Feb

7

Filming Electrons at 1 Quadrillion FPS, from Jeff Watson

February 7, 2026 | Leave a Comment

Veritasium: Filming Electrons at 1 Quadrillion FPS

Explore slow motion like never before, from century-old strobe techniques to a quadrillion FPS camera. Witness light's journey through objects and the movement of electrons within molecules. Discover how scientists use sound and incredibly short laser pulses to capture these breathtaking moments.

Jan

3

Fund manager’s bizarre apology video, from Jeff Watson

January 3, 2026 | Leave a Comment

From 2018: Investment boss in tearful video apology over losses

And a recent take on it: Fund Manager's Bizarre Apology Video

J. Humbert responds:

Reminds me of this one from a few years ago…

Fleeing investment manager offers victims teary bon voyage – Chicago Tribune

Charles Harris wiped tears from his eyes, looked straight at one of his friends and apologized for lying about the value of the commodity pool he oversaw.

This scene was recorded on one of three DVDs made aboard Harris’ boat as it was apparently heading away from the U.S. and the federal authorities who are looking for Harris.

Dec

22

Tales from the pit, from Jeff Watson

December 22, 2025 | Leave a Comment

Chuck Proctor (video interview)

In this episode of In The Harbor, we sit down with Chuck Proctor, a seasoned spread trader specializing in 30-year Treasury bond futures. Chuck takes us through his remarkable rise on the trading floor—from starting as a runner, to becoming a clerk, and ultimately earning his place as a local trader.

Together, we revisit the golden era of open-outcry pit trading: the chaos, the camaraderie, the competition, and the moments that shaped a generation of traders. Chuck shares firsthand stories of what it was like to survive—and thrive—in an environment built on instinct, speed, and human connection.

We then shift to the present day to examine the “death of the pits” and the takeover of markets by computers and algorithms. Chuck offers candid insights on how the culture of trading has evolved, what was lost, and where opportunity still exists for those willing to adapt.

Dec

15

Harvard Club antisemitism, from Jeff Watson

December 15, 2025 | Leave a Comment

No comment needed.

The Harvard Club of New York Cancels Dershowitz Book Event

The Harvard Club of New York is being accused of censorship after abruptly cancelling a book event featuring famed Harvard professor Alan Dershowitz. In a statement, Dershowitz says that invitations were sent out and the event was approaching when he was suddenly told that the Harvard Club would have none of it. He blamed his representation of President Donald Trump for the cancellation. For a club that bills itself as offering “unique experiences,” it appears that hearing from opposing or different views is not one of them. Dershowitz has been associated with Harvard for over 60 years and remains one of its best known law faculty members.

Nils Poertner comments:

Large Universities in the US, Canada and parts of Europe are doomed beyond repair. No error correction process happening- built through collapse.

Henry Gifford writes:

Harvard was just used as an example when Trump tried to cancel “their” research funding (polite word for money). I didn’t pay attention to the details of the outcome - the point got made that universities better step into line.

Sure, Trump’s objection had something to do with DEI and being too liberal, but as all colleges are dependent on not paying taxes, and on government loans for most tuition, and government research money, they can hardly be anything but socialist in thinking, and can be expected I think to stay that way.

If they paid taxes and people had to pay to go there and research had to be paid for by someone spending their own money things would, I think, be greatly improved, but that is not the world we live in.

The government is basically paying the universities to breed socialism. In New York City we even have colleges that teach people to be bureaucrats.

Nov

19

Market lesson, from Jeff Watson

November 19, 2025 | 1 Comment

Ben Mallah is a real player in the real estate market and offers a palate cleanser that applies to any market.

Ben Mallah puts a recently renovated house up for auction. The video documents the preparation and the auction process itself, including discussions with the auctioneer and potential buyers. Viewers will see the property's features and the bidding unfold.

Nov

9

Prestigious consulting firm, from Nils Poertner

November 9, 2025 | Leave a Comment

Came to our financial firm 2007 and gave a 100 page presentation full of bullet points and cartesian logic (why housing boom will last). Either 3,5, or 9 bullet points per page.

At the end of the presentation I was tempted to go over to the presenter and ask him "why do you love your wife? (I didn't). The answer might have been bullet points.

Pamela Van Giessen writes:

Michael Korda tells in his memoir, Another Life, of the time that Simon & Schuster hired probably the same prestigious consulting firm to study how to improve revenues/profitability. Prestigious consulting firm (after taking the prestigious consulting firm fee) told the publishing company that they should publish more bestsellers.

Laurel Kenner comments:

I bet the prestigious firm concluded with ‘Key Takeaways’ as a final insult to the intelligence of the client.

Asindu Drileba writes:

I heard that people pay consultancy firms not for their knowledge, but for the fact that executives use them as a scape goat. If an executive wants to pursue policy X. They simply hire a consultancy to recommend policy X. If policy X ends up as a disaster (legally, morally or financially). They can simply say "Policy X was an idea from XYZ consultancy", we had nothing to do with it.

Peter Ringel adds:

a variation of this are fighting owners/ partners about policy. If decision pipelines are blocked, external council is used. Like a neutral arbitrator. I think, these are the main situations externals are used. Usually a good reason to short the entity, especially outside of markets. If they don't have the capability to decide and act on strategy in-house, it‘s a red flag.

Henry Gifford responds:

Even better is hiring a licensed engineer to instruct everyone to do something stupid that they know won’t work, so everyone who did as the engineer decided is blameless.

Jeff Watson offers:

A consultant is a person who knows 1000 ways to make love to a woman…..but he doesn’t know any women.

Oct

27

State debt, from Jeff Watson

October 27, 2025 | Leave a Comment

Here’s an interesting breakdown and analysis of the debt of individual states. All the usual subjects are near the top.

Report ranks every state’s debt, from California’s $497 billion to South Dakota’s $2 billion

State governments had $2.7 trillion in debt at the end of 2023, a new Reason Foundation analysis finds. This state debt is equivalent to approximately $8,000 per person nationally.

On a per capita basis, Connecticut had the highest state debt, with $26,187 of debt per state resident at the end of 2023. With $22,968 in debt per resident, New Jersey was the only other state with more than $20,000 in liabilities per capita.

Reason Foundation finds 13 states—Connecticut, New Jersey, Hawaii, Delaware, Illinois, Massachusetts, Wyoming, Alaska, North Dakota, California, Washington, New York, and Vermont—had more than $10,000 in debt per resident.

Oct

3

Where am i wrong, from Larry Williams

October 3, 2025 | 2 Comments

Zero sum game: for every $ that wins the same amount will be lost. REALLY? you bought at 7 sold to me at 10 I sell at 20 and the contract goes off the board and delivered at 22 who lost? We lost that we could have made more $$ but where is a net loss?

Steve Ellison comments:

Adverse selection can make us all feel like losers. If I sold at 10, I should have held to 22. Or I should have put on more size. If I bought at 7, and it went to 5, that would have been even worse.

Jeff Watson goes literary:

But Yossarian still didn't understand either how Milo could buy eggs in Malta for seven cents apiece and sell them at a profit in Pianosa for five cents.

[ … ]

Milo chortled proudly. "I don't buy eggs from Malta," he confessed… "I buy them in Sicily at one cent apiece and transfer them to Malta secretly at four and a half cents apiece in order to get the price of eggs up to seven cents when people come to Malta looking for them."

"Then you do make a profit for yourself," Yossarian declared.

"Of course I do. But it all goes to the syndicate. And everybody has a share. Don't you understand? It's exactly what happens with those plum tomatoes I sell to Colonel Cathcart."

"Buy," Yossarian corrected him. "You don't sell plum tomatoes to Colonel Cathcart and Colonel Korn. You buy plum tomatoes from them."

"No, sell," Milo corrected Yossarian. "I distribute my plum tomatoes in markets all over Pianosa under an assumed name so that Colonel Cathcart and Colonel Korn can buy them up from me under their assumed names at four cents apiece and sell them back to me the next day at five cents apiece. They make a profit of one cent apiece, I make a profit of three and a half cents apiece, and everybody comes out ahead."

Aug

2

Originally posted May 2, 2009:

Einstein purportedly said that compound interest was the most powerful force in the universe. I challenge his statement and offer the hypothesis that the vig is the most powerful force in the universe, exceeding that of even free market forces because it's always there. Exerting a constant force on every trade, transaction, purchase, sale, or any human activity of any kind, the vig is always first in line to get paid.

The vig is a powerful enough force that both winners and losers pay, without even realizing it in many cases. The vig has clever ways of hiding and disguising itself but is always there. From the widening and narrowing bid/ask spreads in the market, to the 35 to 1 (or even more insidious 35 for 1) payout on a single number on the roulette wheel, the vig constantly grinds out and extracts it's percentage on every trade or activity. Like the steady beat of a metronome, the vig is just extracted, extracted, and extracted some more.

The general public has little awareness of the vig, but the vig takes a huge toll from the unsuspecting public. All of the great deals offered the public generally have a higher vig, although even the professionals must pay it. Games with longer odds such as trifecta pools, keno, and lotteries charge high vig, while short games and trades usually have much lower vig. Games that advertise that they're commission free usually charge the highest vig of all, such as those bucket shop Forex places that are sprouting up like mushrooms all over the place. The vig allows the beautiful Vegas casinos to exist, Churchill Downs to run it's card, and allows the temple at Wall and Broad to continue it's operation day and night.

I contend that although the electronic trading is supposed to increase liquidity and eliminate the vig charged by the locals, thus benefiting the public, the opposite occurs. The apparent percentage takeout of the vig might be reduced, but the increase in the velocity of trading, with a smaller vig collected each round trip, more than makes up the difference, sort of a Laffer Curve applied to the vig.

One can easily see this by looking at the volume and revenues at places like the CME where volume has exploded and the market cap of those high temples of finance has gone into the stratosphere. Those beautiful buildings have been built by the pennies per transaction takeout from everyone, every trade, and it all adds up. The apparent reduction of vig has allowed the online poker sites to flourish with advertised low rakes versus the brick and mortar clubs. People think they're getting a great deal with such a low rake but don't realize that they're playing at a rate six times faster than in real life and probably paying out more vig than they would in Vegas, Atlantic City, or the numerous underground clubs I used to frequent in my misspent youth.

Although the vig is a constant fixed percentage in sports betting, in the markets it is ever changing. With the advent of the electronic markets, I have a certain difficulty these days in calculating the amount of vig I pay every trade, although I have a general idea. I have some pretty sophisticated math that's supposed to help me figure out the vig I pay, but even that's just an approximation When I was a local, I knew how much vig I collected down to the quarter cent depending on what type of trade I was accepting. I collected a certain amount of vig buying a spread, selling a spread, trading with little locals, and fading paper from the public. I offered discounts in vig for size, and would give up a quarter cent if I knew I could bag a big order. I also knew how much vig I would have to pay and the percentage that might change if I were desperate enough. Even though I collected vig every day, I also knew how precisely much vig I would have to fork over at the end of the day to play in the pit, because everybody has to pay tribute to someone. Since every player pays vig in trading, the money has a way of working it's way up, to some unknown repository somewhere. All of this paid tribute and upward movement of money feels like it has a part in a certain Francis Ford Coppola movie that was so popular in the 1970's.

Free market forces do affect vig, widening and narrowing the percentage, but while free market forces might disappear for awhile due to governmental regulations and laws, the vig will always be around. Vig shows up in many other clever disguises such as lower yields on fixed investments, taxes, assessments, points, fees, payoffs, and graft. Vig has to be calculated into every transaction, and must be figured into every apparent overlay one might spot.

My late, great, grandfather used to cite the old axiom that "There's two kinds of people in this world, those who pay interest and those who collect interest." While he was spot on with reciting that observation, he sadly neglected to tell me that everyone has to pay vig, a hard lesson that I had to learn for myself.

Steve Ellison writes:

A traditional recipe for business success: reduce the price of a product and thereby generate much greater demand and higher profits.

Jul

22

Smörgåsbord

July 22, 2025 | Leave a Comment

Big Al offers:

Very nice Veritasium vid on randomness and information:

Asindu Drileba likes a new interview:

I learned about Gappy Paleologo from this list. He has a new interview on a Bloomberg podcast. In it, he talks about:

- Why he suspects Astrophysicists make good quants

- Why AI can't fully take over trader's jobs (in principle)

- What makes a "good quant"

Jeff Watson is following the floor traders last stand:

Old-School Floor Traders Finally Get Their Day in Court Against CME

Trial opens in the Chicago plaintiffs’ long-running lawsuit claiming harm from the launch of electronic markets

The plaintiffs, who estimate that they are owed about $2 billion in damages plus interest, say the company broke its promises to them when it opened a data center for electronic trading that effectively doomed the old trading floors. CME has called the lawsuit baseless.

A spokeswoman for CME declined to comment. The company repeatedly tried to get the suit thrown out, but failed each time.

The lawsuit, filed in 2014, has dragged on so long that one of the original plaintiffs has died. Hundreds of former floor traders could be affected by the outcome. The trial, being held at a county courthouse in downtown Chicago, kicked off Monday with jury selection. It is expected to last several weeks.

Jul

19

Big Mac Index, from Jeff Watson

July 19, 2025 | Leave a Comment

For those who study such data, here’s the 2025 Big Mac index.

The Big Mac Index, a real and recognized metric developed by The Economist magazine in 1986, initially served as a light-hearted tool to measure purchasing power parity between countries. Today, it has evolved into a significant indicator of the global economy and currency valuation. This index compares the price of Big Macs in various countries to the price in the United States, offering insights into economic conditions.

Steve Ellison writes:

I love the Big Mac Index. But inquiring minds want to know, what about the eurozone, conspicuously missing from the article? The Big Mac Index judges the euro to be 15.2% overvalued, so this year's runup in EUR/USD appears not to be supported by burger fundamentals.

Jun

11

One must admire the first guy to introduce Brownian Motion into a theory about speculation.

Louis Bachelier's Theory of Speculation: The Origins of Modern Finance

Asindu Drileba wrires:

If you like that, you may find Louis Bachelier's other book Sketches in Quantitative Finance interesting. It's very accessible as it has no complex math and describes many concepts in probability/statistics in a very straightforward way. In it, he say's for example that despite Martingale strategies looking lucrative, "no one has gotten rich by using this method."

May

11

Echoes from the past, from Jeff Watson

May 11, 2025 | Leave a Comment

I have heard every single one of these more than once on the floor. This is the G version; the X version would be very inappropriate for this venue.

You’re long hope and short reality.

He couldn’t trade his way out of a wet paper straddle.

You’re bidding like it’s your wife’s money.

His stops have stops.

He buys the high, sells the low, and thinks he’s range trading.

If brains were dynamite, he couldn’t blow his nose.

He's so underwater, Aquaman just waved.

Tighter than a bull’s ass in fly season.

Your size is what we use for toilet paper.

He’s a momentum trader—in reverse.

He couldn’t fill a corn order, let alone an order ticket.

That guy trades like he’s reading Braille.

He thinks ‘limit down’ means he hit the jackpot.

He trades like he’s got a rearview mirror taped to his glasses.

He’s scalping—his own account.

Nice fade. If I ever need a contrary indicator, I’ll call you.

He went from hero to sandwich in one tick.

I’ve seen better risk management at a toddler’s birthday party.

Market’s moving—better go ask your horoscope.

You trading or just making donations today?

He’s got a 30-lot mouth and a 1-lot account.

That guy’s P&L looks like an EKG flatline.

You're not trading—you're gambling, but slower.

He’s so unlucky, he’d lose money in a rigged market where he’s the rigger.

The guy’s charts look like modern art—ugly, meaningless, and overpriced.

He averages losers like he’s building a position in failure.

Don’t worry, he’ll blow up before lunch.

His fills are like Bigfoot—plenty of stories, no proof.

That trade had more slippage than a greased pig at a county fair.

He went full margin—and full stupid.

Asindu Drileba writes:

I watched the documentary "Floored" that was about the extinction of pit traders due to the advent of computer driven traders. A lot of the traders seemed to have their edge in bullying and intimidation that was both physical and psychological.

I made a pit trading playlist that I binged on, and this seemed consistent even to pit traders in the currency pits of London.

One of the pit traders called the computer "The most vile invention ever made." I think he was just sad that his bullying was no longer an advantage. You can't insult a computer, or use your big body to push it away so you can have the edge, or seduce it with good looks.

Michael Brush responds:

Behind every computer, there is a person.

“The offer is $25.”

“But my computer says $45.”

“So sell it to your computer.”

Pamela Van Giessen adds:

For those interested in a biography of a once famous and beloved pit trader, I recommend Charlie D: The Story of the Legendary Bond Trader by William Falloon.

Francesco Sabella adds:

It's an incredible book! I read it years ago, I even saw a 2 hour video of Charlie D. when i was in high school where he gave a lecture on trading on 1989.

Larry Williams writes:

Charly D was one stand up guy. He loved the Bears and suggested a bet with a young lady trader for a nickel on the weekend's game. She said sure…and won. Monday morning Charley D gave her 5 grand (a nickel in betting parlance). She was astounded, told him she meant 5 cents not 5G's. No way could she risk that or take the money. He left it in her hand and walked away.

I was fortunate, thanks to T Demark, to be part of his Vegas support group - he was just amazing to hang with.

Apr

27

Age is just a number, from Jeff Watson

April 27, 2025 | Leave a Comment

88 years old and skating. He started skating at age 70.

Octogenarian skateboarder shreds concrete in Spain's Bilbao

"My bones are special," he chuckles between sips on a post-workout glass of white wine at his favourite bar in Bilbao's working-class neighbourhood of Begoña. "Though I touch wood."

Steve Ellison writes:

In only 2 more years, he will be old enough to have "sufficient experience … to command success" in Wall Street, as Clews put it, and know exactly when to skateboard down to lower Manhattan in a panic.

Apr

24

Planck’s principle, from Nils Poertner

April 24, 2025 | Leave a Comment

A new scientific truth does not triumph by convincing its opponents and making them see the light, but rather because its opponents eventually die and a new generation grows up that is familiar with it…

An important scientific innovation rarely makes its way by gradually winning over and converting its opponents: it rarely happens that Saul becomes Paul. What does happen is that its opponents gradually die out, and that the growing generation is familiarized with the ideas from the beginning: another instance of the fact that the future lies with the youth.

— Max Planck, Scientific autobiography, 1950, p. 33, 97

relevance of how new ideas are being adopted in science, markets, everywhere.

Jeff Watson responds:

Science by consensus is not science. Just ask Galileo.

Pamela Van Giessen writes:

John McPhee wrote extensively about this and how the science of geology advanced over a few centuries in Annals of the Former World. Scientific community consensus is pernicious, and it is clear that there is mostly no convincing it.

William Huggins comments:

the foundation of science rests of replicability - anyone with the same data should be able to replicate results (even if they disagree about the mechanism). once replication is established, the difficult questions come from "is this data sufficient and representative?"; "is the data generating process stable or dynamic?"; "did i gather data in support of my hypothesis or to try to disprove it?". the fun stuff.

philosophy of science ensures we ask good questions and have good tools to tackle them with. this is why the Ph in PhD is short for "philosophy."

correction: "same data" is the wrong phrase - "equivalent, out-of-sample" would be a better choice of words.

Asindu Drileba writes:

The problem with the human mind is that it has too many glitches. You can verify data successfully and still be wrong. Here are two examples from Astronomy. First, The Mayans had models that would accurately predict eclipses. So, your data of when eclipses occur would replicate really well with their model. However the model of the solar system the Mayans used, had the Earth at the centre and the Sun revolved around it. The assumptions of the model were completely wrong, but the data (predictions) were accurate.

Second, is Newton's models, that predicted the movement of a comet accurately. Then you often here people say that Einstein proved Newton wrong with Relativity.

I think when it comes to science, explanations are very flimsy. What should matter is if the idea useful or not.

Francesco Sabella responds:

I think it’s a very good exercise to start from the point of view that our mind is bound to make mistakes, have glitches and start to work from that assumption; even if it’s not always true but it can be good as working hypothesis.

Big Al recalls:

Years ago, doing simple quantitative analyses to post to this list, I learned that one of the biggest pitfalls was my own desire to get a nice result.

Apr

22

Reading list

April 22, 2025 | Leave a Comment

Victor Davis Hanson Should Stick to the Classics

by Don Boudreaux at Cafe Hayek

Prof. Hanson, for example, presumes that the trade surpluses of various foreign countries are the results of clever cheating by those countries’ governments – cheating that yields unfair benefits to those countries as it damages the U.S. and inflicts on us Americans harmful trade deficits. He’s apparently unaware that countries that run trade surpluses also necessarily run capital-account deficits: global investors prefer, on net, to invest elsewhere than in those countries. In contrast, countries that are especially attractive to global investors run capital-account surpluses – another name for trade (or, more precisely, current-account) deficits.

Jeff Watson is keeping up with the CME dispute:

Here’s an interesting article about the upcoming trial:

Judge clears the way for a titanic trial pitting old-school traders against CME Group

But the plaintiff traders, many of whom formerly worked in the pits and are retired now, allege that CME reneged on a deal preserving members’ rights — including preferred trading floor access and pricing and information advantages — when it closed the physical floors and confined transactions to the Aurora operation. As a result, they say, the value of those memberships (reflected in B shares of CME) has fallen by two-thirds in the past decade even as CME’s A shares (the stock held by ordinary investors) have soared in that period.

Humbert X. writes:

I wonder if the PMs will get a heads up on tariff changes?

Trump Media Launches Separately Managed Accounts

SARASOTA, Fla., April 15, 2025 (GLOBE NEWSWIRE) — Trump Media and Technology Group Corp. (Nasdaq, NYSE Texas: DJT) ("TMTG" or "the Company"), operator of the social media platform Truth Social, the streaming platform Truth+, and the FinTech brand Truth.Fi, along with Yorkville America Equities, an America-First asset management firm, and Index Technologies Group (ITG), an originator and provider of thematic investment solutions, today announced that the three firms have created a strategic partnership and launched a new suite of Truth Social-branded Separately Managed Accounts (“SMAs”). These investment strategies offer investors access to curated, thematic investment strategies rooted in American values and priorities.

The initial lineup of SMA strategies includes:

Faith & Values

Liberty & Security

Energy Independence

Made in America

Apr

17

The Theory Of Societal Stupidity, from Jeff Watson

April 17, 2025 | Leave a Comment

Any market parallels?

The Theory Of Societal Stupidity

by Dietrich Bonhoeffer

Dietrich Bonhoeffer (4 February 1906 – 9 April 1945) was a German Lutheran pastor, neo-orthodox theologian and anti-Nazi dissident who was a key founding member of the Confessing Church. His writings on Christianity's role in the secular world have become widely influential; his 1937 book The Cost of Discipleship is described as a modern classic. Apart from his theological writings, Bonhoeffer was known for his staunch resistance to the Nazi dictatorship, including vocal opposition to Nazi euthanasia program and genocidal persecution of Jews.

Stefan Jovanovich asks:

Why do we need a theory?

Steve Ellison adds:

Gustave Le Bon in his 1895 book The Crowd noted that the intellect of any crowd was far lower than that of any of its members. And he considered all political parties to be crowds.

Mar

27

Spec roundup

March 27, 2025 | Leave a Comment

Jeff Watson has been watching the CME:

Anyone else notice the increase in seat prices (trading rights) recently?

Big Al found a history lagniappe:

BabelColour

@StuartHumphryes

Travel back in time 117 years to the Russia of 1908. I have enhanced for you this rare colour photo of the Russian writer Leon Tolstoy, regarded as one of the greatest and most influential authors of all time. It was taken in the grounds of his house at Yasnaya Polyana, near Tula, Russia. It is original colour, not colourised.

Steve Ellison provided his own:

Since one might be well advised to beware the Ides of March, here is a picture I took in 2017 of the ruins of the Theater of Pompey.

Asindu Drileba has been reading:

The importance of contrarianism emphasized by Jeff Bezos, from the Amazon 2020 Letter to Shareholders:

Differentiation is Survival and the Universe Wants You to be Typical

Our bodies, for instance, are usually hotter than our surroundings, and in cold climates they have to work hard to maintain the differential. When we die the work stops, the temperature differential starts to disappear, and we end up the same temperature as our surroundings….While the passage is not intended as a metaphor, it’s nevertheless a fantastic one, and very relevant to Amazon. I would argue that it’s relevant to all companies and all institutions and to each of our individual lives too. In what ways does the world pull at you in an attempt to make you normal? How much work does it take to maintain your distinctiveness? To keep alive the thing or things that make you special?…This phenomenon happens at all scale levels. Democracies are not normal. Tyranny is the historical norm. If we stopped doing all of the continuous hard work that is needed to maintain our distinctiveness in that regard, we would quickly come into equilibrium with tyranny….We all know that distinctiveness – originality – is valuable. We are all taught to “be yourself.” What I’m really asking you to do is to embrace and be realistic about how much energy it takes to maintain that distinctiveness. The world wants you to be typical – in a thousand ways, it pulls at you. Don’t let it happen.

Feb

9

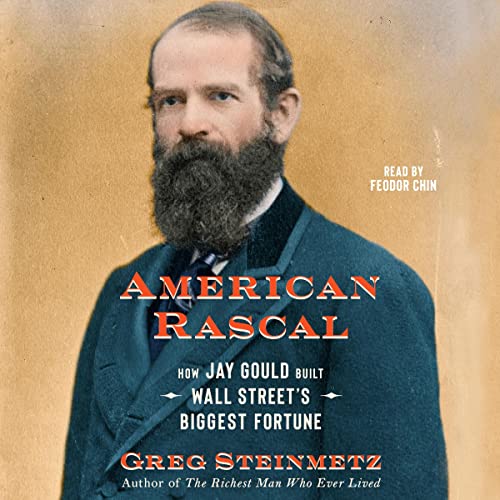

A biography of Jay Gould, from David Lillienfeld

February 9, 2025 | Leave a Comment

American Rascal: How Jay Gould Built Wall Street's Biggest Fortune, by Greg Steinmetz

If you needed to pick out major figures of the Gilded Age, such characters as Rockefeller or Carnegie immediately come to mind. If you were in the midwest, you might include Armour in that list. When I was growing up in the 1960s, Jay Gould might have gotten a mention, but chances are good that he certainly wouldn't have been the first to come to mind. This is unfortunate, insofar as Gould was one of the wealthiest Americans of his day, leaving a fortune of some $75+ million in the 1890s. While some like the Vanderbilts (arguably with a greater net worth) succeeded in one major industry in railroading or Carnegie in steel, Gould's success was in multiple industries, including railroading, telecommunications (think Western Union), finance, and fashion (his early success was in leather goods). Gould not only had an impact in these industries, his actions had national impact, triggering panics, new means of communication (not the technology so much as the scale), political scandals (one of the more stark scandals of the Grant Administration, though that's probably subject to some argument), and even the manner in the US financial world grew on the world stage (though surely not at the scale that JP Morgan or Jacob Schiff did). He left an indelible mark on the United States during a crucial time in its immediate post-Civil War period as the industrial revolution was taking hold in the US.

Steinmetz offers a brief, easy-to-read biography of Gould. Some might argue it's a little too easy to read. It is definitely more of an overview than a deep study of the financier that was Gould. Gould was one of the foci around which some of the more colorful scoundrels that defined Wall Street in the post war period assembled. Daniel Drew, for instance, or Jim Fisk as another. The problem with this biography is that it is good only as an overview. And if that's what you seek, it functions perfectly well. But as Steinmetz did with his biography of Fugger (The Richest Man Who Ever Lived), there's just enough meat to do more than whet the appetite.

If you would like to learn more about the Erie War, there's The Scarlet Woman of Wall Street - not light reading but a tad more insightful than Steinmetz. Or the first Black Friday, when in 1869, Gould tried to corner the gold market, and had all the success that the Hunts would later experience in trying to do the same with silver a century or so later. Steinmetz gives just enough to whet one's appetite, but not enough that one is casting about looking for something meatier. Gould was the force behind Western Union's dominance of the telegraph industry, the world's first internet. He was one of the creators of an empire of transcontinental railroads, as well as elevated local train transit in New York City. Any one of these could be the subject of an in-depth study, but Steinmetz doesn't provide enough to forestall someone from having to consult another book or two.

Some might say that Gould epitomized the Robber Barons on the age, but he actually had little use for any sort of cabals. Sure, he appreciated a monopoly as much as any, but like Commodore Vanderbilt, with whom he waged war of a sort during the Erie War, he ran his businesses with a focus on profitability without necessarily having a monopoly or oligopoly. There are some instances where Gould drove the price of the product down, not hiking it. In building his empire, he demonstrated a shrewd sense of timing and of the anticipated direction of human events.

Jeff Watson writes:

I enjoyed that book. Here’s a lagniappe:

Dark Genius of Wall Street, from Jeff Watson

Stefan Jovanovich adds:

People liked him, and he was - until facial neuralgia destroyed his looks and tuberculosis robbed him of his general health - a charmer.

In 1879 Thurlow Weed said this about him: “I am Mr. Gould’s philanthropic adviser. Whenever a really deserving charity is brought to my attention, I explain it to Mr. Gould. He always takes my word as to when and how much to contribute. I have never known him to disregard my advice in such matters. His only condition is that there shall be no public blazonry of his benefactions. He is a constant and liberal giver, but doesn’t let his right hand know what his left hand is doing. Oh, there will be a full page to his credit when the record is opened above.”

Feb

6

The South Sea Bubble, from Jeff Watson

February 6, 2025 | Leave a Comment

This documentary is a necessity for those interested in markets.

The South Sea Bubble - The First Financial Crash

Khilav Majmudar adds:

The South Sea bubble spared no one, even Isaac Newton! Here is a detailed paper written on his interaction with the bubble, written by a mathematician with a more-than-passing interest in the history of technological and financial manias:

Newton’s financial misadventures in the South Sea Bubble

A very popular investment anecdote relates how Isaac Newton, after cashing in large early gains, staked his fortune on the success of the South Sea Company of 1720 and lost heavily in the ensuing crash. However, this tale is based on only a few items of hard evidence, some of which are consistently misquoted and misinterpreted. A superficially plausible contrarian argument has also been made that he did not lose much in that period, and John Maynard Keynes even claimed Newton successfully surmounted the South Sea Bubble. This paper presents extensive new evidence that while Newton was a successful investor before this event, the folk tale about his making large gains but then being drawn back into that mania and suffering large losses is almost certainly correct. It probably even understates the extent of his financial miscalculations.

Humbert B. offers:

UK Natl Archives: The South Sea Bubble of 1720

Jan

15

Maybe relevant to the issue of stops, from Humbert Q.

January 15, 2025 | Leave a Comment

How to Gamble If You Must: Inequalities for Stochastic Processes

This classic of advanced statistics is geared toward graduate-level readers and uses the concepts of gambling to develop important ideas in probability theory…. Following an introductory chapter, the book formulates the gambler's problem and discusses gambling strategies. Succeeding chapters explore the properties associated with casinos and certain measures of subfairness. Concluding chapters relate the scope of the gambler's problems to more general mathematical ideas, including dynamic programming, Bayesian statistics, and stochastic processes.

And a more recent paper:

How to Gamble If You Must

Kyle Siegrist, Department of Mathematical Sciences, University of Alabama - Huntsville

In red and black, a player bets, at even stakes, on a sequence of independent games with success probability p, until she either reaches a fixed goal or is ruined. In this article we explore two strategies: timid play in which the gambler makes the minimum bet on each game, and bold play in which she bets, on each game, her entire fortune or the amount needed to reach the target (whichever is smaller). We study the success probability (the probability of reaching the target) and the expected number of games played, as functions of the initial fortune. The mathematical analysis of bold play leads to some exotic and beautiful results and unexpected connections with dynamical systems. Our exposition (and the title of the article) are based on the classic book Inequalities for Stochastic Processes; How to Gamble if You Must, by Lester E. Dubbins and Leonard J. Savage.

Jeff Watson comments:

Only play cards with suckers, and never try to fill an inside straight. Never sit in a poker game with a guy named Doc. Never lay the points, stay away from sports betting altogether, never be the bank in a casino baccarat style game. Stay away from slots, casino pit games, you will get ground down by the vig.

There are only two bets I can afford in a casino. One is betting the pass/no pass line in craps, the vig on the pass is 1.414% and 1.36% on the no pass. Plus you can get bets behind the line. The other is the banker bet in baccarat where the house has a 1.06% edge. Even with the commission, it’s a good bet. Still, no matter what, play the game long enough and the vig will kill you.

The banker bet can be real good. Playing for an entire session as banker can cause one the embarrassment of losing everything then having the game boss ask very politely, “How do you plan to settle the commission?”

Nov

21

Poker player’s brain, from Jeff Watson

November 21, 2024 | Leave a Comment

The Incredible Brain of a Poker Player

A true social phenomenon, poker is not just a game of chance and money. From a scientific perspective, we can think of it as a sporting discipline, requiring numerous biological and mental resources. Winning, losing, thinking, bluffing, resisting stress…each of these events results in specific brain activity. By combining testimonials from some of the best players in the world with insights from scientific experts and unique experiences, this documentary will allow each of us to understand the internal processes that govern our risk-taking, and each of our decisions.

Oct

14

1924 Immigration Act, from Stefan Jovanovich

October 14, 2024 | Leave a Comment

This year is the 100th anniversary of the Johnson-Reed Immigration Act signed into law in 1924 by President Coolidge. It was a modification of the 1917 Immigration Act which was the first law to establish quotas for entry into the United States.

Before 1917 the only numerical restrictions on entry to the United States was the Chinese Exclusion Act of 1882, which excluded EVERYONE Chinese. Immigration acts had placed restrictions on individuals (1882 - no convicts, indigents, prostitutes, lunatics, idiots; 1903 - no anarchists, epileptics, crazies; 1907 - no infected, mentally or physically handicapped who could not work), but there had been no quotas. The 1917 Immigration Act continued the exclusion of the Chinese but extended it to everyone else in East Asia except the Japanese and the Filipinos. The law also imposed a literacy test for anyone over 16, but the test was for the person's own language, not just English.

The 1924 Act extended the outright exclusion to the Japanese and can reasonably be identified as the triggering event that allowed Fascists to take control over the government of Japan and spend the next decade and a half convincing the people who had embraced representative democracy, American jazz and baseball that they should choose their own race as the one to come first.

Humbert H. comments:

It’s interesting how some reasons for excluding specific groups from being able to immigrate have changed over time. “Strong economic competitor” has completely disappeared, whereas it was one of two main reasons for excluding the Japanese. There must be some sort of widespread recognition that importing groups that demonstrate great achievement in some economic areas is good for the country even though there is certainly some collateral damage to the established population.

Stefan Jovanovich rejoins:

GR and I have different readings about the exclusion for the Japanese. It was not economic competition; the U.S. had a healthy positive trade balance with Japan between the two world wars. We sent them oil and wheat; they sent us toys and trinkets.

The political pressures for exclusion came from

(1) Teddy Roosevelt's complete hatred of the Japanese AND the Russians (Give a President the Nobel Peace prize and bad things always happen). That made disdain for the Nips into a bedrock belief of all progressive Republicans (Thank you Earl Warren)

(2) The continuing negotiations after the signing of the Washington Naval Treaty of 1922

Humbert H. clarifies:

I didn’t mean economic competition with Japan, but with Japanese immigrants, mainly in California

Asindu Drileba writes:

I heard from somewhere, that before World War 1, passports & visas where not enforced that seriously. You could just show up to any place you wanted to go to without many formal requirements. I just imagine if the world was like that? Anyone can show up anywhere anytime without any legal hurdles?

Noam Chomsky (MIT linguist) says that there are two kinds of globalization.

Globalization 1: Is the free movement of people (labour) around the world with less restrictions.

Globalization 2: Is the free movement of capital & goods (products) with little legal restrictions.

He says that as we we're entering the 21st century, there has been a sharp decrease in Globalization 1 and a sharp increase in Globalization 2. It has been described that Globalization 2 has benefited corporations a lot (some even claim it has benefited the economy as a whole).

Can a country benefit economically (can corporations & markets see gains?) by making immigration as easy as it is to send money around the world? That is, people (labour) moving around with very little restrictions?

Jeff Watson offers:

It would be better this way:

A world of free movement would be $78 trillion richer

Yes, it would be disruptive. But the potential gains are so vast that objectors could be bribed to let it happen.

Humbert H. responds:

Of course anyone with a minimal economic education would realize that free movement of “labor” or entrepreneurs would result in creation of enormous wealth. In the real world though, new immigrants going on the dole has become a feature and not a bug in many wealthy countries. You read anything from England, and that seems like an accepted fact there. The list of various culture-clash and crime issues is long and only irritates people who are for unrestricted immigration. So this not a pure economics problem but more multifaceted. My point was that something, perhaps better knowledge of economics or personal experience, or maybe less dog-eats-dog competition for survival, taught the populace that importing highly capable people usually leads to good outcomes.

Jordan Low adds:

Do you enjoy Bing Cherries? He lost his farm in the act.

Ah Bing was a 19th century horticulturalist and credited as the cultivator and namesake of the popular Bing cherry. Bing migrated to the U.S. around 1855 and worked as foreman in the Lewelling family fruit orchards in Milwaukie, Oregon.

Sep

28

What is in Brooklyn?, from Asindu Drileba

September 28, 2024 | Leave a Comment

Lana Del Rey — My boyfriends really cool, but he is not as cool as me. Cause I'm a Brooklyn Baby. An interview recently posted here with The Chair — "I attribute your being humble to being from Brooklyn" (interviewer referring to The Chair). Another person I listen to - Such mistakes can only be made by people who have not spent a lot of time in Brooklyn. Brooklyn comes up so many times. What's is there to know about it? Of course I have heard of people talking about other cities.

But people that talk about Brooklyn always say it like there is something they know which others don't know. What is in Brooklyn? What does it do to people?

David Lillienfeld adds:

In the epidemiology world, when one of the organizations meets in Manhattan, inevitably someone will suggest to the younger members to go across the Brooklyn Bridge and experience Brooklyn. There is definitely something about Brooklyn that focuses one's thoughts.

Steve Ellison offers:

The Chair wrote a whole chapter on this topic, the first chapter of Education of a Speculator, titled Brighton Beach Training.

Laurel Kenner suggests:

Survivors go there when they get to America.

Alex Castaldo responds:

Agreed, immigrants from Central and Eastern Europe often arrived in Brooklyn as a first step towards success and acceptance in America.

H. Humbert writes:

There is a hierarchy among the real estate developers of New York. Those who develop real estate (especially large commercial buildings) in the central area (the island of Manhattan, also known as New York County) consider themselves socially above the multimillionaires who develop property in the boroughs of Brooklyn, Queens, Bronx and Staten Island. They refer to Manhattan as simply "the City" and seldom go to the other boroughs (other than to take an airplane at LGA or JFK airports, which are in Queens).

Donald Trump's father was a developer of large number of properties all of which were in Queens and Brooklyn and he considered Manhattan development too financially risky. He was quite wealthy but in view of the above was not considered a "major New York developer", like Roth, Reichmann and other well known names.

His son Donald was very ambitious and wanted to move up in society. Contrary to his father's policy he took a gamble and decided to put up a large building, the Grand Hyatt Hotel on 42d street in Manhattan. The project was completed in 1978 and Donald Trump joined the ranks of major NY real estate developers. (What the other developers thought of his operation is another subject and requires a separate article). Even if he wasn't fully accepted by all, when his daughter married a member of the Kushner family, another prominent Manhattan developer, a few years later, it confirmed that the Trump family had reached the first rank among New York's wealthy families. But Donald Trump, having overcome his Queens handicap and shown that he could do better than his father, was not quite satisfied and he decided to enter national politics.

In summary, there is a slight prejudice against people from Queens and Brooklyn, which sometimes causes people to be even more motivated to succeed and be accepted.

In addition Brooklyn has its own distinct accent, which causes the prejudice to be slightly greater. If you would like to know what a Brooklyn accent sounds like you can listen to any speech by Janet Yellen. When she was in line for a top job in Washington, a previous Treasury secretary (probably hoping to get the job himself) mentioned her accent as a reason she should not be appointed. She got the job anyway. Another success for Brooklyn.

Jeff Watson gets musical:

Steely Dan nailed it.

Sep

25

Smörgåsbord

September 25, 2024 | Leave a Comment

Jeff Watson likes info on the softs:

Here’s a copy of a magazine that offers a high level view of all things agricultural:

Carder Dimitroff is watching lithium batteries:

Utility Dive: Lithium battery oversupply, low prices seen through 2028

Despite falling raw material costs and U.S. policy support, North American battery suppliers are delaying or canceling planned capacity investments

Bloomberg: Why Public EV Chargers Almost Never Work as Fast as Promised

Most public machines in the US average about half their maximum speed, a gap that risks hindering further adoption of electric cars.

David Lillienfeld follows pharma:

Immuno-oncology drugs have changed oncology and required rewriting of many sections of medical texts. They have created a revolution. That doesn't mean they are without downsides.

A decade of cancer immunotherapy: Keytruda, Opdivo and the drugs that changed oncology

Medicines that can rev up the immune system against tumors have reshaped expectations of what cancer treatment can accomplish. Their success has hit limits, however.

Sep

22

Choking, from Jeff Watson

September 22, 2024 | Leave a Comment

Ever choke during a big event?

The Brain Really Does Choke Under Pressure

Study links choking under pressure to the brain region that controls movement

Have you ever been in a high-stakes situation in which you needed to perform but completely bombed? You’re not alone. Experiments in monkeys reveal that ‘choking’ under pressure is linked to a drop in activity in the neurons that prepare for movement.

The researchers found that, in jackpot scenarios, the activity of neurons associated with motor preparation decreased. Motor preparation is the brain’s way of making calculations about how to complete a movement — similar to lining up an arrow on a target before unleashing it. The drop in motor preparation meant that the monkey’s brains were underprepared, and so they underperformed. To a certain extent, “you just don't perform better as the reward increases”, Moghaddam says.

Asindu Drileba writes:

This seems related something psychologists call habituation (defined as the diminishing of an innate response to a frequently repeated stimulus). I leaned about it from Daniel Cohen, the first economist I actually enjoyed reading (I recommend the books Prosperity of Vice, Homo Economics). Daniel Cohen mentioned that "habituation" is the reason why in some instances adding financial incentives makes people perform worse at a task.

He gives an example of a Kindergarten School experiment. The school had a problem with parents coming late. So the school said that for every time a parent comes late to pick their child they will be fined a certain amount (lest say $10 every time you come late to pick up your child). The result was that more parents actually came late to pick their kids.

The psychological interpretation might be that parents eventually valued money less than that coming late. So paying a fine made them feel like they have "paid off their sin" that is, the monetary fine erased their guilt.

Daniel Cohen also thinks we are all going to be immortal some day. Here is a nice podcast where he talk about his ideas.

Aug

6

List for a well-lived life, from Jeff Watson

August 6, 2024 | Leave a Comment

Since I have become my grandson’s teacher (and playmate), I’ve been compiling advice lists. Wish someone had shared this with me.

1. Don’t call someone more than twice continuously. If they don’t pick up your call, presume they have something important to attend to.

2. Return money that you have borrowed even before the person who loaned it to you remembers or asks for it. It shows your integrity and character. The same goes for umbrellas, pens, and lunch boxes.

3. Never order the expensive dish on the menu when someone is treating you to lunch or dinner.

4. Don’t ask awkward questions like ‘Oh, so you aren’t married yet?’ Or ‘Don’t you have kids?’ Or ‘Why haven't you bought a house?’ Or ‘Why haven't you bought a car?’ For God’s sake, it isn’t your problem.

5. Always open the door for the person coming behind you. It doesn’t matter if it is a guy or a girl, senior or junior. You don’t grow small by treating someone well in public.

6. If you take a taxi with a friend and he/she pays now, try paying next time.

7. Respect different shades of opinions. Remember, what may seem like 6 to you might appear as 9 to someone else. Besides, a second opinion is good for an alternative.

8. Never interrupt people while they are talking. Allow them to pour it out. As they say, hear them all and filter them all.

9. If you tease someone, and they don’t seem to enjoy it, stop it and never do it again. It encourages one to do more and shows how appreciative you are.

10. Say “thank you” when someone is helping you.

11. Praise publicly. Criticize privately.

12. There’s almost never a reason to comment on someone’s weight. Just say, “You look fantastic.” If they want to talk about losing weight, they will.

13. When someone shows you a photo on their phone, don’t swipe left or right. You never know what’s next.

14. If a colleague tells you they have a doctor's appointment, don’t ask what it’s for. Just say, "I hope you’re okay." Don’t put them in the uncomfortable position of having to tell you their personal illness. If they want you to know, they'll do so without your inquisitiveness.

15. Treat the cleaner with the same respect as the CEO. Nobody is impressed by how rudely you treat someone below you, but people will notice if you treat them with respect.

16. If a person is speaking directly to you, staring at your phone is rude.

17. Never give advice until you’re asked.

18. When meeting someone after a long time, unless they want to talk about it, don’t ask them their age or salary.

19. Mind your business unless anything involves you directly - just stay out of it.

20. Remove your sunglasses if you are talking to anyone in the street. It is a sign of respect. Moreover, eye contact is as important as your speech.

21. Never talk about your riches in the midst of the poor. Similarly, don't talk about your children in the midst of the barren.

22. After reading a good message, consider saying, "Thanks for the message."

APPRECIATION remains the easiest way of getting what you don't have.

Jul

21

Classic SPEC reading list (with movies, too)

July 21, 2024 | 1 Comment

From the original version of the Daily Spec site and worth a review:

Jeff Watson writes:

Being There is a movie adapted from Jerzy Kosinski’s book about a gardener who took Washington DC by storm. His name was Chance and he could not read or write, but the public thought he was a genius. He ultimately became the President of the United States. The book should also be on the list.

Stefan Jovanovich suggests:

Asindu Drileba offers:

- Risk Savvy by Gerd Gigerenzer. How to cut your cancer risk by 50%, how to beat Nobel Prize portfolio strategies, why certainty is an illusion. I think everyone can benefit at least one thing from reading this book. It doesn't matter if you're a spec or not.

- The Visual Display of Quantitative Information (everything by Edward R. Tufte is worth reading)

- Adam Curtis documentaries. He has dedicated his life talking about "Power", mostly the relationship between Markets, Politics, Science, Religion & Philosophy. He informed alot of my thinking about the relationship between those. An incomplete assortment.

- Zurich Axioms. This was recommended by on a podcast. I think it was Larry Williams (but I am not sure). It's a very good book of aphorisms, useful to get your psychology right.

- This is the Road to Stock Market Success (1944). Recommend by Vic. I also find the book very instrumental in developing a psychological edge.

Zubin Al Genubi recommends:

Conrad, J, Heart of Darkness. A river trip into Africa loses grip.

Khilav Majmudar agrees:

Loved Heart of Darkness. Conrad's writing is hypnotic.

Humbert H. adds:

Heart of Darkness is kind of similar to Kafka’s writing in that it’s mysterious and unusual, and nobody knows what it’s really about after reading it. It was famously an inspiration for the movie Apocalypse Now which is arguably even stranger.

Jul

9

Floored, from Jeff Watson

July 9, 2024 | 1 Comment

I’ve posted a link to this documentary before but feel compelled to post it again for all of the newcomers to the list. It’s a great weekend flick, and covers a period when we used to do our business in the pits. There was nothing like it.

Floored - The Complete Documentary Film

Floored is a 2009 documentary film about the people and business of the Chicago trading floors. The film focuses specifically on several Chicago floor traders who have been impacted by the electronic trading revolution and whose jobs have been threatened by the use of computers in the trading world. Directed by James Allen Smith, the film runs for 77 minutes.

Jeffrey Hirsch writes:

Thanks Jeff. Just sent it to my 18yo son who has been getting into the markets and trading.

Nils Poertner asks:

Were you a floor trader, Jeff, and if so, what lessons did you learn that helped you in trading electronically?

Jeff Watson replies:

Yes I was. The most important lesson I learned was to not overtrade.

Humbert H. comments:

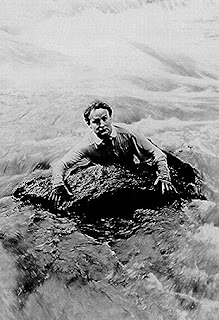

Asking Jeff is he was a floor trader is like asking Paganini if he ever played the violin, asking Taylor Swift if she ever thought of making a living as a pop singer, or LeBron James if he ever heard of a game named "basketball". But what I really want to know Jeff is if you like to surf?

Jeff Watson answers:

I would love to surf, but my health won't allow it. We’re still a surfing family, but I just don’t surf anymore and am relegated to taking pictures from the beach.

May

12

Cost of Carry, from Zubin Al Genubi

May 12, 2024 | Leave a Comment

A carry trade is borrowing/buying at low interest and selling/lending at higher interest rates using leverage. Its used in currencies. The authors propose the trade had become systemic including the FED such that the markets have disconnected from fundamentals and are moved by dynamics of the carry/bust pattern. Further that it is the main driver of economic cycles not classic economic supply and demand.

If so, maybe the Fed watch traders are not always wrong as I've stated and the bad news is good news idea has merit under the carry trade.

Humbert H. writes:

Is there anyone who has done this for decades and not blown up, other than maybe Palindrome? Leverage combined with simultaneous forex and interest rate bets seems like it will eventually blow up, unless you always get advance warnings from central bankers.

Jeff Watson expands:

In the grain markets we determine the cost of carry as Futures price = Spot price + carry or carry = Futures price – spot price. Carry consists of storage costs, insurance, and interest. Carry provides the farmer with signals helping with crop marketing decisions while it provides a trader an opportunity to capture the carry. As an aside, here’s a handy dandy little formula to play around with:

F = Se ^ ((r + s - c) x t)

Where:

F = the future price of the commodity

S = the spot price of the commodity

e = the base of natural logs, approximated as 2.718

r = the risk-free interest rate

s = the storage cost, expressed as a percentage of the spot price

c = the convenience yield

t = time to delivery of the contract, expressed as a fraction of one year

Steve Ellison adds:

The US stock market had a carry trade from 2008 to 2018 and again in 2020 and 2021 when zero interest rate policy made it possible for traders to buy stocks with borrowed money, and cover the interest costs using the stock dividends. Philip L. Carret wrote in his 1931 book The Art of Speculation that the best time to buy stocks is in such situations when stocks "carry themselves".

As a quick approximation, the prices of the front-most ES contracts are:

June 5225

September 5282

So the cost of carry at the moment is roughly 47 points per quarter, and the S&P 500 is not carrying itself (if it were, the contracts would be in backwardation).

May

4

The Doctor Is In. And He’s an Orangutan.

For the first time, researchers have seen a wild animal treat an open wound with a medicinal plant. After getting injured—probably in a brawl with another male—a wild Sumatran orangutan chewed the stems and leaves of a vine humans use to treat wounds and ailments such as dysentery, diabetes and malaria. The orangutan then repeatedly smeared the makeshift salve on an open gash on its cheek until it was fully covered. After the treatment, scientists saw no signs of infection. The wound closed within five days. And it healed within a month.

Jeffrey Hirsch is enthusiastic:

This is awesome! An good friend of mine spent several years in Borneo working with Orangutans under Birute Galdikas’ program. They are super crafty and smart. Don’t doubt this.

Humbert H. writes:

And nobody can explain how they know to do this in these situations. There is obviously a lot of learning apes can acquire from others, but this? There is also no way the current understanding of how genetic information is passed on that can explain this. There is something very mysterious about the mind and animals doing non-obvious things is the best example, this is not a simple biological phenomenon.

Asindu Drileba comments:

One of the things I hear in the AI research community in the pursuit of of AGI (Artificial General Intelligence) is people thinking of intelligence as something hierarchical like height.

In The Singularity is Near Raymond Kurzweil makes a plot of Computers approaching AGI. He puts insects at the bottom and manuals later then humans at the top. You often hear some people say that "We haven't yet reached dog level AI, so we can't say we can reach human level AI soon." That statement makes the assumption that A humans intelligence is more than that of a dog. But it has been reported in some cases a dog's sense of smell can be 100,000 more acute than that of a human being! And not just that it can tell time just by smelling what's around. Another example is also how birds can sense magnetic fields and use them like a compass.

Anyway my point is that just by the (limited) way humans perceive reality we have access to some secrets we can't pass to animals. My suspicion is that animals also have their own secrets that they cannot pass to us.

Humbert H. adds:

They have recently discovered that some insects are self-aware. The test that's used for animals is that they recognize their reflection in the mirror as themselves judging by their reaction. Usually only dolphins, apes, and some corvids (crows) pass the test.

But more importantly, what I meant was that animals seem to "know" how to do things that no current scientific understanding can explain. This means we don't understand basic things about animal (and human) mind. AI is a machine function: an algorithm using some data provides some outputs in response to inputs. A mind is like that too, except we really don't understand the nature of self-awareness, nor do we understand how animals just "know" things. Sometimes they call it "instinct" but there is no real science behind that word. And in this case it's not even that, apes have no "instinct" to cure wounds with specific processed plant material.

Jeff Watson writes:

Here is an interview with cognitive psychologist, Donald Hoffman. Some find him brilliant, some a flake. His ideas are unconventional to say the least, but the questions that come to mind out of his interview will break one’s brain. Many moments in the video, I pause and ask myself how this applies to markets.

Stefan Jovanovich gets philosophical:

The wheel of time turns on the axle of our self-awareness: Transcendentalism.

Mar

25

History of KC BBQ, from Humbert Humbert

March 25, 2024 | 1 Comment

Interesting to learn that Gates and Arthur Bryant's trace their lineage to the original BBQ entrepreneur. As a KC native I'm biased, but it really is the best city for BBQ. Although plenty of good BBQ can also be found in TX and Memphis.

How did Kansas City become Barbecue City, USA? KCQ cooks up a delicious tale

“What’s your KC Q” is a joint project of the Kansas City Public Library and The Kansas City Star. Readers submit questions, the public votes on which questions to answer, and our team of librarians and reporters dig deep to uncover the answers.

Big Al offers:

More BBQ history:

Barbecue in Memphis has a rich history with deep roots

Mapping Texas Barbecue History

A Barbecue Nerd’s Guide to the Most Historic Joints in Texas

The History of BBQ in St. Louis

And for anybody travelling, here is some information on upcoming BBQ competitions and festivals in the US:

Check out 10 of the Best BBQ Festivals in the U.S.

Northeast Barbecue Society: Event Calendar

Rocky Mountain BBQ Association

And per Jeff's comment:

8 Restaurants That Prove Arkansas Barbecue Is Here To Stay

Jeff Watson adds:

This place has the best BBQ in Arkansas, and they’ve only been around for 10-12 years:

Face Behind the Place: Susie Powell of Hoots BBQ & Steaks

Feb

20

Many lessons, from Jeff Watson

February 20, 2024 | Leave a Comment

There are many lessons in this short talk by Richard Feynman.

Barnum’s classic, The Art of Money-Getting, is read aloud in this video. A great addition to any spec’s collection. Quite dated, but the spirit is undeniable.

Feb

5

Trading smörgåsbord

February 5, 2024 | Leave a Comment

Kim Zussman offers:

Meet the Investors Trying Quantitative Trading at Home

Pietros Maneos trades stocks like many of Wall Street’s most sophisticated operations: running dozens of computer-driven strategies in parallel to chase market-beating returns. But he isn’t some tech-savvy math type. He is a published poet who doesn’t know how to code. Maneos, 44 years old, uses online-trading platform Composer.trade to build, test and bet on quantitative trading algorithms that buy and sell stocks and exchange-traded funds out of his home office in Boca Raton, Fla. One algorithm, for example, holds a triple-leveraged exchange-traded fund tracking the Nasdaq-100 index if the S&P 500 index has recently trended higher—and Treasury bills otherwise. He is currently running 72 such schemes he constructed with the application’s graphical interface, but can also type requests in plain English that Composer’s AI will translate into code. “It’s like having my own personal black box,” he said. “You could argue that I’m a hedge fund with 72 strategies.”

Big Al is puzzled by this bit from the above:

Many users praise its simplicity. But several warned about the tax implications of wash sales and the absence of some common Wall Street risk-management tools, such as one that would automatically exit a strategy when a specified loss is reached.

Huh?

Zubin Al Genubi wonders about market microstructure:

On CME is not clear. Is there somewhere how price changes is explained? Seems the asks should go to 0 before price clicks up but they don't. There is a lot of juggling in the queue as well, spoofing, stuffing. I'm reading Flash Crash, by Liam Vaughan.

Jeff Watson responds:

Here is an excellent perspective on spoofing.

Big Al adds:

This book gets recommended a lot but I haven't read it. Pubbed in 2002.

Trading and Exchanges: Market Microstructure for Practitioners, by Larry Harris.

Asindu Drileba recommends:

I am currently enjoying this biography of Jessie Livermore by Patrick Boyle. It's so well narrated, I hope some of you enjoy it.

Henry Gifford observes:

Patrick Boyle says he used to work for Vic.

Jan

7

Lee Stern: legendary trader, from Jeff Watson

January 7, 2024 | Leave a Comment

December 27th was the 97th birthday for Lee Stern, the oldest and longest-standing member of the CBOT. Lee is a legendary trader and one of the most respected members of the exchange. He’s the guy that took the 9 million dollar hit when a fake trader scammed the bond pit. He’s also a spreader which explains his longevity in the business.

Here’s the story of the scammer which is a compelling read on it’s own.

Jan

1

Quant ballyhoo, from Zubin Al Genubi

January 1, 2024 | Leave a Comment

A main goal of the spec list is discrediting ballyhoo: Many so-called quant this quant that show the arithmetic capital appreciation and a fixed bet creating an artificially inaccurate accumulation. Some show the max loss, but due to volatility drag (33% needed to recover 25% drawdown) the growth will not be as their charts show. Instead of $100,000 bet every trade, after a 25% loss the fund is under water.

On the upside geometric returns will rapidly outpace the arithmetic returns due to compounding rather than a fixed trade amount but they don't use that either. So the quant charts twitter charts are wrong in 2 of the most important aspects.

Larry Williams:

What I have come to believe and practice that in money management is all that matters is the trade I’m in right now. The past numbers of the strategy have no bearing on what I will do. Why? Its like a gunfight —you will kill or killed. The trade I am in now will lose or win. There are no other options. That is the hard reality I deal with and protect myself accordingly.

Jeff Watson agrees:

Bingo!

H. Humbert asks:

So are you all saying you literally have to create a new strategy or a version of the old strategy from scratch in every single trade, without regard for the past. This can't be right, can it?

Larry Williams replies:

Oh no, not at all each trade offers the same odds of winning, 50/50, so ‘bet’ accordingly.

Dec

13

Trade N, dispersion, Expectation, from Zubin Al Genubi

December 13, 2023 | Leave a Comment

With a positive expectation (actually doesn't matter how great) increasing N and or decreasing dispersion of returns of trades will increase terminal net wealth in direct proportion! If you understand this you can succeed in trading. Each variable is a leg on a right triangle solvable by the Pythagorean equation!

- James Sogi

Decreasing stop loss to reduce sd will reduce N and may reduce overall return.

Jeff Watson writes:

I only use mental stops, and strive for 100% personal compliance when pulling the trigger to get out. My rationale is that any stops on an exchange or broker server…or in a broker’s deck, become part of the market. That’s too much information to give to the market.

Peter Ringel comments:

yes, quite a few studies show, that stops degrade systems. mental stops but with technical alert levels seem useful. fight for exit - fight for entry. catastrophic hard stop still makes sense.

Larry Williams advises:

Not having a stop has been the death of more traders than having stops.

Humbert H. writes:

To me a "stop" is a trading concept, not an investing concept. It's almost devoid of meaning if you're an investor. Traders operate on price movements, investors operate on price vs. value. Just the way I understand it from observing the lingo in the two "camps", and what it means to be one vs. the other. Of course if you're an investor and there is a huge unexpected price movement, you have to rethink what you know and don't know about the asset.

H. Humbert adds:

My Step 1: Monitor all stops. This is from an Aught's (maybe '03 or '07?) Spec-Gathering in Central Park, per Larry Williams' Wisdom. It is also so appreciated that The Chair, his Dinner Table Guests & Friends, His Co-Opetition Friends (Spec-Listers) & his Superior Employees' annual efforts.

Sep

7

Support, from Nils Poertner

September 7, 2023 | 1 Comment

talented musicians often have support groups, family, friends, even fans. Whereas in trading, when we screw up even a little bit (after many good yrs) the spouse will just throw us with tomatoes and if we are employed - our risk capital cut or we are fired. am half-serious here - being a trader is bloody hard. Very much under-appreciated.

Zubin Al Genubi points out:

We traders have the Spec List!

Jeff Watson writes:

In the late 70’s, I made it a firm and fast rule to never, ever discuss my P&L with my wife….or anyone for that matter. She has no clue as to my positions, and has no idea whether I made or lost money that day. Most successful guys in the pits were the same way with their wives. We saw too many guys complain to their wives, the wives got pissed and nagged them to death, and the negativity provided a catalyst for more losses. Many on this list adhere to the same rule.

H. Humbert comments:

As usual, Jeff speaks wisdom for the ages. The problem is that spouses typically can't determine whether fluctuations are short term, long term, relevant, or irrelevant. A few years ago, my wife logged on at the end of a quarter to get the account value for estimated taxes. It had been a very profitable quarter, but the account was nose-diving that day. I'll never forget her calling out "306, 304, 305, OMG 301, 299!!!" like some panicked automatic altimeter reading. Instead of "pull up, pull up!" she was saying "get out, get out!"

Hernan Avella asks:

To what extent can one really hide one's P&L with a life partner? It's evident when one is thriving. Savings balances, new properties, ventures, new toys, travel, charity contributions. Short term fluctuations are irrelevant, but at the end of the day you are making a bundle or not and your wife knows it.

Jeff Watson replies:

It works for many of us at this dinner party. When one is thriving, does one spend all that money, or does one keep their powder dry for the inevitable big hit?

Hernan Avella agrees:

Absolutely, cash management is an often-overlooked aspect that really demands attention. Think about it: How much opportunity cost are you incurring by running an extremely volatile trading operation that demands a surplus of cash? And man, those big hits? I've been there. It just makes the whole trading thing feel pointless. Ever wonder how many traders, even some big names we're familiar with, end up with lifetime records in the red? Imagine someone starting small, compounding at 40% for a decade, then raising assets 20-fold… and after all that, takes a massive loss. Poof! That trader hasn't earned a cent in profits. Sure, in the real world, they're pocketing yearly fees and stashing money away, but in the grand scheme of things, their investors are at a net loss. High Watermark agreements? Always a gray area. This industry has its shadows. At the end of the day, CAGR should be where our focus is.

P.S. As of now, even the most conservative brokers are offering intraday leverages around 15x for Spu, with a major chunk of the cash invested in bills. Despite a VIX hovering around 13-ish, in just the past five days, we've seen 6 moves that are 25 points or more.

May

29

in what other areas, apart from financial markets and sports betting, is there vig? and what is really relevant for everyday life? and how to avoid it?

maybe we don't see it that way because of Gell-Mann Amnesia affect.

Hernan Avella responds:

There’s a rich literature on rent-seeking behavior. It’s pervasive, Pharma, Telecom, Agriculture, Natural Resources. Not all lobbying is RS but the majority is.

Vic asks:

is there a universal law of vig where it goes to 2% in all activities like sports betting?

Jeff Watson offers:

I wrote this in 2009 about vig:

The Vig Keeps Grinding Away, from Jeff Watson

Steve Ellison comments:

Games that advertise that they're commission free usually charge the highest vig of all …

Mr. Watson's statement was written well before all the retail brokerages offered commission-free trading, which I contend simply means convoluted execution that costs customers much more than the $7.95 commissions that existed previously. "Where are the customers' yachts?", indeed.

Separately, the way the CME evolved is a good example of the Professor's constructal theory that all systems evolve to increase flow and velocity.

Hernan Avella disagrees:

Your insights on electronic trading seem to lack sufficient grounding. Abundant evidence disputes your hypothesis, highlighting the significance of the percentage extracted rather than the total volume. The evidence is clear that more opaque markets, like credit and emerging debt, are more expensive, for everybody except for a selected group that invests heavily in keeping the status quo. Electronic markets are more transparent, more anonymous, standardized, continuous, centralized, offer multilateral interaction and informationally more efficient.