Jan

31

A strange glut of silver, from Laurel Kenner

January 31, 2026 | Leave a Comment

With silver at $110 an ounce, it seemed like a good idea to raid the family heirlooms.

But my friendly coin dealer wasn’t having any. He’s buying nothing but Eagle coins. The usual buyers — industry, mints, and jewelers — don’t have the capacity to handle the inflow.

Read the full post on Laurel's Substack: Nobody Asked Me, But…A strange glut of silver

Nov

26

Give Thanks for Pilgrims — and McDonalds, by Victor Niederhoffer and Laurel Kenner

November 26, 2025 | 1 Comment

Thanksgiving is about sharing prosperity, and it's a good time to think about where prosperity comes from. The Pilgrims figured it out in 1623. We'll retell that story as we celebrate the way it lives on in countless U.S. families and companies today. And in particular at one company, McDonald's (MCD, news, msgs), that in its humdrum way beautifully demonstrates the source of prosperity and the American way of life.

Thanksgiving is about sharing prosperity, and it's a good time to think about where prosperity comes from. The Pilgrims figured it out in 1623. We'll retell that story as we celebrate the way it lives on in countless U.S. families and companies today. And in particular at one company, McDonald's (MCD, news, msgs), that in its humdrum way beautifully demonstrates the source of prosperity and the American way of life.

The Pilgrims started with so little. They had to hide in England because the authorities considered them dangerous. They fled to Holland but found themselves compelled to take menial jobs. On the way to America, many of the company died. They lost their way to Virginia and landed in Massachusetts just as winter set in. The Virginia Co., their backers in London, went bankrupt and couldn't send relief supplies.

To cope with want, the Pilgrims made the same mistake that so many countries do even today: They divided all their land, efforts, supplies and produce in common, to each according to his need.

As always in such systems, need surpassed supply.

The Pilgrims spent their first three years in America suffering from hunger, illness, cold and infighting. People stole from the common stores "despite being well whipped," according to William Bradford's "Of Plymouth Plantation."

Bradford, governor of Plymouth Colony, records what happened next: "They began to think how they might raise as much corn as they could, that they might not continue to languish in misery. After much debate, the Governor decided that each settler should plant corn for themselves."

Under the Land Division of 1623, each family received one acre per family member to farm. That year, three times as many acres were planted as the year before. Prosperity was not long in coming.

The Pilgrims turned from their Old World system of common ownership to incentives. They didn't go that way out of ideological conviction, but because they didn't have the luxury of waiting for support to come to them.

How many families in America tell the same tale? "When we came here, we worked hard and our lives were better."

But that wasn't the end of the story. Before the switch to incentives, the hungry settlers were at each other's throats. Hard workers resented receiving the same portions of food as those who were not able to do even a quarter of the work they did. Young men resented having to work without compensation to feed other men's wives and children. Mature men resented receiving the same allotments as did the younger and meaner sort. Women resented being forced to do laundry and other chores for men other than their husbands. Many people felt too sick to work.

But when they were allowed to farm their own plots, the most amazing thing happened. Everybody — the sick, the women and even the children — went out willingly into the fields to work. People started to respect and like one another again. It wasn't that they were bad people, Bradford explained; it's just human nature. Adam Smith came to the same conclusion later, and Friedrich Hayek updated Smith's ideas for the 20th century. But we don't need to go back to New England for understanding. Similar outcomes can be seen at McDonald's every day.

For centuries, people on the lower rungs of the social ladder weren't able to eat meat. They ate grains and beans. But people like beef. And chicken.

When McDonald's started popping up in every neighborhood, all of a sudden there was an affordable place for families to eat. Previously, one of the main differences between the upper and lower classes was that the rich could eat out. Even if the poor could afford the tab, they couldn't hire baby sitters, and they couldn't bring their kids to the elegant establishments designed for the rich because they would have disturbed the other diners.

Most kids don't like fancy restaurants anyway. They want fries, not polenta with wild mushrooms. They want fried codfish, not turbot. They want burgers, not lamb chops.

How many people has McDonald's made happy? How many families has it brought together? How many Happy Meals have been eaten there? How many kids have enjoyed the playgrounds? How many tired workers have been able to catch a quick meal? How many women are able to pursue careers and other productive activities and dreams because McDonald's has freed them from the task of having to cook every night?

The Pilgrims might have served 200 or 300 American Indians at their Thanksgiving feast. McDonald's serves 26 million customers a day at 13,700 U.S. restaurants.

For the traveler, McDonald's is a home away from home, offering so much for so little. The restrooms are clean. And McDonald's serves hot strong organic coffee in smooth cups of some wonderful material that keeps liquids hot without burning the hand, shaped to fit into the cup holders that just happen to be in your car, with carefully designed tops that permit just the right amount to be sipped.

No regulator, no fascist dictator, no socialist planner decreed sip tops or cup holders. But how many late-night drivers have died for the lack of a good cup of coffee? What could be more munificent than saving lives?

And the story doesn't end there. Consider the employees of McDonald's. How many people have worked there and learned the most important lesson in America: The customer is always right?

The anti-this-and-that people who demonstrate against profit incentives and free markets like to single out McDonald's as a symbol of modern capitalism. (They don't mean that in a nice way.) As the McLibel Support Campaign puts it: "(McDonald's) has pioneered many business practices that have been taken up by others, and have come to represent a symbol of the way that society is going –'McDonaldization.'" But when have you ever seen an unhappy customer at McDonald's? There couldn't be too many of them, because about 10% of America eats there each day. Given the choice of cooking at home or going to other restaurants — and competition ensures that there are other restaurants — people go to McDonald's because they trust they'll find good food, quick service and value for money. What could be more munificent, more representative of sharing the fruits of hard work than McDonald's?

McDonald's and the Pilgrims are the essence of America. The people work hard, motivated by the chance for profits. They provide a welcome to others, whether to Indians joining in harvest celebrations, or to customers looking to satisfy their hunger. Their work results in high quality, low costs and family togetherness.

Those humdrum, everyday attributes are what makes America great. That's what we should be celebrating. It's the source of all our munificence, from the first Thanksgiving to today.

Nov

9

Prestigious consulting firm, from Nils Poertner

November 9, 2025 | Leave a Comment

Came to our financial firm 2007 and gave a 100 page presentation full of bullet points and cartesian logic (why housing boom will last). Either 3,5, or 9 bullet points per page.

At the end of the presentation I was tempted to go over to the presenter and ask him "why do you love your wife? (I didn't). The answer might have been bullet points.

Pamela Van Giessen writes:

Michael Korda tells in his memoir, Another Life, of the time that Simon & Schuster hired probably the same prestigious consulting firm to study how to improve revenues/profitability. Prestigious consulting firm (after taking the prestigious consulting firm fee) told the publishing company that they should publish more bestsellers.

Laurel Kenner comments:

I bet the prestigious firm concluded with ‘Key Takeaways’ as a final insult to the intelligence of the client.

Asindu Drileba writes:

I heard that people pay consultancy firms not for their knowledge, but for the fact that executives use them as a scape goat. If an executive wants to pursue policy X. They simply hire a consultancy to recommend policy X. If policy X ends up as a disaster (legally, morally or financially). They can simply say "Policy X was an idea from XYZ consultancy", we had nothing to do with it.

Peter Ringel adds:

a variation of this are fighting owners/ partners about policy. If decision pipelines are blocked, external council is used. Like a neutral arbitrator. I think, these are the main situations externals are used. Usually a good reason to short the entity, especially outside of markets. If they don't have the capability to decide and act on strategy in-house, it‘s a red flag.

Henry Gifford responds:

Even better is hiring a licensed engineer to instruct everyone to do something stupid that they know won’t work, so everyone who did as the engineer decided is blameless.

Jeff Watson offers:

A consultant is a person who knows 1000 ways to make love to a woman…..but he doesn’t know any women.

Oct

29

The latest from Laurel Kenner

October 29, 2025 | 1 Comment

70++ Trades the Miners

Laurel Kenner

When China suggested Oct. 9 it would strangle rare earth metal exports to the U.S., U.S. mining stocks looked like the easiest way to make a killing since the Internet bubble in 1999.

Being arrogant enough to believe myself among the few who saw the opportunity, I bought a mining stock targeted by Goldman Sachs for a 100% gain.

The stock rose. Then swooned. I sold.

It quickly rose past the earlier high. I bought again. It tumbled below where I had sold the first time.

Greed had led me to forget old investment wisdom. Such as a warning against trying to get even, from Max Gunther’s 1985 “The Zurich Axioms.” Entitled “Stubbornness”, the 11th Major Axiom accurately describes my trade.

I also should have remembered advice from Nick Colas, head of DataTrekResearch, who made his bones at Credit Suisse and Steve Cohen’s SAC Capital. It’s my job, he explained years ago, to know things before they land in the media.

Meaning that if someone is giving tips to news outlets, keep in mind that he inevitably will take better care of his interests than yours.

Read the full post:

Oct

9

Jewish Hungarian, from Nils Poertner

October 9, 2025 | Leave a Comment

What is it with Hungarian Jewish who came to the US - so many of them achieved great things. My book shelf is full of them, Darvas (Trading), S Meisner (Acting)…..even my trading platform Interactive Brokers was founded by one (Thomas Peterffy).

Maybe a combo of rare language ??/ culture + hardship first + grid + ability to flourish in the US gave them superpower. Soros, I guess was (Jewish) Hungarian as well.

Venkatesh Medabalimi asks:

Where is my no.1 Hungarian? May I remind everyone about Paul Erdős.

Laurel Kenner offers:

An amusing book on the subject: Made in Hungary : Or Made by Hungarians, by György Bolgár.

Nils Poertner responds:

Thanks both. Found this on Erdős:

Paul Erdős: The Oddball’s Oddball

He would appear on the doorstep of fellow mathematicians without warning–a frail, disheveled, elderly man, hopped up on amphetamines and wearing a ratty raincoat–and announce, in a thick Hungarian accent, “My mind is open.” For a day, or a week or a month, the man or woman who answered the knock would have to take nonstop care of this helpless guest who couldn’t figure out how to cut a grapefruit or wash his underwear–and in return would be permitted the exhausting, exhilarating experience of following the thought processes of Paul Erdős, the most prolific and arguably the cleverest mathematician of the century.

Sep

7

Music and longevity, from B. Humbert

September 7, 2025 | Leave a Comment

Menahem Pressler played this concert in his 95th year:

Mozart: Piano Concerto No. 23 | Menahem Pressler, Gulbenkian Orchestra & Leo Hussain

Adam Grimes responds:

Thank you. That's lovely. Mozart always requires such precision. That was the second concerto I learned! Near and dear to my heart.

Laurel Kenner writes:

A very great concerto, a very great pianist.

Even monsters have been touched by this haunting music. A vignette re Mozart’s K488 and Stalin, from LA Phil program notes:

In his final years Stalin became addicted to listening to music on the radio, on one occasion a performance of Mozart’s K. 488, played by Maria Yudina, a particular favorite of his – surprisingly, since she was as celebrated for her non-conforming political views as for her interpretations of Shostakovich (of whom she was a close friend), Bach, and Mozart. Instead of playing encores at her recitals, she would read poems by banned Russian writers and recite the sayings of Russian Orthodox clerics: rather than hiding her beliefs, she trumpeted them, so to speak.

Stalin asked Moscow Radio for a copy of Yudina’s K. 488 and they agreed to send it immediately. The problem was that this was a live performance and it had not been recorded. The radio people called Yudina and hastily assembled an orchestra late that night, delivering the recording to Stalin the following day. Volkov relates Shostakovich’s words: “Soon after [Stalin heard the recording] Yudina received an envelope with 20,000 rubles… To which she responded: ‘I thank you, Joseph Vissarionovich… I will pray for you day and night and that the Lord forgive you your great sins…’” The pianist is said to have donated the 20,000 rubles to her church.

Oddly, Yudina was never censured nor imprisoned for any of her renegade acts and her career continued until shortly before her death in 1970. “They [who?] say [according to Shostakovich/Volkov] that her recording of the Mozart concerto was on the record player when the leader was found dead in his dacha [in 1953]. It was the last thing he had listened to.”

Whether one believes all, parts, or none of the story, Yudina did make the recording.

Like Adam, I also played this concerto, written by Mozart at 30. Perhaps you need to be 95 to do it justice. Bravo, Menahem Pressler.

[ One from a list of her performances: Maria Yudina plays Bach Toccata in C minor, BWV 911 - live 1950 -Ed. ]

Laurel Kenner adds:

Yudina's Chromatic Fantasy & Fugue is killer.

Jun

24

Excellent version of Clews, from Laurel Kenner

June 24, 2025 | Leave a Comment

The Wiley edition of Henry Clews, Fifty Years in Wall Street, has annotations by Jon Markman - the editor for Vic and me when we wrote a biweekly column for MSN Money - and a foreword by the Chair.

Henry Clews was a giant figure in finance at that time, and his firsthand account brings this colorful era to life like never before. He reveals shocking stories of political and economic manipulation and how he helped bring down the mighty Boss Tweed. He writes eloquently about the madness of the markets and how the era's greatest speculators amassed their fortunes. This book provides an expansive view of Wall Street in an era of little regulation, rampant political corruption, and rapid financial change.

Henry Clews was born in England in 1836 and emigrated to the United States in 1850. In 1859, he cofounded what became the second largest marketer of federal bonds during the Civil War. Later, he organized the "Committee of 70," which deposed the corrupt Tweed Ring in New York City, and served as an economic consultant to President Ulysses Grant.

Apr

16

The Invisible Gorilla in the Room, from Stefan Jovanovich

April 16, 2025 | Leave a Comment

That is the creature Hugh Hendry - the Acid Capitalist - says we have to find in order to profit from our speculations.

The events in Ukraine are that gorilla. They are predicting the likelihood that Trump, Putin and the Muslim oil producers will establish a Drill, Baby, Drill world of orderly energy production and supply priced in U.S. $. The effects on the European and Asian consumers will be comparable to what happened to the German-speaking world and its silver standard when the French fulfilled the terms of the Treaty of Frankfurt by paying their reparations in gold.

Big Al needs some help:

Perplexity answers the question, "What happened to the German-speaking world and its silver standard when the French fulfilled the terms of the Treaty of Frankfurt by paying their reparations in gold?"

Stefan Jovanovich answers:

They = "events, dear boy". The prediction is that the new cartel of oil and gas exporters will establish "orderly production" that manages the risks of overproduction in the same artful manner that OPEC once operated before the invention of fracking.

William Huggins responds:

So you are suggesting us producers will submit to directives from moscow or Riyadh to limit their production? No evidence of anything but predation among those players but somehow trump purs them all on the same page? I have a bridge for sale….

Apr

7

Surrounded by pessimism

April 7, 2025 | 1 Comment

As we write in mid-2002, surrounded by pessimism, our view is that the required return for holding stocks is at levels unseen since 1990, or 1980, or 1950, when memories of depressions or crashes were still hanging in the air. If ever there were a time that investors would only buy risky investments when the anticipated returns were in the 50 percent-and-over area, this time would seem to be now. We see no reason that our expectations will be disappointed. Why shouldn't an improvement in lifespan or the rules of the game of business reap in the next 50 years the kind of results that greeted investors in the past 50?

Practical Speculation, by Victor Niederhoffer and Laurel Kenner, page 215

Mar

28

The late baseball great studied hitting as closely as a stock strategist studies markets. In fact, Williams' hitting rules can easily make you a better investor.

By Victor Niederhoffer and Laurel Kenner

"Get a good ball to hit."

– Rogers Hornsby to Ted Williams, on the single most important thing for a hitter.

A person, a field, a book. Sometimes they come together with such genius that you wish to carry the lessons around and apply them to everything you do. Such is the case with Ted Williams’ "The Science of Hitting," widely considered the definitive book on the subject. With the baseball season soon starting, the market reeling and investors searching for a rudder, it seems particularly appropriate to learn from the book’s timeless lessons for all fields. But we’ll go even further. We’ll show how to use this method to make a profit by trading IBM (IBM, news, msgs) and similar biggies on Thursdays, when the count is right.

Williams was the last batter to achieve the magic .400 average in a full season — 1941, when he hit .406. (He also had .400 averages in 1952 and 1953, when his seasons were cut dramatically short because of Korean War service.) He is considered one of the three best hitters ever, with Babe Ruth and Rogers Hornsby. “I had to be doing something right,” he said. “And for my money the principal something was being selective.”

His selectivity was unique and inspiring. He divided the 4.6-square-foot batter’s box into 77 zones, and assigned each a hitting percentage. The sweet spot was high over the middle of the plate, where the batting average hit .400.

Rule No. 1: Wait for your pitch

Warren Buffett cited "The Science of Hitting" in his 1998 annual report in a discussion of his favorite subject: How the market doesn’t look good to him. (His most recent annual report, published Saturday, repeats the sentiment.) Buffett said he, like Williams, follows Rule 1 and waits for the great pitches — the great companies — and holds his fire until they arise.

After Rule 1, we will expand the list of hitting rules to 11, drawing from the lessons in Williams’ book.

Mar

13

Seniors: Learn to love AI, from Laurel Kenner

March 13, 2025 | Leave a Comment

Grok 3 helped me drop my glucose from ridiculous to almost normal in one week

I started talking to Grok 3 last week about some health problems. After just a couple of sessions I came to think of AI as a super-helpful genius friend who doesn’t mind long chats, probing questions, or boring tasks.

Feb

23

From the archives: The volatility-market connection

February 23, 2025 | Leave a Comment

Active Trader Magazine, March 2004

The Volatility-Market Connection

By Victor Niederhoffer and Laurel Kenner

Is everything you know about volatility wrong? Find out what history says about the volatility-market relationship — and what the VIX is saying about the stock market’s 2004 prospects.

Volatility is a crucial variable every market participant needs to consider. For speculators, volatility determines how much money to place on each trade relative to initial stake and stop point. For investors, it determines how much to allocate between stocks and bonds, and how much to invest for a secure retirement. For academics, volatility is one blade of the scissors in the fundamental theorem of finance — namely, that expected return is linearly related to volatility.

The article contains a sidebar that begins, "Dr. Hui Guo is one of the most respected and prolific authors in volatility research. Reading some of his articles sparked our quest." Dr. Guo was a senior research economist at the Federal Reserve Bank of St. Louis is currently at U Cincinnati.

Here is one of Dr. Guo's recent research papers:

Taylor Rule Monetary Policy and Equity Market Risk Premia

Hui Guo, University of Cincinnati - Department of Finance - Real Estate

Saidat Sanni, University of Cincinnati

Yan Yu, University of Cincinnati - Lindner College of Business

Posted: 12 Nov 2024, Last revised: 6 Nov 2024

The Fed mainly uses the federal funds rate (FFR) to achieve its dual mandate of price stability and maximum employment. Recent asset pricing models argue that changes in FFR affect equity market risk premia. Consistent with this financial condition channel of monetary transmission, the Fed's macroeconomic needs estimated using the Taylor (1993) rule negatively predict stock market returns. They are also identified as a crucial equity premium determinant along with the scaled market price and conditional market variance via variable selection analyses. The linear multifactor equity premium model has remarkably stable predictive power, outperforming machine learning and other prediction techniques.

Jan

2

Water Into Wine, from Laurel Kenner

January 2, 2025 | Leave a Comment

Maybe Jesus, in his hidden character as humorist and Zen master, was telling us to savor what’s really good for us.

Read Laurel's full post.

Jan

1

A musical New Year’s card, from Laurel Kenner

January 1, 2025 | Leave a Comment

Laurel’s musical New Year’s card

Laurel Kenner performs 1st movement of Mozart Sonata in F major, KV 332.

Oct

31

US National Debt possible consequences & hedges, from Asindu Drileba

October 31, 2024 | Leave a Comment

There is a lot of talk about how precarious US Debt situation is. Two questions:

1. What possible disaster may come out of this? I am thinking Zimbabwe type hyper inflation. What other kind of disaster can happen?

2. What can retail level people do to protect themselves from this? Buy Swiss Francs? Gold & Silver? Bitcoin? What?

Larry Williams responds:

Gloom and doomers here is the chart to look at:

Bud Conrad writes:

Gold 1 year is up 24%. Silver 1 year is up 50%. The circumstances today are still very bad for the dollar. (Which is what is actually declining.)

The BRICS+ are meeting in Russia tomorrow Putin, Xi, Modi, Iran, Saudi Arabia (observer only), UAE etc.) to continue de-dollarization with non-dollar-denominated trade through non-SWIFT transactions for international Central Bank settlement. NO body is talking about this, being focused on how much the candidates will print up to bribe us for votes. The $1.1 T for interest on the $35 T of official Government Debt could rise, as the 10 year Treasury rate hit 4.2% while the Fed CUT short-term rate. Including unfunded liabilities for Social Security and Medicare would say the debt obligations are more like $200 T.

This is 10 year Treasury. Red pointer is when Fed Cut short term rate:

There is no way around avoiding the money printing required. Inflation and price rises are inevitable, as foreigners divest their $8 T of Treasury holdings, to avoid US asserting sanctions or seizing assets like the $300B of Russia holdings. They want out of US Hegemony fast, because of 14 rounds of sanctions on Russia.

Oct

23

Early Voting, from Laurel Kenner

October 23, 2024 | 1 Comment

I am against early voting and other unbounded residuals from Covid. Election day should be a civic event where people actually show up.

Nevertheless, I voted early because it’s now part of the political game. Forecasts based on the ratio of early-voting party members make headlines.

Full post: Nobody Asked Me, But…

Sep

28

What is in Brooklyn?, from Asindu Drileba

September 28, 2024 | Leave a Comment

Lana Del Rey — My boyfriends really cool, but he is not as cool as me. Cause I'm a Brooklyn Baby. An interview recently posted here with The Chair — "I attribute your being humble to being from Brooklyn" (interviewer referring to The Chair). Another person I listen to - Such mistakes can only be made by people who have not spent a lot of time in Brooklyn. Brooklyn comes up so many times. What's is there to know about it? Of course I have heard of people talking about other cities.

But people that talk about Brooklyn always say it like there is something they know which others don't know. What is in Brooklyn? What does it do to people?

David Lillienfeld adds:

In the epidemiology world, when one of the organizations meets in Manhattan, inevitably someone will suggest to the younger members to go across the Brooklyn Bridge and experience Brooklyn. There is definitely something about Brooklyn that focuses one's thoughts.

Steve Ellison offers:

The Chair wrote a whole chapter on this topic, the first chapter of Education of a Speculator, titled Brighton Beach Training.

Laurel Kenner suggests:

Survivors go there when they get to America.

Alex Castaldo responds:

Agreed, immigrants from Central and Eastern Europe often arrived in Brooklyn as a first step towards success and acceptance in America.

H. Humbert writes:

There is a hierarchy among the real estate developers of New York. Those who develop real estate (especially large commercial buildings) in the central area (the island of Manhattan, also known as New York County) consider themselves socially above the multimillionaires who develop property in the boroughs of Brooklyn, Queens, Bronx and Staten Island. They refer to Manhattan as simply "the City" and seldom go to the other boroughs (other than to take an airplane at LGA or JFK airports, which are in Queens).

Donald Trump's father was a developer of large number of properties all of which were in Queens and Brooklyn and he considered Manhattan development too financially risky. He was quite wealthy but in view of the above was not considered a "major New York developer", like Roth, Reichmann and other well known names.

His son Donald was very ambitious and wanted to move up in society. Contrary to his father's policy he took a gamble and decided to put up a large building, the Grand Hyatt Hotel on 42d street in Manhattan. The project was completed in 1978 and Donald Trump joined the ranks of major NY real estate developers. (What the other developers thought of his operation is another subject and requires a separate article). Even if he wasn't fully accepted by all, when his daughter married a member of the Kushner family, another prominent Manhattan developer, a few years later, it confirmed that the Trump family had reached the first rank among New York's wealthy families. But Donald Trump, having overcome his Queens handicap and shown that he could do better than his father, was not quite satisfied and he decided to enter national politics.

In summary, there is a slight prejudice against people from Queens and Brooklyn, which sometimes causes people to be even more motivated to succeed and be accepted.

In addition Brooklyn has its own distinct accent, which causes the prejudice to be slightly greater. If you would like to know what a Brooklyn accent sounds like you can listen to any speech by Janet Yellen. When she was in line for a top job in Washington, a previous Treasury secretary (probably hoping to get the job himself) mentioned her accent as a reason she should not be appointed. She got the job anyway. Another success for Brooklyn.

Jeff Watson gets musical:

Steely Dan nailed it.

Sep

5

A call for an emphasis on predictive distributions, from Victor Niederhoffer and the Spec Trio

September 5, 2024 | 1 Comment

From Ask the Specs, by Victor Niederhoffer, Laurel Kenner, and Dr. Brett Steenbarger (December, 2003):

May I issue a call for an emphasis on predictive distributions rather than descriptive studies? By predictive, I mean, a study that:

• enumerates all observations of what has happened after a defined market event over a specific period of time;

• weighs whether the results indicate a random phenomenon or a tradable anomaly;

• measures the uncertainty associated with the latter conclusion; and

• predicts the probability that an x-percent move will follow the event being studied.

Based on my experience, the biggest mistake a trader can make is to concentrate on “advanced” methods such as Hurst exponents, regression coefficients, Fourier series, chaos, wavelets, fractals, et al. Unfortunately, all of those sophisticated techniques will get you nothing but a barrel of retrospective nothingness.

The key is to find a measure that can be calculated often and independently and then use it to predict. For example, what happens in the next one, five and 10 days after stocks reach a 20-day low? The philosophic memory and longings and expectations of the market are of great interest, but I have found queries as to whether they trend or reverse in accord with Prechter or Fibonacci or Elliott a distraction to the pursuit of profitable trading.

You could put the 100 smartest academics in the world in a room and let them try to predict the market for 100 years, and unless they were steered on a path to make fruitful predictions with readily ascertainable estimates of uncertainty, constantly adjusting for ever-changing cycles, they would achieve below-random results. The numerous professors I have hosted and supported in my office have not disabused me of this assessment.

Aug

7

To Aubrey on Leaving for College, from Laurel Kenner

August 7, 2024 | Leave a Comment

Essentials

See what you look at. Listen to what you hear. Feel what you feel.

Finding a way to use heart, hand, and mind together leads to joy.

Treat yourself as you would a dear friend.

Don’t lie. Lying tangles up your heart and mind. Lies require more lies, sapping energy.

Much of what is considered normal is wrong or worse.

Turn away from cynicism, intoxication, and callousness.

Read Xenophon’s account of Cyrus to learn about leadership. Read Seneca and Publius to learn how to retain your composure and virtue through Fortune’s ups and downs.

Be trustworthy.

Keep a good reputation.

Don’t talk trash about others behind their backs. That sort of talk has a way of flying like a bird back to the target and can turn people into enemies. Talking trash also makes your companions wonder what you say about them when they’re not around.

Genial curiosity can sometimes defuse bad situations.

Bad behavior is often about them, not you.

Deportment

Good manners reveal strength.

Respecting others as human beings is the essence of good manners. You don’t have to overthink it; good manners are often about little things, such as:

Get to appointments early.

Open doors for people with crutches and watch out for their feet.

Open doors for women and mothers with baby carriages.

If a woman joins you at a table where no seat is empty, give her yours. Pull the seat out for her and help her settle in.

Do not swear. It makes you seem churlish.

Don’t comment on the appearance of others. The exceptions: Tell your wife she looks lovely and tell a friend if his fly is open.

Do not make fun of what another person eats, drinks, or thinks.

Invest in comfortable, well-made clothes. Cheap clothes waste money because they don’t last, and they make people wonder if you will be as careless with them as you are with your own appearance.

Women

As you know, one of your most important roles is to protect women.

Women are vulnerable to falling in love too quickly, because they instinctively want a family. That's true of all women.

Sexually liberated women do not exist. Recognize that women who think they can act like men are prey in a harmful culture. You must protect them.

At Home

Wash sheets and pillowcases weekly.

Light and fresh air are healthy. Keep the windows in your room open if possible.

Follow the one-touch rule: Put things in their places. Put dirty clothes in the hamper. Put dishes in the dishwasher. Throw out papers you don’t need.

An orderly house helps keep life happy and productive.

Gratitude

Gratitude creates happiness. Write down five things you’re grateful for in a notebook every day.

Adulthood

What does it mean to become an adult? In a word: responsibility. Paying rent. Creating and protecting your family. Planning ahead. Making a career. Fulfilling your obligations. Making money. Contributing to freedom, community, earth.

On a higher level, adulthood is the ability to consider two opposing concepts. Adults can deal with ambiguity and subtlety.

Many wise sayings have converses that are equally wise and true. For example, perseverance and endurance are virtues; but the adage “survival is mobility” saved many Jews from the Nazi death camps.

In our modern world, “survival is adaptability” may be more apt. You must become adaptable without losing your soul.

Farewell

With all my love, I send you out into the world, an eagle destined to soar among mountain peaks. Be strong. Don’t forget to call.

-Mom

Vic adds:

beautiful advice - reach out to learn new things and be good to friends. don't be too trusting.

Sushil Rungta writes:

Wonderful lessons. While I loved all, the lessons on respecting others resonate with me the most. How often we behave callously towards others! Sometimes, unintentionally. Here, practicing mindfulness really helps.

Jul

26

Precedent weather-change responses, from Kim Zussman

July 26, 2024 | Leave a Comment

A mass sacrifice of children and camelids at the Huanchaquito-Las Llamas site, Moche Valley, Peru

Here we report the results of excavation and interdisciplinary study of the largest child and camelid sacrifice known from the New World. Stratigraphy, associated artifacts, and radiocarbon dating indicate that it was a single mass killing of more than 140 children and over 200 camelids directed by the Chimú state, c. AD 1450. Preliminary DNA analysis indicates that both boys and girls were chosen for sacrifice. Variability in forms of cranial modification (head shaping) and stable isotope analysis of carbon and nitrogen suggest that the children were a heterogeneous sample drawn from multiple regions and ethnic groups throughout the Chimú state. The Huanchaquito-Las Llamas mass sacrifice opens a new window on a previously unknown sacrificial ritual from fifteenth century northern coastal Peru. While the motivation for such a massive sacrifice is a subject for further research, there is archaeological evidence that it was associated with a climatic event (heavy rainfall and flooding) that could have impacted the economic, political and ideological stability of one of the most powerful states in the New World during the fifteenth century A.D.

Laurel Kenner comments:

In Lessons from History, the Durants write that Peru was a happy socialist state until the arrival of the conquistadors in the 16C.

Bo Keely reports:

Iquitos, Peru at the headwaters of the Amazon Rio is the only of two places I've lived in the past 20 years. The other is here in Slab City. I had a trip planned to Peru this month but got a desert skin infection that the jungle would have ravaged. As such, i've lived in the Peruvian Amazon a half-dozen times for months at a stint, all in the jungle hiking and hitchhiking banana boats. The proposed postponed trip was to hitch the rios again doing magic tricks for the natives in putting together a photo-essay. The Peruvian Amazon is my haunt because the people operate very low on the brainstem. Cannibalism and malaria make them perhaps the greatest evolved and toughest humans on the planet. Put succinctly, if one is invited to dinner make sure the host isn't licking his chops. I'll go back, and escape again with magic.

Asindu Drileba is concerned:

Put succinctly, if one is invited to dinner make sure the host isn't licking his chops. I'll go back, and escape again with magic.

You have unlocked a whole new level to what I consider a set of risks people take. Please don't do that again.

Jun

23

Interview with the Chair from 2020

June 23, 2024 | Leave a Comment

Queued up to the start of the actual interview:

An Education from a Speculator: Interview with Legendary Victor Niederhoffer

Laurel Kenner approves:

One of the best interviews of the Chair. —The Collab

Bo Keely writes:

i like it, a fine reacquaintance.

Peter Ringel responds:

Thank you, watching it now. I also want to highlight the recent mkt calls on Twitter, which worked nicely. This and the wonderful articles about MFM Osborne.

May

17

Vienna

May 17, 2024 | Leave a Comment

Vienna: How the City of Ideas Created the Modern World, by Richard Crockett.

Viennese ideas saturate the modern world. From California architecture to Hollywood Westerns, modern advertising to shopping malls, orgasms to gender confirmation surgery, nuclear fission to fitted kitchens—every aspect of our history, science, and culture is in some way shaped by Vienna.

The city of Freud, Wittgenstein, Mahler, and Klimt was the melting pot at the heart of a vast metropolitan empire. But with the Second World War and the rise of fascism, the dazzling coteries of thinkers who squabbled, debated, and called Vienna home dispersed across the world, where their ideas continued to have profound impact.

Humbert H. writes:

When I left the Soviet Union, Vienna was the first western city I saw. It's hard to imagine a bigger contrast. It was like moving from a garbage dump to an immaculately maintained dollhouse. My next stop was Italy, and in spite of being the most beautiful country in the world, IMO, Italy was a letdown after Vienna.

As for it's historical significance, it's huge, but this battle was one of the most important in the history of the world, and that's saying something (there have been a lot of battles).

Laurel Kenner suggests:

For a more detailed overview, I enjoyed The Austrian Mind.

May

11

Small business, from Laurel Kenner

May 11, 2024 | Leave a Comment

Greetings from Greenwich, Connecticut, one of the nation's wealthiest towns. This year:

1) Steinway closed its piano store and announced that all pianos would be liquidated at steep discounts.

2) Saks Fifth Avenue closed its brand-new (and very good) restaurant after spending $1 million on a remodel. Also closed its retail stores along the main drag.

3) A favorite Chinese restaurant in Old Greenwich closed after serving three generations.

4) A venerable Old Greenwich sit-down cafe with the best fish-and-chips in Connecticut also closed.

5) A good-value nice clothing store on Greenwich's main shopping street closed, just one of several.

It isn't just East Coast. On a UCLA visit with my son, I breakfasted at a landmark, Patrick's Roadhouse in my hometown, Santa Monica Canyon. The week after I left, a friend told me that Patrick's had closed after 52 years. COVID relief had expired. Arnold Schwarzenegger, who has a special throne there that can bear his weight, had bailed it out previously — but hasn't stepped up to the plate. A GoFundMe campaign is attempting to keep Patrick's alive. Fixer-uppers on my old street start at $6 million.

Why is any of this important? When small businesses close, the ordinary people must move on, be they customers or owners. They spend less. The economy reflects their diminished circumstances.

What grinds me the most is the Steinway store's failure. I'm teaching piano now, and I am so tired of seeing my students fail to develop their ears because they can only afford horrible electric keyboards.

Bo Keely responds:

i think it's a local thing. we can't see the world forest for the American trees. i just traveled through Mexico the hard way under a pack and the country bustles, thrives, and has altered the mindset to friendliness to strangers. the best investment is along the Sea of Cortez where, 15 years ago, there was one sleepy fishing village where i couldn't find a meal or bed. i slept in the weeds. now it's the Platinum Coast with twenty miles of high rises. there's a 200-mile new skyscraping powerline to meet electricity demand across the dune capped desert where, as seen yesterday on my throne on La Bestia, the last poles are driven and strung to blow open the coast to investment.

Dec

26

Laurel Kenner’s Musical Christmas Card 2023

December 26, 2023 | Leave a Comment

Merry Christmas to all Specs. I hope you enjoy my latest musical Christmas Card. It has been 23 years since the Chair and I, with the assistance of James Goldcamp and now Big Al and Alex Castaldo, founded the SpecList, starting with early readers of our column at TheStreet. The Specs have contributed so much value and humor to our lives. I thank you and wish you all a Happy New Year.

Laurel Kenner's Musical Christmas Card 2023

Laurel Kenner Plays J.S. Bach Prelude in C minor

Laurel Kenner performs Bach's Fugue in C minor, WTC Book I

Adam Grimes responds:

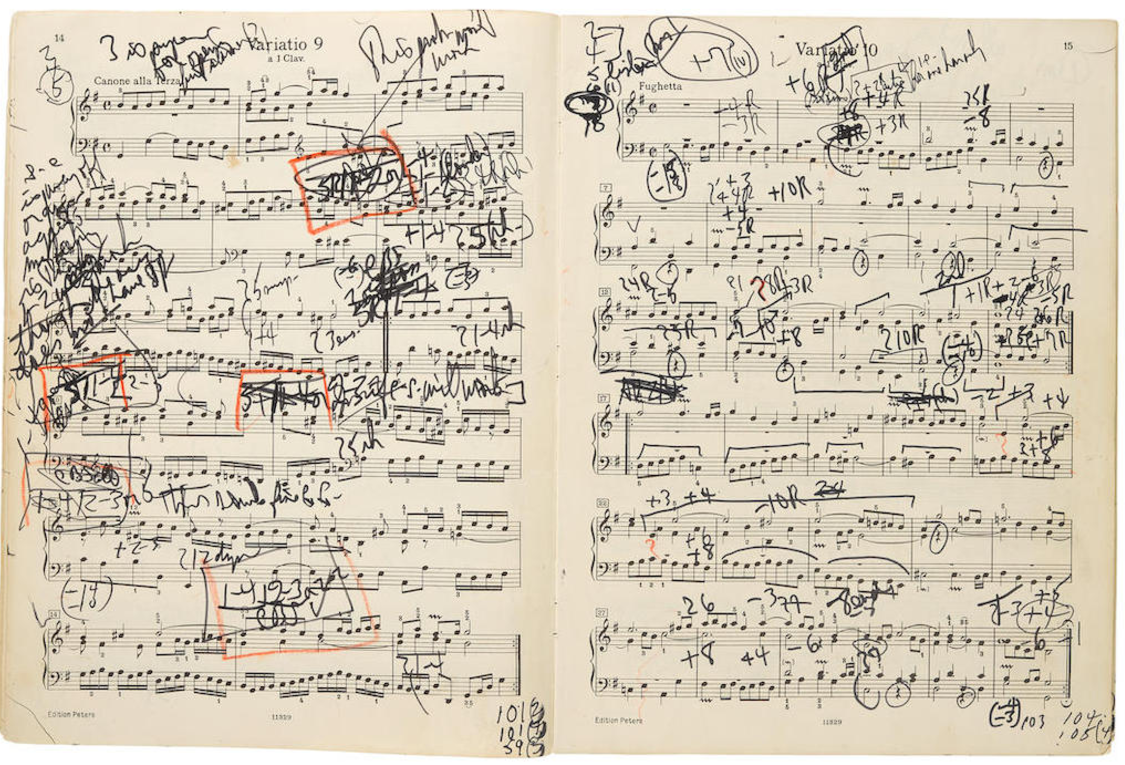

Thank you for sharing! Glorious piece, and such a great set. I continue to chip away through the Goldbergs…a bit at a time. Cheers, Happy Holidays, and perhaps a hint of Peace in these troubled times.

Laurel Kenner encourages:

The Goldbergs are a very worthy pursuit, Adam. Go for it! I’ll look forward to your musical Christmas card!

Oct

19

Bonds…close, from Larry Williams

October 19, 2023 | 2 Comments

Bonds oh so close to major buy point.

Humbert H. writes:

I just keep rolling over T-bills because I don't know any better. Higher for longer or something. At least the interest pays for my recent losses trying to buy all kinds of value stocks at the lows, only to see them broken. That's OK, the next bull market will bail me out completely.

Laurel Kenner comments:

You are never free to deny the truth. You cannot make it up ad you go along.

I bow to Larry. The biggest gains occur in insane bear markets. Because the government has seized control of the bobd market, he is right, especislly leading up to an election. You all should heed him when he gives the buy sign. But it still stinks. I guess you need the nose for success.

Larry Williams replies:

Well lets hope I get this one right and earn those kind words - the ultimate sweet spot to buy is not here yet but it is coming.

Zubin Al Genubi adds:

When the time to buy comes, you won't want to. Like 17% bonds in the 80's.

Richard Bubb writes:

So is the FED [Powell & Co.& etc.] gonna raise the rate, or try the Higher-For-Longer road? Personally I'm thinking the HFL is their better option. Reason: The Fed is notorious for doing one too many rate 'adjustments' that would fix itself if they hit the pause button/s. Back to my 'raise concern'…I think the 2% target is a chimera and going there is an unwinnable move for the Fed.

Humbert H. assumes:

Well they can’t inflate the debt away fast enough at 2% nor is it easy for them to achieve so I’ll assume inflation will stay higher for longer.

Allen Gillespie writes:

While there is a strong seasonal trade that kicks end here around Oct. 19-23 - good till Christmas, such that even during bond bear markets the market held levels for a couple of month, the fundamental issues are the following.

1. Fed Funds Futures are beginning to project a cut in short rates around May 2024 which then continue through the first quarter of 2025 and reach down to a level of about 4.5%.

2. Historical, average spread relations therefore suggest we are seeing a Niederhoffer switch in here where short rates go into the 4-4.5% range and longer instruments up the the around of the current fed funds rates and budget deficit amount. A true switheroo.

3. There is a strong seasonal here (particularly Oct. 19-23) which held even during bond bear markets. IA flush after a weekend would seem about right. In the bond bear markets, however, the range was only good for a couple of month.

4. The long-term fundamental backdrop is the following:

According to the CBO, "since 1973, the annual deficit has averaged 3.6 percent of GDP. In CBO’s projections, deficits equal or exceed 5.5 percent of GDP in every year from 2024 to 2033."

This is the inflation rate - so, if you want a real return on bonds your rates needs to be higher than these levels. That is now just barely true in corporates, but it is not true for government bonds.

If you just charge the inflation rate, there is no real no real return available to bonds. Granted, in the long run government should be neutral offering neither gains nor confiscation, but at any moment they are on either side of that reality.

Today, the CBO projects the deficit will run 6.1% for the next two years. They do have a core adjusted for timing shifting of 3.4% - but do you trust them will all the war supplemental budgets.

Humbert H. responds:

A cut in short rates in May? We have high deficits, strong likelihood of inflation above 2%, no real signs of recession, "higher for longer" is seemingly the consensus of the mainstream economists, but fed fund futures are projecting a cut? Doesn't seem to make much sense.

Allen Gillespie replies:

Election years start getting discounted about Feb/March - so market may start looking past the Biden agenda and the housing season come May will be in the dumps. Forward oil also 10% lower for next year on economic weakness. Oil ran in 3Q because someone probably knew. The energy squeeze in 1973 was 1 year long. Exxon just bought Pioneer, so they can export LNG - trade seems to be setting up to be long domestic production for export.

Oct

12

Wall of worry

October 12, 2023 | Leave a Comment

JPMorgan’s Marko Kolanovic braces for 20% market plunge, delivers recession warning

H. Humbert comments:

Nobody knows anything. If anyone could predict that stuff with any degree of certainty, they’d be worth a trillion dollars over 5-10 years. I listen to what all kinds of analysts say and they modulate their own predispositions by reality, but it’s all worth nothing.

Zubin Al Genubi sees the bright side:

Excellent wall of worry.

He indicates a near-term bounce is still possible because a lot hinges on economic reports over the next few months. "[We’re] not necessarily calling for an immediate sharp pullback,” he said. “Could there be another five, six, seven percent upside in equities? Of course… But there’s a downside."

(Really stupid)

I'll also make a Popperesque non-disprovable prediction: Market might go up, but then again it might go down too.

Laurel Kenner writes:

Sometimes the wall of worry is made of steel-reinforced concrete, viz., late 1999 & 2007.

Humbert H. comments:

This particular wall of worry is made of cotton candy. Not many people on either side predicted the behavior of the market in the last 4 months. Whatever idea people have, they typically expect to be proven right or wrong relatively quickly, and usually proven right.

Laurel Kenner replies:

The smartest bond investor, Paul deRosa, quit several years ago because he no longer understood the bond market after what I think of as the 2008 financial coup. The market hasn't existed since then. This thing that has been committed will bear evil fruit. George Zachar, am I right?

Sure, it could take a long time. Homeowners and businesses locked in those crazy low rates. But the central powers can't keep up the charade. The bond market, what's left of it, will scream. Do we look away now?

Larry Williams doesn't mince words:

This is bullish.

Humbert H. comments:

I wouldn't dismiss any "frame" for predicting the future even if I don't agree with or can't evaluate the premise. Scott Adams, to whom I listen religiously, has a number of "frames" that sound crazy to me but may work. For instance "the most entertaining outcome is the most likely". I don't trade per-se, and the closest I come to is to try to buy value stocks at a local bottom, or sell a current holding to buy a new one of the "local bottom" variety an activity I used to be reasonably good at but have completely failed lately. I do think there is some sort of a possible "scientific" framework to predicting IPOs as they seem to have widely divergent short, medium, and long-term behaviors, seemingly more so than the universe of similar stocks in general. Some of the reasons are obvious, such as the lack of a track record, but even with that emotions seem to play an outsized role.

William Huggins writes:

years ago as a student we ran an investment club with real money that did quite well. the problem, as usual, is leadership succession so in time the org attracted a technical analyst who had lots of prophecies but would offer no reasoning for them ("i'll explain if i'm right…."). this charade impressed some of the newbies but not the vets who demanded to know the basis under which their funds would be invested. being in the skeptical camp, i offered a simple binary prediction exercise: presented with 15 1-year price charts, he simply had to indicate whether to following year would be up or down (we could have corrected for drift but were sufficiently confident his methods were hogwash that we didn't care). if he could get 11 of them correct, that would constitute (roughly) 95% confidence that whatever his techniques were, they weren't producing random results. we didn't tell him but we used 15 of our actual previous holdings which we knew the results of. he got 4/15 correct and promptly stopped trying to inject "woo" into our investment process.

Aug

5

Trees, mostly

August 5, 2023 | Leave a Comment

old gray mare prob at 3-month hi at 35%.

Lott/Stossel: Election Betting Odds

books read this weekend:

The Hidden Life of Trees: What They Feel, How They Communicate - Discoveries from a Secret World

The Battle for Investment Survival

Trees: A Complete Guide to Their Biology and Structure.

i find the study of trees - especially how high they grow, and how they develop buttresses, and how they branch out and compete with other trees for light - immensely revealing for the various moves.

Big Al suggests:

The Age of Wood: Our Most Useful Material and the Construction of Civilization

Nils Poertner comments:

In many parts of central Europe, the Beech tree used to dominate the landscape thousands of yrs ago. Used to be well over 2/3 - and even today it is like 1/3 in Germany. Why? They tend to grow super and sort of take away all the light from slower growing trees. An oak tree would not stand a chance.

Gyve Bones suggests:

Long term strategy: planting a grove of oaks in a forest in France to be ready in 150 years to replace the roof of Notre Dame de Paris when it burns down.

Peter Saint-Andre offers:

Oxford's Oak Beams, and Other Tales of Humans and Trees in Long-Term Partnership

Peter Ringel writes:

For the last two years I am involved in a project for a German horticulture company. They mainly produce young plants of ornamental plants aka flowers. As a little side project (in early stages) they also produce Paulownia trees (as young plants).

Paulownia is the fastest growing tree in Europe. They originate from Asia. (Some criticize them as invasive species.) Typical commercial applications are wood for instrument manufacturing, wood pellets for energy production or particle boards. The wood is very light (caused by very fast-growing).

Propagation is a little challenging. Usually it is done in-vitro via Biotec-lab, which we have. It is not the easiest variety for in-vitro. We also had some success to propagate via cuttings from mother plants.

Laurel Kenner comments:

Terrible idea to grow these, down there with tree of heaven, kudzu and bamboo. Yes, they are quick to grow, but also impossible to eradicate or even to contain. I am not an eco-hippie, just a gardener.

Zubin Al Genubi adds:

A friend planted a tree farm about 25 years ago with rare exotic hardwoods such as Koa, Bubinga, Cedar, rosewood, mahogany, ebony. It is a multigenerational project but some early woods are being harvested. Some of the rare woods will be very valuable as they are disappearing in their disappearing native habitat. There are numerous governmental grants benefiting the project as well.

Laurel Kenner responds:

I like the project. The idea is not to grow "trees" that are in effect big weeds. Pawlonia is illegal in my state, CT, as is Norwegisn maple, another nasty weed-tree planted in a less enlightened day because it grew fast. They often come down in storms because they're weak. One memorably crashed over my driveway in a big blow and its eldritch too brach rang ny side doorbell.

Peter Ringel replies:

Yes, storms are an issue, especially during the first years. My big mouth was referring to the EU government as hippies, because subsidies and grant policies are highly ideological here. Not referring to anyone else.

The church of Greens has Europe tight in their grip and currently they like Paulownia. There is a trend / hype growing. Other psalms the church likes are "renewable raw materials" or "CO2 neutrality". Paulownia fit these mantras. (plants eat and need CO2 to confuse the church)

Paulownia are not really new to Europe. Introduced to Europe 100 years ago or so. So far they were unable to survive in the European wild in size. Maybe because of frequent stronger winds? On a farm, as industrial product it makes a lot of sense to me. I am obviously biased here, because this would be our customers. It is a nice economic product. E.g. after about the first 2 years of growth, farmers cut them back near the ground level. This timber can be sold. They rapidly grow back and faster than without cutting. A case of eat your cake and have it too. One argument is, to use this locally produced timber instead of importing from South America, Asia, Finland or Russia.

forgot: Paulownia on farms are usually all clones of hybrids. Like a mule, they can not reproduce themselves into surrounding areas.

Mar

24

Book recommendation, from Zubin Al Genubi

March 24, 2023 | Leave a Comment

Pirate Latitudes, by Michael Crichton. Aubriesque tale of privateers and Spanish Galleons.

As the SPEC list is about books, as well as markets, counting, and barbeque.

William Huggins adds:

single best book on the history of finance that i've come across is William Goetzmann's Money Changes Everything. He's a Yale finance prof with a background in art history and archeology and its shows throughout the book as he looks at the roots of our toolkit (sumerian word for "baby cow" is the same word they used for "interest", etc). a very good description of the 1720 bubble with the hypothesis that the bubble was a reasonable reaction to the shifting expectations around insurance companies and the lines of risk they could cover. he also suggests that Venetian gov debt (1172) snowballed into the creation of western capital markets, which in turn propelled the west ahead of "the rest" (to steal a ferguson quote). three solid chapters on the tools imperial China used to increase its "span of control" over its rugged territory. 10/10.

(I used to use it as the required reading in my history course until I realized too many were balking at its size)

Jeffrey Hirsch responds:

Appreciate the reco Mr. Sogi. Almost done with Pam V’s reco on Keith Richard’s autobiography, Life, which is far out. Here’s one from me, The Immortal Irishman, by Timothy Egan. Irish revolutionary becomes a Civil War general. Adventurous tale across many continents.

Laurel Kenner writes:

I offer Harpo Speaks, the autobiography of Harpo Marx, the silent brother. Plenty of poker, speculation, and spectacular success, including an account of his Soviet tour, to entertain this List well.

Pamela Van Giessen responds:

Harpo Speaks is fantastic. For a meditative introspective read on things out of our control and how the body copes A Match to the Heart, by Gretel Ehrlich.

Big Al suggests:

I will recommend The Biggest Bluff: How I Learned to Pay Attention, Master Myself, and Win, by Maria Konnikova.

First of all, it's just an entertaining, well-written story. But in her study of poker and portrait of one of the best professional players, Eric Seidel, there are many lessons for traders.

Penny Brown writes:

I recently re-read the cult classic, The Moviegoer, by Walker Percy. It has nothing to do with trading but the main character is a stockbroker. Read it for the wonderful prose and the delineation of Southern characters with great dialogue.

Also, re-read A Fan's Notes, Fredrick Exley's memoir of growing up under shadow of his father's football fame in Watertown. It's amazing that this book even got written since Exley makes three trips to mental institutions where he undergoes electro-shock and insulin therapy and was an inveterate alcoholic for his entire life. You can see the influence of Nabokov and Edmund Wilson (among his favorite writers) in his prose style.

And then I read Embrace the Suck - a book I literally found at my feet on the sidewalk - hey, the price was right - and I assumed it had a special message for me. It certainly did. It describes the training undergone to become a Navy SEAL including the infamously horrid "Hell Week" that resulted in the death of one participant. It has lots of lessons for traders as it extols the virtues of discipline, focus, planning and most of all, a willingness to embrace suffering, as a means of moving beyond mediocrity.

One guy's way of shaping up for the ordeal of SEAL training was to run the Badlands Ultramarathon - a little 100 mile race through the desert at temperatures over 110.

Okay, I'm not going to try that - never could have even in my prime. But it got me out of my chair committed to doing a full set of Bikram's yoga postures including the ones I hate because I can't do it - Salabhsana - or hate because it hurts - Supta-Vajrasana. As the author says, "you've got to embrace the suck everyday."

Gary Boddicker adds:

I recently read Mule Trader: Ray Lum’s Tales of Horses, Mules, and Men. I originally picked it up for the regional interest. Ray was based about 60 miles down Hwy 61 from me in Vicksburg, and traded mules and livestock throughout the Mississippi Delta…but, it turns out a few of the Chair’s favorite writers, Dr.Ben Green and Elmer Kelton, were running buddies of Ray and are mentioned and vouch for his character in the book. Many tales of trades, moving the herds as the tractors slowly replaced them from California to the Delta. In one case, he bought 80,000 horses in South Dakota, and arb’d them to where they could be used. The book rambles a bit, as it is essentially an oral history, but many lessons within.

It brought to mind a discussion I had years ago over dinner with an buddy of mine who farms about 20,000 acres in NE Louisiana. “Gary, there is isn’t a real farmer in Louisiana who picks up that government agricultural census and doesn’t mark down that he owns at least one mule. We are damn slow to admit we gave ‘em up.” I haven’t fact checked him, but a betting man says the mule census is Louisiana is overstated.

Gyve Bones responds:

I have two copies of that book… one autographed by the re-publishing editor. It’s a great book.

Mar

8

On the Firing Line (Fifteenth in a series) Breathe, Breathe in the Air

One of the first exercises we do in clinics is called “Learning to Breathe”. Of course, the athletes have quizzical looks on their face and say, “But we’ve been breathing all our life. What do you mean?” After sharing a laugh, we explain. Infants and very young children breathe very naturally with their belly being drawn down and slightly out as the diaphragm is lowered in order to fill the lungs. Sometime in childhood, as the stress and rush of modern life takes its toll; the natural belly breathing is replaced by a breathing technique that uses upper chest expansion to draw air into the lungs.

In natural belly breathing, the lungs fill in roughly three stages. First the lowest part of the lungs begins to fill as the diaphragm is drawn down and the belly is pushed down and slightly out. Then the middle part of the lungs fill as the lower rib cage expands slightly. Finally, the upper part of the lungs is filled as the upper chest expands. In the more typically observed upper chest breathing, only about 30% of the lung capacity is utilized. Belly breathing has significant positive effect on both the body and the mind.

Vinh Tu writes:

Back when I took piano lessons, I remember getting some advice on how to breathe while playing certain passages. Recently while playing some rhythm-based video games, I've noticed that either I hold my breath, or try to time my inhalation or exhalation so as not to disrupt my rhythm. The wrong syncopation between your breath and the beat can throw you off the rhythm.

Laurel Kenner responds:

For a smooth motion, action should come after you start to exhale.

Dec

7

Trial and error, from Big Al

December 7, 2022 | Leave a Comment

Watching Victoria via PBS Masterpiece sub, and it's shown that, during the 19th century, one treatment for syphilis was basically a mercury sauna, inhaling the vapors - yikes!

The history of syphilis is an interesting case for seeing how quack medical treatments, such as mercury, were applied and killed people even more quickly. Of course, one shouldn't judge too harshly as they were treating things of which they had no understanding.

The relevance to trading is that humans have an impulse, when confronted with challenges they don't understand, to resort to superstition and to believe anything that is claimed with great confidence.

Penny Brown notes:

Flaubert took the mercury treatment for syphilis and as a result his tongue turned blue.

Laurel Kenner adds:

Qin Shi Huang, first emperor of China, drank mercury-infused wine to attain eternal life. Rivers of mercury surrounded his burial chamber, a depiction of China. Qin died at 49.

Gyve Bones writes:

We saw examples of that in the recent pandemic. At first "masks don't work. Don't wear masks." then… "Everyone must wear a mask at all times, even alone outside or in a car." Then "The virus stops dead in the vaccinated person, who will not get Covid, and won't spread it to others." then… "Anthony Fauci contracts COVID three times, but is certain it would have been worse had he not been quad-jabbed."

Now there's this disturbing study which shows the effects on infant cord blood and their immune systems from mothers who have been infected with COVID.

Henry Gifford comments:

The early instruction for people to not wear masks was so that security cameras could see people’s faces. The police seem to really love security cameras with an enthusiasm that strikes me as going above and beyond any usefulness to “fight crime”.

There was the time a landlord in NYC put a camera outside a tenant’s door to prove if the tenant was using the apartment as a “primary residence”, and would therefore still be entitled to rent protection or not. The tenant’s boyfriend put bubble gum on the lens and was promptly hunted down and arrested and charged with every crime the cops could think of, with an enthusiasm certainly not caused by anyone’s love for a NYC landlord.

Not being seen clearly on security cameras was, if I remember correctly, sometimes even stated as the reason to not wear masks, which made me wonder – if they think masks work, more people dying is OK as long as people can be seen on cameras?

Pamela Van Giessen responds:

Henry — There exists decades of research that show that masks do not reduce transmission. I have yet to see meaningful evidence (research or real world) that shows that they do work. The current situation in China would seem real world validation of the lack of mask effectiveness. Lockdowns don’t seem to work much either. Most people don’t die from covid either. They don’t even get very sick.

Henry Gifford writes:

I tend to believe things if they can be measured, if the measurements can be repeated by others, and if they can be explained by the laws of physics. I tend to not believe anything not meeting these three criteria. As the owner and fairly regular user of over fifty measuring instruments, the measuring part often means measured by me.

Nov

21

Boxwood Butchery, from Laurel Kenner

November 21, 2022 | Leave a Comment

A new post from Laurel Kenner: Annals of Greenwich, Pt. 4: Boxwood Butchery

Nov

17

A Trip to the Dump, from Laurel Kenner

November 17, 2022 | Leave a Comment

A new post from Laurel Kenner: Annals of Greenwich, Part 3: A Trip to the Dump

Nov

15

On virtue signaling, from Henry Gifford

November 15, 2022 | Leave a Comment

While Lance Armstrong was racing he tested positive seven times, but was let off the hook on technicalities, not all valid, each time. This was well known at the time, but few journalists mentioned it. As far as I know, among the few with the courage to mention it, none said “therefore he is cheating” or said “therefore he was cheating”.

During the years Lance and The US Postal Service team were winning The Tour de France year after year it was said that the team specializes in winning the team time trial (race against the clock) events that were part of the tour. As a former racer I wondered how that could be, as that event arguably does not require special skills different from the skills required for other events - probably fewer skills are required. I strongly suspect that they won those events with a lot of help from electric motors hidden in the bicycles, probably within the “disk” (streamlined) rear wheels. Maybe motor doping helped Lance in his other events as well.

Bo Keely adds:

i remember reading & studying something similar from you before. or, it could be that the electric clocks were fixed. a guy with a top hat used to walk through las vegas casinos & a device in the hat triggered jackpots to his associates. lance armstrong was the marty hogan of bicycling. people supported his cheating because they wanted a hero, and because his sponsors had so much invested in him.

Pamela Van Giessen writes:

The human animal craves heroes so we will go to a lot of lengths to support the illusion. Because admitting that heroism is an act, not a personage, is almost like refuting the existence of god.

Good people can do bad things and bad people can do good things. Too bad we have such a hard time wrapping our heads around this.

Laurel Kenner agrees:

Brilliant insight, Pamela. The idea is hard to embrace because it means confronting our own bad deeds. We all want to see ourselves as good people.

Nils Poertner comments:

in Vedic culture there is something like Maya- the fog …that we see through the world - everybody has a fog around him/her so we never meet - we just see through this fog…and some are more caught up in Maya than others.

Nov

15

Annals of Greenwich: A wedding scam, from Laurel Kenner

November 15, 2022 | Leave a Comment

A new post from Laurel Kenner: Annals of Greenwich: A wedding scam

Sep

30

The Electric Robots are Here, from Laurel Kenner

September 30, 2022 | Leave a Comment

Bye Bye, Mower-and-Blower Gangs. The Electric Robots are Here.

In a step toward ending mower noise, a robot named Farmer Joe, made a debut on the Town Hall lawn on Sept. 21, cutting grass in total silence as reporters and local leaders looked on.

Sep

21

You can transform a patch of weeds into a piece of heaven, from Laurel Kenner

September 21, 2022 | Leave a Comment

You can transform a patch of weeds into a piece of heaven

Sep

19

A new post from Laurel Kenner

September 19, 2022 | Leave a Comment

The infernal racket of blowers and mowers; Greenwich introduces a robotic solution

Sep

16

Federer adieu, from Duncan Coker

September 16, 2022 | Leave a Comment

Market declining in sympathy with announced retirement. I was lucky to see him play on several occasions. A great player and a great gentleman to the game. What a backhand, and what a forehand, serve, volley, footwork, strategy and touch.

Alston Mabry adds:

Farewell address, very classy.

Bud Conrad agrees:

Yes. Classy.

Laurel Kenner recalls:

My tennis teacher knew him and said he never swore.

Aug

11

Summer reading, from Zubin Al Genubi

August 11, 2022 | Leave a Comment

I need some new books to inspire me. Suggestions? Last few science book were great.

Bill Egan replies:

Against the Tide: Rickover's Leadership Principles and the Rise of the Nuclear Navy by Dave Oliver.

Laurel Kenner adds:

Sue Stuart-Smith: The Well-Gardened Mind: The Restorative Power of Nature

William Logan: Sprout Lands: Tending the Endless Gift of Trees

Thomas Sowell: Black Rednecks and White Liberals

Michael Brush suggests:

The Gene

The Emperor of all Maladies

Why We Sleep

Henry Gifford offers:

Buildings Don’t Lie, Better Buildings by Understanding Basic Building Science: The movement through buildings of heat, air, water, sound, fire, light, and pests. By…well…Henry Gifford!

Big Al recommends:

Prime Obsession: Bernhard Riemann and the Greatest Unsolved Problem in Mathematics

The Seven Pillars of Statistical Wisdom

The Biggest Bluff: How I Learned to Pay Attention, Master Myself, and Win

Re Riemann, 3Blue1Brown has a great bit to enhance the visual:

Visualizing the Riemann zeta function and analytic continuation

A reader writes:

Major Transitions in Evolution: Maynard Smith & Szathmary

Indra's Pearls: Mumford + Series + Wright

Coe/Stone: Reading The Maya Glyphs

Fred Schwed: The Pleasure Was All Mine

Japanese Tales: Royall Tyler

African Folktales : Paul Radin

Ernst Haeckel : Art Forms from the Abyss

Owen Jones: The Complete Chinese Ornament

Trigonometric Delights : Eli Maor

Voices from the Whirlwind - Fenc Jicai

The Cowshed - Ji Xianlin

Rural Worlds Lost - Jack Temple Kirby

Paolo Pezzutti enjoyed:

Relentless Strike: The Secret History of Joint Special Operations Command

Laurence Glazier adds:

Emily St John Mandel, Sea of Tranquility. Sequel to her earlier The Glass Hotel, which was partly about a Ponzi scheme.

And Brandon Q. Morris, physicist sci-fi writer.

Peter Krupp writes:

Here are two science books that I found fascinating focused on quantum physics written by one of the great contributors to the quantum theory of computation, David Deutsch.

The Fabric of Reality (quantum theory - many world interpretation, quantum computation, epistemology, and much more).

The Beginning of Infinity (the nature of scientific progress, how it has accelerated in the past few centuries).

Jul

17

Seen on the streets of Maui, from Zubin Al Genubi

July 17, 2022 | Leave a Comment

/cdn.vox-cdn.com/uploads/chorus_image/image/49716283/531739974.0.jpg)

A 3-4 hour TSA line stretching past baggage claim. Horrifying. Some problems in the transportation industry. Its apparently widespread.

Laurel Kenner responds:

Guaranteed to happen when government goes full authoritarian and shuts down the economy for iffy epidemiological reasons.

Mind owner. Mother of fire kid. Hardened gardener.

Bo Keely recalls:

i had a flight out of SF to JFK on the morning of 9/11. i was sleeping on the couch of an executive hobo named 911 who was in charge of Bay Area disaster response. he shook my shoulder awake, and said, 'roll over and go to sleep. they've cancelled all flights into NY because the world trade center was just blown up.' so, i got to sleep in, and rescheduled for a few days later.

on arriving at JFK the security was crazy. we had to go into a tunnel and wait for about an hour, and then through a metal detector before boarding. as an experiment, i stuck a piece of metal in my cap that should have set off the detector. but it was too high on my head and passed without detection. I probably visited u & vic on that trip.

Jul

7

A new article by Laurel Kenner

July 7, 2022 | Leave a Comment

The Fed Fights Recessions by Dropping Rates. Unless Inflation’s Out of Control.

The Federal Reserve has eased past recessions by cutting interest rates, but right now it’s committed to raise rates to bring inflation under control.

Jun

28

Update on the AI discussion, from Laurel Kenner

June 28, 2022 | Leave a Comment

If you missed Newton Linchen's Zoom talk on AI this morning, here is a link to the recording, passcode: &6yLyn*F.

He included a demo, explained the different types of machine learning, suggested books, and related the colorful story of how a powerful reinforcement learning algo of the sort used for self-driving cars and rocket landings took five days to run and nearly melted his computer. (That's not an algo he uses in his trading for clients.)

If you wish to download the recording you can, but be aware that you will be downloading an untrimmed version as Zoom preserves the original. The talk starts at around 30:15.

Laurence Glazier comments:

This is brilliant. It is so nice that nowadays mathematicians have an alternative to aerospace pursuits. I would like to see AI applied to classical music, so I could have an engine at my side as I tried to figure out the complexities of a piece, much as a grandmaster may be assisted by an AI chess engine like AlphaZero. I am also looking at altering the design of the theramin to interpret conductor gestures, and ultimately AI may have a role here too.

Paolo Pezzutti writes:

Excellent presentation. As you highlighted it is all about features. Models are open source therefore you can only work to tune parameters. The choice of features is fundamental. Either as a continuous series or conditional (1 vs 0). It is is also important how you select training data taking into account the current regime. An interesting approach to study in addition to price relationships is introducing alt data such as payrolls or yields spreads, or intermarket relationships. I guess that brilliant minds with powerful computers are continuosly processing huge amounts of data pursuing an edge that is a moving target due to everchanging cycles.

Jordan Low asks:

Thank you for your talk. One of the problems I had with classifying up or down days is that the ML model tends to find "buy-the-dip" opportunities to pick pennies, but might get wiped out on a larger volatility event such as a pandemic. Is this a problem you face as well, and what are the strategies to mitigate this?

Jun

27

Prediction Power Of Algorithms, from Newton Linchen

June 27, 2022 | Leave a Comment

It’s been said that machine learning algorithms have no particular prediction power for the stock market, due to it’s intrinsic randomness and the all pervasive opportunity for curve fitting. (My very first inquiry here on the List, back in 2009, was about how one could avoid overfitting.)

Specially when dealing with short-term trading (day trading), it’s considered that nothing can really beat the random nature of the market. And I agree, to a certain point.

But my experience in recent years, particularly applying machine learning for the day trading of stock index futures, would suggest otherwise. There’s a frontier between stock market analysis and data science that can lead to predictive power using machine learning algorithms.