May

31

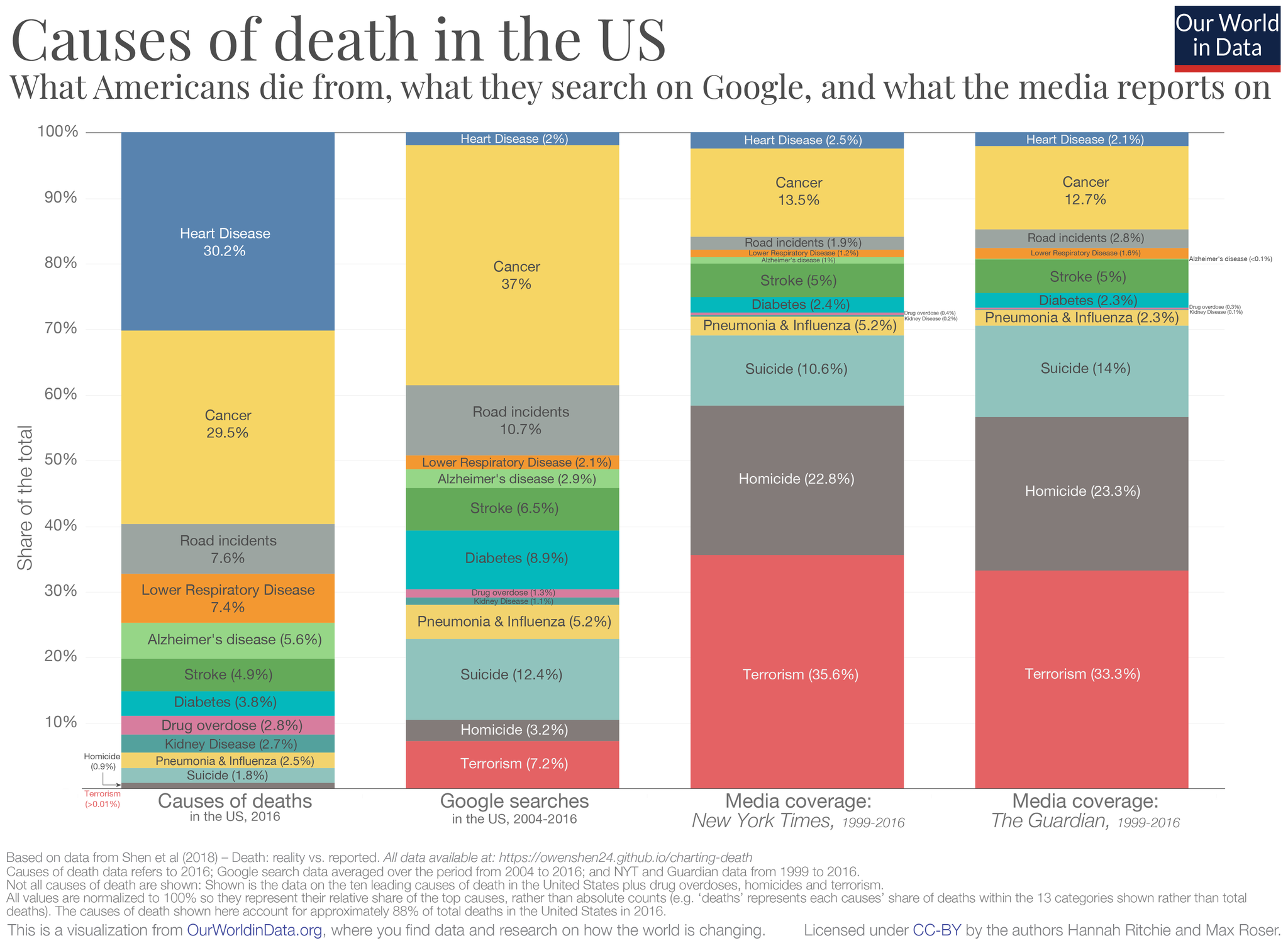

Interesting Graphic, from Alston Mabry

May 31, 2019 | Leave a Comment

Causes of death versus media coverage of the same.

Causes of death versus media coverage of the same.

Presumably they're trying to show that media over-emphasizes terrorism and murder, and that we worry about the wrong things.

But the vast majority of medical mortality is not caused by others, and to a large extent is, at least eventually, unavoidable.

You have to die from something, and the two most common things are cardiovascular disease and cancer.

Actually, that would have been an excellent title for it:

"You have to die from something"

May

28

Correlations for the S&P Quarterly, from Alston Mabry

May 28, 2019 | 1 Comment

Just to scratch a quantitative itch, here are correlations for the S&P quarterly.

Just to scratch a quantitative itch, here are correlations for the S&P quarterly.

One hopes it's clear as presented.

Slightly larger magnitudes in bottom 2 rows one assumes is mostly from smaller sample sizes.

And btw, the Q on Q R, or autocorrelation, is +0.07.

May

28

Memorial Day, from Stefan Jovanovich

May 28, 2019 | Leave a Comment

The accidents of time and circumstance make this a day when John Finn's comment about heroes always comes to mind.

The accidents of time and circumstance make this a day when John Finn's comment about heroes always comes to mind.

And that, in turn, brings up the name of Hank Greenberg, who was one.

.

.

.

May

20

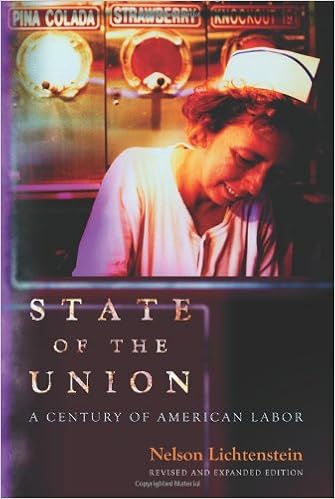

Nelson Lichtenstein, from Mr. Isomorphisms

May 20, 2019 | Leave a Comment

Nelson Lichtenstein wrote interesting books about $WMT, noting that Sears was excluded from the initial 1955 Fortune 500 list "simply because it was a retailer".

Nelson Lichtenstein wrote interesting books about $WMT, noting that Sears was excluded from the initial 1955 Fortune 500 list "simply because it was a retailer".

His "retail revolution" is the transfer of power from manufacturers down the line and closer to the consumer. WMT now significantly controls the supply chain "up" the line.

(Nike and Starbucks have been noted in this regard, but not so far in this book.)

There is a second reason why Burger King management has put the federal Equal Employment Opportunity Commission (EEOC) statement at the very top of the application. Americans consider workplace discrimination on the basis of race and religion and creed un-American. For nearly a third of a century we have had a national debate over the definition of such discrimination and the remedies that are useful and legal to eliminate it. But there is practically no debate about the need to stop it and compensate individuals for it, when discovered.

The overwhelming majority of workers, employers, and politicians believe that the government has a right to insist that active discrimination not take place against anyone covered by Title VII of the 1964 Civil Rights Act or those many statutes that followed in its train. This seems so commonplace and common sensible, that we forget the radical character of this law. If you own a restaurant or a factory or a motel or run a college, you can't make use of your property as you wish. The state mandates you to hire, fire, promote, and otherwise deal with your employees or clients according to a set of rules laid down in Washington and refined by the EEOC and the courts. If litigated, the courts will force an employer to pay real money in compensation and rehire or promote a worker if management is found to have transgressed this new kind of labor law.

Peter Ringel writes:

Yes, the "point of sale" has the dominant power position.

Like the US has it towards China: US is the point of sale.

Mr. Isomorphisms writes:

I think this was a point made by Michael Pettis (shows up on twitter.com/jaredwoodard feed) as well.

Stefan Jovanovich writes:

Some of us are happiest as counter uppunchers. But for I's and PR's wonderful (as always) comments, I would not have spent the first part of the morning rummaging through my books and pestering the wife about her encyclopedic knowledge of employment law. So, I pray these remarks will be taken as merry grumbling, not smart-ass smugness.

1. The EEOC placard is like putting In God We Trust on the Money. It does no harm but it is not proof of anything real. Companies put it up for the same reason water fountains in my birthplace and the nation's capitol once had labels that said colored only; the law made them do it.

2. Labor Union's flourished in the 1930s for the same reason the water fountains had the signs; the Federal law made companies do it. What it did not do, of course, was make the labor unions allow memberships to be open to people regardless of gender and race. On the contrary, those awful capitalist employers had shown a shocking willingness to allow women and Negroes and Mexicans to come to the same workplace. They had, of course, shown the same terrible openness to letting rich black and Creole people in Louisiana ride in the same passenger carriages as white people. In both cases the law put a stop to the dreadful egalitarian idea that anyone could be a source of profit.

3. One should be careful about drawing any inferences from the Fortune List. When Henry Luce ran Time-Life editorial selection had a simple rule: our advertisers are the news. Sears was not a major advertiser in expensive magazines in the 1940s and 1950s. They did not need to be any more than Google (forgive me: Alphabet) needed to buy ads on television in the 1990s and 2000s.

May

20

Commodity/Corn Question, from Zubin Al Genubi

May 20, 2019 | Leave a Comment

I've been long the motorcycle investor's ag fund for what seems like years as part of an asset allocation program. The fund and commodities in general have sucked wind for a long time. However recently it seems to have turned a corner some months ago. Along with some bonds a four class allocation seems to buffer swings in equities fairly well. It's what I recommend to young friends who ask me how they should invest long term with an annual or quarterly review.

Larry Williams writes:

Mr. Motorcycle has not been wearing his helmet in a crash.

There is little if any long term drift to ag prices; they boom and bust. That is why his ag fund has been as dynamic as Joe Biden.

May

20

A sign hangs in prolific romance novelist Danielle Steel's office:

"There are no miracles. There is only discipline."

Interestingly, Steel has 9 children.

May

20

Trumps Trump Card, from Larry Williams

May 20, 2019 | Leave a Comment

Here's an interesting — and for Democrats, ominous — statistic: since the election of 1896, a political party has been denied control of the White House after four years only once. That was in 1980 when incumbent Democrat Jimmy Carter lost his re-election bid to Ronald Reagan. And since 1953, only one party has stayed in office more than eight consecutive years. The Republican administrations of Ronald Reagan and George H.W. Bush lasted from 1981 to 1993. A lot of voters may be reflexively throwing out the bums after eight years, with rare exceptions.

Here's an interesting — and for Democrats, ominous — statistic: since the election of 1896, a political party has been denied control of the White House after four years only once. That was in 1980 when incumbent Democrat Jimmy Carter lost his re-election bid to Ronald Reagan. And since 1953, only one party has stayed in office more than eight consecutive years. The Republican administrations of Ronald Reagan and George H.W. Bush lasted from 1981 to 1993. A lot of voters may be reflexively throwing out the bums after eight years, with rare exceptions.

Stefan Jovanovich writes:

The 19th century was even more fickle. After the first broad expansion of the franchise in the 1820s, only Jackson, Lincoln and Grant were 8 year Presidents in 2 consecutive terms.

May

20

Mueller Report, from Mr. Isomorphisms

May 20, 2019 | 2 Comments

Here are the official links to part I and part II of the Mueller report.

Not strictly to do with markets, but what on the site is these days?

Stefan Jovanovich writes:

If telling people with badges and law degrees that you do not want to talk to them is "obstruction of Justice", then Trump is guilty. That is clearly Mueller and his minions' reading of "the law". They found it impossible to state that conclusion in their report because they could not get Trump to say anything at all while being directly interrogated. Obstruction is the new catch-all crime, even better than conspiracy. With conspiracy you have to make positive statements; with obstruction you can answer "I do not recall" and be found guilty because someone else has a recollection that proves you could have recalled or in the first, fifth or sixteenth answer to the same question you said something that was a recollection. There is no reason to volunteer to say anything, ever, to the people who can put you away if they want to.

May

17

A Fascinating Time Management System, from Sushil Kedia

May 17, 2019 | 1 Comment

Thirty years ago when I was just about finishing high school and entering college, the idea of professional speculation fascinated me. A few of my classmates were sons of established stockbrokers and their forays would cause me a confusion if I should consume several several more years into structured education or just drop out of the classroom routine to hang around the curbs of the Jute Forwards market at 5 Clive Row in Kolkata (Modern Speculation in India arose really from a very active derivatives market in Jute futures almost a 150 years ago & until my college years the Jute traders were the best & biggest in this country).

Thirty years ago when I was just about finishing high school and entering college, the idea of professional speculation fascinated me. A few of my classmates were sons of established stockbrokers and their forays would cause me a confusion if I should consume several several more years into structured education or just drop out of the classroom routine to hang around the curbs of the Jute Forwards market at 5 Clive Row in Kolkata (Modern Speculation in India arose really from a very active derivatives market in Jute futures almost a 150 years ago & until my college years the Jute traders were the best & biggest in this country).

So I would often go and hang around the curbs of this commodity exchange where even in the deep after hours of the formal closing bell of the exchange there would be torrential trading on the pavements and the street outside. Not just testosterone but one would distinctly feel dopamine rushes in these jaunts.

On these visits I used to notice the biggest trader in Jute in perhaps last 50 years frequently pull out a small (very small) diary like pad to look into it, jot something and keep it back in his pocket, while his trading log was always spread on a table as bulky as him. I was intrigued what was that special tiny diary.

Then six years later I had networked enough to know the CEO of one of his companies and at my earnest request to meet with the big man I was introduced to him. I asked him after having had a chance to hear him on many things, whats that special small diary he seems to maintain so well.

He said its my ledger book of time. I got totally intrigued whats a ledger book of time. He said I do a double entry accounting for my time. Each transaction with any other person or object has two elements: (1) the task or goal (2) the other is timeline. So I have dedicated pages for people I continuously and regularly deal. That's the ledger/account of key individuals. Then I have a Sundry Account where I put all other individuals. I keep 30 pages for a month extra in this tiny diary and soon as I have decided upon, agreed upon or have been given a commitment for something I enter it in two places: on the page for the date ahead and a double entry on the page of the individual.

If I have to deliver something to a person I mark him credit and if I have to receive an outcome from a person I mark him debit. My date pages with corresponding contra debits and credits provide me a quick view of how much profit I am making on my time for each day. Any time left on any page is the amount of life I am left with for that day.

I am wondering now that everything is digital, how can we put this simple idea to code and have an efficient time management weapon.

May

16

Jaquith Industries, from Victor Niederhoffer

May 16, 2019 | Leave a Comment

Jaquith Industries is a 100 year old company in Syracuse that has saved many lives. They produce the support poles for all lights at all 2000 airports. The poles buckle at the slightest test and yet can withstand hurricane winds of 150 miles an hour. They also produce the barriers concrete forms on highways. Their high tech poles recall a time I bought a lunch with Wilbur Mills at the congressional offices which were very Southern in wait staff. Wilbur had just returned from the scandal with Fanny and all the congressman came to see him. I bought the lunch because he was chair of the tax writing committee and I wanted to get him to tax unrealize profits from a high basis. The day I came back to NY was a stormy one and the plane just missed one of the poles. Everyone on the plane clapped for the escape. The next day a plane crashed into the same pole and all 250 passengers were killed. Thus became the mandate for Jaquith Industries.

Jaquith Industries is a 100 year old company in Syracuse that has saved many lives. They produce the support poles for all lights at all 2000 airports. The poles buckle at the slightest test and yet can withstand hurricane winds of 150 miles an hour. They also produce the barriers concrete forms on highways. Their high tech poles recall a time I bought a lunch with Wilbur Mills at the congressional offices which were very Southern in wait staff. Wilbur had just returned from the scandal with Fanny and all the congressman came to see him. I bought the lunch because he was chair of the tax writing committee and I wanted to get him to tax unrealize profits from a high basis. The day I came back to NY was a stormy one and the plane just missed one of the poles. Everyone on the plane clapped for the escape. The next day a plane crashed into the same pole and all 250 passengers were killed. Thus became the mandate for Jaquith Industries.

May

16

The NY Fed has an excellent article about the correlations between "economic expectations" and voting behavior in the recent Congressional election.

"Did Changes in Economic Expectations Foreshadow Swings in 2018 Election?"

May

16

Article of the Day, from Rip McKenzie

May 16, 2019 | Leave a Comment

Given music generally reflects the psyche of the masses as opposed to leading it, this study might prove slightly useful:

"Is pop music really getting sadder and angrier?"

May

16

Out of Favor, from Ralph Vince

May 16, 2019 | Leave a Comment

If one googles "is volatility dead?" there are ample articles, multiple pages, etc. However, if you restrict the search to the past year the question seems to not have been asked.

May

16

Russia collapsed. Did anyone anticipate it? Not many!

Russia collapsed. Did anyone anticipate it? Not many!

Why did Russia collapse? Common sense is uncommon. Russians kept selling commodities for more than two decades below cost of production. They were burning an enlarging hole in their real income statement but covering it up with managing artificial strength in their currency (balance sheet pumping).

What is similar to that scene of 1987 and the coming couple of years?

China has been selling everything, not just commodities, at a deep discount to cost of production. Whether this is to gain market-share or there will be another trader who may receive a presidential pardon in the last five minutes of the second term of a US President for having maneuvered the communists yet again to dig their own grave will be known later. The Chinese pegged the "volatility" of their currency to the Volatility of the US Dollar.

The Russian Communists had played the game of hiding their grave by pegging their IOU or their currency to US Currency, the Chinese have pegged the volatility of their currency to US currency. Everything else is same.

Complex explanations need not be better as we know adding more and more variables to a regression doesn't improve the R Squared. Commonsense of business is no one could avoid going broke selling below cost. All dandy accounting or engineering the books or currency can prevent the basics of business to play out.

Even while the CFA Institute taught in its curricula for the last 20 years that China and India will be amongst the top 3 economies of the world in terms of GDP as their growth rates due to demographics were sustainably superior while the western hemisphere was going the Japan way in demographics, the fact remains if you over stretch the binge to grab marketshare and keep hiding the real losses through balance sheet jugglery a day comes when Full Monty happens.

While I do anticipate their will be strong reactions to this simple post, likely in disagreement as much as in agreement I seek the minds of those who are able envision deeper and farther than a mere commonsense guy What If China indeed goes belly up at some point forebodes for the rest of the world since China is the largest holder of the US Bills? Can Great Britain that's getting out with a Brexit be the next bull run? Will the British Pound fetch 2.0 US Dollars in say by 2025 or 2027?

Has anyone ever heard the name of what the Chinese Intelligence Agency is even called? If not, are the very clever Chinese doing deep, detailed, deviant work world over? Is this going to remain merely a trade war? Where are the next big proxy battles going to be fought? Will it begin with the breaking up of Pakistan into a number of smaller states? Oh how badly I miss our all time giant Mr. E a.k.a. Krisrock! I hope he sends some of his intel that was always ahead of almost everyone else. But without him around implies we may have an even more onerous task to imagine more intensely. All forecasting is only imagination modulated, tempered and restrained with study of history.

Greg Van Kipnis writes:

In a well ordered capitalist economy if a company is not covering its variable costs they will be bankrupt quickly once they exhaust their reserves and their credibility. The same is true for a country. From what I know, China is different from Russia in several important ways that gives them greater staying power. They have a positive trade balance, they have large currency reserves and there is little sovereign foreign debt. In the case of Russia the state was bankrupt and it could no longer afford to maintain the Soviet Union because most of the Republics were a drain on the treasury.

In the case of China I know little about the dividing line between the state and the personal financial interests of the mandarins (or whatever the heads of the party are called). These mandarins will be the first to rebel when their sources of income and borrowing from state entities dry up. The government can keep expanding domestic money and credit as long as the mandarins don't want hard currency and inflation doesn't explode (which it sure will after a time).

I believe internal financial stress has begun. I read that private borrowing in dollars is quite large and exceeds privately held dollar balances. This is good for the dollar and bad for the Yuan. Another indicator of private stress that is already starting to happen is the drying up of Chinese buyers of luxury real estate in the New York.

Sushil Kedia writes:

Keeping large forex reserves and maintaining a positive trade balance at the cost of selling everything below cost of production is the hope of the mandarins too that they can stay afloat longer. Irrespective of the length of survival time, a losing trading strategy is a losing trading strategy.

So a simple question whose answer needs imagined on priority now is: if there were continued losses in this trading strategy where are those losses hidden? Or China did not lose by selling everything below cost of production as the Mandarins would like us all to believe?

This is the known unknown, where are the losses hidden? Now coupled with this if capacity utilization dwindles the fixed cost of putting up the gargantuan cities, factories and everything else will weigh in down faster.

May

15

Import from Gaza? from Ralph Vince

May 15, 2019 | 2 Comments

If we imported goods from, say, the Gaza, would that be a good thing?

Peter Ringel responds:

Please allow the kraut to interject:

Hamas bombed Israel with >1200 missiles (and counting) during the last 3 weeks.

Hamas tries to trick Israel into a broad attack because Hamas is losing support in Gaza fast.

Israel showed tremendous restraint so far. Something politically extremely costly during an election year.

It is on the shoulders of the Palestinians to get rid of Hamas. Economic sanctions help with that IMHO.

Then we will see.

May

13

China, from Ralph Vince

May 13, 2019 | 1 Comment

I'm still astounded by the actions of China last weekend. It seems we can count on them to make the stupid move, nearly every time.

I'm still astounded by the actions of China last weekend. It seems we can count on them to make the stupid move, nearly every time.

I'm astounded by how amateur and clumsy that tactic was, the "11:59, sorry man this is all I have in my pocket," move in turning around after 15 months and saying they can;t live up to anything that has been tentatively agreed to as it violates their sovereignty.

To they really think President Bigmouth hasn't seen this move before, hasn't heard this tune before or did have contingency plans in pace for such a stunt? It looks like they do things by committee, this is typical non-US, by committee amateurism to "see how they respond to this."

To Bigmouth's credit, in a move of negotiation jiu-jitsu, the biggest leverage in any negotiation– time–he flipped from being against him to working now in the favor of the US.

No further talks are scheduled. Why would Bigmouth be in ANY hurry to talk to them until 2021, 22 or beyond or if ever?

So what do they do? They antagonize with pipsqueak threats on 25% on 60 bln–the full amount of which Trump is prepared to absorb having announced the grain buyback program in recent days.

My hope is that Bigmouth really is as sharp at negotiating as he is reputed to be, ad says nothing further. Nothing on the additional 300 bln in tariffs today (the anticipation of which is what the markets are reacting to this morning, not the pisqueak retaliation).

Yes, if he escalates, markets will temporarily tank further. OTOH, if he says he's going to leave things alone for now, keep that powder dry, we could have one of these 9/21/87, "Oh sh**, Oh Sh**, OH SH***," -type runaway rallies today.

May

11

My US Grant Story, from Stefan Jovanovich

May 11, 2019 | Leave a Comment

When I torture the rest of you with comments about Ulysses Grant's genius, I usually neglect to point out the obvious. Grant understood what had happened in the Civil War better than anyone else in American history because he was counting up what was happening in plain sight. He saw Haupt's railroads reduce the unit costs of supplying the Union armies by 1865 to a fifth of what they had been in 1861/2. What changed was what Amazon with its earnings reported today: things can be done better, cheaper, faster with declining capital costs.

When I torture the rest of you with comments about Ulysses Grant's genius, I usually neglect to point out the obvious. Grant understood what had happened in the Civil War better than anyone else in American history because he was counting up what was happening in plain sight. He saw Haupt's railroads reduce the unit costs of supplying the Union armies by 1865 to a fifth of what they had been in 1861/2. What changed was what Amazon with its earnings reported today: things can be done better, cheaper, faster with declining capital costs.

Larry Williams writes:

Back about 1967 I had a fellow ask me, "How many days are in a 10 day moving average?" I replied, "Whose buried in Grants Tomb?" to which he replied, "Why are you getting smart with me, I don't even know where that tomb is let alone who is in it".

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles