Sep

30

Spare the Rod and Spoil the Child, from Kim Zussman

September 30, 2008 | 1 Comment

Have you seen the kid who throws a tantrum to manipulate his parents? When he gets what he wants, he quiets down and seems vaguely satisfied. When he doesn't win the game, he throws an even bigger tantrum.

Have you seen the kid who throws a tantrum to manipulate his parents? When he gets what he wants, he quiets down and seems vaguely satisfied. When he doesn't win the game, he throws an even bigger tantrum.

It's not that he particularly wants his object of desire; rather, he is in a power struggle with the authorities and probes their limits. If his parents keep giving in, eventually he will conclude (unless he is religious) there are no higher authorities. He himself holds the power, and is frighteningly in charge of his own destiny in a world without order or structure.

Alex Castaldo queries:

Are you talking about the child or the market?

Vince Fulco adds:

On a related note, when some of the senators were stumping for the 'bailout/rescue/whatever' speech, I was reminded of the prior generation's remarks prior to meting out a spanking. "This is going to hurt me much more than it is going to hurt you." Many of us with 1st and 2nd generation immigrant parents know how that one really turned out!

Sep

28

September 2008 vs September 1873, from Stefan Jovanovich

September 28, 2008 | 1 Comment

Will the Treasury's plan be successful? The future "price" of MBS will be higher than any current estimate, but real estate lending will not resume until prices and the incomes of the borrowers become reasonable, even if the Treasury spends trillions. The single family home prices are coming close to the point of reasonable equilibrium now here in California, but I doubt they are anywhere close to that in the parts of the country where things were OK until this spring (NYC, for example).

Will the Treasury's plan be successful? The future "price" of MBS will be higher than any current estimate, but real estate lending will not resume until prices and the incomes of the borrowers become reasonable, even if the Treasury spends trillions. The single family home prices are coming close to the point of reasonable equilibrium now here in California, but I doubt they are anywhere close to that in the parts of the country where things were OK until this spring (NYC, for example).

What is fascinating to me as an outsider is that the question that Ulysses Grant successfully resolved by resumption of the unitary gold standard (1875) — the financial safety and assured purchasing power of savings — is not seen as of the key problem to be resolved. Everyone is worrying about the borrowers; but it is the savers who need to be reassured first. Some of my friends have wisely pointed out that the actual value of cash savings has been viciously eroded over the past few years by the rise in the price of everything from gasoline to boiled ham. If the Secretary of the Treasury were to announce a consumer TIPs plan, one that would guarantee consumer savings and demand deposits against institutional default and erosion of purchasing power, there would be a flood of deposits to banks that would be more than enough to save the banks.

What Grant understood was that the assurance that their money was as good as gold would allow individuals to "save and do better" and get on with their ordinary (sic) lives without having to pretend to be speculators. He was not a snob, but he knew, from a lifetime of family commercial experience, that most people were better at working than they were at trading and that the promise of liberty for American citizens had to include their right to have money that was permanently sound. What he also understood was that speculation involved the risk of catastrophic loss, and there must not be any government protections against that possibility. This is why he was able to accept the collapse of his fortune from the fraud of a partner with such equanimity; it was a risk he had already accepted when he made the bet. He would have been saddened but not surprised to see very rich people demand that bad credits be made good in the name of "the financial system"; that was what they had done throughout his tenure as President in demanding that the currency be expanded perpetually so that there was never a scarcity of credit.

If you are curious about the panic of 1873, you might look into the career of Bethel Henry Strousberg — a now-forgotten figure whose frauds were the ignition point for bringing down the credit house of cards, which was built, like the present one, on a fantasy of real asset prices' (in that case, railroads rather than houses) rising to the sky.

Kim Zussman sees a different analogy:

Recently here there have been discussions of what happened to Russians who bought property as the Tsarist empire collapsed c.a. 1917, and no doubt Putin's thugocracy is hoping the same for US.

Stefan Jovanovich replies:

The biggest losers in that case were the French investors who had bought Russian railway bonds and government bonds during the pre-War boom. It had seemed to them a reasonable investment since Russia was the fastest-growing economy in the world in the decade leading up to 1914.

The biggest losers in that case were the French investors who had bought Russian railway bonds and government bonds during the pre-War boom. It had seemed to them a reasonable investment since Russia was the fastest-growing economy in the world in the decade leading up to 1914.

A side note: The philosopher Ludwig Wittgenstein's father Karl was considered an oddball for buying American rail bonds after the Panic of 1907 when "everyone knew" that America's best days were behind it. At that time his peers in Austria were buying German paper instead. Twenty plus years later his children were able to escape the Nazis by buying their way out of Austria using the proceeds from those same bonds which they had dutifully held to maturity. The German paper that so many of their friends had owned evaporated during the post-war currency hyperinflation.

Steve Leslie muses:

My experience as a financial advisor and broker for over 25 years tell me this about people and their reactionary practices. The next shoe to fall will be in October when retail investors get their monthly brokerage account reports and mutual funds statements and see how much money they have lost. Impulse will take over and they will issue across the board liquidations of mutual funds, annuities & etc. I just see so much pressure on the system in the short term technically that we are far from a resolution of this going forward.

Sep

26

Number of Observations = 1, from Kim Zussman

September 26, 2008 | 1 Comment

Historically, how many nationwide-housing bubbles have burst, with consumer debt/savings this high, within an extensively global interconnected economy (and markets), five weeks from election, from a problem blamed on Wall Street greed but designed to increase minority home-ownership, while at war in the Middle East, where credit markets are seizing up and the government wants to purchase the bad debt? And what if the markets don't stabilize long-term once a bail-out is approved?

Historically, how many nationwide-housing bubbles have burst, with consumer debt/savings this high, within an extensively global interconnected economy (and markets), five weeks from election, from a problem blamed on Wall Street greed but designed to increase minority home-ownership, while at war in the Middle East, where credit markets are seizing up and the government wants to purchase the bad debt? And what if the markets don't stabilize long-term once a bail-out is approved?

Sep

23

Setting Main Street vs. Wall Street, from Jim Sogi

September 23, 2008 | 15 Comments

The vilification of Wall Street is taking full force. It is the worst form of scapegoating, denial, and mistakes were made (but not by me). It is similar to the criticisms of the legal profession where the intransigence, unreasonableness, and greed of the litigants is blamed on the representatives who are doing the job set out for them in the system. The current crisis originated in the greed and failure to save by homeowners, their use of real estate borrowing for consumptive lifestyles. Their failure to save, their spendthrift ways are all being loaded on to the investment community who were doing their function within the system. Now emails are floating around fighting the bailout of billionaires on Wall Street. You are an easy scapegoat. No matter that the speculator helped provide the liquidity to create trillions in new wealth. No matter that the long held family home is valued at many multiples of it's purchase price. It is the most culpable real estate speculator and overextended consumer that now point the finger in the attempt to avoid their own errors, lack of judgment. With an election coming up, the politicians, the worst of all, are jumping on the BANDWAGON. The cycle is ending. The funny thing is that equities are barely down a 1/5 and they are throwing out the baby along with the bathwater. But it's good. We really don't need the big firms anymore with universal access and electronic execution. Truth is we really don't need big government either, but its turn comes next.

The vilification of Wall Street is taking full force. It is the worst form of scapegoating, denial, and mistakes were made (but not by me). It is similar to the criticisms of the legal profession where the intransigence, unreasonableness, and greed of the litigants is blamed on the representatives who are doing the job set out for them in the system. The current crisis originated in the greed and failure to save by homeowners, their use of real estate borrowing for consumptive lifestyles. Their failure to save, their spendthrift ways are all being loaded on to the investment community who were doing their function within the system. Now emails are floating around fighting the bailout of billionaires on Wall Street. You are an easy scapegoat. No matter that the speculator helped provide the liquidity to create trillions in new wealth. No matter that the long held family home is valued at many multiples of it's purchase price. It is the most culpable real estate speculator and overextended consumer that now point the finger in the attempt to avoid their own errors, lack of judgment. With an election coming up, the politicians, the worst of all, are jumping on the BANDWAGON. The cycle is ending. The funny thing is that equities are barely down a 1/5 and they are throwing out the baby along with the bathwater. But it's good. We really don't need the big firms anymore with universal access and electronic execution. Truth is we really don't need big government either, but its turn comes next.

For the speculator, many new niches and many opportunity will arise. The government will be the ultimate slow mover. As they try to enter the market, as we have seen this last week, there are big waves kicked up. The least qualified populate government functions. Small and fast moving adaptors can thrive in such an environment. Seems that many big hedge funds are going down or weakening. The white shoe brokers are weak. The change will be good. It's just like evolution and climatic change. New species will arise. Many will perish unless they adapt. Even the data itself is reinventing itself with data over a year old being almost irrelevant. As Lack says, regulation will be a joke. Every rule will create a dozen loopholes to exploit that the slow moving professors never thought about. THEY can't control the markets. The big illusion is that government can cure the problems when in fact, THEY are the problem.

Kim Zussman replies:

"Greed and failure to save by homeowners" is also what caused the markets to recover from the tech-bubble / 9-11 bear market. The FOMC could have chosen not to increase liquidity / ease rates in that environment — in which case there might have been a deeper/longer "my father's" recession.

"Greed and failure to save by homeowners" is also what caused the markets to recover from the tech-bubble / 9-11 bear market. The FOMC could have chosen not to increase liquidity / ease rates in that environment — in which case there might have been a deeper/longer "my father's" recession.

Remember the wealth effect: as people's homes increased in value, they felt richer, borrowed more, spent more, and drove earnings up. And felt a lot of pressure to do so. How do you say no to the Mrs. when she complains about the many vacations the neighbors take, or their new boat?

One of my favorite symbols of this period was the web-ads showing ethnic-minority couples dancing on rooftops when their loan was approved. Hey, it's a free country.

Bruno Ombreux sees a silver lining:

Am I the only one thinking that this mess is actually very good news for small speculators?

Fewer investment banks, fewer hedge funds, higher cost of capital and more regulations mean less efficient markets, that is more edges. And at the same time less competition for those edges.

The golden age of speculation is coming.

Janice Dorn adds:

Some days ago, I sent a copy of my first book to Alan Millhone. The title of the book is: Personal Responsibility: The Power Of You.

Some days ago, I sent a copy of my first book to Alan Millhone. The title of the book is: Personal Responsibility: The Power Of You.

We are living through an epidemic of failure/unwillingness to accept personal responsibility for our actions. The blame game is just that. No personal responsibility. Mistakes were made ( but not by me). When the locus of control shifts from inward to outward, there is nothing but whining, blaming, gnashing of teeth, bullying, etc.

The worst lies are the lies we tell ourselves.

Tim Melvin argues:

Don't confuse speculators with the banks and Wall Street. There is an enormous gulf between the two. The fact is the banks did create loans and loan structures that encouraged excessive borrowing. Merrill used to encourage homeowners to take out home equity loans and put the money in stocks. Homeowners did not create option ARMs or understand them. Banks created then and sold them. The public did not slice, dice and engineer toxic securities from their mortgages. Wall Street did that.

Don't confuse speculators with the banks and Wall Street. There is an enormous gulf between the two. The fact is the banks did create loans and loan structures that encouraged excessive borrowing. Merrill used to encourage homeowners to take out home equity loans and put the money in stocks. Homeowners did not create option ARMs or understand them. Banks created then and sold them. The public did not slice, dice and engineer toxic securities from their mortgages. Wall Street did that.

Does the public have culpability for their stupidity and greed? Of course they do and they are paying for it. Look at foreclosures. That can't be a pleasant experience. However, the Street has to take its share of blame for creating the speculative fires and then pouring gas on them.

Most "speculators" had nothing to do with the creation of this mess. They do not lend money or create securities. They trade. And most of us do it with our own money.

Jim Sogi replies:

While you are entirely correct, the public doesn't know or care of the difference, and blames you as much as Gold Man. Anything to deny personal responsibility.

Sep

19

Limit Points of the Great Moderation, from Kim Zussman

September 19, 2008 | 3 Comments

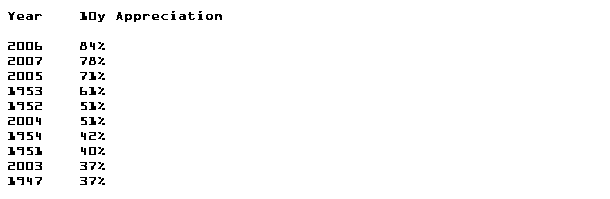

This week's normalized range in SP500 was 6th highest of the 3000+ weeks since January 1950. Normalized range is defined as:

[(week high)-(week low)] / [(week high)+(week low)]/2

(the high minus the low over the midpoint between the high and low)

Here are the biggest ranges (in chronological order), and the respective dates:

[Ed.: this table was updated at 1pm September 20 to correct an error in the previous version. Many thanks to a reader for pointing out the error].

Sep

9

Traits of Survivors, from Kim Zussman

September 9, 2008 | 6 Comments

A CNN program, Deep Survival, comes to some conclusions about the people who survive serious accidents and disasters:

many of the disaster survivors he studied weren't the most skilled, the strongest or the most experienced in their group. Those who seemed best suited for survival — the strongest or most skilled — were often the first to die off in life-or-death struggles, he says. Experience and physical strength can lead to carelessness. The Rambo types, a Navy SEAL tells Gonzales, are often the first to go.

Steven Scoles adds:

I read Gonzales book "Deep Survival" a couple of years ago and found it full of intriguing stories like the one noted in the article. I would highly recomend it. I do fair bit of mountain hiking and river kayaking and it made me realize how my experience has made me complacent in those activites (e.g. more willing to go off on my own in unknown territory)… not unlike bull markets make people complacent about risk.

Gibbons Burke preaches:

Faith in a G_d who promises life everlasting to those who believe and follow Him gives the faithful believer a great deal of peace of mind in the face of dire circumstances.

Kim Zussman replies:

What then is one to do when faced by (the all too frequent) dire circumstances in a world without objective evidence of supernatural benevolence? Do you become forced to take up formerly illogical beliefs, and with that admitting your weakness and defining your faith?

What then is one to do when faced by (the all too frequent) dire circumstances in a world without objective evidence of supernatural benevolence? Do you become forced to take up formerly illogical beliefs, and with that admitting your weakness and defining your faith?

Many traders share the experience of putting on a well-reasoned position which turns around to crush you. During the decision to fold or not (or G_d forbid, Martingale), does your internal voice change from "T=3.2!" to "WTF do I really know?" and if it doesn't, how is this not faith which transcends scientific self-doubt?

Gibbons Burke persists:

We're speculating with regards to the true meal of a lifetime and beyond — or eternal barbeque, depending on your freedom to choose outcome you will. Seems perfectly on topic, no?

We're speculating with regards to the true meal of a lifetime and beyond — or eternal barbeque, depending on your freedom to choose outcome you will. Seems perfectly on topic, no?

With apologies to Blaise Pascal for mangling his famous wager… the gaming odds for the prudent eternal investor favor belief, without even considering the utility of belief:

= A believer, if wrong, will never realize his error: he will be dead and to dust. Poof! His upside is limited to the benefits of that belief - peace, joy, happiness, fortitude, patience, courage, etc. (so-called fruits of the Holy Spirit) and perhaps the blessings of a life well lived, depending on the breaks.

= For the same reason, a non-believer, if right, will never realize any returns from his correct bet, so the upside on this option is capped at his expiration date (death). He, too, may have lived a seemingly good life, relatively uninhibited by the constraints of the believer's conscience and avoidance of sin.

Advantage: subjectively neither at this point.

However…

+ A believer, if right, will enjoy the eternal and infinite upside alpha of his investment in belief: life everlasting in communion with God, who is Himself Truth, Beauty, Virtue and all good things - to behold him face to face, for eternity, as well as the benefits which accrue to a life lived on earth in faith - even perhaps suffering for that faith. What a small premium to pay, relative to the potential reward, no?

- The non-believer, if wrong, will bear the eternal and ultimate lock-limit drawdown, with no stop loss in place. A literal margin call from Hell. Separation from God the Father. He will know he was wrong - for ever, and ever, world without end.

So, to put this into option terms:

The risk profile for investing in the LEAP of faith — a 'call' option of belief in the Underlying Security — is unlimited upside if he's right; limited down side if he's wrong.

The 'naked put' option of the who doesn't believe in the value of the Underlying Security, is a limited upside if he's right; unlimited downside risk if he's wrong. He may end up with a debt he can never repay. (Paging Dr. Faustus…)

For all that is in the world, the lust of the flesh and the lust of the eyes and the pride of life, is not of the Father but is of the world. And the world passes away, and the lust of it, but he who does the will of God abides forever. [1 John 2:16-17]

Stefan Jovanovich generalizes:

One of my favorite pulp fiction moments is in Joss Whedon's Serenity. The preacher, who like many godly men has had a great deal of experience with his own capacity for evil, is dying. Mal, the atheist hero, calls for medical help and tries to reassure the preacher that he will live to preach many more sermons to Mal's skeptical ears. The preacher is having none of it; with his dying breath he replies, "Don't matter what you believe. Just believe in something." I am afraid I share the preacher's hopelessly ecumenical notions of gospel. Belief in the magic of markets, chess, checkers, one's friends, something is the necessary precondition for humility and humility (not passivity) is the necessary precondition for wisdom. The survivors I have known do not necessarily believe in God but they do believe in "something" greater than themselves. They did their best and kept at it - all the while accepting that what happened to them was never entirely under their own control. Or, as the philosopher said after banging his thumb with the hammer, "it happens."

Nigel Davies tries to get back on subject:

This got me thinking about how one should survive in chess and markets. I'm not sure these should be treated in quite the same way as both stakes and sample size are very different. In Gonzales's examples there is a sample of one person in a one-off situation, so luck will be at a premium. As such it may be difficult to separate this out from genuine skills.

This got me thinking about how one should survive in chess and markets. I'm not sure these should be treated in quite the same way as both stakes and sample size are very different. In Gonzales's examples there is a sample of one person in a one-off situation, so luck will be at a premium. As such it may be difficult to separate this out from genuine skills.

In markets too there is a lot of luck.

Turning to chess one can find excellent advise on 'defending difficult positons' from both Lasker ('Lasker's Manual of Chess') and Keres ('The Art of the Middlegame'). Very briefly, Lasker suggests having no weakest point in one's position whilst Keres advises that one should make the opponent's win as hard as possible rather than focusing on counterattack. I think these are both very useful, but there is another dimension which I think is important.

The ability to keep one's position afloat when things go wrong is a function of the earlier disposition of one's forces. So players who proceed in an aggressive and taut style find it very difficult to change this disposition when things start to go wrong. Firstly their forces may be committed to attack, and secondly they may have compromised other parts of their position in a belief that the attack will win.

It's noteworthy that many of the greatest master's of defence (for example Lasker, Capablanca, Korchnoi, Karpov, Kramnik) haven't usually played for the maximum in the opening, looking instead for a certain harmony and balance in their positions. Their games have an unpretentious feel, very few weaknesses and balanced forces.

Chess masters are not noted for their humility but years of experience can teach them how to create balance intuitively. Will reading about it help? I don't think so. And it may even be damaging by providing false confidence or theories which haven't been tested by pain.

Sep

7

Evidence of Regime Change, from Kim Zussman

September 7, 2008 | 2 Comments

Remember February 27, 2007? That day's return (SPY, close-to-close) was almost -4% (supposedly catalyzed by a panic in China's stock market).

Remember February 27, 2007? That day's return (SPY, close-to-close) was almost -4% (supposedly catalyzed by a panic in China's stock market).

It has been 385 trading days since that day. Here are the statistics for daily returns for the 385 days since 2/27/2007, and the 385 days prior (excluding 2/27/2007 itself):

A down market since then (losing 2 basis points a day versus making 5 bp), as well as notable changes in skew and kurtosis. And standard deviation is almost twice as big. The 2/27/2007 move of -0.039 was 6.2 stdev from the mean of the prior 385 days, whereas it was only 3.4 stdev from the mean of the 385 days following.

Sep

1

The Two Year Effect, from Hans Martin Aannestad

September 1, 2008 | 3 Comments

Any thoughts on the paper "The Two-Year Effect" by Graham Bornholt ?

This paper identifies a puzzling form of predictability in U.S. stock market portfolios. For the value weighted market index, those years that follow a low return two years earlier have an average return 11.6% higher than those years that follow a high return two years earlier. The difference in returns is economically and statistically significant.

Vic and Laurel reply:

Let us say it does not come as a complete surprise; the strong negative correlation between the current year return and the return two years back is mentioned in our book Practical Speculation on pages 210-211. See in particular Table 9.2 on Page 211,

We invite the submission of relevant analyses.

Kim Zussman follows up:

Using SP500 (w/o dividends) I checked Dec-Dec returns 1950-07 for years coming 2 years after down years (the year after the year after a down year). Comparing these with all yearly returns for the series showed them to be higher, but the difference is not statistically significant:

Phil McDonnell expresses skepticism:

One way to test for a two year negative correlation is to calculate a correlation coefficient with a lag of 24 months. For S&P adjusted [monthly] returns from 1950 to 2005 we get the following correlations at the various monthly lags from 18 months to 33 months:

Note that the correlation at 24 months is actually +1.55% which does not support the idea of a negative correlation at two years. However overall most of the monthly correlations are negative in the 18 month to 33 month range. Another indication of how weak any effect may be is that none of the correlations rise to the level of 5% significance. Given that there are 16 chances we might expect that at least one would be significant by chance alone.

Dr. McDonnell is the author of Optimal Portfolio Modeling, Wiley, 2008

Alex Castaldo replies:

I thought we were discussing yearly returns, not monthly. You lost me somewhere.

Aug

31

Speed and Longevity, from Victor Niederhoffer

August 31, 2008 | Leave a Comment

I have come across several conflicting ideas about the relation of speed and longevity recently. In Eric Sloane, the idea is that the slowest animals live the longest, but several studies show that that the fastest runners live the longest. I wonder how this would be resolved in the real world of markets. Speed and distance, and lifespan would seem to be helpful concepts to untwine.

I have come across several conflicting ideas about the relation of speed and longevity recently. In Eric Sloane, the idea is that the slowest animals live the longest, but several studies show that that the fastest runners live the longest. I wonder how this would be resolved in the real world of markets. Speed and distance, and lifespan would seem to be helpful concepts to untwine.

Dylan Distasio adds:

Typically, larger animals have longer natural lifespans. This is likely related to their lower base metabolic rates (a smaller mammal is going to have a faster metabolism to offset greater loss of body heat). The most obvious analogy would be market cap and the idea that larger companies are slower to shift course.

Another factor is how prodigious the species is at reproducing. High fecundity usually means a shorter lifespan. Is there an analogy to this in the markets? If we use our imaginations, perhaps. Maybe an area of the market with many competitive companies, and a low barrier for entry like the Internet space.

For those who are gluttons for punishment, there is scientific journal article on body size, metabolism and lifespan that may be worth untangling.

Scott Brooks recalls:

I saw a special on either Discovery Channel about heart rate. They did a comparison between many animals and the number of heart beats they had in a lifetime. The one that stick out in my mind was the difference between some kind of mouse and an elephant. The difference in life expectancy was quite substantial in terms of years, but the average number of total heart beats between birth and death was essentially equal.

This didn't hold up for all species, but there were some striking similarities between mammalian species and heart beats.

If this is true, then am I using up my "lifetime heartbeats" each time I work out?

I know that my family doesn't live particularly long, with most dying at or near average life expectancy. I also know that for my entire life, my resting heart rate has been in the upper 80s or low 90s. I've worked diligently to get it lower, but it doesn't come down. When I exercise, I get my heart rate up into the 160s or 170s — if I'm really working our hard, then I'll get it up into the 180s or 190s.

Am I using up my heartbeats?

Marion Dreyfus reassures:

When I worked for the giant ad agency J Walter Thompson, the physican onstaff, with whom I consulted about all of my copy, used to tell me: "I have grown old walking in the funeral corteges of those more fit than I."

Kim Zussman, on the other hand, enjoys frightening people:

Don't forget, the healthier your heart (and the longer you go without heart attack) — the more likely you are to die of cancer.

Low fat diet, exercise, contol of blood pressure/blood sugar, have much bigger effect in forestalling heart disease than cancer.

Aug

27

The Most Amazing Thing, from Victor Niederhoffer

August 27, 2008 | 7 Comments

The most amazing thing about markets to me is that no matter how many previous instances I have, I can never find days that are anywhere near the ones we are currently having. The S&P is moving from x day highs to y day lows with impunity and alacrity and then hanging on the balance scale at the end of day when Zeus decides who will win.

Peter Earle replies:

I remember reading a book several years ago about Roger Bannister and his breaking of the four minute mile in 1954. At the time there were any number of physicians who predicted that the record was physically impossible to break; one predicted that Bannister's heart would explode in accomplishing such a feat.

I was reminded of this in both watching (and hearing) that, once again, in a seemingly inexorable march of highs (and lows), world records were broken throughout the Olympics in Beijing.

It bears mentioning that the events themselves have changed greatly from year to year: not only in the rise of professional Olympians, undistracted from a training (indeed, a living) regimen by employment, formal education or social duties, but as well in the structure of the events themselves. Engineered swimsuits, deeper pools, vacated end lanes, and other such changes in swimming events alone have contributed to the aforementioned increase of extremes.

So too, in the markets: that the year-over-year outdoing of previous records in extremes have as much, if not more, to do with the character, fragmentation and specialization of market venues; the "democratization" of access to various markets, bringing millions of additional opinions and hundreds of billions more dollars in; the rise of electronic, in particular algorithmic trading; better/faster processing speeds in technology; and the like, ad infinitum — than of any intrinsic quality of markets.

Kim Zussman ponders:

Like global warming, it is hard to measure whether the market becomes progressively and durably more efficient, or just temporarily stations in an efficient regime. Presumably the proportion of outperforming trader/investors who persist over long periods must go down if markets get more efficient, but that number ought to be hard to get, in that widespread knowledge could discourage the hopeful machine.

Anatoly Veltman adds:

I'll give you another factoid: TY (10-y Treasury futures) lost 10% of Open Interest on the Fri, Aug 22 drop. We just found out that FV (5-y Treasury futures) gained almost 10% of Open Interest in Tue, Aug 26 slow trade. Any connection to the recent abandonment of 10-y as the benchmark?

Aug

25

What is Art?, from Scott Brooks

August 25, 2008 | 18 Comments

I have never gotten art. I can't determine what is and isn't a great work of art, or even define what constitutes a great work of art.

Kim Zussman replies:

Scott, in my experience art is very personal communication - between the artist and the viewer, and between the viewers.

Yes, there is much scholarship on the subject: what was innovative, what changed the world. But good pieces talk if you listen carefully. And great pieces will never leave you.

Even modern art.

For example, take this web site's favorite subject of barbecue: There have been many descriptions of delicious smoked ribs, dripping sausages, saucy pulled pork. When you savor this food, you taste something of the life and the love of the cooks - as well as friends who find it important enough to recommend. A common experience, which feels unique, and pre-dates you by thousands of years and will continue to live beyond.

Isn't it wonderful to share food loved by all? That's art - because it is talking to you - and many others. You are connected to past and future. It talks without words and within it you speak loud in silence. If you cannot hear then you are not listening or it is not talking.

Beautiful women are art. Yes, they are up to something, and indeed they are programmed functionaries. But if her flashing eyes unsettle you, or the fine hair on her arm or the particular curve of her breast, this is art (as well they know). That they don't realize the extent of their role is art.

Even not-beautiful women are art. Sometimes the best kind of art.

Art debilitates. And it's funny.

We cannot seek it - it will come for us. And raise us up, by the neck for just long enough to allow the taste of life and the understanding that others can taste it too.

Aug

18

WSJ Calls Inside Buyers Ignorant, from Steve Ellison

August 18, 2008 | 2 Comments

Throughout Wall Street history, insiders have earned superior returns on purchases and sales of their companies' stocks. H. Neyjat Seyhun wrote a book in 1998, "Investment Intelligence from Insider Trading", detailing an exhaustive study of insider transactions. Seyhun found that stocks in which insiders were net buyers outperformed stocks in which insiders were net sellers by an average of 8% in the following 12 months.

Throughout Wall Street history, insiders have earned superior returns on purchases and sales of their companies' stocks. H. Neyjat Seyhun wrote a book in 1998, "Investment Intelligence from Insider Trading", detailing an exhaustive study of insider transactions. Seyhun found that stocks in which insiders were net buyers outperformed stocks in which insiders were net sellers by an average of 8% in the following 12 months.

The Wall Street Journal is well aware of this outperformance and regularly reports on insider transactions. I was quite surprised, therefore, by today's Heard on the Street column. David Reilly suggests that investors would be foolish to follow the lead of financial company executives, whose net purchases of their companies' shares in July were the highest in 10 years.

Excerpt : [subscription required for link to full article].

"Company executives clearly have better information than the average investor. But it doesn't always pay to follow their buying cues.

Like plenty of other investors, executives at financial firms haven't been good at calling bottoms during the credit crunch. In the third quarter of 2007, executives and directors of diversified financial companies — brokers, big banks and exchange operators, among others — bought more stock in their own companies than at any other time since the third quarter of 2002, according to data from Gradient Analytics.

The trade didn't work. The third quarter of 2007 was anything but the bottom for financial stocks …

Today, financial executives are back buying. Since the end of June, the value of purchases, when compared with share sales, has reached its highest level in a decade."

Kim Zussman replies:

It would seem difficult to believe in changing cycles (dissipation of knowable patterns), and not suspect that insider buying has been gamed - by insiders who are informed of the literature and seek (for not unselfish reasons) to align with shareholder objectives.

Whether Seyhun's alpha persists will be answered in time, but like others which are well-known, expect it to run through a period of great disfavor before flying again.

Victor Niederhoffer comments:

It's ridiculous to assume that because in one quarter insiders were wrong, this disproves studies based on hundreds of thousands of trades. Of course it doesn't work, some quarters — like the beaten favorite Federer: that's when he's going to win the doubles for sure.

[Dr. Niederhoffer is the author of "Predictive and Statistical Properties of Insider Trading", The Journal of Law and Economics XI (April 1968): 35-53.]

Aug

11

More Thoughts on Stops, from Jim Sogi

August 11, 2008 | 13 Comments

The use of fixed mechanical resting stops seems to be an admission of inability to trade your way out of a paper bag. It is also an admission you are undercapitalized. It is one thing to realize you were wrong. It is another thing to give up on the bottom tick.

The use of fixed mechanical resting stops seems to be an admission of inability to trade your way out of a paper bag. It is also an admission you are undercapitalized. It is one thing to realize you were wrong. It is another thing to give up on the bottom tick.

Isn't it better to trade your way out of a bad situation rather than give more of your money to the opposition in defeat? It is a harmful mechanical crutch. It is better to watch for a better opportunity to exit with some grace. It is better to know the market, and know yourself.

Larry Williams objects:

What if you cannot exit with grace — market goes limit down 10 days? No way to trade your way out of that…

Stops prevent failures and allow one to regulate the size of the loss.

I'm talking trading here; not investing… value investors buy and hold until value changes or overall market gives a sell, that seems to be best strategy.

Shui Kage adds:

The old Japanese market proverb: "Mikiri senryō".

"To ditch a small loss is worth a thousand ryō" (In today's language: is worth one million dollars).

Most amateurs are unable to take losses at small size and most amateurs are not very good traders.

Phil McDonnell dissents:

If the market goes limit down (or up) against you then stops will not help either. The stops will not be executed. In that case only proper position sizing in the beginning or an option hedge will protect your position. There is no guarantee a stop will be executed at your price or anywhere near your price in the event of a gap open.

If the market goes limit down (or up) against you then stops will not help either. The stops will not be executed. In that case only proper position sizing in the beginning or an option hedge will protect your position. There is no guarantee a stop will be executed at your price or anywhere near your price in the event of a gap open.

There is no theoretical basis that stops should work either. I have written about this here on numerous occasions. Thus the best advice is to back test, taking stops into account explicitly. When testing stops one should use great care to increae the assumptions regarding slippage. Invariably stops will be hit during fast markets when slippage is the greatest. Compare that to a back test without the stops. If the test using stops gives a superior overall risk reward profile then it is reasonable to use stops. One should never think of stops as the sole money management technique because of the slippage and gap issues discussed above. Rather stops are more of a trading tool to reshape your risk reward profile.

There is another reason to consider stops and that is psychological. Many of us are simply unable to pull the trigger when we get into a losing situation. Suppose you had a trading model that predicted that tomorrow would be up by the close. The obvious way to trade that would be to get in and get out by the close tomorrow. But if your system was wrong (and they all are sometimes) then you may find yourself holding the position simply unable to admit the loss and freezing on the trigger. It is easy to come up with all sorts of rationalizations for this behavior. "The drift will bail me out" might be one. Suddenly your plan has changed from a one day trade to hold it for ten years until the long term drift bails me out. So if you find yourself doing this too often then having a preset stop may be the psychological crutch you need to be successful. Better than that, of course, might be to simply write your plan down and execute it as planned.

Dr. McDonnell is the author of Optimal Portfolio Modeling, Wiley, 2008

Janice Dorn adds:

I would add to this that placement of stops is both art and science. It is among the most difficult concepts for a trader to grasp, and there is more confusion surrounding stops than almost any other aspect of trading. How often do we hear: “They see my stops” or “There is clear stop-running going on” or something similar re: stops. That is why when I trade ( not invest), I use multiple contracts, keep taking profits and trailing stops ( on a good trade) and get out as quickly as possible when the trade is not going right for me. Also, I am prepared to lose on a certain percentage of all trades per my trading plan. I used to hate and could not accept getting “stopped out” but now accept it as part of the cost of doing business.

I would add to this that placement of stops is both art and science. It is among the most difficult concepts for a trader to grasp, and there is more confusion surrounding stops than almost any other aspect of trading. How often do we hear: “They see my stops” or “There is clear stop-running going on” or something similar re: stops. That is why when I trade ( not invest), I use multiple contracts, keep taking profits and trailing stops ( on a good trade) and get out as quickly as possible when the trade is not going right for me. Also, I am prepared to lose on a certain percentage of all trades per my trading plan. I used to hate and could not accept getting “stopped out” but now accept it as part of the cost of doing business.

Also, it is very challenging for most traders to “stop out” and then get back in again. Part of the reason for this is inexperience, and the other part is the way that losses are seen by the brain. Losses are weighed about 2.5 times as heavily as gains. This means that if you are down 10% on one position and up 10% on another position, you are break even on paper, but are down 25% in your brain. There is a complex process that goes on inside the brain of the trader that is looking at losses. But that is another topic and I have already digressed from the “stops” thread.

Dr. Dorn is the author of Personal Responsibility: The Power of You, Gorman, 2008

Jeremy Smith tries for the final word:

Everyone uses stops.

Some put them in immediately.

Some keep them stored in gray matter for later deployment.

Some wait for the margin call.

Kim Zussman exclaims:

"Say uncle!"

"Say uncle!"

If you trade less than 100% of your investable capital, that is a stop.

If you trade predominantly the capital of others, that is a stop.

If you let the account blow up without borrowing against your home or retirement accounts, or hitting up friends/family, that is a stop.

If you decide to trade small enough to preserve your marriage, sanity, or life, that is a stop.

Even the Kamikaze had stops.

Nigel Davies suggests extending the discussion:

What about broadening this discussion still further to include the 'reverse-stop', ie a profit target? I don't see much difference between the two from a conceptual point of view, the issue here being psychological (one represents a loss, the other a win).

Can one be ideologically opposed to stops without also being unable to take a profit? I don't see how we can discuss one without the other and they all come under the category of 'planned exits'.

Jul

28

Do Secular Bull/Bear Markets Exist? from Kim Zussman

July 28, 2008 | Leave a Comment

Using DJIA historical weekly closes since 1930, I checked for dates when weekly closes were a new 500 week high (i.e., approx. 10 years). Plotting these vs date shows two periods when 500W highs clustered (50-65 and 82-99), and two gaps in which 500W highs rarely (or never) occur (65-82, 99-06).

Using DJIA historical weekly closes since 1930, I checked for dates when weekly closes were a new 500 week high (i.e., approx. 10 years). Plotting these vs date shows two periods when 500W highs clustered (50-65 and 82-99), and two gaps in which 500W highs rarely (or never) occur (65-82, 99-06).

This is all retrospective but it is possibly supportive of the theory that bull and bear market durations are comparable to investment-lifespan (eg. memory of living investors).

Jul

10

Entry in Subprime Song Contest, from Kim Zussman

July 10, 2008 | 1 Comment

They used to tell me I was building a dream - and so I followed the mob,

When there was earth to grade, or nails to drive, I'd borrow for the job.

They used to tell me I was building a dream, with peace and glory we led,

Why should I now be standing in line, foreclosure just ahead?

Once I built a credit-line, made it run, buying time.

Once I built a credit-line; now it's done. Brother, can we spare sub-prime?

Once I built a McMansion, up to the sun, stucco, sticks..sublime;

Once I built a tower, now it's done. Brother, can we spare sub-prime?

Once in khaki shorts, gee we looked swell,

Full of that Yankee Doodly Dum,

Who'd a thought it dumb!

Say, don't you remember, they called me Mort; Mort I paid - all the time.

Why don't you remember, I'm your pal? Buddy, can we spare sub-prime?

"Brother, Can You Spare a Dime", lyrics by Yip Harburg, music by Jay Gorney (1931)

George Parkanyi adds:

I have another entry!

Sung to the tune of the Beatles’ Yellow Submarine …

In the town, where I was born,

Lived a man, who failed to see

The basic flaw, of going long

Asset-backed securities.

And so he bought, a mighty tranche

Of CDOs he thought secure

From triple A, it slowly dawns

That what he bought, but cow manure

all together now …

We all hold a ton of hollow sub-prime liens,

Hollow sub-prime liens

Hollow sub-prime liens

We all hold a ton of hollow sub-prime liens,

Hollow sub-prime liens

Hollow sub-prime liens

Now we watch, quite nervously

A fast imploding S&P

And we wonder, do we still have

A functioning economy

We all hold a ton of hollow sub-prime liens,

Hollow sub-prime liens

Hollow sub-prime liens

We all hold a ton of hollow sub-prime liens,

Hollow sub-prime liens

Hollow sub-prime liens

(repeat and fade)

Jul

8

Bear (as in Stearns) Markets, from Kim Zussman

July 8, 2008 | Leave a Comment

One way to think of sell-offs is as an attempt to locate and test fixed stops of different kinds. The BSC affair was one; when it was learned that a "too big to fail" failing financial (actually too big to let fail) was handled by the Fed and another financial. Similar tests occurred in January, in order to find out how much Ben cared about the stock market.

Both tests occurred around the level the SP500 is at now, and there could be attempts to bring it lower to find out what happens should other financials go under (eg, WM, WB, LEH ) - with or without government intervention. Or to bring in an "orthogonal" test of an asset related to other systemic problems, such as GM.

Jul

7

A real-estate agent shared some data on the local housing market over the past year, including listing price, sale price, days on market, and selling agent commission. He posed this question:

Commissions are paid by the seller to the listing agent and the selling agent (the agent that brings the buyer). Selling agent commissions range from 2.5% - 3%. The seller selects which commission rate he wishes to pay. Which yields the best result for the seller? My hunch is the higher commission (for many reasons), but I would like to see if the data supports my hunch.

To look at results for the seller, I was interested in DOM (Days on Market), and how much below the listing price the actual sale transacted - a variable I called "discount":

discount = [(listing price)-(sale price)] / (listing price)

In the data I noticed that there were other commissions besides 2.5 and 3.0%. When including these outliers, the analysis was messy - so since there weren't many I threw out all but exactly 2.5% and 3.0% selling agent commission data. Here is a test comparing the mean DOM for sales commission of 2.5 and 3.0%:

Two-Sample T-Test and CI: DOM_1, Commission 1_1

Two-sample T for DOM_1

Commission 1_1 N Mean StDev SE Mean

0.025 398 90.4 73.3 3.7 T=2.08

0.030 164 78.5 56.3 4.4

Those paying sales commission of 2.5% stayed on market an average of 90 days, whereas those who paid 3% stayed on 78, and the difference was statistically significant. Evidently the agent worked harder!

However the discount (drop in price from listing to selling) went the other way:

Two-Sample T-Test and CI: Disc_1, Commission 1_1

Two-sample T for Disc_1

Commission N Mean StDev SE Mean

0.025 398 0.0453 0.0467 0.0023 T=-1.34

0.030 164 0.0513 0.0488 0.0038

The sellers paying the higher commission also had to take about 0.5% more discount from listing to selling price (though not quite statistically significant). This, of course, is made worse for the seller because the commission was also higher by 0.5% - so you could say that the net was really 1% worse including the higher commission.

Taken together it looks like the higher commission for selling agent incentivizes him to close the sale faster, though at a slightly worse price for the seller.

Capitalism works!

Jun

28

Bear Market Sighted, from Kim Zussman

June 28, 2008 | 5 Comments

A nice, clear definition: "a bear market is a 20 percent drop from an all-time high." We'll know when we've had one. Nigel Davies.

Like we used to ask, what about numbers on the table?

Using DJIA 1950-2008 monthly data (skipping the Depression because it can't happen again), a bear was defined as this month's close < 20% below the high of any of the prior 24 months. Comparing the mean return of months following bear months with all months in the series shows they are actually higher - though not significantly:

Note that at least some of the insignificance is stemming from the higher volatility of 'after bear market' months:

The higher volatility is quite statistically significant.

—–

Speaking of numbers on the table, here's a reminder to budding real estate moguls just how pricey bubbles can get Homeowner offers her house and her 'love' for sale

Jun

22

Spectrum of S&P Closes, from Kim Zussman

June 22, 2008 | 1 Comment

When excited properly gases emit radiation at specific wavelengths, because electron transitions to lower energy levels is quantized. This is seen well as emission lines on spectra.

When excited properly gases emit radiation at specific wavelengths, because electron transitions to lower energy levels is quantized. This is seen well as emission lines on spectra.

If stock prices were attracted to round numbers, in terms of frequency one might expect to see something like a spectral pattern. For example, the count of daily closing prices in SP500 should be higher around round numbers. A dot-plot (like a histogram with dots) was used to check for round-clustering using daily SPY closes multipled by 10 (to replicate the actual SP500 index number). This particular dot plot tallies up to 7 observations per dot, and each column represents a bin of 20 SP500 points (eg, "1000" is all daily closes from 990 to 1010)

A dot plot of 10X SPY does not appear to show clustering around the "hundreds" (900, 1000, etc) in S&P 500.

Jun

12

Alpha Optimism, from Kim Zussman

June 12, 2008 | 5 Comments

It's notable that many of the wealthiest investors are optimistic. But not all of them are, and certainly pessimism pays well from time to time.

It's notable that many of the wealthiest investors are optimistic. But not all of them are, and certainly pessimism pays well from time to time.

Assuming there is a payoff to optimism, what if Penn's Dr Seligman (optimism can be learned) is wrong, and optimism/pessimism is - like many personality traits - genetically determined and rather immutable? Inherently optimistic investors get the rewards of their fortuitous place in time, when they are fortunate to be placed in times of fortune.

Dr Goulston's recent post about personality types suggests there must be studies on which personalities are suited to trading financial markets, and which not. There are lots of these tests - you can take one (such as this Myers-Briggs type test) and then ask whether your successes and failures were predetermined.

In any case, haircuts never go out of style, they just change in type (remember the old song by Crosby Stills Nash and Young).

Riz Din adds:

My optimism is partly a function of recent documentaries watched, but it looks to this layman that even if mankind is only equally as clever as they have been in recent years, then the gains to humanity will be breath-taking as the digital revolution becomes all encompassing.

Instead of observing incremental changes in technology lets remind ourselves of the state of the world a just few decades ago. Thinking back, I remember adding a 32k ram extension on to my ZX Spectrum. Today, you can pick up an 8GB portable thumbdrive for under GBP 10. I won't try and calculate the gains that have taken place, but I'm pretty sure that if progress simply continues as is, the world is going to be a very interesting place. As the digital world widens and reaches into other fields such as genetics, and perhaps even energy technologies, these fields will reap the benefits of rapidly increasing processing power and depreciation that ensures wide affordability. I can't wait to see what innovations emerge in coming years.

Esteemed former intern Jan-Petter Janssen (NEPS '06) writes in:

If you define optimism as the tendency to overestimate the probability of favorable outcomes, it is clearly irrational and should be avoided. However, it is a good antidote to another unwanted bias; the propensity to suffer mentally from losses more than you benefit from gains (a la Kahneman-Tversky.) [The latter may not be irrational, but is clearly not a good way to think for a successful-to-be speculator.]

A (too?) much used tool in finance is to compare the utility you gain from a certain outcome versus the expected utility if you choose to take risk. I will apply this to a social setting all guys have to (or had to for the lucky ones) deal with: Should you ask the most beautiful girl out for a date? A Kahneman-Tversky mindset would suggest no action too often because of the fear of rejection. Optimism has the opposite effect of course.

More generally I believe optimists choose action (i.e. risk) over inaction (i.e. status quo) more often than pessimists. And from my own experiences; it's the losses, humiliations and embarrassments that in retrospect have made me fight back and grow … while much success, although good, sometimes lead to hubris and a personal bubble to burst. The bottom line is that action is usually better than inaction. So triumph of the optimists!

Vic observes:

There has been a most unusual clustering of big minima in the S&P recently. Naturally this clustering has been followed and coterminous with all sorts of negative news. Those who are short have not been reluctant to discuss their positions before the close in interviews. The word "ideal" comes to mind.

Jun

5

Valuing Yourself as a Business, from Kim Zussman

June 5, 2008 | Leave a Comment

Stefan's recent post on his business reminded me of some recent ones about yields on investment and how to value a business.

Stefan's recent post on his business reminded me of some recent ones about yields on investment and how to value a business.

If someone sold you a business for $1 million which over time averaged income of $70,000 per year, with some years much higher, some lower, and many losing quite a bit, you might wonder if you overpaid. That's the stock market, which is probably better considered an investment - not a business. A business is a system where the proprietor can have some large direct effect on outcome (income), and ostensibly be compensated for personal abilities and effort.

To a great extent, each person is a business; with various assets, liabilities, capacities, and reserve capital, as well as capitalization of barriers to access. Perhaps successful traders are rare because they compete in a system with few barriers to access (no degrees or licenses needed), and irregularly dispersed severe reward/punishment which restricts long term success to supernatural intellects and/or stomach for pain. By definition no obvious profitability is persistent, and by correlation few can adjust to an unstable reward/punishment schema.

Yet there are the undeniable attractions of heroic market figures, who bravely took huge risks to finance their opinions of the world, and got it right. Walter Mitty, had there been an Internet, might have hoped to make a fortune trading markets (while keeping his desk job).

If trading, what becomes of those attributes beyond using an iron gut to second guess a random system? A trader with people skills, charm, or good looks squanders these normally valuable assets yoked to the torture machine all day. There are lots of folks who make very good stable incomes, if for no other reason than that humans are social animals who will pay to feel better.

There seems no shortage of causes behind the data showing that a very small fraction of traders out-perform the market long term.

May

23

Or red.

Earlier this year, traders were compensated for enduring declines with further losses. Then after a volatile March, buying or holding declines was rewarded with gains, and even the risk of holding gains was well compensated.

What is the intermediate trend? Now going down again, one question is when we will see a return to decline-momentum, and is there still compensation for betting against it.

A better question is whether the opportunity cost of fighting the beast is ever adequately compensated in the long term.

May

14

Speaking of Quitting, from Kim Zussman

May 14, 2008 | 1 Comment

(Warning: plot spoilage below……. skip if you plan to see the movie).

We rented this year's big Oscar winner "No Country for Old Men", and there was some fairly intense discussion afterwards. Pretty gritty stuff if you can cut through the Texas twang.

One theory of good art is that it locates and awakens something personal in the viewer, even if repugnant. Some of the symbols included the post-modern theme of bad defeating good (on all accounts, thoroughly), bad deeds going unpunished, good deeds not going unpunished, the role of chance in success and doom (duh), the attractive logic and invincibility of an intelligent psychopath, the religious quality of effective evil, and the crippling effect of introspection during battle.

A most interesting theme was the role of age in perception. The aging sheriff hesitated in his pursuit of a daunting foe, and commiserated with his peers about how bad things were compared to the old days. But a decrepit old friend (or relative) countered to the sheriff how his grand-uncle-lawman had been ruthlessly killed by Indians back in nineteen and zero-nine. Even though the bad guy put the sheriff into retirement, brutality in the past was as bad or worse.

The reason many think the shiny old days were better may have more to do with our own changes than those of the world. Which makes sense, since at our youngest we evolved within the protected/deterministic systems of our parents, friends, and schools (at least the fortunate ones), which continued sweetly into young adulthood because in hindsight now we know all the endings. There is no risk in the past, only the future.

Many of our days now will one day be precious in hindsight. It is difficult to keep this in mind even part of the time, but ostensibly worth the effort even if the required level of introspection forfeits many battles.

To paraphrase spec posts from 04-06, if you are on the winning side it pays never to give up.

Movie snippet here.

Stefan Jovanovich dissents:

I apologize to Kim and everyone else who loves the Coen brothers. Since my tastes are sufficiently bizarre that I rate Joss Whedon's Serenity a far better space oater than any of Lucas' Star Wars snorers, I hardly expect to win this argument; but those of us here in Chaos Manor simply don't get it. I lasted about 20 minutes with No Country; Nora, who is 23 and has far more stamina, was able to hang on to the bitter end. She said the best comparison she could offer was that it was like part in Annie Hall where Woody Allen goes to visit the crazy country folk and has his special talk up to Dwayne's bedroom - with lots of ketchup and walking down hallways added. The Coen's skillful but truly absurd splatter films are like modern war movies; the tech is magnificent, but the stories can only seem credible if you share the Coen's religious belief that violence offers some special insight into life. Clearly they are relying on the assumption that no one in the audience has any experience at all with firearms. Blowing out the chambers in a revolver to allow it to fire was an interesting bit of make believe, but by the time it got to the bit with an assassin carrying around a compressed air canister attached to a modified nail gun, I had to hold my sides to stop shaking with laughter. What was the guy going to do for reloads? Go to the Home Depot?

May

14

Housing drop

Subprime flop

Credit crunch

Belly ups

Bail outs

Fed puts

No recession

Jobs in session

GDP

Low inflation

High oil

Faked them out

Stocks up

May

13

A Trek Out West, from Kim Zussman

May 13, 2008 | Leave a Comment

A useful program for market operators includes long hikes alone in barren wilderness. On a recent 20 mile day hike in the beautiful Sespe North of Ojai, California, there were silent companions along the way.

The Sespe area has no cell-phone coverage, and one can hike for days among the black bears, deer, rattlesnakes, and coyotes without seeing other humans.

Here is the beginning of the trail early that morning, with the Piedra Blanca rock formations considered sacred by the Chumash people who used to live here.

The trail follows Sespe creek, which is a raging river during winter storms and has claimed many lives over the years, including a boy scout troop in the 1940's.

Part of the wilderness was burned in the huge Day fire a few years back, which has now regenerated and energized flora and fields of lupine, poppy, and other colors. Charred shrubs are twisted similar to to the fetal position taken by those burned alive (check your pathology book), and stand starkly against the sweet wildflower breeze:

After a very long trek, we reached the ruins of Willet campground, which was used as a way-station for equestrian pack trips.

Willet includes several shacks which are still used at night by hearty souls of many worlds.

As seen by their religious inscriptions made with flint knives late at night:

In one scorched canyon are the famous fossil remains of a trader, January Man.

Apr

26

No Uptick, from Kim Zussman

April 26, 2008 | 2 Comments

Knock knock!

Who's there?

Uptick.

Uptick who?

No Uptickrule 7/6/07

Some have suggested recent volatility may be linked to repeal of the uptick rule as of 7/6/07. Certainly volatility has been high since then, as shown by F-test comparing variance of post no-uptick with the prior period (at least in terms of SPY: stdev of cls-cls returns 93-7/5/07 vs 7/6/07-present):

Test for Equal Variances: post, pre1

95% Bonferroni confidence intervals for standard deviations

. N Lower StDev Upper

post 203 0.011560 0.012853 0.014457 (post-7/6/07)

pre1 3635 0.010327 0.010599 0.010885 (prior)

F-Test (normal distribution)

Test statistic = 1.47, p-value = 0.000

Levene's Test (any continuous distribution)

Test statistic = 18.53, p-value = 0.000

But in comparing the post-no-uptick period of 204 days to the 17 other non-overlapping 204 day periods since 2004, the recent period is not that unusual (see attachment: 1=post uptick, with 95CI for variances), and it would be hard to argue much beyond partial causation.

Apr

22

Smoothing the Range, from Kim Zussman

April 22, 2008 | Leave a Comment

To the extent which moving averages may convey information, there might be a better way to model the decay of investor (emotional) memory decay. Presumably t mattered more than t-1, which mattered more than t-3.

Many biological processes scale logarithmically, so here is an lnMA of daily range which weights each day less by ln(countback) (here for n days). r = range = SPY (H-L)/C:

nD lnMA = {r[0]/ln(2)+r[-1]/ln(3)+….r[-n]/ln(n)}/n

The most recent day's range (r[0]) is scaled by ln(2) to avoid the divide by zero problem.

Attached is simple 10d MA for SPY daily range, vs 10d ln MA, vs 1/10000 SPY close (I used 1/10000 to put it on same scale).

Apr

19

Epiphytes, from Victor Niederhoffer

April 19, 2008 | 3 Comments

There were all sorts of records in stocks and bonds last week with stocks having their sixth best week in history, and bonds having their 10th worst week. Strangely, only once before have stocks moved up and bonds down this much, the week of March 21 2003, when bonds were down 4.5 points and stocks up 54. Because of the small number of observations the expectations next week for the events singly or in combination are not meaningful.

There were all sorts of records in stocks and bonds last week with stocks having their sixth best week in history, and bonds having their 10th worst week. Strangely, only once before have stocks moved up and bonds down this much, the week of March 21 2003, when bonds were down 4.5 points and stocks up 54. Because of the small number of observations the expectations next week for the events singly or in combination are not meaningful.

In retrospect, this was a natural result of the increased liquidity provided by the Central Banks. They were able to get the stock market up, but in the process they raised the specter of inflation again and commodities went through the roof and interest rates had a climactic increase. Thus, the bond vigilantes came to the fore again and forced the Fed to trot out their higher ups to say they are very concerned now about inflation, this coming of course after the 3% rally in stocks so as not to hurt the market too much.

The key event in the climactic moves had to be the big brokerage house bail out. It always seems that the destruction of a big institution is the key to renewed success in the market. It was that way with the big commodities firm, the big Nobel Prize fixed-income fund, and also the big banks and brokerages of the past including Barings in two events separated by 100 years.

The epyphytes like the orchids find it much easier to get to the light after the leaves of a tree have fallen, and they can grow quickly since they don't have to waste their energy in growing support structures of their own . Think of the countless businesses and opportunities for making money that will come now that all the weak assets have been, or are in the process of being, withdrawn from the asset pool.

The same thing happens when Walmart enters a town. A few slow-moving competitors like Kmart might find their business depressed, and the local hardware store might find that many of its customers prefer the lower prices Walmart offers. But these lower prices lead to increased spending and new businesses arise that quickly fill the vacuum.

Such can be expected in the next several years in the stock market, until the weight of the epiphytes is so large that the limb breaks.

Bill Craft adds:

Spanish Moss, a southern epiphyte enjoys a shaded environment whilst dangling from trees within the shaded canopy. Tillandsia usneoides are bromeliads, related to Pineapple.

Contemplating the dangling plumes of graybeard(s) on a recent trip, I could see the colony living off structure created by tall, towering trees intersecting the mists that provide life giving nutrients.

The support and sustenance offered here rhymes.

Steve Ellison expands:

A corollary might be that, when interest rates rise and credit is restricted, and a big institution has not yet failed, markets will behave in very unexpected ways in order to locate the vulnerable institutions and force them to liquidate at distress prices. As Damon Runyon said, "One of these days in your travels, a guy is going to come up to you and show you a nice brand-new deck of cards on which the seal is not yet broken, and this guy is going to offer to bet you that he can make the Jack of Spades jump out of the deck and squirt cider in your ear. But, son, do not bet this man, for as sure as you are standing there, you are going to end up with an earful of cider."

As an example, Goldman Sachs said that the results of pairs trades in August 2007 were 25 standard deviations away from historical averages. The market was doing its best to find someone vulnerable.

Stefan Jovanovich objects:

The line quoted is not from Damon Runyan's Idyll of Miss Sarah Brown but from the screenplay for the movie of Guys and Dolls. The credit should go to Jo Swerling and Abe Burrows who wrote the book for the musical and Joseph L. Mankiewicz and Ben Hecht who reworked the musical into a movie.

Kim Zussman drifts off subject:

Here are some fortune cookies appropriate to these difficult times:

You can't know what you were trying to find until seeing it in hindsight

The thing you are looking for won't occur until you are so discouraged that you stop looking

The obvious thing is only right if you decide it is too obvious to be right

The cynical interpretation is only true when you don't act on it

Wealth and philanderosophy are the secular cousins of immortality

Apr

19

Dow Theory, from Kim Zussman

April 19, 2008 | 5 Comments

Now with a Dow Theory buy signal hit, big up week, breakout to many week high and >100d moving average, we get a real-time test of positive momentum in stocks.

Now with a Dow Theory buy signal hit, big up week, breakout to many week high and >100d moving average, we get a real-time test of positive momentum in stocks.

We never hit the "bear market" cutoff of -20% from the October (all time) high. Presumably they will conclude this was a nascent recession doused out by Helicopter Ben; definitely not what NBER's Feldstein was calling for. Those hoping for a big drop to buy will have to wait for another financial bail-out, which won't happen until we are back to 1500 as everyone piles in afraid to miss the rebound.

Or not.

You can pick your poison or you can pick your antidote. But you can't know the antidote for your poison.

Apr

3

Bears Galore, from Phil McDonnell

April 3, 2008 | 17 Comments

Hedgefund monitoring service Greenwich Alternative Investments reports 58% bears on the S&P, 58% bears on the dollar and 67% bears on the 10 yr T-Notes. Sentiment is overwhelmingly negative.

Hedgefund monitoring service Greenwich Alternative Investments reports 58% bears on the S&P, 58% bears on the dollar and 67% bears on the 10 yr T-Notes. Sentiment is overwhelmingly negative.

Nigel Davies replies:

Seems odd that these learned gentlemen would be so bearish on both the dollar and the S&P. I would have thought there'd come a point at which a weak dollar would start to get good for exports.

Jim Joyce writes:

Sentiment stats must be tested. One can't just glibly assume they are contrarian indicators.

Victor Niederhoffer remarks:

The key to this market was when Abbey Cohen refrained from making any more bullish forecasts and it was accepted that we were in bear market by Goldman itself.

Stefan Jovanovich explains:

Measures of the current cycle need to include adjustments for the change in the value of the dollar. If those changes are included, the S&P 500 at 1374.9 is still down roughly 25% from its 12-month high on May 29th of last year and down 7% from its 3-month high at year-end. One could argue that the "bear" market is still intact — given that the S&P 500 adjusted from the value of the dollar is down 60% from its high on August 30, 2000 and up only 17.3% from its low on March 3, 2003. Comparisons with 1938 seem appropriate when looked at with this particular historical lens.

Nigel Davies agrees:

It is helpful to consider the value of assets relative to other assets rather than just the dollar. The dollar is by no means a fixed entity, though when one talks about 'bottoms' or 'tops' in assets like stocks or gold, there's an implicit assumption that it is.

J.T. Holley replies:

The dark clouds cover only the Big Apple. The dark and dirty forecasts are associated with NYC. My assumption is cutbacks, losses, write-offs, and a slowing beat of the heart of the financial world. Outside NYC, in beautiful Brentwood, TN where the buds are blooming, daffodils sprinkle the green fields, and opportunity is much appreciated, I'm as bullish as ever. It seems that far and few are remembering the drift, that bear markets exist only by looking at the rearview mirror, while one is driving forward utilizing the windshield to block the bugs and grit.

Kim Zussman reports:

Yesterday was third highest first day of month in 14 years (SPY c-c). Those >3% gain were, on average, followed by gains the rest of that month:

Apr

2

Bird Brain Solves Market Puzzle, from Kim Zussman

April 2, 2008 | 2 Comments

Durychka our yellow parakeet (Durychka is Russian for "stupid little girl") is remarkably insightful for a small beast. She uses a 3-note song I taught her as my name; when I come home and she hears my my keys, she calls me. This bird is very attached to me, and when the Mrs hugs me she jealousy hurls herself against the bars of the cage like a desperate woman in prison.

Durychka our yellow parakeet (Durychka is Russian for "stupid little girl") is remarkably insightful for a small beast. She uses a 3-note song I taught her as my name; when I come home and she hears my my keys, she calls me. This bird is very attached to me, and when the Mrs hugs me she jealousy hurls herself against the bars of the cage like a desperate woman in prison.

She must know I am too big for her, but that doesn't matter because her utility is to own my intentions. It is amazing how the entire female emotional phenotype lives in a brain the size of a lentil.

Recently Durychka learned about money and friendship. Months ago I noticed she calls back to birds she hears outside, so when the weather is nice I hang her cage in the apricot tree near the patio. One day the shrub across from her happened to be loaded with berries, so there were dozens of hungry robins jumping all over the yard. Many of the wild birds came to check out the yellow girl in a cage, and she was very enthusiastic about all the attention. But the next day the bush had been picked clean, and gone were all her fat fair weather friends. Now she sat lonely in the tree, wondering how she had offended them.

Durychka has lots of toys in her cage, many with mirrors. She spends hours looking at herself - frequently pecking and licking her image. Parakeets are social birds from Australia, where they live in trees by the hundreds in close quarters. When they are solo in captivity, they appear to be executing a futile program of socialization - recognizing another bird in the mirror. Even though the feedback from the reflection must fall short of the real thing, she can't fight the hard-wired attraction.