May

6

The Value of Doing Nothing, from George Parkanyi

May 6, 2011 | 2 Comments

A while back, someone asked about the value of doing nothing. I had two positions on going into this morning - short S&P, and short natural gas. Had I not turned on a computer today, I would have made enough money to forgive many a sin of the first quarter. As it is, I ended the day breaking even when I had started out being significantly short two markets that gapped in my favour and then later basically went over a cliff. I won't go into the gory details of what and why I traded - nor share my feelings - but I'm pretty convinced that I'm going to have to hire a guy with a gun who, after I've set up the trade and the risk management, under contractual obligation is required to say to me "Sir, step away from the keyboard, or I'm going to have to shoot you in the head."

A while back, someone asked about the value of doing nothing. I had two positions on going into this morning - short S&P, and short natural gas. Had I not turned on a computer today, I would have made enough money to forgive many a sin of the first quarter. As it is, I ended the day breaking even when I had started out being significantly short two markets that gapped in my favour and then later basically went over a cliff. I won't go into the gory details of what and why I traded - nor share my feelings - but I'm pretty convinced that I'm going to have to hire a guy with a gun who, after I've set up the trade and the risk management, under contractual obligation is required to say to me "Sir, step away from the keyboard, or I'm going to have to shoot you in the head."

I would say there is value in doing nothing.

Speaking of doing nothing, the hockey game is on and the couch beckons.

Alston Mabry comments:

One sympathizes. It brings to mind this proverb.

Kim Zussman writes:

Randomly speaking, the market might have just as easily shot up and you could have avoided regret.

Gordon Haave writes:

Whenever I am in a business meeting and someone has come to it with some pressing need we have to react to right away, I always ask "what if we do nothing?". Everyone is always stunned.. they haven't even considered not doing anything. After asking that usually the consensus become to, in fact, do nothing.

Alston Mabry writes:

I would say that the over-arching issue is that the Market Mistress can torment her lovers in many, many ways. And experience would lead one to believe that tormenting her lovers is, in fact, her main obsession.

George Parkanyi replies:

Oh sure, Kim, you're right about that. But I had my risk management in place. Stops. But the point is, I had my idea right, and the method of executing basically set up to exploit the anticipated scenario. That would have played out very well, since there was nothing more that I needed to do at that point. Then I started changing stuff …

I don't mind being wrong, because that always happens in the markets, and you plan for it. What really gets me angry at myself is when I'm right and then I get in my own way. What other people do, I can't control, but what I do I SHOULD be able to control. Not being able to maintain self-discipline is a character flaw that has to be actively managed, and today it got the best of me. Doesn't always, but today it did. (Tomorrow may not be so good either, because before the close I went long a little silver.)

Jim Sogi writes:

Well, the next best thing to doing nothing is doing just a little to see what happens. If you're wrong, not such a big deal, but a small sample gives a good sign. Like Commodore when the guy gives him a hot tip in Reminiscences of a Speculator. See how it gets swallowed up.

Jeff Watson writes:

Jim mentioned probably the best thing I ever learned in my speculation game which is still going since 1973. "See how it gets swallowed up." Second best lesson I ever learned, but it only works with big orders and can tell so much about the markets, where they are, where they're going, who want's what, etc. Many things can be said with words, but until the order is put to the market, one can't say anything. The order getting digested is where the rubber hits the road and contains so much information(even in these electronic days), almost 10,000 pages per order if one is willing to keep an open mind and analyze it. The Commodore's system still works well in the grains, more than any other market I've seen and has been responsible for much of my limited success.

Vince Fulco writes:

The multi-day swing boys and the deep pockets are the big winners in GC1 so far tonight. Late afternoon, the contract came in like a ton of bricks as ES tumbled, with modest movement in equities after hours, zoom goes Gold as if the latter part of the day didn't even matter. The solid long moves all seem to be held "in reserve" till the day traders are flat.

Jim Sogi responds:

I know its so minuscule, but the market knows when I put in my and my order makes it harder for Globex to move to the price and for a fill. I try to stealth even my limit orders keeping them mental until the price is where I want, ambush like. It puts me near the end of the queue, but at least its the right queue at the right price tick. Less chance of the hunter becoming the hunted, less exposure.

Apr

22

Gaps, from Jim Sogi

April 22, 2011 | Leave a Comment

It's interesting to see the big gaps, active overnight sessions, and sleepy daytime session in SP. Seems overseas traders are starting to wag the dog.

Sushil Kedia writes:

The Senator taught me a trick when he was in Mumbai almost five years ago to treat the overnight gaps as the cost the public is paying and the intraday range as the action of the pros.

Overseas or local, the battle is fought in that same pit. Senator's attitude to gaps left a few meals for a lifetime.

Apr

21

Wolfram Products, from Jeff Watson

April 21, 2011 | 2 Comments

Wolfram has added a new toy to their magnificent engine. They added age pyramids to their distribution data, which should be fun to play around with. Pretty soon, they will have many other pyramids that a curious person can play around with and tweak. It is of my opinion that every speculator should be well versed in using the Wolfram products.

Wolfram has added a new toy to their magnificent engine. They added age pyramids to their distribution data, which should be fun to play around with. Pretty soon, they will have many other pyramids that a curious person can play around with and tweak. It is of my opinion that every speculator should be well versed in using the Wolfram products.

Jim Sogi writes:

Very interesting to see difference in distributions for Japan/US vs China. China is young. Japan is old, bulging in 60+ band. US middle aged.

Laurence Glazier writes:

What is the value of Wolfram Alpha for us. I've been meaning to try it out for possible trading benefits. I would love to be able to ask it for the 100 most trending stocks.

So I just did, and while it has not obliged me, the same question posited to Google has provided some likely looking links. Has anyone found a summary of useful adaptations by traders for this tool?

Apr

20

10 Things I’ve Learned About Markets, from Victor Niederhoffer

April 20, 2011 | 1 Comment

1. "There is no such thing as easy money"

1. "There is no such thing as easy money"

2. Events that you think are affected by cardinal announcements like the employment numbers at 8:30 am on Friday are often known to many participants before the announcement

[An example supplied on April 18 by Mr. Rogan: "The Reason For Geithner's Weekend Media Whirlwind Tour: White House Learned About S&P Downgrade On Friday" (zerohedge )]

3. It's bad to try to make money the same way several days in a row

4. Markets that have little liquidity are almost impossible to profit from.

5. When the stock market is way down, policy makers take notice and do what they can to remedy the situation.

6. The market puts infinitely more emphasis on ephemeral announcements that it should.

7. It is good to go against the trend followers after they have become committed.

8. The one constant, is that the less you pay in commissions, and bid asked spread, the more money you'll end up with at end of day. Too often, a trader makes a fortune on the prices showing when he makes a trade, and ends up losing everything in the rake and grind above.

9. It is good to take out the canes and hobble down to wall street at the close of days when there is a panic.

10. A meme about the relation between today's events and those of x years ago is totally random but it is best not to stand in the way of it until it is realized by the majorit of susceptibles

11. All higher forms of math and statistics are useless in uncovering regularities.

Mark Schuetz comments:

A point about # 2: This one might be fun to try to rigorously measure and test, looking at price movements in the time leading up to and including certain announcements (knowing this type of thing has been shown by list members before, but usually it's more descriptive instead of measured). Is it possible to show which types of announcements are more often known by participants beforehand as opposed to other types? Also, if certain participants are informed ahead of time, how far ahead of time do they know and in which way will they "front-run" the announcement (there can sometimes be many different ways to make a position on one economic statistic) ?

Victor Niederhoffer replies:

Certain participants know it and they react to it, and you can figure out which announcements are go with and go against——-but but but. The pre and the post regularities are always changing vis a vis the flexions and cronies and their nephews.

Ralph Vince writes:

What a great post. Thanks Vic. I certainly must second points 1 and 11, the bookends….and they have me thinking…

1. There is no such thing as easy money

This is so true, in the markets, in everything. Those who happen upon money where it DID come to them easily, it seems, as a witness, have had it very fleetingly. In my own case, although I am supremely confident in the profitabliity of what I am doing, in practically any market, in virtually any "regime," doesn't mean it's easy. It works like clockwork and is incredibly painful and distressing. It would be so much easier to simply sell buckets of blood."

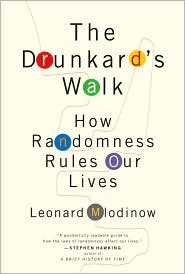

11. All higher forms of math and statistics are useless in uncovering regularities.

Certainly in a post-'08 world, quants are out of favor, and for good reason. Most anyone I know who DOES make money in the markets, does so with very simple, robust techniques. Having considered going to quant school, and studied a good deal of it, I finally came to the conclusion that they are simply working with "models." Models of how the world behaves. unlike hard sciences like Physics and such where you can perform a test, come back a year from now, perform it again and get the same results, you don't have this in financial modeling. And I think this is where the quants have fallen short. Models are NOT reality, and they never got down to the bedrock, the reality of what his game is about. Of course it had to fail, and in a large way, at some point. A good rule of thumb is that if I need a computer, if it isn't simple enough to do in my head on the fly in the foxhole after I have been awake for over 100 hours, I can't use it.

Jim Lackey writes:

About point # 10: It takes no time at all for the information to spread. Yet how many times have we acted, lost a bit, recovered, then seemingly too much market time expires, and we close out a position. We say "awe everyone knows that it's priced in." The meme is then repeated for the 57th time and on a low pressure day, month, or year and then, kaboom!

Of course, I can think of the few times where we missed a huge score, being short YHOO in 2000 or selling some short in 2008. Yet there are hundreds of low magnitude fantastic long only ideas that we forget about. I look back 6 months later and say wow look at that beautiful rise, what happened? It went up very small, day after day, and only buy and hold would have worked.

Alston Mabry adds:

12. One should not make one's analysis more precise than one's actual trading could ever possibly be.

12. One should not make one's analysis more precise than one's actual trading could ever possibly be.

13. If the rational mind has not determined the parameters of a trade, then upon execution, the lizard brain will decide.

14. Never go on vacation with open trading positions.

Or, zooming in:

<click> home

<click><click> to lunch

<click><click><click> to the bathroom

Paolo Pezzutti writes:

One could test how the stock market reacts to good (very good, wonderful) or bad (very bad, terrible)(a sort of matrix) news when the news is released and after some time. It might help build a strength indicator. Amazing how the earthquake in Japan and the unrest in Middle East, admittedly extremely bad news, were absorbed by the strong trending markets without any problem (so far). In other times, stock markets might have crashed confronting with the same news.

Alston Mabry comments:

Amazing how the earthquake in Japan and the unrest in Middle East, admittedly extremely bad news, were absorbed by the strong trending markets without any problem (so far). In other times, stock markets might have crashed confronting with the same news.

Chris Tucker adds:

Stick to your guns, but realize when you are wrong. Easier said than done. Good ideas can lead to conviction, but only experience can strengthen ones resolve. Forget the last trade, look to the next. Try, try, try to learn from your mistakes, but also from your wins.

Anton Johnson writes:

15. When correlations among many typically disparate markets become high, one should reassess leverage and seek novel opportunity.

Jeff Rollert writes:

17. Sell side liquidity is an inverse function of cell signal strength and micros0ft patch frequency, especially at lunch time.

Rocky Humbert writes:

The First Law of Rocky – In every "macro market" (indices, bonds, commodities), all prices WILL be seen at least twice. The only unknowns are: (1) how long it takes and (2) how far prices go, before the price is re-visited. This Law is true 99.999999999% of the time.

The Second Law of Rocky – Rocky always keeps his calculator precision set to two decimal places. Any trade that requires more precision than the hundreth decimal place, is a trade that Rocky leaves for smarter participants

Jeff Sasmor writes:

About Jeff R's # 16:

16a. Never go to the doctor when you have a profitable position as it will reach its maximum profit and reverse exactly at the time that you enter the doctor's office.

Happened to me yesterday…

Ralph Vince comments:

With regards to the First Law of Rocky…."Unless it is a new high, that price has already been seen before."

Victor Niederhoffer adds:

Beware of using hard stops as it's bad enough that the floor can always know your physical hard stops.

Jay Pasch comments:

No wonder over-leveraged daytraders always lose as they are required to deposit a hard stop with their leverage, along with their hard earned money…

Ralph Vince adds:

Despite numerous posts on this thread, it has not been opened up beyond Vic's original 11…

T.K Marks writes:

Aristotle felt the same way about drama, posited that it could be comprehensively reduced to 6 elements. And any additional analysis would by definition be but variations on those original half-dozen themes:

"…tragedy consists of six component parts, which are listed here in order from most important to least important: plot, character, thought, diction, melody, and spectacle…"

Jim Sogi writes:

Always be aware of and consider current market conditions and how they might affect or even negate your prior analysis.

Even the the weather forecast says sunny, if the clouds look dark and the wind is blowing, stay home or dress warm.

James Goldcamp writes:

One good anecdotal rule I've found that works for investing is that the market that causes you the most psychological pain, revulsion, and visceral response from prior bad investments, or overall perception, is probably currently the best opportunity since others may also have a similar overly pessimistic view (or over assign risk premium). This seems to be especially true for post calamity emerging markets, high yield bonds, and fallen growth stocks (tech). If for no other reason, this is why I think stocks like Citi and the West Virginian's company are good buys now (and perhaps government motors and Russian stocks).

Ralph Vince comments:

Thinking on this a great deal the past 24 hours, I think I would add one more, which is to me the most important of them all perhaps, or at least tied with #1 and #11. And that is that most people have no business being here. They don't know why they are here, and, if pressed, can only give a sloppy, struggling answer. "I'm here to make money." "I'm here to improve my risk-adjust return," or some other nonsense.

Thinking on this a great deal the past 24 hours, I think I would add one more, which is to me the most important of them all perhaps, or at least tied with #1 and #11. And that is that most people have no business being here. They don't know why they are here, and, if pressed, can only give a sloppy, struggling answer. "I'm here to make money." "I'm here to improve my risk-adjust return," or some other nonsense.

They are here for action– whether they know it or not, whether they acknowledge it or not. The market is a magnet for gamblers, a magnet for those who compulsively seek out the very action she puts out. People are here because they want to feel they have one-up on the masses, the system, or that they are not as inadequate as they suspect. The very proof of that is their utter inability to instantly articulate their criteria in specific terms. Absent that– they're in a bad place.

They're looking for girls in the wrong dark alley.

It makes no difference how well-capitalized the individual is. The world is full of guys with $10,000 accounts who will lose it all and then some, and full of guys with very fat checkbooks who will lose all of it equally as quickly, in similar fashion.

They still think it is about what you buy, when you buy it and when you get out, facets that have nothing to do with what is going on here (which is specifically why mathematics, simple or higher-order, fails in this endeavor; people are applying to aspects they mistakenly think this thing is about.)

If you examine institutions, they may be equally as clueless as to what this thing is about, but they have one big up on the individuals– they have a specific, well-defined criteria in most cases about what they are in this for, what they are willing to do to achieve something very specific.

Most individuals– of all gradations of wealth– can't, and that's the red flag that they here for all the wrong reasons.

Jeff Rollert adds:

Amen. If it doesn't hurt a little, you're wrong.

Apr

19

I Do It In Reverse, from Jim Sogi

April 19, 2011 | 2 Comments

I do it in reverse. I watch the market. If it moves, like yesterday or the earthquake, then I look to see what happened.

I do it in reverse. I watch the market. If it moves, like yesterday or the earthquake, then I look to see what happened.

Except announcements which are scheduled ahead of time. The market usually seems to be wrong about the news.

News is just a reflection of the tenor of the popular mass and as a result is behind the curve. Markets reflect the same but is ahead of the news as it looks to the future.

The myth that the media likes to perpetuate is that the news predicts or causes the market.

Apr

18

Top Ten Reasons Not to Trade– and Why You Should Do It Anyway, from Jan-Petter Janssen

April 18, 2011 | 1 Comment

#1 Trading creates no greater good

#1 Trading creates no greater good

- like when you buy grain futures, the price skyrockets, and you make a killing! A poor farmer plants more seeds as a consequence, third world children get affordable bread, hmm, did I say you make a living?

#2 Trading makes you selfish

- and that's why filthy rich old speculators turn to philanthropy.

#3 Staring at screens all day is not healthy

- which is true, and why slow lunch hours are perfect for physical exercise.

#4 Staring at screens all day is not good for your social skills

- which is why traders are out having fun when the market is closed. (Don't "normal" people spend evenings in front of the TV?)

#5 The market is a casino

- where scrupulous gamblers make it easier (and more important) for sane traders to make a living.

#6 Changing cycles make it hard to make consistent money

- and that's why I take months off traveling the world.

#7 Watching the market is sometimes like watching paint dry

- which is true, and why you should use slow hours to study arts and sciences (while some make #5 come true).

#8 Most traders lose money

- which makes it even more rewarding for successful ones.

#9 You won't make it without talent

- just like a talent is needed to become a piano, chess, or basketball professional. A zillion different market niches should make it possible to succeed for a variety of personality types though.

#10 Traders do not deserve all that money

- if spent on booze and babes. Do good and create exponentially more "greater good"! (ref #1)

Jim Sogi counters:

Good Reasons to Trade

1. Trading provide capital and liquidity for production of good.

2. Trading is an honorable profession.

3. Trading give time to exercise, ski, surf when markets close and you always get weekends off.

4. The gains have favorable tax treatment.

5. The competitive environment is tremendously rewarding.

6. The analysis is deep, wide ranging, complex and also very rewarding. It covers history, math, statistics, current events, politics, economics. No other field is as broad or deep for study.

7. Trading has economies of scale built in to the structure.

8. Immediate and easy credit is available.

9. The Spec List.

10. You can trade from home, be it Hawaii, Alaska, CA, NY, Bahamas, Singapore.

11. There are world wide markets, and many niches to fit many styles and temperments.

Apr

8

Life Designed to Kill, from Jim Sogi

April 8, 2011 | 1 Comment

A good friend told me, "The longer you live, the closer you are to dying." I got a good laugh from that one.

A good friend told me, "The longer you live, the closer you are to dying." I got a good laugh from that one.

Ken Drees adds:

or, "Life, its designed to kill you".

Victor Niederhoffer comments:

There is great deep truth in this as applied to markets. Although like the micro organism the body likes to let into the body, a slow death is programmed so that the maximum of chips can be obtained from you, and other poor fool humans will maintain hope so that they can sustain the similar microorganisms that will appropriately sap away the life of other market players. Thus, what started out as a joke has all too much applicability. The purpose of the Market. Ha, it's to take away the chips from the weak, so that the flexions and other top feeders can prosper. That's a terrible but beautiful thought, I think.

Mar

31

10 Things We Can Learn From Japan, from Anatoly Veltman

March 31, 2011 | 7 Comments

I didn't make this up, I read it on Facebook and it is pretty interesting:

10 things we can learn from Japan

1. THE CALM Not a single visual of chest-beating or wild grief. Sorrow itself has been elevated.

2. THE DIGNITY Disciplined queues for water and groceries. Not a rough word or a crude gesture.

3. THE ABILITY The incredible architects, for instance. Buildings swayed but didn't fall

4. THE GRACE People bought only what they needed for the present, so everybody could get something.

5. THE ORDER No looting in shops. No honking and no overtaking on the roads. Just understanding.

6. THE SACRIFICE Fifty workers stayed back to pump sea water in the N-reactors. How will they ever be repaid?

7. THE TENDERNESS Restaurants cut prices. An unguarded ATM is left alone. The strong cared for the weak.

8. THE TRAINING The old and the children, everyone knew exactly what to do. And they did just that.

9. THE MEDIA They showed magnificent restraint in the bulletins. No silly reporters. Only calm reportage.

10. THE CONSCIENCE When the power went off in a store, people put things back on the shelves and left quietly.

Jim Sogi adds:

This is the face they want the world to see. What isn't shown is the massive corruption underylying the nuclear plants and electrical system. Much is hidden in the Japanese culture, like an iceberg. You're only meant to see the nice surface. Its a show. Don't be deceived.

Gary Rogan comments:

Is it really deception though? The restaurants didn't cut prices to protect massive corruption in the nuclear plants and the grieving relatives didn't hold back tears to protect the image of the country. The people are orderly, reserved, and polite to each other in public. Are they angels? No.

Mar

11

Tsunami, from Jim Sogi

March 11, 2011 | Leave a Comment

Tsunami sirens are wailing in Hawaii.

Tsunami sirens are wailing in Hawaii.

They are evacuating the coast.

It's just after 11 pm.

Markets in turmoil in afterhours trading.

It's interesting how Twitter and Blogs are carrying better info than either news, radio, or Civil Defense or Government. This is a very interesting article about it.

Mar

10

Nervous Market, from Jim Sogi

March 10, 2011 | Leave a Comment

The market seemed nervous yesterday. It had a lot of travel with some good pumps. Fewer bids and offers on CME. Market was down a bit last night. The contract roll is a bit unnerving with the backwardation. On the macro front, gas is really expensive here, $4.19 and its eating into disposable income.

Feb

24

Blockbuster, from Jim Sogi

February 24, 2011 | 3 Comments

Their initial business model passed Blockbuster by and they did not meet the change. They couldn't. They are in bankruptcy. They are closing down stores.

Their initial business model passed Blockbuster by and they did not meet the change. They couldn't. They are in bankruptcy. They are closing down stores.

I haven't been there for years after a "late charge".

Netflix passed them by with mailers, and now with streaming. Who would drive to a seamy dirty store to rent old movies? It's a good example of obsolescence.

In any case, back to the fray to personally hold up the entire market.

Feb

1

Turning Points, from Larry Williams

February 1, 2011 | Leave a Comment

I don't think one becomes good at trading until we have been beaten so much that we no longer fear the beast…once you learn how to take any shot the market give you, success comes so much easier.

Jay Pasch replies:

There is wisdom in this post; it also emphasizes the importance of having enough skin in the game to experience its sensitivities especially when it comes to turning points– turning points start to hurt, they frustrate you, they wear you down, they rub you raw to a point where you think you can't take it anymore, to a point where you question your methods, why you trade for a living, to a point of throwing in the towel– it is then that the trader needs his perseverance the most and to stay awake.

Victor Niederhoffer asks:

What are the turning points and how can they be predicted? That's a good way of

trading I think. A turning point and run are pretty much the same with

proper definitions as a start.

Jim Sogi writes:

There are enough niches and styles in markets that a person can find one in which his own weaknesses create the least problems.

Rocky Humbert writes:

Craig wrote about Cyclone Yasi a few days ago. This is a monster storm, and may hit Queensland sugar (and other ag) production. It will be a couple of days before the markets "digest" the results.

Spot sugar is already in tight supply. If the Queensland crop is damaged, it could push up out-month sugar prices, and this might even feed into higher corn prices (i.e. corn syrup). Conversely, the ag markets are already extremely "hot," and we've not seen a bearish headline for ages.

Earlier this morning, the chair asked a most relevant question: "what are turning points and how can they be predicted?" The chair has also previously written that "reversals are more lucrative than trends." Over the past 12 months, sugar is up 65%, coffee is up 76%, cotton is up 125%. If reversals are indeed more lucrative than trends, I'd love to figure out when I should reverse these positions, since I keep wasting money on my hedges. Sadly, the only turning points that I ever see are with 20:20 hindsight.

Vince Fulco writes:

There seems to be a prevailing reasoning in the trading world that "reversals" or "turning points" are something which must be predicted– while trading "trends" is something which is not predicted, but merely, reacted to. The latter, not requiring "prediction."

I think that prevailing reasoning is false. Being a trend follower still requires one to predict in the sense that he is predicting the trend will continue. Both approaches require prediction. (Similarly, a non-directional approach, a market-neutral approach, say, writing butterflies, is, by the same reasoning, requiring prediction in that one is predicting the market will stay sideways, or at least not go into a protracted trend).

So my question to the site is this: Is it possible therefore to trade and not predict?

Gibbons Burke comments:

Method one: Book your profits in your mind, don't treat it as "house money" and decide right now, for each market, how much of your money you are willing to give back to the markets. Draw your line in the sand and let the market take you out at that point. If it takes you out and then goes back to make new highs, consider maybe getting back in.

Method two, which I prefer: take half of your positions off the table, cash in the chips and reward your self for being right. Let the rest ride with a stop set at the point determined by method one. If you keep being right, and start feeling like you want to reward yourself for being right again, take half off again. Keep raising your stop on the remaining positions to lock in your profits, and let the market take you out when it feels like doing so. And given the magnitude of the trends, the likelihood is that when it decides to take you out, it will keep going in lobogola fashion.

I've had this very argument with a well known trend follower/leader on his Facebook page a couple of times. He keeps insisting that trend followers are superior to the other species of traders because they don't make predictions. But my contention is that trend followers are simply deluding themselves if they think they aren't making predictions.

They are predicting that when they get a trend following signal that the market will continue in their direction by a magnitude that is more than twice the size of the risk they are taking on. They predict that this will happen maybe 20% of the time, and that when they catch those big moves they will make up for all the psyche-destroying losses of which they predict their method will keep small.

It is a different sort of prediction, but it is nonetheless a prediction.

Jan

31

Decline Effect, from Jim Sogi

January 31, 2011 | Leave a Comment

In a fascinating article in the New Yorker Magazine, Lehrer describes the inability to replicate significant scientific studies due to a decay in the significance of the underlying data. It might be caused by the publication effect, the bias toward finding significant results or hypothesis creep, or reversion to the mean. More insidiously he asks whether the scientific method is eroding or some underlying phenomenon is at work.

In a fascinating article in the New Yorker Magazine, Lehrer describes the inability to replicate significant scientific studies due to a decay in the significance of the underlying data. It might be caused by the publication effect, the bias toward finding significant results or hypothesis creep, or reversion to the mean. More insidiously he asks whether the scientific method is eroding or some underlying phenomenon is at work.

In market studies significant results tail off with time, and prior significant regularities do not guaranty similar results going forward. The changing cycles affect results. Is the data moving away from normality and are distributions changing or is there some other phenomenon causing this decay of the data previously found to have significance?

In an infinite series of randomly generated characters or events, our entire history, the works of Shakespeare, and the entire laws of physics will appear almost by definition, only at some point to erode to randomness. This is not logically consistent with the scientific method. In a series of a trillion to the trillionth power of 0's and 1, there will appear several sequences of all 1's a million long. Dr. Phil regularly reminds us that of 20 studies, 1 will appear significant purely at random and not signify some important regularity. Are one of these effects at work ? Is this the same problem Lehrer describes or something else?

Stefan Jovanovich writes:

In keeping with my obligation to continue to contest for the title of the site's most irritating contributor, I took the trouble to read the entire New Yorker piece. The "scientific" discoveries that were found to have become invalidated were these:

1. Anti-psychotics, specifically anti-depressants

2. verbal overshadowing

3. extrasensory perception

4. symmetry and sexual selection

Each of these phenomena is one where the measurements are determined soley by the observer's personal judgments; even in the question of symmetry the ruler takes second place to the a conclusive decision by the experimenter.

The article's conclusion gives away the real problem: "Even the law of gravity hasn't always been perfect at predicting real-world phenomena. (In one test, physicists measuring gravity by means of deep boreholes in the Nevada desert found a two-and-a-half-per-cent discrepancy between the theoretical predictions and the actual data.) Despite these findings, second-generation antipsychotics are still widely prescribed."

Our present "scientific" world is one where a bedrock axiom of physics is considered equal in substance to the continuing prescription popularity of a class of drugs that zombifies otherwise troublesome people.

As Thomas Szasz– a professional pain-in-the-ass who puts this amateur to shame, has already pointed out, mental illnesses such as depression have no clinical markers that can be verified objectively as medical conditions. "Verbal overshadowing", "ESP" and "symmetry" are also equally free of any quantitative standards that can be replicated consistently. My, how much progress we all have made since education in America became successfully socialized.

Gary Rogan writes:

It's interesting that Global Warming was never mentioned. It was the first thing I thought of when I read "Many scientific theories continue to be considered true even after failing numerous experimental tests", let alone documented massive pro-supporting-evidence discrimination in the selection of results. One shudders to think about what all of this means in the context of government-driven statistical findings where various labor statistics are a running joke, inflation measurement is a "science" in how to find the lowest inflation, and "saved or created" jobs are a statistic that can't possibly make any sense with the best data gathering, but especially when jobs in non-existing congressional districts, etc. are included.

Jan

21

SGX, by James Sogi

January 21, 2011 | Leave a Comment

Heard that Singapore Exchange will get rid of its infernal lunch hour break.

Michael Cohn comments:

As someone who very much enjoyed my old 11-1 TSE break later revised during my tenure to 1.5 hours I regret the lost of civility. Started work at 7am. Exercised during the break. Would work perhaps to 7-7:30pm and home at 8 fully exercised and sated with the work experience.

Jeff Watson writes:

In the old days, I might have said that I would enjoy what basically is two opens and closes in a day, especially from a floor perspective. That being said, I'm sure that Mr' Sogi is relieved as there's not the opportunities today that were present in the opens and closes 20 years ago.

Jan

17

T-Bond Bearitude, from Nigel Davies

January 17, 2011 | 1 Comment

A question from a novice:

A question from a novice:

Noting the general bearishness on t-bonds I'm wondering why someone would want to participate in a game in which both the bonds and the currency are controlled by the dealer (can't US inc print the money it needs to support the prices, as and when it needs to to keep China inc and Russia inc happy)?

I've played in a lot of tournaments where even the strict rules of chess can be severely bent to favour home grown players, isn't this one a whole lot worse?

Jim Sogi writes:

Well, at least it moves up and down a bit, unlike equities.

Jan

13

Thought of the Day, from Dan Grossman

January 13, 2011 | 1 Comment

I haven't read the book, her WSJ article, or followed this at all. But are the Asian-American children's academic and music results a fair statistical test of their mothers' methods? How many Asian-American youngsters are there in the NFL or the NBA? That is, maybe their success in academics and music relates to some other than their maternal environment.

Jim Sogi writes:

Yao Ming

Ralph Vince writes:

If I were to believe the argument, then I would have to believe that black mothers raise their kids to be great defensive corners, and miserable placekickers (The socio-economic argument, that sports like football draw the poorer kids and hence the duskier kids by some reasoning, just knocked out of the ballpark).

Football is a sport where you see the minor physical differences under great magnification. That's not to say someone cannot be of primarily Asian descent and not be a great defensive corner (or placekicker). But the empirical data certainly seems to speak to an awful lot.

I refuse to disregard empirical data. (Just as I may believe in the notion of fiscal conservativism, but can clearly see empirical correlation between GDP growth and government deficit spending– even that clown Krugman [no defensive corner he], like a broken watch, right on occasion).

Dan Grossman responds:

But genes play a big role in whether you can demand that your child get an A in advanced calculus or make first seat in the violin section of the orchestra. With that in mind, let's contemplate the genes being fed into those Chua children who are doing so well.

Maternal grandfather: EE and computer sciences professor at Berkeley, known as the father of nonlinear circuit theory and cellular neural networks.

Mother: able to get into Harvard (a much better indicator of her IQ than the magna cum laude in economics that she got there); Executive Editor of the Law Review at Harvard Law School.

Father: Summa cum laude from Princeton and magna cum laude from Harvard Law School, now a chaired professor at Yale Law School.

Guess what. Amy Chua has really smart kids. They would be really smart if she had put them up for adoption at birth with the squishiest postmodern parents. They would not have turned out exactly the same under their softer tutelage, but they would probably be getting into Harvard and Princeton as well. Similarly, if Amy Chua had adopted two children at birth who turned out to have measured childhood IQs at the 20th percentile, she would have struggled to get them through high school, no matter how fiercely she battled for them.

Accepting both truths—parenting does matter, but genes constrain possibilities—seems peculiarly hard for some parents and almost every policy maker to accept.

Jan

8

Three Point Stability, from Jim Sogi

January 8, 2011 | 2 Comments

A chair needs three points to be stable. A hiker benefits from a stick for a third stability point. In life there should be a good balance of family, work, friends. Univariate analysis and even bivariate analysis lacks this stability and is subject to failure, changing cycles unless n is rather high. I suggest that a third element adds stability. Single condition filters, or double conditions may suffer the same weakness. The problems of curve fitting plagues 3 condition filters but if a third conditions remains broad, perhaps it adds protection and stability to the return.

Jan

5

Book Recommendation, from Jim Sogi

January 5, 2011 | 1 Comment

I highly recommend Roughing It by Mark Twain. A thoroughly enjoyable read, especially on, say, a camping trip. Twain has a great talent to form a twist of a phrase, and a great way of describing people in events that makes one laugh out loud.

Jan

3

A Good Karma Day, from Jim Sogi

January 3, 2011 | 2 Comments

The first big swell of the season hit yesterday. The waves were 15 feet or so with a few 20 footers rolling through, and had power in them. I had one of those flawless sessions with no wipeouts, and the sets focused right where I was sitting allowing me to catch the wave with ease when those right near could not. I felt strong. At the end of one wave I saw a boy with no board floating in the impact zone with wide eyes. Though he wasn't drowning, he was on the edge and out of breath, so I asked him if he needed help and let him rest on my board to catch his breath. I paddled him out of the waves and helped him find his boogie board with had drifted off 1/3 mile in the rip current. No one else helped him and he would have drowned. I remember when a person did the same for me on the biggest day of the century when I was near drowning myself. Later, after paddling half a mile across the bay back to the beach, I noticed two heads floating in the rip current. As I got closer I saw they were two tourists with sunglasses and they were struggling against the current and being sucked out out to sea and big breakers and were going backwards. The husband could barely keep up himself, and the wife could not. I saw their predicament and paddled over to help. I towed the lady against a strong current and it took me quite a while. One of them would have drowned. They can't see the rip current that flows rapidly along the shore, and once in it, they can't get back to the beach. I felt good that day saving three people. It was a good karma day.

The first big swell of the season hit yesterday. The waves were 15 feet or so with a few 20 footers rolling through, and had power in them. I had one of those flawless sessions with no wipeouts, and the sets focused right where I was sitting allowing me to catch the wave with ease when those right near could not. I felt strong. At the end of one wave I saw a boy with no board floating in the impact zone with wide eyes. Though he wasn't drowning, he was on the edge and out of breath, so I asked him if he needed help and let him rest on my board to catch his breath. I paddled him out of the waves and helped him find his boogie board with had drifted off 1/3 mile in the rip current. No one else helped him and he would have drowned. I remember when a person did the same for me on the biggest day of the century when I was near drowning myself. Later, after paddling half a mile across the bay back to the beach, I noticed two heads floating in the rip current. As I got closer I saw they were two tourists with sunglasses and they were struggling against the current and being sucked out out to sea and big breakers and were going backwards. The husband could barely keep up himself, and the wife could not. I saw their predicament and paddled over to help. I towed the lady against a strong current and it took me quite a while. One of them would have drowned. They can't see the rip current that flows rapidly along the shore, and once in it, they can't get back to the beach. I felt good that day saving three people. It was a good karma day.

George Parkanyi writes:

Congratulations Jim. That's an amazing and commendable success. Some people don't have the opportunity to save a life through a whole lifetime, and you saved 3 in one day. I was involved in a water rescue situation many years ago under different circumstances, and though I was successful as well, I was struck by the fact that out of maybe 30 bystanders, no-one else thought to act– they just watched. I've often wondered about the psychology of that. Perhaps when there are too many people, everyone assumes that someone else has or will take action, and the individual imperative is suppressed. If each of those people were alone with no-one else around in the same situation, how many more would act? I think a larger proportion (because of the heightened sense of urgency when it's one on one, and there's no-one else to take charge).

Dec

26

Billion Price Project at MIT now available, from Rocky Humbert

December 26, 2010 | 1 Comment

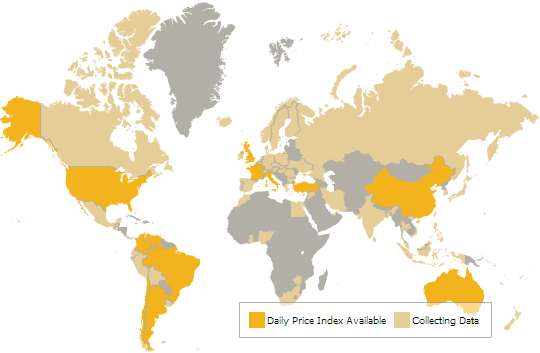

The long-heralded MIT Billion Price Project , which monitors the daily price-changes on 5 million items is now available. This is a valuable data for TIPS and other traders, and a step forward in the dissemination/analysis of market-based data….independent of the Labor Department.

The long-heralded MIT Billion Price Project , which monitors the daily price-changes on 5 million items is now available. This is a valuable data for TIPS and other traders, and a step forward in the dissemination/analysis of market-based data….independent of the Labor Department.

Worth a visit.

Jim Sogi writes:

The data is surely helpful, but the the graphic on the site using colors and a separate legend is nearly impossible to decipher, especially for the colorblind. They would learn much from Tufte.

Rocky Humbert adds:

I'm sure if you make a sufficiently generous donation to MIT, they will send you a copy in whatever color you'd like.

Your comment is reminiscent of when I was a first-year associate at GS (in Fischer Black's group), and delivered one of the first option-pricing models to the new oil trading desk. The app ran on an IBM 3270 terminal (hooked to a System /370). The trader said, "This is really nice. But can you do it in yellow?" [IBM 3270 terminals were monochrome and informally known as "green screen terminals."

Epilogue: That trader didn't last very long at GS.Personally, I find the following text from the MIT website more interesting than the color: " As part of the BPP we are not only constructing average price indexes – such as those you can see in the web page – but also construct tracking indexes with the purpose of predicting macroeconomic variables. We are working on predicting the CPI seasonally-adjusted announcements, the PCE, and even the GDP. These tracking indexes use the information from daily price changes to improve standard models that predict the macroeconomic performance of the US economy.

We started in the most obvious place – trying to forecast what the BLS will announce in terms of monthly inflation. Although the BLS publishes the inflation of November in mid December, today is the last day of the month so we already have a measure of the inflation rate of the retailers in our data. So, here we go… Our prediction is that the BLS will announce November's inflation rate (headline, seasonally-adjusted) of 25 basis points. Our models produce estimates between 21 and 27 depending on how the different prices are aggregated. Well, we now have to wait 15 days to see how close we are… that long? yes… that long.

An important point: this estimate is different from the inflation you can compute in the average of online prices (the indexes we are showing on this page). They are related but not identical. We are not going to release the tracking indexes yet. We are at the stage in which we are mostly testing and researching the best way to do the prediction.Epilogue: The CPI actually came in at 0.12% … so there's a divergence that will either resolve or cause MIT to tweak their methodology….

Dec

23

Briefly Speaking, from Victor Niederhoffer

December 23, 2010 | Leave a Comment

1. I am reading the deeply flawed book Bounce by Matthew Syed who believes that the quantity and quality of practice is key to determining greatness. Also reading another book from the same garage of hatred of the subject he writes about– The Company Town by Hardy Green and also Titanic Thompson: The Man Who Bet On Everything by Kevin Cook, about a man that should be hated but is quite interesting.

2. They say that when there is a big traffic accident in an area and it's cleared, there is still a traffic jam there the next day, I think because people are slow to observe past effects. And one is reminded of that at the opens of all the markets. In the pit days, there used to be tremendous volatility and big moves like in the first 5 minutes. But now there is no pit trading in most markets, but there's still the same volatility that occurs, like in bonds today at 820.

3. One notes that after 13 or more 10 day changes up, the expectation the

next day is -1/10 of a % and after 13 or more 10 day changes down the

expectation for the next day is -1/10 of a % however there are 244

occasions when the 10 day SP is down 13 or more times in Rowand 398

occasions when the 10 DYA SP is up 13 or more times in row. Thus,

declining 10 day moves less harmonious than up 10 day moves a meal for a

day not here but possibly for life time.

Thomas Miller shares:

Trafficwaves is an awesome website by an electrical engineer about what causes "invisible traffic jams" with lots of illustrations.

Chris Tucker writes:

I've heard this referred to in an astrophysics class as a Density Wave, it is one of several theories brought up to account for the formation of the distinct arms in spiral galaxies. The teacher used this specific example of highway traffic to explain it.

Jim Sogi adds:

When particles interact due to input of energy they move at different speeds. The faster ones overtake the slower ones. A buildup occurs at the slow point. Everyone has seen this in traffic. This is how big waves are created in the ocean. The interaction of energy pushing forward, and forces of resistance due to bunching, due to structural resistance (in the ocean its the bottom) in markets due to vig etc., and the secondary forces created by interaction of the various maxima and minima gets complex. It seems the areas of maxima and minima are easy to focus on and they provide distinct boundaries, maximum energy, and minimal densities.

T.K Marks comments:

Apropos of the peculiarities of traffic mishaps otherwise involving cars, just moments ago I had sent sent a similar response to your thoughts contained below only to be have it unceremoniously bounced back to your humble correspondent.

So here we go again.

Back in the day when pit trading held sway, the lion's share of the action took place on the open. Afterwards, the tempo was akin to the pace of watching grass grow. The occasional rock'n'roll news developing days notwithstanding.

So after I would take care of my market opening responsibilities and see that there was not unduly pressing on my book, I would delegate responsibilities to my second-in-command and repair upstairs to the the gym on the 8th floor gym of the WTC for a palliative steam and sauna.

The equilibrium benefits of such generally worked wonders because the close made the open look like the most genteel of tea parties,. It was the closet I'v been to Nam. Every day was a Tet Offensive.

Dec

11

The Art of Survival, from Jim Sogi

December 11, 2010 | Leave a Comment

98.6 Degrees: The Art of Keeping your Ass Alive , Cody Lundin is the best survival book.

98.6 Degrees: The Art of Keeping your Ass Alive , Cody Lundin is the best survival book.

The key to survival is to manage fear, keep warm and hydrated.

The key to survival is mental. Survival at its basic requires maintaining core temperatures and hydration. Fear has grave physiological effects on circulation, metabolic processes, judgment, and attitude. Fear can kill. Failure of judgment due to fear, panic, anxiety, causes bad errors of judgment that lead to death. Fear destroys fine motor coordination. Many outdoor deaths are due to simple hypothermia. Food is not the problem as most can live for days without food. Most survival scenarios last only three days. Water and core temperature are key. Physiologically loss of 2% of weight in water reduces judgment by 25%. Basic preparation requires adequate clothing and water, not just for the day hike, but for unexpected adverse weather and duration. Lundin discusses the physiological aspects to prove his points. Preparation should be basic, clothes, water, fire.

Applying survival lessons to markets is worthwhile as trading is a performance endeavor. The physiological aspects must be considered in addition to the statistical, the macro and qualitative. Sleep, fear, mental aspects and even hydration are key. 3/4 of you are chronically dehydrated. Dehydration is often confused with hunger and fatigue.

The second excellent book is First Aid, A Pocket Guide by Christopher Van Tilberg. It is a basic rundown of back country first aid procedures in a checklist form of the major injuries and treatments.

Rocky Humbert writes:

Try trading without electricity, telephone, and even Windows/XP/Linux!

The "modern" "self-reliant" speculator is as dependent upon the Lineman climbing the telephone pole as he is to the Chinese factory worker who assembled the replacement step-down transformer which failed due to the weather; as he is to the FedEx driver who spent the night delivering the replacement part.

Our complex and specialized society is dependent upon the countless people who all get up each morning and do their jobs creating a sum that is greater than the parts.

A modern speculator cannot function without water anymore than he can function without the vast and dynamic human and capital infrastructure that is modern society.

As the saying goes, "for want of a horseshoe nail, the kingdom was lost."

Dec

3

Avalanches and Markets, from Jim Sogi

December 3, 2010 | Leave a Comment

I've been really stoked on backcountry skiing this year. The danger is avalanches.

A tester digs snowpits to analyze the snow pack to find weak layers that might cause avalanches. The procedure is to dig a pit in the snow to the ground on the hill one intends to ski. This year there is already 12 feet fallen and 6 feet on the ground in the Sierra's. The tester pokes the snow with the fist, or fingers, and runs a card through it to feel for the densities, the layers, the crusts, and the loose snow looking for weaknesses. Then several columns are isolated with a snowsaw. The snow is tapped on top 30 times with increasing force from the wrist, elbow then shoulder. The tester looks to see if the snow columns shears off at any level in the snowpack. The number tap at which the snow shears is the first metric of the Compression Test giving a CT number. The depth of the various layers and at which the shears occurs is quantified. The fourth metric is the force with which the snow shears. Crumbly snow is Q3, but a clean shear that slides off easily with a few taps is Q1 and present clear avalanche danger. There is also an extended column test to test if the cracks propagate easily leading to widespread avalanche failures. The tester also reviews the weather patterns that created the snowpack and the subsequent temperatures and humidity and how it affects the snow pack. The quality of the various layers is qualified. Some problem snow is qualified as sugar, hoar frost, rime, windslab.

Curiously, this is similar to quantitative back testing and the market analyst has things to learn from the avalanche testers. By measuring the the actual condition of the recent snow pack as to both compression and energy, better predictions can be made. The mistake of quantitative testing is to use numbers over numerous years where the conditions may have been different. Use of the actual conditions in the current market "snowpack" would have good predictive properties for avalanches such as this morning's jobs number. An example of this is the trader's saw that gaps fill. Gaps are like a weak layer in the snow pack, and tend to back fill or even avalanche down. The thing about markets is that they can avalanche up as well as we saw earlier this week. It might be good practice to quantify or qualify the various market levels, the market conditions in which they occurred, the way in which subsequent event affected prior events and their "healing", the strength or weakness of various market levels, the length of time from various events, the theoretical or historical properties of the market, All in all, its fertile ground for testing ideas. At the least we should come up with some colorful names for market conditions in addition to gaps, consolidation, based on quantifiable conditions as opposed to chart patterns.

Nov

21

More to Learn about the Hindenberg Omen, from Steve Ellison

November 21, 2010 | Leave a Comment

It has been three months since the confirmation of the Hindenburg Omen, and the S&P 500 is up 12% since then.

Larry Williams writes:

True on H Omen sell but….there was what I call a H Omen buy on 8/27 and 8/30. I am writing a paper about this.

Jim Sogi writes:

Steve's point is why I believe that quantitative price analysis must be augmented with game theory such as Chair's infrastructural and and natural observations, but also with Mr. E's macro observation and political gamesmanship. This helps with the cycle analysis.

Nov

20

Trends, Reversals, Cycles, from Jim Sogi

November 20, 2010 | 1 Comment

Many assume the continuation of trends beyond their turning points. Such thinking is evident in the news. The opposite view is the statistical lack of trends and the assumption of reversion to the mean. However trends exist in a random or due to macro effect such as government (mis)policy or herding, none of which can be ignored except to one's detriment. The pure quantification of price makes discernment of the change of cycles hard to see except in retrospect, thus other forward and current input seem worthy to consider. There are tells to macro effects if they can be discerned. The random trends also may have their characteristics. Philosophers like to define their terms, and traders also need to define their time frames to clearly state the issues. This seems to be a common point of misunderstanding in debates on these issues.

Many assume the continuation of trends beyond their turning points. Such thinking is evident in the news. The opposite view is the statistical lack of trends and the assumption of reversion to the mean. However trends exist in a random or due to macro effect such as government (mis)policy or herding, none of which can be ignored except to one's detriment. The pure quantification of price makes discernment of the change of cycles hard to see except in retrospect, thus other forward and current input seem worthy to consider. There are tells to macro effects if they can be discerned. The random trends also may have their characteristics. Philosophers like to define their terms, and traders also need to define their time frames to clearly state the issues. This seems to be a common point of misunderstanding in debates on these issues.

Steve Ellison writes:

As long as governments feel the need to intervene whenever their economies are considered bad, there will be business cycles that result in multi-year trends in earnings and prices.

In a much shorter time frame, order flows can cause intraday trends. If a mutual fund has a quota to buy a certain number of shares before the close, the fund's buying may push the price up. When there was floor trading in cotton, the locals loved to push prices to levels where stop orders were clustered. Every once in a while, the price would rise or fall by several percentage points within minutes as waves of stop orders were triggered.

In academic theory and simulations, trends occur when markets are mispriced, as informed traders use market orders to buy undervalued assets or sell overvalued assets (see, this chart, for example).

Finally, as Mr. Sogi notes, some trends may be random. Professor Aronson suggests flipping a coin 300 times and charting the cumulative difference of heads and tails to get an idea of what a random walk can look like. My first attempt resulted in the attached chart, which appears to have clear trends even though the underlying process was random.

Nov

17

Sage Gratitude: Thank You, Uncle Sam, shared by Jim Sogi

November 17, 2010 | Leave a Comment

More grist for the Chair:

More grist for the Chair:

Buffett Thanks Uncle Sam for Helping Economy

The Associated Press By JOSH FUNK AP Business Writer OMAHA, Neb. November 17, 2010 (AP)

Billionaire Warren Buffett wants people to know he thinks the U.S. government performed well during the economic meltdown of 2008.

So the chairman and CEO of Berkshire Hathaway Inc. wrote a thank-you note to "Uncle Sam" that the New York Times published Wednesday on its op-ed page.

Buffett used the opinion piece to reiterate his view that the government should be praised for its efforts to stabilize the economy with massive bailouts and stimulus spending.

Nov

7

Good Beverages, from Victor Niederhoffer

November 7, 2010 | 5 Comments

The leading historian says that he'll buy me a $ 8 cup of coffee under certain considerations. And I don't know much about coffee. But I've had occasion to have coffee at Stumptown Coffee, an Oregon firm with branches in New York now, and it's far and away the best coffee i've ever had. Next in line is the coffee at Kaffe that Mr. Florida surfer has recommended. The web mistress is a vegan, and I don't pay her that much to do all the editing and picturing so she usually doesn't put our stuff on barbecue up unless I get her mother on the case, which isn't that effective since she doesn't believe in coercion. Let us expand our mandate from bar b que to good beverages like coffee and tea.

The leading historian says that he'll buy me a $ 8 cup of coffee under certain considerations. And I don't know much about coffee. But I've had occasion to have coffee at Stumptown Coffee, an Oregon firm with branches in New York now, and it's far and away the best coffee i've ever had. Next in line is the coffee at Kaffe that Mr. Florida surfer has recommended. The web mistress is a vegan, and I don't pay her that much to do all the editing and picturing so she usually doesn't put our stuff on barbecue up unless I get her mother on the case, which isn't that effective since she doesn't believe in coercion. Let us expand our mandate from bar b que to good beverages like coffee and tea.

Vince Fulco comments:

I wouldn't say THE top tier but for solid, day-in, day-out coffee, a NYC mail order institution which we order from is portorico. It's been around for over 100 years and we especially like their couple times a year sale with numerous versions of beans $5.99-7.99/lb, a veritable bargain when retail goes for similar prices for 10 ounces. They also have a weekly sale of one kind or another.

Jeff Sasmor writes:

For NJ suburbanites, the local roasting of primo beans and a nice college town quasi-hipster atmosphere is provided by Small World Coffee in Princeton. In spite of a Starbucks opening around the corner, Small World has actually grown larger.

David Hillman writes:

Stumptown is among best ever drunk here, too. We have a pound or two shipped in regularly. They ship the same day they roast and deliver in about 2-3 days, so coffee is very fresh. Currently in the cabinet is Indonesia Sulawsi Toarco and the African's are exceptional this year. An admirable direct trade business model worthy of support.

Also, when in Portland, breakfast at Mother's. They serve Stumptown varieties in a french press at the table. That and the wild salmon hash is more than worth the long weekend a.m. waits.

Also, when in Portland, breakfast at Mother's. They serve Stumptown varieties in a french press at the table. That and the wild salmon hash is more than worth the long weekend a.m. waits.

Boom Bros. in Milwaukee is also happily recommended. Excellent roastmaster, their Velvet Hammer is the 'every morning' coffee at Cafe DGH.

Another favorite is this coffee from the D.R. Very cheap, very good. Best drunk in a cafe on the beach in Sosua. Maybe there's a Caribbean store of some sort in NYC?, but if not, there's always Bonanza:

"…..Always the most fresh production guaranteed! Manufacturer send my orders 3 times a week…..Thanks for looking!!!"

Chris Cooper writes:

Coincidentally, I have recently embarked on a quest to brew (consistently) the best cup of coffee. I have started roasting my own beans, and now it is evolving to importing my own green beans. Next month on the container arrives 300 kg of single-origin green beans from Indonesia from five farms. We call them Bali Kintamani, Java Jampit, Aceh Gayo, Sumatra Lintong, and Torajah Kalosi. I guess this may become more than just a hobby.

While Mr. Surfer and family visited not so long ago, we served some Kopi Luwak, famous due to the journey of the fresh beans through the digestive tract of a civet. It turns out that there are various grades of Kopi Luwak, and since that time I've found a verifiably authentic version, which is rarer because often the growers will mix in other beans. I may try to import that as well, but it's very, very expensive, and I can probably only get 10 kg per year. The taste is really different, much earthier.

While Mr. Surfer and family visited not so long ago, we served some Kopi Luwak, famous due to the journey of the fresh beans through the digestive tract of a civet. It turns out that there are various grades of Kopi Luwak, and since that time I've found a verifiably authentic version, which is rarer because often the growers will mix in other beans. I may try to import that as well, but it's very, very expensive, and I can probably only get 10 kg per year. The taste is really different, much earthier.

Larry Williams comments:

My cup runneth over with coffee from these guys, but thanks for the tips. I will begin my journey again for greatest java.

By the way, Overstock.com seems to have the best deals on espresso machine.

T.K Marks writes:

All this talk of coffee has gotten me nostalgic for one of my life's more squandered opportunities.

There was this little coffee spot on the Upper West Side, just a stone's throw from Lincoln Center, called Cafe Mozart. I used to spend much time there.

I would get a pot of coffee. Once even this thick Turkish stuff that perhaps made one look of Left Bank sensibilities, but tasted like tar. Would while away the hours there with reading, backgammon, or chess. It was a peaceful place.

So one night I'm sitting alone at my table reading when walks in and approaches, a woman.

A woman with a very fetching smile.

Bob?…she asked hesitatingly, as one would when meeting a blind date.

I stood up politely, smiled at her for a few seconds, and, No, was all I said.

Till this day I regret not lying through my teeth.

Had nothing to lose.

Jeff Watson writes:

Many of my friends are coffee experts but I am sadly lacking in that department. One thing I do know is how to make is one of the better pots of coffee on the planet. The following recipe will even make even the most mediocre coffee taste good, and good coffee taste……delicious.

Many of my friends are coffee experts but I am sadly lacking in that department. One thing I do know is how to make is one of the better pots of coffee on the planet. The following recipe will even make even the most mediocre coffee taste good, and good coffee taste……delicious.

1. Wash an egg then break it into the bottom of an old fashioned metal campfire coffee pot, beating the egg slightly, leaving egg, shells and all in bottom of the pot..

2. Add a cup of very cold water to the pot, covering the egg and then add a pinch of salt.

3. Pour in a whole cup of course ground coffee to the water and egg mixture, and stir it up.

4. Pour enough boiling water over the coffee, egg, mixture to almost fill the pot up, and stir until mixed.

5. Cover the pot and plug the spout with a dish towel.

6. Put the coffee pot over a fire, heat it up to a gentle boil, back off, then let it simmer for a couple of minutes.

7. Take the pot off of the fire, let the coffee settle for a couple of minutes then add a cup of very cold water to precipitate the coffee grounds/egg mixture. Let the coffee settle for another minute, then serve.

My grandfather was taught to make coffee this way from some real cowboys when he went to the Arizona Territory for a trip sometime before 1910. He taught me how to make coffee when I was around 7 or 8, and put me in charge of the coffee every time there was a family picnic or outing. The secret to wonderful coffee is the egg, the pinch of salt, and good water. Coffee prepared in this manner evokes many good memories, and the good smell alone will attract any friends or neighbors in the near vicinity. Once in a great while, I will make this coffee on the stove and it's almost as good as on a campfire.

I have often wondered what a Kona coffee would taste like if prepared in this manner.

J.T Holley writes:

I'm not a professional roaster or barista, but the keys that I learned in the 8-9 years that I mentored to roast, grind, and brew coffee are the following:

I'm not a professional roaster or barista, but the keys that I learned in the 8-9 years that I mentored to roast, grind, and brew coffee are the following:

1) The time between roast and grind needs to be minimal (oils of the roast and storage important)

2) Method of brewing important to your individual tastes (percolate, press, or electric drip)

3) Water is 99% of a cup of coffee! Good tasting waters need to be used and free of chlorines, flourides, and impurities

4) Filtration choice and cleanliness of the brewer of choice imperative for consistent cups of good flavor

5) Once pot is brewed then stirring the pot and stirring the cup is important regardless of cream and sugar for consistency of coffee.

That's the basics!

All good shops should know this regardless if its a private house, private shop, franchise or friend.

Kim Zussman queries:

How can coffee gourmets taste fluoride but not civet excrement?

Jim Sogi writes:

Chris's special Java java was distinctive and earthy. A treat especially in the palatial surroundings.

The key to brewing good coffee from whatever origin, is:

1. Be sure the parchment is sun dried, not machine dried. It has a much mellower smooth flavor.

2. Roast your own coffee. My favorite roast is 462 degrees, 11 minutes give or take based on humidity and ambient. Roast until the oil just starts to show, but is not oily. The oily roast is more for show. Roast only what you can use in 3 days.

3. Grind your own fresh roast. This is the most important of all. Don't try to freeze coffee beans.

When brewing in filter, only pour a little, not boiling, water through at a time.

Oh yes, Kona Coffee is without doubt the best in the world.

Nov

2

Midrange Close Cycle, from Jim Sogi

November 2, 2010 | 2 Comments

Interesting stem comparison of recent midrange closes as positions from

lowest tenth (0) to middle tenth (5) to highest tenth (10) of high and

low range. With the last 9 years or so.

Distribution of last 2000 closes:

0 |115

1 |104

2 | 84

3 | 85

4 | 76

5 | 78

6 | 100

7 | 128

8 | 188

9 | 213

Last 20

0 | 4

2 | 048

4 | 059266

6 | 00064

8 | 11580

Oct

29

Speed Trading, from Victor Niederhoffer

October 29, 2010 | Leave a Comment

How would the speed up stuff (see below) work in trading?

Trading while standing up?

Trading with a gun rather than a mouse?

Taking a fast 4 ticks? (guaranteed to lose money unless you have the infrastructure of a flexion)

Trading 3 markets in succession???

Larry Williams adds:

Going from yesteryear's 200 day moving average to a shorter one? Trading instant spreads?

Jim Sogi writes:

It's a whole new skill set, both different motor and mental with a learning curve. Years of practice with certain tools cannot be discounted. Like switching from squash to tennis to ping pong. Or longboard to shortboard.

Ralph Vince writes:

Great questions. Based on my own, limited, life experience, I would add that there is an element of a certain mental "groove," to all of this, necessary to success, not altogether very different than that of an athlete on the top of his game (we have discussed this at length in this forum– some great discussions on it I think) or when you are thinking a problem through– a very difficult, elusive one, threatening to drip off the edge of your consciousness…….and I'm not so sure that is even timeframe-specific, so long as you find your groove.

When I put on a trade, I KNOW I'm going to make money on it, I'm not worried about it one jot. You get into certain habits, which are a function of your cadence, and "settling in' to that, whereas I think it IS timeframe-specific, seems to be timeframe specific to the individual and how he trades.

I very much believe that the kind of "hurry up" trading you are describing here may fit certain individuals and may sabotage others. Even if on a purely mechanical basis. What comes to mind for me on this is trying to play simple, basic strategy blackjack at a table with a fast cadence– I can't handle it, and am certain to fumble it.

Ken Dreees writes:

It would be interesting to create a dynamic trading skills test in which you had mutliple positions open in multiple markets and were then given simulated info in a real time sense that caused market disruptions. You would be graded under criteria such as:

1. exiting safety

2. capital protection

3. Finding and exploiting panic etc.

Like a trading version of star fleet's test.

Jeff Watson adds:

Here's an interesting site with info on CBOT full seat prices from 1898-2004. There's a handy little excel download in the site with the high/low of CBOT seat prices on a yearly basis. 1942 was the year to go long the CBOT.

Russ Sears comments:

My opinion is that building up the endurance to concentrate for long periods of time is not like riding a bike. If you've been away from it a while train yourself back into it.

Taking scheduled stress relief breaks should be required to be on your best defensively, especially in volatile markets.

Oct

28

New Highs, from Jim Sogi

October 28, 2010 | Leave a Comment

For well over a month no more than 2 days have passed before another new monthly high is reached. How long can these record sessions continue, I wonder.

Oct

28

SUP, from Jim Sogi

October 28, 2010 | Leave a Comment

Stand up paddle boarding didn't exist 10 years ago, but now it is a fast growing sport. It is not intuitive to stand up on a surfboard and paddle it with a paddle, and there is a short learning curve. Contrary to my initial impression that it was a fad that would soon die out, the sport has exploded. SUP can be done not only in surf, but in flat water, lakes, rivers (a guy went down the Colorado!) and the open ocean. You could do it Central Park or the Hudson River. (It won't fit in an elevator or subway tho. They are 11 feet long, 30 inches wide and 4 inches thick.) It doesn't take the strength required of surfing because the paddle leverages the power, and the board is huge and is stable and floats so many women who lack arm strength can do it, as can children, and older out of shape guys. In fact the big growth is in flat water paddling. There are even expedition SUP boards that can carry gear. Guys paddle interisland Hawaii, and from England to France.

Stand up paddle boarding didn't exist 10 years ago, but now it is a fast growing sport. It is not intuitive to stand up on a surfboard and paddle it with a paddle, and there is a short learning curve. Contrary to my initial impression that it was a fad that would soon die out, the sport has exploded. SUP can be done not only in surf, but in flat water, lakes, rivers (a guy went down the Colorado!) and the open ocean. You could do it Central Park or the Hudson River. (It won't fit in an elevator or subway tho. They are 11 feet long, 30 inches wide and 4 inches thick.) It doesn't take the strength required of surfing because the paddle leverages the power, and the board is huge and is stable and floats so many women who lack arm strength can do it, as can children, and older out of shape guys. In fact the big growth is in flat water paddling. There are even expedition SUP boards that can carry gear. Guys paddle interisland Hawaii, and from England to France.