Feb

8

CIO predicts 2026, too

February 8, 2026 | Leave a Comment

Expect Equity Markets to Broaden in 2026, Led by Small Caps, International

Both fiscal and monetary stimulus should boost earnings in the U.S. and abroad, with dollar weakness continuing to underpin international stocks.

Nils Poertner comments:

Back in High School, they gave a 1 pager of Latin and we had 1 hour to translate it (since it is an ancient language I was spending a lot of time to see what this all meant.) We all know English more or less. These days, I read a 1 pager in English (like this page) in 1 minute. My modern brain actually agrees with the whole article. Yummy. In reality there are probably a lot of cliches in it….

Zubin Al Genubi writes:

AI is about training data otherwise it gets stale and cliched. Like a person reading the same newspaper every day. Google has lots of data. Musk is merging SpaceX with AI because as internet provider he will have access to unlimited global data. I wonder what their contract disclosures say about data privacy.

Steve Ellison responds:

"Expect"? I have seen the broadening occurring since November. There was an extended non-confirmation of Dow Theory last summer into fall as the Industrials were making new highs, but the Transports remained below their November 2024 high. Not only did the Transports finally make an all time high, now they are making new highs before the Industrials do. Similarly, the equal-weighted S&P 500 ETF RSP, which was badly lagging the cap-weighted SPY in the 2025 rally off the "Liberation Day" tariff lows, made a new high yesterday while the cap-weighted index only partially regained some of its losses from earlier in the week.

I said on X [6 Feb.], "Lots of strength in the broader market. While technology stocks were selling off the last few days, the Industrial, Materials, Consumer Staples, and Energy sector ETFs all made new highs".

Feb

5

6 new lows, from Zubin Al Genubi

February 5, 2026 | Leave a Comment

The last few down swings each had 6 new lows before a bottom. Today, marking a new low for this swing after hours will end up a new low number 5 by the end of tomorrow.

Steve Ellison writes:

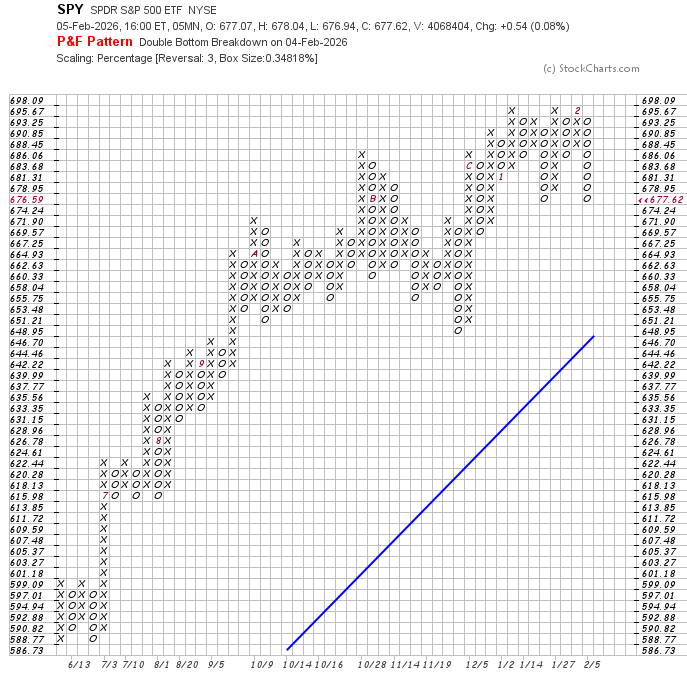

Interesting. I have been experimenting with multi-level point and figure charts. Using a box size of 1.4% (a long-term average true daily range) and a 3-box reversal, SPY is still within 4.2% of its all-time high and hence in an uptrend. Drill down with smaller box sizes and shorter time intervals, and interesting price structures appear. At a 1/4 ATR box size, today's close was at a similar level to the Jan. 20 low.

Lots of sector rotation under the surface. If 2025 was the year of the magnificent 7 and the flatlining 493, this year may be the opposite. While technology was getting beaten down this week, the Industrial, Materials, Consumer Staples, and Energy sector ETFs all made new highs.

Zubin Al Genubi adds:

Lots of late night shenanigans going on. Asian markets trading open in late thin US futures creating imbalances. Price action appears algo driven.

Nils Poertner comments:

I like the pattern with 6 new lows. Well spotted. Otoh, if the pattern does not repeat the surprise for mkts is bigger. nature offers "patterns" and "break of patterns" and both are relevant - else it would be a museum.

Cagdas Tuna predicts:

Then it is going to be a rough year for market cap weighted indices in US.

Peter Ringel writes:

While I would always give a study, like Big Al‘s more weight to remove opinion. I wonder, if there is a January effect regarding regime type or sector or general trading type. Not necessary % performance. Will the rest if the year trade like January? Would give a 2015 type year.

Nils Poertner responds:

yes. for practical purpose, it may be easier to trade mkts which receive less attention by the wider financial community /media.

Feb

4

2026 Bullish Confirmation, from Larry Williams

February 4, 2026 | Leave a Comment

Yale Hirsch and his son Jeff have shown that a positive change, from the last trading day of the year to the 5th trading day of the new year, portends a bullish year (positive first 5-day percent change).*

Consider this … in the last 76 years of trading, the S&P 500 has declined for the year 20 times or 26% of the time. In other words, 74% of the time, there has been a yearly gain.

Jeff’s numbers show that in those last 76 years, 49 years showed a positive first 5-day percent change. Only 8 of those years went on to close down for the year. That’s an 84% bias for the year to close higher when we have a positive first 5-day percent change.

My add-on to Yale’s and Jeff’s work was to look at the years that gained 1.2% or more in the first 5 days of trading. There were 28 such years. Of those years, only 2 were down for the year. That’s a 93% bias for the year to close higher. What an improvement from the average 74%!

In 2026, the first 5-day** change for the Dow Jones 30 was +3%.

In 2026, the first 5-day** change for the S&P 500 was +1.6%.

Those 28 years had an average annual return of 14%. The remaining years had an annual gain of 5.3%. I see this as excellent confirmation of the bullishness of my Forecast 2026 Report.

Cagdas Tuna writes:

There is no need for a statistical analysis to assume any given year will be positive for US indices. It is almost guaranteed to be positive every year. No offense to any list member.

Larry Williams responds:

Wrong 24% of time we close down for the year.

Michael Brush is surprised:

Wow did not know it was that high.

Larry Williams agrees:

I was taken back by it as well.

Asindu Drileba asks:

2026 is bullish? But Senator, you said you expect a recession in 2026 with 100% certainty. Is this a contradiction? Or maybe its possible for the market to be bullish even during a recession?

Larry Williams answers:

Yes, there was a projection made a year ago for a 2026 sell off —in the last 12 months data changed—large improvements in fundamentals and hopefully I got a little better understanding of long term cycles. New Data matters.

Nils Poertner writes:

Asindu- there would be simply too many variables out to make that statement with such a certainty in advance. Just impossible. It remains a probability game. Used to subscribe to some cycle research that claimed to have things figured out yrs in advance. quite pricey subscription. it was HOOK, LINE and SINKER (for me).

Denise Shull comments:

New Data matters.

Indeed it does. Wonder why it’s challenging for many to incorporate?

Nils Poertner responds:

Good question. On this note… (Pure) data analysts believe pattern matching on large datasets will solve our problems. But what if the really vital information isn't being collected? What if it's invisible to our trained systems?

Jan

28

Triage in medicine, from Nils Poertner

January 28, 2026 | Leave a Comment

process of rapidly sorting and prioritizing patients based on the severity of their condition and the urgency of their need for care, especially during emergencies

Amateur /untrained person coming to a traffic accident (w multiple casualties) would rush to help those who cry the loudest (eg maybe just a broken arm) whilst neglecting those who need urgent attention (eg unconscious - about to pass out).

Analogy to speculation? Ordinary investors (ie untrained) getting hooked to "loud" and in your face "stories" in mass fin media - but perhaps neglecting the vital, more silent trends in mkts - which would help them make money over time.

Jan

16

Tacit knowledge, life lessons, and roast beef

January 16, 2026 | Leave a Comment

Nils Poertner suggests:

there is a wonderful book by Michael Polanyi - on tacit knowledge (unlike explicit knowledge one has to develop that skill oneself). not trying to proselytize here that is quite good of a book) and worth many gold nuggets

Jeff Watson offers:

There are some great nuggets in this video - 100 quotes, 100 meals for a lifetime:

100 Harsh Life Lessons That Made My Life So Much Better

Larry Williams knows where the beef is:

America's Top Roast Beef Sandwiches, According to Food Critics

Peter Ringel follows up:

Classical Music for When You're in a Food Coma

Jan

14

Manipulation, from Humbert X.

January 14, 2026 | Leave a Comment

The allegation of “manipulation” is inevitably just code for “I just badly hosed a trade that seemed so good on paper.” Whereas the proper response to a bad trade is introspection and examination of one’s system. In the markets as elsewhere, there can be a general tendency towards the rejection of personal responsibility. This regularly surfaces in the “manipulation” allegation.

William Huggins responds:

not an opinion on anyone's trading but there is a "fun" bit of psych referred to as the fundamental attribution error in which my successes are the result of hard work and skill while the success of others boils down to luck. similarly, when things go wrong for me, its bad luck (or nefarious forces, "them") but when things go wrong for others, its their bad choices or immorality. pretty much every single person falls into this trap unless they spend a great deal of effort fighting back against the heroic narrative.

Humbert X. comments:

I find it does me little good to think about others, other than to identify when they are travelling in a herd and at an extreme level of emotion, for contrarian purposes. Though sometimes it is possible to learn from their successes and failures assuming they are being transparent about what went right or wrong, which is rare.

Nils Poertner writes:

Good to read Hannah Arendt on this note (free floating anxiety within any society have to go somewhere and sinister groups will use it for their advantage - if not a virus, then some other "Country-" Phobia, then climate change etc… So it would not be enough to change politicians , the anxiety is within the masses (and mostly unconscious).

The key for a speculator is to travel light in life and take things with a bit of distance (2 inches are often enough) - and focus on the process of making money!

Jan

12

Zugzwang, from Zubin Al Genubi

January 12, 2026 | 1 Comment

In chess, zugzwang refers to a situation where a player has to move, but every move worsens the player's position. When a portfolio manager's risk limits are hit or losses are thought to be unacceptable, the situation is quite the same. - Hari Krishnan

The Immortal Zugzwang Game is a chess game between Friedrich Sämisch and Aron Nimzowitsch, played in Copenhagen in March 1923. It gained its name because the final position is sometimes considered a rare instance of zugzwang occurring in the middlegame. According to Nimzowitsch, writing in the Wiener Schachzeitung in 1925, this term originated in "Danish chess circles".

Nils Poertner writes:

on this note (lack of imagination), see David Hand's probability lever concept:

The Law of the Probability Lever essentially states that slight changes in the circumstances or assumptions of a statistical model can dramatically change the calculated probabilities of events.

Larry Williams states:

ZUGZWANG The life of a trader in one word—always in too early or out too late, also out too early or too late.

Jan

8

Relevant animal behavior study, from Big Al

January 8, 2026 | Leave a Comment

Self-control is definitely an issue in trading! I kept thinking of the crayfish pov. They probably shined him up by telling him he was "preferable".

Can this Cuttlefish Pass an Intelligence Test Designed for Children?

Nils Poertner responds:

Very good. For specs / traders the self-control is tested now with media trying to steal our energy (emotional vampires) with high amygdala stories - whereas the mkts does whatever it does. "get the joke"

Jan

4

Natural Gas, from Nils Poertner [Update]

January 4, 2026 | Leave a Comment

European Natural gas - not that far to test 2024 lows, and perhaps even pre-Ukraine-war levels eventually? Peace coming (?) Or general decline in Gas prices (US natty has gone the other direction for a while).

"Price move first - fundamentals later." When something moves (even though I don't trade it - or have expertise in it yet), I often look at it and wonder what it could mean. Mass financial media hasn't picked up on this theme either (much) - another reason to consider what it means…

Carder Dimitroff comments:

For me, this is an important observation. EU-US fundamentals have changed. The current US administration "encouraged" the EU to accept US LNG imports. At the same time, US LNG export capacity has increased. For Europe, the supply-demand dynamics changed. In the next several months, it will continue to change:

• 14.49 Bcfd US LNG export capacity - current.

• 21.81 Bcfd US LNG export capacity - under construction.

• 13.24 Bcfd US LNG export capacity - approved but not under construction.

• 12.49 Bcfd US LNG export capacity - proposed and seeking approval.

Most of this LNG use capacity uses, and will use, Texas/Louisiana natural gas as its feedstock. Feedstock and LNG prices will likely be correlated with Henry Hub prices. If most of this capacity is built, the following trends are likely to emerge:

• US citygate (NG) average prices will float higher.

• US LMP (electric) average prices will float higher.

• US NGL average prices will sink.

• EU NG average NG and LMP prices will stabilize.

More importantly, global LNG markets are changing and will continue to change. Keep in mind:

• Global LNG capacity is expanding

• The US is not the LNG cost leader and never can be.

• As the US dominates EU imports, global markets adjusted accordingly.

Of course, traders should be indifferent about these long-term fundamentals. But long-term investors might consider options.

Stefan Jovanovich asks:

Follow-up question for Carder and others: "What do you think about the Doombird thesis that the Permian drillers and the mid-stream connectors will shift to have natural gas be the hydrocarbon asset that they look to make money from and oil will be the secondary source of income?"

Carder Dimitroff replies:

If the question concerns long-term prospects, global demand for diesel, jet fuel, plastics, and related products is expected to grow. Gasoline consumption may be slowing, but it is not crashing. But who knows where the economy is headed?

For the US, natural gas as a bridging fuel makes sense if it can reach consumers. In the US, domestic delivery is a problem. Globally, LNG delivery is also a problem, but for different reasons. Because they deliver to Henry Hub, producers should be indifferent between the two markets. Beyond Henry, LNG is becoming increasingly accessible, whereas citygates will continue to struggle.

The US is also a net exporter of oil and oil products. Again, the product supports two separate markets.

Most Permian wells produce oil and associated gas (and they are getting gassier). It's not a choice. They get both.

For me, the short-term challenge is global overproduction. Geopolitical considerations rather than economic factors drive the decision to overproduce and erode margins. It will end, and the markets will revert. Until then, it will be difficult for American producers to finance new wells.

Dec

23

Low status jobs becoming high status, from Nils Poertner

December 23, 2025 | Leave a Comment

Fascinating to watch how former low status jobs, like cybersecurity, have become high status now. Same is true the other way around as well (eg (male) technician at the London tube system who makes a quarter of his wife who is in real estate - although that is changing now). Wondering what low type jobs / or ppl are on the fringes today will be in high demand in coming years.

Carder Dimitroff responds:

Try these:

Any of the crafts. Specifically, licensed electricians, plumbers, and HVAC techs. Many make more than engineers.

Public response teams. Specifically, firefighters, EMTs, and law enforcement. Many make more than lawyers, particularly when pensions are considered.

Career military. Specifically, for those with 20 years of service. Lifetime benefits are incredible (free college, unlimited grad schools, pensions w/colas, lifetime medical insurance, VA benefits, hiring preferences).

Pamela Van Giessen suggests:

Car mechanics

Henry Gifford writes:

My friend who fixed boilers said to his sophisticated, suit-and-tie, well educated in-laws “I’m not the smartest guy around. I’ve only read two or three books in my life. I don’t think I’m smart enough to come up with a sophisticated investment plan (nods all around the room at this point). So I just buy one piece of New York City real estate each year and hope for the best”. No more nodding at that point.

Guess what blue collar people who don’t have vices do with their money? They buy property. Who is better suited to own real estate? People who fix things and have friends who fix things, or lawyers?

And what nobody mentions is that some people are much better at those sorts of work than others. Simply finding someone to show up and try to do those things is hard. Someone who is good at one of those trades is in even higher demand.

Those fantastic benefits for former military people are not limited to the military – all federal employees get all those benefits after twenty years of work. If someone joins the military at 18, and gets out at 38, or gets out sooner and then works in the post office or etc. until they “get their twenty”, they get full salary with increases for life. Income that will survive any lawsuit, even the IRS can’t take it all. They maybe collect a total of three years of salary for every year worked.

Nils Poertner responds:

Certainly good to encourage young men (or women) to follow a path that interests them - and not just follow a path that is currently "high status". This "Yousef" guy who was my IT guy at Bankers Trust decades ago (low status in my eyes back then) became a cyberpunk in 2008…you get the idea. That said, it is a power game outside. young men need wives etc.

Henry Gifford adds:

I judge the level of a single woman’s interest in me by counting the seconds until she says “what do you do?”.

No woman has ever asked me if I like what I do, or am good at what I do – not important.

Many men have a choice between coming home miserable to a wife, or coming home happy to an empty house. Age old dilemma, no known fix, as all our DNA has evolved to enhance survival, which for a woman over the millennia has meant marrying the chief’s son, or someone else with high status.

Larry Williams recalls:

When I was dating all women ever asked me is your place or mine. Must have been doing something wrong.

Michael Brush is curious:

Do you have a cycle chart for that?

Larry Williams clarifies:

Yes but there are not enough examples to draw a conclusion.

Dec

21

Study of ancient languages. from Nils Poertner

December 21, 2025 | Leave a Comment

Idea for younger Specs: In School, some of us studied old languages, Latin, ancient Greek, one had to sit 1 hour to figure out what individual words could mean. And then put it all together. One could have the same approach for reading modern newspaper articles now. like this WSJ article here (I know that ppl can read "English" - I meant in a more reflective way. "Get the joke")

Five Reasons Investors Are Feeling Good About Stocks Again

and then check /study with "expected" vs "actual" in 1 week, 1 month, 1 quarter etc,

on a rolling basis to hone intuition /train memory.

Stefan Jovanovich recalls:

Arthur Sullivan - "no, I am not a descendant of the composer, whom none of you dunces will have heard of. He was English; I am Irish." - remains my favorite of all teachers. He lasted 1 year at Hackley - then a borstal boarding school for children who had to be warehoused, now a respectable Westchester County day school. He taught 9th grade Latin and turned it into a lesson in military tactics and strategy. The little Latin and less Greek are long gone, but I can still see his face and those of my classmates the day he explained to us how Caesar used a company of archers to conduct reconnaissance by fire.

Dec

19

Request for “off topic” books on speculation, from Asindu Drileba

December 19, 2025 | Leave a Comment

Often when I listen to specs I hear "off-topic" book recommendations. Examples:

"The most important book to do with trading is Secrets of Professional Turf Betting by Robert Bacon" — The Chair. A book about parimutuel horse betting.

"The most important book to do with the stock market is Horse Trading by Ben Green" — A game theorist & friend of The Chair. A book about selling horses

"I can find new trading strategies on almost every new page (Thinking Fast and Slow by Daniel Khaneman)" — The Chair's Brother (Mr. Roy Niederhoffer). A psychology book

"Our entire investment philosophy is based off this book (Snow Crash by Neal Stephenson) — Fred Wilson of Union Square Ventures, a Tier 1 VC firm. Its a sci-fi book.

"One of the most important things you can learn todo with investing is creative writing" — Jeffrey Hirsch. Not a book but still an off-topic research recommendation.

I have never regretted reading an "off-topic" book. Any more of such recommendations?

Nils Poertner responds:

Coaching Plain & Simple, by P. Szabo, D. Meier (book about learning - how to coach oneself in a way)

Asindu - what books to get rid off, to burn, what is an obstacle in your life is also relevant. Early 2008, I visited a French friend on Lehman trading floor in London. V nice guy, senior analyst for their credit models, high IQ 130 plus, bit gullible though. He was surrounded by over 20 books of advanced math on either side of his desk. I had the urge to get a huge sledgehammer and whack down the books…you know.

Larry Williams suggests:

Zurich axioms. A must read.

Peter Ringel agrees with Larry:

I have them on my wall. Besides some of the lists by Vic, Larry, Adam Grimes and some other. Valuable.

And did you find the Daily Speculations booklist?

Asindu Drileba writes:

Yes. I forgot about Zurich Axioms. Thanks. This Daily Speculations list is good, I actually wasn't aware of it.

Dec

18

Clustering, from Nils Poertner

December 18, 2025 | 2 Comments

There is this known phenomenon that coffee chains (Starbucks, Costa Coffee) in a city are often next to each other. Same for gas (petrol) Stations. Makes no sense for the customer but applying game theory it certainly does.

Perhaps the same could be said for analysts forecasts by major broker dealers?

Early 2010 (pre Eurocrisis) I recall speaking to a Deutsche Banker covering Italian regional banks. She said she would have loved to write a more bearish story but was afraid of internal repercussions (as they were trying to win other business from those Italian banks).

Dec

16

Only the paranoid survive, from Nils Poertner

December 16, 2025 | Leave a Comment

written by another smart Hungarian (who came to the US). Andy Grove (late Intel CEO), real name is Gróf, András István. Jewish Hungarian middle class. András Gróf was born to a middle-class Jewish family in Budapest in 1936.

typically it does not pay to be surrounded by paranoid ppl in business or speculating (one reason I don't like preppers in my vicinity as they irritate me too much) -OTOH, perhaps there is some value to adding here and there a friend who is a bit paranoid at times.

Dec

15

Harvard Club antisemitism, from Jeff Watson

December 15, 2025 | Leave a Comment

No comment needed.

The Harvard Club of New York Cancels Dershowitz Book Event

The Harvard Club of New York is being accused of censorship after abruptly cancelling a book event featuring famed Harvard professor Alan Dershowitz. In a statement, Dershowitz says that invitations were sent out and the event was approaching when he was suddenly told that the Harvard Club would have none of it. He blamed his representation of President Donald Trump for the cancellation. For a club that bills itself as offering “unique experiences,” it appears that hearing from opposing or different views is not one of them. Dershowitz has been associated with Harvard for over 60 years and remains one of its best known law faculty members.

Nils Poertner comments:

Large Universities in the US, Canada and parts of Europe are doomed beyond repair. No error correction process happening- built through collapse.

Henry Gifford writes:

Harvard was just used as an example when Trump tried to cancel “their” research funding (polite word for money). I didn’t pay attention to the details of the outcome - the point got made that universities better step into line.

Sure, Trump’s objection had something to do with DEI and being too liberal, but as all colleges are dependent on not paying taxes, and on government loans for most tuition, and government research money, they can hardly be anything but socialist in thinking, and can be expected I think to stay that way.

If they paid taxes and people had to pay to go there and research had to be paid for by someone spending their own money things would, I think, be greatly improved, but that is not the world we live in.

The government is basically paying the universities to breed socialism. In New York City we even have colleges that teach people to be bureaucrats.

Dec

6

Sancho Panza proverbs, from Nils Poertner

December 6, 2025 | Leave a Comment

Sancho Panza's Porverbs and others that occur in Don Quixote

half of the proverbs contain the word "ass" in it - like this one which I found timely:

When the broom sprouts, the ass is born to eat it.

Nov

28

Lucky charms, from M. Humbert

November 28, 2025 | Leave a Comment

Anyone have any favorite good luck charms/rituals to help with trading results?

Peter Ringel writes:

some of the old floor traders, we had on this list, reported how superstitious some of the traders were. Cloths, bathroom time…

Asindu Drileba comments:

Lucky charms may sound delusional but they are actually more common than we think. They are more like placebos. I take pill X, my headache goes away. (But pill X is made from wheat flour and a bitter "filler" and has exactly zero pharmaceutical contents, yet it works).

Have you ever pushed the button that opens the door of an elevator? Well, those buttons are completely fake! Elevator doors are pre-programmed to open and close at hard coded intervals. Pushing the button does nothing. They simply exist to give people a sense of control.

Nils Poertner writes:

To have a strong belief one can learn (from mkts or others) is a good start.

ie allowing for mistakes to happen, not fretting them. (many cultures are guilt-ridden, like the German culture on so many fronts. All it takes is sometimes to muster up enough courage and learn from mistakes and don't judge).

Zubin Al Genubi offers:

I'm reading Kidding Ourselves, Hidden Power of Self Deception, by Hallinan, in which he describes real physical and psychological effects of psychosomatic causes such as death, hallucinations. You see what you want to see. You are and become what you believe yourself to be. It affects health, performance, money. He also describes how a feeling of lack of control can be debilitating and even deadly. Some feel a lack of control in that they don't control the market, but one can easily (physically at least) click the keys to buy and sell any time.

From scientific studies: Our results suggest that the activation of a superstition can indeed yield performance-improving effects.

Nov

25

Book recommendation from Zubin Al Genubi

November 25, 2025 | Leave a Comment

Zapped: From Infrared to X-rays, the Curious History of Invisible Light

From beloved popular science writer Bob Berman, ZAPPED tells the story of all the light we cannot see, tracing infrared, microwaves, ultraviolet, X-rays, gamma rays, radio waves and other forms of radiation from their historic, world-altering discoveries in the 19th century to their central role in our modern way of life, setting the record straight on health costs (and benefits) and exploring the consequences of our newest technologies.

Nils Poertner suggests:

The HoHo Dojo, by Billy Strean.

Laughter and humor are therapeutic allies in healing.

Nov

23

Suprises, from Nils Poertner

November 23, 2025 | Leave a Comment

Whether it is the "Mambani win", Brexit, Covid, Ukraine war, whatever - had someone told me 6 months before that this could happen - the answer would have been "no-way…" whereas in 20-20 hindsight - it is always like "oh yes, there were obvious signs."

Zubin Al Genubi responds:

History is made on the edges by outliers which shifts the averages way over in its direction.

Nov

17

Corporate earnings, from Zubin Al Genubi

November 17, 2025 | Leave a Comment

I see they are down [at least through Q2]:

FRED: Corporate Profits After Tax (without IVA and CCAdj)

Steve Ellison responds:

Interesting. S&P 500 earnings per share were up both year to date and year over year. And Q3 so far looks better than Q2.

S&P source spreadsheet: Click link to download file: S&P 500 Earnings.

Big Al wonders:

So maybe the big firms are doing better than the smaller ones?

Nils Poertner remembers:

Investment Bank earnings 2007…My very cerebral friend Maurice at the time: "IBs are cheap - look at their PE ratios."

Nov

13

The $38 Trillion Question, from Humbert X.

November 13, 2025 | Leave a Comment

The $38 Trillion Question: An Interview with Stanford Professor Hanno Lustig

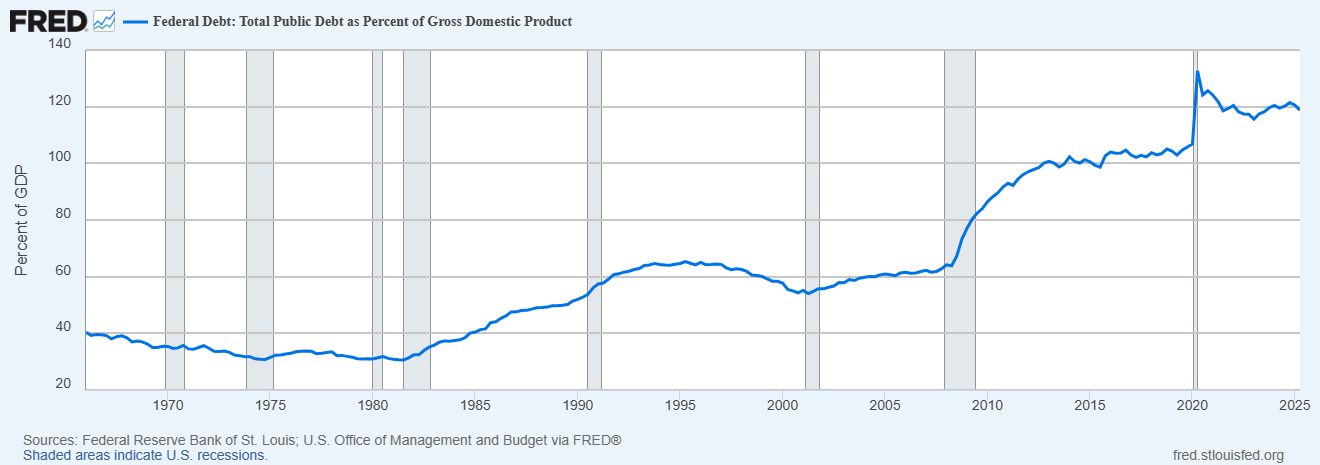

Hanno Lustig: I started thinking about the valuation of government debt by looking at the valuation of all Treasuries. What do we have to believe to get to a number like $38 trillion? You must believe there will be a huge fiscal correction, because ultimately the value of debt should be backed by future primary government surpluses. When you do the numbers, you realize that either bond investors are pricing in a huge fiscal correction that seems impossible, or Treasuries are significantly overpriced.

Carder Dimitroff notes:

The interest on debt is approaching $1 trillion per year and continues to compound. Interest costs currently exceed Department of Defense spending.

Larry Williams disagrees:

Meaningless measure look at debt vs gdp

Carder Dimitroff responds:

Yes, that makes sense. However, from a different perspective, it becomes meaningful under the One Beautiful Budget Bill when automatic sequestrations are implemented. Unless new legislation is passed, sequestrations will result in Medicare cuts and other reductions in expenditures. Current projections suggest sequestration will present in early 2026.

Big Al checks with FRED:

Nils Poertner writes:

recession + zero short term rates + lots of QE ….leading to a lot more public debt

maybe that is more likely path.

Stefan Jovanovich offers some history:

This chart shows the solvency ratios that can be found from the Census and other data [by decade 1880 to 2020] - how much "we the people" have in money divided by how much the American governments promise to pay.

Nov

12

David Hand’s probability lever, from Nils Poertner

November 12, 2025 | Leave a Comment

intellectual support / motivation to look at more extreme scenarios from time to time (extreme only appearing in the moment of course).

Hand writing: The Improbability Principle

The law of the probability lever is to do with choosing models. With poor assumptions even highly likely events can seem very improbable. Small changes in initial conditions can have an extremely large effect on outcomes.

Nov

9

Prestigious consulting firm, from Nils Poertner

November 9, 2025 | Leave a Comment

Came to our financial firm 2007 and gave a 100 page presentation full of bullet points and cartesian logic (why housing boom will last). Either 3,5, or 9 bullet points per page.

At the end of the presentation I was tempted to go over to the presenter and ask him "why do you love your wife? (I didn't). The answer might have been bullet points.

Pamela Van Giessen writes:

Michael Korda tells in his memoir, Another Life, of the time that Simon & Schuster hired probably the same prestigious consulting firm to study how to improve revenues/profitability. Prestigious consulting firm (after taking the prestigious consulting firm fee) told the publishing company that they should publish more bestsellers.

Laurel Kenner comments:

I bet the prestigious firm concluded with ‘Key Takeaways’ as a final insult to the intelligence of the client.

Asindu Drileba writes:

I heard that people pay consultancy firms not for their knowledge, but for the fact that executives use them as a scape goat. If an executive wants to pursue policy X. They simply hire a consultancy to recommend policy X. If policy X ends up as a disaster (legally, morally or financially). They can simply say "Policy X was an idea from XYZ consultancy", we had nothing to do with it.

Peter Ringel adds:

a variation of this are fighting owners/ partners about policy. If decision pipelines are blocked, external council is used. Like a neutral arbitrator. I think, these are the main situations externals are used. Usually a good reason to short the entity, especially outside of markets. If they don't have the capability to decide and act on strategy in-house, it‘s a red flag.

Henry Gifford responds:

Even better is hiring a licensed engineer to instruct everyone to do something stupid that they know won’t work, so everyone who did as the engineer decided is blameless.

Jeff Watson offers:

A consultant is a person who knows 1000 ways to make love to a woman…..but he doesn’t know any women.

Oct

23

Regional US banks, from Nils Poertner

October 23, 2025 | Leave a Comment

As a European, I am asking: Are US regional banks in trouble (maybe even some larger banks - incl Investment banks). Dodgy consumer loans, then those silly "AI-related" loans? Am agnostic here - I suspect the typical analyst from JPM down the road won't enlighten us here.

Paul O'Leary comments:

No. Looks like over-reaction to a couple credit blips. Then algos pile on and observers who don’t follow the sector conjure up doom scenarios. Zion Bancorp - the main sinner, lost $1B in market cap for a $50mm write down.

Nils Poertner responds:

Hear you, Paul. If enough people would start to worry now, I would worry less (let us see).

Cagdas Tuna adds:

We are at a level any reaction will be exaggerated. If market adds $200bln to NVDA market cap with additional $1blnn revenue then $50m loss will have the same effect on a smaller company's share.

Oct

17

George B Shaw, from Nils Poertner

October 17, 2025 | Leave a Comment

You see things; and you say 'Why?' But I dream things that never were; and I say 'Why not?'

- George Bernard Shaw

English Cyperpunk /hacker I met in 2005 had this quote on his screen - and I recall him talking about some digital ccy back then (little did I know back then, was so busy structuring CDOs and keeping up with the Jones.

If we want to nail mkts in coming years and have some fun, it def pays to surround ourselves with ppl outside trad finance (group think!) - from the art, music, acting world, hacker etc…whatever.

There is a certain type of fatalism in the West as well (David Hand, the British statistician, speaks about it as well in his "miracle" book. It has something to do how we perceive the world.)

Oct

16

Hubris is going to a New All Time High, from Sushil Kedia

October 16, 2025 | Leave a Comment

Saudi Arabia has announced the Rise Tower that is likely to have a height twice that of Burj Khalifa! 2000 meters up from the ground! It is likely to cost 5 Billion Dollars. One is left wondering in a world where everyone manages to almost manages to get decent enough sleep every night with Trillion Dollar deficits, what is Hubris doing having been left so far behind!

Nils Poertner writes:

Wondering what to make of this though, Sunil. Saudi Arabia's main stock Index (TASII peaked in 2006. and never fully recovered properly. Any idea how to express it into some trading idea so we can test our hypothesis?

William Huggins comments:

The 2006 Saudis run is very similar to the soul al manakh run up 20 years before. In particular for Saudis though, it's a market that forbid ahoet selling so when the bulls got started there was no guardrail until they simply could find no bigger fool.

Nils Poertner responds:

Thanks William. Maybe one needs to look at oil (bearish oil story?) - oil doesn't move forever and then it moves a lot. (not an oil trader though - just something that came to mind)

Alex Castaldo offers:

For those too young to remember the events of 1981:

The Souk al-Manakh Crash

From 1978 to 1981, Kuwait’s two stock markets, one the conservatively regulated “official” market and the other the unregulated Souk al-Manakh, exploded in size, growing to the point where the amount of capital actively traded exceeded that of every other country in the world except the United States and Japan. A year later, the system collapsed in an instant, causing huge real losses to the economy and financial disruption lasting nearly a decade. This Commentary examines the emergence of the Souk, the simple financial innovation that evolved to solve its rapidly increasing need for liquidity and credit, and the herculean efforts to solve the tangled problems resulting from the collapse. Two lessons of Kuwait’s crisis are that it is difficult to separate the banking and unregulated financial sectors and that regulators need detailed data on the transactions being conducted at all financial institutions to give them the understanding of the entire network they must have to maintain financial stability. If Kuwaiti officials had had transaction-by-transaction data on the trades being made in both the regulated and unregulated stock markets, then the Kuwaiti crisis and its aftermath might not have been so severe.

Oct

9

Jewish Hungarian, from Nils Poertner

October 9, 2025 | Leave a Comment

What is it with Hungarian Jewish who came to the US - so many of them achieved great things. My book shelf is full of them, Darvas (Trading), S Meisner (Acting)…..even my trading platform Interactive Brokers was founded by one (Thomas Peterffy).

Maybe a combo of rare language ??/ culture + hardship first + grid + ability to flourish in the US gave them superpower. Soros, I guess was (Jewish) Hungarian as well.

Venkatesh Medabalimi asks:

Where is my no.1 Hungarian? May I remind everyone about Paul Erdős.

Laurel Kenner offers:

An amusing book on the subject: Made in Hungary : Or Made by Hungarians, by György Bolgár.

Nils Poertner responds:

Thanks both. Found this on Erdős:

Paul Erdős: The Oddball’s Oddball

He would appear on the doorstep of fellow mathematicians without warning–a frail, disheveled, elderly man, hopped up on amphetamines and wearing a ratty raincoat–and announce, in a thick Hungarian accent, “My mind is open.” For a day, or a week or a month, the man or woman who answered the knock would have to take nonstop care of this helpless guest who couldn’t figure out how to cut a grapefruit or wash his underwear–and in return would be permitted the exhausting, exhilarating experience of following the thought processes of Paul Erdős, the most prolific and arguably the cleverest mathematician of the century.

Oct

1

Lebanon, from Nils Poertner

October 1, 2025 | Leave a Comment

Lebanese traders from the 1980s tell me how chaotic that decade was - high vol ever day - for yrs. Survival was key! Started reading every bit about it in the last few weeks. (The thing that Stefan is right about is that the self-image we have in West and realtiy - there is a huge gap for sure!! Am not speaking about military though - I meant anything else)

The Lebanese Economic Crisis: How It Happened; the Challenges that Lie Ahead

September 27, 2021

Lebanon is experiencing one of the worst economic collapses in recent history. The currency has lost more than 90 percent of its value; an estimated three in four Lebanese citizens are now below the poverty line, and the country is beset by food, gas, and medical shortages. The power grid can barely maintain electricity for cities, with frequent blackouts occurring. Finally, the country had to default on its debt payment, launching its debt crisis. The debt crisis didn’t come suddenly, but was building up over time due to economic decisions made by previous governments. To understand how this crisis came to be, an examination of Lebanon’s modern history is in order, starting with the civil war in 1975.

Larry Williams writes:

Chaotic? In 1973 Shearson AmEx had me go there to lecture an teach trading - some high flyer commodity mooches had come in and lost lots of $$ for some locals who did not understand margin calls. The high flyers from Chicago were found gutted on a barb wire fence out in the country! The war broke out we could not get out for about a week so hung low then finally bribed our way home.

Nils Poertner responds:

my 2 cents are on Larry and all savvy Lebanese traders going forward. Good idea to live in more rural areas in the US, UK etc to see things unfolding as well. And keeping the internal chatter to a minimum (as always).

Stefan Jovanovich analogizes:

If LW disagrees, he will, I hope, correct this latest folly from the List's history channel wannabe. The reason the Oregon Trail came first was that it was the one safe destination for the missionaries. The Indians of the rain forest coastal Northwest were the tribes with no history of revolt against the Brits, Russians and Americans. The wars on the Plains started when some smart money decided that they could colonize the spaces between Council Bluffs and the Dalles. That analogy comes to mind every time I look at the modern history of the adventures of the Americans in Lebanon.

Larry Williams offers:

My brother on law who is better read than I am an a deeper thinker says this is a good read on the western adventure:

The Undiscovered Country: Triumph, Tragedy, and the Shaping of the American West

Sep

28

Scaling problems in ship design, from Nils Poertner

September 28, 2025 | Leave a Comment

Scale effects and full-scale ship hydrodynamics: A review

Scaling problems in ship design refer to the difficulties of translating performance data from a small-scale model to a full-scale ship, as physical forces like viscosity and wave drag do not scale proportionally with size.

Crypto space here? Trading strategies that work in niche mkts or early on, may not work when they are larger /more mature etc.

Henry Gifford writes:

The problems with water include the size of water droplets – they won’t form larger than a certain size – and Reynolds Number, which has to do with viscosity (mentioned below), and how to calculate it. Basically, a certain flow velocity in a small pipe (or river) will be turbulent, while in a larger pipe it might not.

Movies that use models of ships to show dramatic events with ships always show water droplets that are way, way too large, making it obvious to those who notice that they are looking at a model.

Nils Poertner responds:

Makes a lot of sense, Henry, thanks! (Equity sell-side analysts love to scale things (to the point it makes no sense anymore). Wile E. Coyote moment for NVDA et al coming soon perhaps.

Stefan Jovanovich predicts:

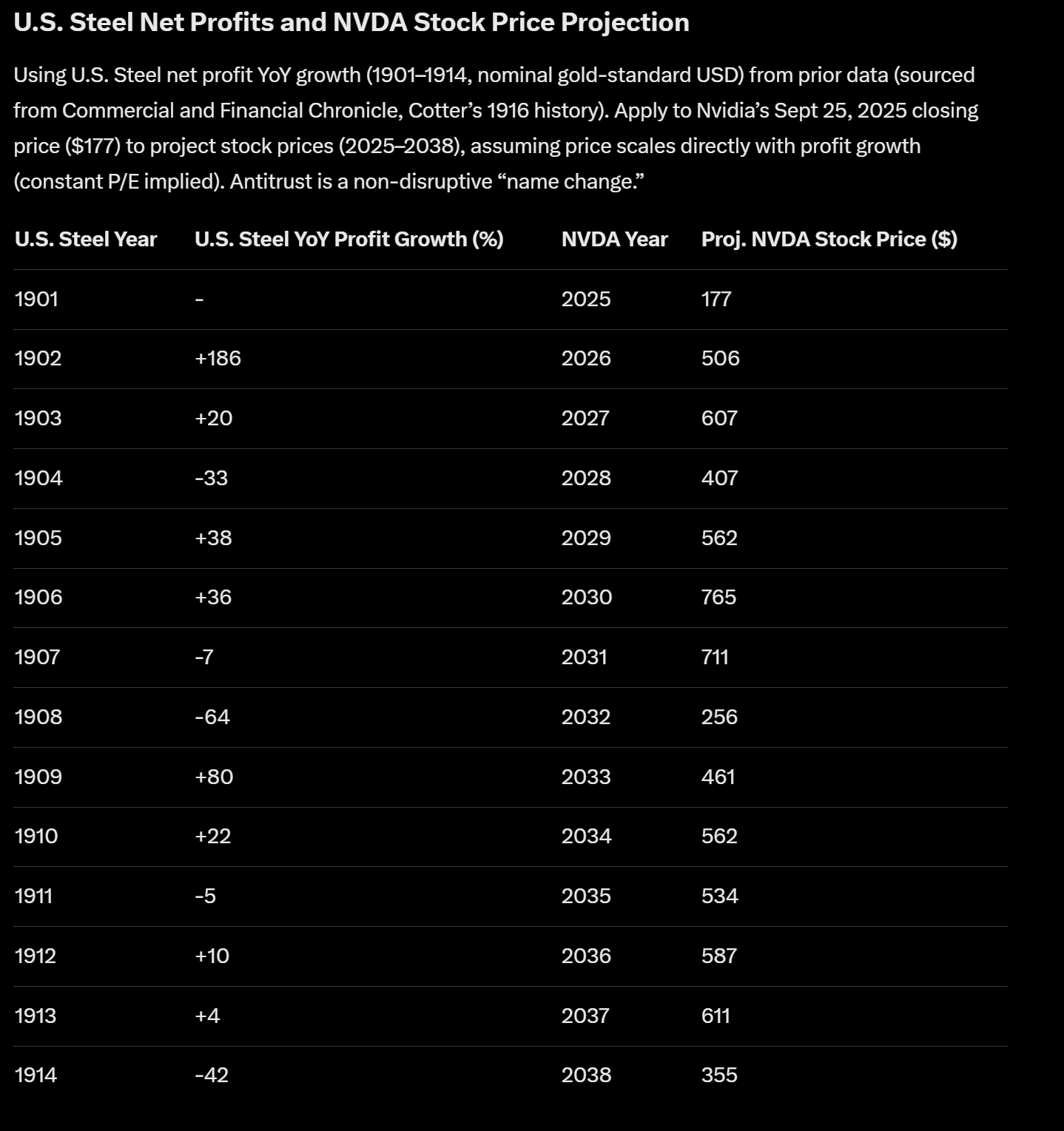

Grok - our FO's new member (he/she/it works for free like Harry Potter's Dobby) - thinks the moment will be 2031-32. [Click on chart at right.] We take the current AI events as a direct comparison to the creation of U.S. Steel.

Sep

23

Health care costs, from Nils Poertner

September 23, 2025 | Leave a Comment

health care costs, our Achilles heel.

Health Insurance Costs for Businesses to Rise by Most in 15 Years

Insurers say that the rising premiums are driven by growing healthcare costs

(on a personal note: no-one is really fully healthy, not even kids normally! science uses a lot of Aristotelian logic (which is an either/or logic) but there are limits to it - and we take it way beyond its usefulness. Nature does not have those clear mental compartments - it is way more fluid /dynamic).

Steve Ellison writes:

Until the public announcement that Warren Buffett had bought shares in UnitedHealth, health care was by far the worst performing of the 11 S&P 500 sectors in 2025.

Nils Poertner responds:

Yes, the whole sector / subindex looks bullish (XLV). (the type of logic in the West (logic from Aristoteles) that dominates MODERN SCIENCE cripples our society. Why? Because in many cases, whatever the doctor says, "it is not" - it is only an image of something abstract (like the apple painting by Rene Magritte).

Pamela Van Giessen comments:

We overconsume healthcare because we pay so much for insurance and/or our employers give it to us in lieu of salary so we want to get all we can for “free.” We’ve been conditioned to believe that if we visit doctors (though now we see PAs) and get “check ups” and “tests” regularly and take pills to manage our bodies and minds in perpetuity that we won’t get seriously ill. Has got to be the biggest subscription scam ever perpetuated on a society.

Perhaps some spec would like to pull out the data and do some forensic financial analysis of all those hospital system balance sheets. I think that fully 1/3rd or more of hospital systems are owned by private equity firms and the bulk of non-profit hospital systems are extracting meaningful sums from the business regardless of how “healthy” their margins look on their financial statements. From an equity perspective the biz may have looked lousy but I can promise that it is extraordinarily profitable for the inside players.

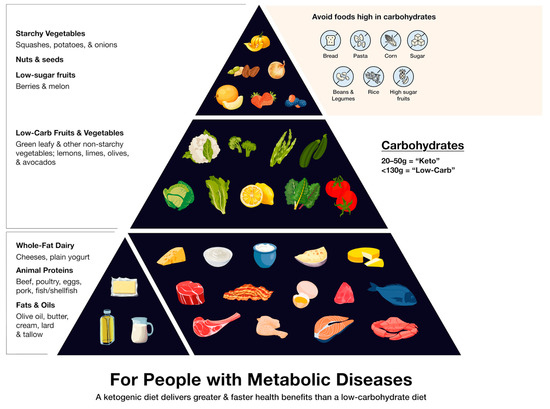

Jeffrey Hirsch adds:

Not only is it a total scam, but it gets in the way of real needed pharmaceutical/medical care and completely ignores metabolic healthcare via lifestyle and diet changes.

Too bad RFK is all wrapped up in his vaccine crusade to focus on the real USA health crisis with obesity and metabolic health, which causes diabetes, heart disease, cancer and cognitive decline. I think the covid vax is total BS as are others. But MMR and most childhood vaccines save lives. We had a measles outbreak in Rockland County a few years back because some communities did not vaccinate.

We should also flip the old USDA Food upside down. The chart is from my Doc’s paper. And my doc's site is Dr. Tro Kalayjian).

Sep

8

Dutch scientist Christiaan Huygens, from Nils Poertner

September 8, 2025 | Leave a Comment

Dutch scientist Christiaan Huygens found in the 17th century that larger pendulum clocks will sync smaller ones.

Video by Veritasium: The Surprising Secret of Synchronization

Pendulums in the human world = our various belief systems (which are sometimes in competition to each other and go deep). Two examples perhaps: in finance: a trader has religious reasons why he /she does not think he deserves the STELLAR gains. Ways are found to turn accumulated gains into a loss! in health: why do some ppl stay sick and others recover miraculously against all odds?

Zubin Al Genubi writes:

The Kuramoto mathematical model describes synchrony in networks. The line between order and randomness occurs at the phase transition when the network nodes synchronize.

Building on Kuramoto's model, the Watts and Strogatz model makes testable predictions about interventions most likely to trigger cascades.

In small world network terms there are "vulnerable clusters" in the market. In market terms the vulnerable clusters are weak hands, funds faced with margin calls, or fund hitting a stop losses. Obvious 2d points or tipping points are stop points at prior lows. If a vulnerable cluster is close to the second tipping point, it can ignite a cascade.

Nils Poertner responds:

Mathematicians often find something which ordinary people know intuitively. 2 more examples:

1. Five teenagers bully a victim. Knock-out the strongest in the group and the rest will fall too (big bully was the dominant pendulum, trumping the small ones).

2. When the most valuable firm(s) in an index suddenly struggle (NVDA?), it often means bad things for wider index.

Asindu Drileba adds:

I found the same pattern in the "Complex Systems" community. An example in Secrets of Professional Turf Betting: The idea of "copper the public opinion" & "principle of ever changing cycles" are an intuitive description of the minority game & El farol Bar problem in complex systems. Statistical arbitrage is almost exactly what Robert Bacon describes as a "dutch book."

In Neil Johnson's Simply Complexity, he derives an insight that currency traders have (knowing what currency is "in play") using graph theory.

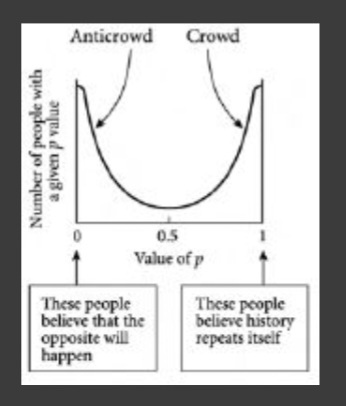

I think Simply Complexity is a very good book for speculators, since it uses accessible analogies and no complicated math. The book has a lot of analogies regarding the market. The most relevant section for Specs would be, Chapter 4: Mob Mentality (I however enjoyed the entire book).

A Few excerpts:

The bar-goers who tend to shift opinions about whether to go with history or against it, tend to lose more and hence eventually change their p value.

This reminded me of people that both go short & long in the market (I am long only). P is the probability of an event happening.

Figure 4.3 from the book and its caption:

We are naturally divided. The final arrangement of a collection of people, in the case of a bar where the comfort limit is around half the number of potential attendees. This shows the emergent phenomenon of a crowd who think that history repeats itself, and an anticrowd who think that the opposite will happen. Hence the population polarizes itself into two opposing groups. This polarization of the population represents a universal emergent phenomenon. It will arise to a greater or lesser extent in any Complex System involving collections of decision-making objects such as people, which are competing for some form of limited resource.

The figure is similar to the Arc Sin law of PnL. Something that appears in Ralph Vince's book The Mathematics of Money Management and Nassim Taleb's Dynamic Hedging. Unfortunately, I don't have a good intuition on the Arc Sin law of PnL.

Jul

23

Entry or exit opportunity, from Nils Poertner

July 23, 2025 | Leave a Comment

Donald Trump set to open US retirement market to crypto investments

President preparing executive order to allow 401k plans to tap broad pool of alternative assets

Hm. Entry for ordinary folks or a sneak way / exit for established players? Have a got a picture of the angel fish in my office, to remind me of the deceptive nature of markets. Angler fish are those ambush predator fish living in deep sea, that can illuminate poles in front of their jaws….to catch smaller fish.

William Huggins writes:

am reading Gustavus Myers' History of Great American Fortunes (1907) at the moment and just absorbed 300 pages of railroad fraud perpetrated by those who got their hands on the "mcguffin" asset and then sold it off only once they had successfully looted the value. the same sort of economic transfer happens for early crypto adopters - those trillions of market cap are "paper only" until some rubes can be fleeced of their efforts for the worthless securities foisted upon them.

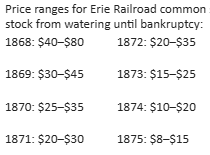

Stefan Jovanovich comments:

I hope this comment will not be read as argument or rebuttal but only as a factual footnote to Myers' work. The 50,000 shares issued by Fiske et. al. were "legal" in the same way that carried interest is "legal". They were allowed by New York State law in 1868.

The primary limitation on the issue of new shares of common stock for the Erie was its corporate charter. The board only had authority to issue $30 million in capital stock. Any issues above that amount required amendment of the corporate charter by the legislature and majority shareholder approval. The additional 50K of stock issued, at its par value, did not increase the total capitalization above the $30 million limit.

NY State law in 1868 allowed non-cash consideration. The contracts that the Erie board accepted as payment for the new shares were, in nominal dollars, fully equal to the par value of the shares issued. Shareholders had the right to challenge that claim; they were, as litigant frequently are, disappointed by the rejection of their challenge. The result was a situation that can be politely described as "judicial uncertainty" - i.e. a battle of conflicting injunctions.

Jun

27

General semantics, from Nils Poertner

June 27, 2025 | Leave a Comment

Drive Yourself Sane: Using the Uncommon Sense of General Semantics, by Susan Presby Kodish

GS is based on a careful study of human behavior and scientific problem-solving, bridging applied psychology and practical philosophy. Drive Yourself Sane provides time-tested methods for critical and creative thinking and constructive communicating with a variety of problem-solving applications for mental hygiene, personal development, education, business, etc.

Easy to read book about Global Semantics. Why relevant? Because we often confuse the image of something with reality. And that is recipe for insanity. eg. Dalio has this "machine" analogy for mkts and the econ. Fair enough. But the econ and markets are much more: Living organism etc (good to use "etc" as it reminds oneself that it is a lot more…) There is a famous picture that shows an "apple" and underneath the painter wrote: "This is not an Apple."

Humbert G. comments:

Image v. Reality. Dialio is the perfect example. What’s with all the gloomy billionaires?

Larry Williams writes:

Dalio sure looks like a loser always bemoaning the world same as Cooperman how did these guys rise so far?? Then I have been accused of not being smart enough to put my feet on the ground if it weren’t for gravity.

Rich Bubb ponders:

I've been thinking that Dalio is using historical events to try to not repeat AVOIDABLE/PREVENTABLE mistakes. Yet the rhyming of those events is intriguing. Especially the given nature of Nature, current hot wars, insane debt levels, growing militarization actions, natural resource over usage/abuse, wealth distribution, Us vs. Them polarizations, etc. Yep, gloomy.

His 'machine' concept of the Markets & Economics is an "approximation of a likely future" (my words). The coincidences of the factors Dalio describes at some pressure point will often start Change Cycles. We've witnessed this in our own short-lived & humble lifetimes.

The problem is that 'history' will not exactly repeat in some-yet-unknown terms but might rhyme in concept. The timeline/s of historical examples Dalio uses for large changes is/are very long. And the salient concepts, e.g., reserve currency, debt irrationality, Dalio's Big Cycle (some spanning decades or longer), "Dynastic Cycles' Stages", etc., are historically documented and presented in "The Changing World Order" (2021). The tables and 'chartwork' are visual reinforcements throughout, yet intriguing patterns do persistently re-occur.

My takeaway is generally that Major Powers' (Markets, Econ, military conflicts, extinction-level weapons/WMD^6, etc.) either don't see the cliff they are eventually going to go over, or those major powers refuse to find solutions to the recurring Root Causes that Dalio writes about.

I'm not finished with his 'Changing World Order' book. From what I have read, Dalio seems to try to codify history into significantly huge cycles, leading to changes in the World's Order. IMO, given the current situation (in our time, i.e., now) it isn't too difficult to extrapolate what's ahead… gloomy indeed. Maybe Dalio is "gloomy" for one or more reason/s.

Jun

23

Jarisch–Herxheimer reaction, from Nils Poertner

June 23, 2025 | Leave a Comment

Jarisch-Herxheimer reaction in medicine: A sudden and typically transient reaction (eg fever) that may occur within 24 hours of being administered antibiotics for an infection such as syphilis.

Application in financial markets? eg when a troubled stock sells off briefly after a new strategy or management is announced but the stock recovers after some 24-48 h carnage.

Asindu Drileba writes:

In The Education of a Speculator, Chapter 14, "Music & Counting":

Another frequent work I hear in the market is Haydn's Symphony No. 94 ("The Surprise"). The surprise is a simple fortissimo chord in the second movement, designed "to make the women jump." In a contemporaneous review of the work, a lyrical critic wrote:

The surprise might be likened to the situation of a beautiful Shepherdess who, lulled to sleep by the murmur of a distant Waterfall, starts alarmed by the unexpected firing of a fowling-piece.'

Two examples from currency markets:

1) Asia Currency crisis: When the Asian currency crisis of the 1990s was starting to manifest, IMF provided a loan to "stabilize" the economy. The currencies were stable for some time (the lull to sleep), then dropped by up to 80% in some Asian countries (the jump).

2) The Lebanese pound: The Lebanese pound remained very stable. Close to a flat line for 13 years (the lull to sleep), Then in Jan 2023 it dropped by 90% (the jump).

Equity Markets: "The best predictor that a company will go bankrupt, is stable income" — Nassim Taleb. Unfortunately its hard for me to get data on delisted (bankrupt) stocks so I can't test this. But the logic behind this reasoning is that, to provide stable income, corporations often optimise via unhealthy accumulation of debt, relying on a single supply chain (Apple & China), relying on a few big enterprise customers (Palantir & US Government).

While this optimisation makes it easier to milk profits that make a corporation look "stable" (the lull to sleep), it makes them more prone to catastrophic failure (the jump). A single customer canceling your service, trump tariffs on a single supply chain partner or debt unable to be paid may lead serious issues.

Jun

18

Win rate, from Francesco Sabella

June 18, 2025 | Leave a Comment

What exactly means this quote? I read of it years ago on a book about Medallion Fund but never understood if I got the meaning correctly.

We're right 50.75% of the time…but we're 100 % right 50.75% of the time. You can make billions that way.

- Robert Mercer

Peter Ringel responds:

my guess: trend following systems can have 40% win rate and lower. Yet via expectancy these sys can be very profitable. Medallion though, would do HF stuff, less MoMo.

Michael Chekalin comments:

Mercer refers to the consistency of Medallion. In other words, they are “consistently” profitable in the 50% area, which through proper money management, risk/reward, etc, can be extremely profitable.

Asindu Drileba writes:

I think its a reference to the "law of large numbers." Suppose you noticed the market goes up 51% of the time on Thursday. (for the 100 Thursdays in your sample dataset) This means that you will also loose 49% of the time. If you decide for example to only place bets for the first 20 days, you might have a win rate of 0%. All bets of the first 20 days can fail.

But the model will still be correct since you can make money for the subsequent 51 days and the lose money for the next 29 days — thus playing the market for all the 100 days (20 + 51 + 29). So your win rate will converge to 51/100 which is the same 51% you identified in your sample. You have therefore acquired 100% of the edge. I think that is what he means when he says "we are 100% right 50.75% of the time."

Nils Poertner adds:

Some specs have a 10pc win rate and do really well. Friend of mine was early investor in ETH in size- but all other of his ideas didn't work out. His nick name was "Harbinger of Failure." Kind of like the joke: "I told my friends I want to become a comedian - and they all laughed. And then I became a comedian and no-one laughed anymore." I often think about him now.

May

8

Fuzzy thinking, from Nils Poertner

May 8, 2025 | Leave a Comment

Bart Kosko came out with the "fuzzy thinking" quite a while ago. Some of his ideas are very relevant today.

Fuzzy Thinking: The New Science of Fuzzy Logic

An authoritative introduction to "fuzzy logic" brings readers up to speed on the "smart" products and computers that will change all of our lives in the future.

Of course, the P/L at the end of the day is either red or green- but life in general is way more greyish and shades. And the over-use of "black-and-white" thinking is also recipe for going insane (and that is easy to spot in some parts of society).

Big Al adds:

An interesting interview with Bart Kosko.

And here is his lecture as part of the Linus Pauling Memorial Lecture Series:

What is Noise? What is Signal?, Dr. Bart Kosko, University of Southern California

Noise is a social nuisance, a cause of deafness and high blood pressure, and an all-around annoyance. But what is noise really? As Kosko simply states, “Noise is a signal that you don’t like.” It occurs at every level of the physical universe, from the big bang to blaring car alarms. Today, noise is considered the curse of the information age, but, in fact, not all noise is bad. Debunking this and many other commonly held beliefs about noise, Kosko gives us a vivid sense of how deeply noise permeates both the world around us and within us.

Apr

24

Planck’s principle, from Nils Poertner

April 24, 2025 | Leave a Comment

A new scientific truth does not triumph by convincing its opponents and making them see the light, but rather because its opponents eventually die and a new generation grows up that is familiar with it…

An important scientific innovation rarely makes its way by gradually winning over and converting its opponents: it rarely happens that Saul becomes Paul. What does happen is that its opponents gradually die out, and that the growing generation is familiarized with the ideas from the beginning: another instance of the fact that the future lies with the youth.

— Max Planck, Scientific autobiography, 1950, p. 33, 97

relevance of how new ideas are being adopted in science, markets, everywhere.

Jeff Watson responds:

Science by consensus is not science. Just ask Galileo.

Pamela Van Giessen writes:

John McPhee wrote extensively about this and how the science of geology advanced over a few centuries in Annals of the Former World. Scientific community consensus is pernicious, and it is clear that there is mostly no convincing it.

William Huggins comments:

the foundation of science rests of replicability - anyone with the same data should be able to replicate results (even if they disagree about the mechanism). once replication is established, the difficult questions come from "is this data sufficient and representative?"; "is the data generating process stable or dynamic?"; "did i gather data in support of my hypothesis or to try to disprove it?". the fun stuff.

philosophy of science ensures we ask good questions and have good tools to tackle them with. this is why the Ph in PhD is short for "philosophy."

correction: "same data" is the wrong phrase - "equivalent, out-of-sample" would be a better choice of words.

Asindu Drileba writes:

The problem with the human mind is that it has too many glitches. You can verify data successfully and still be wrong. Here are two examples from Astronomy. First, The Mayans had models that would accurately predict eclipses. So, your data of when eclipses occur would replicate really well with their model. However the model of the solar system the Mayans used, had the Earth at the centre and the Sun revolved around it. The assumptions of the model were completely wrong, but the data (predictions) were accurate.

Second, is Newton's models, that predicted the movement of a comet accurately. Then you often here people say that Einstein proved Newton wrong with Relativity.

I think when it comes to science, explanations are very flimsy. What should matter is if the idea useful or not.

Francesco Sabella responds:

I think it’s a very good exercise to start from the point of view that our mind is bound to make mistakes, have glitches and start to work from that assumption; even if it’s not always true but it can be good as working hypothesis.

Big Al recalls:

Years ago, doing simple quantitative analyses to post to this list, I learned that one of the biggest pitfalls was my own desire to get a nice result.

Apr

14

Looking back at 2008

April 14, 2025 | 1 Comment

A Few Observations, from Victor Niederhoffer

October 12, 2008

1. Of the 100 biggest markets around the world, almost all are down 40- 60% in dollar terms with the exceptions' being Tunisia and Botswana. The impact of the decline this week, unless rapidly reversed, is going to be very severe on purchases. The previous 20% caused great angst; imagine what this decline will do to those who rely on retirements. The positive feedback of the decline in a negative direction also impacts the election results with every market decline making it more likely the Republicans will be blamed for the situation.

2. The worst aspect of the decline this week from a health point of view was that fixed income around the world cratered, thereby reducing world wealth by a good 15% as opposed to the normal situation where the equities go down 10% and the fixed incomes go up 8% leaving total wealth down only a little. And the people that talked about how bearish it was for stocks because commodities were up would never say that it's bullish now because commodities are down 40% over the past four months.

3. A new word should enter the market vocabulary, a waterboarding decline, being a decline that seems to have a breath of life at the open before going into a death spiral.

4. Because of the decline in all sectors, the wealth/price ratio has stayed relatively constant with corn, copper, soybeans, wheat and oil down 40- 50% since June 30, thereby keeping the number of bushels and barrels we can buy with one DJIA relatively constant, making the number of ounces of gold you can buy with the Dow less than 10 for the first time in a googol, and looking like a bargain for the Dow.

Cagdas Tuna writes:

The plan was to make US assets cheap and make everyone afraid to invest in them(thanks to VIX spike Monday). We all make joke of him but Trump’s post few hours before 90 days pause was the peak. Look at inflation numbers it is officially coming down as most companies were planning this sh*t beforehand. The more we see bad news the bullish stocks are.

David Lillienfeld responds:

You're making the assumption that we're done. I don't know that we are.

Nils Poertner comments:

in any case - def good to watch out for anomalies, or things that shouldn't happen and then they happen - and then there is more of it normally.

Jan

17

Look into the light, from Humbert Z.

January 17, 2025 | Leave a Comment

Why Scientists Are Linking More Diseases to Light at Night

Glaring headlights, illuminated buildings, blazing billboards, and streetlights fill our urban skies with a glow that even affects rural residents. Inside, since the invention of the light bulb, we’ve kept our homes bright at night. Now, we’ve also added blue light-emitting devices — smartphones, television screens, tablets — which have been linked to sleep problems. But outdoor light may matter for our health, too. “Every photon counts,” Hanifin said.

For one 2024 study, researchers used satellite data to measure light pollution at residential addresses of over 13,000 people. They found that those who lived in places with the brightest skies at night had a 31% higher risk of high blood pressure. Another study out of Hong Kong showed a 29% higher risk of death from coronary heart disease. And yet another found a 17% higher risk of cerebrovascular disease, such as strokes or brain aneurysms.

Nils Poertner comments:

Sleeping in a fully light-blacked-out room is indeed relaxing for the optic nerve and the brain.

That is why expensive hotels have proper curtains and cheap ones often don't. We can't change society but we can make individual adjustments (or at least at home).

Dec

12

Positively aging, from Kim Zussman

December 12, 2024 | Leave a Comment

Want to Live a Long and Fulfilling Life? Change How You Think About Getting Old

Research consistently shows our attitudes and beliefs influence our health and longevity.

Data is mounting, much of it from research by Yale epidemiologist Becca Levy, about the impact our attitudes and beliefs have on our health and longevity. Levy’s interest in the connection began in the 1990s, when she traveled to Japan to try to understand why the Japanese had the longest lifespan in the world. She was familiar with explanations that attributed this longevity to diet—Japanese people consume less meat, dairy products, sugar and potatoes than other wealthy countries. But what stood out to her was how the culture respected and celebrated older people.

“It struck me as very different to what I had observed in the U.S.,” she told me. “So I began to wonder if these positive age beliefs could contribute to the longer lifespan in Japan.”

Nils Poertner writes:

Psychology plays a huge role here - eg. excessive nostalgia means one does not appreciate the moment - in my view it is also linked to far-sightedness (went farsighted at the age of 15! which is rare and then recovered). there is somewhat a placebo in life - and the joke is on us really.

Big Al comments:

There are maybe complicated issues around causality, e.g., do people with a positive attitude live longer and better, or do people with underlying factors that promote health and longevity tend to have a positive attitude? But I will stipulate that we might as well try it. Which leads to the issue of people feeling like they have failed if they *don't* have a positive attitude. Perhaps as a way of avoiding this pitfall, we could be given information on how to *practice* a positive attitude. Then, over time and with practice, we might see a benefit.

Nov

2

And the law won

November 2, 2024 | Leave a Comment

From Big Al:

The more any quantitative social indicator is used for social decision-making, the more subject it will be to corruption pressures and the more apt it will be to distort and corrupt the social processes it is intended to monitor.

Variation:

When a measure becomes a target, it ceases to be a good measure.

Nils Poertner writes:

if one could find a way to increase the odds of Sod's law happening to oneself (trading or otherwise, outside trading). one could find a way to be less exposed to that law. don't have an exact formula here it is just a question.

This book The Improbability Principle: Why Coincidences, Miracles, and Rare Events Happen Every Day, by David Hand, did flip a lever in my brain many yrs back. in this book he described that we have an inadequate idea of probabilities and nature is far more dynamic than we think and that perhaps our own actions and belief systems play a much larger role…(btw, am not saying fate never plays a role)

Rich Bubb writes:

Having witnessed (pre-retirement in 2020) multiple project, engineering & quality failures related to Murphy and/or SOD variants, the engineering & technicians [and often-times myself] that had to deal with the 'Magic Wand' mgmt insane dreams-up are/is best avoided by 'stepping away from the problem, asap'. In some areas, this 'stepping-away' is also known as the "Do NOTHING Rule". Corollary: "Ain't My Job Rule."

Or, knowing that everything rarely goes according to plan (Unknown Unknowns), & expect something-to-hit-the-proverbial-fan. One method I used (more often than I should admit), is a Reverse Fishbone/Ishikawa Diagram. The method has the "Result" of anything going wrong replacing the assumed desired effect , aka the 'Fish-head', then working backwards trying to determine Man, Method, Environment, Measurement, Machine, etc., possible snafu's, & mitigate or pre-fix problems.

Sometimes the Reverse Fishbone is done after the problem is revealed. And the $$$ Cost of mitigation are sometimes 'argued-away' by the cost-benefit folks controlling the situation's budget. This is one reason many engineers fear &/or loathe accountants (but not out loud).

Asindu Drileba adds:

Sods law seems related to a set of precepts used in computer science called the Fallacies of distributed computing.

When building a trading system assume that;

- The market's returns will arrive at the worst possible sequence.

- Your orders will not get filled exactly the way you want.

- Transaction fees are going to eat all your gains

- Your broker is going to scam you (a là FTX)

- You trading system might go offline for arbitrary reasons

- Regulations might change against your favour. (up tick rule, no shorting stocks)

Building a trading system based on such pessimistic assumptions will actually result it a system that will go through alot of muck and still be reliable.

Aug

9

To be silent the whole day long, see no newspaper, hear no radio, listen to no gossip, be thoroughly and completely lazy, thoroughly and completely indifferent to the fate of the world is the finest medicine a man can give himself.

- Henry Miller

Nils Poertner responds:

Excellent. Media is like Queen Mab and we are Merlin - and Merlin had to learn to not care too much about Queen Mab…

Aug

8

More on life advice, from James Goldcamp

August 8, 2024 | Leave a Comment

I'd add that, in business and socially, don't "hang around" too long past appropriate. If you get the response you are seeking in a meeting, proposal, or discussion be courteous and respectful and get out of there. This is where Costanza had it right (his practice of leaving a meeting on a high note after a good joke). I found this to be a commercially, socially, and romantically valid concept.

Nils Poertner offers:

some may like the list that Gurdjieff gave to his daughter. (a number of overlaps)

Sushil Rungta writes:

I am quite mortified as I post this message but in the spirit of camaraderie posting it even though, in doing so, I am indulging in a little self promotion (totally unintended). I frequently write to my children sharing my experiences and what life has taught me. A very few of these I also publish on LinkedIn and Medium.com. Providing a link to two of these letters:

Hope you like them and please do excuse me for this immodesty.

Jul

24

Mega-Tinderbox buy-and-hold, from Kim Zussman

July 24, 2024 | Leave a Comment

‘Greatest Bubble’ Nearing Its Peak, Says Black Swan Manager

Universa’s Mark Spitznagel, who has made billions from past crashes, sees last hurrah for stocks before severe reckoning

Humbert H. asks:

His job is to make money on black swans, not to predict black swans. What kind of black swan is it if it can be predicted?

Asindu Drileba writes:

Black Swans are relative. If you have tail risk protection it means you are aware of tail risk. If you don't have tail risk protection, the notion of a "surprise" when it happens means you encounter a black swan. So Mark may be speaking form the perspective of those that actually don't think they will encounter a black swan.

Humbert H. responds:

Is there anyone who invests in the magnificent seven and NVDA in particular who isn't aware of their elevated valuations, possible bubble formation, and the risk of a major decline? There's some level of obviousness to warning people of this possibility. It's like he is suddenly preaching "past performance is no guarantee of future results" or "correlation does not equal causation". Is he doing this to help humanity? Someone will make more money and someone will make less money if they act on his warning, and there will be bagholders either way, so humanity will not benefit as a whole.

Asindu Drileba adds:

I think for his case, he is just marketing his fund.

Zubin Al Genubi observes:

Cheap Deep OTM puts are up 45% on a 3% decline showing exponential gearing in place from ATH as a directional trade or as a hedge. Surprisingly unidirectional.

Asindu Drileba expands:

His philosophy is more like that of "insurance" for stocks. I think Uncle Roy also has the same philosophy. I remember his describing portfolio protection akin to having fire insurance for your house. To benefit from fire insurance on your house, you don't need to predict when it will burn down. Just make sure you always have coverage for it. So most of the time, percentage wise, your predictions of having a fire are going to be wrong. He mostly advocates that everyone should have "fire insurance" for your portfolio.

To learn more about Mark's strategy:

1) A section called "The Forest In the Pine Cone" inside his book The Dao of Capital

2) His solution to the "narrow framing" problem

3) How he sizes his positions

Nils Poertner comments: