Oct

26

Scary Headlines, from Ralph Vince

October 26, 2018 | Leave a Comment

And at this very minute, the ten day correlation between VIX and he S&P 500 is -.97. VIX is running a positive carry both to cash and futures months more distant for any given futures month.

It is a condition which, if persists, allows a portfolio manager to in effect get a completely free lunch via Markowitz. Either stocks go up in the not-too-distant future, or the carry on VIX goes negative again (which occurs….when stocks go up).

Oct

24

Marie Curie, from Jeff Watson

October 24, 2018 | Leave a Comment

An interesting article on how Marie Curie spent WW1 learning radiology and setting up portable x-ray machines to attend to the wounded soldiers.

An interesting article on how Marie Curie spent WW1 learning radiology and setting up portable x-ray machines to attend to the wounded soldiers.

Pitt T. Maner III writes:

Ironic that one of Madame Curie's daughters, Irene, developed leukemia from probable exposure to x-rays too and likely radioactive material (lab explosion) and died even younger than her mother at the age of 58.

Madame Curie's other daughter Eve, the non-scientist/pianist, however lived to be 102.

1) From Eve Curie wiki–'She sometimes joked that she brought shame on her family. "There were five Nobel Prizes in my family," she joked, "two for my mother, one for my father, one for [my] sister and brother-in-law and one for my husband. Only I was not successful…".

Apparently all of M. Curie's descendants have been at the genius level–even the living great, grand children.

Oct

24

Speculators: Then and Now, from Pete Earle

October 24, 2018 | Leave a Comment

From Hamon's New York Stock Exchange Manual, 1865:

From Hamon's New York Stock Exchange Manual, 1865:

"Great gains usually alternate with great losses in this kind of business. One would think that jobbers would soon die of worry and anxiety, and often enough they are seen to be very 'down in the mouth'. But nature is kind, and fits the back to the burden, or rather most of these men have been born with the peculiar temperament of the speculator.

They have an extra amount of hopefulness, and get through life with more excitement, indeed, but hardly with less equanimity on the whole than other men engaged in trade."

Oct

21

Polling Report, from Stefan Jovanovich

October 21, 2018 | Leave a Comment

RCP's current list of "Swing Districts" totals 49. This includes the following districts held by Republicans: 3 that are "Likely Dem", 11 "Lean Dem" and 31 "Toss Up". It also includes 4 districts held by Democrats: 1, "Toss UP", 2 "Leans GOP" and 1 rated "Likely GOP". So far, I have analyzed 31 districts, including the 5 reviewed today.

The total pick up for the Democrats so far is 6 seats. Adding that to the seats the Democrats now hold (193) gets them to 199 and reduces the Republican majority to 229. If the Democrats win all 15 of seats held by Republicans in the races I have not yet reviewed, the two parties would be EVEN, each with 214. Control would then be determined by the 7 remaining "surprise" districts. Those would be among the 56 districts I had not planned to review: the 18 Democrat seats that are "Likely" or "Lean" Democrat and the 38 Republican seats that are only (sic) "Likely" or "Lean" Republican.

My dedication to sloth leads me to pray that the Democrats will only pick up another half dozen seats from the 18 remaining to be reviewed. That would leave the Republicans with 223 seats - a loss of 18 seats from the results in 2016 - and not require any further labor on my part. The odds are in my favor. There has been only 2 elections since 1952 in which a Republican President had a majority in the House of Representatives during the mid-term elections of his first 4 years in office: (1) Eisenhower in 1954 and (2) Bush II in 2002. In 1954 the Republicans, who had an 8-seat majority, lost 18 seats. In 2002 the Republicans held a 9-seat advantage and gained 8 seats, increasing their majority to 24 seats. For the Democrats, since Eisenhower, their President's first mid-terms with them in charge of the House, have been these: Kennedy in 1962, Johnson in 1966, Clinton in 1994 and Obama in 2010. In 1962 the Democrats lost only 4 seats from their 87 seat majority; in 1966 they lost 47 but that was from a 155 seat majority. Clinton's first mid-term was a complete disaster. For the first time since the 1952 election, the Republicans won the House of Representatives - winning 54 seats and turning an 82-seat minority into a 26 seat majority. Obama's first mid-term was even worse; the Republicans gained 63 seats and a 49 seat-majority, destroying Speaker Pelosi's 2008 moment of glory when the Democrats had won an 87-seat majority. In that election the Republicans outpolled the Democrats by 6 million votes.

It may be that the Democrats' belief in a "wave" this year is a projection of what has recently happened to them. It is certainly not a dispassionate assessment of what happened to Ike and Shrub in their first mid-terms.

The List of Real Clear Politics "Swing" Districts: The 18 districts that remain to be reviewed are identified by *.

FL-26 is a district that, by all 538-style model calculations, should be a lock for the Democrats. It is Cook D+6, Obama carried it by 11 1/2 points and Clinton by 16. Yet, the incumbent Republican Carlos Curbelo managed to win 53% of the total vote against both a Democrat and Independent challenger. The Mason-Dixon poll has Curbelo up 1 point on his Democrat challenger; their sample shows Party Registration as R-33, I/O-30, D-37. Curbelo's incumbency is likely to prevail, especially since his challenger's surname is Mucarsel-Powell is unforgivably diverse in a district where 4 out of 10 likely voters self-identify as Cuban.

IL-6 is Peter Roskam's suburban Chicago district. Roskam matters. He is the Republican Chairman of the House Ways and Means Subcommittee on Tax Policy. He began in the House in 2006, when he beat Tammy Duckworth by 2 points. Since then, he has never been seriously challenged. His margins of victory have been 18 (2008), 26 (2010), 18 (2012), 26 (2014) and 18 (2016). Even the Times is gracious enough to concede that he is ahead by 1 point in their September poll. Republican wins.

Oct

21

China GDP vs. Market Performance, from anonymous

October 21, 2018 | Leave a Comment

So I was looking at statistics around China and noticed a couple things.

So I was looking at statistics around China and noticed a couple things.

Chinese GDP has reportedly over tripled since 2006 while Chinese markets in dollar terms are only up 40%. In the meanwhile the US markets have doubled while GDP is up only 40%.

Has all the growth been in the private sector? Have earnings been secretly paid out to the party? Or are the GDP numbers likely false? Or something else entirely?

Books/articles on the subject would be appreciated!

anonymous writes:

Chinese GDP is tricky. There are 2 Chinese economies–the state economy and the private economy. The private economy follows short boom/bust cycles like the US economy in the 70’s/80’s, overall grows healthily but with high volatility and high frequency. The state economy is where the zombies are.

The PBOC believes that Chinese NPLs are effectively in the 15% range. They calculate this by counting all debt >180 days past due as delinquent, but crediting back about 20 cents on the dollar, because delinquent bank debt can be auctioned off to private investors at around 25c on the dollar.

Chinese gross debt is 250% of GDP. 15% of all debt as bad debt equals 37.5% of GDP. This was also true of other countries like Japan where for cultural reasons bad debt is not called bad debt.

Additionally, the bad 37.5% debt has grown at faster than the economy rate, as the private economy’s growth rate has slowed down and the government has effectively leaned harder on the bloated state sector to hit headline GDP growth numbers.

Michael Pettis has blogged a lot about this if you want to read the much longer academic version of this thesis.

Oct

19

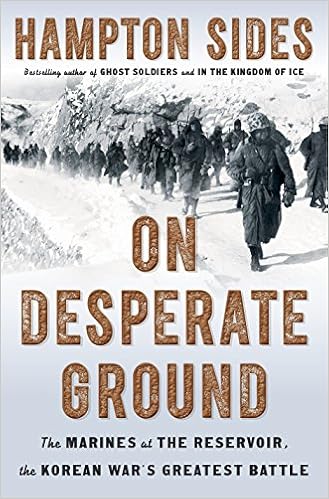

Book Recommendation: On Desperate Ground, from Victor Niederhoffer

October 19, 2018 | 1 Comment

The history and events of the battle of Chosin during the Korean War has been described as the best depiction of a battle ever.

The history and events of the battle of Chosin during the Korean War has been described as the best depiction of a battle ever.

Michael J. Edelman

TOP 500 REVIEWER VINE VOICE

5.0 out of 5 stars

A superb, literate, popular history that illuminates the greatest battle of the Korean War

August 17, 2018

It's not often that you come across popular history that reads like good literature. On Desperate Ground follows the First Marine Division from their landing at Inchon to their legendary route at the Chosin Reservoir, and manages to be both detailed history and gripping narrative. Author Hampton sides provides a detailed look at the men, the commanders, the strategies, the terrain, and the politics for not just the Marines and allied Korean and UN troops, but also their North Korean and Chinese opponents.

If there's a hero in this book it is Marine General Oliver Smith, commander of the First Marine Division and architect of the Inchon landing. It was Smith who turned MacArthur's plan- "We will land at Inchon"- into reality, and it was Smith who led the breakout and retreat from Chosin, managing to extract the 100,000 soldiers of the American X Corps and Republic of Korea I Corps along with nearly 98,000 citizens, surrounded by 120,000 soldiers of the Chinese PLA. Smith's nemesis was his direct commander, Major General Ned Almond. Almond was one of MacArthur's inner circle of trusted aids, or as others often characterized them, toadies. Almond had an undistinguished career in WWII, and blamed his poor performance leading the 92nd Infantry in Italy- which he blamed entirely on his African American soldiers. His racism extended not only to his troops, but to Filipino troops who were part of the UN forces, and to the Republic of Korea troops, who had shown themselves to be fierce fighters in the battles to retake the South. Alexander Haig, who was an aide to Almond in Korea, wrote that "[Almond] was not a believer in the racial integration of the Army, and thought those of us who were, such as myself, were in the need of education, or perhaps something stronger, to wake us up to reality."

Having secured Inchon and driven the North Korean soldiers from South of the 82nd Parallel, MacArthur decided to push North to the Yalu, and chose Almond to lead that campaign, much to the dismay of Smith and others. Almond had his forces advance along narrow roads, making resupply or reinforcement difficult or impossible. Smith and others warned that Almonds plan was a dangerous division of forces, to which Almond maintained that North Korean forces would not put up a fight. Almond also echoed MacArthur's opinion that, contrary to intelligence assessments, China would not intervene, and even if they did, they were not a significant fighting force. Meanwhile, hundreds of thousands of PLA soldiers were preparing a trap for invasion forces.

The results of MacArthur's grand strategy and Almond's ground tactics are well known. UN forces encountered a massive PLA force, and despite superior tactics, weapons, and experience, found themselves outnumbered and encircled. Author Hampton Sides follows the progress of the battle and retreat through the eyes of commanders and individual Marines, soldiers, and airmen. It's a powerful, realistic, narrative and a book I recommend highly to anyone with an interest in the Korean war.

It depicts the arrogance of General Douglas MacArthur very well and provides a nice example of how arrogance and self promotion can lead to terrible consequences.

One anecdote is priceless. The US Marines called for ammunition which they nicknamed tootsie rolls. The headquarters in Japan thought they wanted the candy rather than ammunition. Tens of thousands of tootsie rolls were delivered and the tootsie rolls were used by the engineers to plug holes and as an adhesive and became the most desirable currency of the engagement.

Oct

19

The Most Sensible Thing, from Victor Niederhoffer

October 19, 2018 | Leave a Comment

The most sensible thing out of the Fed in years.

"There's a New Bullard Rule That Finds No Need to Raise Rates"

By Steve Matthews (Bloomberg) –

Federal Reserve Bank of St. Louis President James Bullard is proposing a new monetary policy rule — effectively the Bullard rule — that updates popular policy guidelines such as the Taylor Rule and concludes there's no reason to raise interest rates further.

Bullard's benchmark adjusted the Taylor rule for developments in the past two decades, such as the weak link between the unemployment rate and inflation, the aging of the U.S. population and low inflation expectations.

"Incorporating these developments yields a modernized policy rule that suggests the current level of the policy rate is about right over the forecast horizon,'' or the next several years, Bullard said Thursday in a speech in Memphis, Tennessee. The Federal Open Market Committee discussed raising rates to a "restrictive'' level, or a rate that would slow growth, at its meeting last month, according to a record of that debate released Wednesday. Fed officials projected that rates would rise to 3.4 percent by 2020, their latest forecasts show. The Fed has raised rates three times this year and has penciled in a fourth hike, which is expected in December.

Bullard has been the most dovish Fed official the past two years. He's argued that the U.S. economy has been saddled with persistently low growth, so there is little need to raise interest rates much. His development of a rule is an effort to provide some academic justification to his viewpoint. "The modernized version of the Taylor (1999) rule recommends a relatively subdued policy rate path over the forecast horizon — similar to the St. Louis Fed's recommended path,'' Bullard said.

The Taylor Rule was developed by Stanford University professor John Taylor, who has preferred his original rule as a guideline for policy, which suggests further rate hikes are necessary.

Cagdas Tuna writes:

He can always find an excuse for not raising rates!

Oct

19

Polling Report, from Kim Zussman

October 19, 2018 | Leave a Comment

They say the market is upset about the jump in bond yields but maybe she's anticipating a premature return to socialism

Stefan Jovanovich writes:

If I thought there was any reliable direct connection between elections and speculations, I would be tempted to join LW and you other clever traders and bet my "system" - which does better than average at guessing political horse races. I don't because, if there were any such link, I would not be able to pretend to be an expert in such company. You guys would already know the odds down to the precinct levels if that mattered.

I think, in fact, you all do know what matters regarding politics and money. Now that I am 60% of the way through the House "swing" districts, I are learning what the markets have already predicted: Jim Jordan is going to be the new Speaker of the House of Representatives. When that happens, the Federal budget and the Treasury's operations are going to be subject to the approval of the 21st century successor to John Sherman; and the shock is going to be that the national debt will be brought home. The taxpayers are going to become the Federal bond holders just as they did during and after the Civil War; and they are going to want tariffs and "sound" money to protect their investments, even as Confederate paper (aka Chicago municipal bonds) is allowed to evaporate.

Larry Williams writes:

If the new speaker shrinks debt stocks will get hit hard. Deficits are very bullish for equities.

Alex Forshaw asks:

Larry, why do you say that/how do you strip out correlation vs causation in this? The blowoff 1998-2000 top occurred among budget surplus and deficits are inherently counter cyclical i.e. generally low in late cycle/high in early cycle (deficit as % of GDP biggest in 1981-83, during/after 2 recessions or 1 severe recession; 1991-93 after a fairly deep recession; 2002-03 after a recession; 2009-10 after a severe recession.) To the extent that the deficit is high adjusted for its place in the economic cycle (2012, 2018 ytd) it doesn't seem bullish. To the extent that deficits are unusually low cyclically adjusted (late 90s, 2007 arguably, 2015 arguably) it definitely does not seem bearish.

Larry Williams replies:

I don't think it is correlation but causation. Large deficits means lots of money floating around the hood. That translates to expansion, building–which translates to jobs, and that to consumer spending, and that to corporate profits. I'm traveling so lack data. The "one and only" Mr Vince may wade into this with data.

Ralph Vince responds:

25+ years ago I bought the Commerce Dept Database of 900 data items, and set u p a program (that would take two months to run, with a math coprocessor no less!) to examine each pairwise data set, and for each pairwise data set, to skew them +12/9/6/3/0…/-12 months, and record only those dataskew pairs with absolute value of correlation > some value (I forget which, but it was quite high).

One of the (many) dataskew pairs that filtered through very highly was that of federal deficits and economic growth (and broadly, we can stipulate that ROC of economic growth correlates to equity returns). The greater the deficits, the greater the market gains.

There were periods that did not fit this pattern, of course, it was not absolute (one out-of-sample period being the Robt Rubin era which was yet to transpire).

My guess is like the Senator's here; greater money floating around menas greater economic activity. I think it;s even a deeper causation than that. I would define it by saying that debt needs be repayed only once (if ever, it can also be perpetually rolled — the "problematic" nature of this is solely a function of rates. If manageable due to rates, it is virtually nothing. Further, even if rates become problematic, the yield curve itself provides an avenue of release — cue Rubin again), whereas the borrowed dollar can circulate multiple times.

So there is the multiplier effect of borrowed money vs the borrower's asset which is a one-time shot

If it weren't for borrowing, in particular the fractional banking system, we'd be in the year 1,000.

Oct

17

Generic Ballot Polling, from Stefan Jovanovich

October 17, 2018 | Leave a Comment

The generic ballot poll for the House of Representatives, which was, until this week, the best evidence for the predicted "Blue Wave", asks a sample of adults, registered voters and/or likely voters which major party they favor for "Congress" (the word of both the House and the Senate has, in modern parlance, come to mean only the House).

The logical flaw in using such a poll is that no office in the Federal government is determined by a national vote–not the President, not the Senate, not the House. But, the poll does have the great advantage of being easy. The only alternative is to go by individual House district; I am not even 30% of the way through the "battleground" House districts, and I am - for the first time in my sedentary life–beginning to have a sense of what long-distance runners mean when they discuss "hitting the wall". I promise to finish; but getting the data for each House race is a long slog.

That is why I am following 538 and taking the easy road for an hour this morning.

But, I can't be a complete cheat. No political poll, of any kind, avoids GIGO if it does not disclose its sample's partisan allocation. It will not surprise any of you to learn that the New York Times and the other most frequently cited generic ballot polls are scrupulous about not providing any such useful data. I did find one polling organization that has gone against the GIGO trend. The YouGov people have been remarkably forthcoming about how they get their numbers. In their CBS/You Gov Tracker poll, their sample data for party ID is R-42, I/O-15, D-43; for political affiliation it is Conservative-38, Moderate-32, Liberal-30. What they do not disclose is their methodology for converting these sample numbers into their overall prediction: R-48 and D-52.

I can explain how they get there, but I was not able to find any explanation of the why. The recipe for How works by taking the middle third of voters - the Moderates - and asking the Lean question in such a way that more than 3 to 1 favor of the Democrats. The result of their party ID inquiries is to assign 13 points to the Democrats and 4 points to the Republicans. That reduces the "middle of the road" share of the electorate to 1/7th. To get to their final D +4 result, their algorithm assigns 60% of the Independent/Other vote to the Democrats and 40% to the Republicans.

When YouGov did a second generic ballot poll for the Economist, they queried 1500 adults. Their bottom line result was similar to the one from their CBS tracking poll: D +6. But, here, too the How and the Why seem very much at odds. Their political affiliation numbers show a slight leftward variation on the common 1/3rd, 1/3rd, 1/3rd distribution pattern. Their sample has Conservative - 31, Moderate - 34 and Liberal - 35. But, that somehow shifts to a Party ID landslide for the Democrats: Republican - 23, Independent - 42, Democrat - 35. Where the numbers get really strange is in the data for 2016 voting. The 931 respondents who voted in the last Presidential election produce a sample that is divided Republican - 45.8 and Democrat 54.2.

But we know that the actual vote count was Republican - 62.98M and Democrat - 65.84M. That was Republican - 48.9 and Democrat - 51.1. Somehow a sample that should, to be representative of known ballot numbers, have a D +2.2 margin ends up with a D +8.4 spread.

No wonder the statistical affiliates of the party of Native American heritage prefer national algorithms above all else. They are not only easier but they always give the right answer.

Oct

17

Canes, from Zubin Al Genubi

October 17, 2018 | Leave a Comment

The hardest part is resting on your oars, but 58pts is a good time to ease off leverage. I think Ralph is right and there is more to go. Unlike RG I can't wait to learn patience.

The hardest part is resting on your oars, but 58pts is a good time to ease off leverage. I think Ralph is right and there is more to go. Unlike RG I can't wait to learn patience.

Peter Pinkhasov writes:

Most of the close to close stats I'm seeing for such a decline are coming with the narrative that "but it has a potential to go lower" which I think takes away from being data and analytically driven to make decisions. I think with the large move in short term rates, it's better to use that as an independent variable for forecasting future returns given we have seen a new interplay in the last two weeks between stocks and bonds.

Ralph Vince writes:

The upmove in st rates is and has been exceedingly bullish here.

Oct

15

Poling Report, from Stefan Jovanovich

October 15, 2018 | Leave a Comment

Maine - The Suffolk poll is wonderfully detailed. They break down their registered votere sample into R, D, I and then add Green and Libertarian. They also distinguish between Unenrolled (which they include with Independent) and Undecided. R-28.6,I/U-33,R-28.6,G-1.2,L-.6,U-2.8. Eric Brakey, the Republican, has no chance, given the bias of the Democrats in favor of King, the "Independent" (sic).

Vermont - No one has bothered to take a poll. Socialism rules! Sanders is anointed again.

Rhode Island - The "conservative" news had a recent flurry of articles about how this might be a competitive race. It is not. The most recent UNH poll sample has the electorate R-28, I-24, D-48. Whitehouse in the usual landslide.

Connecticut - Quinnipiac has given up on telling us what its samples contain; but their estimate for the race is not going to be so far off as to give the Republicans an upset. When Gravis did a sample earlier this year, it was R-26, I/O-34, D-40. Murphy is re-elected easily.

New Jersey - The news may say that this race is close; but it is not. Fairleigh Dickinson's poll sample has the state: R-36,I-8,D-56 among Likely Voters; yet it has the race as a statistical "dead heat" between the incumbent Democrat Robert Menendez and the Republican Hugin. More than 1 in 5 Democrats (22%) and nearly half the Independents (42%) declare themselves undecided. The problem for the Republicans is that it is still New Jersey. The statistical "dead heat" is Menendez-43, Hugin-37; and the odds are beyond hope that Hugin can somehow win 2 out of every 3 of the votes from the 20% of the electorate that has not made up its mind. Menendez will win because New Jerkers, especially women, seem to loath the Donald. Prediction: Menendez +4/5.

Pennsylvania - Franklin & Marshall's sample is R-40, I/O-8, D-52. Casey will be re-elected easily.

Maryland - This state makes California look purple. The Goucher Likely Voter poll sample is R-27, I/O-12, D-61. Cardin will win, even if he is in a coma on election day.

Delaware - Gravis sample: Conservative-32, Moderate-45, Liberal-23. On its face that might offer the Republicans a chance; but the term "Moderate" is now code for Democrat-leaning Independent. The sample shows the party affiliation as R-32,I/O-21,D-47. Their Likely Voter poll was taken in July and had Carper +8. The most recent poll - from the University of Delaware - offers no sample and has Carper +37. Carper should win easily.

Virginia - The University of Mary Washington poll has R-29,I/O-35,D-31 and C-37,M-31,L-32. Kaine, the Democrat, is not an attractive candidate; but he has the advantage of running in a 3-way race. The Libertarian candidate is likely to get 5% of the vote. Prediction: Kaine +8.

West Virginia - This race is really a Republican primary in drag. Manchin, the Democrat, was clever enough to not commit political suicide by voting against Kavanaugh; and his personal popularity is distinctly higher than Morrisey's, his Republican opponent. Gravis's likely voter sample has the state R-35,I/O-22,D-43. Trump has been to West Virginia for several rallies, but he has been careful not to criticize Manchin harshly, except at the one held before the Senate vote on Kavanaugh. The Republican party in WV is very much as the Republican party in Alabama was in 2017 - fractured by internal scandals. Prediction: Manchin +6. Commentary: Manchin will become the White House favorite for "bi-partisanship". He is likely to campaign for Trump in 2020.

Ohio - Suffolk's poll sample: R-34.8,I/U/O-23.8,D-38.4. Sherrod Brown, the Democrat incumbent, polls consistently with a double-digit lead. That will be the final election result.

Indiana - None of the polls - Ipsos/Reuters, Fox News, NBC News/Marist - deigns to disclose their sample. The RCP Average has the Democrat incumbent Donnelly +2.5 over the Republican challenger Braun. They show the Libertarian candidate Brenton getting 7% of the final vote. In the absence of any usable data, I am relying on the judgment of the brains of the outfit - Susan, who was born and raised in Evansville and whose mother still lives there. (Margaret Mead: "Everyone knows somebody from Evansville, Indiana"). She thinks Donnelly's vote against Kavanaugh was fatal. I agree. I also think the Libertarian vote will be half the RCP prediction; and Braun will be get those votes. Prediction: Braun +2/3.

Florida - Mason-Dixon poll sample: R-37,I/O-25,D-38. RCP's current average is Nelson, the incumbent Democrat, +2.4. The governor's race is equally tight. Prediction: Genuine Toss-Up.

Tennessee - Gravis poll sample: R-40,I/O-29,D-31 and C-39,M-42,L-19. Gravis had Blackburn, the Republican candidate, at +4 in August; CNN, with their usual bias, had Bredesen, the Democrat, at +5 a month later. The NY Times/Sienna poll from this week (as always, no sample data) had Blackburn +14. That is likely an exaggeration. TN is a Republican state; but Republican states never reward their candidates with landslides. Prediction: Blackburn +7/8.

Wisconsin - Marquette University's Law School poll sample data is wonderfully precise. They not only include the historical data of their previous samples. The sample for the current poll: R-47,I/O-8,D-44; when the pollsters exclude "leaners" it is R-33,I/O-36,D-30. Wisconsin's electorate is true to its good government heritage; and I do not offer that as a snarky comment. Their voters are genuinely independent-minded and have no difficulty in splitting their tickets - i.e. voting for candidates from both parties for the offices on the ballot in a single election. That is not good news for the Republican Senate candidate - Vukmir. The voters are likely to reward the Republicans by re-electing Scott Walker as governor and Brad Schimel as Attorney General and then by "fair" by re-electing Democrat Senator Tammy Baldwin. Prediction: Baldwin +7/8.

Mississippi - At least the GOP has one state where RCP and 538 concede that their incumbent hold a "safe" seat. Roger Wicker will be re-elected. Cindy Hyde-Smith will also win and take the seat Thad Cochran held before his retirement. There have been polls taken in MS but only for the "jungle" primary. No one is bothering to talk to the voters for the general election. The Democrats have Vermont; the Republicans have Mississippi.

Minnesota - Klobuchar is an absolute lock; but the race to fill the comedian's seat could be interesting. The Star Tribune/MPR poll sample is R-31,I/O-32,D-37; and they have Smith, the DFL (Democrat Farm Labor) candidate at 44, Housley, the Republican at 37, Other - 4 and Undecided - 15. That is less than half the margin of the latest poll from NBC/Marist, which offers no sample data at all. What makes this interesting to me is that Smith's lead is almost entirely from "Da Yute". There has been a flurry of new registrations among voters 18-30; and they hate Housley - perhaps because the old people like her. Housley is definitely a longshot; but the Michael Moore effect could easily take hold, especially if Minnesota has one of its lovely blizzards. And, MN is very much like its Southern neighbor, WI - a good government, ticket-splitting state. If I did trade, the Housley win would be the black swan option I would buy. Prediction: Smith +3

Montana - Remington Research offers its sample data: R-42,Non-Partisan-30,D-28 and C-47,M-38,L-15. RCP has the incumbent Democrat Tester at +3. It is the contest of Marine haircuts; both Tester and his opponent Matt Rosendale sport buzzcuts. Trump's popularity is likely to be enough to defeat Tester, especially since he was foolish enough to vote against Kavanaugh. Prediction: Rosendale +2/3

Washington, California, New Mexico, Utah, Wyoming, Nebraska. These states will all return the incumbents who are evenly split 3-3.

Overall Forecast: Republicans gain 3 to 5 seats. They are nearly certain to win Indiana, Missouri and Montana without losing Arizona or Nevada. They have a good chances to win Florida and a longshot to win the open seat in Minnesota. If you include Manchin's conversion to being the President's new and permanent bi-partisan best friend, the election could be enough of a gain for McConnell to decide that the 60-vote filibuster rule has to go so that Tax Cut - 2 and Build the Wall funding can be passed, either during the lame duck session or in the next Congress (if the Republicans keep their majority).

That will be the question for the next 2 weeks when I plan to review each of the 41 House races that RCP lists as either a Toss-Up or a Republican incumbent in a Lean Democrat seat.

One last snark for the weekend: Using the Generic Ballot for the country as a means of predicting the results in the House is the polling equivalent of the Hillary Clinton campaign thinking that total votes is the way you keep score in a Presidential campaign. It is truly Garbage Data In = Nonsense Out.

Oct

12

Opinions Wanted, from Ralph Vince

October 12, 2018 | 4 Comments

I'm very bullish. I can take the pain of that (and in truth this "pain" is something of a joke compared to what we went through in the 80s and 90s). I won't even attempt to trade the short side and such a strong bullish Market this move notwithstanding. That makes the current situation all the more juicy for getting or building long position–even if Kora's research manifests here and it goes on to seeing lower prices. Higher highs in the coming weeks and months are inevitable. This thing is nowhere near a high in price, in valuation or sentiment.

I'm very bullish. I can take the pain of that (and in truth this "pain" is something of a joke compared to what we went through in the 80s and 90s). I won't even attempt to trade the short side and such a strong bullish Market this move notwithstanding. That makes the current situation all the more juicy for getting or building long position–even if Kora's research manifests here and it goes on to seeing lower prices. Higher highs in the coming weeks and months are inevitable. This thing is nowhere near a high in price, in valuation or sentiment.

Russ Sears writes:

Perhaps I am too conspiracy and paranoid minded, but I see a parallel to Kavanaugh seated and Trumps election where market participants on the left saw a tragedy, and quickly exited only to miss out on a nice bull market. Not that I think Kavanaugh seat matter much to the economy or markets direction. But when people work themselves up into turmoil the markets reflect more volatility as it's made up of people's emotions

Oct

12

Bonds China, from Jim Sogi

October 12, 2018 | Leave a Comment

I've been pondering the big drop in bonds and the China moves and if they signal something was up.

Looking at bonds, I wondered why they dropped, who had the means and the motivation to cause such as drop. Looking at the move it appears concerted and done with virtually unlimited selling power. Game theory looks at means and motivation. Trump's recent lambast of the Fed gave me the clue. The Fed has the means and the motive to raise yields and they have expressly said they would use interest rates. They have a large inventory to sell, and rather than move the short end, moved the long end, maintained stimulus with the positive curve, but raised yields and thus put a bit of a damper on the works as we saw yesterday in the equities. The bond market is much bigger than equities so such a tectonic shift was bound to have repercussions. I was surprised how little comment resulted.

The other player who has the means and motivation is China. By raising yields, they strengthen the dollar by enough to offset any tariff, and encourage trade with China.

Oct

12

Premature Canes, from anonymous

October 12, 2018 | 1 Comment

Canes need to be walked out when blood in the streets is almost dried. I think cane talk now is a wee bit early.

Canes need to be walked out when blood in the streets is almost dried. I think cane talk now is a wee bit early.

The market has been up for 9 plus years on monetary steroids–and we go down half-hard one day and folks are extolling and faux strolling out with their bullish canes???

Now that is perma bull–shiess.

Oct

12

Halloween Trick? from anonymous

October 12, 2018 | Leave a Comment

Perhaps it's a bit of a Halloween Trick by the Fed and the Treasury. Much like February this current selloff was triggered by the Jobs Report, all-time market highs and perhaps the Fed's need to unload a bunch of bonds. So if they talk down equities, and the market cracks, folks will run and gobble up all the bonds. What's the difference between 3.21% yield and 3.25% yield on the 10-year Treasury? Four beeps. Bupkes. A rounding error… What magically happened when the 10-year traded above 3.25% in early trading Tuesday? 3.25 is arbitrary. Why not 3.27 or 3.30?

Oct

9

If I Was a Gambling Man, from Ralph Vince

October 9, 2018 | 1 Comment

If I was a gambling man, I'd be getting very long here.

6-week weekly coefficient of variation in SPX calling for a major move.

Volume Thurs and Fri say to be a buyer on weakness.

A certain alliteration in the way prive & volume work on the short term is occurring here. OooOooOO this is hard!

Thurs SPY volumes on and Friday SVXY volumes - indicating to be a buyer on weakness in the coming day or two, followed by a little weakness this morning, and I'll double down on the gambling man proposition. (I have other signals too confirming this, but not going into the long-winded diatribe here at this time).

It;s hard because that 6 week weekly coefficient of variance, calling for a good, prolonged market run in one direction or the other, could be signalling a drop much further from here. But the odds favor the upside, so does the nose.

Oct

8

Today’s Date is a Palindrome, from Sushil Kedia

October 8, 2018 | Leave a Comment

Oct

6

Real Return, from Greg Van Kipnis

October 6, 2018 | Leave a Comment

I attached the latest calculation for the yield on TIPS. The prices across the board have dropped rapidly in the last few days to the point were greater than 1% real yields can be realized above the CPI on Treasuries for maturities as short as 2022. I find this quite surprising. Any thoughts about the pros and cons of this opportunity which hasn't been seen in years.

| Maturity | Coupon | Bid | Asked | Chg | Yield* | Accrued principal |

| 2019 Jan 15 | 2.125 | 100.10 | 100.12 | + 1 | 0.770 | 1173 |

| 2019 Apr 15 | 0.125 | 99.15 | 99.17 | + 2 | 1.022 | 1075 |

| 2019 Jul 15 | 1.875 | 101.08 | 101.10 | unch. | 0.160 | 1180 |

| 2020 Jan 15 | 1.375 | 100.22 | 100.24 | + 1 | 0.791 | 1165 |

| 2020 Apr 15 | 0.125 | 98.20 | 98.22 | + 1 | 0.989 | 1076 |

| 2020 Jul 15 | 1.250 | 101.01 | 101.03 | unch. | 0.622 | 1155 |

| 2021 Jan 15 | 1.125 | 100.14 | 100.16 | unch. | 0.898 | 1152 |

| 2021 Apr 15 | 0.125 | 97.25 | 97.27 | unch. | 0.998 | 1063 |

| 2021 Jul 15 | 0.625 | 99.17 | 99.19 | - 1 | 0.771 | 1118 |

| 2022 Jan 15 | 0.125 | 97.09 | 97.11 | - 1 | 0.950 | 1113 |

| 2022 Apr 15 | 0.125 | 96.28 | 96.30 | - 2 | 1.014 | 1036 |

| 2022 Jul 15 | 0.125 | 97.09 | 97.11 | - 1 | 0.845 | 1095 |

| 2023 Jan 15 | 0.125 | 96.14 | 96.16 | - 2 | 0.966 | 1091 |

| 2023 Apr 15 | 0.625 | 98.09 | 98.11 | - 2 | 0.999 | 1014 |

| 2023 Jul 15 | 0.375 | 97.18 | 97.21 | - 3 | 0.880 | 1082 |

| 2024 Jan 15 | 0.625 | 98.03 | 98.06 | - 3 | 0.981 | 1080 |

| 2024 Jul 15 | 0.125 | 95.13 | 95.16 | - 4 | 0.927 | 1061 |

| 2025 Jan 15 | 0.250 | 95.06 | 95.09 | - 4 | 1.031 | 1064 |

| 2025 Jan 15 | 2.375 | 108.03 | 108.06 | - 6 | 1.024 | 1337 |

| 2025 Jul 15 | 0.375 | 95.30 | 96.01 | - 6 | 0.982 | 1062 |

| 2026 Jan 15 | 0.625 | 96.27 | 96.30 | - 7 | 1.065 | 1060 |

| 2026 Jan 15 | 2.000 | 106.15 | 106.18 | - 7 | 1.060 | 1269 |

| 2026 Jul 15 | 0.125 | 93.08 | 93.11 | - 6 | 1.019 | 1051 |

| 2027 Jan 15 | 0.375 | 94.11 | 94.14 | - 7 | 1.080 | 1043 |

| 2027 Jan 15 | 2.375 | 110.04 | 110.07 | - 8 | 1.080 | 1249 |

| 2027 Jul 15 | 0.375 | 94.11 | 94.14 | - 7 | 1.041 | 1030 |

| 2028 Jan 15 | 0.500 | 94.21 | 94.24 | - 9 | 1.098 | 1021 |

| 2028 Jan 15 | 1.750 | 105.21 | 105.24 | - 9 | 1.097 | 1203 |

| 2028 Apr 15 | 3.625 | 122.18 | 122.23 | - 12 | 1.104 | 1558 |

| 2028 Jul 15 | 0.750 | 97.00 | 97.06 | - 9 | 1.056 | 1004 |

| 2029 Jan 15 | 2.500 | 113.11 | 113.16 | - 12 | 1.106 | 1173 |

| 2029 Apr 15 | 3.875 | 126.31 | 127.04 | - 14 | 1.131 | 1533 |

| 2032 Apr 15 | 3.375 | 127.21 | 127.26 | - 17 | 1.147 | 1419 |

| 2040 Feb 15 | 2.125 | 116.28 | 117.02 | - 34 | 1.216 | 1166 |

| 2041 Feb 15 | 2.125 | 117.16 | 117.22 | - 37 | 1.219 | 1150 |

| 2042 Feb 15 | 0.750 | 90.04 | 90.09 | - 34 | 1.231 | 1115 |

| 2043 Feb 15 | 0.625 | 87.03 | 87.08 | - 35 | 1.233 | 1096 |

| 2044 Feb 15 | 1.375 | 102.29 | 103.02 | - 38 | 1.234 | 1081 |

| 2045 Feb 15 | 0.750 | 88.29 | 89.02 | - 38 | 1.238 | 1070 |

| 2046 Feb 15 | 1.000 | 94.10 | 94.16 | - 41 | 1.238 | 1063 |

| 2047 Feb 15 | 0.875 | 91.06 | 91.12 | - 40 | 1.238 | 1044 |

| 2048 Feb 15 | 1.000 | 94.03 | 94.08 | - 46 | 1.234 | 1022 |

Oct

6

Thoughts, from Peter Ringel

October 6, 2018 | Leave a Comment

The NAFTA/USMCA success is significant for the US economy.

Note how Canada was played against Mexico and negotiated between the two. A success for the Trump camp (& staff).

Next on the calendar are trade negotiations with Japan and China. They will be seemingly independent events, but there is an interrelation, since both compete for the US market and both will watch the deal of the other side.

After that, I think, comes Europe.

Trump and others hint at India FTA.

Oct

2

The Moves, from Victor Niederhoffer

October 2, 2018 | 1 Comment

The moves from the open to key afternoon hours can be thought of as a lever. The fulcrum would be say, the 1:00 pm price. We can either be above the fulc or below the fulc.

Effort is the move from the open to key afternoon price.

Oct

1

Chez Galton, from Steve Stigler

October 1, 2018 | 1 Comment

Took a pilgrimage to a hallowed place.

Best,

Steve

[The plaque reads: Sir Francis Galton, 1822-1911, explorer statistician, founder of eugenics, lived here for fifty years].

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles