Feb

5

6 new lows, from Zubin Al Genubi

February 5, 2026 | Leave a Comment

The last few down swings each had 6 new lows before a bottom. Today, marking a new low for this swing after hours will end up a new low number 5 by the end of tomorrow.

Steve Ellison writes:

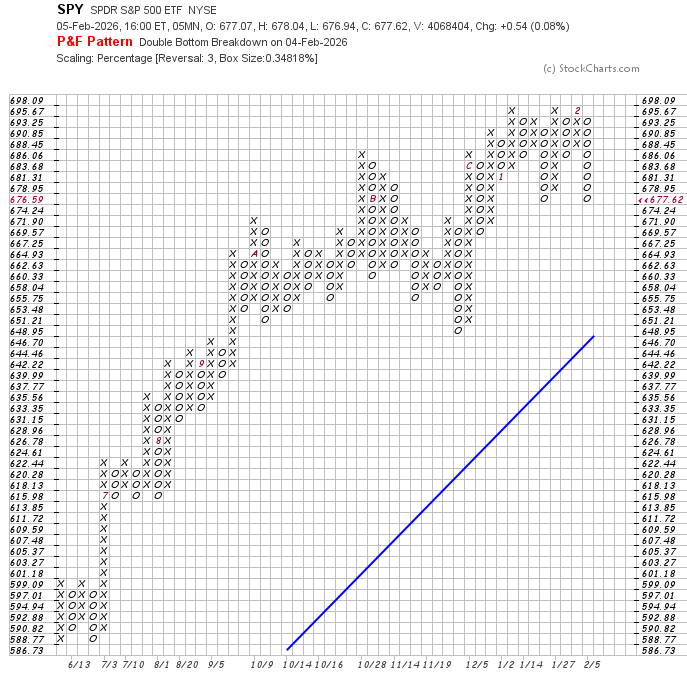

Interesting. I have been experimenting with multi-level point and figure charts. Using a box size of 1.4% (a long-term average true daily range) and a 3-box reversal, SPY is still within 4.2% of its all-time high and hence in an uptrend. Drill down with smaller box sizes and shorter time intervals, and interesting price structures appear. At a 1/4 ATR box size, today's close was at a similar level to the Jan. 20 low.

Lots of sector rotation under the surface. If 2025 was the year of the magnificent 7 and the flatlining 493, this year may be the opposite. While technology was getting beaten down this week, the Industrial, Materials, Consumer Staples, and Energy sector ETFs all made new highs.

Zubin Al Genubi adds:

Lots of late night shenanigans going on. Asian markets trading open in late thin US futures creating imbalances. Price action appears algo driven.

Nils Poertner comments:

I like the pattern with 6 new lows. Well spotted. Otoh, if the pattern does not repeat the surprise for mkts is bigger. nature offers "patterns" and "break of patterns" and both are relevant - else it would be a museum.

Cagdas Tuna predicts:

Then it is going to be a rough year for market cap weighted indices in US.

Peter Ringel writes:

While I would always give a study, like Big Al‘s more weight to remove opinion. I wonder, if there is a January effect regarding regime type or sector or general trading type. Not necessary % performance. Will the rest if the year trade like January? Would give a 2015 type year.

Nils Poertner responds:

yes. for practical purpose, it may be easier to trade mkts which receive less attention by the wider financial community /media.

Jan

30

Another volatility measure, from Zubin Al Genubi

January 30, 2026 | 1 Comment

Take a price corridor by forming a double barrier (rounds might be nice) delta up and delta down from the initial spot price. When the barrier is touched, we note the exit time, t1, and reset the barrier around the current price. This generates a sequence of exit times t1, t2,…,tn from which we want to estimate volatility. This shows how fast price moved.

Peter Ringel writes:

TY, this looks like a clever approach. I do something similar with zigzag vol and time. It is computational heavier. Yours sounds lighter. Will try it.

Jan

27

Ralph Vince’s latest, from Larry Williams

January 27, 2026 | Leave a Comment

Ralph Vince's newest book. Not about the markets.

The Theology of Lust follows Ricky “Pork Chop” White — a wounded, self-mythologizing erotic savant — as he stumbles through desire, regret, and violent entanglements, trying to turn raw masculinity into something redemptive. It’s a darkly funny, psychologically unfiltered journey where erotic obsession, betrayal, and a lurking murder plot converge on one man’s desperate attempt to find some sort of salvation out of the mess he calls a life.

Asindu Drileba writes:

Nice! I remember Ralph Vince mentioned that one of his favourite books was The Bible. There is a strange relationship between speculation, theology & computers(artificial intelligence) that no one has comprehensively talk about. Hopefully, I will learn more about theology from this book.

Peter Ringel comments:

When I read the senator writing "the greatest project of his life", I immediately feared, that he fell victim to French, Spanish or Portuguese girls. The title seems to confirm this.

Larry Williams responds:

Good guess but not quite Ralph has a new steal proof coin coming out the book is a year old but was just translated to English from French.

Steve Ellison recalls:

We had a long-ago list member who would frequently draw parallels between never-ending market arguments such as fundamental vs. technical analysis and the European religious wars of the 1600s or theological debates such as predestination vs. free will.

Jan

25

The Chair’s quest, from Peter Ringel

January 25, 2026 | Leave a Comment

Vic gives out a quest (a research quest).

I swear, I did see Vic's X post only afterwards. I too was thinking about the levels / rounds and how to test them today during my drive. Probably everybody is tired of starring at the same levels and so the mind wonders and wanders.

I am thinking of this approach:

utilize volume profile / volume per price level

(here a buffer bin can be applied / granularity from tick to x points)

(this will become important)

slice / bin the time series in segments of x

x needs to be defined,

I am thinking simple price ranges right now

normalize the segments

create a summary volume profile of all the segments ( an average or total sum )

plot it and hope something stands out

then a deeper statistical analysis of the volume profile, which is a frequency distribution

another approach could be to look at the "rejection power" of a price level after a crossing / touching event.

the crossing / touching events are often fuzzy in time

maybe remove time here a la range bars

after the event qualify the price range traveled for a fix time interval

so price-no-time vs price-time

Zubin Al Genubi writes:

The sample generally is biased bullish. Maybe take a look at bear regimes to see how hypothesis hold up. Also need to use unadjusted prices to retain rounds.

Peter Ringel responds:

TY. I am also thinking cash and virgin levels (around ATHs). the question of prices vs percentages will come up here too again.

If one sticks to prices and assumes an underlying behavioural cause of rounds, there probably are regimes with more or less black and white borders (fast transition) from 50 with weight to 100 with weight to maybe back to 50 in low volatility environments. Also the question, what difference does it make, if the index is 7000 vs 700.

William Huggins suggests:

it may be worth seeing if there are "liquidity cliffs" at rounds rather than sticky prices (order clustering as opposed to price clustering)

Peter Ringel adds:

The open interest at rounds at the option chain is usually noticeable higher vs all other steps.

Now I am thinking to look at the waning of these. Are they getting eaten up. Would explain the multiple crossings of a round needed till we get new ATHs.

Jan

21

US Stock Mkt Value as pc of GDP (US), from Humbert X.

January 21, 2026 | Leave a Comment

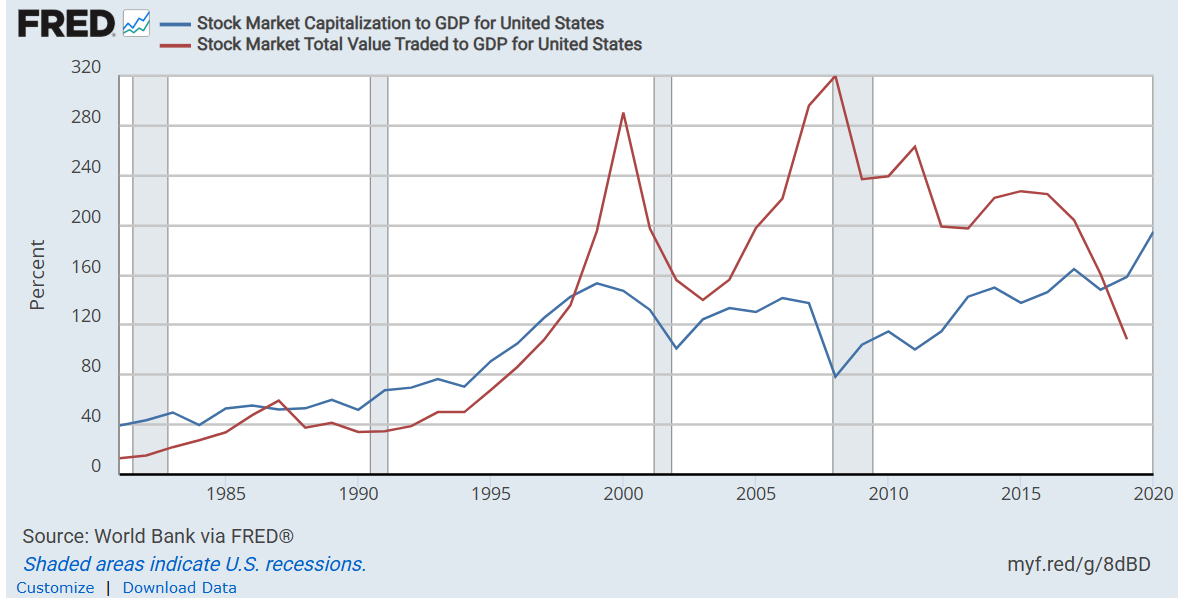

Used to be like sub 50pc in the 1990 and now well over 200pc. Not meant to be of any value for speculation (would have been rubbish in the past and don't think any value for future). but one wonders what it does in terms of tension (internal/ external) as we as shareholders would not like to give back gains so easily (and there is the drift etc). Tricks to be used to keep it up - see v recent events- not judging here.

Larry Williams offers a chart:

Big Al wonders:

I wonder to what extent the decline in "Stock Market Total Value Traded to GDP" reflects a shift to dark-pool/off-exchange trading.

Peter Ringel writes:

TY Larry, great data! looks like we are severely undervalued. A 90s style party is coming.

@BigAl this too is a valid point. If founders don't go the exchanges anymore. Is there data on this off-exchange size? At least for their exit they will most likely show up in equities. Why should early backers not do this in the end? Its too juicy.

related: If off-exchange sector really gets dominant, then FED policy becomes even more toothless.

They have no tools to influence this.

Big Al asks Gemini:

In the US, how much stock trading occurs in dark pools or otherwise off exchanges?

Over 50% of all U.S. stock trading volume now occurs off-exchange, in venues such as dark pools and through internalizers at major firms, exceeding the volume on public exchanges for the first time in early 2025.

Overall Off-Exchange Volume: While dark pools specifically account for a smaller portion of the off-exchange activity (around 13% of consolidated turnover), the overall off-exchange market, including internalizers and bilateral trades, accounts for the majority of U.S. equity trading volume.

Purpose of Dark Pools: Dark pools and other off-exchange venues are primarily used by large institutional investors to execute big orders anonymously, which helps them avoid significant market impact and predatory high-frequency trading (HFT) strategies that can occur on public "lit" exchanges.

Regulatory Oversight: Despite their name, dark pools are regulated as Alternative Trading Systems (ATS) by the SEC and must report executed trades to regulators like the FINRA on a delayed basis.

Market Share Trends: Off-exchange trading share has been on a general upward trend for years, driven by the desire for better execution quality and anonymity. This shift has implications for traditional price discovery on public exchanges.

Steve Ellison does some analysis:

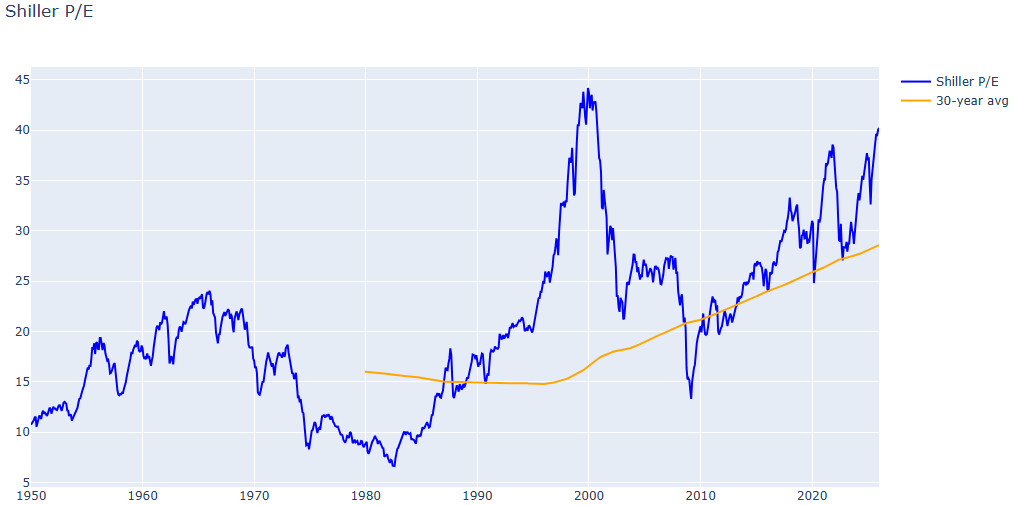

The Shiller Cyclically Adjusted Price Earnings (CAPE) ratio is at its second highest level in history, exceeded only in 1999-2000. What I find interesting is that the 30-year moving average of this ratio has nearly doubled since 1990. My theory is that permanently lower interest rates in an aging population support generally higher stock valuations than in past eras when large families were the norm.

And in the spirit of the old Spec List, here is the Python code I used (.text file) to generate this graph.

Big Al adds:

Another issue is the effect of Mag7 stocks which are global in a new way, beyond US GDP.

Jan

16

Tacit knowledge, life lessons, and roast beef

January 16, 2026 | Leave a Comment

Nils Poertner suggests:

there is a wonderful book by Michael Polanyi - on tacit knowledge (unlike explicit knowledge one has to develop that skill oneself). not trying to proselytize here that is quite good of a book) and worth many gold nuggets

Jeff Watson offers:

There are some great nuggets in this video - 100 quotes, 100 meals for a lifetime:

100 Harsh Life Lessons That Made My Life So Much Better

Larry Williams knows where the beef is:

America's Top Roast Beef Sandwiches, According to Food Critics

Peter Ringel follows up:

Classical Music for When You're in a Food Coma

Jan

6

Leather jacket indicator, from Cagdas Tuna

January 6, 2026 | Leave a Comment

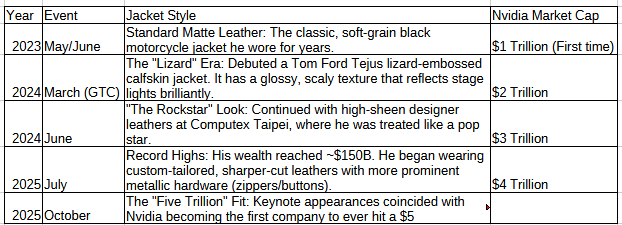

I asked Gemini if the Nvdia stock price milestone dates associated with Jensen Huang's famous leather jackets. Here is the timeline of Jensen's jacket evolution alongside Nvidia’s stock milestones:

The one that caught my attention is Lizard Era in March 2024. At that time Nvdia price was around $100 and after Jensen's Lizard Jacket appearance Nvdia stock fell 20-25%. And here is Jensen while debuting new chips last night. We will learn soon if the Lizard Jacket is a helpful tool for front running Nvdia stock!

Steve Ellison likes the idea:

Very unique and insightful analysis. My wife read a biography of Mr. Huang. When he was growing up in Oregon, his immigrant relatives wanted to put him in a private school, but the school they enrolled him in was a reformatory. After that life experience, I am pretty sure that Mr. Huang can't be intimidated by Donald Trump or Xi Jinping.

Peter Ringel adds:

agree. probably useful insights can come from seemingly absurd corners. Like the weather of sports teams in NYC.

Dec

31

Great recent webinars, from Peter Ringel

December 31, 2025 | Leave a Comment

Reviews of 2025 and previews of 2026:

Mr Hirsch:

- Got many new ideas for research and helpful context

- also learned that I use the term Santa wrong!

Adam Grimes:

Trading the Changes: Structure, Regimes, and the Path to 2026

- always brilliant

- lots of actionable stuff and gems

Larry Williams:

Larry Williams’ 2026 Market Forecast: Cycles, Risks, and Opportunities

Dec

29

A curious case of silver, from Anatoly Veltman

December 29, 2025 | Leave a Comment

So as Silver trades yet another stratospheric (psychological) target, there are a few questions. On commercial side, both Demand and Supply are price-inelastic. Whatever industrial uses are, Silver is hardly substitutable, especially at the time when other metals are just as pricey. And on new Supply side, much Silver gets out of the ground as a by-product from mines not primarily operating as "a Silver mine". So, again, Silver production can't be easily jacked up during Silver's rise.

On non-commercial side, however, it's the opposite. Supply/Demand balance works as it should. $77 (or $100 lol) market would cause Buyers to be abandoning bids; while grandmas might start dusting silverware off and storming pawnshops. Any other considerations?

Peter Penha responds:

Exactly - if you look at the Silver Institute Supply / Demand models it shows we have been in several years of deficits (still in deficit of course this year and next) - Mine supply peaked a decade ago

If you add up all the non industrial uses of silver (Jewelry, Photography+film (Chris Nolan & IMAX), and all silverware) they do not make up the deficit.

So in the Silver Institute model and I am talking 2023 $28 silver price we have some 20% of total ounces that need to be divested every year to maintain supply/demand.

60% of uses are industrial - solar is the future everywhere now….for those missing the US battery trade —> the Biden era tax credits for solar are now Trump credits for solar+batteries & the AI data centers are now going to be Bring Your Own Capacity and storage & connect to the grid.

Read the full post with additional comments.

Dec

19

Request for “off topic” books on speculation, from Asindu Drileba

December 19, 2025 | Leave a Comment

Often when I listen to specs I hear "off-topic" book recommendations. Examples:

"The most important book to do with trading is Secrets of Professional Turf Betting by Robert Bacon" — The Chair. A book about parimutuel horse betting.

"The most important book to do with the stock market is Horse Trading by Ben Green" — A game theorist & friend of The Chair. A book about selling horses

"I can find new trading strategies on almost every new page (Thinking Fast and Slow by Daniel Khaneman)" — The Chair's Brother (Mr. Roy Niederhoffer). A psychology book

"Our entire investment philosophy is based off this book (Snow Crash by Neal Stephenson) — Fred Wilson of Union Square Ventures, a Tier 1 VC firm. Its a sci-fi book.

"One of the most important things you can learn todo with investing is creative writing" — Jeffrey Hirsch. Not a book but still an off-topic research recommendation.

I have never regretted reading an "off-topic" book. Any more of such recommendations?

Nils Poertner responds:

Coaching Plain & Simple, by P. Szabo, D. Meier (book about learning - how to coach oneself in a way)

Asindu - what books to get rid off, to burn, what is an obstacle in your life is also relevant. Early 2008, I visited a French friend on Lehman trading floor in London. V nice guy, senior analyst for their credit models, high IQ 130 plus, bit gullible though. He was surrounded by over 20 books of advanced math on either side of his desk. I had the urge to get a huge sledgehammer and whack down the books…you know.

Larry Williams suggests:

Zurich axioms. A must read.

Peter Ringel agrees with Larry:

I have them on my wall. Besides some of the lists by Vic, Larry, Adam Grimes and some other. Valuable.

And did you find the Daily Speculations booklist?

Asindu Drileba writes:

Yes. I forgot about Zurich Axioms. Thanks. This Daily Speculations list is good, I actually wasn't aware of it.

Dec

11

Brilliant Marketing, from Peter Ringel

December 11, 2025 | Leave a Comment

I rarely use a squawk box. But on a day like FOMC I do. I don't trade news, mkt is usually earlier. I use it more like an alarm clock. So Y/D I tuned in and so did all the other zillion retailies.

They have a tiered model, there the premium is real-time (+ latency…hmmm) and the rest is delayed. A few major news like FOMC are real-time also on the free tier.

So seconds before the FOMC announcement, at the moment of highest attention by potential future paying customers, they piped in an add:

In the voice of Trump (surely AI generated):

"You are not on the premium feed. You are missing out. Lets make the news great again“

Brilliant

(not an endorsement of news trading )

Nov

28

Lucky charms, from M. Humbert

November 28, 2025 | Leave a Comment

Anyone have any favorite good luck charms/rituals to help with trading results?

Peter Ringel writes:

some of the old floor traders, we had on this list, reported how superstitious some of the traders were. Cloths, bathroom time…

Asindu Drileba comments:

Lucky charms may sound delusional but they are actually more common than we think. They are more like placebos. I take pill X, my headache goes away. (But pill X is made from wheat flour and a bitter "filler" and has exactly zero pharmaceutical contents, yet it works).

Have you ever pushed the button that opens the door of an elevator? Well, those buttons are completely fake! Elevator doors are pre-programmed to open and close at hard coded intervals. Pushing the button does nothing. They simply exist to give people a sense of control.

Nils Poertner writes:

To have a strong belief one can learn (from mkts or others) is a good start.

ie allowing for mistakes to happen, not fretting them. (many cultures are guilt-ridden, like the German culture on so many fronts. All it takes is sometimes to muster up enough courage and learn from mistakes and don't judge).

Zubin Al Genubi offers:

I'm reading Kidding Ourselves, Hidden Power of Self Deception, by Hallinan, in which he describes real physical and psychological effects of psychosomatic causes such as death, hallucinations. You see what you want to see. You are and become what you believe yourself to be. It affects health, performance, money. He also describes how a feeling of lack of control can be debilitating and even deadly. Some feel a lack of control in that they don't control the market, but one can easily (physically at least) click the keys to buy and sell any time.

From scientific studies: Our results suggest that the activation of a superstition can indeed yield performance-improving effects.

Nov

9

Prestigious consulting firm, from Nils Poertner

November 9, 2025 | Leave a Comment

Came to our financial firm 2007 and gave a 100 page presentation full of bullet points and cartesian logic (why housing boom will last). Either 3,5, or 9 bullet points per page.

At the end of the presentation I was tempted to go over to the presenter and ask him "why do you love your wife? (I didn't). The answer might have been bullet points.

Pamela Van Giessen writes:

Michael Korda tells in his memoir, Another Life, of the time that Simon & Schuster hired probably the same prestigious consulting firm to study how to improve revenues/profitability. Prestigious consulting firm (after taking the prestigious consulting firm fee) told the publishing company that they should publish more bestsellers.

Laurel Kenner comments:

I bet the prestigious firm concluded with ‘Key Takeaways’ as a final insult to the intelligence of the client.

Asindu Drileba writes:

I heard that people pay consultancy firms not for their knowledge, but for the fact that executives use them as a scape goat. If an executive wants to pursue policy X. They simply hire a consultancy to recommend policy X. If policy X ends up as a disaster (legally, morally or financially). They can simply say "Policy X was an idea from XYZ consultancy", we had nothing to do with it.

Peter Ringel adds:

a variation of this are fighting owners/ partners about policy. If decision pipelines are blocked, external council is used. Like a neutral arbitrator. I think, these are the main situations externals are used. Usually a good reason to short the entity, especially outside of markets. If they don't have the capability to decide and act on strategy in-house, it‘s a red flag.

Henry Gifford responds:

Even better is hiring a licensed engineer to instruct everyone to do something stupid that they know won’t work, so everyone who did as the engineer decided is blameless.

Jeff Watson offers:

A consultant is a person who knows 1000 ways to make love to a woman…..but he doesn’t know any women.

Oct

20

Calming musical interlude for spicy markets, from Big Al

October 20, 2025 | 1 Comment

I first heard this piece as a teenager, sitting in the theater

watching Barry Lyndon, and I was transfixed:

The Messiaen Trio performs Schubert's Trio No. 2 in E-flat Major, D. 929

I did not know this Mendelssohn work until today and I wondered if

somebody said to her, "Oh yeah? Well, try it in heels!"

Yuja Wang Mendelssohn Songs Without Words Op 67 No 2

Peter Ringel writes:

my emergency high vola setup always includes Chopin. everything to stay off tilt.

Big Al responds:

Gotta love Chopin for the workday playlist.

Chopin: 24 Preludes, Op. 28, Vladimir Ashkenazy

Another discovery for me (fades out but still enjoyable):

Interpreti Veneziani, Antonio Vivaldi RV711 Gelido in Ogni Vena, Davide Amadio

Oct

19

Le Chiffre attacks, from Asindu Drileba

October 19, 2025 | Leave a Comment

In Casino Royal (2006) there is a speculator called Le Chiffre. He would manage money for war lords & other "underground" clients. He would take positions in markets, and then "manipulate them". For example in this clip, he takes a short position in an airlines company, then later bombs a plane belonging to it.

This year, I am starting to think that Le Chiffre is real. Someone opened a crypto account on Hyperliquid (decentralized exchange) and made an $88m profit from short positions that very day.

Cagdas Tuna responds:

Good catch! I have been reading these whales news since March-April 2025 mostly tied to Trump’s policy shifts. It is not difficult to guess who those Le Chiffres might be related to!

Peter Ringel writes:

I wanted to place 1 Nov in my calendar - as a new Mkt Risk date based on Trumps post. Only to realize, I placed this date regarding tariffs before. This makes this old news to some degree. And all of this is potentially an overreaction / a play.

Ed. - lagniappe: Forget Sean Connery, Watch James Bond Make His Real Debut on TV

Before Connery registered his license to kill in the 1962 hit Dr. No, millions of viewers were introduced to Barry Nelson’s “Bond, Jimmy Bond” in a 1954 episode of the CBS anthology series Climax! The show’s producers secured the rights to adapt Ian Fleming’s just-published debut Bond novel, Casino Royale, during their first season.

Since the Climax! version of Casino Royale is only 50 minutes, the plot has obviously been shortened considerably. And yet, if you’ve read the book or, more likely, seen the 2006 movie version that launched Craig’s Bond career, you’ll recognize the basic narrative, even though none of the familiar 007 flourishes are in place. In fact, Nelson doesn’t enjoy “00” status at all — he’s merely identified as a “Combined Intelligence” agent who is tasked with competing head-to-head against the mysterious Le Chiffre (Peter Lorre) in a rousing game of baccarat.

Jeff Watson does some research:

James Bond, the complete list…there are more than you think:

Please list every James Bond on film, TV, and radio. Grok: Alright, here goes-starting with the big-screen Bonds: Sean Connery, George Lazenby, Roger Moore, Timothy Dalton, Pierce Brosnan, Daniel Craig. Then David Niven in the 1967 spoof Casino Royale. On TV, there's Barry Nelson from a 1954 Climax! episode of Casino Royale. Radio Bonds? Bob Holness in a 1956 BBC Casino Royale adaptation, Tom Hiddleston in a 2014 Heart of the Matter series, and Toby Stephens in various BBC radio dramas.

Aug

26

0DTE & Volatility, from Peter Ringel

August 26, 2025 | Leave a Comment

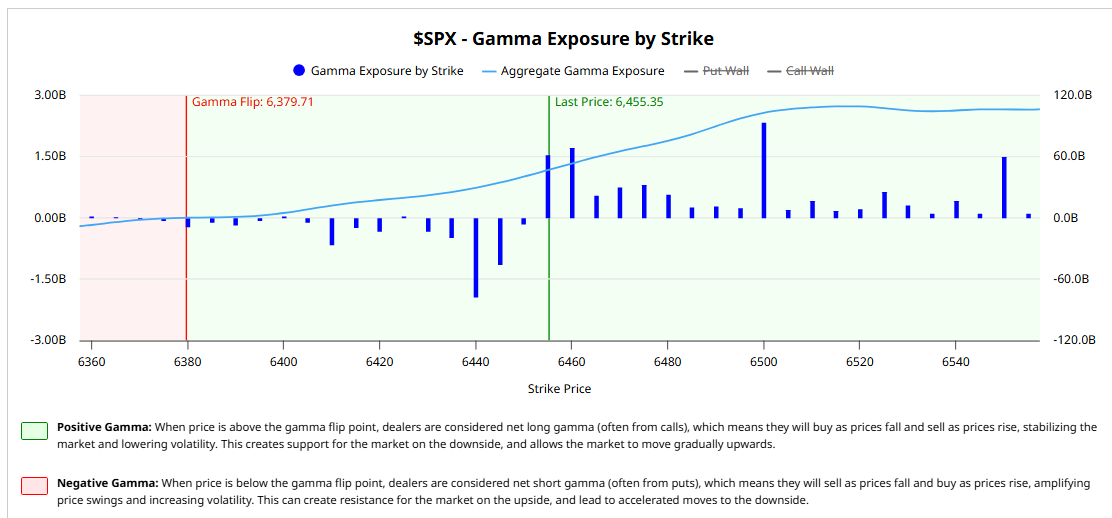

The abysmal Volatility last Monday, 18 August, and the dead stop last Tuesday, EOD, were attributed by some to 0DTE. A little back on Spec List, papers were posted, showing this Volatility suppression effect by 0DTE options and their market makers.

I know it is just the latest holy grail traders flog to. Quite a few websites are offering subscriptions for the data. So, I was surprised to find it for free on Barcharts – the EOD version:

Steve Ellison adds:

Important information, thanks. Jeff Clark said on a podcast that 68% of all S&P 500 option contracts are 0DTE.

Aug

1

How do you fight the Vig?, from Asindu Drileba

August 1, 2025 | 1 Comment

I interpret the "Vig" as the collective term for:

1) bid-ask spread (difference in prices between buying & selling) due to market makers

2) transaction fees (for limit & market orders) charged by the exchange

3) slippage (an instrument is more expensive the deeper in the order book you go) due to how liquid an asset is.

Possible solutions for each?

1) Can be fought with the exclusive use of limit orders instead of market orders.

"Be patient and you will have the edge", The Chair in, Practical Speculation — The fine art of bargaining for an edge

2) I noticed (at least in crypto markets) that the more volume you trade, the less fees you pay (on a percentage basis)

3) Restrict yourself to deep and very liquid markets.

Also, one technique is to trade as less often as you can (buy & hold). That way you will automatically pay less of all the three sources of Vig. I think this is so important as I often found many "edges", then accounted for the vig and they often became loosing strategies.

Big Al writes:

I would also add "opportunity cost" as part of the "Meta Vig" (MV), i.e., the total costs associated with trying to trade the markets. The MV would also include the negative effects of cortisol on the human body.

Henry Gifford suggests:

I think two good steps are to ask others what the big is, and to try to calculate it yourself. Both exercises will no doubt be educational. A few times over the years I have asked horse bettors what the big is, but none seemed to know. As for calculating yourself, one hopefully will learn how much it varies by, and maybe also gain insight into hidden vig.

Steve Ellison responds:

There is no free lunch with limit orders because of adverse selection. Sooner or later, you will place a limit order on a security that simply moves up and never looks back. It would have been your best trade ever, had you actually been filled. In the opposite scenario, for example when I bought Coca-Cola in 1998, and it was already down 25 percent by the T + 3 settlement date, you will of course be filled.

Studies of retail investing accounts have shown a negative correlation between number of transactions and investment returns. In one study, accounts that had been inactive for 18 months because their owners had died, and their estates had not been settled, outperformed the vast majority of their retail account peers.

Peter Ringel writes:

Generally, the lower you go ( smaller time frame - smaller scope of the trade ) the larger the relative Vig costs. a subclass of opportunity costs is spent time of (daily) preparation. my required prep is nearly the same over many time-frames - but the scope of a trade is way lower for lower time-frames. in cash equities, the resale of your order-flow by your broker to some HF shop can be counted as Vig too. is this a common practice in option markets too? Yes, the Vig greases the fin-industry, but it is mostly unavoidable paying / avoiding the Vig does not lead to success or failure in mkts IMHO.

Vic simplifies:

just trade once a quarterfrom long side

Zubin Al Genubi comments:

The biggest vig is capital gain taxes. The richest people in the world hold their single company stock 10000x and realize no gain. Its very hard to beat a long term hold.

Jul

28

Tufte fail, from Humbert X.

July 28, 2025 | Leave a Comment

Specs have been posting about copper, and I happened across this act of chartcrime.

Steve Ellison comments:

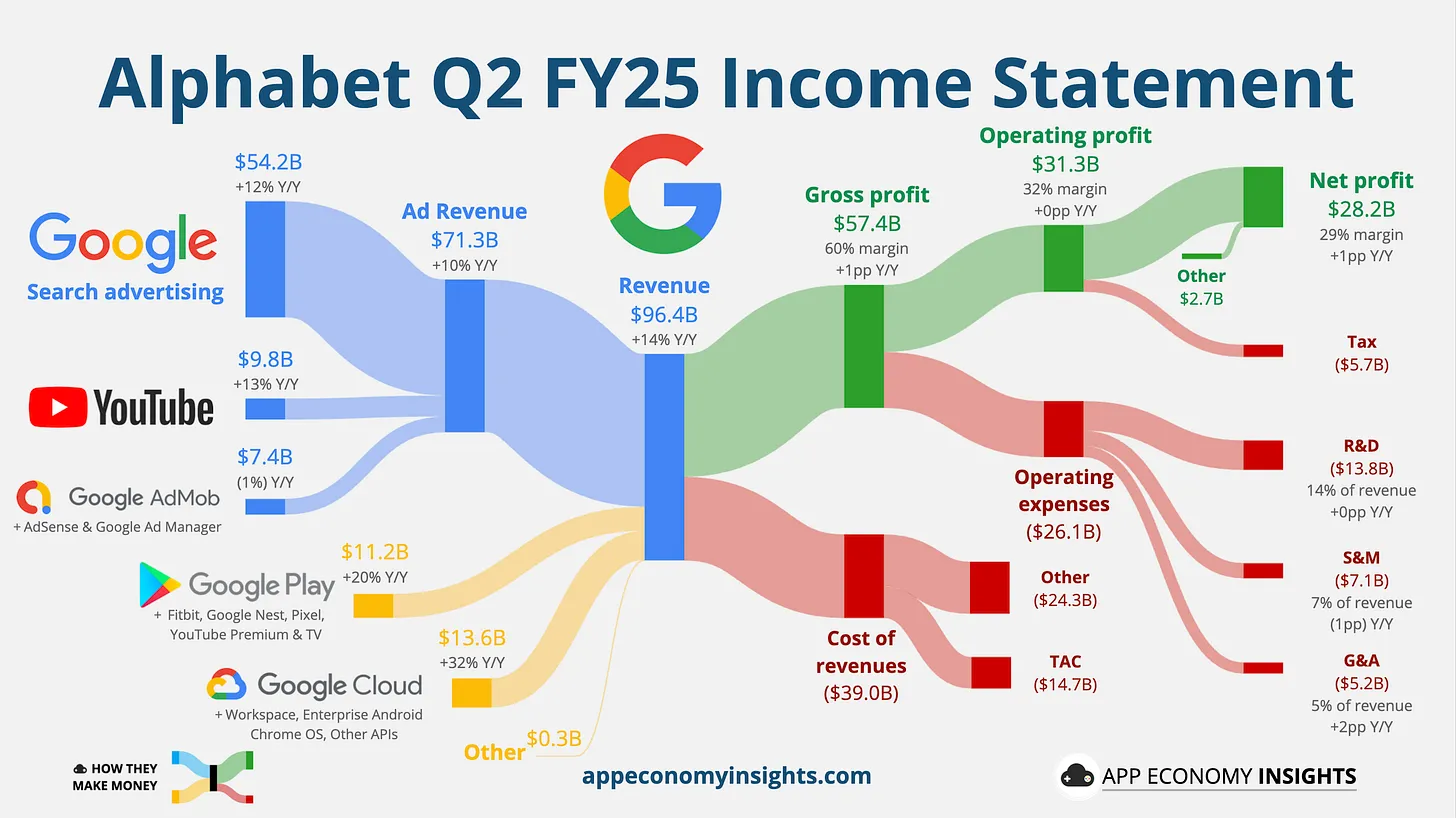

Wow, I don't think the software I used to generate Sankey charts in a previous career analyzing a petabyte-sized data lake to surface key insights for one of the big 3 personal computer companies would have allowed me to just start a new stream in the middle ("Imports of Refined Copper"). Anyway wouldn't it make more sense to join "Concentrate Net Exports" and "Scrap Net Exports" on the right side of the chart, and then put "Imports of Refined Copper" downstream of that junction?

I was using D3 in those days; now that I am much more experienced with Python, maybe I should search for a Sankey charting library in Python.

On the subject of copper, I perceive a macro trend that the US has geopolitical risk because too much domestic mining and basic material production was shut down, partly in order to export environmental impacts to less developed countries. Lithium and steel are in similar situations.

Peter Ringel writes:

"Sankey" that is a nice search term. I had it on my list to research. These guys use it a lot..

One finds several sankey libraries in Python on Github, such as this one.

Jul

21

CPI Data Quality Declining

July 21, 2025 | Leave a Comment

CPI Data Quality Declining

June 20, 2025

Torsten Sløk

Apollo Chief Economist

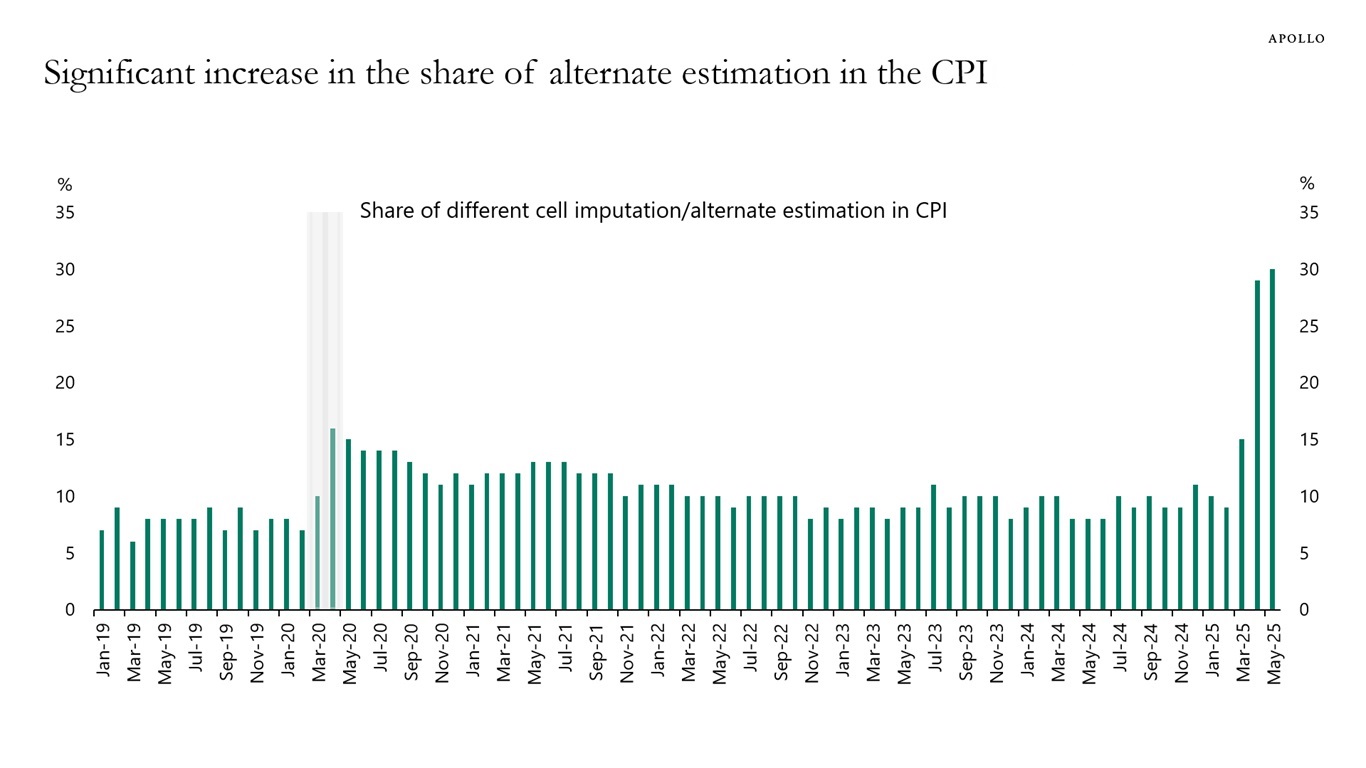

To calculate CPI inflation, BLS teams collect about 90,000 price quotes every month covering 200 different item categories, and there are several hundred field collectors active across 75 urban areas.

When data is not available, BLS staff typically develop estimates for approximately 10% of the cells in the CPI calculation. However, in May, the share of data in the CPI that is estimated increased to 30%, see chart below.

In other words, almost a third of the prices going into the CPI at the moment are guesses based on other data collections in the CPI.

Bill Rafter writes:

Would anyone in the data business be surprised by this? I’m not.

Peter Ringel wonders:

Doge related?

Big Al offers:

US Labor Department reducing CPI collection sample amid hiring freeze

By Reuters

June 4, 2025

The U.S. Labor Department's economic statistics arm said on Wednesday it was reducing the Consumer Price Index collection sample in areas across the country due to resource constraints, but the move should have "minimal impact" on the overall CPI data.

Jun

26

Increase in yields, from Jeff Watson

June 26, 2025 | Leave a Comment

Adam Grimes comments:

Cool chart. Interesting data. We have some farmers in the family but I would not have expected such a big difference.

Peter Ringel writes:

I think, this productivity boost shows Norman Borlaug‘s Green Revolution. There would be no India or China as we know it . And in the West too. The topic seems close to not being politically correct in our upside-down world.

Michael Ott brings expertise:

The Y axis is Mg/hectare, which is a different way to measure weight per unit area. Technically, a bushel is a unit of volume (8 gallons) that is understood to be equivalent to 56 pounds of corn or 60 pounds of soybeans. Most US farmers measure in bushels per acre, which is a different way to express weight per unit area.

The major increase in corn came from breeding AND fertilization. GMO corn was introduced in 1996 and reached 50% market share around 2001, which is pretty fast adoption for agriculture. Biotech traits certainly help with yield, but more so prevent disasters from insects and weeds, which harm yields.

Big Al finds another chart interesting:

Jun

18

Win rate, from Francesco Sabella

June 18, 2025 | Leave a Comment

What exactly means this quote? I read of it years ago on a book about Medallion Fund but never understood if I got the meaning correctly.

We're right 50.75% of the time…but we're 100 % right 50.75% of the time. You can make billions that way.

- Robert Mercer

Peter Ringel responds:

my guess: trend following systems can have 40% win rate and lower. Yet via expectancy these sys can be very profitable. Medallion though, would do HF stuff, less MoMo.

Michael Chekalin comments:

Mercer refers to the consistency of Medallion. In other words, they are “consistently” profitable in the 50% area, which through proper money management, risk/reward, etc, can be extremely profitable.

Asindu Drileba writes:

I think its a reference to the "law of large numbers." Suppose you noticed the market goes up 51% of the time on Thursday. (for the 100 Thursdays in your sample dataset) This means that you will also loose 49% of the time. If you decide for example to only place bets for the first 20 days, you might have a win rate of 0%. All bets of the first 20 days can fail.

But the model will still be correct since you can make money for the subsequent 51 days and the lose money for the next 29 days — thus playing the market for all the 100 days (20 + 51 + 29). So your win rate will converge to 51/100 which is the same 51% you identified in your sample. You have therefore acquired 100% of the edge. I think that is what he means when he says "we are 100% right 50.75% of the time."

Nils Poertner adds:

Some specs have a 10pc win rate and do really well. Friend of mine was early investor in ETH in size- but all other of his ideas didn't work out. His nick name was "Harbinger of Failure." Kind of like the joke: "I told my friends I want to become a comedian - and they all laughed. And then I became a comedian and no-one laughed anymore." I often think about him now.

May

15

I went to China recently. What I saw and nearly all the people I talked to were not happy about the economic situation there and almost everyone thinks Xi is stupid.

Humbert A. responds:

This has been the status quo since pre-Covid times imo.

David Lillienfeld writes:

Peter Drucker observed that the problem with totalitarian regimes is that with only one person in charge and no one in a position to offer alternatives/challenge that individual, there is no means of identifying and developing managerial talent in a society and the society inherently slows until the person in charge dies and there is a contest/market for new leadership. There will be problems showing in China soon enough–it has a demographic hurdle coming and it shows no signs of having any idea how to deal with it. It has lots of domestic health issues that will likely cost it considerably within the next decade. Maybe Xi will demonstrate Drucker as being wrong, but I doubt it. Barely three decades ago, the concern in the US was that Japan was about to walk all over the US. It didn't. I'm not sure that China is going to do any better.

Asindu Drileba writes:

This is my exact suspicion.

1950s to Soviet collapse — US Vs Russia (Narrative is Russians will take over USA)

1980s to Asia Currency Crisis — USA Vs Japan (Narrative is Japan will take over USA)

Early 2000s to Present — USA Vs China (Narrative is China will take over USA)

Peter Ringel adds:

There is a perverse stickiness to it. I grew up in one of these shit-holes ( not Japan ! ) - East Germany in my case. All the models and all the data point to implosion. And then it takes decades and centuries and more. And finally, when it collapses everyone is surprised, and no one was expecting it.

Mar

29

Catching up with Dr Brett

March 29, 2025 | Leave a Comment

On his blog:

TraderFeed

Exploiting the edge from historical market patterns

Sunday, March 23, 2025

Keys to Great Trading

Peter Ringel adds:

He was also on CWT recently:

Trade Like You: Why Playing to Your Strengths Works Better · Dr. Brett Steenbarger

Mar

15

The Cosmic Distance Ladder, from Big Al

March 15, 2025 | Leave a Comment

Maybe the most fundamental thread on Spec List has been counting/data/figuring things out, so here is a marvelous two-part video by 3Blue1Brown, with Terrence Tao, about how we determined various cosmic distances.

The Cosmic Distance Ladder, Part 1

The Cosmic Distance Ladder, Part 2

Additional commentary and corrections from Prof Tau

Gyve Bones writes:

This was a fascinating lunch lecture. Thank you. I first became fascinated with the story of how science and technology developed with the 1977 PBS series by James Burke "Connections" which told the story, without the aid of CGI graphics in my high school years. I was given the companion book for the series that Christmas by my very thoughtful mom. (It's also the story that launched my falling away from the Catholic faith in which I was raised, my teenage rebellion.)

Here's the episode which details how the Babylonian star tables by Ptolemy used by Copernicus were preserved from the destruction of the Library of Alexandria, found on papyrus scrolls in a cave backup library:

James Burke Connections, Ep. 2 "Death in the Morning"

Asindu Drileba responds:

Connections is so good. I really wish there was a remastered version (in HD at least). One of the things I still don't understand is how government funded broadcast corporations like PBS, BBC and DW make such high quality non-fiction films. I would go to say the have the best non-fiction documentaries. Capitalism doesn't apparently do well when it comes to making non-fiction. What makes them so good? Are they just structured properly?

Gyve Bones replies:

Here is a very well mastered set of the videos for Connections (1978).

Peter Ringel adds:

there is a Conjecture, that astronomers are the more happy and humble people. I guess, this is because, it is all so vast and relative.

Mar

11

More on ‘attention’, from X. Humbert

March 11, 2025 | Leave a Comment

I think a lot about how attention, like a searchlight, moves around the markets. I like, too, the simple logic that when retail investors are deciding what to buy, they have a huge array of choices, but when deciding what to sell, they are limited to what they own. (Leaving out the idea of looking at thousands of options to try to decide what to short.) Maybe index ETFs simplify this process, but then, before index ETFs we had mutual funds, so maybe not.

All That Glitters: The Effect of Attention and News on the Buying Behavior of Individual and Institutional Investors

Brad M. Barber, Graduate School of Management, University of California, Davis

Terrance Odean, Haas School of Business, University of California, Berkeley

Advance Access publication December 24, 2007

We test and confirm the hypothesis that individual investors are net buyers of attention-grabbing stocks, e.g., stocks in the news, stocks experiencing high abnormal trading volume, and stocks with extreme one-day returns. Attention-driven buying results from the difficulty that investors have searching the thousands of stocks they can potentially buy. Individual investors do not face the same search problem when selling because they tend to sell only stocks they already own. We hypothesize that many investors consider purchasing only stocks that have first caught their attention. Thus, preferences determine choices after attention has determined the choice set.

Asindu Drileba writes:

Laslo Barabasi has a model called preferential attachment. His model can simply be defined as "people usually prefer to bet on a horse that is already winning". I hear night club promoters also do this. To pull in customers, you create artificially fake long lines. These long lines make a night club appear popular, and thus make people interested in going in.

For the S&P index for example, index rebalancing algorithms are at times market cap weighted. That is, stocks with a larger cap, get more money than those with smaller market caps. Which will increase their future allocations, as their market caps grow. Retailers and others seeking "Blue chips" cannot invest in the top 500 stocks. They may focus on the top 20, which further distorts the market caps. Barabasi claims that this is partly why stock market caps have a pareto-like distribution. 20% for stocks may hold 80% of the index value market cap. (I am not saying this so what is exhibited it's just an illustration).

Peter Ringel comments:

I hear night club promoters also do this. To pull in customers, you create artificially fake long lines. These long lines make a night club appear popular, and thus make people interested in going in.

This is one of the many cognitive biases of humans. Any group over 5 attracts attention by by-passers. It even works with cutouts of >5 humans. The research papers above immediately bring my thoughts to manipulation. The searchlight is a daily reality in markets to me. But someone is holding it and is pointing it. Wyckoff style manipulation games on and on. For hundred years. I do disagree a little with the paper about retail trader as the main victim. Institutional smart money today - in one corner of the market - is tomorrows dump money in another corner. They are easily also susceptible to the manipulation games.

Feb

19

Strange AI twist, from Larry Williams (updated)

February 19, 2025 | Leave a Comment

We sent my 2025 annual forecast to the Copyright office. They would not copyright it saying, “it was AI generated so could not be copyrighted.” We replied it was not AI, showing why so were finally approved. This raises an unraised question about AI protection. What is/will be the law??

Asindu Drileba comments:

The purpose of AI regulation is just so the big players can build a cartel and lock in the market. This is why people like Sam Altman say they "welcome it".

Big Al gets conspiratorial:

Not to be too conspiratorial, but…

OpenAI whistleblower found dead at 26 in San Francisco apartment

A former OpenAI employee, Suchir Balaji, was recently found dead in his San Francisco apartment, according to the San Francisco Office of the Chief Medical Examiner. In October, the 26-year-old AI researcher raised concerns about OpenAI breaking copyright law when he was interviewed by The New York Times.

Peter Ringel writes:

I always suspected, that the senator is a robot. His performance is inhuman!

Your work is obviously your work. But, what if one uses AI for ones work, creations and everything? It should be still your IP. We have musicians on this list, who use AI for inspirations and research. I constantly lookup code via AI, b/c I am not a good coder. But the final script is mine. I even run AI models locally. The opensource models like Facebook's LAMA. (for an easy install, i can recommend: msty.app)

There is creativity in asking questions, to squeeze the right results out of AI. Prompt engineering is a thing.

Pamela Van Giessen prompts:

No doubt every single publishers’ lawyers are fighting the ability for AI generated anything to be copyrighted because so much AI is taking from existing copyrighted works, usually without permission or payment. Some publishers are feeding into AI programs with permission/payment (I think my previous employer, Wiley, is feeding at least some content into AI, for instance). This is a lousy deal for the authors and artists. The publishers will make vast sums, much like Spotify, and the content creators (I really hate that phrase) will get less than pennies on the dollar.

Liberals have done a great job of deflecting the real problem with platforms (omg, no content moderation or fact checking, TikTok is spying on Americans, the world will end!). The real problem with platforms is that they steal content, outright theft. And where is your government protecting you from this theft? NOWHERE.

Easan Katir relates:

I sent an unpublished manuscript to an Oxford-educated editor, asking her to edit. She asked if any of it was AI. I replied truthfully that I wrote most of it but I asked AI to add some. She declined the job, I guess making a stand: humans vs. AI. Fortunately or not, we know which is going to win.

Peter Ringel offers:

Pamela Van Giessen comments:

I imagine that the courts are going to get involved at some point. Since much AI is from existing copyrighted material, some (most?) used without permission, someone is going to challenge copyrighted AI that is really someone else’s material.

Jordan Low agrees:

precisely. i have been seeing a lot of content creators complain that their work is just automatically reworded into another article without attribution.

Update: Big Al offers an historical lagniappe:

The battle of Cúl Dreimhne (also known as the Battle of the Book) took place in the 6th century in the túath of Cairbre Drom Cliabh (now County Sligo) in northwest Ireland. The exact date for the battle varies from 555 AD to 561 AD. 560 AD is regarded as the most likely by modern scholars. The battle is notable for being possibly one of the earliest conflicts over copyright in the world.

Stefan Jovanovich writes:

The first written mention of the Battle of the Book occurs in the Life of Saint Columba composed by Manus O'Donnell in 1532. Britain did not have a formal copyright law until the passage of the Statute of Anne in 1710; that gave authors their first ownership claim to their writings. Until then the Stationers' Company had an exclusive right to all printing and publishing in Britain. The term "copyright" comes from the right a member of the Stationers' Company had to copy a written manuscript into print after the text had been registered with the Stationers' Company. The charter for the Stationers' Company was granted in 1557 by Queen Mary and King Philip, then confirmed in 1559 by Queen Elizabeth. The Company had the authority to seize "offending books".

Carder Dimitroff adds:

From March's Library: Early printed books were customized with hand-painted illumination for the wealthy.

Oct

5

Larry Williams comments:

Yield curve is very bullish at this time - it is so misunderstood.

Peter Ringel does some counting:

I found a FED Cut gives some bear pressure on SPY 5, 10 days after. Then it goes into meaningless regarding SPY.

only T+5 , T+10 are probably significant. We just crossed the end of that bearish pressure.

T+1 10000 reshuffled - Observed difference: -0.03, Bootstrap p-value: 0.8573

T+5 10000 reshuffled - Observed difference: -0.96, Bootstrap p-value: 0.0206

T+10 10000 reshuffled - Observed difference: -1.13, Bootstrap p-value: 0.0514

T+20 10000 reshuffled - Observed difference: -0.88, Bootstrap p-value: 0.2829

(a work in progress)

Oct

2

Maybe G*d plays dice after all, from Kim Zussman

October 2, 2024 | Leave a Comment

Anyone else sick of the idea that gamblers are best at financial markets? Why aren't the champion players the richest in the world? Would you hire a gambler to manage your life savings? Don't gamblers (Livermore, etc) die broke?

Why This Wall Street Firm Wants Its Traders to Play Poker

Young traders who join the trading giant Susquehanna International spend at least 100 hours playing cards during a 10-week training program. When the stock market closes at 4 p.m., they often head straight from the trading floor to a dedicated poker room at the firm’s headquarters in the Philadelphia suburbs.

Jeff Yass, Susquehanna’s co-founder, sometimes joins in, scrutinizing hands new hires play and gauging how effectively they bluff. Thousands of employees, from traders to technologists, participate in the firm’s annual poker tournament. At least three have notched wins at the World Series of Poker in Las Vegas.

Big Al offers:

Peter Ringel writes:

I agree to all the points from the trading side. I know the basics of poker, but not a skilled player. Not even a novice. It makes sense to use the filter "skilled poker player" for manager selection. But how to become a skilled player ? Is it easier to become skilled in poker vs a skilled trader? I suspect it is a similar hard battle.

Asindu Drileba comments:

The problem with "skill level" is that they kind of translate differently. Warren Buffet for example is a Bridge addict. (Bridge is also a game of chance like poker) He (Buffet) is definitely an "above average skill player", but nit amongst the top 20 in the world. In investing however, Buffet may be regarded as part of the top 5.

The same goes for other financiers. Sam Altman (top VC in Silicon Valley), Jason Calcanis (Top VC in Silicon Valley), Charlie Munger were probably above average poker players but their edges were stronger in the finance & investing world — but all these attribute poker to their success.

Big Al writes:

1. Poker is very different from other casino games. There is a lot of skill involved, a lot of math (at the higher levels), a deep understanding of game theory (at the very high levels), and there are many more decisions to be made in poker compared to, say, roulette. Most poker pros probably wouldn't call poker "gambling", though some are degen gamblers when they walk away from the poker table.

2. Poker is a lot like the other casino games in that, for most people, the best decision is not to play. Like in markets, where the best decision for most is not to trade but just buy a diversified portfolio and hold it for a long time.

3. But firms like Susquehanna are not advising "most people" and they're not buying and holding SPY. For them, poker is a good way to assess and develop various skills that are relevant to hacking the market and making big bets. Poker is a great laboratory for testing "risk tolerance".

4. The poker "ecosystem" is a lot like the trading market in that there is a need to keep getting new suckers to enter at the bottom level and convince them they can win.

Sep

30

Ed Thorp hosts Joseph Granville at UC Irvine (1981), from Big Al

September 30, 2024 | Leave a Comment

Interesting, for the history of market prognostication:

On May 27, 1981, Joseph Granville addressed a standing-room-only audience in the Science Lecture Hall at the University of California, Irvine campus. The event was sponsored by the Graduate School of Management and I served as the Master of Ceremonies.

In the first hour Joseph Granville was supposed to explain his theories to us. The hour proved entertaining with many anecdotes and stories, but the theories were not explained.

Peter Ringel offers:

You guys probably already found his interview on CWT:

EP 109: The man who beat the dealer, and later, beat the market – Edward Thorp

The man gamed Casino Roulette on a mechanical level and was probably targeted by the mafia back then.

Jul

27

Here's a performance of a one-movement sonata for flute and piano I wrote a few years ago.

Traditionally, sonatas were three or four movements. My goal here was to respect that structure, but to do so in a highly compressed format. The piece is built around a recurring pattern (an ostinato) that the flute first "discovers" before it lands in the bass of the piano. The middle section begins with a nod to a more primitive, primal flute. Again, a pattern is discovered that is worked and reworked in counterpoint between the instruments. This little sonata is a pretty solid reflection of my musical aesthetic: I'm striving for a whole that makes sense, but also exploring some extremes.

What I think might be interesting to the group is that some elements of this piece were generated from financial market data. (Think of a GARCH-type process.) Aspects of volatility were allowed to dictate some elements of harmonic density and texture in the piece. I bent this to my overall musical concept as opposed to leaving it bare. (I don't find much engaging in process-driven compositions… they are far more interesting to write and maybe to talk about then to hear, in most cases.)

Sushil Rungta appreciates:

Very much enjoyed it. It was marvelous. Thanks for sharing.

Peter Ringel responds:

Beautiful. TY Adam.

some elements of this piece were generated from financial market data. (Think of a GARCH-type process.)

This seems brilliant. I have no doubt that volatility is deeply human. Sadly, my ear is too poorly trained to understand your translation of this into composition.

Somewhat related: I use order-flow audible sounds during my day-trading. Like the old guys used floor noise. There is a non-regular rhythm to it. For me it is so ingrained now, I feel naked without it. It also helps with not needing to stare at the screen all the time. The Mkt- music will alert me if necessary.

[ Lagniappe: Sonata, pl. sonate; from Latin and Italian: sonare [archaic Italian; replaced in the modern language by suonare], "to sound"), in music, literally means a piece played as opposed to a cantata (Latin and Italian cantare, "to sing"), a piece sung. -Ed ]

Jun

23

Interview with the Chair from 2020

June 23, 2024 | Leave a Comment

Queued up to the start of the actual interview:

An Education from a Speculator: Interview with Legendary Victor Niederhoffer

Laurel Kenner approves:

One of the best interviews of the Chair. —The Collab

Bo Keely writes:

i like it, a fine reacquaintance.

Peter Ringel responds:

Thank you, watching it now. I also want to highlight the recent mkt calls on Twitter, which worked nicely. This and the wonderful articles about MFM Osborne.

Jun

15

Megacaps in Random Land, from Big Al

June 15, 2024 | Leave a Comment

Lots going around about how NVDA dominates; and MSFT, NVDA and AAPL now account for about 20% of the S&P 500. I was curious to see what happened in a toy index and so did an experiment (using R):

1. Create an index of 500 stocks, each with a starting value of $100.

2. Each year, for 40 years, each stock's value is multiplied by 1 + a value randomly drawn from a normal distribution with mean 8% and sd 15%, roughly what you might see with the S&P 500.

3. The starting value of the index was $50,000. The final value after 40 years was $1,152,446.

4. The final summed value of the largest 10 out of 500 stocks was $142,320, or 12.35% of the 500-stock index.

I was curious to see if megacaps would emerge from a simple toy model. I ran it only once, and they did. For me, this is a comment on the perennial alarm stories about "Only X% of stocks account for Y% of the market!" Even with a simple model, you wind up with something like that.

Adam Grimes agrees:

Can confirm. Have done variations of this test with more sophisticated rules, distribution assumptions, index rebalancing, etc. Get similar results.

Peter Ringel responds:

so we can take this ~12% of the index as a base value, that develops naturally or by chance? Then a clustering of being 20% of a total index (only greater by 8%) does not look so outrageous.

William Huggins is more concerned:

keep in mind it's 10 companies making up 12% (~1.2% each) vs 3 companies making up 20% (8.3% each) - in that sense, the concentration DOES look pretty high. am reminded of when NT was 1/5 of the entire CDN index in 99/00.

Peter Ringel replies:

You are right, I failed to catch this difference of only 3 stocks. In general, I am not so much surprised about the concentration. Money always clusters. Always clusters into the perceived winners of the day. Should they blow up, money flows into the next winner. To me, the base for this is herd mentality.

Adam Grimes comments:

It's Pareto principle at work imo. I'm not making any claims about exact numbers or percents, but as you use more realistic distribution assumptions (e.g., mixture of normals) the clustering becomes more severe. There's nothing in the real data that is a radical departure from what you can tease out of some random walk examples. Winners keep on winning. Wealth concentrates. (As Peter correctly points out.)

Asindu Drileba offers:

Maybe you try replacing the normal distribution of multiples with a distribution of multiples constructed with those historically present in the S&P 500? It may reflect the extreme dominance in the market today.

To me, the base for this is herd mentality.

It is also referred to as preferential attachment:

A preferential attachment process is any of a class of processes in which some quantity, typically some form of wealth or credit, is distributed among a number of individuals or objects according to how much they already have, so that those who are already wealthy receive more than those who are not. "Preferential attachment" is only the most recent of many names that have been given to such processes. They are also referred to under the names Yule process, cumulative advantage, the rich get richer, and the Matthew effect. They are also related to Gibrat's law. The principal reason for scientific interest in preferential attachment is that it can, under suitable circumstances, generate power law distributions.

Zubin Al Genubi writes:

Compounding of winners is also at work and returns will geometrically outdistance other stocks. No magic, just martini glass math.

Anna Korenina asks:

So what are the practical implications of this? Buy or sell them? Anybody in the list still owns nvda here? If you don’t sell it now, when?

Zubin Al Genubi replies:

Agree about indexing. Hold the winners, like Buffet, Amazon, Microsoft, NVDIA. Or hold the index. Compounding takes time. Holding avoids cap gains tax which really drags compounding. (per Rocky) Do I? No, but should. It also works on geometric returns. Avoid big losses.

Humbert H. wonders:

But what about the Nifty Fifty?

May

10

Same-Weekday Momentum

May 10, 2024 | Leave a Comment

Same-Weekday Momentum

Zhi Da, University of Notre Dame - Mendoza College of Business

Xiao Zhang, University of Maryland - Robert H. Smith School of Business

Apr 24, 2024

A disproportionately large fraction (70%) of stock momentum reflects return continuation on the same weekday (e.g., Mondays to Mondays), or the same-weekday momentum. Even accounting for partial reversals in other weekdays, the same-weekday momentum still contributes to a significant fraction (20% to 60%) of the momentum effect. This pattern is robust to different size filters, weighing schemes, time periods, and sample cuts. The same-weekday momentum is hard to square with traditional momentum theories based on investor mis-reaction. Instead, we provide direct and novel evidence that links it to within-week seasonality and persistence in institutional trading. Overall, our findings highlight institutional trading as an important driver of the stock momentum.

Peter Ringel writes:

I find this a sexy area of research. It also effects the indices. My guess is some sort of behavioral bias among large players plus some technical constraints, how they have to enter complex trades. Why is a certain fund buying the sector every Tuesday at 10:30? I see such regularities pop up, exist for a while - and vanish again.

Big Al does some counting:

Here is a quick, simple study just to kick this can. This is looking at NVDA, days of the week, for about the last year. The z scores show Wednesday being a significantly poor day and Thursday being good (but with a big sd).

I also did a thousand sim runs, resorting the % changes randomly, and pulled out the max-min spread for each sim run. For the actual data, the range is 1.86% points (Thursday mean minus Wednesday mean). Only 2.08% of the sim runs had a wider range. Taking that to a z score table gives the actual range a score of +2.03.

However, here is the correlation for each weekday predicting the next trading day that is the same weekday:

NVDA correlations, weekday to next instance

Mon-Mon 0.06

Tues-Tues 0.04

Wed-Wed 0.03

Thurs-Thurs 0.09

Fri-Fri 0.01

Apr

15

Reading (and viewing) recommendations

April 15, 2024 | Leave a Comment

From Easan Katir:

The Hall of Uselessness: Collected Essays, by Simon Leys.

Simon Leys is a Renaissance man for the era of globalization. A distinguished scholar of classical Chinese art and literature and one of the first Westerners to recognize the appalling toll of Mao’s Cultural Revolution, Leys also writes with unfailing intelligence, seriousness, and bite about European art, literature, history, and politics and is an unflinching observer of the way we live now.

From Zubin Al Genubi:

Pathogenesis: History of the World in Eight Plagues, by Jonathan Kennedy.

According to the accepted narrative of progress, humans have thrived thanks to their brains and brawn, collectively bending the arc of history. But in this revelatory book, Professor Jonathan Kennedy argues that the myth of human exceptionalism overstates the role that we play in social and political change. Instead, it is the humble microbe that wins wars and topples empires.

From Asindu Drileba:

Math Without Numbers, by Milo Beckman.

Math Without Numbers is a vivid, conversational, and wholly original guide to the three main branches of abstract math—topology, analysis, and algebra—which turn out to be surprisingly easy to grasp. This book upends the conventional approach to math, inviting you to think creatively about shape and dimension, the infinite and infinitesimal, symmetries, proofs, and how these concepts all fit together. What awaits readers is a freewheeling tour of the inimitable joys and unsolved mysteries of this curiously powerful subject.

Peter Ringel is watching:

Voltaire: The Rascal Philosopher

I discovered a terrible knowledge gap and missed details of a great one. so many angles to be impressed. his writings seem to be the least of it. he even gamed the king's lottery and won with a group of investors & mathematicians.

William Huggins suggests a somewhat older work:

A General History of The Most Prominent Banks, by Thomas H. Goddard, published in 1831.

its dry - but if you are interested in the 1819 panic, there are some good details. the book is mistitled imo as 3/4 of its pages and 2/3 of its text centers on the history of central/national banking in the united states from 1786 through 1831 (publication). on titular matters, it had a couple of interesting tidbits on the bank of genoa and some "interesting" statistical information for archivists but there are better modern sources on major banks in venice, the netherlands, england, and france (for example, the author skips over how the bankers of geneva funded the french revolution to knock the bank of genoa off its perch, etc). i suspect such deficiencies are because the text was designed as ammo in the "bank wars" of the early 1830s rather than a deep exposition on titular topics.

its exposition on us matters feels remarkably haphazard, i presume because the author's intended audience would have the context to appreciate why it includes what it does, including a description of the bank of north america, hamilton's report to congress on the need for a bank, and a brief on the First Bank of the US. where it begins to shine is in the next set of docs, which includes an auditor's report and statement by the president of the Second Bank of the US on how the panic of 1819 was navigated. it follows with mcduffie's 1930 report to congress on the SBUS (includes more details on the rise and fall of FBUS), and closes with a statistical archive of the "monied institutions of the US" and an appendix on how banking and commercial exchange granularly worked in the 1800s.

Stefan Jovanovich comments:

I was puzzled by the "decline and fall" description, since the Bank did not fail but simply had its charter expire without renewal because George Clinton did not like what Thomas Willing had done as President of the Bank. (Clinton failed to cast what would have been the winning vote for renewal.)

William Huggins responds:

"fall" referring to its near brush with survival, not any sort of mismanagement or fraud as in 1819. mcduffie describes FBUS as the victim of partisan politics, but one of such import that the same party who killed it started calling for a replacement almost immediately.

Stefan Jovanovich adds:

They wanted what Willing would not give them - a central bank that would do what the Fed does now - discount the Treasury's IOUs at par. Can't have a war without that.

Mar

13

Contextualization, from Asindu Drileba

March 13, 2024 | Leave a Comment

I found this podcast episode very interesting.

Contextualization Within a Framework of Conditional Probabilities w/ Will Gogolak

As a risk officer with the Chicago Mercantile Exchange, Will Gogolak was setting margin requirements and saw a wide variety of traders’ accounts and what separated the winning traders from the losing ones, before leaving to pursue his own trading and obtaining a PHD in finance and share his knowledge of quantitative analysis and market experience with students at Carnegie Mellon University. Combining his market experience with knowledge of statistics helps William create his custom buy the dip strategy with futures and leveraged ETFs, and focusing on probabilities and determining market direction for informed trading decisions.

Peter Ringel agrees:

Love the hole series. Half of speclist was a guest.

Big Al offers:

Also very informative are these interviews with "Uncle Roy", on Top Traders Unplugged:

Zubin Al Genubi comments:

Speaking of cognitive bias, I realize that if I feel bearish, so does everyone else. You have to go against how you feel and against the consensus.

Sam Johnson asks:

Do you need to go against the cognitive bias of how everyone FEELS or how everyone is positioning?

Zubin Al Genubi responds:

Don't most traders and their systems trade and position for that past regime? As Roy said, trend followers are all piled in at the turns and all will reverse at the same time. With the widespread use of systems everyone is doing basically the same trade. You can't get a fill after the turn as we saw last fall. You have to pre-position…be in position ahead of the enemy forces.

Mar

2

ATH, from Zubin Al Genubi

March 2, 2024 | Leave a Comment

While S&P 500’s Friday [23 Feb] gain was only 0.03%, it was enough to propel it to another all-time high (13th record close this year); in years when S&P 500 did hit an all-time high, it did so 29 times on average since inception of modern version of index in 1957.

-Liz Ann Sonders

Here's #14 this year as we close up [1 Mar].

Peter Ringel asks:

How & why should one exit any equity longs [given the market advance of the last 10 years]? Not a trivial question to me.

Zubin Al Genubi responds:

Trade your system expectation time. Develop systems that can capture a trend. (Good luck with that.) (Or at least allow re entries, break outs.) Use appropriate money management and the geometric returns over time and increase net wealth. Trading in a nutshell.

Peter Ringel continues:

what if buy & hold is the best system in your arsenal - not annualized systems, but realized systems and normalized for risk? (though normalized for risk & leverage might be a debate.)

Let's say I have an uber-bullish setup: enter on 5th trading day of year and hold 5 days (not a real one). I can annualize it to compare it to other systems, but really it is just one trade, just a little slice of the year. In this case and current drift - an exit on day 5 is not justified, holding forever is.

Zubin Al Genubi sums it up:

Hard to beat buy and hold, but the drawdowns are hard to handle. Define your risk tolerance and design system around money management. As long as the system is positive it doesn't really matter how good because all returns were in the past. If you mean by "annualize" compounded annual geometric returns, that is the right way to compare systems, but also include the money management in the comparison. That is critical part many leave out.

Jeffrey Hirsch writes:

Today’s post RE ATH:

Ex-2020 S&P 500 Flatter Election Year March

But after 4 months of solid gains the market is poised for a modest pullback of maybe 3-6%.

S&P 500 Support: 4800 old ATH.

Steve Ellison comments:

A decade or so ago, I studied the 4-year presidential cycle and concluded that the pattern in annual returns had been very pronounced from 1948 to 1980. After 1980, maybe as a result of the pattern becoming widely known, later results were much more mixed and fell below statistical significance.

That said, for the past two years beginning with bearish midterm election year 2022, the major market averages have closely followed the classic presidential cycle playbook. I assume that, like the uptrend in NVDA, it will continue to work until it doesn't.

Feb

12

Reminiscences of a Stock Operator, Annotated Edition, from Victor Niederhoffer

February 12, 2024 | Leave a Comment

i reviewed the Livermore book for Barron's and i believe if covers the bad quite well.

History Lessons for Investors

Reviewed by Victor Niederhoffer

Imagine that master novelist and chess aficionado Vladimir Nabokov wrote a fictional memoir about Capablanca—the 1920s world champion who never made a mistake on the board—and that Bobby Fisher then published an updated and annotated version, incorporating all of the important developments of modern chess strategy, along with a foreword by Anatoly Karpov.

A similar multilayered feast on investment is now available, with minor differences. Edwin Lefevre's Reminiscences of a Stock Operator is a novel told in the first person by a character inspired by legendary trader Jesse Livermore. This classic is now graced with extensive annotations by investment advisor Jon Markman and a foreword by hedge-fund manager Paul Tudor Jones.

The result is big and beautiful, cutting across two centuries of booms and busts and market and economic history, with a myriad of vintage historical photos and instructive historical charts throughout.

Peter Ringel responds:

Thank you, Vic. For many traders, Reminiscences was their first book about speculation.

Jan

26

Variance swap, from Zubin Al Genubi

January 26, 2024 | Leave a Comment

Daily sd's 1 (1,1,1,1,1,0,0) mean variation .71 PL 2

Daily sd's 2 (0,0,0,0,0,0,5) mean variation .71 PL -18

Correct forecast, but went bust anyway, due to lumping of volatility.

Asindu Drileba asks:

What would be the best strategy to capture the return of this distribution? How would the position size be computed? Say you have $10.

Zubin Al Genubi replies:

OTM option? Don't know which direction so maybe a strangle? Its an example of a fat tail event surprising someone expecting a certain variance. Like the LTCM guys. $.20? 2%? As a hedge. Depends if its hedge or a trade.

William Huggins comments:

what you're picking up on is that variance alone doesn't describe non-normal distributions very well - you need additional tools like skewness (possibly kurtosis) to pick up on those differences. despite having a better description though, there is the presumption that the data generating process is stable across the sample period, and going forward. I've generally found (despite my poor timing record) that money is to be made when the distribution is changing, not stable (the computers rule those waves imo) so detecting breaks may be more valuable than fixed descriptions.

Peter Ringel writes:

I can confirm this from the math-undereducated trading side. Stability is boring, and boredom can lead to undisciplined trades. Shocks and short-term exaggerations are great.

Art Cooper points out:

Stability is boring, and boredom can lead to undisciplined trades. It's Minsky's Theory when this becomes widespread.

Zubin Al Genubi responds:

Thank you Dr Huggins. That is indeed the point that variance, regression, sd, means, should be used with power law distributions with extreme caution or not at all.

Hernan Avella questions:

Why is all that mumbo necessary when all you need is good entries and good stops? The house never closes and there are so many opportunities ahead. f you need that big of a stop, or it gets triggered so frequent that ruins the profits, your system sucks! It’s not a stop-loss problem.

H. Humbert comments:

I think he is saying the system did suck because it relied on improper statistical analysis, using gaussian distributions for prediction when it should have used a more sophisticated statistical analysis that doesn't make such assumption. If you know of good entries reliably without using statistics, more power to you! And maybe he needs volatility swaps in addition to variance swaps and then his system will be A-OK because that could be a simple way to hedge the fat tails. Since I don't trade, I'm just trying to interpret what's flying by.

Humbert H. writes:

Var swap vs. vol swap would be the purest expression. You could also buy a call on realized variance, by buying an uncapped variance swap and selling a capped variance swap (for historical reasons, the cap is struck at 2.5x the variance swap strike, the cap level acting as your effective call strike).

For 100k vega notional and uncapped strike at 22, and capped strike at 20, and realized vol over the period of 80:

100,000/(2*strike) = var notional = 2,272.72 var units uncapped, 2500 var units capped

Pnl uncapped 13.4mm

Pnl capped -4.1mm

Net 9.3mm for ~0.2m cost, not bad (approx (22-20) * vega not).

Some payouts were on the order of 2000:1 during March 2020. Pre 2020 you had some active sellers:

‘Amateurish’ Trades Blew Up AIMCo’s Volatility Program, Experts Say

H. Humbert responds:

Interesting. And an interesting article. You'd think that after LTCM people would realize that 100 year floods are just named that for convenience. That's why I never buy stocks in insurance companies. He whose name shouldn't be mentioned (not the fractalist but the Middle Eastern guy) always advocated buying black swan options, but I think the Chair didn't think he made money on this.

Kim Zussman links:

Jan

14

The Wisdom of Rationals, from Asindu Drileba

January 14, 2024 | Leave a Comment

I have an interest in prediction markets (also known as information markets or idea futures), such as election betting odds, that allows people to place bets on who they think will be the next president. I wrote an article on my blog some time back (2020) describing the phenomena referred to as the "wisdom of the crowds" that makes these prediction markets possible:

For years now I have been fascinated by prediction markets. The source of excitement is the idea is that you can use financial markets to do inference — just like machine learning. A famous example of such prediction markets are the orange futures. The orange futures market is one that allows entities to buy oranges in advance. How it works, is that one can pay $1,000 to receive 1,000 oranges that will be delivered next year. An interesting side effect of this orange futures market is how it accurately predicts temperatures in certain locations more specifically, the temperature of the locations where the oranges are from.

Peter Ringel writes:

this is a clever thought, and also a terrible situation. I too noticed that it seems - in places - to be easier to predict pockets of the real economy with the financial markets. Of course, traders like it the other way around. Mkts got so efficient. The outside world has way more inefficiency left. (Also enjoyed your mention of "J" language - never heard about it before.) the source of excitement is the idea is that you can use financial markets to do inference.

Zubin Al Genubi comments:

The difference between prediction markets and financial markets is that prediction markets are binary outcomes and markets have non binary outcomes. The distributions are different.

Larry Williams responds:

What a great point. That’s a massive difference….then add in position size.

H. Humbert writes:

An option price seems awfully similar to a prediction market price: both deal with a discrete event at a particular time in the future (or at least close enough for most prediction markets), and right before expiration both, in a way, create a binary choice. I don't trade options, but that's what it appears like.

Zubin Al Genubi replies:

One big difference is options are subject to arbitrage. The prediction markets are not and get wildly inaccurate swings.

Big Al offers:

Binary Option

Superforecasting: The Art and Science of Prediction

Brier scores

From an interview with Michael Mauboussin: