Mar

17

A Specialist in Panics, from Steve Ellison

March 17, 2025 | Leave a Comment

From the first section of:

Fourteen Methods of Operating in the Stock Market

Magazine of Wall Street, 1918

Mar

16

10% correction in S&P 500, from Steve Ellison

March 16, 2025 | Leave a Comment

Before last week, the S&P 500 index had 25 declines of 10% or more since 2003. The median of the maximum drawdowns is -14.6%.

Mar

15

The Cosmic Distance Ladder, from Big Al

March 15, 2025 | Leave a Comment

Maybe the most fundamental thread on Spec List has been counting/data/figuring things out, so here is a marvelous two-part video by 3Blue1Brown, with Terrence Tao, about how we determined various cosmic distances.

The Cosmic Distance Ladder, Part 1

The Cosmic Distance Ladder, Part 2

Additional commentary and corrections from Prof Tau

Gyve Bones writes:

This was a fascinating lunch lecture. Thank you. I first became fascinated with the story of how science and technology developed with the 1977 PBS series by James Burke "Connections" which told the story, without the aid of CGI graphics in my high school years. I was given the companion book for the series that Christmas by my very thoughtful mom. (It's also the story that launched my falling away from the Catholic faith in which I was raised, my teenage rebellion.)

Here's the episode which details how the Babylonian star tables by Ptolemy used by Copernicus were preserved from the destruction of the Library of Alexandria, found on papyrus scrolls in a cave backup library:

James Burke Connections, Ep. 2 "Death in the Morning"

Asindu Drileba responds:

Connections is so good. I really wish there was a remastered version (in HD at least). One of the things I still don't understand is how government funded broadcast corporations like PBS, BBC and DW make such high quality non-fiction films. I would go to say the have the best non-fiction documentaries. Capitalism doesn't apparently do well when it comes to making non-fiction. What makes them so good? Are they just structured properly?

Gyve Bones replies:

Here is a very well mastered set of the videos for Connections (1978).

Peter Ringel adds:

there is a Conjecture, that astronomers are the more happy and humble people. I guess, this is because, it is all so vast and relative.

Mar

14

Best review of a great person

March 14, 2025 | Leave a Comment

Nicholas Wright Gillham

A Life of Sir Francis Galton: From African Exploration to the Birth of Eugenics

Oxford University Press, 2001

Reviewed by Gavan Tredoux, August 2002

This is only the third full-length biography of the eminent Victorian scientist and polymath Sir Francis Galton (1822-1911). Remarkably, it is the first in quarter of a century. Galton was the product of a distinguished lineage, with men of marked ability in every one of ten preceding generations. He had first made a name as an African explorer and meteorologist, active in the affairs of the Royal Geographical Society. Late in life, inspired by his half-cousin Charles Darwin, he went on to found the scientific study of heritability, which soon encompassed differential psychology, anthropology, genetics, criminology, statistical methods, and eugenics. Starting almost from scratch in all the subjects he investigated, Galton invented rigorous intelligence testing, founded experimental psychology in Britain, established the scientific basis for fingerprint identification, formulated the statistical concepts of regression and correlation, pioneered early investigations of genetics, and founded the biometrical school. Financially secured by a legacy from his moderately wealthy father, he might have followed so many of his contemporaries into comfortable idleness. Instead he chose the career of a “gentleman scientist”, and would on his death endow his well-managed legacy to further research in the areas that interested him.

Mar

13

Seniors: Learn to love AI, from Laurel Kenner

March 13, 2025 | Leave a Comment

Grok 3 helped me drop my glucose from ridiculous to almost normal in one week

I started talking to Grok 3 last week about some health problems. After just a couple of sessions I came to think of AI as a super-helpful genius friend who doesn’t mind long chats, probing questions, or boring tasks.

Mar

12

A nice find at Moe’s

March 12, 2025 | Leave a Comment

The Invisible Hand, First Edition

by John Eatwell (Editor), Murray Milgate (Editor), Peter K. Newman (Editor)

Covers Smith, Bentham, Hobbes, Hume, Locke, and Mill, as well as collective action, economic freedom, individualism, and property rights.

The Highlite of a trip to Berkeley: Moe's Books

Moe Moskowitz opened the doors of Moe’s Books in 1959, and so established one of America’s preeminent independent bookstores, a favorite destination for book-loving locals and tourists alike. Now boasting an inventory of over 200,000 new, used, and rare selections, Moe’s was noted by the New York Times in 2008 as the bookstore where “those in the know still all head.” Moe revolutionized the predigital used book business by establishing buying policies that ensured a trust with his customers: the highest prices would be assured when they brought their books to his store. Moe may be gone, but his policies and store remain very much alive today.

Mar

11

More on ‘attention’, from X. Humbert

March 11, 2025 | Leave a Comment

I think a lot about how attention, like a searchlight, moves around the markets. I like, too, the simple logic that when retail investors are deciding what to buy, they have a huge array of choices, but when deciding what to sell, they are limited to what they own. (Leaving out the idea of looking at thousands of options to try to decide what to short.) Maybe index ETFs simplify this process, but then, before index ETFs we had mutual funds, so maybe not.

All That Glitters: The Effect of Attention and News on the Buying Behavior of Individual and Institutional Investors

Brad M. Barber, Graduate School of Management, University of California, Davis

Terrance Odean, Haas School of Business, University of California, Berkeley

Advance Access publication December 24, 2007

We test and confirm the hypothesis that individual investors are net buyers of attention-grabbing stocks, e.g., stocks in the news, stocks experiencing high abnormal trading volume, and stocks with extreme one-day returns. Attention-driven buying results from the difficulty that investors have searching the thousands of stocks they can potentially buy. Individual investors do not face the same search problem when selling because they tend to sell only stocks they already own. We hypothesize that many investors consider purchasing only stocks that have first caught their attention. Thus, preferences determine choices after attention has determined the choice set.

Asindu Drileba writes:

Laslo Barabasi has a model called preferential attachment. His model can simply be defined as "people usually prefer to bet on a horse that is already winning". I hear night club promoters also do this. To pull in customers, you create artificially fake long lines. These long lines make a night club appear popular, and thus make people interested in going in.

For the S&P index for example, index rebalancing algorithms are at times market cap weighted. That is, stocks with a larger cap, get more money than those with smaller market caps. Which will increase their future allocations, as their market caps grow. Retailers and others seeking "Blue chips" cannot invest in the top 500 stocks. They may focus on the top 20, which further distorts the market caps. Barabasi claims that this is partly why stock market caps have a pareto-like distribution. 20% for stocks may hold 80% of the index value market cap. (I am not saying this so what is exhibited it's just an illustration).

Peter Ringel comments:

I hear night club promoters also do this. To pull in customers, you create artificially fake long lines. These long lines make a night club appear popular, and thus make people interested in going in.

This is one of the many cognitive biases of humans. Any group over 5 attracts attention by by-passers. It even works with cutouts of >5 humans. The research papers above immediately bring my thoughts to manipulation. The searchlight is a daily reality in markets to me. But someone is holding it and is pointing it. Wyckoff style manipulation games on and on. For hundred years. I do disagree a little with the paper about retail trader as the main victim. Institutional smart money today - in one corner of the market - is tomorrows dump money in another corner. They are easily also susceptible to the manipulation games.

Mar

10

If war is a racket, where are the market gains?, from Asindu Drileba

March 10, 2025 | Leave a Comment

A few years ago, I read Brig. General Smedley Darlington Butler's War is a Racket (full text). Sample passages:

In the World War a mere handful garnered the profits of the conflict. At least 21,000 new millionaires and billionaires were made in the United States during the World War. That many admitted their huge blood gains in their income tax returns. How many other war millionaires falsified their income tax returns no one knows.

The Nye Committee uncovered some astounding information about the munitions industry, including a confession to profits as high as 800 percent.

Inspired by the book, I looked up publicly listed defense companies and marked out dates for conflicts like the Gulf War, Iraq invasion, Assassinations, Ukraine Vs Russia, Palestine Vs Gaza. While there were some blips on defense stocks, they were not that impressive. So if people say the US defense "complex" is fleecing the government, where exactly is this money going? What doesn't it reflect on stock prices?

Gold on the other hand frighteningly has so many coincidents, when it actually "predicts" aggression. The price of Gold for example went up for a moment before Qasem Soleimani was killed in a drone strike by the Trump regime. Not to mention how it behaved during the previous "Gaza - Israel" & "Ukraine - Russia" conflicts. I also found a similar observation in The Education of a Speculator:

Then, out of the clear blue, from 2 P.M. to 3 P.M., gold jumped $7. No reason for the rise, just technical buying by the funds, we were told. But that weekend, around 4 A.M. on Sunday, U.S. Navy fighter planes shot down a Libyan jet flying over the Mediterranean. This caused tremendous tension, always good in those days for at least a good run in gold. After all, nuclear war in the Mideast was now possible.

— Chapter 4, Subsection (Practical Losses)

Why is Gold way better at predicting political aggression than defense stocks?

Big Al responds:

I find the tricky thing with macro events is being precise enough with dates. Some events, like Fed announcements or other econ data releases, can be timed more precisely. With bigger, geopolitical events, it's less definite. With defense stocks, I would look at their performance in the months before the event, on the assumption that the market would be anticipating rather than reacting. As for strong reactions, look at the chart of Rheinmetall since the start of the Ukraine war and also since the US election.

As for gold, here's an interesting approach, looking at market sectors:

Navigating crises: Gold's role as a safe haven for U.S. sectors

This paper investigates the correlation between U.S. sectors and gold, and whether gold can serve as a safe haven for investors in specific U.S. sectors during the global financial crisis, COVID-19, and the Russia-Ukraine war. We use data from the Standard & Poor's Depository Receipts (SPDR) Select Sector Exchange Traded Fund (ETF) to capture the performance of the respective sectors. Our findings document that gold is a weak safe haven for most U.S. sectors. Gold is not a safe investment for energy, materials, utilities, and consumer staples. Gold does provide vital protection for financial, consumer discretionary, industrial, technology, and healthcare.

Asindu Drileba comments:

Thanks for pointing me to RHM.DE. I didn't even know the company existed. It is exactly how I expected US defense stocks to behave during the Ukraine-Russia & Gaza-Palestine conflicts.

Mar

8

Jobs, from Bill Rafter

March 8, 2025 | Leave a Comment

Despite what talking heads may say about Jobs and the current Non-Farm Payrolls Report, there are two items that suggest Recessionary times. The current (daily) Payroll Tax Receipts growth, and the dichotomy between Full-time and Part-time workers (monthly). Click on the charts to open them for full view.

Mar

6

Disruptive behavior

March 6, 2025 | Leave a Comment

Examples of disruptive behavior in animals

like disruptive behavior in markets.

yale opponent who tried to kill me - ancestors surrendered to George Washington.

Mar

5

The search for a foolproof system

March 5, 2025 | Leave a Comment

"the search for a foolproof system is in vain. there will never be a foolproof system." - vn and tw.

very good advice from bacon and all speculators and gamblers:

Some amateur players carry inconsistency to such a degree that they demand consistency from the horses, while at the same time being utterly inconsistent in their methods of play. It's not the races that beat these players — it's the switches!

Racing is simple. Everything about the game is logical and common sense and elementary. All the figuring and the mathematics and the mechanics of racing can be understood by a child in junior-high school. But the game is decked out in an endless number of minor contradictions and open switches and deadfall traps, in order to lure the average player into doing everything wrong .

If the average player — the public play — kept out of all these switches and traps, then the powers-that-be would have to make the game far more complicated in order to insure the fact that the majority of players (as we learned in a previous chapter) continue to lose and thus continue to furnish money to keep up the game.

The amateurs who play so carelessly and who fall into all the wrong switches, do not stop to consider the percentages of their rightful losses. When an amateur goes to the track and loses nine bets (eight races and a daily double) and loses all his capital for the day, he has lost many times what the percentage calls for. He has no right to lose so much. It's almost as if he did it on purpose!

- Secrets of Professional Turf Betting

and just when you are ready to give up at the bottom or top, get ready for a change.

as you get nearer the King's row, you remember all your victories vividly (whether they happened or not).

ratio of Europeans like dax to sp at an all time hi.

I remember my 6 gold rackets (an important tourney in my day where my opponent tried to kill me by hitting at my head just when he was about to lose) which reminds me of the turn around in sp today.

Mar

5

If your company is a domestic power generator like Constellation (CEG) or Calpine (CPN), the proposed Trump Administration tariffs at the Canadian and Mexican borders could help elevate gross margins. If Canada cuts off electricity altogether, additional margins may become available. While generators may benefit, US consumers will be harmed.

Uncertainty clouds northern US grids amid Canada tariff threat

Canadian premier says he will cut off electricity exports to US ‘with a smile on my face’

M. Humbert writes:

It’s my understanding that utilities are generally regulated to provide a steady ROA based return. If so, I don’t believe that they can raise their prices and increase their gross margins, as that would raise their ROA. They can raise their prices though if their costs go up (to maintain their ROA). It’s been a while since I last looked at utilities though. Am I mistaken about this?

Carder Dimitroff responds:

Yes, regulated utilities generally provide steady ROAs. However, some states fully regulate their electric utilities. Other states deregulated bulk power (wholesale power) and the generators that supply bulk power. Most population centers in the US are in deregulated states.

In the deregulated states, the title to bulk power passes to regulated distribution utilities at substations adjacent to transmission lines. Specifically, titles pass to distribution utilities at substations' step-down transformers.

Ontario supplies bulk power to unregulated states (Minnesota, Michigan, and New York). Quebec supplies bulk power to New York and New England. New Brunswick also supplies New England. All three provinces own and operate nuclear power plants. While Canadian transmission lines feed power directly to specific locations within those states, imbalances propagate to other states.

Ontario updated its strategy. They now plan to tax Ontario power exports at 25%.

Steve Ellison writes:

In this video Peter Zeihan says that a hurdle to green energy is that essentially all cost is up front, unlike natural gas plants in which only 20% of the lifetime cost is in construction, and 80% is in fuel costs over the life of the plant. So even when total lifetime cost of green energy is less than that from a natural gas plant, the higher upfront costs make financing more difficult. If true, I would guess cost recovery of the upfront expenses is also more risky in a deregulated market.

Mar

3

Computer Based Horse Race Handicapping and Wagering Systems: A Report

William Benter, HK Betting Syndicate, Hong Kong

Certain authors have convincingly demonstrated that profitable wagering systems do exist for the races. The most well documented of these have generally been of the technical variety, that is, they are concerned mainly with the public odds, and do not attempt to predict horse performance from fundamental factors. Technical systems for place and show betting, (Ziemba and Hausch, 1987) and exotic pool betting, (Ziemba and Hausch, 1986) as well as the 'odds movement' system developed by Asch and Quandt (1986), fall into this category. A benefit of these systems is that they require relatively little preparatory effort, and can be effectively employed by the occasional racegoer. Their downside is that betting opportunities tend to occur infrequently and the maximum expected profit achievable is usually relatively modest. It is debatable whether any racetracks exist where these systems could be profitable enough to sustain a full-time professional effort.

To be truly viable, a system must provide a large number of high advantage betting opportunities in order that a sufficient amount of expected profit can be generated. An approach which does promise to provide a large number of betting opportunities is to fundamentally handicap each race, that is, to empirically assess each horse's chance of winning, and utilize that assessment to find profitable wagering opportunities. A natural way to attempt to do this is to develop a computer model to estimate each horse's probability of winning and calculate the appropriate amount to wager.

William Benter (born 1957) is an American professional gambler and philanthropist who focuses on horse betting. Benter earned nearly $1 billion through the development of one of the most successful analysis computer software programs in the horse racing market and is considered to be the most successful gambler of all time.

Mar

1

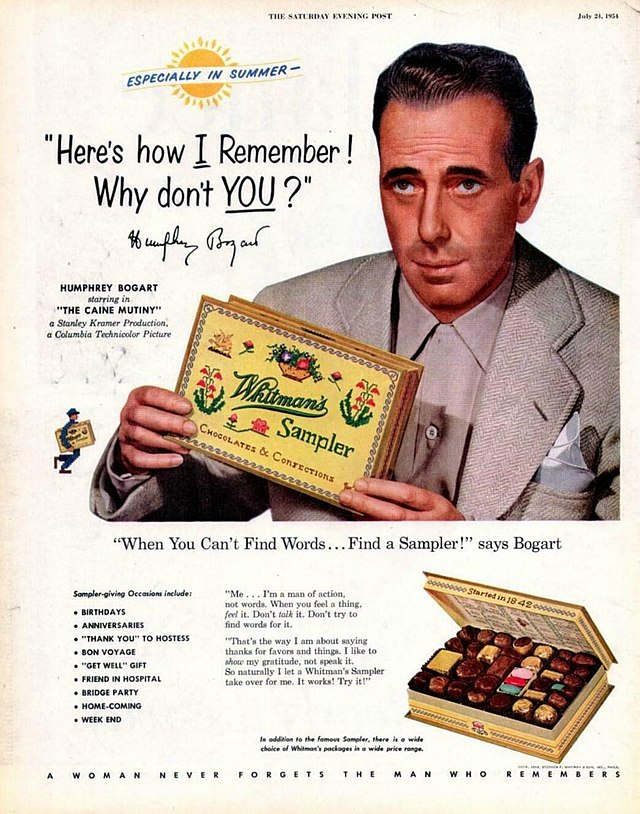

Sampler

March 1, 2025 | Leave a Comment

Carder Dimitroff points to:

Michigan’s Palisades nuclear plant nearing reopening

Michigan’s Palisades Nuclear Generating Station is one step closer to becoming the first nuclear power plant in the United States to reopen. After closing in 2022, the company that was set to decommission the plant has changed course, aided by a $1.5 billion loan from the U.S. Department of Energy to restart operations.

And a new SMR will be added on the same property in about 2030:

Michigan: First nuclear re-start is scheduled for this August

FWIW, the federal regulator (NRC) may be immune from budget cuts. Their licensing and regulatory activities are funded by the industry, not taxpayers.

Asindu Drileba suggests:

Great podcast on LLMs:

What kind of Intelligence is an LLM

[Part 3 of a 6-part series on intelligence in the Complexity podcast series by the Santa Fe Institute.]

Stefan Jovanovich finds:

The best underdog story in professional baseball in US:

The Best Underdog Story of 2025

Payton Eeles #11

St. Paul Saints

Minnesota Twins

Triple-A Affiliate

2BB/T: L/R5' 5"/180Age: 25

Feb

27

Attention Induced Trading and Returns: Evidence from Robinhood Users, from Humbert X.

February 27, 2025 | Leave a Comment

Attention Induced Trading and Returns: Evidence from Robinhood Users

Brad M. Barber, University of California, Davis

Xing Huang, Washington University in St. Louis - Olin Business School

Terrance Odean, University of California, Berkeley - Haas School of Business

Christopher Schwarz, University of California, Irvine - Finance Area

Date Written: October 12, 2021

We study the influence of financial innovation by fintech brokerages on individual investors’ trading and stock prices. Using data from Robinhood, we find that Robinhood investors engage in more attention-induced trading than other retail investors. For example, Robinhood outages disproportionately reduce trading in high-attention stocks. While this evidence is consistent with Robinhood attracting relatively inexperienced investors, we show that it can also be partially driven by the app’s unique features. Consistent with models of attention-induced trading, intense buying by Robinhood users forecast negative returns. Average 20-day abnormal returns are -4.7% for the top stocks purchased each day.

Feb

25

Spurious correlations, from A. Humbert

February 25, 2025 | Leave a Comment

Lots of them! And with AI-generated explanations.

Asindu Drileba responds:

Wow. As much as the explanations may be wrong, they logically make sense. LLMs are really getting good. I didn't know they could do this.

Gyve Bones writes:

You can do similar things with astrological cycles and events, I came to realize when I built an ephemeris for the Market Information Machine and coded macros for ways to use the data. You can curve-fit any data to some combination of sinusoidal cycloids and get a 99% correlation, which then falls apart going forward because it was indeed a spurious back-fit with no reasonable causal linkage.

M. Humbert suggests:

If you track which countries where I’ve lived, those markets always experienced a bear market. I’m currently in the US. Advise strongly that you bet the farm, take out a 2nd mortgage, and buy out of the money put options the Magnificent 7.

Feb

23

From the archives: The volatility-market connection

February 23, 2025 | Leave a Comment

Active Trader Magazine, March 2004

The Volatility-Market Connection

By Victor Niederhoffer and Laurel Kenner

Is everything you know about volatility wrong? Find out what history says about the volatility-market relationship — and what the VIX is saying about the stock market’s 2004 prospects.

Volatility is a crucial variable every market participant needs to consider. For speculators, volatility determines how much money to place on each trade relative to initial stake and stop point. For investors, it determines how much to allocate between stocks and bonds, and how much to invest for a secure retirement. For academics, volatility is one blade of the scissors in the fundamental theorem of finance — namely, that expected return is linearly related to volatility.

The article contains a sidebar that begins, "Dr. Hui Guo is one of the most respected and prolific authors in volatility research. Reading some of his articles sparked our quest." Dr. Guo was a senior research economist at the Federal Reserve Bank of St. Louis is currently at U Cincinnati.

Here is one of Dr. Guo's recent research papers:

Taylor Rule Monetary Policy and Equity Market Risk Premia

Hui Guo, University of Cincinnati - Department of Finance - Real Estate

Saidat Sanni, University of Cincinnati

Yan Yu, University of Cincinnati - Lindner College of Business

Posted: 12 Nov 2024, Last revised: 6 Nov 2024

The Fed mainly uses the federal funds rate (FFR) to achieve its dual mandate of price stability and maximum employment. Recent asset pricing models argue that changes in FFR affect equity market risk premia. Consistent with this financial condition channel of monetary transmission, the Fed's macroeconomic needs estimated using the Taylor (1993) rule negatively predict stock market returns. They are also identified as a crucial equity premium determinant along with the scaled market price and conditional market variance via variable selection analyses. The linear multifactor equity premium model has remarkably stable predictive power, outperforming machine learning and other prediction techniques.

Feb

21

Good day(s)

February 21, 2025 | Leave a Comment

A good day -1.6% to start another break of all-time hi with dax and bonds moving to great support and foundation.

Those were the days:

NY Squash Legend: Victor Niederhoffer, Storied American Player of the 60’s and 70’s

And Steely Rival to International Legend Sharif Khan

A five-time winner of the U. S. Nationals and one of only seven American-born players to capture the most coveted crown of hardball squash, the North American Open, Victor Niederhoffer is very near the top of the list of squash’s most significant figures and intriguing personalities. His rivalry with Sharif Khan during the mid-1970’s defined that crucial era in the sport’s evolution and played a determinate role in the formation and rise to prominence of the professional hardball tour that had such an impressive run in the following decade.

Part of what made Niederhoffer’s ascent to the top echelon of the sport so compelling is the degree to which his background and self-presentation differed from the norm during the era in which he competed. Unlike the large majority of America’s best college and amateur players—almost all of whom by the time they entered college had learned the game either in junior programs at exclusive private clubs or while attending prestigious New England prep schools (and in many cases from fathers who themselves had been active squash players)—Niederhoffer, the son of a Brooklyn cop, had never played squash prior to entering Harvard in September 1960. His sole previous exposure to wall games had been to those that were played at the Brighton Beach Baths, a sports complex located near the Niederhoffer's home near Coney Island. This complex featured more than 20 one-wall handball courts and was known as the mecca for that sport.

Feb

21

Spec sampler

February 21, 2025 | Leave a Comment

Asindu Drileba recommends:

The Count of Monte Cristo was my favourite movie of 2024. I would recommend it to specs as it has a very interesting stock market trading segment. The stock trading segment was brilliant in that it incorporated ideas from poker (previously discussed in this list). It's also a good demonstration Howard Mark's "Second level thinking", and the use of deception in the market.

Also, the best description of the Fourier transform I have seen so far.

Jeffrey Hirsch is on IBD:

How To Trade Trump 2.0 And Why DeepSeek Is Not The End Of The AI World | Investing With IBD

Big Al offers:

Humorous and with many lessons:

How I Helped to Make Fischer Black Wealthier

Jay R. Ritter, Cordell Professor of Finance at the University of Florida

Hillary Clinton wasn't the only person who made money speculating in the futures market during the late 1970s and early 1980s. A lot of finance professors did, including me. However, I used a different strategy than Hillary. Following the advent of stock index futures trading in 1982, many finance professors started playing the turn-of-the-year effect. The most popular approach was to buy the Value Line futures and short the S&P 500 futures. This is what I did. Of course, if there is easy money to be made, prices should adjust as the market learns, and a perpetual money machine will cease to exist. But I figured out a way to still make money. Or so I thought. Unfortunately, there was an unexpected danger in my strategy. In 1986, Fischer Black of Goldman Sachs figured it out and took me to the cleaners.

Feb

19

Finally, an ATH, and The Origins of Value

February 19, 2025 | Leave a Comment

Finally an ATH after 20 days of feinting and following the intellectual and second handed who hate Wealth.

The Origins of Value: The Financial Innovations That Created Modern Capital Markets is a beautiful and informative book that traces the development of all current financial instruments and institutions to their origins especially in Holland in the 16th century.

From the invention of interest in Mesopotamia and the origin of paper money in China, to the creation of mutual funds, inflation-indexed bonds, and global financial securities, here is a sweeping survey of financial innovations that have changed the world. Written by a distinguished group of experts - including Robert Shiller, Niall Ferguson, Valerie Hansen, and many others - The Origins of Value traces the evolution of finance through 4,000 years of history.

the chapter Origins of the NYSE by Richard Sylla is the best illumination to the forces that led to American Capitalism from the 18th century to today, completely enthralling and informative. The whole book is one of the best I've ever read of the thousands I've read on this subject.

Feb

19

Strange AI twist, from Larry Williams (updated)

February 19, 2025 | Leave a Comment

We sent my 2025 annual forecast to the Copyright office. They would not copyright it saying, “it was AI generated so could not be copyrighted.” We replied it was not AI, showing why so were finally approved. This raises an unraised question about AI protection. What is/will be the law??

Asindu Drileba comments:

The purpose of AI regulation is just so the big players can build a cartel and lock in the market. This is why people like Sam Altman say they "welcome it".

Big Al gets conspiratorial:

Not to be too conspiratorial, but…

OpenAI whistleblower found dead at 26 in San Francisco apartment

A former OpenAI employee, Suchir Balaji, was recently found dead in his San Francisco apartment, according to the San Francisco Office of the Chief Medical Examiner. In October, the 26-year-old AI researcher raised concerns about OpenAI breaking copyright law when he was interviewed by The New York Times.

Peter Ringel writes:

I always suspected, that the senator is a robot. His performance is inhuman!

Your work is obviously your work. But, what if one uses AI for ones work, creations and everything? It should be still your IP. We have musicians on this list, who use AI for inspirations and research. I constantly lookup code via AI, b/c I am not a good coder. But the final script is mine. I even run AI models locally. The opensource models like Facebook's LAMA. (for an easy install, i can recommend: msty.app)

There is creativity in asking questions, to squeeze the right results out of AI. Prompt engineering is a thing.

Pamela Van Giessen prompts:

No doubt every single publishers’ lawyers are fighting the ability for AI generated anything to be copyrighted because so much AI is taking from existing copyrighted works, usually without permission or payment. Some publishers are feeding into AI programs with permission/payment (I think my previous employer, Wiley, is feeding at least some content into AI, for instance). This is a lousy deal for the authors and artists. The publishers will make vast sums, much like Spotify, and the content creators (I really hate that phrase) will get less than pennies on the dollar.

Liberals have done a great job of deflecting the real problem with platforms (omg, no content moderation or fact checking, TikTok is spying on Americans, the world will end!). The real problem with platforms is that they steal content, outright theft. And where is your government protecting you from this theft? NOWHERE.

Easan Katir relates:

I sent an unpublished manuscript to an Oxford-educated editor, asking her to edit. She asked if any of it was AI. I replied truthfully that I wrote most of it but I asked AI to add some. She declined the job, I guess making a stand: humans vs. AI. Fortunately or not, we know which is going to win.

Peter Ringel offers:

Pamela Van Giessen comments:

I imagine that the courts are going to get involved at some point. Since much AI is from existing copyrighted material, some (most?) used without permission, someone is going to challenge copyrighted AI that is really someone else’s material.

Jordan Low agrees:

precisely. i have been seeing a lot of content creators complain that their work is just automatically reworded into another article without attribution.

Update: Big Al offers an historical lagniappe:

The battle of Cúl Dreimhne (also known as the Battle of the Book) took place in the 6th century in the túath of Cairbre Drom Cliabh (now County Sligo) in northwest Ireland. The exact date for the battle varies from 555 AD to 561 AD. 560 AD is regarded as the most likely by modern scholars. The battle is notable for being possibly one of the earliest conflicts over copyright in the world.

Stefan Jovanovich writes:

The first written mention of the Battle of the Book occurs in the Life of Saint Columba composed by Manus O'Donnell in 1532. Britain did not have a formal copyright law until the passage of the Statute of Anne in 1710; that gave authors their first ownership claim to their writings. Until then the Stationers' Company had an exclusive right to all printing and publishing in Britain. The term "copyright" comes from the right a member of the Stationers' Company had to copy a written manuscript into print after the text had been registered with the Stationers' Company. The charter for the Stationers' Company was granted in 1557 by Queen Mary and King Philip, then confirmed in 1559 by Queen Elizabeth. The Company had the authority to seize "offending books".

Carder Dimitroff adds:

From March's Library: Early printed books were customized with hand-painted illumination for the wealthy.

Feb

17

Very bullish

February 17, 2025 | Leave a Comment

refusal [on Friday] to go last 20 pts for a.t.h very bull.

The Mountain Shadow, sequel to Shantaram, is a set of contrived incidents of violence and corruption with made up characters. I gave up on it after 500 pages when a ridiculous financial coup involving the fictional Karla was so fake.

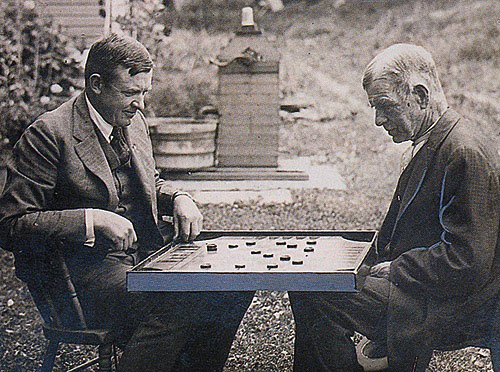

Christy Mathewson once beat world checker champion Newell Banks in a game of checkers. he liked to angle the board after a game and then review the baseball game with checkers being the players.

The Player: Christy Mathewson, Baseball, and the American Century

Feb

16

From the archives: 22 Things a Man Should Know About Trading

February 16, 2025 | Leave a Comment

1. Never try to make money the same way twice in a row.

2. Don't trade inactive markets.

3. Don't assume that the relation between your two favorite markets will stay the same from year to year.

4. Be alert to big minimums on Monday as they tend to reverse.

5. Try not to sell markets that have big drifts upwards like stocks.

6. Try to go with with the central banks.

7. Be one with the idea that has the world in its grip and be on the side of the market that will further that grip.

8. Never go for small profits as the vig is too great relative to your gain as a %.

9. Don't trade when a loved one is very sick.

10. Round numbers will be broken.

11. For example, play the yen to break 100 and the S&P to break 16000 and Apple to swing from below 400.

12. Gold has been a store of value for a long time. When it gets hit hard, think of all the people in the world and the institutions that use it for insurance.

13. Don't sell premium in the grains as they move explosively.

14. Never trade so that you exceed your margin. (You will have to get out at the close unless it moves in your favor and that makes you weak).

15. Don't listen to tips or try to follow fast moving operators as you won't know when they are going to change positions and how strong and on what basis their views are made.

16. Let your profits run after you have a big loss and get back to even sell to the sleeping point.

17. Don't take positions that you plan to extricate from in inactive trading hours.

18. After or just before a major announcement don't use limits.

19. Only buy the worst markets or stocks at the end of a quarter or year.

20. Never trade when you're out of the office or on vacation or on a whim.

21. Beware of trading when the market is going to be closed and you will not be able to extricate from your position like European markets when they close for a month around Christmas.

22. Don't short big up opens.

Okay, that's a start. Hopefully, I am more adept at this kind of thing a trader should know than I am at the things a man should know.

- posted by Vic, 29 April, 2013

Feb

14

Research on retail option trading, from Humbert Q.

February 14, 2025 | 1 Comment

Losing is Optional: Retail Option Trading and Expected Announcement Volatility

Tim de Silva, Stanford University

Kevin Smith, Stanford University Graduate School of Business

Eric C. So, Massachusetts Institute of Technology (MIT) - Sloan School

of Management

Date Written: January 14, 2025

We document the growth of retail options trading and provide evidence that retail investors are drawn to options by anticipated spikes in volatility. Retail investors purchase options in a concentrated fashion before earnings announcements, particularly those with greater expected abnormal volatility. Comparing across asset markets, we also find retail investors disproportionately trade options over stocks as anticipated announcement volatility increases. In doing so, retail investors display a trio of wealth-depleting behaviors: they overpay for options relative to realized volatility, incur enormous bid-ask spreads, and sluggishly respond to announcements. These translate to retail losses of 5-to-9% on average, and 10-to-14% for high expected volatility announcements.

Feb

13

Silver, from Anatoly Veltman

February 13, 2025 | Leave a Comment

I paused Asindu-posted link at time-stamp 1.33.30, to turn your attention to 150 years ago - when Silver first got demonetized:

The Money Masters - The Rise Of The Bankers

Below is where we are this decade, at the 90:1 Gold/Silver ounce/ounce price ratio (click to expand):

Silver has a special place in my conscience, since I lost my first million on April 28th, 1987 - having misjudged the magnitude potential of COMMODITY EXCHANGE floor shenanigans, which cost me that much in mere minutes (of failed calendar spread execution) between the Limit-up lock and the Limit-Down lock in the May contract. I then managed to recoup, and by the end of 1989 achieved my goal of heading a COMEX member firm. Memoirs aside: the above Bullish-projecting chart is nailing the fate of Silver - as one of industrial metals of today. Take the above as note of importance to listers in the commodities space.

Stefan Jovanovich gets into the history:

Silver was not demonetized in 1873. Coin continued to be minted in record volumes and used for the China trade. Grant ended the wonderful arbitrage that had made the Treasury everyone's bitch by limiting the amount of metal that the Mint had to accept for exchange. So, no more bringing silver and asking for gold when the market had taken silver lower than the ratio set by the Coinage Act and no more bringing gold and selling it to the Mint to buy China dollars when the ratio was the opposite. The ability of the Congress to issue money was voided by ending all presumption that Federal debt could be legal tender. Greenbacks had to be exchanged for coin whenever presented to the Treasury.

Those remained the rules until 1914 when the Treasury and the Federal Reserve agreed that European central bank IOUs dud not have to be cleared in coin or specie.

Peter Penha writes:

My favorite metal Silver (at these prices) and relative to Gold both for the Gold/Silver ratio long term and in Ag's natural occurring parts per million of ore in mining vs Au. Stefan’s comment about changing les règles du jeu is a reminder that it will happen again as it always does to try to hold things together.

The US Government is adding to our debt at $1 trillion every 90 days. Gold mined annually ~3000 tonnes (~1.9% of above ground reserves) * 31500 ounces * $3000 = $ 283 billion dollars worth - I trust that more than 1/2 of that gold that is mined cannot ever come to market as taken directly by the Chinese government & other central banks directly now to offset that very US treasury printing press. The silver market is 25000 tonnes a pittance in terms of nominal value of $24 billion at $30 an ounce - this is added to our national debt every 2 1/2 days.

I understand the debasement of our national currency is the upside drift in markets this list teaches as the key thing to take advantage of long term via the s&p 500 and equities, but things do sometimes get out of line on a relative value basis.

The world’s 3rd largest producer of Silver is Peru (after Mexico and China) and iI read somewhere as part of a let’s move off the USD for trading commodities, that Peru as part of the construction of the giant deep water port north of Lima built by China/COSCO (with it's potential dual military/commercial use) has agreed to send all its physical silver output to China for processing.

Stefan Jovanovich comments:

I am not qualified to assess the usefulness of The Money Masters documentary to traders. Its description of the 19th century assumes that there was a continuing debate after the Civil War over the rules for "moneyness" - the quality that gives a paper and coin its status as legal final payment - and how much the government would supply. No. On those questions Grant as President won an unconditional victory: the government would have no control over the supply other than the Bureau of Engraving being responsible for printing the notes for each United States Bank. (Grant lost that argument with Senator Sherman; he wanted each bank to have the ability to order its notes directly from the printer because he knew how the Treasury monopoly over printing would reply in a crisis.)

"Gold" would not be the only form of coined money, but the dealers would no longer have the opportunity to engage in serial arbitrage in foreign exchange. The limits on the amount of silver that the Mint would exchange were not a restriction on the domestic money supply (I look to Peter to confirm this based on the amounts of silver dollars that survive to this day). The Panic of 1893 can largely be explained by the market's fear that Congress signalling was about to return the U.S. to bimetallism for foreign exchange - at the very time when the British were ending direct currency exchanges between India (on the silver standard) and the United Kingdom whose banks cleared everything in sovereigns.

Feb

13

Update: Is Professional Licensing a Racket?

February 13, 2025 | Leave a Comment

Freakonomics podcast: Is Professional Licensing a Racket?

Licensing began with medicine and law; now it extends to 20 percent of the U.S. workforce, including hair stylists and auctioneers. In a new book, the legal scholar Rebecca Allensworth calls licensing boards “a thicket of self-dealing and ineptitude” and says they keep bad workers in their jobs and good ones out — while failing to protect the public.

Feb

12

Squeakers?

February 12, 2025 | Leave a Comment

an interesting study that shows that buying relative strength gives superior returns - consistent with all other studies on ssrn:

Relative strength over investment horizons and stock returns

do similar studies show that betting on squeaker winners in baseball and football are losers? does betting against squeaker winners work in baseballl, football, and markets?

Tom Wisell: "sometimes it is the move you didn't make that beats you rather than the move you did make."

Feb

11

Full vs part-Time employment growth rates, from Bill Rafter

February 11, 2025 | 1 Comment

Steve Ellison wonders:

Will NBER ever acknowledge there was a recession? Or maybe as in 2001, they will retrospectively announce a recession after the recession has already ended. The job market for white collar job seekers was horrendous in 2023 and 2024. But GDP never went negative. "Learn to code" is out; "Learn to weld" is in.

Bill Rafter responds:

Yes, there was Recession. If bureaucrats in power refuse to admit the obvious, or use obtuse metrics to define economic activity, then the Intelligent Man has to find another way to define or measure that activity. The chart below, of Payroll Tax Receipts Growth, matches the negative period you described.

Feb

10

Sports betting; prediction markets (updated)

February 10, 2025 | Leave a Comment

Gambler: Secrets from a Life at Risk, by Billy Walters. A spectacle of compulsive gambling in every field by a very flawed individual with a template of ever changing factors that influence football betting.

Andrew Moe agrees:

Would also recommend Gambler, by Walters - in particular for the two chapters where he details his method of handicapping NFL games. He uses a variety of factors to build his own line and compares that to the public line. The bigger the difference, the bigger the bet. Lots of quantitative factors, for example being the home team on a Thursday night game is worth 0.4 spread points. If home and away have different playing surfaces (grass/turf), it's worth 0.2 spread points. A great team coming off a bye and away is worth 1.6 points - if they are home off a bye, it's worth 1.4 pts.

Big Al writes:

I have read various pieces re online sports betting recently. I also have been listening to season 4 of Michael Lewis's podcast, Against the Rules, which is all about sports betting.

The podcast reinforces points made by others, the main one being that Draft Kings and Fan Duel weed out the winners and allow only losers to make bets. Pros try to find ways around this, but amateurs are just suckers. Also, thanks to software, the system is largely automatic.

When I compare this to markets, I think of market makers on one side, and retail traders on the other, along with the whole ecology of touts that try to get retail's attention and make you think you should be buying this or selling that.

One specific bit from the Lewis podcast I thought was interesting: A pro was talking about prop bets on individual player performance and he said that people like to see things happen as opposed to not happen, so usually betting the under is advantageous because the over is over bet.

Asindu Drileba comments:

I think the days of the bookies are numbered. I am confident the future of sports betting rests in prediction markets like Khalshi, Poly Market, Smarkets etc. The odds will be better, will change in real time, and best of all, there will be no need to kick out winners. It will be like the futures market.

Only two reasons why bookies still exist: 1. The infrastructure for these "Event Derivatives" has not yet been built. 2. Regulatory hurdles.

Big Al offers:

A very interesting deep read:

Why prediction markets aren’t popular, by Nick Whitaker & J. Zachary Mazlish:

Rather than regulation, our explanation for the absence of widespread prediction markets is a straightforward demand-side story: there is little natural demand for prediction market contracts, as we observe in practice. We think that you can classify people who trade on markets into three groups, but each is largely uninterested in prediction markets.

Savers: who enter markets to build wealth. Prediction markets are not a natural savings device. They don’t attract money from pensions, 401(k)s, bank deposits, or brokerage accounts.

Gamblers: who enter markets for thrills. Prediction markets are not a natural gambling device, due to various factors including their long time horizons and often esoteric topics. They rarely attract sports bettors, day traders, or r/WallStreetBets users.

Sharps: who enter markets to profit from superior analysis. Without savers or gamblers, sharps who might enter the market to profit off superior analysis are not interested in participating. They also largely don’t need prediction markets to hedge their other positions.

Update: Asindu Drileba remains confident:

I see the article was written in May 2024. Towards the US presidential election, close to $2B in real money was placed on Polymarket. Polymarket is extremely difficult to use (you need to buy the right crypto, install the proper wallet, just to get it working). Last year Americans spent $100+ Billion on sports betting.

Sports betting books can simply be restructured to work by having their odds computed by a prediction market and not bookies. It would also be the best way to buy insurance. On say hurricanes, earthquakes, fires. I see a lot of catastrophe insurance gravitating towards prediction markets.

If someone asked me. "What trillion dollar business is no one building?" I would respond, "A well done prediction market." Trust me, the demand is there.

Feb

9

A Plethora of Auguries

February 9, 2025 | Leave a Comment

For those who don't have a statistical mind or who have not been exposed to card games or gambling, the possibility of a random explanation for many phenomena is hard to grasp. Simply put, what we observe in real life is a sample from a population. Even if the sample is random, the mean of the values observed from the sample is likely to differ from the population mean. The differences observed for many market phenomena are merely due to sampling variations resulting from the large number of samples taken and the high variability within the population.

Consider, for example, the world famous Superbowl indicator. Germany watches it like a hawk. If the winner of America's Superbowl is a team that hailed originally from the NFL, the signal is bullish. If a team originally from the AFL wins, the signal is bearish. The moves in stocks in the 12 months following the NFL and AFL wins are enumerated and summarized in table 3.3.

The results are striking. The total change in the DJIA during the 12 months following victories by teams originally in the NFL has been 4412.08. The average change is 259 Dow points. During years when AFL teams were victorious, the total DJIA change has been -7.3. Reviewing the average ranks of changes in the Dow with respect to the two origins of winners, it turns out that differences as large as these could be explained by chance only once in 300 occurrences. But how many different sporting events could be served as a benchmark predictor with equal plausibility? The World Series, the NBA Championship, the NHL Stanley Cup, the New Year's Day bowl games, or the won-lost record of the Chicago Bulls or the New York Yankees over a single season? Each of the winners might provide an independent prediction of the Dow. Reformulating the question: Since 1967, what are the chances that, in five major annual sporting events, the win by one of the 10 competitors will be associated with the DJIA's rising at least 250 points in that year? The answer, determined by simulation, turns out to be about 1/2. And if not predictive of the Dow, how do bonds match up with the winners?

The Superbowl analysis shows why the random walk or efficient markets model is often consistent with many of the effects found by technical analysts or the more dressed up retrospective anomalies of the academics.

When people ask me whether markets are random, I feel as I did when people asked me who, in my opinion, was the best squash player of all time. "Jack Barnaby, my coach," I always replied.

- The Education of a Speculator, pages 78-82.

Feb

9

A biography of Jay Gould, from David Lillienfeld

February 9, 2025 | Leave a Comment

American Rascal: How Jay Gould Built Wall Street's Biggest Fortune, by Greg Steinmetz

If you needed to pick out major figures of the Gilded Age, such characters as Rockefeller or Carnegie immediately come to mind. If you were in the midwest, you might include Armour in that list. When I was growing up in the 1960s, Jay Gould might have gotten a mention, but chances are good that he certainly wouldn't have been the first to come to mind. This is unfortunate, insofar as Gould was one of the wealthiest Americans of his day, leaving a fortune of some $75+ million in the 1890s. While some like the Vanderbilts (arguably with a greater net worth) succeeded in one major industry in railroading or Carnegie in steel, Gould's success was in multiple industries, including railroading, telecommunications (think Western Union), finance, and fashion (his early success was in leather goods). Gould not only had an impact in these industries, his actions had national impact, triggering panics, new means of communication (not the technology so much as the scale), political scandals (one of the more stark scandals of the Grant Administration, though that's probably subject to some argument), and even the manner in the US financial world grew on the world stage (though surely not at the scale that JP Morgan or Jacob Schiff did). He left an indelible mark on the United States during a crucial time in its immediate post-Civil War period as the industrial revolution was taking hold in the US.

Steinmetz offers a brief, easy-to-read biography of Gould. Some might argue it's a little too easy to read. It is definitely more of an overview than a deep study of the financier that was Gould. Gould was one of the foci around which some of the more colorful scoundrels that defined Wall Street in the post war period assembled. Daniel Drew, for instance, or Jim Fisk as another. The problem with this biography is that it is good only as an overview. And if that's what you seek, it functions perfectly well. But as Steinmetz did with his biography of Fugger (The Richest Man Who Ever Lived), there's just enough meat to do more than whet the appetite.

If you would like to learn more about the Erie War, there's The Scarlet Woman of Wall Street - not light reading but a tad more insightful than Steinmetz. Or the first Black Friday, when in 1869, Gould tried to corner the gold market, and had all the success that the Hunts would later experience in trying to do the same with silver a century or so later. Steinmetz gives just enough to whet one's appetite, but not enough that one is casting about looking for something meatier. Gould was the force behind Western Union's dominance of the telegraph industry, the world's first internet. He was one of the creators of an empire of transcontinental railroads, as well as elevated local train transit in New York City. Any one of these could be the subject of an in-depth study, but Steinmetz doesn't provide enough to forestall someone from having to consult another book or two.

Some might say that Gould epitomized the Robber Barons on the age, but he actually had little use for any sort of cabals. Sure, he appreciated a monopoly as much as any, but like Commodore Vanderbilt, with whom he waged war of a sort during the Erie War, he ran his businesses with a focus on profitability without necessarily having a monopoly or oligopoly. There are some instances where Gould drove the price of the product down, not hiking it. In building his empire, he demonstrated a shrewd sense of timing and of the anticipated direction of human events.

Jeff Watson writes:

I enjoyed that book. Here’s a lagniappe:

Dark Genius of Wall Street, from Jeff Watson

Stefan Jovanovich adds:

People liked him, and he was - until facial neuralgia destroyed his looks and tuberculosis robbed him of his general health - a charmer.

In 1879 Thurlow Weed said this about him: “I am Mr. Gould’s philanthropic adviser. Whenever a really deserving charity is brought to my attention, I explain it to Mr. Gould. He always takes my word as to when and how much to contribute. I have never known him to disregard my advice in such matters. His only condition is that there shall be no public blazonry of his benefactions. He is a constant and liberal giver, but doesn’t let his right hand know what his left hand is doing. Oh, there will be a full page to his credit when the record is opened above.”

Feb

7

The wisdom of Wiswell, the effort of Carnegie

February 7, 2025 | Leave a Comment

As we get older, we remember all our victories whether they happened or not. -Tom Wiswell (and many older men).

T.W. again: At 83, I've lived life. I've done my work. Now I will take my hat and go.

Andrew Carnegie: A Hero of Capitalism

Andrew Carnegie’s life, if conceived by an imaginative novelist, would be difficult to believe. It is perhaps the greatest example of an individual rising from “rags to riches” via talent and productive effort, a rise enabled by the essentially free market system of 19th-century America.

Feb

7

The Licensing Racket, from Humbert Q.

February 7, 2025 | Leave a Comment

The Licensing Racket: How We Decide Who Is Allowed to Work, and Why It Goes Wrong

by Rebecca Haw Allensworth

A bottom-up investigation of the broken system of professional licensing, affecting everyone from hairdressers and morticians to doctors, lawyers, real estate agents, and those who rely on their services.

Pamela Van Giessen writes:

When my dad was suffering from dementia and it was too stressful on him to go places, I called in a podiatrist to take care of his feet and toe nails. I asked the doctor if he could also clip my dad’s fingernails, at least on his right hand which suffered constant trembles from a stroke. I did not feel confident doing it with the tremors.

The podiatrist informed me that he was not licensed to clip fingernails. I asked who was licensed and was told that in IL only manicurists and nurse aids in care homes can clip fingernails. I asked him if he thought it would be a good idea to take my dad to a manicurist (or have one come to dad) given his tremors. Dr said “no, and probably no manicurist wants to trim your dad’s fingernails.”

I called the state licensing board to complain and was told this rule existed for a good reason to protect people like my dad. I told them that this was absurd and not protective of anyone except this bizarre bureaucracy. I was told that I was being disrespectful and they hung up on me. Fortunately the podiatrist took pity on the situation after seeing my dad and broke the rules.

Licensing (and certification) is a racket. It is meant to keep some out and it is also a lucrative racket for states, licensing boards, and non-profit organizations. The CFA Institute makes over $275M annually on the CFA certification (and it costs less than 1/2 that to administer the program).

Sushil Rungta comments:

Agreed! Licensing is a racket and in many instances, unnecessary. Often, it is nothing more than a means to generate revenues for the licensing authority!

Rich Bubb writes:

I completely agree with the 'license Non-sense' of some (ahem) rationales. My basic take is that if some institute was involved, they were rarely better than learning-by-doing types (eg., me). When I was working thru attaining six sigma black belt (SSBB looked good on the resume), the major quality name (withheld) institution was over-hyping their SSBB program only as some sort of easy-to-attain achievement, [but] with their seminars/classes/literature/mentors/videos/etc., only. Truth to tell, I knew so-called 'withheld-name'-SSBB-certified wingnuts that knew nearly 10% of what I'd literally done already. Oftentimes by doing deep research and generally trying to learn more about More.

Henry Gifford provides the NY POV:

In New York City a plumbing license is like a license to print money. More and more work requires a permit, and therefore a license. Hire a licensed plumber for an agreed-on price of $10,000, usually the bill comes in at about double. Hire by the hour and keep careful track of the hours and you still get a bill for double. After you pay you notice the permit is not closed out (signed off by the licensed plumber), which becomes a violation on the property, and a bar to clean title at sale. Want it signed off? Maybe another $10K?

Word is that the number of licenses is fixed - they give them out only at the rate that licensed plumbers die. Applying for a license requires seven years of "experience", which is defined as being an employee of a licensed plumber - basically sons and nephews, someone with ambition who buys a van and tools and goes to work is nobody's employee, thus never can get a license. Then comes the written test.

Not long ago the written test had a drawing of all the drains in a building, with inch sizes marked next to each piece of pipe. The question required calculating how many ounces of lead are required to pour molten lead into all the joints in the drain pipes to connect them - something not done regularly for 50 years at the time of the test. The drawing was a copy of a copy of a copy, not legible - required guessing at the pipe sizes, or else buying the answer for cash.

Then comes the practical test, which not long ago required melting lead pipes together, but without the help of a propane torch or any other torch. Thee equipment supplied is a cast iron kettle and a stove - melt some lead or solder in the kettle, throw the molten lead at the joint, wipe it smooth with an asbestos rag or similar.

I know a guy who got his experience and passed both tests, but the city didn't give him a license. He went to court and sued the city, and after much time and expense finally won - hooray! The judge ordered the city to give him a license. But, last I heard, he still didn't have a license.

Other parts of the US are catching up. Most professional licenses cannot be transferred to another city. A friend of mine in NYC married a guy in Vermont who was a counselor to juvenile delinquents. His experience in Vermont was not transferrable to NY State - he would have to start all over, thus she moved to Vermont.

Does this system benefit anyone but holders of existing licenses, and the powers that be? I don't think so.

Stefan Jovanovich gets historical:

The licensing presumption goes back to the royal charters of the English kings and queens. The sovereign has the (God-given) authority to decide who has the right to practice a trade. The Saddler's Company received theirs from Edward I in 1272.

Gyve Bones writes:

Very interesting account of how the plumbers' trade operates in NYC. It reminded me of Mark Twain's account of how the Pilot's Association formed on the Mississippi River. Samuel Clemens, before he took the pen name "Mark Twain", was a riverboat pilot, and a member of the Association so he knows and tells the story well in Life on the Mississippi. He shows how at first the really good pilots avoided joining the Association out of pride and because they had such a good reputation they didn't need it. And the Association became the refuge of B and C rank pilots… at first. But Twain shows how the Association provided an information edge about the current state of the river conditions which the "outsiders" could not match, and were able to develop a monopoly once the underwriters found that Association pilots were better at avoiding claim losses.

Here's a link to Life on the Mississippi, Chapter XV which contains the story.

I think there are excellent insights in this story how any sort of trade establishes a guild system that protects the trade, creating moats to competition. We see it with doctors, lawyers, undertakers, nail salons, barbers, electricians &c. &c. ad infinitum. Lots of the work of legislatures is creating laws for these associations to institutionalize the moats with the force of law for the various guilds.

The previous chapters detail very interestingly on how riverboat pilots do their jobs, which is a fascinating context if you want a deeper dive. It's one of my favorite books of all time.

Feb

6

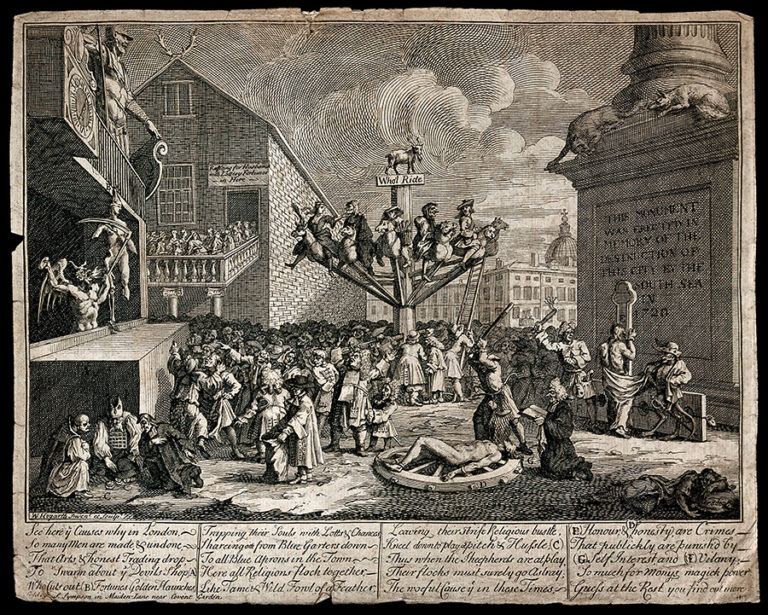

The South Sea Bubble, from Jeff Watson

February 6, 2025 | Leave a Comment

This documentary is a necessity for those interested in markets.

The South Sea Bubble - The First Financial Crash

Khilav Majmudar adds:

The South Sea bubble spared no one, even Isaac Newton! Here is a detailed paper written on his interaction with the bubble, written by a mathematician with a more-than-passing interest in the history of technological and financial manias:

Newton’s financial misadventures in the South Sea Bubble

A very popular investment anecdote relates how Isaac Newton, after cashing in large early gains, staked his fortune on the success of the South Sea Company of 1720 and lost heavily in the ensuing crash. However, this tale is based on only a few items of hard evidence, some of which are consistently misquoted and misinterpreted. A superficially plausible contrarian argument has also been made that he did not lose much in that period, and John Maynard Keynes even claimed Newton successfully surmounted the South Sea Bubble. This paper presents extensive new evidence that while Newton was a successful investor before this event, the folk tale about his making large gains but then being drawn back into that mania and suffering large losses is almost certainly correct. It probably even understates the extent of his financial miscalculations.

Humbert B. offers:

UK Natl Archives: The South Sea Bubble of 1720

Feb

4

Francis Galton’s Travel Map, from Stefan Jovanovich

February 4, 2025 | Leave a Comment

Travel times from London in 1881 (click for full view in new window):

Feb

3

Inflation and it’s Causes, from Asindu Drileba

February 3, 2025 | Leave a Comment

What causes inflation? Suppose we define inflation simply as the rise in prices of commodities, stocks, real estate etc. What causes it?

1) A generic explanation people offer (acolytes of Milton Friedman & Margaret Thatcher for example) is to blame monetary policy. Simplified as, inflation is caused by "too much money chasing too few goods."

Many people blamed President Trump's COVID stimulus packages for the rise of prices during that period. It seems specs in this list agree upon this when it comes to stock prices, i.e., lower interest rates (higher money supply) -> Higher stock prices (inflated stock prices).

2) An alternative explanation is that higher prices are caused by supply chain issues.

So they would claim that higher commodity prices were so because it was extremely difficult to move them around during lockdowns, let alone processing them in factories. A member also described that egg prices may be going up because of disease (a chink in the supply chain) not necessarily monetary policy. I am thinking that supply chain issues are more important to look at, than monetary policy.

Larry Williams predicts:

Inflation is very, very cyclical so maybe the real cause resides in the human condition and emotions. It will continue to edge lower until 2026.

Yelena Sennett asks:

Larry, can you please elaborate? Do you mean that when people are optimistic about the future, they spend more, demand increases, and prices go up? And then the reverse happens when they’re pessimistic?

Larry Williams responds:

Just that it is very cyclical— as to what drives the cycles I am not wise enough to know…though I suspect…some emotional pattern dwells in the heart and souls of as all that creates human activity—along the lines of Edgar Lawrence Smiths work.

Feb

1

The Emergence of Probability, from I. Humbert

February 1, 2025 | Leave a Comment

The Emergence of Probability: A Philosophical Study of Early Ideas about Probability, Induction and Statistical Inference, by Ian Hacking.

From Chapter 12, Political Arithmetic:

Statistics began as the systematic study of quantitative facts about the state. From 1603 the City of London kept a weekly tally of christenings and burials. Desultory records had existed earlier but a desire to know about the current state of the plague made it necessary to set out the figures in a more regular way. Most of the people 'who constantly took in the weekly bills of mortality, made little other use of them, than to look at the foot, how the burials increased, or decreased; and among the casualties, what had happened rare, and extraordinary, in the week current'. Or so John Graunt [1662] tells us in the preface to his Natural and Political Observations upon the selfsame bills. He and William Petty - whose various essays on 'Political Arithmetic' make him the founder of economics - seem to have been the first people to make good use of these population statistics.

Why did no one do so earlier? It is plausible to suppose that inference from statistics evolved slowly because there were few data, but this is not the whole story. It is true that once Graunt had made plain the value of statistics, the capitals of Europe copied London and so data became more ample. For example, Paris started its tabulations in 1667, the year after Petty reviewed Graunt's book in the Journal des Sçavans [Petty, 1666]. But plenty of data were already in existence. Annuities had been an established method of national or local fund-raising for a very long time. The records of pay-offs from annuity funds provided ample information about the population. There was a good motive to examine this data, namely to determine whether annuities were profitable to own. But no serious analysis of such material was provided before John de Witt made his presentation to the Estates General of Holland and West Friesland in 1671.

Jan

31

Varieties to species, horses to bicycles to airplanes, and round numbers

January 31, 2025 | Leave a Comment

in reading The Origin of Species yesterday along with Scribners 1895 concerning the evolution of the bicycle industry to cars and airplanes I was struck with how the transformation of industries was similar to the move of varieties to species.

Having always had this mild mania for flying, I was much impressed a few years ago when some one said to me: “If you want to come as near flying as we are likely to get in this generation, learn to ride a pneumatic bicycle.” Then I began for the first time to take a serious interest in the bicycle upon which my eldest boy was so fond of scurrying around the country; and today I am only too willing to say all that I can in its favor. When one begins to tell why the bicycle is one of the great inventions of the century, it is hard to begin, because there is so much to say. A bicycle is better than a horse to ninety-nine men and women out of a hundred, because it costs almost nothing to keep, and it is never tired.

- Philip G. Hubert, Jr., in Scribners 1895.

apparently this subject has been well researched:

The Evolution of Industry 1.0 to 4.0 and Beyond

People have been revolutionizing the production and manufacturing industry for as long as mankind has been around. The changing of items being made and distributed in the home to transitioning to them being mass manufactured and distributed using machines and new technology is what we call the Industrial Revolution. There are four main Industrial Revolutions: coal, gas, electronics and nuclear, and currently the internet and renewable energy. These are also known as Industry 1.0, 2.0, 3.0, and currently 4.0. At the rate technology and knowledge is going though, is an Industry 5.0 soon to follow? If so when and what will that entail? Let’s look into each Industry and see how they have each helped shape and create the next.

the best description I can think of for the way the sp attempted to break the round at 6100 and waited to do so decisively was the way Jimmy Jacobs played handball, waiting 30 shots to hit a killer. can you think of a better example?

Jan

30

New Wiswell proverbs

January 30, 2025 | Leave a Comment

Some recently discovered proverbs of Tom Wiswell that apply to markets:

1. Often by the time the opening is over what is going to happen in the ending is already happening and cannot be reversed.

2. It isn't only the number of games you win that counts. It's the number of drawn games you don't try to win. In short, don't overplay a slight edge.

3. All the wins and draws must be in your head before they can be at your fingertips (or else how can you beat those who beat you to the price and pay 1/10 of commissions as you - VN).

4. Some players study too much and play too little. Unless you are an isolated player in the country, you should play and study in equal parts. Studying is the planning, play is the doing.

5. Games in commerce are usually won or lost in the first 10 minutes (moves). Have a good plan.

6. Take a writing pad with you and record your game. Go over the games - especially the losses - or you'll surely repeat them.

Tom Wiswell says that the greatest influences on his career were having his father reading Tom Sawyer to him.

Here is the DailySpec archive of Wiswell's proverbs.

Jan

29

From the archives: Mind Set! by John Naisbitt, from Steve Ellison

January 29, 2025 | Leave a Comment

Book Review: Mind Set! by John Naisbitt, from Steve Ellison, April, 2007

Some interesting bits:

- One trend is the continuing growth of China, which Mr. Naisbitt points out is quite decentralized: “Beijing pretends to rule, and the provinces pretend to be ruled”.

- While some fear that American culture is obliterating local cultures, Mr. Naisbitt asserts that the world is changing America more than America is changing the world, as more than 1 million legal immigrants per year enter the United States.

- In an intriguing tidbit, Mr. Naisbitt quotes Alan Greenspan as expecting private currencies to return by the end of the 21st century.

Steve Ellison updates:

That book was written in 2004, before bitcoin was invented (speaking of "private currencies"). Mr. Naisbitt is no longer with us, having passed on at age 92. The last thing I noticed him doing, in 2010 or so, was touting the emerging world as the most important story. In my opinion, A LOT has changed since then. We have macro experts on the List who would have much better insight, but I would start with Rocky's accurate prediction in 2016 that the Brexit vote was the canary in the coal mine for the post-Cold War global elite and their policies of globalization, mass immigration, and "cling[ing] to the religion and arrogance of knowing what is best for the common man — and which often also involves rejecting common sense and facts in evidence."

The decentralization of Chinese government finances is today a key reason why a massive economic stimulus from Beijing, as urged by many Western economists, simply cannot happen. The critical mass of government spending is in the provinces, and their governments are starved for revenue after the real estate bust. Christopher Balding writes frequently about all things China on X as @BaldingsWorld.

Jan

28

An anecdote which gave me a lot of pleasure

January 28, 2025 | Leave a Comment

An anecdote which gave me a lot of pleasure: Darwin wrote the origin in 1868 and in 1869 there was tremendous fervor and a meeting of 1000 people at the British Museum was called. Huxley as a defender of the evolutionists cause was persuaded to attend. Bishop Wilberforce was there. Professor Henslow was the chairman. The then Admiral Fitz-Roy, still and ardent fundamentalist was there. Darwin was absent. The Bishop spoke for half an hour and ridiculed Darwin and Huxley "but all in such dulcet tones, so persuasive a manner, and in such well-turned periods." However, the bishop showed himself to be quite ignorant of the details of Darwin's book and said, "I should like to ask Prof Huxley, who is sitting by me and is about to tear me to pieces when I have sat down, as to his belief in being descended from an ape. It is on his grandfather's or his grandmother's side that the ape ancestry comes in?"

The bishop concluded with the point that Darwin's ideas ran counter to the revelations of god in the scriptures. Huxley was reluctant to reply but eventually he said, "I am here only in the interest of science and I have not heard anything which can prejudice the case of my august client." He then demonstrated the bishop's poor understanding of Darwin's thesis and concluded with a reference to his descent from a monkey. "I asserted and I repeat that a man has no reason to be ashamed of having an ape for his grandfather. If there were an ancestor whom I should feel shame in recalling, it would be a man, a man of restless and versatile intellect, who not content with an equivocal success in his own sphere of activity, plunges into scientific questions with which he has no real acquaintance, only to obscure them by an aimless rhetoric and distract the attention of his hearers for the real point at issue by eloquent digressions and skilled appeals to religious prejudice."

The Bishop's remarks remind of chronic bear of the stock market and other useful idiots that I have not refrained from quoting.

Jan

26

Terrance Tau does a Bayesian worksheet, from B. Humbert

January 26, 2025 | Leave a Comment