Jun

27

Games old and new

June 27, 2023 | Leave a Comment

i grew up playing paddle tennis and beat Bobby Riggs in a money match. Paddle tennis is 99% identical to pickleball except that it used a good punctured tennis ball instead of the monstrosity they use in the promoted game of pickleball.

In honor of Alfred Cowles who started the Cowles Commission at Yale and whose articles in Econometrica and the Monthly Weather Review sparked my interest in stock market behavior 60 years ago: after stock market down prev day, expectation 3 days later is 2.5, but after stock market up prev day, expectation 3 days later is 0.7. based on last 7000 obs from 1996.

the grandfather holding the hand of the 4-yr-old as she climbs up the stairs of plane is the kind of thing that most people would be turned off by as it's so obvious.

the old gray mare: Lott-Stossel: Election Betting Odds

Hayek Was Right: The Worst Do Get to the Top

Jun

27

Ergodicity, from Zubin Al Genubi

June 27, 2023 | Leave a Comment

Ergodicity - odds of group equal odds of individual over time. Risk differs in coin toss and Russian Roulette due to absorbing barrier. Adopt strict risk aversion in trading. Survival is key.

Big Al suggests:

Luca Dellanna on Risk, Ruin, and Ergodicity

May 29 2023

Author and consultant Luca Dellanna talks with EconTalk host Russ Roberts about the importance of avoiding ruin when facing risk. Along the way Dellanna makes understandable the arcane concept of ergodicity and shows the importance of avoiding ruin in every day life.

Ergodicity: Definition, Examples, And Implications, As Simple As Possible, by Luca Dellanna

Larry Williams asks:

What the fun of life with modulated risk?

Nils Poertner wonders:

why do so many traders self-sabotage themselves (self-sabotage is perhaps a strong world but from the outside world it looks like that). some deeper religious guilt thing or so? addictions?

H. Humbert responds:

You can get your fun from winning instead of from the risk taking it takes to win.

Larry Williams asks again:

And how do you win without risking???

H. Humbert answers:

You can't. I was reacting to "the fun of life with modulated risk" comment. You can enjoy the risk taking part, the winning part, both, or none. To me, simply enjoying the risk taking part incentivizes the wrong thing, but enjoying winning, the right thing. You could say that simply enjoying taking risks will lead to winning but then every gambling addict would be a winner, so it's not that simple.

Zubin Al Genubi responds:

As a practical matter money management and convex asymmetric payoffs. Recognizing the risk and the extent is a big part of the puzzle. There is a large range from the coin flip to Russian Roulette not quite recognized by static statistics. The time element is important, hence ergodicity.

Larry Williams states:

Risk within reason but still risk - keeps us young!

Jun

24

Capitalism in America

June 24, 2023 | Leave a Comment

Interesting and poignant articles in The Austrian point out that the Fed now owns 2.6. trillion of mortgage securities. it built this up since 2008 and caused distortion in the real estate markets. The fed has a 408 billion mark to market loss on these securities - 10 times the Fed's capital of 42 billion.

The Fed Is Overindebted, Isn’t It?

Wall Street to the Fed: Inflation Is Over. Give Us More Easy Money!

An excellent and inspiring book:

Capitalism in America: A History, by Alan Greenspan and Adrian Woolridge

Chapter 3 of Greenspan's book is inspiring: "In 1914, Americans were able to shave with Gillette, gab on phones, drive a Model T…before that there were more animals that people in cities."

Hany Saad is surprised:

Victor Niederhoffer praising “anything” Greenspan!!!!! Now I know I am in Kansas.

Vic clarifies:

the last part of the book is typical Greenspan propaganda for the progressives.

Jun

19

Apropos of the roll, from Hernan Avella

June 19, 2023 | Leave a Comment

SP futures implied financing rate 5.62%

Sep/Jun spread = 45 points

SP Earnings Yield = 4.85%, -0.95% Real

10Y Yield = 3.72%, 1.55% Real

Interesting to consider that during the previous regime, people were very bullish with the adage of "stocks carry themselves". What do they say now?

Steve Ellison comments:

Speaking as one of those who said, "stocks carry themselves", stocks are not carrying themselves now. The dividend yield on the S&P 500 is about 1.6%, compared with the 3-month Treasury bill yield of 5.2%. It is now a different point in the business cycle as outlined by Philip L. Carret in his 1931 book The Art of Speculation (I have the version republished by Wiley in 1997 with a foreword by the Chair).

Business cycles don't always follow the textbook script, but if I had to guess, the likely next steps are a slow-motion banking crisis (as depositors one by one compare their banks' interest on deposits with the aforementioned Treasury bill yield) and recession.

Mr. Carret appeared on Wall Street Week at age 98 in 1995. At 1:40 in this video:

Louis Rukeyser: What do you do, given your experience, when you think there may be too much froth, when you think there may be a major correction, even a crash? Do you sell all your stocks?

Philip Carret: No, I really don’t do anything … I’ve seen a lot of recessions, and I can live through them, and I can do it again.

Hernan Avella replies:

Thanks Steve. I believe looking at the dividend yield only is folly. You need to add the buybacks (Known as shareholder yield). Currently @ 4.62%.

Steve Ellison responds:

It is worth noting that, based purely on the S&P 500 dividend yield, stocks never carried themselves for 50 years from 1958 to 2008. Nevertheless, the upward drift continued, and there were many bull markets during that time.

I reviewed the Art of Speculation here on December 13, 2007, 49 years into the period of stocks never carrying themselves, noting that it might be difficult to follow the advice to buy when stocks carried themselves. Here is an excerpt:

"Borrowed money is the lifeblood of speculation" (p. 101). Interest rates greatly influence the direction of stock prices. "A bull market undermines itself" (p. 119) as prosperity and increased borrowing for speculation drive up interest rates. One of Mr. Carret's specific methods might be difficult to replicate today. He suggested borrowing money when interest rates were low to buy stocks with higher dividend yields than the interest rate on the borrowed funds. A stock bought in this fashion would "carry itself" and have a high probability of moving higher. With today's much lower dividend yields, such stocks are probably difficult to find today.

Hernan Avella writes:

Some YTD figures [as of 13 June]:

Semiconductors (SMH) +51%

NQ100 + 36%

Commodities -8.98%

Low Vol Sp500 stocks -2.19%

Emerging Bonds, local currency +6.5%

European "Growth" stocks +15%

What happened with the bears in this list?

H. Humbert responds:

What happened? Nothing happened, wrong so far. Old favorites never lead a new bull market, but they are now. Saw an article today, people are cutting back on fries at McDonald's but that doesn't seem to matter. Semis are going gangbusters, but they're not hiring. Anyway, I never sell and buy when I see value regardless of "the market". Bought my first stock of the year two weeks ago.

Humbert H. adds:

Hernan, if you go down the route of buybacks you need to account also for stock issuance, employee options, M&A/deletions from the index, IPOs/additions to the index etc to estimate the net buyback yield. This way it is apples to apples. If you do that you will get a small positive number <1% (you prob want to smooth out considering that buybacks are cyclical).

Tim Melvin comments:

Buybacks and debt reduction play no role in determining of stocks are a carry trade. Cash received versus interest paid.

William Huggins comments:

the free yield on buybacks has been the manipulation of earnings downward prior to announcement of said buyback (and subsequent restoration). its generally done in a small enough amount that its hard to pick up individually (but shows up plainly in large samples). (chair mentioned this back in 2007 i think?)

Jun

18

Tale of two sons

June 18, 2023 | Leave a Comment

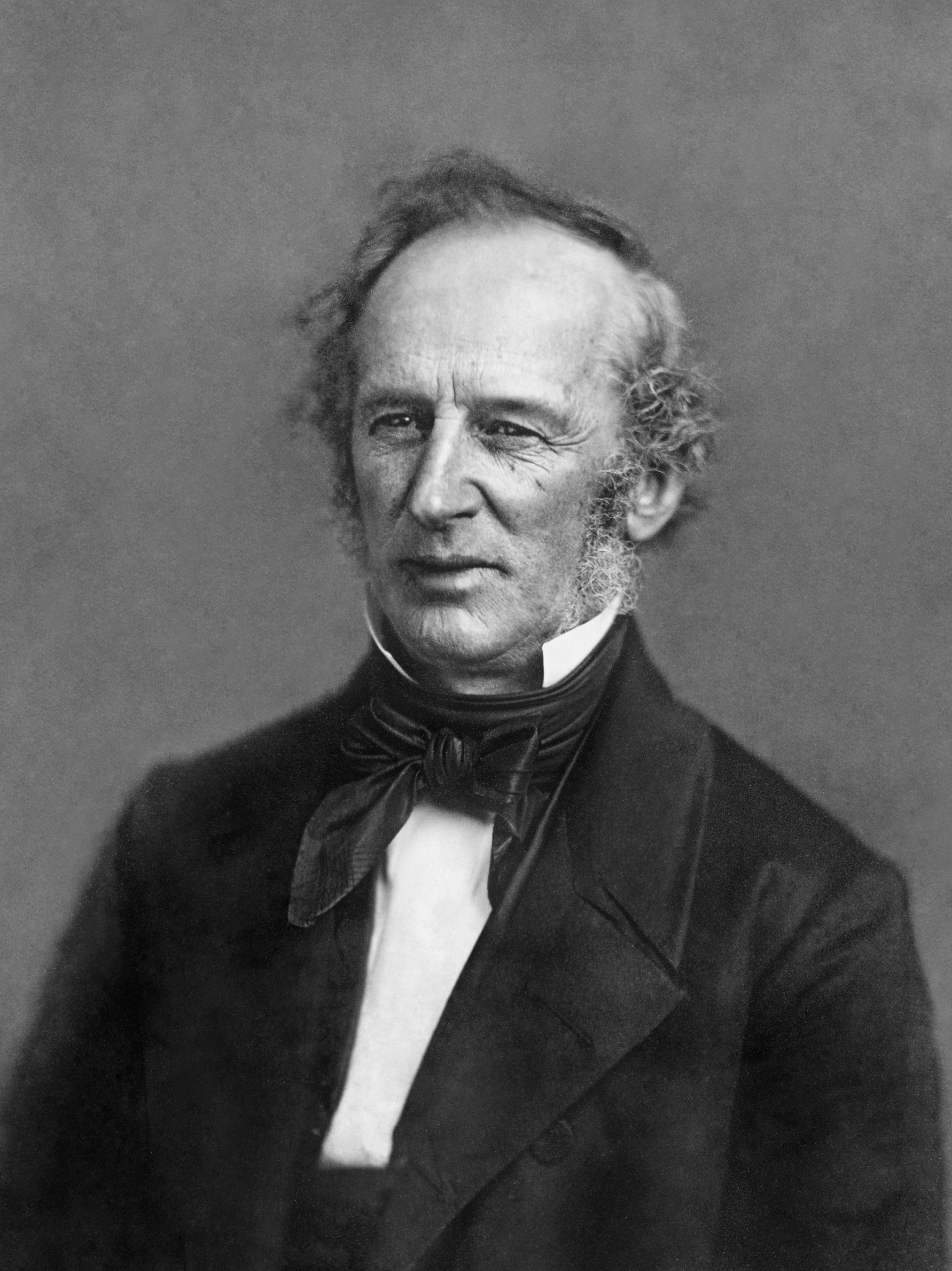

tale of two opposite sons: Cornelius Vanderbilt ("the Commodore") had two sons. one, William, attended to every detail of the business, including signing all checks. the other, Cornelius Jeremiah ("Corneel"), was hooked on faro and borrowed heavily.

the Commodore had an eye for pretty women. when Corneel's prospective father-in-law asked the Commodore about the marriage, he asked, "does she have many silk dresses and expensive jewelry? if she does, Corneel will pawn them when he loses in gambling."

William went on to become the richest man in the world. Corneel was limited to $200 a month which inevitably he lost and borrowed heavily form Horace Greeley to tide him over.

Jun

17

Methods, vig, heroics

June 17, 2023 | Leave a Comment

in my response to critique of my methods I refer to the reason that certain famous investors have succeeded so well. It's due imho to being one with idea that has world in its grip - how this and long life enables compounding to grow apace without concern about service beating you down.

there have been so many nice testimonials to me and my style,- some way over the top that I am becoming convinced that some thing I am close to 7 feet under or at least very close to the Bad One. i am still alive.

much attention has been focused on heightened scrutiny of those who don't believe in agrarianism, but little attention has been focused on the opposite, i.e., the free pass for those who hate enterprise and how this increases compounding exponentially the law of ever increasing vig. in 1940 there used to be 1 minute of advertising for 60 minutes of content. on Yankees game nowadays its 50-50. where else do you find much increased vig. the advertisement for the radio broadcasts for the Yankees are so unpleasant and so frequent that one wishes bad luck to them and can't wait to turn them off. the advertisements themselves all encourage ever-increasing vig thru emphasis on lotteries, parleys and service deals for Kids.

I've Got a Little List (with lyrics) / The Mikado / Gilbert and Sullivan

Lois in on my list and her fellow travelers who don't find anything amiss.

one comes back from dinner and hears a recap of New Deal Economics - increased service rates, replacement of private sector by gov - but it isn't from 1934 but is our most agrarian treasury person.

my passing reference to The Wager: A Tale of Shipwreck, Mutiny and Murder did not do it enuf credit as it tells a story of Anson's heroics and survival every well.

Jun

15

LWV Greenwich Announces the Winners of Its Fourth Annual Student Essay Contest

June 15, 2023 | 1 Comment

LWV Greenwich Announces the Winners of Its Fourth Annual Student Essay Contest

League of Women Voters Greenwich is pleased to announce the winners of its fourth annual Student Essay Contest. The Student Essay Contest is one League initiative that seeks to involve young people in the League’s mission to build an understanding of and participation in the democratic process.

High School, Winner:

Aubrey Niederhoffer, Greenwich High School, Grade 11

Co-Founder and CEO of Amalgam Talent, a eSwatini-based HR agency connecting remote workers in developing countries to global markets. Passionate about international development.

Jun

15

Wagers and squeezes

June 15, 2023 | Leave a Comment

no matter how high they go, most gentlemen don't like stocks. nor do they realize that bonds have to go up to save the banks from marking down their holdings.

10 Qualities of a Modern Gentleman

seems like a good day to review all the reasons that the former president didn't win in 2020. lets start with the big pharma that withheld the announcement that they had an effective vaccine until the day after the election.

Steve Ellison replies:

Marginal voters proverbially vote their pocketbooks, and Mr. Trump had the misfortune to be the incumbent as GDP abruptly contracted by 9%, and unemployment rose to 15% in April 2020.

Vic writes:

yes that's a winner although no evil hand in that. let us not forget the military in their advocacy and demeaning and threats. all the three-letter agencies and the doj. scores of 4-star generals comparing Pres to Mussolini and guaranteeing that they would escort him out of office if he resisted. the professional sports leagues all acting to undermine. Director Wray negating all of Trumps critiques about their bias. another reason for the former golfer to lose was the lineup of all of the Fangs to do whatever they could to do him in.

Gary Boddicker adds:

Constitutionally questionable executive and judicial changes to voting rules in key states, bypassing legislatures and favoring Democrats. “It’s unsafe to vote in person!”

Vic continues:

excellent book for those who like Patrick O'Brian but aren't see salts. none of O'Brian's erudition but author made valiant attempt to research incident.

The Wager: A Tale of Shipwreck, Mutiny and Murder

Also: Shantaram: A Novel

a critique of my methods, lifestyle and answer is elicited on twitter. i don't know when exchange took place - i would guess 15 years ago. I would add to my defense that I was much younger then and also I did not take account of ability of market to squeeze you and margin you out. they and the market inexorably get together by an evil hand to manipulate prices and margins so that you will contribute to the big players so that one day they will do you in and then prices will get back to their norm. one solution is to have good credit. Imagine the palindrome having enuf confidence to withstand the Bank of England and all the banks they control to speculate against the Pound successfully.

Jun

7

Distractions

June 7, 2023 | Leave a Comment

with all the hoopla about the perfect father stumbling - one notes that he can get up from the floor with ease - more important he can create 10 LLCs with beneficiaries of all in family with impunity. the odds of perfect father winning the election now at a max of 38%.

The venerable Sam Eisenstat liked to run overlapping monthly S&P as independent and would predict the next 6 months as momentous with great accuracy.

who is the most corrupt shark now trying to deflect attention by pretending to be anti-woke? perfect example of distraction behavior by spiders.

how much money can one make from Sam while pretending to be vigilant in stopping his predations?

The Folly of Fools is one of the most foolish books i've ever read. the vigilance against deception is very high and no subject is more studied and self restrained.

there are at least 3 big speculators i know who have many daughters with one of them being a bad seed as far as the others are concerned. is this chance? or some hidden regularity?

Jun

1

Steel Box Indicator, from Stefan Jovanovich

June 1, 2023 | Leave a Comment

In the first quarter of 2023, container output contracted by 71% compared to the previous year, with only 306,000 TEUs produced, marking the lowest level since 2010. Drewry estimates that full-year production will not exceed 1.8 million TEUs, the lowest since the recession-hit year of 2009.

Container Production Slumps to Lowest Level in 14 Years, Says Drewry

Henry Gifford writes:

What sort of time lag can be expected between ordering the containers and their actual use? I order cardboard boxes, and they are used to ship goods a few weeks later, I expect a shorter time lag for larger cardboard box users. But I expect it takes time to ramp up steel container production and delivery.

Stefan Jovanovich responds:

Top 10 Shipping Container Manufacturers In USA

Steve Ellison adds:

Maybe the shipping container industry does not have just in time inventory replenishment, or maybe it did, but the policies did not survive the covid pandemic. In a previous career in supply chain management, I needed to be aware of how inventory and decision lags downstream in the supply chain amplified demand fluctuations upstream, on manufacturers for example. This is known as the bullwhip effect.

Pamela Van Giessen comments:

There was an article in the WSJ earlier this year/late last year (the months seem to fly by) that shipping has fallen off a cliff. Part due to less goods needed/wanted, overstock because of covid era over ordering, and backlogs having caught up. Could it be there is an oversupply of containers based on things normalizing and/or a temp decrease while everything catches up?

I have been interested in knowing what the rail freight looks like but haven’t been able to find a source that provides that info (also haven’t looked that hard). Living in a rail town, it was much definitely quieter 6 mos ago than it has been lately. But maybe it’s just more coal out of the Powder River basin for China, India, etc. At least 3 long trains of coal/day. Every time I hear the environmentalists cry about CO2 emissions and how we have to get rid of xyz in the US, I have to laugh at the latest pet peeve (gas stoves & furnaces, increasing energy efficiency in dishwashers, wash machines, etc), it will never make a dent against all that coal being fired up in other parts of the world.

Jeff Watson offers:

Stefan Jovanovich adds:

Container Shipping Industry Faces Unprecedented Slump in Long-Term Rates

The container shipping industry experienced a significant downturn in global long-term freight rates during the month of May, as the contracted cost of shipping containers plummeted by a staggering 27.5%, according to Xeneta’s Shipping Index (XSI®). This marks the ninth consecutive month of rate drops and represents the largest monthly fall ever recorded on the platform.

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles