Jun

18

Back to school

June 18, 2024 | Leave a Comment

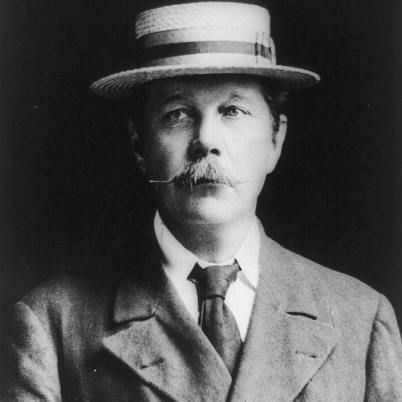

Aubrey one day before Berkeley. My kids all asked if I would be moving as Beethoven did when Karl left for school.

i cried when he didn't get into Harvard. he tried so hard and did so much. how could someone with 1600, a benevolent business in Eswatini, and 20 straight 5's on AP not get in? i guess his squash was not world caliber, and dei.

he only ran a 4.5 mile. his compatriots said if he knocked 30 seconds off he 'd have a chance. the best i ran was a 7.5 minute mile.

Jun

17

NVDA, from Big Al

June 17, 2024 | Leave a Comment

Yes, the chart looks like a moonshot. Two things:

1. NVDA is selling for about 37x revs, which looks very expensive. But at that P/S ratio, it's selling for only 70x earnings. The reason is that it's a profit monster, with ttm operating income almost 60% of ttm revs.

2. Maybe tech gurus can comment on this: Looking into GPUs, I find they have a limited lifespan, especially if run 24/7 at high workload, which AI seems to demand. Even ignoring upgrades, I'm thinking the chips NVDA is selling today may need to be replaced in as little as 3-4 years. Maybe I'm wrong, but I don't read about this aspect of their business model.

Humbert H. writes:

What matters is whether anyone will catch up. That is truly an open question. They're the leader, but more so due the inertia of their customers and not because nobody can replicate their technology. That's the thing about super-highly valued tech growth stocks, nobody can predict their situation even two years from now. Starting before the dotcom era, Microsoft has been growing forever, Cisco not as much, Nortel even less so, to put it mildly.

High-end AI chips are replaced due to obsolescence much more so that "wearing out". Some will certainly fail, but less so than the graphics card-type GPUs, and that's not the driving force for the replacement cycle. Trying to decide if Nvidia is properly valued is a pointless exercise. There are always people who will know 100x about the situation, and if they could truly value it properly, they'd find a way to follow up.

H. Humbert comments:

I would think as the computing power of the GPU or TPU (tensor processing unit) increases, the communication bandwidth among the chips, server chassis and server racks is the limiting factor that affects the overall computing speed of the entire AI high performance computing center's performance. The latter is a complicated issue, depending on the data center's server connection topology and so forth. I am sure NVDA knows about the issue and they will come up with a solution to resolve some of the speed bottlenecks either organically or by M&A. As a result, they will come up with next-gen solutions and products undoubtedly. There are designed obsolesces built into the products.

There is another issue. The training of the LLMs requires exorbitant amount of energy that it can't be sustained. The energy trajectory is almost exponential. Somehow these issues need to be mitigated. The increasing amount of energy expended also translates to the huge burden of cooling for the data center. So either NVDA or other companies may come up with the solutions to address some or all of the issues. Long story short, the product lifecycle remains relatively short.

The culmination of these issues and hence the potential solutions are of course good business for those who sell the gadgets. Both of the private sectors and the brain trust of the government and the defense departments worldwide are well aware of these issues and have been working hard to come up with some viable solutions.

Asindu Drileba writes:

There are other areas like Gaming, Molecular Dynamics Simulation, 3D Rendering/Computer Graphics, Video Editing, Crypto Mining that are GPU heavy and expected to grow in the future. As for AI, I think Nvidia riding on the AI hype is a bit precarious. Yes. They have mostly "locked in" AI tooling such that it makes no sense to compete with them.

What makes it precarious, is that a single paper that finally describes how to perform current AI applications with very cheap compute i.e CPU compute. Will destroy a lot the stock. As this problem is more of a software problem and not a hardware problem. So I expect it to move & get adopted very fast if it is actually solved. Several companies like Symbolica are working on such a solution.

Dylan Distasio adds:

No comment on the investing angle or future of the industry, but modern day chips are capable of handling pretty high temperatures for a very long time. Running at 24/7 high work load at a stable temp within the safe zone probably would actually result in a longer life than a gamer situation where the chip is stressed/heated and cooled down repeatedly. In any case, I don't think lifespan and failure due to thermal issues (if maintained properly) is a significant concern with GPUs. They'd be replaced due to obsolescence first.

Humbert Humbert writes:

This is a position for electrical interconnect. The current NVDA Blackwell chiplets are connected with very short electrical interconnects which are reaching their speed limits. The speed resolutions are to bring the optical connects closer to the edges of the chips. A few years ago DAPRA has a program called PIPES is to do just that using optical fibers. I don't recall the spec and I believe it has energy spec in terms of how many femtojoules per bit as it have been recognized a number of years ago that the digital switching energy will become an energy burden. But this solution may eventually run into chip edge real estate problem because of the size of the optical fiber core.

There are limits with the current state of the art digital neural network even though it is the hottest subject in town. Analog neural network may have its niche applications that could compute at higher speed and with lower power consumption. The following is one of the many example programs that the DoD is investing in.

Jun

16

Brighton Beach knishes

June 16, 2024 | Leave a Comment

I grew up in Brighton Beach Brooklyn. By far the greatest Knishes of all time. The long gone Mrs Stahls.

Mrs. Stahl’s delicious Brighton Beach knishes

Yonah Schimmel gets credit for inventing the humble knish in 1910 at his still-thriving knishery on East Houston Street.

But knish fiends all over New York still lament the loss of Mrs. Stahl’s Knishes, a dingy place tucked under the elevated train at Brighton Beach Avenue.

The shop served up hand-made cushions of potato, kasha, and cabbage inside flaky baked dough. They were truly legendary.

A recipe: Old Fashioned Potato Knishes

Jun

15

Megacaps in Random Land, from Big Al

June 15, 2024 | Leave a Comment

Lots going around about how NVDA dominates; and MSFT, NVDA and AAPL now account for about 20% of the S&P 500. I was curious to see what happened in a toy index and so did an experiment (using R):

1. Create an index of 500 stocks, each with a starting value of $100.

2. Each year, for 40 years, each stock's value is multiplied by 1 + a value randomly drawn from a normal distribution with mean 8% and sd 15%, roughly what you might see with the S&P 500.

3. The starting value of the index was $50,000. The final value after 40 years was $1,152,446.

4. The final summed value of the largest 10 out of 500 stocks was $142,320, or 12.35% of the 500-stock index.

I was curious to see if megacaps would emerge from a simple toy model. I ran it only once, and they did. For me, this is a comment on the perennial alarm stories about "Only X% of stocks account for Y% of the market!" Even with a simple model, you wind up with something like that.

Adam Grimes agrees:

Can confirm. Have done variations of this test with more sophisticated rules, distribution assumptions, index rebalancing, etc. Get similar results.

Peter Ringel responds:

so we can take this ~12% of the index as a base value, that develops naturally or by chance? Then a clustering of being 20% of a total index (only greater by 8%) does not look so outrageous.

William Huggins is more concerned:

keep in mind it's 10 companies making up 12% (~1.2% each) vs 3 companies making up 20% (8.3% each) - in that sense, the concentration DOES look pretty high. am reminded of when NT was 1/5 of the entire CDN index in 99/00.

Peter Ringel replies:

You are right, I failed to catch this difference of only 3 stocks. In general, I am not so much surprised about the concentration. Money always clusters. Always clusters into the perceived winners of the day. Should they blow up, money flows into the next winner. To me, the base for this is herd mentality.

Adam Grimes comments:

It's Pareto principle at work imo. I'm not making any claims about exact numbers or percents, but as you use more realistic distribution assumptions (e.g., mixture of normals) the clustering becomes more severe. There's nothing in the real data that is a radical departure from what you can tease out of some random walk examples. Winners keep on winning. Wealth concentrates. (As Peter correctly points out.)

Asindu Drileba offers:

Maybe you try replacing the normal distribution of multiples with a distribution of multiples constructed with those historically present in the S&P 500? It may reflect the extreme dominance in the market today.

To me, the base for this is herd mentality.

It is also referred to as preferential attachment:

A preferential attachment process is any of a class of processes in which some quantity, typically some form of wealth or credit, is distributed among a number of individuals or objects according to how much they already have, so that those who are already wealthy receive more than those who are not. "Preferential attachment" is only the most recent of many names that have been given to such processes. They are also referred to under the names Yule process, cumulative advantage, the rich get richer, and the Matthew effect. They are also related to Gibrat's law. The principal reason for scientific interest in preferential attachment is that it can, under suitable circumstances, generate power law distributions.

Zubin Al Genubi writes:

Compounding of winners is also at work and returns will geometrically outdistance other stocks. No magic, just martini glass math.

Anna Korenina asks:

So what are the practical implications of this? Buy or sell them? Anybody in the list still owns nvda here? If you don’t sell it now, when?

Zubin Al Genubi replies:

Agree about indexing. Hold the winners, like Buffet, Amazon, Microsoft, NVDIA. Or hold the index. Compounding takes time. Holding avoids cap gains tax which really drags compounding. (per Rocky) Do I? No, but should. It also works on geometric returns. Avoid big losses.

Humbert H. wonders:

But what about the Nifty Fifty?

Jun

14

Oppenheimer and his students, from M. F. M. Osborne

June 14, 2024 | Leave a Comment

To give you another example of Oppenheimer and the way he acted, and also which illustrates that his bark was worse than his bite, is when I took my prelims, they came in two parts - one in physics and one in astronomy - and he was the sole administrator of the physics prelim, which was an oral. This was probably in the spring of 1941. I am not sure exactly when it was.

He called me into his office and started asking me questions in physics and it was a disconcerting procedure, because he would ask you a question and if you started to answer it and he could see that you did know the answer, he would cut you off without allowing you to answer it as soon as he saw that you knew it or knew enough about it, and move on to something else. Well, pretty soon he found something I did not know and he listened to me flounder for a while and then he said, "Well, you should know that and this is the answer," and he even wrote it down on the board and then he said, "You passed and did very well," which sort of left me gasping.

But it turned out that I do not think my treatment from him was different from other people, in that he really did give a damn about his students and when he found out that I was going to leave Berkeley in 1941 (because the war was on and the draft was on), he wrote letters around to find me employment without my even asking him for it. I mean he assessed me and assessed other students and did things for them.

Another thing which other students pointed out to me was that Oppenheimer really made his contribution through his students. That the number of papers which came out from Berkeley, especially theoretical papers (but others too, in experiments and interpretation) rarely had his name on them, but if you looked at the bottom line at the end you would always see an acknowledgement or very often that great help was provided by, or the problem was suggested by Dr. Oppenheimer, and that is the way he operated.

From his daughter, Melita Osborne's biographical document available here [MS word .docx file, approx 300 Kb].

Jun

12

Capgras delusion

June 12, 2024 | Leave a Comment

when a sizable part of speculators refuses to acknowledge the work of dimson et al and lorie and fisher et al in showing the 1000 fold increase in stocks over the last 100 years, we may attribute it to capgras delusion of imposters within.

Capgras delusion or Capgras syndrome is a psychiatric disorder in which a person holds a delusion that a friend, spouse, parent, another close family member, or pet has been replaced by an identical impostor. It is named after Joseph Capgras (1873–1950), the French psychiatrist who first described the disorder.

odds differential is now max of 17 percentage pts against regulatory capture. need a reduction.

Jun

12

Opposites

June 12, 2024 | Leave a Comment

Gilbert and Sullivan by Hesketh Pearson: sullivan was an inveterate gambler and inventor. personality was opposite to gilbert who was most litigious playwright in history.

From page 195:

Sullivan was at Monte Carlo when this letter arrived. He had recently been staying with the Prince and Princess of Wales at Sandringham, had then accompanied the Prince to the Continent, and was now enjoying princely festivities on the Riviera. His regular visits to the tables were reported in the papers, and he was extremely annoyed when certain English journals commented on his heavy gambling. What with dining among lords and counting his losses, he was in no mood to discuss grand opera with Gilbert. But he wrote again, recapitulating his main objections to Gilbertian comic opera: he was tired of it; his work was too good for it; he did not want to spend the rest of his life in clothing the same old types with music, e.g. "the middle-aged woman with fading charms"; he disliked the inhuman and impossible plots; in fact, the whole business had become distasteful to him.

Hesketh Pearson:

Hesketh Pearson published his first full-length biography, Doctor Darwin, when he was 43. By the time of his death thirty-four years later he had written another eighteen biographies, three travel books (all with Hugh Kingsmill), three books of reminiscences (one written with Malcolm Muggeridge), four collections of brief lives, a collection of short stories and essays, and a book on the craft of biographical writing, as well as numerous articles and talks. In England he was the most popular and successful biographer of his time.

From: Harry Ransom Center at the University of Texas

Jun

11

Recession of recession indicator, from Kim Zussman

June 11, 2024 | Leave a Comment

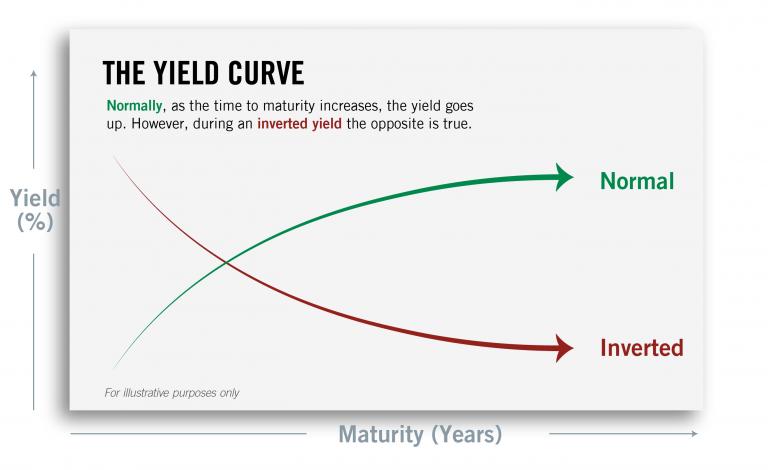

Wall Street’s Favorite Recession Indicator Is in a Slump of Its Own

Treasury yields have been inverted for the longest stretch on record

One of Wall Street’s favorite recession indicators looks broken. An anomaly known as an inverted yield curve, in which yields on short-term Treasurys exceed those of longer-term government debt, has long been taken as a nearly surefire signal that an economic pullback looms. In each of the previous eight U.S. downturns, that has happened before the economy sputtered. There haven’t been any glaring false alarms.

Now, though, that streak is threatened. The yield curve has been inverted for a record stretch—around 400 trading sessions or more by some measures—with no signs of a major slowdown. U.S. employers added a solid 175,000 jobs last month, and economic growth this quarter is expected to pick up from earlier in the year.

Big Al snarks:

If a recession doesn’t materialize soon, it could do lasting damage to the yield curve’s status as a warning system.

I'd hate to have to spend my day thinking up stuff like that.

Larry Williams writes:

A close up study of it shows it has often been way wrong—this is just one more time.

Nils Poertner comments:

As those "indicators" lose their importance, the more ppl (and WSJ and FT in particular!!) talk about it. "get the joke" Lack would have said.

Jeffrey Hirsch responds:

NBER that said 2020 was a recession. Fed started cutting rates in 2019 and the curve inverted then.

The recession lasted two months, which makes it the shortest US recession on record.

It is just a shame bond market traders didn’t tell the rest of us that covid was coming. And what about the 2 back-to-back negative quarters of GDP in Q1&2 of 2022? That looked like a recession as well IMHO.

Big Al adds:

The Fed (from before the GFC) says levels matter, too:

The Yield Curve and Predicting Recessions

Jonathan H. Wright, Federal Reserve Board, Washington DC

February 2006

Abstract:

The slope of the Treasury yield curve has often been cited as a leading economic indicator, with inversion of the curve being thought of as a harbinger of a recession. In this paper, I consider a number of probit models using the yield curve to forecast recessions. Models that use both the level of the federal funds rate and the term spread give better in-sample fit, and better out-of-sample predictive performance, than models with the term spread alone. There is some evidence that controlling for a term premium proxy as well may also help. I discuss the implications of the current shape of the yield curve in the light of these results, and report results of some tests for structural stability and an evaluation of out-of-sample predictive performance.

Jun

10

Stock/Bond ratio, from Hernan Avella

June 10, 2024 | Leave a Comment

I use a slightly modified version, I think is apt to use a rolling vol adjustment. Using VFINX (stocks) Long, VUSTX (long bonds) short. The stock bond ratio is higher than it was in 2000. the chart will show whatever you want; however, if you make the assumption that stocks and bonds have similar RISK ADJUSTED returns, mean reversion should be expected….at some point, but I don't think there's an actionable point here other than stay diversified. Here's a visual:

Stefan Jovanovich writes:

In the 40 years between the return of the dollar to the Constitutional standard (i.e. all paper issued by the Treasury had to be redeemable in coin) and the creation of a central bank that guaranteed that call money would always be available, the returns on the stock and bond markets had similar risk adjusted returns. For investors it was a choice whether to buy the common stocks of railroads with their wonderful but variable dividends or the secured bonds of the same companies.

A reversion to the mean could be a return to a period when cash, bonds and stocks all competed with one another in a connected equilibrium. That world saw creations of extraordinary fortunes; but against the one successful oil trust one had to measure the losses of all the enterprises that were unable to compete with Rockefeller's price-cutting for kerosene. What if AI means that sourcing for semiconductors only needs a few large relentlessly successful companies?

Vic asks:

how about no roll, no averaging on the bonds stock ratio?

Jun

9

M. F. M. Osborne recalls Oppenheimer

June 9, 2024 | Leave a Comment

There was one other pearl of information of a technical sort that I got from Oppenheimer, although it took me about ten or fifteen years to really appreciate it, but it shows how his mind worked. I asked him about two partial differential equations - one the Laplace equation and the other the Wave equation (d'Alembert's equation). The two were almost alike except that one has a plus sign and the other has a minus sign; and the conventional interpretation of the Wave equation is of two waves moving to the right and the left, and this is something you can read in any textbook. And I asked him why one could not have the same kind of an interpretation of the Laplace equation because you could get from the one to the other by changing one of the coordinates from real to imaginary units.

Oppenheimer said without any hesitation that the solution of two waves going in opposite directions didn't tell you a damn thing about the answer, contrary to whatever you read in the textbook. That tells you nothing beyond the continuity of the answer and, in fact, the real interest in those problems is not where the solution exists, but at the boundaries or the initial conditions where the continuity and solution breaks down; and that really controls what the answer is all about. In other words it is not where the equation is satisfied. It is where the equation is not satisfied that really describes a specific problem. The same happens to be true for Laplace's equation; it's the poles and the singularities where the analytic properties break down that really controls what the solution of Laplace's equation is like.

Well, the idea that you understand the theory and how a theory is determined is not the way it works but the way it does not work is a very useful idea. As I said it took me ten or fifteen years to suddenly realize, or gradually realize, that this was a very profound and important piece of mathematical and physical philosophy. You can in a sense relate it to Popper's ideas (that is Karl Popper), that a theory is not a theory unless you can show where it breaks down and then you begin to understand it. It is not where it works but where it does not work that really gives you enlightenment as to what it is all about and, of course, this statement of Oppenheimer's is an example of this. That it is the boundaries and the initial conditions where the equation breaks down that really control what is going on in any particular problem.

From his daughter, Melita Osborne's biographical document available here [MS word .docx file, approx 300 Kb].

Jun

8

Coney Island again

June 8, 2024 | Leave a Comment

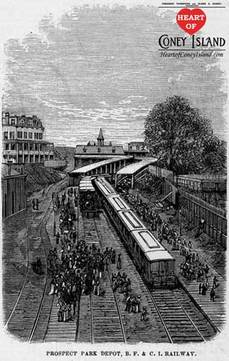

Coney Island History: The Rise and Fall of Engeman's Brighton Beach Resort

This article covers the rise and fall of Brighton Beach as a leading resort between 1870 and 1920. During these years, Brighton Beach competed for supremacy of Coney Island with Manhattan Beach to its east, and West Brighton to its west. Bill Engeman and the Brighton Beach Railroad Company both placed their bets on Brighton Beach and did everything they could to attract visitors to their particular resort. Brighton Beach was home to a beautiful hotel, music hall, and a well-known horse-racing track. When first built, it appealed primarily to the middle and upper-middle classes, while its competitor West Brighton initially appealed to the working and middle classes, and Manhattan Beach to the upper class.

Jun

7

More classic research

June 7, 2024 | Leave a Comment

Market Making and Reversal on the Stock Exchange

Victor Niederhoffer, University of Chicago, and M. F. M. Osborne, Washington, D. C.

Source: Journal of the American Statistical Association, Vol. 61, No. 316, (Dec., 1966), pp. 897-916

The accurate record of stock market ticker prices displays striking properties of dependence. We find for example that after a decline of 1/8 of a point between transactions, an advance on the next transaction is three times as likely as a decline. Further examinations disclose that after two price changes in the same direction, the odds in favor of a continuation in that direction are almost twice as great as after two changes in opposite directions.

Jun

5

M. F. M. Osborne

June 5, 2024 | Leave a Comment

M. F. M. Osborne. works on farm for free. uses his strength to go on anthropological dig. purposely spends 1 month in jail. graduate degree at Lick Obs. in Berkeley. becomes student of Oppenheimer who was smartest man at School. takes job at US Naval Research in sound division. writes scenes from life of the greatest contributor to random walk behavior.

while carrying his bio around, I fell down 7 stairs on my head onto concrete and all pages mixed up.

Brownian Motion in the Stock Market, M. F. M. Osborne.

It is the purpose of this paper to show that the logarithms of common stock prices can be regarded as an ensemble of decisions in a statistical steady state and that this ensemble of logarithms of prices, each varying with the time, has a close analogy with the ensemble of coordinates of a large number of molecules. We wish to show that the methods of statistical mechanics, normally applied to the latter problem , may also be applied to the former.

Jun

4

Top-Level Domains | The Economics of Everyday Things

Those letters at the end of web addresses can mean big bucks — and, for some small countries, a substantial part of the national budget. Zachary Crockett follows the links.

Asindu Drileba writes:

Mali owns the .ml domain for that may do well for Machine Learning. I wonder why they are sleeping on it?

Jun

1

Demonstration of Non-linear Effects Using Volumes of Cones, Asindu Drileba

June 1, 2024 | Leave a Comment

Numberphile Video demonstrating that a cone that is 80% full in height is actually 50% full in volume. You will also know if your getting scammed in a bar.

Cones are MESSED UP - Numberphile

Zubin Al Genubi writes:

This is why convexity, compounding, and geometric or exponential growth are hard to comprehend.

Kim Zussman comments:

Geometric returns are important when assessing performance. From an investor's perspective, average returns underweight when a manager loses everything (because it is sum-based), but geometric returns don't (because it is a product).

May

31

Kings of the Court

May 31, 2024 | Leave a Comment

Kings of the Court: The Story of Lawn Tennis by E. C. Potter, Jr. - the good old days in 1879, the third Wimbledon victory, Hartley got to the finals on Saturday. he had not arranged for anyone to replace him in pulpit. he rushed off the court, took a one-hour trip to Yorkshire, arrived at W. just in time to change his flannels, averted default and won W. those were the days of the identical twin Renshaws and Dohertys. many still rank the Dos in top 5 of all time from 1903. Pim in between the two sets of twins could pull of a let cord whenever he wanted. But he only won W twice because he only cared about perfecting his stoke.

May

30

NYC history lagniappe

May 30, 2024 | Leave a Comment

Coney Island Was Once Full of Dueling, Backstabbing Theme Parks

Come one, come all to the controversial, ugly beginnings of what was once called ‘Sodom by the Sea.’

Coney Island was once a glittering star of the early 1900s. It was the Progressive Era, amusement parks were becoming enormously popular across America, and New York City’s version of roller coasters and carnival games seemed like the epitome of wholesome fun. But the beachy entertainment land was quite different than it is today. Coney Island mainly consisted of three theme parks: Steeplechase Park, Luna Park, and Dreamland. And from 1904 to 1911, all were locked into a perpetual dance of stealing acts, copying rides from each other, and some dirty competition.

Steve Ellison recalls:

We had a big Spec Party event at Coney Island in 2007 when Aubrey was still a toddler.

May

29

A good overview, from Hernan Avella

May 29, 2024 | Leave a Comment

A Fresh Look at the Kalman Filter

In this paper, we discuss the Kalman filter for state estimation in noisy linear discrete-time dynamical systems. We give an overview of its history, its mathematical and statistical formulations, and its use in applications. We describe a novel derivation of the Kalman filter using Newton's method for root finding. This approach is quite general as it can also be used to derive a number of variations of the Kalman filter, including recursive estimators for both prediction and smoothing, estimators with fading memory, and the extended Kalman filter for nonlinear systems.

Big Al adds:

Forecasting with the Kalman Filter

Mike Mull, PyData Chicago 2016

The Kalman filter is a popular tool in control theory and time-series analysis, but it can be a little hard to grasp. This talk will serve as an introduction to the concept, using an example of forecasting an economic indicator with tools from the statsmodels library.

May

28

The Last Bear, from Humbert H.

May 28, 2024 | 1 Comment

The last bear on Wall Street: Why JPMorgan's Marko Kolanovic is sticking by his forecast for a 20% market sell-off

• JPMorgan's Marko Kolanovic sees no reason to turn bullish on the stock market despite record highs.

• In a Monday note, Kolanovic reiterated his view that the S&P 500 could fall 20% to 4,200.

• "We do not see equities as attractive investments at the moment and we don't see a reason to change our stance," Kolanovic said.

Larry Williams responds:

Here is something from what I have been writing:

Led by “Rich Dad, Poor Dad” Robert Kiyosaki’s warning of, “Be careful, it’s the biggest crash in world history,” the bears have come out of their winter caves. “We can’t make it past 2025,” warns Patrick Bet-David. Wells-Fargo is saying it’s recession time. Mark Spitznagel, who serves as chief investment officer of Universa Investments, is predicting “Biggest market crash since 1929."

They always walk among us…if they can only last until late 2025.

May

27

Weekend Reading, from Zubin Al Genubi

May 27, 2024 | Leave a Comment

Right, that Comey, fired as head of the FBI. But the book is a good murder mystery by someone who obviously knows law enforcement and investigation, and has a real nice human touch. Recommended. Also it has a pretty funny dig on the hedgies…right, that Westport.

Westport, by James Comey:

It's been two years since Nora Carleton left the job she loved at the US Attorney's Office to become lead counsel at Saugatuck Associates, the world's largest hedge fund. The career change also meant a change of scenery, relocating her to Westport, Connecticut, fifty miles north of New York City. But it was worth it to get her daughter, Sophie, away from the city. Plus, she likes the people she works with. Especially Helen, who recruited Nora because of her skills as an investigator.

Then, Nora's new life falls apart when a coworker is murdered and she becomes the lead suspect. Nora calls in her old colleagues from the US Attorney's Office, Mafia investigator Benny Dugan and attorney Carmen Garcia. To clear Nora's name, Benny and Carmen hunt for the true killer's motive, but it seems nearly everyone at Saugatuck has secrets worth killing for. As Benny sets out to interrogate her colleagues, Nora examines her history with the company to determine who set her up to take the fall.

May

26

The Oceans and the Stars, from Zubin Al Genubi

May 26, 2024 | Leave a Comment

This modern Jack Aubreyesque story of naval warfare is some of the best fiction I've read recently. Lots of action written in beautiful prose.

The Oceans and the Stars, by Mark Helprin.

A Navy captain near the end of a decorated career, Stephen Rensselaer is disciplined, intelligent, and determined to always do what’s right. In defending the development of a new variant of warship, he makes an enemy of the president of the United States, who assigns him to command the doomed line’s only prototype––Athena, Patrol Coastal 15––with the intent to humiliate a man who should have been an admiral.

Big Al recommends:

Covers key psychological issues around trading, with clear action steps:

The Mental Game of Trading: A System for Solving Problems with Greed, Fear, Anger, Confidence, and Discipline, by Jared Tendler.

Khilav Majmudar is reading:

Models.Behaving.Badly.: Why Confusing Illusion with Reality Can Lead to Disaster, on Wall Street and in Life, by Emanuel Derman.

In this bitterly funny novel by the renowned Polish author Witold Gombrowicz, a writer finds himself tossed into a chaotic world of schoolboys by a diabolical professor who wishes to reduce him to childishness. Originally published in Poland in 1937, Ferdydurke became an instant literary sensation and catapulted the young author to fame. Deemed scandalous and subversive by Nazis, Stalinists, and the Polish Communist regime in turn, the novel (as well as all of Gombrowicz’s other works) was officially banned in Poland for decades. It has nonetheless remained one of the most influential works of twentieth-century European literature.

Vic adds:

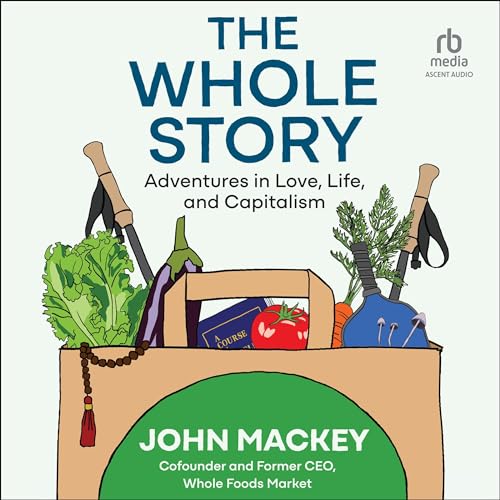

The Oceans and the Stars, and The Whole Story: two excellent books that have similar trajectories and conclusions - struggle, with love conquering adversity.

May

25

Looking back at Spec research history

May 25, 2024 | Leave a Comment

The Behavior of Stock Prices on Fridays and Mondays, by Frank Cross

Financial Analysts Journal, November-December 1973

The objective of this article is to document an example of non-random movements in stock prices. Specifically, we shall examine the distribution of price changes on Fridays and Mondays, and the relationship that exists between price changes on those two days. Other researchers have found little or no evidence of dependence in successive daily price changes. Apparently, however, these researchers have not investigated the possibility that dependence might occur on some days of the week but not on others.

Frank Cross is Secretary and Treasurer of Niederhoffer, Cross & Zeckhauser, Inc. The author wishes to express his thanks to Dr. Victor Niederhoffer for his helpful suggestions concerning this paper.

May

24

Slow to adapt, from Big Al

May 24, 2024 | Leave a Comment

It's been 44 years since the introduction of the 3-point line in the NBA. To me, it's a curious case of slow adaptation. Of course, you have new generations of players growing up shooting the 3, but surely players in the early 80s were capable of learning and practicing. The low number of 3s seems like a failure of analysis, failure to understand the impact on points-per-possession, which wasn't much of a moneyball concept yet.

Also, early on it was pretty much just guards who shot the 3 well, with the big exception of Larry Bird. But now, lots of players 6-10 or taller shoot 3s with considerable accuracy. To me, this is more an issue of assumptions, that big men couldn't shoot from long. And then some big men put in more practice and showed they could do it, opening up the possibilities.

Interesting how there are thresholds people believe can't be crossed…until somebody crosses them…and then lots of people are running sub-4-minute miles.

The 3-Point Revolution, by Stephen Shea:

A gimmick? A publicity stunt? That’s what many thought of the 3-point line when the NBA adopted it for the 1979-80 season. Back in 1979, Washington Bullets coach Dick Motta commented, “The three-point field goal will definitely make things interesting.” He meant interesting in the sense that a game that would have been over might now be sent to overtime by a desperation heave. Neither Coach Motta nor anyone else foresaw an NBA game played like it is today.

Five years after its inception, NBA teams were only averaging 2.4 three-point attempts (3PA) per game. This past season, James Harden alone averaged ten. Teams averaged 29.

[ More data on 3-point shooting. ]

Larry Williams comments:

Good point!! …like the 4 minute mile…and we can only beat the averages by a few points…

Vic wonders:

what adjustments have markets been slow to adapt to in last 5 years?

Big Al adds:

An interesting sidebar from 2017:

The Basketball Team That Never Takes a Bad Shot

The NBA’s most efficient offenses seek out layups and threes. A high school in Minnesota takes the idea to the extreme.

By Ben Cohen

PINE CITY, Minn.—Jake Rademacher made a mid-range jumper in a recent high-school basketball game. But as soon as the ball left his hands, even before it banked in, Rademacher knew it was a bad shot. And his team doesn’t take bad shots.

Pine City High School seeks out only the most valuable shots in basketball: from underneath the rim or beyond the 3-point line. They play as if they’re allergic to all the space in between.

May

23

The Whole Story

May 23, 2024 | Leave a Comment

The Whole Story by John Mackey - a story of how an entrepreneur learned about the bourgeois virtues and thanks to his father and his supportive partners, wives, and in spite of the venture capitalists, went from rags to riches.

Whole Foods Market's cofounder and CEO for forty-four years, John Mackey offers an intimate and provocative account of the rise of this iconic company and the personal and spiritual journey that inspired its remarkable impact.

The Whole Story invites listeners on the adventure of building Whole Foods Market: the colorful cast of idealists and foodies who formed the company's DNA, the many breakthroughs and missteps, the camaraderie and the conflict, and the narrowly avoided disasters. Mackey takes us inside some of the most consequential decisions he had to make and honestly shares his regrets looking back.

May

22

AI again: weather forecasting, from Big Al

May 22, 2024 | Leave a Comment

Learning skillful medium-range global weather forecasting, from Google DeepMind:

Global medium-range weather forecasting is critical to decision-making across many social and economic domains. Traditional numerical weather prediction uses increased compute resources to improve forecast accuracy but does not directly use historical weather data to improve the underlying model. Here, we introduce GraphCast, a machine learning–based method trained directly from reanalysis data. It predicts hundreds of weather variables for the next 10 days at 0.25° resolution globally in under 1 minute. GraphCast significantly outperforms the most accurate operational deterministic systems on 90% of 1380 verification targets, and its forecasts support better severe event prediction, including tropical cyclone tracking, atmospheric rivers, and extreme temperatures. GraphCast is a key advance in accurate and efficient weather forecasting and helps realize the promise of machine learning for modeling complex dynamical systems.

Asindu Drileba writes:

I looked and how they split the surface of the earth into tiny meshes in order to form a Graph upon which the rest of the model is built. This technique's description looked familiar to another technique called "Numerical Weather Prediction" or "NWP". The paper by Deep Mind does have several papers referencing "Numerical Weather Prediction" or "NWP".

I learnt about NWP from this PBS Nova documentary, Prediction By The Numbers. The documentary has many descriptions on tools for predicting. Wisdom of the Crowds, Probability Theory, and Numerical Weather Prediction. Meteorologists were interviewed and they showed their NWP programs in action (it is shown how the model generalized with time to predict a more accurate forecast of the in the weather). The meteorologist says it is their best model and also goes ahead to say that "it works so well."

May

21

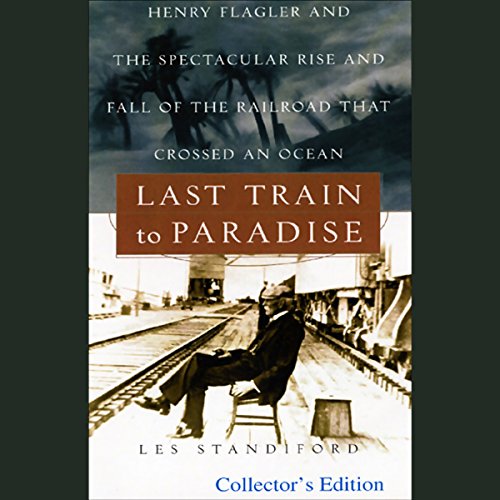

Last Train to Paradise

May 21, 2024 | Leave a Comment

an excellent bio of the gilded age and a man who loved adventure and created the Florida East railroad and overcame numerous engineering and weather challenges. highly recommended.

The paths of the great American robber barons were paved with riches, and though ordinary citizens paid for them, they also profited. Les Standiford, author of the John Deal thrillers, tells how the man who turned Florida's swamps into the playgrounds of the rich performed the almost superhuman feat of building a railroad from the mainland to Key West at the turn of the century. An extraordinary man and partner of John D. Rockefeller in the Standard Oil Company, Flagler had the vision to build railroads to link this backward territory with the rest of America. Last Train to Paradise shows how he masterminded the nearly impossible engineering feat of spanning more than 100 miles of ocean and islands to reach the southernmost tip of the Eastern seaboard.

May

19

Apropos worry wall:

- Unprecedented US debt

- Presidential candidates to debate from jail cell vs hospital room

- Democracy in decline

Humbert H. writes:

Sooner or later, everyone is right.

Larry Williams responds:

Bob Prechter would like to hear that!

Steve Ellison adds:

My pinned tweet documents 53 bricks in a 53-year wall of worry. But Venita Van Caspel made the original chart in her 1983 book The Power of Money Dynamics. I just added 40 years of additional worries.

May

18

Following the money, from Asindu Drileba

May 18, 2024 | Leave a Comment

Lots More on How CHIPS Act Money Got Awarded

In 2022, Congress passed the CHIPS Act, which set aside tens of billions of dollars in loans and grants in order to encourage companies to build new semiconductor fabs in the United States. We're still very early in the process. It's going to be a long time before we know if the US will become a major player again in the production of advanced chips. But the process is well underway and the bulk of the awards have been officially announced, with much of the money going to Intel, Samsung, TSMC, and others. So how did the grants get allocated — and what's next?

While it is clear that money earning or losing events like quarterly earnings announcements have an impact on the market (stock prices). I am not sure if government subsidies & grants have an impact on stock prices. Is there a tool that can be used to track events related to government subsidies & grants?

Big Al responds:

An interesting question. Probably start here:

USAspending is the official open data source of federal spending information, including information about federal awards such as contracts, grants, and loans.

Also interesting research tracking stock trades by members of the US Congress:

Capitol Trades

Smart Insider

Senate Stockwatcher

May

17

Vienna

May 17, 2024 | Leave a Comment

Vienna: How the City of Ideas Created the Modern World, by Richard Crockett.

Viennese ideas saturate the modern world. From California architecture to Hollywood Westerns, modern advertising to shopping malls, orgasms to gender confirmation surgery, nuclear fission to fitted kitchens—every aspect of our history, science, and culture is in some way shaped by Vienna.

The city of Freud, Wittgenstein, Mahler, and Klimt was the melting pot at the heart of a vast metropolitan empire. But with the Second World War and the rise of fascism, the dazzling coteries of thinkers who squabbled, debated, and called Vienna home dispersed across the world, where their ideas continued to have profound impact.

Humbert H. writes:

When I left the Soviet Union, Vienna was the first western city I saw. It's hard to imagine a bigger contrast. It was like moving from a garbage dump to an immaculately maintained dollhouse. My next stop was Italy, and in spite of being the most beautiful country in the world, IMO, Italy was a letdown after Vienna.

As for it's historical significance, it's huge, but this battle was one of the most important in the history of the world, and that's saying something (there have been a lot of battles).

Laurel Kenner suggests:

For a more detailed overview, I enjoyed The Austrian Mind.

May

16

“Index young man, index!”, from Kim Zussman

May 16, 2024 | Leave a Comment

Wealth Creation in the U.S. Public Stock Markets 1926 to 2019

Hendrik Bessembinder, W.P. Carey School of Business

Last revised: 12 Nov 2020

Date Written: February 13, 2020

Abstract

This report quantifies long-run stock market outcomes in terms of the increases or decreases (relative to a Treasury bill benchmark) in shareholder wealth, when considering the full history of both net cash distributions and capital appreciation. The study includes all of the 26,168 firms with publicly-traded U.S. common stock since 1926. Despite the fact that investments in the majority (57.8%) of stocks led to reduced rather than increased shareholder wealth, U.S. stock market investments on net increased shareholder wealth by $47.4 trillion between 1926 and 2019. Technology firms accounted for the largest share, $9.0 trillion, of the total, but Telecommunications, Energy, and Healthcare/ Pharmaceutical stocks created wealth disproportionate to the numbers of firms in the industries. The degree to which stock market wealth creation is concentrated in a few top-performing firms has increased over time, and was particularly strong during the most recent three years, when five firms accounted for 22% of net wealth creation. These results should be of interest to any long-term investor assessing the relative merits of broad diversification vs. narrow portfolio selection.

May

15

Florence Nightingale, statistician

May 15, 2024 | 1 Comment

Florence Nightingale - Statistics and sanitary reform

Florence Nightingale exhibited a gift for mathematics from an early age and excelled in the subject under the tutelage of her father. Later, Nightingale became a pioneer in the visual presentation of information and statistical graphics. She used methods such as the pie chart, which had first been developed by William Playfair in 1801. While taken for granted now, it was at the time a relatively novel method of presenting data.

The image is an example from the Crimean War by way of The Royal Society.

More from Scientific American:

How Florence Nightingale Changed Data Visualization Forever

In the summer of 1856 Florence Nightingale sailed home from war furious. As the nursing administrator of a sprawling British Army hospital network, she had witnessed thousands of sick soldiers endure agony in filthy wards….Nightingale arrived back in London determined to prevent similar suffering from happening again. It would be an uphill slog. Many government leaders accepted the loss of common soldiers as inevitable….Resolute, Nightingale set out to sway the minds of generals, medical officers and parliamentarians. Their poor data literacy muted statistical arguments that could have oriented them toward the facts. Nightingale, with her quantitative mind, had to persuade people with common understanding but uncommon standing. Her prime target throughout this effort was the head of the British Army, Queen Victoria.

And an expert offers a balanced view:

The real goods and the oversell

To many, Florence Nightingale is a hero. But like all heroes, elements of her story have been exaggerated. Lynn McDonald, editor of Nightingale’s collected works, sorts fact from fiction.

May

13

TLT returns, from Big Al

May 13, 2024 | Leave a Comment

Not sure why I did this, but once I did, I thought it was interesting. This shows the to-date total return of TLT depending on when you bought it. The data is weekly adjusted close (so I'm assuming YHOO got it right, with interest payments correctly included). Some buyers as far back as 2012 are under water, whereas from last October nicely ahead. Speaks to a comment from Dr. Zachar re bonds: "date them but don't marry them."

May

12

Cost of Carry, from Zubin Al Genubi

May 12, 2024 | Leave a Comment

A carry trade is borrowing/buying at low interest and selling/lending at higher interest rates using leverage. Its used in currencies. The authors propose the trade had become systemic including the FED such that the markets have disconnected from fundamentals and are moved by dynamics of the carry/bust pattern. Further that it is the main driver of economic cycles not classic economic supply and demand.

If so, maybe the Fed watch traders are not always wrong as I've stated and the bad news is good news idea has merit under the carry trade.

Humbert H. writes:

Is there anyone who has done this for decades and not blown up, other than maybe Palindrome? Leverage combined with simultaneous forex and interest rate bets seems like it will eventually blow up, unless you always get advance warnings from central bankers.

Jeff Watson expands:

In the grain markets we determine the cost of carry as Futures price = Spot price + carry or carry = Futures price – spot price. Carry consists of storage costs, insurance, and interest. Carry provides the farmer with signals helping with crop marketing decisions while it provides a trader an opportunity to capture the carry. As an aside, here’s a handy dandy little formula to play around with:

F = Se ^ ((r + s - c) x t)

Where:

F = the future price of the commodity

S = the spot price of the commodity

e = the base of natural logs, approximated as 2.718

r = the risk-free interest rate

s = the storage cost, expressed as a percentage of the spot price

c = the convenience yield

t = time to delivery of the contract, expressed as a fraction of one year

Steve Ellison adds:

The US stock market had a carry trade from 2008 to 2018 and again in 2020 and 2021 when zero interest rate policy made it possible for traders to buy stocks with borrowed money, and cover the interest costs using the stock dividends. Philip L. Carret wrote in his 1931 book The Art of Speculation that the best time to buy stocks is in such situations when stocks "carry themselves".

As a quick approximation, the prices of the front-most ES contracts are:

June 5225

September 5282

So the cost of carry at the moment is roughly 47 points per quarter, and the S&P 500 is not carrying itself (if it were, the contracts would be in backwardation).

May

11

Small business, from Laurel Kenner

May 11, 2024 | Leave a Comment

Greetings from Greenwich, Connecticut, one of the nation's wealthiest towns. This year:

1) Steinway closed its piano store and announced that all pianos would be liquidated at steep discounts.

2) Saks Fifth Avenue closed its brand-new (and very good) restaurant after spending $1 million on a remodel. Also closed its retail stores along the main drag.

3) A favorite Chinese restaurant in Old Greenwich closed after serving three generations.

4) A venerable Old Greenwich sit-down cafe with the best fish-and-chips in Connecticut also closed.

5) A good-value nice clothing store on Greenwich's main shopping street closed, just one of several.

It isn't just East Coast. On a UCLA visit with my son, I breakfasted at a landmark, Patrick's Roadhouse in my hometown, Santa Monica Canyon. The week after I left, a friend told me that Patrick's had closed after 52 years. COVID relief had expired. Arnold Schwarzenegger, who has a special throne there that can bear his weight, had bailed it out previously — but hasn't stepped up to the plate. A GoFundMe campaign is attempting to keep Patrick's alive. Fixer-uppers on my old street start at $6 million.

Why is any of this important? When small businesses close, the ordinary people must move on, be they customers or owners. They spend less. The economy reflects their diminished circumstances.

What grinds me the most is the Steinway store's failure. I'm teaching piano now, and I am so tired of seeing my students fail to develop their ears because they can only afford horrible electric keyboards.

Bo Keely responds:

i think it's a local thing. we can't see the world forest for the American trees. i just traveled through Mexico the hard way under a pack and the country bustles, thrives, and has altered the mindset to friendliness to strangers. the best investment is along the Sea of Cortez where, 15 years ago, there was one sleepy fishing village where i couldn't find a meal or bed. i slept in the weeds. now it's the Platinum Coast with twenty miles of high rises. there's a 200-mile new skyscraping powerline to meet electricity demand across the dune capped desert where, as seen yesterday on my throne on La Bestia, the last poles are driven and strung to blow open the coast to investment.

May

10

Same-Weekday Momentum

May 10, 2024 | Leave a Comment

Same-Weekday Momentum

Zhi Da, University of Notre Dame - Mendoza College of Business

Xiao Zhang, University of Maryland - Robert H. Smith School of Business

Apr 24, 2024

A disproportionately large fraction (70%) of stock momentum reflects return continuation on the same weekday (e.g., Mondays to Mondays), or the same-weekday momentum. Even accounting for partial reversals in other weekdays, the same-weekday momentum still contributes to a significant fraction (20% to 60%) of the momentum effect. This pattern is robust to different size filters, weighing schemes, time periods, and sample cuts. The same-weekday momentum is hard to square with traditional momentum theories based on investor mis-reaction. Instead, we provide direct and novel evidence that links it to within-week seasonality and persistence in institutional trading. Overall, our findings highlight institutional trading as an important driver of the stock momentum.

Peter Ringel writes:

I find this a sexy area of research. It also effects the indices. My guess is some sort of behavioral bias among large players plus some technical constraints, how they have to enter complex trades. Why is a certain fund buying the sector every Tuesday at 10:30? I see such regularities pop up, exist for a while - and vanish again.

Big Al does some counting:

Here is a quick, simple study just to kick this can. This is looking at NVDA, days of the week, for about the last year. The z scores show Wednesday being a significantly poor day and Thursday being good (but with a big sd).

I also did a thousand sim runs, resorting the % changes randomly, and pulled out the max-min spread for each sim run. For the actual data, the range is 1.86% points (Thursday mean minus Wednesday mean). Only 2.08% of the sim runs had a wider range. Taking that to a z score table gives the actual range a score of +2.03.

However, here is the correlation for each weekday predicting the next trading day that is the same weekday:

NVDA correlations, weekday to next instance

Mon-Mon 0.06

Tues-Tues 0.04

Wed-Wed 0.03

Thurs-Thurs 0.09

Fri-Fri 0.01

May

9

Teller of tales

May 9, 2024 | Leave a Comment

an excellent bio of a multitalented writer, thinker, and sportsman. a very chivalrous man. the story of Doyle going to a performance of Patience is resonant.

Teller of Tales: The Life of Arthur Conan Doyle

This compelling biography examines the extraordinary life and strange contrasts of Sir Arthur Conan Doyle, the struggling provincial doctor who became the most popular storyteller of his age when he created Sherlock Holmes. From his youthful exploits aboard a whaling ship to his often stormy friendships with such figures as Harry Houdini and George Bernard Shaw, Conan Doyle lived a life as gripping as any of his adventures. Exhaustively researched and elegantly written, Teller of Tales sets aside many myths and misconceptions to present a vivid portrait of the man behind the legend of Baker Street, with a particular emphasis on the Psychic Crusade that dominated his final years, the work that Conan Doyle himself felt to be "the most important thing in the world".

May

8

Commodities voyeurism (and also some ride-hitching for Bo), from Big Al

May 8, 2024 | Leave a Comment

This Sahara Railway Is One of the Most Extreme in the World

Trains on the railway are up to 3 kilometres (1.9 mi) in length, making them among the longest and heaviest in the world. They consist of 3 or 4 diesel-electric EMD locomotives, 200 to 210 cars each carrying up to 84 tons of iron ore, and 2-3 service cars. The total traffic averages 16.6 million tons per year.

And a bit of Oz, with "driverless" thrown in:

The Driverless Iron Ore Trains Of Rio Tinto Australia

May

7

Sogi levels, from Zubin Al Genubi

May 7, 2024 | Leave a Comment

From Market Tremors: Quantifying Structural Risks in Modern Financial Markets, discussing how dealers and market makers need to rebalance delta on their option book with futures causing mean reversion:

We observe that interest tends to be highest for strikes that are a multiple of 50. Investors typically like round numbers.

Hence Sogi levels. Finally, an explanation:

Pinning Arises from Dealer Hedging: Avellaneda and Lipkin (2003)

We propose a model to describe stock pinning on option expiration dates. We argue that if the open interest in a particular contract is unusually large, Delta-hedging in aggregate by floor market-makers can impact the stock price and drive it to the strike price of the option. We derive a stochastic differential equation for the stock price which has a singular drift that accounts for the price-impact of Delta-hedging. According to this model, the stock price has a finite probability of pinning at a strike. We calculate analytically and numerically this probability in terms of the volatility of the stock, the time-to-maturity, the open interest for the option under consideration and a "price-elasticity" constant that models price impact.

Asindu Drileba writes:

I first saw this in Vic's Practical Speculation. I discovered a few edges based on this in the Bitcoin market.

May

6

Thomas Sowell’s personal journey

May 6, 2024 | Leave a Comment

Thomas Sowell's A Personal Odyssey shows him as a Maverick in military, government, foundations and academia. the book follows his path to greatness through 70 years. He shines as a photographer, boxer, thinker, family man. an inspiring bio.

wherever he went, and refused to kowtow, his compatriots would remark "we have another Thomas Sowell in our midst." Reminds one of how Elmer Kelton was called "Doc" 5 years after his father upbraided him for being slow at cowboy things.

May

5

For the O’Brian fans

May 5, 2024 | Leave a Comment

Six Frigates, by Ian W. Toll (2006).

From the NYT review:

This first book by Toll, a former financial analyst and political speechwriter, is a fluent, intelligent history of American military policy from the early 1790s, when Congress commissioned six frigates to fight the Barbary pirates, through the War of 1812. But the book’s real value, and the pleasures it provides, lies in Toll’s grasp of the human dimension of his subject, often obscured in the dry tomes of naval historians. The battle depictions are worthy of Patrick O’Brian (whose fictional hero, Jack Aubrey, he cleverly uses to illustrate a scene in the December 1812 shootout between the American frigate Constitution and the British frigate Java).

Stefan Jovanovich adds:

Here is a discussion with Toll about his book on the last two years of WW 2 in the Pacific.

May

4

The Doctor Is In. And He’s an Orangutan.

For the first time, researchers have seen a wild animal treat an open wound with a medicinal plant. After getting injured—probably in a brawl with another male—a wild Sumatran orangutan chewed the stems and leaves of a vine humans use to treat wounds and ailments such as dysentery, diabetes and malaria. The orangutan then repeatedly smeared the makeshift salve on an open gash on its cheek until it was fully covered. After the treatment, scientists saw no signs of infection. The wound closed within five days. And it healed within a month.

Jeffrey Hirsch is enthusiastic:

This is awesome! An good friend of mine spent several years in Borneo working with Orangutans under Birute Galdikas’ program. They are super crafty and smart. Don’t doubt this.

Humbert H. writes:

And nobody can explain how they know to do this in these situations. There is obviously a lot of learning apes can acquire from others, but this? There is also no way the current understanding of how genetic information is passed on that can explain this. There is something very mysterious about the mind and animals doing non-obvious things is the best example, this is not a simple biological phenomenon.

Asindu Drileba comments:

One of the things I hear in the AI research community in the pursuit of of AGI (Artificial General Intelligence) is people thinking of intelligence as something hierarchical like height.

In The Singularity is Near Raymond Kurzweil makes a plot of Computers approaching AGI. He puts insects at the bottom and manuals later then humans at the top. You often hear some people say that "We haven't yet reached dog level AI, so we can't say we can reach human level AI soon." That statement makes the assumption that A humans intelligence is more than that of a dog. But it has been reported in some cases a dog's sense of smell can be 100,000 more acute than that of a human being! And not just that it can tell time just by smelling what's around. Another example is also how birds can sense magnetic fields and use them like a compass.

Anyway my point is that just by the (limited) way humans perceive reality we have access to some secrets we can't pass to animals. My suspicion is that animals also have their own secrets that they cannot pass to us.

Humbert H. adds:

They have recently discovered that some insects are self-aware. The test that's used for animals is that they recognize their reflection in the mirror as themselves judging by their reaction. Usually only dolphins, apes, and some corvids (crows) pass the test.

But more importantly, what I meant was that animals seem to "know" how to do things that no current scientific understanding can explain. This means we don't understand basic things about animal (and human) mind. AI is a machine function: an algorithm using some data provides some outputs in response to inputs. A mind is like that too, except we really don't understand the nature of self-awareness, nor do we understand how animals just "know" things. Sometimes they call it "instinct" but there is no real science behind that word. And in this case it's not even that, apes have no "instinct" to cure wounds with specific processed plant material.

Jeff Watson writes:

Here is an interview with cognitive psychologist, Donald Hoffman. Some find him brilliant, some a flake. His ideas are unconventional to say the least, but the questions that come to mind out of his interview will break one’s brain. Many moments in the video, I pause and ask myself how this applies to markets.

Stefan Jovanovich gets philosophical:

The wheel of time turns on the axle of our self-awareness: Transcendentalism.

May

3

Odds and highlights

May 3, 2024 | Leave a Comment

change in odds to induce bullish press conference. how's the weather in durham? the next rate cut will depend on the odds, not on the labor market.

The highlight of this week's listening makes me cry about the untimely passing of Artie and Elaine.

Saddle up and come along on a Cowboy Christmas with Marshal Matt Dillon and "King of the Cowboys" Roy Rogers! During the years now known to old-time radio fans as the Golden Age of Radio, listeners could expect to hear special guests and holiday sketches on their favorite programs. Even the Western shows and cowboy stars of the day could be counted on to show the holiday spirit, especially at Christmas time. This Audio Archive presentation showcases two such Christmas episodes from two of radio's most popular Western programs: Gunsmoke and The Roy Rogers Show, both from December 1952.

i listen to The Complete Sherlock Holmes every evening and accompany it with the life and music of Verdi and the life and music of Gilbert and Sullivan - thereby bringing me back to a beautiful and restful Victorian age.

May

2

Smörgåsbord for the beginning of May

May 2, 2024 | Leave a Comment

Smörgåsbord for the beginning of May

Zubin Al Genubi recommends:

Market Tremors: Quantifying Structural Risks in Modern Financial Markets

Clear exploration of potential causes of and prediction of volatility events caused by Dominant Agents. Explores imbalances created by ETFs ETNs Banks, FED Market Makers.

Asindu Drileba suggests chaos:

Doyne Farmer describes the relationship between Roulette Wheels, The Weather, Financial Markets, and Economies as a whole. He thinks companies that don't make the energy transition from fossil fuels will all go bankrupt in the next 5 years. He is also promoting his new book:

Here is the discussion:

Simplifying Complexity: Making sense of chaos with Doyne Farmer

Nils Poertner points to probability:

stochastics is really quite counter-intuitive - it deals with "uncertainty" rather than basic algebra or geometry which one learns in schools. good training ground for learning about markets as well. (always found that stochastics often attracts folks who are a bit off the normal conventions / and have an genuine curiosity in things rather than go with what is fashionable)

Apr

30

For the cowboys thread

April 30, 2024 | Leave a Comment

The Highly Exalted documents the life of working cowboys on the last horse-drawn chuckwagon in modern America. Shot against the spectacular backdrop of northern Nevada, nine cowboys and their cook tell colorful stories of six months roaming the half million acre ranch where they work. These are some of America’s last true cowboys. They are horse-back specialists: men unwilling to do the haying and maintenance work and who are not looking for job security or a permanent home. The Highly Exalted presents a vestige of the past, a portrait of a nearly extinct way of cowboy life. Against the wild and isolated country of northern Nevada, the nine cowboys and chuckwagon cook tell their stories of six months roaming the half-million acres of the IL Ranch.

Apr

29

Follow-up to bourgeois virtues

April 29, 2024 | Leave a Comment

Jimmy Buffett and the Bourgeois Virtues

Jimmy Buffett was known for his “tropical rock,” whose music and lyrics borrowed liberally from rock, country, calypso, and island life. He sang with Frank Sinatra and Alan Jackson, and covered Old Hank. But he was also a lifelong entrepreneur – and erstwhile journalist – much like the great French economist Frédéric Bastiat. AIER is the home of the Bastiat Society, “a global network of individuals committed to advancing free trade, individual freedom, and limited government.” AIER is also the home of the Sound Money Project, something Jimmy knew about: “Now I got quarters in my loafers, tryin’ to fight inflation/When it only used to take a cent.”

Jimmy’s unflagging entrepreneurship embodies the “bourgeois virtues,” about which my AIER colleague and friend Art Carden has written with his mentor Deirdre McCloskey. Art is a Senior Fellow at AIER and Dr. McCloskey is a contributor. I don’t know if either is a fan of Jimmy Buffett.

Apr

28

A good antidote

April 28, 2024 | Leave a Comment

Carnegie Hero Fund Commission

Jameson Lobb, New York, NY

Jameson Lobb helped save a man from drowning, New York, New York, October 4, 2021. As a middle-aged man floated motionless in the East River between two piers at a popular waterfront overlook, a bystander on the pier nearest the man called for help. Alerted on the opposite pier was Lobb, 24, banking analyst, who was exercising with his friend. Lobb climbed over a railing and, fully clothed, jumped into the cold river and swam toward the submerging man’s location. Lobb submerged, grasped him, and resurfaced as the friend swam to them and positioned the man, who appeared to be unconscious, face up on the friend’s chest. Lobb held the man’s legs, and they swam, towing the man at least 100 feet back to the wooden, barnacle-covered fender of the far pier, where they had entered the water. While the friend held the man to the fender about 8 feet below the pier’s deck, Lobb climbed onto a beam, and they used a rope and life ring lowered by others to secure the man as he became responsive. With help from Lobb and the friend, bystanders then lifted the man onto the pier. Arriving first-responders tended to the man, who was taken to a hospital. Lobb, who suffered cuts on his arms, climbed back onto the pier and went to a hospital for precautionary treatment.

Apr

27

A few useful ideas

April 27, 2024 | Leave a Comment

From Asindu Drileba:

This video is about how to use a technique known as "dimensional analysis" that can be used to derive equations or attain further insights about a physical system.

From Big Al:

A nice, simple explanation of Markov chain.

(Sidebar history note:Alexandre-Théophile Vandermonde.)

More complex: Markov Decision Processes - Computerphile.

Apr

25

FTC Announces Rule Banning Noncompetes, from Big Al

April 25, 2024 | Leave a Comment

FTC Announces Rule Banning Noncompetes

Today, the Federal Trade Commission issued a final rule to promote competition by banning noncompetes nationwide, protecting the fundamental freedom of workers to change jobs, increasing innovation, and fostering new business formation.

“Noncompete clauses keep wages low, suppress new ideas, and rob the American economy of dynamism, including from the more than 8,500 new startups that would be created a year once noncompetes are banned,” said FTC Chair Lina M. Khan. “The FTC’s final rule to ban noncompetes will ensure Americans have the freedom to pursue a new job, start a new business, or bring a new idea to market.”

Kim Zussman writes:

This will also help knock down the value of businesses. Mike sells his business to Mary. One week later Mike opens the same kind of business one block away, and contacts all his old customers. How much should Mary pay to buy Mike's business?

H. Humbert comments:

Certainly has more merit than trying to destroy Amazon or preventing Kroger from buying Alberson's, her two other favorite busybody activities. Not a very libertarian thing to do, but noncompetes are often used against many powerless people as a nakedly aggressive move.

The argument she uses is that Silicon Valley where noncompetes are illegal beat out Boston Route 128, and is doing just fine in terms of starting new businesses. Whether it's due to noncompetes or the weather is anybody's guess. The other argument is that noncompetes are used to restrain security guards or sandwich shop workers from getting employment across the street, cases where intellectual property or customer lists are clearly not involved.

Pamela Van Giessen adds:

There is another downside to this. When companies lay off people, especially middle and senior management, they give them attractive parting gifts that are contingent on non-compete agreements. E.g, ABC co lays off senior manager, pays them up to 1 yr salary plus health benefits, etc. but the caveat is that former senior manager doesn’t work for a competitor for x period of time. These workers already have the right to decline the parting gifts if they don’t want to sign the non-compete. Now there is almost no incentive for companies to provide compensation to the people they lay off since they can’t bargain for a non compete. That sucks for employees who can now be laid off with pretty much nothing. I’d say this is a loss for employees and a win for big companies. Thank you to Joe Biden & co.

William Huggins responds:

let's not oversell this - firms seek out non-compete agreements for THEIR benefit, not that of employees. strange that an erosion of their position would somehow strengthen them but war is peace and ignorance strength?

Apr

24

Pandemics good for profits, from Big Al

April 24, 2024 | Leave a Comment

From FRED:

George Zachar comments:

A big inflation effect — the cpi index:

Apr

23

Speak of the devil, from William Huggins

April 23, 2024 | Leave a Comment

Looks like someone in Can Gov was listening in for ideas (Tax rate to rise from 50% of reg to 67% of reg):

In the 2024 budget unveiled Tuesday, Finance Minister Chrystia Freeland said the government would increase the inclusion rate of the capital gains tax from 50 per cent to 67 per cent for businesses and trusts, generating an estimated $19 billion in new revenue. Capital gains are the profits that individuals or businesses make from selling an asset — like a stock or a second home. Individuals are subject to the new changes on any profits over $250,000.

Big Al is sanguine:

No worries - it only affects a few:

The government estimates that the changes would impact 40,000 individuals (or 0.13 per cent of Canadians in any given year)…

H. Humbert writes:

With 67%, the government clearly thinks that either it both needs and deserves the profits of some people more than they do OR that those people need to be treated like one would treat an enemy, without any regard for their needs or feelings. Let's see, would a Communist think that way (both ideas) about his or her class enemy?

William Huggins explains:

It's a move back towards the status quo ante 1980s tax cut. The idea that tax cuts are only good is just silly. As silly as the notion that government is efficient with those same taxes. This isn't revolutionary, simply the slow reduction of a subsidy we -thought- would lead to more investment. Turns out future demand is a larger determinant of that than current taxes. We gave too much to capital back in the early 80s when we rebalance last time and now were rebalancing again. Cap gains will still pay less tax than working folks. No need for enemies or "communists".

H. Humbert replies:

I apologize William, the problem was my reading comprehension as I wasn't familiar with the meaning of the term "inclusion rate" in the Canadian tax system and interpreted it incorrectly after, to be honest, spending about 20 seconds to "read" the article. With your explanation and the tiniest bit of research, this makes sense. As I mentioned before, I'm against special cap gains rates, but only if (a) the losses aren't capped (b) there is no special "investment gains" tax as currently exists in the US.

Asindu Drileba adds:

David Graeber once mentioned that the most productive period in American industry was when the tax rates were highest (65%). The referenced the advances made by Bell Labs as a example. He claimed that the productivity occurred because corporations were nudged by the high taxes to invest more money into research and development.

H. Humbert provides context:

Very few people paid the top marginal rate as tax shelters were highly prevalent and a lot easier to use than they are now.

Hernan Avella comments:

True MMT’rs would argue that rates should be 0 and the tax rate higher, as needed to curb inflation.

Apr

21

Very bullish

April 21, 2024 | Leave a Comment

very bullish when S&P is down 7 days in a row - only occurred 5 times since 1996, expectation in 2 days is +39 big. 6 20-day minimums in a row, happened 7 times since 1996, expectation in 4 days 100% up, mean gain 45 big.

Hernan Avella agrees:

I imagine the 2 or 3 fellow specs that still trade a significant size in this list are already loaded up with enough spu, because one expects fireworks next week.

From the department of non predictive studies: Choose your favorite trend indicator, or better yet, create an ensemble of trend indicators. Choose a measure of persistence of extreme readings (intensity and duration). Look back in history what happens after your signal gets triggered, look at different time frames.

I get 12 signals since 1980: 1985, 1987, 1991, 1994, 2001, 2007, 2008, 2009, 2011 and 2022.

Good luck next week.

Larry Williams comments:

We have only seen 6 down days in a row here in S&P 500 and not that in the Dow.

Big Al suggests:

Regarding the Dow vs S&P divergence, a relevant comparison below. INTC is the only shared component.

Apr

21

Good book, good food, good company

April 21, 2024 | Leave a Comment

great book that i'm reading as I am taking Aubrey around to visit colleges that accepted him:

The Bourgeois Virtues: Ethics for an Age of Commerce, by Deirdre Nansen McCloskey.

For a century and a half, the artists and intellectuals of Europe have scorned the bourgeoisie. And for a millennium and a half, the philosophers and theologians of Europe have scorned the marketplace. The bourgeois life, capitalism, Mencken’s “booboisie” and David Brooks’s “bobos”—all have been, and still are, framed as being responsible for everything from financial to moral poverty, world wars, and spiritual desuetude. Countering these centuries of assumptions and unexamined thinking is Deirdre McCloskey’s The Bourgeois Virtues, a magnum opus that offers a radical view: capitalism is good for us.