Jun

14

‘Certain Hedge Funds,’ from East Sider

June 14, 2007 | Leave a Comment

10:14 *VINIAR SAYS INCENTIVE FEE DROP DUE TO `CERTAIN HEDGE FUNDS'

11:26 *GOLDMAN'S VINIAR SAYS REDEMPTIONS FROM GLOBAL ALPHA `MINIMAL' — Bloomberg

And I thought the dumb guys were buying the toxic stuff at rich levels, not GS and BSC…

Jun

14

A Lesson from Andy Roddick, by Riz Din

June 14, 2007 | Leave a Comment

Andy Roddick, who won the Stella Artois Championship three years straight (2003 to 2005), has just provided us with an excellent lesson on the importance of balanced, competitive temperament.

Andy Roddick, who won the Stella Artois Championship three years straight (2003 to 2005), has just provided us with an excellent lesson on the importance of balanced, competitive temperament.

He was up again 23 year old Alex Bogdanovic, a British unknown who was playing the better all round game today, constantly hitting the ball up against the tram lines or deep to the base line, and always making it difficult for Roddick to return. In contrast, Roddick was having a really bad day at the office. His game not only lacked any spark but by constantly playing the ball back to Bogdanovic and hardly ever making him stretch, he was almost actively putting his opponent in the driving seat. Where Roddick had the clear edge however, was in his service game. He was firing accurate rockets for serves, ending his service game in minutes, often with love score. He knew that this could be enough to get through the day. Roddick lost the first set after losing a service game, but he didn't crumble under pressure. He wasn't enjoying it one bit and you could see the struggle he was going through, but he continued to fight in a controlled manner, not letting his emotions get the better of him. Roddick won the second set after a tense tie-break, and then went on to break Bogdanovic late in the third set for a victory. Roddick rightly said of the game, 'I was lucky to get out of there today'.

So many times I have watched the likes of Tim Henman and Andy Murrary crumble in the face of adversity, often looking to externalise their problems by blaming poor line calls or other factors as soon as things stop going their way, and it was a real joy to see Andy Roddick deal with his poor game play with maturity. He knew he could win if he persevered (he had the edge where it counted) and that's exactly what he did. It was a joy to watch and a valuable lesson.

Jun

14

Some Thoughts on Forecasting, by Victor Niederhoffer

June 14, 2007 | Leave a Comment

I often wonder why the public can be repeatedly misled by forecasts that are consistently wrong, and by forecasters that have no raison d'etre. I believe the underlying reason is that we are brought up to be insecure, and we look to others for the sources and solutions to our problems, rather than looking to ourselves.

I often wonder why the public can be repeatedly misled by forecasts that are consistently wrong, and by forecasters that have no raison d'etre. I believe the underlying reason is that we are brought up to be insecure, and we look to others for the sources and solutions to our problems, rather than looking to ourselves.

Such forecasters as the weekly financial columnist, can be consistently wrong, (he has been bearish every week since the Dow was at 800), and yet be among the most revered and respected forecasters of all. For an answer to this, I turned to Harry Browne's book, Why the Best Laid Investment Plans Go Wrong.

I always start with the Humble Pie with Whipped Cream, on p.43, where Browne points out that the archetypal forecaster looks for anything in his forecast that happens to have the vaguest resemblance to the ultimate outcome, and then tells you in subtle ways that "he told you so" or "it was so clear from this or that indicia."

Browne reviews the yearly self-evaluation of an investment adviser, who might be prone to using levels and ranges as his weapon for misdirection:

He almost always seems to have been around 87% right … He usually cites some examples that turned out to be wrong – "I was a bit too optimistic about the high in gold, I said 450 when it was actually 406." You can see that he's being more than open and honest, and he demonstrates that his talent and even his standards tower far above yours and mine … Any man who's wrong 13% of the time, and who's that close when he's wrong must be a genius … When I check, however, I find that his original forecast was "Gold's high will be between 450 and 500," and this was made when gold was already at 406. So he missed the high by 15% and failed to note that gold actually ended the year at 350, down 15% from his forecast.

For many years, I have believed that there is little correlation between the past record of an adviser or manager and his future success. Too often, adviser get good results with small amounts of money, but the market loves to let you make a small amount of money, just to encourage you to then raise a larger investment to lose.

I believe that the period of 2000-2002, where advisers and managers made money by being hedged or net short, was a period that was particularly detrimental to investors, in that it has led so many of them to stay with those who were relatively successful in this period. These managers and advisors have lost their investors so much more money in the subsequent period, when the markets have doubled, than the amounts they made their investors when they initially began investing.

I try to eschew from forecasts on this self improvement, mutual education, deflation of ballyhoo, forum. For one, I know how fallible I am, and second, I am cognizant of the principles of ever changing cycles, (Robert Bacon.) If we did forecast, many very potent readers might mistakenly believe that what we have to forecast is better or worse than average, and in either case it would be detrimental to all concerned. Also, I would find it hard to make a forecast where I didn't have a position, because I trade often … and if I did have a position, my position could be helped along by my communiqué. Furthermore, when I got out of the position, I would be hard pressed to be so fair and honorable that I would let all of my readers extricate themselves before I did, to my disadvantage.

Of course, if I were an innocuous type, and was prone to forecast without having a position, then I would be subject to making absurd calls, without possible economic feedback, and could possibly be wrong as consistently as the weekly financial columnist, or others of his ilk. I would never know how much damage and harm and loss my forecasts might cause to those poor souls who actually placed any reliance on them.

Harry Browne's book is a treasure trove of insights as to how one can watch out for being misled, and I recommend it highly. I also encourage all of you not to rely unduly on forecasts in the future.

As an afterthought, while considering this question, I couldn't help but notice that the Fake Doctor might do well to refrain from making so many forecasts in future. His former economics forecasting company was not well known for its accuracy, and recently he has been involved in an orgy of forecasts on such things as interest rates, the extent of reserves in the earth, and the likelihood of gains in the Chinese markets.

Browne lists several criteria for evaluating the likelihood of a forecaster to stand out from the crowd, such as talent in the field, and expertise. Other caveats, like the self interest they might have in their forecasts, the ability of those who follow them to extricate safely, and the likelihood that their own expertise in areas like geology, or Asian activities, might not be greater than average, should be considered also.

Riz Din writes:

Judging by the content in much of the media, there certainly seems to be an education of insecurity taking place, well beyond the realms of the financial forecaster. Combined with the tendency to focus on the shorter-term and not to cultivate the big, broad outlook, these are good conditions in which the pessimistic forecaster can flourish. I also wonder whether their is an evolutionary component that plays a role in this game, since the average human is a risk-averse individual.

Regarding the Fake Doctor, in March of 2004, he commented on exchange rate forecasting that,

…despite extensive efforts on the part of analysts, to my knowledge, no model projecting directional movements in exchange rates is significantly superior to tossing a coin. I am aware that of the thousands who try, some are quite successful. So are winners of coin-tossing contests.

He is obviously now paid to have a view, but I wonder whether he really believes it.

Sam Humbert comments:

To all the good arguments for abstention from forecasting, I'd like to add: publicly touting one's views leads to psychological lock-in ('getting married to a position'), because changing one's mind and dumping a losing position will result in a loss of face, in addition to the (perhaps less costly and painful) loss of dollars.

Riz Din adds:

Adding to Steve's point, the problem of 'lock-in' of public forecasts may be exacerbated by the fact that much time and money is often spent generating a forecast and thesis. From the sell-side, creating a unified thesis across research departments is no small feat, and new data that are coming days and weeks may be judged less on their own merits than on how they can be interpreted to fit with this thesis, i.e., going about things backwards. I'm guessing the ability to turn on a dime is a valuable advantage to the likes of Soros and other nimble macro players.

On a separate note, I recall when I was working in the prediction business. It would be about a month or so before the start of a new financial year when clients would call asking for various forecasts for the year ahead, sometimes even further out. I'm sure many of these folk knew better, but they did it any way. They had spreadsheets to fill in.

It reminds me of story about the general who told his team of weather forecasters, "I appreciate being informed that your forecasts are no better than random, but please keep sending them on, as the army needs your predictions for planning purposes."

Charles Humbert extends:

There are three classes of money managers:

1) If your edge is unreliable, or modest to nonexistent, then your best approach is maximum publicity. If you're good at promotion this may lead to much greater benefits than you will derive purely from money management.

2) If your edge is positive but not spectacular, you should try to manage OPM. In this case a little bragging is part of the game; but it must be done with discretion. The goal is to be credible thus attracting investors and increasing your earnings in direct proportion.

3) In the rare case where your edge is outstanding, shut up and trade. If at all possible trade only your own money. Resist the temptation to make your brilliance visible to all. Always keep in mind the goal, which is to last as long as possible before the competition catches up.

Trading is a cutthroat business. If you make it easier for your opponents you eventually make it harder for yourself. The only reason for making public forecasts is to feed your ego. But those who deserve it most are the least well-served by such promotion.

Nigel Davies writes:

One of the tactics that can be used for nobbling a tournament leader is to congratulate him on his fine performance and asking what the secret is. The self-consciousness and commitment induced by a reply can take them out of 'the zone' with a bump. Not that I'd use anything like this myself, it's just something to watch out for if one is in the lead.

I think a similar effect can be at work when players write books. Besides making them a target should they publish anything too valuable, there's a certain inflexibility that can be induced by the 'lock-in' affect of going to print.

J T Holley contributes:

There needs to be if not already a study of the "Power of Anonymity".

It is the spirit of the AA program and one that Mr. Bill must have suggested or he saw this same powerful principle in its possession.

Having quit smoking numerous times, I know that I tried I didn't lick it until I remained anonymous about my intentions. The minute you tell people they will ask you when you bump into them, "still cravin'?" "want to smoke?" "how you doin'?" Even with their good intentions the first thing you do is start thinking about smoking and it simply fuels the fire. Maybe this is why you shouldn't share speculation positions as well.

Doing a quick count I can think of very few times where I've gone out and said something in the touting category and come across a winner. Yet being the anonymous I have risen to the occasion and accomplished magnificent goals. Card games and betting are the horrible exception because one must always be vocal with intentions and can never be silent.

If you look at the risk/reward of touting vs. non-touting it seems so unaligned to me. Even if you tout and succeed then you still lose it seems. You are disliked, set up to be the "one" to knock down and most of the time left doubting the outcome or feeling a Nietzschean withdrawal. Does touting burn unwarranted energy and power as well?

The anonymous one walks freely and has the power. Think of sports when something great happens and the comment is "who was that guy?" This years Masters is a good example.

I think anonymity has got to be the most powerful principle next to compounding.

Anthony Tadlock remarks:

It seems that forecasters and others with the most bearish and pessimistic outlooks don't actually own any stocks and generally never have.

Steve Wisdom replies:

I especially like these standard tropes from bear newsletters: "We advise you to liquidate all stocks," and "We advise you to take profits on stocks now,"… Begging the question: ‘What stocks? If I believed your newsletter, I'd have sold all my stocks years ago.’

Jun

14

We’re proud to feature Nemo Lacessit, a Chicago boulevardier and bon vivant. Nemo periodically reviews notable New York, London and Chicago restaurants for the edification of DailySpec readers.

Copperblue, Chicago

580 East Illinois Street

312-527-1200

Sometimes one stumbles on a small gem. Not a big gem, not a brazenly daring gem, nothing to turn the knock the lights out but a small, reserved, tightly bound, exquisitely grown gem. Copperblue is such a gem. Tucked away at the base of Lake Point Tower in Chicago (the only building jutting to the east of Lake Shore Drive) this petit-boite serves up culinary masterpieces without pomp and circumstance.

The style is a cross of French-Mediterranean (done the right way, which means French, Italian, Spanish, with hints of Arabesque) in well-crafted dishes by two up-and-coming chefs. Chef-owner Michael Tsonton and Chef de cuisine Victor Newgren's 50 seat intimate restaurant present a whimsical balance of presentation, appealing colors and rainbow tastes. The menu is divided into "work" and "play" — the former are humble and down-to-earth while the latter emphasizes whimsicality and fun. I had the seven course chef's tasting menu which started with braised lamb and red lentil brik, goat cheese, and curry vinaigrette, then moved to pan-roasted diver scallops, aromatic "18" carrot soup and organic olive oil. For the next few plates I had viognier-braised farm rabbit, English peas, mushrooms, spring onion, parpardelle in natural "thumper" jus. Sprinkled between these plates were two cheese courses that actually made sense; spread out between the entree so as to suggest and stimulate but not overwhelm.

The style is a cross of French-Mediterranean (done the right way, which means French, Italian, Spanish, with hints of Arabesque) in well-crafted dishes by two up-and-coming chefs. Chef-owner Michael Tsonton and Chef de cuisine Victor Newgren's 50 seat intimate restaurant present a whimsical balance of presentation, appealing colors and rainbow tastes. The menu is divided into "work" and "play" — the former are humble and down-to-earth while the latter emphasizes whimsicality and fun. I had the seven course chef's tasting menu which started with braised lamb and red lentil brik, goat cheese, and curry vinaigrette, then moved to pan-roasted diver scallops, aromatic "18" carrot soup and organic olive oil. For the next few plates I had viognier-braised farm rabbit, English peas, mushrooms, spring onion, parpardelle in natural "thumper" jus. Sprinkled between these plates were two cheese courses that actually made sense; spread out between the entree so as to suggest and stimulate but not overwhelm.

On my trips to Spain and the south of France I learned that true Mediterranean cuisine loves rice, specially saffron rice as can be found on a paella. Copperblue has a variation on this with their saffron seafood risotto, "paella" lobster, shrimp, baby clams and mussels in a lobster broth. The specialty of the house is their "organic duck two ways" duck leg spice "ras el hanout", roasted duck breast with "Don Cherry" trumpet mushrooms and fresh chick peas.

The wine list is selective and reflects the ambiance of the restaurant. There is the mandatory 2000 Chateau Latour (Haut Brion), 2003 Maison Champy Vosne Romanee Les Beaux (1ere Cru), but better yet some Italian 2004 Bruni Morellino di Scansano, which goes well with everything.

The restaurateurs should really be in bigger space with more commanding presences, but they're having fun, making people happy, and keeping it simple, relaxed, and simply fabulous. This is perfect venue for a relaxed up-scale dinner without all the drama.

Jun

13

Romancing the Stone, from Bo Keely

June 13, 2007 | 2 Comments

Here are three reasons from Blythe, California to be thankful for where you live.

Here are three reasons from Blythe, California to be thankful for where you live.

A month ago I tapped my brake as a semi-truck with double-trailers of gravel from the local mine tailgated me at 55 mph. He waited five minutes to retaliate and ran me off the road in front of the in-session middle school. I took the license number to the police station where there was no one on duty, so I chased down a patrol car and made the report. Today I see that the old speed limit sign of 45 mph is replaced by a brand new one of 55 mph at the scene of the tailgate.

A week ago, I toddled with a probable kidney stone to doctor "A" for x-rays. I was rescheduled as an 'understanding client' for the next day, but there the doctor arrived three hours late from a dentist appointment and asked me to return tomorrow. I did and was startled to get hooked with twelve leads to an EKG. The switch flicked, the paper clattered and the nurse screamed, 'Doctor, it's going all over the place!' Doc yelled, 'I'll take care of it!' and sent me to a doctor B who does radiographs. There the receptionist ordered me to return the following morning, and at that hour I sat in a waiting room jammed with the indigent, handicapped, elderly and likely illegal aliens that dwindled through two showings of Jim Carey's 'Dumb and Dumber' until I sat alone.

The mop lady entered like a caricature to swab around my shoes, and ask, 'Where's the x-rays?' She registered shock and promised to take care of it 'Now', but scowled when I didn't lift my feet. Doctor B announced somewhere, 'I'm going for a coffee', entered and asked who I was. 'This is your kidney stone appointment,' replied the mop lady. He located my appointment slip that had fallen into a crack and escorted me to radiograph. In five minutes he produced, 'The only abdominal x-ray in history with the zipper behind the coccyx!' and seemed not to want to give it up.

I explained that I'd rigged my shorts with rope suspenders and backwards to relieve the pain, grabbed the film and hobbled from him yelling, 'You promised no zipper!'

The waiting room back at doc A's brimmed with sick, angry people as I raised the film like a scepter to cut to the front desk. The receptionist screamed, 'You were supposed to be back yesterday!' I told what had happened. 'The next appointment is in two weeks!', so I spun and fled the shouting crowd, 'Hey, Hey!' out the door not knowing if they cheered for or against me.

I slept well last night as always on a picnic table north of town near the mine and awoke this morning with two honeybees at my jugular and lay there thinking it's time to move. I drove and found an abandoned sofa away from blossoming Ironwoods on a canal as wide and deep as a river. I jumped in to cool off, and now sit in the college library romancing the stone.

The college V.P. a beefy ex-sheriff, claps me on the back as I scan the Internet for 'calculi cures' for recently diagnosing a foreign body in his gangrenous forearm that the local hospital had missed. Now the V.P. pulls from his pocket a tiny framed-behind-glass two-inch palm frond that proved the culprit. The hospital after surgery made him stay for five days alone as the local physicians are boycotting it with their patients for graft and corruption. 'I've told everyone in the college about you,' cries the V.P., 'So expect a rush!'

My getaway car is in the parking lot with one pack ready to hike the Continental Divide Trail and another to bus via Mexico to Central America. But the Internet just shut down. By the time you read this I should be far away from here.

Jun

13

A Fechnerian Day, by Victor Niederhoffer and Tom Downing

June 13, 2007 | 1 Comment

The S&P index was at exactly 1500 yesterday at 10:00 a.m., with the futures at exactly 1515 at the same time. The total ground covered in the S&P futures yesterday, using two point up and down swings as a measure, had to be one of highest in history. From a 1525 close the previous day to a 1517 open, to 1522 at 9:40, 1513 at 10:30, 1521 at 11:40, 1516 at 1:00 p.m., to 15:26 at 2:00 p.m. (at which time I tried to book tennis court), to 1506 at the close. That is 65 points of movement to make a mistake in — truly disruptive and encouraging Fechnerian decision making.

The S&P index was at exactly 1500 yesterday at 10:00 a.m., with the futures at exactly 1515 at the same time. The total ground covered in the S&P futures yesterday, using two point up and down swings as a measure, had to be one of highest in history. From a 1525 close the previous day to a 1517 open, to 1522 at 9:40, 1513 at 10:30, 1521 at 11:40, 1516 at 1:00 p.m., to 15:26 at 2:00 p.m. (at which time I tried to book tennis court), to 1506 at the close. That is 65 points of movement to make a mistake in — truly disruptive and encouraging Fechnerian decision making.

Today, (Wednesday), the cast bond has moved up from a low of .90 to .9126 at its high, (it was at .9116, as of 10:10 a.m., time of writing), after moving from .9216 to .9016 yesterday, mostly between 2:00 - 5:30 p.m..

The omniscient market of Israel has moved from its low of 1078 to 1094 this morning, up slightly on day, and the VIX has moved from its 14.7 Monday close to 16.7 by yesterday's close, near its high of 17.1, but dropped back to 15.7 today. Many markets seem to be trading about half way between their recent highs and lows.

The move on retail sails in the S&P and the Bonds, down three quarters of a percent and then up one percent from there, was completely disruptive. It reminded me of the play by play of a sumo match, which also takes place in 25 seconds and is the only thing in the world that goes through so many gyrations in that short amount of time.

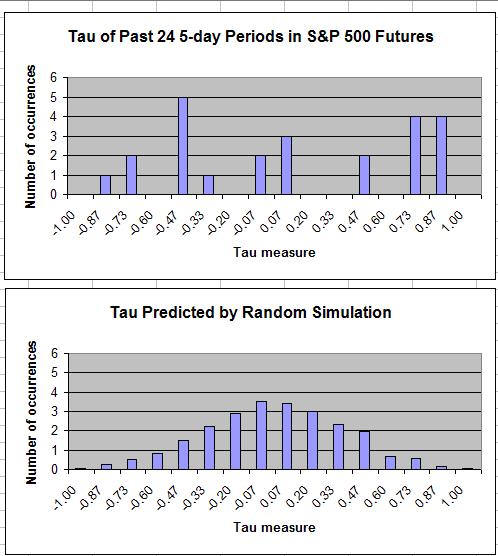

We calculated Kendall Tau for S&P prices for 5, 10, 15, and 20 day non-overlapping intervals since 1996.

We then compared these empirical estimates to estimates calculated from synthetic price series created using bootstrapped daily changes.

In general, the observed Kendall Taus were higher than you'd expect from the simulated distributions, significant at about a ten percent level.

Method (using the 5-day as an example):

1) First I generated 1000 bootstrapped price series.

2) Split each series into non-overlapping 5-day intervals

3) calculated Kendall Tau for all 1000. now we have a distribution of taus:

The average of Tau was 0.0482, and the standard deviation of Tau was 0.0243

4) Calculate the Tau from the actual observed price series = 0.0778

5) Figure out where 0.0778 falls within the simulated distribution: in this case it turns out that the Empirical Tau (0.0482) was greater than 88.39% of the Taus from the simulated distribution.

Results: Simulated Distribution of Kendall Tau (based on 1,000 simulated price series for each interval):

Interv. 5-day 10-day 15-day 20-day

mean 0.0482 0.0455 0.0446 0.0460

stdev. 0.0243 0.0317 0.0374 0.0418

Empirical Distribution mean 0.0778 0.0900 0.0898 0.1120

%le of Emp. mean in Simulated Dist. %le 0.8839 0.9189 0.8911 0.8541

Jun

13

Fedwatching, from East Sider

June 13, 2007 | Leave a Comment

Geithner Says Bond Volatility May Return to `Normal'

June 13 (Bloomberg) — Federal Reserve Bank of New York President Timothy Geithner said volatility in U.S. Treasuries, at the highest in almost two years, may be returning to "normal."

I laughed when I saw this. Geithner is padding the newswires while he pads his resume. Where will he go? Peterson's Blackstone? Fink's Blackrock alongside Peter Fisher? Maybe Carlyle needs an ex-Fed geek?

A Council of Economic Advisers post in Hillary's administration is conceivable but unlikely. CEA is "below" the Fed in the gray-dotted line organizational chart I have in my head. Recall that Yellen went the other way, from CEA to San Francisco Fed President. More likely would be, say, Goldman, then Treasury Secretary.

My vibe is that he's still a lightweight needing seasoning. He hasn't been tested outside of browbeating the dealers into cleaning up their backlog of swap tickets.

Jun

13

Housing, from Allen Gillespie

June 13, 2007 | Leave a Comment

In my work, long rates do not matter to housing because everyone financed with short term ARMs. That is the reason others missed the bust whereas I caught the top on TOL's stock split in 2005. The central banks have tightened enough to address the immediate inflation issues, but are trapped by the structural inflation issue. I suspect the Fed will cut as the housing bust forces the issue.

In my work, long rates do not matter to housing because everyone financed with short term ARMs. That is the reason others missed the bust whereas I caught the top on TOL's stock split in 2005. The central banks have tightened enough to address the immediate inflation issues, but are trapped by the structural inflation issue. I suspect the Fed will cut as the housing bust forces the issue.

The mistake the market made was to assume that Fed cuts would lead to lower long rates even though long term historical averages suggest 4.50% on overnight and 5.25% on long paper is a reasonable price, and a history of rates going to 6% during times of conflict. Five-year continuous bond futures charts since 2001 look like the Dow from 1998 to 2002. I believe we are on the tail end.

Jun

13

Kids’ Books, from Russell Sears

June 13, 2007 | 1 Comment

I have been researching on the web how to teach children to dream. What is left out is how to develop a passion for life when dreams fail to develop. I suspect their father's example is the best teacher.

I have been researching on the web how to teach children to dream. What is left out is how to develop a passion for life when dreams fail to develop. I suspect their father's example is the best teacher.

John Floyd writes:

I am looking for recommendations for children’s books. I would like to include the right mix of education, capitalism, logic, reason, imagination, and individuality among other things. A few books and stories that I have found, and the kids enjoy: Jonathan Livingston Seagull, Thidwick the Big Hearted Moose, An Airplane is Born, and The Little Prince.

Scott Brooks adds:

As much as we push education in our home, we've had a dickens of time getting our children to read outside of school. Finally last year, my oldest daughter got into reading the Goose Bumps series. She loves them and needs no prodding to read up on them.

My youngest son somehow got into reading the Star Wars books. He doesn't read them religiously, but will read outside of class if given a little reminder. Interestingly, I bought him a book on bullets at the Quality Deer Management Association national convention in Chattanooga last week and he's been perusing it almost everyday. He's 8 years old and it's way above his level, but he seems fascinated by it. He had his home school teacher read it with him and explain the more difficult parts to him.

For my 12-year-old, we've had to use a different tactic. He doesn't read unless we push him to do it. However, he's really into the markets and learning about investing. So he reads stuff on the net about companies he's thinking of buying and watches and reads investing information.

I guess the key is to immerse your kids in reading and let them find what they like. When I was kid, I'd read one or two Hardy Boys book's a week. I tried to get my kids into them, but to no avail. Keep searching to help your kids find something that they like. There have been a lot of good books recommended here (and I'm saving this thread for future reference for my kids and their home school).

Many of these books are important and are one's that I'll have the kids read as part of their school work assignments (whether they want to or not). But the biggest thing that I've searched for is, how do I instill in them a love for reading a thirst for knowledge? I can't do that by forcing books on them. Sure, I can help them to learn important lessons by requiring that they read certain books. But what I really want to see is them sitting down curled up with a book reading it because they want to. I believe that should be goal!

From Bill Humbert:

One of my children was a reading-avoider. My goal was to get the kid reading and I happened to see the movie League of Their Own in which the Madonna character teaches the non-literate character to read by using trashy novels. I believe the quote was something like, Who cares? She’s reading isn’t she? It’s a scene we always laugh at.

Well, I didn’t use trashy novels, but I did use comic books. We started with the superhero genre and then I gradually slipped in the newer version of the old Classic Comics. For certain works I also acquired Books on Tape, which is more useful than listening to the radio in the car and it gave the child a general understanding of the work.

Since the brain stores different types of input in different locations, this child had an advantage over the children who only had read say Homer’s Odyssey. The child had the pictures from the Classic Comics, the audio from Books on Tape and the printed word itself. After a while the child started to excel in those classes. And only then did the overall desire to read take over. I think it was like a pump that needed to be primed.

Get the child reading. "What" does not matter. If the child finds that useful and desired knowledge comes from reading, eventually that child will take to the books. But you have to prime the pump by starting with something that they want to read, which is not always what we want them to read.

Larry Williams adds:

When I wanted my kids to read a book I was reading I told them they probably should not read it — that it was too adult for them. A cheap trick, I know, but they pick up those books like a brown trout seeing a grasshopper in August.

Nat Stewart writes:

My parents did much to foster my love of reading. In early grade school I would go with my mother to the local library, where I was allowed to pick any books I wanted for that week. I quickly fell in love with the selection of children's books that focused on biographies of America's great heroes. My particular favorites where books on:

1. Thomas Jefferson

2. Thomas Edison

3. George Washington

4. Paul Revere

5. John Paul Jones

6. George Washington

7. Davey Crockett

8. Henry Ford

9. Daniel Boone

10. the Wright brothers

I loved these books! The children's books focus on a narrative of struggle, adventure, and heroism, ingenuity, and are often historically accurate enough to prove very educational. I remember reading them late into the night, hoping no one notice that I had my light on long past the official bed time.

My parents also spent a good deal of time reading to me. My favorites included books about King Author and Nights of the Round Table, "Little House on the Prairie" books, and The Chronicles of Narnia.

Let a kid explore the library and pick favorites. Provide enough options so that reading can become an adventure rather than a chore. Spend some time reading to them over summer vacation.

From Bill Rafter:

We all remember our trips to the library. However that cannot be replicated today. The libraries simply cannot compete with television and the Internet either with content or "wow" factor. The answer to the problem will be in using the new technology not avoiding it. Television, even the good stuff like National Geographic or Ken Burn's "Civil War", is still second-rate because it's passive. The Internet is active, and thus has more potential as a learning tool.

We all remember our trips to the library. However that cannot be replicated today. The libraries simply cannot compete with television and the Internet either with content or "wow" factor. The answer to the problem will be in using the new technology not avoiding it. Television, even the good stuff like National Geographic or Ken Burn's "Civil War", is still second-rate because it's passive. The Internet is active, and thus has more potential as a learning tool.

Games can be very helpful. One that had particularly helped me (both myself and subsequently my children) was Scrabble. After a street game of "boxball" we would dig out the Scrabble board while we cooled down. Those games got very competitive to the extent that several of us kids started doing research on words by randomly reading the dictionary. Scrabble also required you use arithmetic to keep score.

My favorite Scrabble word was "ennui," as it cleaned out your collection of accumulated poor-value tiles. It also led to challenges, which led to another turn and more points. While researching through the dictionary I stumbled upon the word "eunuch", which also had good Scrabble possibilities. Being in 6th grade, I didn't care what it meant, but kept a mental file for future use.

Well somehow I got into a name-calling event in the schoolyard with a girl and called her a eunuch. She had no idea what it meant, but the teacher Sister Mary Hatchetface was in earshot and she most certainly knew. The next thing that happened was that I was in the principal's office (Sister Jane Battleaxe). My father was summoned. He was a Philadelphia policeman, and he happened to be in uniform.

So there I was in the Holy of Holies with the two nuns in their penguin uniforms and Dad in his, trying to learn what trashy literature I was reading. The revelation that it was the dictionary left them with no solution.

Ahhh, the ability to stick it to authority…priceless.

Jun

13

Voices From the Grave, from Kim Zussman

June 13, 2007 | Leave a Comment

It has been 342 trading days since Mr. Ben began chairing the Fed. Has his kingdom been different from his immediate predecessor? SPY daily returns compared Bernanke and Greenspan:

Two-sample T for Ben returns vs. Greenspan:

N Mean StDev SE Mean

Ben ret 342 0.00054 0.0066 0.00036 T=0.1

Grn ret 342 0.00049 0.0065 0.00035

no difference

What about volatility? Here the same data are used to compare variance:

Test for Equal Variances: Ben ret, Grn ret

95% Bonferroni confidence intervals for standard deviations:

N Lower StDev Upper

Ben ret 342 0.0061 0.0066 0.0072

Grn ret 342 0.0060 0.0065 0.0071

F-Test (normal distribution)

Test statistic = 1.03, p-value = 0.760

no difference

The Fed chairs have not exerted differing effects on mean or variance of stock returns, which does not exclude certain efforts for Alan to Pimpco his ride.

Jun

12

Clintonite hackademic Brad DeLong on folks who disagree with the the nanny state:

The neoclassical economics toolkit makes you a smarter, stronger, more powerful, more effective, more reality-based leftie. By contrast, the neoclassical toolkit can be absolute poison for people right on center. It functions like a kind of crack, reducing their arguments to empty slogans: "the market takes care of that"; "acts of capitalism between consenting adults"; "they hired the money, didn't they?"; "it's not the government's, it's theirs." People right-of-center should be exposed to the neoclassical economics toolkit only after posting a $1M bond to cover collateral damage, and only under the supervision of trained professionals.

Jun

12

Puissance of the Palate, from Marion Dreyfus

June 12, 2007 | Leave a Comment

These photos of representative food per week around the world indicate the puissance of the American palate. See how many of these families chow down on Coke and soft drinks, and how popular relatively useless cereal appears to be. Kellogg's and Coke — our cultural exports — seem to make friends everywhere.

These photos of representative food per week around the world indicate the puissance of the American palate. See how many of these families chow down on Coke and soft drinks, and how popular relatively useless cereal appears to be. Kellogg's and Coke — our cultural exports — seem to make friends everywhere.

It was also interested to see the Beijing family eats enough sushi to include it as a regular food. They overtly hate the Japanese and love their own cuisine, so seeing Japanese food there was a big clue to a softening of attitudes. For some of the first-worlders, much of their intake seems to be what I call expendable foodstuffs — junk food. ''Correct food choices,'' as the nutritionists are wont to say, are missing in sophistication.

Also, the family sizes varied so drastically and in some photos you cannot tell if it is an extended family or one couple with offspring. The African family clearly had no male; if it had a male adult, would the expenditure have been different? Would the food have been other than what they had? There were no vegetables and fruits there — but of course, their expenditure was under two dollars.

Adi Schnytzer remarks:

What was particularly interesting about the Beijing family was that their expenditure was around double the average worker's income! Do these sushi and junk-food eating Chinese really represent anything?

Marion Dreyfus replies:

From my on the ground experience in the real China (not Beijing or Shanghai), this family is atypical. They spend an outsized amount of their income on food. Also, food in Beijing is outlandishly more costly than in the four cities in which I resided. The average worker in the country makes $80-$90 a month. Prof. Schnytzer is correct that such a tab for food is bizarrely irregular. I wonder if all the families were similarly unrepresentative in terms of their averageness.

Jun

12

June Drops, from Kim Zussman

June 12, 2007 | Leave a Comment

Curious whether June (or any month) in particular has historically hosted big sell-offs, I checked S&P500 index daily returns (1952-present). I found the low close of the last 10 days of each month and compared this to the high close of the 1st 10 days of the same month.

The ratio min/max for each month was then ranked, and the worst 10% of the declines noted. Here they are (69 months): 1st column = month, 2nd = count of months, 3rd = mean min/max drop, standard deviation, and 95% CI:

Individual 95% CIs For Mean Based on Pooled StDev

Mon N Mean StDev

1 6 -0.085 0.013

2 2 -0.086 0.016

3 3 -0.105 0.031

4 4 -0.088 0.022

5 9 -0.094 0.037

6 7 -0.084 0.019

7 6 -0.099 0.047

8 7 -0.112 0.032

9 10 -0.089 0.026

10 8 -0.117 0.082

11 6 -0.088 0.017

12 1 -0.084 *

-0.160 -0.120 -0.080 -0.040

The count of 7 for June was close to mean count for all (5.75), and the mean drop (-8.4%) tied December (the only one in the sample) near the top of "least worst."

Jun

12

Faithful Albion, from George Zachar

June 12, 2007 | Leave a Comment

London Tops as World Commerce Center, MasterCard Says (Bloomberg) June 12 –

London tops a list of 50 cities as the world's commerce center, beating New York, Tokyo and Chicago, a report by MasterCard Inc., the world's second-biggest credit- card company, showed. London surpasses New York in four of six areas in the report covering economic stability, the ease of doing business, volumes of financial flows and attributes as a business center, MasterCard said in a statement today.

When the unwitting question free markets' ability to generate prosperity, I point to the side-by-side real-time economic experiments of North vs. South Korea, pre-takeover Hong Kong, or the Cold War's East and West Berlins.

Now, I will use London.

If "Europe" is so grand and wonderful, why isn't Paris or Brussels or Frankfurt or Milan that continent's economic center of gravity? Why is rainy, gray and gritty London the focus of commerce and wealth, not the putative "City of Light"?

Economic freedom trumps the epicurean charms of Paris. QED.

Laurence Glazier adds:

Gratifying though it is that my home town wins, I will understand the local frenzy better when there is an options exchange to rival those across the Pond. To compensate for this there is a huge spread-bets industry but I have not yet found or figured out how to synthesize time or vertical (or indeed diagonal) spreads with them.

Jun

12

Time Series, a query from Jim Armstrong

June 12, 2007 | 2 Comments

I have started to look into modeling time series. One thing I can't understand is that all the models in the financial literature, such as GARCH and ARIMA, have the random walk as their base assumption. But if markets are assumed to be random from the onset, what good are models? Sure, they can be useful when pricing options and such, but they are useless for making accurate predictions on the time series itself. Am I right?

Philip McDonnell replies:

To an extent the premise of the question is true. Random walks are a pretty good model for markets. The purpose of time series analysis or any other is to detect subtle deviations from randomness. To the extent that the model is unable to detect deviations from randomness then a trader will not be able to profit from it except by luck alone.

The opportunities lie in the deviations from randomness. These can be identified by the model and their strength and statistical significance estimated. Significance testing always starts with the naive null hypothesis that the market is random and cannot be beaten. The burden of proof is upon the data to 'prove' that the null is incorrect and that the market can be beaten.

Jun

12

Bubbles on the Brain, noticed by Gabe Ivan

June 12, 2007 | Leave a Comment

Marc Andreessen writes of permabears:

Marc Andreessen writes of permabears:

The human psyche seems to have a powerful underlying need to predict doom and gloom. I suspect this need was evolved into us way back when. If there is a nonzero chance that a giant man-eating saber-tooth tiger is going to come over the nearest hill and chomp you, then it's in your evolutionary best interest to predict doom and gloom more frequently than it actually happens.

Jun

12

Lessons, from Henrik Andersson

June 12, 2007 | 1 Comment

Nothing has inspired me more in my investing career than Vic and Laurel's books. Between May 3, 2004 and June 1, 2007, I recorded every trade I did and some of the thoughts behind them, and published them in near real time. Some of the things that I have learned from Vic and Laurel and tried to apply to my own trading:

- The media will almost always make you lean the wrong way.

- Don't take market wisdom for granted. Many precepts don't hold up to testing.

- It pays to be an optimist in the stock market.

- The concept of 'trend' is backward-looking.

- Count.

Jun

12

Last Week, from Kim Zussman

June 12, 2007 | Leave a Comment

I lost money last week but I'm still up since starting to trade futures in late January. Ironically, I lost Wednesday and stayed out Thursday until right at the close. My mistake: sold too soon in the AM and shorted prior to the close, thinking ‘no way they hold the weekend.’ I should know better and was mad at myself for selling too soon.

Currently I wonder if last Thursday's big sell-off will act as a mini-2/27 or there is more to come. Lots of worry in the air; that must be good. Seems like PPI/CPI later this week will fuel or douse the fire.

Victor remarks:

Shorting after a big decline is an unforgivable mistake.

Jun

12

New Twist for Donchians? from Nigel Davies

June 12, 2007 | Leave a Comment

In an idle moment I checked the classic Donchian moving average cross (5/20) over the last 3,000 days and gave it the advantage of only trading the long side. Even so the whipsaws were so many that it produced a loss, and that before commissions and slippage.

But it was interesting to see that this system produces a profit when applied to a stock/bond ratio over the same period, on both the long and short side and in both stocks and bonds. It even beats buy and hold, though I didn't include commissions and slippage.

I mention this because the first just gave a short signal after a long run on the long side. But the second has not.

I don't actually think this is a good system or I wouldn't be posting it. But the result seems kind of interesting and may be food for thought.

J T Holley adds:

Having read and heard numerous presentations from well known and lesser known Donch's over the last five years it is always amazing to hear them down-speak equities. and if you look, their "diversified approach" index futures tend to be a smaller allocation. Their answers to questioning tends to be:

"Equities tend not to trend."

"The whipsaws don't justify a bigger allocation."

"This is the last frontier in trend following."

Nigel's study shows why they make those replies, but they still try. I often asked them "why not just take them out of your allocations?" with no good answer. I guess it is some Edisonian effort to persist or maybe Vic's often quoted "lose more than they should."

Once the Donch's deviate from the fixed system and try to screen, filter, and curve-fit a new fixed I have often wondered why in their attempt at scientific discovery don't they realize the "Law of Ever Changing," and abort the 5/20 or any variation or breakout in same fashion for another method?

One is only left with the assumption that they too have been Bodysnatched!

Jun

12

I had the pleasure of being at a yearly checker tournament this past weekend in Grove City, Pa. Our current world champion, Mr. Alex Moiseyev, was there and he hosted other players who competed. Alex won the tournament by one point over Mr. Bruch, who lost but one game to Alex after 7 rounds of playing other opponents. Last year's American Checker Federation National Tournament was held in Medina, Ohio and the tourney was named in Mr. Bruch's honor.

I had the pleasure of being at a yearly checker tournament this past weekend in Grove City, Pa. Our current world champion, Mr. Alex Moiseyev, was there and he hosted other players who competed. Alex won the tournament by one point over Mr. Bruch, who lost but one game to Alex after 7 rounds of playing other opponents. Last year's American Checker Federation National Tournament was held in Medina, Ohio and the tourney was named in Mr. Bruch's honor.

In 1939 Ed played in the 10th ACA (American Checker Association) National Tournament (later in 1948 the name was changed to the American Checker Federation) which is a 501 (c) 3 non-profit under IRS guidelines for education. Below I quote from Ed’s biography. He has played competitive checkers all his life. His mind is sharp as a razor and he possesses a remarkable memory and has the patience of Job. I feel lucky to know him and have played him on several occasions.

Edward (Ed) Bruch was born on June 12, 1916, in Buffalo , NY and today at age 91, is the only active Grand Master player and one of just two survivors of the 1939 10th. Am. Tournament, the other being Eugene Zuber who, at age 97, is residing in a retirement complex in Northern Ohio. Ed became interested in the game at age 14, by one of his school's coaches, who was a member of the Buffalo Checker Club, where he met Harrah B. Reynolds, a ranking Master, who was instrumental in coaching Ed, and also Jack Dworsky, and Joe Kitka. Playing in Humbolt Park, across from the Buffalo Post Office, where Reynolds was Superintendent of the Postal Division. Practice such as this, over six or seven years, advanced all three to the expert class. And so, Ed Bruch entered his first U.S. National Tournament. Ed won three rounds over O'Melay, Gould, and Zuber, drew one round vs. Gene Winter, and lost to Fuller and Lewis, to finish in a tie for 7th.-8th. with DeBern.

Ed's checker career was interrupted by the advent of WW2, in which he served in an infantry division under Omer Bradley's 1st. Army, with combat in the Normandy Invasion, France and in the Battle of the Bulge in Germany, April 1941 to October 1945. He joined the Buffalo Police Dept. as a street patrolman in a densely populated high crime area, and retired in 1980 with the rank of Lieutenant.

Ed lives with his wife Vickie in a patio community in Buffalo, with his married daughter living nearby. Ed is the oldest active Master player and is rated in the top 10 players on earth. Later this year he will travel to the Plaza Hotel in Vegas to compete in a WCDF (World Checker/Draughts Federation) sanctioned World Qualifier.

Mr. Bruch always records his games and keeps them in a handwritten manuscript for later reference so hopefully the same mistakes won't be repeated again.

Much of what I have written carries over into the market and the market players who are attempting to master the Market Mistress. One must keep their ego in check, show humility, and don't execute a 'move' (checker game or market one) until you are sure and have done all the research.

Jun

11

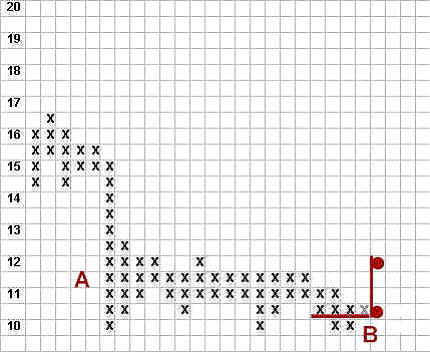

Between the Scylla of Levels and Charybdis of Changes, by Victor Niederhoffer

June 11, 2007 | Leave a Comment

One of the most common problems when studying markets is deciding whether to study levels, or the changes themselves. For example, when looking at weekly levels of stock market prices, one knows that the changes between the consecutive closes might not contain all the regularities, yet by analyzing the levels one runs into the problem of serial correlation, with levels near the previous being much more likely than the mean level.

One of the most common problems when studying markets is deciding whether to study levels, or the changes themselves. For example, when looking at weekly levels of stock market prices, one knows that the changes between the consecutive closes might not contain all the regularities, yet by analyzing the levels one runs into the problem of serial correlation, with levels near the previous being much more likely than the mean level.

In Data Analysis Tools # 11, which I found helpful in writing this piece, they list four reasons for such serial correlation:

- The market has a trend within the period. In the following case the levels at the beginning are closer together than the levels at the end of the period, which is what makes the serial correlation.

- The market varies seasonally, which has been overlooked. This would apply more to economic announcements, with the always suspect seasonality corrections.

- The market is missing some explanatory variables that are serially correlated, like bonds and the dollar.

- The market includes random noise that is serially correlated or that has persistent effect, (that being the name of the game of course).

The usual method of handling this problem is to take first differences, but this has several technical problems due to the implicit assumption one has to make as to the correlation between the consecutive levels and errors. There are several parametric solutions to this, but as far as practical market work goes, they induce so much data fitting and variability to the analysis. In my opinion they are merely window dressing for academic practitioners, whose purpose is to invent methods that are results impossible to duplicate by the layman, therefore maintaining the academics' ivory towers, useful for consulting and marketing purposes.

A solution that is often used for for problems of this nature is to take the ranks of the levels of changes and apply the normal methods of correlation on the ranks. Whilst going through the book Rank Correlation Methods, I wondered if the use of Tau as a correlation measure might unravel many of the statistical problems in testing for randomness in such a series. I reflected on such, and came across several papers that had taken similar technical approaches, including a Kendall's Tau for Autocorrelation by Ferguson et. al., in the Canadian Journal of Statistics.

The results and procedures of that paper are interesting, but I found it better to continue pursing the subject on my own, as I believe the methodology and approach I take is more direct and relevant to market analysis. Let us start with what Tau is, adopted from Kendall himself.

Suppose a number of boys are ranked according to their ability on mathematics and music:

BOY A B C D E

Math 7 4 3 10 6

Music 5 7 3 10 1

Let us consider boys A and B; B is below A on math, but on music, B is above A — their ranks are in opposite order in this comparison. Now if we look at C, he is below A on math and below A on music, making it in natural order. D is above A in both subjects, so again this in natural order. E is also below A on both, so in natural order. Three of A's relationships were in natural order and one was not.

Let us now focus on boy B. He is in natural order with C, natural order with D and in opposite order with E. That is 2 in natural order in 1 out. Now C is in natural order with D and E. That is two more relationships in natural order. D is in Natural order with E, which is another relationship in natural order — thus of ten possible comparisons, there were eight in natural order, and two not.

Tau would be computed as six out of ten (the number concordant minus the number discordant), and it could have varied from plus one to minus one.

Now let us consider using Tau as a test for trend, where we look at time as one variable and price as the other. Here are prices starting with Friday January 5th and ending with Friday January 12th, this year.

DAY NATURAL LEVEL

Fri, 05, 1 1442.3

Mon, 08 2 1448.5

Tue, 09 3 1446.7

Wed, 10 4 1450.6

Thur, 11 5 1457.6

Fri, 12 6 1467.6

There are fifteen possible comparisons here, and of these fifteen, only one is discordant, (out of natural order) — Tuesday with Wednesday, with Wednesday being down from Tuesday, but coming later in the week. Thus there were 14 in natural order, and tau for the week would be 13/15 = 0.87.

I believe that the absolute value of Tau computed in such a manner for each week, with positive Tao meaning a positive trend and vice versa, is a good measure of the trendiness in the market for the week. Here are Tau calculations for the first few weeks of the year, and then last week, for S&P futures.

Week Ending Tau measure of Trend.

Jan 05 -0.6

Jan 12 0.90

Jan 19 -0.6

Jan 26 -0.2

Feb 02 0.9

Feb 09 0.07

Feb 16 0.7

Feb 23 -0.60

Jun 08 -0.7

The tendencies are apparent even in this cursory analysis, which will doubtless be finalized by the young intern scion, and compared with the random character of the actual price changes in the series, by the artful simulator, Mr. Tom Downing.

Steve Ellison adds:

I generated 2400 random sequences of 6 numbers and calculated the tau measures of each sequence. I then calculated the tau measure for each of the past 24 5-day periods in the S&P 500 futures. The distribution of the S&P 500 tau measures appears quite different from the randomly generated distribution.

Jun

11

To Learn or To Win? from Scott Brooks

June 11, 2007 | 3 Comments

This evening, I watched my ten year old daughter's softball game. She played a very good game and her team won 22 - 16 (yes, that's softball, not football).

This evening, I watched my ten year old daughter's softball game. She played a very good game and her team won 22 - 16 (yes, that's softball, not football).

As I watched them play I figured out how to easily win the game. All the players had to do was stand there and never swing the bat under any circumstances. You see, the pitchers at this level are simply not able to throw three strikes in seven pitches. They would have walked every one. Of course the league only allows a maximum of seven runs per inning, so we would have had to play defense some of the time.

So, when our team went out to pitch, I would have told them to forego the windmill pitching action and just do a slow underhand lob over the plate for strikes or close enough to force the other team to swing. The other players would have struck out some of the time, but otherwise, the only way to get outs was to get them in the field. Still the other team would have been limited to seven runs in an inning. Therefore, in order to win, all our team would have to do is limit the other team to fewer than seven runs per inning.

Nigel Davies comments:

You don't think they missed out on a great lesson in flexibility and adaptability, rather than going through the motions of what they thought they should be doing? As Sun Tzu stated, "To subdue the enemy without fighting is the acme of skill."

In my experience playing-strength is fostered first and foremost by the pursuit of victory, with mentality and technique improving to meet new challenges. Those who focus on appearance and style usually turn out to be weak posers with no real substance behind their moves, just shadows of what a good player should be.

Rodger Bastien writes:

I am sure this piece was all written tongue in cheek. As a little league coach I am on a personal crusade to de-emphasize winning vs. learning to play baseball in K-6th grade. Granted, you could "win" using the methods you describe but my team "lost" a game last week by taking the exact opposite approach.

After witnessing a couple of innings of a an endless walks I could see a palpable lack of interest amongst all of the players. I instructed my players to go up there hacking and I’ll be darned if we didn’t rattle off 9 straight hits before the ump declared the "6 run maximum per inning" rule with no outs. In the bottom half of the inning our opponents maxed out on runs without taking the bat from their shoulders.

We lost the game but afterwards you would never tell that my guys were the losers from the pie-eating grins on each of their faces. In baseball, as in life, there is much more to be gained by taking your hacks than standing there with the bat on your shoulder.

Jun

10

I got a lot of positive feedback on last year's posting of rose pictures from the New York Botanic Garden so I'm taking the liberty of posting this year's effort.

I got a lot of positive feedback on last year's posting of rose pictures from the New York Botanic Garden so I'm taking the liberty of posting this year's effort.

Today was the annual Puerto Rico Day parade, which makes doing anything in my neighborhood an enormous hassle due to the crowds. My strategy for the day was to take the kids up to the Bronx via mass transit and be in a quiet wooded place while the East Side was thronged. We lucked out as we caught more roses than usual at peak bloom.

Business anecdote: The Chrysler Imperial was the first rose to be used in marketing.

Jun

10

Will Sex Sell Market Economics? from Greg Rehmke

June 10, 2007 | Leave a Comment

A common complaint is that investors run in herds, throwing new money at whatever seemed to work yesterday. The huge success of the movie Gladiator led Hollywood studios to fund a series of genre knock-offs.

A common complaint is that investors run in herds, throwing new money at whatever seemed to work yesterday. The huge success of the movie Gladiator led Hollywood studios to fund a series of genre knock-offs.

The unexpected success of Steven Levitt's Freakonomics, a popular introduction to innovative (mostly market-failure) economics, led book publishers hoping for another hit to sign book contracts with many articulate economists. So we have: John Lott's Freedomnomics: Why the Free Market Works and Other Half-Baked Theories Don't; Tyler Cowen's, Discover Your Inner Economist: Use Incentives to Fall in Love, Survive Your Next Meeting, and Motivate Your Dentist; and Steven Landsburg's unfortunately-titled, More Sex is Safer Sex: The Unconventional Wisdom of Economists.

I haven't purchased or read any of these so don't yet know the secrets promised in the titles. I think it is worth noting in regard to the Landsburg's More Sex title, that more sex for an economist is still not very much (with the possible exception of Joseph Schumpeter).

Sex aside, I highly recommend the short article by Landsburg linked at the end of Stefan Jovanovich's post, titled A Brief History of Economic Time. If those who teach history in our high schools and colleges were less ignorant about economics and economic growth, these straight-forward facts about progress over the last century would be less unconventional and less completely unknown to the public.

A more detailed look at economic progress in America can be found in the excellent annual report essays from the Dallas Fed by W. Michael Cox. The 1993 essay "These are the Good Old Days" is a classic.

We will see if sex and weird titles help new economic titles sell. (I wonder if Naked Economics: Undressing the Dismal Science sold better than The Undercover Economist: Why the Rich are Rich, the Poor are Poor–and Why You Can Never Buy a Decent Car?

A recommended alternative is Common Sense Economics: What Everyone Should Know About Economics and Prosperity. And most highly recommended is Paul Heyne's textbook, The Economic Way of Thinking. The new edition is expensive, but the earlier editions are great and cheap.

Jun

10

Movies and Video Games, from Jeff Sasmor

June 10, 2007 | Leave a Comment

Shrek 3 is a great movie. If you have seen the first two this one is worth it. One of my interests is computer graphics and each one of these movies is more and more impressive. One of the things to watch is hair and clothes. At this point, with massive computer efforts, hair motion (look at Puss-in-Boots and Donkey's hair in particular) is very realistic. Also look at clothes.

Shrek 3 is a great movie. If you have seen the first two this one is worth it. One of my interests is computer graphics and each one of these movies is more and more impressive. One of the things to watch is hair and clothes. At this point, with massive computer efforts, hair motion (look at Puss-in-Boots and Donkey's hair in particular) is very realistic. Also look at clothes.

Clothes now can realistically drape and move with the character. The first computer graphics that I played with was on the Commodore Pet - not bimapped but nothing much outside military systems in 1978. The creators of Shrek 3 threw in some classic rock music to hook the parents, like Zeppelin's "Immigrant Song," in one scene where Snow White becomes a riparian ninja. I've actually seen it twice in the last three weeks.

Pirates of the Caribbean is worth seeing if you want to know how it all ends (if it did end - I'm not sure). And the effects are really good. But it's way too long at three hours and the plot is a bit disjointed.

If you have a Nintendo Wii, Super Paper Mario is highly recommended. It is fun and challenging for children and adults alike. You move between a linear two-dimensional world (side-scrolling for hipsters) and a 3-D representation of the same space. Press a button and features of the environment that are hidden in 2-D mode suddenly appear. It's intriguing and addictive as all h-e-double-hockeysticks. I've been playing it every afternoon apres 4 PM. It's actually a role-playing game to some degree.

If you have a Nintendo Wii, Super Paper Mario is highly recommended. It is fun and challenging for children and adults alike. You move between a linear two-dimensional world (side-scrolling for hipsters) and a 3-D representation of the same space. Press a button and features of the environment that are hidden in 2-D mode suddenly appear. It's intriguing and addictive as all h-e-double-hockeysticks. I've been playing it every afternoon apres 4 PM. It's actually a role-playing game to some degree.

While many people say that video games are bad for children, I think that properly-chosen games are actually very good for them. Platforming games (where you have to jump around from one place to another) are really good for building hand-eye coordination. Role-playing games are good to help young children learn to read as the interactions between characters largely appear in dialog boxes. I used this to help my younger daughter learn to read. It also helps kids learn to follow a story and the development of characters.

Jun

10

Custer, from Peter Grieve

June 10, 2007 | Leave a Comment

I've been thinking about guerrilla war as a result of a trip to the Custer battlefield. Everyone knows that guerillas usually shun contact with conventional forces, "evaporate like the mist". I thought this was only good for self preservation.

I've been thinking about guerrilla war as a result of a trip to the Custer battlefield. Everyone knows that guerillas usually shun contact with conventional forces, "evaporate like the mist". I thought this was only good for self preservation.

But now I see the obvious fact that it has an offensive component. If the men of the conventional forces become hungry for contact and their officers come under career-changing pressure actually to fight a battle, they may become less fastidious about the kind of contact they're after. And then they get the kind they want least.

Stefan Jovanovich adds:

The pressure that Custer felt was of his own making. He and his wife believed that a victory against the Sioux would reward him with enough notoriety to make him president. In retrospect that seems like a mad fantasy. But by 1876 the Republican Party had had only three candidates for President - Fremont, Lincoln, and Grant, and two of them had been U.S. Army officers.

Largely because of Mrs. Custer's relentless promotion of her husband's folly into heroism, Custer's subordinate commanders, especially Major Reno, became the fall guys. The truth is that Lt. Colonel Custer (he had been a General of Volunteers during the Civil War) would have been court-martialed if he had survived. The plan for the campaign against the Lakota had been for three columns to attack jointly.

As commander of one of the columns, Custer disobeyed his orders by not waiting for the other 2 columns and then spliting his own command in thirds. He ended up attacking with a force 11% of the planned assault force. Yet, had he shared Teddy Roosevelt's incredible good fortune at Kettle Hill and become a hero of the Indian Wars, Custer might have become President.

From Russell Sears:

This leads to the countable hypothesis that CEOs who marry/partner with someone within the company, soon cause the company to under perform.

Dean Parisian writes:

My father retired from the Bureau of Indian Affairs in Crow Agency, MT in 1985 and as a kid I spent a fair amount of time at the Battlefield there as Crow Agency adjoins the Custer Battlefield monument.

The lesson here is that when you chase returns in markets you aren’t familiar with or chase Indians in country you don’t know very well there is a good chance one can get hurt. Quick and seriously. Stick with what you know and when it looks like you are out-manned, cut your losses and run. Living to fight another day is paramount.

Jun

10

UK Stock Picking, from Nigel Davies

June 10, 2007 | 1 Comment

Does anyone know of a good service/methodology for selecting UK stocks? I only know of the 'OCD' (Outstanding Companies Digest), which despite some apparently good picks has the Sage of Omaha as one of its heroes.

I find this slightly off-putting, leaving me to wonder if Sage is just a marketing ploy or whether they manage to bury their mistakes. I remember Marconi being covered in their previous incarnation as 'The Analyst' (this is a lousy name because of too much competition with search engines), but then it was dropped without trace when the company went bankrupt.

OK, I have a methodology based on reading Clews plus my view that the UK is heading for stagnation (the idea that the gold trader, Chance Brown, was good at his job will shortly be exposed as being nothing more than being in the right place at the right time). But it would be nice to get some science into such decisions.

Jun

10

Cork Removable, from Jim Sogi

June 10, 2007 | 1 Comment

Say you are in a remote valley with a nice bottle of wine to go with the barbeque but darn, forgot the wine bottle opener, don't forget the Hawaiian wine bottle opening method. Take the wine bottle and wrap the bottom of it with a towel. Go the a tree and smack the bottom of the bottle while wrapped in a towel against the tree about 50 times really hard. (not so hard you break the bottle of course). The raps slowly move the cork out enough to grap it. Try it, it works. Enjoy your wine.

Say you are in a remote valley with a nice bottle of wine to go with the barbeque but darn, forgot the wine bottle opener, don't forget the Hawaiian wine bottle opening method. Take the wine bottle and wrap the bottom of it with a towel. Go the a tree and smack the bottom of the bottle while wrapped in a towel against the tree about 50 times really hard. (not so hard you break the bottle of course). The raps slowly move the cork out enough to grap it. Try it, it works. Enjoy your wine.

Jun

10

Property and Casualty, from Gordon Haave

June 10, 2007 | Leave a Comment

Investment Manager D.E. Shaw Set to Acquire Specialty Insurer James River

June 11, 2007

Global investment manager D. E. Shaw group has organized a Bermuda-based holding company to acquire James River Group, Inc. a North Carolina-based excess and surplus and workers' compensation insurer, in a transaction with a total equity value of approximately $575 million.

I have been constructive on P&C shares generally. Think about it: You are an insurance company, you have set rates based on the probability of loss times the magnitude of the loss across your insured base. Along comes a big hurricane and you take the big loss.

Unless the calculation of probability of loss times the magnitude of loss increases, your rates should stay the same. Instead, rates along the Gulf Coast have gone through the roof — doubled, tripled, or more.

Were the insurance companies really that far off in their calculations pre-Katrina? Or is there an inefficiency in the market such that they have been able to raise rates due to limited competition in the heavily regulated industry, magnified by state insurance commissions willing to go along with the rising rates due to Gore-inspired panic?

Jun

9

Why presume that all those billions of people who have gone before us and lived on $400 to $600 a year lacked optimism, enterprise, and faith? What a truly ignorant snobbery. The 18th century politicians and citizens in the United States took it so much for granted that the future would be "better" that they were arguing over who would own "Louisiana" (the land Jefferson purchased) before they had figured out a way to safely get west of Lynchburg. None of them would have asked "are you better off?" because they would have assumed - rightly - that being better off was everyone's goal and the question was how to get there.

Why presume that all those billions of people who have gone before us and lived on $400 to $600 a year lacked optimism, enterprise, and faith? What a truly ignorant snobbery. The 18th century politicians and citizens in the United States took it so much for granted that the future would be "better" that they were arguing over who would own "Louisiana" (the land Jefferson purchased) before they had figured out a way to safely get west of Lynchburg. None of them would have asked "are you better off?" because they would have assumed - rightly - that being better off was everyone's goal and the question was how to get there.

They would have been pleased for our prosperity, but they would not have assumed that their ancestors were dolts simply because they had not yet invented the steam engine. They would also have been humble enough to know that fate has a way of erasing certainties, even economic ones, and they would truly have laughed at Mr. Landsburg's notions about sex, in his article, A Brief History of Economic Time. Better was not more; it was sleeping with someone you love who loves you, and no amount of money in the world could buy that.

Steven E. Landsburg responds:

The issue I was addressing was not whether they lacked optimism, enterprise and/or faith, but whether they lacked material prosperity, and whether they lacked any experience of material progress. It is a matter of fact that with very few exceptions, prior to the Industrial Revolution, life above the subsistence level was a rarity, and economic progress was also a rarity. (In the original article, I noted a few important exceptions that were cut by the editor.)

The enthusiasm for Louisiana was a product of the Industrial Revolution. Those "18th century politicians and citizens" cited above were in fact nineteenth century politicians and citizens.

Jun

9

Milk Your Own Cows First, from Steve Leslie

June 9, 2007 | Leave a Comment

One of the interesting aspects of the great Tiger Woods is that he is an extremely composed person. He always is meticulously groomed and very gracious in public especially during interviews. Arnold Palmer also displayed such characteristics and is one of the great reasons why he is so embraced by tens of millions worldwide even 30 years after he has stopped being a force on the PGA tour.

One of the interesting aspects of the great Tiger Woods is that he is an extremely composed person. He always is meticulously groomed and very gracious in public especially during interviews. Arnold Palmer also displayed such characteristics and is one of the great reasons why he is so embraced by tens of millions worldwide even 30 years after he has stopped being a force on the PGA tour.

Tiger also has the character to summon awesome Herculean powers to focus instantaneously on the task at hand. Ben Hogan and Jack Nicklaus had such a skill. This may very well be the reason why they could separate themselves from the field seemingly at will especially during the latter stages of a tournament or at crunch time.

To this end, however, each has been perceived at times to be standoffish and unapproachable. Even Tiger has been criticized for not signing as many autographs as some think he should after a tournament. I feel that this is an unfair assessment by the public looking for flaws in character, perhaps even a dark desire to pin something unsavory upon them. Even more, it could be a futile attempt to search for something to find unlikable or at the very least printable to satiate a fringe group who finds delight in bringing to light that these people are human and flawed after all.

My point is that their fantastic focus is spun to reflect a weakness especially by those who have never won anything of consequence or excelled on their own. And yet why should we really look for any reasons to cast aspersions? Should we not look for the positives to build upon to improve our own lives?

There is an old adage: "Milk your own cows first." I think upon my own cows that I need to milk and find this enough of a challenge. My goal is to be a better milker.

On markets, The Chair makes a statement here that is most interesting: When will someone get up and say that all this hawkish talk about the threat of inflation is the most bullish possible thing for bonds, as it beats down expectations and prevent succumbing to short-term solutions and keeps the lids on any bad policy?

Jun

9

Apologia, from Victor Niederhoffer

June 9, 2007 | Leave a Comment

Sholem Aleichem has a good short story on Yom Kippur. The gist is that all the meanest merchants, worst cheats, and most deceptive partners go to each other’s houses and beg forgiveness for their sins on this day. I feel like I should do the same to our readers, since I've been so busy trading I've been remiss in updating the site.

Sholem Aleichem has a good short story on Yom Kippur. The gist is that all the meanest merchants, worst cheats, and most deceptive partners go to each other’s houses and beg forgiveness for their sins on this day. I feel like I should do the same to our readers, since I've been so busy trading I've been remiss in updating the site.