Nov

30

Productivity and AI, from David Lillienfeld

November 30, 2024 | 1 Comment

When do we start seeing the effects of AI show up in national economic data? If you had invested $5K in a laptop and a word processing program, you could replace a secretary at multiples of the cost. When the web came in, there was Amazon squeezing out the costs of the middlemen.

But I don't see the savings for AI. I see lots of talk, some free programs, but in terms of real productivity, not so much. I'm also told that it's early days and I'm asking for too much in posing such a question, but I think we're now getting far enough into AI that it's not an unreasonable matter to bring up.

One thing that's clear is that AI isn't going to generate employment the way the last tech push did. But if it's going to really change the world as its advocates suggest that it will, those productivity gains should be apparent by now.

M. Humbert writes:

However AI productivity gains are measured, it’ll have to account for the productivity loss due to its high energy consumption. For the Austrian economics fans here. I’ve found Copilot to be a helpful time saving tool, so others probably do as well, so time savings definitely are occurring from AI use today.

Laurence Glazier responds:

Using it all the time, huge experiential benefit. Chatting to GPT every morning while reading Thoreau. Instant context. The other big breakthrough is spatial computing. All in the service of art.

Asindu Drileba comments:

From my experience, co-pilot and other LLMs, have not solved anything that could not already be done via ordinary Googling. Looking up solutions to code issues on stack overflow is no different from LLMs. And stack overflow is still better for some tasks (fringe computer languages like APL for example). LLMs are impressive, but are mostly just gimmicks. The only thing it has actually saved me time on is generating copyrighter material and filler text.

Jeffrey Hirsch adds:

Just had that discussion today about ordinary google still being even better than LLM Ais in finding info. Had some fun with AI editing and embellishing copy.

Asindu Drileba adds:

I suspect that the bad SWE job market is due to high interest rates, no AI. The SWE job market is enriched mostly by VC money. And VC money dried up when LPs withdraw to earn risk free money in treasuries instead of betting on start-ups whose success is on probability. I expect it to recover if interest rates come down to previous levels.

I think the LLM narrative was just something that tech executives parroted to show they had an LLM strategy. It's, Like how in 2018/2017 every executive had a "Blockchain" strategy. A lot of businesses assumed that LLMs would replace simple customer support jobs but they just saw their tickets pile up. Even the $2B valued, Peter Thiel financed, code assistant that would make you money on Up work as you sleep turned out to be a blatant scam.

Steve Ellison writes:

I don't have an answer for Dr. Lilienfeld's question about when AI effects will show up in productivity statistics. But I do hear anecdotally through my professional networks that AI projects are adding real value.

At the same time, Asindu is correct that the bad job market for techies, myself included, is more a consequence of rising interest rates–and I would add overhiring during the pandemic–than positions being replaced by AI. As Phyl Terry put it, "But this company [that announced layoffs] wants to go public so the better story is 'we are smart leaders using AI to become more efficient and profitable' vs 'we were idiots during the pandemic and have to lay off some people because we messed up.'"

Gyve Bones writes:

I find that the AI's ability to interpret my request and put together a coherent synthesis of several sources to be very helpful. Grok is nice because it provides a set of links to sources relevant to the prompt, and to related ??-posts and threads.

Laurence Glazier asks:

I usually have audio conversations with GPT rather than the older typed-in input/output. I just subscribed to X Premium to get access to Grok. Any good links for learning good usage? How nice Musk names it from the Heinlein novel.

Gyve Bones responds:

Check out the sample prompts Grok supplies on the [ / ] section in ??. The news analysis prompts for trending items is pretty cool.

Bill Rafter writes:

My business partner and I are in the process of marketing a new software application. Although we are rather literate, we have been running all of our marketing materials through Copilot, and we are amazed at the improvements Copilot makes to our text. It results not only in improved communication, but is a real time-saver. We even asked it to write a business plan, and it came back with a better one than our original.

Peter Penha offers:

I have not (yet) been on Grok but have found that the prompts do not differ very much across LLMs:

A Primer on Prompting Techniques, June 2024.

Prompt engineering is an increasingly important skill set needed to converse effectively with large language models (LLMs), such as ChatGPT. Prompts are instructions given to an LLM to enforce rules, automate processes, and ensure specific qualities (and quantities) of generated output. Prompts are also a form of programming that can customize the outputs and interactions with an LLM. This paper describes a catalog of prompt engineering techniques presented in pattern form that have been applied to solve common problems when conversing with LLMs. Prompt patterns are a knowledge transfer method analogous to software patterns since they provide reusable solutions to common problems faced in a particular context, i.e., output generation and interaction when working with LLMs. This paper provides the following contributions to research on prompt engineering that apply LLMs to automate software development tasks. First, it provides a framework for documenting patterns for structuring prompts to solve a range of problems so that they can be adapted to different domains. Second, it presents a catalog of patterns that have been applied successfully to improve the outputs of LLM conversations. Third, it explains how prompts can be built from multiple patterns and illustrates prompt patterns that benefit from combination with other prompt patterns.

This is earlier/shorter February 2023 paper - I am also a fan/follower of Prof. Jules White’s classes on Coursera why I flag the shorter/earlier paper as well.

Separate on the subject of AI - Eric Schmidt has a new book Genesis with Dr. Kissinger as a co-author (his last work before his passing) but Schmidt did a Prof G Pod Conversation released Nov 21st - in the podcast Schmidt goes over the threat from LLMs that are unleashed and noted that China in his view has open sourced an LLM equal to Llama 3 and that China instead of a being three years behind the USA on LLMs is a year behind. That China comment can be found here at 26:30.

Finally if anyone wants a great book I have read, on the history of the race to AGI going back to 2009: the Parmy Olsen book Supremacy on the histories of Sam Altman and Demis Hassabis is a wonderful read. Also breaks the world down between the AI accelerationists and the AI armaggedonists.

Big Al adds:

I do use Bard to learn or refresh my memory with R. For example, I am trying to use the "tidyverse" set of packages, and Bard is very useful when asked to write code for some task specifically using, say, tidyquant. The code almost never works first time cut & paste, but I can see how things are done differently and figure out what needs fixing. And I get answers to simpler problems faster than on Stack Exchange which is better for more complicated issues.

Laurence Glazier comments:

It's an inverted Turing test situation. The things that AI can't do help identify our humanity, our birthright.

Nov

25

From the archives: How To Become a Professional Con Artist

November 25, 2024 | Leave a Comment

Book Review: How To Become a Professional Con Artist

3/25/2005

Dennis Marlock opens his "How To" book with a testimonial:

As a law professor, I have read countless books, articles, and dissertations on fraud and deception. This, however, is the first time I have elected to endorse any author's work. The book is indeed an academic gem worthy of inclusion in university curriculums throughout the nation.

The beautiful thing about the professor's testimonial and the related, "I first bought the book hoping to discover why a cop would tell people how to commit fraud. Having read the book, I must now ask why he didn't write it sooner" is that they were both short cons written by the author.

The book lacks the scholarship, timelessness, humor and general principles of David Maurer's classic The Big Con, which I would recommend as one of the seven best books for market practitioners right after Ben Green's Horse Trading. Nevertheless, it is replete with cons and techniques we are exposed to in our day-to-day work in the market. The most relevant topic is chapter 4, "Tools of the Trade," which lists such essentials as "How to Talk Without Saying Anything." An example of this would be market talk such as "1040 is a key level." Yes, if it turns at that level and goes up it was key, and if it hits that level and goes below, why that proves that it didn't hold. A variant of this is the "the market is good as long as stays in the 1025-1075 range."

An important sub-technique is to "use abstract and otherwise equivocal and meaningless rhetoric." I have already written about this, and California Phil's precis of the earthquake "professor" is a classic here. But the market confidence man in general does always frame his thoughts in ways that cannot be disproved or refuted.

One loves the discussions of power laws in this context, as there's no way to differentiate a normal distribution from a power law with any degree of confidence for any samples involving 750 observations or less, and by then the situation has changed so much that one can always rely on Oct 19, 1987.

One must always appear confident as a confidence man and "I am completely confident that you will be totally satisfied with this necklace" is a phrase that the confidence man uses often. This is even more effective when you receive this assurance from a friend of the confidence man. I recently read an interview about a large man who has lost billions of dollars for his investors in publicly reported funds, yet the interviewer refers to the millions he has made the 30% a year internal rates of return, and the nine-figure amount that his followers made applying the techniques that the large man proudly boasts he took the lions share of , and the amazing returns he himself is making at the very present time, despite the difficulties he apparently has in making money for customers.

One of my favorite passages in "How to Become a Professional Con Artist" is the depiction of the big businessman as the ideal mark. "They're cows waiting to be milked," Marlock writes. "They are in abundance, they don't complain when being milked, they provide useful products, and they are used and abused by almost everyone. They are abused daily by employees, lawyers, stockholders, customers, suppliers, lenders, accountants, partners, tax collectors, and competitors. except for the stiff competition, bus schemes are the easiest, safest, and most profitable.

Nov

24

Stops, from Hernan Avella

November 24, 2024 | Leave a Comment

Contrary to what has often been repeated on this esteemed list over the years, the art and process of trading is fundamentally the art and process of setting the right stops. Simpletons may claim that adding stops to a system (trading ES) reduces profitability, but that's only because the system itself is flawed, with laziness baked into its design. Setting the right stop is an integral process—it involves gauging current and expected volatility, weighing potential paths, and accounting for the bias.

Steve Ellison writes:

One of my best experiences with this list was that at the sparsely attended Spec Party in summer 2009, the 20 or so of us who were there had a very spirited discussion in Victor's living room about whether it was advisable to use stops or not. Many excellent points were made both pro and con.

Speaking for myself, I usually don't enter stop orders because they become part of the market, but I have mental stops. On the rare occasions when I actually have a profit, I am determined to not let it turn into a loss. And if a trade goes against me (by a nontrivial amount), that's new information that apparently my original analysis missed; in that case I am determined not to let a small loss turn into a big loss.

To put it another way, I entered a trade because I thought I had an edge, but the market moved in the wrong direction. Maybe something bigger is going on than, say, my analysis of the last 10 post-options-expiration weeks.

Big Al offers:

Stop Orders in Select Futures Markets

Nicholas Fett and Lihong McPhail

Office of the Chief Economist

Commodity Futures Trading Commission

August 29, 2017

This paper analyzes trade and order book audit trail data to provide a detailed summary of the use of stop orders in select futures markets; specifically E-mini S&P 500 Futures, Ten Year Treasury Note Futures, and WTI Crude Oil Futures. Recent flash rallies and the ever increasing speed of futures markets have called into question the appropriateness of traditional stop order strategies. By utilizing metrics related to both placement of and execution of stop orders, we show that stop orders are being used in these futures contracts with varying frequency and the strategy of stop order placement varies greatly by participant. As expected, trades involving stop orders are found to be highly correlated with intraday price volatility. Existence of stop orders is generally unknown to market participants as stop orders are not visible in the orderbook but must be triggered by a trade in the market at the corresponding price. More importantly, our analysis indicates that many traders are not only using stop orders for hedging purposes but also using them for latency reduction strategies. We provide a background on the usage and depth associated with stop orders in selected futures markets.

Larry Williams responds:

THANKS FOR THE POST. This should dispel the notion "they are going after my stops."

Asindu Drileba writes:

I don't actually use stops at all. My position size is my stop. I only bet a maximum of 3% of my bankroll. I really only get out of the market when I am liquidated. I sleep knowing that if I am to loose, my maximum loss is capped at 3%. I don't even respond to margin call emails. I often want to capture the moves between the daily open and the close. So what happens in between is something I usually ignore.

Nov

23

Deems Taylor

November 23, 2024 | Leave a Comment

this satirical bit brings to mind a Deems Taylor story. He came in for the second piece of concert that was complete programmatic movement. Deems thought the first piece was being performed. and all the allusions were wrong. Mark Twain in Roughing it writes of many mistakes like this.

father of the great libertarian scholar and editor Joan Taylor.

Deems Taylor: A Biography, by James A. Pegolotti.

Composer, critic, author, and radio personality, (Joseph) Deems Taylor (1885-1966) was one of the most influential figures in American culture from the 1920s through the 1940s. A self-taught composer, the New York City native wrote such pieces as the orchestral suite Through the Looking Glass and the acclaimed operas The King's Henchman and Peter Ibbetson, the first commissions ever offered by the Metropolitan Opera. Taylor's operatic works were among the most popular and widely performed of his day, yet he achieved greatest fame and recognition as the golden-voiced intermission commentator for the New York Philharmonic radio broadcasts and as the on-screen host of Walt Disney's classic film Fantasia. With his witty, clever, charming, and informative but unpatronizing manner, he almost single-handedly introduced classical music to millions of Americans across the nation.

Nov

22

The wisdom, wit, and saltiness - with market implications - of Don Quixote

November 22, 2024 | Leave a Comment

_David_-_Don_Quixote_and_Sancho_Panza_illustration_of_book_by_Miguel_de_Cervantes_Histoir_-_(MeisterDrucke-1474017).jpg)

All affectation is bad.

Something is better than nothing.

Between friends sharp eyes.

He who leans against a good tree finds good shelter.

The ass laden with gold mounts lightly up the hill.

Well-gotten wealth is lost, but with the ill-gotten the master is lost too.

The wheel of fortune turns quicker than a mill-wheel.

That which costs us little, is valued at even less.

Where one door is shut, another opens.

He who seeks danger perishes in it.

There are no birds in last year's nest.

A sparrow in the hand is better than a vulture on the wing.

Many littles make a Much.

Patience, and shuffle the cards!

All is not gold that glitters.

He who does not intend to pay is not troubled in making his bargain.

He who buys and lies, feels it in his purse.

One misfortune calls another.

Who goes ill, ends ill.

To draw one's beard out of the mire.

Where you least expect it up starts the hare.

The reputation of the master reveals that of the servant.

The ball is drawn up by the thread.

A single swallow does not make a summer.

The dry throat can neither grunt nor sing.

Fortune favors the brave.

What hath been, hath been.

Where duennas intervene, nothing good can come of it.

Make a bridge of silver for a flying enemy.

Upon a good foundation a good building may be raised, and the best foundation in the world is money.

Diligence is the mother of good fortune.

You cannot catch trout with dry breeches.

Here come the Bulls for certain!

Time is the discoverer of all things.

With life many things are remedied.

Nov

21

Poker player’s brain, from Jeff Watson

November 21, 2024 | Leave a Comment

The Incredible Brain of a Poker Player

A true social phenomenon, poker is not just a game of chance and money. From a scientific perspective, we can think of it as a sporting discipline, requiring numerous biological and mental resources. Winning, losing, thinking, bluffing, resisting stress…each of these events results in specific brain activity. By combining testimonials from some of the best players in the world with insights from scientific experts and unique experiences, this documentary will allow each of us to understand the internal processes that govern our risk-taking, and each of our decisions.

Nov

20

Howard Hammer

November 20, 2024 | Leave a Comment

Vic and Howie Hammer being inducted into paddlable hall of fame. Howie at 88 the founder.

Howard Hammer – PFA Paddleball Legend of the Game Profile

Howard Hammer is the first inductee into the PFA Hall of Fame, and rightfully so. He was not only one of the greatest players the game has ever seen, but he also contributed more to the game than anyone I know. No one else is more associated with paddleball than Howie. Therefore, the title “Mr. Paddleball” is really appropriate.

Video: Paddleball Shots: Fundamentals, by Howard Hammer

Book: Paddleball: how to play the game, by Howard Hammer, 1979.

Nov

18

The wisdom of Sancho

November 18, 2024 | Leave a Comment

while Don quixote is voted the best novel of all time, and its humour and anecdotes are considered sui generis, not many have commented on the wisdom of this book as great as its wit. I have found the proverbs contained within - all very short, salty and sententious - the perfect companion to the book itself. the companion by Ulick Ralph Burke, Sancho Panza's Proverbs, is the perfect partner to the duo and is a work of masterly scholarship. In addition to the saltiness of all proverbs, there is an underlying Spanish diffidence and pregnancy to all the proverbs that enhances the novel.

Nov

17

New study by Dimson, et. al.

November 17, 2024 | Leave a Comment

the authors of this study should receive a Nobel Prize. the study is magnificent and the conclusions are useful and surprising. I would add that the studies do not take into account the theory of ever changing cycles. current conditions differ from the 19th century.

Long-run Asset Returns

Annual Review of Financial Economics, volume 16, issue 1,

2024[10.1146/annurev-financial-082123-105515]

David Chambers, University of Cambridge - Judge Business School; CEPR

Elroy Dimson, University of Cambridge - Judge Business School; European Corporate Governance Institute (ECGI)

Antti Ilmanen, AQR Capital Management

Paul Rintamäki, Aalto University

Date Written: October 10, 2024

The literature on long-run asset returns has continued to grow steadily, particularly since the start of the new millennium. We survey this expanding body of evidence on historical return premia across the major asset classes-stocks, bonds, and real assets-over the very long run. In addition, we discuss the benefits and pitfalls of these long-run data sets and make suggestions on best practice in compiling and using such data. We report the magnitude of these risk premia over the current and previous two centuries, and we compare estimates from alternative data compilers. We conclude by proposing some promising directions for future research.

Nov

16

Favorite piano

November 16, 2024 | Leave a Comment

my favorite piano work at my favorite venue by my favorite non-family woman who I've known for 50 years:

Pianist Rorianne Schrade plays Eduard Schütt's Paraphrase of J. Strauss Tales from the Vienna Woods

Rorianne Schrade YouTube channel

Rorianne's website.

Nov

15

A case for BTC

November 15, 2024 | Leave a Comment

a very resonant and helpful piece highly recommended:

Get Rich While Saving the World! Baby Tristan's Case for Bitcoin

one wouldn't be surprised if Tristan's middle name was Victor.

Nov

14

Crypto and the money supply, from Bill Rafter

November 14, 2024 | Leave a Comment

Should the market cap of crypto currencies be included in money supply for macroeconomic purposes?

William Huggins replies:

I'd you cant use it to pay taxes it doesn't count (just another asset, like a stamp).

Kim Zussman asks:

Why not? They add because if you pay taxes with fiat you can buy merch with crypto.

William Huggins responds:

you can barter wine or chocolate for a ton of things online too but we don't count those either. if money is "anything taken as payment" then we have to get very serious about "degrees of moneyness" (hence m0,m1,etc). in that spectrum, its pretty clear that the only things on the list are legal tender so unless you live in the land of bukele, it doesn't count (also, whose money supply does crypto count as exactly?)

Peter Penha:

I will volunteer that there is no moneyness to crypto as it was determined a 100% haircut asset by the DTC.

I think this leaves Blackrock and other crypto ETF managers in the interesting position that they cannot include crypto ETFs in one of their asset allocation funds or a target date fund, etc - inclusion would pollute.

Crypto in the USA appears to be a walled garden - the only contagion I can see to the financial world would be to holders of Micro Strategy Convertible Debt.

Stefan Jovanovich writes:

The question you all are raising here has a history - how far can "the law" go to monetize promises to pay? Originally, the answer was not one step. The Constitution says that legal tender can only be Coin. Article I, Section 8.

The lawyers have been working around that limitation ever since. Their greatest difficulty has been getting around the literalist non-lawyer Presidents who keep following the actual instructions the People established by vote as "the law".

Success came with the Aldrich-Vreeland Act which authorized banks with Federal charters to form "currency associations". Those were given authority to issue emergency currency could be backed by securities other than U.S. bonds, including commercial paper, state and local bonds, and other miscellaneous securities.

Section 18 of the Act: "The Secretary of the Treasury may, in his discretion, extend from time to time the benefits of this Act to all qualified State banks and trust companies, which have joined the Federal reserve system, or which may contract to join within fifteen days after the passage of this Act: Provided, That such State banks and trust companies shall be subject to the same regulations and restrictions as are national banks under this Act: And provided further, That the circulating notes issued under this Act shall be lawful money and a legal tender in payment of all debts, public and private, within the United States."

Everything since 1908 has been a variation on that theme - "lawful money" can be whatever Congress says it is.

Bill Rafter comments:

I started this question because I am working on a slight variation of digitally quantifying inflation. With the loose definition of inflation being “too much money chasing too few goods”, then the “money” part should include all that can conceivably buy the “goods”. Since one can increasingly buy a whole lot of stuff with crypto, then crypto deserves inclusion. If one were to fast-forward to a time of massive currency instability (this is just a thought experiment), having included the cryptocurrency might have facilitated greater forecasting.

Stefan Jovanovich adds:

For me the paradox of Bitcoin is that it has been a spectacularly successful asset - like a share of Berkshire Hathaway stock bought in the days before Buffett even went public - but it has never been a money. If I had Bill's brain and cleverness, I would try to include in the calculations the sum of personal and corporate credit that the lenders cannot easily pull away from the table (the potential moneyness supply) and the amount of credit actually used; and then seek the correlations to the fluctuations in that spread. In the days before central banking, speculators watched the net supply of commercial paper as such an indicator.

Nov

12

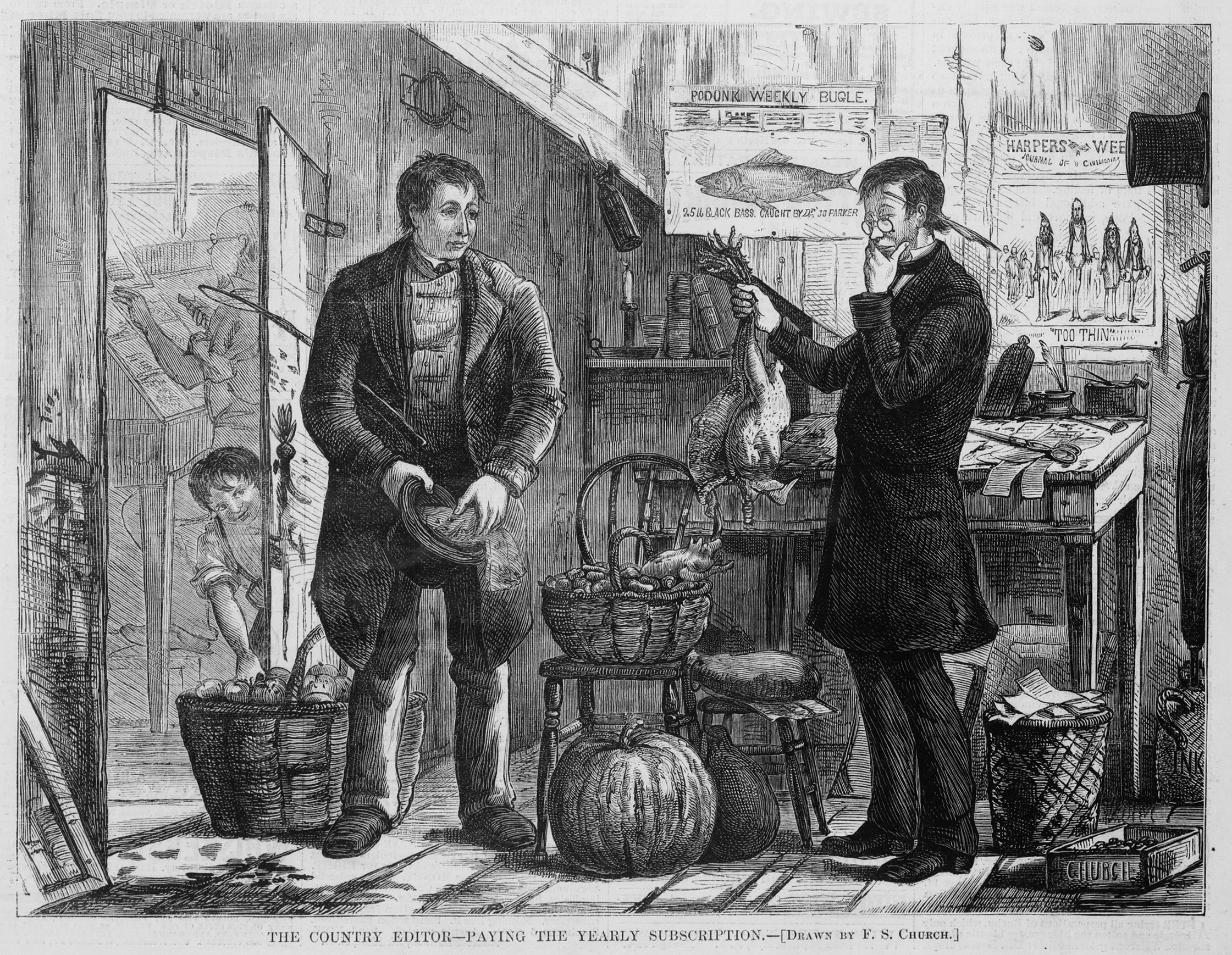

Sporting anecdotes

November 12, 2024 | Leave a Comment

Sporting Anecdotes (1923) shows us what the state of sports was like in England in 1800's. much betting on walking races, boxing, horse racing. and here is the greatest fives player of all time: john cavanaugh, much fighting of badgers, etc; great match of walking 1000 miles in 1000 hours; gouging match in america; fidelity of a dog; curious wager - walking against eating; throwing cricket ball 100 miles to deliver a post and win a bet; wisdom of Pliny who lived 100+ years.

Nov

10

The Old Right was a principled band of intellectuals and activists, many of them libertarians, who fought the “industrial regimentation” of the New Deal, and were the first to note that, in America, statism and corporatism are inseparable.

Despite some current claims, however, these writers ardently defended capitalism, including big business and corporations, celebrated the profit motive, and took a strict laissez-faire attitude towards international trade. They loathed tariffs, and saw protectionism as a species of socialist planning.

Humbert H. writes:

Current restrictionist trade theories in the conservative movement, therefore, are not those of the Old Right. Their intellectual legacy is more likely British mercantilism.

The British did pretty well under mercantilism. I have always supported free (meaning from both sides) trade with equally situated countries, like US and Canada, but I love restrictionism and tariffs imposed on countries like China. It's crazy, in my opinion, to have "free trade" with a country that can and routinely does restrict imports, has slave labor, no "social safety net", steals intellectual property in a variety of ways, and can chose to focus on any trade area to bankrupt it's counterparts in a "free" country. The ability to produce a variety of goods is fundamental to the strength of the country. In wars, pandemics, and trade wars the other country starts having domestic capabilities is crucial. When this debate was first discussed in France, restricting the imports of oranges from Spain and Portugal into France was used as an example of what not to do, and that's a poor example compared to importing steel and semiconductors.

Larry Williams comments:

Hamilton's use of tariffs made America great.

Stefan Jovanovich writes:

Hamilton made his living as a private attorney in New York representing the marine insurance companies whose policies required shippers to be "woke" - i.e. perfect observers of their policies' neutrality warranties.

Pamela Van Giessen adds:

Silent Cal Coolidge the Vermonter was also good with tariffs and preferred them to income taxes.

Along with Secretary of the Treasury Andrew Mellon, Coolidge won the passage of three major tax cuts. Using powers delegated to him by the 1922 Fordney–McCumber Tariff, Coolidge kept tariff rates high in order to protect American manufacturing profits and high wages. He blocked passage of the McNary–Haugen Farm Relief Bill, which would have involved the federal government in the persistent farm crisis by raising prices paid to farmers for five crops. The strong economy combined with restrained government spending produced consistent government surpluses, and total federal debt shrank by one quarter during Coolidge's presidency.

Michael Brush responds:

Smoot-Hawley worsened the Great Depression.

Humbert H. cautions:

That's not really a fact, it's a debatable point. There's a range of opinions there from "it caused it" to "it did nothing to worsen it". It's one of those things like "what caused the fall of Rome" that can't be decisively proven.

Stefan Jovanovich offers:

Effective date of Smoot-Hawley Tariff: June 17, 1930

Tariff collections:

Fiscal Year 1931: $378,354,005.05

Fiscal Year 1932: $327,754,969.45

Fiscal Year 1933: $250,750,251.27

Total tax collections by Treasury:

Fiscal Year 1931: $2,118,092,899.01

Fiscal Year 1932: $2,118,092,899.01

Fiscal Year 1933: $2,576,530,202.00

Pamela Van Giessen writes:

Amity Shlaes goes into detail about how the depression was extended (or recovery didn’t come) in The Forgotten Man. She attributes the worsening of the depression, especially in the late ‘30s, to a combination of government interventions that included the Smoot-Hawley tariff, government (and union) demands to keep wages high, banking regulation, over-regulation, and FDR’s new deal, among other government interventions. In short, there doesn’t seem to be just one cause though it seems reasonable to blame each of the interventions.

Art Cooper adds:

I also found Murray Rothbard's America's Great Depression to have worthwhile insights.

Nov

7

Gouging, controls, and heroism

November 7, 2024 | Leave a Comment

Price Controls: Still A Bad Idea, by David R. Henderson.

When University of Chicago economist Harold Demsetz gave a talk in the winter of 1970 at the University of Winnipeg, where I was an undergrad, he used an analogy that many critics of price controls still use. Demsetz told his audience that using price controls to reduce inflation is like responding to cold weather in Winnipeg by breaking the thermometer. His point was that just as thermometers respond to temperature, prices are an indicator of underlying economic phenomena, namely supply and demand. Breaking a thermometer doesn’t cause the temperature to rise; controlling prices doesn’t cause inflation to fall.

The Edict of Diocletian: A Case Study in Price Controls and Inflation, by Murray N. Rothbard.

Citizens of the old Roman Empire distrusted paper currency and refused to accept anything but gold or silver coin as money. So the rulers found themselves barred from inflating the money supply by the unobtrusive method of printing additional currency.

But the Roman emperors soon discovered an ingenious device. They proceeded to call in the coins of the realm, ostensibly for repairs. Then, by various means, such as filing off small parts of the coins, or introducing cheaper alloys, they reduced the silver content of the money without changing its original face value. This devaluation enabled them to add many more silver coins to the Roman money supply. The practice was started by Nero, and accelerated by his successors. By Diocletian’s time, the denarius (standard silver coin) had been reduced to one-tenth of its former value.

The Speculator As Hero, by Victor Niederhoffer.

Some speculators are discoverers like Christopher Columbus, creators like Henry Ford, or inventors like Thomas Edison. Their job is easy to place on a high plane. My role in the grander order is indirect, relatively invisible and unplanned. The only discoveries I make are the routes that prices will travel. Like hundreds of thousands of other traders, I try to predict the prices of common goods a day or two in the future. If I think the price of an item will go up, I buy today and sell later. If I think that the price is going down, I’ll sell at today’s higher price. The miracle is that in taking care of ourselves, we speculators somehow ensure that producers all over the world will provide the right quantity and quality of goods at the proper time, without undue waste, and that this meshes with what people want and the money they have available.

Nov

6

From the research archives: Predictive and Statistical Properties of Insider Trading

November 6, 2024 | Leave a Comment

Predictive and Statistical Properties of Insider Trading

Author(s): James H. Lorie and Victor Niederhoffer

Source: Journal of Law and Economics, Vol. 11, No. 1, (Apr., 1968), pp. 35-53

Published by: The University of Chicago Press

The subject has been studied before in many ways, but none of the preceding studies has been definitive and the additional methods of analysis seemed promising. Opinions are somewhat polarized. Academic studies have found virtually no evidence of profitable exploitation by insiders of their special knowledge and no value to outsiders in data on trading by insiders. Others believe that insiders often make extraordinary profits and that knowledge of their trading is valuable. Both the SEC and investors should be interested in which opinion is correct. The methods and coverage of this study differ from those of earlier work, as do our conclusions. We show that proper and prompt analysis of data on insider trading can be profitable, although almost all earlier academic work has reached the contrary conclusion.

Nov

4

Poker again - for those times when you need something to study, from Humbert X.

November 4, 2024 | Leave a Comment

Poker Theory and Analytics

MIT OpenCourseWare

Topics:

Basic Strategy

Analysis Techniques and Applications

Preflop Analysis

Tournament Play

Poker Economics

Game Theory

Decision Making

Article about the instructor (for the 2015 class)

Nov

2

And the law won

November 2, 2024 | Leave a Comment

From Big Al:

The more any quantitative social indicator is used for social decision-making, the more subject it will be to corruption pressures and the more apt it will be to distort and corrupt the social processes it is intended to monitor.

Variation:

When a measure becomes a target, it ceases to be a good measure.

Nils Poertner writes:

if one could find a way to increase the odds of Sod's law happening to oneself (trading or otherwise, outside trading). one could find a way to be less exposed to that law. don't have an exact formula here it is just a question.

This book The Improbability Principle: Why Coincidences, Miracles, and Rare Events Happen Every Day, by David Hand, did flip a lever in my brain many yrs back. in this book he described that we have an inadequate idea of probabilities and nature is far more dynamic than we think and that perhaps our own actions and belief systems play a much larger role…(btw, am not saying fate never plays a role)

Rich Bubb writes:

Having witnessed (pre-retirement in 2020) multiple project, engineering & quality failures related to Murphy and/or SOD variants, the engineering & technicians [and often-times myself] that had to deal with the 'Magic Wand' mgmt insane dreams-up are/is best avoided by 'stepping away from the problem, asap'. In some areas, this 'stepping-away' is also known as the "Do NOTHING Rule". Corollary: "Ain't My Job Rule."

Or, knowing that everything rarely goes according to plan (Unknown Unknowns), & expect something-to-hit-the-proverbial-fan. One method I used (more often than I should admit), is a Reverse Fishbone/Ishikawa Diagram. The method has the "Result" of anything going wrong replacing the assumed desired effect , aka the 'Fish-head', then working backwards trying to determine Man, Method, Environment, Measurement, Machine, etc., possible snafu's, & mitigate or pre-fix problems.

Sometimes the Reverse Fishbone is done after the problem is revealed. And the $$$ Cost of mitigation are sometimes 'argued-away' by the cost-benefit folks controlling the situation's budget. This is one reason many engineers fear &/or loathe accountants (but not out loud).

Asindu Drileba adds:

Sods law seems related to a set of precepts used in computer science called the Fallacies of distributed computing.

When building a trading system assume that;

- The market's returns will arrive at the worst possible sequence.

- Your orders will not get filled exactly the way you want.

- Transaction fees are going to eat all your gains

- Your broker is going to scam you (a là FTX)

- You trading system might go offline for arbitrary reasons

- Regulations might change against your favour. (up tick rule, no shorting stocks)

Building a trading system based on such pessimistic assumptions will actually result it a system that will go through alot of muck and still be reliable.

Nov

1

The beauty of prices

November 1, 2024 | Leave a Comment

From Prices, by Warren and Pearson (1933):

Prices are the major criterion by which the producer can know what society wants. The only way the farmer can tell whether to produce cabbages or wheat is on the basis of price. The only way that his son can determine whether society wants him to be a farmer or a coal miner or doctor is on the basis of price. The woman with the market basket, the retailer who must sell to live, the farmer who must have fence wire to keep his cattle in, the steel producer who must sell in order to operate his mill — all combine to make prices. The algebraic sum of all the millions of transactions between all the buyers and sellers of the world makes prices. The system does not always work perfectly, but no committee could guide the millions of producers to meet human needs so well as prices guide them — provided the medium of exchange functions properly. When it functions badly, the people turn to dictators and social control.

Only through prices can consumption be wisely guided. We would all like porterhouse steak and Packard cars, but these require so much human effort to produce that it is not possible to produce enough for all. Hens do not lay many eggs in winter. Consumers would like them in winter as well as or better than in summer. By raising prices in winter, the supply is made to last.

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles