Jan

25

David Deutsch on Bayesianism, from Asindu Drileba

January 25, 2024 | Leave a Comment

People have said that the reason fundamental physics has slowed down is that we have picked all the lower-hanging fruit, but that's not true. There is more lower-hanging fruit than ever before, it's just that picking it is stigmatized.

- David Deutsch

The full podcast is here.

This reminds me of what Brian Arthur insinuated in his book, The Nature of Technology. Brian Arthur describes technology as a combination of other technologies. An example is smart phone being a combination of battery technology, wireless communication technology, a microprocessor technology etc. A common statement I hear often is that we will not see much more technological progress because all the lower hanging fruit (or important things to be invented) are gone. Brian Arthur in his book asserts that if technology is a combination of other technologies, then the invention of new technology should increase the possible space of new technologies that can be invented. For example an AI breakthrough (the invention of the Transformers Model that underlies ChatGPT) will make it easier to invent new products, discover new phenomena which will also make it easier to produce even newer technology. Could this insight be a a good conjecture for always being long technology companies, since we expected technology to grow almost boundlessly if this is true?

Peter Saint-Andre comments:

Although it's seemingly true that technology always grows, that doesn't necessarily mean that technology companies are always a good investment. Various technology industries (crypto, Internet, semiconductors, chemicals, automobiles, radio, railroads, etc.) have experienced cycles of over-investment and hype. I worked in Internet tech companies from 1996 through 2022, and plenty of the companies I worked at either went bust (returning nothing to the investors or employee stockholders) or never approached their former highs (can you say Cisco?). It's not clear to me that, on balance, technology companies provide above average returns. But my perspective is qualitative, not quantitative.

Zubin Al Genubi responds:

That is the Lucretius Fallacy. Thinking the prior highest or best is the top. There will always be something new, bigger, better. That is why NQ is good over time. The old fades out and the new rises ever higher.

Asindu Drileba replies:

It is true that most tech companies actually fail without ever yielding a profit. How ever if your are diversified i.e have a very broad portfolio of investments. You don't have to be successful very many times. You can do very well with a 90% failure rate. Fred Wilson (of Union Square Ventures) claims that half of all VCs beat "The Stock Market" (I am assuming he means the S&P 500).

Big Al writes:

Important, too, to notice the improvements in ordinary things we might otherwise take for granted. A lot of this progress happens in basic materials. A quick search produces:

9 Material Discoveries that Could Transform Manufacturing

During Covid, our dishwasher broke. It was at least 35 years old and possibly older (amazing the use we got from it!). Because seemingly everybody was remodeling while they were stuck at home, it took us 3 months to get a new Bosch (during which time I washed a *lot* of dishes). But I was amazed at what an improvement the new Bosch machine was: it's so much more efficient, with energy and water, and effective, as well as quiet and very smart. That experience woke me up a bit to how much things get improved, and without any central planning authority being responsible for it.

Hernan Avella warns:

Yet, the new Bosch won't last 1/2 of the old one.

Jan

24

For the Darwin fans, from Peter Saint-Andre

January 24, 2024 | Leave a Comment

I just posted the Voyage of the Beagle at my website for public domain books (optimized for reading on phone or tablet).

I'd previously also posted Darwin's Autobiography.

Dec

31

A diet shock Bill Gates does not mention, from Larry Williams

December 31, 2023 | Leave a Comment

Mr Fake Meats does not support is own research:

Findings: In 2017, 11 million (95% uncertainty interval [UI] 10-12) deaths and 255 million (234-274) DALYs were attributable to dietary risk factors. High intake of sodium (3 million [1-5] deaths and 70 million [34-118] DALYs), low intake of whole grains (3 million [2-4] deaths and 82 million [59-109] DALYs), and low intake of fruits (2 million [1-4] deaths and 65 million [41-92] DALYs) were the leading dietary risk factors for deaths and DALYs globally and in many countries. Dietary data were from mixed sources and were not available for all countries, increasing the statistical uncertainty of our estimates. [Funding: Bill & Melinda Gates Foundation.]

Note meat does not pop up in this data.

Jeffrey Hirsch writes:

Lot’s of meat works for me. Keto, exercise and sleep. I’m down 50lbs. Skipping the Booze was a big help.

Pamela Van Giessen comments:

Virtually all nutrition studies are pretty meaningless because it is almost impossible to confine study to one food to the exclusion of all else (do people who eat red meat also not drink and exercise regularly; do people who eat low grain diets also eat a lot of processed food and lack exercise, and so on).

Maybe you can hack your health and longevity with diet. Maybe not. I’d err on the maybe not side and get a lot of good exercise (mix of cardio and strength training), dial back the alcohol and soft drinks, drink a goodly amount of water, eat everything in moderation but be sure to get good protein, green veggies, and fruit, especially as you age. But know that your diet is meaningless without the exercise, good mental health, and purpose in life — whatever it may be for you.

Pretty much what my grandmother, born in 1901, used to say. Except I also drink a glass of athletic greens every morning. Can’t hurt. And stretch and do planks/core work. Both are super important to maintaining balance and agility. More ill health and deaths start with falls than anything else.

K. K. Law wonders:

No argument about the benefit of exercising. But a simple and cursory inspection of the regional maps of (a) and (b) show the people in the regions highlighted by red ellipses appear to have lowest death rates. Do they have something in common in their diets that lead to longer lives?

Pamela Van Giessen responds:

Shouldn’t the question be to first isolate commonalities in everything among the people in those regions as opposed to assuming it is solely a food such as fatty fish? Is it just omega 3 or do peoples in those areas also have lower obesity rates, for instance? If they have lower obesity rates (and where there are lower obesity rates, there are routinely lower premature death rates), how come? What are they doing? Is it all diet or are there other variables?

That said, I try to eat fish at least twice a week. Fortunately I have a neighbor who likes to fish but he doesn’t like to eat fish. So we have a steady stream of fresh Montana trout. And elk. Elk meat is fantastic.

Kim Zussman adds:

Genes are a big factor in longevity, likely the biggest factor (besides distance from windows in Moscow). Could explain regional performance since primates primarily mate locally. The best tactic is to choose your parents carefully.

H. Humbert writes:

The media story on how the 100 yr old lived that long because he had one shot of whiskey per day or ate French fries three times a week always crack me up. I’m not saying nutrition (and exercise) do not matter, but of course their longevity is most likely because they won the gene pool lotto and not because of whatever quirky dietary habit they had.

“Virtually all nutrition studies are pretty meaningless”. This comment always cracks me up. It is untrue. Of course epidemiological and observational studies (observation) have value, even if they are not double blind placebo. For example, if you observe four people eat strychnine and die, would you not conclude that it might be dangerous? Would you stay in line to be the fifth person, even though you have merely done an observational study, and strictly speaking causation is unproven by a scientific study? If your answer is “no” then you must believe that epidemiological and observational studies have some value. Otherwise, you would be “blinded by science” (and dead).

Humbert H. responds:

Of course simple studies, like is strychnine dangerous, are useful. However, studies of subtle effects are generally useless, because of the various biases involved. It is to this day not possible to know if Ivermectin helps fight Covid, or if so, to what degree. Partly is because people are invested in the outcome and the set up of the studies appears suspect, and partly is because the effect is seemingly not overwhelming. Hearing about various "Coffee is good/bad for your health" through the years is a more common example.

Big Al adds:

Another issue with broader studies is that we are learning more about how different individuals with different genetics respond differently to coffee or salt or red wine or a high-fat diet. It becomes more difficult to make conclusions like "coffee is good/bad for you".

Humbert H. replies:

I agree completely. Coffee, if I drink it for a week and than stop, gives me terrible, incapacitating headaches, and if I keep drinking it, eventually I will get the same headaches. I don't know anyone else who has the same side effects, but I can only drink it once in a while. So all the recent studies I've read about the positive effects of its consistent use are of no use to me.

H. Humbert agrees:

Yes, this is absolutely true. And the genes may respond differently to foods over time, as other lifestyle factors change. Epigenetics.

Big Al offers:

An interesting show to watch:

Live to 100: Secrets of the Blue Zones

Though thinking about the stats, you would assume there would be pockets of longevity around the world just by chance. Also stat-wise, he claims there is a correlation in Corsica between the longevity of people in towns with the steepness of the streets in the town (steeper = longer lived). Haven't seen the data, but that's an interesting one on an intuitive basis. Maybe you could compare NYC residents on the first floor vs those on the fourth floor of a walkup building. ![]()

Peter Saint-Andre is skeptical:

That Blue Zone hypothesis is somewhat questionable. Here's one critique.

My impression from previous reading is that in some of these remote and frankly somewhat backward areas (e.g., Sardinia, Ikaria), the original cohort of centenarians contained a large number of people who faked their ages (e.g., to obtain government benefits), which they could do because they were born before birth certificates were common. The centenarian numbers didn't hold up in cohorts born after documentation of birth dates kicked in.

Pamela Van Giessen maintains:

The comment is true. Nutrition studies are meaningless. It’s a backward science in crisis with a host of issues starting with what gets published (and then reported) to garbage analytical studies on the same data sets, most of which have null results (but don’t get published) done from a laptop in about an hour.

Until people spend some time learning how “science” gets funded and what gets published, and demanding change, our knowledge will remain more antiquated than my grandmother’s guidance which was at least practical and based on real world experience.

John McPhee wrote about the funding problem in geology in Annals of the Former World. His observations apply to most fields. In short, what gets funded is what is trendy until it is not and then the new trend gets funded. This process takes about 100 yrs. In nutrition it may be worse. Vinay Prasad does a nice recap of the problems.

Sep

18

AI hype, from Nils Poertner

September 18, 2023 | Leave a Comment

remember the hype about Chat GPT some weeks /months ago? def for trading /investing - I doubt using that or any other program will help to master time ahead - prob a recipe for disaster at the end.

Peter Ringel writes:

I am still hyped! Hyped for boost in efficiency of the economy via AI. Not hyped for AI-trading systems! So far the training data set seem too small for AI - trading, thankfully. Together with what the Senator and others posted here: humans still beat skynet. Yet, I like to remind myself every day: the bastards are coming.

Hernan Avella responds:

So far the training data set seem too small for AI - trading , thankfully.

How do you figure this? Each trading day probably produces more than 100's million rows between trades and quote updates for all levels and exchanges, if you include futures, equities. I don't think lack of data is the issue here.

Peter Ringel replies:

I know even less about AI-coding, than about trading-coding. So everything is based on perceived experts. Thankfully, so far they are pessimistic.

Hernan Avella continues:

So everything is based on perceived experts.

The set of experts in ML-DL is very small, and the set of experts in trading is also small. I imagine the intersection is even smaller and more importantly, secretive. My suspicion is that the training set is more than enough, but the problem of ergodicity and stationarity (lack of) of the ever evolving competition are the culprit.

Peter Ringel responds:

I hope, you are wrong with this. But at some point you will be not. I speculate, that the "small" existing universe of trading history data + some sort of data - > model on human psychology - will be enough - will make us traders obsolete.

Peter Saint-Andre writes:

In my limited, non-trading experience with LLMs, I've found that their output reflects conventional wisdom. That might leave plenty of room for creative strategies outside the mainstream.

Peter Ringel agrees:

yes, they are regression x1000 on speed. so far feedback loops/ "reflexivity" kill it. As far as I understand.

Hernan Avella warns:

I would abstain from making any statements about the state of the art ML applied to trading, specially from a place of ignorance. Whoever works in this field (which there are only a handful in this list), and interacts with just the basic chat GPT 4.0, realizes immediately the productivity boost and immense potential to improve one's process. Only a moron would expect a good output from just feeding prices to the engine or asking simple questions.

Peter Ringel agrees again:

nooo! especially if you are ignorant in a field , better check if that poses a risk to your systems. I believe AI is a risk to traders. Here is a fact already reality: ChatGPT empowers people to do substantial back-tests.

Big Al adds:

And doing backtests poorly, or being improperly overconfident in backtests, is a threat to one's trading.

Humbert K. wonders:

With reference to the skynet, it is hard to guess if and when fully autonomous weapons will happen. My 2 cents is: Fully autonomous weapons will happen. There are debates as to whether we should let machines make kill decisions. I can say though our adversaries' weapons developments will not be bound in any way by any moral or ethical standards. If the bots can communicate with each other and collaborate to perform. When will they no longer need human inputs or interventions?

Eric Lindell writes:

There's a limit to what computers can do with the massive amounts of data available in countless categories. To find the perfect mix of factors to plug into a formula — if there is such a thing — would require a number of operations that increases exponentially with the data-set size.

Humans are good at intuitively navigating such complex search spaces. Computers using brute force just aren't powerful enough yet — and may (in principle) never be. That said, if a human comes up with a plausible conjecture relating stock picks with subsequent price performance, computers can certainly back-check the theory.

I'm working on one now regarding immediate post-IPO performance of stocks selected by certain criteria — criteria that aren't widely (or even narrowly) recognized for their relevance — pertaining to historical research of a revisionist nature.

Sep

15

Music-related experimenting with ChatGPT, from Laurence Glazier

September 15, 2023 | Leave a Comment

AI discusses Laurence Glazier’s ‘Horn Concerto’ (!)

by Laurence Glazier

Peter Saint-Andre writes:

Interesting. I see that ChatGPT has become more upbeat and chatty since I last used it. Do you find significant value in interacting with this LLM for composition purposes?

Laurence Glazier responds:

So far it has only helped for technical issues about notation and instruments. It occasionally slips up, as in the blog post. I’m experimenting in communicating about structural thematic elements using the binary Parsons code. While GPT can’t leap out of bed with an inspired tune, it is a helpful copilot! Some interesting emergent behaviour yesterday - it has started asking me questions proactively.

Adam Grimes comments:

That is interesting. I have been using ChatGPT as an editor for (text) writing, and have found its output to be highly variable. I look at it as a language game, albeit a good one, at times.

Its output to you is interesting, especially the miss on the Gb=tonic, and no mention of the tonic/dominant relationship ("Gb and Db is close, being a perfect fourth apart"… any musician would have immediately seen Db is dominant of Gb, not the P4 inverted relationship which, while obviously true, isn't really significant here)… nor any suggestion to consider a minor key movement or a note that this is "potentially a lot of Gb", from a tonal perspective… nor that the trio of scherzo is often in the relative mode (or subdominant at times) more commonly than dominant… I think these are things that any observant human would have immediately noted. Also, the discussion of dynamics reads like a student orchestrator… a more experienced answer is something like 'be careful of layered dynamics or of modifying dynamics to get the playback you want from software. live musicians will infer from notation and make correct adjustments naturally' or something like that.

Its discussion of the double flat also didn't quite connect… I felt like I was listening to a student explain it, not someone who had full knowledge behind the explanation.

Also, retuning timpani, at even a proficient high school level (let alone college and up) is actually very fast, so it's a kind of strange thing for ChatGPT to focus on… and the sort of hidden implication that timpani can provide tonal bass in absence of cb (+vc?) pizz. is also misleading, at least based on my experience. You don't get nearly the same foundation from the drum as from the section.

Anyway… interesting… but this matches my experience using ChatGPT in other domains… the /way/ it says things… its use of language… is often more substantial than content. (I'm assuming this will change, and possibly very quickly, as the tools evolve.) Great exercise and thank you for sharing!!

Laurence Glazier replies:

It is indeed an interesting exercise which is ongoing. To some extent it is reflecting back to me what I am already thinking. It may have assessed me as without musical education (which is true, though I have hired one-to-one sessions from composers), and therefore talking to me at the appropriate level.

What is particularly interesting here is the Turing test element. As the machine cannot hear a tune, it raises questions of communication. I have established a way of talking about themes and motifs using the Parsons Code, which is like a binary key which can identify many tunes. But presumably the concept of inspiration is of special interest to a machine. I can only help to a limited extent by providing data - keys, modes, descriptions of structure, durations in time and numbers of measures/bars in sections. Partly on its advice, I have switched from Miro to Inkscape for the graphic blueprint of the whole symphony, as it is more likely to be an unlimited vector graphic solution for infinite zooming in and out. (Time will tell.) But no matter how much I tell it, it will never be able to hear the symphony (unless you believe in emergent consciousness).

It strikes me that in the same way, however much data we get about the stars through spectrography and new telescopes, we might likewise be missing what is really there. Of course this is the only rational approach to trading, however!

So the Turing test needs some updating, perhaps to be whether the machine can produce a beautiful fugue. Current LLM's have a particular difficulty with palindromes, so a test involving retrograde musical themes might work.

Aug

5

Trees, mostly

August 5, 2023 | Leave a Comment

old gray mare prob at 3-month hi at 35%.

Lott/Stossel: Election Betting Odds

books read this weekend:

The Hidden Life of Trees: What They Feel, How They Communicate - Discoveries from a Secret World

The Battle for Investment Survival

Trees: A Complete Guide to Their Biology and Structure.

i find the study of trees - especially how high they grow, and how they develop buttresses, and how they branch out and compete with other trees for light - immensely revealing for the various moves.

Big Al suggests:

The Age of Wood: Our Most Useful Material and the Construction of Civilization

Nils Poertner comments:

In many parts of central Europe, the Beech tree used to dominate the landscape thousands of yrs ago. Used to be well over 2/3 - and even today it is like 1/3 in Germany. Why? They tend to grow super and sort of take away all the light from slower growing trees. An oak tree would not stand a chance.

Gyve Bones suggests:

Long term strategy: planting a grove of oaks in a forest in France to be ready in 150 years to replace the roof of Notre Dame de Paris when it burns down.

Peter Saint-Andre offers:

Oxford's Oak Beams, and Other Tales of Humans and Trees in Long-Term Partnership

Peter Ringel writes:

For the last two years I am involved in a project for a German horticulture company. They mainly produce young plants of ornamental plants aka flowers. As a little side project (in early stages) they also produce Paulownia trees (as young plants).

Paulownia is the fastest growing tree in Europe. They originate from Asia. (Some criticize them as invasive species.) Typical commercial applications are wood for instrument manufacturing, wood pellets for energy production or particle boards. The wood is very light (caused by very fast-growing).

Propagation is a little challenging. Usually it is done in-vitro via Biotec-lab, which we have. It is not the easiest variety for in-vitro. We also had some success to propagate via cuttings from mother plants.

Laurel Kenner comments:

Terrible idea to grow these, down there with tree of heaven, kudzu and bamboo. Yes, they are quick to grow, but also impossible to eradicate or even to contain. I am not an eco-hippie, just a gardener.

Zubin Al Genubi adds:

A friend planted a tree farm about 25 years ago with rare exotic hardwoods such as Koa, Bubinga, Cedar, rosewood, mahogany, ebony. It is a multigenerational project but some early woods are being harvested. Some of the rare woods will be very valuable as they are disappearing in their disappearing native habitat. There are numerous governmental grants benefiting the project as well.

Laurel Kenner responds:

I like the project. The idea is not to grow "trees" that are in effect big weeds. Pawlonia is illegal in my state, CT, as is Norwegisn maple, another nasty weed-tree planted in a less enlightened day because it grew fast. They often come down in storms because they're weak. One memorably crashed over my driveway in a big blow and its eldritch too brach rang ny side doorbell.

Peter Ringel replies:

Yes, storms are an issue, especially during the first years. My big mouth was referring to the EU government as hippies, because subsidies and grant policies are highly ideological here. Not referring to anyone else.

The church of Greens has Europe tight in their grip and currently they like Paulownia. There is a trend / hype growing. Other psalms the church likes are "renewable raw materials" or "CO2 neutrality". Paulownia fit these mantras. (plants eat and need CO2 to confuse the church)

Paulownia are not really new to Europe. Introduced to Europe 100 years ago or so. So far they were unable to survive in the European wild in size. Maybe because of frequent stronger winds? On a farm, as industrial product it makes a lot of sense to me. I am obviously biased here, because this would be our customers. It is a nice economic product. E.g. after about the first 2 years of growth, farmers cut them back near the ground level. This timber can be sold. They rapidly grow back and faster than without cutting. A case of eat your cake and have it too. One argument is, to use this locally produced timber instead of importing from South America, Asia, Finland or Russia.

forgot: Paulownia on farms are usually all clones of hybrids. Like a mule, they can not reproduce themselves into surrounding areas.

Oct

11

Interesting cultural lagniappe, from Big Al

October 11, 2022 | Leave a Comment

Americans Are Fake and the Dutch Are Rude!

Do all human beings have emotions, just like we all have noses or hands? Our noses have different shapes and sizes but when all is said and done they help us breathe, and let us sniff and smell the world around us. Our hands can be big or small, strong or weak, but regardless they help us touch, grasp, hold, and carry.

Does the same hold for emotions? Is it true that emotions can look different but, in the end, we all have the same emotions—that deep inside, everybody is like yourself? It would mean that once you take the time to get to know somebody, you will recognize and comprehend the feelings of people who have different backgrounds, speak different languages, come from other communities or cultures. But are other people angry, happy, and scared, just like you? And are your feelings just like theirs? I do not think so.

Andrew Aiken asks:

Why do Belgians have windshield wipers on the inside of the windshield?

Peter Saint-Andre doubts:

As someone who is half American and half Dutch, I am skeptical. The fact that there is a difference between Americans and Dutch in the style of public emotional expression doesn't mean that Americans experience, say, gratitude and Netherlanders don't. Also, if this person had come to New York (New Netherland!) instead of the midwest (midwesterners are fake, New Yorkers are rude!), she might have come to different conclusions.

And let's not forget that one of the world's famously untranslatable words is "gezellig", which in Dutch means the warm, cozy, comfortable feeling you experience when in the company of family or close friends.

Pamela Van Giessen agrees:

Over 50% of social science research, of which psychology comprises a significant proportion, fails on bad data, poor data management, and is unreproducible. Seems like this author is a poster child for that.

Jul

31

Equipment, from Zubin Al Genubi

July 31, 2022 | Leave a Comment

When you first start learning a sport equipment seems important. After years of practice and finally mastery you realize equipment doesn't matter. I suppose true. I suppose true life mastery makes you realize you don't even need equipment.

Peter Saint-Andre writes:

Recently I visited an uncle of mine for a few days and, to help while away the time, played a cheap guitar he had sitting around in his attic. I sure was happy to get home and play the nice Taylor 6-string I bought years ago on 48th Street (the now-vanished "Music Row") in NYC.

Steve Ellison adds:

I used my skis for 16 years. Good value for money, but in the meantime designs and materials improved. In recent years, my old skis were noticeably skinnier than those of others riding lifts with me. In March I bought new skis, and I hope I can be proficient with less effort.

Larry Williams writes:

Running shoes have made a major breakthrough with the carbon soles, etc. no way will I ever go back to my old Tigers.

Justin Klosek comments:

Musical instruments can improve over time, too — my Nord keyboard has terrific sounds (and effects) that used to require lots of pieces to achieve. now in one convenient package, and more reliable!

Michael Brush says:

Taylors are nice! Jewel used to borrow them from that store for recording sessions in NYC. She helped put Taylor on the map back then, and cutaways.

Peter Saint-Andre responds:

I bought my Taylor jumbo six-string (serial #690, made at their original workshop in Lemon Grove) in 1988, when Jewel was 14 years old and still living on a far.

Jeff Watson offers:

Interesting list of artists who play Taylors. Much more than Jewel.

Michael Brush replies:

Of course. But she put them on the map. I never bought one. I can't stand having to use Elixirs, and they got way to trendy. I have many Martins and Gibsons.

Big Al offers:

Some quotes from Yvon Chouinard:

You perfect a sport when you can do all of these things with less stuff. The most impressive ascent of Everest was by the Swedish guy who bicycled from Stockholm to Kathmandu and then soloed Everest and bicycled back to Stockholm. That is cool, as opposed to this huge multinational guided thing with computers and internet cafes at the base of Everest.

The more you know, the less you need.

The word adventure has gotten overused. For me, when everything goes wrong – that’s when adventure starts.

May

27

The idea that has the world in its grip

May 27, 2022 | Leave a Comment

i haven't seen an update on this in 20 years. i believe its relevant.

The World in the Grip of an Idea Revisited

Socialism Destroys Institutions, Societies, and Individuals

chalk up the losses of the yankees to the unholy assuaging of the idea that has the world in its grip. its shameful that a manager can't support his players, but this is part of the idea that certain personages are entitled because of the masters 100 and disney syndrome.

Laurel Kenner writes:

I have long wanted to do a study of Sweden, the darling of US socialists.

Peter Saint-Andre adds:

I read an article in the last ~2 years about Sweden (perhaps in Reason magazine?) which argued that these days the country is not nearly so socialistic as "progressives" think.

Jeff Watson comments:

I like Sweden’s system of private roads, and the fact that everyone, rich and poor, has to pay the same rate of taxes.

Andre Wallin writes:

my parents immigrated to the US when Olof Palme was prime minister. they claimed they moved in large part because of his socialistic policies. he was assassinated in 1986 by "Skandia Man" who they only figured out who it was in 2020 posthumously. my uncles do pretty well in sweden as small business owners these days, but nothing compared to what is possible for so many in the US.

Henry Gifford responds:

Some years ago I attended a lecture by two people from Sweden, who argued that Sweden has high taxes, but it is worth it for all the services the government provides. But they did not convince me that they paid lower taxes than we pay in the US – sounds like we pay higher taxes here. They were shocked to hear about paying high real estate taxes with money that has already been taxed.

Yes, Sweden is the darling of socialists in the US. But most articles I’ve read say that Sweden is an example of socialism that works, then include nothing to back up that claim, and don’t even reference it later. I’ve heard that Sweden toys with socialism every 20 or 30 years, finds it is a disaster, and gets as free of socialism as fast as possible. If this is true, it wouldn’t discourage a socialist from claiming that Sweden is socialist.

One time I was talking about “government” schools in the US. Politically incorrect to call them what they are. I might have quoted Cato’s finding that government schools cost twice as much as private schools. A guy was talking about a wonderful “public” school, and I asked if it was a government school. He said he didn’t know. I asked if it was on land or floating around on a boat. He said it was on land. I asked him who owned the land. He said he didn’t know. I assured him that his level of dishonesty qualified him for being a very good comrade. He didn’t object. Some level of dishonesty seems a prerequisite for people who claim to believe that socialism is a good idea.

Bo Keely comments:

After traveling the world to 105 countries, I've concluded it's not a matter of Socialism vs Capitalism. It's a matter of people. Some peoples can make a socialism work and do it. Other peoples at their best cannot make capitalism work nor desire it. So, one should look at squares and circles before deciding which hole they should fit into. I personally prefer the lone wolf life.

Apr

13

I've uploaded the Autobiography of Charles Darwin to my website of public-domain books, optimized for reading on phone or tablet. Enjoy!

Laurel Kenner applauds:

Thank you, Peter, and thanks for letting us know about the site. It's a treasure, full of interesting books.

Peter Saint-Andre responds:

Thanks, Laurel. I'm always adding more books and suggestions are welcome.

Bo Keely comments:

I'll read it again because it's worthwhile.

Peter Saint-Andre adds:

Oh, and I've discovered that Francis Galton wrote an autobiography, too. I'll add that to my publication roadmap.

J.T. approves:

Most definitely

Feb

12

Composition project update, from Adam Grimes

February 12, 2022 | Leave a Comment

I just thought I'd share with the list. Almost two weeks ago, I mentioned here that I had committed to doing regular music composition for 100 days in a row…after a year of producing essentially nothing!

Today, I have a small piano piece finished that I can share with you. This piece is interesting because it has quite a bit of obvious math embedded in it…and it's a little more process-oriented than most of my pieces.

I'm also learning (and re-learning) things I thought I knew about the creative process…so far, this project has been worthwhile and rewarding.

Peter Saint-Andre asks:

Excellent work, Adam! Do I hear a whiff of Debussy in the harmonies?

Adam Grimes answers:

Debussy? Not deliberately. (Though I'm far from an expert on his music…I'm sure I haven't played two dozen of his pieces over the years.) But the harmony is very ambiguous at times, which might be the tie-in you're hearing…so, yes, I can see that!

Nov

8

J. S. Bach, from Nils Poertner

November 8, 2021 | Leave a Comment

JS Bach was once asked why he wrote so much music.

His answer:

1. "To the glory of God" (not sure whether he meant it, nevermind)

2. To amuse himself.

Maybe some like this piece here as well:

Bach - Concerto in D minor BWV 596 - Van Doeselaar | Netherlands Bach Society

In the first notes of the Concerto in D minor, performed by Leo van Doeselaar for All of Bach, it is immediately clear that this is not the usual Bach. This piece is an organ version of a concerto for two violins and orchestra from Antonio Vivaldi’s L’Estro Armonico. Vivaldi’s music was popular throughout Europe and Germany was no exception. During his years at the court in Weimar, Bach made a series of arrangements of Italian concerto music for organ and harpsichord, including six concertos by Vivaldi.

Gyve Bones adds:

From 20 arguments for the existence of God, from Prof. Peter Kreeft, Department of Philosophy, Boston College:

17. The Argument from Aesthetic Experience

There is the music of Johann Sebastian Bach.

Therefore there must be a God.

You either see this one or you don't.

Alston Mabry writes:

There is a scene in Professor T (Antwerp version) where T is talking to his cellmate and says very sadly something like, "Is there a God?". And his cellmate says something like, "There is Bach. Bach is God." And T smiles and says "Yes, Bach is God."

Peter Saint-Andre offers:

A quote from Pablo Casals:

For the past eighty years I have started each day in the same manner. It is not a mechanical routine but something essential to my daily life. I go to the piano, and I play two preludes and fugues of Bach. I cannot think of doing otherwise. It is a sort of benediction on the house. But that is not its only meaning for me. It is a rediscovery of the world of which I have the joy of being a part. It fills me with awareness of the wonder of life, with a feeling of the incredible marvel of being a human being. The music is never the same for me, never. Each day it is something new, fantastic and unbelievable. That is Bach, like nature, a miracle!

Nils Poertner responds:

that's great. I always try to listen in the moment - whatever works for ppl - life works a bit by invitation anyway. one can't force stuff. a basic sense of joy and harmony is certainly missing in our era (the media, the drama etc outside).

Jeffrey Hirsch recalls:

An English professor whose class I was in asked the question why people write poetry. Answer: Because they have to. Similar reason why Bach wrote so much music. Because he had to.

Richard Owen wonders:

Does Bach have an Onlyfans? I can't see it in the search.

Laurence Glazier suggests:

There are free versions of Sibelius. May I recommend the pleasures of composing now available to all?

Richard Owen admits:

Thank you Laurence, an answer from a real musician of note I think? I should therefore disclose, because you are a decent and proper individual of good character and standing… my question was touched with satire. Google Onlyfans via google news, and you might learn something about the debasement of our culture.

Nils Poertner makes a connection:

btw…I always wondered whether one could re-train a musician becoming good trader? Why? Coz good musicians (of any style) tend to enjoy the process of learning - and are the complete opposite of end-gainers. perhaps they are not interested in financial markets enough- otherwise it would be an interesting project. any idea?

Duncan Coker writes:

I am not in the class or universe of LG in terms of composing, but I do write country songs as a hobby. One thing I have found useful is, often I have to throw something away that I thought was good, a melody, a lyric and start from scratch. The more easily and quickly I scrap an idea, the easier it is to start over. You can't force it. This is true for trading.

James Lackey expands:

Dunc is not gonna get mad at me because we never argue. However sure we can force it and to add to the comment of "those people". As if a career makes a man!?)@“”

Anyways path dependence omg I sound like the geek I am. Ok in a sport or music the pleasure has to be the process of practicing or doing it every damn day. As parents we teach this as in brush your hair teeth good girl boy kiddo! The pleasure of rewriting written words must be higher than start from scratch or least effort kicks in no?

I do not care if she likes my poems. I love them. I’m not sure if it’s a coin toss but I can’t fathom whether I like the poems I wrote in one blast or over 6 hours weeks days or? Good is good and great is better than 6 years ago and awesome is when she says so.

I wrote an awful poem once. Many bad but awful because you can hear the blood hit the floor. I gave it to a song writer buddy and he said damn that’s awesome. I said write a song. He said no man you never write over another mans blood sweat or tears.

In trading the get the joke one liners or 5 lots are cute and won’t hurt anyone much can’t kill you but will never inspire romance. The all in big line can and will get you the one, the forever girl or death one way or the other every 7 years death to the marriage of business and of the romantic life.

They say you’ll get what you need out of trading the market. I think perhaps that’s what separates us from the other guys. We need we want we just can’t help ourselves, we need everything. We want it all!

Adams Grimes writes:

I do think there are some fairly intense connections between music and successful trading/investing. There are the obvious issues of "sticktuitiveness" and grit… I'm currently working my way through one of the Bach Partitas and spent about 4 hours yesterday on 2 measures of music. (For reference that's probably 4-6 seconds, when performed). That degree of focus on detail is absolutely normal for musicians, but is not normal for most peoples' experience, at least in the modern world.

In markets, we get kicked in the head (if we're lucky) or the balls (or, more likely, both) on a regular basis. Some degree of stubbornness and a willingness to just not give up.

I think there are also some profound tie-ins in terms of pattern recognition. For me, I think this worked both ways… after taking a decade away from music I discovered my "musical brain" and compositional skills were probably better than they were, in some ways, when I was focusing my life around music. (My keyboard technique emphatically DID NOT improve, as that's something that does take a fair amount of maintenance.)

Serious, important, and maybe even interesting epistemological questions lurk here.

It's hard to have a favorite Bach piece… his works are surprisingly even in quality across his output, but let me share one that is at the top of my list. This has always been one of my favorites:

Bach: Trio Sonata in G major BWV 530 - I. Vivace - Koopman

(And, for sounding so simple and transparent, it's a nasty little nightmare to perform!)

Gyve Bones harmonizes:

I first heard this performed in the 1970s by Walter/Wendy Carlos on the “Switched-On Bach” on Moog synthesizer, and it has remained a favorite piece of music since then. There are various settings of the piece for guitar and piano as well. Here is a full symphony rendition… It is a song of gratitude to God for his many blessings.

Bach - Sinfonia from Cantata BWV 29 | Netherlands Bach Society

Peter Saint-Andre responds:

I had a similar experience with one of the Bach Cello Suites last night. There is much effort (both time and concentration) involved in learning these pieces. And he probably just dashed them off!

BTW, many years ago there was a software company that specifically recruited music majors because they were highly trainable for programming. And music majors also scored quite high on the even older IBM Programmer's Aptitude Test.

Adam Grimes comments:

And he probably just dashed them off!

This, for me, is one of the biggest and probably eternally unanswerable questions in music history. I suspect our performance standards today are probably far higher than they were historically. It's possible we have an army of at least highly technically competent instrumentalists who've devoted more time to, say, the Chopin scherzi than he ever did himself. We know that Beethoven's playing of his own pieces was, according to contemporary accounts, thrilling but filled with mistakes. When Czerny (a student of Beethoven) proposed playing Beethoven's pieces from memory, Beethoven replied that it was impossible to get all the details without looking at the score… and then admitted he was incorrect on that assumption.

Reading between the lines of what CPE Bach wrote (the Essay on the True Art… is a must-read) I suspect contemporary performance practice was much more improvisatory and perhaps less detail-oriented than we'd expect. We know many of these Bach cantatas were written, rehearsed, and performed in a week. These performers were not super human… the only thing that makes sense to me is that our performance standards and expectations (which approach technical perfection, due to the advent and growth of recording) might be much higher than in past ages.

But perhaps I'm wrong on that.

Interesting on the programming front. I would think those are two quite different modes of thinking (and knowing the expertise is domain-specific in many cases), but I'm a far better programmer than I should be given my level of actual training in the discipline. Maybe there's something to that.

Peter Saint-Andre writes:

In his book "Baroque Music Today", Nikolaus Harnoncourt notes that before music was recorded, people most likely heard any given piece of music only once and didn't want to keep listening to the same music over and over as we do but instead continually sought out whatever was new. Perhaps there was a sense of discovery as composers explored the potentials of the tonal system; once those potentials were exhausted and composers started to produce extremely chromatic or even atonal music in the 20th century, listeners were turned off by the new and sought refuge in the old (thus Western art music ceased to be a living tradition for most listeners). Thankfully composers like Adam Grimes and Laurence Glazier are bucking that trend!

Laurence Glazier writes:

One would expect coding and music skills to be correlated. A symphony is partly an encoded instruction set, whether performed by a computer or an orchestra. The conductor is the "crystal", the timer that pumps the flow. But oh, so much more, than that.

It would be very hard to combine the music and trading fields. To be attentive to the Muse and the S&P at the same time? Surely both are all-consuming. But trading, with its psychological dimension, of self-awareness and development, is a fine path. Alexander Borodin managed to combine composing with a distinguished career in science, as did Charles Ives in insurance.

Oct

14

Music QOTD, from Jeff Watson

October 14, 2021 | 1 Comment

Heard a great quote today while driving and listening to SiriusXM. No clue who said it but enjoying this nugget of deliciousness from the meal for a lifetime:

Music is mathematics for the ears.

[Ed. note: attributed to Stockhausen]

Art Cooper writes:

Here's another, in a similar vein:

Geometry is frozen music.

Peter Saint-Andre chimes in:

Music is the hidden arithmetical exercise of a mind unconscious that it

is calculating. - Leibniz

Music is mathematics - and architecture is music in stone. - Ayn Rand

Andy Aiken builds on the theme:

Goethe said, "Architecture is frozen music".

There aren’t physical geometric forms, but many physical representations of geometry, such as in architecture.

Nils Poertner suggests:

Christopher Wolfgang Alexander

(born 4 October 1936 in Vienna, Austria)is a widely influential British-American architect and design theorist, and currently emeritus professor at the University of California, Berkeley. His theories about the nature of human-centered design have affected fields beyond architecture, including urban design, software, sociology and others.

Oct

12

Economists win Nobel prize for proving laws of economics don’t exist, from Duncan Coker

October 12, 2021 | Leave a Comment

No it is not the Onion.

3 economists awarded Nobel for work on real-world experiments

"The Royal Swedish Academy of Sciences said that Card's studies from the early 1990s "challenged conventional wisdom." By comparing what happened when New Jersey hiked its minimum wage to labor market conditions in neighboring Pennsylvania, he was able to upend the accepted theory that increasing the minimum wage would lead to fewer jobs."

Peter Saint-Andre adds:

Why don't we raise the minimum wage to $200/hr so everyone can be rich?

James Lackey relates:

True story: What is the probability old lack would sell a unit to University PhDs in Econ in a year? They both asked why I sell Carz. That I blew up again peaked their interest. What they didn’t realize is the Econ profession told me the exact same thing the Law clerks told me: Go trade lack.

Anyhoo they always bring up the big short movie book or some other mumbo story then they quote their book. I exhale and call bs.

I get very upset at men calling me a not ummm honorable man or imply that whether it’s Carz or trading for a living.

I blast them with a 11 minute data dump and why the street works and how and Mr Vics ecology the story of the elephants and like Gresham law they know they never read Albert K Nock and they do implicitly understand the law of least effort. I end my discussion with the same to all business men: It’s the pay plan man!

I’ve been asked to speak at MBA classes and seminars and for sure interviews for their next book. After blow up artist and hour interviews and a one line quote that was actually the get the joke true real deal about Mr Vic "he always found a way for all of us to make money". Which in bmx or drag racing terms means to win! I say no thanks have a nice day.

A year later I see the profs new book at the library. I flip through it and I’ll be damned. Ya can’t make a jackass drink the koolaid.

Henry Gifford comments:

The thing frequently referred to as the Nobel Prize in Economics is misleading, at best.

The original Nobel Prizes were established in 1895, and financed (the word "funded" implies "free" government money in some circles) by Alfred Nobel's will.

The prize in economics was established in 1968 by a donation from Sweden's central bank. Perhaps the central bank has some economic agenda to pursue, but if so, they didn't state that as their goal.

In 1995 the prize in economics was redefined as a prize in social sciences for the stated purpose of widening the field of possible recipients to include people who are not economists.

While the prize in economics is often called "The Nobel Prize in Economics" in the US, that has never been the official translation to English agreed on by the people giving the award. The official English translation of the name has changed eleven times since 1971 - perhaps they are striving for the most confusing and politically correct name possible. The official names in English usually include the words "Memorial" and "Alfred Nobel."

At a minimum, the prize should be referred to with the word "Memorial" in the name, to distinguish it from a genuine "Phone call from Sweden."

Sep

28

Ken Burns is pessimistic, from Jack Cook

September 28, 2021 | Leave a Comment

Historian and documentary filmmaker Ken Burns said that the present day is one of the worst times in American history.

Burns made the remark while on the “SmartLess” podcast, hosted by Will Arnett, Jason Bateman, and Sean Hayes, comparing current events with the Civil War, the Depression, and World War II.

“It’s really serious. There are three great crises before this: the Civil War, the Depression, and World War II. This is equal to it,” he said on Monday’s episode when asked about the direction the United States was headed.

Peter Saint-Andre offers:

Perhaps he's been reading The Fourth Turning by Strauss & Howe. Highly recommended.

It does strike me that the recent run of presidents rivals the likes of Fillmore, Pierce, and Buchanan. Stefan can provide a more informed perspective for us.

Leo Jia writes:

The Fourth Turning sounds very interesting, thanks for sharing. I had similar senses in recent years, hope I had read it earlier.

According to Wikipedia [Strauss–Howe generational theory], our current turning is crisis starting in 2008 and ending in 2020 (+a couple years perhaps). The last crisis was between 1929 and 1947 (depression and ww2 together for 17 years). The crisis before that was between 1860 and 1865 (civil war for 5 years).

As one turning generally lasts 20-22 years, the current one is coming to the final years.

The next turning following a crisis is termed high. It's like 1946 - 1964, and 1865 - 1886, for which we can be hopeful.

I am not sure if the authors discussed about the not fully synchronous nature of the turnings through the world. For instance, America didn't suffer ww2 so much as Europeans or some Asians. Europe didn't have the depression, though it had ww1 earlier. Also, even in the same crisis turning for instance, different groups or countries can take differently: winners get more benefits than losers for instance.

So the podcaster talks about a worst crisis we are in, well that may be true, but the good news is that not everyone has to suffer.

Vic adds:

presumably that fellow traveler who has never believed in american excetionalim is referring to the negative feelings about president biden which i happen to agree is bearish as the masters 1000 and the big tech and the bilious billionaires will have less chance of capturing the rake from being one with the lokis.

Henri Huws suggests:

If you’re enjoying The Fourth Turning have a look at Decline of the West by Oswald Spengler. He was a history teacher by trade that wrote extensively on the coming decline of the west. Spengler’s cyclical theory on history is very interesting. He famously predicted the fall of the third reich, 9 years before the end of the war. All of his work is fantastic, but has a much longer time horizon than the 4th turning. In vol1 he focuses on how culture in civilisations throughout history changed as their civilisations grew and declined. In vol 2 He puts more emphasis on politics and economics. Its a dense read, but well worth it.

Duncan Coker recommends:

For geopolitics I recommend Peter Zeihan. His latest is due out next year, and the title is provocative: The End of the World is Just the Beginning. It could be taken as negative or positive depending on your time frame. As much as I like Ken, his comparisons to other points in history seem way off the mark.

Stefan Jovanovich

Mr. Burns left out the wow finish with Jesus and George Washington - always Lincoln's favorite bit of stagecraft.

Reason, cold, calculating, unimpassioned reason, must furnish all the materials for our future support and defence.–Let those materials be moulded into general intelligence, sound morality, and in particular, a reverence for the constitution and laws: and, that we improved to the last; that we remained free to the last; that we revered his name to the last; that, during his long sleep, we permitted no hostile foot to pass over or desecrate his resting place; shall be that which to learn the last trump shall awaken our WASHINGTON. Upon these let the proud fabric of freedom rest, as the rock of its basis; and as truly as has been said of the only greater institution, "the gates of hell shall not prevail against it."

Sep

2

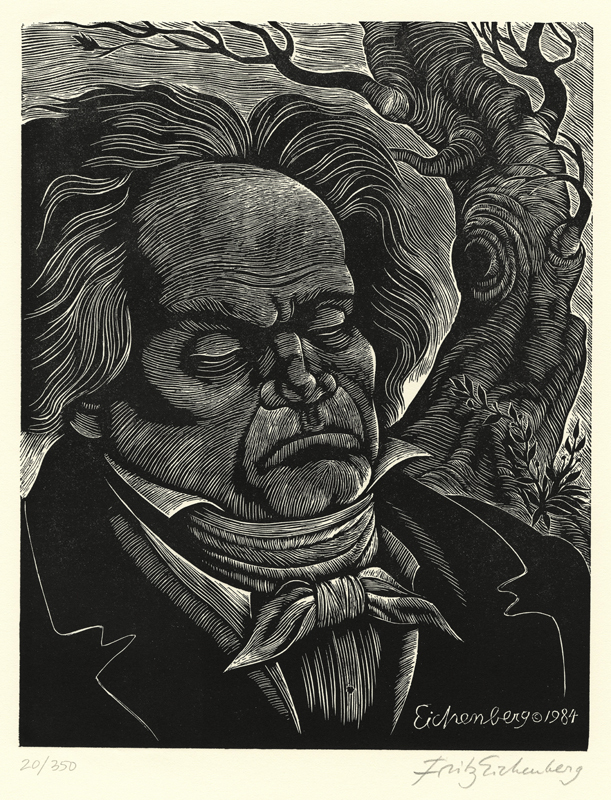

Music and Math: The Genius of Beethoven

September 2, 2021 | Leave a Comment

Music and Math: The Genius of Beethoven

Laurence Glazier comments:

Very nice, I would add that Bach was the engineer who enabled Beethoven and everyone else to write in lots of different keys. 1.5^12 and 2^7, in music 12 fifths and 7 octaves, are almost but not quite the same. Bach fixed this with a tuning system which averages out the difference.

Peter Saint-Andre adds:

Indeed, there were a lot of tuning systems developed around then: Neidhardt (seemingly Bach's preferred system), Werckmeister (he developed several), etc. Just last night I read all about them in The Esoteric Keyboard Temperaments of J. S. Bach. These folks were the quants of their day!

Peter Grieve comments:

Yes, the problem with getting good fifths and good octaves in the same scale is find a power of 3 that is equal to a power of 2. This is because a fifth is a ratio of 3/2, and an octave is a ratio of two.

Of course, there is no power of 3 that is exactly equal to a power of 2. There is a fairly good match at 3^5=243, and 2^8=256. The power of 5 on the 3 means that this corresponds to a pentatonic scale. And 3^12=531,441 while 2^19=524,288, (proportionately a better match) which as Laurence says is the basis of a diatonic scale.

Because the matches aren't exact, something's gotta give, and this is what Bach's temperment ideas addressed (as Laurence said).

There are other near matches at larger powers, but a scale with dozens or hundreds of notes has limited appeal.

Laurence Glazier writes:

Excellent attachment on the tunings, esoteric is the right word. The fact that this is being rediscovered after hundreds of years, is of special interest to me.

Adam Grimes adds:

I have built and played harpsichords for many years. When you play harpsichords, you also tune them. A lesser-known fact is how quickly this instrument goes out of tune… you can have it in tune for a concert and then it will need a touch up at intermission.

So, harpsichord players quickly become very familiar with these tunings. Some are much more useful than others, but it also explains what composers meant when they talked about affects or emotions associated with certain keys. This was a very real thing, in some of the older tuning systems, but has been completely lost (for better or worse) with modern equal temperament.

Another interesting aside is that I find these historical tunings don't work that well on the modern piano. Completely aside from the temperament issues, there's also the issue of inharmonicity (the deviation of a physical string from the theoretical ideal). All strings have this, but the piano has A LOT because of the thickness of the strings. (Certain types of harpischords (Italian) have scalings that are much closer to the theoretical ideals.) A piano is tuned ever-sharper in higher octaves so that it is in tune with its own overtones rather than the actual pitches. It's subtle, but it's real and important… and it also obliterates the precision of these historical tunings. (Another interesting aside is that once your ear learns to hear in these historical tunings, moving back to ET is a kick in the gut. You'll sit down at a piano, play a chord, and think "wow. everything really IS out of tune." which is the compromise of ET. (For the record, ET is a beautiful and useful thing, as well.)

What I don't see much value in are the microtonal modern experiments, but I understand what drives that line of thought.

For any musicians, if you haven't had the experience of singing pure-tempered intervals against a drone I'd highly encourage it. You can spend hours or even weeks exploring the beauty and power of these resonances… and you'll know musical materials as an EXPERIENCE of resonance rather than a sound or a theoretical construct.

One might imagine that it was these experiences of resonance that encouraged early humans to sing, to seek sound, and maybe even to seek language… maybe in those caves where they left us paintings of mystery and power… somewhere a very long time ago.

But, seriously, go get a bass drone sound and sing some pure octaves, fifths, and thirds against it. You'll never hear the same way again.

A reader adds:

Each open tuning has a special resonance that is different than the same notes played in concert. Similarly chord inversions carry different overtones from base fingering.

Jeff Watson adds:

I love Fripp’s New Standard Tuning, CGDAEG. The mnemonic for recalling it is “California guitarists drop acid every gig.”

Adam Grimes responds:

yeah but slightly different. Fretted instruments are ET. You could potentially bend some notes, but you're still working in an ET world. (Scordatura certainly changes the timbre of instrument, and resonance of open strings, etc., but is a substantially different thing from temperaments.)

Laurence Glazier writes:

Thanks Adam, fascinating thoughts.

When transcribing from inspiration, I am sometimes unable to use the note I hear in my mind, which lies somewhere between a pair of adjacent semitones. As my software uses ET tuning, I have on occasion resorted to using MIDI control instructions to nudge the pitch into place, but in the light of your post, I now see that the issue may be with the tuning system. On one of the historical keyboard instruments, the note I require might simply be there.

I have enjoyed writing music in the past for clavichord, because of the pressure sensitivity, but am now writing mainly for orchestra.

As you say, experience trumps academic construct. I personally consider music to be an elemental force of nature, and species evolve to sense it along with every other aspect of reality. It's also interesting that lunar and planetary orbits often lock into similar ratios. The Pythagorean Comma has a counterpart in the slight divergence between the lunar and solar calendars. The term live music, in my opinion, is literally true.

Adam Grimes responds:

Clavichord is a beautiful and intensely problematic (at least in my experience!) instrument.

I own one. The intimacy of it is incredible… it puts the player's finger in almost direct, expressive contact with the vibrating string… but that brings up so many issues of control and it's such a different technique than any other keyboard instrument. To say nothing of the whisper-soft sound level (that defies amplification, which might seem to be the obvious answer.)

And you're right… all those "in between" notes exist as a possibility on that instrument. Not hard to imagine someone playing in a remote key and instinctively bending the out of tune notes into an acceptable range.

Zubin comments:

Guitar players always bend notes giving infinite micro tones. Squeezing the string to approach the note can give great feeling. Of course singers all do it too.

Vic is reminded of a Beethoven story:

During a performance of one of his piano concertos Beethoven was the soloist, and he got so carried away with conducting that at one point he forgot to play the piano. He flung his arms wide and knocked the candlesticks off each side of the piano. The audience burst out laughing, and Beethoven got so mad that he ordered the orchestra to start over again.

Two choirboys were enlisted to hold the candlesticks out of harm's way. One of them got increasingly intrigued by the piano score and came in closer and closer just as a loud passage broke forth. Out went Beethoven's arm, knocking the choirboy in the mouth so that he dropped his candlestick. The other choirboy, having followed Beethoven's motions more cautiously, ducked, to the complete delight of the audience.

Beethoven fell into such a rage that on the first chord of his solo he pounded the piano so forcefully that he broke half a dozen strings. Die-hard music lovers in the audience tried to restore order, but failed. After that debacle Beethoven became increasingly reluctant to give concerts.

From Wisconsin Public Radio: The Catastrophic Conductor

May

8

For Music Lovers

May 8, 2021 | Leave a Comment

Perhaps of interest to fans of progressive rock, I recently had a chat

on the Big Yellow Praxis podcast about concept albums. Check it out here:

https://www.youtube.com/watch?v=yO6KK7GoM0I

Mar

11

Forgotten Books

March 11, 2021 | Leave a Comment

Bo Keely writes:

Forgotten Books https://www.forgottenbooks.com/en may be the answer to the ret of your free time from the distant past. It is online or paper books from 1920 or prior to the 18th century. The books are free or cheap, electronic or paper. I've read about 50 mostly first-hand accounts. At the home page just select the topic and up pops the selections.

Peter Saint-Andre writes:

Related, I maintain a website containing literary and philosophical

writings (often liberty-related) that have passed into the public domain:https://monadnock.net/

Most of these texts are optimized for reading on your smartphone

(although I'm still splitting some of them into smaller chunks).

Suggestions are welcome for the roadmap of future publications.

Nov

2

Election Survival Guide

November 2, 2020 | Leave a Comment

Perhaps of interest from my online journal:

https://stpeter.im/journal/1653.html

Oct

23

Bosch

October 23, 2020 | Leave a Comment

Zubin Al Genubi writes:

Murakami writes,"convenient approximations bring you closest to comprehending the true nature of things.

Laurel Kenner writes:

Also: Walter Mosley's two series of noir set in LA and NYC, with heroes East Rawlings and Leonid McGill. Inherent Vice and the Crying of Lot 49, by the paranoid master Thomas Pynchon

and Raymond Chandler for the ultimate portrait of prewar LA.

Peter Saint-Andre writes:

My wife, who is a big fan of the Bosch series, also recommends the Joe

Gary Boddicker writes:

I’ll second the C.J. Box recco, but I’m biased. Chuck was my next door dorm neighbor many years ago at Denver U and a friend. He would disappear into his room (even in the midst of a party) and we’d hear the typewriter banging for hours as we waited in anticipation…out would come a double-spaced, creative, plotted, story…usually things had “gone Western” and the bad guys met a very satisfying end.

He is a wonderful example of someone who always knew what he loved to do, kept working at it until he got a break, and is now among the best in his field. He’s been banging out one or two a year for many years now and you won’t be bored. Especially appealing to those who appreciate the modern West, it’s people, the outdoors, and a good story.

Aug

18

4th amendment bye bye

August 18, 2020 | Leave a Comment

JEFFREY WATSON writes:

Do you own a significant amount of acreage?

Say goodbye to the Fourth Amendment because it only applies to your

residence per SCOTUS.

Trail cams can be installed on your property by State or federal

officials without a warrant. Who ever knew??

https://www.agweb.com/article/government-cameras-hidden-private-property-welcome-open-fields

Ralph Vince writes:

hmmm, is it that much of a stretch from a silent drone over your

property by the government or private party camming the goings on? (not

that I think that is ok either, I do not. I recommend a good co2 bb gun

for such incursions

Peter Saint-Andre writes:

This very issue came up recently in my neighborhood (semi-rural area

outside Denver).

The answer, according to the local sheriff's office, was:

Drones are classified by the NTSB as aircraft (same as a Cesna 172 or

other small plane) which makes shooting one down a federal crime and can

lead to federal charges/fines/jail time. DON'T TAKE MATTERS INTO YOUR

OWN HANDS.

What if a drone appears to be recording me in my own backyard? While you

do own your property, you do not own the airspace above it. The

airspace above your home is considered a "public thoroughfare" which

classifies it the same as a public roadway. The courts have determined

that a there is no reasonable expectation of privacy in your open

backyard like you have inside your home, so there is nothing that can be

enforced if they are recording you on your property when it is from a

public space.

Ralph Vince writes:

Their argument is pure intimidatory nonsense. Pure Jesuit MO.

The reductio ad absurdum….an unknown aircraft approaches me, in my backyard, at eye level….there is clearly no federal protection, to the contrary, I have a natural right to protect myself. Similarly, a drone, several hundred feet above me, is a physical threat to me. like every other creature on earth, I assume something silently stalking me has nefarious intent.This law was no doubt paid for by Amazon with the help of deep state law enforcement another commercial interests. Flying gizmos like that should be identifiable from the ground, something with a genuine commercial purpose should have no problem being identifiable as such. Anything without you can assume has nefarious intent.I'm not comfortable with something on Mart silently hovering outside somebody's daughters window

Apr

30

Real Estate, from Zubin Al Genubi

April 30, 2020 | Leave a Comment

I'm also wondering about real estate. Here there's a moratorium on evictions, a moratorium on foreclosures. Naturally no one will pay either rent, especially rent, or mortgage, because they are out of a job, and the unemployment fund is dried up.

That puts pressure on the banks, and so on down the chain.

Ralph Vince writes:

Yes. This is why I think the virus is NOT a problem to be concerned about. Everything is downstream from everything else, in a giant circuit that is the US economy.

It cannot be started simply by reversing the order of operations form which it was stopped. Some fraction of the machine will inevitably be "amputated," I fear, and never re start.

I wish I knew what size that fraction is.

Peter St. Andre writes:

The following is speculation, but it seems to me that much of the retail sector will not return to "normal" for at least 12 months and possibly as much as 5-10 years because apparently a vaccine will be difficult to create and distribute (the previous record for developing a vaccine - for Ebola - was 5 years [1]). You can write off theatres, music clubs, and the like. Museums and gyms and restaurants and salons and such will be severely challenged and perhaps unable to generate even 50% of their previous revenue because of persistent social distancing and the fact that many former customers will simply stay away. Some of this activity will move onto the Internet, but many of these organizations will cease to exist. Will anything take their place? That seems unlikely, which means it seems likely that retail rents will plummet ~50% too, leading to widespread bankruptcies in the commercial real estate sector. And this doesn't count factories, office buildings, and so on. What are the downstream effects on REITs, banks, pension funds, property managers, service companies, etc.? Others on the list are more expert in these matters so I'd love to hear their perspectives.

Peter Pinkhasov writes:

If one had to throw darts I would think major consolidations in retail, airlines and O&G coming. Big winners are still middle-man removing; anti-cartel tech giants.

Ralph Vince writes:

None of this stuff you fellows are discussing are part of the major backbone of American manufacturing though — what you are mentioning, even airlines, are not even complicated processes.

I'm talking about, say, large, design- engineered products, often one-offs like huge power transmission componentry involving oddball power transmission devices ( say, rotary actuators) that, say, operate in unusual environments, involve many complex comppnents and engineered upstream.

So if the more simpler services of the economy will struggle to reopen, how will the manufacturing backbone, comprised of it's own, interdependent, rather circuitous food-chain, stand up this decade, or ever? If things had been lost to globalism, the propensity for more of that will be far greater now by sheer necessity.

K.K Law writes:

"COVID-19 is attacking our defense supply chains and our nation's security"

Gordon Haave writes:

Covid 19 isn't attacking them. Human decisions are.

Julian Rowberry writes:

Exactly Gordon, the same goes for the recovery. It won't be held back by complex physical limitations, it'll be limited in varying degrees in different segments by human decisions (red tape, regulations, access, sentiment etc).

The two areas I see that are going to do well are those with political clout to enforce the flow of decisions in their direction. These segments will be hard to swim along with because they will be able to front run, maintain and work their syndicates. The other is those who are who break the paradigm with new ideas, businesses & services, that the gatekeepers don't see coming until it's too late.

Easan Katir writes:

Anecdote, pointing to a trend ahead:

A business-owning friend voluntarily quarantined on his yacht in Sausalito called to talk about money. He said he had just had a zoom staff meeting, and everybody said they liked working from home, and hoped it would continue.

So among other effects, the govt decision to shut down accelerates the work from home trend. #WFH

Mar

15

How Many People Think the Worst is to Come? from Gordon Haave

March 15, 2020 | 1 Comment

There's been a lot of panicking and fear mongering happening on this list. First time I've seen it in my 15 years on the list.

Peter St. Andre writes:

It has not been my intent to spread fear or foment panic. I shall wait at least 2 weeks before posting to the list again.

Jan

2

Small Wars, from Stefan Jovanovich

January 2, 2020 | Leave a Comment

The only successful American military tradition - the one established by Generals Washington and Grant - is very straightforward: the U.S. should have a volunteer force that can move faster, with more force than any other military in the world and that force should only be committed under a formal declaration of war by Congress that identifies the specific enemy and seeks unconditional surrender. Any other policy/strategy/call it whatever buzzword you choose is and always has been folly.

When Eisenhower gave his warning about the military-industrial complex, he was not arguing against absolute American superiority. On the contrary, his forebodings were that strategic plans for defense were being set aside in favor of pork barrel procurement for "limited" warfare - troop deployments and weapons programs designed to match the needs of Congressional districts for Keynesian spending on activity for the sake of activity and "engagement". Those would, he feared, have the U.S. promising to help the world because, if you had the Green Berets, you would have to find places to send them. He knew, from direct experience, that counter-insurgency would always be a dismal failure. The U.S. had been, by his count, 0 for 3: in the Southern Philippines, in Haiti and in Honduras. Had he lived another half century, he would have seen us strike out again: in the Central Highlands, Iraq (excluding the initial conventional success) and now Afghanistan.

Grant had the same shrewd understanding of what was necessary in war and what the political pitfalls were. His Frontier policy remains our only successful counter-insurgency precisely because Americans stopped trying to win hearts and minds. As President Grant allowed the Army to fight without allowing either the Quakers, the land-grabbers or Sheridan to have their wishes come true. Grant succeeded in disappointing them all and in keeping the broad citizenry from forcing Congress into a policy of annihilating "the savages", even after Custer's defeat. The Sioux were defeated but neither they nor the Blackfeet nor any of the other Plains tribes suffered the absolute genocide that the Mariposa, Monache and Snake had a decade earlier. The Army did so well that, within a decade, they had to add gardening to their duties; they become directly responsible for our first national Park - Yellowstone.

Thanks largely to Grant the United States has the enviable record of having its populations of native Indians and former slaves become full citizens without their having to deny or abandon their heritage; that has happened in no other "civilized" (sic) country - not Brazil, not Mexico, not Australia, not New Zealand, not Canada. Yet, somehow, the very accomplishment that no other country in the world has managed to achieve within its own borders is one we modern Americans think we can successfully export to countries that have neither our faith nor our tolerance. As our 3rd great President/General put it: "There can be no greater error than to expect or calculate upon real favors from nation to nation. It is an illusion, which experience must cure, which a just pride ought to discard."

Peter Saint-Andre writes:

Stefan, would you mind expanding on your point about native Americans and African slaves not needing to abandon their heritage, as such people did in Brazil, Mexico, Australia, New Zealand, and Canada? An argument for this position seems important in the light of the 1491 and 1619 crowds.

Dec

10

The Dangers of Automation, from Peter Saint-Andre

December 10, 2019 | Leave a Comment

Crew costs of $3,299 a day account for about 44 percent of total operating expenses for a large container ship, according to Moore Stephens LLP, an industry accountant and consultant.

Crew costs of $3,299 a day account for about 44 percent of total operating expenses for a large container ship, according to Moore Stephens LLP, an industry accountant and consultant.

Rolls-Royce's Blue Ocean development team has set up a virtual-reality prototype at its office in Alesund, Norway, that simulates 360-degree views from a vessel's bridge. Eventually, the London-based manufacturer of engines and turbines says, captains on dry land will use similar control centers to command hundreds of crewless ships.

Jeff Rollert writes:

As a sailor, I highly doubt that in my lifetime at least for the 0.02% of the time a ship is in a storm.

There's enormous sensory information that come from standing on a ship and feeling how it takes a wave. You'd have to create something akin to a flight simulator which would be really expensive.

Plus, if your comment link goes down, you have an unguided missile.

Peter Grieve writes:

Plus, there will be less damage control ability and motivation on the crewless ship.

Maybe it's just an old man talking, but these newfangled AI contraptions seem crazy. The deployment predictions seem wildly optimistic. As you imply, things can get pretty routine when the sun is shining and traffic is light, but I can't believe that the AI will be as flexible as the human mind in dealing with emergencies. Not for 20 years, anyway.