Mar

31

An insightful section

March 31, 2025 | Leave a Comment

An insightful section of Mr. Tredoux's Francis Galton's Nature and Nurture: 1822-1865 shows that the poor forecasts and poor scientific methods of Robert Fitzroy, as uncovered by Galton, probably led to his suicide. Let us hope that a similar fate does not await some of the useful idiots and bears recounted in my posts.

Mar

30

The hypothesis is that at the end of a quarter in which bonds are up while stocks are down, institutions need to rebalance their asset allocations by selling bonds and buying stocks.

I found 14 such quarters since 2002, not including the current quarter. In the last 5 trading days of those 14 quarters, SPY was up 8 times and down 6 times, with an average net change of 0.9% with a t score of 0.76–statistically insignificant.

My Python code that I used to obtain the above results.

Big Al responds:

That's an event I hadn't thought about in a long time. It's hard to imagine a lot of big institutions running a simple strategy like that these days, which doubt your study would appear to support. But it does make me wonder if there are other, more complex balances or relationships that big players do manage on a calendar basis.

Alex Castaldo comments:

The general idea of trying to take advantage of "fixed behavior" by others is a good one IMO.

Paolo Pezzutti agrees:

It's like finding regularities end of month or Holiday's behavior or several others. I think there may be many still uncovered. Steve on Github has made public a number of Python notebooks. Very nice work to stimulate curiosity in searching patterns. It's not rocket science based on Artificial Intelligence, but I think this methodology has still value.

Asindu Drileba writes:

The rebalancing edge is real. In BTC for example, I realized that the most consistently active, "high activity" period is the time around 0:00 UTC (Server time). Something interesting is always happening during that period.

It turns out alot of people trade BTC daily and it just makes sense to rebalance the position size at midnight. I too even choose it sub-consciously. I don't think many people are choosing 03:00 UTC , 17: 43 UTC etc. Unfortunately, you need second by second, price quotes over many days, weeks, months and years to investigate this activity further. So I put it on pause. But the "activity" still exists.

M. Humbert adds:

Window dressing at quarters end is probably still occurring as well.

William Huggins writes:

several years ago i followed in Markman's steps of investigating the S&P500 drops and additions for irregularities (they did exist but have since been arb'd out). the driving mechanism was that index fund managers were paid to minimize tracking errors, not maximize performance so they would all trade at the same time, causing a secondary effect on the day the change actually took place (there was a preliminary change the day of announcement). it was a pretty basic academic event study but the most valuable part was uncovering "why" big money was doing a thing that created opportunities for fast moving traders (email me if you want it, but the trade doesn't work anymore)

Mar

29

Catching up with Dr Brett

March 29, 2025 | Leave a Comment

On his blog:

TraderFeed

Exploiting the edge from historical market patterns

Sunday, March 23, 2025

Keys to Great Trading

Peter Ringel adds:

He was also on CWT recently:

Trade Like You: Why Playing to Your Strengths Works Better · Dr. Brett Steenbarger

Mar

28

Reverse effects, trunks

March 28, 2025 | Leave a Comment

usually one is accustomed to a political news effecting stocks but now after 50 days form a 20-day high and only 2 pts from a 50-day low at 5579 on march 13, we can expect stocks to effect politics. another decline in sp will create tariff easing.

Single trunks grow at a rate determined by the species of tree and the care it gets. Multi-trunks have seperate root systems and since they are close together, they compete for nutrients. This competition results in slower growth rates….Since they compete, multi-trunk trees grow 30% to 50% slower than singles trunk trees of the same species. Despite a slower growth rate, these trees can still flourish with attention and care.

Heritage Tree Service of Texas

a single trunk tree grows considerably faster than a multitrunk tree. is the same true for stocks? a test will answer this.

Mar

28

The late baseball great studied hitting as closely as a stock strategist studies markets. In fact, Williams' hitting rules can easily make you a better investor.

By Victor Niederhoffer and Laurel Kenner

"Get a good ball to hit."

– Rogers Hornsby to Ted Williams, on the single most important thing for a hitter.

A person, a field, a book. Sometimes they come together with such genius that you wish to carry the lessons around and apply them to everything you do. Such is the case with Ted Williams’ "The Science of Hitting," widely considered the definitive book on the subject. With the baseball season soon starting, the market reeling and investors searching for a rudder, it seems particularly appropriate to learn from the book’s timeless lessons for all fields. But we’ll go even further. We’ll show how to use this method to make a profit by trading IBM (IBM, news, msgs) and similar biggies on Thursdays, when the count is right.

Williams was the last batter to achieve the magic .400 average in a full season — 1941, when he hit .406. (He also had .400 averages in 1952 and 1953, when his seasons were cut dramatically short because of Korean War service.) He is considered one of the three best hitters ever, with Babe Ruth and Rogers Hornsby. “I had to be doing something right,” he said. “And for my money the principal something was being selective.”

His selectivity was unique and inspiring. He divided the 4.6-square-foot batter’s box into 77 zones, and assigned each a hitting percentage. The sweet spot was high over the middle of the plate, where the batting average hit .400.

Rule No. 1: Wait for your pitch

Warren Buffett cited "The Science of Hitting" in his 1998 annual report in a discussion of his favorite subject: How the market doesn’t look good to him. (His most recent annual report, published Saturday, repeats the sentiment.) Buffett said he, like Williams, follows Rule 1 and waits for the great pitches — the great companies — and holds his fire until they arise.

After Rule 1, we will expand the list of hitting rules to 11, drawing from the lessons in Williams’ book.

Mar

27

Spec roundup

March 27, 2025 | Leave a Comment

Jeff Watson has been watching the CME:

Anyone else notice the increase in seat prices (trading rights) recently?

Big Al found a history lagniappe:

BabelColour

@StuartHumphryes

Travel back in time 117 years to the Russia of 1908. I have enhanced for you this rare colour photo of the Russian writer Leon Tolstoy, regarded as one of the greatest and most influential authors of all time. It was taken in the grounds of his house at Yasnaya Polyana, near Tula, Russia. It is original colour, not colourised.

Steve Ellison provided his own:

Since one might be well advised to beware the Ides of March, here is a picture I took in 2017 of the ruins of the Theater of Pompey.

Asindu Drileba has been reading:

The importance of contrarianism emphasized by Jeff Bezos, from the Amazon 2020 Letter to Shareholders:

Differentiation is Survival and the Universe Wants You to be Typical

Our bodies, for instance, are usually hotter than our surroundings, and in cold climates they have to work hard to maintain the differential. When we die the work stops, the temperature differential starts to disappear, and we end up the same temperature as our surroundings….While the passage is not intended as a metaphor, it’s nevertheless a fantastic one, and very relevant to Amazon. I would argue that it’s relevant to all companies and all institutions and to each of our individual lives too. In what ways does the world pull at you in an attempt to make you normal? How much work does it take to maintain your distinctiveness? To keep alive the thing or things that make you special?…This phenomenon happens at all scale levels. Democracies are not normal. Tyranny is the historical norm. If we stopped doing all of the continuous hard work that is needed to maintain our distinctiveness in that regard, we would quickly come into equilibrium with tyranny….We all know that distinctiveness – originality – is valuable. We are all taught to “be yourself.” What I’m really asking you to do is to embrace and be realistic about how much energy it takes to maintain that distinctiveness. The world wants you to be typical – in a thousand ways, it pulls at you. Don’t let it happen.

Mar

25

We were younger

March 25, 2025 | Leave a Comment

i had the privilege of sitting at the actual Galton desk and a secretary was using it. Jensen and I complained about the sacrilege, and the secretary moved to a modern desk. I noted there in Galton's library a well-read copy of the 1st edition of Wealth of Nations.

we were younger:

Someone in a Tree - Stereo - Pacific Overtures - Original Broadway Cast

Mar

24

Two champs skiing

March 24, 2025 | Leave a Comment

Mar

23

One of my favorite books of all time

March 23, 2025 | Leave a Comment

Dear Mr. Tredoux : I am now through p. 157 of the first volume of your bio of Galton, Francis Galton's Nature and Nurture: 1822-1865. I have never found a life more interesting than yours of Galton. Even though I had read all books and previous bios of Galton I found new material on every page.(i never know he played fives and could throw)

congrats Mr. Tredoux on the Homeric epic you wrote. I particularly admired the way you followed up every mention of people Galton met until 30 with their subsequent fate and fame.

I am sure Mr. Tredoux that many of my friends now departed (like Arthur Jensen) would have enjoyed and learned from your book as I did ( with many questions and follow up still to be.

Perhaps you will cover it later but I still have not seen the answer to why Galton did not have children. (was it the few moments of Pleasure that he experienced on his Islamid travels at age 25?)

Mar

21

Dimson, et al, 2025

March 21, 2025 | Leave a Comment

Global Investment Returns Yearbook 2025

(Public summary edition available as free download.)

The Global Investment Returns Yearbook, a body of work assembled by Professor Paul Marsh and Dr. Mike Staunton of London Business School and Professor Elroy Dimson of Cambridge University, has established itself as the definitive source for the analysis of the long-term performance of global financial assets. The 2025 edition, launched today by UBS Investment Bank and UBS Global Wealth Management’s Chief Investment Office, marks something of a milestone, providing us the opportunity to compare the first quarter of the 21st century’s market performance with that of the 20th century. This edition also includes a deep dive on diversification.

Mar

20

WealthWise Relaunch: Jeffrey Hirsch & Larry Williams Unveil 2025-2027 Market Strategies

CrossCheck Media proudly presents the relaunch of WealthWise, now hosted by market expert Jeffrey A. Hirsch, Editor-in-Chief of the Stock Trader's Almanac! In this exciting first episode, Jeffrey welcomes legendary trader Larry Williams, a veteran with nearly six decades of expertise in futures, commodities, and stocks.

Mar

20

Shoeshine boy, from P. Humbert (Updated)

March 20, 2025 | 1 Comment

I had a reverse shoe shine boy moment to day. A friend, who shouldn't talk to me about markets, talked to me: "Your boy Trump is crashing the markets. My portfolio …." I take such data points serious - in combinations.

Steve Ellison responds:

Similarly, my sister in October 2008 was getting 150 calls per day from clients asking, "Should I sell?" She worked at an insurance company that also offered investment services. My reaction at the time was, "Isn't anybody calling to ask, 'Should I buy?'"

Jeffrey Hirsch writes:

Still hearing a lot of “Should I buy?” Two weekends ago was asked if would come on cable biz Monday 2/24 to say I was buying mega cap tech. I declined and said I did not think is was time. Posted this that day.

Updates:

Nils Poertner writes:

valid observations here. good to pay attention to odd moves, anything strange (eg like bund move recently) - as there may be more odd things coming!! in other words, be like Alexander Fleming - who stumbled on penicillin by chance - and didn't bin the sample as he wasnt looking for it.

Adam Grimes comments:

I obviously understand the shoe shine boy/taxi driver point here, but it's worth considering that market psychology is not asymmetrical.

P. Humbert responds:

Hi Adam. there is high risk, that I initially heard about the old masters from your writings. I agree, that it probably has more weight for tops. I think, that is where you are pointing to? My friend has quite a good performance in being wrong. He called the the Bitcoin top being bullish and some more. He is a nice guy, just not for markets.

Adam Grimes agrees:

Yeah that's always been my thinking–a little more actionable with exuberance at tops. Bottoms tend to overshoot a bit more, on balance, so I think the shoe shine boy cries uncle a bit too soon.

Nils Poertner adds:

sometimes the crowd is right or they have a hunch but they don't connect the dots yet

eg. "a bit of subprime" in early 2008 - as sort of consensus view among your typical investor back them it was high time to position extra cautious.

Bill Rafter comments:

The “crowd” is mostly right, but the problem is that there are usually several crowds, and of course the composition of the crowds change. If you’re lucky, there will only be two crowds, the knowledgeable ones, and those “asleep at the switch”. The trading rule is simple: follow the informed ones, particularly if the uninformed ones are 180 degrees away. A classic example of this is the Commitment of Traders Report. Ideally the reporting specs will be one way, with the non-reporters the other way (and preferably short). Without the benefit of COT, you can identify best- and worst-informed with regression.

Mar

19

QOTD, ATH, Lunar Society

March 19, 2025 | Leave a Comment

A human being should be able to change a diaper, plan an invasion, butcher a hog, conn a ship, design a building, write a sonnet, balance accounts, build a wall, set a bone, comfort the dying, take orders, give orders, cooperate, act alone, solve equations, analyze a new problem, pitch manure, program a computer, cook a tasty meal, fight efficiently, die gallantly. Specialization is for insects.

- Robert A. Heinlein

best for stocks, now 20 days since ATH.

UBS Global Investment Returns Yearbook 2024

Leveraging deep history to navigate the future

Elroy Dimson, Paul Marsh, Mike Staunton

one has been reading of the Lunar Society and the early childhood of Francis Galton in the fascinating and magnificent book Francis Galton's Nature and Nurture: 1822-1865. one of my favorite books of all time.

Mar

17

A Specialist in Panics, from Steve Ellison

March 17, 2025 | Leave a Comment

From the first section of:

Fourteen Methods of Operating in the Stock Market

Magazine of Wall Street, 1918

Mar

16

10% correction in S&P 500, from Steve Ellison

March 16, 2025 | Leave a Comment

Before last week, the S&P 500 index had 25 declines of 10% or more since 2003. The median of the maximum drawdowns is -14.6%.

Mar

15

The Cosmic Distance Ladder, from Big Al

March 15, 2025 | Leave a Comment

Maybe the most fundamental thread on Spec List has been counting/data/figuring things out, so here is a marvelous two-part video by 3Blue1Brown, with Terrence Tao, about how we determined various cosmic distances.

The Cosmic Distance Ladder, Part 1

The Cosmic Distance Ladder, Part 2

Additional commentary and corrections from Prof Tau

Gyve Bones writes:

This was a fascinating lunch lecture. Thank you. I first became fascinated with the story of how science and technology developed with the 1977 PBS series by James Burke "Connections" which told the story, without the aid of CGI graphics in my high school years. I was given the companion book for the series that Christmas by my very thoughtful mom. (It's also the story that launched my falling away from the Catholic faith in which I was raised, my teenage rebellion.)

Here's the episode which details how the Babylonian star tables by Ptolemy used by Copernicus were preserved from the destruction of the Library of Alexandria, found on papyrus scrolls in a cave backup library:

James Burke Connections, Ep. 2 "Death in the Morning"

Asindu Drileba responds:

Connections is so good. I really wish there was a remastered version (in HD at least). One of the things I still don't understand is how government funded broadcast corporations like PBS, BBC and DW make such high quality non-fiction films. I would go to say the have the best non-fiction documentaries. Capitalism doesn't apparently do well when it comes to making non-fiction. What makes them so good? Are they just structured properly?

Gyve Bones replies:

Here is a very well mastered set of the videos for Connections (1978).

Peter Ringel adds:

there is a Conjecture, that astronomers are the more happy and humble people. I guess, this is because, it is all so vast and relative.

Mar

14

Best review of a great person

March 14, 2025 | Leave a Comment

Nicholas Wright Gillham

A Life of Sir Francis Galton: From African Exploration to the Birth of Eugenics

Oxford University Press, 2001

Reviewed by Gavan Tredoux, August 2002

This is only the third full-length biography of the eminent Victorian scientist and polymath Sir Francis Galton (1822-1911). Remarkably, it is the first in quarter of a century. Galton was the product of a distinguished lineage, with men of marked ability in every one of ten preceding generations. He had first made a name as an African explorer and meteorologist, active in the affairs of the Royal Geographical Society. Late in life, inspired by his half-cousin Charles Darwin, he went on to found the scientific study of heritability, which soon encompassed differential psychology, anthropology, genetics, criminology, statistical methods, and eugenics. Starting almost from scratch in all the subjects he investigated, Galton invented rigorous intelligence testing, founded experimental psychology in Britain, established the scientific basis for fingerprint identification, formulated the statistical concepts of regression and correlation, pioneered early investigations of genetics, and founded the biometrical school. Financially secured by a legacy from his moderately wealthy father, he might have followed so many of his contemporaries into comfortable idleness. Instead he chose the career of a “gentleman scientist”, and would on his death endow his well-managed legacy to further research in the areas that interested him.

Mar

13

Seniors: Learn to love AI, from Laurel Kenner

March 13, 2025 | Leave a Comment

Grok 3 helped me drop my glucose from ridiculous to almost normal in one week

I started talking to Grok 3 last week about some health problems. After just a couple of sessions I came to think of AI as a super-helpful genius friend who doesn’t mind long chats, probing questions, or boring tasks.

Mar

12

A nice find at Moe’s

March 12, 2025 | Leave a Comment

The Invisible Hand, First Edition

by John Eatwell (Editor), Murray Milgate (Editor), Peter K. Newman (Editor)

Covers Smith, Bentham, Hobbes, Hume, Locke, and Mill, as well as collective action, economic freedom, individualism, and property rights.

The Highlite of a trip to Berkeley: Moe's Books

Moe Moskowitz opened the doors of Moe’s Books in 1959, and so established one of America’s preeminent independent bookstores, a favorite destination for book-loving locals and tourists alike. Now boasting an inventory of over 200,000 new, used, and rare selections, Moe’s was noted by the New York Times in 2008 as the bookstore where “those in the know still all head.” Moe revolutionized the predigital used book business by establishing buying policies that ensured a trust with his customers: the highest prices would be assured when they brought their books to his store. Moe may be gone, but his policies and store remain very much alive today.

Mar

11

More on ‘attention’, from X. Humbert

March 11, 2025 | Leave a Comment

I think a lot about how attention, like a searchlight, moves around the markets. I like, too, the simple logic that when retail investors are deciding what to buy, they have a huge array of choices, but when deciding what to sell, they are limited to what they own. (Leaving out the idea of looking at thousands of options to try to decide what to short.) Maybe index ETFs simplify this process, but then, before index ETFs we had mutual funds, so maybe not.

All That Glitters: The Effect of Attention and News on the Buying Behavior of Individual and Institutional Investors

Brad M. Barber, Graduate School of Management, University of California, Davis

Terrance Odean, Haas School of Business, University of California, Berkeley

Advance Access publication December 24, 2007

We test and confirm the hypothesis that individual investors are net buyers of attention-grabbing stocks, e.g., stocks in the news, stocks experiencing high abnormal trading volume, and stocks with extreme one-day returns. Attention-driven buying results from the difficulty that investors have searching the thousands of stocks they can potentially buy. Individual investors do not face the same search problem when selling because they tend to sell only stocks they already own. We hypothesize that many investors consider purchasing only stocks that have first caught their attention. Thus, preferences determine choices after attention has determined the choice set.

Asindu Drileba writes:

Laslo Barabasi has a model called preferential attachment. His model can simply be defined as "people usually prefer to bet on a horse that is already winning". I hear night club promoters also do this. To pull in customers, you create artificially fake long lines. These long lines make a night club appear popular, and thus make people interested in going in.

For the S&P index for example, index rebalancing algorithms are at times market cap weighted. That is, stocks with a larger cap, get more money than those with smaller market caps. Which will increase their future allocations, as their market caps grow. Retailers and others seeking "Blue chips" cannot invest in the top 500 stocks. They may focus on the top 20, which further distorts the market caps. Barabasi claims that this is partly why stock market caps have a pareto-like distribution. 20% for stocks may hold 80% of the index value market cap. (I am not saying this so what is exhibited it's just an illustration).

Peter Ringel comments:

I hear night club promoters also do this. To pull in customers, you create artificially fake long lines. These long lines make a night club appear popular, and thus make people interested in going in.

This is one of the many cognitive biases of humans. Any group over 5 attracts attention by by-passers. It even works with cutouts of >5 humans. The research papers above immediately bring my thoughts to manipulation. The searchlight is a daily reality in markets to me. But someone is holding it and is pointing it. Wyckoff style manipulation games on and on. For hundred years. I do disagree a little with the paper about retail trader as the main victim. Institutional smart money today - in one corner of the market - is tomorrows dump money in another corner. They are easily also susceptible to the manipulation games.

Mar

10

If war is a racket, where are the market gains?, from Asindu Drileba

March 10, 2025 | Leave a Comment

A few years ago, I read Brig. General Smedley Darlington Butler's War is a Racket (full text). Sample passages:

In the World War a mere handful garnered the profits of the conflict. At least 21,000 new millionaires and billionaires were made in the United States during the World War. That many admitted their huge blood gains in their income tax returns. How many other war millionaires falsified their income tax returns no one knows.

The Nye Committee uncovered some astounding information about the munitions industry, including a confession to profits as high as 800 percent.

Inspired by the book, I looked up publicly listed defense companies and marked out dates for conflicts like the Gulf War, Iraq invasion, Assassinations, Ukraine Vs Russia, Palestine Vs Gaza. While there were some blips on defense stocks, they were not that impressive. So if people say the US defense "complex" is fleecing the government, where exactly is this money going? What doesn't it reflect on stock prices?

Gold on the other hand frighteningly has so many coincidents, when it actually "predicts" aggression. The price of Gold for example went up for a moment before Qasem Soleimani was killed in a drone strike by the Trump regime. Not to mention how it behaved during the previous "Gaza - Israel" & "Ukraine - Russia" conflicts. I also found a similar observation in The Education of a Speculator:

Then, out of the clear blue, from 2 P.M. to 3 P.M., gold jumped $7. No reason for the rise, just technical buying by the funds, we were told. But that weekend, around 4 A.M. on Sunday, U.S. Navy fighter planes shot down a Libyan jet flying over the Mediterranean. This caused tremendous tension, always good in those days for at least a good run in gold. After all, nuclear war in the Mideast was now possible.

— Chapter 4, Subsection (Practical Losses)

Why is Gold way better at predicting political aggression than defense stocks?

Big Al responds:

I find the tricky thing with macro events is being precise enough with dates. Some events, like Fed announcements or other econ data releases, can be timed more precisely. With bigger, geopolitical events, it's less definite. With defense stocks, I would look at their performance in the months before the event, on the assumption that the market would be anticipating rather than reacting. As for strong reactions, look at the chart of Rheinmetall since the start of the Ukraine war and also since the US election.

As for gold, here's an interesting approach, looking at market sectors:

Navigating crises: Gold's role as a safe haven for U.S. sectors

This paper investigates the correlation between U.S. sectors and gold, and whether gold can serve as a safe haven for investors in specific U.S. sectors during the global financial crisis, COVID-19, and the Russia-Ukraine war. We use data from the Standard & Poor's Depository Receipts (SPDR) Select Sector Exchange Traded Fund (ETF) to capture the performance of the respective sectors. Our findings document that gold is a weak safe haven for most U.S. sectors. Gold is not a safe investment for energy, materials, utilities, and consumer staples. Gold does provide vital protection for financial, consumer discretionary, industrial, technology, and healthcare.

Asindu Drileba comments:

Thanks for pointing me to RHM.DE. I didn't even know the company existed. It is exactly how I expected US defense stocks to behave during the Ukraine-Russia & Gaza-Palestine conflicts.

Mar

8

Jobs, from Bill Rafter

March 8, 2025 | Leave a Comment

Despite what talking heads may say about Jobs and the current Non-Farm Payrolls Report, there are two items that suggest Recessionary times. The current (daily) Payroll Tax Receipts growth, and the dichotomy between Full-time and Part-time workers (monthly). Click on the charts to open them for full view.

Mar

6

Disruptive behavior

March 6, 2025 | Leave a Comment

Examples of disruptive behavior in animals

like disruptive behavior in markets.

yale opponent who tried to kill me - ancestors surrendered to George Washington.

Mar

5

The search for a foolproof system

March 5, 2025 | Leave a Comment

"the search for a foolproof system is in vain. there will never be a foolproof system." - vn and tw.

very good advice from bacon and all speculators and gamblers:

Some amateur players carry inconsistency to such a degree that they demand consistency from the horses, while at the same time being utterly inconsistent in their methods of play. It's not the races that beat these players — it's the switches!

Racing is simple. Everything about the game is logical and common sense and elementary. All the figuring and the mathematics and the mechanics of racing can be understood by a child in junior-high school. But the game is decked out in an endless number of minor contradictions and open switches and deadfall traps, in order to lure the average player into doing everything wrong .

If the average player — the public play — kept out of all these switches and traps, then the powers-that-be would have to make the game far more complicated in order to insure the fact that the majority of players (as we learned in a previous chapter) continue to lose and thus continue to furnish money to keep up the game.

The amateurs who play so carelessly and who fall into all the wrong switches, do not stop to consider the percentages of their rightful losses. When an amateur goes to the track and loses nine bets (eight races and a daily double) and loses all his capital for the day, he has lost many times what the percentage calls for. He has no right to lose so much. It's almost as if he did it on purpose!

- Secrets of Professional Turf Betting

and just when you are ready to give up at the bottom or top, get ready for a change.

as you get nearer the King's row, you remember all your victories vividly (whether they happened or not).

ratio of Europeans like dax to sp at an all time hi.

I remember my 6 gold rackets (an important tourney in my day where my opponent tried to kill me by hitting at my head just when he was about to lose) which reminds me of the turn around in sp today.

Mar

5

If your company is a domestic power generator like Constellation (CEG) or Calpine (CPN), the proposed Trump Administration tariffs at the Canadian and Mexican borders could help elevate gross margins. If Canada cuts off electricity altogether, additional margins may become available. While generators may benefit, US consumers will be harmed.

Uncertainty clouds northern US grids amid Canada tariff threat

Canadian premier says he will cut off electricity exports to US ‘with a smile on my face’

M. Humbert writes:

It’s my understanding that utilities are generally regulated to provide a steady ROA based return. If so, I don’t believe that they can raise their prices and increase their gross margins, as that would raise their ROA. They can raise their prices though if their costs go up (to maintain their ROA). It’s been a while since I last looked at utilities though. Am I mistaken about this?

Carder Dimitroff responds:

Yes, regulated utilities generally provide steady ROAs. However, some states fully regulate their electric utilities. Other states deregulated bulk power (wholesale power) and the generators that supply bulk power. Most population centers in the US are in deregulated states.

In the deregulated states, the title to bulk power passes to regulated distribution utilities at substations adjacent to transmission lines. Specifically, titles pass to distribution utilities at substations' step-down transformers.

Ontario supplies bulk power to unregulated states (Minnesota, Michigan, and New York). Quebec supplies bulk power to New York and New England. New Brunswick also supplies New England. All three provinces own and operate nuclear power plants. While Canadian transmission lines feed power directly to specific locations within those states, imbalances propagate to other states.

Ontario updated its strategy. They now plan to tax Ontario power exports at 25%.

Steve Ellison writes:

In this video Peter Zeihan says that a hurdle to green energy is that essentially all cost is up front, unlike natural gas plants in which only 20% of the lifetime cost is in construction, and 80% is in fuel costs over the life of the plant. So even when total lifetime cost of green energy is less than that from a natural gas plant, the higher upfront costs make financing more difficult. If true, I would guess cost recovery of the upfront expenses is also more risky in a deregulated market.

Mar

3

Computer Based Horse Race Handicapping and Wagering Systems: A Report

William Benter, HK Betting Syndicate, Hong Kong

Certain authors have convincingly demonstrated that profitable wagering systems do exist for the races. The most well documented of these have generally been of the technical variety, that is, they are concerned mainly with the public odds, and do not attempt to predict horse performance from fundamental factors. Technical systems for place and show betting, (Ziemba and Hausch, 1987) and exotic pool betting, (Ziemba and Hausch, 1986) as well as the 'odds movement' system developed by Asch and Quandt (1986), fall into this category. A benefit of these systems is that they require relatively little preparatory effort, and can be effectively employed by the occasional racegoer. Their downside is that betting opportunities tend to occur infrequently and the maximum expected profit achievable is usually relatively modest. It is debatable whether any racetracks exist where these systems could be profitable enough to sustain a full-time professional effort.

To be truly viable, a system must provide a large number of high advantage betting opportunities in order that a sufficient amount of expected profit can be generated. An approach which does promise to provide a large number of betting opportunities is to fundamentally handicap each race, that is, to empirically assess each horse's chance of winning, and utilize that assessment to find profitable wagering opportunities. A natural way to attempt to do this is to develop a computer model to estimate each horse's probability of winning and calculate the appropriate amount to wager.

William Benter (born 1957) is an American professional gambler and philanthropist who focuses on horse betting. Benter earned nearly $1 billion through the development of one of the most successful analysis computer software programs in the horse racing market and is considered to be the most successful gambler of all time.

Mar

1

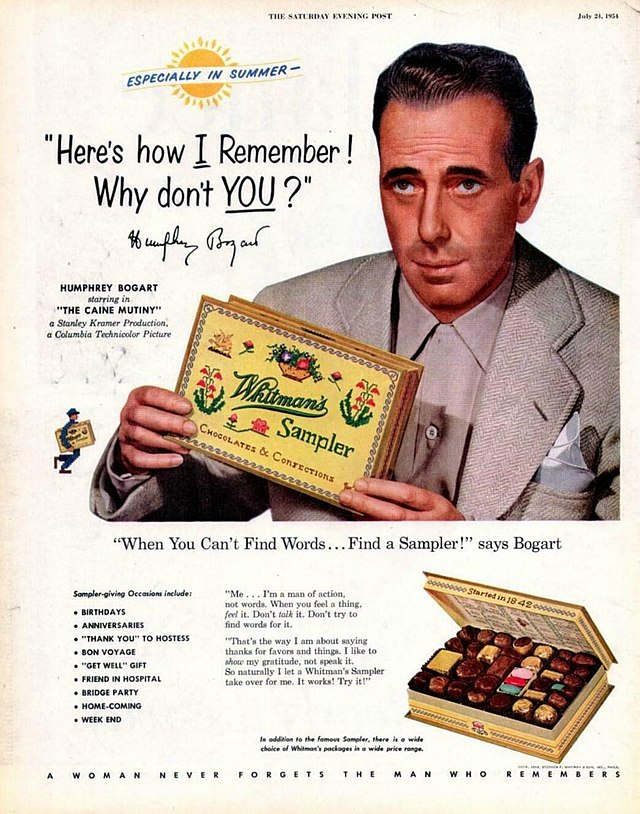

Sampler

March 1, 2025 | Leave a Comment

Carder Dimitroff points to:

Michigan’s Palisades nuclear plant nearing reopening

Michigan’s Palisades Nuclear Generating Station is one step closer to becoming the first nuclear power plant in the United States to reopen. After closing in 2022, the company that was set to decommission the plant has changed course, aided by a $1.5 billion loan from the U.S. Department of Energy to restart operations.

And a new SMR will be added on the same property in about 2030:

Michigan: First nuclear re-start is scheduled for this August

FWIW, the federal regulator (NRC) may be immune from budget cuts. Their licensing and regulatory activities are funded by the industry, not taxpayers.

Asindu Drileba suggests:

Great podcast on LLMs:

What kind of Intelligence is an LLM

[Part 3 of a 6-part series on intelligence in the Complexity podcast series by the Santa Fe Institute.]

Stefan Jovanovich finds:

The best underdog story in professional baseball in US:

The Best Underdog Story of 2025

Payton Eeles #11

St. Paul Saints

Minnesota Twins

Triple-A Affiliate

2BB/T: L/R5' 5"/180Age: 25

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles