Nov

13

Holbrook Working on price changes

November 13, 2022 | Leave a Comment

My work has made it clear that changes in a speculative price may profitably be regarded as arising from two classes of influence, namely disturbing influences and changes in price-relevant economic prospects; and that the disturbing influences generate chiefly negative autocorrelations among price changes, while changes in economic prospects generate positively autocorrelated price changes. The negative autocorrelations generated by disturbing influences occur at lags ranging from minutes to at least several days; changes in economic prospects generate positively autocorrelated price changes at lags within that range, and also at much longer lags.

the preceding letter was from Holbrook Working to VN on 4-11-1969. Holbrook Working, along with M. F. M. Osborne, was a giant in the speculative price arena of the 1930-1970 era.

S&P has risen a reasonable amount 6 days in a row and has gained 10% since 11-3-2022, such an event is exceedingly rare. indeed has occurred zero times since 1996. and twice above 10 big a day since 1996 is anything but random. it was slightly bullish in past.

Nov

10

A chart re-enforcing Vic’s #1 lesson, from Larry Williams

November 10, 2022 | Leave a Comment

72 years looks like more green than red to me:

Steve Ellison adds:

I have a similar graph on my Twitter page that I annotated with each year's most convincing reason to be bearish. There is always some plausible-sounding reason why the market should go down, but we see on the Senator's chart how much more green there is than red. I adapted this annotation format from a similar chart in Venita Van Caspel's 1983 book The Power of Money Dynamics.

Nov

10

Elections, big market moves, and fuddy duddies

November 10, 2022 | Leave a Comment

takeaways from the midterm: (1) fortunately for the S&P the senate wasn't reversed. (2) the betting odds were incredibly wrong for the 3rd election in row. (3) the senate probs switched from 75% r to 10% r in an hour. (4) the horse bet wisdom of waiting to bet near post time is shown.

second largest open ever up 120 big pts. only exceeded on 11-9 2020 when it was up 150 big pts at open. (how a little 0.1 change from expectations can create such big change. all we need is the useful idiot saying the fed must be resolute.)

it is fortunate for the outs that the D.O.L. is not responsible for the reporting of the CPI. if they tweaked it last month by 0.1 up, the outs would surely have lost both houses. with every market down about 20% from last month, was the 0.1 decline that surprising?

bonds at 124 at highest level since oct 17,2022. query: did the Commissioners at the fed forecast this and was that why they were adamant that bonds were going higher? stocks still at 20 day hi as 10-28 was 3948.

guaranteed to happen just like in the old days. when the buzz and media are most negative, time to buy, and the opposite. rite out of the books of the corners and propaganda of 50 years ago.

this is the second biggest rise ever in S&P, only 3-13 22 higher up 220 big. seems to be the greatest rise in wealth in one day ever as when bonds up 3 pts or more stocks were never up more than 100 big triumph of the optimists and proof that the market loves agrarian reformers.

alan abelson and the upside down man previously had the record for the worst advice on stocks of all time having lost hundred of billions for their followers. but their losses were over years. the fed people and their followers who have been beating the pessimistic drums. while it was guaranteed to happen, the question arises if they knew that such an increase in wealth was imminent, how many folks were induced to go into cash or reduce exposure to wealth because of their wrongful bearishness.

amazingly crude only up 0.60 after 5% decline in last 3 days. when the sun is shining , the agrarians make hay all around.

its the little things that the 3-letter agencies tweak that make the drift happen and get one off balance.

The Little Things You Do Together

i am thinking of the old fuddy duddies at the Metropolitan Club on 5th avenue who look out the window and cast dark grimaces at the Women with short skits and congratulate themselves on their disapproval and abstinence. The same must be true of all the governors at the Fed who have twisted all the weak longs out of stocks and bonds with their infernal pessimism and wrongful admonitions. Are they congratulating themselves like the boys at the Cosmopolitan?

the final shoe falls: “This time around, the Fed cannot step in and provide stimulus. So I don’t think it’s good news that we’re not going to get anything out of Congress over the next two years,” El-Erian said.

Nov

7

Mid-term election weeks

November 7, 2022 | Leave a Comment

Three predictions around election day: (1) we will hear much more about P. Pelosi after Tuesday. (2) the ray-ban sunglasses will be used much more frequently by the unifier. (3) based on patterns, the move from day of election to 2 days after is up 13 big or about 1.5%.

Last 6 midterm elections S&P 500 average move from open to close:

MON +3.38

TUE +5.70 (election day)

WED +8.95

THU +4.42

FRI -1.45

[Click image to open for full analysis showing S&P futures data for the mid-term election weeks from 1998-2018.]

Nov

3

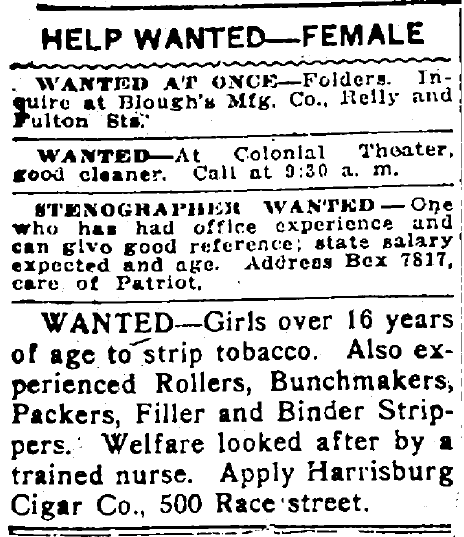

Want-ad indicator, from Henry Gifford

November 3, 2022 | Leave a Comment

The want ads are perhaps the most honest part of a newspaper – the editors have little say in what gets written. The obituaries are interesting to me. I hear they are written years ahead of time, except for the part about how and when the person died.

Bo Keely expands:

it brings out something i didn't know: check various market in the want ads. that's as sure as hobo's checking the 'help wanted' ads when he rolls into town and decides whether or not to stay.

it would seem to me, and i don't have time now or i'd do it, to be simple to study and test a few newspapers' classified ads to find something that correlates either to a specific or the general market. if something were found it would likely be consistent. beats the moon.

Nov

3

Markets, predictions, and announcements

November 3, 2022 | Leave a Comment

very small variations in S&P on Monday oct 31 , 3.5 a half hour versus normal var on 10 a half hour. largest change was 12 pts versus normal largest change of 20 pts. since a major purpose of markets is to move enough to force out weak with big moves that public can't requite. big moves and margin calls will force enuf of them out to feed the top infrastructures. the market will have to make it up with some extraordinary changes next two days [Nov 1-2]. hang on to seat belt.

takeaways from Powell's remarks: inspector general :inflation hurts those in poverty the most: amazing that someone with no economic training can talk such a good game.

"Give a thief enough rope, and he'll hang himself." all the traders that front run the announcement of an easing next month and bought when they got the news release or heard it from their colleagues at the Fed directly or indirectly were caught long and are blowing in wind.

interesting that both the most popular sports commentator and the most popular stock commentator, mad dog russo and mad money cramer, are both proud of their madness and both seem very ethical and both make numerous predictions that are valueless. guaranteed to happen.

nice move from 14:30 on nov 2 at 3899 to nov 3 at 10:00 AM am 3708 - 5% down in blink of eye - thereby making up for the lack of margin calls and volatility in previous days.

Mr. Powell emphasized the integrity of the Federal Reserve in his commentary on wed Nov 2. he spoke of the Inspector General's probity and independence. Will someone please contact the powers that be concerning the 12 pt S&P rise form 13:30 et to 14:00 right before the announcement? it wasn't chance the announcement seemed very bullish and it was obviously leaked. How was it leaked? its inimical to a fair market which is everybody's stated goal. billions were lost and made with the leak.

Oct

30

Corporate profits, and Dr. Stigler’s new book

October 30, 2022 | Leave a Comment

Steve Stigler's new book Casanova's Library is a fascinating trip down the history of lotteries, history mathematics, of combinations, and utility theory. It also explains many of the hopes and failings of gamblers in our markets. well worth reading.

how can stocks go up at a much larger rate than corporate profits over time? the reason i think is that companies have developed the art of taking more emoluments from the government each year thru sneaking into more regulatory extracts.

Oct

29

Madmen and the 52% level

October 29, 2022 | Leave a Comment

much talk about the 1900s custom of touting a stock at its high, and selling out. but the contrition this time is as if it was a first time. What i disagree with is the expression "go woke, go broke" quite the opposite it true as all the big companies that prospered typically by adamantly going against Georgia on their election reform. in general they love regulatory capture which is always greater with more regs. watch out if the house and senate are reversed on Nov 8. it's very bearish. I guess 90% of CEOs now are agrarian.

i guess its only fair to relate that I worked for the repentant Meta Bull for one day before I was fired. my lapse was I said that Galton was the founder of correlation and regression and contingency tables (among other things like weather maps, finger prints, psychometrics, biometrics - i could go on). Fortunately John Markman hired Laurel shortly thereafter and I have infinite respect for him.

if only the golfer celeb were to concentrate on the 30 things that unfairly worked against him before the election, we'd all be so much better off. i'll list them daily: (1) The big pharma that withheld the announcement that they had an effective vaccine until the day after the election.

it is good to have a man in power who is young at heart and hit a 368 baseball single in a congressional game as well as a football star who lettered on the varsity team that beat Ohio state. to say nothing about his prowess in martial arts. He would beat the Hades out of his past opponent if he were still in high school.

two of the most entertaining and boisterous and knowledgeable people in their respective fields are Mad Dog Chris Russo and the always certain but not chastened Jim Cramer (who fired me after one day). It is instructive but not by chance that despite all their erudition, both "madmen" are no better than 50-50 in their frequent predictions. It is not chance that they both approach 50% but part of an inevitable tendency for forecasters to approach and breach the 52% accuracy level needed for profits in sports betting. I believe frequent forecasters in markets don't approach the 52% needed in sports and this is guaranteed to happen by evolution.

Oct

27

Checkers and logic

October 27, 2022 | Leave a Comment

nand from computer circuitry, checkers, or move from 4:00 ET to 4:15. this was my most important post of the week. the circuitry for computers, based on Boolean algebra, has paths for and, not, or, and nand ("not and", false only when all inputs are true). in checkers there are usually two moves that are likely. the checker moves are much closer to real binary decision making than chess.

how is this related to the moves in the last 15 minutes? why is this be a key reason that checkers is more difficult and relevant than chess? perhaps Mr. Millhone will ask some of the computer literate checker players to expand on this theme so that we will never hear again "he plays checkers while the real smarty plays chess."

let us hope in the new regime that the platform will not cancel by suppression any views that are not woke as they do with so many posters like me. I can reach a wide swath only by paying which I'd be much more willing to do if fair play all around.

it is interesting that my post on nand was noticed by 300 people on the platform. perhaps it was mistakenly considered a not (the unifier or his counterpart). what would the platform's earnings be if they had to deduct from earnings like all other companies their salary expense?

the three major problems with get-rich or trading schemes is: (1) multiple comparisons, (2) ever-changing cycles, (3) lack of testing, (4) self interest, or (5) front running. i have to laugh when half of the reviewers of Ed Spec complain and rate it the worst because "he doesn't give you any trading systems that work."

Oct

27

A sense of triumph, from Nils Poertner

October 27, 2022 | Leave a Comment

really a sign for things to go other direction sometimes. eg, the moment Tchernobyl engineering team got awarded prize - 1 year before the disaster. your typical trader eventually buying his dream house or so and bragging about it to friends etc etc. maybe USD bulls brag now? or 30yr bond bears?

bragging is far more subtle than one imagines. most academics brag (via the number of articles they write), even in social groups they do (look how clever I am since I can do this or that or have this insight.)

sly traders don't brag as they prob have been alone in the trenches so many times, WW1 like trenches…its is cold there and dark and lonely ![]() so they kind of know.

so they kind of know.

Steve Ellison suggests:

There was a whole chapter about hubris, including statistics on underperformance of shares in companies that bought stadium naming rights, in Practical Speculation.

Stefan Jovanovich corrects the history:

The comparison of sly traders' adventures with WW 1 trenches has its own touch of hubris; it is also bad military history. The trenches were not "dark"; by 1915 both sides on the Western front had them electrified. They were not "lonely". That was the cause of the greatest slaughter.

Based on their experience in colonial wars, the general staffs assumed that packing men into dense line formations was the solution to holding ground. (Holding and retaking ground were the primary tactical objective for the Allies because they had already surrenders to much territory in Belgium and France. As much as the movies, then and now, want to picture the slaughter as a matter of men running upright across open ground and being mowed down by machine guns, that was the smaller part of the killing. 3 out of every 4 deaths and wounds on Western front were caused by artillery barrages against trench lines and rear assembly areas where troops were massed to rotate up to and back from the forward trenches.

Oct

27

Yankees, markets, and the warlord deception

October 27, 2022 | Leave a Comment

how can weekend be over without canceling Yankees for: (1) keeping players in lineup with 100 averages, (2) reliance on ridiculous analytics, (3) not resting Judge, (4) the Boston Redsox tape, (5) futility of listening to an old man on the radio saying ridiculous things like "you can't predict baseball".

do you agree or not "the public got a better deal and a higher chance of making a profit in the days of bucket shops and commissions 100 times higher than today" (i.e., circa 1900)?

a fantasy - i see in my mind's eye the boy wonder saying goodbye to his coven of models and disboarding his yacht thankful that one of them had not killed him yet and rushing to Delmonico's.

it is good to view once again Kagemusha to see how a dead or dying warlord can be hidden from the adversary with respect to the Penn race and debate.

Oct

25

The Trader and the Professor

October 25, 2022 | Leave a Comment

professor and I meet as S&P crosses 3800 amid Bloomberg warning on Friday oct 21 that an armageddon in the market seems likely.

at the turn of the century, it was common practice of Gould and Drew to spread rumors of a catastrophe on the market before buying with abandon to cover their shorts. thus the advice when the papers and brokers were most negative to buy . As I was out visiting children on Oct 21 and Oct 24 and the only contact I had with market was the bearish news and data source, i thought back to the days of the manipulators memorialized so well by Lefevre.

Bejan's latest book will be on evolutionary design (e.d.). we discussed the e.d. in the market over the last hundred years. commissions have gone from 10% a trade to zero, but the rake and vig and the chances of making a profit with short term trading has remained near zero.

it is instructive to realize that Livermore went bankrupt 5 times by not realizing the inevitability of the rake and the vig (bid-asked and commissions) to lead to bankruptcy and in his case suicide. The thing I loathe the most is when some well meaning personage says that two favorite books are Reminiscences and Education of a Spec.

guaranteed to happen: the powers that be make sure that, before an election, good news is rampant and reduction of service revenues is off the table forever.

Steve Ellison adds:

Remembering that the upside down man and his successor are often quoted as being bearish about the stock market, and remembering that they were bond salesmen whose best interest might not be served by clients buying stocks, I recall the fear, uncertainty, and doubt (FUD) technique that the 1980s IBM sales force was known for.

My first job out of college was assembly language programming on IBM mainframe computers that were the standard for large corporations. IBM essentially had a monopoly in this market from the 1960s on, but by the time I started in the 1980s, competitors such as Amdahl were nibbling around the edges of the market by offering "clones" of IBM systems for lower prices.

The IBM sales force's primary technique if they were worried a customer might buy from a different vendor was FUD. The IBM sales guys would come in and cast as much fear, uncertainty, and doubt on competitor products as possible. Other technology sales forces adopted the technique, too. In one example I was involved with while working at a technology company, a competitor's sales person told a customer that our product could not be programmed in Kanji. Kanji is not a programming language at all; it's a writing system for Japanese.

One ought to keep this history in mind when evaluating bearish statements about the stock market by bond fund managers.

Jeffrey Hirsch replies:

Appreciate the reminder, Steve and Vic. Been observing Goldman and other firms doing this in recent years.

Oct

19

Benjamin Franklin

October 19, 2022 | Leave a Comment

nobody asked me but…the greatest writer, diplomat and scientist and a man completely indispensable to the birth of America was Benjamin Franklin. I am reading Walter Isaacson's excellent bio of Franklin and it is mind-blowing in so many ways, such as how Franklin dealt with spies at Passy by being honest and good. How long will it be until he is painted and toppled?

From: Spies, Patriots, and Traitors, Review by Amb. (ret.) Edward Marks

More questionable is the characterization of Benjamin Franklin’s activities in France as “intelligence” operations rather than diplomacy. Just because Franklin’s work was often “secret” and just because he was the target of British intelligence does not mean that Franklin himself was a “spy” or intelligence operator. He was an accredited diplomat pursing bilateral negotiations with his official host.

The chapter on Franklin, in fact, is one of the best as it re-interprets a story we all thought we knew. The British were all over the American mission to Paris, surrounding it with spies and observers, but more important inserting an agent, American-born Dr. Edward Bancroft, on to Franklin’s staff. In fact, the British were fully informed of everything the Americans were doing, to the point of receiving full and complete copies of the most secret communications. As the author quotes from another historian, "Franklin’s embassy at Passy, it now appears, was almost a branch office of the British Secret Service."

But this is where the story becomes even more educational. Despite this fully successful intelligence operation against Franklin, he was completely successful in his diplomatic mission.

The book: Spies, Patriots, and Traitors: American Intelligence in the Revolutionary War

Oct

18

No barnacles, much malaise

October 18, 2022 | Leave a Comment

barnacles aparently will not be increased on open tomorrow. two big big opens have only happened four times since 2011. and it's not bearish.

a symptom of malaise. the Yankees radio are forced to air commercials that are total promotions, twisted. they have one about diverse groups that get gypped on water, another about wearing a helmet that breaks if not patented, to say nothing about buying a Kar without cred.

a bicycle celebration for a player who has a 100 average but kneels during the anthem.

Oct

13

The Dark Trader

October 13, 2022 | Leave a Comment

market below the round temporarily.

i join the bicyclist.

the more he unifies the better the market.

today his unification falls to 17%.

after 6 down days in a row, it had a lot of ground to cover on the upside and it exceeds the level 4 days ago by a google.

interesting gain in senate now 50-50. the unifier falls correspondingly.

Oct

11

Greg Steinmetz - Biography of Jay Gould, from Stefan Jovanovich

October 11, 2022 | Leave a Comment

Learning From the Most Ruthless Robber Baron (Jay Gould) | Greg Steinmetz

American Rascal: How Jay Gould Built Wall Street's Biggest Fortune

Kim Zussman comments:

Likely worthwhile but I was stopped out at 2:59 "Buffett was a model of integrity"

Stefan Jovanovich replies:

Agreed. One of the many things the List has done is teach me the limits of my own understanding. I find the Oregano offensive because he has an outright pimp for a partner; in a decade of active practice in LA during the GO-GO years of the 70s and 80s, Munger's firm was - by far - the worst combination of self-righteousness and chickenshit deviousness that we and every lawyer we knew encountered. But, Buffett's artful dodging as a taxpayer has never bothered me. Thx to KZ for reminding me that all cheating really is equal in the eyes of God.

Jeff Watson writes:

I liked this biography better.

Oct

11

Interesting cultural lagniappe, from Big Al

October 11, 2022 | Leave a Comment

Americans Are Fake and the Dutch Are Rude!

Do all human beings have emotions, just like we all have noses or hands? Our noses have different shapes and sizes but when all is said and done they help us breathe, and let us sniff and smell the world around us. Our hands can be big or small, strong or weak, but regardless they help us touch, grasp, hold, and carry.

Does the same hold for emotions? Is it true that emotions can look different but, in the end, we all have the same emotions—that deep inside, everybody is like yourself? It would mean that once you take the time to get to know somebody, you will recognize and comprehend the feelings of people who have different backgrounds, speak different languages, come from other communities or cultures. But are other people angry, happy, and scared, just like you? And are your feelings just like theirs? I do not think so.

Andrew Aiken asks:

Why do Belgians have windshield wipers on the inside of the windshield?

Peter Saint-Andre doubts:

As someone who is half American and half Dutch, I am skeptical. The fact that there is a difference between Americans and Dutch in the style of public emotional expression doesn't mean that Americans experience, say, gratitude and Netherlanders don't. Also, if this person had come to New York (New Netherland!) instead of the midwest (midwesterners are fake, New Yorkers are rude!), she might have come to different conclusions.

And let's not forget that one of the world's famously untranslatable words is "gezellig", which in Dutch means the warm, cozy, comfortable feeling you experience when in the company of family or close friends.

Pamela Van Giessen agrees:

Over 50% of social science research, of which psychology comprises a significant proportion, fails on bad data, poor data management, and is unreproducible. Seems like this author is a poster child for that.

Oct

11

Competition and adaptation

October 11, 2022 | Leave a Comment

phenotype selection: Darwin's theory of evolution explains why living things change over time: the mechanism is adaptation - the tendency for living things to become well designed for reproduction and survival. many factors in the environment cause this including competition.

selection causes: predation, weather. in summarizing the subject, Pfenning and colleagues say selection is common in nature and is often sufficiently strong to cause substantial evolutionary change.

there has been a substantial change in market activity and structure in the last year. From 2019 to year end 2021, the S&P was up 54% of the time for an average of 0.3 a day. During 2022, the S&P was up 46% of days and down -4.8 a day. What are the reasons? Lets start with bonds: at year end 2021 they stood at 159, today at 125.5; nasdaq at 16 500, today at 11 100; crude at 76.5 now at 91.2; eurodollar 1.13 now at 98. yen down 40% , gold down 100.

what are the reasons for this change: the answer from ecology is usually increased competition — in this case it would be from fixed income like bonds. but the answer is somewhat deeper I think: there has been a massive increase in regulatory capture, in agrarian reform.

when will it reverse? the statistic shows that after every bad year, the next year is very bullish. perhaps the November election now at 80% for the non-unifiers is a telescopic date.

Oct

5

Speaking of chess…and cheating, from Stefan Jovanovich

October 5, 2022 | Leave a Comment

Larry Johnson writes:

What Do You Make of Russia’s Strategy in Ukraine?

Russia is now sacrificing pawns in the form of strategically useless territory, while Ukraine is rushing forward to seize symbolic territory without having the necessary reserves in terms of trained soldiers and equipment to sustain the attack and defeat Russia. Russia, meanwhile, is moving its Knights, Rooks and Bishops into position for checkmate. The question remains – what is Putin’s gambit?

One likely answer: Putin follows the path Metternich would have taken if the British had not had their Navy.

Mahan missed the part about how Napoleon lost. In a world of anti-ship missiles, the Americans cannot hope to do what Britain did after 1815 and use sea power alone to rule world trade. The Continental system failed because Russian would not go along. Now, to succeed, a Russian continental energy system only needs to have Poland and Ukraine neutered by having Americans remove all military assistance. Those countries will continue to hate and despise Russians the way John McCain did; but they will have no more ability to do anything to change the pieces on the board in central Europe than American Cold Warriors had between the Korean War and the fall of the Berlin Wall.

Putin can, in the name of peace, build new improved pipelines to follow the route that Russia took against the Ottomans. Russian oil and gas - and Iranian as well - can go around the Black Sea coast and through Moldavia to Hungary and Austria where Germany and Italy can accept deliveries.

Oct

5

Cheating, from Zubin Al Genubi

October 5, 2022 | Leave a Comment

Chess.com: 'Niemann Has Likely Cheated In More Than 100 Online Chess Games'

We based this decision on several factors. First, as detailed in this report, Hans admitted to cheating in chess games on our site as recently as 2020 after our cheating-detection software and team uncovered suspicious play.

The interesting thing to me is the cheating detection system.

Big Al imagines:

Trying to imagine what it might be, the first thing that comes to mind is feeding each situation, move by move, into AlphaZero and seeing what AlphaZero would do. If the player's moves match too closely to a program rated 3800, when the player's rating is maybe 1200 points lower, then one must assume the play is computer-assisted.

Antonio Porres Miranda offers:

Steve Ellison writes:

I am not sure if the grandmaster is still among us on the list, but I have seen him on social media expressing concerns about what level of due process there is in the event of a public accusation of cheating. He thinks the possibility of being accused might be enough to motivate top players to skip events. For example, here.

Oct

5

What Computers (Still) Can’t Do, from Nils Poertner

October 5, 2022 | Leave a Comment

In What Computers Still Can't Do: A Critique of Artificial Reason Hubert Dreyfus argued that an important part of human knowledge is tacit. Therefore, it cannot be articulated and implemented in a computer program.

first book was written in 1972. true back then and true today despite what others want to tell us. don't need a nano-second to know this by heart.

Zubin Al Genubi adds:

My theory is computer algos leave trails.

William Huggins agrees:

they always do. a friend who was at MIT for a few years had an interesting talk on algos and the firms tracking/hunting them.

Oct

1

Numb3rz

October 1, 2022 | Leave a Comment

good article:

Raging Markets Selloff in Five Charts: $36 Trillion and Counting

• S&P 500 posts rare third straight quarterly loss as Fed Hikes

• Stocks and bond fall in tandem as investors rush to cash

dark bicyclist now behind baseball player at 17.1% versus 18.1% [as of 1 Oct]. what is expectation going forward? for oct, for 4th quarter, and next year.

Laurel and I once visited Cooperstown and met an idiot savant who knew and told us about the batting average of every player going back to 1894. attending the advanced study classes that a certain offspring of me is taking reminds me of that savant. all formulas to prepare for test.

Oct

1

Consumer confidence, from Zubin Al Genubi

October 1, 2022 | Leave a Comment

Sentiments of individual investors about the stock market improve with consumer confidence about the economy, as if individuals were unaware that stock prices are a leading indicator of the economy.

Consumer Confidence and Stock Returns

Consumer confidence index (CCI)

Larry Williams comments:

Consumer confidence—MOST BEARISH EVER

Bud Conrad replies:

Thank you Larry. This 37-minute video presents about 50 charts showing everything already in collapse.

Stanley Druckenmiller said in his 25 year career investing he has never seen anything as negative as he sees now (Interview with head of Palantir)

Zubin Al Genubi writes:

The counter rallies sure can be violent in a bear market and it is easy getting buy orders filled. Interesting night [27 Sept]. Definitely foreign influence.

Stefan Jovanovich suggests:

Zubin Al Genubi adds:

Someone did a quick study a while ago where most gains were in night session. Seems like that lately that bears sleep at night. No scary overnight crashes and trading halts.

Larry Williams is optimistic:

Perma bears! We are in a bull market.

Stefan Jovanovich agrees:

++++++

Sep

30

The Electric Robots are Here, from Laurel Kenner

September 30, 2022 | Leave a Comment

Bye Bye, Mower-and-Blower Gangs. The Electric Robots are Here.

In a step toward ending mower noise, a robot named Farmer Joe, made a debut on the Town Hall lawn on Sept. 21, cutting grass in total silence as reporters and local leaders looked on.

Sep

28

BOE, commods, and bonds

September 28, 2022 | Leave a Comment

The IMF called the UK’s unfunded tax cuts excess in need of revision, while Moody’s warned about the UK. Mohamed El-Erian, chief economic adviser at Allianz SE, said the Bank of England now needs to raise interest rates by at least 100 basis points its next meeting on Nov. 3.

coordination or lone wolf?

UK Long Bonds Post Record Rally as BOE Moves to Stem Crash

• Yield on 30-year gilts fell 106 basis points to 3.93%

• BOE move follows disorderly selloff in recent sessions

The Bank had been warned by investment banks and fund managers in recent days that the collateral requirements could create a situation in which forced selling drove up the yield on UK debt. ie, money mite be lost by longs.

all concerned that the English wish to lower service rates:

Bank of England Buys U.K. Government Bonds, Intervening to Stabilize Market after Huge Selloff

cotton joins lumber and copper and every other market:

Cotton Prices Drop Amid Economic Worries, Strong Dollar Pressure

Futures shed one-fourth of their value in a month as slowing consumer demand overshadows potentially poor harvest

service cuts could create deficits: "US 10-year yields gained almost 80 basis points to head for largest monthly increase since 2003. The yield rose to 3.97% later in the day. global bond rout accelerated this as the UK’s plan for large tax cuts reinforced fears of more rate hikes."

us putting pressure on IMF to remove lowering of service rates:

US Encourages UK to Dial Back Tax-Cut Plan

• UK bond plunge has forced emergency Bank of England purchases

• Selloff in gilts, pound reverberated across world markets

Sep

27

Paying the vig in the Royal Navy, from Alston Mabry

September 27, 2022 | Leave a Comment

The historical moment is France's declaration of war against England and Holland in 1793. From Cochrane: Britannia's Last Sea King, by Donald Thomas, p. 37:

However, a young officer in Cochrane's position, joining the navy with a hope of enriching himself with prizes, faced a more powerful enemy than France or Spain, and one whose weapons were a good deal more sophisticated: the Admiralty and its prize courts. In the view of many serving officers, these courts were at best unsympathetic and, all too often, cynically corrupt. It was relatively common for a hopeful young commander and his men to find that, after a hard-won capture, the Admiralty proposed to appropriate the entire value of the prize. It was always open to the heroes to fight for their claim in the prize court. But even if they won the case, they might hear that the cost of the proceedings had swallowed up more than the sum due to them, so that they were now in debt to the court as well as having been robbed of the proceeds of their valour.

A man might complain publicly or privately against the prize system. But before he set himself up as a "sea lawyer", he was well advised to remember that this very employment, let alone his promotion, lay in the hands of the Admiralty itself. In consequence, there was a good deal of private grumbling and very little public campaigning.

Vic writes:

very much like the market where often the only way to receive or fight back is to sign away your rights in a preliminary hearing or arb.

Sep

27

Events and probabilities

September 27, 2022 | Leave a Comment

events i am looking at: (1) Pres prob of winning at new high, (2) 3 20-day lows in a row in S&P [as of Sunday], (3) almost every commodity down 20% in last month, (4) 30-year bonds and crude down 7% to new yearly low on thur to new 120-day low, (5) bitcoin below 2000, gold at new lo at 1652.

with every market down 20% from a few weeks ago, how insensitive and virtue-signaling are the CBs with their unanimous and irrevocable stance to beat fixed income down. and will we have to wait for friday before they stop their virtue signaling?

like the dark bicyclist they ride the wave, and he's now for the first time more likely than the baseball player from florida at 17%.

there's something apropos of all the CBs reaffirming their idolatry of the tall chair from 1986 who hated capitalism like they do and so many others these days. but eventually the "preferred measure of inflation" announced on Friday will hit the real world.

don't believe that I have approx 9200 followers normal way by gradual accumulation. only way I could stop the decline was by promoting at $5 each increment. on the other hand all of my tweets are canceled because the algo doesn't realize that the more the unifier rises, the better for the S&P.

a typical recent commodity move:

Lumber Prices Fall Back to Around Their Pre-Covid Levels

Rising interest rates have taken an ax to one of the pandemic's hottest commodities

Sep

21

You can transform a patch of weeds into a piece of heaven, from Laurel Kenner

September 21, 2022 | Leave a Comment

You can transform a patch of weeds into a piece of heaven

Sep

20

Broken windows, FOMC effects, and the vig

September 20, 2022 | Leave a Comment

it used to be a given that when the private sector performed a job, it was much more efficient than the alternative. a variation of the broken window fallacy. thus the estimate that 100 executive orders of the bicyclist cost the taxpayer 1.5 trillion understates.

the reason for inflation is the decreased trade in the economy that by the quantity theory leads to higher prices.

nobody asked me, but…it used to be that the money supply announced thur after the close had the greatest influence on the market. now it's not even published anymore and M2 is not published either. in the old days, say 2000 and before, a spec paid commissions of $10 or so a side. now one pays 0.25 + 1/75 a side to the CME vig. but in the old days the members on the floor wouldn't give you a fair deal. now it's the high-frequency persona. I liked the 20th century better. it was a fairer deal.

and yet the chair is proudly following Volker who caused the 1987 crash along with Baker and wished to stamp out all technology. he didn't use a typewriter nor tape. i met him at Larry Ritter's bedside and it was a dismal experience to meet someone who lived in an era 50 years receding. and yet he is idolized. he should be ostracized. no wonder chance gardener tore up his speech and gave us Volker. fortunately the FOMC is very bullish for bonds and S&P.

Sep

19

A new post from Laurel Kenner

September 19, 2022 | Leave a Comment

The infernal racket of blowers and mowers; Greenwich introduces a robotic solution

Sep

18

Infrastructure: cities, states, and markets

September 18, 2022 | Leave a Comment

anatomy of a city, infrastructure, and the road not taken from a trio that will alert you to the engineering, planning, and beauty of the things that make life work:

The Road Taken: The History and Future of America's Infrastructure

In The Road Taken, acclaimed historian Henry Petroski explores our core infrastructure from historical and contemporary perspectives and explains how essential their maintenance is to America's economic health. Recounting the long history behind America's highway system, Petroski reveals the genesis of our interstate numbering system (even roads go east-west, odd go north-south); the inspiration behind the center line that has divided roads for decades; and the creation of such taken-for-granted objects as guardrails, stop signs, and traffic lights - all crucial parts of our national and local infrastructure.

A compelling work of history, The Road Taken is also an urgent clarion call aimed at American citizens, politicians, and anyone with a vested interest in our economic well-being. The road we take in the next decade toward rebuilding our aging infrastructure will in large part determine our future national prosperity.

the move from 4:30 to 5:00pm is very diabolical as it leaves options at 3900 uncovered. perhaps someone knowledgeable about options can explain the intricacies of who's hurt and who's naked as well as the CME rule that allows members only to execute options after 4:15 pm.

looking back at the pools and cliques of the 1900's, and comparing that to the deal that the public gets today relative to the insiders, I believe that 1900 was better.

Sep

17

Nobody asked me, but…

September 17, 2022 | Leave a Comment

nobody asked me, but…(1) as always the more the dark bicyclist gains, the better for the market. he's now up to 15.2% prob versus 9% 2 weeks ago. (2) the professor could not be denied as he refuses to allow the round number of 3900 to be undefended. but he does it in the company way so only the member can profit as it goes above the rounds at 3900 at 5pm closing time so the members can rake the shorts on Monday. (3) I read The Book of Daniel Drew, and it's amazing how evil and unrepentant Drew and his associates Fiske and Gould were as they formed pools to rake, deceive, and break the public and repeatedly tried to turn on the partners out of vengeance for past misdeeds.

The saying, "selling watered stock," has now got to be well-known in the financial world. So I've wrote down in this paper about the affair of salting my critters. Some time later I became an operator in the New York Stock Exchange; I hung out my shingle on Broad Sweet. And the scheme was even more profitable with railroad stocks. If a fellow can make money selling a critter just after she has drunk up fifty pounds of water, what can't he make by issuing a lot of new shares of a railroad or steamboat company, and then selling this just as though it was the original shares?

- The Book of Daniel Drew

I have an updated study of the likely performance of the market the rest of the year based on the last 50 years. in sum, its much better for the market to be up the first 9 months. neutral if down, but very bullish for year following - never two downs in row.

For a story that you will want to share with your kids and have a good joyful cry about:

Mom's reaction to son's long-awaited callup is priceless

After 863 Minor League games, Wynton Bernard stars in debut in Rockies' win

nobody asked me but…(4) when are speculators going to learn that a bad earnings guidance or report after the close is just one S&P arrow in the spring and is not a cause to panic? (5) after a tremendous decline in the previous week ending Friday, is it the time to be bullish or bearish? (6) dark bicyclist unifier continues to climb in the prob of winning. a hypothetical: if the R's lost the senate and house in November, the market would have its greatest rise ever. the worse the market looks, the better it is for the future - the more agrarian the mojo, the better it is.

Sep

16

FedEx prior one day 10% down moves since 1980, from Kora Reddy

September 16, 2022 | Leave a Comment

Below the historical FDX down moves of more than 10% in one single day, since 1980:

Sep

16

Federer adieu, from Duncan Coker

September 16, 2022 | Leave a Comment

Market declining in sympathy with announced retirement. I was lucky to see him play on several occasions. A great player and a great gentleman to the game. What a backhand, and what a forehand, serve, volley, footwork, strategy and touch.

Alston Mabry adds:

Farewell address, very classy.

Bud Conrad agrees:

Yes. Classy.

Laurel Kenner recalls:

My tennis teacher knew him and said he never swore.

Sep

16

Talking with strangers, from John Floyd

September 16, 2022 | Leave a Comment

Talking with strangers is surprisingly informative

"anybody knows more about something than you do"

Significance

Conversation can be a useful source of learning about practically any topic. Information exchanged through conversation is central to culture and society, as talking with others communicates norms, creates shared understanding, conveys morality, shares knowledge, provides different perspectives, and more. Yet we find that people systematically undervalue what they might learn in conversation, anticipating that they will learn less than they actually do. This miscalibration stems from the inherent uncertainty of conversations, where it can be difficult to even conceive of what one might learn before one learns it. Holding miss-calibrated expectations about the information value of conversation may discourage people from engaging in them more often, creating a potentially misplaced barrier to learning more from others.

Zubin Al Genubi agrees:

I've noticed people don't listen well. They often like to talk. Its good to listen and encourage others to talk and they think you are a great conversationalist. As Yogi Berra said, Listen and its amazing what you can learn. I have some good ideas but no one listens to me.

William Huggins adds:

2018's Nobel in econ went out (in part) for the endogenous growth theory, which posits that a good part of economic growth that isn't "more people" or "more kit" comes from the positive externality associated with education. Romer basically says that once someone learns how to do something better, we gain by having them tell us about it. people uncomfortable with updating their beliefs might avoid conversation and lose out as a result (value of keeping an open mind?)

Nils Poertner writes:

deep down it is probably that we are so excited about our own ideas (whether adequate or not) - that we often over-sell it to ppl in our own social circle. mea culpa. whereas with strangers it is often more a light touch - or an encounter that lasts a few minutes only and this lightness creates a magic…and a sparkle and that is all that is needed sometimes.

Gary Phillips expands:

I've always been a gregarious person, not because I am socially needy, but because I often find conversations with strangers to be an edifying experience. Quite instinctively I gravitate to the following people:

1) smarter / better educated individuals - if you're going to converse with someone, you might as well learn something. I love talking with my friend David, who is a Lubavitch rabbi. His knowledge of the Talmud is extraordinary, and its analogs to trading are remarkable.

2) older people - experience has given them a rational perspective on life and insights that are invaluable. My favorite encounter was with Lou Lesser, a L.A. real estate developer who was 93 when I picked him up in Beverly Hills and drove him to Laguna Beach. He regaled me with stories about his life, including personal experiences with Marilyn Monroe, John Kennedy, and Mickey Cohen. It was a ride I'll never forget.

3) tourists in the U.S. - talking with a 2 young ladies from Kyrgyzstan I met at a local bar in Chicago. Extremely intelligent and well educated, they were extremely critical of the lack of education and sophistication of the average American. They were completely shocked by Americans' lack of knowledge and ignorance of what lies outside of America. I was the only American they had met, who had heard of their country. Nevertheless, while they were very cynical, they were also beautiful, charming, and thoroughly engaging.

4) people from diverse and varied walks of life- if you are seeking a diverse experience with people of varying levels of social status, there's no place better than the joint. My 30 days spent incarcerated in the Montgomery County Correctional facility was not necessarily entertaining, but it was certainly educational. There's not much street cred to be earned jacking an O.G., so I was afforded a level of respect, and was able to engage and befriend various inmates, from incredibly disparate backgrounds and lifestyles.

5) people you meet while travelling- my favorite aspect about traveling is the ability to meet a wide variety of people. I have a tendency to let my guard down while traveling, and open up even more than usual. recent trips to Japan, Mexico, and Crete were made all the more enjoyable because of the people my wife and I interreacted with and met.

Kim Zussman responds:

Typically internationals - especially Europeans - look down on Americans in this way. As if the prize is not what you own but what (or who) you know (especially in France).

Funny thing is that in most countries outside the US wealth-generation efforts are futile because of huge governments and massive corruption. At least if smart people aren't allowed to become rich at least they can become educated, cultured, and erudite. Their educated-but-poor status is a consolation prize, and when they are here there is envy.

In the USSR the only wealthy people were in government or military - which is the same now with the addition of para-governmental oligarchs. You can be talented and work like the devil but if you're not connected you have to settle for Dostoyevsky and Dugin.

The problem with America is that, for the most part - less so in recent years - the main limit on your personal success is yourself. This is not very compassionate (elevation of failure), and is the fuel of socialism. We are ugly Americans for not expending formative decades on poetry, languages, and philosophy - but allowing people to compete in a quasi-free economy.

Pamela Van Giessen writes:

There are interesting people wherever you look for them. Especially in this day and age, no one place has a monopoly on interesting and clever.

Larry Williams agrees:

And they don’t have a clue where our state and cities are. Snobs for the most part Europe is not superior to much of anything other that Italian wine and food. It’s a worn out old lady that was beautiful in its day.

William Huggins asks:

Any Americans here happen to read Gustavus Myers America Strikes Back (1935)? He had a pretty savage takedown of European elitists that's heavy on economic history and well referenced. Much of the sentiment here echoes his charges.

Stefan Jovanovich notes:

Disdain for Americans at home and abroad is the oldest of all cultural traditions. It has survived the death of beaver hats, bustles and whist and shows no signs of decline. I think the scorn for Americans here in their own country has its root in bewilderment - how can all these fat stupid slobs have made their language and money the world standards for communication and exchange? Beats me.

Boris Simonder suggests:

A test would be to survey domestic population on domestic locations of cities/states. Who would do better since you mention location of cities/states? Jay Leno has some clips from his Walk of fame episodes.

High quality cars Larry, at least fossil, although EVs and H2 is up-coming and leading. Telecom networks, Beer, furniture design, clothing designs, Handbags/Cases, Trucks, Industrial/Electrical Machinery/Equipment, Pharma, Mineral fuels, Plastics, Optical/technical medical apparatus, Iron/Steel, Organic chemicals, Insulated wire/cables, Optical readers, Centrifuges, Electrical converters, Auto parts to name a few high value exports. EU accounts for approx 30% of total global export value. Just a tad more than Italian wine and food.

That old lady still has some of the most beautiful ones. Go visit Norway again.

Larry Williams responds:

I'll take the food! You can have the handbags and such.

Sep

10

Mysteries, solved and unsolved

September 10, 2022 | Leave a Comment

every morning I wake up to another solved mystery where Sherlock Holmes applies the powers of deduction and observation to solve another crime thinking backward to see what chain of events led up to the current crime scene. I try to apply that same reasoning to the market.

what led to the amazing rally in crude today and the hyperbolic rise in S&P from 3900 at 9:A.M EST on wed sep 7? it had to be the rising prob of the dark bicyclist winning the 2024 election to 15% from 11% a few days ago.

Victor Hanson says the reason is the increasing woke everywhere. He details 10 examples of this in his current. as I have mentioned many times, the more woke it is the more regulatory capture there is. the big corps, the prof leagues, the Ivys are ecstatic.

nobody asked me but…why is the tall chair Volker lionized for fining the economy by raising rates to 18% in his tenure and trying to make the world free of technology and innovation and growth? No wonder the current chair tries to emulate him to the dark bicyclist's ascent.

now dark unifier at 17.2% prob same as desantis. an amazing increase. doing the rite thing for improvement in his chances and it follows the market nice 4%+ move this week in S&P and Nasdaq but strangely bonds are down 7 percentage pts at 60-day low. somehow the signaling of the bears in bonds to help the dark one are believable. the chair mite be switching his allegiance to 30-year bonds.

query: the traders instruction book is full of signals to buy grains around the new moon. has it worked for grains and others markets? someone would kindly explain this study to me:

Impact of the Moon Phases on Prices of 110 Equity Indices and Commodities

looking at the 4 years since 1996 that as of sep 15 were down for the year: 2000, 2008, 2011, 2015. the change to the end of the year was approximately -100 points with 3 of 4 down for the year. before 1996 the same qualitative expectation.

for the 11 years it was up from the beginning of the year, all were up from sep 15 to the end of the year about the same 100 S&P pts as the move when it was down for the year. note that 4 observations is not statistically meaningful.

of all the Sherlock Holmes stories, my least favorite is The Hound of the Baskervilles. however, there is some great advice for speculators in it. Lord Baskerville had made back his fortune by speculating in S. African equities. "however knowing that after a big win it is good to stop, he withdrew his money from S. Africa at the top and lived comfortably and generously in his mansion" (i paraphrased). the question of the ideal stopping point is a very good one. Certainly not at the bottom like most gamblers but perhaps not at the top.

a correlation between being the first on Yankees to kneel during the National Anthem and subsequent quitting? and Boone was his usual self in praising Hicks when he benched him. was it partly because of the kneeling?

Yankees' Aaron Hicks benched after terrible mistake leads to runs

Sep

7

Timely advice

September 7, 2022 | Leave a Comment

timely advice from 1904 Wall Street Speculation: Its Tricks and Tragedies:

By the time the insiders are ready to sell their stocks, the insiders have the public all deceived into believing that it is now just the time to buy and on the other hand when the insiders are ready once more to buy stocks, it is as easy to have the public again misled into thinking that now it is the time to sell if they would get out before the crash comes.

many persons don't have the dignity of receiving my tweets since they are held because they are not uniformly in favor of the bicyclist. the only way persons get my tweets is if I pay to promote. while I have 9000+ followers because of my payments, a normal tweet of mine will only receive 4000 impressions because the tweets are restricted. now that the bicyclist is at a max of 15% in his prob of winning, perhaps the canceling will not be as egregious.

it was a jay powell day, "green all around except in Texas." methinks he doth protest too much as do the colleagues especially now that they see the bicyclist has the weather gage.

Sep

6

Biases, useless information, and grace

September 6, 2022 | Leave a Comment

by the way, unlike the contrived biases of the Harvard pseudo-stat, master of self-fulfilling questionnaire to college students, the stock market shows real biases. one is the tendency to take small profits after a big loss. all who sat thru the depression succumb.

free associations: 37-day low in S&P at 3941 (july 18, 2022, was 3811), fake hecklers, blood red, 2 marines, unifying, semi, amnesia, founder of regression, senate prob of 38%.

application for drs. these days: "what have you done to stamp out and reverse?"

a good essay query for incoming students: compare and contrast the post-game interview of the home run champion with the beaten female star. pay particular attention to the compliments to competitors and teammates. what is the signif of this for market and crime?

Sherlock Holmes has numerous gems of advice for market people. My favorite is how he discards useless knowledge for useful ones. Let us not allow the useless to crowd out the useful ones. In this he was very similar to Emanuel Lasker the champion chess player of Victorian times.

How does this apply to markets? remember when the whole world is giving you one reason after another to sell like now and symbolized by El Erian and the always-bearish former mayor's news and data service - remember how the old time cliques worked. when they wanted to accumulate, they fed the newspapers and important players bearish but very persuasive news. and when they wanted to sell, the opposite. what is the solution? discard the ephemeral and concentrate on the 10,000-fold a century drift - especially when the market is at a 30 day minimum.

Lasker like Sherlock never studied opening games or book games as it crowded out his creativity during games. I hated to get coached in between racquet games as it dampened my free style.

Sep

3

Tiger Management founder Julian Robertson dies at 90, from Nils Poertner

September 3, 2022 | Leave a Comment

Tiger Management founder Julian Robertson dies at 90

I enjoy reading obituaries because there is a series of events that we use to describe a person - at the same time there is this internal rollercoaster of emotions going on - which we never know.

Alston Mabry adds:

From the NYT obit:

“I had become convinced that the hedge fund was the way to invest,” he

recalled, and that short-selling was “a license to steal.”Mr. Robertson prospered, but in the mid-1990s his performance grew

ragged amid the mania for untested dot-com stocks. Investors withdrew,

and in 2000 a baffled Mr. Robertson, his strategy no longer working,

closed shop.“There is no point in subjecting our investors to risk in a market

which I frankly do not understand,” he told investors.In a 2004 biography, “Julian Robertson: A Tiger in the Land of Bulls

and Bears,” Daniel A. Strachman quoted Mr. Robertson as saying, “The

mistake that we made was that we got too big.” This meant, he added,

that “to make it meaningful we had to buy a huge amount of a company’s

stock, and there were only a few companies” where that was an option.

Easan Katir remembers:

While on a road show pitching a private equity deal in 1989 I recall a rendezvous Dean Witter had arranged at Tiger Management. I briefly chatted with Julian. He handed us off to a few of his cubs for the meeting. RIP, Julian.

Sep

3

Reading upside down, from Zubin Al Genubi

September 3, 2022 | Leave a Comment

I was reading upside down to a grandkid today. Its an interesting exercise. Requires a mental readjustment. I recall some people looking at charts upside down. They are not the same. The Beatles and Jimi Hendrix used to play recordings of guitar played backwards. Bach used palindromic music. Also an interesting effect requiring a mental shift. This kind of exercise is good for the mind.

Alston Mabry responds:

In learning science this is called "disfluency." If one group reads some material normally, and a second group reads it upside down, the second group will have significantly better retention of the material over any given time frame. It's been done with things like normal type vs funky, hard-to-read type, as well as clear type versus fuzzy type. The group that struggles more mentally to read the material demonstrates greater retention.

Zubin Al Genubi adds:

In the book Why We Sleep he says a full night's sleep after learning helps retention by over 40% over all night crammers.

Nils Poertner writes:

reading a text upside down can have other positive effects, eg:

1. pay attention to the white between the black ink letters,

2. then turn it right again and read the text

3 reading is then typically easier

we all learn to read letter by letter. "w" "e", too, but overtime we tend to rush things and want to grasps whole words and lines but vision is all about habits and a lot more than reading a text.

smart phones support bad visual habits , as one is tricked to look at the whole text at once - but we need to practice the art of looking at details -at least from time to time, too, and to remember it. we got to remember things- memorize - that gives us the speed later. and first, we got to relax the visual field /brain (looking at white spaces is just one way to achieve it- there is a lot more one could say - see Bates method uses micro print for visual relaxation- yes micro print).

Easan suggests:

The advent of inverse ETFs helps look at charts upside down, doesn't it?

Aug

30

Keeping charts by hand, an interview with Helene Meisler

August 30, 2022 | Leave a Comment

Big Al writes:

A fun and interesting interview with Helene Meisler who has been keeping charts by hand since the 80s.

Helene Meisler On What's Going On With the Stock Market Now

The Federal Reserve is in tightening mode. And there's that old adage "don't fight the Fed" which means in theory it's a bad time for stocks. And yet we saw a surprisingly powerful rally off the bottom in June. But now what? Can the market resume its ascent? Or will we return to the lows, or possibly make new lows? On this episode we speak to Helene Meisler, who has been trading stocks for roughly four decades, and who has a unique approach to analyzing the market. She draws stock charts by hand. In our chat, Meisler explains her methodology, and gives her assessment of the market right now.

Jeff Watson comments:

I still keep up my charts by hand, and I know at least 3 others on the list who do the same. Does keeping charts add value for those who partake in the practice?

Duncan Coker responds:

I would posit that the physical act of writing and drawing is beneficial. It improves focus and generates a sense of mastery and accomplishment, however small, both of which are good for trading. This is all in addition to the statistical information garnered.

Aug

30

Practical applications of counting beyond finance /trading, from Nils Poertner

August 30, 2022 | Leave a Comment

1. telling marauding children in back of a car (when on longer trips) to count number of green vehicles….and then red and so on (or let them experience boredom and don't give in and hand over a tablet).

2. for natural vision building -so ppl who lost ability to see far ahead (myopia), they would benefit from counting leaves of a tree or anything they can see - and don't worry if it is still blurry…it is getting better - coz nature rewards those who at least try….but once we believe something (that it can't get better - well, then it won't) - same for presbyopia (start counting tiny letters font size 1 btw).

counting can be wonderful for the brain and the brain is the motor that keeps it all together….millions of other applications. I wish ppl would do more counting - we are just going (as society) in the complete other direction. but the individual can escape that trend.

Vic comments:

very Galtonian who said "always count" and he kept a little pad and pricker with him at all times. counted the number of fidgets in the audience at 90.

Big Al offers:

I practice counting steps to measure distance, say around the park with the dogs, or on a hike. I count only lefts or rights (switching between the two at intervals) so that for me one "pace" is two "steps". I calibrated my pace counting against a wristband GPS and found that a mile is about 1100 paces for me.

Another practice is to count breaths, on the exhale, following the breath with one's attention. It is focusing and relaxing. One can calibrate one's breaths to measure time.

Nils Poertner writes:

love that counting for breathing - it is not that the drama outside does not exist, but in order to see things more realistically and go with probabilities also for trading… one better improve own mental health….. and many people (not just traders) are so fickle.

eg one of my trader friends would call me in the middle of the night and leave a voicemail that this and that is going to happen since he saw it on TV - mostly pictures that have a strong impact on his amygdala…

Zubin Al Genubi adds:

I count breathing 5.5 seconds in, 5.5 second out, 5.5 breaths a minute, and 5.5 liters per breath.

Andrew Moe writes:

I count seconds during cooking, particularly when operating on multiple dishes simultaneously. Also count seconds when trying to squeeze out an extra minute or two in the sauna.

Duncan Coker notes:

Watering the plants with a garden hose. 10 seconds about half gallon with my

sprayer.

Aug

29

Hedging the minutes

August 29, 2022 | Leave a Comment

H. L. Mencken's ideas very relevant now: "Every election is a sort of advance auction sale of stolen goods."

Heard on racquetball courts at Jackson hole: "how do we pretend we are harsh on inflation without hurting the big guy?" correction. lost in time. only pickle ball and paddle now. racquetball going to zero play. play in Jackson Hole is golf.

"when i came back to the Fed i saw that they needed a published paper by a senior guy to say that they shouldn't pay attention to economic models" (saying to worry about recession - a typical comment from the bearish former mayors site).

all smiles at Jackson Hole. "have to help that man." especially now that senate is a lock. crude takes a break. went so far as to edit dissenting opinions out of the official minutes of its meetings. one queries if the minutes of the FOMC are manipulated this same way to stop the "bad brash man."

But the ex-Chancellor also points to a failure to understand the scientific models they were being fed. How true of many supposedly quasi-scientific conclaves and minutes.

Some virtual definitions. a Texas Hedge: long stocks and crude. a new mexico hedge: long crude and long bonds. a Baron Coleman hedge: long stocks, bonds and crude. a Powell hedge: long stocks and bonds. what else do you propose?

bullard hedge: short bonds and S&P. Interactive hedge: margin call at 3 am then reverse, after down 150 pts from 20 day high 8 days ago - we call for an interactive hedge Mon 3am.

Kerry Packer Hedge: long everything and persists in it. margin calls may already have taken their toll: possibly no longer bear.

bonds were up on 2-day and 5-day as of Friday close but S&P was down 100 big and 200 big respectively…what's the panic? we'll know perhaps on the next margin call. looked pretty hairy at 4110.

Aug

24

Payola, parties, and positive sums

August 24, 2022 | Leave a Comment

Non-Zero, by Robert Wright, shows persuasively that there is an élan vitale of history with non-zero-sum games of mutual benefit leading to sustained growth especially fomented by gains in information like printing press and internet. wright's book is another reason like the grandeur of evolution of Darwin to believe that the 10,000-fold gain a century will continue.

an interesting study: Hidden Cost of Free Trading? $34 Billion a Year, Study Says. of course the maximum is going to be greater than the average. but this is the tip of the iceberg. study should have compared to brokerages like Interactive that make money off commissions and margin calls rather than kickbacks.

From: Laurel Kenner

Sun, Aug 21, 5:25 PM

To: me

I was at a dinner party last night, with a neurologist. He said that medical people have been forbidden to use the words "sir" or "madam" for patients, and nobody knows what to call them. "Patient 6074?"

I suggested "comrade."

fellow travelers and agrarian economists all around. the more prevalent it is the better for regulatory capture and the market. amazing how none of my tweets are transmitted to an audience except when I pay $5 a follower. apparently I am on a x-list with the algorithms not knowing that whenever reg capture increases, the better it is for market.

the best way for me to approach the market is by paying attention to the interactions between the bonds and stocks. I believe that the fed is mainly interested in stocks and how that will affect the elections. rite now the S&P is down 3 days in a row and the life expectancy hazard ratios are very bullish. a former female associate of mine used to say that the Fed doesn't care about bonds because they all trade stocks. I have found that a good theme to follow even if its only true in part. But no way will they hurt their young-looking boy.

so far the Ibiza trade was rite on only 1 of 3 markets but Dr Brett told me that it gets more and more frenetic in Ibiza as the nite progresses.

My history with Victor is far more personal, as it was his influence and inspiration that brought me to financial markets nearly 20 years ago. It was then that he and co-columnist Laurel Kenner announced an online competition for the best market indicator. I had some free time in my medical school office, thanks to a couple of students who had canceled their counseling meetings, so I assembled my submission. It tracked the average beats per minute of popular music and the level of the Dow Jones Industrial Average. I surmised that we could be near a market peak, citing the growing popularity of the electronic/rave scene, as epitomized at the time in Ibiza. Victor and Laurel declared me the winner, the year 2000 did fortuitously turn out to be a market peak, and the valuable prize I collected was a visit to Victor's trading office in Weston, CT.

From: 3 Things To Learn From Market Speculator Victor Niederhoffer

ibiza not working on bonds yet. don't they realize that when long-term bonds go down, it is self-correcting because it brings economy and stocks down? and remember they have to pretend to help the young-looking bicyclist.

Aug

20

Vic’s remarks at Arthur Niederhoffer’s memorial

August 20, 2022 | Leave a Comment

Arthur Niederhoffer

1917 - 1981

Dad would love this ceremony. He wishes me to thank all of you for coming and taking out so much time from work and family. The family deeply appreciates all of the very generous contributions to the memorial fund. But he quickly adds "that's enough" and truly the tribute would be more appropriate for others here today like Alex Smith or Al Danoff or Mother; that he's just an ordinary man and he doesn't understand why so many people love him.

Aug

17

The Yankees, the fallacies, and Ben Franklin’s advice

August 17, 2022 | Leave a Comment

the Yankees fortunes losing 9 of last 10 are similar to the bear stock market people gartman and el erian. Aaron Boone's decisions are like those of the ray ban bicyclist - yet they are both in first with senate odds now almost 60% in favor of D's.

what is the best explanation for the 100% correlatioon betweeen the yankees losses since the all-star game 11 of 15 and the steady gains of the dark bicyclist in the pres odd (now up to 13.2% of becoming 47)? the degree of advocacy for social justice is paramount and at a maximum for Hicks and the GM.

Benjamin Franklin was a most admirable and accomplished man and his advice on all matters is well worth taking. His thoughts on markets rested primarily on the power of compound interest and frugality and industry leading to wealth and success.

Here is some advice he gave on exercise: there is better exercise in walking one mile up and down stairs than five on a level floor. He recommended a cold bath naked in cold air each morning and silence as a virtue that should be practice by all the young. He practiced all virtues each day and in a Galtonian way, made check marks on his favorite 15 each day to count how he was doing and develop the habit.

fallacies about S&P most harmful: (1) when an announcement in the past has been predominantly bearish but the markets since the last announcement have been bullish, go with the markets. they are at least 2 months ahead of the announcements.

(2) The alphabet agencies are peopled by fair-minded employees who will go beyond their 95% political bias to be fair. (3) a rise in the prospects of the ray ban bicyclist party is bearish. (4) a big decline in bonds overnite is bearish for S&P. (5) a decline in crude is bearish for S&P. (6) an overreach by law enforcement is bearish for S&P.

(7) the professional sports leagues are all in what they espouse. (8) a 50-day high in S&P is bearish. (8) El erian and the congo dancer can be followed with profit.

(9) a bear market in S&P or NASDAQ is bearish for the future (10) you can make money in markets by going for a 1/2% swing. (12) the public get a much better deal because of HFT.

(13) the degree of followership and notice on social media is related to the intrinsic interest in its content.

(14) the minutes of Fed meetings are bearish for S&P when there has been a big rise recently.

Aug

11

Highs in markets and people

August 11, 2022 | Leave a Comment

only question is how long to all-time hi. i don't know but it looks like another big hi in 10 trading days. if bicyclist and senate continue to gain, could be sooner. you have to admire the full court press of the dark bicyclist and of course this is very bullish.

the bonds have arabesqued very quietly to a 17-day low, and crude is up 5 days in a row with stocks at a 120-day hi.

as grandpa Martin would say: Martin served as court interpreter and spoke 25 languages. he didn't like that court interpreters were paid 1/2 of court clerks so he took the exam at 70 years of age and came in second out of 5000. he was a genius. still have his old math books.

He served as controller for Irving Berlin's music firm and there he met his wife who he proposed to on first meeting her. he traded with the boy wonder and liked to buy stocks such as allis chalmers, air reduction, and american standard.

he liked to use the theory of least effort to guide his speculations. "i believe the least effort would be for stocks to go down" he would say. Having lost his fortune in the depression, he always feared a repeat and never took more than a 10% profit on any holding.

like so many others I was fortunate enough to know well, I wish I realized his greatness at the time. Some unsung heroes I have not written about are the Schrade family, Herb London, and Harvey Sellers. "a kite not caught on a tree is like an ice cream cone not eaten."

Aug

11

Summer reading, from Zubin Al Genubi

August 11, 2022 | Leave a Comment

I need some new books to inspire me. Suggestions? Last few science book were great.

Bill Egan replies:

Against the Tide: Rickover's Leadership Principles and the Rise of the Nuclear Navy by Dave Oliver.

Laurel Kenner adds:

Sue Stuart-Smith: The Well-Gardened Mind: The Restorative Power of Nature

William Logan: Sprout Lands: Tending the Endless Gift of Trees

Thomas Sowell: Black Rednecks and White Liberals

Michael Brush suggests:

The Gene

The Emperor of all Maladies

Why We Sleep

Henry Gifford offers:

Buildings Don’t Lie, Better Buildings by Understanding Basic Building Science: The movement through buildings of heat, air, water, sound, fire, light, and pests. By…well…Henry Gifford!

Big Al recommends:

Prime Obsession: Bernhard Riemann and the Greatest Unsolved Problem in Mathematics

The Seven Pillars of Statistical Wisdom

The Biggest Bluff: How I Learned to Pay Attention, Master Myself, and Win

Re Riemann, 3Blue1Brown has a great bit to enhance the visual:

Visualizing the Riemann zeta function and analytic continuation

A reader writes:

Major Transitions in Evolution: Maynard Smith & Szathmary

Indra's Pearls: Mumford + Series + Wright

Coe/Stone: Reading The Maya Glyphs

Fred Schwed: The Pleasure Was All Mine

Japanese Tales: Royall Tyler

African Folktales : Paul Radin

Ernst Haeckel : Art Forms from the Abyss

Owen Jones: The Complete Chinese Ornament

Trigonometric Delights : Eli Maor

Voices from the Whirlwind - Fenc Jicai

The Cowshed - Ji Xianlin

Rural Worlds Lost - Jack Temple Kirby

Paolo Pezzutti enjoyed:

Relentless Strike: The Secret History of Joint Special Operations Command

Laurence Glazier adds:

Emily St John Mandel, Sea of Tranquility. Sequel to her earlier The Glass Hotel, which was partly about a Ponzi scheme.

And Brandon Q. Morris, physicist sci-fi writer.

Peter Krupp writes:

Here are two science books that I found fascinating focused on quantum physics written by one of the great contributors to the quantum theory of computation, David Deutsch.

The Fabric of Reality (quantum theory - many world interpretation, quantum computation, epistemology, and much more).

The Beginning of Infinity (the nature of scientific progress, how it has accelerated in the past few centuries).

Aug

10

Baseball, bears, and bicycles

August 10, 2022 | Leave a Comment

young-appearing bicyclist up to 12.6% chance of victory and his party now 53% to take senate. regulatory capture looks good. the dark bicyclist pulling out all stops to suppress competitor like brumfield.

Joe Torre says the most important thing for winning baseball is to adjust to new conditions. same is true in markets. Elmer Kelton says same thing.

el erian, ms. meister at max of bearishness. only up this much at 930 11 times since 2011. Nice kitchen talk and delphic forecast from bearish site: "i'm no economist but when I go to the supermarket i am paying higher prices."

Aug

10

The Count, from Duncan Coker

August 10, 2022 | Leave a Comment