May

12

A Prize for a Test of the Principle of Least Action, from Victor Niederhoffer

May 12, 2011 | 7 Comments

UPDATE:

UPDATE:

The Winners of the least effort contest were jointly in a tie. Mr. Gary Rogan and Mr. Steve Ellison. I will split the prize between them. The creative and physical ideas of Mr. Rogan were very excellent and best of all, but there was no testing. Mr. Ellison gave a great test, and a complete answer, but Rogan can't be denied his place either. vic

I'll give a prize of 1000 to the person or locus of his choice that comes up with the best way to test the principle of least action or a related principle of least effort.

It's in honor of my grandfather. Whenever I'd ask him which way he thought the market would go he'd say, "I think the path of least resistance is down" starting with Dow 200 in 1950. We need some more quantification around here.

You might consider max to min or a path through a second market back to home. Or round to round? Or amount of volume above or blow. Or angle of ascent versus angle of descent. Or time to a past goal versus the future? Or some mirror image or least absolute deviation stuff?

Sushil Kedia writes:

With utmost humility and clearly no cultivated sense of any derision for the Fourth Estate, I would submit that since it is the public that is always flogged and moves last, the opinions of all media writers, tv anchors are the catalysts, the penultimate leg of the opinion curve. A test of the opinions of the fourth estate on the markets would provide the most ineffective wall of support or so called resistances. Fading the statistically calculated opinion meter (if one can devise one such a 'la an IBES earnings estimate a media estimate of market opinion) and go against it consistently over a number of trades, one is bound to come out a winner. Can I test it? Yes its a testable proposition, subject to accumulation of data.

Alston Mabry writes:

The following graph (attached and linked) is not an answer but an exploration of the "least effort" idea. It shows, for SPY daily since August last year, the graph of two quantities:

1. The point change for the SPY over the previous ten trading days.

2. The rolling 10-day sum of the High-Low-previous-Close spread, i.e., "max(previous Close, High) minus min(previous Close, Low)". This spread is a convenient measure of volatility.

Notice how these quantities move in tight ranges for extended periods. These tight ranges are some measure of "least effort", i.e., the market getting from point A to point B in an efficient fashion. As one would expect, the series gyrate when the market takes a temporary downturn. Also note how when one of the quantities swings above or below it's mean or "axis", it seems to need to swing back the other way to rebalance the system.

Bill Rafter writes:

This nicely illustrates how relative high volatility is bearish on future price action.

This nicely illustrates how relative high volatility is bearish on future price action.

Jim Sogi writes:

The path of least resistance would be the night session. Low liquidity allows market mover to move market. Every one is asleep. Dr. S did a study some years ago. Updating shows total day sessions yielding 94 pt, but night session yielding 232 points. Don't sleep…stay up all night or move to Singapore. Recent action is in line with hypothesis.

Bill Rafter writes:

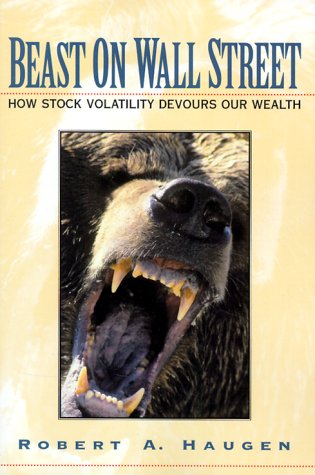

Haugen's "The Beast on Wall Street" (i.e. volatility) came to the conclusion that if you want less volatility in the markets, keep them closed more, to essentially force the liquidity into specified periods. That is, 24 hour markets promote volatility. Or a corollary was that a market is never volatile when it is closed. [this is from memory and I may also be regurgitating from a personal conversation with him]. An oft cited example is the period in the summer of 1968 when equities were closed on Wednesdays to enable the back offices to get up to date with their paperwork and deliveries. During that time the Tuesday close to Thursday opening was less volatile than expected (twice the daily overnight vol).

One could take this thought and stretch it to say that the periods of least resistance would be those without heavy participation. One could easily compare the normalized range (High/Low) of those periods versus the same of the well-participated periods.

Craig Mee writes:

Hi Bill,

You would have to think that in 68 there was sufficient control of price and news dissemination. In these times of high speed everything, that this could create bottlenecks and add to the volatility. No doubt a bit of time to cool the heels i.e limit down and up for the day restrictions, is a reasonable action, even if it goes against "fair open and transparent markets" but unfortunate it seems little is these days.

Bill Rafter replies:

I should have been more specific about the research: take the current normalized range for those periods of high liquidity (when the NY markets are open) and compare that to the normalized range of the premarket and postmarket periods. Do it for disjoint periods (but all in recent history) so you don't have any autocorrelation. My belief is that you will find there is less volatility intra-period during the high liquidity times. While you are at that you can also check to see during which period you get greater mean-reversion versus new direction.

If that research were to show that (for example) you had greater intra-period volatility during the premarket and postmarket times, and that those times also evidenced greater mean-reversion, you could then conclude that those were the times of least resistance. That would answer Vic's question. Okay, now what? Well you could then support an argument that with high volatility and mean reversion you should run (or mimic running) a specialist book during those times. That's not something I myself am interested in doing as it would require additional staff, but those of you with that capacity should consider it, if you are not yet doing so.

Historical sidebar: '68 was a bubble period caused in part by strange margin rules that enabled those in the industry to carry large positions for no money. The activity created paper problems as the back offices were still making/requiring physical delivery of stock certificates. The exchanges closed trading on Wednesday to enable the back offices to have another workday to clear the backlog. The "shenanigan index" was high during that time.

Phil McDonnell writes:

Bill, you said "During that time the Tuesday close to Thursday opening was less volatile than expected (twice the daily overnight vol)."

For a two day period and standard deviation s then the two day standard deviation should be sqrt(2)s or 1.4 s. So the figure of twice the volatility would seem higher than expected.

Or am I missing something?

Steve Ellison submits this study:

The traditional definition of resistance is a price level at which it is expected there will be a relatively large amount of stock for sale. Starting from this point, my idea was that liquidity providers create resistance to price movements. If a stock price moved up a dollar on volume of 10,000 shares, it would suggest more resistance than if the price moved up a dollar on volume of 5,000 shares. To test this idea, I used 5-minute bars of one of my favorite stocks, CHSI. To better separate up movement from down movement, for each bar I calculated the 75th and 25th percentiles of 5-minute net changes during the past week. If the current bar was in the 75th percentile or above, I added the price change and volume to the up category. If the current bar was in the 25th percentile or below, I added the price change and volume to the down category. Looking back 200 bars, I divided the total up volume by the total up price change to calculate resistance to upward movement. I divided total down volume by the total down price change to calculate resistance to downward movement. I divided the upward resistance by the downward resistance to identify the path of least resistance. If the quotient was greater than 1, the past of least resistance was presumed to be downward; if the quotient was less than 1, the path of least resistance was upward.

For example:

Previous 200 bars Up Date Time Up Points Volume Down Points Volume Resistance 3/25/2011 15:50 53 6.49 99431 61 -7.38 149867 15311 Down Resistance Actual Resistance Ratio net change 20310 0.754 -0.03

Unfortunately, the correlation of the resistance ratio to the actual

price change of the next bar was consistent with randomness.

May

4

Query of the Day, from Craig Mee

May 4, 2011 | Leave a Comment

Yesterday's release of GBP PMI Manufacturing number saw the market drop 60 points 2 minutes before the announcement in a 74 point 1 minute range, and in line with the weaker than expected announcement. The market than went back to its happy 5-10 point 1 minute range for the rest of the evening. More flexions at work?

Yesterday's release of GBP PMI Manufacturing number saw the market drop 60 points 2 minutes before the announcement in a 74 point 1 minute range, and in line with the weaker than expected announcement. The market than went back to its happy 5-10 point 1 minute range for the rest of the evening. More flexions at work?

Paolo Pezzutti writes:

All algos working around the globe now are working to buy any type of dip following "bad" news. I don't know if there's an agreement among strong forces to do so or if, more simply, this kind of behavior has generated "spontaneously" because of other considerations (quant, fundamental or whatever). It would be interesting to learn what would take to change their trading approach. Probably a sudden and "unexpected" big loss. I don't think that "smooth"adjustments of market sentiment could influence this raging river of money flowing into the markets. However, it is well known that some believe that the least beating of wings of a butterfly is able to cause a hurricane on the other side of the world. Paolo

May

4

A Zacharian Variant, from Victor Niederhoffer

May 4, 2011 | Leave a Comment

Let us augment the Zacharian situation which I used to call a Finnegan where you look at the screen and a price is too terrible to contemplate because it's ruinous to you, and then you realize to your utter delight that the price was a misprint on the screen, and you're whole, and not losing at all, but …. by the end of the day or week, the price you feared actually turns out to be worse than you feared and you lose even more. Such a situation occurred in conjunction with the flash crash of May 6 when the price of 1060, which was ruinous for individual stocks and S&P was there for a second, but then it rose 8% in a day, and then Zachar predicted it would go bak there after it rose 100 points.

Let us augment the Zacharian situation which I used to call a Finnegan where you look at the screen and a price is too terrible to contemplate because it's ruinous to you, and then you realize to your utter delight that the price was a misprint on the screen, and you're whole, and not losing at all, but …. by the end of the day or week, the price you feared actually turns out to be worse than you feared and you lose even more. Such a situation occurred in conjunction with the flash crash of May 6 when the price of 1060, which was ruinous for individual stocks and S&P was there for a second, but then it rose 8% in a day, and then Zachar predicted it would go bak there after it rose 100 points.

Okay, two other situations deserve a name.

You look at the screen, and you smile. Your market or stock is way up you think. But then– "Oh no," you were looking at the wrong market. And your thing is the only one that's not good or up if your long. That happened to me with my Rimm and Vix today. I see a market way up. I smile. Oh no. It's not Rimm, it's Vix that's way up.

What should this be called. And what about the variant where you have a price in mind to get out, and then you go to shave or take a call from a non-agenarian, and the price is realized, but by the time you can enter the order it's not there any more. And it never gets back.

A related situation is that you're out of office for a second, and you hear an announcement. The economy is very strong. However, bonds are down because of the crazy idea that a strong economy is inflationary. But that's causing stocks to go down. Okay, you're losing money on your longs. The market is crazy right? You grit your teeth and go back to take a look. Amazingly the bonds are way up however. WHY? Because stocks are way down. In other words, you lost on stocks because bonds were going to be down, but they actually went up when stocks went down, so you lost for an opposite reason.

What are the proper names for all these? And what variants of these type of things deserve a name?

Peter Earle writes:

The one where you look at the screen and smile– perhaps that moment is best termed an "Eastwood", a "Harry", or a "Dirty Harry", or being struck with/by (a) "Sudden Impact", as demonstrated by the relevant portion of this scene: first from 0:18 to 0:51…and then from approximately 1:05 to 1:13.

Chris Tucker writes:

The last situation could be referred to as a "Cyclone", not for the storm, but in honor of the Chair and the iconic roller coaster of his youthful digs at Coney Island. The Cyclone is terrifying, filled with thrills, dips, lunges and jerks. And people keep coming back to plunk down there hard earned cash for more.

Very nice short history of the park at Coney Island here.

Vince Fulco writes:

The Cyclone seems most apropos. What is it about Mr. Market's ability, esp. with these leveraged ETFs to give you a nice gain but not hit your target price and then revert back to your cost in an instant (many multiple percent away and seemingly not to be seen again in the near future with the new info) then turn within pennies and return you back to profit mode testing your temperament so mightily? The silver ETFs have acted like scalded dogs the last few days.

George Zachar comments:

The Coney Island Cyclone was the signature thrill ride of my youth. I've ridden it well over 100 times.

What's always fascinated me about it, is how the experience varied with one's position in the 12 rows of seats.

In the very front, with the center of gravity many feet behind you, the visual danger signs led the acceleration by a couple of seconds, giving you the sensation of hanging over a cliff.

In the very back, my favorite spot, the acceleration came before you could see the rails dip, so it would catch you unawares and whip you sooner/faster than your mind anticipated.

Also, at the start of the right turn off the NW corner, the right-front wheels would leave the track for an instant, making first-time riders wonder if they were destined to die on Surf Avenue, in the shadow of the D train.

Alston Mabry writes:

The one where you're out of the office for a second, and hear an announcement– It's called "duck season".

The followup is too good to leave out: "Pronoun trouble".

Craig Mee writes:

About the one where "it's even worse than the mistaken price you mistakenly thought was your" :

I thought you were going to say, Victor, if after getting heart palpitations at the first incorrect reading, just by the fact you had done this, it's better to get out of your said stock now anyway, as you've brought bad karma to the trade.

Apr

27

Dollar Day, from Craig Mee

April 27, 2011 | Leave a Comment

I couldn't help noticing a few things joined at the hip today …before FOMC…

I couldn't help noticing a few things joined at the hip today …before FOMC…

Gold Recent rally from 15 march - 25 April ….of 7 weeks 1382.40-1519.20 = 136.80

Previous rally from 28 Jan- 7 March…. of 7 weeks 1310.90-1447.20 = 136.30

Dollar index on Nov 08 Low 74.00

Eurusd: Recent large rally from low on 6 June 2010 to present = approx 2841 points

Previous large rally from low on 27 Oct 2008 to high Dec 09 = approx 2848 points.

Maybe stars are alligning for some hocus pocus.

And although I would hate to say just off this goldmine, the gods may ulimately have there say.

Apr

26

Deep Optimism, from Craig Mee

April 26, 2011 | Leave a Comment

Matt Ridley's concept of Deep Optimism is very much a concept that the readers of this site can benefit from, and no doubt is a part of our script:

"the knowledge on how to make most of our technologies is distributed collectively across society, it is not held in individual brains…thats is why Im not very interested in IQ and the debate about whether one group is more clever than another. What counts is not how clever people are but how good they are communicating."

Apr

25

Games Show How Economists Lead Us Astray, from Craig Mee

April 25, 2011 | Leave a Comment

These researchers say the social-exchange frame induced a motivation for the players to do what was right, whereas the business-transaction frame induced the motivation to get as much money from playing the game as possible.

All this suggests the success economists have had in recent decades in propagating their way of framing the choices we face has subtly influenced our thinking and behavior, making us more competitive and self-seeking and less co-operative and public-spirited.

If so, we're the poorer for it. We need to frame the economic problem more carefully.

Apr

6

Market Lessons From Photography, from Craig Mee

April 6, 2011 | 2 Comments

Pictures don't get better the longer you're around the subject. The magic goes. If I go to Delhi, I get off the plane and I start photographing because days later it all starts to look normal.

Pictures don't get better the longer you're around the subject. The magic goes. If I go to Delhi, I get off the plane and I start photographing because days later it all starts to look normal.

Market analogy–once you know what your looking for, you will know straight away if there's a trade there. That's why I can't teach anyone, why I'm not a big education man. I think they're a bunch of parrots all learning the same thing.

Market analogy– too much education directs everyone in the same place. You need to be creative in your own right.

Because black and white gives you the message immediately. Colour's a warning thing. Berries are red so that the birds know to eat them. When they're green they don't eat them. When you look at a colour picture you see the colour before you see the message.

Market analogy– don't concentrate too much on the details, just get with the form.

Here is an interesting conversation with notorious photographer David Bailey for more insights on this topic.

Mar

22

Parasites, Edges, and Trading Success, from Craig Mee

March 22, 2011 | Leave a Comment

You think you don't have an edge in the market, well, if you don't have this you may just have one…… Toxoplasmosis:

You think you don't have an edge in the market, well, if you don't have this you may just have one…… Toxoplasmosis:

Around 15 to 20 per cent of Americans are infected with the parasite, according to a study by the U.S. Centres for Disease Control and Infection (CDC).

The study suggests that male carriers have shorter attention spans, a greater likelihood of breaking rules and taking risks, and are more independent, anti-social, suspicious, jealous and morose. The behaviors observed, if caused by the parasite, are likely due to infection and low-grade encephalitis, which is marked by the presence of cysts in the human brain, which may produce or induce production of a neurotransmitter, possibly dopamine, therefore acting similarly to dopamine re-uptake inhibitor type antidepressants and stimulants.

Femi Adebajo:

There we go again so many conditional verbs and clauses… suggests….likelihood….if….likely due to….may produce..or induce the production of…possibly dopamine… a flimsy theory built on a speculative (not in a trading sense) foundation.

Victor Niederhoffer explains:

Okay. The mice make themselves sexy so they be eaten by cats. Then the cats spread the mice around through the sewerage system. The breakout occurs and the trend followers jump in (one can now say this with much greater impunity than the last year), and then the trend followers and pivot boys and breakout boys spread their genes, I mean money, around to the locals and the homeostasis boys when they get out. In former days the locals played a role in the detritovore works.

Anon writes:

[I hate ladies with too many cats.] The scented candle, mystical music, flavored coffee crowd always that has the de rigeur loofah brush hanging somewhere in the shower. It's all part of the Bed, Bath, and Beyond archetype.

Russ Sears replies:

Considering the alternative Bed, Bath and Beyond is to be praised. Besides John Adam's compassionate pining over his alcoholic son, another major difference between David McCullough's book [John Adams ] versus the mini series movie version was his relationship with Ben Franklin. It was not the moral filth of Franklin's mistress that Adams wrote his wife about that he could not stand, it was the literal smell and filth of the pets of this mistress. This filth was hard for Adam's to get past.

Comparing the movie version to the books is a good lesson in the necessary pandering to the liberal stereotyping needed in a movie this days. Let the historical facts be damned.

Mar

21

Indonesian Coffee, from Chris Cooper

March 21, 2011 | Leave a Comment

A couple of months ago I was trying to put together a container of coffee from Indonesia, and my experience is somewhat different from SBUX. I find that the "speculators" responsible for the very tight current supplies are the coffee producers themselves. Many farmers have seen prices going up and up, and they therefore hold on to their current supplies in the hope that they can get even more for them. If you do manage to buy some coffee you must be very careful that what you receive is what you tested because there is strong incentive for the farmer to mix in lower-quality beans. Thus it is very hard to put together a large order of high-quality beans. This situation will only rectify itself when prices start to decrease. In this part of the world, that may be around June or July when the new crop comes in. Buyers are now having to consider buying for their anticipated yearly needs at once and storing the beans. Of course, due to their heavy volumes, SBUX has been using forward contracts for a long time, so they have been partially insulated from price hikes.

A couple of months ago I was trying to put together a container of coffee from Indonesia, and my experience is somewhat different from SBUX. I find that the "speculators" responsible for the very tight current supplies are the coffee producers themselves. Many farmers have seen prices going up and up, and they therefore hold on to their current supplies in the hope that they can get even more for them. If you do manage to buy some coffee you must be very careful that what you receive is what you tested because there is strong incentive for the farmer to mix in lower-quality beans. Thus it is very hard to put together a large order of high-quality beans. This situation will only rectify itself when prices start to decrease. In this part of the world, that may be around June or July when the new crop comes in. Buyers are now having to consider buying for their anticipated yearly needs at once and storing the beans. Of course, due to their heavy volumes, SBUX has been using forward contracts for a long time, so they have been partially insulated from price hikes.

Though I do not yet have much experience in this field, I do think that higher coffee prices are here to stay. The gross margins on coffee are pretty high, leading to an inelastic demand curve. There is more and more demand for "specialty" coffee, which sells for higher prices and is not price-sensitive. It is also interesting that pricing for Indonesian beans tracks very closely to the New York price.

Ken Drees writes:

If you do manage to buy some coffee you must be very careful that what you receive is what you tested because there is strong incentive for the farmer to mix in lower-quality beans.

An unscrupulous cantonese tea farmer in the late 1700s had the idea too: a very detailed account of tea and its trading, of how it was evaluated, graded and which trading houses bought which varieties was described. The usual cheating methods were illuminated for the reader-stale tea added to fresh tea, chopped willow leaves added for increasing bulk, additives of Prussian blue added for brilliant appeal.you needed a good Chinese point man at the cantonese port to ensure that what you bought was what was loaded onto your ship for the return trip.

From Otter Skins, Boston Ships and Chinese Goods by Gibson.

Craig Mee writes:

When looking at traditional gold mining in local areas of Indonesia, I noticed I could buy good physical 10% below spot, however this was unrefined, and no doubt paying the bro, and slippage would negate the edge in this case. Then with the added query of dealing size, and you really need another 15% off for "local" risk.

I spoke to local geo about one such query, about a new mining venture. He mentioned a company who had claimed the title got approval for mining (no easy task), shipped in all the machinery, and at the 12 hour, a man's brother appeared out of the forest waving a "title paper", and they had no choice but to pay him off.

It seems there is no better place for knowing your market and its participants.

Mar

20

Hoodoos and U2, shared by Craig Mee

March 20, 2011 | Leave a Comment

This is quite a funny read and applicable to Vics hoodoo's in markets:

It took me a while to come to terms with this, to take stock of my envy, put my ambition in perspective and draw some life lessons. But eventually I wrote a book about our misadventures, I Was Bono's Doppelganger. The title was inspired by Bono's joking suggestion that we were cosmic opposites, and I had soaked up his bad luck.

Mar

20

1995 and 2011 Japan Earthquakes, from Kim Zussman

March 20, 2011 | 1 Comment

The attached plots log(nikkei225). The dark line is from a year before to a year after the 1/17/95 Kobe earthquake (arrow). The red line is log Nikkei from a year ago to +5 days after the 3/11/2011 earthquake (arrow).

The 1995 event - which occurred in a market that was flat to slightly declining - was followed by a modest decline over 4 days, then a small rally, followed by a decline which deepened over the next 6 months.

The recent quake occurred with Nikkei substantially lower than in '95, and followed a flattish period which was rising (with all other markets) over the past 6 months. So far the 2011 tragedy has taken the form of a deep 2-day drop followed by a 3-day bounce.

In terms of contextual backdrop, arguably there are more differences than similarities: Earthquake size/damage/future ramifications, recent global financial crisis, etc.

Craig Mee writes:

Thanks, Kim.

Of note the SP in 1995 was up 18.8% in the following 6 months to 17/8/95.

A spread trade short Nikkei, against one of the more stable Indexes at the moment, (potentially one least effected over the last weeks volatility), maybe a consideration as of 3/20/11.

The Russell 2000 index of smaller companies has lost 1 percent since the earthquake in Japan, a slide that is less than half of the pullbacks of large company indexes like the Dow or S&P 500. That's a surprise, considering that the smaller, riskier companies tend to fall the most during stock downturns. Last year, for instance, the Russell index lost 2 percentage points more than the S&P 500 during a market drop that lasted from April to June.

Mar

18

Volatility, from Craig Mee

March 18, 2011 | Leave a Comment

In periods of higher volatility and shocks across the board, as in the last week, be prepared to alter your trading plan as a position taker.

In periods of higher volatility and shocks across the board, as in the last week, be prepared to alter your trading plan as a position taker.

Where once a constructive market under low-medium volatility allowed you to set defined price entries, and the usual patterns and trading synergies of a particular market held true, which in effect gave you your original edge, now to perform when volatility picks up and markets change, don't be so cute on your entries and exits.

In effect, if it gets close and you want a position, pull the trigger, reduce size and get involved, and be prepared to reload.

The added volatility and your experience in the market should more than make up for any short term hits.

Mar

15

Personal Energy and P and L, from Craig Mee

March 15, 2011 | Leave a Comment

It's quite amazing how personal energy is directly related to p and l. Especially during the drawdown, including whether all safe guards are up held. Then when the dam breaks, so does footspeed. Possibly the following account performance is a direct correlation of this combustion.

Mar

12

Distractions, from Jim Sogi

March 12, 2011 | Leave a Comment

There are so many distractions that try to take your focus off the market when you need it the most. Wailing sirens every hour, tsunamis, earthquakes, movies, pretty girls, boats, music, food, the news, the mideast, the electrical workers strike, thunder, lighting, vacations, family obligations, phone calls, bills, errands, and the list goes on. Obviously some require a balance. Its a common strategic trick used in other contexts of battle, combat, negotiation, art, humor, magic, romance.

There are so many distractions that try to take your focus off the market when you need it the most. Wailing sirens every hour, tsunamis, earthquakes, movies, pretty girls, boats, music, food, the news, the mideast, the electrical workers strike, thunder, lighting, vacations, family obligations, phone calls, bills, errands, and the list goes on. Obviously some require a balance. Its a common strategic trick used in other contexts of battle, combat, negotiation, art, humor, magic, romance.

Alan Millhone writes:

You make good points on distractions. I know that many on the list have no TV which plays on our emotions.

At Checker tournaments I pretty much block out all around me and concentrate on the board before me. My opponent is there but only to make their move or reply to mine. I keep a legal pad handy and record my moves and on occasion make a note beside my move here and there or same with my opponent.

I suspect the Market trader should conduct themselves in a similar way.

Craig Mee writes:

Remember Tiger Wood's father used to either yell at him or play music super loud on the putting green– one or the other, from a very early age to combat distractions.

No doubt the scalpers in the pit that excelled had mastered that area as well.

Mar

12

From a Banker Mate in Tokyo, shared by Craig Mee

March 12, 2011 | Leave a Comment

I honestly thought as I was running down 19 floors of stairs at full pace with the building creaking and swinging like a pendulum that "this was it". It was hard to keep on your feet. Then I got out, and was running home like a rabbit. Things started to return to normal so I slowed down, but I got home and couldn't find the family. Then the aftershocks started again, and I just wanted us to be together. Phones were out on the mobile network almost straight away but then even the landlines were clogged. Needless to say, the bath is now stocked with blanket, phone, water and food… and a whistle.

Last night was a series of one aftershock after another. I feel so bad for those 300km north of us and the tragedy that is unfolding. We watched it all on the Internet unfold until 4am as we were rocked with one aftershock after the next. And we were the lucky ones. How someone can build a 27 story skyscraper that withstands that– and thank goodness, our house– I am in total awe.

Our house was trashed inside… but I don't care. We've cleaned up and although insurance will cover it, I couldn't care less. The total feeling of helplessness has now passed. I can't explain it.

All friends seem to be safe– albeit shaken AND stirred.

Youtube video of office blocks swinging.

Mar

11

A Natural Inborn Refining Mechanism, from Craig Mee

March 11, 2011 | Leave a Comment

There's no doubt a direct relationship with your natural inborn refining mechanism and one's trading turnover.

It appears if you're protecting your equity curve, and have a a few losses in a row, and meanwhile have a nice profitable trade on that you're running, the only solution is too cut the profitable one as well. (since any adjustment in the market stops really need to be widened at this point when in the money, not tightened).

This, with Newton's Law, seems to make you pay double for your losses, since the profitable trade keeps running, but it's the only way it seems to keep the wolf from the door, by making a sacrifice to the market mistress, and hopefully by refining your selection criteria, so as too not achieve so many losses in a row that this proves problematic.

It also has to do with how successful you are after a profitable run, and wanting to protect, you find yourself also wanting to leverage and take advantage of the run. If this turns you can give back that hard fought gain, and need to cut that winner as well.

It's really the market's natural inbuilt refining mechanism. The costs of bad trades are not just whats upfront, but what comes from behind is really what's going to hold you back from premium performance.

Mar

11

Extra Nimble Feet Needed, from Craig Mee

March 11, 2011 | Leave a Comment

Got to love it when you are 3 bucks in the money short crude, as you wake in the early hours checking the pocket watch.

Here is my thought process as a holder and trend follower:

"Ok, 3 bucks daily ranges doesn't usually extend too much more than that on a day."

"Though this could be a reversal, may push, to a 96 target next week."

"Equity holding weak, so pressure may hold"

But, I'll roll out, and watch it for a bit to protect account p and l.

Boom. Go to laptop. Scratch trade. 270 point swing in 15-20 minutes

"Gee, that was lucky for me. Guess the market as always makes the right decision for me and is a step ahead of me!"

Mar

11

This article is something I don't understand. I can understand that rewards should reflect the risk that people are willing to take. What risks do financial advisors personally take to justify the rewards they reap? It seems to me that if you take a much bigger reward than the risk you personally take, then that reward is undeserved and a pure expression of greed vs. what you're truly entitled to. Am I missing something?

This article is something I don't understand. I can understand that rewards should reflect the risk that people are willing to take. What risks do financial advisors personally take to justify the rewards they reap? It seems to me that if you take a much bigger reward than the risk you personally take, then that reward is undeserved and a pure expression of greed vs. what you're truly entitled to. Am I missing something?

Gary Rogan writes:

Clearly the flexionic millionaires don't deserve their rewards, especially after their companies should be long bankrupt if left to the vagaries of the free market. Is the remuneration of a financial adviser, who without any governmental or otherwise illegal/unethical tricks, derives good income from seemingly simple work, "justified"? I suggest that this is another "angels on the head of a pin" questions that cannot be answered, because it's "ill posed". In a free market, anything you get from a voluntary exchange is "justified" by it's existence. If you want what he's got, try it on your own and see if you can do as well or better. I personally don't believe in the services of a "financial advisor" so I've never been to one. I have the same attitude towards them as I do toward well-paid athlete in a sport I don't care about: if somebody is willing to voluntarily pay them their salary, it's not my problem or concern.

The article, in a true populist fashion, confuses ill-gotten gains with the rewards of the free market. This "trick" is a favorite of revolutionaries, who use the existence of scoundrels to destroy any semblance of order and replace it with a dictatorship led by even worse scoundrels.

Mark Goulston replies:

Thank you Gary. It is aimed at the true "flexionic millionaires," and I am in favor of the free market and oof people who are willing to put themselves and finances at risk to reap the rewards when they pay off. I'm just not sure I agree with "flexionic" people reaping the rewards as a result of their risking other people's money.

Gary, Hit me with your best shot about: The Obsfuscation Conspiracy.

Gary Rogan responds:

Mark, I think that most of the "flexionic millionaires" are probably CEOs of large, mostly (but not exclusively) financial companies and to a lesser extent, some hedge and other fund managers. It seems from the context that you were referring to the latter group rather than some down-home financial advisors who take on a few clients personally. To the extent that they derive their gains from their flexionic connection they are just thieves. The problem is it's often hard to separate what percentage of their gains comes from their honest skills and what percentage comes from exploiting the illegal/unethical schemes.

The real truth is that in complex societies those who learn to exploit complicated "angles", legally or illegally do well. We should try to clamp down on the illegality because otherwise everything else becomes corrupt, as corruption cannot be contained to one sector. The quest however to link compensation to the social value of one's work by anything other than enforcing anti-corruption laws and encouraging such attitudes is likely to become a fight with windmills or worse, a populist revolutionary crusade with disastrous consequences. Freedom trumps unfairness, but unfairness due to corruption should fought by good people.

Fast Anonymous writes:

While the flexonic millionaire are an issue. The cause of this issue is those millionaires that made their money by skimming a small sliver of risks and put it on the unsuspecting. No body has gone to jail, for this willful blindness. Not only have they not gone to jail those very workers are the new untouchable, too big too fail, in with the government: flexons. Of course they can put together a new system built on trust (wink, wink, nod, nod). We have all heard of perhaps the urban legend "penny skimming" millionaire. The con where you simply take a few pennies from every account, and 99.9% never notice but simply adjusted their books each month it happens . Those that did notice, did not take the time to complain. those that complained never sued etc.

Many in Wall Street simply skimmed the risks, added more and more risks, to those that thought they were buying safety, got sold garbage. The truth got stretched further an further out. One in 1 in million soon became 1/1000, then 1/100 then 1/10 and thereafter bound to happen sooner or latter. Allstate has done a statistical study that proves without a reasonable doubt many of these mortgage pools were outright frauds. The audacity of the lies were staggering to me. AIG sold over $500 billion of insurance on such securitized products, that they could not cover. They eagerly took the premium thinking they were the ones selling worthless promises.

Craig Mee writes:

Give people an inch and they take a mile. How long is a piece of string… if you do something, your kids will follow. At times no doubt its to do with re-educating people. For example, when countries move to a greater minority group within their populace, initially sometimes, those then deem to capitalise on looseness within the system. The locals then realise they're paying higher premiums because of this and get in on the act. And then the snowball begins. (A mate recently in court with a bad neck from car crash…usd7000 was the going rate. Turns out 8 people were sitting beside him with their hand out, all from the same family two car accident, usd 56000, a nice down payment on small business.)

As banks have been shown to "take liberty" so has the public. On a recent problem with a bank in Australia, atm's started punching out cash regardless of balance… from an official : "we have some people innocently trying to get sums of money out and being given more, through to people pushing security guards out of the way to go and get to it."*

We breed it and deliver 4 year political terms for those to give our cash away at will to secure votes in a socialist environment, and pay the consequences.what the answer. Work Harder!

The old laborer had to stand together, from such risks skimmers, to make a safe work place.

Wall Street must stand up to these skimmers of risks also.

Mr. Krisrock writes:

I appreciate that you posted this because it exposes that you are a supporter of Obama's strategy to VILIFY 500,000 people working in financial services and millions more who work in service industries that support them and the capitalist methods of allocating capital.

VERY VERY VERY few of these people were responsible for the financial crisis and in fact, some of us saw the fact that these same people never chose to attack the PUBLIC PRIVATE SYNDICATE called Fannie Mae.

Craig Mee writes:

Mr Krisrock, you may want to set your scope on a more deserving recipient. How my idea that "banks have taken liberty" has anything to do with a slam dunk and vilification of 500,000 financial service workers I don't quite understand.

I am a supporter of less taxes, that's what I'm a supporter of, and a fair go, for those who are having a crack.

Kim Zussman comments:

The meme gains momentum.

Ralph Vince writes:

It's ALL about money. Nothing else. In ALL walks of life, medicine, teachers, cops, politicians, waitresses, hookers, traders and traitors. Pretending to be "Above it all," is alway, bankably, a phoney act. All the little people's greed is always at the fore of their consciousness (excepting in young men, where that greed is surrogated by something else).

And who says the compensation should be consistent with the risks one takes? Or the good one does? Or their intellect?

I love that expression "…what you are entitled to." It rather rings of the other one those kind of thinkers lob out there, "…fair share."

It's enough to make you think we don't really live in a jungle. My experience, is that these are expressions of the largest predators among us, their weaponry consisting of the very specious argument that we are not in a jungle.

Let's not believe that for one second.

Gary Rogan writes:

The way the world really works is that if you unleash the government to take from those who have to cure sick patients and to house homeless children, you will have more patients unable to pay and more homeless children. Not immediately though. The liberal argument is always about here and now: "If we take the money today, we can spend more of it on worthy causes immediately. How can you not see that those in pain deserve it more than the rich who have more than enough?". Michael Moore who inserted himself into the Wisconsin crisis the other day went further. His claim was that we don't have ANY financial crisis and no government is broke because there is this untapped resource which really belongs to "the people", the wealth of the rich, that is simply not being tapped.

The real argument in Wisconsin is actually more about power than money. In this case the money, more specifically the forcefully extracted union dues of the public employee union members, is what has kept the Democrats in power in a self-sustaining feedback loop: we give you more secure and better paying jobs, you keep getting us elected with your contributions. The left is having the proverbial cow that the election process has somehow gone so wrong as to break this loop. Their reaction is bewilderment and blind rage.

Mar

8

For Those Who Missed It, from Craig Mee

March 8, 2011 | 1 Comment

Copper finally succumbed last night, and whether it leads the equity market, or equities lead it, they tend to mimic each other pretty well over the March/April reversal period for the next several months. If they hold this relationship, copper will now have a bit to make up to give this duo strength.

Copper finally succumbed last night, and whether it leads the equity market, or equities lead it, they tend to mimic each other pretty well over the March/April reversal period for the next several months. If they hold this relationship, copper will now have a bit to make up to give this duo strength.

Anatoly Veltman writes:

1. it happened quite abruptly in North American session.

2. mass media explanation: potential premium fuel costs dim prospects for industrial demand.

3. over the years, I've often seen other metals follow next day - although there is no fundamental link. It always was: like players were too busy knocking one market down today; and they switch to the next market next day. Which will be interesting to note tomorrow, as one important nouveau element (cross-market algorithms) should have kicked in already today (?).

Larry Williams adds:

Dominoes is the next game?

Mar

8

Rare Earths, from Craig Mee

March 8, 2011 | Leave a Comment

Nick Curtis made a $5 million contrarian bet in 2002 to develop an Australian rare earth mine, aiming to challenge China's control of global supply of the metals. His company, Lynas, now has a market value of $3.5 billion.

The reform process in China in the metals sector goes through a period of unfettered competition leading to chaos followed by which the state tries to get control of things again," Curtis said.

New supply

Sydney-based Lynas, the second-best performer on the benchmark S&P/ASX200 index last year, is set to become the first new source of supply outside China in at least two decades with the start up this year of the $535 million Mt Weld project, the world's richest deposit of rare earths according to Lynas.

rest here.

I bought this stock on the day before the crash in 87. Cheers! It was demolished at the time. Though I got my brother in too, no doubt he bottom drawed it. Time to let him know the good news! 24 years. Gees it went quick. Many stocks reinvent themselves, just like the wheel.

Mar

4

Amazing, from Craig Mee

March 4, 2011 | Leave a Comment

It's amazing how something, showing all the resilience of a bull one day (or over several days), then turns to water the next, where the past means nothing, and is another "market force" by the mistress which the speculator has to navigate. Like changing winds in the ocean from a increasing build to absolute clear water today. Yesterday's strength, can not be guaranteed to for anything, and only gets in the way, like a ghost plays with the mind. Where this weather was at 3- 6- 12 months ago, is no doubt a truly better indicator. (Even for those looking for a reversal of behavior.)

Mar

3

Excerpt of the Day, shared by Craig Mee

March 3, 2011 | Leave a Comment

30 M Gone: Jetsetter Accused of Having A Lend:

Due to the lack of funding available after the financial crisis, many of them were teetering on the verge of collapse. Unable to secure funding in Australia, dozens of businesses beat a path to luxurious offices in Bahrain seeking financial salvation….

Each was required to pay a non-refundable fee of £26,000 ($41,800). Not only that, borrowers had to pay an upfront fee of 1.6 per cent of the value of their loan. That meant most of the Australian borrowers handed over more than $1 million each.

Not one of the dozens of people who signed up for loans with WGA have received their money.

…This is all the more extraordinary considering that only six years ago Mr Ali, then living in London, left behind a messy flat and £7800 in back rent. He also owed council taxes.

Mr Ali has morphed into a billionaire claiming, erroneously, that he was a graduate of the London School of Economics. Back in Australia, desperate investors are too afraid to speak out as they still hope to recoup their fees.

Mar

1

The Lady From Sorrento, from a Nautical Personage

March 1, 2011 | Leave a Comment

The view of the bay was breathtaking. The evening breeze caressed her skin. She shivered. "I am sure he loves me," she said, "but I'll never manage to get out of this situation. It hurts so badly."

The view of the bay was breathtaking. The evening breeze caressed her skin. She shivered. "I am sure he loves me," she said, "but I'll never manage to get out of this situation. It hurts so badly."

"I cannot command winds and weather," he started. "Nelson was the greatest Admiral of all times. He meant to say that you cannot change the facts of life. You have to adapt, understand the forces at play and use them to your advantage".

He would not follow the herd. When prices plunged 50% he bought those stocks although there was no real setup. From there the market panicked, the pain seemed to be unbearable. Nevertheless he did not close the trade. It would have been a blow to his self-esteem. Then the market printed a long rebound and he recovered half of his losses. The pain became less intense. With time wounds heal and only scars remind you what happened. Even if you are still losing big money.

He explained: "I learned from markets that taking a loss does not mean there is something wrong with you. Get rid of his ghost, wait for a set up and open a new trade. It is as simple as that."

He was lying to her and to himself. They were friends, but he had always considered the possibility of a different relationship. She was beautiful; there was something intriguing about her. But he was well aware there was no future. She would not be the right person. Her unhappiness, her attitude towards life would drain his energy and he was already exhausted. He needed a dreamer; someone that would give him strength, incentives to do things and not complain or regret something that had not happened or could never happen. Nevertheless, he stuck to this relationship. The same way he stuck to his loss in the stock market. It had been pretty painful at the beginning. Now he had scars to remind the pain and he was still uncomfortable. This would never go away.

Suddenly, as if she was reading his mind, she said: "I will love him forever. Nothing will change this. I must try to forget him even if I know it will not work. I need to replace him in my mind with someone else. That someone cannot be you". He had been awaiting his turn, sitting with his legs at the edge of an abyss and helping her whenever she allowed him to do it. It was like a flash, and he realized he had to do something about it. He turned on his IPhone, accessed the trading account and introduced a sell market order at the next day's open. He had decided to get rid of his long held position and to close a losing trade in his life.

Then he said: "There is no reason for me to be in this trade, I need to get out. I want to look to the future, to the next trade". He thought he would also be a better trader from now on. She looked at the dark sea: "It is your choice. I will not ask you to change your mind. Maybe one day…" He did not let her continue. "Hope is for losers in trading as in life. He managed to say, holding back his tears: "Once a trade is closed, you don't want to look back…to feel regret…or remorse."

He left without turning back. He could imagine her on the terrace, as beautiful as ever.

There was a lady in Sorrento wearing a pink dress at a party that night…

George Coyle asks:

This is great. I thought it might be literature but for the inclusion of the iPhone. The patterns in romance and trading are so similar. Good trades are easy to get into, they go in your direction almost immediately, and they require minimal effort and are a pleasure to have on. Thinking about them makes you feel good. Bad trades inspire doubt and rationalizing, can result in sleepless nights, and usually begin with immediate loss which results in more rationalizing such that even if you are down 50% a small rally inspires unwarranted optimism (even though you are still down 45%). And one generally winds up in emotional distress and makes rash decisions exiting at inopportune times. I have drawn the parallels many times; hope and human psychology seem to be at the core.

I think this is why systematic approaches are so popular in the short-term in trading, the human element is removed. But a systematic approach to dating doesn't really work. For one, by definition if you are in fact part of the dating pool, every relationship you had up until now has failed so it seems a fool's game to even play based on odds. It becomes worse if you have an adequate enough sample size to have approximated the population via the central limit theorem! And you could be viewed as cold and calculating, two things which seldom result in romantic success. Inevitably the initial honeymoon goes awry and a rolling stop results in the end of a relationship. And the vig can be very high so it might pay to approach relationships with a long-term hold investment bent post some initial time based rolling stop out (if one wanted to use a pseudo scientific method). But being a trader, one is always aware when the trade feels bad which can lead to dismay as the patterns usually don't lie!

Craig Mee writes:

The market mistress plays with one's inner demons. On a big turnaround, you can't help but get on, though your immediately exposed to the gun slingers, but as traders know the worst of the two evils is when that baby pops to the moon, and you're not on. To commit and face certain high winds or not commit and be left in the shallows. .. mmm I hate harbour.

Feb

24

From High Frequency Trading To Nothing, from Craig Mee

February 24, 2011 | Leave a Comment

I could have sworn I heard the market take a breath on the low of the mini SP a moment ago.

Maybe not one for day traders or position holders, but maybe for scalpers, the pause can mean indecision. No doubt this can be measured and worth more on a meaningful move.

Feb

17

Here Is An Off-Beat Indicator, from Anatoly Veltman

February 17, 2011 | 4 Comments

Say you're a little perplexed by a slow creep-up in commodities last few sessions. On the one hand, most commodities have been now climbing day-in day-out for months - so naturally a contrarian, or value seeker would look to be a seller. On the other hand, you are not really getting a tremendous spike, a blow-off into which to sell. So here comes Cotton to your rescue!

Say you're a little perplexed by a slow creep-up in commodities last few sessions. On the one hand, most commodities have been now climbing day-in day-out for months - so naturally a contrarian, or value seeker would look to be a seller. On the other hand, you are not really getting a tremendous spike, a blow-off into which to sell. So here comes Cotton to your rescue!

You see, Cotton just nearly tripled in the two-quarter period. Obviously, it's a top-of-the-needle daily war of attrition right now between the Longs and the Shorts in that market. Margin hikes by the exchange, price-limit moves adjustments and all that jazz… So watch closely; and the moment that Cotton finally reverses - there will be your indicator that the drift is changing in commodities. Whether it will be orchestrated (in Cotton) by one or another power-party - the jig will be up that, temporarily, Bull market deflation is favored by someone with influence

Ken Drees writes:

A friend just called me this morning saying he heard on Glenn Beck radio about cotton and clothing price hikes– I would be in the cotton correction camp, if I traded this item–usually when a not often talked market is in the news it's time to consider exit door locations.

Anatoly Veltman reponds:

Because of likely limit lock-down in many of the sessions– the outsiders will be confused as to "real" dimension of price changes and balance-of-power day to day. My point was that someone not taking position in Cotton per se– will still get a hint of shifting wind for all of the inflated markets! Remember that today's markets are arguably the most manipulated in decades. Thus, it's doubly important to be tipped-off as to when the flexions decide to loosen the upward pressure valve.

Rocky Humbert writes:

I think Anatoly's focus on cotton as a "tell" is misplaced. I think the entire commodity complex is keying off of Netflix stock (NFLX). As soon as the farmers stop watching videos and get back on their tractors, Netflix stock will crater, and so will the grains…

(Calculating the R-squared between Netflix and one's favorite commodity is left as an exercise for the reader.)

Craig Mee adds:

Talking to a mate in Singapore today in a trip to the sunny island, and he mentioned a farmer in China, who has stock piled cotton: "he has 6 tonnes of the stuff, taking up every inch of his shack, stock piling with price where it is, no interest in selling." I suppose why would you, with price ferociously in the one direction. Though two questions remain, is this a trait of the Chinese race in general… accumlate accumlate… and for such a specie position…is it another reverse market indicator?

Feb

6

Liverpool Owner John W. Henry, from Craig Mee

February 6, 2011 | 2 Comments

John W Henry, is trying to turn the fortunes of English Premiership team Liverpool, after being a success across the pond at the Red Sox. In a interview in The Guardian, he disclosed a few points in his battle which may be of assistance to us. First, an extract from his trading thinking:

John W Henry, is trying to turn the fortunes of English Premiership team Liverpool, after being a success across the pond at the Red Sox. In a interview in The Guardian, he disclosed a few points in his battle which may be of assistance to us. First, an extract from his trading thinking:

I don't believe that I am the only person who cannot predict future prices. No one consistently can predict anything, especially investors. Prices, not investors, predict the future. Despite this, investors hope or believe that they can predict the future, or someone else can. A lot of them look to you to predict what the next macroeconomic cycle will be. We rely on the fact that other investors are convinced that they can predict the future, and I believe that's where our profits come from. I believe it's that simple.

John W. Henry

On his battle with Liverpool, and strategies for a premiership:

1. That, he said, will be Liverpool's two-pronged approach to rebuilding the squad, which will be financed only out of its income; he and his fellow investors in Fenway will not be pouring cash in.

2. Henry, however, said this did not mean they were not prepared to spend big fees on the right players, as the group has done when turning the Red Sox into a World Series-winning baseball team again.

3. "We intend to get younger, deeper and play positive football.

4. Adding two top players "We intend to get younger, ………Adding two top players [Carroll and Suárez] who have just turned 22 and 24 is a good first step.

5. "It's not a coincidence that the last two ownership groups could not get a new stadium built," he argued pointedly. "What they proposed or hoped for just didn't make any economic sense6. Our goal in Liverpool is to create the kind of stability that the Red Sox enjoy," he said. "We are committed to building for the long term."

OK what does all that mean with respect to trading.

1. Invest from within. Generate cash from within other ares of your business, then use this to improve revenue in your core model (and fit under regulation framework in doing so).

2. Rio trade is alive and well! Well, at least investing larger on a proven strategy where the rest of the business model can fit around it. In fact, this might be the only way to take you over the line with some kind of speed, without grinding it out, and losing to the vig.

3. Do not expect to play defense and win. You must trade positively and add to positions when you can in an effort to score the match winner.

4. Law of ever changing cycles. Get fresh new ideas and strategies. Add to the old tried and true with fresh blood, since this will be where your future lies.

5. Do your books. Money management. Don't over extend on risk.

6. Your after stability in trading and low volatility returns over the long term… not in beating the morning star monthly genius.

Jonathan Bower writes:

I dunno, blowing GBP 35 million on an unproven and injured 22 year-old player with multiple arrests for assault, including his ex-girlfriend, (Carroll) makes much sense from a business or trading perspective.

Feb

3

Kids at Your Side, from Larry Williams

February 3, 2011 | 3 Comments

Trading is hard with small kids around. I remember when I was trading copper. I'm long, and my actress daughter gets a bloody nose (of course she dramatizes it, she's a born actress). I forget the trade in copper, stop the bleeding….and….go back to see a 45,000 loss in copper. It would have been cheaper to med-evac her to the hospital.

Trading is hard with small kids around. I remember when I was trading copper. I'm long, and my actress daughter gets a bloody nose (of course she dramatizes it, she's a born actress). I forget the trade in copper, stop the bleeding….and….go back to see a 45,000 loss in copper. It would have been cheaper to med-evac her to the hospital.

Victor Niederhoffer reminisces:

Twenty five years ago I lost half my wealth between the first and second games of a racquetball game with Reuben Gonzales.

Craig Mee writes:

Shocking…It reminds me of a local interest rate trader, heavily

short, who went for a "quick" haircut, next door to the exchange in

Sydney…. BOOM. Reserve bank unexpected rate move …house wiped out.

An anonymous contributor writes:

They [ed.: i.e. the French] had then learned how easy it is to issue it; how

difficult it is to check its over issue; how seductively it leads to the

absorption of the means of the workingmen and men of small fortunes;

how heavily it falls on all those living on fixed incomes, salaries or

wages; how securely it creates on the ruins of the prosperity of all men

of meager means a class of debauched speculators, the most injurious

class that a nation can harbor,—more injurious, indeed, than

professional criminals whom the law recognizes and can throttle; how it

stimulates overproduction at first and leaves every industry flaccid

afterward; how it breaks down thrift and develops political and social

immorality. All this France had been thoroughly taught by experience.Everything was enormously inflated in price except the wages of labor.

As manufacturers had closed, wages had fallen, until all that kept them

up seemed to be the fact that so many laborers were drafted off into the

army. From this state of things came grievous wrong and gross fraud.

*- Andrew Dickson White, “Fiat Money Inflation in France”, How it Came, What it Brought and How it Ended*

Feb

3

A Fast Food Interest Rate, from Craig Mee

February 3, 2011 | Leave a Comment

Looking at interest rate futures and considering that trends appeared a lot more prevalent in the 90s and that as a direct result of the world markets becoming more and more intertwined, (and no doubt with rates getting squeezed closer to zero this doesn't help)– the noise and the vig play an ever increasing part.

Looking at interest rate futures and considering that trends appeared a lot more prevalent in the 90s and that as a direct result of the world markets becoming more and more intertwined, (and no doubt with rates getting squeezed closer to zero this doesn't help)– the noise and the vig play an ever increasing part.

It appears simple markets out on their own, unbiased, uninfluenced by the majors, are where the drive through meals are. Not sitting down at the hustle and bustle of a downtown cafe, which is akin to trading treasuries. Alright for the scalpers who enjoy the noise, but for us who just want good service and good food, and to be out the door, there are probably easier places to eat.

Feb

1

Tropical Cyclone Yasi, from Craig Mee

February 1, 2011 | Leave a Comment

For anyone interested in big natural events, check out this article: "Yasi could become category five monster ".

For anyone interested in big natural events, check out this article: "Yasi could become category five monster ".

At the moment it's eerily calm… very, very strange. I woke up this morning and there were no birds flying around, no sounds, absolutely nothing. It's like the wildlife knows there's something going on.

CAIRNS resident Carl Butcher is taking a stand against the might of oncoming Cyclone Yasi– he has vowed to keep tweeting through the terror of the storm.

Butcher, whose Twitter handle @cycloneupdate is fast gathering followers worldwide…

Victor Niederhoffer writes:

There are many books by Henty, favorite author of Getty, that describe how frontiersmen could tell what was happening 30 miles away, especially massacres by Indians, by the bird and insect cover in their own settlements. There are numerous market implications of this. I'd be appreciative of other references to the wisdom of birds, and how the layman can improve his profitability based on observing birds.

Ken Drees writes:

Here's a great article about bird behavior prior to the Longbeach earthquake in 1933.

Feb

1

Thought of the Day, from Craig Mee

February 1, 2011 | Leave a Comment

It's funny how just like in building a building, any construction that takes off too rapidly without adequate care and time, usually crumbles, just like the markets and just like riots. Great work and great markets can be torn down in seconds. To gauge what constitutes an adequate time to construct and whether it is strong enough, one must also bring in how tall the building is, how many pillars it has…

Jan

24

Market Choppy? Tepper, by Gary Rogan

January 24, 2011 | 1 Comment

David "Buy Everything" Tepper Will Make An Encore Appearance on CNBC Friday

Ken Drees comments:

There must be a huge request list for his bullish tunes—second time around play–eh?

Craig Mee comments:

Like a trend, while in the top 10 and runs on the board "I'm all ears" but be quick adjust to those melody changes.

Anatoly Veltman writes:

Tepper comes across a totally brilliant man. His September Bullish call at near 1000.00 SP came out as simplistic no-brainer, and it did mark acceleration ofthe upside trend. Tepper's current call is widely perceived to predict 1500.00 SP within a year, although he did remark that current near-1300.00 market contains that much more technical risk - in pursuit of the fundamentally-justified gain.

It's hard to understand why perception of currently-embedded risk appears to completely escape just about anyone's attention. I contend that current market condition, technically, will not allow much enjoyment over 1300, period. Let alone the distant 1500 prospect. We have the market that nobody appears to want to Short anymore; everyone speaking about the market is totally spent out of any will for Bearishness whatsoever .

Ken Drees responds:

State of the union and 12000dow / 1300 s&p nice rounds at a nice time.

Jan

24

The Choking of China - and the World, by Craig Mee

January 24, 2011 | 2 Comments

Firstly, 700,000 people are dying every year in China as a result of the extreme pollution, according to the World Bank. They can’t be compensated at some later date with a wind farm. Secondly, and even more crucially, the West “cleaned up” largely by exporting its pollution to poor countries like China. As Watts puts it: “This model relied on those at cleanup stage being able to sweep the accumulated dirt of development under a new and bigger rug. When this process reached China, it had already been expanding for two centuries. Now “the waste [is] getting too big and the rug too small.” Where is China going to export it to? For how long?

A "plastic soup" of waste floating in the Pacific Ocean is growing at an alarming rate and now covers an area twice the size of the continental United States, scientists have said.

The vast expanse of debris – in effect the world's largest rubbish dump – is held in place by swirling underwater currents. This drifting "soup" stretches from about 500 nautical miles off the Californian coast, across the northern Pacific, past Hawaii and almost as far as Japan.

Ralph Vince Comments:

Nonsense. It wasn't "The West" that swept our pollution to China. It was the multinational entities that TOOK it to China because we (specifically, the United States) passed (and enforced) regulations to clean up.

I'm old enough to remember the stench of sulfer in my fair city, and to remember my father pointing out that the orange-rust-colored ribbon 48 stories below was a river.

The rest of "The West" followed in part. Everywhere else was always a pig sty, even absent the heavy industry which would be fleeing The West. Latin America is a pig sty, as is the middle east and, Eastern Europe, and, with the exception of Japan and Singapore, so is Asia. The subcontinent isn't even worth mentioning.

The academic explanation that the collective "West" swept it under a bigger rug is a lie. The United States would have loved to have kept those manufacturing jobs but the decision was made to move it to where they could pollute with impunity by the polluting entities themselves. Later, trade treaties with these places would be opposed by voters in America, but like the misnomered "Health Care" bill of 2010, would be crammed down the voters throats.

Jan

24

Daily Reckoning.com, No Beating Around, by Craig Mee

January 24, 2011 | Leave a Comment

First, why are so many people unemployed? The answer is very simple.

Because there is no profitable work for them to do as present labor

rates. Thanks to previous meddles, the US economy focused itself on

building houses and importing geegaws from overseas for people who

couldn't afford to pay for them. This was a dead-end economic model. And

the end came in 2007. Now, the latest figures show an uptick in

manufacturing…which is clearly the direction to go. But it will take

years before the US economy has made the adjustment to a new, healthier

model…making and selling things at a profit.

In the meantime, unemployment levels will remain high.

But wait…there's more. For which the adjustment is taking place, US

authorities are trying to block it. How? By taking resources from the

new, unborn industries and using it to prop up the old, dying ones. Like

Wall Street, for example. The financial industry grew like Topsy in the

bubble years. It began to shrink in the crisis of '07-'09, but the feds

came in and pumped more than a trillion dollars into the financial

sector, producing record profits for the big banks, but depriving the

rest of the economy of much needed capital.

Not only that, the feds also take the pressure off labor to make

adjustments. Food stamps, minimum wages, unemployment compensation,

make-work, shovel-ready boondoggles - all these things cause workers to

think they can continue as before…that a "recovery" of the good ol'

days is just around the corner…and that they'll soon be earning as

much as they were in 2007. Maybe more!

Want to really fix the unemployment problem? Listen up. Eliminate all

bailouts, subsidies, giveaways and support systems - both to business

and to labor. Abolish all employment restrictions and employment

paperwork. All free labor - undocumented non-citizens - to compete

equally with native-born workers. Cut taxes to a flat 10% rate for

everyone. Abolish every government agency that begins with a letter of

the alphabet. Then abolish the rest of them.

We confidently guarantee that the nation would be back at full employment within 30 days.

Tyler McClellan comments:

This whole argument is bullshit.

The productive industries are by their own choice and for their own

reasons net suppliers of capital to the rest of the economy. It's a

myth, complete myth that capital flows to where it is most profitable.

It flows from where it is most profitable to where it will be accepted.

Stefan Jovanovich writes:

I wish I could agree with Craig, but he omits a significant handicap.

Because of the catastrophic decline in the productivity of American

elementary and secondary and college education, the skill sets of

workers under 30 are far, far lower than they were in 1945 - 1955. The

transcripts are immeasurably more impressive that they were for people

coming out of the military service and leaving college after the GI

bill. That Army confirms this sad fact in its recruiting statistics. The

handicaps for inductees in WW II were that some had had very little

formal education and were underweight from having struggled through the

Depression. The Army found that these could be remedied with "basic

training" in the 3 Rs (Reading, writing and arithmetic) - usually a 3-4

month course - and some decent chow.

The handicaps for recruits now are obesity and the creeping dumbs -

almost all the kids from the inner cities and slum suburbs are fat,

illiterate and without any learning skills. No entrepreneur in his or

her right mind is going to hire these kids, even if Craig's hallelujah

miracle of sane political economy suddenly appears. Full employment is a

long, long way off - as far away for this generation as it was for

people like my father-in-law in 1930. He had degrees in geology and

petroleum engineering from the Universities of Texas and Oklahoma, and

it took him half a decade to find steady work - initially as a

roughneck. These poor (in all senses of that word) kids don't stand a

chance.

Gary Rogan responds:

While I agree with all the recommendations, guaranteeing full

employment within 30 day while possible contradicts some fairly recent

Nobel prize work (of course the very fact that Krugman has one

invalidates it stature, but still it's something to consider).

The work of the winners,

Professor Diamond of the Massachusetts Institute of Technology, Dale

T. Mortensen of Northwestern University and Christopher A. Pissarides of

the London School of Economics, is best known for its applications to

the job market.

The researchers spent decades trying to understand why it takes so long

for people to find jobs, even in good economic times, and why so many

people can be unemployed even when many jobs are available.

Traditional economics, after all, would predict that wages should simply

drop, helping the labor supply to meet labor demand automatically and

sweeping jobless workers into whatever positions were immediately open.

These researchers’ explanation addresses the complications that come

from searching for jobs and job candidates: it takes time for unemployed

workers to be matched with the proper opening, since people are not

identical, cookie-cutter units, and neither are jobs.

While all this may seem intuitive, in the 1970s it was considered quite

radical. The resulting insights about how search costs can affect

markets also helped revolutionize not only labor economics, but fields

like public finance and housing economics as well. The work is

especially relevant today, as policy makers try to understand and combat

the causes of stubbornly high unemployment in countries like the United

States.

Stefan Jovanovich responds:

The equilibrium assumption behind the Diamond, Mortensen, Pissarides

study is fascinating. Why should there be any necessary match between

ALL the skills being offered and ALL the skills being demanded? Prices

can adjust supply and demand where markets exists; they cannot produce

demand for skills that offer no profit to the buyer at any price. The

neo-Keynesian fallacy is that money dropped from helicopters will cause

private employers to find profits in having holes dug and then filled up

again; the original Keynesian fallacy was that the government can take

money from the incomes of people whose skills are marketable and give

the money to the hole diggers without reducing the amount of savings

available for investment.

Scott Brooks writes:

Capital doesn't flow where it will be accepted, it flows to where the government allows it to flow.

America is like a sick body riddled with metastasizing cancer. Nothing

works properly in a body that is fighting for it's life. Nothing "flows"

properly. The "Body America" is riddled with the cancer of statism. As a

result, the entire "financial organ" of the "Body America" isn't

working properly.

Mr. Albert comments:

The 'Greatest Generation' had an enormous advantage. After the war,

the US faced essentially no mercantile or manufacturing competition, and

thus dominated foreign markets at a time of enormous replacement need.

It was easy for the unskilled and unlearned to find work in that