Jun

6

Pitch and Rhythm, from Brett Steenbarger

June 6, 2007 |

It is interesting that in the recesses of academe there are a few Galtonian souls studying the psychology of music empirically. One thrust pertains to analyzing both speech and music according to pitch perception; how we view music and speech may be quite similar.

One finding, for instance, is that pitch is related to perception of social dominance and submission in both speech and music:

A commentator on the latter article notes that you can accurately predict an animal's size from its pitch.

Do markets have pitch and do they invite psychological responses with messages of submission (come hither) and dominance (threat)? Could we explain behavioral finance phenomena in the same terms as behaviors in the wild, communicated by the pitch of animal sounds?

It's a fascinating literature. Rhythm (shifts in frequency of ticks) might just be a consequence of pitch, as speculators respond to market communications. Perhaps it's no coincidence that rising markets are so inviting; falling markets so threatening.

Todd Tracy writes:

Emotional stability in musical rhythm goes a long way on the road to complex weaving of interactions. It is best not to get too carried away with the music as it is occurring and to keep an observant eye on possible upcoming change ups in the rhythm, however, not to be so observant as to get cold.

Emotional stability in musical rhythm goes a long way on the road to complex weaving of interactions. It is best not to get too carried away with the music as it is occurring and to keep an observant eye on possible upcoming change ups in the rhythm, however, not to be so observant as to get cold.

In my capacity as a producer of commercial types of music one of my most important tools is the use of tension and its undoing. I would tend to think that as human beings we would react emotionally to the tension in a universal way, the shiver that runs down your spine when you hear a section of a particular song. Breaking away from the expected syncopation in such a way as to capture the attention of the listener, not as a total distraction but as a way to lead the listener into the enfolding polyrhythm. One cool way to capture attention is to have the band just stop in the middle of the verse, for one beat and then continue on as if you never skipped a beat. You can usually only get away with that one once per song.

A technique I have been using for awhile to further the management of syncopated air-pressure is the use of a "ghost track". Rather like an "invisible hand" simulation in that music is played on top of a prearranged rhythm and then that rhythm is removed from the mix as it were. The ghost track can be a drumbeat, a whole other song or just about any kind of rhythmic audio. Tempo and rhythm modeling can help the music to feel more spontaneous as even the best musicians will tend to play up to and around the beat. After the original beat is removed the music is left precariously dangling on its own. So thereby combining multiple musical performances that dance around a beat that is not there provides a sophisticated allure.

Adding random elements in a sprinkled fashion music production could be like BBQ. Much testing is required. After I finish many performances I will always look around for other drum tracks of the exact same speed (tempo) and slip in and review many beats just to see what I might be missing. The question can become which track is the ghost track and which is actually the track. Many of these questions are left for the final mix in which a systematic top to bottom approach is always the way to go. For instance the kick drum is the first level set so that every vibration is set in relation to that level, the snare might be second followed by the bass and a rhythm guitar or keyboard. Next the lead vocal followed by high hats and solos. Special effects are always last.

There is a direct correlation between understanding rhythmic vibrations in music to market tension. It is the ability to absorb the tension in a cool manner. When a random gyration begins to make sense my emotional response is to trade because I feel that I am in sync with the mind of the mistress. By stepping outside of the song in my mind I can see the vibrational landscape in a more objective fashion.

It is a duality of experience to be able to hear the music in my imagination and then to create those exact imagined vibrations in the same split second. The markets are like songs just begging for solos. The unrealized vibration that we can imagine in the price changes are calling us to jump right in and start soloing, however if the ghost track is removed after you have jumped in you will find yourself quickly hoping for the song to end.

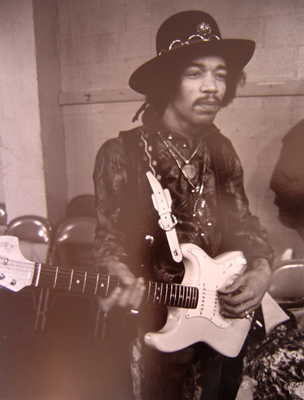

Jimi Hendrix was great in his ability to start playing a different rhythm in the middle of a song and to stick to it even if the drums and bass were doing something different. So too, reading all the market tensions but to not be drawn in by the emotions, so as to coolly carry out the plan. The tricks that a composer will use to get the listeners attention are similar to that of the mistress. How far can Robert Plant stretch that note? How far up can the price go?

Jim Sogi comments:

One thing I've noticed about rhythm is that you've got to feel it in your body. If you are busy counting 1,2,3,4 in your head, you've already missed the beat or it starts to get mechanical sounding and stiff.

Sure it can be quantified, sliced and diced, and put into numbers, but it is only the hours and hours of practice, of feeling and living the music that mean a musician can feel the beat. The rhythm is more than a count, there is an unquantifiable element that allows it to swing, to move in and out of the beat, a fraction before, a fraction after, and pulsing and changing in unpredictable cycles. It is what gives live music its life. It is why a canned computer drummer sounds so dry, so dead and uninspiring.

Hours, days, years watching the markets gives the same feel for the rhythm. This is not to say that quantification and study will not give understanding about the structures, the chords, the main time signatures, but the discretionary element to me is an integral part of the process that numbers alone can not totally replace.

Kim Zussman adds:

It isn't too difficult to follow established rhythms and melodious sequences. What is hard is to recognize changes the first notes of which sound familiar and sweet, but devolve rapidly into deadly arrhythmia.

Normal sinus rhythm > Ischemia > Inverted T-wave > Ventricular tachycardia > Ventricular fibrillation > asystole

Will Kenney offers:

Will Kenney offers:

I agree that you don't have to count simple forms, like blues or AABA stuff, that is so internalized that not much thought is required. However, it's often enough that someone puts some complicated music in front of you and then you'd better be counting. the challenge then is making the music really breathe while having to pay close attention to the page. at the end of the day the slice and dice of it all is very important. it's the command of the tools that allows the most freedom and puts you in the place of getting a groove together.

"Technique is the means by which the heart is allowed to fly freely." - Olivier Messiaen

Comments

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles