still value.

Asindu Drileba writes:

The rebalancing edge is real. In BTC for example, I realized that the most consistently active, "high activity" period is the time around 0:00 UTC (Server time). Something interesting is always happening during that period.

It turns out alot of people trade BTC daily and it just makes sense to rebalance the position size at midnight. I too even choose it sub-consciously. I don't think many people are choosing 03:00 UTC , 17: 43 UTC etc. Unfortunately, you need second by second, price quotes over many days, weeks, months and years to investigate this activity further. So I put it on pause. But the "activity" still exists.

M. Humbert adds:

Window dressing at quarters end is probably still occurring as well.

William Huggins writes:

several years ago i followed in Markman's steps of investigating the S&P500 drops and additions for irregularities (they did exist but have since been arb'd out). the driving mechanism was that index fund managers were paid to minimize tracking errors, not maximize performance so they would all trade at the same time, causing a secondary effect on the day the change actually took place (there was a preliminary change the day of announcement). it was a pretty basic academic event study but the most valuable part was uncovering "why" big money was doing a thing that created opportunities for fast moving traders (email me if you want it, but the trade doesn't work anymore)

Mar

27

Spec roundup

March 27, 2025 | Leave a Comment

Jeff Watson has been watching the CME:

Anyone else notice the increase in seat prices (trading rights) recently?

Big Al found a history lagniappe:

BabelColour

@StuartHumphryes

Travel back in time 117 years to the Russia of 1908. I have enhanced for you this rare colour photo of the Russian writer Leon Tolstoy, regarded as one of the greatest and most influential authors of all time. It was taken in the grounds of his house at Yasnaya Polyana, near Tula, Russia. It is original colour, not colourised.

Steve Ellison provided his own:

Since one might be well advised to beware the Ides of March, here is a picture I took in 2017 of the ruins of the Theater of Pompey.

Asindu Drileba has been reading:

The importance of contrarianism emphasized by Jeff Bezos, from the Amazon 2020 Letter to Shareholders:

Differentiation is Survival and the Universe Wants You to be Typical

Our bodies, for instance, are usually hotter than our surroundings, and in cold climates they have to work hard to maintain the differential. When we die the work stops, the temperature differential starts to disappear, and we end up the same temperature as our surroundings….While the passage is not intended as a metaphor, it’s nevertheless a fantastic one, and very relevant to Amazon. I would argue that it’s relevant to all companies and all institutions and to each of our individual lives too. In what ways does the world pull at you in an attempt to make you normal? How much work does it take to maintain your distinctiveness? To keep alive the thing or things that make you special?…This phenomenon happens at all scale levels. Democracies are not normal. Tyranny is the historical norm. If we stopped doing all of the continuous hard work that is needed to maintain our distinctiveness in that regard, we would quickly come into equilibrium with tyranny….We all know that distinctiveness – originality – is valuable. We are all taught to “be yourself.” What I’m really asking you to do is to embrace and be realistic about how much energy it takes to maintain that distinctiveness. The world wants you to be typical – in a thousand ways, it pulls at you. Don’t let it happen.

Mar

20

Shoeshine boy, from P. Humbert (Updated)

March 20, 2025 | 1 Comment

I had a reverse shoe shine boy moment to day. A friend, who shouldn't talk to me about markets, talked to me: "Your boy Trump is crashing the markets. My portfolio …." I take such data points serious - in combinations.

Steve Ellison responds:

Similarly, my sister in October 2008 was getting 150 calls per day from clients asking, "Should I sell?" She worked at an insurance company that also offered investment services. My reaction at the time was, "Isn't anybody calling to ask, 'Should I buy?'"

Jeffrey Hirsch writes:

Still hearing a lot of “Should I buy?” Two weekends ago was asked if would come on cable biz Monday 2/24 to say I was buying mega cap tech. I declined and said I did not think is was time. Posted this that day.

Updates:

Nils Poertner writes:

valid observations here. good to pay attention to odd moves, anything strange (eg like bund move recently) - as there may be more odd things coming!! in other words, be like Alexander Fleming - who stumbled on penicillin by chance - and didn't bin the sample as he wasnt looking for it.

Adam Grimes comments:

I obviously understand the shoe shine boy/taxi driver point here, but it's worth considering that market psychology is not asymmetrical.

P. Humbert responds:

Hi Adam. there is high risk, that I initially heard about the old masters from your writings. I agree, that it probably has more weight for tops. I think, that is where you are pointing to? My friend has quite a good performance in being wrong. He called the the Bitcoin top being bullish and some more. He is a nice guy, just not for markets.

Adam Grimes agrees:

Yeah that's always been my thinking–a little more actionable with exuberance at tops. Bottoms tend to overshoot a bit more, on balance, so I think the shoe shine boy cries uncle a bit too soon.

Nils Poertner adds:

sometimes the crowd is right or they have a hunch but they don't connect the dots yet

eg. "a bit of subprime" in early 2008 - as sort of consensus view among your typical investor back them it was high time to position extra cautious.

Bill Rafter comments:

The “crowd” is mostly right, but the problem is that there are usually several crowds, and of course the composition of the crowds change. If you’re lucky, there will only be two crowds, the knowledgeable ones, and those “asleep at the switch”. The trading rule is simple: follow the informed ones, particularly if the uninformed ones are 180 degrees away. A classic example of this is the Commitment of Traders Report. Ideally the reporting specs will be one way, with the non-reporters the other way (and preferably short). Without the benefit of COT, you can identify best- and worst-informed with regression.

Mar

17

A Specialist in Panics, from Steve Ellison

March 17, 2025 | Leave a Comment

From the first section of:

Fourteen Methods of Operating in the Stock Market

Magazine of Wall Street, 1918

Mar

16

10% correction in S&P 500, from Steve Ellison

March 16, 2025 | Leave a Comment

Before last week, the S&P 500 index had 25 declines of 10% or more since 2003. The median of the maximum drawdowns is -14.6%.

Mar

5

If your company is a domestic power generator like Constellation (CEG) or Calpine (CPN), the proposed Trump Administration tariffs at the Canadian and Mexican borders could help elevate gross margins. If Canada cuts off electricity altogether, additional margins may become available. While generators may benefit, US consumers will be harmed.

Uncertainty clouds northern US grids amid Canada tariff threat

Canadian premier says he will cut off electricity exports to US ‘with a smile on my face’

M. Humbert writes:

It’s my understanding that utilities are generally regulated to provide a steady ROA based return. If so, I don’t believe that they can raise their prices and increase their gross margins, as that would raise their ROA. They can raise their prices though if their costs go up (to maintain their ROA). It’s been a while since I last looked at utilities though. Am I mistaken about this?

Carder Dimitroff responds:

Yes, regulated utilities generally provide steady ROAs. However, some states fully regulate their electric utilities. Other states deregulated bulk power (wholesale power) and the generators that supply bulk power. Most population centers in the US are in deregulated states.

In the deregulated states, the title to bulk power passes to regulated distribution utilities at substations adjacent to transmission lines. Specifically, titles pass to distribution utilities at substations' step-down transformers.

Ontario supplies bulk power to unregulated states (Minnesota, Michigan, and New York). Quebec supplies bulk power to New York and New England. New Brunswick also supplies New England. All three provinces own and operate nuclear power plants. While Canadian transmission lines feed power directly to specific locations within those states, imbalances propagate to other states.

Ontario updated its strategy. They now plan to tax Ontario power exports at 25%.

Steve Ellison writes:

In this video Peter Zeihan says that a hurdle to green energy is that essentially all cost is up front, unlike natural gas plants in which only 20% of the lifetime cost is in construction, and 80% is in fuel costs over the life of the plant. So even when total lifetime cost of green energy is less than that from a natural gas plant, the higher upfront costs make financing more difficult. If true, I would guess cost recovery of the upfront expenses is also more risky in a deregulated market.

Feb

11

Full vs part-Time employment growth rates, from Bill Rafter

February 11, 2025 | 1 Comment

Steve Ellison wonders:

Will NBER ever acknowledge there was a recession? Or maybe as in 2001, they will retrospectively announce a recession after the recession has already ended. The job market for white collar job seekers was horrendous in 2023 and 2024. But GDP never went negative. "Learn to code" is out; "Learn to weld" is in.

Bill Rafter responds:

Yes, there was Recession. If bureaucrats in power refuse to admit the obvious, or use obtuse metrics to define economic activity, then the Intelligent Man has to find another way to define or measure that activity. The chart below, of Payroll Tax Receipts Growth, matches the negative period you described.

Jan

29

From the archives: Mind Set! by John Naisbitt, from Steve Ellison

January 29, 2025 | Leave a Comment

Book Review: Mind Set! by John Naisbitt, from Steve Ellison, April, 2007

Some interesting bits:

- One trend is the continuing growth of China, which Mr. Naisbitt points out is quite decentralized: “Beijing pretends to rule, and the provinces pretend to be ruled”.

- While some fear that American culture is obliterating local cultures, Mr. Naisbitt asserts that the world is changing America more than America is changing the world, as more than 1 million legal immigrants per year enter the United States.

- In an intriguing tidbit, Mr. Naisbitt quotes Alan Greenspan as expecting private currencies to return by the end of the 21st century.

Steve Ellison updates:

That book was written in 2004, before bitcoin was invented (speaking of "private currencies"). Mr. Naisbitt is no longer with us, having passed on at age 92. The last thing I noticed him doing, in 2010 or so, was touting the emerging world as the most important story. In my opinion, A LOT has changed since then. We have macro experts on the List who would have much better insight, but I would start with Rocky's accurate prediction in 2016 that the Brexit vote was the canary in the coal mine for the post-Cold War global elite and their policies of globalization, mass immigration, and "cling[ing] to the religion and arrogance of knowing what is best for the common man — and which often also involves rejecting common sense and facts in evidence."

The decentralization of Chinese government finances is today a key reason why a massive economic stimulus from Beijing, as urged by many Western economists, simply cannot happen. The critical mass of government spending is in the provinces, and their governments are starved for revenue after the real estate bust. Christopher Balding writes frequently about all things China on X as @BaldingsWorld.

Nov

30

Productivity and AI, from David Lillienfeld

November 30, 2024 | 1 Comment

When do we start seeing the effects of AI show up in national economic data? If you had invested $5K in a laptop and a word processing program, you could replace a secretary at multiples of the cost. When the web came in, there was Amazon squeezing out the costs of the middlemen.

But I don't see the savings for AI. I see lots of talk, some free programs, but in terms of real productivity, not so much. I'm also told that it's early days and I'm asking for too much in posing such a question, but I think we're now getting far enough into AI that it's not an unreasonable matter to bring up.

One thing that's clear is that AI isn't going to generate employment the way the last tech push did. But if it's going to really change the world as its advocates suggest that it will, those productivity gains should be apparent by now.

M. Humbert writes:

However AI productivity gains are measured, it’ll have to account for the productivity loss due to its high energy consumption. For the Austrian economics fans here. I’ve found Copilot to be a helpful time saving tool, so others probably do as well, so time savings definitely are occurring from AI use today.

Laurence Glazier responds:

Using it all the time, huge experiential benefit. Chatting to GPT every morning while reading Thoreau. Instant context. The other big breakthrough is spatial computing. All in the service of art.

Asindu Drileba comments:

From my experience, co-pilot and other LLMs, have not solved anything that could not already be done via ordinary Googling. Looking up solutions to code issues on stack overflow is no different from LLMs. And stack overflow is still better for some tasks (fringe computer languages like APL for example). LLMs are impressive, but are mostly just gimmicks. The only thing it has actually saved me time on is generating copyrighter material and filler text.

Jeffrey Hirsch adds:

Just had that discussion today about ordinary google still being even better than LLM Ais in finding info. Had some fun with AI editing and embellishing copy.

Asindu Drileba adds:

I suspect that the bad SWE job market is due to high interest rates, no AI. The SWE job market is enriched mostly by VC money. And VC money dried up when LPs withdraw to earn risk free money in treasuries instead of betting on start-ups whose success is on probability. I expect it to recover if interest rates come down to previous levels.

I think the LLM narrative was just something that tech executives parroted to show they had an LLM strategy. It's, Like how in 2018/2017 every executive had a "Blockchain" strategy. A lot of businesses assumed that LLMs would replace simple customer support jobs but they just saw their tickets pile up. Even the $2B valued, Peter Thiel financed, code assistant that would make you money on Up work as you sleep turned out to be a blatant scam.

Steve Ellison writes:

I don't have an answer for Dr. Lilienfeld's question about when AI effects will show up in productivity statistics. But I do hear anecdotally through my professional networks that AI projects are adding real value.

At the same time, Asindu is correct that the bad job market for techies, myself included, is more a consequence of rising interest rates–and I would add overhiring during the pandemic–than positions being replaced by AI. As Phyl Terry put it, "But this company [that announced layoffs] wants to go public so the better story is 'we are smart leaders using AI to become more efficient and profitable' vs 'we were idiots during the pandemic and have to lay off some people because we messed up.'"

Gyve Bones writes:

I find that the AI's ability to interpret my request and put together a coherent synthesis of several sources to be very helpful. Grok is nice because it provides a set of links to sources relevant to the prompt, and to related ??-posts and threads.

Laurence Glazier asks:

I usually have audio conversations with GPT rather than the older typed-in input/output. I just subscribed to X Premium to get access to Grok. Any good links for learning good usage? How nice Musk names it from the Heinlein novel.

Gyve Bones responds:

Check out the sample prompts Grok supplies on the [ / ] section in ??. The news analysis prompts for trending items is pretty cool.

Bill Rafter writes:

My business partner and I are in the process of marketing a new software application. Although we are rather literate, we have been running all of our marketing materials through Copilot, and we are amazed at the improvements Copilot makes to our text. It results not only in improved communication, but is a real time-saver. We even asked it to write a business plan, and it came back with a better one than our original.

Peter Penha offers:

I have not (yet) been on Grok but have found that the prompts do not differ very much across LLMs:

A Primer on Prompting Techniques, June 2024.

Prompt engineering is an increasingly important skill set needed to converse effectively with large language models (LLMs), such as ChatGPT. Prompts are instructions given to an LLM to enforce rules, automate processes, and ensure specific qualities (and quantities) of generated output. Prompts are also a form of programming that can customize the outputs and interactions with an LLM. This paper describes a catalog of prompt engineering techniques presented in pattern form that have been applied to solve common problems when conversing with LLMs. Prompt patterns are a knowledge transfer method analogous to software patterns since they provide reusable solutions to common problems faced in a particular context, i.e., output generation and interaction when working with LLMs. This paper provides the following contributions to research on prompt engineering that apply LLMs to automate software development tasks. First, it provides a framework for documenting patterns for structuring prompts to solve a range of problems so that they can be adapted to different domains. Second, it presents a catalog of patterns that have been applied successfully to improve the outputs of LLM conversations. Third, it explains how prompts can be built from multiple patterns and illustrates prompt patterns that benefit from combination with other prompt patterns.

This is earlier/shorter February 2023 paper - I am also a fan/follower of Prof. Jules White’s classes on Coursera why I flag the shorter/earlier paper as well.

Separate on the subject of AI - Eric Schmidt has a new book Genesis with Dr. Kissinger as a co-author (his last work before his passing) but Schmidt did a Prof G Pod Conversation released Nov 21st - in the podcast Schmidt goes over the threat from LLMs that are unleashed and noted that China in his view has open sourced an LLM equal to Llama 3 and that China instead of a being three years behind the USA on LLMs is a year behind. That China comment can be found here at 26:30.

Finally if anyone wants a great book I have read, on the history of the race to AGI going back to 2009: the Parmy Olsen book Supremacy on the histories of Sam Altman and Demis Hassabis is a wonderful read. Also breaks the world down between the AI accelerationists and the AI armaggedonists.

Big Al adds:

I do use Bard to learn or refresh my memory with R. For example, I am trying to use the "tidyverse" set of packages, and Bard is very useful when asked to write code for some task specifically using, say, tidyquant. The code almost never works first time cut & paste, but I can see how things are done differently and figure out what needs fixing. And I get answers to simpler problems faster than on Stack Exchange which is better for more complicated issues.

Laurence Glazier comments:

It's an inverted Turing test situation. The things that AI can't do help identify our humanity, our birthright.

Nov

24

Stops, from Hernan Avella

November 24, 2024 | Leave a Comment

Contrary to what has often been repeated on this esteemed list over the years, the art and process of trading is fundamentally the art and process of setting the right stops. Simpletons may claim that adding stops to a system (trading ES) reduces profitability, but that's only because the system itself is flawed, with laziness baked into its design. Setting the right stop is an integral process—it involves gauging current and expected volatility, weighing potential paths, and accounting for the bias.

Steve Ellison writes:

One of my best experiences with this list was that at the sparsely attended Spec Party in summer 2009, the 20 or so of us who were there had a very spirited discussion in Victor's living room about whether it was advisable to use stops or not. Many excellent points were made both pro and con.

Speaking for myself, I usually don't enter stop orders because they become part of the market, but I have mental stops. On the rare occasions when I actually have a profit, I am determined to not let it turn into a loss. And if a trade goes against me (by a nontrivial amount), that's new information that apparently my original analysis missed; in that case I am determined not to let a small loss turn into a big loss.

To put it another way, I entered a trade because I thought I had an edge, but the market moved in the wrong direction. Maybe something bigger is going on than, say, my analysis of the last 10 post-options-expiration weeks.

Big Al offers:

Stop Orders in Select Futures Markets

Nicholas Fett and Lihong McPhail

Office of the Chief Economist

Commodity Futures Trading Commission

August 29, 2017

This paper analyzes trade and order book audit trail data to provide a detailed summary of the use of stop orders in select futures markets; specifically E-mini S&P 500 Futures, Ten Year Treasury Note Futures, and WTI Crude Oil Futures. Recent flash rallies and the ever increasing speed of futures markets have called into question the appropriateness of traditional stop order strategies. By utilizing metrics related to both placement of and execution of stop orders, we show that stop orders are being used in these futures contracts with varying frequency and the strategy of stop order placement varies greatly by participant. As expected, trades involving stop orders are found to be highly correlated with intraday price volatility. Existence of stop orders is generally unknown to market participants as stop orders are not visible in the orderbook but must be triggered by a trade in the market at the corresponding price. More importantly, our analysis indicates that many traders are not only using stop orders for hedging purposes but also using them for latency reduction strategies. We provide a background on the usage and depth associated with stop orders in selected futures markets.

Larry Williams responds:

THANKS FOR THE POST. This should dispel the notion "they are going after my stops."

Asindu Drileba writes:

I don't actually use stops at all. My position size is my stop. I only bet a maximum of 3% of my bankroll. I really only get out of the market when I am liquidated. I sleep knowing that if I am to loose, my maximum loss is capped at 3%. I don't even respond to margin call emails. I often want to capture the moves between the daily open and the close. So what happens in between is something I usually ignore.

Oct

16

Professor Bejan interview, from Steve Ellison

October 16, 2024 | Leave a Comment

75-minute interview with Professor Bejan on the occasion of his winning the 2024 Association of Mechanical Engineers Medal: The professor discusses, among other things, how his experience playing basketball gave him insights into how systems of flow evolve.

J.A. Jones Distinguished Professor of Mechanical Engineering

Professor Bejan was awarded the Benjamin Franklin Medal 2018 and the Humboldt Research Award 2019. His research covers engineering science and applied physics: thermodynamics, heat transfer, convection, design, and evolution in nature.

He is ranked among the top 0.01% of the most cited and impactful world scientists (and top 10 in Engineering world wide) in the 2019 citations impact database created by Stanford University’s John Ioannidis, in PLoS Biology. He is the author of 30 books and 700 peer-referred articles. His h-index is 111 with 92,000 citations on Google Scholar. He received 18 honorary doctorates from universities in 11 countries.

Oct

12

Asking for recommendations, from Steve Ellison

October 12, 2024 | Leave a Comment

Recommendations for an intro to multivariate statistics?

Bill Egan replies:

Here are four excellent multivariate statistics books I have used for many years. I suggest tackling them in this order.

1. Jerrold Zar - Biostatistical Analysis, 5th ed. (this is half univariate and half multivariate)

2. Neter, Kutner, Wasserman, Nachtsheim - Applied Linear Statistical Models, 4th ed (there is now a 5th ed and you can find the pdf by googling)

3. Alvin Rencher - Methods of Multivariate Analysis (there is now a 3rd ed.)

4. Mardia, Kent, Bibby - Multivariate Analysis (there is now a 2nd ed.)

You need to understand linear algebra to do this, e.g., at the level of Strang's Introduction to Linear Algebra, 6th ed. (his lectures are on MIT's opencourse website). Rencher, Neter, and Mardia all use that notation extensively. You also need to understand and be able to do univariate stats at the level of:

• Snedecor and Cochran - Statistical Methods, 8th ed.

• Riffenburgh and Gillen - Statistics in Medicine, 4th ed.

You will really learn multivariate methods only if you code them. Matlab is the best (Matlab Home is cheap), and yes, I coded everything in these books and a lot more work of my own invention in Matlab.

David Lillienfeld adds:

Snedecor and Cochran is the grand old lady of texts. Neter et al is still pretty popular on campuses.

Asindu Drileba asks:

Concerning statistical packages. I often hear some data science communities complain about how there are simply too many bugs & wrong implementations in the Python space. Maybe this is why you are recommending MATLAB? What do think of R or Julia?

Bill Egan responds:

I have used Matlab since 1993 for many things - research, papers, patents, commercial scientific software products. Matlab stands for matrix laboratory. The original data structure was scalar, vector, matrix. If you like to work in matrix/linear algebra notation, or need to, Matlab is the program to use. Other data structures have been added on, such as tables for mixed data types, but like al ladd-ons, this does not always work well. Quality control of the software is great. Very widely used by engineers. Very high level language, so you can see the algorithm without getting lost in the details like you do in C++.

R is not so good for linear algebra because the original data structure is a table for mixed data types. Matrix work is more difficult. Quality control of core R and major packages is good despite R being open source (although it has license restrictions) because it is used by many academic statisticians. I used R for analysis for a couple of years. Fairly high level language. Better for classical stats work where you make a table out of the data and have mixed data types.

Python is completely open source and the people who created and use it most have no knowledge of statistics and that shows. We used it primarily as a scripting/control language inside one of my software products. Available packages do have bugs/errors or are missing methods for stats. We tested them and could not use them; I had my guys code any stats related stuff from scratch. It is not as high level a language as R or Matlab, so you have to do more work. Do not recommend it.

I have no experience with Julia.

Sep

28

What is in Brooklyn?, from Asindu Drileba

September 28, 2024 | Leave a Comment