Sep

15

Streaks of down days, from Big Al

September 15, 2024 | Leave a Comment

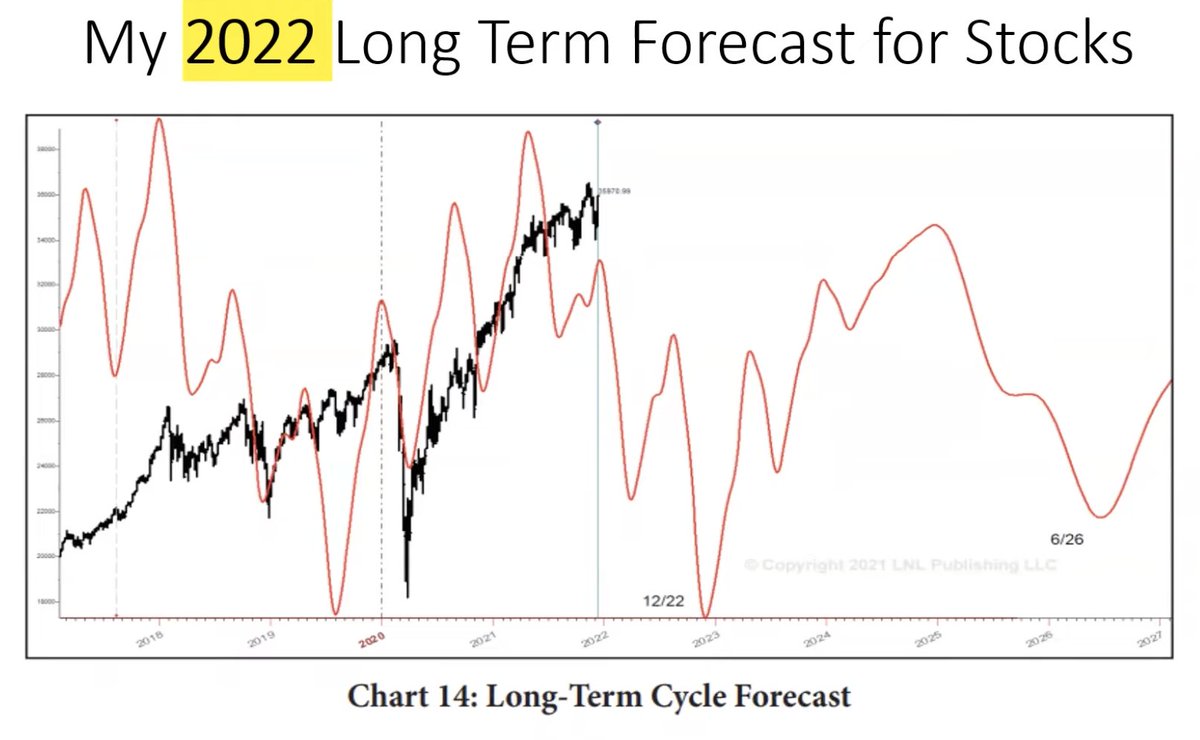

Vic tweeted that "after 5 down days in a row for S&P, it's very bullish. 5 days later only 2 of ten down with high positive expectation especially with bonds up and last one down."

That provoked a quick counting project. The main issue with this analysis is that everything is overlapping, but nonetheless I think it's an interesting result.

The data is SPY adjusted closes from inception thru 6 Sept. I identified all the down days and the streaks of down days, including 1-day "streaks", up to the longest which were 8-day streaks. So each down day fell into a bin, 1 up to 8. Each down day was put in a bin, whether it was the last day in a streak or not. (This eliminates the look-ahead bias of just considering only the final day of streaks.)

Then I calculated the 5-, 10- and 20-day % moves for every day in the data and compared the results for all the down days with the % moves for all days.

The table shows the results, with the best outcomes - streaks of 3, 4, and 5 days - highlighted.

Sep

14

Politics, rackets, markets

September 14, 2024 | Leave a Comment

the more he claims he won, the greater the odds against him. reminds me so much of the refereeing against me in the 1970's. of the 5 national singles i won, my opponent in finals didn't reach double digits. that was the only way for me to overcome bias.

Ed. - Racket Guy from Brooklyn, Sports Illustrated, March 03, 1975:

To the victor—Victor Niederhoffer, that is—belongs another silver pitcher. Last week in New York, at 31, he won the U.S. National Singles Squash Racquets championship for the fifth time. His opponents did little but gasp, sweat and run. But Niederhoffer seemed to play effortlessly. His shots were not always brilliant, but he patiently waited out long rallies, and his frustrated opponents consistently found themselves in situations where most of their moves were of high risk. And then they were forced to make mistakes which ruined them.

reminds me of what my father always said when people told him how good he looked as he was suffering from chemo: "thank you, i'll be the healthiest corpse in the graveyard."

the symmetry of it all. last week 5 down days in a row - from 5659 to to 5515. this week 5 days up in a row from 5421 to 5630.

Sep

13

Politics, money

September 13, 2024 | Leave a Comment

the forces of regulatory capture won the debate handily and that is good for the stock market. more emoluments to business. more centralized control, or as Waltz says, "neighborliness".

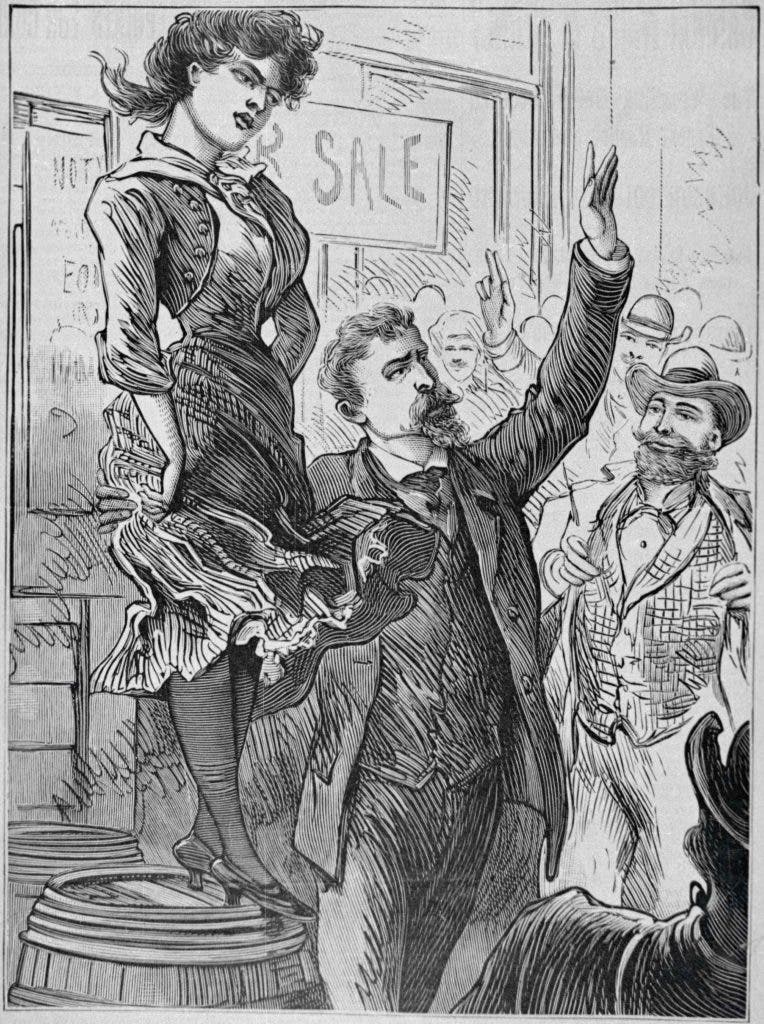

As money mutates into a new form that demands all kinds of markets, new ways of making financial transactions, and new kinds of business.

From: The History of Money, by Jack Weatherford.

From primitive man's cowrie shells to the electronic cash card, from the markets of Timbuktu to the New York Stock Exchange, The History of Money explores how money and the myriad forms of exchange have affected humanity, and how they will continue to shape all aspects of our lives–economic, political, and personal.

Sep

12

From the archives, still fresh: The Math Behind the Music, reviewed by Vic

September 12, 2024 | Leave a Comment

Book Review by Victor Niederhoffer: The Math Behind the Music (25 Sept, 2006)

The Math Behind the Music (Cambridge University Press, 2006) by Leon Harkleroad, will be of interest to musicians, mathematicians and marketicians. In a form that is accessible to every layman, the author describes the elementary mathematical principles behind sounds, instruments, compositions and visual aspects of scores in just 135 pages with a nice section of references and an included CD that covers examples of music that used math. No background is required as even such simple lower-school concepts as the factorial are developed by counting.

The first chapter is about the connections, history, common abstract patterns, and the composers and compositions that used math. The second chapter is about the physical basis of harmony, pitch and timbre that make up music. Considerable attention is paid to the frequency relations of various harmonies, and it's a good refresher for those who don't remember off the top that a fourth comes from any note by raising its frequency by 4/3, a fifth by raising its frequency by 1/2 and an octave by doubling. Sine curves are introduced to encapsulate the frequency patterns of various notes produced at different pitches by different instruments. Overtones are explained simply as the ratios of higher frequencies that a note produces that don't block out the original frequencies and the relation between harmonies and overtones is shown.

The third chapter discusses instrument tuning systems consistent with all the overtones and frequency relations between the notes of a scale.

The fourth chapter is the most interesting in that it shows how themes and melodies can be varied with simple rules such as opposition, inversion, and transposition. The relation between these simple rules and group theory are examined, and various ways of notating and combining the rules are covered.

The fifth chapter is about bell music, which is merely a variation of permutation and combination theory.

The sixth chapter is about randomization in music, with many of the same methods used to construct music as we use for simple simulations in markets.

The seventh chapter is about an attempt by one student to find the common basis, the patterns of harmony that make up the most popular songs. The eighth chapter is about how scores of music can be developed from visual cues, with rules to go from visual to music.

The ninth and final chapter is about failed efforts to combine music and math, with particular reference to George Birkhoff's efforts to develop a complete theory of aesthetics by developing a scale of beauty based on the simplicity-to-complexity ratio of a composition.

I found myself thinking many times of the relations between music and markets as I read the book. The combinations of opposites and inversions (where the intervals above a note and played the same intervals below, and transpositions (where the same theme is repeated a given number of intervals up) happens every day in the markets. The notation that musicians have developed to grapple with these techniques, including the summary of horizontal and vertical movements in visual sightings that the composer Villa-Lobos used to construct symphonies that depict buildings in a city, seems like a very fruitful field to augment technical analysis of markets.

The book is full of anecdotes and charts and methods that will be right on the top of the page for market practitioners, and will spark many a fruitful extension by those who wish to take the pencil to paper, and systematize what they have been doing in markets or charting with the work of some great composers and mathematicians in this related field.

Laurence Glazier offers:

This sounds a fine book. Abstract shapes indeed can be used for thematic material, in my chess days I considered using the outline of pawn structures like black's in the Dragon Variation. My mentor uses the letters in his friends' names. Music is developed by changing patterns in various - ever-changing! - ways, whether transposition, inversion, speed-changing, and I would add to the list in the book the use of rotation, a technique Chris Sansom and I used in the Fractal Music software. All this (except presumably rotation) applies in trading. The issue is whether it is predictive for traders, and that is akin to trying to predict what a Bach would do, the patterns are especially evident once they have happened.

Asindu Drileba adds:

The work of Dmitri Tymoczko might also be interesting for those that want to understand the relationship between randomness and music.

Sep

10

A statistical read relevant to trader research, from Big Al

September 10, 2024 | Leave a Comment

It's a critique of the relatively famous Kahneman et al study on how meal breaks affected sentencing by judges:

Which also led to more background, because I had not heard of "Cohen's d":

Sep

9

Full-time vs. Part-time Employment, from Bill Rafter

September 9, 2024 | Leave a Comment

Bud Conrad comments:

The US BLS understates inflation, which causes the calculation for Real GDP growth to become overstated. Thus, we have a recession going on, but it is hidden by the BLS's low inflation rate. The rich are doing well as asset prices have risen; the rest have lost ground because the cost of everything has increased more than the labor rates.

Ditto on jobs and employment that suggests there are lots of new jobs every month, but then restates the number downward in succeeding months, which accumulated to 818 K jobs that are overcounted in the year ending March.

The supposed Fed's being "data dependent" is a cop-out from thinking "How to stabilize the dollar", meaning that they claim they will use these corrupt numbers for policy decisions.

Sep

7

An excellent book by someone we know

September 7, 2024 | 1 Comment

Buildings Don't Lie: Better Buildings by Understanding Basic Building Science

Hardcover – January 1, 2017

by Henry Gifford (Author)

A simple, clear, thorough, and complete explanation of basic building science applicable to any building in any climate. Over 1,000 large color drawings and photos, plus fun quizzes. No charts, graphs, or math. Read this book and become your own expert on making buildings comfortable, healthy, safe, durable, and very energy efficient, because you will understand the underlying science of the movement through buildings of heat, air, water, light, sound, fire, and pests, and how these can be controlled. This book also includes sections on designing building enclosures, indoor air quality, choosing heating and cooling systems, and how to ventilate, heat, and cool different types of buildings.

Henry Gifford comments:

Yes, I wrote and published that book, now in its fourth printing. Book is divided up into chapters on basic science, nothing about buildings, followed by that science applied to buildings, to learn the science better and to understand buildings better. Could ruin some of your teenage offspring for some college science classes.

Gyve Bones appreciates:

I am grateful and obliged to Henry for his magnificent book. I have long lamented not having an owner's manual for my house and this would seem to fill that need—not only the owner's manual, but the service manual as well, and along the way lessons in physics, fluid dynamics, thermodynamics, natural philosophy, and practical engineering. Very well illustrated and pains-takingly explained. I am enjoying learning so much I took for granted or was ignorant of in the science and technology of creating and maintaining a comfort-able habitable shelter.

Sep

5

A call for an emphasis on predictive distributions, from Victor Niederhoffer and the Spec Trio

September 5, 2024 | 1 Comment

From Ask the Specs, by Victor Niederhoffer, Laurel Kenner, and Dr. Brett Steenbarger (December, 2003):

May I issue a call for an emphasis on predictive distributions rather than descriptive studies? By predictive, I mean, a study that:

• enumerates all observations of what has happened after a defined market event over a specific period of time;

• weighs whether the results indicate a random phenomenon or a tradable anomaly;

• measures the uncertainty associated with the latter conclusion; and

• predicts the probability that an x-percent move will follow the event being studied.

Based on my experience, the biggest mistake a trader can make is to concentrate on “advanced” methods such as Hurst exponents, regression coefficients, Fourier series, chaos, wavelets, fractals, et al. Unfortunately, all of those sophisticated techniques will get you nothing but a barrel of retrospective nothingness.

The key is to find a measure that can be calculated often and independently and then use it to predict. For example, what happens in the next one, five and 10 days after stocks reach a 20-day low? The philosophic memory and longings and expectations of the market are of great interest, but I have found queries as to whether they trend or reverse in accord with Prechter or Fibonacci or Elliott a distraction to the pursuit of profitable trading.

You could put the 100 smartest academics in the world in a room and let them try to predict the market for 100 years, and unless they were steered on a path to make fruitful predictions with readily ascertainable estimates of uncertainty, constantly adjusting for ever-changing cycles, they would achieve below-random results. The numerous professors I have hosted and supported in my office have not disabused me of this assessment.

Sep

4

Richard Hamming: You & Your Research, from Asindu Drileba

September 4, 2024 | Leave a Comment

Richard Hamming, "You and Your Research", June 6, 1995 (44:02)

The Art of Doing Science and Engineering: Learning to Learn was the capstone course by Dr. Richard W. Hamming (1915-1998) for graduate students at the Naval Postgraduate School (NPS) in Monterey California.

This course is intended to instill a "style of thinking" that will enhance one's ability to function as a problem solver of complex technical issues. With respect, students sometimes called the course "Hamming on Hamming" because he relates many research collaborations, discoveries, inventions and achievements of his own. This collection of stories and carefully distilled insights relates how those discoveries came about. Most importantly, these presentations provide objective analysis about the thought processes and reasoning that took place as Dr. Hamming, his associates and other major thinkers, in computer science and electronics, progressed through the grand challenges of science and engineering in the twentieth century.

Sep

3

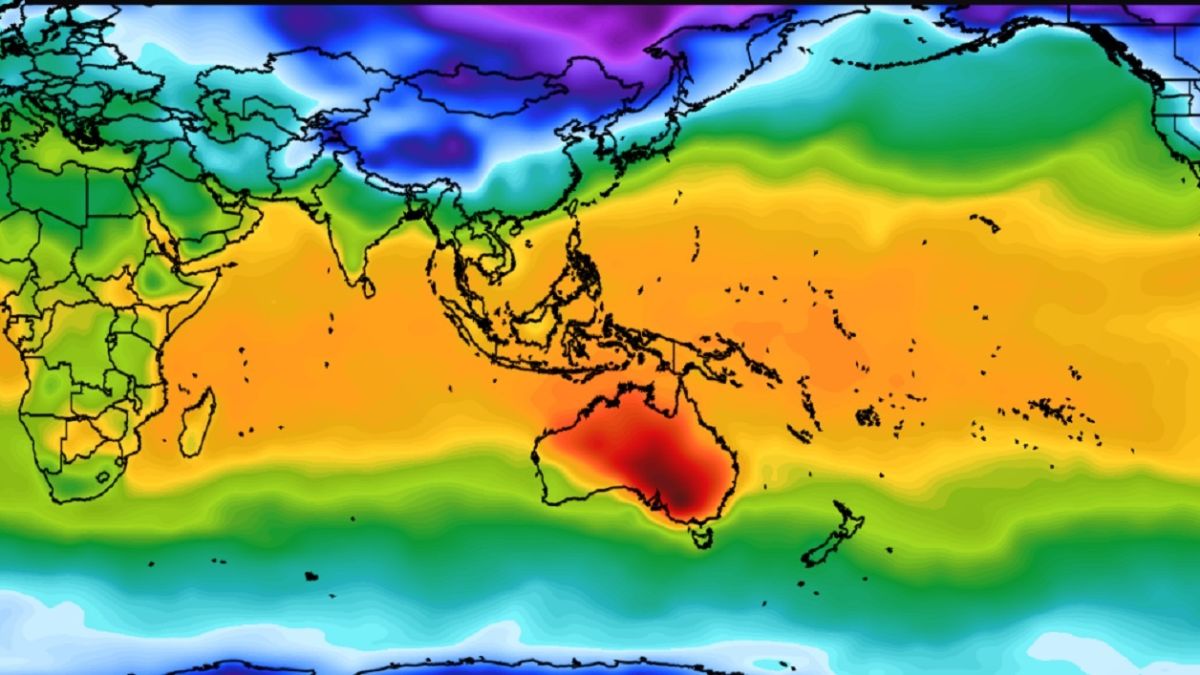

Apparently, it’s not just an American thing - Australia, from Carder Dimitroff

September 3, 2024 | Leave a Comment

Sydney Morning Herald: Three Months to Back Up the Grid as Risk of Summer Blackouts Ramps Up.

Interesting Engineering: Australia Is Generating Too Much Solar Power (12:25).

IMO, expect:

1. volatile wholesale energy prices, including deeply negative prices,

2. forced load shedding and expanding demand-response programs,

3. sudden awareness that infrastructure is needed,

4. growing reliance on natural gas/ LNG, and

5. growing interest in competitive energy contracts

Sep

2

Counting: Seasonality

September 2, 2024 | 1 Comment

A lesson from the archives: Seasonality and changing cycles, by Victor Niederhoffer and Laurel Kenner, (04/26/2004)

A good part of the anomaly literature is devoted to studies of seasonality. A basic problem with these studies is that merely picking a season to study involves making guesses as to when and where the seasonality is. For example, is it in January or December, on Monday or Friday, in the United States or the Ukraine? (Yes, our Google search turned up a study of anomalies in the Ukraine.) Thus, the very choice of a subject might involve random luck.

Another aspect of seasonality studies that must be considered is whether the effects noted are sufficient to cover transaction costs. A retrospective study showing that you can make 2 cents more on Friday trades than Monday trades in your typical $50 stock would not be sufficient in practice to leave anyone but the broker and the market-maker richer.

Thus, it's essential to temper the conclusions of such studies with out-of-sample testing — in other words, with real trading.

[ … ]

Comment by Philip J. McDonnell, a former student of the Chairman at UC Berkeley: Dr. Niederhoffer points out that there is no a priori reason to believe that any one day of the week is stronger than any other. Thus when Y— collected the data (thank you!), presumably the reason was to find out if any days of the week behaved differently. Only after peeking at the data was it possible to say that Monday was the best and Tuesday the worst.

There are 10 such pairwise comparisons:

Mon with other 4 days 4

Tues with 3 last days 3

Wed with Thu & Fri 2

Thu with Fri 1

Total 10

In other words it is also possible that Tuesday could have been the best day and Monday the worst or any other pairwise comparison by chance alone. So when the one best and the one worst day shown by the data are compared and shown to have say a 5% significance we need to remember that we implicitly ruled out the other nine cases which weren't the best or worst. So we need to take our 5% number and multiply by 10 to get the correct significance of 50%. 50% is exactly consistent with randomness.

The problem is multiple comparisons are often subtle and remain unrecognized. Multiple comparisons are insidious because they dramatically reduce the power of the statistical tests we employ.

[ … ]

[More reading: Multiple comparisons problem]

William Huggins offers:

Bonferonni method suggests raising the confidence level proportional to the number of tested hypotheses. To get 95% confidence despite ten tests, he suggests 99.5 as a threshold. It's a huge problem when testing which variables to include in a regression model.

Asindu Drileba writes:

The right way to do this type of thing is to form a specific hypothesis based on a single comparison and then to test it on the data. It is even possible to use data from a prior period to formulate our hypothesis. We then test our hypothesis on the subsequent period which excludes the period where we formed our hypothesis.

This is an approach used in machine learning. Datasets are always split into "training" and "test" datasets. "Training" datasets are exclusively used to build the components of the model. "Test" datasets are not used to build the model at all. They are excluded when building the model. The model built using the "training" dataset is then asked to make predictions on the "test" dataset. The accuracy on predictions made on the "test" datasets is then used to determine how accurate the model is (so it can be tuned for improvement or thrown away).

I found this particular statement from the full post so insightful because I didn't think of applying this approach to building models using other statistical methods (I thought it was something limited to machine learning).

Sep

1

Executive Hobo: The Extraordinary Life of Bo Keeley

September 1, 2024 | 1 Comment

Executive Hobo: The Extraordinary Life of Bo Keeley

Changing Roads Podcast

Travel back in time with us as we sit down with the legendary adventurer, Bo Keeley. From his humble beginnings, to veterinary school, to his rise in fame in sports, to his break from society, trading a normal life for the hobos life, to traveling the world, to his unconventional home in a shipping container in Slab City, California, Bo's life is a testament to relentless exploration and resilience.

With every twist and turn, Bo imparts invaluable lessons on survival, curiosity, and the unyielding human spirit. This episode is a treasure trove of stories from a life lived on the edge, full of profound moments and unforgettable encounters.

Aug

31

Trader longevity

August 31, 2024 | Leave a Comment

Shigeru Fujimoto, age 88:

Video: Why the Japanese Yen Is So Volatile

Bloomberg Originals

Asahi Shimbun: 88-year-old Kobe day trader talks about his life, investing keys

Fujimoto has lived his life by the philosophy that, "You should take a chance, even at the risk of a failure, when something makes you think, ‘This is it’, whatever your age.”

He began operating mah-jongg parlors after he had a flash of inspiration saying, “This is it.” The parlors prospered, and he sold the business for 65 million yen after it had grown large enough to have three outlets.

He capitalized on his nest egg to become a full-time investor in 1986. He rode the tide of Japan’s asset-inflated economic boom of the late 1980s and increased his assets at the time to 1 billion yen.

The economic “bubble,” however, burst. There was nothing he could do as his assets slid to 200 million yen. He suffered an additional blow from the Great Hanshin Earthquake of 1995, which left the entranceway to his apartment crushed.

He fled the strong tremors with only the clothes on his back and walked barefoot on streets that were littered with glass shards. His heart drifted away from investments as he lived the life of an evacuee in an elementary school building.

A turning point came when Fujimoto became acquainted with the world of online stock trading in 2002. Fujimoto, who was 66 at the time, had never even touched a personal computer, but he was undaunted.

His approach has, of course, sometimes led him to make wrong decisions and suffer failures.

“I have stumbled not just seven, but about 50 times,” Fujimoto said in referring to a Japanese idiom that goes, “stumble seven times but recover eight.”

Aug

30

The warrior’s path, and a favorite song

August 30, 2024 | Leave a Comment

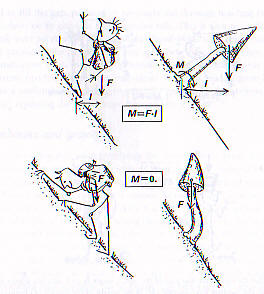

many market lessons The Warrior's Path: Wisdom from Contemporary Martial Arts Masters. concentrate on one move or trade. be humble, et al. start at 5 yrs old. stick to one martial arts. what else?

Karate: The Art of Empty Hand Fighting: The Groundbreaking Work on Karate, by Hidetaka Nishiyama (Author), Richard C. Brown:

The remarkable strength manifested by many individual karate techniques, both offensive and defensive, is not the mysterious, esoteric thing many observers, as well as certain proponents of the art itself, would have you believe. On the contrary, it is the inevitable result of the effective application of certain well-known scientific principles to the movements of the body. Likewise, knowledge of psychological principles, along with constant practice, enable the karate man to find openings and execute the proper techniques at the proper times, no matter how minute the movements of his opponent. At an advanced level, it is even possible for a karate expert to sense the movements of his opponent before they take place.

grandfather Martin's favorite song from the 1930's:

Most Gentlemen Don't Like Love

Aug

29

Speaking of efficient buildings, from Kim Zussman

August 29, 2024 | Leave a Comment

How Big Data Centers Are Slowing the Shift to Clean Energy

In Virginia’s data-center alley, rising power demand means more fossil fuels

An explosion of so-called hyperscale data centers in places such as Northern Virginia has upended plans by electric utilities to cut the use of fossil fuels. In some areas, that means burning coal for longer than planned.

These giant data centers will provide computing power needed for artificial intelligence. They are setting off a four-way battle among electric utilities trying to keep the lights on, tech companies that like to tout their climate credentials, consumers angry at rising electricity prices and regulators overseeing investments in the grid and trying to turn it green.

Ground zero for the fight is Northern Virginia’s “Data Center Alley.” About 70% of global internet traffic passes through the area’s data centers. A spider web of power lines connecting data centers to the grid crisscross neighborhoods and parks. More are coming.

Henry Gifford provides some analysis:

There are about three laws of thermodynamics, the first says that energy cannot be destroyed or created.

I’ve seen photos of data centers that allegedly use huge amounts of electricity. If that is true, all that energy enters the building as electricity and somehow has to leave as heat. I saw one photo of part of a building that looked like it had cooling equipment, but mostly I just see ominous looking buildings – maybe the photos are darkened in photoshop. If the building does not have a huge cooling system, such as a large row of large cooling towers – those machines on the roof that evaporate water, putting off a cloud of visible water droplets – or some other large cooling system - then either they don’t use much energy or the buildings are cooled by politics or magic or etc.

No, they can’t use geothermal cooling systems, those systems that put the heat into the soil under the building, because very soon that soil would heat up, rendering the cooling system inoperable. That works for a single-family house, especially if they take heat back out of the ground to heat the building during the winter, but a large building that dumps heat into the ground all year long? No, it doesn’t work.

Yes, liquid cooling is part of the picture; the liquid takes the heat from the computers, then the liquid gets pumped to something to cool the liquid. Cooling towers are a common way to cool the liquid - this is how office buildings are usually cooled. Geothermal uses the ground as a heat sink to cool the liquid. The heat goes from the computers to the liquid and then to someplace else.

Given the enormous amounts of electricity data centers are typically described as using, the someplace the heat goes cannot be very small - that something must be large.

Aug

28

Phenotypic plasticity and reaction norms

August 28, 2024 | Leave a Comment

often the markets move to a constellation where the expected move is different despite the similarity of the independent variables. Bacon called it ever changing cycles. the silviculturists call it a reaction norm:

A ‘reaction norm’ describes the sensitivity of an organism, or of a set of organisms of the same genotype (e.g., the members of a clone), to some specific environmental variable. It quantifies phenotypic change (or lack of change) in a selected aspect of the phenotype as a function of variation in the environmental factor of interest.

A book of interest on this and other topics:

Geographic Variation in Forest Trees: Genetic Basis and Application of Knowledge in Silviculture

Geographic Variation in Forest Trees is the first book to examine this subject from a world-wide perspective. The author discusses population genetic theory and genetic systems of native North American tree species as they interact with environments in the major climatic regions in the world. He then demonstrates how this knowledge is used to guide seed zoning and seed transfer in silviculture, basing much of his discussion on models developed in Scandinavia and North America. In the final chapter, the author addresses the issue of genetic conservation — a subject of great concern in the face of accelerated forest destruction, industrial pollution, and climatic change. This comprehensive, well-researched book makes a significant contribution to the knowledge of one of our most important renewable natural resources.

More background: Phenotypic plasticity

Aug

27

Another stat book recommendation, from Bill Egan

August 27, 2024 | Leave a Comment

Applied Linear Statistical Models, by J. Neter, M. H. Kutner, C. J. Nachstein, and W. Wasserman, (Times Mirror Higher Education Group, Chicago, 1996), 4th ed.

I have been using and teaching from Neter et al.'s book on regression for 28 years now. Great book. First chapters show you how to do univariate regression via loop/summation indexing on a worked example, then they show you how to do multivariate regression using matrix notation. All the best/hard topics are covered, including multi-collinearity and prediction intervals. You need to understand regression at this level to know when it is working and not working, as well as to code it and interpret outputs from stats programs like JMP. The 2nd half of the book shows you how to do ANOVA in terms of regression.

There is a 5th edition out, and you can download the pdf from various places.

Aug

26

Speaking of regression

August 26, 2024 | Leave a Comment

A Primer on Correlation and Regression, by Victor Niederhoffer

(07-Nov-2006)

Applying Regression and Correlation: A Guide for Students and Researchers, by Jeremy Miles of the RAND Corporation and Mark Shevlin of the University of Ulster, illustrates the proper and pitfall-laden path that leads to the many beautiful and illuminating things that correlation and regression can accomplish. The book is written for psychology students without any training in calculus, and it contains simple examples and extensive commentary on the regression output from standard statistical programs such as SPSS. However, the applications for psychology are almost identical to those that would be used in markets, with such variables as industries substituted for classes and companies for individuals.

And what a wonderful array of applications and extensions this book contains. I found myself augmenting my knowledge or learning something new on almost every page, and I have read many dozens of books on this subject. There are great sections on how to code your data so that you can do categorical regression, categorical covariance, structural equation analysis. There is a very good section on how to go through all the steps of logistic regression with simple examples and calculations to show how the maximum likelihood solution is computed. There is a very fine discussion of the reasons that you should never use stepwise regression and why hierarchical regression is much better. There is a complete chapter on all the computational methods of measuring the individual contributions to the prediction and the influence of each independent variable and each observation in the regression.

One of the main themes of the book that hold everything together is that everything that can be done with the usual analysis of variance techniques can be done with regression, but that regression does so much more. While I had read this before, I had never seen such a clear exposition of how to code the data so that you can actually accomplish the transformation and always come up with the more complete and useful regression solutions to such problems.

Aug

25

Counting and ML, from Paolo Pezzutti

August 25, 2024 | Leave a Comment

What is the role of Machine Learning models and Features selection in this "counting" philosphy? Have all these "new" methodologies overcome and made useless the traditional counting and statistical approach? Or can they coexist, as long as one can find a niche in which to conduct profitable operation?

William Huggins responds:

ML and feature selection run on "traditional statistics", which is basically about comparing empirical data to what randomness around a benchmark should look like. think of them as like hydraulics, which transformed the shovel into the backhoe for large operations but without rendering the "basic version" obsolete.

Big Al links:

In the Google Crash Course in Machine Learning, the first model is Linear Regression.

Aug

24

Counting, cycles, and regime change, from Humbert H.

August 24, 2024 | Leave a Comment

In all these years I could never understand how this [counting] approach can coexist with affirming the reality of the ever-changing cycles. Like how do you know when to trust this counting and when the cycles changed on you?

H. Humbert responds:

My understanding has been that counting is also usually rather simple and apparently (but not) naive statistics. That there's great power in simply comparing counts on a fundamental level. And yes, everything cycles, but cycles have their predictability as well so our data gathering needs to understand this. Am I wrong on this?

Peter Ringel writes:

to have a workflow for out-of-sync systems is a/the king's discipline of trading to me. Monitoring the equity curve in a naive or clever manner is probably always involved. Ever changing cycles / relations is often a function of reflexivity, IMHO. Required minimal sample size is also important here. Because of the drift, one can get away with quite a lot in equities. But laziness it is.

H. Humbert responds:

cycles have their predictability

Seems questionable as it relates to counting.

Peter Ringel replies:

cycles, as in phases/regimes, not as in 7-week cycles. Though the senator showed us many "classic" cycles too.

Larry Williams comments:

Once you count and have the numbers you may find patterns or cycles, etc.

Humbert H. asks:

But we're talking about the "ever-changing" part. How do you know when past information is no longer as predictive as it once was?

Larry Williams responds:

Great question. in my working theory of cycles all data is important for long term. for shorter term 5-10 years… but I am still a student of this stuff.

Aug

24

Meaning of “Counting”, from Asindu Drileba

August 24, 2024 | Leave a Comment

I remember an interview by Vic where he said he did a lot of "counting". Does he mean combinatorics? Or something else. What are some resources where he has talked about this "counting" in more detail?

William Huggins replies:

he literally meant count the data/do the math. at its most basic, statistics is about counting and comparing to the results we would have expected from randomness. too many people form their beliefs because they were told something, or were presented with cherry-picked "supporting" data so the chair's injunction has been to actually check before committing capital.

Zubin Al Genubi adds:

Count the number of: Private Jets, pretty girls, closed businesses, for lease signs, big market drops, increase in vix, number of down days, number of days since last high/low, volume of trades, bids, offers, crashes, all time highs, stocks at new highs/ lows, crosses of round numbers, cigarette butt length, change in price, etc etc.

Test: is number above or below mean/ median? How many standard deviations away from mean? What happened after the time of count?

Penny Brown adds more:

I'll add to the list: the price of thoroughbred horses sold at auction and the length of women's dresses. (long hem below knee is bearish as was style in 70s, short hem in mini skirts is bullish)

Asindu Drileba responds:

Thank you. "Test Everything" is definitely something that keeps coming up whenever I listen to the chair.

Humbert H. asks:

In all these years I could never understand how this approach can coexist with affirming the reality of the ever-changing cycles. Like how do you know when to trust this counting and when the cycles changed on you?

Laurence Glazier offers:

Music is the pleasure the human mind experiences from counting without being aware that it is counting.

- Gottfried Leibniz

Aug

23

Counting is one thing, statistics is another, from Carder Dimitroff

August 23, 2024 | Leave a Comment

Today, the U.S. Energy Information Administration (EIA) is counting how many power plants were added in the first half of 2024 and projecting how many will be added in the last half.

It's all wonderful news. About 20.2 GW (the equivalent of about 18 nuclear power plants) were added. By the end of the year, EIA expects about 62 GW of new capacity. About 95 percent of these additions are intermittent sources (wind, solar, batteries).

Offsetting this new capacity are retirements. Utilities plan to retire 7.6 GW, all of which use coal, natural gas, and petroleum as fuel. They are likely being retired because they are uneconomic and rarely dispatched. Their levelized costs exceed revenues, and investors want to tidy up their books.

Statistics unearth a problem that counting hides. The problem is not on the supply side; it's on the demand side. Specifically, counting 24/7 demand reveals tremendous growth (e.g., baseload). It appears there's a hidden mismatch between supply and demand. While there will be hours on most days when the grid is flooded with cheap power, there will also be hours on other days when there will not be enough supply to serve all loads.

Retail prices will jump. In fact, they already have. PJM is the Regional Transmission Organization (RTO) that manages bulk power markets for the mid-Atlantic region. It's one of the largest of the nation's ten RTOs. In addition to transmission line responsibilities, PJM manages energy and capacity auctions for power plant production.

PJM conducts an auction for capacity each year. Power plant asset owners may enter the auction and offer their prices. Owners are paid a daily rate for each megawatt if their bids clear. Auction results:

2024/2025

$28.92 / MW-day

2025/2026

$269.92 / MW-day

Next year, a 1,000 MW power plant can earn $269,920 daily compared to $28,920 this year. These payments are in addition to any revenues earned from energy auctions.

While these auctions seem arcane to the average consumer, they will feel it in their pocketbooks—and not just in one part of the country—it's everywhere. All these costs will flow to the consumer, who will have only the choice of paying or reducing consumption.

Two options may become quickly viable. One is to build gas turbines as fast as possible. To attract investors, capacity payments have to be attractive. But starting new projects today may be too late.

The other option is "demand-response," where consumers are enticed to reduce demand for a price. Demand response is in place today but has yet to be aggressively implemented. It appears grid operators like PJM (not the government) will be forced to become aggressive and offer lucrative demand-response programs.

Lastly, those who invest in "behind-the-meter" assets like their own renewable energy sources, including geothermal, will avoid some of these accelerating costs. Those who have already invested will likely experience returns higher than expected.

The roots of this problem germinated decades ago. That is its own story for another time.

Kim Zussman wonders:

XLU?

Big Al observes:

XLU up 25% from Feb low.

Jeffrey Hirsch was there before us:

Our recommendation at the outset of XLU/Utes seasonal bullish March-Oct period.

Humbert H. writes:

Nuclear is clearly the real solution as the current generation of nuclear reactors are pretty much (we hope) not vulnerable to meltdowns. But as the situation stands, battery technology is likely to receive an ever-increasing amount of investment, and also reused old EV batteries will be more and more prevalent as storage banks for solar and wind. Intermittent sources = more and more need for battery capacity.

William Huggins offers:

one possible solution to transmission problems is to use rail-bound batteries.

Aug

22

Talks on financial history, from William Huggins

August 22, 2024 | Leave a Comment

A great thanks to Henry for sharing his book Buildings Don't Lie. As a prospective homeowner, I plan to devour it upon arrival.

I don't have a proper book to share but I did author a course on financial history that I teach. To help my students, I recorded all the one-directional talks as short videos. Rather than proceeding chronologically overall, I broke things down into 11 topics (plus an intro) and did those chronologically: payments, debt, banking, central banking, companies, stock markets, derivatives, insurance, trusts and funds, pensions, government finances.

Aug

21

Creative destruction, primordial edition, from Kim Zussman

August 21, 2024 | Leave a Comment

Financial Statement Analysis with Large Language Models

Chicago Booth Research Paper

Fama-Miller Working Paper

54 Pages Posted: 21 May 2024

Alex Kim, Maximilian Muhn, Valeri V. Nikolaev

University of Chicago Booth School of Business

We investigate whether an LLM can successfully perform financial statement analysis in a way similar to a professional human analyst. We provide standardized and anonymous financial statements to GPT4 and instruct the model to analyze them to determine the direction of future earnings. Even without any narrative or industry-specific information, the LLM outperforms financial analysts in its ability to predict earnings changes. The LLM exhibits a relative advantage over human analysts in situations when the analysts tend to struggle. Furthermore, we find that the prediction accuracy of the LLM is on par with the performance of a narrowly trained state-of-the-art ML model. LLM prediction does not stem from its training memory. Instead, we find that the LLM generates useful narrative insights about a company's future performance. Lastly, our trading strategies based on GPT's predictions yield a higher Sharpe ratio and alphas than strategies based on other models. Taken together, our results suggest that LLMs may take a central role in decision-making.

Aug

18

A Spec recalls fondly

August 18, 2024 | Leave a Comment

Back in the day, Chair treated spec-listers to a night of classical music at Lincoln center, then dinner at Picholine. It was an unsurpassed evening, especially in generosity. The last course was a cheese course, and the restaurant's cheese sommelier - Max McCalman - made a short presentation about the wonderful cheeses being served.

This was Mrs and my introduction to fine/delicious cheeses, which we enjoy to this day. Max showed us his book The Cheese Plate, and immediately Chair offered free copies to all the ladies in the room and asked Max to autograph them. The Cheese Plate remains a valued book in our collection.

Here is Max and an aficionado.

Alex Castaldo adds:

Yes, I remember that dinner well! Vic took guests to the best restaurants of New York in the early 2000s (Boulud, Le Bernardin, Picholine, Four Seasons, etc.). Those were great occasions, that I will always remember. Met some knowledgeable people, including Henry Gifford, on some of those occasions. Unfortunately I also remember that I never adequately thanked Victor for his generosity. Which I regret.

Aug

17

Index of stocks nixed from indexes, from Kim Zussman

August 17, 2024 | Leave a Comment

Wall Street’s Trash Contains Buried Treasure

Investors buying index-fund castoffs could have made 74 times their money since 1991

Rebound relationships are best avoided, but maybe not in the stock market.

In a paper that starts out by stating that “no one enjoys getting dumped,” two investing quants reveal some surprising, and potentially lucrative, traits of companies that have really let themselves go. With about half of the money invested in American stocks now sitting in index funds, and many active managers holding portfolios that resemble them — just try beating the market these days without “Magnificent 7” stocks such as Nvidia or Microsoft — index castoffs have a hard time meeting someone new.

That is when investors should pounce, says Rob Arnott, chairman of advisory firm Research Affiliates, with colleague Forrest Henslee. This week they are unveiling a stock index named NIXT that would have earned investors about 74 times their money since 1991 by buying stocks kicked out of indexes.

Big Al links:

The Disappearing Index Effect

Robin Greenwood & Marco Sammon, Harvard Business School

Revised, November 2023

The abnormal return associated with a stock being added to the S&P 500 has fallen from an average of 7.4% in the 1990s to 0.3% over the past decade. This has occurred despite a significant increase in the share of stock market assets linked to the index. A similar pattern has occurred for index deletions, with large negative abnormal returns during the 1990s, but only 0.1% between 2010 and 2020. We investigate the drivers of this surprising phenomenon and discuss implications for market efficiency. Finally, we document a similar decline in the index effect among other families of indices.

Aug

16

Smart guy talks about AI, from Big Al

August 16, 2024 | Leave a Comment

The Potential for AI in Science and Mathematics - Terence Tao

Terry Tao is one of the world's leading mathematicians and winner of many awards including the Fields Medal. He is Professor of Mathematics at the University of California, Los Angeles (UCLA). Following his talk, Terry is in conversation with fellow mathematician Po-Shen Loh.

Po-Shen Loh is an American mathematician specializing in combinatorics. Loh teaches at Carnegie Mellon University, and formerly served as the national coach of the United States' International Mathematical Olympiad team. He is the founder of educational websites Expii and Live, and lead developer of contact-tracing app NOVID.

Aug

14

Observations

August 14, 2024 | Leave a Comment

one listens to the radio broadcast of the yankees game. about 60% of time is devoted to advertisement. about 95% of these ads are dei. why?

amazing jump for regulatory capture of 35 percentage in just 3 weeks.

Aug

13

Diffusion of Innovations

August 13, 2024 | Leave a Comment

diffusion of information has been applied to everything (soon AI ) but not to change in relations of markets. a good book.

Diffusion of Innovations, 5th Edition Paperback – Illustrated, August 16, 2003, by Everett M. Rogers

In this renowned book, Everett M. Rogers, professor and chair of the Department of Communication & Journalism at the University of New Mexico, explains how new ideas spread via communication channels over time. Such innovations are initially perceived as uncertain and even risky. To overcome this uncertainty, most people seek out others like themselves who have already adopted the new idea. Thus the diffusion process consists of a few individuals who first adopt an innovation, then spread the word among their circle of acquaintances—a process which typically takes months or years. But there are exceptions: use of the Internet in the 1990s, for example, may have spread more rapidly than any other innovation in the history of humankind. Furthermore, the Internet is changing the very nature of diffusion by decreasing the importance of physical distance between people. The fifth edition addresses the spread of the Internet, and how it has transformed the way human beings communicate and adopt new ideas.

Aug

12

Texas Data Centers, from Carder Dimitroff

August 12, 2024 | Leave a Comment

This is not going to end well:

59 GW in data center load seeking to connect to Oncor’s system: CEO

Nearly three-fourths of new interconnection requests are coming from data centers, Oncor officials said.

FWIW:

59 GW ˜ 50 nuclear power plants.

80 GW ˜ 65 nuclear power plants.

1 new nuclear plant - about 15 years to build one.

Conclusion:

If these loads connect to the grid as planned, expect sizeable investments in natural gas and combined-cycle gas turbines. Turbines may share the same real estate as data centers and avoid utility costs.

I expect to see development near the Texas Waha hub (Waha prices tend to be lower than Henry Hub), or if not on or near Waha, on a pipeline connected to Waha.

CCGT strategies may work in the short term. However, history suggests they could be financially problematic for turbine owners in the long term.

Humbert H. writes:

Next gen data centers are expected to have about 18% lower in overall energy consumption. Next gen would mean it is likely happening in a couple of years. It doesn't quite move the needle in the percentage sense. But every bit helps. Let me quote what Wayne Gretzky once said, "Focus on where the puck will be at, not where the puck is at."

Aug

11

From the archives: Vic reviews Trees: Their Natural History, by Peter Thomas

August 11, 2024 | Leave a Comment

22-Aug-2006

Almost every page of the book Trees: Their Natural History teaches one new things about the workings and adaptations of trees, and I find these lessons of great value in improving my understanding of the markets.

The chapter on the shape of trees starts with the idea that one of the objectives of a tree is to raise its leaves above a competitor's, so that it can get the greatest possible share of light. It makes its shape based on a compromise between this and its other needs; its ability to pollinate and disperse its seeds, how much trunk it needs to support itself against wind, snow, and moisture, the conditions of the soil, the threat of fire and insect pests. All of the compromises vary with age.

One thing learned is that trees found at a high latitude and altitude are cone shaped with short downward sloping branches, and that the broad crowns of most hardwoods are associated with moist sites, deep shade, or harsh tree line conditions. In Britain there is a moist environment so most of the trees take on spherical shape.

Pines further south develop a flat topped umbrella shape which helps resist drying winds and maximizes convective heat loss by allowing free passage through the canopy.

The tree is an expert in shifting its center of gravity so as to minimize stress on any part of its structure. The principle it uses is to minimize lever arms. This means making the weight that any branch carries away from a fulcrum as small as possible, reducing the possibility of breakage. This principle keeps the horizontal length of a branch as small as possible, always subject to the compromise that the further a branch is extended outwards, often the more light it can get.

What the tree does is to bend its branches upright, so that the lever arms are not pulling the tree sideway. This applies not only to branches, but to the leaning of trees towards the sun. A beautiful set of diagrams illustrate the similarity of the adaptations that the tree makes to maintain a center of gravity to the adaptations a human makes to maintain their center of gravity. Trees use their terminal buds to build modules that change their shape, while humans use the brain to decide to change our center of gravity, for example when we bend forward whilst we are climbing up a hill.

Sample market hypotheses generated by this way of thinking are: The horizontal moves of markets would seem to be the reversals that they take from a given center of gravity. The more that they reverse to one side from a central point, perhaps a round number, the more likely that structures and activity will grow on the other side to minimize the stress. Eventually, conditions of light (competition) cause the market or a stock to move.

Alternatively, the greater the rate of ascent or descent, the more likely a market or stock is to show movement in a opposite direction to bring its center of gravity to a more stable level.

J.T. Holley responds:

Something that I have dealt with recently is the feeding of dying trees to resuscitate or bring them back to life. 'Spiking' trees with silly fertilizer spikes works well with the smaller trees, but you need bigger guns when you have the limbs leaning downward towards the ground. In parks and high traffic areas this is a huge hazard, the tree will seem to shed the limb to relieve the stress that Vic has mentioned above.

The only thing I learned regarding saving a tree is to take an auger, pipe, or some large metal rod and drive it into the ground. Rotate this until you have a two to three foot deep hole and pull it out. Fill this two thirds full of 10-10-10 and cover the rest with dirt and put your grass back over. These holes must be done around the 'drip zone' coming off the base of the trunk just inside the 'splash zone' from the outermost limbs.

I too believe, and should test, that the markets use these round numbers or spots to relieve their stress. These spots of light and competition allow it to be able to gain strength in times of weakness (sell off) to gain the nutrients to move higher and become stronger than before! Its like testing and finding Trend followers spots where they utilize "reversing stops" with their "fixed system". The Drip Zone is where the fertilizer is planted to pick 'em off and gain the edge.

Aug

10

Grip strength, chair rise-time, one-legged balance predict life expectancy, Kim Zussman

August 10, 2024 | Leave a Comment

Physical capability in mid-life and survival over 13 years of follow-up: British birth cohort study

Grip strength was measured isometrically with an electronic handgrip dynamometer. The dynamometers were calibrated at the start of testing by using a back-loading rig and are accurate, linear, and stable to within 0.5 kg. The retest variability within individual participants for maximal voluntary tests of strength in those unused to such measurements is about 9%. Two values were recorded for each hand and the highest used in analyses. Chair rise time was measured with a stopwatch as the time taken to rise from a sitting to a standing position with straight back and legs and then to sit down again 10 complete times as fast as possible. For high scores to indicate good performance, we calculated chair rise speed by dividing the number of rises (that is, 10) by the time taken to complete 10 rises (in minutes). Standing balance time was measured, using a stopwatch, as the longest time, up to a maximum of 30 seconds, participants could maintain a one-legged stance in a standard position with their eyes closed.

Big Al lists:

I've been doing balance exercises with a stopwatch, but mostly eyes-open. With eyes closed, I've only gotten up to 12 seconds.

Humbert H. comments:

It seems the article deliberately stayed away from remedies. It noted that certain things (most of which I have seen before in similar contexts, so this isn't entirely new) are associated with increased mortality. Exercise is universally recognized as positive, but there wasn't even a hint that doing anything specific about any of the indicators reduces mortality. Causation and what to do about any of these need a lot more research, it seems.

Big Al responds:

Yes. Causation arrow pointing one way: Eyes-closed balance measures some more complex internal state of health that predicts longevity. Flip the arrow: I practice balance exercises to improve my balance and thus reduce the chance of falling which is a major cause of hospitalization and death in older cohorts.

Humbert H. agrees:

Excellent point, that can be generalized as follows: when you don't understand the root cause of the problem, limiting its negative effects is always the right strategy.

James Goldcamp writes:

The eyes closed one leg stand is exceptionally hard.

I used to measure grip strength and own a hand dynameter. I found grip strength could vary/range as much 145 lbs to 177 lbs in the same month based on rest and recovery state.

Since these are all basically a function of power and strength (standing up and rate), and neurological efficiency (grip/ balance) unilateral leg strengthening (e.g. pistols to a chair of suitable height) and carrying objects (walk around room it yard with a dumbbell or kettlebell within ones level of strength) would be the obvious activities. Another challenge as we age is doing any resistance activity for power (vs strength)since the obvious choices carry injury risk (sprinting, box jumping, Olympic lifts, med ball throwing).

However, I believe its less a matter of training to these qualities than these measurements select for people who have maintained power/strength generally (strength trumps muscle for longevity though they obviously overlap).and are thus less susceptible to falls and things like hip fractures that cascade people downwards. It would be interesting to know how much of the longevity is predicated on fall reduction and or recovery after.

Aug

9

To be silent the whole day long, see no newspaper, hear no radio, listen to no gossip, be thoroughly and completely lazy, thoroughly and completely indifferent to the fate of the world is the finest medicine a man can give himself.

- Henry Miller

Nils Poertner responds:

Excellent. Media is like Queen Mab and we are Merlin - and Merlin had to learn to not care too much about Queen Mab…

Aug

8

More on life advice, from James Goldcamp

August 8, 2024 | Leave a Comment

I'd add that, in business and socially, don't "hang around" too long past appropriate. If you get the response you are seeking in a meeting, proposal, or discussion be courteous and respectful and get out of there. This is where Costanza had it right (his practice of leaving a meeting on a high note after a good joke). I found this to be a commercially, socially, and romantically valid concept.

Nils Poertner offers:

some may like the list that Gurdjieff gave to his daughter. (a number of overlaps)

Sushil Rungta writes:

I am quite mortified as I post this message but in the spirit of camaraderie posting it even though, in doing so, I am indulging in a little self promotion (totally unintended). I frequently write to my children sharing my experiences and what life has taught me. A very few of these I also publish on LinkedIn and Medium.com. Providing a link to two of these letters:

Hope you like them and please do excuse me for this immodesty.

Aug

7

To Aubrey on Leaving for College, from Laurel Kenner

August 7, 2024 | Leave a Comment

Essentials

See what you look at. Listen to what you hear. Feel what you feel.

Finding a way to use heart, hand, and mind together leads to joy.

Treat yourself as you would a dear friend.

Don’t lie. Lying tangles up your heart and mind. Lies require more lies, sapping energy.

Much of what is considered normal is wrong or worse.

Turn away from cynicism, intoxication, and callousness.

Read Xenophon’s account of Cyrus to learn about leadership. Read Seneca and Publius to learn how to retain your composure and virtue through Fortune’s ups and downs.

Be trustworthy.

Keep a good reputation.

Don’t talk trash about others behind their backs. That sort of talk has a way of flying like a bird back to the target and can turn people into enemies. Talking trash also makes your companions wonder what you say about them when they’re not around.

Genial curiosity can sometimes defuse bad situations.

Bad behavior is often about them, not you.

Deportment

Good manners reveal strength.

Respecting others as human beings is the essence of good manners. You don’t have to overthink it; good manners are often about little things, such as:

Get to appointments early.

Open doors for people with crutches and watch out for their feet.

Open doors for women and mothers with baby carriages.

If a woman joins you at a table where no seat is empty, give her yours. Pull the seat out for her and help her settle in.

Do not swear. It makes you seem churlish.

Don’t comment on the appearance of others. The exceptions: Tell your wife she looks lovely and tell a friend if his fly is open.

Do not make fun of what another person eats, drinks, or thinks.

Invest in comfortable, well-made clothes. Cheap clothes waste money because they don’t last, and they make people wonder if you will be as careless with them as you are with your own appearance.

Women

As you know, one of your most important roles is to protect women.

Women are vulnerable to falling in love too quickly, because they instinctively want a family. That's true of all women.

Sexually liberated women do not exist. Recognize that women who think they can act like men are prey in a harmful culture. You must protect them.

At Home

Wash sheets and pillowcases weekly.

Light and fresh air are healthy. Keep the windows in your room open if possible.

Follow the one-touch rule: Put things in their places. Put dirty clothes in the hamper. Put dishes in the dishwasher. Throw out papers you don’t need.

An orderly house helps keep life happy and productive.

Gratitude

Gratitude creates happiness. Write down five things you’re grateful for in a notebook every day.

Adulthood

What does it mean to become an adult? In a word: responsibility. Paying rent. Creating and protecting your family. Planning ahead. Making a career. Fulfilling your obligations. Making money. Contributing to freedom, community, earth.

On a higher level, adulthood is the ability to consider two opposing concepts. Adults can deal with ambiguity and subtlety.

Many wise sayings have converses that are equally wise and true. For example, perseverance and endurance are virtues; but the adage “survival is mobility” saved many Jews from the Nazi death camps.

In our modern world, “survival is adaptability” may be more apt. You must become adaptable without losing your soul.

Farewell

With all my love, I send you out into the world, an eagle destined to soar among mountain peaks. Be strong. Don’t forget to call.

-Mom

Vic adds:

beautiful advice - reach out to learn new things and be good to friends. don't be too trusting.

Sushil Rungta writes:

Wonderful lessons. While I loved all, the lessons on respecting others resonate with me the most. How often we behave callously towards others! Sometimes, unintentionally. Here, practicing mindfulness really helps.

Aug

6

List for a well-lived life, from Jeff Watson

August 6, 2024 | Leave a Comment

Since I have become my grandson’s teacher (and playmate), I’ve been compiling advice lists. Wish someone had shared this with me.

1. Don’t call someone more than twice continuously. If they don’t pick up your call, presume they have something important to attend to.

2. Return money that you have borrowed even before the person who loaned it to you remembers or asks for it. It shows your integrity and character. The same goes for umbrellas, pens, and lunch boxes.

3. Never order the expensive dish on the menu when someone is treating you to lunch or dinner.

4. Don’t ask awkward questions like ‘Oh, so you aren’t married yet?’ Or ‘Don’t you have kids?’ Or ‘Why haven't you bought a house?’ Or ‘Why haven't you bought a car?’ For God’s sake, it isn’t your problem.

5. Always open the door for the person coming behind you. It doesn’t matter if it is a guy or a girl, senior or junior. You don’t grow small by treating someone well in public.

6. If you take a taxi with a friend and he/she pays now, try paying next time.

7. Respect different shades of opinions. Remember, what may seem like 6 to you might appear as 9 to someone else. Besides, a second opinion is good for an alternative.

8. Never interrupt people while they are talking. Allow them to pour it out. As they say, hear them all and filter them all.

9. If you tease someone, and they don’t seem to enjoy it, stop it and never do it again. It encourages one to do more and shows how appreciative you are.

10. Say “thank you” when someone is helping you.

11. Praise publicly. Criticize privately.

12. There’s almost never a reason to comment on someone’s weight. Just say, “You look fantastic.” If they want to talk about losing weight, they will.

13. When someone shows you a photo on their phone, don’t swipe left or right. You never know what’s next.

14. If a colleague tells you they have a doctor's appointment, don’t ask what it’s for. Just say, "I hope you’re okay." Don’t put them in the uncomfortable position of having to tell you their personal illness. If they want you to know, they'll do so without your inquisitiveness.

15. Treat the cleaner with the same respect as the CEO. Nobody is impressed by how rudely you treat someone below you, but people will notice if you treat them with respect.

16. If a person is speaking directly to you, staring at your phone is rude.

17. Never give advice until you’re asked.

18. When meeting someone after a long time, unless they want to talk about it, don’t ask them their age or salary.

19. Mind your business unless anything involves you directly - just stay out of it.

20. Remove your sunglasses if you are talking to anyone in the street. It is a sign of respect. Moreover, eye contact is as important as your speech.

21. Never talk about your riches in the midst of the poor. Similarly, don't talk about your children in the midst of the barren.

22. After reading a good message, consider saying, "Thanks for the message."

APPRECIATION remains the easiest way of getting what you don't have.

Aug

5

How bacteria use the Kelly criterion, from Asindu Drileba

August 5, 2024 | Leave a Comment

From Cellular bet-hedging:

Today, we seek to gain some insight into how bacteria bet hedge. We will imagine that we are designing the stress response system for a custom, designer super-bacterium. Our goal is to maximize its survival and proliferation. To help it out, we provide it with an array of sensors, information processing circuits, and responses—exactly the sorts of circuits we have been studying.

A poor little bacterium doesn’t stand a chance of accurately predicting future temperature, salt, toxins, antibiotics, and attacking immune cells all by itself. Instead, it uses a form of biological bet hedging, in which the shared genome of a clonal cell population effectively spreads its bets, in the form of individual cells, across multiple physiological states, each adapted to a different possible future.

It is part of a larger course called Biological Circuit Design. I really don't like reading maths as I don't understand most of it. But fortunately, this course also has Python implementations for a lot of the concepts they outline.

Big Al adds:

You might also call this a good example of portfolio diversification.

The portfolio concept in ecology and evolution

Biological systems have similarities to efficient financial portfolios; the emergent properties of aggregate systems are often less volatile than their components. These portfolio effects derive from statistical averaging across the dynamics of system components, which often correlate weakly or negatively with each other through time and space. The “portfolio” concept when applied to ecological research provides important insights into how ecosystems are organized, how species interact, and how evolutionary strategies develop. It also helps identify appropriate scales for developing robust management and conservation schemes, and offers an approach that does not rely on prescriptive predictions about threats in an uncertain future. Rather, it presents a framework for managing risk from inevitable perturbations, many of which we will not be able to understand or anticipate.

Aug

4

Book Review from Victor Niederhoffer: 'An Illustrated Guide to Theoretical Ecology'

(02 October, 2006)

Every now and then one comes across a book that completely clarifies what every educated person should know about a subject that is essential to understand as we go about the humdrum business of life and trading. Such a book is An Illustrated Guide to Theoretical Ecology, by Ted J. Case. I cannot recommend this book too highly, as it provides a foundation for thinking about competition, mutualism, growth, resource depletion, diffusion, population density, predation, life cycles and space. The book introduces the basic principles behind each of these subjects with simple algebraic equations and illustrative charts that describe various plausible relations. It then follows through with analytic solutions to develop a deep understanding.

Aug

3

European vs American Power Markets, LNG, and Natural Gas, from Carder Dimitroff

August 3, 2024 | Leave a Comment

Europe (decreasing use of natural gas)

It appears Europe needs less natural gas and will import lower volumes of LNG. As a whole, their gas-fired and thermal power plants are experiencing lower capacity factors. Several factors contribute to the decline.

One factor is the French nuclear power plant fleet, which has been experiencing higher capacity factors and lower production costs. Another is the EU's wind, solar, and energy storage assets, which have low production costs. Other factors include the EU's weaker economy and milder winters.

- Gavin Maguire, Reuters, 6 February 2024

- Sarah Brown, Dave Jones, EMBER, 7 February 2024

- Seb Kennedy, EnergyFlux.News, 1 August 2024

- European Network of Transmission System Operators for Electricity (ENTSO-E)

United States (increasing use of natural gas)

U.S. power plant operators generated 6.9 million MWh of electricity from natural gas on a daily basis in the lower 48 states on July 9, 2024, the U.S. Energy Energy Information Administration (EIA) said, which is “probably” the most in history, and definitely the most since at least January 1, 2019, when the EIA began to collect hourly data about natural gas generation.

The spike in natural gas-fired generation on July 9 was because of both high temperatures across most of the country and a steep drop in wind generation. According to the National Weather Service, most of the U.S. experienced temperatures well above average on July 9, 2024., with particularly high temperatures on the West Coast and East Coast.

- Sean Wolfe, Power Engineering, 25 July 2024

With July heatwaves, US ‘probably’ saw highest natural gas generation in history, EIA says

Differences

Several factors may explain why the United States is consuming more natural gas than Europe. One factor is price. Wholesale natural gas prices in the United States are much lower than in Europe.

Air conditioning is an important factor. Air conditioning is widespread in the United States but not so much in Europe. Air conditioners consume large amounts of electric power, and they are the key asset targeted by utility demand-response programs.

A related factor is that the United States has two energy-consuming peaks (summer and winter), while Europe's major peak is in the winter. With lower bulk pricing for natural gas, bulk power prices are also low, and incentives to conserve energy are muted.

Finally, the United States economy is outperforming Europe.

There's India:

- John Kemp (Reuters), India electricity generation - Selected indicators, 31 July 2024

Aug

2

Incentives

August 2, 2024 | Leave a Comment

the CEA test has a positive predictivity of 80% for colon cancer. most studies show it doesn't have a cost effectiveness. How accurate is a CEA blood test?

Doctors don't use the CEA test to make a first-time diagnosis of cancer. This test isn't an accurate way to screen for it because many other diseases can cause the levels of this protein to rise. And some people with cancer don't have high CEA levels.

but but but… the studies don't take account of the incentives and the next steps taken / it has positive predictivity of 80%. who wouldn't take the next step after a positive (CEA above 3.5)? I am not an MD. none of my kids and good friends who are MD's recommend it.

Aug

1

AI wins silver, from Kim Zussman

August 1, 2024 | Leave a Comment

Google DeepMind’s new AI systems can now solve complex math problems

AlphaProof and AlphaGeometry 2 are steps toward building systems that can reason, which could unlock exciting new capabilities.

Google DeepMind says it has trained two specialized AI systems to solve complex math problems involving advanced reasoning. The systems—called AlphaProof and AlphaGeometry 2—worked together to successfully solve four out of six problems from this year’s International Mathematical Olympiad (IMO), a prestigious competition for high school students. They won the equivalent of a silver medal.

To test the systems’ capabilities, Google DeepMind researchers tasked them with solving the six problems given to humans competing in this year’s IMO and proving that the answers were correct. AlphaProof solved two algebra problems and one number theory problem, one of which was the competition’s hardest. AlphaGeometry 2 successfully solved a geometry question, but two questions on combinatorics (an area of math focused on counting and arranging objects) were left unsolved.

Download the 2024 International Mathematical Olympiad problems

Jul

31

A comparison

July 31, 2024 | Leave a Comment

Deep Enough, a beautiful heroic book about the same subject as a hateful book, Angle of Repose. one won the Pulitzer Prize, the other is hardly known but highly recommended by me.

Jul

30

Intermittent fasting and your noodle, from Kim Zussman

July 30, 2024 | 1 Comment

Two Diets Linked to Improved Cognition, Slowed Brain Aging

An intermittent fasting (IF) diet and a standard healthy living (HL) diet focused on healthy foods both lead to weight loss, reduced insulin resistance (IR), and slowed brain aging in older overweight adults with IR, new research showed. However, neither diet has an effect on Alzheimer's disease (AD) biomarkers.

Although investigators found both diets were beneficial, some outcomes were more robust with the IF diet.

Larry Williams adds:

A “dry” fast loses weight more than wet fast.

Big Al writes:

Sergei's AI says:

The main difference between dry fasting and wet fasting, also known as water fasting, is whether you consume liquids:

Dry fasting: Restricts both food and liquids, including water, broth, and tea. It can be done as part of intermittent fasting, which cycles between eating and fasting. For example, you might restrict food for 16 hours and eat during an 8-hour window. Wet fasting: Allows you to drink water, and sometimes certain teas.

Dry fasting can be dangerous, especially for long periods of time. Some potential side effects include: Dehydration, Nutrient deficiencies, Urinary problems, Kidney issues, Heat injury, and Swollen or ruptured cells.

Jul

29

Federer…on trading?

July 29, 2024 | Leave a Comment

In the 1,526 singles matches I played in my career, I won almost 80% of those matches. What percentage of the POINTS do you think I won in those matches? Only 54%.

When you’re playing a point, it is the most important thing in the world. But when it’s behind you, it’s behind you. This mindset is really crucial, because it frees you to fully commit to the next point… and the next one after that… with intensity, clarity and focus.

The truth is, whatever game you play in life… sometimes you’re going to lose. A point, a match, a season, a job… it’s a roller coaster, with many ups and downs.

[ H/t to Ritholtz ]

Jul

28

Inflection points, from Zubin Al Genubi

July 28, 2024 | Leave a Comment

Inflection points at prior highs and lows seem pretty obvious recently especially in lowered liquidity. The market makers seem to thin and spread their markets for protection resulting in bigger directional moves. The vol gives a small trader good opportunity as the big boys dump large orders creating large auto trade moves like escalators.

Anatoly Veltman wants more information:

every word I read on three lines of text appears totally (?) random. It would be extremely impressive, if you ventured to explain at least ONE of these, and how this could be used as edge. P.S. Bonus would be to know the approximate date (?) of "lowered liquidity"

William Huggins responds:

It's not random, it's about microstructure. MMs spread their risk as they usually get caught out by information driven moves while they supply liquidity. When they spread their capital to diversify, or withdraw from choppy markets, the price impact of trading rises (Kyle's lambda).

Steve Ellison comments:

My takeaway from Zubin's post is that there are edges to be found in studying market microstructure and looking for clues in price action of what some of the key players are doing. A specific example I have found is, if you bin trading days by number of days before or after options expiration, options expiration day has had the worst total return in the S&P 500 of any day of the month in the past 6 years or so. Apparently the need for a large number of market players to adjust and re-establish hedges can create imbalances in supply and demand of various assets.

I could form a hypothesis about liquidity that a sustained price move in one direction, as happened a couple of times to the downside in the S&P 500 since July 17, is toxic for market makers and forces them to widen their spreads lest they be saddled with unwanted inventory. I'll leave it as an exercise for the reader to test this hypothesis.

Jul

27

Here's a performance of a one-movement sonata for flute and piano I wrote a few years ago.

Traditionally, sonatas were three or four movements. My goal here was to respect that structure, but to do so in a highly compressed format. The piece is built around a recurring pattern (an ostinato) that the flute first "discovers" before it lands in the bass of the piano. The middle section begins with a nod to a more primitive, primal flute. Again, a pattern is discovered that is worked and reworked in counterpoint between the instruments. This little sonata is a pretty solid reflection of my musical aesthetic: I'm striving for a whole that makes sense, but also exploring some extremes.

What I think might be interesting to the group is that some elements of this piece were generated from financial market data. (Think of a GARCH-type process.) Aspects of volatility were allowed to dictate some elements of harmonic density and texture in the piece. I bent this to my overall musical concept as opposed to leaving it bare. (I don't find much engaging in process-driven compositions… they are far more interesting to write and maybe to talk about then to hear, in most cases.)

Sushil Rungta appreciates:

Very much enjoyed it. It was marvelous. Thanks for sharing.

Peter Ringel responds:

Beautiful. TY Adam.

some elements of this piece were generated from financial market data. (Think of a GARCH-type process.)

This seems brilliant. I have no doubt that volatility is deeply human. Sadly, my ear is too poorly trained to understand your translation of this into composition.