May

24

Noticed Today, from Jim Sogi

May 24, 2009 | 2 Comments

The mosquitoes in Hawaii are gnarly, fast, smart. They hide behind your leg where you can't see them. They hide in the dark under my desk. They circle smelling the blood. They love fresh meat from the mainland. They're fast compared to the bombers in Alaska. They've wiped out most of the native birds.

The mosquitoes in Hawaii are gnarly, fast, smart. They hide behind your leg where you can't see them. They hide in the dark under my desk. They circle smelling the blood. They love fresh meat from the mainland. They're fast compared to the bombers in Alaska. They've wiped out most of the native birds.

Chris Cooper responds:

I live part-time in Indonesia (Bali) now, and can't say that I have found the mosquitoes to be much of a problem. Granted, where I live in the hills it is better than in the lowlands. I sometimes will spray repellant on my skin around sunset. I used to use mosquito netting over the bed, but now find it is unnecessary as long as you keep the door closed around sunset. I would be much happier if my neighbor would do something about the standing water in his rice fields, but really it's not bad at all. It's also very pleasant to sit in the open-air living room as it is getting dark and watch the local bats fly around the room looking for mosquito morsels.

Another tactic is to stay near my partner, who seems much more attractive to the bugs than I am. I don't have to be entirely unattractive to mosquitoes, I just have to be less attractive than he is.

May

22

5% Swings — Bathtub Trade, from Jim Sogi

May 22, 2009 | Leave a Comment

The market feels, looks, trades and counts like political discourse these days. Everyone either bullish or real bearish. Not much middle ground. Like a bathtub swashing its whole contents from side to side. S&P cut through 900 in the middle of the night like nothing.

May

20

Trends, from Phil McDonnell

May 20, 2009 | 8 Comments

To understand the serial correlation in a time series it is helpful to look at a simple random walk model such as:

To understand the serial correlation in a time series it is helpful to look at a simple random walk model such as:

p(t) = p(t-1) + u

where p(t) is the price level at time t and u is a random variable, the net change for the time period.

Suppose the price started at 100 years ago. Then the current price level will be the sum of all the previous daily changes plus the original 100. Over time the dispersion of the sum of these random changes will increase with the square root of elapsed time. This growing dispersion can be interpreted as a trend by one reading a chart even for a truly random price series.

As far as real markets go, we know that the daily serial correlations between changes is small and generally has tended to be negative in recent years. But it is also true that the variance of the market movement is serially correlated. In other words volatility persists. So we wind up with a slightly more complicated model where the u's in the above formula have a wandering variability.

Dr. McDonnell is the author of Optimal Portfolio Modeling, Wiley, 2008

Jim Sogi comments:

Phil has written often that price levels are serially correlated. This is a characteristic of a time series. Why is this? For some mechanical or structural reason levels are limited in the amount of their change over a given time. In markets in general, the market forces and competition of bid and ask tend to compress prices. In Globex, the 1/4 point tick and the depth prevents large jumps or moves in between trades. I posit that this is one of the basic market forces, and can be used to the trader's advantage. Globex itself as a market making mechanism has incentive to dampen wild price swings. Market makers, and stat arb traders have incentives to prevent wild price swings and big trends.

The second main force in markets is the force that overcomes the gravity, so to speak, of the serial correlation, and overcomes the structural dampening mechanisms inherent in a time series. This is described in part as volatility, or also as trending. This is the force that moves the market away from any given price. What is this force? It might be market imbalance of supply and demand much larger than the inside depth or of one day or week's trade volume as we saw this year and last. It could be underlying financial movements, changes in investor perceptions that outweigh the tendency of correlation. It might be government risk. This appears to be the balance of force between mean reversion and trending.

Another aspect of trending is the appearance of trends in a random time sequence as an artifact of the correlation and the increase or variation in volatility. This calls into question the fundamental nature of the force or explanation of the market forces as an explanation for trends.

These two forces might be quantified, and a metric used to define a trend. The serial correlation appears to be the basis for mean reversion trading for which trending is an anathema. Some trading methods utilize trending but it is problematic defining a trend. One of the problems is the existence of trends as an artifact of random time series and how to distinguish such artifacts from a fundamental move, in advance. The answer will also change with cycles.

The worst thing for a range trader is for a break out. The worst thing for a trend follower is a range. A single big move can wipe the reverter, and multiple range entries can ruin the trend follower before he catches the train. The correlation continues during a trend and results in the channel phenomenon, so this can be used to the traders advantage both contra and following.

May

19

900, from Jim Sogi

May 19, 2009 | 2 Comments

S&P crossed 900 on 25 days on the way down. And it took detours to 800 as well in the process. It's been only seven days so far on this side of the river.

S&P crossed 900 on 25 days on the way down. And it took detours to 800 as well in the process. It's been only seven days so far on this side of the river.

May

19

Arnold’s Six Secrets of Success, from Jim Sogi

May 19, 2009 | 5 Comments

Arnold Schwarzenegger spoke at my son's graduation ceremony at USC. Despite criticisms of how he governs California, he is a great speaker. His secrets of success:

Arnold Schwarzenegger spoke at my son's graduation ceremony at USC. Despite criticisms of how he governs California, he is a great speaker. His secrets of success:

1. Do what you love and want to do, not what others tell you to do.

2. Ignore the naysayers.

3. Work your butt off.

4. Don't be afraid to fail.

5. Break the rules.

6. Give back.

He loved bodybuilding, but when his mother saw the pictures of the half naked men she brought in the doctor and cried. They said: be a policeman. Bodybuilding will get you nowhere. Mohammad Ali didn't even start counting situps until the pain started. Give it all you have. There will be setbacks. All traders know this. Everyone said no one would appreciate Arnold's accent or huge build in movies.

May

11

Nobody Asked Me, But… from Victor Niederhoffer

May 11, 2009 | 3 Comments

Nobody asked me, but which recent Wimbledon champion had his role in default due to mother and daughter sanitized to win because of injury in a recent obit?

Nobody asked me, but which recent Wimbledon champion had his role in default due to mother and daughter sanitized to win because of injury in a recent obit?

As usual the bond vigilantes are close to causing a double dip, and a well deserved one at that, in the economy.

The US long bond and German Bund now both at 120 1/3 move together like love and marriage despite their differences in everything, like the S&P and Nikkei now close to the magic 1000 but still flirting with the mid 900s.

Longwood Gardens has the most fun children's garden in the world and had lines of 50 cars waiting to get into their 1500 car parking lot.

There are entire blocks of seaport communities wherever I look vacant before the boom season of summer auguring badly for the state of recreation.

A store offers 10% off to those ripped off by Madoff and another one out of business offers prices reduced by 70% in line with the cold weather of February.

The discount stores continue to do very well with all the Bob Evans and Applebees I went to with big lines outside. Thus the price mechanism works well with high priced items showing much reduced demand and low priced items increasing in line with Walmart and McDonalds performing better than Tiffany's .

The price to weight ratio pioneered by Roger Longman is a better indicator of abnormal, exceptional business than return on equity. The correlation between the price to weight ratio and subsequent return is highly negative during recessions.

The economy would have been in much better shape right now without the interventions than with them. The evidence that bank failures were highly correlated with reductions in output is due mainly to the output's causing the failure rather than the bank failures' causing the output declines.

The fears of crony capitalism that Albert Jay Nock wrote about vis a vis the Secretary of the Interior's being the most important person in the government that everyone wanted to glad hand as he twirled around like a teetotum not being able to sing the last lines of Marching Through Georgia are so resonant with the crony capitalism that is so common in Russia, the old Germany, and places and times so much closer.

Alan Millhone writes in:

Speaking of one of favorite restaurants, I took my mother to the Parkersburg Route 50 Bob Evans today for the last time as it closed for good today at 4 PM. Very unusual for any Bob Evans to ever close as new ones open all the time in America. A good book is out about the life of Bob Evans who began as a short order cook at his roadside cafe in Gallipolis, Ohio years ago. He and his wife lived on a farm in Rio Grande, Ohio and he passed away not that long ago. He gave away much of his wealth to a variety of good causes. It was sad to see today one of his namesakes close. All the workers there knew our names and we knew theirs. We will miss going there.

Jim Sogi comments:

Look at some past excesses that in hindsight seem so obvious, but at the time seemed, well, kind of high. Real estate of course seemed kind of high, but it wasn't clear the effect of the fallout on credit and bonds. The dot com bubble of course seemed high, but the fall out was bad tho contained. The premature bailout caused the real estate boom. The high teen bond yield in the 80s was outlying. Looking around now, what seems, 'kind of high'? Government spending/debt is the obvious answer. Just as crashing real estate wasn't really comprehensible, government itself crashing isn't comprehensible to many. But look at the Palindrome, the Distinguished Prof, at Russia, at Iraq, at Sarajevo, Japan, Germany, all governments that fell rapidly in recent memory. It's not so farfetched. States and municipalities are stretched. The Feds are painting themselves into a corner. The boomers are getting old. I shudder to think of the downside. To protect yourself, you have to think of the downside. What if?

Look at some past excesses that in hindsight seem so obvious, but at the time seemed, well, kind of high. Real estate of course seemed kind of high, but it wasn't clear the effect of the fallout on credit and bonds. The dot com bubble of course seemed high, but the fall out was bad tho contained. The premature bailout caused the real estate boom. The high teen bond yield in the 80s was outlying. Looking around now, what seems, 'kind of high'? Government spending/debt is the obvious answer. Just as crashing real estate wasn't really comprehensible, government itself crashing isn't comprehensible to many. But look at the Palindrome, the Distinguished Prof, at Russia, at Iraq, at Sarajevo, Japan, Germany, all governments that fell rapidly in recent memory. It's not so farfetched. States and municipalities are stretched. The Feds are painting themselves into a corner. The boomers are getting old. I shudder to think of the downside. To protect yourself, you have to think of the downside. What if?

Douglas Roberts Dimick comments:

Why Nobody Did…

All the time that Greenspan and clan where being hurrahed, I wondered about the Bob Evans and Big Mac folks.

It seemed he was fixated on the eminence of real estate and stock portfolio managers and their giants of ownership, allowing them to feast and fatten on the depositories of working people post Glass-Steagall.

Meanwhile, Greenspan’s so favored and their legions of bean counters and suits figured new ways to lean out related entitlements and private sector employee benefits.

This article’s taking to task the recent interventions appears well founded in that context of price to weight ratio. Though valid in ideal and policy, two-party, two-administration applications may be collectively recorded as the epitome of the saying that we use to spout out in the Army… “Good enough for government work.”

Therewith, the legalized corruption of the US federal (and some state) electoral processes came to roost.

The question to be answered now: as a society and as a voting electorate, have Americans become too blind (or perhaps jaded or merely reduced in common sense quotient) to see above those well manicured bank and financial hedges, now only pillared a la government bailouts when not political party sellouts?

Will we seek out those who now hide behind well-trimmed bush, so appropriately labeled “crony capitalists” as they are now seen, as the tide continues to ebb outward, to be not only financially and morally naked but quite two-faced about the role(s) of government in business and society?

The time to smell the roses is past. Time to spread their manure and plant our new, hopeful hybrid-seeds for individual and collective wealth generation.

Derrick Humbert writes:

When in the Atlanta area I strongly recommend Callaway Gardens, located 50 mi southwest of Atlanta and 60 miles from Auburn Al. It has so much to offer from PGA golf, to world class bass fishing to butterfly exhibit to herb garden seen on PBS to a Christmas display.

I visited it some years back and the view is absolutely breathtaking. I suggest if you plan on lodging you get a cabin for the week and a restaurant package as there are no real restaurants in the area. Plan ahead as cabin availability is severely limited for the summer.

Nearby is the winter home of FDR, who came for the warm springs to help with his polio.

Much to offer here and the place in not affiliated with the golf company Callaway.

Apr

18

Volume, from James Sogi

April 18, 2009 | 3 Comments

Interesting drop off in ES volume today. Not sure what it means if anything.

2009-04-17 866.75 1873990

2009-04-16 861.50 2587100

2009-04-15 848.50 2175733

2009-04-14 840.25 2351211

2009-04-13 854.00 1635670

2009-04-09 852.50 2081575

2009-04-08 822.50 2088351

Apr

11

Ships and Markets, from Paolo Pezzutti

April 11, 2009 | 4 Comments

When you maneuver a ship, there are controllable forces, such as propeller and rudder effects. There are also uncontrollable forces, such as wind, current, sea conditions. Moreover, each vessel has different characteristics and reacts differently. You have also to take into account the characteristics of your ship that may not be constant and given, such as ship loading and hull conditions. As a result, a captain works in an environment where a ship's behavior is not observed in exactly the same way and each situation is different from another. A maneuver is a dynamic process. You have your plan and when you execute it, you want to have a continuous update to understand the effect that your order has achieved and the next course of action in order to be able to follow your plan. Each time you find yourself in situations where your ship reacts differently due to everchanging combinations of speed, rudder, wind, current, sea state.

When you maneuver a ship, there are controllable forces, such as propeller and rudder effects. There are also uncontrollable forces, such as wind, current, sea conditions. Moreover, each vessel has different characteristics and reacts differently. You have also to take into account the characteristics of your ship that may not be constant and given, such as ship loading and hull conditions. As a result, a captain works in an environment where a ship's behavior is not observed in exactly the same way and each situation is different from another. A maneuver is a dynamic process. You have your plan and when you execute it, you want to have a continuous update to understand the effect that your order has achieved and the next course of action in order to be able to follow your plan. Each time you find yourself in situations where your ship reacts differently due to everchanging combinations of speed, rudder, wind, current, sea state.

You need to be adaptable to the environment. Often, a too frequent assessment of your orders is not good because you need some time to let the ship react to your order because of its inertia. At the same time, if your feedback cycle is too slow, you might not have enough time to correct your action. You might end up not being able to follow your plan any more. In that case, the wisest thing you can do is give up and start again the maneuver from scratch instead of trying improbable corrections.

In markets, you do not have controllable forces, but you have expected crowd behaviors. In this context also each situation is different. A trader establishes a plan and during the trade execution, as new data come in, he/she assesses the market's behavior. The frequency at which this feedback process is done is critical. Traders may overreact and be deceived by the short term noise (you need time for the trade to develop), or they may be too slow to realize that the trade is not going as expected. How much data do you need, how often? How is the behavior different from what is expected is an interesting parameter. What is the threshold that makes you realize the trade went wrong? A ship maneuvering characteristics can be modeled mathematically, but in real life captains have to apply their experience and judgment to work in an observe-evaluate-decide-act cycle, which is very similar to what a trader does in a real time environment. Similarly, the market can be modeled, but most of the times expected outcomes require judgment and interpretation. It is all about the human dimension, where the action-effect cycle is matched against broad assessments of a generic "system" behavior.

Jeremy Smith comments:

“Consider how often a vessel must change its course in leaving a harbor, yet once on the high seas a single heading may bear it to its destination. Only

a major navigational hazard could change it.”

– Louis Auchincloss, The Embezzler [1966]

J.T. Holley adds:

In the spirit of Patrick O'Brian I would have to disagree or at least add to this quote. Pirates, Enemies and Gov't can cause navigational changes in both the ships directions and destinations as well as in the markets. Seamanship by David Dodge is a excellent book that discusses the navigational patterns as well that the U.S. Navy utilizes. Having served onboard the U.S.S. Stark I can assure you that rarely is "a single heading" utilized to reach a destination. Sure it is the broad direction, but there are other directions that are in between when going from point A to point B.

Pitt T. Maner III writes:

Let me add a nice quote from The New Dictionary of Thoughts (1963). I wish I knew who "Anon" was:

A smooth sea never made a skilful mariner, neither do uninterrupted prosperity and success qualify for usefulness and happiness. The storms of adversity, like those of the ocean, rouse the faculties, and excite the invention, prudence, skill, and fortitude of the voyager. The martyrs of ancient times, in bracing their minds to outward calamities, acquired a loftiness of purpose and a moral heroism worth a lifetime of softness and security. Anon.

The pdf of the book is searchable and many a fine old quote can be found there.

Jim Sogi adds:

Jeff is right. A sailing ship in particular will sail the best course made good, rather than rhumb line. For example, it will take the best angle to the wind, for the ship best speed, even though off rhumb line, for best course made good. A catamaran, for example, will go faster tacking down wind, zig zagging rather than shortest distance. I think day traders know this instinctively. It's quantified in markets in the absolute volatility numbers, or in Sharpe result numbers.

Another curious effect is when there is a strong current setting the vessel down. The vessel aims at a different point than where it intends to go, and 'crabs' along its course. This is hard for people to understand, as they can't really see the current, but one has to be aware of the motion of the ship in relation to the course, which is a derivative function. I suppose this might be thought of as Sharpe as opposed to gross dollars in trading or percent.

Another odd effect I experienced last weekend up in Alaska skiing was during a white out, a sense of vertigo. There is no visual reference point to balance, and its easy to lose balance in total white out conditions. While standing still, a small avalanche passed by, and though I was standing still, seeing the snow pass by gave the impression of motion, and threw me off balance. Or there is the feeling of standing still, then all of a sudden hit a bump and realize the skier was moving, but couldn't see it. The idea is that sometimes the perception is not correct and some other reference is needed. Pilots know this. This was one of the main points in survival. Loss of a reference point often lead to panic and death. In the markets, it's easy to lose reference. Chair's international numbers, I believe, are an attempt to get some sort of reference point. I had guides skiing up in the wilderness, who have a lifetime of experience and reference. Like markets, if you lose your reference point, you'll be dead in short order.

Apr

7

Redundancy is one of the keys to digital cell phone transmissions, and packet transmissions for the internet, human speech, credit card numbers, music composition. The list goes on and on, but should include the market. In speech, typically people say the same thing over and over, to guaranty the message gets through. Digital cell phone technology uses some sort of redundant error correction to insure the correct message. Musical composition often has three verses, and repeats the theme to get the message through.

Redundancy is one of the keys to digital cell phone transmissions, and packet transmissions for the internet, human speech, credit card numbers, music composition. The list goes on and on, but should include the market. In speech, typically people say the same thing over and over, to guaranty the message gets through. Digital cell phone technology uses some sort of redundant error correction to insure the correct message. Musical composition often has three verses, and repeats the theme to get the message through.

The market does the same. The mechanism is the result of trial and error, to some degree, but also of communication, error correction. A minimum of three is needed to provide some sort of error correction, and to insure transmission of the message. This is why we often see things in threes. It is good to know or expect repetition or redundancy as it gives an edge. For some reason the news and commentators seems to think rather of endless continuation as the normal mode.

Paolo Pezzutti adds:

Redundancy increases reliability of systems, usually in the case of a backup. You can find in many critical-performance systems and applications that some components or modules can be at least doubled. When you have a federated system, for example, you can choose to have a central "intelligent' core and a number of "non-intelligent" sub-systems, or you can have "intelligent" subsystems providing a higher degree of resilience to failures. This is typical of some combat systems on board ships for example. The point is that not only redundancy adds reliability, but it increases also the performance, because intelligence is distributed throughout the system of systems and decentralization is a more efficient and effective solution (there are less bottlenecks and so on).

Redundancy and reliability, however, have a cost. When designing a system you have to weigh costs and benefits to find a balance that meets the user requirements. Markets find dynamically a balance between costs and benefits through the price discovery process. Also in this case, network-enabled players that apply a decentralized approach have an advantage in situational awareness, speed of evaluating the situation and making decisions, and speed of execution have an advantage over bureaucratic, centralized and slow players.

Phil McDonnell comments:

Redundancy can be very good but there are some occasions when it accomplishes less than one might think. For example, most data centers have more than one server. But if they are running on the same electrical power system they are still vulnerable to the loss of that common critical resource.

Another example might be when the sources of failure are not independent. One example using two servers might be if both are plugged into the same wall plug. They are susceptible to common power surges and lightning strikes transmitted over the power lines. Even several computers connected via long network cables can be simultaneously damaged by the EM pulse from a nearby lightning bolt.

Apr

3

Linear Trend Lines, Part I, from Phil McDonnell

April 3, 2009 | 3 Comments

The Chair has issued a challenge for anyone who can prove of disprove the existence of linear trend lines as suggested by Jim Sogi.

The Chair has issued a challenge for anyone who can prove of disprove the existence of linear trend lines as suggested by Jim Sogi.

The first issue in doing a market study is to develop an adequate definition of what a trend is. Given that the idea is widely and perhaps first used in Technical Analysis it is good to start there. Tom DeMark, a widely known and respected TA guru, defines a trend line as the line connecting two bottoms in a price series. This, of course assumes one has a good definition of a bottom. He defines a bottom as a daily low which has the property that the low of the previous day and the low of the next day are higher than the bottom low. Thus it takes three days to define a bottom day. The most recent bottom cannot be known until one day after it has happened.

The idea of a trend line is to find the most recent bottom and then go back to the next most recent bottom. The whole pattern takes at least 6 days to work out and can be much longer because there can be an arbitrary number of days between the two most recent bottoms. Our own John Bollinger has confirmed that this is essentially what his understanding is of how trend lines are used by practitioners.

The theory of a trend line based on lows is that it acts as support. In other words the market will tend to stay above the line more often than would be expected by chance. It should be noted that nothing in the above definition presupposes an uptrend or a down trend. In an uptrend the second low point is higher than the first low point. And the difference per day defines the slope of the line. In a down trend the second low is lower than the first.

There is another type of trend line which is based on the highs of the day. A high point is defined as the high day between two adjacent days, whose highs are both lower. Again two high point days are required to draw a well defined trend line.

Mathematically it is always possible to draw a line between two points, so one should not be surprised to find trend line patterns in random data as well as real market data. The real challenge is to test whether they occur more frequently or less frequently. More importantly do trend lines have any predictive value either as measured by higher probability of a successful trade or a higher average return?

The study looked at 1800 trading days of SPY, the S&P ETF. This period started 100 days ago and went back 1800 days. It should be noted that the SPY was down 1.5 points during this period resulting in an average daily return of 0.00% to 5 decimal places. The study was further classified into four categories based on whether it was a high point or low point trend and whether it was an up or down trend:

Low Up

Low Down

High Up

High Down

The measure of profitability was the simple next day close to close return for the trade.

For trends based on Low points we have:

Trend n # Up % Up Avg Profit Total Profit

Up 204 109 53.4 -0.212 -43.23

Down 202 115 56.9 +0.031 6.33

For trends based on High points we have:

Trend n # Up % Up Avg Profit Total Profit

Up 182 86 47.3 -0.143 -25.98

Down 225 106 47.1 -0.050 -11.22

Most of the results showed about 200 pairs of trend points. This means that the typical trend point pair took about 9 days to form and thus had about 3 days in between points. TA practitioners would expect more days to be up after a trend point pair is put in place. There appears to be weak support for this idea because for both cases based on Low points the % Up seems slightly favorable. However this is belied by the fact that the avg profit for Up trends is actually strongly negative. Thus the preferred strategy is probably to fade the appearance of and up trend pattern.

For High Points the expectation is that the market has reached an extreme. Thus we expect it to fall back. In fact all the above does qualitatively agree with that premise because both the % Up and the Avg Profit are negative.

The key to all of this is to test the results for significance. Often one has noted that when a trend line is broken there is sometimes a dramatic drop. The import of this is not whether it is true or not. Rather if true then it implies a negatively skewed distribution. Thus the standard normal / log-normal assumptions may be too far off. For something like this then that argues that it would be better to choose a bootstrap test for significance so that we do not have to worry about the normality of our data.

That is the subject of Part 2.

Dr. McDonnell is the author of Optimal Portfolio Modeling, Wiley, 2008

Jim Sogi writes:

Thanks Phil. The problem with defining a 'trend line' is that a rather random number of bars may or may not form the trend 'line'. More than two points would be needed to define a trendline as any two points forms a line, so it become totally random as to which points when only two define it. Then when not all lines touch the support line, then it turns random again. By the way, I was wrong. Random walks DO regularly form 'trend lines' to the naked eye.

Thanks Phil. The problem with defining a 'trend line' is that a rather random number of bars may or may not form the trend 'line'. More than two points would be needed to define a trendline as any two points forms a line, so it become totally random as to which points when only two define it. Then when not all lines touch the support line, then it turns random again. By the way, I was wrong. Random walks DO regularly form 'trend lines' to the naked eye.

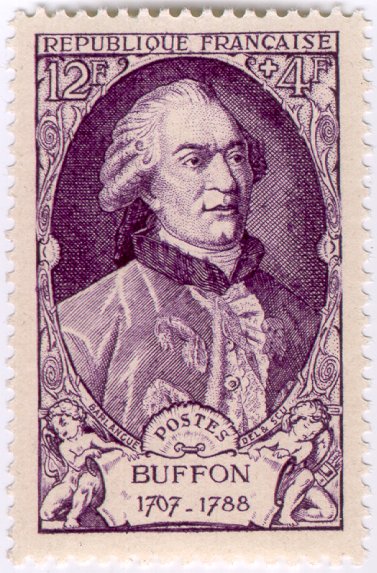

One idea is to follow the a variant to the solution to the math problem Buffon's Needle which determines the probability of a needle of a given length touching two parallel lines when its thrown down. The problem must be restated to determine the probability of a needle of fixed or variable length touching three or more points on a grid of timeseries points. Then the time series could be randomly simulated from actual data, and probability determined or randomly generated and compared to actual data. Here is a nice trailhead with the R code to visualize the problem.

If this code could be altered to solve the above variation, this might help solve this problem.

The solution may require limiting the time period to some defined time period such as a day, week or month so that the 'straw' has a defined length and require that the touches, touch within 1 point of an interval low to give a little slack as you do when eyeballing. However, there appear to be solutions to Buffon's Needle allowing for various or random length needle's. Perhaps Buffon's 'points' could also be lengthened to be short parallel lines that make up the time series, and use the formula to determine the probability that the needle (trendline) crosses three or more time series points to create the trendline.

Apr

3

Linear, from James Sogi

April 3, 2009 | 38 Comments

I don't understand why prices seem to chart out along a line along their tops or bottoms of the bars in a line. A random walk would not and does not do that. What is the function that makes it happen?

I don't understand why prices seem to chart out along a line along their tops or bottoms of the bars in a line. A random walk would not and does not do that. What is the function that makes it happen?

Victor Niederhoffer replies:

What we need to do is write a little essay on the linear thing of Jim's. He asks "why lines drawn between highs or lows tend to be straight in markets." Its a very good question. It reminds me of the work that The Professor and his student Chris Hammond did to test whether there were turning points or bear and bull markets in the Dow. An anonymous donor will give $500 for the best answer for this. Committee of me and Doc Castaldo and Jim Sogi to decide. I would point out that the above duo concluded there was no such thing as bull and bear markets, that the turning points were completely consistent with chance. My working hypothesis is that the same thing is true here.

Phil McDonnell responds:

One possible idea is the cobweb theory. In this, the declines come back to the demand curve which is a 45 degree line supporting successive bottoms. The upper bounds (the tops) are delineated by a parabola. The whole thing can be described by a difference equation. The following site describe the math and have some graphics. The graphs with the rising 45 degree line and the overlaid parabola above it are the most interesting.

Dr. McDonnell is the author of Optimal Portfolio Modeling, Wiley, 2008

Mar

29

Bollinger Bands, from Sam Marx

March 29, 2009 | 1 Comment

I have a question regarding Bollinger Bands. Is there such a thing as Double Bollinger Bands? That is when the stock goes down and touches the first Bollinger Band ring, you buy, but if the stock does not reverse itself and continues downward, you sell out when it hits the second Bollinger Band ring.

Jim Sogi writes:

Buy and Read John's Book, Bollinger Bands by Bollinger. He explains all the various signals there. He's a member of the list, so I will tout for him. My only comment, is that like other indicators, they are retrospective. They are better than most because of the prospective expectation of persistence of volatility. My theory as I have propounded here is that concurrent market internals are helpful if not better than many retrospective guides, and even prospective guides from prior data used alone especially on a short term horizon or at least for execution.

Mar

29

A Month and a Year, from Victor Niederhoffer

March 29, 2009 | 1 Comment

What a difference in the complexion of the world markets from last year where at the end almost every market was down 50% with no exceptions. This year as of March month-end the world markets are down a mere 10% and there are exceptions galore, notably Israel up 15% and Russia up 31%. All over, anomalies exist. Norway up 10%. Pakistan and Taiwan up 17%. Indonesia up 10%. All over South America markets up from 10 to 30 % in Peru and Venezuela. Venezuela up 40% from 1999. Recapping the wisdom of Maturin during the French Revolution advising Sophie to buy stocks, a stridency relevant to today shortly.

What a difference in the complexion of the world markets from last year where at the end almost every market was down 50% with no exceptions. This year as of March month-end the world markets are down a mere 10% and there are exceptions galore, notably Israel up 15% and Russia up 31%. All over, anomalies exist. Norway up 10%. Pakistan and Taiwan up 17%. Indonesia up 10%. All over South America markets up from 10 to 30 % in Peru and Venezuela. Venezuela up 40% from 1999. Recapping the wisdom of Maturin during the French Revolution advising Sophie to buy stocks, a stridency relevant to today shortly.

George Parkanyi writes:

Many a financial network talking head these days pronounces that "buy-and-hold" is dead. Here, or somewhere around here, is the perfect time to initiate a buy-and-hold strategy. This is from where the $3 AMDs and Motorolas of the world go back to $30 or $40 in the next bull market. And what of it if it takes 10 years, not that it's likely to take that long. That's still 100% per year non-compounded. My ex-high-school teacher and stock market mentor Omar Sheriffe Vernon-el-Halawani in the last two decades of his life (he passed away in 2005) did just that for most of his portfolio — buy good companies on the incredible cheap when the opportunities arose, and just put them away. He introduced me to "Reminiscences of a Stock Operator" long long ago, and in his last few years kept admonishing "George, why bother to sell?" (Though he wasn't inflexible either — he did sell Sun Microsystems once it got to $200. A couple of his closer friends rode Nortel back down to nothing.)

Paolo Pezzutti replies:

What if in ten years from now Motorola and AMD do not exist any more because a Chinese or Taiwanese corporation has wiped out these companies in an already mature market of telecoms and semiconductors? Sort of a General Motors and auto industry fate in 2015? In the meantime we have to see if the Western countries will manage to lead the next wave of innovation. It is not a given.

Stefan Jovanovich adds:

Motorola may survive as a defense/government contractor like Studebaker did; but its days as a competitor in the mobile dial-tone device market are long over. It has a legacy business in walkie-talkies, but those devices are now commercial products for — oh, happy day! — the construction and events trades. The "next bull market" will be in businesses that do not need the help or money of the academic/finance/regulatory complex. Some pissed off genius who is dropping out of graduate school right now because he can't stand another day listening to a discussion about hockey sticks will be the guy who creates a viable alternative to the internal combustion engine. The fact that the next Henry Ford did it because his uncle died and left him enough money to allow him to pursue his dream of racing an electric motorcycle will definitely NOT make the history books. Instead, some not-so-bright but perfect resume student of "economic trend analysis" at Berkeley will write a seminal paper explaining how it was all due to the "convexity of the forces of ecological history" (assuming, of course, that CalPERS has not blown all the money and put the University of California into receivership — which may the wildest of all my surmises). On a happier note, the Cal Men won the national swimming championships this week. Go Bears!

Pitt T. Maner III writes:

"Hardened silo" companies, with strong management, that have survived through and handled multiple, steep cycles over the past decades by mothballing equipment as needed, sending seasoned hands "back to the house" when necessary, and which have high barriers to entry (and negative government support) into the particular business would appear value candidates now. High quality drilling and drilling service companies, over the longer term, are appealing at present prices unless solar, windmill, nuclear, and alternate energy supplant the need for hydrocarbons. There are many other groups and companies that probably fit this undervalued, "tough-times survivor" model that odds would favor moving forward.

Jim Sogi adds:

After such a rally, and now when more and more people and pundits are calling a bottom, and I hear news proclaiming a thaw, and I hear talk of people starting to buy, these are the type of things that put my radar up. It's funny that the news media is somewhat stultified in that despite their steady barrage of bad news, the markets are all up. They actually have to change their copy of bit as it's hard to proclaim, markets up 15% on steady barrage of bad news. Obama did make a good call to buy, the day before the low and gave everyone a chance to buy. He knew what was in the govvy cards of course. That was the time to make the big commitment, not now. There should be more chances before they proclaim the next bull market as the market tops.

Legacy Daily writes:

Given things stay roughly the same, I cannot disagree with any of these comments. The challenge right now is that nothing is given.

For people who trade via systems, I have a question.

At which point does one decide to a) modify the system (and to what degree and based on what), b) discard the system (and why), c) continue relying on the system (and for how long); if such a system is producing losing trades more recently but has worked fine for a long time (definition of time scales not relevant)?

Perhaps the answer contains clues regarding our recent government actions (and market reactions) where the scale of the system and the magnitude of its impact is great. The problem is further complicated by control over one's actions but lack of control over [negative] consequences of those actions in a human system.

The second question that does not leave me alone is whether a game of chess (or any other game) can be won if every few moves, the game rules are modified. Does the player quickly adjust and remain focused on winning the game according to the new rules ("queen can only move three squares at a time" for example) or does the focus shift on guessing what the next set of rule changes may be? After a few set of changes and corresponding adjustments, does the player begin to suspect the rule maker in taking one side or the other?

Mar

22

Form, from Victor Niederhoffer

March 22, 2009 | 2 Comments

Is there a form for the typical market? Does it have a shape, a proper way of conducting itself? Is the form for a week regular enough to defy randomness or better yet to be predictive in any way? Is there a form corresponding to the a b a form of music in markets? How does rhythm and volume of sound enter into the picture? Those are the questions I'm pondering this after reading a great book on the walking bass by Jon Burr.

Is there a form for the typical market? Does it have a shape, a proper way of conducting itself? Is the form for a week regular enough to defy randomness or better yet to be predictive in any way? Is there a form corresponding to the a b a form of music in markets? How does rhythm and volume of sound enter into the picture? Those are the questions I'm pondering this after reading a great book on the walking bass by Jon Burr.

Thomas Miller writes:

I have always believed the markets are similar to musical pieces. A rhythmic sideways market lulls many into relaxed state only to burst higher or lower in mighty sudden crescendos, and a rallying or declining market moves in musical waves with mini crescendos noting momentary tops or bottoms. I wonder how many successful traders have musical backgrounds? Music and mathematics are universal languages and convey the messages of markets. I regret not having more formal training in either.

Newton Linchen replies:

I always thought "Metamorphosis IV" by Philip Glass to be the perfect "market music", not only by its crescendos and decrescendos, but by its impression of regularity (Philip Glass is known as the father of "repetitive music"). Nevertheless, its changes in tempo and volume (strength) gives a rhythm almost fluid. And there's a part of "explosion" (volatility) where the fast-pace is in order — without loss in harmony or structure. I always thought of moments of "trading range" of market going aimlessly followed by a explosion in price upwards or downwards. And it's kind of sad melody remembers us of the majority who only find losses in the markets.

James Lackey comments:

Yeah it's been brutal awful market music. Reminds me of all the VIP mumbo parades, changes of command formations, and dress blue parties I was forced to attend in the Army.

0300 with the Dax open its reveille. Then we all form up into one huge cluster in the parade grounds stand for an hour then "the stars and stripes forever" plays with a government official on the mic saying how far we have come our history and how they are committed to Change "us" with too many last hour's "retreat."

Then with so many brutal last hours "to the colors" reminds me of Flag detail after the close then the discussions with old Colonels passed over, that didn't want to go home to family asking "the kids" new soldiers over a 5pm coffee what we wanted to do with our lives "when I was your age and if I could do it all over" then every few nights after Chow we get "Washington post march" the tune used most in movies to sound off patriotism and how if we all work together, after the next bailout everything will be back to the normal American way… Then back at 7pm "Auld Lang song" to the Nikkei open.

I have noticed over the years my music tastes intra day trading go with the market flows, Baroque, Jazz, Fusion, and when the market is rockin', new alternative rock.

I am in a bad way when all music sounds awful, like Army band music. I would rather listen to the hum of the ceiling fan and as of late the birds singing to the open windows..and to my surprise, spring has sprung and a lawnmower engine sounds more inviting than the music of the markets. ha.

The U.S. Army Band Ceremonial Music Guide

Legacy Daily responds:

When the Soviet Union collapsed, I witnessed the creation of foreign exchange markets and also of stock and other types of markets in Armenia. These images are very vivid in my mind. When I read about people trading on Wall Street (I mean before the exchange building was even a consideration), I can see how that trade took place, because I participated in similar trades in a few of the streets of Yerevan (different places of gathering for different markets). That experience always overrules the charts, the derived statistics, the counts, and all the jargon that I hear daily.

When the Soviet Union collapsed, I witnessed the creation of foreign exchange markets and also of stock and other types of markets in Armenia. These images are very vivid in my mind. When I read about people trading on Wall Street (I mean before the exchange building was even a consideration), I can see how that trade took place, because I participated in similar trades in a few of the streets of Yerevan (different places of gathering for different markets). That experience always overrules the charts, the derived statistics, the counts, and all the jargon that I hear daily.

Does the market have a form, a proper way of conducting itself? This question brings up the picture of the crowd dealing in foreign exchange (with the usual guys leaning against their usual trees) against the typical crowd dealing in real estate or stocks or stamps or coins. Of course each market has its form, its unique characteristics, its shape, its place, its rules. Each market has its rhythm, its language. I have not had the opportunity (and never really wanted) to participate in the floor trade at the NYSE or in the outcry system. But having seen the seedlings in their early stages of germination, I only see supply and demand and the various factors that affect these.

In this digital age, it is easy for one to go long bonds and short stocks or long XOM short CVX without ever realizing that the market for every single security represents a unique gathering of those who run the market and those come to the market. If I had to put this picture into something related to music, I'd imagine a choir of professional singers that sing a particular song we recognize. At some point, we join in singing in our heads and then at one point begin to sing out loud thereby changing the overall experience of everyone around us until we move on to the next choir singing a different song. Could one be successful in singing with multiple choirs all at the same time? Can we really understand the market for the SDS and SPY which are derived from hundreds of unique markets with their tunes in addition to their own market creating noise at the same time? What about the noise from the "gold" room affecting the singing going on in the "dollar" room or the other way around?

When it comes to commodity markets, I remember the fruit and vegetable market where some of the sellers would sell what they had grown and the others would sell what they had bought from those who couldn't or didn't want to travel to the market. Does that have a music? If you have ever been in a similar market, you'd recognize the buzz, the "singing" of the man selling his delicious watermelon, and the aroma coming from the area where peaches are sold.

The big question - is all this random or is it predictable? There is nothing random to it, yet it is completely unpredictable. The market makers operate in a very normal expected way, yet those who come to the market act in ways I cannot anticipate or predict. The only elements visible are my own instincts, wishes and desires which happen to approximate those of the people who go to the market very well. Imagine you have a phone to your ear that is connected to a line on a speakerphone where hundreds of people are talking at the same time. What do you hear? Noise! Can you find patterns and conversations in the noise, in some cases yes. Are the conversations and patterns going to repeat? In some cases, absolutely ("How are you today?" is typically followed by "I'm well thank you." or some variation of that) I'd like to be convinced that they could be consistently reliable but then again if that was feasible someone would have already found a way and would have proudly advertised that "past performance does not guarantee future results" does not apply to them.

Jim Sogi writes:

One constant regularity of form in music is the return to the root or home base. I think the market tends to have a root or home for each of its pieces. Recent root seems to be 800. Prior jump on Fed had to return Treasury plan to resolve. 800 was a big theme earlier in the year as well. Now we are in the contrapuntal mode, as Bach would play it doing it from the reverse. In a larger sense, it all satisfies the craving for symmetry and resolution.

Often the craving is frustrated creating a tension. Music is all about emotions on different levels, as is the market. Musical gaps are one of the greatest sources of tension. We still have this Monday gap right below created by maestro Timmy G and the trillion dollar blues. Too much tension and disruption of rhythm to make good music.

Mar

18

Other People’s Mistakes, from Jim Sogi

March 18, 2009 | 1 Comment

Thanks to Ryan for recommending The Game by Ken Dryden. It is a very human and personal analysis of top level pro sports that makes it applicable to all high level activity. Also touching to me was the part about getting old. Ironically he wrote it in his twenties. I face this out in the big wave lineup competing with the young guys. I wonder how much longer can I do it. Of the many lessons in the book a few really jumped out at me. First was his routine before games designed to give him emotional equanimity and balance and to quiet all the inner voices that might throw him off. I've read of the trainers of the high level sumo wrestlers in Japan who protect their fighters from emotional upset that might affect their sport performance. I know I need to come to the fray each day on an even keel. If there is an imbalance in the force, I'll walk away.

Thanks to Ryan for recommending The Game by Ken Dryden. It is a very human and personal analysis of top level pro sports that makes it applicable to all high level activity. Also touching to me was the part about getting old. Ironically he wrote it in his twenties. I face this out in the big wave lineup competing with the young guys. I wonder how much longer can I do it. Of the many lessons in the book a few really jumped out at me. First was his routine before games designed to give him emotional equanimity and balance and to quiet all the inner voices that might throw him off. I've read of the trainers of the high level sumo wrestlers in Japan who protect their fighters from emotional upset that might affect their sport performance. I know I need to come to the fray each day on an even keel. If there is an imbalance in the force, I'll walk away.

Dryden wondered about the difference between his own, or his own team's, performance and other people's mistakes. In my life as a lawyer, I see people make mistakes, high powered guys who act like they should have known better. In trading, I believe I can see when people make mistakes. Today for example, bidding up the contract to a new high on the belief that the Fed can solve our problems. Well, that was a 2% mistake right off the bat. In the summer of '07 I wondered about the 9K plus bidders buying the tops at days end. I wondered what they were doing up there. They are too, now. Sometimes its not so obvious, but there are times to be aware of. I sure know when I blow it. The dangerous times are when you blow it and don't know it. Dryden always lived in fear of that, as should we all.

Mar

18

Risk Theory, from Jim Sogi

March 18, 2009 | 2 Comments

Here's an investment theory. Rather than buy when the expectation is greatest, buy when the risk is the least. The question is whether or not they are the same times. I define risk as the lowest probability of account drawdown from entry, rather than common definitions of volatility. A corollary of this is that buying at what appears to the public as the greatest risk is actually the time of least risk. A recent discussion here looked at expectation of range vs expectation of change. The theory of the least risk would be to buy at the expected maximum extension of range, at the time of greatest expectation. The other issue is the holding period and expectation of gain. Some argue that the maximum expectation period over time will reap the highest returns. The problem is that the deviation goes up as fast if not faster, increasing risk. The second problem is the issue of changing cycles and prior history may not match future performance. Dr. Phil has pointed out that profit stops reduce deviation but not necessarily rate of return. Yet account deviation is the bottom line. He has proposed formulas to optimize risk/loss vs return. But realtime trading demands some sort of realtime system. This is hard to implement. The underlying idea is that management of risk is more important than maximizing return. This has been the basic systemic flaw in the recent boom and bust. The idea is distinct from the idea of leverage as risk. The answer will differ from individuals to institutions and funds with differing goals.

Here's an investment theory. Rather than buy when the expectation is greatest, buy when the risk is the least. The question is whether or not they are the same times. I define risk as the lowest probability of account drawdown from entry, rather than common definitions of volatility. A corollary of this is that buying at what appears to the public as the greatest risk is actually the time of least risk. A recent discussion here looked at expectation of range vs expectation of change. The theory of the least risk would be to buy at the expected maximum extension of range, at the time of greatest expectation. The other issue is the holding period and expectation of gain. Some argue that the maximum expectation period over time will reap the highest returns. The problem is that the deviation goes up as fast if not faster, increasing risk. The second problem is the issue of changing cycles and prior history may not match future performance. Dr. Phil has pointed out that profit stops reduce deviation but not necessarily rate of return. Yet account deviation is the bottom line. He has proposed formulas to optimize risk/loss vs return. But realtime trading demands some sort of realtime system. This is hard to implement. The underlying idea is that management of risk is more important than maximizing return. This has been the basic systemic flaw in the recent boom and bust. The idea is distinct from the idea of leverage as risk. The answer will differ from individuals to institutions and funds with differing goals.

Martin Lindkvist comments:

Try creeping commitment, that is, start with a small line and increase if market goes in one's favour. But this has a built in assumption of some kind of trending behavior of prices, which might or might not be true depending on other circumstances.

A twist to the creeping commitment of a single position is to start out a period (year, or other of your choice) and increase risk taking after profits have been made, and decrease if losses are incurred to the capital at beginning of time period; that is play harder with "market money". I believe that both this method and the first one might have some psychological benefits if nothing else.

Risk in the usual deviation sense has sometimes been disguised, through e.g asymmetrical strategies ("picking up nickels in front of a bulldozer") where the risk might seem far away only come back hard when least expected. Moral - one should always be suspect when one thinks one have found a good way of managing risk - "what am I missing". Liquidity issues comes to mind too.

Using leverage as the risk manager, still seems to me the most clean way to manage risk. Cutting off risk with stops or options also is a way but run of the mill costs for these should be higher over time. That doesn't matter though if you meet black swan on day one….

Phil McDonnell writes:

A knotty part of this question is to define risk. To academics it is probably something like standard deviation of returns. To traders it may be only the losing trades, in other words only the downside deviations need to be considered. Another metric might be draw down or maximum loss.

The risk measure one chooses makes a big difference. For example suppose we look at the standard deviation of the market after it has been rising for a while. Assume our criteria of rising is that the market is above its 200 day moving average. We would find that the risk measured by the standard deviation is less for all such periods than it would be for those periods which are below the 200d moving average.

When markets approach major bottoms they are often quite volatile. Currently we often have daily moves of 3 to 5%. If one were to study the subsequent behavior the probability of large down moves the next day are quite high as are the chances of large up moves at such times. This is true even though one can often argue that after such large declines the market is close to good value levels and has not much more to fall.

Note that one can get two different answers to the question depending on time frame. At a low area such as now, the long term risk outlook might be that it cannot go much lower. But because of volatility the short term outlook is for continued riskiness.

Dr. McDonnell is the author of Optimal Portfolio Modeling, Wiley, 2008

Legacy Daily replies:

As for this statement, "Rather than buy when the expectation is greatest, buy when the risk is the least," the risk of not being in the market is the least (assuming cash is constant). Perhaps you mean "buy the highest expected return for the lowest risk." Theoretically, "maximize return but minimize risk" may be suitable for a linear programming model where one would need to define the various constraints and let the machine solve for the best alternative to maximize return given the constraints. The challenge: the right definition of the constraints. Also, the optimal solution may change tick by tick.

And as for this statement, "a corollary of this is that buying at what appears to the public as the greatest risk is actually the time of least risk," I think many market participants buy and hold. Therefore, the main reason a market appears a great risk to them is because their money disappears. The more money disappears, the greater the fear (hence perception of risk). It also seems that these "emotions" are only visible during intermediate-term/long-term market turning points which may not be suitable for a day trader.Furthermore, "time in the market" and "percent invested" are also ways to increase/decrease risk when account balance rather than security price volatility is the key criteria. Account balance is an extremely useful risk manager. AUM does not have the same effect.I cannot remember where but I came across the concept of a very successful trader at one point or another getting completely wiped out and some being so good that they could build a fortune multiple times and get wiped out more than once in a lifetime. If true, is that possibly a manifestation of "buy when the expectation is greatest" with not enough focus on "when the risk is the least?"

Mar

12

21st Century Games, from Victor Niederhoffer

March 12, 2009 | 12 Comments

I wonder if snow, for example the deluge on Feb 1, 2009, in New York has a negative impact on stocks. It had a positive influence on the ability of youngsters in the 1950s to buy stamps, as school was out and Nassau Street was accessible by train. Now you can't even find kids having snowball fights as they are all inside with Nintendo or Twitter or IM.

I wonder if snow, for example the deluge on Feb 1, 2009, in New York has a negative impact on stocks. It had a positive influence on the ability of youngsters in the 1950s to buy stamps, as school was out and Nassau Street was accessible by train. Now you can't even find kids having snowball fights as they are all inside with Nintendo or Twitter or IM.

Paolo Pezzutti comments:

Last evening I left my girls to spend a few hours at some friends' place. I left them playing with a "Chinese" toy pen with very basic videogames such as bowling or skying in it. When I came back they were still playing with that silly toy. They were hypnotized, although sleepy, but they would not give up. What is the power of these applications — even as simple as this? We can track a parallel with a trading screen and its ability to hypnotize wanna-be traders (and not only them) creating a compulsive attraction and dark force to trade even when it is not the best setup.

I was somewhat nervous about my daughters because they were not stimulated to do something different. It seems that if they are not "educated" and addressed to healthier and outdoor activities kids (and adults too) in most cases prefer spending their time following action on a screen. This is what game companies and stock brokers exploit.

Michele Pezzutti adds:

That's true. This is something I always think about when I reflect on the way kids are growing. I often wonder if the way the kids play today is healthy. I do not want to sound old-fashioned. I do not come from the 18th century. But are fantasy and creativity stimulated the same way by a computer game as they are by Legos, for example? I think that the problem is not in the technology itself but in the use we make of it as in everything else. Too much is poisonous. And I feel relieved when I see that my kids, when they feel like, can still play as only kids can do. From nothing they are still able to create their world and stories. They have plenty of imagination. Then my worries fade away as I can see in them the same kids we used to be. In the end, every new generation must have asked the same question.

That's true. This is something I always think about when I reflect on the way kids are growing. I often wonder if the way the kids play today is healthy. I do not want to sound old-fashioned. I do not come from the 18th century. But are fantasy and creativity stimulated the same way by a computer game as they are by Legos, for example? I think that the problem is not in the technology itself but in the use we make of it as in everything else. Too much is poisonous. And I feel relieved when I see that my kids, when they feel like, can still play as only kids can do. From nothing they are still able to create their world and stories. They have plenty of imagination. Then my worries fade away as I can see in them the same kids we used to be. In the end, every new generation must have asked the same question.

Jim Sogi replies:

When my son was younger, we also worried that he also loved computer games and stayed up all night playing. I reasoned, better playing at home than out on the street. He was also an athlete who surfed, snowboarded, skate boarded. But the training he got playing games serves him well now in his new career in the financial markets. Is what we do 24 hours a day glued to a screen any healthier? I say no. It's really the future of work and communication and social structure.

When my son was younger, we also worried that he also loved computer games and stayed up all night playing. I reasoned, better playing at home than out on the street. He was also an athlete who surfed, snowboarded, skate boarded. But the training he got playing games serves him well now in his new career in the financial markets. Is what we do 24 hours a day glued to a screen any healthier? I say no. It's really the future of work and communication and social structure.

Speaking with my daughter, we compared our contacts with old high school friends and family. She right pointed out that it is easier for her with IM, Twitter, email, sms, and use cell phones to keep in touch. Don't be old fashioned. It's a new world.

Alan Millhone writes:

On the news tonight it was reported on a program in El Paso, Texas schools that has a regular exercise program in the schools that shows that regular exercise in youth produces better test scores, etc.

On the news tonight it was reported on a program in El Paso, Texas schools that has a regular exercise program in the schools that shows that regular exercise in youth produces better test scores, etc.

When I was a youth the neighborhood kids played outside till dark and our parents had to call us in for supper. In the Winter we built snow forts that we defended with snow balls against attackers. In the Summer if a new basement for a house was being excavated when the workers left we had dirt clod battles!

I began collecting stamps at age seven when that Christmas my parents gave me a Coronet stamp album and some stamps from H. E. Harris and Co. of Boston. In my early years they gave me sets of Lionel Trains (still have both sets in the original boxes ). We had no computers, cells, Ataris, etc. to fritter away our time and no TV for several years. We played board games, rode our Huffy bikes with a baseball card held in the rear spoke with a wooden clothespin. Modern technology is good to a point for youngsters. Much though that was good and wholesome has been forever lost. Just like the Checker players that at one time could be found on a daily basis in Central Park under the wooden canopied shelters. Tom Wiswell would not believe the changes there.

Jeff Watson comments:

I just got through watching the excellent movie Surfing For Life. Written and produced by David Brown and narrated by Beau Bridges, it chronicles the lives of people who are still surfing in the twilight of their lives. The movie took a sampling of notable surfers from the ages of 60-93, gave brief bios, and showed them surfing well as seniors. Surfing for Life is much more than a surfing documentary, it's a celebration of man's optimism and the results of living a life of optimism. It showed one particular surfer who visits senior facilities on a volunteer basis, and most of his charges are younger than him. It then cut away to him surfing a nice 6' wave. The central theme of this movie is that living a life with an optimistic bias will ensure personal happiness. My favorite scene is the closing where they show Doc Ball, 93 years old, riding a skateboard. Not only was he riding a skateboard, it was obvious that he was clearly enjoying it like a little kid. I've been told by many that I'm just like a little kid, and take that as a compliment whether they meant it as such or not. Little kids enjoy playing games, are optimistic by nature, and receptive to new experiences and knowledge. I'm of the view that trading is a game, an extension of the games we played as children. It can't be mere coincidence that a plurality of traders I know usually excel at one form of game or sport. Whether it's checkers, chess, poker, the racket sports, or surfing, these games played for a lifetime keep one's mind sharp, and mentally nimble. Game playing also keeps our competitive edge well honed, which serves us well in the markets. Surfing for Life is such a positive, uplifting movie that it should be seen by all, as it exudes optimism. It would be an interesting study to analyze the optimism/pessimism ratio for all market players. I have a hunch that the successful players would fall into the optimistic category. Optimism breeds self confidence.

Russ Sears says:

When I hear tales of the freedom of youth my thoughts often turn me back to my 7th grade year, in Pauls Valley OK, where I delivered the Pauls Valley Daily Democrat door to door on a rusted out Schwinn bike I had spray painted baby blue.

When I hear tales of the freedom of youth my thoughts often turn me back to my 7th grade year, in Pauls Valley OK, where I delivered the Pauls Valley Daily Democrat door to door on a rusted out Schwinn bike I had spray painted baby blue.

I recently went back and visited the town 33 years later. The drugstore where my brother and I spent our share of the subscription price on comic books, baseball cards and soda fountains chocolate shakes had moved from across the street from the newspaper to the new Wallmart. Parts where still the same, with only a fresh coat of paint, others totally gone.

We had a great time "owning" our part of town. However, I think we were one of the last two kids to deliver papers this way. The only reason they gave me the job, since the Sunday papers weight more than me, was cause they were desperate. Few parents would let their kids do something like this even in small town mid late 70s. And thinking back, there were several times where I think "what were my parents thinking"… As I had a machete to my neck from a high druggie, learned where to drop my collection money off before I went to certain areas, and narrowly escaped a pedophile.

Bottom line is it's not all the kids' fault.

Anton Johnson writes in:

In addition to dirt clod fights, we would play king-of-the-hill on construction excavation mounds, resulting in the occasional emergency room visit. During spring-time we played Monkey-in–the–Middle and 500, honing our baseball skills, all the while dodging vehicles and swatting mosquitoes. On moonless sultry summer nights, we played neighborhood wide team hide-in-seek, some of us subtly maneuvering to get close to the object of our affection. Not even brutal winter weather could keep us inside. Often a dozen would-be Bobby Hulls would play ice hockey, taking brutal hits without pads (some of us even wearing figure skates). We shoveled our own rink on the lake, and hauled seemingly endless buckets of water to fill in ice cracks. Almost nothing could deter us, we played whether +40F or -15F degrees, sometimes coming home soaked after falling through the ice or occasionally with a frostbitten appendage. I wonder whether the electronic generation will reflect on their childhood with a similar nostalgia.

Mar

9

Survival, from Jim Sogi

March 9, 2009 | Leave a Comment

Deep Survival by Laurence Gonzales is good re-read in these troubled times. I've reviewed it before, (see past discussion on the site here) but so many big and small are not surviving. Live a river, a good book is never the same when read over. He has some good advice.

Deep Survival by Laurence Gonzales is good re-read in these troubled times. I've reviewed it before, (see past discussion on the site here) but so many big and small are not surviving. Live a river, a good book is never the same when read over. He has some good advice.

There are two aspects to survival: avoiding getting into trouble, and surviving once in deep.

How to avoid getting into trouble.

Tao Te Ching says, The farther ones goes, the less one knows. There are a number of phenomenon at work that put you in deep trouble.

1. When in danger, the IQ goes down and the mind starts shutting out appropriate input, or goes into a stupor. This compounds the danger and leads to death. 75% of people react this way. Perceptions themselves change. Its very dangerous. Training and preparation help avoid shutdown.

2. We make mental models and as a result of confirmation bias, ignore cues that the model is not appropriate. Experts are especially susceptible to this. Models are simplifications, and complex systems can go way out of bounds. Like the current market situation. Then the models are no longer appropriate but we cling to them, putting us in harms way. Models come from past experience, limited experience and may not be appropriate as new situations arise, as they always do. Here is where humility comes in. A Zen saying,"In the beginners mind there are many possibilities: in the expert's mind there are few."

3. Be able to perceive, change plans, adapt, bail out.

How to get out of trouble.

4. The right positive mental attitude can keep one out of trouble, and allow survival when in deep. Some aspects of the right attitude are humility, awareness. Take personal responsibility rather than blaming outside factors. Surprisingly empathy and taking on the role of rescuer, rather than victimhood helps with survival. Death comes when people lie down and give up.

5. An interesting aspect of survival is friction. More effort cannot overcome friction. It only leads to exhaustion. Plans never go right, there are always delays, at the worst possible moment. Its Murphy's law at work. Its the vig. The cure is to conserve energy. Only go at 60%. Keep a reserve. Exhaustion is often the cause of death. When in danger or lost, people panic, and start flailing about, become exhausted, and lay down and die. Rather, be still, rest, observe. Then start to consolidate and make a plan. Get your bearings. Don't hurry. Get back on path.

Epitecus said, "Let silence be the general rule, or let only what is necessary be said, and in few words." The idea is to avoid chattering. Mental balance and focus is critical in survival situations.

"If you get a lucky break really use it. You have to fight like a bastard." Says one survivor. Other use other mantras repeated, to help survival mentality.

Last thing: be cool.

George Parkanyi writes:

In late October 1999 I went into a cold river and pulled someone out who had jumped off a bridge. Luckily her winter clothing had kept her afloat, and as it turns out thankfully the rescue was not all that difficult. . When I saw her shadow floating in the dark under the bridge, I remember thinking she could sink at any time, and for all I knew she was already dead. She'd been in the water at least 5-7 minutes. (I had run from the nearby video store to see what was going on when someone rushed in to call 911.) I quickly threw off my coat, sweater, and shoes so I'd have something dry to come back to, said a split-second prayer, and waded in. Then time slowed down — and I felt more like a detached observer. It was like something or someone else had taken over and was driving, and I was just watching it happen. I don't remember feeling the cold.

When I reached her, surprisingly she was still afloat, face-up and conscious. I was up to my chin in water but didn't have to swim. I introduced myself with "Hi I'm George. I'll be your rescuer for this evening. What's your name?" "Nobody", she murmured — par for the course I suppose as she was trying to kill herself. So I grabbed her coat and literally just towed her in. I heaved her onto shore and threw my coat over her, but about half a minute later the firefighters and paramedics arrived and took over.

Before then, I never knew what I'd do in that situation, or what it would be like. As Jim says, the mind really does go into a totally different state. And I think it starts at the point where you've fully committed yourself. But before I went in I did make some quick calculations; perhaps 30 seconds worth — help would be on its way, I was a strong swimmer, pretty cold water, shoes off, need something dry later, how much time to get there, how much time would she have, how much time would I have. So the rational mind is still key.

The one funny thing about that night was the look the video store clerk's face when I sloshed back into the store all wet and finished renting my video.

Russ Sears writes:

Just today, I was thinking about what makes US strong is that we all face the "prisoners' dilemma" together, but most of the people I know tend to think of it instead as the "rescuers' dilemma".

Best case, small gain, most likely case cold, pain from an ungrateful soul, but the worst case…

Do you risk it?

When the neighbor's barn burns or is hit by a tornado, we all pitch in to help. Because we know it could have been us. She may not have wanted help, but if she was your daughter, you would have been delighted that someone like you was there. People here in fly over country are talking survival of buying guns and heading for the hills of Canada or Alaska, if things get ugly and bad. But it is just talk, always will be, we have a duty.

George Parkanyi replies: