Feb

18

Vol in percent versus dollars, from Zubin Al Genubi

February 18, 2026 | Leave a Comment

More on the points vs % argument. % vol or Vix is misleading and inaccurate measurement of vol. A better measure is abs vol in points/$ because we live and measure ultimately in dollars.

Accordingly at 7000 abs vol is 350% of what is was a few years ago at 2000. Trading has to adjust accordingly to maintain the same portfolio volatility of returns. Thus leverage, targets, systems, time have to adjust to match.

Adam Grimes disagrees:

because we live and measure ultimately in dollars

This does not strike me as coherent. Returns are the only reasonable way to understand market movements. Just imagine a portfolio of two assets, one at $1 and the other at $100,000 (or other arbitrarily wide handles). The only way to think about those is to normalize for price via %, so it follows that volatility would be equally incoherent measured in points. (Sorry for the Finance 001 example, but I think 'Explain It Like I'm Five Years Old' cuts through a lot of confusion.)

% and vol measured as vol of %'s (i.e., returns) is the only thing that makes actual sense here unless I'm misunderstanding the argument. What am I missing?

Accordingly at 7000 abs vol is 350% of what is was a few years ago at 2000.

Scratching my head here. "So what?" and "of course" are the only things I could manage to say here.

I'm probably missing something, though. What is it? (btw VIX sucks as much as any other clunky measurement of implied vol. I'll agree with you on that one, but I don't think that's your point.)

Zubin Al Genubi responds:

1 ES contract used to move 7 points as an average range 20 years ago. You made or lost $350. 1 contract now moves 50 or 100 points a day, same percentage, but your account is up or down $5000. The volatility in your account in dollars is higher than 20 years ago. If you lost 1% in 2000, its $600, but 1% now is $3500 per contact. You don't see too many 2% days like before. Abs vol is up while Vix or % vol is down. Its apples and oranges.

The trading style, research should change. Straight percentages for expectations, returns, targets don't work like they used to, especially using historical data. Silver now has micro contract because $5000 a dollar too is high volatility in dollars with $20 or more ranges. I guess I'm suggesting using abs vol as a better measure of vol.

Appropriate here, Feynman in 6 Not so easy pieces, cites Wyle on symmetry, "Suppose we build a certain piece of apparatus, and then build another apparatus five times bigger in every part, will it work exactly the same way? The answer is, in this case, no!" My point is the market does not the same way as it did 25 years ago in large part because it is bigger. The fact that the laws of physics are not unchanged under a change of scale was discovered by Galileo. He realized that the strengths of materials were not in exactly the right proportion to their sizes. [Ibid]

Adam Grimes writes:

I'm sorry, but I still find these points trivially obvious. Of course nominal price swings are bigger because price levels are higher, so of course holding a single contract would result in larger dollar swings. Who's holding a single contract? Position size takes care of all of this.

And I don't think the physical analogs add anything beyond confusion. Physical properties scale differently. For instance volume scales as cube and surface area as square. This is why we could not have a science fiction 100 ft tall lobster in reality…because of material constraints. There's no market analog to this. A 1% move is a 1% move. There's no hidden non linearity there.

If your claim is that markets don't move the same they did 25 years ago I would challenge that claim. What's the evidence for this? Statistically there's always the issue of non-stationarity but it seems to me you're claiming there's something more meaningful here. What am I missing?

Asindu Drileba comments:

I think Zubin is simply trying to say that he had found measuring volume in dollar terms (absolute terms) more relevant than measuring it in percentage terms.

Richard Hamming has an interesting talk, You get what you measure

Here us a good summary:

You may think that the title means if you measure accurately you will get an accurate measurement, and if not then not; it refers to a much more subtle thing - the way you choose to measure things controls to a large extent what happens. I repeat the story Eddington told about the fisherman who went fishing with a net. They examined the size of the fish they caught and concluded there was a minimum size to the fish in the sea. The instrument you use clearly affects what you see.

I for example, completely stopped measuring market returns in percentage terms a few years ago. I now exclusively use log returns. Why did I stop using percentages? The problem with percentages is that they are not equal to each other (ignoring the negative sign). (a 50% move) + ( a -50% move ) does not give you 0 in dollar terms. But what you get is 0% in percentage terms. Percentages are not symmetrical. Does this mean they don't measure growth? They actually do. But they simply should not be compared. As the absolute values may mean something different.

- A 0% return percentage may (erroneously)

indicate that you have broken even.

- The same 0% percent return may also show that you are actually loosing money in absolute (dollar) terms

Adam Grimes writes:

Of course log returns are well known, and this is more finance 101. There are several qualities that make them more attractive for some analyses. (just dont mix percents and log returns!)

But that's not the same as measuring market movements in raw dollars (which is the only reasonable companion to volatility measured in absolute dollars (or points).

And as for measuring what you see, methodology (and perhaps even experimenter expectations) greatly affecting outcomes and conclusions, we're on the same page there. This is fascinating territory for discussion and I'd welcome it.

But his point about volatility only extends to someone trading a single contract in 2001 and also trading a single contract today. That is irrelevant.

If there's something at work here and legitimately some way the market "doesn't move the same way" it did decades ago… I'm all ears and very interested. Always looking to learn more about what I don't know or might be missing.

Zubin Al Genubi does some counting:

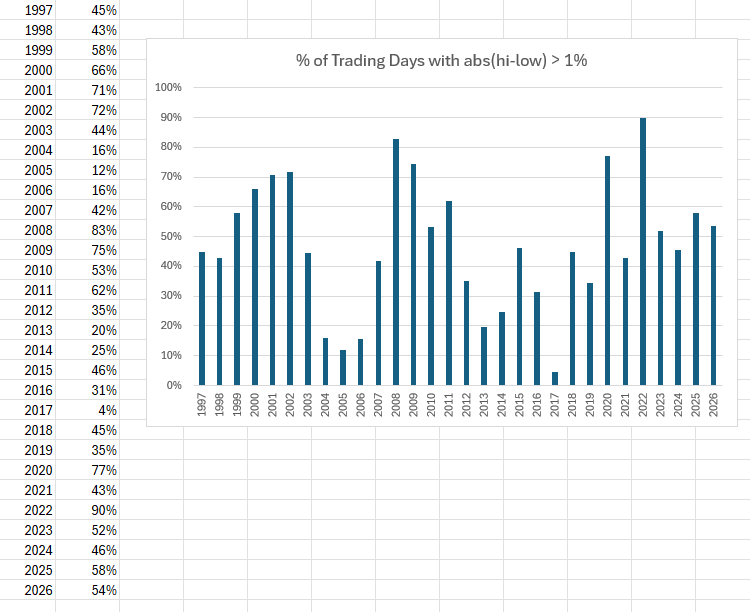

There were 31 days in 2006 and 67 days in the last year with percent moves >1%. This is due to Big Tech being 32% of ES with higher beta and the speed and intraday persistence of algorithmic trading. Lastly, it 'feels' different. A 120 point drop trades different than a 13 point drop in 2002.

Stated quantitatively, now nearly half of our trading days have abs vol hi-lo >1% while in 2006 only a quarter of days had abs vol >1%. That is a big difference and clearly explains why trading is different (better) now. Today is just 1 of the many such days.

Cagdas Tuna adds:

All futures contracts of index products have adjusted to gross notional value of underlying stocks. At the same time VIX contract specifications and notional value it can represent almost remain unchanged. Although calculation method of VIX is the same, the number of futures contracts hedgers need to cover notional values they trade in underlying assets are totally different.

Adam Grimes writes:

Stated quantitatively, now nearly half of our trading days have abs vol hi-lo >1% while in 2006 only a quarter of days had abs vol >1%.

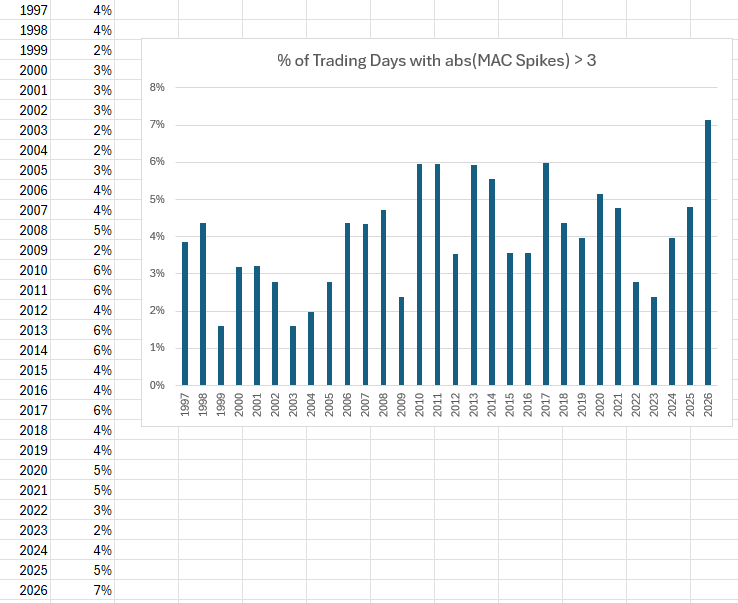

I'm sorry but I have to be direct. I find this annoying. You have moved the goalposts and are now making a completely different argument. You began advocating for measuring volatility in absolute dollars and now you are using a percentage measure. You are literally using the metric you said was wrong to support your argument that the metric is wrong.

Furthermore, your data are bad. It's simply a volatile measure. Volatility is volatile. Here's a look at the FULL history of the ES futures [first chart] (back-adjusted so this may not be fully accurate, but I think the % adjustment fixes the back-adjustment distortion) counting the number of trading days in each calendar year that had abs(high-low) / close > 1%. It's simply an unstable measure and I don't know what is to be drawn from this.

If your argument is that there are more days with "surprise" distortions, this is maybe nominally true, but better measured with better tools. I use a tool that expresses each day in terms of the mean average absolute closing difference [second chart]. Taking an arbitrary bound of 3 for that, the argument that this year is on track to show more surprise shocks than usual is true (but also reflective of a generally lower baseline).

You've flipped to percentage measures and we're left with hand waving "it feels different now." That's a different claim and it's qualitative, perhaps has value, but not in supporting your original claim.

I'll reiterate my position: percentage measures are the only thing that make sense. Point values are arbitrary and can be easily handled via position sizing (within the limits of granularity of instruments vs account size.) I don't think this is revolutionary or controversial. This is truly finance 101.

Feb

4

2026 Bullish Confirmation, from Larry Williams

February 4, 2026 | Leave a Comment

Yale Hirsch and his son Jeff have shown that a positive change, from the last trading day of the year to the 5th trading day of the new year, portends a bullish year (positive first 5-day percent change).*

Consider this … in the last 76 years of trading, the S&P 500 has declined for the year 20 times or 26% of the time. In other words, 74% of the time, there has been a yearly gain.

Jeff’s numbers show that in those last 76 years, 49 years showed a positive first 5-day percent change. Only 8 of those years went on to close down for the year. That’s an 84% bias for the year to close higher when we have a positive first 5-day percent change.

My add-on to Yale’s and Jeff’s work was to look at the years that gained 1.2% or more in the first 5 days of trading. There were 28 such years. Of those years, only 2 were down for the year. That’s a 93% bias for the year to close higher. What an improvement from the average 74%!

In 2026, the first 5-day** change for the Dow Jones 30 was +3%.

In 2026, the first 5-day** change for the S&P 500 was +1.6%.

Those 28 years had an average annual return of 14%. The remaining years had an annual gain of 5.3%. I see this as excellent confirmation of the bullishness of my Forecast 2026 Report.

Cagdas Tuna writes:

There is no need for a statistical analysis to assume any given year will be positive for US indices. It is almost guaranteed to be positive every year. No offense to any list member.

Larry Williams responds:

Wrong 24% of time we close down for the year.

Michael Brush is surprised:

Wow did not know it was that high.

Larry Williams agrees:

I was taken back by it as well.

Asindu Drileba asks:

2026 is bullish? But Senator, you said you expect a recession in 2026 with 100% certainty. Is this a contradiction? Or maybe its possible for the market to be bullish even during a recession?

Larry Williams answers:

Yes, there was a projection made a year ago for a 2026 sell off —in the last 12 months data changed—large improvements in fundamentals and hopefully I got a little better understanding of long term cycles. New Data matters.

Nils Poertner writes:

Asindu- there would be simply too many variables out to make that statement with such a certainty in advance. Just impossible. It remains a probability game. Used to subscribe to some cycle research that claimed to have things figured out yrs in advance. quite pricey subscription. it was HOOK, LINE and SINKER (for me).

Denise Shull comments:

New Data matters.

Indeed it does. Wonder why it’s challenging for many to incorporate?

Nils Poertner responds:

Good question. On this note… (Pure) data analysts believe pattern matching on large datasets will solve our problems. But what if the really vital information isn't being collected? What if it's invisible to our trained systems?

Jan

27

Ralph Vince’s latest, from Larry Williams

January 27, 2026 | Leave a Comment

Ralph Vince's newest book. Not about the markets.

The Theology of Lust follows Ricky “Pork Chop” White — a wounded, self-mythologizing erotic savant — as he stumbles through desire, regret, and violent entanglements, trying to turn raw masculinity into something redemptive. It’s a darkly funny, psychologically unfiltered journey where erotic obsession, betrayal, and a lurking murder plot converge on one man’s desperate attempt to find some sort of salvation out of the mess he calls a life.

Asindu Drileba writes:

Nice! I remember Ralph Vince mentioned that one of his favourite books was The Bible. There is a strange relationship between speculation, theology & computers(artificial intelligence) that no one has comprehensively talk about. Hopefully, I will learn more about theology from this book.

Peter Ringel comments:

When I read the senator writing "the greatest project of his life", I immediately feared, that he fell victim to French, Spanish or Portuguese girls. The title seems to confirm this.

Larry Williams responds:

Good guess but not quite Ralph has a new steal proof coin coming out the book is a year old but was just translated to English from French.

Steve Ellison recalls:

We had a long-ago list member who would frequently draw parallels between never-ending market arguments such as fundamental vs. technical analysis and the European religious wars of the 1600s or theological debates such as predestination vs. free will.

Jan

18

Traders and Art/Music, from N. Humbert

January 18, 2026 | Leave a Comment

Noticed many of my trading friends have an affinity for either ART or MUSIC or both (active or passive) It occurred to me the other day, that both offer ways to somewhat stay sane, it allows the adult to play and have some fun /relax.

Because society as a whole has something matrix like (going to school, learn about consensus reality, fill out the forms, get a BS job, keep up with the JONES, feel empty..) and this is a nice way to see beyond it and feel a bit at ease. That is all.

Here is a lovely Schubert piece. enjoy

Schubert, Trio No. 2, Op. 100, Andante con moto | Ambroise Aubrun, Maëlle Vilbert, Julien Hanck

Asindu Drileba responds:

Narrator: "Fate had already determined that he will die childless and penniless."

Epilogue: "It was in the reign of George III that the aforesaid personages lived and quarreled; good or bad, handsome or ugly, rich or poor, they are all equal now."

Whenever I hear that piece, I think of those words from Barry Lyndon. It was such a good "slice of life" type film.

Jeffrey Hirsch recalls:

Yale was quite a composer. I tried to produce the musical he wrote about the Elephant Man called Merrick & Melissa. But he was a better composer than I was a producer.

Jan

15

Boids, from Asindu Drileba

January 15, 2026 | Leave a Comment

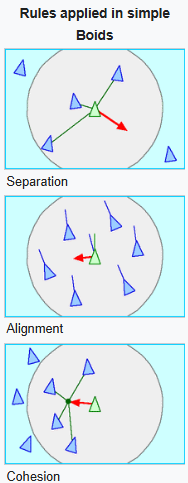

Their is a more interesting school of Artificial Intelligence branded as "Artificial Life" (AL). Their goal is mostly on how to simulate living things in nature, in contrast to Artificial Intelligence where the goal is to solve day to day human problems (it doesn't matter to AI people if the solutions are not consistent with how nature actually does it, but for AL people it does).

An Artificial Life researcher at Nvidia in the 1980s came up with the idea of Boids. It was a very simple algorithm for the simulation of collective intelligence i.e schools of fish, flocks of birds, herds of herbivores. If you have watched The Lord of the Rings, the battle scenes are generated using boids.

One of the parameters of boids is "cohesion". Cohesion is the tendency of "boids" (individual entities in a flock) to move towards their "center of mass". Cohesion is computed by listing the individual coordinates of each "boid" and then finding their average.

In markets, the "current price" can be thought of as the "center of mass" or "cohesion", an "average" of offerings on the order books. Traders may prefer to place orders close to current prices to get filled faster.

When I trade manually and get filled, I am often tempted to close my position in event of small loss (away from the average). Or take profit in event of a small win (still away from the average). I feel like a "boid", and It seems like my need to undergo "cohesion" or chase the "center of mass".

Jan

11

Movie Recommendations for Specs, from Asindu Drileba

January 11, 2026 | Leave a Comment

In case you're looking for some movies for the holiday season that may be of interest to a "spec persona", I have a few I recommend:

1. Uncut Gems: Perfect depiction of the of the life of a speculator with no risk management or "system".

2. The Count of Monte Cristo: Perfect illustration of Howard Mark's second level thinking, deception & poker in the markets.

3. The Game: Good movie on self reflection.

4. The Conversation : Deception in the context of corporate board members. To lure his prey, an apex predator (played by Harrison Ford) baits his victims with a "weak target". The Godfather is Francis Coppola's most popular film, but this one is definitely my favourite of his movie's. Also, if you like Jazz music you will love this!

5. The International: Evil specs (arms dealing & nation state money lending). The movie has a very serious tone. No unnecessary jokes or unrealistic fight scenes. Based off the real BCCI scandal.

Dec

26

Fantastic Veritasium video on power laws, from Asindu Drileba

December 26, 2025 | Leave a Comment

With direct application to speculation (featuring VC's):

You've (Likely) Been Playing The Game of Life Wrong

The world is not Normal.

Dec

19

Request for “off topic” books on speculation, from Asindu Drileba

December 19, 2025 | Leave a Comment

Often when I listen to specs I hear "off-topic" book recommendations. Examples:

"The most important book to do with trading is Secrets of Professional Turf Betting by Robert Bacon" — The Chair. A book about parimutuel horse betting.

"The most important book to do with the stock market is Horse Trading by Ben Green" — A game theorist & friend of The Chair. A book about selling horses

"I can find new trading strategies on almost every new page (Thinking Fast and Slow by Daniel Khaneman)" — The Chair's Brother (Mr. Roy Niederhoffer). A psychology book

"Our entire investment philosophy is based off this book (Snow Crash by Neal Stephenson) — Fred Wilson of Union Square Ventures, a Tier 1 VC firm. Its a sci-fi book.

"One of the most important things you can learn todo with investing is creative writing" — Jeffrey Hirsch. Not a book but still an off-topic research recommendation.

I have never regretted reading an "off-topic" book. Any more of such recommendations?

Nils Poertner responds:

Coaching Plain & Simple, by P. Szabo, D. Meier (book about learning - how to coach oneself in a way)

Asindu - what books to get rid off, to burn, what is an obstacle in your life is also relevant. Early 2008, I visited a French friend on Lehman trading floor in London. V nice guy, senior analyst for their credit models, high IQ 130 plus, bit gullible though. He was surrounded by over 20 books of advanced math on either side of his desk. I had the urge to get a huge sledgehammer and whack down the books…you know.

Larry Williams suggests:

Zurich axioms. A must read.

Peter Ringel agrees with Larry:

I have them on my wall. Besides some of the lists by Vic, Larry, Adam Grimes and some other. Valuable.

And did you find the Daily Speculations booklist?

Asindu Drileba writes:

Yes. I forgot about Zurich Axioms. Thanks. This Daily Speculations list is good, I actually wasn't aware of it.

Nov

28

Lucky charms, from M. Humbert

November 28, 2025 | Leave a Comment

Anyone have any favorite good luck charms/rituals to help with trading results?

Peter Ringel writes:

some of the old floor traders, we had on this list, reported how superstitious some of the traders were. Cloths, bathroom time…

Asindu Drileba comments:

Lucky charms may sound delusional but they are actually more common than we think. They are more like placebos. I take pill X, my headache goes away. (But pill X is made from wheat flour and a bitter "filler" and has exactly zero pharmaceutical contents, yet it works).

Have you ever pushed the button that opens the door of an elevator? Well, those buttons are completely fake! Elevator doors are pre-programmed to open and close at hard coded intervals. Pushing the button does nothing. They simply exist to give people a sense of control.

Nils Poertner writes:

To have a strong belief one can learn (from mkts or others) is a good start.

ie allowing for mistakes to happen, not fretting them. (many cultures are guilt-ridden, like the German culture on so many fronts. All it takes is sometimes to muster up enough courage and learn from mistakes and don't judge).

Zubin Al Genubi offers:

I'm reading Kidding Ourselves, Hidden Power of Self Deception, by Hallinan, in which he describes real physical and psychological effects of psychosomatic causes such as death, hallucinations. You see what you want to see. You are and become what you believe yourself to be. It affects health, performance, money. He also describes how a feeling of lack of control can be debilitating and even deadly. Some feel a lack of control in that they don't control the market, but one can easily (physically at least) click the keys to buy and sell any time.

From scientific studies: Our results suggest that the activation of a superstition can indeed yield performance-improving effects.

Nov

21

VIX Intraday Range, from Cagdas Tuna

November 21, 2025 | 1 Comment

Yesterday's range in VIX was one of the widest & wildest one I have seen in a very long time that happened without any major news. Wednesday close to Thursday low 18% decline followed by 46% rally to the day's high. Is there anyone who can check the occurrences in the past and how SPX traded in the following days of such a massive range explosion?

Asindu Drileba responds:

The Chairman's book, Practical Speculation, has a detailed analysis of the multivariate relationship between the VIX and the SPY. Unfortunately I forgot the page, and I am currently not close to my copy. [see pages 107-110] But it has something to do with how the fluctuations around the average of the VIX affects the SPY.

Paolo Pezzutti does some counting:

#VIX +11.71% at 26.43

Highest close since 24 April

Since 2020 VIX>26 has occurred 290 times.

After 4 days the Emini S&P Futures:

+27.01 pts Mean, 63.4% Wins, 1.63 Profit Factor

Larry Williams cuts to the chase:

Vix goes up when stocks go down they are inverse of each other—no magic there are all.

Nov

10

Best indicators for inflation, from Asindu Drileba

November 10, 2025 | Leave a Comment

The more goods cost, the more money visa makes since the fees they charge Issuing banks & acquiring banks are based on a percentage basis. So, higher prices (inflation) –> better predicted revenues for Visa? Inspired by a nice documentary on the history of VISA.

I wonder what the best indicator for inflation would be for testing this? CPI? Oil?

Cagdas Tuna writes:

I was thinking as to find a similar indicator for economic slow turn, spending cuts. It came to my mind to follow sales slips. I live in Malta which is a very tech friendly country for spending habits such as Apple/Google Pay availabilities, many digital banks access etc. I often asked if I need a receipt that I usually don’t. It depends for every country but if there is a rule for stores/restaurants to keep at least a copy for each transaction then it might be the indicator to follow. It might be used for inflation as well but of course needs detailed information.

Pamela Van Giessen comments:

To the best of my knowledge, merchants are not required to keep receipts. We track each sale but it will be the credit card processor or platform such as Square that holds the credit card or Apple or Google pay receipts. I can’t imagine that merchants would be willing to share their sales data. I know I wouldn’t.

Visa doesn’t care how much goods cost. They get their nearly 3% processing fee (+ .10 or .15 per transaction) whether there are 20 transactions for $100/ea or 40 transactions for $50/ea. In fact, they make more $ on a higher volume of transactions.

I don’t think tracking Visa or MC, etc could be a meaningful prediction of inflation as all the credit card companies continuously fight for market share. Note that they all send out multiple credit card offers to everyone all the time. Then, you have a store like Costco that only accepts their credit card (Citibank).

Additionally, there are people who use primarily cash. Those $ would be left out. You may say that cash use is low, and maybe it is. What I can tell you is that today at a market 80% of my sales were cash and that was likely the case for all the other merchants at this market. Older people especially use cash a lot. Just like drug dealers.

I have a theory that the cash economy is much bigger than everyone thinks. Insight into that might be more interesting.

Carder Dimitroff responds:

After considering Panela's cash sales point, I remembered that several companies required customers to switch from credit card payments to bank transfers. Additionally, several small establishments offer incentives for customers to pay in cash. They may be attempting to simplify their accounting and tax reporting. I do know that the federal government has immediate access to individual credit card transactions.

Pamela Van Giessen adds:

I thought it was the Fed that used to report on aggregated credit card data.

The other challenge with using credit card financials is that the credit card processors raise their % cut all the time. This is not due to actual inflation; it is due to them having a government protected moat that allows them to take more and more whenever they want because merchants are stuck with the whole system and consumers don’t realize that they will pay for the service — in increased prices. Every time Square, PayPal, etc., send me notices that they will be increasing fees, I increase my prices. I guess that is a kind of proxy for inflation but it’s a lousy sort of financial market induced inflation not based on anything more than their desire for more profits. I am all about free markets but the credit card processing biz is not even close to a free market.

The government using credit card processing to surveil us may be one reason I see more and more people using cash.

Larry Williams suggests:

Stock market is good predictor of inflation.

Nov

9

Prestigious consulting firm, from Nils Poertner

November 9, 2025 | Leave a Comment

Came to our financial firm 2007 and gave a 100 page presentation full of bullet points and cartesian logic (why housing boom will last). Either 3,5, or 9 bullet points per page.

At the end of the presentation I was tempted to go over to the presenter and ask him "why do you love your wife? (I didn't). The answer might have been bullet points.

Pamela Van Giessen writes:

Michael Korda tells in his memoir, Another Life, of the time that Simon & Schuster hired probably the same prestigious consulting firm to study how to improve revenues/profitability. Prestigious consulting firm (after taking the prestigious consulting firm fee) told the publishing company that they should publish more bestsellers.

Laurel Kenner comments:

I bet the prestigious firm concluded with ‘Key Takeaways’ as a final insult to the intelligence of the client.

Asindu Drileba writes:

I heard that people pay consultancy firms not for their knowledge, but for the fact that executives use them as a scape goat. If an executive wants to pursue policy X. They simply hire a consultancy to recommend policy X. If policy X ends up as a disaster (legally, morally or financially). They can simply say "Policy X was an idea from XYZ consultancy", we had nothing to do with it.

Peter Ringel adds:

a variation of this are fighting owners/ partners about policy. If decision pipelines are blocked, external council is used. Like a neutral arbitrator. I think, these are the main situations externals are used. Usually a good reason to short the entity, especially outside of markets. If they don't have the capability to decide and act on strategy in-house, it‘s a red flag.

Henry Gifford responds:

Even better is hiring a licensed engineer to instruct everyone to do something stupid that they know won’t work, so everyone who did as the engineer decided is blameless.

Jeff Watson offers:

A consultant is a person who knows 1000 ways to make love to a woman…..but he doesn’t know any women.

Oct

21

Trading the transition to AV1, from Asindu Drileba

October 21, 2025 | Leave a Comment

AV1 is a new video compression format that may reduce the size of a video file by up to 50%. The big advantage is that videos will be up to half the size, with the exact same image and audio quality.

Two big consequences may ensue (when AV1 is fully adopted):

- Internet bills for streaming Netflix will reduce.

A 2 GB movie will only cost 1 GB from the perspective of a customer paying their Internet Service Provider. So more frequent subscriptions?

- Netflix will cut its bandwidth costs by 50%. So the profit margin (respective to bandwidth costs) will go up by 50% if users fully adopt AV1?

Currently, AV1 is only available on select hardware chips (listed table on Wikipedia) Maybe as users get new devices, use of AV1 will grow. This will likely happen gradually over several years (maybe half a decade). But an obvious winner would be Netflix & YouTube (Google Stock). Maybe bandwidth is so cheap it won't make a dent in the business revenues? But all major companies seem very enthusiastic about implementing AV1. Maybe bandwidth has it's (less talked about) variant of Moore's law. Where after a few years it gets easier to move stuff around the internet.

Cagdas Tuna wonders:

How many nuclear plants we need to feed that endless “technology”?

Nils Poertner asks:

How would you express this into a trade idea, Asindu? I find it easy to put ideas into a trade - it encourages deeper thinking and gives a feedback when wrong. eg, I was bullish housing London property 2007, but short-term it didn't really work out at all! longerterm yes. it was fuzzy thinking of my behalf.

Asindu Drileba answers:

Going long $NFLX since the business is largely about streaming video. The same pattern occurred in Tesla when the cost of efficient batteries dropped by like 90%. So margins automatically go up. (in theory) Tesla could have still gone under due to debt or something else. So, of course it may may fail (most likely)

Another big draw back is that such "qualitative" insights cannot be tested in the past. Maybe a good analogy would be to go long Starbucks $SBUX if you think the price of coffee wil drop the next 5 years by 50%.

So the ideas may be generalized to:

- Find key Ingredient company X uses in thier products

- Find out if the drop in key ingredient's price over 5 years improves profit margin over X years -> positively impacts stock prices.

This general idea, may then be tested across several industries for example:

- MacDonalds (drop in price of beef)

- TSMC, ASML, INTEL, NVDA (drop price of silver) as silver is very essential in chip manufacturing.

Hopefully testing this across multiple industries on different historical accounts may yield some consistent patterns.

Nils Poertner responds:

Good to write it down in a trading journal and look in a few months what happened. Started writing hand-written letters to friends now. In our digital age, everyone incl me, is going for speed, but deeper thinking - also quality in thinking /research is underrated. Intuitively speaking - we are prob getting some unexpected moves coming, as well.

Oct

19

Le Chiffre attacks, from Asindu Drileba

October 19, 2025 | Leave a Comment

In Casino Royal (2006) there is a speculator called Le Chiffre. He would manage money for war lords & other "underground" clients. He would take positions in markets, and then "manipulate them". For example in this clip, he takes a short position in an airlines company, then later bombs a plane belonging to it.

This year, I am starting to think that Le Chiffre is real. Someone opened a crypto account on Hyperliquid (decentralized exchange) and made an $88m profit from short positions that very day.

Cagdas Tuna responds:

Good catch! I have been reading these whales news since March-April 2025 mostly tied to Trump’s policy shifts. It is not difficult to guess who those Le Chiffres might be related to!

Peter Ringel writes:

I wanted to place 1 Nov in my calendar - as a new Mkt Risk date based on Trumps post. Only to realize, I placed this date regarding tariffs before. This makes this old news to some degree. And all of this is potentially an overreaction / a play.

Ed. - lagniappe: Forget Sean Connery, Watch James Bond Make His Real Debut on TV

Before Connery registered his license to kill in the 1962 hit Dr. No, millions of viewers were introduced to Barry Nelson’s “Bond, Jimmy Bond” in a 1954 episode of the CBS anthology series Climax! The show’s producers secured the rights to adapt Ian Fleming’s just-published debut Bond novel, Casino Royale, during their first season.

Since the Climax! version of Casino Royale is only 50 minutes, the plot has obviously been shortened considerably. And yet, if you’ve read the book or, more likely, seen the 2006 movie version that launched Craig’s Bond career, you’ll recognize the basic narrative, even though none of the familiar 007 flourishes are in place. In fact, Nelson doesn’t enjoy “00” status at all — he’s merely identified as a “Combined Intelligence” agent who is tasked with competing head-to-head against the mysterious Le Chiffre (Peter Lorre) in a rousing game of baccarat.

Jeff Watson does some research:

James Bond, the complete list…there are more than you think:

Please list every James Bond on film, TV, and radio. Grok: Alright, here goes-starting with the big-screen Bonds: Sean Connery, George Lazenby, Roger Moore, Timothy Dalton, Pierce Brosnan, Daniel Craig. Then David Niven in the 1967 spoof Casino Royale. On TV, there's Barry Nelson from a 1954 Climax! episode of Casino Royale. Radio Bonds? Bob Holness in a 1956 BBC Casino Royale adaptation, Tom Hiddleston in a 2014 Heart of the Matter series, and Toby Stephens in various BBC radio dramas.

Oct

12

Counting and measuring, from A. Humbert

October 12, 2025 | Leave a Comment

We use quantitative tools - "counting" - to measure and analyze markets, and I enjoy coming across scientific measurements that are new to me and also amazing in scope, such as the sverdrup. The sverdrup is a unit describing the volume of water transport in ocean currents. One sverdrup is a volume flux of one million cubic meters per second (1 Sv = 10^6 m^3 per second). Named after Harald Sverdrup.

From the web:

The strongest ocean current measured in sverdrups is the Antarctic Circumpolar Current (ACC), the largest and most powerful current system on Earth. The ACC is a wind-driven current that flows clockwise around Antarctica, uninterrupted by landmasses.

Measurements of the ACC's volume transport vary, but all figures show it is in a class of its own:

Estimates of the ACC's mean transport range from 100 to over 170 sverdrups (Sv). One study found an average transport of 173.3 Sv through the Drake Passage, the current's narrowest choke point. To put this in perspective, this is over 100 times the combined flow of all the world's rivers.

The graphic shows how relatively narrow the Drake Passage is.

We certainly measure volume in markets. Are there specific flows and currents? Choke points?

Asindu Drileba writes:

In a book recommended by The Chair, This is the Road to Stock Market Success, the author mentions that (paraphrased), "When the trading volume of a stock changes by a large amount, yet the price doesn't move by much, it is time to get out of the market."

Oct

7

Miscellany

October 7, 2025 | Leave a Comment

Asindu Drileba has been watching the Daily Spec calendar:

After being hammered in Aug, Orange did well in Sept. It transitioned to a positive day in the S&P 5/6 times.

Nils Poertner is getting wisdom from the classics:

The most certain sign of wisdom is cheerfulness.

- Michel de Montaigne

some type of cheerfulness def relevant for us in markets /trading - in particular when social moods go south / ppl fall for chatboxes (overuse it !) and confuse with reality etc.

Big Al is going for history:

This is the audio version:

The History of the United States Navy

but I am also watching the video version for free on Amazon Prime. The author:

Craig Lee Symonds (born 31 December 1946, in Long Beach, California) was the Distinguished Visiting Ernest J. King Professor of Maritime History for the academic years 2017–2020 at the U.S. Naval War College in Newport, Rhode Island. He is also Professor Emeritus at the U. S. Naval Academy, where he served as chairman of the history department. He is a distinguished historian of the American Civil War, World War II, and maritime history. His book Lincoln and His Admirals won the Lincoln Prize. His book Neptune: The Allied Invasion of Europe and the D-Day Landings was the 2015 recipient of the Samuel Eliot Morison Award for Naval Literature, and his book Nimitz at War: Command Leadership from Pearl Harbor to Tokyo Bay won the Gilder-Lehrman Military History prize.

Sep

11

Power Laws in Economics and Finance, from Big Al

September 11, 2025 | Leave a Comment

Gappy (Giuseppe Paleologo) posted this on X, and it prompted me to wonder if a power law would apply to the skill differences and win rates of tennis players viz their rankings. Need to find some easily accessible data for that. And of course, how PLs apply to the distribution of returns with the S&P 500 in a given time period. But could it be predictive?

Power Laws in Economics and Finance

Xavier Gabaix, Stern School, NYU

A power law (PL) is the form taken by a large number of surprising empirical regularities in economics and finance. This review surveys well-documented empirical PLs regarding income and wealth, the size of cities and firms, stock market returns, trading volume, international trade, and executive pay. It reviews detail-independent theoretical motivations that make sharp predictions concerning the existence and coefficients of PLs, without requiring delicate tuning of model parameters. These theoretical mechanisms include random growth, optimization, and the economics of superstars, coupled with extreme value theory. Some empirical regularities currently lack an appropriate explanation. This article highlights these open areas for future research.

Asindu Drileba writes:

One of the funniest commodities traded in Uganda (my country) is Vanilla. The price fell from, $156 per kilo, to $1.14 per kilo. A -99% drop during the 2020 covid lock down.

Vanilla cultivation is special in that it can't be farmed mechanically.

- It only flowers once a year

- The flower is only open for 24 hours in one year

- It can only be hand pollinated

- If you miss those 24 hours in one year, your done, wait for the next season.

So a lot of the cultivation is by small "artisanal" farmers.

Madagascar produces close to 80% of the world's vanilla. All other countries produce the rest. So its a power law distribution. The smallest hiccup in Madagascar can cause the vanilla price to skyrocket or drop.

I think power laws outside prices (like supply chains of vanilla) can be used to predict what asset, commodity or instrument will be volatile (large moves both up & down). I think these underlying setups in assets are what echo as power law distributions into prices.

Sep

8

Dutch scientist Christiaan Huygens, from Nils Poertner

September 8, 2025 | Leave a Comment

Dutch scientist Christiaan Huygens found in the 17th century that larger pendulum clocks will sync smaller ones.

Video by Veritasium: The Surprising Secret of Synchronization

Pendulums in the human world = our various belief systems (which are sometimes in competition to each other and go deep). Two examples perhaps: in finance: a trader has religious reasons why he /she does not think he deserves the STELLAR gains. Ways are found to turn accumulated gains into a loss! in health: why do some ppl stay sick and others recover miraculously against all odds?

Zubin Al Genubi writes:

The Kuramoto mathematical model describes synchrony in networks. The line between order and randomness occurs at the phase transition when the network nodes synchronize.

Building on Kuramoto's model, the Watts and Strogatz model makes testable predictions about interventions most likely to trigger cascades.

In small world network terms there are "vulnerable clusters" in the market. In market terms the vulnerable clusters are weak hands, funds faced with margin calls, or fund hitting a stop losses. Obvious 2d points or tipping points are stop points at prior lows. If a vulnerable cluster is close to the second tipping point, it can ignite a cascade.

Nils Poertner responds:

Mathematicians often find something which ordinary people know intuitively. 2 more examples:

1. Five teenagers bully a victim. Knock-out the strongest in the group and the rest will fall too (big bully was the dominant pendulum, trumping the small ones).

2. When the most valuable firm(s) in an index suddenly struggle (NVDA?), it often means bad things for wider index.

Asindu Drileba adds:

I found the same pattern in the "Complex Systems" community. An example in Secrets of Professional Turf Betting: The idea of "copper the public opinion" & "principle of ever changing cycles" are an intuitive description of the minority game & El farol Bar problem in complex systems. Statistical arbitrage is almost exactly what Robert Bacon describes as a "dutch book."

In Neil Johnson's Simply Complexity, he derives an insight that currency traders have (knowing what currency is "in play") using graph theory.

I think Simply Complexity is a very good book for speculators, since it uses accessible analogies and no complicated math. The book has a lot of analogies regarding the market. The most relevant section for Specs would be, Chapter 4: Mob Mentality (I however enjoyed the entire book).

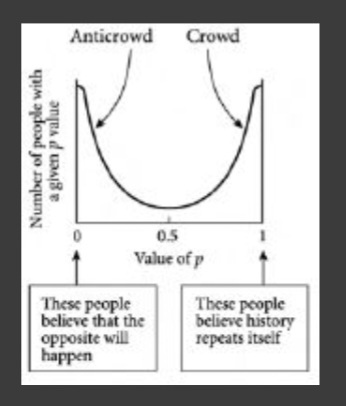

A Few excerpts:

The bar-goers who tend to shift opinions about whether to go with history or against it, tend to lose more and hence eventually change their p value.

This reminded me of people that both go short & long in the market (I am long only). P is the probability of an event happening.

Figure 4.3 from the book and its caption:

We are naturally divided. The final arrangement of a collection of people, in the case of a bar where the comfort limit is around half the number of potential attendees. This shows the emergent phenomenon of a crowd who think that history repeats itself, and an anticrowd who think that the opposite will happen. Hence the population polarizes itself into two opposing groups. This polarization of the population represents a universal emergent phenomenon. It will arise to a greater or lesser extent in any Complex System involving collections of decision-making objects such as people, which are competing for some form of limited resource.

The figure is similar to the Arc Sin law of PnL. Something that appears in Ralph Vince's book The Mathematics of Money Management and Nassim Taleb's Dynamic Hedging. Unfortunately, I don't have a good intuition on the Arc Sin law of PnL.

Sep

3

Data centers and power demand, from Big Al

September 3, 2025 | Leave a Comment

I post these wondering what Carder D thinks:

Big Tech’s A.I. Data Centers Are Driving Up Electricity Bills for Everyone

Electricity rates for individuals and small businesses could rise

sharply as Amazon, Google, Microsoft and other technology companies

build data centers and expand into the energy business.

14 August, 2025

AI Boom Reshapes Power Landscape as Data Centers Drive Historic Demand Growth

Monday, March 3, 2025

The power industry was once considered slow-moving and perhaps even boring. That is no longer the case as technology has expanded and power demand projections skyrocket. New reports released by analysts at Enverus and Deloitte are examined to provide insight on what’s likely to evolve in the power industry over the coming year and beyond.

Carder Dimitroff responds:

I believe these articles present several issues that could benefit investors:

1) Transformers (not pole transformers). The queue for new transformers is long, and about half are manufactured offshore. Data centers need transformers as do new power sources.

2) Gas turbines. Same situation as transformers. For efficient turbines, the queue is about 5 years.

3) Solar panels. Those who previously invested in solar will see their ROIs grow faster than they expected.

4) Retail consumers. They will see their gas and electric utility bills grow as they pay for higher costs of energy and subsidize infrastructure costs to support new loads.

5) New manufacturing. Several geographical options will present better opportunities than others, as the cost of power is regional and seasonal.

6) Forget new nuclear as a near-term solution.

Asindu Drileba asks:

What do you think about nuclear fusion? Is it really close? The joke is that nuclear fusion has always been ready in 5 years for many decades. But I recently heard Chris Sacca (one of the best VCs ever, made over 250x for his entire fund), mention it is genuinely close and that his new fund, Lower Carbon existing partly to capture the incoming advancements in nuclear fusion.

Carder Dimitroff replies:

Today, nuclear fusion is a science project. Keep in mind that fusion requires operating temperatures of over 100 million degrees (at this level, the distinction between Fahrenheit and Celsius is irrelevant). Producing bulk power from this technology is more than ten years away. At these temperatures, it's unlikely they will be operating near population centers.

Aug

31

George Pólya, from N. Humbert

August 31, 2025 | Leave a Comment

George Pólya came up with the term Inventor Paradox.

Basically, if one thinks about a problem more deeply, something else may open up. And one can achieve extraordinary results! Plenty of examples in finance, engineering, medicine.

Steve Ellison writes:

From the Wikipedia link about the inventor's paradox:

When solving a problem, the natural inclination typically is to remove as much excessive variability and produce limitations on the subject at hand as possible. Doing this can create unforeseen and intrinsically awkward parameters.

Very interesting idea with applications in many fields. As one example, I recently told my daughter, who is a partner at Boston Consulting, that I was reading a book about strategy by a professor at Harvard Business School. She told me, "Boston Consulting literally wrote the book on strategy": Your Strategy Needs a Strategy.

I ordered that book and so far have read the first chapter. One of the key questions is how predictable the business environment is. Another is, how much can you influence the environment? "Classical strategy" as taught in business schools generally assumes that the environment can be forecast and that the company has very limited influence over it. A case study was the Mars candy bar company.

But if you cannot forecast the environment, a very different approach is called for, with heavy emphasis on learning and iterating. And if you can in fact shape the business environment, you might want to find some partners and create an ecosystem.

As a footnote, the book I was originally reading, which I also found informative, was by Richard Rumelt: Good Strategy, Bad Strategy.

Asindu Drileba offers:

Optimize the Overall System Not the Individual Components, interview given by Edwards Deming. Excerpts:

The results of a system must be managed by paying attention to the entire system. When we optimize sub-components of the system we don’t necessarily optimize the overall system.

Optimizing the results for one process is not the same as operating that process in the way that leads to the most benefit for the overall system.

Applied to markets:

- It's easier to do well on the S&P 500 index (the general market), than do well in a single stock (picking).

- Attributed Mark Spitznagel, we should judge the buying of far OTM puts based on how they help the entire portfolio. Not the individual PnLs of buying the far OTM puts.

- Attributed to Roy Niederhoffer, many traders turn off trading strategies once they start loosing money, but different trading strategies make money at different times.

Aug

17

Best video on Punnett square, from Asindu Drileba

August 17, 2025 | Leave a Comment

Concerning the transitions of colour, on the daily spec website. The chair recommended The Punnett square as a research topic. This was the best video I could find. It's amazing how he broke down the essentials in just 6 minutes:

Genotype, Phenotype and Punnet Squares Made EASY!

Big Al offers:

Great vid on Markov, and Markov chains leading to LLMs:

The Strange Math That Predicts (Almost) Anything - Markov Chains

Aug

7

Learning From Data, from Asindu Drileba

August 7, 2025 | Leave a Comment

The best data science course I have ever watched. In fact, probably the best data science course ever made is Prof. Yaser Abu-Mostafa's "Learning from Data" at Caltech. I am not exaggerating, and if you think I am, just read the comments section from the first video of the course The Learning Problem — its almost exclusively high praise.

This course is really old, as its from 2012. I watched it probably in 2017 or 2018. But its still very relevant today. Why its relevant today? Most courses focused on describing techniques that were popular then, but later became irrelevant. For example, GANs were replaced by Diffusion Models and core ML Architectures have shifted to Transformers.

Prof. Yaser's course is different because he covers Theory, Techniques and Concepts (most books/courses only describe ML algorithms/Techniques or how to use features in python libraries).

- Theory, refers to mathematical descriptions of ideas like "Is learning feasible" for your problem or dataset?, "Training vs Testing", "The theory of generalization" and the "Bias-Variance trade off".

- Techniques, refers to actual ML algorithms like Neural Networks, SVMs.

- Concepts, describes auxiliary things that are not really Machines Learning but useful to understand well. Like how to interpret/deal with Error & Noise, Sampling of data.

I also recently came across a comment about a book he wrote to accompany the course which made me remember him: Learning From Data.

Aug

1

How do you fight the Vig?, from Asindu Drileba

August 1, 2025 | 1 Comment

I interpret the "Vig" as the collective term for:

1) bid-ask spread (difference in prices between buying & selling) due to market makers

2) transaction fees (for limit & market orders) charged by the exchange

3) slippage (an instrument is more expensive the deeper in the order book you go) due to how liquid an asset is.

Possible solutions for each?

1) Can be fought with the exclusive use of limit orders instead of market orders.

"Be patient and you will have the edge", The Chair in, Practical Speculation — The fine art of bargaining for an edge

2) I noticed (at least in crypto markets) that the more volume you trade, the less fees you pay (on a percentage basis)

3) Restrict yourself to deep and very liquid markets.

Also, one technique is to trade as less often as you can (buy & hold). That way you will automatically pay less of all the three sources of Vig. I think this is so important as I often found many "edges", then accounted for the vig and they often became loosing strategies.

Big Al writes:

I would also add "opportunity cost" as part of the "Meta Vig" (MV), i.e., the total costs associated with trying to trade the markets. The MV would also include the negative effects of cortisol on the human body.

Henry Gifford suggests:

I think two good steps are to ask others what the big is, and to try to calculate it yourself. Both exercises will no doubt be educational. A few times over the years I have asked horse bettors what the big is, but none seemed to know. As for calculating yourself, one hopefully will learn how much it varies by, and maybe also gain insight into hidden vig.

Steve Ellison responds:

There is no free lunch with limit orders because of adverse selection. Sooner or later, you will place a limit order on a security that simply moves up and never looks back. It would have been your best trade ever, had you actually been filled. In the opposite scenario, for example when I bought Coca-Cola in 1998, and it was already down 25 percent by the T + 3 settlement date, you will of course be filled.

Studies of retail investing accounts have shown a negative correlation between number of transactions and investment returns. In one study, accounts that had been inactive for 18 months because their owners had died, and their estates had not been settled, outperformed the vast majority of their retail account peers.

Peter Ringel writes:

Generally, the lower you go ( smaller time frame - smaller scope of the trade ) the larger the relative Vig costs. a subclass of opportunity costs is spent time of (daily) preparation. my required prep is nearly the same over many time-frames - but the scope of a trade is way lower for lower time-frames. in cash equities, the resale of your order-flow by your broker to some HF shop can be counted as Vig too. is this a common practice in option markets too? Yes, the Vig greases the fin-industry, but it is mostly unavoidable paying / avoiding the Vig does not lead to success or failure in mkts IMHO.

Vic simplifies:

just trade once a quarterfrom long side

Zubin Al Genubi comments:

The biggest vig is capital gain taxes. The richest people in the world hold their single company stock 10000x and realize no gain. Its very hard to beat a long term hold.

Jul

22

Smörgåsbord

July 22, 2025 | Leave a Comment

Big Al offers:

Very nice Veritasium vid on randomness and information:

Asindu Drileba likes a new interview:

I learned about Gappy Paleologo from this list. He has a new interview on a Bloomberg podcast. In it, he talks about:

- Why he suspects Astrophysicists make good quants

- Why AI can't fully take over trader's jobs (in principle)

- What makes a "good quant"

Jeff Watson is following the floor traders last stand:

Old-School Floor Traders Finally Get Their Day in Court Against CME

Trial opens in the Chicago plaintiffs’ long-running lawsuit claiming harm from the launch of electronic markets

The plaintiffs, who estimate that they are owed about $2 billion in damages plus interest, say the company broke its promises to them when it opened a data center for electronic trading that effectively doomed the old trading floors. CME has called the lawsuit baseless.

A spokeswoman for CME declined to comment. The company repeatedly tried to get the suit thrown out, but failed each time.

The lawsuit, filed in 2014, has dragged on so long that one of the original plaintiffs has died. Hundreds of former floor traders could be affected by the outcome. The trial, being held at a county courthouse in downtown Chicago, kicked off Monday with jury selection. It is expected to last several weeks.

Jul

2

Gem from Operations Research, from Asindu Drileba

July 2, 2025 | Leave a Comment

I recently came to the conclusion that a lot of quants come from the field of Operations Research. I noticed a paper of MFM Osbourne was also published in an Operations Research Journal. After a bit of research with in this space I came across an approach called "Metaheuristics."

I think its very relevant to this list. Mr. Jim Sogi once described The Chair's approach to thinking as "Neiderhoffian thought." E. O Wilson called it "Consilience." "Metaheuristics", "Neiderhoffian Thought" and "Consilience" are all related, in that, they champion the idea that we can come across novel solutions via thinking in analogies & metaphors.

There is a table of curated Metaheuristics. It has algorithms inspired by Ants, Buffaloes, Rivers, Art (yes, like paintings), Squirrels, Wasps and Korean TV Shows (Squid Game Optimizer).

The gem I am talking about is a book called Advanced Optimization by Nature-Inspired Algorithms, by Omid Bozorg-Haddad. The book has 15 Algorithms. Notable mentions are:

- League Championship Algorithm (Inspired by sports)

- Shark Smell Optimisation (Inspired by how sharks use their sense of smell to find prey)

- Ant Lion Optimizer (Inspired by how larvae of Antlions entrap prey)

I consider the book well written. Each of the 15 algorithms are described in 4 ways. For example, the Ant Lion Optimiser algorithm:

1) It's done in plain English to give you a verbal understanding of what the algorithm does.

2) It's done in mathematics so you can know how to better understand the algorithm in math notation.

Example of math description of ant-lion algorithm

3) It's described using flow charts.

4) It's described in pseudocode so you can better know how to code the algorithms up.

All the 15 algorithms are described in this way. This was something I appreciated so much.

Jun

30

Daily Spec Calendar Transitions

June 30, 2025 | Leave a Comment

sp and bonds 1-day changes similar to Mendel's independent moves to next generation. when an event occurs that throws one of pair of bond or sp off, treat it as a mutation.

The Punnett square is a square diagram that is used to predict the genotypes of a particular cross or breeding experiment. It is named after Reginald C. Punnett, who devised the approach in 1905. The diagram is used by biologists to determine the probability of an offspring having a particular genotype. The Punnett square is a tabular summary of possible combinations of maternal alleles with paternal alleles. These tables can be used to examine the genotypical outcome probabilities of the offspring of a single trait (allele), or when crossing multiple traits from the parents.

Asindu Drileba writes:

Orange (S&P Up, Bonds Down) and Green (S&P Up, Bonds Up)

Orange appeared 4 times. In 3/4 times, Orange transitioned to Green with an average point gain of 35.4 in the SPY.How long will this continue? I noticed the pattern last month, unfortunately I didn't "count" it. Was it around for longer periods of time?

Jun

23

Jarisch–Herxheimer reaction, from Nils Poertner

June 23, 2025 | Leave a Comment

Jarisch-Herxheimer reaction in medicine: A sudden and typically transient reaction (eg fever) that may occur within 24 hours of being administered antibiotics for an infection such as syphilis.

Application in financial markets? eg when a troubled stock sells off briefly after a new strategy or management is announced but the stock recovers after some 24-48 h carnage.

Asindu Drileba writes:

In The Education of a Speculator, Chapter 14, "Music & Counting":

Another frequent work I hear in the market is Haydn's Symphony No. 94 ("The Surprise"). The surprise is a simple fortissimo chord in the second movement, designed "to make the women jump." In a contemporaneous review of the work, a lyrical critic wrote:

The surprise might be likened to the situation of a beautiful Shepherdess who, lulled to sleep by the murmur of a distant Waterfall, starts alarmed by the unexpected firing of a fowling-piece.'

Two examples from currency markets:

1) Asia Currency crisis: When the Asian currency crisis of the 1990s was starting to manifest, IMF provided a loan to "stabilize" the economy. The currencies were stable for some time (the lull to sleep), then dropped by up to 80% in some Asian countries (the jump).

2) The Lebanese pound: The Lebanese pound remained very stable. Close to a flat line for 13 years (the lull to sleep), Then in Jan 2023 it dropped by 90% (the jump).

Equity Markets: "The best predictor that a company will go bankrupt, is stable income" — Nassim Taleb. Unfortunately its hard for me to get data on delisted (bankrupt) stocks so I can't test this. But the logic behind this reasoning is that, to provide stable income, corporations often optimise via unhealthy accumulation of debt, relying on a single supply chain (Apple & China), relying on a few big enterprise customers (Palantir & US Government).

While this optimisation makes it easier to milk profits that make a corporation look "stable" (the lull to sleep), it makes them more prone to catastrophic failure (the jump). A single customer canceling your service, trump tariffs on a single supply chain partner or debt unable to be paid may lead serious issues.

Jun

18

Win rate, from Francesco Sabella

June 18, 2025 | Leave a Comment

What exactly means this quote? I read of it years ago on a book about Medallion Fund but never understood if I got the meaning correctly.

We're right 50.75% of the time…but we're 100 % right 50.75% of the time. You can make billions that way.

- Robert Mercer

Peter Ringel responds:

my guess: trend following systems can have 40% win rate and lower. Yet via expectancy these sys can be very profitable. Medallion though, would do HF stuff, less MoMo.

Michael Chekalin comments:

Mercer refers to the consistency of Medallion. In other words, they are “consistently” profitable in the 50% area, which through proper money management, risk/reward, etc, can be extremely profitable.

Asindu Drileba writes:

I think its a reference to the "law of large numbers." Suppose you noticed the market goes up 51% of the time on Thursday. (for the 100 Thursdays in your sample dataset) This means that you will also loose 49% of the time. If you decide for example to only place bets for the first 20 days, you might have a win rate of 0%. All bets of the first 20 days can fail.

But the model will still be correct since you can make money for the subsequent 51 days and the lose money for the next 29 days — thus playing the market for all the 100 days (20 + 51 + 29). So your win rate will converge to 51/100 which is the same 51% you identified in your sample. You have therefore acquired 100% of the edge. I think that is what he means when he says "we are 100% right 50.75% of the time."

Nils Poertner adds:

Some specs have a 10pc win rate and do really well. Friend of mine was early investor in ETH in size- but all other of his ideas didn't work out. His nick name was "Harbinger of Failure." Kind of like the joke: "I told my friends I want to become a comedian - and they all laughed. And then I became a comedian and no-one laughed anymore." I often think about him now.

Jun

11

One must admire the first guy to introduce Brownian Motion into a theory about speculation.

Louis Bachelier's Theory of Speculation: The Origins of Modern Finance

Asindu Drileba wrires:

If you like that, you may find Louis Bachelier's other book Sketches in Quantitative Finance interesting. It's very accessible as it has no complex math and describes many concepts in probability/statistics in a very straightforward way. In it, he say's for example that despite Martingale strategies looking lucrative, "no one has gotten rich by using this method."

Jun

3

Books again, from Asindu Drileba

June 3, 2025 | Leave a Comment

I can't find any books from the 1700s. Big events like the Mississippi Scheme and the South Sea Bubble happened in that period. But I can't find literature from the 1700s of people describing markets then. Maybe they had PTSD from having their fingers burnt? I heard Newton never wanted anyone to mention "South Sea" around him. (he lost his pile in the investment)

Stefan Jovanovich responds:

Essai sur la Nature du Commerce en Général, by Richard Cantillon (1680s–1734)

During 1719 Cantillon sold Mississippi Company shares in Amsterdam and used the proceeds to buy them in Paris. Mississippi Company shares surged from 500 livres in January 1719 to 10,000 livres by December 1719; during the same period the prices in Amsterdam went from 400 to 7,000. The daily average spread is calculated to have been between 20% and 40%.

Carder Dimitroff suggests:

Empire Incorporated — The Corporations that Built British Colonialism, by Philip J. Stern

The book provides historical perspectives about British markets and corporate financing. It's not an easy read, but it is fascinating.

William Huggins writes:

there is a collection of "things written afterwards" about 1720 called The Great Mirror of Folly but its mostly moralizing tracts than a steely-eyed review of what went down. keep in mind the experience (a bubble in uk-fr-nl, all at the same time) had profound effects on the market for almost a century afterwards with the fr retreating from paper money and the british passing the bubble act which made it waaaay harder for anyone to raise capital. trading stock largely returned to being an insiders game until the 1800s. GMoF was recently published along with a pile of other primary docs by Yale U press:

The Great Mirror of Folly: Finance, Culture, and the Crash of 1720

I like the goetzmann treatment of 1720 from Money Changes Everything personally. He's got a couple of good recorded talks on it too. for those interested in institutional developments around markets and financial institutions in north america, I strongly recommend Kobrak and Martin's "Wall Street to Bay Street."

Steve Ellison offers:

Extraordinary Popular Delusions and the Madness of Crowds was written in 1841 by Charles Mackay. The first three chapters are devoted to the Tulip Mania, the South Sea Bubble, and the Mississippi scheme. The remainder of the book is about non-financial episodes of irrationality, including a chapter about plagues that I re-read closely in March 2020.

May

31

All higher forms of math and statistics are useless in uncovering regularities, from Asindu Drileba

May 31, 2025 | Leave a Comment

I was browsing the Daily Speculations archive and found this:

10 Things I’ve Learned About Markets, from Victor Niederhoffer

No. 11 is, "All higher forms of math and statistics are useless in uncovering regularities."

Define "higher form". To someone that has just learned basic arithmetic, basic algebra seems "higher form". Does The Chair maybe mean "PhD level" math? Or does he mean that basic "counting" is the only proper way to uncover regularities?

Fazil Ahmed responds:

I think Ralph Vince has explained well, copying from the post:

Certainly in a post-'08 world, quants are out of favor, and for good reason. Most anyone I know who DOES make money in the markets, does so with very simple, robust techniques. Having considered going to quant school, and studied a good deal of it, I finally came to the conclusion that they are simply working with "models." Models of how the world behaves. unlike hard sciences like Physics and such where you can perform a test, come back a year from now, perform it again and get the same results, you don't have this in financial modeling. And I think this is where the quants have fallen short. Models are NOT reality, and they never got down to the bedrock, the reality of what his game is about. Of course it had to fail, and in a large way, at some point. A good rule of thumb is that if I need a computer, if it isn't simple enough to do in my head on the fly in the foxhole after I have been awake for over 100 hours, I can't use it.

Larry Williams comments:

This gets down to there are hard questions: What is the capitol of Montana? Only one answer: Helena.

And soft questions: How many people are in Montana? Varies from hour to hour.

May

30

The problem facing China, from Larry Williams

May 30, 2025 | Leave a Comment

Perplexity says it best:

The U.S. population is projected to keep growing through the end of the century, mainly due to immigration, even as deaths begin to outnumber births after 203325. By 2055, the U.S. is expected to reach 372 million people, with net immigration as the primary driver of growth. In contrast, China faces a rapidly aging population: by 2050, about one-third of its population will be over 65, and the number of elderly will vastly outnumber children, creating an “inverted pyramid” demographic structure. This aging trend is expected to slow China’s growth and strain its social systems, leading some to describe China as “becoming a nursing home” by century’s end. Meanwhile, the U.S., thanks to sustained immigration, will remain younger and larger than it would be from natural increase alone.

Asindu Drileba writes:

Professor Bejan's constructal law guarantee's that China will go bust on a long enough time horizon. I attribute this to China's rigid political system. Like Daenerys Targaryen said, "Those that don't bend, will break." Professor Bejan's TED Talk.

William Huggins responds:

for entirely different reasons, both Daron Acemoglu (econ Nobel 24) and Peter Zeihan are also in the China-bear camp long term - the former due to hitting the limits of "growth under extractive institutions", the latter due largely to demography (even if his tone is alarmist). Dalio's indicators suggest the opposite but all his data comes from a demographic regime of pyramids, not chimneys or inverted pyramids so i'm not sure his forecast will play out.

May

28

Adapting to the situation, from Big Al

May 28, 2025 | Leave a Comment

Street smarts: how a hawk learned to use traffic signals to hunt more successfully

But what was really interesting, and took me much longer to figure out, was that the hawk always attacked when the car queue was long enough to provide cover all the way to the small tree, and that only happened after someone had pressed the pedestrian crossing button. As soon as the sound signal was activated, the raptor would fly from somewhere into the small tree, wait for the cars to line up, and then strike.

Easan Katir predicts:

Next iteration: the hawk will be pressing the pedestrian crossing button!

Michael Brush quips:

Pavlov’s birds.

Henry Gifford writes:

When I was hiking down The Grand Canyon I sat on a rock at the edge of the trail and took out a sandwich and started to eat. A bird came flying from my left side, toward the sandwich in my right hand. I reacted by pulling the sandwich back, to the right side of my head. Another bird came from behind and grabbed it.

Later I heard the birds’ favorite food is tuna fish, which they steal cans of from hikers. They open the can by grabbing it in their beak and flying above the one of the three cabins at the bottom of the canyon where the park rangers live and dropping it on the roof. The rangers have been trained to comply by opening the can and placing it on a convenient rock.

Pamela Van Giessen responds:

Was it a raven? They are particularly smart birds when it comes to getting food out of visitors to the national parks we have visited.

Asindu Drileba writes:

Crows & ravens would make good scientists. Here for example a video of a crow showing that it understands water displacement in different scenarios.

Bo Keely, from the desert:

Yesterday at the meteor crater in Death Valley two crows perched on the rim. They had grown feather sunglasses and asked for food. I went to the car & they followed and I gave them whole wheat bread. Then I got in & drove a couple miles down the road, pulled over to check directions, and they landed outside the driver's door asking for more bread.

May

27

An interesting read, from Humbert X.

May 27, 2025 | Leave a Comment

Drawdowns and Recoveries: Base Rates for Bottoms and Bounces

Michael J. Mauboussin

Dan Callahan, CFA

Long-term wealth creation for companies is also heavily skewed.

Hendrik Bessembinder, a professor of finance at Arizona State

University, studied the roughly 28,600 public companies that have been

listed in the U.S. from 1926 to 2024. Key to his definition of wealth

creation is that a stock produce returns in excess of one-month

Treasury bills.His data show that just under 60 percent of the sample failed to match

the returns of Treasury bills, destroying $10.1 trillion in value

through December 2024. The other 40 percent or so created $89.5

trillion in value. Just 2 percent of the companies produced 90 percent

of the aggregate wealth creation of $79.4 trillion, and the top 6

(Apple, Microsoft, NVIDIA, Alphabet, Amazon, and ExxonMobil) alone

added $17.1 trillion.Had you been astute enough to buy and hold any of these super wealth

creators you would have suffered meaningful drawdowns. For example,

the lifetime wealth creation of Amazon, a technology company known for

e-commerce and cloud computing, was $2.1 trillion from its initial

public offering in 1997 to year-end 2024. Yet Amazon shares dropped 95

percent from December 1999 to October 2001. The average maximum

drawdown for the stocks of the top 6 companies was 80.3 percent,

similar to the average of the full sample.

Asindu Drileba responds:

This is fairly consistent with the findings of Robert J Frey (former Managing Director of Rentech). He gave a talk titled 180 years of Market Drawdowns. The main point of the talk is that since the 1830s to present, the structure of the market has changed a lot.

- Different political regimes

- Different sets of stocks

- The creation of a central bank (in 1913)

- The advent of electronic trading

- The rise of high frequency trading

- The creation of the SEC (1934)

- Many new regulations

- Different people trading the markets in those 180 years.

But one thing has remained constant in those 180 years: The S&P is in a drawdown 75% of the time. He defines draw downs as a period between the decline from an all time high [where somebody bought] to the point that they break even. So psychologically speaking, 75% of the time, [some] investors in the S&P are in a state of regret. I am thinking that if you can find a way of trading this, the edge will probably last forever.

May

26

Every trade a loser, from Larry Williams

May 26, 2025 | Leave a Comment

I believe every trade I enter will be a loser–that is my most powerful trading belief. That concept keep me on guard and alert. Emotions are strictly Money Management. If/when you are too emotional, it just means your position size is too big for your emotions.

H. Humbert responds:

The attitude will tend to put you in contrarian positions at the best times, the times of maximum fear in the market or towards a stock. What you said is the same as saying "your best purchases are the ones that are the hardest to make." Of course if you recognize that you are a contrarian, at the same time on some level you have faith that the position will work out. It just depends on what level you want to think about it, emotionally. First derivative second derivative stuff.

The point is, with money in the market based on who is, or who is not, playing tennis (times 10,000 investors with their own 10,000 irrational superstitions), there are bound to be mispriced securities somewhere. Our job is to find them. Despite all their spreadsheets, NPVs, TA, back testing and “counting,” investors remain among the most irrational and emotional creatures on the planet. That is a good thing. That has always created mispricing, and opportunities. In essence, trading is about betting against human nature.

Galen Cawley writes:

I would say that thinking in advance that every trade will be a loser does not provide a positive edge so much as it prevents behavioral errors.

1) If you are a completely algorithmic trader, then the question is largely moot.

2) On the discretionary side, focusing on potential losses prevents unforced errors such as overconfidence manifested in the form of both overtrading (size and frequency).

3) Visualizing worst-case outcomes can prevent you from going on tilt during a crisis or during a string of losses.

Asindu Drileba agrees:

I have this attitude too. I assume every position will be a loss. So practically it helps me size my positions modestly. When I am placing a trade. A position is only in two states: a) I am over betting, in which case I may blow up. b) I am under betting, in which case I won't blow up. The only way to make sure that you are on the side of b) is to: 1) over estimate your losses; and then 2) under estimate your wins.