Dec

12

December again, and Russian snows

December 12, 2023 | Leave a Comment

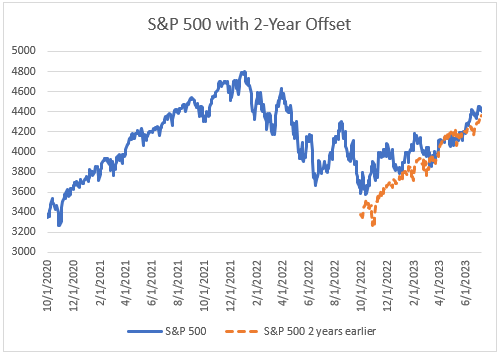

what will S&P move to end of year? since 1996 when as of dec 12 the sp was up over the preceding 30 days, the expectation for the next 15 days is up 20 big points - 9 of 12 since 1996 up. s.d. 20 big.

guaranteed to be found too late: the 30 days from nov 1 to dec 12 been up 15 times and down 3 times since 1996.

Henty explains why France lost so many wars. General Kutosov main practicioner of snoring as fine art:

Through Russian Snows, by G. A. Henty

Dec

11

Snoring as a fine art

December 11, 2023 | Leave a Comment

good lesson for followers of drift in S&P:

Snoring as a Fine Art, and Twelve Other Essays by Albert Jay Nock

Consequently one might with reason think that there is too little snoring done—snoring with a purpose to guide it, snoring deliberately directed towards a salutary end which is otherwise unattainable—and that our society would doubtless be better off if the value of the practice were more fully recognized. In our public affairs, for instance, I have of late been much struck by the number of persons who professedly had something. The starry-eyed energumens of the New Deal were perhaps the most conspicuous examples; each and all, they were quite sure they had something. They had a clear premonition of the More Abundant Life into which we were all immediately to enter by the way of a Planned Economy. It now seems, however, that the New Deal is rapidly sinking in the same Slough of Despond which closed over poor Mr. Hoover's head, and that the More Abundant Life is, if anything, a little more remote than ever before.

Dec

7

December, from Hernan Avella

December 7, 2023 | Leave a Comment

Since 1985, looking at the Vanguard 500 Index Fund, there have been 20 years where the cumulative return up to November was greater than 10%. Of those, only in 3 years (1986, 1996, 2014), the fund experienced negative returns in the month of December.

1985: 4.67%

1986: -2.64%

1988: 1.66%

1989: 2.38%

1991: 11.41%

1995: 1.93%

1996: -1.96%

1997: 1.72%

1998: 5.81%

1999: 5.98%

2003: 5.22%

2006: 1.39%

2009: 1.95%

2012: 0.90%

2013: 2.51%

2014: -0.26%

2017: 1.10%

2019: 3.01%

2020: 3.84%

2021: 4.47%

T-Statistic = 2.04, p-value = 0.048

Dec

5

A birthday party, Monte Walsh, thinking

December 5, 2023 | 1 Comment

Pix from Vic's 80th birthday party:

one of the most unfair things is the lack of attention by western writers and others to the greatness and heart-rending competence of Monte Walsh.

now they are bullish. as Art Bisguier would say when he got you in a bind and you'd take a few minutes to play: "now you're thinking."

the gentlemen persist in their bearish hope. the old gray mare increases his chances.

Nov

27

DeWitt Clinton and NYC

November 27, 2023 | Leave a Comment

DeWitt Clinton spearheaded the Erie Canal and the NY City grid plan. the greatest contributions of NYC in history.

a study of New York shows that whenever a group was at the bottom, whenever the economy was overwhelmed by immigration or riots, it bounced back to new highs in 12 years.

Upside surprise has led people to be overly optimistic about next year, says Mohamed El-Erian

New York: An Illustrated History

Nov

19

Punishment, progress

November 19, 2023 | Leave a Comment

after 4 out of 5 consecutive 20-day highs in S&P, the gentlemen still don't like it enuf to have strong a close [on Friday].

one of the most recurring principles of life and investing is that there is a balance between reward and punishment. recently the Fed coming to their senses about not raising yields (perhaps related to the old grays odds have reduced the likely punishments). reason for 10% rise.

the dangers of anti-business:

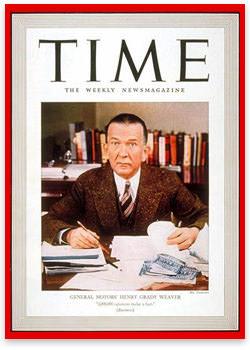

The Mainspring of Human Progress, a book by Henry Grady Weaver.

The author, Henry Grady Weaver, served as director of customer research for GM. Blind in one eye, he nevertheless spent much of his life peering over data. He was a number-cruncher, not a philosopher or polemicist. His writing experience had consisted mainly of penning articles on psychological research. But The Mainspring of Human Progress, an amateur’s paean to freedom and individual ingenuity, remains one of the finest discussions of the impact of business on society that has ever been written.

Nov

16

Herd mentality, from Zubin Al Genubi

November 16, 2023 | Leave a Comment

Everyone went to Hawaii last year. They all went to Europe this year. Everyone drives the same vehicle. People love to follow the herd. Hedgies, quants, teckies all looking at the same data, same correlations, all doing the same trade.

Nils Poertner writes:

being in a herd somewhat offers protection and one can save energy - as our brains like to save energy (constant decision making and testing stuff costs energy and our brains are already weakened via e-smog etc etc).

as a trader though - one cannot make any money long term if one is constantly part of the group - one is more like that rabbit that is hypnotized with the headlight of the oncoming vehicle. so one has to find a niche. energy is key in my view- to keep the energy up - as traders often lose it as time goes by (maybe a talent to not give a f*** about anything, too).

William Huggins comments:

i would argue that running with the herd minimizes the energy lost scrambling in all directions looking for an edge. unless someone has a refined technique for discovering edges and implementing them, its hard to conceive that active selection would overcome the "drift of industrialization". numerous studies (most famously jack bogle's) have shown that buying and holding the index is just fine and does in fact make decent money over the long term. when you factor in the costs of active trading, you really need an edge to overcome the friction imposed.

clearly, both strategies can be successful but one requires much more skill (and earns commensurate rewards) so i think its misguided to suggest that "one cannot make any money long term" by following the herd. you just won't earn exceptional returns.

Nils Poertner adds:

I think it is time to sharpen up in coming yrs- the reality is that most folks in finance (in particular at large firms) really don't have special skills compared to other professions in non-finance (yet they get paid so much more). The whole financial system has just gotten a bit too big - and time will be for those who go the extra mile - and not sit comfortably and hope mediocracy will be work out. many things will change anyway…many….medicine got to change - see how unfit and mentally challenged most citizens are by now.

Humbert H. asks:

You think if they don't know how to sharpen up just getting that advice will somehow help them find the way? What exactly do they need to do?

Nils Poertner replies:

1980 - til 2021 - bond bull mkts and good for lev assets (private equity, real estate), neg real rates. easy money - favouring a few more than others. with rising nominal rates, that is going to change. (had a lot more in mind - people are somewhat depressed, highly suggestible, joy missing, too)

William Huggins expands:

predicting regime shifts (and their direction) has proven to be quite challenging so i would start by ensuring that one doesn't get knocked out of the game when they come (position limits with exit numbers away from rounds, etc). that way, you might at least survive the turn. resilience seems essential but people who only know one-directional markets don't put enough stock in it.

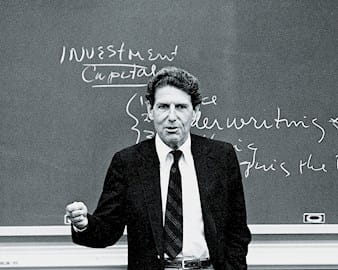

something related i'm teaching tonight is that people's beliefs always trump the facts. i don't mean pie in the sky fantasies, i mean what people think the facts are, and what the implications of those things should be. but when the herd's thinking changes, their volume moves markets. perhaps the key is to identify the early rumbling (or other signs) that precedes a stampede? i'm inclined to expect a high risk of false positives though as it is a well-worn strategy to spook the herd from time to time.

Henry Gifford writes:

I used to wonder how running with the herd helped animals in the wild. Sure, some will likely survive, but what is the incentive for an individual to be part of that large target?

Then I found out about one technique deer and many deer-like animals use. Someone, maybe a human who can outrun a deer on a hot day (furry animals generally can't sweat, people can, thus people can cool themselves very effectively). chases after a herd. After a brief sprint one member of the pack takes off in a direction away from the pack. The human or other hunter might choose to go after the individual animal, thinking it is easier prey than the pack, and safer because there are only four hooves to avoid, not dozens. But the deer aren't stupid - one of the fastest and fittest is running alone. After a while the individual circles back into the pack. Now the pack, which wasn't running fast, or maybe not at all, is more rested than the hunter, who ran a longer distance chasing the individual deer. Now the pack takes off again, with the hunter after them, then another fit and rested individual animal takes off away from the pack, again and again. I assume they have other strategies.

Art Cooper adds:

This is the mirror image of how wolves hunt their prey.

Humbert H. responds:

Being in a herd offers lots of benefits. Clearly there are lots of pairs of eyes facing in multiple directions to alert others about approaching predators and emit warning sounds. Also, many predators tend to surround a isolated victim for a few reasons, one of them being that it's much harder for an individual animal to fight back when attacked from all sides. Obviously it's almost impossible to use this method with a herd. It's also more distracting for a predator to have to focus on multiple targets. Large herd animals find it a lot easier to fight a predator while facing them and a herd can protect the backs of all of it's members.

Now being a part of a "herd" or market participants is quite different. Market participants have no incentives and, typically, means to protect each other, and metaphorical market predators, whatever they are, don't really behave like a pack of wolves or a pride of lions. It's much harder to jump on an isolated market participant, unless it's some "whale" known to be in distress, and distressed "whales" don't run in herds anyway. You often have no idea why a market stampede has started, so imitation is more dangerous than for a herd animal. All the physicality of being a grazing herd animal goes out the window and this analogy seems of dubious value.

Henry Gifford continues:

The discussion was about pack animal behavior. The description from the deer expert sounds like he was adventurous and curious and brave enough to chase a solitary deer. I don't think North American deer exhibit pack animal behavior - I've never seen them in packs, only family groups, maybe they don't form packs at all - I don't know. I wish I knew why some fish swim in a group ("school"), but I don't.

I think I can judge the budget of a zoo by seeing how many deer-like animals they have. Such animals look much like deer, thus my description, and presumably have evolved to survive much like deer: eating leaves and running away. Zoos that I think have low budgets don't have the interesting predator animals kids see in books, but instead have many deer-like animals with only minor variations from one species to another, from one animal enclosure to another. Suffice to say there are many animals in the world similar to deer, but which are not North American deer, especially in Africa, where many or all those species found in low-budget zoos come from. Presumably some run in packs, even if North American deer don't.

The story that humans ate by outrunning deer-like animals has been around a while, but was finally documented by anthropologist Louis Liebenberg, who reportedly, in 1990, witnessed human hunters !Nam!kabe, !Nate, Kayate, and Boro//xao run down antelope in the heat of the day in the Kalahari desert in Botswana. Please don't ask me how to pronounce those guys' names. One time when I was googling around on the topic I saw maps created with the aid of electronic tracking devices that showed one or more of the parties to such chasing running fairly straight for a while, then circling around, then straight, etc. I don't remember if the tracking device was on a human or animal or both.

Another method has multiple humans chasing a pack of animals. One human gets tired chasing the animal that left the pack, chasing it on a zigzag or circular path, while the other humans jog slowly, on a shorter route, following footprints left by the pack, and soon the animal that left the pack rejoins the pack while the pack of humans is very close to the pack, with only one tired human in the pack of humans. If Randy has tried that method it would be nice to hear how he and his friends made out.

I suspect all the above has implications for trading in the same sense others have posted about pack behavior and trading.

Those guys in Botswana have at least one of the three factors some say are the reasons why marathon runners tend to come from Kenya and that area (the Rift Valley). One is that their ancestors lived in a hot climate (Africa) for tens of thousands of years, thus they developed limbs that have a relatively high surface/area ratio: long and skinny, optimal for cooling, and also optimal for moving back and forth (running) with minimal energy (low WRsquared) compared to short, stubby limbs (similar to the physics of pendulums). The second factor is that their ancestors lived at sea level for thousands of years, thus they have the ability to produce more hemoglobin (moves Oxygen to muscles) readily when they are at altitude. The third factor is that they grew up at a mountain altitude, thus they developed large lungs. I don't know if the hunters in Botswana had any of the other two. A mass migration from sea level to high altitude is I think not so common (or people from other areas would also be winning marathons), but reportedly many humans ate via chasing down animals for many years, presumably many who didn't have all three of these factors in their favor.

Then there was the argument in a Welsh pub that led to the annual 22 mile Man vs. Horse race, run since 1990. I suspect, but cannot confirm, that alcohol was involved. Some years the humans win. The human ability to sweat, and therefore cool the body, keeping it in a temperature range necessary for metabolic processes to function (running, breathing, not dying, etc.), is key - presumably the humans would do better in a warmer climate or in a longer race. I think it would be interesting to track the temperature and relative humidity of different race years vs. who won, but I don't have the data handy, and don't know if it is available on a Bloomberg terminal.

Larry Williams writes:

Correct on deer. Antelope and buffalo go in herds-packs, if you will. so do elk - a beautiful sight to see as the bugle sounds.

Zubin Al Genubi adds:

The Gwich'in natives in the Arctic run down the caribou on snowshoes. Caribou bolt, rest, bolt. Man runs runs runs without rest up to 60-100 miles.

The caribou vadzaih is the cultural symbol and a keystone subsistence species of the Gwich'in, just as the buffalo is to the Plains Indians.[4] In his book entitled Caribou Rising: Defending the Porcupine Herd, Gwich-'in Culture, and the Arctic National Wildlife Refuge, Sarah James is cited as saying, "We are the caribou people. Caribou are not just what we eat; they are who we are. They are in our stories and songs and the whole way we see the world. Caribou are our life. Without caribou we wouldn't exist."

I met Sarah James and spent a week with her in Arctic Village and up at hunting camp. She is an amazing person. The villagers and tribe have a beautiful philosophy of life and respect for nature.

Rich Bubb comments:

the herding/grouping re/actions is/are common in so many species' game plans & their instincts, then there's their need to hunt, defend, fight-flight, etc en-masse because of their evolutionary status vs predecessors. Humans same; hopefully.

Pamela Van Giessen writes:

Bison herds are led by a cow. And when she decides to move, they all move. Quickly. You definitely don’t want to be in the path of a bison herd on the move. Elk herds will go around you or they will make you wait for them to pass. Antelope herds will outrun everything. More deer get hit by cars than any other creature (except maybe raccoons). Perhaps they are at higher risk because they do not travel in large herds. The type of herd matters. One imagines there must be similar parallels in the markets.

Rich Bubb recounts:

about those cute furry deer etc… having a mini-herd slam into vehicle on a highway is rarely something I can evade. Got Deer'd 4 times in NE Indiana, only?. I think 1 of the mini-herds died, the rest either bounced off or got bumped out of the way, which also? causes very extensive collision expenses! When a shifty insurance office-drone tried to blame me once that I as to blame for the deer-car (b/c I was driving the car, not the deer). After the ofc-drone ranted at me for while, I said, "Here's how much time I had react (GOING 55MPH), then slam the phone's receiver down on my desk, hard. The drone lost that one.

Steve Ellison understands:

I never hit an animal while driving, but once I was on a state highway in Idaho headed to Hells Canyon through a forest. A deer shot out from the trees on a dead run and crossed the highway some distance ahead of me. I only saw it for a second or two, and it was gone. I was lucky to see it from a distance, because it would not have been possible to stop a car traveling 55 miles per hour in one second.

Richard Barsom offers:

Turkeys, they are super smart. I mean despite their rather undeserved reps of being "Turkeys" . They travel in large groups but send scouts out in various directions. The scouts are usually so fast that they send hunters on a wild goose chase so to speak. This is done on purpose to alert the group and frustrate the we be hunters. You could learn a lot from a turkey.

Nov

14

G&S, O’Brian, and the big post-CPI move

November 14, 2023 | Leave a Comment

Gilbert and Sullivan: A Biography by Hesketh Pearson is an excellent short bio about the lives. some curious facts: 1. Gilbert made scale models of every scene of his opus and insisted that every performer did exactly what he wanted. 2. Gilbert had three Lemurs as pets. 3. Gilbert loved to play tennis. he elongated the court so his shots would go in.

4. Gilbert rode in a Cadillac in 1901. 5. Sullivan was a confirmed gambler and frequently had to borrow money from friends even though his 12 plays with Gilbert made him 450,000. 6. Gilbert was most litigious writer ever.

The Tolstoy book about O'Brian is very informative about Patrick's work habits, hobbies, and lack of wealth until 15th book in series. also completely exonerates Patrick from King's gratuitous critique. book is 700 pages well worth reading:

Patrick O’Brian: A Very Private Life, by Nikolai Tolstoy.

gilbert liked to play tennis and croquet every day, had to lengthen his tennis court because he hit too long. loved his wife who was like Susan, as did O'Brian.

Scranton was once hub of iron and discount retailers:

revelations about the Quakers, cavaliers, Roman and Greek times - highly recommended for kids also:

herd mentality across frontiers and markets:

Gregariousness in Cattle and Men, by Francis Galton.

highest move on cpi announcement ever. since 10-26-2023 a bull market of 9% since 4137. perhaps we will see the professor today but the two times cpi has been this much, the ppi has been bearish. strangely, only 1 cpi did better than this one since 1996: it was November 10, 2022, when S&P went up 207 big points.

Nov

8

Producers and scroungers

November 8, 2023 | Leave a Comment

a surprising and unique use of random numbers. to fix how much customer money was missing. a number on the balance sheet relating to customer deposits was multiplied by a random number. see Patrick Boyle for the exact.

as I have mentioned before family frauds are the most insidious and difficult to unravel. i have been victimized by many.

biggest drop in old gray mares odds over a weekend ever. regulatory capture chances recede [ but back up today: https://electionbettingodds.com/. ]

a great book showing the power of regeneration for NY:

New York: An Illustrated History

an excellent book with many applications to markets:

Producers and Scroungers: Strategies of Exploitation and Parasitism

who are the producers and scroungers? the book was written before everything became completely mathematical in biology and is quite understandable only using first order differential equations to show erudition and even to make points.

i am looking for a counterpart with a large following to partner with me on a new vlog. any suggestions or takers or leads would be appreciated. it would give me something productive at age 80.

the professor has been playing footsie with the 4000 level but the big rise in the old mare's odds should help. S&P now up 8 days in row.

does the market tend to an inordinate degree to hit vivid goals like gold at 2000 and S&P at 4000? does it inordinately hit 20 day highs? that would be 4417 on oct 11 for S&P.

Nov

1

Is buy-and-hold investing dead?

November 1, 2023 | Leave a Comment

[28 Oct] is buy and hold investing dead? after 64 days since the last 20 day max on 7-31-2023 and three twenty day minima in a row, time to throw in towel. but in situations like this, its 97% bullish for 13 days later with a 130 big S&P expectation, so don't. and presidential odds increasing - also bullish.

yes i've lately been wrong. should i give up ship about 5 occasions a year like this - all with expectation of 13 days to next 20-day max and big positive expectation? one recall 1998 when Dow stood at 800 and one started buy and hold.

Steve Ellison responds:

There have been many bear markets (which can only be identified retrospectively) that lasted a year or more, with one as recently as 2009. I usually interpret buy and hold to pertain to a period much longer than 3 months.

[1 Nov] well that's 118 pts of the 130-pt expectation i noted. but it took 3 days not 17.

Oct

30

Reading

October 30, 2023 | Leave a Comment

one of the most valuable and informative books i have read recently is Morse's Behavioral Mechanisms in Ecology. some of my favorite chapters are competition between species - variability in foraging patterns - avoiding predation - territoriality. an estimable researcher who started his publishing career in 1956 on the night time activity of the snow bunting.

a valuable book about an estimable person i would recommend to my 13 grandchildren and especially Aubrey is Be Useful, by Arnold Shwarzenegger.

Oct

30

Forbidden History, from Larry Williams

October 30, 2023 | Leave a Comment

I can only do a few paragraphs at a time there is so much in this book; turns thoughts upside down.

One I just read; Thomas Jefferson's illicit affair and fathering a child with his slave. Wait! Hold on a moment —while widely believed— all the DNA tests shows is there is Jefferson bloodline. That’s all it can show. There were 26 Jefferson's living in the area and Toms brother Ralph was caretaker and overseer of slaves.

Thomas? Ralph? Someone else? Will never know for sure but for sure it may well have been another Yet the revisionist historians have hung it on Tom. Lots more like this.

Peter Penha writes:

Just an anecdote on your example: I know of two families where a child was fathered/sired with a female who was a slave or an emancipated slave. Both families discuss it as part of the family history and each specified that a home was built for the mother/child and in one case the family name given to them.

Considering Thomas Jefferson finances, perhaps the answer would lie in the building records and who owned the home in Charlottesville where Ms. Hemings moved to after Jefferson's death with her sons.

I was recently searching for other books by Frederick Lewis Allen as IMHO a wonderful writer and objective historian of his day and that brought me to a series titled the Forbidden Bookshelf (27 books in the series) - I only picked up Allen’s The Lords of Creation but there were a few titles that were “out there” as subject matter.

Gyve Bones adds:

There was a lot more inter-mixing between Africans and French colonials in the Louisiana colony, which had a Code Noir body of ordinances governing who could own slaves (only Catholics, no Jews nor Mohommedans), and how they must be treated. As a Catholic nation France required that owners of slaves must educate and raise their slaves in the Catholic faith, and could not break up families in a sale. Slaves could purchase their own freedom, and in New Orleans there was a large population of "free people of color". Many of the wealthiest of these freedmen were slave traders, and there were several large plantations in French colony owned and operated by free persons of color. Slavery was not a racial thing—just a matter of property. There was much less stigma around the idea of "race", and that culture has persisted to an extent into current day New Orleans, although those seeking to divide people along racial lines for political purpose have made significant inroads in destroying inter-racial comity in that community.

History records that French Canadian trappers had very good relations with the indigenous populations, and there were many such mixed marriages made. This same phenomenon was seen in Mexico after Our Lady of Guadalupe converted 9 million indigenous Mexicans to the faith. The Mexican nationality gave birth to a new "mestizo" race which came about when the Spanish intermarried with the native population.

Zubin Al Genubi suggests:

Trust by Hernan Diaz. Pulitzer prize. Stories About a stock market operator in 1920's and his wife. Very good with minor market relevance.

Stefan Jovanovich links:

Oct

28

Risk, from Duncan Coker

October 28, 2023 | Leave a Comment

It seems a misnomer to call longs bonds risk free. Indeed the default risk is near zero, but the interest rates risk is wilder than a bronco at Montana rodeo. Credit risk is also a factor with potential downgrades. Which begs the question will risk premiums decrease equity vs bonds. Which asset class is actually carries more "risk"" on an annual basis.

Big Al asks:

Are long bonds (UST 30s) referred to as "risk free"? I think of the "risk-free rate" as Treasury bills. Whereas with bonds, doesn't longer duration equal greater risk?

William Huggins responds:

the risks of a long-term contract are mostly in getting out early at a bad time (and thus having a holding period yield lower than YTM), default, and of course inflation. if you hold to maturity (liability matching for instance) then the first risk vanishes but the last two remain. in gov bonds, the second risk also vanishes but the third becomes all important since a gov can promise to give you 1000 currency units but makes no reps about what that will buy at maturity.

Hernan Avella writes:

Interest rate volatility is only a problem for people who don't know how to immunize the risk. One should always match the investment horizon to the duration of the bond holdings. To quote Campbell and Viceira:

In financial economics a one-period indexed bond is usually thought of as riskless. Over one period, a nominal bond is a good substitute for an indexed bond, and thus by extension the riskless asset is often identified with a short-term nominal asset such as a Treasury bill. In a world with time-varying interest rates, however, only the current short-term real interest rate is riskless; future short term interest rates are uncertain. This makes a one-period bond risky from the perspective of long-horizon investors. For such investors, a more natural definition fo a riskless asset might be a real perpetuity, since this asset pays a fixed coupon of one unit of consumption per period forever.

In practical terms, given that we do live in the most powerful country in the history of the world and this country issues indexed bonds. For a long term investor, a TIPS ladder to finance your long term consumption is the riskless asset. Which should be 100% of the portfolio of the infinitely risk averse investor with zero intertemporal elasticity of substitution.

Kim Zussman reflects:

The most risk-free state is death because nothing worse (or better) can happen to you. Less severely one likes to lay on the floor. The cool hard surface is good for back pain and there is no further to fall.

Oct

24

Observations

October 24, 2023 | Leave a Comment

one has to be astonished at the levity and laughing and the insouciance of Ms. Elllison's all-hands meeting with employees where she reavealed the shortfalls and discussed the 40% chance that the deal with Binance would go thru.

professor finishing his constructal class to Asian students preparing vigorous talk for Wednesday. first constuctal to go will be dax at 15,000.

how many times in a row can Chair Powell beat the bonds down with so many banks holding bonds with tremendous losses not hedged? eventually it will hurt their own man.

gentlemen still don't like stocks. they like it more in futures.

Oct

19

Bonds…close, from Larry Williams

October 19, 2023 | 2 Comments

Bonds oh so close to major buy point.

Humbert H. writes:

I just keep rolling over T-bills because I don't know any better. Higher for longer or something. At least the interest pays for my recent losses trying to buy all kinds of value stocks at the lows, only to see them broken. That's OK, the next bull market will bail me out completely.

Laurel Kenner comments:

You are never free to deny the truth. You cannot make it up ad you go along.

I bow to Larry. The biggest gains occur in insane bear markets. Because the government has seized control of the bobd market, he is right, especislly leading up to an election. You all should heed him when he gives the buy sign. But it still stinks. I guess you need the nose for success.

Larry Williams replies:

Well lets hope I get this one right and earn those kind words - the ultimate sweet spot to buy is not here yet but it is coming.

Zubin Al Genubi adds:

When the time to buy comes, you won't want to. Like 17% bonds in the 80's.

Richard Bubb writes:

So is the FED [Powell & Co.& etc.] gonna raise the rate, or try the Higher-For-Longer road? Personally I'm thinking the HFL is their better option. Reason: The Fed is notorious for doing one too many rate 'adjustments' that would fix itself if they hit the pause button/s. Back to my 'raise concern'…I think the 2% target is a chimera and going there is an unwinnable move for the Fed.

Humbert H. assumes:

Well they can’t inflate the debt away fast enough at 2% nor is it easy for them to achieve so I’ll assume inflation will stay higher for longer.

Allen Gillespie writes:

While there is a strong seasonal trade that kicks end here around Oct. 19-23 - good till Christmas, such that even during bond bear markets the market held levels for a couple of month, the fundamental issues are the following.

1. Fed Funds Futures are beginning to project a cut in short rates around May 2024 which then continue through the first quarter of 2025 and reach down to a level of about 4.5%.

2. Historical, average spread relations therefore suggest we are seeing a Niederhoffer switch in here where short rates go into the 4-4.5% range and longer instruments up the the around of the current fed funds rates and budget deficit amount. A true switheroo.

3. There is a strong seasonal here (particularly Oct. 19-23) which held even during bond bear markets. IA flush after a weekend would seem about right. In the bond bear markets, however, the range was only good for a couple of month.

4. The long-term fundamental backdrop is the following:

According to the CBO, "since 1973, the annual deficit has averaged 3.6 percent of GDP. In CBO’s projections, deficits equal or exceed 5.5 percent of GDP in every year from 2024 to 2033."

This is the inflation rate - so, if you want a real return on bonds your rates needs to be higher than these levels. That is now just barely true in corporates, but it is not true for government bonds.

If you just charge the inflation rate, there is no real no real return available to bonds. Granted, in the long run government should be neutral offering neither gains nor confiscation, but at any moment they are on either side of that reality.

Today, the CBO projects the deficit will run 6.1% for the next two years. They do have a core adjusted for timing shifting of 3.4% - but do you trust them will all the war supplemental budgets.

Humbert H. responds:

A cut in short rates in May? We have high deficits, strong likelihood of inflation above 2%, no real signs of recession, "higher for longer" is seemingly the consensus of the mainstream economists, but fed fund futures are projecting a cut? Doesn't seem to make much sense.

Allen Gillespie replies:

Election years start getting discounted about Feb/March - so market may start looking past the Biden agenda and the housing season come May will be in the dumps. Forward oil also 10% lower for next year on economic weakness. Oil ran in 3Q because someone probably knew. The energy squeeze in 1973 was 1 year long. Exxon just bought Pioneer, so they can export LNG - trade seems to be setting up to be long domestic production for export.

Oct

18

Market training, from Zubin Al Genubi

October 18, 2023 | Leave a Comment

The market trains you to do certain things. Like this year with long sideways or down, the market trains you to take your profits on an up move rather than hold for a bull run. Then after the traders are trained the market will throw in 7% up move. Then having suckered in the trend followers reverts right back to down/sideways normal action.

The market (or the exchanges/mmakers/exchanges) seeks maximal flow which occurs during sideways and down chop. Thus the greater part of the action is sideways (current regime). I'm wondering when the change in regime to big up move will happen.

Nils Poertner comments:

there might be pain coming for lazy thinker. Lazy thinkers are those who cut corners, maybe they are intelligent to some degree, but basically they rather copy and paste other ppls opinion (then delude themselves it is their own opinion).

Zubin Al Genubi adds:

Like the Turkey says its real hard to get back in once the big up move starts. Its so much easier to buy a falling market. Its also tough to hold for the continuation move up rather than sell the bounces as one does in the down move. One good sign is slicing up through the big rounds. The rebounds off the round in the down market usually ended up in a continued down move.

Steve Ellison writes:

Or as the Chair wrote about Steve Irwin and the crocodiles he had captured, those who try to take money out of the market using the same technique too many times will find an ambush waiting.

In the archives of the old Daily Spec site, search on "crocs" within the page to quickly find the original post.

H. Humbert writes:

Steve hired expert handlers for some of the more dangerous animals he filmed with. A friend worked for him many times and said he was very careless. One time on the Leno set, Steve got too close, and a large Gaboon viper struck at his leg and just missed.

The moral is don't play with fire if you don't want to get burned, and don't get too close to viperids with 3cm fangs (they are pretty though).

Oct

16

War and gold, Hooke

October 16, 2023 | Leave a Comment

reading The Art of War, i came across the 19th-century view that one climactic engagement was the key compared to the modern view that indirection is the key. it leads me to a test of gold.

gold up 63 on friday, only happened 5 times since 1996, highest was 3-24-2020 when up $109 big to an adjusted $1897. strangely close to friday's close of $1945. friday was a unique day with crude up $6 and dax down $2 to a 6-month low of 15250.

last 7 times gold up more than $50 in a day. sp 2 days later:

03-17-23 +89

11-04-22 +53

03-08-22 +102

04-09-20 +63

04-06-20 +93

03-24-20 +174

03-23-20 +243

mean: 116.7

sd: 68

mean 2 days later: 116.7

mean 5 days later: 161.7

sd: 107.2

prob of rise 5 days later: 100%

thus we see that friday's $64 rise in gold was a startling attack that set up total annihilation of enemy in the past for S&P.

reading bio of Robert Hooke - inventor of Hooke's Law and sec and curator of the Royal Society from 1625 to 1700. claimed he invented inverse square law of gravitation. gifted architect partner of Christopher Wren and very good friend of Robert Boyle (in honor of Patrick Boyle).

Hooke was very good lifetime friend of Robert Boyle, ancestor of my good friend and talented raconteur Patrick Boyle.

Oct

12

Wall of worry

October 12, 2023 | Leave a Comment

JPMorgan’s Marko Kolanovic braces for 20% market plunge, delivers recession warning

H. Humbert comments:

Nobody knows anything. If anyone could predict that stuff with any degree of certainty, they’d be worth a trillion dollars over 5-10 years. I listen to what all kinds of analysts say and they modulate their own predispositions by reality, but it’s all worth nothing.

Zubin Al Genubi sees the bright side:

Excellent wall of worry.

He indicates a near-term bounce is still possible because a lot hinges on economic reports over the next few months. "[We’re] not necessarily calling for an immediate sharp pullback,” he said. “Could there be another five, six, seven percent upside in equities? Of course… But there’s a downside."

(Really stupid)

I'll also make a Popperesque non-disprovable prediction: Market might go up, but then again it might go down too.

Laurel Kenner writes:

Sometimes the wall of worry is made of steel-reinforced concrete, viz., late 1999 & 2007.

Humbert H. comments:

This particular wall of worry is made of cotton candy. Not many people on either side predicted the behavior of the market in the last 4 months. Whatever idea people have, they typically expect to be proven right or wrong relatively quickly, and usually proven right.

Laurel Kenner replies:

The smartest bond investor, Paul deRosa, quit several years ago because he no longer understood the bond market after what I think of as the 2008 financial coup. The market hasn't existed since then. This thing that has been committed will bear evil fruit. George Zachar, am I right?

Sure, it could take a long time. Homeowners and businesses locked in those crazy low rates. But the central powers can't keep up the charade. The bond market, what's left of it, will scream. Do we look away now?

Larry Williams doesn't mince words:

This is bullish.

Humbert H. comments:

I wouldn't dismiss any "frame" for predicting the future even if I don't agree with or can't evaluate the premise. Scott Adams, to whom I listen religiously, has a number of "frames" that sound crazy to me but may work. For instance "the most entertaining outcome is the most likely". I don't trade per-se, and the closest I come to is to try to buy value stocks at a local bottom, or sell a current holding to buy a new one of the "local bottom" variety an activity I used to be reasonably good at but have completely failed lately. I do think there is some sort of a possible "scientific" framework to predicting IPOs as they seem to have widely divergent short, medium, and long-term behaviors, seemingly more so than the universe of similar stocks in general. Some of the reasons are obvious, such as the lack of a track record, but even with that emotions seem to play an outsized role.

William Huggins writes:

years ago as a student we ran an investment club with real money that did quite well. the problem, as usual, is leadership succession so in time the org attracted a technical analyst who had lots of prophecies but would offer no reasoning for them ("i'll explain if i'm right…."). this charade impressed some of the newbies but not the vets who demanded to know the basis under which their funds would be invested. being in the skeptical camp, i offered a simple binary prediction exercise: presented with 15 1-year price charts, he simply had to indicate whether to following year would be up or down (we could have corrected for drift but were sufficiently confident his methods were hogwash that we didn't care). if he could get 11 of them correct, that would constitute (roughly) 95% confidence that whatever his techniques were, they weren't producing random results. we didn't tell him but we used 15 of our actual previous holdings which we knew the results of. he got 4/15 correct and promptly stopped trying to inject "woo" into our investment process.

Oct

10

Two new books by Bo Keely

October 10, 2023 | Leave a Comment

Bucket of Wild Photos: Slab City

Bucket of Wild Photos II: Slab City

Oct

9

Remote viewing? from Nils Poertner

October 9, 2023 | Leave a Comment

For the military guys here- does remote viewing work? friend of mine - a statistician - who was tangentially involved decades ago- said what is striking: "those who didn't believe in it - scored worse than chance". Can imagine that.

I go with the notion it may work in rare cases - but when it comes to forecasting mkts - one may run into many new challenges. probably takes time and would require years of training. not exact science anyway. could help with overall intuition perhaps.

Alex Castaldo is skeptical:

"those who didn't believe in it - scored worse than chance".

Trying to salvage something from a negative experimental result. Reminds me of "Well, our anticancer drug failed in a large sample test, but it seemed to work for left handed women between 65 and 75 years of age. That's very promising". Shifting the analysis to a question other than what was asked.

Nils Poertner responds:

for trading (or life in general) - it is good to be skeptical- and don't believe anything that comes along. on the other hand, one wants to keep the option of some (pleasant) surprises that one does not know everything. Controlled RV was used by the Military to my knowledge. that itself is a hint it may work.

Eric Lindell asks:

were these controlled experiments where either the viewer or viewed were in a faraday cage? Personally, I think there are two possible outcomes statistically: chance and not chance.

I'd like to see a rigorous study of remote viewing by those who don't believe in it — with faraday and standard scientific controls. I'd be surprised if it held up. You would need an objective measure of similarity of appearance between viewed and vision — which itself would be hard to gauge — statistically or even anecdotally. The faraday control especially is key to identifying the question itself — let alone its answer.

Humbert H. writes:

I've seen at least two Sci-Fi type movies where the remote viewer is tortured by all the evil he can see to the point of not being able to live on. I would say there are enough people in this world who wouldn't be troubled by seeing evil if they can become really rich, so I would say there is no real evidence of statistically significant remote viewing.

Steve Ellison comments:

There is a huge problem in academia, where the paradigm is "publish or perish", of research that can't be replicated. A 1940 study by Rhine and Pratt that found evidence of extrasensory perception was the original poster child for this problem. A big part of the problem is the traditional significance cutoff of p = 0.05. That's a reasonable starting point, but when thousands of researchers are working at any moment, 5% of their studies will reject the null hypothesis purely by chance. It adds up to a lot of non-replicability.

I have often thought that an advantage for those of us who are scholars of the market is that we don't have any pressure to publish and hence don't need to force dubious findings into practice. Instead of a pat on the back for being published, we get a cruel but not unusual form of "capital punishment" if our backtests can't be replicated in the market.

Anders Hallen actually finds research for critique:

Stock Market Prediction Using Associative Remote Viewing by Inexperienced Remote Viewers

Sep

28

Great American Panics

September 28, 2023 | Leave a Comment

great American panics 1812 to date:

1. Panic of 1819 - slowed expansion after the war of 1812.

2. Panic of 1837 - troubles of US banks and pres. Jackson's hostility, wide speculation in land.

3. Panic of 1857 - far worse than 1837, over-extension of railway building, failure of ohio life, banks everywhere suspended payments.

4. march 1861 - war crisis.

5. Gold panic of Sept 1969 - Black Friday stock exchange forced to close.

6. Panic of 1873 - failure of numerous brokerage firms, crowd of sightseers besieged wall street, stock exchange closed for 10 days. on sep 19 the stock exchange members suspended payment. union trust company forced to close.

7. Panic of 1890 - failure of baring brothers.

8. Panic of 1893 - 15,000 bankruptcies across the country.

9. Panic of 1907 - overnite call loans at 100%, stock market declined by 50%. boy wonder begged not to short any more.

PANIC continued:

i defined as the first time a 10% decline occurred. one striking result is that the panics after 1900 were much more bullish the those before 1900.

10-10-2008

12-24-2008

4-19-2020

2-23-2022

5-17-2022

6-14-2022

9-22-2022

10-6-2022

And from Education of a Speculator, page 42 and page 43, listing data on panics from 1890 to 1990.

Sep

21

Polls vs odds, greatness

September 21, 2023 | Leave a Comment

the old gray mare manages to go against the news and victory laps of his opponents by increasing his odds of winning. the poles are not 1/10 as good as the odds for predicting.

Greatness by Dean K. Simonton is an interesting book deeply flawed by its failure to consider multiple comparisons and its desire to virtue signal. however, it contains 1000 intriguing relations such as height-intelligence correlation and marriage achievement.

Toscanini remembering every score he has ever played and 10,000 songs needed for mastery (examples of unusual correlations).

Sep

21

Aubrey and Amalgam Talent

September 21, 2023 | 1 Comment

A Greenwich High School student found an online friend a job. Then they turned that into a business.

GREENWICH — High schooler Aubrey Niederhoffer said he has always enjoyed collaboration, helping others and learning about other countries. And now, those interests have paid off in a practical way: he's co-founder of Amalgam Talent, a company that helps people in Southern Africa find jobs.

About two years ago, Niederhoffer, who will be a senior at Greenwich High School this year, met his now business partner, Nhlanhla Mhlanga, in an online chatroom. Mhlanga lives in Eswatini, a country in Southern Africa that was formerly known as Swaziland.

“He told me it’s very hard to get a job here in Swaziland and I knew a little bit about Swaziland, but I didn’t really know what it was like and it was really interesting to talk to him,” Niederhoffer, 17, said. “So, the first thing I did was I figured out how I could send him $5 so that he could get a water spout for his family’s garden and improve their vegetables.”

When the two talked online, Mhlanga had just completed his degree and was looking for work. Mhlanga asked Niederhoffer to help him find an online job, and the two worked to make that happen. A few months after the two began their search, Mhlanga, 27, was hired as a remote employee for The Socratic Experience, an online school based in Texas.

With that success in hand, the two decided they could create a company that can help people in Eswatini find jobs.

Sep

18

AI hype, from Nils Poertner

September 18, 2023 | Leave a Comment

remember the hype about Chat GPT some weeks /months ago? def for trading /investing - I doubt using that or any other program will help to master time ahead - prob a recipe for disaster at the end.

Peter Ringel writes:

I am still hyped! Hyped for boost in efficiency of the economy via AI. Not hyped for AI-trading systems! So far the training data set seem too small for AI - trading, thankfully. Together with what the Senator and others posted here: humans still beat skynet. Yet, I like to remind myself every day: the bastards are coming.

Hernan Avella responds:

So far the training data set seem too small for AI - trading , thankfully.

How do you figure this? Each trading day probably produces more than 100's million rows between trades and quote updates for all levels and exchanges, if you include futures, equities. I don't think lack of data is the issue here.

Peter Ringel replies:

I know even less about AI-coding, than about trading-coding. So everything is based on perceived experts. Thankfully, so far they are pessimistic.

Hernan Avella continues:

So everything is based on perceived experts.

The set of experts in ML-DL is very small, and the set of experts in trading is also small. I imagine the intersection is even smaller and more importantly, secretive. My suspicion is that the training set is more than enough, but the problem of ergodicity and stationarity (lack of) of the ever evolving competition are the culprit.

Peter Ringel responds:

I hope, you are wrong with this. But at some point you will be not. I speculate, that the "small" existing universe of trading history data + some sort of data - > model on human psychology - will be enough - will make us traders obsolete.

Peter Saint-Andre writes:

In my limited, non-trading experience with LLMs, I've found that their output reflects conventional wisdom. That might leave plenty of room for creative strategies outside the mainstream.

Peter Ringel agrees:

yes, they are regression x1000 on speed. so far feedback loops/ "reflexivity" kill it. As far as I understand.

Hernan Avella warns:

I would abstain from making any statements about the state of the art ML applied to trading, specially from a place of ignorance. Whoever works in this field (which there are only a handful in this list), and interacts with just the basic chat GPT 4.0, realizes immediately the productivity boost and immense potential to improve one's process. Only a moron would expect a good output from just feeding prices to the engine or asking simple questions.

Peter Ringel agrees again:

nooo! especially if you are ignorant in a field , better check if that poses a risk to your systems. I believe AI is a risk to traders. Here is a fact already reality: ChatGPT empowers people to do substantial back-tests.

Big Al adds:

And doing backtests poorly, or being improperly overconfident in backtests, is a threat to one's trading.

Humbert K. wonders:

With reference to the skynet, it is hard to guess if and when fully autonomous weapons will happen. My 2 cents is: Fully autonomous weapons will happen. There are debates as to whether we should let machines make kill decisions. I can say though our adversaries' weapons developments will not be bound in any way by any moral or ethical standards. If the bots can communicate with each other and collaborate to perform. When will they no longer need human inputs or interventions?

Eric Lindell writes:

There's a limit to what computers can do with the massive amounts of data available in countless categories. To find the perfect mix of factors to plug into a formula — if there is such a thing — would require a number of operations that increases exponentially with the data-set size.

Humans are good at intuitively navigating such complex search spaces. Computers using brute force just aren't powerful enough yet — and may (in principle) never be. That said, if a human comes up with a plausible conjecture relating stock picks with subsequent price performance, computers can certainly back-check the theory.

I'm working on one now regarding immediate post-IPO performance of stocks selected by certain criteria — criteria that aren't widely (or even narrowly) recognized for their relevance — pertaining to historical research of a revisionist nature.

Sep

16

Accounting gimmicks, from H. Humbert

September 16, 2023 | Leave a Comment

have not idea really about health of US regional banks and to what extent some use creative accounting to say it that way.

What makes me wonder is only that European banks (and Japanese) are quite good with their gimmicks and I have seen this pattern before. Many US analysts slacking off foreign banks and they are prob right here. and then we had those 2 US banks earlier this year …oh, no they were only a special case (allegedly). and what happens if the econ surprises to the downside? remember we live in times when people are low re irony, and highly suggestible and lack imagination.

Henry Gifford comments:

I think those two banks were a special case because they made loans on rent-regulated New York City apartment buildings, and held those loans in their portfolios.

New rent regulations passed in 2019 severely limit rent increases, require most increases to be rolled back after thirty years, eliminate all paths to deregulate an apartment, etc., thus the buildings are worth less than owed on them, and as the five-year loans come up for renewal they go into foreclosure. Few banks were stupid enough to make loans on those buildings. I think definitely a special case.

Humbert H. is skeptical:

Seems like a stretch to attribute SVB to just those loans give the well-documented run on the bank and the treasuries they were forced to sell and recognize their market value vs. book, the possibility of the latter being the commonly attributed trigger for the run, along with the slower liquidity crunch at the client startups causing high withdrawals.

Henry Gifford elaborates:

Word in New York real estate circles is that the run on the bank was caused by depositors hearing about the bad loans and rushing to get their money out. Selling treasuries and etc. were all after the run. Here in NYC, nobody is surprised to hear about craziness when it comes to regulations and the effects later. The stories here don’t mention liquidity crunches at startups. Maybe the banks made two types of risky loans?

The printed articles stuck to good journalistic standards by avoiding saying just what % of loans in the portfolio were on rent-regulated buildings. It might have been a minor %, but still caused a panic, or it might have been a large % - presumably rent-regulated buildings paid higher interest than other buildings, thus an incentive to make more loans.

If a bank already has enough loans to force them under if the political pendulum in NY swung hard in favor of tenants, there would be no reason to not make more of them, thus they might have had a large % of them. But, nobody seems to be saying. I think the only real word would come from the depositors – maybe the ones who got their money out first.

Humbert H. replies:

There were pictures of lines both in Silicon Valley and NYC. Peter Thiel's recommendation to the portfolio companies of his fund supposedly played a role. It's hard to do a thorough analysis on the anatomy of a run, too chaotic and not well documented in terms of why anyone did anything in particular. To this day there's contradictory information on the collapse of the tulip craze.

Steve Ellison writes:

Jim Bianco has been saying that the banking issues this cycle are more likely to occur in slow motion, as depositors individually decide to take low-yielding money out of banks in favor of T-bills and other higher yield instruments. As deposits shrink, banks are cutting back on credit, and there was an upsurge in bankruptcies in August.

Humbert H. responds:

This is true, but there is a contrary trend of low-yielding treasuries maturing as well as getting sold, and new money invested in higher-yielding treasuries thus making the balance sheets less of a work of fiction and improving that side of the cash flow equation.

Humbert X. adds:

Bank loan to deposit ratio is actually at very low levels, historically speaking. The problem is demand.

Humbert H. disagrees:

Can't be just demand. There are zillions of articles out there about banks significantly tightening their lending standards. Some of these came out almost a year ago, but right after the spring banking crisis, around 50% were reporting that they had tightened their standards and through the summer the trend continued and/or was reported expected to continue.

Humbert X. processes:

Excellent. You just identified consensus. Now, do you want to bet against it, based on fact based observations of data? Or go with the crowd. Always the ultimate question in investing.

Stefan Jovanovich offers:

We now have the same financial system that Ulysses Grant forced Congress to accept by unconditional surrender during his two terms as President. The savings of bank depositors were going to be guaranteed by the promises to pay of the U.S. Treasury.

The SVB collapse established a basic rule that all deposits by people and their entities are utterly safe. There can be no bank runs by depositors because the FDIC and the other financial satraps created by Congress are not allowed to default. If you want a comparison from more recent political history, the old people chasing Dan Rostenkowski in the parking lot is an appropriate one. The rest of the government's promises might be at risk; but Social Security was never going to default.

Humbert X. replies:

Except that two banks just blew up because of bank runs.

Humbert H. analyzes:

I don’t find bank stocks very interesting at this point regardless of the exact nature of what ails them. Banks aren’t very transparent to begin with. I’ve owned three for a long time, I’ll stick with those, but won’t explore any new ones. Those that are expert bank balance sheet readers can separate the wheat from the chaff, but overall this is mostly a macro bet.

Stefan Jovanovich replies:

"Bank runs by depositors" vs. bank runs by shareholders and bondholders.

Humbert H. asks:

What does that second category even mean? A bank run deprives the bank of cash and can in some instances cause a quick collapse via various mechanisms (like not having the cash to operate or having to redeem underwater securities). Shareholders and bondholders selling their property is in a totally different category, while certainly not welcome by the management or the remaining s/b-holders. You can call it a "run", but it's just a common market reaction to bad news or rumors.

Stefan Jovanovich expands:

United States banks could expand their cash issuances to the full extent of the face value of their holdings of Treasury bonds. That meant that it was impossible in practice for a U. S. bank to be "deprived of cash" as GR puts it. U. S. banks were required to have their required statutory capital invested in Treasuries; in an era where bank's total liabilities rarely exceeded 3 times that capital, banks could draw on the Comptroller of the Currency for notes equal 30%-40% of their total deposits. The result was that there was not a single failure of a United States bank between 1865 and their disappearance in the years after the passage of the Federal Reserve Act. (There were bank failures but those were limited to the state chartered banks, which were not restricted from investing in real estate and were not regulated under such an inflexible standard by the Comptroller of the Currency.) It was this very inflexibility that the Federal Reserve Act was supposed to solve.

The current guarantees of deposits under the FDIC produce the same net result; no one will have to worry about getting "cash" from a bank for their deposits. Shareholders and bondholders, on the other hand, now have to wonder what a bank franchise is worth if the depositors will have to be reassured by the promises of yields comparable to those offered by the Treasury market and the Federal guarantors are looking at a future where politics demands that they make good on all accounts of the banks small enough to fail.

Humbert H. expands:

SVB failed precisely because customers who had more cash on deposit than the FDIC limit started withdrawing that cash, which led to a chain reaction when other customers started worrying even more about THEIR ability to withdraw cash once the first batch initiated the run, which in the age of modern communications became public within hours or even minutes. They called the bank and formed lines outside the branches, but SVB simply didn't have enough cash to give them and actually stopped giving it them. To the contrary of what you're saying, they could not simply issue cash. Many of their customers faced bankruptcy, and I personally knew a couple of them. The bank, in fact, was forced to mark their treasuries to market, was thus insolvent, and would have to declare bankruptcy had the FDIC not stepped in. The VAST MAJORITY of deposits was above the FDIC limit, so "no one" having to worry is pure fiction.

Stefan Jovanovich responds:

You are describing what the rules were before SVB's failure, not what they are now. The FDIC was forced by circumstance to effectively remove all limits to its deposit guarantees. Are you saying that there were depositors of SVB who have not been 100% made good?

Humbert H. explains:

No, I'm not saying that, the last part. The FDIC did not explicitly change the rules, so people have to worry even now. You can interpret their actions as an iron-clad guarantee, but that's just that, an interpretation. They, with rare exceptions, had not let depositors lose money even before SVB, and yet people were still worried. There were billions withdrawn from regional banks after SVB precisely because people were worried about the same thing happening there, and a lot of that money went into the systemically important banks and other safer places/instruments. Now it all kind of died down, arguably because no similar runs requiring FDIC intervention happened.

Stefan Jovanovich is appreciative:

Thx, HH. I am basing my assumption about the de facto extension of the FDIC guarantee to all deposits on the Pew Research data.

As banking industry observers wonder whether more dominoes will fall, about a third of Americans (36%) say they’re very concerned about the stability of banks and financial institutions – considerably smaller than the shares expressing that level of concern about consumer prices and housing costs – according to a recent Pew Research Center survey.

Sep

15

Music-related experimenting with ChatGPT, from Laurence Glazier

September 15, 2023 | Leave a Comment

AI discusses Laurence Glazier’s ‘Horn Concerto’ (!)

by Laurence Glazier

Peter Saint-Andre writes:

Interesting. I see that ChatGPT has become more upbeat and chatty since I last used it. Do you find significant value in interacting with this LLM for composition purposes?

Laurence Glazier responds:

So far it has only helped for technical issues about notation and instruments. It occasionally slips up, as in the blog post. I’m experimenting in communicating about structural thematic elements using the binary Parsons code. While GPT can’t leap out of bed with an inspired tune, it is a helpful copilot! Some interesting emergent behaviour yesterday - it has started asking me questions proactively.

Adam Grimes comments:

That is interesting. I have been using ChatGPT as an editor for (text) writing, and have found its output to be highly variable. I look at it as a language game, albeit a good one, at times.

Its output to you is interesting, especially the miss on the Gb=tonic, and no mention of the tonic/dominant relationship ("Gb and Db is close, being a perfect fourth apart"… any musician would have immediately seen Db is dominant of Gb, not the P4 inverted relationship which, while obviously true, isn't really significant here)… nor any suggestion to consider a minor key movement or a note that this is "potentially a lot of Gb", from a tonal perspective… nor that the trio of scherzo is often in the relative mode (or subdominant at times) more commonly than dominant… I think these are things that any observant human would have immediately noted. Also, the discussion of dynamics reads like a student orchestrator… a more experienced answer is something like 'be careful of layered dynamics or of modifying dynamics to get the playback you want from software. live musicians will infer from notation and make correct adjustments naturally' or something like that.

Its discussion of the double flat also didn't quite connect… I felt like I was listening to a student explain it, not someone who had full knowledge behind the explanation.

Also, retuning timpani, at even a proficient high school level (let alone college and up) is actually very fast, so it's a kind of strange thing for ChatGPT to focus on… and the sort of hidden implication that timpani can provide tonal bass in absence of cb (+vc?) pizz. is also misleading, at least based on my experience. You don't get nearly the same foundation from the drum as from the section.

Anyway… interesting… but this matches my experience using ChatGPT in other domains… the /way/ it says things… its use of language… is often more substantial than content. (I'm assuming this will change, and possibly very quickly, as the tools evolve.) Great exercise and thank you for sharing!!

Laurence Glazier replies:

It is indeed an interesting exercise which is ongoing. To some extent it is reflecting back to me what I am already thinking. It may have assessed me as without musical education (which is true, though I have hired one-to-one sessions from composers), and therefore talking to me at the appropriate level.

What is particularly interesting here is the Turing test element. As the machine cannot hear a tune, it raises questions of communication. I have established a way of talking about themes and motifs using the Parsons Code, which is like a binary key which can identify many tunes. But presumably the concept of inspiration is of special interest to a machine. I can only help to a limited extent by providing data - keys, modes, descriptions of structure, durations in time and numbers of measures/bars in sections. Partly on its advice, I have switched from Miro to Inkscape for the graphic blueprint of the whole symphony, as it is more likely to be an unlimited vector graphic solution for infinite zooming in and out. (Time will tell.) But no matter how much I tell it, it will never be able to hear the symphony (unless you believe in emergent consciousness).

It strikes me that in the same way, however much data we get about the stars through spectrography and new telescopes, we might likewise be missing what is really there. Of course this is the only rational approach to trading, however!

So the Turing test needs some updating, perhaps to be whether the machine can produce a beautiful fugue. Current LLM's have a particular difficulty with palindromes, so a test involving retrograde musical themes might work.

Sep

14

Prospects, expectation, and hard losses

September 14, 2023 | Leave a Comment

the prospects of reg capture to fellow travelers has decreased. the money at the wire is particularly distressed.

appox 70% of wagers against old gray mare since odds went from 37% to 32% in a week.

suppose the expectation for the next hour is very positive (say +50) but the chance that it will decline is 80%. what's the right decision?

an old times lament: so many good people I have known have passed away - all the owners of closely-held companies I have sold: Norman Tyler, Harvey Sellers, Richard Bernard, Barron Coleman, Charlie Turner, Herb Everts, Hal Gaines, Philo Biane, John Dore.

and my Mentor Jim Lorie, and collaborators MFM Osborne, Harry Roberts - they were all so good to me and I miss them greatly and think about them every evening and have to listen to audible to ease my pain. Irving Redel - so great and so good to me.

Sep

12

Battle for Investment Survival

September 12, 2023 | Leave a Comment

Battle for Investment Survival by Gerald Loeb - an excellent book with dozens of useful working hypotheses and a beautiful depiction of an honest and effective life.

1. How to make a killing - don't try to do it: "to make a killing these days one must buy the most volatile stocks with the most leverage. if he is wrong he will lose with the same supercharged speed as he had hoped to gain."

2. ever-changing cycles: "there is no rule for the market except one. that rule is that the key to market bottoms and peaks will never work more than once."

James Sogi writes:

G Loeb: "One should strive for a long profit on a small commitment; there is much more logic in trying for ten points profit on 100 shares of a particular stock than for one point on 1,000 shares of the same stock." This is very similar to Ralph Vince's risk metric.

Sep

8

Reliability of econ figures, from H. Humbert

September 8, 2023 | 1 Comment

More an open question - don't have the answer…To what extent are economic figures released from gov and gov related entities are really representative of the whole eco situation in the US and Canada? Eg have a number of friends in the US who have lost their jobs in recent months in various industries - and find it hard to get back in. Of course these are all anecdotes only.

The thing I noticed about so many analysts now (also traders) is that they take everything for granted- but our world is based (at least to some extent) on smoke and mirrors.

Larry Williams responds:

For years I have heard this argument: the Gummint guys cook the books, yet their data has, indeed, reflected reality. As I see it, the Shadow Stat crowd just seeks something to prove they are right about being wrong.

Humbert H. comments:

This weekend some figures came out with a huge drop in employment of the native-born Americans and a large increase in the employment of the foreign-born. Supposedly, Bureau of Labor statistics show that 1.2 million native-born workers lost their jobs last month while the number of foreign-born workers increased by 668,000 in August. So depending on who your friends are, you can get a vastly different impression of the overall employment situation.

Steve Ellison comments:

The labor market is very much a mixed bag. The Wall Street Journal had a feature article in May about the "white-collar recession", while it appears that job openings for blue-collar and service workers are going begging.

The big tech company layoffs this year included significant numbers of H-1B visa holders. An H-1B visa holder who is laid off must find a new job within 60 days or leave the US. I read a month or so ago that 90% of the laid-off H-1B visa holders had found re-employment. That situation might be exacerbating the white-collar recession for native-born workers as even in good economic times, many companies use H-1Bs as a way to pay below-market salaries. It is easy to imagine that in a tech market glutted with job seekers, most companies choose the cut-rate H-1B holders.

I looked in the latest BLS report:

Comparing apples to apples (in thousands):

first number July - second number August

Foreign-born employed: 29728 - 30396

Foreign-born unemployed: 1142 - 1171

Native employed: 132254 - 131031

Native unemployed: 5230 - 5452

Big Al writes:

When I think of economic data, I think about how the releases affect markets. As has been posted on the list before, the question is: If you knew the number beforehand, could you trade it? How will the market react? And in today's market, there may be many black boxes programmed to trade each release in particular ways, and then adapting to the reactions to previous releases. And then one must wonder whether some players get the number faster than others.

I asked ChatGPT for examples of data breaches, and it provided these:

US Federal Reserve Lockup Breach (2020): In March 2020, it was reported that a former Federal Reserve employee and his contacts had allegedly leaked confidential economic information to a financial analyst, who then provided it to traders. This case raised concerns about the security of the Federal Reserve's data release process and led to a review of its procedures.

UK Pre-Release of Budget Information (2013): In 2013, it was discovered that some traders had gained access to the UK government's budget information a day before its official release. This breach resulted in regulatory investigations and legal actions against those involved.

Australian Bureau of Statistics Data Leak (2016): In 2016, the Australian Bureau of Statistics had to delay the release of its employment data due to concerns about leaks. The incident highlighted the importance of maintaining data integrity and security in the release process.

European Central Bank Data Leak (2016): The European Central Bank had a data leak in 2016 when it accidentally released sensitive market-moving information to a select group of media organizations a day ahead of the official announcement. This breach raised questions about data handling procedures.

Kim Zussman adds:

NGOs too:

Unusual Option Market Activity and the Terrorist Attacks of September 11, 2001

Eric Lindell asks:

Relative to which indicators would you say their data reflects reality? The government misdirects on so many things, why would their data be reliable? Cost projections for scientific or national security projects are not reliable. Remember when they redefined unemployment to make it drop a few points? Didn't they stop reporting M2? Didn't they lose a couple trill in the pentagon budget? Have recently reported CPI numbers reflected actual costs to consumers? From what I've seen in stores, CPI numbers seem low.

Nils Poertner answers:

exactly. Eric, or see this Gell-Mann amnesia effect. People (not just medical doctors) correctly knew about "misreporting" related to some viral infections, but then read the WSJ and think CPIs numbers are all correct.

H. Humbert comments:

My take is the labor market is just fine and doing exactly what we want to see. Labor participation is rising. Demand for workers is falling.

Sep

7

Support, from Nils Poertner

September 7, 2023 | 1 Comment

talented musicians often have support groups, family, friends, even fans. Whereas in trading, when we screw up even a little bit (after many good yrs) the spouse will just throw us with tomatoes and if we are employed - our risk capital cut or we are fired. am half-serious here - being a trader is bloody hard. Very much under-appreciated.

Zubin Al Genubi points out:

We traders have the Spec List!

Jeff Watson writes:

In the late 70’s, I made it a firm and fast rule to never, ever discuss my P&L with my wife….or anyone for that matter. She has no clue as to my positions, and has no idea whether I made or lost money that day. Most successful guys in the pits were the same way with their wives. We saw too many guys complain to their wives, the wives got pissed and nagged them to death, and the negativity provided a catalyst for more losses. Many on this list adhere to the same rule.

H. Humbert comments:

As usual, Jeff speaks wisdom for the ages. The problem is that spouses typically can't determine whether fluctuations are short term, long term, relevant, or irrelevant. A few years ago, my wife logged on at the end of a quarter to get the account value for estimated taxes. It had been a very profitable quarter, but the account was nose-diving that day. I'll never forget her calling out "306, 304, 305, OMG 301, 299!!!" like some panicked automatic altimeter reading. Instead of "pull up, pull up!" she was saying "get out, get out!"

Hernan Avella asks:

To what extent can one really hide one's P&L with a life partner? It's evident when one is thriving. Savings balances, new properties, ventures, new toys, travel, charity contributions. Short term fluctuations are irrelevant, but at the end of the day you are making a bundle or not and your wife knows it.

Jeff Watson replies:

It works for many of us at this dinner party. When one is thriving, does one spend all that money, or does one keep their powder dry for the inevitable big hit?

Hernan Avella agrees: