Oct

30

Demand, Supply, and Electricity Prices, from Carder Dimitroff

October 30, 2025 | Leave a Comment

Funded by the U.S. Department of Energy, five scientists associated with California's Lawrence Berkeley National Laboratory claim that data centers are not a significant cause of retail electricity price increases. Counterintuitively, they suggest that data centers could have a beneficial effect in lowering costs. But more research is needed.

Factors influencing recent trends in retail electricity prices in the United States

Summarizing their "Ten Key Findings":

4.1. National-average retail electricity prices have tracked inflation in recent years.

4.2. State-level retail electricity price trends vary widely.

4.3. Residential customers and investor-owned utilities experienced greater increases.

4.4. Load growth has tended to depress retail electricity prices in recent years.

4.5. Behind-the-meter solar was associated with higher prices.

4.6. Utility-scale wind and solar are not—alone—broadly related to recent price increases.

4.7. State renewables portfolio standards are associated with recent price increases.

4.8. Exposure to natural gas price risk increases electricity prices when gas prices rise.

4.9. Hurricanes, storms, and wildfires have increased retail prices.

4.10. Several other variables appear to have limited statistical explanatory power.

Oct

29

An attempt

October 29, 2025 | Leave a Comment

An attempt by chair to halt margin of victory in 2026 for opposition.

Oct

29

The latest from Laurel Kenner

October 29, 2025 | 1 Comment

70++ Trades the Miners

Laurel Kenner

When China suggested Oct. 9 it would strangle rare earth metal exports to the U.S., U.S. mining stocks looked like the easiest way to make a killing since the Internet bubble in 1999.

Being arrogant enough to believe myself among the few who saw the opportunity, I bought a mining stock targeted by Goldman Sachs for a 100% gain.

The stock rose. Then swooned. I sold.

It quickly rose past the earlier high. I bought again. It tumbled below where I had sold the first time.

Greed had led me to forget old investment wisdom. Such as a warning against trying to get even, from Max Gunther’s 1985 “The Zurich Axioms.” Entitled “Stubbornness”, the 11th Major Axiom accurately describes my trade.

I also should have remembered advice from Nick Colas, head of DataTrekResearch, who made his bones at Credit Suisse and Steve Cohen’s SAC Capital. It’s my job, he explained years ago, to know things before they land in the media.

Meaning that if someone is giving tips to news outlets, keep in mind that he inevitably will take better care of his interests than yours.

Read the full post:

Oct

28

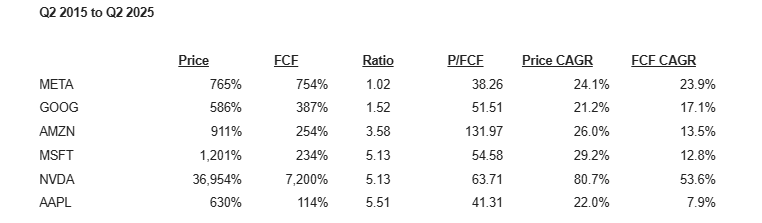

Entertaining valuation exercise, from Big Al

October 28, 2025 | Leave a Comment

Looking at some of the megacaps and comparing their share price growth and FCF growth between Q2 2015 and Q2 2025. The price/FCF figures are the most recent.

Oct

27

State debt, from Jeff Watson

October 27, 2025 | Leave a Comment

Here’s an interesting breakdown and analysis of the debt of individual states. All the usual subjects are near the top.

Report ranks every state’s debt, from California’s $497 billion to South Dakota’s $2 billion

State governments had $2.7 trillion in debt at the end of 2023, a new Reason Foundation analysis finds. This state debt is equivalent to approximately $8,000 per person nationally.

On a per capita basis, Connecticut had the highest state debt, with $26,187 of debt per state resident at the end of 2023. With $22,968 in debt per resident, New Jersey was the only other state with more than $20,000 in liabilities per capita.

Reason Foundation finds 13 states—Connecticut, New Jersey, Hawaii, Delaware, Illinois, Massachusetts, Wyoming, Alaska, North Dakota, California, Washington, New York, and Vermont—had more than $10,000 in debt per resident.

Oct

26

The forgotten janitor who discovered the logic of the mind, from B. Humbert

October 26, 2025 | Leave a Comment

AI relevant:

Finding Peter Putnam

The forgotten janitor who discovered the logic of the mind

Every game needs a goal. In a Turing machine, goals are imposed from the outside. For true induction, the process itself should create its own goals. And there was a key constraint: Putnam realized that the dynamics he had in mind would only work mathematically if the system had just one goal governing all its behavior.

That’s when it hit him: The goal is to repeat. Repetition isn’t a goal that has to be programmed in from the outside; it’s baked into the very nature of things—to exist from one moment to the next is to repeat your existence. “This goal function,” Putnam wrote, “appears pre-encoded in the nature of being itself.”

Stefan Jovanovich offers, with a bit of irony:

From Grok:

Peter Putnam (1927–1987) was an American physicist and theoretical neuroscientist whose work anticipated many modern concepts in cognitive science, artificial intelligence, and philosophy of mind. He studied under prominent figures like Albert Einstein, Niels Bohr, and John Archibald Wheeler, and his ideas influenced early developments in computational theory of mind, though he remained largely unpublished and obscure during his lifetime. Putnam's writings, now digitized and discussed in recent scholarship (particularly following the 2025 rediscovery and publication of his papers), propose a functional model of the nervous system that integrates physics, game theory, and neuropsychology. His theory emphasizes how the brain achieves order and learning through mechanisms like Hebbian plasticity, distributed neural networks, and conflict resolution—ideas that predate similar concepts in predictive processing and reinforcement learning. Putnam's work is not a single, neatly packaged "theory of repetition" but rather a core principle woven throughout his model of cognition and behavior. Repetition serves as a foundational "goal function" for existence, learning, and induction (the process of generalizing from specific experiences).

Oct

25

Second favorite Hungarian, from Venkatesh Medabalimi

October 25, 2025 | Leave a Comment

György Buzsáki is my second favorite Hungarian [after Paul Erdős]. Brain Prize winner, he is from a later cohort. One of the few neuroscientists with a good theory for the Brain, a field that was ~mostly into measuring neural responses in parts of the brain to external stimuli and then telling a story around it. A great talk by him for the interested:

Ways to think about the brain: Emergence of cognition from action | ISTA Lecture with Gyorgy Buzsaki

Oct

24

The gentlemen don’t believe

October 24, 2025 | Leave a Comment

a new all time high at 6825 but the gentlemen don't believe it as it drops 20 points in the last 30 min.

Oct

24

Another Historical Analogy, from Stefan Jovanovich

October 24, 2025 | Leave a Comment

Grok and I have produced this summary of the growth of the electric utilities industry in the United States from 1910 to 1930. [Click on chart for full view.]

Bud Conrad comments:

Not sure what you take from this data. Electrification was probably more important than AI. Its growth rate was big at first in %, but slowed. Recessions were big downturns. What do you apply to today?

Steve Ellison writes:

My grandmother was a telephone operator in the 1920s. It was a high-tech industry at the time.

Carder Dimitroff clarifies:

The definition of an "electric utility" changed over time.

Big Al suggests:

An excellent series available on Prime:

Shock and Awe: The Story of Electricity

Professor Jim Al-Khalili tells the electrifying story of our quest to master nature's most mysterious force: electricity.

Books I haven't read yet, which get lots of stars:

The Power Makers: Steam, Electricity, and the Men Who Invented Modern America

The power revolution is not a tale of machines, however, but of men: inventors such as James Watt, Elihu Thomson, and Nikola Tesla; entrepreneurs such as George Westinghouse; savvy businessmen such as J.P. Morgan, Samuel Insull, and Charles Coffin of General Electric. Striding among them like a colossus is the figure of Thomas Edison, who was creative genius and business visionary at once.

Empires of Light: Edison, Tesla, Westinghouse, and the Race to Electrify the World

In the final decades of the nineteenth century, three brilliant and visionary titans of America’s Gilded Age—Thomas Edison, Nikola Tesla, and George Westinghouse—battled bitterly as each vied to create a vast and powerful electrical empire. In Empires of Light, historian Jill Jonnes portrays this extraordinary trio and their riveting and ruthless world of cutting-edge science, invention, intrigue, money, death, and hard-eyed Wall Street millionaires.

Oct

23

Regional US banks, from Nils Poertner

October 23, 2025 | Leave a Comment

As a European, I am asking: Are US regional banks in trouble (maybe even some larger banks - incl Investment banks). Dodgy consumer loans, then those silly "AI-related" loans? Am agnostic here - I suspect the typical analyst from JPM down the road won't enlighten us here.

Paul O'Leary comments:

No. Looks like over-reaction to a couple credit blips. Then algos pile on and observers who don’t follow the sector conjure up doom scenarios. Zion Bancorp - the main sinner, lost $1B in market cap for a $50mm write down.

Nils Poertner responds:

Hear you, Paul. If enough people would start to worry now, I would worry less (let us see).

Cagdas Tuna adds:

We are at a level any reaction will be exaggerated. If market adds $200bln to NVDA market cap with additional $1blnn revenue then $50m loss will have the same effect on a smaller company's share.

Oct

22

Government shutdown question, from Cagdas Tuna

October 22, 2025 | Leave a Comment

Are the furloughed government employees going to be counted as unemployed? I believe they will be which will be considered as a huge green light for 50bps rate cut in the December FOMC. This shutdown is the perfect storm for Trump’s “Fire Powell and get rates to 0%” scenario.

Bill Rafter responds:

The requirements for being “Unemployed” are that (a) the person is not working , and (b) that person is “looking for work”. I believe the latter qualification would disqualify those furloughed from being considered as unemployed. Not only the shutdown [will delay BLS releases], but the recently nominated BLS head, E.J. Antoni has withdrawn his name from nomination. So BLS is headless.

Alex Castaldo comments:

That is good news for all statisticians, I am sure he is a wonderful guy but he had a reputation for mistakes in calculations.

Oct

22

The Tipster

October 22, 2025 | Leave a Comment

The Tipster:

As he walked, a great sense of loneliness came over him.

He was back in Wall Street. At the head of the Street was old Trinity; to the right the subTreasury; to the left the Stock Exchange.

From Maiden Lane to the Lane of the Ticker — such had been his life.

"If I could only buy some Cosmopolitan Traction!" he said. Then he walked forlornly northward, to the great Bridge, on his way to Brooklyn to eat with Griggs, the ruined grocery-man.

from Wall Street Stories by Lefevre circa 1895 and similar to many who i've known and similar to many get-rich ads of today.

Oct

21

Oil and PPI

October 21, 2025 | Leave a Comment

correlation between the price move of oil in the last month and the ppi rep. it's hard to believe that any except chauncey chair would be worrying about inflation with oil at $56 per barrel.

Oct

21

Trading the transition to AV1, from Asindu Drileba

October 21, 2025 | Leave a Comment

AV1 is a new video compression format that may reduce the size of a video file by up to 50%. The big advantage is that videos will be up to half the size, with the exact same image and audio quality.

Two big consequences may ensue (when AV1 is fully adopted):

- Internet bills for streaming Netflix will reduce.

A 2 GB movie will only cost 1 GB from the perspective of a customer paying their Internet Service Provider. So more frequent subscriptions?

- Netflix will cut its bandwidth costs by 50%. So the profit margin (respective to bandwidth costs) will go up by 50% if users fully adopt AV1?

Currently, AV1 is only available on select hardware chips (listed table on Wikipedia) Maybe as users get new devices, use of AV1 will grow. This will likely happen gradually over several years (maybe half a decade). But an obvious winner would be Netflix & YouTube (Google Stock). Maybe bandwidth is so cheap it won't make a dent in the business revenues? But all major companies seem very enthusiastic about implementing AV1. Maybe bandwidth has it's (less talked about) variant of Moore's law. Where after a few years it gets easier to move stuff around the internet.

Cagdas Tuna wonders:

How many nuclear plants we need to feed that endless “technology”?

Nils Poertner asks:

How would you express this into a trade idea, Asindu? I find it easy to put ideas into a trade - it encourages deeper thinking and gives a feedback when wrong. eg, I was bullish housing London property 2007, but short-term it didn't really work out at all! longerterm yes. it was fuzzy thinking of my behalf.

Asindu Drileba answers:

Going long $NFLX since the business is largely about streaming video. The same pattern occurred in Tesla when the cost of efficient batteries dropped by like 90%. So margins automatically go up. (in theory) Tesla could have still gone under due to debt or something else. So, of course it may may fail (most likely)

Another big draw back is that such "qualitative" insights cannot be tested in the past. Maybe a good analogy would be to go long Starbucks $SBUX if you think the price of coffee wil drop the next 5 years by 50%.

So the ideas may be generalized to:

- Find key Ingredient company X uses in thier products

- Find out if the drop in key ingredient's price over 5 years improves profit margin over X years -> positively impacts stock prices.

This general idea, may then be tested across several industries for example:

- MacDonalds (drop in price of beef)

- TSMC, ASML, INTEL, NVDA (drop price of silver) as silver is very essential in chip manufacturing.

Hopefully testing this across multiple industries on different historical accounts may yield some consistent patterns.

Nils Poertner responds:

Good to write it down in a trading journal and look in a few months what happened. Started writing hand-written letters to friends now. In our digital age, everyone incl me, is going for speed, but deeper thinking - also quality in thinking /research is underrated. Intuitively speaking - we are prob getting some unexpected moves coming, as well.

Oct

20

Calming musical interlude for spicy markets, from Big Al

October 20, 2025 | 1 Comment

I first heard this piece as a teenager, sitting in the theater

watching Barry Lyndon, and I was transfixed:

The Messiaen Trio performs Schubert's Trio No. 2 in E-flat Major, D. 929

I did not know this Mendelssohn work until today and I wondered if

somebody said to her, "Oh yeah? Well, try it in heels!"

Yuja Wang Mendelssohn Songs Without Words Op 67 No 2

Peter Ringel writes:

my emergency high vola setup always includes Chopin. everything to stay off tilt.

Big Al responds:

Gotta love Chopin for the workday playlist.

Chopin: 24 Preludes, Op. 28, Vladimir Ashkenazy

Another discovery for me (fades out but still enjoyable):

Interpreti Veneziani, Antonio Vivaldi RV711 Gelido in Ogni Vena, Davide Amadio

Oct

19

Le Chiffre attacks, from Asindu Drileba

October 19, 2025 | Leave a Comment

In Casino Royal (2006) there is a speculator called Le Chiffre. He would manage money for war lords & other "underground" clients. He would take positions in markets, and then "manipulate them". For example in this clip, he takes a short position in an airlines company, then later bombs a plane belonging to it.

This year, I am starting to think that Le Chiffre is real. Someone opened a crypto account on Hyperliquid (decentralized exchange) and made an $88m profit from short positions that very day.

Cagdas Tuna responds:

Good catch! I have been reading these whales news since March-April 2025 mostly tied to Trump’s policy shifts. It is not difficult to guess who those Le Chiffres might be related to!

Peter Ringel writes:

I wanted to place 1 Nov in my calendar - as a new Mkt Risk date based on Trumps post. Only to realize, I placed this date regarding tariffs before. This makes this old news to some degree. And all of this is potentially an overreaction / a play.

Ed. - lagniappe: Forget Sean Connery, Watch James Bond Make His Real Debut on TV

Before Connery registered his license to kill in the 1962 hit Dr. No, millions of viewers were introduced to Barry Nelson’s “Bond, Jimmy Bond” in a 1954 episode of the CBS anthology series Climax! The show’s producers secured the rights to adapt Ian Fleming’s just-published debut Bond novel, Casino Royale, during their first season.

Since the Climax! version of Casino Royale is only 50 minutes, the plot has obviously been shortened considerably. And yet, if you’ve read the book or, more likely, seen the 2006 movie version that launched Craig’s Bond career, you’ll recognize the basic narrative, even though none of the familiar 007 flourishes are in place. In fact, Nelson doesn’t enjoy “00” status at all — he’s merely identified as a “Combined Intelligence” agent who is tasked with competing head-to-head against the mysterious Le Chiffre (Peter Lorre) in a rousing game of baccarat.

Jeff Watson does some research:

James Bond, the complete list…there are more than you think:

Please list every James Bond on film, TV, and radio. Grok: Alright, here goes-starting with the big-screen Bonds: Sean Connery, George Lazenby, Roger Moore, Timothy Dalton, Pierce Brosnan, Daniel Craig. Then David Niven in the 1967 spoof Casino Royale. On TV, there's Barry Nelson from a 1954 Climax! episode of Casino Royale. Radio Bonds? Bob Holness in a 1956 BBC Casino Royale adaptation, Tom Hiddleston in a 2014 Heart of the Matter series, and Toby Stephens in various BBC radio dramas.

Oct

18

Lessons from The Godfather

October 18, 2025 | 1 Comment

many accomlished and very successful specs and investors have told me that the most helpful book for the young spec to read is The Godfather (and the movies, part 1 and part 2). what advice would you say is the most helpful in these works?

one lesson that is very improtant is never interfere with a relative's marriage and never say anything bad about a relative's spouse.

family and loyalty are keys to success.

never let the others know what you are thinking. and above all never disagree with the boss in front of rivals.

Big Al adds:

The Offer is a really enjoyable derivative work.

Oct

17

George B Shaw, from Nils Poertner

October 17, 2025 | Leave a Comment

You see things; and you say 'Why?' But I dream things that never were; and I say 'Why not?'

- George Bernard Shaw

English Cyperpunk /hacker I met in 2005 had this quote on his screen - and I recall him talking about some digital ccy back then (little did I know back then, was so busy structuring CDOs and keeping up with the Jones.

If we want to nail mkts in coming years and have some fun, it def pays to surround ourselves with ppl outside trad finance (group think!) - from the art, music, acting world, hacker etc…whatever.

There is a certain type of fatalism in the West as well (David Hand, the British statistician, speaks about it as well in his "miracle" book. It has something to do how we perceive the world.)

Oct

16

Hubris is going to a New All Time High, from Sushil Kedia

October 16, 2025 | Leave a Comment

Saudi Arabia has announced the Rise Tower that is likely to have a height twice that of Burj Khalifa! 2000 meters up from the ground! It is likely to cost 5 Billion Dollars. One is left wondering in a world where everyone manages to almost manages to get decent enough sleep every night with Trillion Dollar deficits, what is Hubris doing having been left so far behind!

Nils Poertner writes:

Wondering what to make of this though, Sunil. Saudi Arabia's main stock Index (TASII peaked in 2006. and never fully recovered properly. Any idea how to express it into some trading idea so we can test our hypothesis?

William Huggins comments:

The 2006 Saudis run is very similar to the soul al manakh run up 20 years before. In particular for Saudis though, it's a market that forbid ahoet selling so when the bulls got started there was no guardrail until they simply could find no bigger fool.

Nils Poertner responds:

Thanks William. Maybe one needs to look at oil (bearish oil story?) - oil doesn't move forever and then it moves a lot. (not an oil trader though - just something that came to mind)

Alex Castaldo offers:

For those too young to remember the events of 1981:

The Souk al-Manakh Crash

From 1978 to 1981, Kuwait’s two stock markets, one the conservatively regulated “official” market and the other the unregulated Souk al-Manakh, exploded in size, growing to the point where the amount of capital actively traded exceeded that of every other country in the world except the United States and Japan. A year later, the system collapsed in an instant, causing huge real losses to the economy and financial disruption lasting nearly a decade. This Commentary examines the emergence of the Souk, the simple financial innovation that evolved to solve its rapidly increasing need for liquidity and credit, and the herculean efforts to solve the tangled problems resulting from the collapse. Two lessons of Kuwait’s crisis are that it is difficult to separate the banking and unregulated financial sectors and that regulators need detailed data on the transactions being conducted at all financial institutions to give them the understanding of the entire network they must have to maintain financial stability. If Kuwaiti officials had had transaction-by-transaction data on the trades being made in both the regulated and unregulated stock markets, then the Kuwaiti crisis and its aftermath might not have been so severe.

Oct

13

Advice from the past, from Humbert X.

October 13, 2025 | Leave a Comment

Stock market advice from 1944 - how would one test it?

This Is the Road to Stock Market Success

Page 30:

If one cannot profit by trading in the highest grade issues — one certainly cannot profit by trading in "cats and dogs". If our industrial giants cannot advance — what prospects arc there in the stability of others? Although this sounds logical there are exceptions, and the "time element" has much to do with the selection.

At the top of a Bull market, when uncertain as to whether the upward movement is exhausting itself or not, it is comparatively safer to have your money in investment, rather than speculative, issues. Of course, it is most advisable to be out of the market entirely at such periods. Investment stocks are not the leader in a Bear movement and, therefore, it is safer to have your money invested in this category — and to watch the market closely. If the speculative and "cheap" stocks begin to decline — you can still dispose of your investment issues without much loss — as they follow rather than lead the Bear movement. Likewise, when you note that investment stocks stand still — and "cats and dogs" or even the better grade issues advance — it should put you on your guard as the market may be "topping" and in line for a good reaction. The 1937 Bear market was foretold by investment stocks in November, 1936. They refused to go higher.

Larry Williams comments:

I learn so much from his writings, such as comparative strength and targets.

[Ed. - Note on the photo:

In 1943, when World War II came, Helen Hanzelin, a Merrill Lynch, Pierce, Fenner, & Beane telephone clerk, became the first woman to work on the NYSE Trading Floor.

Another three dozen women answered the country’s call to duty and filled vacant posts vacated by soldiers sent overseas on the trading floor but were booted out when the war ended, and men returned home.

Women of the New York Stock Exchange ]

Oct

12

Counting and measuring, from A. Humbert

October 12, 2025 | Leave a Comment

We use quantitative tools - "counting" - to measure and analyze markets, and I enjoy coming across scientific measurements that are new to me and also amazing in scope, such as the sverdrup. The sverdrup is a unit describing the volume of water transport in ocean currents. One sverdrup is a volume flux of one million cubic meters per second (1 Sv = 10^6 m^3 per second). Named after Harald Sverdrup.

From the web:

The strongest ocean current measured in sverdrups is the Antarctic Circumpolar Current (ACC), the largest and most powerful current system on Earth. The ACC is a wind-driven current that flows clockwise around Antarctica, uninterrupted by landmasses.

Measurements of the ACC's volume transport vary, but all figures show it is in a class of its own:

Estimates of the ACC's mean transport range from 100 to over 170 sverdrups (Sv). One study found an average transport of 173.3 Sv through the Drake Passage, the current's narrowest choke point. To put this in perspective, this is over 100 times the combined flow of all the world's rivers.

The graphic shows how relatively narrow the Drake Passage is.

We certainly measure volume in markets. Are there specific flows and currents? Choke points?

Asindu Drileba writes:

In a book recommended by The Chair, This is the Road to Stock Market Success, the author mentions that (paraphrased), "When the trading volume of a stock changes by a large amount, yet the price doesn't move by much, it is time to get out of the market."

Oct

9

Jewish Hungarian, from Nils Poertner

October 9, 2025 | Leave a Comment

What is it with Hungarian Jewish who came to the US - so many of them achieved great things. My book shelf is full of them, Darvas (Trading), S Meisner (Acting)…..even my trading platform Interactive Brokers was founded by one (Thomas Peterffy).

Maybe a combo of rare language ??/ culture + hardship first + grid + ability to flourish in the US gave them superpower. Soros, I guess was (Jewish) Hungarian as well.

Venkatesh Medabalimi asks:

Where is my no.1 Hungarian? May I remind everyone about Paul Erdős.

Laurel Kenner offers:

An amusing book on the subject: Made in Hungary : Or Made by Hungarians, by György Bolgár.

Nils Poertner responds:

Thanks both. Found this on Erdős:

Paul Erdős: The Oddball’s Oddball

He would appear on the doorstep of fellow mathematicians without warning–a frail, disheveled, elderly man, hopped up on amphetamines and wearing a ratty raincoat–and announce, in a thick Hungarian accent, “My mind is open.” For a day, or a week or a month, the man or woman who answered the knock would have to take nonstop care of this helpless guest who couldn’t figure out how to cut a grapefruit or wash his underwear–and in return would be permitted the exhausting, exhilarating experience of following the thought processes of Paul Erdős, the most prolific and arguably the cleverest mathematician of the century.

Oct

8

Charles Ranlett Flint

October 8, 2025 | Leave a Comment

a key figure of the 1900s, according to Sobel:

Charles Ranlett Flint (January 24, 1850 – February 26, 1934) was the founder of the Computing-Tabulating-Recording Company which later became IBM. For his financial dealings, he earned the moniker "Father of Trusts". He was an avid sportsman and member of the syndicate that built the yacht Vigilant, that was the U.S. defender of the eighth America's Cup and was the owner of the yacht Gracie.

Oct

7

Miscellany

October 7, 2025 | Leave a Comment

Asindu Drileba has been watching the Daily Spec calendar:

After being hammered in Aug, Orange did well in Sept. It transitioned to a positive day in the S&P 5/6 times.

Nils Poertner is getting wisdom from the classics:

The most certain sign of wisdom is cheerfulness.

- Michel de Montaigne

some type of cheerfulness def relevant for us in markets /trading - in particular when social moods go south / ppl fall for chatboxes (overuse it !) and confuse with reality etc.

Big Al is going for history:

This is the audio version:

The History of the United States Navy

but I am also watching the video version for free on Amazon Prime. The author:

Craig Lee Symonds (born 31 December 1946, in Long Beach, California) was the Distinguished Visiting Ernest J. King Professor of Maritime History for the academic years 2017–2020 at the U.S. Naval War College in Newport, Rhode Island. He is also Professor Emeritus at the U. S. Naval Academy, where he served as chairman of the history department. He is a distinguished historian of the American Civil War, World War II, and maritime history. His book Lincoln and His Admirals won the Lincoln Prize. His book Neptune: The Allied Invasion of Europe and the D-Day Landings was the 2015 recipient of the Samuel Eliot Morison Award for Naval Literature, and his book Nimitz at War: Command Leadership from Pearl Harbor to Tokyo Bay won the Gilder-Lehrman Military History prize.

Oct

5

The Pursuit of Wealth

October 5, 2025 | Leave a Comment

The Pursuit of Wealth by Robert Sobel is a quirky but informative history of wealth creation, introducing such things as the use of ice, and beer, and cattle as drivers of wealth. there is a very good discussion of the start of Merrill Lynch, also the history of IBM.

An epic saga that recounts the turbulent history of money. The Pursuit of Wealth is a fascinating 5,000 year journey through the evolution of money and investing. From risk versus return in Mesopotamia through today's rough-and-tumble, high-stakes stock markets, this behind-the-scenes tale will intrigue both financial historians and history-minded investors alike.

The Ancient World — The Imperial Age of Alexander and Rome — The European Middle Ages: The Birth of a New Economic Age — The Italian Bankers and their Clients — The Atlantic Age — Europe's American Empires — The English Advantage — The American Paths to Wealth — Industrial Wealth — The Mechanization of Agriculture — Infrastructure and Wealth — Emperor Wheat and King Cotton — Gold, Silver, and the Civil War — The Impact of the Transcontinentals — The Arrival of Big Business — The Government-Industrial Complex, 1914-1929 — The Great Bull Market of the 1920s — The Old and the New in Post-World War II America — The Revival of the Securities Markets — Creating Wealth During the Great Inflation — The Democratization of Wealth.

Oct

3

Where am i wrong, from Larry Williams

October 3, 2025 | 2 Comments

Zero sum game: for every $ that wins the same amount will be lost. REALLY? you bought at 7 sold to me at 10 I sell at 20 and the contract goes off the board and delivered at 22 who lost? We lost that we could have made more $$ but where is a net loss?

Steve Ellison comments:

Adverse selection can make us all feel like losers. If I sold at 10, I should have held to 22. Or I should have put on more size. If I bought at 7, and it went to 5, that would have been even worse.

Jeff Watson goes literary:

But Yossarian still didn't understand either how Milo could buy eggs in Malta for seven cents apiece and sell them at a profit in Pianosa for five cents.

[ … ]

Milo chortled proudly. "I don't buy eggs from Malta," he confessed… "I buy them in Sicily at one cent apiece and transfer them to Malta secretly at four and a half cents apiece in order to get the price of eggs up to seven cents when people come to Malta looking for them."

"Then you do make a profit for yourself," Yossarian declared.

"Of course I do. But it all goes to the syndicate. And everybody has a share. Don't you understand? It's exactly what happens with those plum tomatoes I sell to Colonel Cathcart."

"Buy," Yossarian corrected him. "You don't sell plum tomatoes to Colonel Cathcart and Colonel Korn. You buy plum tomatoes from them."

"No, sell," Milo corrected Yossarian. "I distribute my plum tomatoes in markets all over Pianosa under an assumed name so that Colonel Cathcart and Colonel Korn can buy them up from me under their assumed names at four cents apiece and sell them back to me the next day at five cents apiece. They make a profit of one cent apiece, I make a profit of three and a half cents apiece, and everybody comes out ahead."

Oct

2

Academic panic

October 2, 2025 | Leave a Comment

a tragedy from not followinig drift

UChicago Lost Money on Crypto, Then Froze Research When Federal Funding Was Cut

While Stanford responded to the federal funding research freeze by halting administrative hiring and protecting research, the University of Chicago panicked.

Oct

1

Lebanon, from Nils Poertner

October 1, 2025 | Leave a Comment

Lebanese traders from the 1980s tell me how chaotic that decade was - high vol ever day - for yrs. Survival was key! Started reading every bit about it in the last few weeks. (The thing that Stefan is right about is that the self-image we have in West and realtiy - there is a huge gap for sure!! Am not speaking about military though - I meant anything else)

The Lebanese Economic Crisis: How It Happened; the Challenges that Lie Ahead

September 27, 2021

Lebanon is experiencing one of the worst economic collapses in recent history. The currency has lost more than 90 percent of its value; an estimated three in four Lebanese citizens are now below the poverty line, and the country is beset by food, gas, and medical shortages. The power grid can barely maintain electricity for cities, with frequent blackouts occurring. Finally, the country had to default on its debt payment, launching its debt crisis. The debt crisis didn’t come suddenly, but was building up over time due to economic decisions made by previous governments. To understand how this crisis came to be, an examination of Lebanon’s modern history is in order, starting with the civil war in 1975.

Larry Williams writes:

Chaotic? In 1973 Shearson AmEx had me go there to lecture an teach trading - some high flyer commodity mooches had come in and lost lots of $$ for some locals who did not understand margin calls. The high flyers from Chicago were found gutted on a barb wire fence out in the country! The war broke out we could not get out for about a week so hung low then finally bribed our way home.

Nils Poertner responds:

my 2 cents are on Larry and all savvy Lebanese traders going forward. Good idea to live in more rural areas in the US, UK etc to see things unfolding as well. And keeping the internal chatter to a minimum (as always).

Stefan Jovanovich analogizes:

If LW disagrees, he will, I hope, correct this latest folly from the List's history channel wannabe. The reason the Oregon Trail came first was that it was the one safe destination for the missionaries. The Indians of the rain forest coastal Northwest were the tribes with no history of revolt against the Brits, Russians and Americans. The wars on the Plains started when some smart money decided that they could colonize the spaces between Council Bluffs and the Dalles. That analogy comes to mind every time I look at the modern history of the adventures of the Americans in Lebanon.

Larry Williams offers:

My brother on law who is better read than I am an a deeper thinker says this is a good read on the western adventure:

The Undiscovered Country: Triumph, Tragedy, and the Shaping of the American West

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles