Dec

31

A diet shock Bill Gates does not mention, from Larry Williams

December 31, 2023 | Leave a Comment

Mr Fake Meats does not support is own research:

Findings: In 2017, 11 million (95% uncertainty interval [UI] 10-12) deaths and 255 million (234-274) DALYs were attributable to dietary risk factors. High intake of sodium (3 million [1-5] deaths and 70 million [34-118] DALYs), low intake of whole grains (3 million [2-4] deaths and 82 million [59-109] DALYs), and low intake of fruits (2 million [1-4] deaths and 65 million [41-92] DALYs) were the leading dietary risk factors for deaths and DALYs globally and in many countries. Dietary data were from mixed sources and were not available for all countries, increasing the statistical uncertainty of our estimates. [Funding: Bill & Melinda Gates Foundation.]

Note meat does not pop up in this data.

Jeffrey Hirsch writes:

Lot’s of meat works for me. Keto, exercise and sleep. I’m down 50lbs. Skipping the Booze was a big help.

Pamela Van Giessen comments:

Virtually all nutrition studies are pretty meaningless because it is almost impossible to confine study to one food to the exclusion of all else (do people who eat red meat also not drink and exercise regularly; do people who eat low grain diets also eat a lot of processed food and lack exercise, and so on).

Maybe you can hack your health and longevity with diet. Maybe not. I’d err on the maybe not side and get a lot of good exercise (mix of cardio and strength training), dial back the alcohol and soft drinks, drink a goodly amount of water, eat everything in moderation but be sure to get good protein, green veggies, and fruit, especially as you age. But know that your diet is meaningless without the exercise, good mental health, and purpose in life — whatever it may be for you.

Pretty much what my grandmother, born in 1901, used to say. Except I also drink a glass of athletic greens every morning. Can’t hurt. And stretch and do planks/core work. Both are super important to maintaining balance and agility. More ill health and deaths start with falls than anything else.

K. K. Law wonders:

No argument about the benefit of exercising. But a simple and cursory inspection of the regional maps of (a) and (b) show the people in the regions highlighted by red ellipses appear to have lowest death rates. Do they have something in common in their diets that lead to longer lives?

Pamela Van Giessen responds:

Shouldn’t the question be to first isolate commonalities in everything among the people in those regions as opposed to assuming it is solely a food such as fatty fish? Is it just omega 3 or do peoples in those areas also have lower obesity rates, for instance? If they have lower obesity rates (and where there are lower obesity rates, there are routinely lower premature death rates), how come? What are they doing? Is it all diet or are there other variables?

That said, I try to eat fish at least twice a week. Fortunately I have a neighbor who likes to fish but he doesn’t like to eat fish. So we have a steady stream of fresh Montana trout. And elk. Elk meat is fantastic.

Kim Zussman adds:

Genes are a big factor in longevity, likely the biggest factor (besides distance from windows in Moscow). Could explain regional performance since primates primarily mate locally. The best tactic is to choose your parents carefully.

H. Humbert writes:

The media story on how the 100 yr old lived that long because he had one shot of whiskey per day or ate French fries three times a week always crack me up. I’m not saying nutrition (and exercise) do not matter, but of course their longevity is most likely because they won the gene pool lotto and not because of whatever quirky dietary habit they had.

“Virtually all nutrition studies are pretty meaningless”. This comment always cracks me up. It is untrue. Of course epidemiological and observational studies (observation) have value, even if they are not double blind placebo. For example, if you observe four people eat strychnine and die, would you not conclude that it might be dangerous? Would you stay in line to be the fifth person, even though you have merely done an observational study, and strictly speaking causation is unproven by a scientific study? If your answer is “no” then you must believe that epidemiological and observational studies have some value. Otherwise, you would be “blinded by science” (and dead).

Humbert H. responds:

Of course simple studies, like is strychnine dangerous, are useful. However, studies of subtle effects are generally useless, because of the various biases involved. It is to this day not possible to know if Ivermectin helps fight Covid, or if so, to what degree. Partly is because people are invested in the outcome and the set up of the studies appears suspect, and partly is because the effect is seemingly not overwhelming. Hearing about various "Coffee is good/bad for your health" through the years is a more common example.

Big Al adds:

Another issue with broader studies is that we are learning more about how different individuals with different genetics respond differently to coffee or salt or red wine or a high-fat diet. It becomes more difficult to make conclusions like "coffee is good/bad for you".

Humbert H. replies:

I agree completely. Coffee, if I drink it for a week and than stop, gives me terrible, incapacitating headaches, and if I keep drinking it, eventually I will get the same headaches. I don't know anyone else who has the same side effects, but I can only drink it once in a while. So all the recent studies I've read about the positive effects of its consistent use are of no use to me.

H. Humbert agrees:

Yes, this is absolutely true. And the genes may respond differently to foods over time, as other lifestyle factors change. Epigenetics.

Big Al offers:

An interesting show to watch:

Live to 100: Secrets of the Blue Zones

Though thinking about the stats, you would assume there would be pockets of longevity around the world just by chance. Also stat-wise, he claims there is a correlation in Corsica between the longevity of people in towns with the steepness of the streets in the town (steeper = longer lived). Haven't seen the data, but that's an interesting one on an intuitive basis. Maybe you could compare NYC residents on the first floor vs those on the fourth floor of a walkup building. ![]()

Peter Saint-Andre is skeptical:

That Blue Zone hypothesis is somewhat questionable. Here's one critique.

My impression from previous reading is that in some of these remote and frankly somewhat backward areas (e.g., Sardinia, Ikaria), the original cohort of centenarians contained a large number of people who faked their ages (e.g., to obtain government benefits), which they could do because they were born before birth certificates were common. The centenarian numbers didn't hold up in cohorts born after documentation of birth dates kicked in.

Pamela Van Giessen maintains:

The comment is true. Nutrition studies are meaningless. It’s a backward science in crisis with a host of issues starting with what gets published (and then reported) to garbage analytical studies on the same data sets, most of which have null results (but don’t get published) done from a laptop in about an hour.

Until people spend some time learning how “science” gets funded and what gets published, and demanding change, our knowledge will remain more antiquated than my grandmother’s guidance which was at least practical and based on real world experience.

John McPhee wrote about the funding problem in geology in Annals of the Former World. His observations apply to most fields. In short, what gets funded is what is trendy until it is not and then the new trend gets funded. This process takes about 100 yrs. In nutrition it may be worse. Vinay Prasad does a nice recap of the problems.

Dec

29

The new year market, and a book

December 29, 2023 | Leave a Comment

looks good for last two market days of the year and first 10 days of jan. then it's very iffy until feb. friday should be very good for the S&P.

the sign of the four. all 4 observations from 1996 to present with S&P way up in the previous 30 days - 1998, 2017, 2019, 2020 - were extraordinarily bullish. average up 2% by 3 weeks forward.

nature as guideline for building. the r and k factors in buildings. the importance of novelty. all sorts of guidelines for building. many market analogies:

Construction Ecology: Nature as a Basis for Green Buildings

Industrial ecology provides a sound means of systematising the various ideas which come under the banner of sustainable construction and provides a model for the design, operation and ultimate disposal of buildings.

Dec

28

Context

December 28, 2023 | Leave a Comment

back to the old days. a certain university indicated pleasure with their 2.2% return in yr ending june 23 in the Context of the S&P and Nasdaq returning 20%+ each during the period. they praised the fund managers.

too terrible to be true. were mainly invested in venture capital and private equity. apparently they never heard of the Context of ever changing cycles. Dare I suggest Bacon professional turf handicapping or edspec to them.

a loss of 20%+ on 50 billion endowment versus their bogey could pay for much DEI research. The arrogance of their slapping themselves on the back for the Context of this performance is too horrible to believe.

A reader writes:

Imagine the fees they are paying for that pittance of a return.

Vic continues:

that goes without saying. they are past masters at paying their fund managers fantastic salaries and bonuses based on their sector comparison.

Dec

26

Laurel Kenner’s Musical Christmas Card 2023

December 26, 2023 | Leave a Comment

Merry Christmas to all Specs. I hope you enjoy my latest musical Christmas Card. It has been 23 years since the Chair and I, with the assistance of James Goldcamp and now Big Al and Alex Castaldo, founded the SpecList, starting with early readers of our column at TheStreet. The Specs have contributed so much value and humor to our lives. I thank you and wish you all a Happy New Year.

Laurel Kenner's Musical Christmas Card 2023

Laurel Kenner Plays J.S. Bach Prelude in C minor

Laurel Kenner performs Bach's Fugue in C minor, WTC Book I

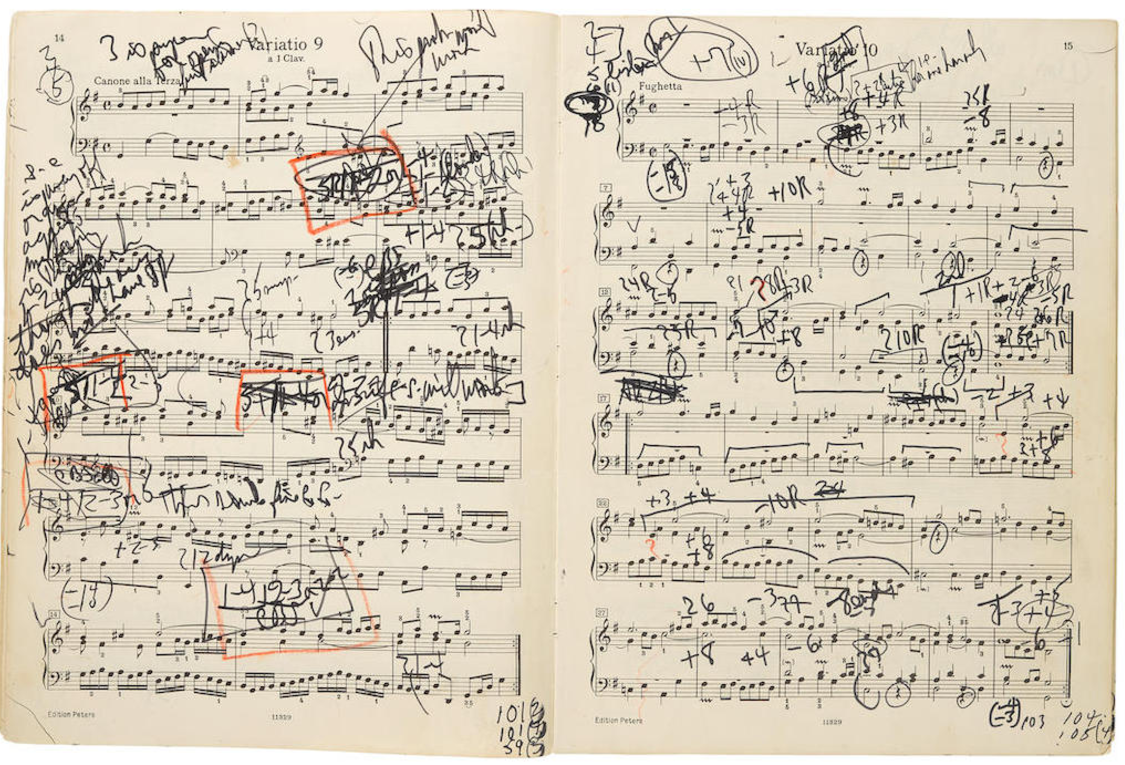

Adam Grimes responds:

Thank you for sharing! Glorious piece, and such a great set. I continue to chip away through the Goldbergs…a bit at a time. Cheers, Happy Holidays, and perhaps a hint of Peace in these troubled times.

Laurel Kenner encourages:

The Goldbergs are a very worthy pursuit, Adam. Go for it! I’ll look forward to your musical Christmas card!

Dec

26

Happy new year?

December 26, 2023 | Leave a Comment

one big question is where is sp going to end of year and first days of new year. the years 2921, 2020, 2019, 2010, and 1998 appear most similar. nothing special to end of year. then big up starting near the end of Jan.

too small a sample size - too many changes. but it looks like 4 of 5 up to end of year, up big 58. up big 44. and the previous 3 unchanged.

Dec

25

Holiday book rec that Aubrey-Maturin fans should enjoy

December 25, 2023 | Leave a Comment

Cochrane: Britannia's Sea Wolf

Daring and dashing, Thomas, Lord Cochrane led an extraordinary life. This bold commander, whose exploits far exceeded those of any fictional counterpart, was dubbed the "Sea Wolf" by no less than Napoleon himself. More than just a colorful military figure, however, Cochrane entered Parliament, became a radical reformer, and fought official corruption…earning powerful enemies in the process. They plotted revenge–and very nearly succeeded–but Cochrane's final triumph as a conquering hero remains one of the most amazing tales ever told.

Gyve Bones adds:

O'Brian based much of Jack Aubrey's character and several exploits from the life and naval adventures of Earl Cochrane. C.S. Forrester was inspired by Cochrane as well for his Horatio Hornblower novels.

Here are some public-domain works by Cochrane himself, memoirs of his service in (and out of) the Royal Navy.

Dec

22

Fire, from Nils Poertner

December 22, 2023 | Leave a Comment

A number of factors contributed to the destruction caused by the Great Fire of 1910. The wildfire season started early that year because the winter of 1909–1910 and the spring and summer of 1910 were extremely dry, and the summer sufficiently hot to have been described as "like no others." The drought resulted in forests with abundant dry fuel, in an area which had previously experienced dependable autumn and winter moisture. Hundreds of fires were ignited by hot cinders flung from locomotives, sparks, lightning, and backfiring crews. By mid-August, there were 1,000 to 3,000 individual fires burning in Idaho, Montana, and Washington.

same as in mkts- the longer the rally…might not be one major fire but more a series coming.

Perhaps the most famous story of survival is that of Ranger Ed Pulaski, a U.S. Forest Service ranger who led a large crew of about 44 men to safety in an abandoned prospect mine outside of Wallace, Idaho, just as they were about to be overtaken by the fire. It is said that Pulaski fought off the flames at the mouth of the shaft until he passed out like the others. Around midnight, a man announced that he, at least, was getting out of there. Knowing that they would have no chance of survival if they ran, Pulaski drew his pistol, threatening to shoot the first person who tried to leave. In the end, all but five of the forty or so men survived. Pulaski has since been widely celebrated as a hero for his efforts; the mine tunnel in which he and his crew sheltered from the fire, now known as the Pulaski Tunnel, is listed on the National Register of Historic Places.

Stefan Jovanovich recommends:

Gyve Bones agrees:

I was tempted to mention that book, which I enjoyed. I read it after reading A River Runs Through It.

Pamela Van Giessen suggests:

For a comprehensive look at the fire of 1910 and how it was fought (and lost), The Big Burn: Teddy Roosevelt and the Fire that Saved America, by Timothy Egan, is interesting.

Big Al points to:

Fire Weather: A True Story from a Hotter World

About the Fort McMurray wildfire in 2016.

Dec

21

Thought Leaders: Christopher Alexander, from Nils Poertner

December 21, 2023 | 1 Comment

Chris Alexander on architecture (ugliness, beauty and a lot more) and why it matters to humans. He taught at Berkeley, California. The immediate surrounding (office, residential place) probably also influences how we view the world (even markets). (I always preferred City of London - the old square mile - vs the new Canary Wharf buildings etc.)

Gyve Bones writes:

H.L. Mencken wrote about this in the Baltimore Evening Sun, and the column was included in his Prejudices: Sixth Series (1927):

I have seen, I believe, all of the most unlovely towns of the world; they are all to be found in the United States….Here is something that the psychologists have so far neglected: the love of ugliness for its own sake, the lust to make the world intolerable. Its habitat is the United States. Out of the melting pot emerges a race which hates beauty as it hates truth.

Nils Poertner responds:

imagine people would slow down a bit in their lives and appreciate some of the better architecture (it is not that we don't have it).

Larry Williams differs:

Right! Americans love ugly, hate beauty …that’s why we go to the Grand Canyon, Glacier, Yosemite, the beaches, and have great museums. Mencken must have had a very long nose to look down upon.

William Huggins comments:

Best view on neoism was Chris Beckwith in Empires of the Silk Road: A History of Central Eurasia from the Bronze Age to the Present where he identified the problem as the belief in constant revolution, that there was no future unless the old was destroyed. This morphs into a fetish for the new, regardless of its merit. He clearly loves the classics and hates to communists for their desire to cast aside beauty for revolutionary.

Dec

20

Still December

December 20, 2023 | Leave a Comment

is there a tendency for the S&P to rise in last 7 days of dec? i looked at this when the previous month was way up since 1996, the answer is yes. about 3/4 up to end of month.

the sp has gone up 11 days in a row. never before in dec. what does it portend? meager rise with not much vol until end of year. slightly bullish for jan.

[After the close…]

always the unexpected: the decline of 42 big S&P points from 2pm to 2:30 et was the 3rd biggest ever. and yet 5 days later the market on the 5 occasions it dropped 40 big or more, the sp was up 97 big with a s.d. of 100.

Dec

19

Arithmetic vs geometric average returns, from Zubin Al Genubi

December 19, 2023 | Leave a Comment

How does the arithmetic average differ from the geometric average in measuring returns?

The arithmetic average calculates the average gain per trade without accounting for the compounding effect. On the other hand, the geometric average (CAGR) considers the actual compounding from start to finish, providing a more accurate measure of the actual return.

Can positive arithmetic averages lead to losses or ruin in trading?

Yes, even with a positive expected arithmetic average, losses or ruin are possible due to the risk of ruin and the increased burden in recovering from drawdowns, . Geometric averages, considering drawdowns and compounding, offer a more realistic view of potential outcomes.

From quantified strategies.

This is the path dependency issue. Conclusion is position sizing is important to avoid risk of ruin or catastrophic drawdown.

Bill Rafter responds:

You are almost there. Think: can these two means be used to identify anything else?

Kora Reddy adds:

also called volatility drag:

vol_drag = mean(x) - exp(mean(log(x)))

or an approximated formula

Volatility Drag = -0.5* (Volatility)^2

PFA useful leteratrue

Zubin Al Genubi replies:

The expectation and the maximum drawdown can be used to compute optimum f, the fixed fraction of capital to risk on each trade.

I read the article [on volatility drag] and disagree with it. Ralph Vince says that a system will experience drawdowns equal to f and that is the only way to the highest compounding resulting return. It is impossible to get the return without the volatility. Diversifying systems can counter balance drawdowns if truly uncorrelated.

It is non-ergodicity of trading markets that make the geometric mean more important. A loss is not a straight line down, but convex because it takes a 100% gain to recoup a 50% loss. The geometric mean captures this. Arithmetic mean does not.

Big Al offers:

Shannon's Demon, or rebalancing between uncorrelated assets (they claim it's "little known", but that is doubtful).

Kim Zussman contextualizes:

"Say, your fund is down almost every year. What value do you add?"

"We're uncorrelated! (with buy and hold)."

Dec

19

Our fellow Spec LW does a new interview, from Easan Katir

December 19, 2023 | Leave a Comment

Larry Williams 2024 Market Outlook

Dec

19

Optimizing profit over time, from Zubin Al Genubi

December 19, 2023 | Leave a Comment

Most people search or try optimize for highest system return. It is not the most profitable over time. The amount of profit over time is determined by the money management you apply to the system more than by the system itself. This is mind boggling to me.

H. Humbert counters:

In one of the many money manager podcasts I listen to, one of them used this very assertion as an example of, shall we say politely, a less than optimal belief. But he used stronger language.

Peter Ringel writes:

It is still important to aim for a good naked system (without position sizing applied). The risk/drawdown vs overall return relation comes from the position sizing applied world. A better core system makes more aggressive position sizing possible.

Zubin Al Genubi replies:

A better core system makes more aggressive position sizing possible.

Disagree. According to Ralph Vince bets in excess of optimal f results in lower overall system returns due to larger drawdowns with larger size! Comparing core systems should be by geometric mean, not necessarily w/l, %win, t score, etc. Interestingly Sptiznagel says something very similar. There is something very important going on here that is being missed.

Gyve Bones comments:

Depending on the breaks of course, there is no money management system method that can turn a no-edge “loser” naked trading system into a winner apart from lucky breaks. But a winner with a naked edge can be ruinous with over-sized bets, or smothered by various vig drags if the bets are under-sized. As one guy put it in this article from 2000, the key is to find the sweet spot in between.

But as Ralph has shown, the sweet spot, the “optimal-ƒ”, means that the better the system, the higher the ƒ value, on a scale of 0.0 to 1.0 means that if the largest losing trade used in the sample ever re-occurs, your stake will have a single-trade drawdown equal to ƒ%. That is, if the optimal–ƒ is 0.65, and then you have a re-occurrence of the worst trade from the history of the system, you will have a 65% drawdown of the portfolio. But trading at ƒ is the only way to make sure you’re not over betting or under-betting in order to maximize the potential gains of the trading system, if you accept the premise that the series of trades you feed into the optimal-ƒ algorithm is a reasonable and realistic representative of the trade returns going forward trading that system.

Larry Williams has a definite view:

BETTER CORE SYSTEM ETC IS MEANINGLESS. The past is never the future and it takes only one trade to put a bullet through your skull when you mess up. Past ’good numbers’ from a trading strategy are meaningless.

Peter Ringel responds:

but even the Kamikaze-trader dialed it up to 11 to win championships in a stellar way and endured brutal drawdowns. and the final win, of course, impossible without an underlying strategy.

Larry Williams replies:

Kamikaze man was clueless, mindless and fearless as well as blessed with luck and Mr Vince to plug holes in the dyke.

Zubin Al Genubi gets statistical:

A benefit of using parametric techniques is that empirical data isn't required and we can do what if's as conditions change.

James Goldcamp writes:

When coming up with a position size rule it must be as with the system itself subjected to in and out of sample testing. We used to have a program circa 1998 that would calculate the optimal ("f") amount of capital over first X trades then apply to the rest of history using the optimal method. This led to hypothetical out of sample blow up not infrequently due to the instability of model returns (even for models that were to some degree still profitable on blind data).

My subjective belief is that most edges (perhaps other than those derived for market making ultra, frequent, or arbitrage/structural type trades) are way too unstable to try to extract anything approaching a past optimal bet size. It seems like the 3 questions or dimensions that one deals with are will it still work at all in future, if it does how much will it vary from the past (expectation and path), and how will the aforementioned two work in relation to other methods you have that work. The last point relates to in my observation the most common form of risk management, multiple bets with negative or low correlation, that's perceived to be a better way of managing risk than dialing leverage of any particular return stream. Any of the aspects are subject to the ever changing cycles.

Big Al adds:

Often the tricky part is finding uncorrelated assets that are reasonable trades or investments.

James Goldcamp responds:

I agree totally. For me it's the 3rd uncontrollable variable - if the ideas work, how well they repeat (robustness I guess), and how they continue to relate to other things. Hypothetical modeling of complex portfolios often assumes all of these properties will continue. There are lots of ways for a leg on your table to collapse!

H. Humbert comments:

Since the number of unknown important variables in complex real-world problems as opposed to simple games of chance of even poker can never be fully known, and the influence of even known variables, by themselves and in combination, can only be examined via past data and in no controlled experiments, it seems like any system can experience a catastrophic failure and/or change in being amenable to any strategy at any time. I admire traders who brave these unknowns and prefer to rely on drift that seems to be more robust and stopped only by major wars and revolutions.

Dec

18

TLT follow-up, from Big Al

December 18, 2023 | Leave a Comment

TLT was way down since we discussed it at the end of August. Interestingly, HYG down nowhere near as much and still ahead of TLT YTD. My intuition would *not* be to see a narrowing of the spread between UST and HY.

Zubin Al Genubi responds:

Bonds have positive convexity, and will experience larger and larger price increases as the yield falls.

Alex Castaldo explains:

I am disappointed that the major ETF web sites (etfdb.com, etf.com, etc.) don't seem to give Duration values for Bond ETFs in a reliable and consistent way (sometimes they have it sometimes they don't). With a little effort I was able to find the following on 2 different sites:

TLT Portfolio Data

DURATION 16.11

YIELD TO MATURITY 5.19%

HYG Portfolio Characteristics

Average Yield to Maturity as of Dec 15, 2023 7.64%

Effective Duration as of Dec 15, 2023 3.37 yrs

Assuming these are both correct, up to date, etc. we can see that the Duration (responsiveness of price to yield change) of TLT is about 4.7 times that of HYG. And this is quite common when comparing high yield and high rating bonds (or bond funds).

Zubin Al Genubi adds:

Convexity, along with duration explains bank issues with rapid yield changes, and TLTs rise this month.

Dec

18

Sleep to solve problems, from Larry Williams

December 18, 2023 | Leave a Comment

Edison believed that the human mind solves problems best just after a person wakes up from sleep. When he was working on a difficult problem, he would nap in his office armchair and hold a steel ball in his hand. When he would start to fall asleep, his arm muscles would relax and the ball would drop from his hands and land on the floor. This would wake him up and he would find that he had the solution to his problem.

Salvador Dalí, the painter, also believed that interrupting the onset of sleep could make him more creative, and he held a heavy key rather than a metal ball.

Now, more than 100 years later, a scientific study has shown that people can solve problems better just after they awake from a nap as long as they wake before they fall into deep sleep (Science Advances, Dec 8, 2021;7(50)).

Edison was right: Waking up right after drifting off to sleep can boost creativity

Zubin Al Genubi suggests:

Why We Sleep: Unlocking the Power of Sleep and Dreams, Matthew Walker. Great book. Lack of good sleep is really bad.

Hernan Avella warns:

Matthew Walker book is ok in spirit, we all know sleep is good. I'm an athlete and try to get 9-10hrs, but on closer inspection, the book is full of omissions, misinterpretations and overstatements. See: Matthew Walker's "Why We Sleep" Is Riddled with Scientific and Factual Errors.

Nils Poertner writes:

when waking up during the nite more than once, it may be my position that I kept overnite. and during Asian times, mkts turned and I got wrong footed and next day will be brutal too. could be something else of course too but I give it some reflection when it happens. like Elias Canetti says: "All the things one has forgotten scream for help in dreams."

Easan Katir adds:

Not that I've solved any problem as great as Edison providing electric light for the world, yet I've found that pre dawn time between first waking and getting up best for solving business and life issues. I write down the solution so I don't forget amidst the daily cacophony of market news.

Dec

17

Advice to Aspiring NYC Cops, from Bo Keely

December 17, 2023 | 1 Comment

[Ed., for color: 14 Days In a City With No Laws: Slab City a Squatters Paradise]

A friend Ron in Slab City was a NYC police officer for one day. It was his dream come true to work the beat, the highest pay grade due to overtime, doing what he liked to do. ‘I can communicate with and help any person on any level.’ Two years ago, a Mensa, he completed the cadet course with one of highest grades in history and became a NYC beat cop for one day.

The second day, his lieutenant called him in and said, ‘Are you thinking of taking another job?’ ‘Never,’ he replied. ‘Why don’t you use your degrees in nutrition, business and psychology to become a teacher?’ ‘No, I want to walk the beat.’

The lieutenant continued, ‘I have to let you go. We can’t keep anyone on the force who scores a 90 or above. I myself got a 70. It’s not financeable feasible because it takes five years to become a detective where you’d shine. Nobody will want to work with you until then because you’re too smart. You probably don’t even want to hurt criminals. You’d figure out how things work.’

My buddy couldn’t argue with that, and turned in his shield and gun. He started a window washing company in the Westport, CT area to earn a stake to buy a van and drove it to Slab City, ‘The Last Free Place.’

I stood with him this morning inside what Slabbers call the Fortress of scrap metal and pallets atop a four-story crow’s nest looking over the town as far as the eye can see.

Dec

17

Deflation, from Nils Poertner

December 17, 2023 | Leave a Comment

is as good/bad for the economy and stock mkts (as leading econ) as being sober is for the alcoholic. credit mkts will not like deflation.

Eric Lindell responds:

deflation poses the same problem as inflation — introducing random noise into the price system. With stable prices, producers know that a price increase signals increased demand for a product. Von Mises compares inflation to running someone over and deflation to running him over backward. January 2014 was the only deflationary month in recent years. Deflation as cure for inflation is bad mathematics.

H. Humbert asks:

But there is no deflation. Other than the Walmart CEO talking about some possible food deflation (which is not deflation overall) who has any original information that deflation is likely?

Eric Lindell responds:

Re MV = PQ, deflation would accompany decreased money supply/velocity or in increased output.

H. Humbert replies:

That's true, but not in itself predictive. Will any of these things occur and be strong enough to matter? All that can be said now is that there seems to be some evidence of disinflation, not deflation. I'll believe deflation overall when I'll see it.

William Huggins writes:

the reason we aren't likely to see it is the totem power of irving fisher who taught generations of american economists that deflation led to an activity-suppressing feedback loop. far be it from me to opine on the well-regarded analysis of a seminal thinker (for several other reasons), but it may be worth noting the source of this deeply held belief. as a result of fisher's expert authority, particularly among other influential economists like friedman, the view is profoundly held by today's cadre of central bankers whose playbook warns them that deflation will lead to the great depression pt 2.

historically, the US had a notable 20 year run of deflation in the late 19th century and the economy at the time was soaring. (very) reasonable arguments can be made for confounding factors like mass land seizures, new tech, reconstruction, immigration, etc at the same time but to bring it back to the basic monetarist framework (assuming stable V during the period), the economy could have simply been expanding faster than the money supply. the big difference with today is that the money supply has been untethered from physical constraint. combining (potentially) limitless quantity with a dread of not having enough pretty much assures the outcome.

interesting question arises when one thinks about palindrome's reflexivity theory, where systematic incorrect beliefs start to create new (unsustainable) realities that seem to defy physics and then burst suddenly. are the CBs doing enough to trim their BS and get the money supply under control? (M2 drifting back to that 6% annual growth since the 90s) but will the fear of deflation drive us too far in the other direction?

H. Humbert comments:

It's an interesting coincidence that the belief that deflation is bad for highly technical economic reasons that have nothing to do with unsustainable money printing, coincided with inflation being useful when said money printing occurred.

What Irving Fisher was evidently saying was that deflation is bad because it suppresses economic activity through some sort of a feedback loop. I think the deranged animals that advocate (or justify or fight any attempts to control) the kind of deficit spending that we have given the debt that we have don't like deflation because it would cause them to have to stop the spending a couple of years sooner than otherwise, hence they would lose their hold on power that much sooner, and that's all that they care about. Irving Fisher is described thusly in his wiki page:

Irving Fisher (February 27, 1867 – April 29, 1947) was an American economist, statistician, inventor, eugenicist and progressive social campaigner. He was one of the earliest American neoclassical economists, though his later work on debt deflation has been embraced by the post-Keynesian school. Joseph Schumpeter described him as "the greatest economist the United States has ever produced", an assessment later repeated by James Tobin and Milton Friedman.

So it's an interesting coincidence that the some progressive social campaigner economist found through his incredibly insightful, but totally politically unmotivated, theoretical work a formula that the animals need to stay in power.

William Huggins responds:

exactly - they will either inflate it away, or at some point engage in a selective default. that said, societies can go on self-financing for a very long time (japan) as much of that interest is being put right back in the pockets of americans. its not like the wealth is being disintegrated, its simply being moved around. i have no idea how to gauge the limit.

i wouldn't be so quick to dismiss Fisher's work simply because you dislike "animals" who are actually your fellow countrymen whom you disagree with (do americans really hate one another so much? is there another reflexive breakpoint that's much more important to watch for?).

my point was that he was very wrong about the 1929 crash and I believe his losses must have set a terrifying fear upon him when the markets didn't bounce back. hence deflation as his bete noir, not some silly "convenience" for politicians who weren't even a dirty twinkle when we wrote. the issue is inherited wisdom being unbalanced, not conspiracy most foul.

H. Humbert replies:

You may very well be right about his motivation, I just found it interesting. I hate inflation because it's unfair to people who are good, who behave according to what I consider to be good moral principles. It also hurts many who are weak, whether through no fault of their own or otherwise. But those I call animals talk about any feeble attempt to restore sanity to the budget as an attempt to simply stop the government from functioning, just because those who attempt it are somehow motivated by evil intent. Lying to keep power while destroying the country is despicable behavior.

Dec

17

Holiday history and the nature of money

December 17, 2023 | Leave a Comment

Thanksgiving menu at the Plaza Hotel, 1899.

From the NYPL collection of menus.

H. Humbert comments:

All under a dollar. Special holiday dinner for well-to-do customers. Anyone wants to make the case that those who deliberately cause deficit spending are not deranged animals? Is this price change good? Milei just said he will abolish the Fed of Argentina. Non negotiable. Of course he didn’t kill himself, I mean if there are ever any health problems in his immediate future.

Stefan Jovanovich offers:

The BW recommends Turback's book, What a Swell Party It Was!: Rediscovering Food & Drink from the Golden Age of the American Nightclub; it has menus and venues from the great age of actual fun and dancing.

William Huggins writes:

looks like every single government since the 1950s were full of "animals" - not a single one seems capable of maintaining a surplus for more than 3 years (and that was Clinton…):

United States Federal Government Budget

Andrew Aiken adds:

There was never a surplus in the 1990s, at least by the accounting principles that a business is required to use. The “surplus” was entirely due to short-term overages in payroll taxes for Social Security, and they were wasted and not used to shore up the system.

Stefan Jovanovich comments:

Since the purpose of central banking is to allow legislatures to increase their debts, is it surprising that "deficits" are now the cultural equivalent of what "sin" was in the ages when most everyone went to church? Everyone is against it, in principle, but not where principal and interest are concerned.

Larry Williams applauds:

+10 QUOTE OF THE DAY!!

William Huggins responds:

i wouldn't say the "purpose" of centrals is to enable money printing, rather I would say that's how governments prefer to use centrals but since the last of the independents were taken over by the end of WW2, that may have become an irrelevant distinction in the modern world. the main reason for pointing it out is that we could easily return to a world without state controlled centrals and their purpose would be notably quite different (usually running the payments system, think Amsterdamsche Wisselbank).

Stefan Jovanovich replies:

The Federal Reserve does not print our money; the Treasury does. In allowing its member banks to hold Federal government IOUs at par as their reserves, our central banking system effectively outlaws the pricing of all legal tender. Actual money can only be exchanged for itself, whatever the amount. The result is a wonderful inversion of monetarism as a theory. Money can be printed, without limit, but only if Congress votes to expand the supply of collateral that the banks can buy and endlessly rediscount.

William Huggins disagrees:

this is incorrect - the Fed can and does use several other assets aside from federal government debt to back its liabilities. back in 2010, they held more mortgage debt than government debt. the choice of backing asset is often dominated by gov debt but the BoJ (among others) is also sitting on corp debt (and equity for that matter)

Peter Penha writes:

I disagree and it is because of who is on the hook first. The Federal Reserve can only purchase government guaranteed debt for its account (including FNM FRE GNMA which it did in GFC and in amounts greater than existed - the w/i mtge owed the Fed at one point was around $1 trillion and at a spread below treasuries when adjusted for the embedded prepayment option by the borrower.

All the MS pledging boxes of toilet paper at the Fed window in late 2008 & the HY ETF purchases in March 2020 were against a Treasury guaranteed account at the Fed. If you care to argue that in difficult times there is no difference between Fed & Treasury as the Fed takes orders, that there is a myth of central bank independence - no argument.

The Fed now losing some $200 billion a year from it asset/liability mismatch is putting those losses against a future Treasury payments owed account - so the Fed does not need a capital call from its losses. If however the Fed decided it did need capital - that gets taken from its shareholders who are the money center / fed member banks. JPM is on the hook for Fed insolvency (or BAML and C trading below book tell you they will be forced sellers of equity below book to shore up their capital).

Perry Mehrling (the professor Zoltan wishes he had had in college) does a great history course (and free) on the hierarchy of money, and how private (CHIPS) and public (Fed Wire) clearing houses are allowed to create credit out of thin air to make up for shortfalls - guaranteed by all the other members.

Your money deposited in the bank is not money it is you extending credit to the bank and an IOU (down the tier). In normal times they all appear equal and settle normally but a Eurodollar is not the same as a dollar (see SVB dollar deposits made whole / offshore SVB deposits a general creditor (gone) as per the FDIC statement on SVB).

Stefan Jovanovich suggests:

Money and Empire: Charles P. Kindleberger and the Dollar System

Dec

15

Why does Japan have a CA surplus? from Alex Castaldo

December 15, 2023 | Leave a Comment

Not for the reason I thought:

Japan’s current account surplus may not be a surprise to those of us who remember Japan as a major exporter. But a closer examination shows that the current account surpluses recorded today are NOT DUE TO THE TRADE ACCOUNT but rather the net primary income balance. Japan used the trade surpluses of the 1970s and 1980s to build up its holdings of foreign assets and prepare for the day when it would need income from abroad to pay for its aging population. Last year, according to The Economist, the country earned a net $269 billion on its primary income balance, equal to 6% of its GDP.

Dec

13

Trade N, dispersion, Expectation, from Zubin Al Genubi

December 13, 2023 | Leave a Comment

With a positive expectation (actually doesn't matter how great) increasing N and or decreasing dispersion of returns of trades will increase terminal net wealth in direct proportion! If you understand this you can succeed in trading. Each variable is a leg on a right triangle solvable by the Pythagorean equation!

- James Sogi

Decreasing stop loss to reduce sd will reduce N and may reduce overall return.

Jeff Watson writes:

I only use mental stops, and strive for 100% personal compliance when pulling the trigger to get out. My rationale is that any stops on an exchange or broker server…or in a broker’s deck, become part of the market. That’s too much information to give to the market.

Peter Ringel comments:

yes, quite a few studies show, that stops degrade systems. mental stops but with technical alert levels seem useful. fight for exit - fight for entry. catastrophic hard stop still makes sense.

Larry Williams advises:

Not having a stop has been the death of more traders than having stops.

Humbert H. writes:

To me a "stop" is a trading concept, not an investing concept. It's almost devoid of meaning if you're an investor. Traders operate on price movements, investors operate on price vs. value. Just the way I understand it from observing the lingo in the two "camps", and what it means to be one vs. the other. Of course if you're an investor and there is a huge unexpected price movement, you have to rethink what you know and don't know about the asset.

H. Humbert adds:

My Step 1: Monitor all stops. This is from an Aught's (maybe '03 or '07?) Spec-Gathering in Central Park, per Larry Williams' Wisdom. It is also so appreciated that The Chair, his Dinner Table Guests & Friends, His Co-Opetition Friends (Spec-Listers) & his Superior Employees' annual efforts.

Dec

12

December again, and Russian snows

December 12, 2023 | Leave a Comment

what will S&P move to end of year? since 1996 when as of dec 12 the sp was up over the preceding 30 days, the expectation for the next 15 days is up 20 big points - 9 of 12 since 1996 up. s.d. 20 big.

guaranteed to be found too late: the 30 days from nov 1 to dec 12 been up 15 times and down 3 times since 1996.

Henty explains why France lost so many wars. General Kutosov main practicioner of snoring as fine art:

Through Russian Snows, by G. A. Henty

Dec

11

Snoring as a fine art

December 11, 2023 | Leave a Comment

good lesson for followers of drift in S&P:

Snoring as a Fine Art, and Twelve Other Essays by Albert Jay Nock

Consequently one might with reason think that there is too little snoring done—snoring with a purpose to guide it, snoring deliberately directed towards a salutary end which is otherwise unattainable—and that our society would doubtless be better off if the value of the practice were more fully recognized. In our public affairs, for instance, I have of late been much struck by the number of persons who professedly had something. The starry-eyed energumens of the New Deal were perhaps the most conspicuous examples; each and all, they were quite sure they had something. They had a clear premonition of the More Abundant Life into which we were all immediately to enter by the way of a Planned Economy. It now seems, however, that the New Deal is rapidly sinking in the same Slough of Despond which closed over poor Mr. Hoover's head, and that the More Abundant Life is, if anything, a little more remote than ever before.

Dec

7

December, from Hernan Avella

December 7, 2023 | Leave a Comment

Since 1985, looking at the Vanguard 500 Index Fund, there have been 20 years where the cumulative return up to November was greater than 10%. Of those, only in 3 years (1986, 1996, 2014), the fund experienced negative returns in the month of December.

1985: 4.67%

1986: -2.64%

1988: 1.66%

1989: 2.38%

1991: 11.41%

1995: 1.93%

1996: -1.96%

1997: 1.72%

1998: 5.81%

1999: 5.98%

2003: 5.22%

2006: 1.39%

2009: 1.95%

2012: 0.90%

2013: 2.51%

2014: -0.26%

2017: 1.10%

2019: 3.01%

2020: 3.84%

2021: 4.47%

T-Statistic = 2.04, p-value = 0.048

Dec

5

A birthday party, Monte Walsh, thinking

December 5, 2023 | 1 Comment

Pix from Vic's 80th birthday party:

one of the most unfair things is the lack of attention by western writers and others to the greatness and heart-rending competence of Monte Walsh.

now they are bullish. as Art Bisguier would say when he got you in a bind and you'd take a few minutes to play: "now you're thinking."

the gentlemen persist in their bearish hope. the old gray mare increases his chances.

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/8742783/shutterstock_139851025.jpg)