Nov

6

Ketchup Bottle, from Alan Millhone

November 6, 2007 | Leave a Comment

Right now in my area of Ohio it is tough to find a qualified renter — one who has his deposit and first month's rent in hand. I have one renter I am currently evicting who has not been there for two weeks, but will hang onto the unit and not pay anything till I go to court and take possession of the unit from him. Looking through his window I can see his belongings scattered all around the bedroom and can see through the kitchen and note a ketchup bottle on the counter that is upside down. This fellow will not return my calls and left me no choice but to file for eviction. The ketchup bottle, to me, indicates he is broke. Owning rental property is an entirely different education in the economy and is not for everyone.

Right now in my area of Ohio it is tough to find a qualified renter — one who has his deposit and first month's rent in hand. I have one renter I am currently evicting who has not been there for two weeks, but will hang onto the unit and not pay anything till I go to court and take possession of the unit from him. Looking through his window I can see his belongings scattered all around the bedroom and can see through the kitchen and note a ketchup bottle on the counter that is upside down. This fellow will not return my calls and left me no choice but to file for eviction. The ketchup bottle, to me, indicates he is broke. Owning rental property is an entirely different education in the economy and is not for everyone.

Scott Brooks adds:

I used to own a piece of rental property and I hated it. First of all, I am not a handy guy. My wife has a toolbox and will not allow me to touch it under any circumstances. All the other men in my family are extremely adept at handy work, but somehow I managed to have a mutated "handy gene."

I used to own a piece of rental property and I hated it. First of all, I am not a handy guy. My wife has a toolbox and will not allow me to touch it under any circumstances. All the other men in my family are extremely adept at handy work, but somehow I managed to have a mutated "handy gene."

What bothered me about renters was that they were often late with payments and always had some lame excuse as to why. When I would go by the house to pick up the late rent, there were always lots of beer cans in the trash, beer and liquor bottles in the fridge and cartons of cigarettes on the counter (the lease prohibited smoking in the house).

These people could afford alcohol and cigarettes, but couldn't afford their rent payment. When I would ask them about this, it was like talking to a wall. It seemed that they were completely incapable of understanding the simple concept of financial prioritization and that shelter was far more important that cigarettes.

But in retrospect, maybe they did understand the concept. They probably knew that they had the ultimate "enabler" in a government that protected their rights far and above my rights, and the same government would shelter them from the consequences of their poor decisions.

I sold the house at a profit and have not gotten back into the rental property game.

Alan Millhone updates:

The ketchup bottle has not moved and is still inverted! However, one new twist I noticed this afternoon in this renter's door: a court notice has been placed there by a process server sometime today! My late father used to quip, "When they get the court notice they don't have to move right away, but they know that someone will be breathing down their neck soon." Court day for his eviction is 11/30/07 at 2pm. Stay tuned!

Oct

30

Pumpkin Drop! from Alan Millhone

October 30, 2007 | 1 Comment

Tonight I watched 100 carefully wrapped pumpkins thrown off a second-story roof by two overzealous pumpkin tossers. My nine year old grandson's pumpkin was one of those tossed. It survived and he got a free book of his choice as a prize. My wife yesterday selected a small and firm pie pumpkin rather than a larger one. She decided the smaller one would survive the fall (reduction of risk) better than a larger one (more exposure to risk) falling two stories. Packaging is the key so this morning I visited a UPS store and bought a 10×10x10 box, shipping 'peanuts' and a roll of good strapping tape. The pumpkins falling and some splattering all over the ground remind me of investing and deciding if more or less exposure is the best route to follow. Also, finding ways to insulate your exposure (doing careful research) in stocks make sense. A good time was had by 200 students, parents and grandparents.

Tonight I watched 100 carefully wrapped pumpkins thrown off a second-story roof by two overzealous pumpkin tossers. My nine year old grandson's pumpkin was one of those tossed. It survived and he got a free book of his choice as a prize. My wife yesterday selected a small and firm pie pumpkin rather than a larger one. She decided the smaller one would survive the fall (reduction of risk) better than a larger one (more exposure to risk) falling two stories. Packaging is the key so this morning I visited a UPS store and bought a 10×10x10 box, shipping 'peanuts' and a roll of good strapping tape. The pumpkins falling and some splattering all over the ground remind me of investing and deciding if more or less exposure is the best route to follow. Also, finding ways to insulate your exposure (doing careful research) in stocks make sense. A good time was had by 200 students, parents and grandparents.

Oct

29

Rounding, from Alan Millhone

October 29, 2007 | Leave a Comment

There is a saying in the construction business that 'rounding' will get your estimates in trouble! All insurance adjusters hate 'rounding' of insurance estimates that a contractor prepares and submits. An estimate for insurance repairs will have smooth sailing with an adjuster (for the most part) if you use odd dollar and cent amounts for each item you are bidding; this will make the adjuster smile from ear to ear. I had a mentor years ago who specialized in fire loss restoration who told me to break down each segment of the estimate; this way you have less chance of missing anything and can get more out of the job.

Having a penchant for detail is good in construction estimates, evaluating a checker or chess move, or looking at a market move in detail before you hit the 'buy' button. In all three cases a handwritten manuscript will allow you to do a synthetic study of past performance and to see how it applies in your current scenario.

Oct

24

Scout’s Honor, from Jeff Rollert

October 24, 2007 | 1 Comment

I was in the LA wildfire this weekend, and I can tell you that having been in hurricanes, this held up in comparison. We had a thirty person Cub Scout camping trip to Leo Carrillo State Park campground, five miles north of Malibu. Friday was quiet, but the wind started picking up about midnight Saturday night. By 1 am, gusts were at 60 mph, and I had to wake about half the sleeping campers at other campsites to put out the fires they had left unattended (140 campsites). One guy had embers blowing about 20 feet. Our campsite was at the end of a box canyon, so with the wind at our back we'd never smell the fire coming if these bozos caused one. I kept a few people alive that night. By 3 am, the gust were up to 80 mph. My son and I were lifted and moved just short of two feet in our pup tent — while we were lying down in it trying to sleep. Surprisingly, only one tent shredded in the wind that night. When the wind lifted us, it blew our ground cloth away — out from under us. I guess we weren't in Kansas. We were told to evacuate at 8:30 am and drive to Oxnard. Up to that point, the skies were azure blue all weekend and the weather was incredible. Right now in Pasadena, you would think it's sunset.

I was in the LA wildfire this weekend, and I can tell you that having been in hurricanes, this held up in comparison. We had a thirty person Cub Scout camping trip to Leo Carrillo State Park campground, five miles north of Malibu. Friday was quiet, but the wind started picking up about midnight Saturday night. By 1 am, gusts were at 60 mph, and I had to wake about half the sleeping campers at other campsites to put out the fires they had left unattended (140 campsites). One guy had embers blowing about 20 feet. Our campsite was at the end of a box canyon, so with the wind at our back we'd never smell the fire coming if these bozos caused one. I kept a few people alive that night. By 3 am, the gust were up to 80 mph. My son and I were lifted and moved just short of two feet in our pup tent — while we were lying down in it trying to sleep. Surprisingly, only one tent shredded in the wind that night. When the wind lifted us, it blew our ground cloth away — out from under us. I guess we weren't in Kansas. We were told to evacuate at 8:30 am and drive to Oxnard. Up to that point, the skies were azure blue all weekend and the weather was incredible. Right now in Pasadena, you would think it's sunset.

Alan Millhone writes:

To earn my First Class in the Boy Scouts I had to "get a message through" in Morse Code, 20 words in a minute. I still have all my Cub and Boy Scout manuals and all my scouting items! Fond memories of a much simpler time in America. I am proud to have been involved in Scouting. In today's world Scouting should offer a merit badge in the markets — a real challenge for proficiency!

Oct

21

Blackbeard the Pirate, from Duncan Coker

October 21, 2007 | Leave a Comment

While spending some time in the Outer Banks of North Carolina I had a chance to read "Blackbeard the Pirate" by Robert Lee, published 1974. Blackbeard often sailed in this area and met his bloody end in Ocacoke inlet at the southern end of the Outer Banks. Born as Edward Teach, he was from Bristol, England, and perhaps from an educated family. He quickly went to sea on an "expedition" to the West Indies. The author argues that at this time in history most sea adventures were mainly plunder activities, which lasted for several years and were often hugely profitable. For example a century earlier, Francis Drake's famous three-year expedition earned 1.5m pounds. In Blackbeard's time, around the turn of the 18th century, ventures would routinely bring back 200,000-800,000 pounds. This alone would be strong incentive to go to sea to seek fortune. In addition, England was constantly at war with either Spain or France and often employed privateers to disrupt enemy shipping. This distinction gave private ships a license to plunder at will enemy ships abroad. Pirates would do the same, though without license, so technically illegal.

While spending some time in the Outer Banks of North Carolina I had a chance to read "Blackbeard the Pirate" by Robert Lee, published 1974. Blackbeard often sailed in this area and met his bloody end in Ocacoke inlet at the southern end of the Outer Banks. Born as Edward Teach, he was from Bristol, England, and perhaps from an educated family. He quickly went to sea on an "expedition" to the West Indies. The author argues that at this time in history most sea adventures were mainly plunder activities, which lasted for several years and were often hugely profitable. For example a century earlier, Francis Drake's famous three-year expedition earned 1.5m pounds. In Blackbeard's time, around the turn of the 18th century, ventures would routinely bring back 200,000-800,000 pounds. This alone would be strong incentive to go to sea to seek fortune. In addition, England was constantly at war with either Spain or France and often employed privateers to disrupt enemy shipping. This distinction gave private ships a license to plunder at will enemy ships abroad. Pirates would do the same, though without license, so technically illegal.

The Bahamas at that time was under the authority of the England, but had no rule of law to speak of other than that of the pirate and privateers. They had a semi-democratic system of government, though most disputes were settled by one of the captains, at the tip of a sword. The formed a loose Alliance and called themselves the Brethren of the Coast. While at sea, the Brethren would never attack one another. Outsiders like Spanish or French trading ships were fair game. On land the pirates broke few laws other than drunkenness and small arguments. Blackbeard apprenticed here under another captain and showed all the core traits for a successful pirate. Highest among these was an excellent knowledge of the sea, navigation, and naval combat. He was also ruthless, violent and aggressive in his pursuit of "prizes." After several years, Blackbeard took over one of the captured sloops and command of a crew of 50 men.

Blackbeard cultivated his reputation and was feared across the sea. Many under attack would surrender before shots were ever fired. He was tall, did indeed have a long black beard, carried two pistols and a cutlass, the pirate sword of the day. He would, oddly, burn rolls of hemp strung from his hair to add to the image. Blackbeard enjoyed a decade of successful plundering during the early 1700s. One of his boldest acts was a blockade of the city of Charleston, which he held for ransom. At that time he had four ships under his command. It goes to show how defenseless and lawless the early colonies were. No one was killed in this blockade, and he collected only a small ransom of medical supplies, which apparently were highly valued at the time.

Often when ships would approach at sea they would fly false colors to confuse the other ship. Most ships carried at least six flags. So it was a dance as they would approach, each knowing the other was trying to deceive and each changing flags as they got closer. Usually it was only within shouting distance that they could identify the other party and know his intentions. For Blackbeard it was an ultimatum: surrender and he would grant quarter; resist and all would be killed.

Often when ships would approach at sea they would fly false colors to confuse the other ship. Most ships carried at least six flags. So it was a dance as they would approach, each knowing the other was trying to deceive and each changing flags as they got closer. Usually it was only within shouting distance that they could identify the other party and know his intentions. For Blackbeard it was an ultimatum: surrender and he would grant quarter; resist and all would be killed.

On land, many of the local economies were based around the pirate trade. Brokers thrived by trading the riches pirates had obtained, often bought at a huge discount. The taverns, brothels and inns catered to pirates. Piracy was accepted as a business activity of the time by the locals, though still not legal. Blackbeard, when on land, was very popular with the fair sex. He was a softy with women and would many times marry as he left port, thought maybe never see his new wife again. He was married sixteen times. Often when a war would end in Europe, the Crown would offer clemency to existing pirates, if they swore an oath to stop their ways.

Blackbeard is believed to have gone into semi-retirement around this time in 1716, near the town of Bath in North Carolina. Though he still took small prizes in his local waters, his major ventures into the West Indies came to an end. However, after several years even these small conquests were noticed by authorities. As a result the governing authority of Virginia sailed south and came into battle with Blackbeard in Ocracoke inlet. After a bloody day, Blackbeard was killed, taking five bullets and dozens of sword wounds. Blackbeard died as he had lived. Virginia took 2200 pounds from his ship. But his real treasure, many times greater, was believed to be buried elsewhere, and is searched for to this day. His reputation and place in history were welled earned. He is deservedly the most famous and successful pirate of his time.

Alan Millhone writes:

In 1985 my late father took my younger brother and me to Normandy to see all the landing points of the D-Day Invasion that our father was a part of in the Signal Corps. One day we took a catamaran from France to Jersey. On the approach, our boat guide told us the fortress we saw ahead at the tip of Jersey was once inhabited by Blackbeard and later by Sir Walter Raleigh as the island's governor. Both men literally lost their heads in their later days.

Oct

13

Tesla Motors, from Bud Conrad

October 13, 2007 | 4 Comments

I went to a presentation by Martin Eberhard, co-founder and President of Tesla Motors, on Wednesday. I've seen one of the eight cars built and it is slick: 0 to 60 in 3.86 seconds with no shifting. And Eberhard is a slick presenter. Arnold Schwarzenegger has ordered a car.

I went to a presentation by Martin Eberhard, co-founder and President of Tesla Motors, on Wednesday. I've seen one of the eight cars built and it is slick: 0 to 60 in 3.86 seconds with no shifting. And Eberhard is a slick presenter. Arnold Schwarzenegger has ordered a car.

But they have a huge mountain to scale with gargantuan problems, not the least of which is the distribution and service. They have taken the unprecedented step of making a completely new car that is to be status symbol and new technology at once. It is a complete design from bumpers and fenders to suspension and the electronically controlled antilock breaks. I think they have bitten off too much. Battery technology is the latest lithium, but with stacks and stacks of cells, it is a huge battery. It takes all night to charge from a 220 electric dryer but does go for 250 miles. The electricity is cheap at pennies per mile. The car is expensive at over $100K. Divide that by 100,000 miles of useful life and you have capital costs of $1/mile.

Great breakthroughs in technology, but the take-out is a rich Asian car company with lots of dollars. Reminds me of Tucker Car that after WWII developed the best technology but was squashed by the big guys.

Alan Millhone adds:

Nice to see something new and innovative in the automotive area! My first car was a 1964 Mustang fastback that was raven black with a white interior, 289 H.P. and a Hurst shifter and Hurst mags. I ordered it from the factory for $3,105! I still have the original owner's manual, bill of sale and a sterling Mustang tie-tack (still on the card). The car is gone, but the memories of taking possession of that car at the dealership will stay with me like it was yesterday. America has always had a love for the automobile and I hope the Tesla will have its own following.

J.P. Highland remarks:

For $100,000 I would rather buy a Porsche Cayman and a Toyota Tundra, one for the fun and the other to be my workhorse.

Oct

10

Organizing My Mind, from Alan Millhone

October 10, 2007 | Leave a Comment

This past weekend in Richmond, KY, I was playing Checkers with Don Brattin and made a move that enticed him to move out of his king row and put the 'squeeze' on one of my pieces. He thought I would 'close up' the position with another of my singles. Instead I moved a piece from my king row and allowed him to jump two of my pieces. Then I took two of his back and got an early king and got behind his singles and won the game on position. This past weekend I finished second, my top finish for a long period of playing in tournaments. I only lost one game out of 14 played and had two draws with the player who won. He won his other six rounds and I was the only player to draw him two games. I have not been studying much, but feel that reading Daily Spec has greatly organized my mind and thought processes and I find myself in complex checker games looking at positions in a far different way than I have in the past. In Ohio recently at our yearly tourney, World Champion Alex Moiseyev told me that my game has improved and in Kentucky last weekend two players told me the same, so it is not just my imagination. I read every posting on Daily Spec and try to garner positive information that I can use in everyday life, in my business and in competitive checkers.

This past weekend in Richmond, KY, I was playing Checkers with Don Brattin and made a move that enticed him to move out of his king row and put the 'squeeze' on one of my pieces. He thought I would 'close up' the position with another of my singles. Instead I moved a piece from my king row and allowed him to jump two of my pieces. Then I took two of his back and got an early king and got behind his singles and won the game on position. This past weekend I finished second, my top finish for a long period of playing in tournaments. I only lost one game out of 14 played and had two draws with the player who won. He won his other six rounds and I was the only player to draw him two games. I have not been studying much, but feel that reading Daily Spec has greatly organized my mind and thought processes and I find myself in complex checker games looking at positions in a far different way than I have in the past. In Ohio recently at our yearly tourney, World Champion Alex Moiseyev told me that my game has improved and in Kentucky last weekend two players told me the same, so it is not just my imagination. I read every posting on Daily Spec and try to garner positive information that I can use in everyday life, in my business and in competitive checkers.

Oct

9

Motorcycle Helmets, from Alan Millhone

October 9, 2007 | Leave a Comment

Leaving last weekend's Richmond, KY, Checker Tournament, on I-75 I saw an overhead sign and could not believe what it said:

YOUR HELMET MISSING?

HAVE YOU SIGNED YOUR ORGAN DONOR CARD?

I found it to the point and a real attention-getter! I think South Carolina, and my own state of Ohio, are the only two states without a motorcycle helmet law in place.

David Hillman explains:

It's far more complicated than that. Only four states have no helmet restrictions; South Carolina and Ohio are not among them. Colorado, Illinois, Iowa and New Hampshire are. Ohio and 18 other states exempt adult riders [age 18+]. South Carolina and six other states exempt riders age 21+, and 20 states have full helmet laws [everybody wears]. The full helmet law states are predominantly West coast, Southeast and Northeast. if you're cagey, you can actually ride from Phoenix to Dover, DE without ever donning a hard hat. You see, we hilljacks and clodhoppers out here in the Midwest and Plains [except Michigan, Missouri, Nebraska] don't care much about head injuries. It's true there's not much uglier than a deer strike on a bike, but, hey, give us freedom and/or give us death.

Oct

1

Handicap Tags, from Alan Millhone

October 1, 2007 | 1 Comment

In my little town of Belpre, OH, lives a couple who now sport handicap tags on their mirrors 24/7. In Ohio you are supposed to remove them while driving. They both now have the tags, and I wonder why? The man broke his hip years ago and walks with a limp but I see him and his wife out doing yard work every week. Recently they both went to Africa and went on a safari! I feel doctors may be too quick to hand the tags out to anyone who asks for them. My mother is 86 and walks on a cane and has failing eyesight, but will use hers only if it's raining really hard as she moves quite slowly.

Sep

29

At Last My Trophies I Lay Down, from Alan Millhone

September 29, 2007 | Leave a Comment

The ACF (American Checker Federation) recently lost one of our Life ACF Members and a top Master player — Gene Lindsay of Tennessee. Gene was 52, never married and no children. He loved the game of checkers, as I and many others do as well. The ACF a couple of years ago hosted an International Match at the Plaza Hotel in Vegas and we paid for rooms and meals for visiting players from England, Scotland and Ireland and received some contributions to defray expenses. Gene told me then he had a dream of putting $100,000 into a trust account with the interest to be used to fund a tournament every five years — we'd alternate between their coming here or a team of Americans going to Europe to play. We discussed his idea at several tournaments.

The ACF (American Checker Federation) recently lost one of our Life ACF Members and a top Master player — Gene Lindsay of Tennessee. Gene was 52, never married and no children. He loved the game of checkers, as I and many others do as well. The ACF a couple of years ago hosted an International Match at the Plaza Hotel in Vegas and we paid for rooms and meals for visiting players from England, Scotland and Ireland and received some contributions to defray expenses. Gene told me then he had a dream of putting $100,000 into a trust account with the interest to be used to fund a tournament every five years — we'd alternate between their coming here or a team of Americans going to Europe to play. We discussed his idea at several tournaments.

The day Gene died of a massive heart attack I received in the mail from him a large packet of papers that he found from when he was ACF Secretary in the mid-1990s. That evening I opened the packet and was pleased at what he had sent and decided to call his cell and thank him. I got no answer so I called his home and Betty, Gene's companion of 20-some years, answered. Betty and I chatted and I told her I'd called to thank Gene for what he sent and Betty replied, "Alan don't you know?" and then told me Gene had died that morning at 10:30. I was shocked and speechless.

Nigel Davies adds:

Events like this put things into perspective, and there tend to be more of them as we get older. Of the things we leave behind personal wealth may be one of the most transitory, and I suspect there is strong mean reversion amongst the descendents of the wealthy.

This leaves things like 'creative output' and the effect (good or bad) we might have had on friends and family. And all this presupposes that we're not here to just have fun.

Sep

25

Ahmadinejad, from Alan Millhone

September 25, 2007 | 3 Comments

Someone invited him into the USA and Customs admitted his entry. Now we get him here and he is subjected to ridicule and verbal abuse. Two wrongs don't make a right! Even President Bush got his jabs in. The US should show we are the better people and not lower ourselves with verbal tirades while he is a guest in America. If his mind is ever to be changed (perhaps it cannot be) America and its leaders need to set a pristine example. I totally disagree with Iran's terriorist ties and abuses of human rights — but we did invite him here.

Someone invited him into the USA and Customs admitted his entry. Now we get him here and he is subjected to ridicule and verbal abuse. Two wrongs don't make a right! Even President Bush got his jabs in. The US should show we are the better people and not lower ourselves with verbal tirades while he is a guest in America. If his mind is ever to be changed (perhaps it cannot be) America and its leaders need to set a pristine example. I totally disagree with Iran's terriorist ties and abuses of human rights — but we did invite him here.

Nigel Davies writes:

Reminds me of a live televised discussion I once saw between a British and Russian school, back in the days of the USSR. The Brit kids were incredibly obnoxious, using it as an opportunity to lambast the USSR without really knowing what they were talking about. The Soviets kids, on the other hand, were really nice and polite and tried very hard to have a normal civilized conversation. As this was televised live in Russia too, it was quite a coup in demonstrating the superiority of the Soviet child.

This sensitivity might be a games player's thing. In our tournaments and travels we have to get on with a wide range of folk who can be culturally very different. I don't see much sign of it in the Western mainstream.

Eric Blumenschein responds:

I don’t believe appeasement as a geopolitical strategy works. Neville Chamberlain was very polite to Adolf Hitler and WW2 still came around. If I am correct, Ahmadinejad was invited to the UN, not to the USA. If he thought Columbia University was going to fold over like sheep and give him the podium unchallenged, then he was obviously mistaken. Kudos to that university to call him out in a way that would never happen at the UN.

Nigel Davies replies:

Chamberlain tends to be dredged up a lot with such issues, but there is middle ground between appeasement and plain rudeness. The way this has been handled the guy will look like a hero back home for sallying forth into a hostile land. And now if they invite Bush to Iran and he declines, it can be portrayed as cowardice back home. You’ve gotta consider the other guy’s moves.

Adi Schnytzer remarks:

My understanding is he came to visit the UN and as such the US government was forced to let him in. Columbia then decided to invite him and in the spirit of democracy (which was the original excuse for inviting him) they permitted an expression of views contra his own.

Nigel Davies responds:

The issue as I see it is one of strategy. He will soar in the opinion polls back home because of his 'courage' in going to a hostile land and fighting the infidel.

What about just not giving him quite so much attention? If he can't distract the Iranian population with his slanging matches with external enemies, they're more likely to judge him on his actual leadership qualities.

Sep

7

Oysters, from Mark McNabb

September 7, 2007 | Leave a Comment

In the US, those oysters along the Katrina coast are some of the sweetest and largest found. But here in the southern Chesapeake, which has the best oysters on the East Coast, those found on the Middle Peninsula are even sweeter, almost like butter. However, don't expect to find the best on a plane to NYC — waterman keep their best for local customers, as most in the cities have no idea how a good oyster tastes. We have to call a tug captain named Puddin', who is about 400 pounds, and he'll send a diver down by a bridge support to get some of the really large ones in return for beer money. If you want the best, come down to the Urbanna Oyster Festival on the first weekend in November you'll be very pleased. On the Eastern Shore, the Chincoteague oyster is a saltier (brinier) lad with a taste that some NYC critics prefer, but in oysters (and music) it gets personal after a while. I've been along the NW and NE coasts and those oysters taste like seaweed to me.

In the US, those oysters along the Katrina coast are some of the sweetest and largest found. But here in the southern Chesapeake, which has the best oysters on the East Coast, those found on the Middle Peninsula are even sweeter, almost like butter. However, don't expect to find the best on a plane to NYC — waterman keep their best for local customers, as most in the cities have no idea how a good oyster tastes. We have to call a tug captain named Puddin', who is about 400 pounds, and he'll send a diver down by a bridge support to get some of the really large ones in return for beer money. If you want the best, come down to the Urbanna Oyster Festival on the first weekend in November you'll be very pleased. On the Eastern Shore, the Chincoteague oyster is a saltier (brinier) lad with a taste that some NYC critics prefer, but in oysters (and music) it gets personal after a while. I've been along the NW and NE coasts and those oysters taste like seaweed to me.

Alan Millhone adds:

A few years ago we stayed in Blainville with our French-Canadian friends Jean-Claude and Joelle. One day with the tide out Jean-Claude took me, my wife Vickie and our oldest grandson David out oyster hunting. The law there is that any oysters on the outside of the oyster cages were free for the taking by anyone. We waded into the soft seabed and collected a bucket of fresh live oysters. Jean-Claude and I shucked the oysters while Vickie and Joelle prepared a clear sauce for them. I prefer a hot sauce — but, when in Rome! They were great. Nice memories.

Bill Rafter advises:

Always go to a real oyster bar, where you can watch the staff shucking the oysters. Watch for a while (not just five minutes), ask questions and then tip the guy when you're done. Note that they can enter the oyster from either the bill end or the hinge end. If you are going to shuck them yourself, don't buy many, as you will probably give up. I like using an awl and entering from the hinge end. Avoid using a hammer and smashing the bill end to gain entry. The shells are quite brittle if hit that way and you will be picking the bits of shell out of your mouth.

You may want to try clams first, as they are considerably easier to open, but not as interesting. Do not waste money buying a "clam knife" which has a sturdy handle and a really dull blade. A paring knife with a sharp blade is best. Little Neck clams are small, tasty and considerably easier to open than Top Necks or Cherrystones.

At home: If you have access to clean salt water, get a bucket full and put the critters in there for several hours. As they have been shut up for hours or days in a cooler, they have been defecating in their shells. A couple hours in salt water and they will clean themselves. After you dump the water you will be most glad you did. You don't want to ingest that stuff.

Frequently, clams and oysters are sold at bayfront shacks. Most people are put off by that, but if the shack does of volume, patronize it. If you are coming to Long Beach Island NJ, there's such a place on Bay avenue in Manahawkin.

Sep

4

Fear, from Ken Smith

September 4, 2007 | 2 Comments

_____goateestyle.jpg) Bad news is always around. Bad news and dire predictions are reasons to dump holdings and perspicacious traders are aware of this. They game the news, game economists, game everyone. Fear drove me out of a position Friday; had I held I would have had a profit to take as of half an hour into the trading day. I let fear temporarily overtake logic.

Bad news is always around. Bad news and dire predictions are reasons to dump holdings and perspicacious traders are aware of this. They game the news, game economists, game everyone. Fear drove me out of a position Friday; had I held I would have had a profit to take as of half an hour into the trading day. I let fear temporarily overtake logic.

Eric Ross adds:

Join the team! Fear and emotions have driven me out of trades, have prevented me from taking positions. Today, after dawn patrol, I wanted to enter the market, but emotions prevented me. It seems one should just buy the dips and not look back, accept the risk of a drawdown.

Alan Millhone remarks:

I wonder if we had no TV, did not look at magazines or newspapers, and stayed focused on the data at hand — would that exclude emotions and thus make traders more successful? The news media can twist anything — and when you see something you automatically believe it!

Sep

2

The UI of the 1915 Dodge, from Sam Humbert

September 2, 2007 | 1 Comment

At the farm-market in Greenfield Hill today, a restored 1915 Dodge pulled up, and as the wife browsed the corn and tomatoes, hubby gave our family a quick tour of the car.

At the farm-market in Greenfield Hill today, a restored 1915 Dodge pulled up, and as the wife browsed the corn and tomatoes, hubby gave our family a quick tour of the car.

What struck me was how close the user-interface is to today's. Gear selection was via a floor-mounted shift-lever on the driver's right, with gears 1-3 and reverse in an H-pattern. The gas/brake/clutch petals were arranged right-to-left on the floor. Steering was via a hand-controlled wheel. Round tick-marked analog gauges indicated speed, RPMs, electrical current, oil pressure.

Essentially, today's UI is unchanged from this setup (excepting the automatic transmission, popular with Californians who need a free hand for the cell phone). The driver of a 1915 Dodge could step into a modern auto, nearly 100 years later, and operate it immediately.

When I remarked on this, the owner told me that in the years just before 1915, there was widespread experimentation with user-interfaces in the auto industry, and the 1915 Dodge's layout was the design that "stuck."

The QWERTY keyboard comes to mind as a parallel. And I wonder if the computer GUIs of 100 years hence will still involve overlapping windows, icons of running programs at the bottom, pulldown menus at the top, left-click to select, right-click for context menus…

Arthur Cooper adds:

The experimentation period is illustrated by the autos in the collection of the National Auto Museum in Reno NV. It's definitely worth a visit.

Alan Millhone writes:

I have a four-door 1948 Chevy that needs restoration. The motor is frozen (not original, a re-built Sears six-banger). The car is an antique, which makes me one as well — '48 is my birth year!

Sep

2

Sound Moves, from Alan Millhone

September 2, 2007 | Leave a Comment

On September 17-21 the Plaza Hotel in Vegas will host the American Checker Federation (ACF) World Qualifier, with players coming from all parts of the globe to compete for the right to challenge for the Go As You Please ("Freestyle") World Checker Title, currently held by Ron "Suki" King of Barbados. Playing for draws will not win this tournament. Players will have to sharpen their lines of play, be innovative and play for wins. Players will have to play for strong mid-game positions, then hope for favorable endgames with an edge that can secure a win.

On September 17-21 the Plaza Hotel in Vegas will host the American Checker Federation (ACF) World Qualifier, with players coming from all parts of the globe to compete for the right to challenge for the Go As You Please ("Freestyle") World Checker Title, currently held by Ron "Suki" King of Barbados. Playing for draws will not win this tournament. Players will have to sharpen their lines of play, be innovative and play for wins. Players will have to play for strong mid-game positions, then hope for favorable endgames with an edge that can secure a win.

The late GM Marion Tinsley used to quip, "Many tournaments are won before the tournament begins". A player will find previously played games of possible opponents and study their style, look for a chink in their armor, see if they play a strong endgame (many Masters neglect endgame study) and rely too much on knowledge of prepared lines of play.

In checkers, with the red pieces beginning 11-15 is supposed to offer a slight advantage by coming directly out of the "single corner." Checkers is a constant battle for control of the board's center. I will be at the World Qualifier as an observer and ACF Official and will observe the methods players use in their games to score wins. "Stepping out" can lead to disaster, as can overextending one's position. "Keep the draw in sight," the late GM Tom Wiswell used to admonish.

There will be turmoil between rounds of play. The market of late has also exhibited much turmoil and one has to be as careful as possible in seeking an advantage when making trades. Tom Wiswell also used to say that "Moves that disturb your position the least disturb your opponent the most." In checkers, many times "waiting moves" are indicated, to avoid disturbing your position. Then your opponent has to show his hand. Many times, by waiting you cause your opponent's position to crumble right before your eyes.

Making "sound moves" in the market during troubled times is important in "holding your position" till an "opening" presents itself. "Move in haste, repent at leisure," said Tom Wiswell.

Nigel Davies remarks:

A major difference between markets and board games is that in markets every score is carried over to the next tournament. I believe this puts the onus on consistency and strong defense rather than a high rate of scoring.

Aug

22

Toxic Waste, from Alan Millhone

August 22, 2007 | Leave a Comment

I just looked over the state-by-state list and noted many former landfills are now golf courses. The average person in the US throws away 3.5 lbs. of garbage a day. I visit my local Waste Management landfill in Parkersburg, WV with regularity with construction debris from my jobs and am charged $34.05 per ton for dumping, plus a fee for being "out of watershed" because I cross the Ohio River from Ohio to dump there.

I just looked over the state-by-state list and noted many former landfills are now golf courses. The average person in the US throws away 3.5 lbs. of garbage a day. I visit my local Waste Management landfill in Parkersburg, WV with regularity with construction debris from my jobs and am charged $34.05 per ton for dumping, plus a fee for being "out of watershed" because I cross the Ohio River from Ohio to dump there.

It is unreal what you see dumped. One time I backed my dump beside a Dept. of Natural Resources truck that was loaded with dead deer. Really nice to be there on a hot August day!

Aug

20

Mastery of the Game of Checkers and the Market, from Alan Millhone

August 20, 2007 | Leave a Comment

I’ve been reading with interest the definition of the word "master" in many situations. Looking through my checker library I found two books of interest and will make some observations. In 1909, William Timothy Call wrote his Vocabulary of Checkers. It is a small hardbound book that has become quite scarce. I decided to find the word 'master' in it and was surprised not to find that word listed, but the word 'expert' was instead.

I’ve been reading with interest the definition of the word "master" in many situations. Looking through my checker library I found two books of interest and will make some observations. In 1909, William Timothy Call wrote his Vocabulary of Checkers. It is a small hardbound book that has become quite scarce. I decided to find the word 'master' in it and was surprised not to find that word listed, but the word 'expert' was instead.

But on the first page of his book is found the word “abecedarian.” Maybe it’s a new Scrabble word for many of you. Call’s definition: One who is learning the rudiments of the game; a new beginner. The stage of advancement are: abecedarian, beginner, novice, student, advanced player, expert, champion. I note the obvious absence of the word “master.”

Call says about the beginner on page 16 of his work: One who has started to learn something about the game as a science. The abecedarian becomes a beginner, then a novice, then a student.

Novice according to Call: An advanced beginner who has not had much experience in the game as a scientific diversion, no matter he may have indulged in it as an amusing pastime.

Thumbing through the book I find a term I have heard on some occasion: “scrub.” It is a colloquialism to designate the large class of adroit players who are not rated as experts. Tyro: A beginner or novice.

On page 190 of Learn Checkers Fast, we find the word “master.” Comparatively few players ever reach this high station in the game. Actually, the name is misleading, as no expert has ever really mastered the game to the extent he was immune to defeat. The author lists the following classifications of checker players: novice, amateur, near expert, expert, junior master, master and grandmaster.

Student: One who occupies an intermediate position between the novice and the expert class, particularly one who follows new play (lines of published checker play) with a critical eye.

My observation: I can see where beginners in the market (as myself) would begin at the bottom of the list and hopefully through study, listening to others, making mistakes, keeping a hand written manuscript, etc., would gain knowledge and put that knowledge to proper use in the market.

Aug

7

A Higher Purpose, from Riz Din

August 7, 2007 | Leave a Comment

.jpg) I fully agree that trees are not thinking things in the strict sense, and they cannot imagine the future. However, trees may 'think' (I use that term very loosely) about the future as much in as it is to their benefit. That is, while certain aspects of trees are purely reactionary to circumstance (e.g., growing toward light), if we consider seed dispersal strategies then perhaps it could be said that trees are exhibiting a form of forward looking intelligence. They are making their best guess about what time to release their seeds. While it probably a very simple model, based on tens of thousands of years experience of the seasons, it could be called a form of anticipation and planning.

I fully agree that trees are not thinking things in the strict sense, and they cannot imagine the future. However, trees may 'think' (I use that term very loosely) about the future as much in as it is to their benefit. That is, while certain aspects of trees are purely reactionary to circumstance (e.g., growing toward light), if we consider seed dispersal strategies then perhaps it could be said that trees are exhibiting a form of forward looking intelligence. They are making their best guess about what time to release their seeds. While it probably a very simple model, based on tens of thousands of years experience of the seasons, it could be called a form of anticipation and planning.

Alan Millhone writes:

Earlier today I had a conversation with one of my long time renters. Next to his building is a very tall and full oak tree and it has begun to release its acorns. The renter was complaining about the mess the tree was making. I told him that the tree in its fullness was shading his side of the building, filtering the air we breathe and cooling that air by about 20 degrees when the hot air (95 degrees here in Belpre today) passes through the branches and leaves to reach his windows. I told him the tree needs to be trimmed sometime, but care must be taken not to injure such a wonderful living thing.

The taller part of the tree has extended its branches over to the gutters of the building, knowing that water flows there when it rains. The tree has deep roots and is solidly anchored. It has learned to withstand gusty winds, hot weather and the cold winters of Ohio. Man can learn much by careful observation of trees and the ways they adapt to many situations.

Bill Craft writes:

Working with forest ecology on a daily basis I have seen and studied the adaptive response of trees to stimuli, growth and regeneration. Whether it be seed dispersal, wind, sun or gravity, as earlier stated these responses evolved over many millennia and are fun to observe, admire and use. Something stalwart, romantic and functional about trees. Trees’ persistence to survive always inspires me to take out the cane and invest.

Aug

3

Emotions vs. Rationality, from Henrik Andersson

August 3, 2007 | 2 Comments

It is so easy to be negative on the future after the market is down. But I believe to be successful you need to be more positive the more the market drops. Yet maybe it has to be this way for the market to take its rake.

Alan Millhone writes:

The late World "Free Style" Checker Champion, Mr. Tommie Wiswell told me once to "eliminate the negative and accentuate the positive," and "to keep your head, while others around you are losing theirs."

I do my own thing and don’t march to the same drummer as others. I try and do a little good every day. Does the Market Mistress take her 'rake,' or do the soaring vultures swoop down on occasion to feast? It appears to me to be in anything over the long haul one has to be able to ride the waves.

Aug

2

Engineering Indicators: An Update, from Rick Foust

August 2, 2007 | 2 Comments

Background: I once described how I use fellow engineers as contrary indicators. Engineers nearing retirement are best. When they walk up on their toes, sell. When they shuffle with their heads hanging, buy. One engineer in particular was such a precise indicator that, for example, he bought his first (and last) block of NASDAQ stocks on the day before the bottom fell out in 2000, and traded an economy car for a new Chevy Tahoe just before gas began to rise. As he came within 10% of the nest egg value he had targeted for retirement his moods intensified and he became a precise contrary indicator for stock market swings. Unwittingly I had even improved his precision by clueing him into the correlation. After that he would try to resist his own tendencies, only to betray himself a few times per year at major inflections.

Background: I once described how I use fellow engineers as contrary indicators. Engineers nearing retirement are best. When they walk up on their toes, sell. When they shuffle with their heads hanging, buy. One engineer in particular was such a precise indicator that, for example, he bought his first (and last) block of NASDAQ stocks on the day before the bottom fell out in 2000, and traded an economy car for a new Chevy Tahoe just before gas began to rise. As he came within 10% of the nest egg value he had targeted for retirement his moods intensified and he became a precise contrary indicator for stock market swings. Unwittingly I had even improved his precision by clueing him into the correlation. After that he would try to resist his own tendencies, only to betray himself a few times per year at major inflections.

Update: Well, he retired, and for a while I was partially blinded. But as luck would have it, he has come out of retirement to work part time. So, last week he bears down on me and loudly pronounces that the market is about to tank for three days and then run up. Why? He had committed to pull $28K out of a mutual fund to finance the purchase of a hybrid car and it would take three days for the transaction to clear. As I pondered whether or not he had given me a valuable stock market tip, it became clear that gas prices had peaked.

I know that many here are confident in their quantitative analysis. But I have to tell you that when I witness the ability of the human subconscious to process countless diverse inputs and arrive at precisely the wrong answer, I suspect that quantitative analysis is a distant second.

Alan Millhone asks:

I wonder what input your fellow engineers will offer on the current Minneapolis bridge collapse? Something I suspect in the way of construction repairs and one lane traffic triggered this horrible disaster.

Rick Foust replies:

There has been no mention of a bridge collapse among our engineers. But your email gave me quite a start. My permanent residence is in Minneapolis, a small town I affectionately refer to as Mayberry, where 1500 souls live, in north central Kansas. I am away from home four days per week and don’t turn on the TV, so it came as a quite a shock to hear that one of our two tiny bridges had finally collapsed.

OK, I am not quite that naive, but the thought did cross my mind. Regarding an engineering assessment of the catastrophe in a somewhat larger Minneapolis, it may be a while before the engineering collective falls into sync with speculation on this event.

Jul

20

Cheesed Off, from Alan Millhone

July 20, 2007 | Leave a Comment

In the paper recently was a half-page article on the rising cost of cheese. Block cheddar cheese — the benchmark for mozzarella and other cheeses — reached $2.08 a pound on the Chicago Mercantile Exchange, up 78% from $1.17 a pound a year ago! Experts see no immediate relief in sight for pizza makers. The article featured a photo of a worker at Constantly Pizza in Concord, N.H. preparing a pizza and carefully watching his cheese use (skimping on how thick they pile on the cheese?).

In the paper recently was a half-page article on the rising cost of cheese. Block cheddar cheese — the benchmark for mozzarella and other cheeses — reached $2.08 a pound on the Chicago Mercantile Exchange, up 78% from $1.17 a pound a year ago! Experts see no immediate relief in sight for pizza makers. The article featured a photo of a worker at Constantly Pizza in Concord, N.H. preparing a pizza and carefully watching his cheese use (skimping on how thick they pile on the cheese?).

My family prefers The Pizza Place because they use a first-quality cheese on their pizzas. Some others use a type of artificial cheese and you can tell the difference.

Atlanta-based United Dairy Industry Association says corn prices have risen amid growing demand for ethanol fuel. Also driving higher cheese costs has been a strong U.S. and global demand for dairy products.

And speaking of corn, in our area some of the best corn comes from along the Ohio River at Reedsville, Ohio. A dozen fresh picked ears runs $4.00 at a local roadside market.

Jul

19

Truss Bridges, by Jim Sogi

July 19, 2007 | Leave a Comment

Tower and suspension bridges are good market models, but an important structure is the truss.

The zig zag price over the last three months and beyond forms beams with zig zags between, and larger truss structure in the June July area. The reason for a larger beam would be to support more weight. The current structure this week reminds me of cable stay bridges.

Mixed metaphors seem to work well in the market, and the classic Beethoven's Fifth pattern, di- di- di- dah, played out its tune. In the Fifth, Beethoven plays the signature lick twice, the second time a little bit lower and slower as the set up.

Alan Millhone writes:

Some years ago in checkers there was an author by the name of Ben Boland who wrote many ending books on the game. One was Boland’s Bridges. This is where you have supporting pieces in your king row (usually on 2 & 4 or 30 & 32).

Peterson's Drawbridge is a standard checker ending that can be won or lost according to positioning of single pieces around the bridge. In checkers at times your bridge is 'blown' by your opponent and your 'position' is crushed as your bridge collapses. I can see this happening in the market as you attempt to shore up a shaky position. In construction, loads, and the proper calculation of loads are critical to maintaining safety. 'Spanning' the market with safe positions is just as critical.

Jul

16

No Ethanol in Greece? from Alan Millhone

July 16, 2007 | Leave a Comment

My best friend is Greek, and he has been in Greece for a month now. He emailed me today that roast corn on the grill in Athens is two euros a cob ($2.70 US)! The smog and acid rain in Athens are terrible, but at those prices one cannot imagine any of their corn will go towards alternative fuels!

My best friend is Greek, and he has been in Greece for a month now. He emailed me today that roast corn on the grill in Athens is two euros a cob ($2.70 US)! The smog and acid rain in Athens are terrible, but at those prices one cannot imagine any of their corn will go towards alternative fuels!

Cliff Roche replies:

My brother-in-law just vacationed in Corfu. He had a great time and said prices were dirt cheap. And the pictures showed it was a beautiful location. Like most places, I guess it all depends on where you are in Greece.

Jul

11

Did You Know? from Alan Millhone

July 11, 2007 | Leave a Comment

In my latest Northwest Draughts Federation Newsletter is an article about English exhibition player William Strickland giving a draughts (checkers) exhibition in South Stockton in 1855, consisting of playing 10 boards simultaneously while blindfolded. After the games concluded he astonished everyone by repeating all of the moves played on the 10 different boards both forwards and backwards!

In my latest Northwest Draughts Federation Newsletter is an article about English exhibition player William Strickland giving a draughts (checkers) exhibition in South Stockton in 1855, consisting of playing 10 boards simultaneously while blindfolded. After the games concluded he astonished everyone by repeating all of the moves played on the 10 different boards both forwards and backwards!

What an exceptionally well organized mind he must have possessed. A market trader of today could keep track of multiple trades and instantly recall previous trades, etc. The study of board games will enhance ones mind in many areas that carries over into many facets of life. Developing mental acuteness could save anyone from a serious blunder by doing something hurriedly that was not carefully planned.

Jul

5

San Francisco Food Review, from Victor Niederhoffer

July 5, 2007 | 2 Comments

One can’t leave San Francisco without posting some comments on the two restaurants there that have been in continuous operation and under relatively the same ownership since the gold rush days, 1850 in Tadich’s case, and 1865 for Sam's Grill on Bush Street.

One can’t leave San Francisco without posting some comments on the two restaurants there that have been in continuous operation and under relatively the same ownership since the gold rush days, 1850 in Tadich’s case, and 1865 for Sam's Grill on Bush Street.

Both restaurants prove that supplying goods to a growing business is a very profitable way of prospering, as they were able to provide a small item to all who came in the gold rush days without being caught up in the speculative frenzy of the day. I first ate at these restaurants 45 years ago, and it was good to see that they were both going strong without any changes of consequence over the years.

A 1943 menu is posted for Sam's and almost all items are the same on both menus. The prices then for appetizers and main courses and desserts are about 10 times today what they were 65 years ago, with a petrale being about 10 dollars today and 1 dollar in 1943, a shoestring potatoes being four dollars today versus forty cents yesterday, and a Coke being 2.50 versus 0.15. The two exceptions are that a whole chicken is 10 dollars today versus 1.25 in 1943 and abalone is 50.00 today versus 75 cents in 1943.

Abalone today is farm raised around Monterey and loses much in comparison to the fresh product that was available before unintended consequences from environmental regulation depleted the supply. The prices illustrate that stocks which had gone up by some 150-fold during this period have realized about a 10 to 15-fold increase over labor and food costs during this period, and also provides indirect evidence concerning the vast improvement in standard of living during the period.

Both restaurants are still packed for lunch and dinner every day, and their longevity illustrates that a formula for great prosperity is to give the average person a superb product and value, and stick to your knitting, and if you do it better than anyone else you will prosper. Both restaurants are famous for concentrating on superb product and not caring that much about personal service. Indeed, the waiters at both places are known for their reticence and lack of glad handing their customers.

I found the Sand Dabs and Petrale, and the Oyster bellies at Sam's far superior to any fish dinner I have had at any other restaurant, with the exception of some turbot from the North Sea, about 18 inches in diameter, that I had in Venice, the Four Seasons, and Circo. The potato dishes at both places which presumably have evolved to perfection over 150 years were also highly superior and great values at three dollars each for the 10 varieties they offered. And I am told by Mr. Gibbs, of the food bus Gibbs McComick, and a 75-year customer whom I met there, whose in laws met there 100 years ago, that the Veal Chop, and Sam's other meat dishes are equally meritorious. He assures me nothing has changed at Sam's in 100 years.

He was not as high on Tadich’s saying that the service there was so bad that he felt they were resting on the laurels. I tend to agree with him, although I found the Oysters Rockefeller at Tadich’s a most superior concoction to most I have had elsewhere. Too many of the dishes at Tadich’s had succumbed to popular taste and were combo fish and turf, and fish medleys and bouillabaisses, and in my case tasteless turbot wrapped around listless shrimp in a turbot wraparound.

The cost in both establishments is about fifty dollars a head, and both restaurants apparently have three times as much lunch business as dinner business. Sam’s will always have a deep place in my heart as it was my custom to celebrate all my fine Berkeley student grad papers there with a dinner, and John Mcquown of Wells Fargo, introduced me to it some 50 years ago. Its been my favorite fish restaurant since then, and I expect it to remain so. I can highly recommend Sams' as one of life’s best dining experiences.

The decor at Sam's and Tadich’s consist of wood paneling, white table cloths on wooden tables in booths, and the general look of an old-fashioned bus station. The waiters are knowledgeable and the service is fast. The entrees are grilled simply without any sauces except for the celery Victor and oyster stew at Sam's and the Oyster's Rockefeler at Tadich, which I found to be one of the best recipes and tasting versions I have sampled.

My favorite dish at Sam’s was the pancakes Anisette which I still remember with pleasure from 40 years ago. It gains much from a just flambéed presentation, which I had on two of three occasions I sampled it at Sam's on this trip. The price of a good dinner is $60-75 at Sam’s and $50 at Tadiches, great bargains in this day and age for perfect fish and meat dinners.

Alan Millhone writes:

In 1972 the Army brought me back to Oakland, Ca. to be discharged. A buddy of mine learned in finance that we had two to three days before our names were called. We put our money together and decided to head to Frisco and see the City. We stayed in a round hotel called the Villa Roma. We beat around the city and I told him some day I would like to return.

In the late 90s I took Vickie and we booked a hotel on the waterfront called the Cable Car Inn for a week. We settled in and had a great time riding the cable cars, visiting China Town and dining there on several occasions, visited an old brewery near Height/Asbury and a turn-of-the-century bar. We took a side trip one day to Muir Woods and enjoyed the redwoods and the fresh air there.

We took a trip over to 'the rock' and a trip to wine country one day and savored the wines at each stop that day, and had supper one night near Pier 54. I was amazed at all the different oysters they offered. I decided to have a large platter with a varied selection and deliciously prepared fish for supper and enjoyed some Dungeness crab and the sour dough bread.

I brought back good family memories. The saddest part of our trip was our visit to the SF Zoo. It was pitiful to see, and I hope over the years the conditions there have improved. I remember a lady working there told us they were severely under funded for operating.

Your account brought back good memories of my visit and I enjoyed reading your account.

Jul

2

Technology Corner, started by Steve Leslie

July 2, 2007 | 2 Comments

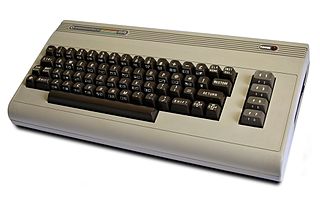

I remember back in the mid 1980s, the huge battle when AT&T and IBM entered the personal computer market. The Commodore 64 was the product that first entered the market place as I remember, in 1982, and it was an amazing hit. Then everyone else decided to pile in.

I remember back in the mid 1980s, the huge battle when AT&T and IBM entered the personal computer market. The Commodore 64 was the product that first entered the market place as I remember, in 1982, and it was an amazing hit. Then everyone else decided to pile in.

I also recall the Bowmar Brain that was so popular as a hand held calculator. Bowmar was later overtaken in market share and technology by Texas Instruments, Hewlett Packard, and others.

AT&T, after years of losing money, exited the PC business and left it to HP, Apple and Dell to charge forward. IBM is as strong and as powerful as any technology company ever was — they did not get the name "Big Blue" for nothing.

Ultimately IBM decided to leave the PC business and focus on their bread and butter mainframe business. Technology can be a very very difficult boat to steer, and it can be extremely hazardous and dangerous to stay ahead of consumer needs, wants, and demands.

Andrew Moe comments:

Talking of advancing technology, these guys are in the news today after taking apart an iPhone step by step, and identifying all the parts by make and model. If the profits are ephemeral, they won't be for Apple alone.

James Lackey adds:

The iPhone may be a leap of innovation, but of course others will adapt, and prices will fall. What is uncertain is how much innovation and cost will trickle down to the sedan market of cell phones. Perhaps that equation, how the mass market accepts and is willing to pay for the new bells and whistles, will set the pricing and production of future iPhones? Will the iPhone still be a sporty two seater high performance vehicle, or just another used sedan at 50% off current retail, in five years time.

Greg Calvin offers:

The fear of competition eating away market share of the iPod has been one of the chief concerns for aapl shareholders over the last few years. Somehow its market share has held up, despite an array of competitors entering the arena, including Microsoft and Sony. The iPod, and it would increasingly seem Apple themselves, have garnered cache, or an enviable 'cool' factor. Cache, when ingrained into the social consciousness, draws and retains business, wards off even possibly superior competition, and protects profits that would all but disappear with commoditization. Sony had it, and for the most part lost it.

The first generation iPhone needs a good number of improvements, notably Web speed, voice rec., an expansion slot, and availability of keyboard in landscape mode. A shame not to have GPS with that big beautiful display. If Apple can address the most critical of these issues, the challenge of attaining 1% market share might be done more with brand than technical wizardry. Who knows what the competition might come up with however. Advanced voice recognition apps, maybe.

Just a few of the countless names that still do at least reasonably well and lever their brand names to command premium over cheaper generic and/or superior competition include Coke, Bayer, Nyquil, Listerine, Marlboro, Intel, Rolex, Bose Wave $400 alarm clocks, Oakley, diamonds, Baskin Robbins, Harley Davidson, Jim Beam, Windows, Rolls Royce, Foster Farms, Chanel, Federal Express and Starbucks.

Alan Millhone adds:

In 1964 my parents took my to NYC for the World's Fair. My father worked all his life for the telephone company and I remember going to the 'Ma Bell' exhibit with them. There we saw things of the future like being able to see one another when you talk!

Scott Brooks adds:

I am reminded of two things from college (1982 - 1986) at little 'ol Southeast Missouri State University.

I took a statistics class and we had what I believe were Texas Instrument calculators. They were a bit bigger and bulkier than the units we have available today (maybe the size of two or three calculators stacked on top of each other). Their read-outs were all and you had to push the buttons real hard to the point where they "clicked". But what I remember most about them was that they were "caged" to the desks. Literally attached to the desk by some sort of metal unit that prevented them from being stolen.

The other thing I remember was that the statistics professor, who was also a psychology instructor, had me do an experiment with him of the effects of Scopolamine Hydrobromide on mice. It was pretty cool. I got to give mice shots of SHB, and put them in spinning apparatus to make them dizzy. Then the coolest part was that I got to do brain surgery on the mice.

At the end of the experiment, I had to type up a paper on my findings and notes. Bob, one of my fraternity brothers, had this typewriter looking thing that had a small screen on the front of it (similar in size to the read out screen on an calculator). You could type the words and see them scroll across the screen. As a result, you could proof read what you were typing, but only one or two words at a time. And there was no spell check so you’d better know how to spell. If memory serves me right the read out was so small that I couldn't even fit big words or phrases on the screen at the same time.

It was a very slow and tedious way to type a paper. Finally Bob, who was a computer science major, decided to type it for me since he figured he'd need the practice to be ready for the real world. I remember thinking to myself that he wasted his college career on a worthless major. I couldn't see how computers were ever going to catch on. There was no way that this tedious machine with a small 10 or so letter screen was ever going to achieve wide spread public acceptance!

I don't know what ever became of Bob. What I do know is that I was completely wrong about computers. I've never forgotten that lesson and try to apply it to my life everyday, especially when confronted with something that I think is stupid and a waste of time. I try to look beyond whatever that something is today and see what it can become tomorrow!

Jul

2

Oil at Seventy Dollars per Barrel, from Sam Marx

July 2, 2007 | 2 Comments

Oil is again trading at over $70 per barrel. However, as I understand it we (the US) have more oil in four states than there is in Saudi Arabia, locked in shale, and it can be extracted profitably at less than $35 per barrel.

Oil is again trading at over $70 per barrel. However, as I understand it we (the US) have more oil in four states than there is in Saudi Arabia, locked in shale, and it can be extracted profitably at less than $35 per barrel.

Meanwhile the U.S. is pursuing and subsidizing ethanol from corn, driving up corn and meat prices. I think that a policy of extracting oil from shale should be our primary policy. What am I missing?

Of course, more than 30 Senators are from farm states and a policy of oil from shale, tar sands (under $30/barrel), or coal ($40/barrel) would drive down oil prices.

Jaime Klein writes:

Exploiting shale requires immense investments as well as a change in environmental regulations. Historically, oil markets suffer from cycles of overproduction followed by tight supply (like recent years). Investment in oil production has a long maturation period and is very risky. Any number of events, such as an outbreak of stability in Iraq, opening up Iran to foreign investments in oil, Hugo Chavez retired by a military coup, strengthening of demand destruction (in many developed countries oil demand is falling), could cause crude prices to collapse and then settle at its historical level (maybe half of its current price). I am shorting oil.

Sam Marx replies:

If oil goes below $50, Saudi Arabia will cut production as it has in the past.

Alan Millhone comments:

Yes, then a 'created' scarcity. Alternative fuels, hybrid cars, etc. have been 'beat around' for years, but little done. In Vegas they have built an elevated monorail from MGM to the Sahara and talk is to extend it all the way to the airport. Taxi drivers are against this, but something has to be done to ease traffic congestion and fuel consumption in one isolated area of the US. America has always had a love affair with the automobile.

In Europe you can get a passenger train to about any location and buses and subways are readily available. I drove in Paris once and quickly realized I would not want to have a car there. Problem is not many of us are willing to 'cut back' on our driving.

Sam Marx writes:

I believe that the only "alternative" fuel that will work is oil produced in this country. That means drilling in Alaska, offshore, and very deep drilling on land. Aside from that are oil produced from shale, coal, and tar sands (Canada). Money and necessity should be the solution to environmental problems.

I believe that by hybrid cars you mean they also use ethanol. For many reasons I don't believe that ethanol is the solution. As for smaller cars, it is my understanding that since 1972, an additional 50,000 people have died in auto accidents in the U.S. because they were in a small car, but would've survived if protected by being in a larger car.

During WW II , Germany had to resort to oil from coal. After everything is considered and there is rational leadership in this country, willing to stand up to big oil, I believe we will have to resort to oil from shale, tar sand, or coal also.

I don't believe that there is a conspiracy by big oil to drive up prices, but I do believe that they don't want prices to come down and oil from shale, tar sands, or coal would do that.

Henry Gifford writes:

A man named Peter Judd did a study of the amount of fuel used to make heat and hot water for each of thousands of apartments in New York City in the 1980s. He divided the buildings into five categories: old law tenements (pre 1901), new law tenements, pre WW2, post war, and post 1974 oil embargo. The average use for each category was about the same, except for some improvement in the post 74 buildings, which when credit for more bulk and therefore a lower surface area/floor area ratio is considered, means there has been approximately zero progress in 100 years.

The most interesting thing he discovered was the spread between the best and the worst buildings - about 700% when the unusually high and low consumption buildings were tossed out of the mix. The spread persisted in all categories.

The main exception were the buildings gut renovated in the 1980s, which had new double pane windows, insulation for the first time, and new boilers and controls. They used 50% more fuel than the average of the existing housing stock. Since they were renovated by the government, and Peter was a government employee, he was moved to a do-nothing job, and soon left. His counting skills are now put to use in producing off-off-Broadway theatre.

The lesson I took from this is that some buildings use 1/7 of what others use, while providing better comfort. Meanwhile, this is all done unintentionally, as it wasn't until the mid 1990s that anyone even claimed to be making energy efficient houses in NYC. The extra cost of course was zero. I think this argues that there is a lot of potential gain from conservation.

It turns out there is a field called "Building Science" which is a study of the factors which effect comfort and building durability and energy use, which is widely ignored by the industry. But the science to explain this exists, as does the counting to show what is possible. Knowledge of these things has led me to believe that buildings could be built that use 10% or 20% of the energy that existing, average buildings use, and be built this way for no extra cost. I have done this, and am one of the only people in the field who shows fuel bills to back up claims. Of course, zero extra cost has its own problems, not the least of which is that there are approximately four people in the US who work on energy efficiency in buildings and are not paid by the government. This causes many conversations to start with "money is available for…" instead of "energy can be saved by…", which of course is an impediment to innovation.

I cannot predict how widespread sound building practices will become, but have no doubt that from a technical perspective, all the necessary technology has existed for decades, and is currently for sale in Home Depot. It's just that the industry that knows how to design and build such buildings mostly does not exist.

As for oil from coal, it is true the Germans did it, but at a high cost, and only in the face of severe shortages. The rumor that fuel was so scarce in Germany that the first jet planes in history were towed to the runway with horses is simply not true. They used cows, because the army was using all the horses. I think fuel will get more scarce before oil shale is economically viable.

One of the costs is the energy used in the process. The Canadians say that it will take the energy from two barrels of oil shale to produce a third barrel. Perhaps in our milder climate the numbers will be a bit better, but probably not by much. At best, it will be a costly and difficult process.

Jul

1

Some Random Thoughts, from Victor Niederhoffer

July 1, 2007 | Leave a Comment

The specialist in panics, from The Ticker magazine of 1908, went through a three year period while he waited for the steel markets to crack: ten, twenty, thirty percent on the day, and it was very hard for him. All of his friends were making money, and going to Delmonico's and fancy watering spots like the Brighton and Sheepshead race tracks. Even the hack drivers were moving up in the world as they opened up trading accounts too.

Many speculators must feel the same way about the markets now, where the reasons for bearishness seem so flimsy and so labored. First it was an increase in bond yields, but then the bonds went up three points in two weeks, and all yields go to or below, five percent, and the curve isn't inverted any more.

It's the bomb scare in Boston, or the smoking car outside the night club in London, or the other events of this kind that the bears like to jump on to increase the fear factor. When these blow over, it's the hedge fund that lost money, or the lender that called the high risk mortgage market wrong, or the contagion from all those unwanted dollars from foreign sources, or the risk for the layman in derivatives (a'la the Sage), or the risk of a global economic meltdown (a'la the star CNBC Dow 5000 advertiser).

Needless to say, this has been the same beat we've been hearing since 2002, and it's amazing that those who are hoping they can catch the next bear move still have the mojo to communicate and strut after losing so much during the doubling of the S&P that has taken place during these years. Yet they persist, and if it's a slow Friday, they can knock it down a fast 1% in 10 minutes, on a sighting of a stranger or straggler.

I believe the differential between the five percent on bonds, and the sixteen percent on equities, will eventually come through and be of higher significance than the recent end of world stories. Those who wait for that opportune time to get out of stocks, and into the fixed income, as recommended in the (much too harshly reviewed by me) Ken Fisher book, will have no more luck in overcoming the drift in stocks, than all the palookas and poseurs who would have you believe that they see the debacle coming off the back of one or another scare stories.