Sep

30

Ed Thorp hosts Joseph Granville at UC Irvine (1981), from Big Al

September 30, 2024 | Leave a Comment

Interesting, for the history of market prognostication:

On May 27, 1981, Joseph Granville addressed a standing-room-only audience in the Science Lecture Hall at the University of California, Irvine campus. The event was sponsored by the Graduate School of Management and I served as the Master of Ceremonies.

In the first hour Joseph Granville was supposed to explain his theories to us. The hour proved entertaining with many anecdotes and stories, but the theories were not explained.

Peter Ringel offers:

You guys probably already found his interview on CWT:

EP 109: The man who beat the dealer, and later, beat the market – Edward Thorp

The man gamed Casino Roulette on a mechanical level and was probably targeted by the mafia back then.

Sep

29

Review redux: The Seven Pillars of Statistical Wisdom, from Vic

September 29, 2024 | Leave a Comment

The Seven Pillars of Statistical Wisdom, by Steve Stigler, provides an illuminating and entertaining foundation for statistical activity. The seven pillars are Aggregation, Information, Likelihood, Intercomparison, Regression, [Experiment] Design, and Residuals. Every page of the book contains something fascinating and instructive.

It is at once an adventure story, a history lesson, a textbook on the foundations of statistics, and a tour de force with ingenious extensions of the works of the great in each field in Stigler's own inimitable hand — a persona that reminds one of Stigler's heroes, Galton himself.

The level of the book is such that the layman and the expert will both gain from it. I found every page insightful and it uplifts one to be part of a field with so many ingenious founders, and to know that there are such pillars that hold the edifice up.

I recommend the book highly. It is a masterpiece classic that will live forever.

Sep

28

What is in Brooklyn?, from Asindu Drileba

September 28, 2024 | Leave a Comment

Lana Del Rey — My boyfriends really cool, but he is not as cool as me. Cause I'm a Brooklyn Baby. An interview recently posted here with The Chair — "I attribute your being humble to being from Brooklyn" (interviewer referring to The Chair). Another person I listen to - Such mistakes can only be made by people who have not spent a lot of time in Brooklyn. Brooklyn comes up so many times. What's is there to know about it? Of course I have heard of people talking about other cities.

But people that talk about Brooklyn always say it like there is something they know which others don't know. What is in Brooklyn? What does it do to people?

David Lillienfeld adds:

In the epidemiology world, when one of the organizations meets in Manhattan, inevitably someone will suggest to the younger members to go across the Brooklyn Bridge and experience Brooklyn. There is definitely something about Brooklyn that focuses one's thoughts.

Steve Ellison offers:

The Chair wrote a whole chapter on this topic, the first chapter of Education of a Speculator, titled Brighton Beach Training.

Laurel Kenner suggests:

Survivors go there when they get to America.

Alex Castaldo responds:

Agreed, immigrants from Central and Eastern Europe often arrived in Brooklyn as a first step towards success and acceptance in America.

H. Humbert writes:

There is a hierarchy among the real estate developers of New York. Those who develop real estate (especially large commercial buildings) in the central area (the island of Manhattan, also known as New York County) consider themselves socially above the multimillionaires who develop property in the boroughs of Brooklyn, Queens, Bronx and Staten Island. They refer to Manhattan as simply "the City" and seldom go to the other boroughs (other than to take an airplane at LGA or JFK airports, which are in Queens).

Donald Trump's father was a developer of large number of properties all of which were in Queens and Brooklyn and he considered Manhattan development too financially risky. He was quite wealthy but in view of the above was not considered a "major New York developer", like Roth, Reichmann and other well known names.

His son Donald was very ambitious and wanted to move up in society. Contrary to his father's policy he took a gamble and decided to put up a large building, the Grand Hyatt Hotel on 42d street in Manhattan. The project was completed in 1978 and Donald Trump joined the ranks of major NY real estate developers. (What the other developers thought of his operation is another subject and requires a separate article). Even if he wasn't fully accepted by all, when his daughter married a member of the Kushner family, another prominent Manhattan developer, a few years later, it confirmed that the Trump family had reached the first rank among New York's wealthy families. But Donald Trump, having overcome his Queens handicap and shown that he could do better than his father, was not quite satisfied and he decided to enter national politics.

In summary, there is a slight prejudice against people from Queens and Brooklyn, which sometimes causes people to be even more motivated to succeed and be accepted.

In addition Brooklyn has its own distinct accent, which causes the prejudice to be slightly greater. If you would like to know what a Brooklyn accent sounds like you can listen to any speech by Janet Yellen. When she was in line for a top job in Washington, a previous Treasury secretary (probably hoping to get the job himself) mentioned her accent as a reason she should not be appointed. She got the job anyway. Another success for Brooklyn.

Jeff Watson gets musical:

Steely Dan nailed it.

Sep

27

Hedge funds and the positive idiosyncratic volatility effect, from Big Al

September 27, 2024 | Leave a Comment

I am curious about the claim that hedge fund alpha derives from timing entries and exits in high-vol stocks. There are lots of interesting trailhead links provided, too.

Hedge funds and the positive idiosyncratic volatility effect

Turan G. Bali, McDonough School of Business, Georgetown University

Florian Weigert, Institute of Financial Analysis, University of Neuchatel, Switzerland and Centre for Financial Research, Cologne, Germany

This Version: July 2023

Abstract

While it is established that idiosyncratic volatility is negatively priced in the cross-section of stock returns, the relation between idiosyncratic volatility and hedge fund returns is largely unexplored. We document that hedge funds with high idiosyncratic volatility earn higher future risk-adjusted returns of 6 percent p.a. than hedge funds with low idiosyncratic volatility. The outperformance arises because hedge funds trade high idiosyncratic volatility stocks wisely. They pick high volatility stocks when they are underpriced and short-sell high volatility stocks when they are overpriced. Our results support the notion that hedge funds’ idiosyncratic volatility is a measure of managerial skill.

Sep

26

An informal analysis, and books

September 26, 2024 | Leave a Comment

performing an informal content analysis of fox news 50 articles, the news about vp is overwhelmingly negative. however, she still leads in the odds by at least 5 percentage pts. under circumstances the other side's insistence they won debate is blind. this refusal to accept reality should lead to all sorts of negative results.

meanwhile, in books:

The Walking Drum is an erudite louis lamour adventure about 12th century business.

the book The Merchant in Medieval Europe is one of the most scholarly and complete I have ever read. A summary on the back cover is very apt. the book made me realize that most of my commercial inspirations were merely following the paths set by our predecessors.

some chapters: the merchant in the 13th century, trading companies, commercial correspondence, bookkeeping and commercial correspondence, arithmetic insurance, banking, interest rates, fairs, money supply, information, careers, exchange, brokers.

Power and Profit, an alternate title, is beautiflly illustrated with 200 prints and maps. "an academic classic that can be read purely for pleasure."

a well lived life: Peter Spufford

More:

Money and Its Use in Medieval Europe, by Peter Spufford.

Sep

25

Smörgåsbord

September 25, 2024 | Leave a Comment

Jeff Watson likes info on the softs:

Here’s a copy of a magazine that offers a high level view of all things agricultural:

Carder Dimitroff is watching lithium batteries:

Utility Dive: Lithium battery oversupply, low prices seen through 2028

Despite falling raw material costs and U.S. policy support, North American battery suppliers are delaying or canceling planned capacity investments

Bloomberg: Why Public EV Chargers Almost Never Work as Fast as Promised

Most public machines in the US average about half their maximum speed, a gap that risks hindering further adoption of electric cars.

David Lillienfeld follows pharma:

Immuno-oncology drugs have changed oncology and required rewriting of many sections of medical texts. They have created a revolution. That doesn't mean they are without downsides.

A decade of cancer immunotherapy: Keytruda, Opdivo and the drugs that changed oncology

Medicines that can rev up the immune system against tumors have reshaped expectations of what cancer treatment can accomplish. Their success has hit limits, however.

Sep

23

Methods of trade

September 23, 2024 | Leave a Comment

three highly recommended books:

Power and Profit: The Merchant in Medieval Europe

all show how commerce, fairs and bazaars, and bourses in the 1100-1400 era showed the way for all modern methods of trade.

Sep

22

Choking, from Jeff Watson

September 22, 2024 | Leave a Comment

Ever choke during a big event?

The Brain Really Does Choke Under Pressure

Study links choking under pressure to the brain region that controls movement

Have you ever been in a high-stakes situation in which you needed to perform but completely bombed? You’re not alone. Experiments in monkeys reveal that ‘choking’ under pressure is linked to a drop in activity in the neurons that prepare for movement.

The researchers found that, in jackpot scenarios, the activity of neurons associated with motor preparation decreased. Motor preparation is the brain’s way of making calculations about how to complete a movement — similar to lining up an arrow on a target before unleashing it. The drop in motor preparation meant that the monkey’s brains were underprepared, and so they underperformed. To a certain extent, “you just don't perform better as the reward increases”, Moghaddam says.

Asindu Drileba writes:

This seems related something psychologists call habituation (defined as the diminishing of an innate response to a frequently repeated stimulus). I leaned about it from Daniel Cohen, the first economist I actually enjoyed reading (I recommend the books Prosperity of Vice, Homo Economics). Daniel Cohen mentioned that "habituation" is the reason why in some instances adding financial incentives makes people perform worse at a task.

He gives an example of a Kindergarten School experiment. The school had a problem with parents coming late. So the school said that for every time a parent comes late to pick their child they will be fined a certain amount (lest say $10 every time you come late to pick up your child). The result was that more parents actually came late to pick their kids.

The psychological interpretation might be that parents eventually valued money less than that coming late. So paying a fine made them feel like they have "paid off their sin" that is, the monetary fine erased their guilt.

Daniel Cohen also thinks we are all going to be immortal some day. Here is a nice podcast where he talk about his ideas.

Sep

18

Hikes, cuts, and differentials

September 18, 2024 | Leave a Comment

now 8 percentage differential in favor of vice pres. the more things emerge as favoritism in debate, the greater the differential.

it took 12 days for a 20-day high and months for an all-time high which comes auspiciously for Hayek's road.

average number of consecutive decreases in fed rates after a turning point to a decline is 14.

In light of the progress on inflation and the balance of risks, the Committee decided to lower the target range for the federal funds rate by 1/2 percentage point to 4-3/4 to 5 percent.

Forbes Advisor: Federal Funds Rate History 1990 to 2024

Plenty of other data factor into Fed monetary policy decisions, including gross domestic product (GDP), consumer spending and industrial production, not to mention major events like a financial crisis, a global pandemic or a massive terrorist attack.

To that end, we’ve structured this compendium of fed funds historical data with narratives about the different factors that informed the Fed’s decisions. The central bank may be staffed by officious economists, analysts and business experts, but it’s also highly responsive to the changing political winds.

the swings in S&P futurs in last half hour from up 30 to down 15 and now +20 reminds me of how a loser in a squash game flails around with a big swing and no caution hitting all three walls on each shot. one fine player whose forefather lost the american revolution in the battle of Long Island hit one with all his power at my head when he was behind in a situation like this. i imediately called for the ref to default him, to no avail.

what was the match beween federer and djoko where federer was up match point and served to djok backhand and djok gave up and shot a hail Mary from his back hand and he won the match?

Djokovic's INSANE Comeback Against Federer! | 2011 US Open Semifinal

Sep

18

Even card counting made the house money

September 18, 2024 | Leave a Comment

A Perspective on Quantitative Finance: Models for Beating the Market, Ed Thorp © 2003

Quantitative Finance Review

From the first section, on his card-counting research and successful play:

The relevance to finance proved to be considerable. First, it showed that the “gambling market” was, in finance theory language, inefficient (i.e. beatable); if that was so, why not the more complex financial markets? Second, it had a significant worldwide impact on the financial results of casinos. Although it did create a plague of hundreds and eventually thousands of new experts who extracted hundreds of millions from the casinos over the years, it also created a windfall of hundreds of thousands of hopefuls who, although improved, still didn’t play well enough to have an edge. Blackjack and the revenues from it surged.

(See Beat the Dealer for more detail on Thorp's blackjack strategies.)

Sep

16

Cognitive dissonance

September 16, 2024 | Leave a Comment

odds in favor of vp reaches maximum with a 6% lead over former Pres. and former Pres claims he won the debate handily. as Soros liked to say: the more he talked about his honesty, the more closely i counted my silver.

perfect example of cognitive dissonance in our time.

She attracted a group of followers who left jobs, schools, and spouses and who gave away money and possessions to prepare to depart on a flying saucer that, according to Mrs. Keech, would arrive to rescue the true believers. Given the believers’ serious commitment, Festinger wondered how they would react when the prophecy failed. He and his colleagues, posing as believers, infiltrated Mrs. Keech’s group and kept notes on the proceedings surreptitiously.

The believers shunned publicity while they awaited the flying saucer and the flood. But when the prophecy was disconfirmed, almost immediately the previously most-committed group members made calls to newspapers, sought out interviews, and started actively proselytizing.

Festinger was unsurprised by the sudden proselytizing after the prophecy’s disconfirmation; he saw the cult members as enlisting social support for their belief to lessen the pain of its disconfirmation. Their behaviour confirmed predictions from his cognitive dissonance theory, whose premise was that people need to maintain consistency between thoughts, feelings, and behaviours.

a question out of the blue????? "would you have a Republican in your cabinet?" one would like to have the moderators predicting stock prices?

Sep

15

Streaks of down days, from Big Al

September 15, 2024 | Leave a Comment

Vic tweeted that "after 5 down days in a row for S&P, it's very bullish. 5 days later only 2 of ten down with high positive expectation especially with bonds up and last one down."

That provoked a quick counting project. The main issue with this analysis is that everything is overlapping, but nonetheless I think it's an interesting result.

The data is SPY adjusted closes from inception thru 6 Sept. I identified all the down days and the streaks of down days, including 1-day "streaks", up to the longest which were 8-day streaks. So each down day fell into a bin, 1 up to 8. Each down day was put in a bin, whether it was the last day in a streak or not. (This eliminates the look-ahead bias of just considering only the final day of streaks.)

Then I calculated the 5-, 10- and 20-day % moves for every day in the data and compared the results for all the down days with the % moves for all days.

The table shows the results, with the best outcomes - streaks of 3, 4, and 5 days - highlighted.

Sep

14

Politics, rackets, markets

September 14, 2024 | Leave a Comment

the more he claims he won, the greater the odds against him. reminds me so much of the refereeing against me in the 1970's. of the 5 national singles i won, my opponent in finals didn't reach double digits. that was the only way for me to overcome bias.

Ed. - Racket Guy from Brooklyn, Sports Illustrated, March 03, 1975:

To the victor—Victor Niederhoffer, that is—belongs another silver pitcher. Last week in New York, at 31, he won the U.S. National Singles Squash Racquets championship for the fifth time. His opponents did little but gasp, sweat and run. But Niederhoffer seemed to play effortlessly. His shots were not always brilliant, but he patiently waited out long rallies, and his frustrated opponents consistently found themselves in situations where most of their moves were of high risk. And then they were forced to make mistakes which ruined them.

reminds me of what my father always said when people told him how good he looked as he was suffering from chemo: "thank you, i'll be the healthiest corpse in the graveyard."

the symmetry of it all. last week 5 down days in a row - from 5659 to to 5515. this week 5 days up in a row from 5421 to 5630.

Sep

13

Politics, money

September 13, 2024 | Leave a Comment

the forces of regulatory capture won the debate handily and that is good for the stock market. more emoluments to business. more centralized control, or as Waltz says, "neighborliness".

As money mutates into a new form that demands all kinds of markets, new ways of making financial transactions, and new kinds of business.

From: The History of Money, by Jack Weatherford.

From primitive man's cowrie shells to the electronic cash card, from the markets of Timbuktu to the New York Stock Exchange, The History of Money explores how money and the myriad forms of exchange have affected humanity, and how they will continue to shape all aspects of our lives–economic, political, and personal.

Sep

12

From the archives, still fresh: The Math Behind the Music, reviewed by Vic

September 12, 2024 | Leave a Comment

Book Review by Victor Niederhoffer: The Math Behind the Music (25 Sept, 2006)

The Math Behind the Music (Cambridge University Press, 2006) by Leon Harkleroad, will be of interest to musicians, mathematicians and marketicians. In a form that is accessible to every layman, the author describes the elementary mathematical principles behind sounds, instruments, compositions and visual aspects of scores in just 135 pages with a nice section of references and an included CD that covers examples of music that used math. No background is required as even such simple lower-school concepts as the factorial are developed by counting.

The first chapter is about the connections, history, common abstract patterns, and the composers and compositions that used math. The second chapter is about the physical basis of harmony, pitch and timbre that make up music. Considerable attention is paid to the frequency relations of various harmonies, and it's a good refresher for those who don't remember off the top that a fourth comes from any note by raising its frequency by 4/3, a fifth by raising its frequency by 1/2 and an octave by doubling. Sine curves are introduced to encapsulate the frequency patterns of various notes produced at different pitches by different instruments. Overtones are explained simply as the ratios of higher frequencies that a note produces that don't block out the original frequencies and the relation between harmonies and overtones is shown.

The third chapter discusses instrument tuning systems consistent with all the overtones and frequency relations between the notes of a scale.

The fourth chapter is the most interesting in that it shows how themes and melodies can be varied with simple rules such as opposition, inversion, and transposition. The relation between these simple rules and group theory are examined, and various ways of notating and combining the rules are covered.

The fifth chapter is about bell music, which is merely a variation of permutation and combination theory.

The sixth chapter is about randomization in music, with many of the same methods used to construct music as we use for simple simulations in markets.

The seventh chapter is about an attempt by one student to find the common basis, the patterns of harmony that make up the most popular songs. The eighth chapter is about how scores of music can be developed from visual cues, with rules to go from visual to music.

The ninth and final chapter is about failed efforts to combine music and math, with particular reference to George Birkhoff's efforts to develop a complete theory of aesthetics by developing a scale of beauty based on the simplicity-to-complexity ratio of a composition.

I found myself thinking many times of the relations between music and markets as I read the book. The combinations of opposites and inversions (where the intervals above a note and played the same intervals below, and transpositions (where the same theme is repeated a given number of intervals up) happens every day in the markets. The notation that musicians have developed to grapple with these techniques, including the summary of horizontal and vertical movements in visual sightings that the composer Villa-Lobos used to construct symphonies that depict buildings in a city, seems like a very fruitful field to augment technical analysis of markets.

The book is full of anecdotes and charts and methods that will be right on the top of the page for market practitioners, and will spark many a fruitful extension by those who wish to take the pencil to paper, and systematize what they have been doing in markets or charting with the work of some great composers and mathematicians in this related field.

Laurence Glazier offers:

This sounds a fine book. Abstract shapes indeed can be used for thematic material, in my chess days I considered using the outline of pawn structures like black's in the Dragon Variation. My mentor uses the letters in his friends' names. Music is developed by changing patterns in various - ever-changing! - ways, whether transposition, inversion, speed-changing, and I would add to the list in the book the use of rotation, a technique Chris Sansom and I used in the Fractal Music software. All this (except presumably rotation) applies in trading. The issue is whether it is predictive for traders, and that is akin to trying to predict what a Bach would do, the patterns are especially evident once they have happened.

Asindu Drileba adds:

The work of Dmitri Tymoczko might also be interesting for those that want to understand the relationship between randomness and music.

Sep

10

A statistical read relevant to trader research, from Big Al

September 10, 2024 | Leave a Comment

It's a critique of the relatively famous Kahneman et al study on how meal breaks affected sentencing by judges:

Which also led to more background, because I had not heard of "Cohen's d":

Sep

9

Full-time vs. Part-time Employment, from Bill Rafter

September 9, 2024 | Leave a Comment

Bud Conrad comments:

The US BLS understates inflation, which causes the calculation for Real GDP growth to become overstated. Thus, we have a recession going on, but it is hidden by the BLS's low inflation rate. The rich are doing well as asset prices have risen; the rest have lost ground because the cost of everything has increased more than the labor rates.

Ditto on jobs and employment that suggests there are lots of new jobs every month, but then restates the number downward in succeeding months, which accumulated to 818 K jobs that are overcounted in the year ending March.

The supposed Fed's being "data dependent" is a cop-out from thinking "How to stabilize the dollar", meaning that they claim they will use these corrupt numbers for policy decisions.

Sep

7

An excellent book by someone we know

September 7, 2024 | 1 Comment

Buildings Don't Lie: Better Buildings by Understanding Basic Building Science

Hardcover – January 1, 2017

by Henry Gifford (Author)

A simple, clear, thorough, and complete explanation of basic building science applicable to any building in any climate. Over 1,000 large color drawings and photos, plus fun quizzes. No charts, graphs, or math. Read this book and become your own expert on making buildings comfortable, healthy, safe, durable, and very energy efficient, because you will understand the underlying science of the movement through buildings of heat, air, water, light, sound, fire, and pests, and how these can be controlled. This book also includes sections on designing building enclosures, indoor air quality, choosing heating and cooling systems, and how to ventilate, heat, and cool different types of buildings.

Henry Gifford comments:

Yes, I wrote and published that book, now in its fourth printing. Book is divided up into chapters on basic science, nothing about buildings, followed by that science applied to buildings, to learn the science better and to understand buildings better. Could ruin some of your teenage offspring for some college science classes.

Gyve Bones appreciates:

I am grateful and obliged to Henry for his magnificent book. I have long lamented not having an owner's manual for my house and this would seem to fill that need—not only the owner's manual, but the service manual as well, and along the way lessons in physics, fluid dynamics, thermodynamics, natural philosophy, and practical engineering. Very well illustrated and pains-takingly explained. I am enjoying learning so much I took for granted or was ignorant of in the science and technology of creating and maintaining a comfort-able habitable shelter.

Sep

5

A call for an emphasis on predictive distributions, from Victor Niederhoffer and the Spec Trio

September 5, 2024 | 1 Comment

From Ask the Specs, by Victor Niederhoffer, Laurel Kenner, and Dr. Brett Steenbarger (December, 2003):

May I issue a call for an emphasis on predictive distributions rather than descriptive studies? By predictive, I mean, a study that:

• enumerates all observations of what has happened after a defined market event over a specific period of time;

• weighs whether the results indicate a random phenomenon or a tradable anomaly;

• measures the uncertainty associated with the latter conclusion; and

• predicts the probability that an x-percent move will follow the event being studied.

Based on my experience, the biggest mistake a trader can make is to concentrate on “advanced” methods such as Hurst exponents, regression coefficients, Fourier series, chaos, wavelets, fractals, et al. Unfortunately, all of those sophisticated techniques will get you nothing but a barrel of retrospective nothingness.

The key is to find a measure that can be calculated often and independently and then use it to predict. For example, what happens in the next one, five and 10 days after stocks reach a 20-day low? The philosophic memory and longings and expectations of the market are of great interest, but I have found queries as to whether they trend or reverse in accord with Prechter or Fibonacci or Elliott a distraction to the pursuit of profitable trading.

You could put the 100 smartest academics in the world in a room and let them try to predict the market for 100 years, and unless they were steered on a path to make fruitful predictions with readily ascertainable estimates of uncertainty, constantly adjusting for ever-changing cycles, they would achieve below-random results. The numerous professors I have hosted and supported in my office have not disabused me of this assessment.

Sep

4

Richard Hamming: You & Your Research, from Asindu Drileba

September 4, 2024 | Leave a Comment

Richard Hamming, "You and Your Research", June 6, 1995 (44:02)

The Art of Doing Science and Engineering: Learning to Learn was the capstone course by Dr. Richard W. Hamming (1915-1998) for graduate students at the Naval Postgraduate School (NPS) in Monterey California.

This course is intended to instill a "style of thinking" that will enhance one's ability to function as a problem solver of complex technical issues. With respect, students sometimes called the course "Hamming on Hamming" because he relates many research collaborations, discoveries, inventions and achievements of his own. This collection of stories and carefully distilled insights relates how those discoveries came about. Most importantly, these presentations provide objective analysis about the thought processes and reasoning that took place as Dr. Hamming, his associates and other major thinkers, in computer science and electronics, progressed through the grand challenges of science and engineering in the twentieth century.

Sep

3

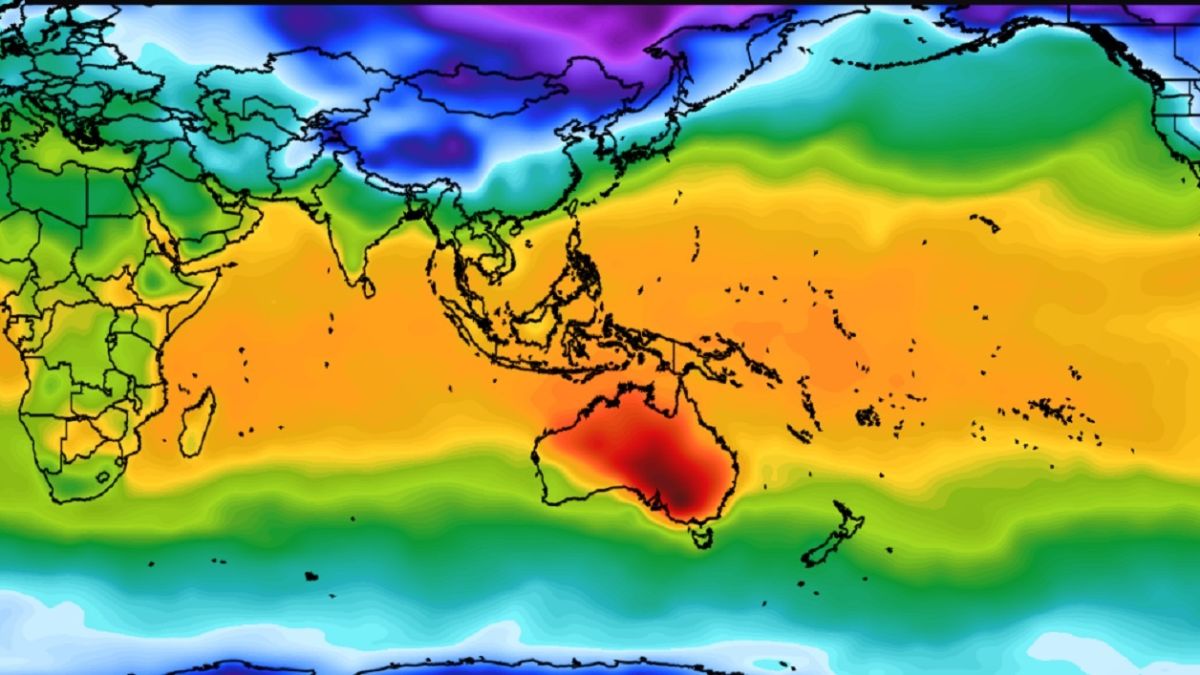

Apparently, it’s not just an American thing - Australia, from Carder Dimitroff

September 3, 2024 | Leave a Comment

Sydney Morning Herald: Three Months to Back Up the Grid as Risk of Summer Blackouts Ramps Up.

Interesting Engineering: Australia Is Generating Too Much Solar Power (12:25).

IMO, expect:

1. volatile wholesale energy prices, including deeply negative prices,

2. forced load shedding and expanding demand-response programs,

3. sudden awareness that infrastructure is needed,

4. growing reliance on natural gas/ LNG, and

5. growing interest in competitive energy contracts

Sep

2

Counting: Seasonality

September 2, 2024 | 1 Comment

A lesson from the archives: Seasonality and changing cycles, by Victor Niederhoffer and Laurel Kenner, (04/26/2004)

A good part of the anomaly literature is devoted to studies of seasonality. A basic problem with these studies is that merely picking a season to study involves making guesses as to when and where the seasonality is. For example, is it in January or December, on Monday or Friday, in the United States or the Ukraine? (Yes, our Google search turned up a study of anomalies in the Ukraine.) Thus, the very choice of a subject might involve random luck.

Another aspect of seasonality studies that must be considered is whether the effects noted are sufficient to cover transaction costs. A retrospective study showing that you can make 2 cents more on Friday trades than Monday trades in your typical $50 stock would not be sufficient in practice to leave anyone but the broker and the market-maker richer.

Thus, it's essential to temper the conclusions of such studies with out-of-sample testing — in other words, with real trading.

[ … ]

Comment by Philip J. McDonnell, a former student of the Chairman at UC Berkeley: Dr. Niederhoffer points out that there is no a priori reason to believe that any one day of the week is stronger than any other. Thus when Y— collected the data (thank you!), presumably the reason was to find out if any days of the week behaved differently. Only after peeking at the data was it possible to say that Monday was the best and Tuesday the worst.

There are 10 such pairwise comparisons:

Mon with other 4 days 4

Tues with 3 last days 3

Wed with Thu & Fri 2

Thu with Fri 1

Total 10

In other words it is also possible that Tuesday could have been the best day and Monday the worst or any other pairwise comparison by chance alone. So when the one best and the one worst day shown by the data are compared and shown to have say a 5% significance we need to remember that we implicitly ruled out the other nine cases which weren't the best or worst. So we need to take our 5% number and multiply by 10 to get the correct significance of 50%. 50% is exactly consistent with randomness.

The problem is multiple comparisons are often subtle and remain unrecognized. Multiple comparisons are insidious because they dramatically reduce the power of the statistical tests we employ.

[ … ]

[More reading: Multiple comparisons problem]

William Huggins offers:

Bonferonni method suggests raising the confidence level proportional to the number of tested hypotheses. To get 95% confidence despite ten tests, he suggests 99.5 as a threshold. It's a huge problem when testing which variables to include in a regression model.

Asindu Drileba writes:

The right way to do this type of thing is to form a specific hypothesis based on a single comparison and then to test it on the data. It is even possible to use data from a prior period to formulate our hypothesis. We then test our hypothesis on the subsequent period which excludes the period where we formed our hypothesis.

This is an approach used in machine learning. Datasets are always split into "training" and "test" datasets. "Training" datasets are exclusively used to build the components of the model. "Test" datasets are not used to build the model at all. They are excluded when building the model. The model built using the "training" dataset is then asked to make predictions on the "test" dataset. The accuracy on predictions made on the "test" datasets is then used to determine how accurate the model is (so it can be tuned for improvement or thrown away).

I found this particular statement from the full post so insightful because I didn't think of applying this approach to building models using other statistical methods (I thought it was something limited to machine learning).

Sep

1

Executive Hobo: The Extraordinary Life of Bo Keeley

September 1, 2024 | 1 Comment

Executive Hobo: The Extraordinary Life of Bo Keeley

Changing Roads Podcast

Travel back in time with us as we sit down with the legendary adventurer, Bo Keeley. From his humble beginnings, to veterinary school, to his rise in fame in sports, to his break from society, trading a normal life for the hobos life, to traveling the world, to his unconventional home in a shipping container in Slab City, California, Bo's life is a testament to relentless exploration and resilience.

With every twist and turn, Bo imparts invaluable lessons on survival, curiosity, and the unyielding human spirit. This episode is a treasure trove of stories from a life lived on the edge, full of profound moments and unforgettable encounters.

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles