Jan

16

10 Men, from Femi Adebajo

January 16, 2011 | 1 Comment

This was forwarded to me by a banker friend.

For the figure lovers…………

Suppose that every day, ten men go out for beer and the bill for all ten comes to $100. If they paid their bill the way we pay our taxes, it would go something like this:

The first four men (the poorest) would pay nothing.

The fifth would pay $1.

The sixth would pay $3.

The seventh would pay $7.

The eighth would pay $12.

The ninth would pay $18.

The tenth man (the richest) would pay $59.

So, that ' s what they decided to do.The ten men drank in the bar every day and seemed quite happy with the arrangement, until one day, the owner threw them a curve. "Since you are all such good customers," he said, "I ' m going to reduce the cost of your daily beer by $20." Drinks for the ten now cost just $80. The group still wanted to pay their bill the way we pay our taxes so the first four men were unaffected. They would still drink for free. But what about the other six men– the paying customers? How could they divide the $20 windfall so that everyone would get his fair share? They realized that $20 divided by six is $3.33. But if they subtracted that from everybody ' s share, then the fifth man and the sixth man would each end up being paid to drink his beer. So, the bar owner suggested that it would be fair to reduce each man ' s bill by roughly the same amount, and he proceeded to work out the amounts each should pay.

And so:

The fifth man, like the first four, now paid nothing (100% savings).

The sixth now paid $2 instead of $3 (33%savings).

The seventh now pay $5 instead of $7 (28%savings).

The eighth now paid $9 instead of $12 (25% savings).

The ninth now paid $14 instead of $18 (22% savings).

The tenth now paid $49 instead of $59 (16% savings).Each of the six was better off than before. ! And the first four continued to drink for free. But once outside the restaurant, the men began to compare their savings. "I only got a dollar out of the $20,"declared the sixth man. He pointed to the tenth man," but he got $10!" "Yeah, that ' s right," exclaimed the fifth man. "I only saved a dollar, too. It ' s unfair that he got ten times more than I!" "That ' s true!!" shouted the seventh man. "Why should he get $10 back when I got only two? The wealthy get all the breaks!" "Wait a minute," yelled the first four men in unison. "We didn't get anything at all. The system exploits the poor!"

The nine men surrounded the tenth and beat him up. The next night the tenth man didn't show up for drinks, so the nine sat down and had beers without him. But when it came time to pay the bill, they discovered something important. They didn't have enough money between all of them for even half of the bill! And that, ladies and gentlemen, journalists and college professors, is how our tax system works. The people who pay the highest taxes get the most benefit from a tax reduction. Tax them too much, attack them for being wealthy, and they just may not show up anymore. In fact, they might start drinking overseas where the atmosphere is somewhat friendlier.

David R. Kamerschen, Ph.D. Professor of Economics

University of Georgia

For those who understand, no explanation is needed. For those who do not understand, no explanation is possible (this is the comment by the professor).

Jan

16

Kappa Beta Phi, from Victor Niederhoffer

January 16, 2011 | 1 Comment

One believes that the invisible clubs, the riding in cars together of competitors, the lunches at the gilded offices at the Federal Reserve banks, the squash games, the parties that the partners of the flexions themselves go to together, the telephone calls et al, are the main lines of communication. A point I would make is that trillions have been taken out of the total pot, or the energy totality (in ecological terms), and that these trillions would have been disseminated to what Amiity Schlaes calls "the forgotten man".

One believes that the invisible clubs, the riding in cars together of competitors, the lunches at the gilded offices at the Federal Reserve banks, the squash games, the parties that the partners of the flexions themselves go to together, the telephone calls et al, are the main lines of communication. A point I would make is that trillions have been taken out of the total pot, or the energy totality (in ecological terms), and that these trillions would have been disseminated to what Amiity Schlaes calls "the forgotten man".

I would also point out that such badges and emblems of self dealing, (call it a conspiracy or an informal network, or a kinship thing), have been endemic to wall street from its inception (in a price fixing deal to keep commissions up under the buttonwood tree).

Such insider, wrongful, and dysfunctinoal activity, needs a very capable, speptical, and dedicated personage, a Patrick or Patricia O Brian or Serpico or Puzo to record, memorialize, expose and eliminate.

Wall Street's Secret Society Inducts Members With Lehman Video

By Max Abelson Jan. 15 (Bloomberg)

– A bald man in a tuxedo walked into Manhattan's St. Regis Hotel, muttered to a uniformed attendant and was ushered to an elevator. A woman in a fur hat the size of a lampshade followed, then a man in a topcoat, who licked his lips as he walked under a ceiling painted with naked cherubs.

Kappa Beta Phi, the banking fraternity founded before the 1929 stock-market crash that counts Wall Street's most senior executives and regulators among its past members, held its annual induction dinner behind closed doors at the landmark New York hotel on Jan. 13. This year's names included Josh Harris, senior managing director at Apollo Global Management LLC, the buyout firm led by Leon Black, according to two attendees, who spoke on the condition of anonymity because the society's activities are secret. Harris, 46, was No. 655 on Forbes Magazine's billionaires list last year.

read full article here.

T.K Marks writes:

When word of Wall St.'s pervasive machinations first began to bubble up during the (selective) bailout bonanza, somebody I know likened the expected fallout to the public relations Chernobyl that the Catholic Church continues to face in the wake of the predatory priests scandal. The thinking being that people will not soon forget being duped on a systematic scale. The Church is still reeling from that situation, as the litigation liabilities would bear out.

The difference in the two situations however is that in the eyes of some Wall St. would appear to have an unseemly symbiotic relationship with the government entities that are in theory supposed to ferret out high-level duplicity. They're the guys with the Geiger counters and if they say the situation is not inherently radioactive, who has the wherewithal to challenge them?

Jan

16

Paean to the Big Apple Big-Inch Flurry, from Marion Dreyfus

January 16, 2011 | Leave a Comment

Yellow grubby

The first day

of a snowfall

in NYC is

mag-magical

The second day

of a snowfall

in NYC is

tech-sledgical

The third day

of a snowfall

in NYC is

yekk-tragical

Jan

15

An Evil Hand, from Victor Niederhoffer

January 15, 2011 | 1 Comment

This story reminds one of the many times a trader has a position that he is helpless to defend, and is certain to be buffeted by superior line of force from an enemy deploying its resources to the traders certain ruination. The Knicks are completely random. They are always grindable into the dust. It's only a question of how hard, or how marshalled the opponent is. The random nature of the Knicks down town helter skelter play is reminiscent of what the trend followers always call a counter trend rally. While there is no such thing, ultimately a weak trader will go under as the flexions gather together and by an evil hand, visible or invisible, ultimately must prevail, as I did in all my squash games against a player without a big back swing, or one who hit too many short shots like a certain former employee of mine, who married a very worth assistant, and was actually a great player, regardless of that fatal weakness. v

Jan

15

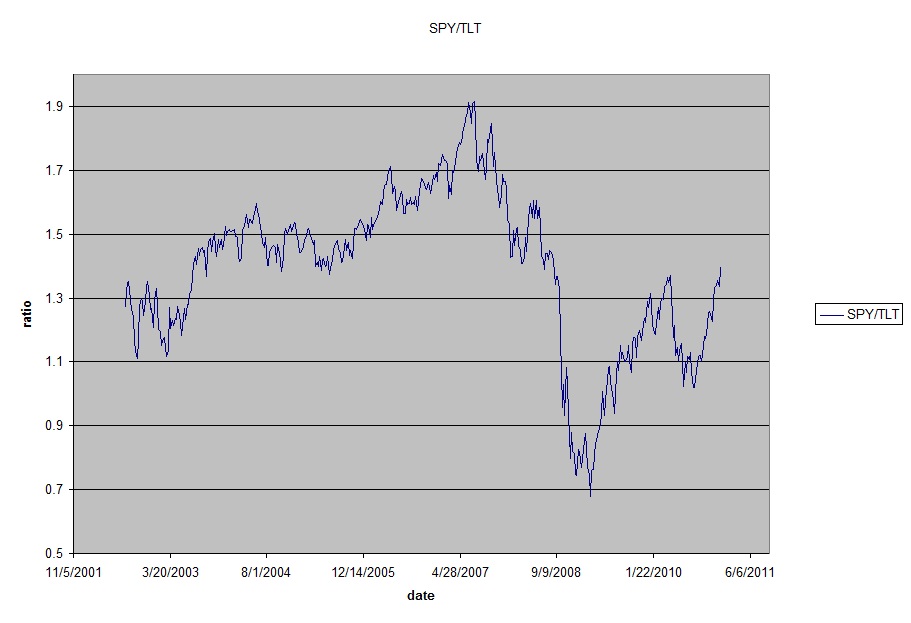

Martin Luther King Day–Then and Now, from Victor Niederhoffer

January 15, 2011 | Leave a Comment

It is interesting to speculate on the difference between Martin Luther King Day, 2008 when the French flexions sold their position at SP 1200, a seemingly low level, marking the market down 7% in the process and the current situation with the market just 10 below 1300. It's very Lobagola like, Gann like, symmetric, and harmonious in a sense. How many flexions have taken money out of the pot during this time, and how much of this has come at the expense of the non-flexions?

Jan

14

Sports Announcers, from Victor Niederhoffer

January 14, 2011 | 1 Comment

Is the quality of the announcing teams for sports broadcasts unusually high because aside from those who are readers of westerns, the sports listener is the most demanding of accuracy in the world? I like the Yankees baseball announcers, and the Knicks television announcers very much. They seem to be very sagacious, infinitely more so than the average market analyst or CNN reporter.

Is the quality of the announcing teams for sports broadcasts unusually high because aside from those who are readers of westerns, the sports listener is the most demanding of accuracy in the world? I like the Yankees baseball announcers, and the Knicks television announcers very much. They seem to be very sagacious, infinitely more so than the average market analyst or CNN reporter.

Dan Grossman writes:

The quality mentioned by Vic also applies to commentary.

Over breakfast I usually switch back and forth between CNBC and Mike & Mike in the morning. The quality, no-nonsense content and science of the latter far exceed any financial commentary that may be offered on the former.

Russ Sears writes:

I had always thought it was because of the large number of former elite athletes that they have to compete with to get a spot. They love the sport either they are doing this in sports retirement or were great in college but not the right size for the big leagues. These elites raise the bar for all candidates.

The elite athlete, transforming himself into an elite second life, is proof that the elite often can transform themselves to what is valued. Rather than just the "luck" of being born in a system that values "X" as the non-hunting gather Sage would have you believe.

I believe you see this somewhat better at the college level where local announcers are often great local college player. But have not thought up a test of this hypothesis on "quality".

Jan

14

Chinese Style of Parenting, from Ralph Di Fiore

January 14, 2011 | 2 Comments

I am the principal of a high school in which 95% of the students are

from China. Almost of them regret the Chinese style of parenting so

highly praised in the WSJ article and book. The Chinese school system

has produced many frustrated young people, and more and more Chinese

parents are sending their students to North America to obtain their high

school diploma and University education.

Charles Chen points out:

The Chinese school system and Chinese style of parenting, they are not equivalent.

Jan

14

Book Recommendations, from Victor Niederhoffer

January 14, 2011 | Leave a Comment

If you are looking for a good book, try The Shadow Elite by Janine Wedel. She coined and documented the flexions of all stripes. Also very good is The Short Stories of Jack Schaefer, and Mathematics Unlimited, 2001 and Beyond by Engquist, Schmid et al

If you are looking for a good book, try The Shadow Elite by Janine Wedel. She coined and documented the flexions of all stripes. Also very good is The Short Stories of Jack Schaefer, and Mathematics Unlimited, 2001 and Beyond by Engquist, Schmid et al

John Tierney writes:

OK, if you are looking for non-fiction try The Invisible Hook: The Hidden Economics of Pirates

Kim Zussman recommends:

"This Time is Different" by Reinhart and Rogoff

(Spoiler hint: the common ploy of sovereign debt default via confiscation and hyperinflation appears not to apply to U$)

Scott Brooks writes:

We've talked about it on the list before and I I found it very good: Amity Shlaes "The Forgotten Man"

Easan Katir writes:

To the Last Penny is an excellent but little-known Edwin Lefevre work, which, thanks to Google books, one can read online.

Bud Conrad writes:

How about my book, which explains how the economy works from the view of an engineer looking at the total system. It also gives investment recommendations in the second half. It is titled Profiting from the World's Economic Crisis and published by John Wiley. Amazon has reviews and some sample pages. It is number one in one category on interest rates.

Craig Mee adds:

I recommend the Book on Games of Chance. A few of you may be no doubt already connected with it. Here is an interesting excerpt about it:

Cardano was an illegitimate child whose mother had tried to abort him. His father was a mathematically gifted lawyer and friend of Leonardo da Vinci. Cardano studied medicine at the University of Pavia, but his eccentricity and low birth earned him few friends. Eventually, he became the first to describe typhoid fever, a not inconsiderable achievement in itself, but today, he is best known for his love affair with algebra. He published the solutions to the cubic and quartic equations in his 1545 book Ars Magna, but Cardano was notoriously short of money, and had to keep himself solvent by gambling and playing chess. His book Liber de ludo aleae ("*Book on Games of Chance*") written in 1526, but not published until 1663, contains the first systematic treatment of probability, as well as a section on cheating methods. I told you he was bad.

Vince Fulco adds:

A little late to this thread but "Panic" by Andrew Redleaf and Richard Vigilante is proving to be a good read. Redleaf is a convert arb manager out in my neck of the woods who runs Whitebox Advisors. He is in print in his Dec 2006 letter stating, "Here is a flat out prediction for the New Year. Sometime in the next 12-18 months there is going to be a panic in credit markets. Spreads which now hover at an extremely tight 300 bps or so, will gap to more than 1,000. To put it another way, prices of HY securities will drop by something like 20 percent with some weak paper plunging even deeper"

A few powerful paragraphs from the first chapter:

The ideology of modern finance tears capitalism in two, then abandons the half beyond the ken of bureaucrats and the professors. Capitalism demands free markets because it needs free minds. Modern investment theory says efficient markets can moot the minds entirely. The entrepreneur cherishes freedom including the freedom to fail. The bureaucrat of capital dreams of a world in which failure is impossible. Confronted with demons of uncertainty, the entrepreneur wrestles with them till dawn. The bureaucrat of capital crafts idols of ignorance and worships in the dark.

Prevailing in Washington as on Wall St. were the most vile and self-destructive assumptions of anti-capitalists everywhere who imagined they could wield capital while abandoning the principles that created it; that systems could substitute for the moral standards they once embodied; or that men who lost trillions of dollars of other people's money might somehow recover it if only the govt gave them trillions more. Crony capitalists on the right and socialists on the left united as always behind their most fundamental belief, that wealth is to be captured by power and pull rather than created in the minds of men.

Jan

14

To My Credit, from Easan Katir

January 14, 2011 | Leave a Comment

Once upon a time a Chicago acquaintance called. He was raising money for his new company, which was going to manufacture aluminum shipping pallets, and replace all those grungy wooden ones upon which goods are shipped. I reviewed the pro forma, assessed the risk, pointed out that unit cost would be an insurmountable hurdle as with so many new inventions, and said no.

A month or so later he called again, saying he had raised all the money except for one last tranche, and would I please reconsider, that i was such a good friend, and he had always admired my singing voice. When I said no, his voice got thick, he said I was his only hope, that couldn't i just lend it to him for a short time. He was actually crying and pleading. I said i had no interest in being part of the venture, but since he put it that way, I would loan him the money secured by his house. Amid wailing, and protests that his wife would divorce him, he finally agreed. He signed the paperwork, and i wired the funds.

Years of drama-filled annual reports went by. He listed me as an investor in the company, which died a torturous, lingering death, after a second round of capitalization.

More years went by, and I had written it off and forgotten about it.

Lo and behold, one day a set of papers arrived for my signature. The fellow called, and sounding much like a weasel, explained he just needed a quick signature to 'clean up some past documents', which of course he needed asap. After a day, I recalled what the deal had been: I guessed he was now refinancing his house, as this happened back when hapless bankers and reckless householders were still dancing jigs together.

I said I would be happy to sign upon his repayment of the loan. Oh, the shrieking! The sound of his gnashing teeth! He tried to argue I was merely a shareholder, and had taken the risk, and as the stars had in retrospect been badly misaligned, and the venture was kaput, it was only fair i suffered the same fate as his other good friends. I reminded him of the real deal, and proposed that if he paid up withing three days, I would forgive the interest. His other needs must have been pressing, because he sent me a payoff check.

When my son was very young and i was teaching him new words, i taught him this one:

kol - at - er - al …. and had him repeat it over and over and explain the meaning.

Craig Mee adds:

A friend recently told me that a friend of his, quite well-off, borrowed a sizeable "mates" loan… and unfortunately x months later, and after asking for it, had not payed it back. He then mentioned he spoke to an old mentor. His words were "when you make the decision to give a friend money, never ask for it back, and if it reappears then you have had a win". Very interesting, and I find good advice.

Jan

14

Lactose Intolerance, from Dan Grossman

January 14, 2011 | Leave a Comment

Lactose Intolerance is a compelling example of recent evolution. Belies the common belief that evolution takes hundreds of thousands of years, and that human evolution under civilization (rather than the wild) has slowed down.

Lactose Intolerance is a compelling example of recent evolution. Belies the common belief that evolution takes hundreds of thousands of years, and that human evolution under civilization (rather than the wild) has slowed down.

Lactose intolerance is NOT a defect or disease. The default condition of humans (and others) is lactose intolerance. There is no reason why humans, certainly not adult humans, should be able to easily digest the maternal milk of another species.

Humans as they began in Africa were lactose intolerant. Humans migrated from Africa to the Middle East, Africa and Asia. As humans in the Middle East and then Europe domesticated the cow and the goat, it became a tremendous evolutionary advantage to be able to digest the milk (and cheese) of such species. When a mutant gene for lactose tolerance arose there, it spread incredibly fast because it allowed for far greater nutrition and survival, especially in high diary farming Western European countries. I believe something like 99% of the native population of Denmark is lactose tolerant.

In Asia, diary cows and goats were not highly developed. While a separate (from the European one) lactose tolerance mutant gene also came about in Asia, its spread was much more limited. Thus a majority of Asians share lactose intolerance with Africans. For the same reason. It was the original, default condition of humans, and the mutation did not spread as rapidly and fully as it did in Western Europe.

Jan

14

Book Recommendation, from Dan Grossman

January 14, 2011 | 1 Comment

I highly recommend The Master Switch by Tim Wu. It's a new book, by an Internet entreprenuer turned Columbia law professor, on the last hundred years of communications and communications policy. An exciting read and certainly the most engrossing book by a law professor I ever read.

Jan

14

Parenting for personal development, from Nigel Davies

January 14, 2011 | Leave a Comment

On the subject of parenting, one aspect that has forcibly struck me (very forcibly in fact!) is the opportunity for personal development. I've found that my time management and organisational skills have improved hugely since becoming a father, not to mention patience. One specific aspect may be particularly interesting from a speculative/chess point of view, the need to constantly improvise new plans and adjust my 'fatherhood game' according to constantly changing situations. I don't think it works to go in with an overly dogmatic and detailed plan, instead I've found it better to improvise within the overall mission statement of fostering junior's development.

This is certainly highly analogous to chess in which multiple adjustments are vital. And I wonder if this is also the experience of speculator parents.

David Hillman writes:

This is certainly true in traditional business and strategic planning. Basically, one creates a mission and vision, sticks a stake in the ground out on the planning horizon, develops goals and objectives, creates action items to achieve them, and proceeds. Then, at specific points or at random, one reviews and analyses data, i.e., produces feedback, measures progress against benchmarks, uses that info to re-evalute one's plan, then adjusts accordingly.

From the onset, we know the initial plan is pretty much smoke and mirrors, a wish list, as it were, as none of us knows exactly what the future holds or if the plan will be successful as written. In fact, if we're smart, we expect it won't be. It's essentially a road map, and as we know, Rand McNally doesn't illustrate every pothole in the pavement or provide up-to-the-minute traffic and weather reports in its road atlases. We only know about those things when we buckle up and hit the road, then we adapt our route and driving as necessary. If we do this successfully, we reach our destination, but it may be by a different route or in a different time frame.

Much as I've never seen a kid that came an instruction manual, I've never seen a kid that came with a proforma [if they did, perhaps people would be more cautious in considering parenthood], but I'm kinda thinking that, like applying geophysical models to finance, the basic strategic planning framework is pretty much transferrable across enterprises and that would include parenting.

Jan

13

50 Cent, from Bill Egan

January 13, 2011 | Leave a Comment

This is a funny rag on 50 Cent: "50 Cent's Investment Library"

This is a funny rag on 50 Cent: "50 Cent's Investment Library"

But once done laughing, you might enjoy the excellent book by Robert Greene with 50 Cent's name on it, The 50th Law.

Here is a quote from the book:

"The greatest fear people have is that of being themselves. They want to be 50 Cent or someone else. They do what everyone else does even if it doesn't fit where and who they are. But you get nowhere that way; your energy is weak and no one pays attention to you. You're running away from the one thing that you own - what makes you different. I lost that fear, and once I felt the power that I had by showing the world I didn't care about being like other people, I could never go back."

- 50 Cent

J.T Holley writes:

I get the joke, but he actually chose the name as a metaphor– "Change". He took it upon himself to make something of himself other than what he was accustomed to seeing in Queens.

I think the Wall Streeters who bash him are just a little bit on the "sour grapes" side. He moved from Queens to Farmington. Those MBA's probably don't like that and neither do all the other critics who reside elsewhere. Ironically, the Farmington mansion was owned by Mike Tyson whose former bodyguard put 9 shots into .50 cents body. Just a theory, but I think the house was purchased as a personal mark of his own overcoming.

His success as an entrepreneur is something that isn't appreciated and should be looked at in my opinion quantitatively by his checking account and its sustainability thus far. He is an entrepreneur. Took the effort and time to do such. Get's paid for his services. He has his critics and they don't like it. Go figure.

I like when he was working on the movie and soundtrack to "Get Rich or Die Tryin'" he was asked when he found time to sleep. He was either working on the film or the soundtrack and people took notice. His response, to paraphrase, was "Sleep is for people that are broke, I don't sleep. I have a small window to make my dreams reality".

Also when shown or quoted 50 almost never seems like a braggart. He appears humbled and utilizes his time to profit.

Jan

13

AAPL to 1000/sh, from Ken Drees

January 13, 2011 | 1 Comment

The first paragraph of this article "Could Apple Hit 1000" reminded me of a spec post recently using the XOM measure:

" OK, I give up. Apple $1,000?

Eighteen months ago I questioned whether Apple stock could keep up its amazing momentum: "Over the past five years the stock has gained an average of 56% a year, an extraordinary achievement," I wrote. "For the shares to rise at a similar rate from here would take it to $1.25 trillion by 2014. Even to grow at a more modest 20% a year would take it to $333 billion-more valuable than Exxon Mobil (NYSE: XOM - News) today

Jan

13

Quote of the Day, from Marion Dreyfus

January 13, 2011 | Leave a Comment

Midlife crisis. Age. The heart gets more interesting than structure. I've got kids, I've got a wife, we're stuck with each other for a while. And suddenly there's an understanding that this is what life is — it's actually the mess, it's the mud, it's the tangle. It's not the clean, hygienic … fireworks. It's the little invisible novels that get written between two people every day of their lives. It's the subtle power shifts. It's the love, it's the less-noble sentiments that make every single day either good or bad or not so good or wonderful or moving through all these things at the speed of West Cork weather. This is interesting stuff. Why go out there in search of extraterrestrial life when it's already here?

–David Mitchell

Jan

13

Evaluating Op-Eds, from David Hillman

January 13, 2011 | Leave a Comment

My friend Kim sent me this article "Climate of Hate" by Paul Krugman. It got me thinking. Why is it every 'news' outlet seeks out the opinion and commentary of the then current media darling on each and every topic, regardless of that darling's expertise and/or knowledge thereof?

My friend Kim sent me this article "Climate of Hate" by Paul Krugman. It got me thinking. Why is it every 'news' outlet seeks out the opinion and commentary of the then current media darling on each and every topic, regardless of that darling's expertise and/or knowledge thereof?

One should be perfectly happy to include Krugman's thoughts on 'the economy' in the body of economic literature one reviews/studies, whether one is aligned with his thinking on same or not. He has exhibited his expertise in the discipline and, at the very least, he provides a legitimate counterpoint.But, when exactly did Krugman become a learned sociologist, psychologist, political scientist, etc? Not that he's not entitled to personal opinion. Certainly, he is, as much as are the rest of us. But why should any of us find his opinion on a topic in which he has produced no body of scholarly or practical work any more credible or influential than that of anyone else? If we do, shame on us for being influenced.

Why is Sean Penn asked for his thoughts on Cuban relations? It's pretty clear he has demonstrated his stellar acting abilities. But, does activism and meeting with dictators for a couple of hours here and there constitute expertise? Is there no one with greater insight into these matters?

Why are/were Sornette's and Mandelbrot's thoughts on finance sought out? Is there no financier more credible? [Ok, this is an attempt at levity. Everyone knows that after Stephen Hawking, these guys are/were the smartest guys on the planet and everything they say/said about anything should be taken as gospel.]

It's a given that many are quite broad and reasonably deep in a number of subjects. But those who are generally have a record of clear accomplishments in, not just an abiding interest in, more than one discipline. Elizabeth Brown Pryor, Ken Dryden and Wayne Rogers [whose thoughts might very well have helped prevent what led to the recent recession, if only Congress had heeded his 1991 testimony urging it not to repeal Glass-Steagall] are a few that come to mind.

The point is, as much as we ought take great care in who we nominate and elect to public office, we ought also take great care in evaluating opinion pieces, and we ought always consider the source. Not that an accomplished individual cannot have a reasonable thought regarding a discipline or event outside of one's area of expertise. They can, just as much as they are entitled to express them and to be published. But, one might think that authority should be earned, not bestowed, and that credibility requires a greater standard than fleeting popularity with the media or general public.

I, myself, have no idea what motivated this gunman to shoot innocent people in Tucson. We may never know. But, if we do, it likely will be Mr. Loughner himself, not Mr. Krugman, nor Glenn Beck, who tells us what that was.

Jan

13

The American Dream in Asia, from George Coyle

January 13, 2011 | Leave a Comment

From the front lines as a soon to graduate grad student in the market for employment in the finance sector, the US can't hold a candle to China/Asia in terms of jobs and opportunity. The US has effectively become a place where a "trade" wins out over a degree. There are very specific skills and requirements to get in the door these days in America. Quants want C++ programmers and data scrubbers, fundamentalists want financial statement analyzers and channel checkers, macros want Econ PhDs who chaired a University Econ program or spent half a life with the IMF/Worldbank/Fed (I guess this one isn't so much a "trade"), sales teams want cold callers and entertainers who also understand the business. Once one enters one of these "silos" good luck moving to another unless you possess a multitude of different degrees, skills, and designations (Compu Sci, Econ, Stats, Math, Finance, MBA, Engineering, Hard Science PhD, 2 yrs Inv Banking, CFA, C++, MatLab, VB, CMT, etc.). And not many opportunities exist which don't fit into one of these categories.

The Asian markets on the other hand are so illiquid on a relative basis and so many rules apply that they generally want smart people who can figure out cross country nuances and a trader serves almost as an international lawyer figuring where to trade, how to trade, and how to settle (while learning a lot of markets and likely seeing vast opportunities). On top of this, the Asian trading desks are expanding headcount at a much higher rate. One desk, which will remain unnamed to protect the innocent, is hiring over 10 new people in their group alone in the next two years. I have not heard of a single US desk with a similar hiring plan. If anything I hear of jobs being cut in the USA and openings result from people leaving (one out, one in). Moreover, these jobs in Asia are very diverse. A person on a desk in Asia will get to deal with virtually all product types (equities, credit, FX, commodities, IPOs, etc.) and a ton of different countries. In the US it tends to be segmented by type further siloing (not sure this is a word) the silos (i.e. fundamental equity or macro FX). From what I am told the majority of job takers in Asia wind up with their choice of options (buyside/sellside, US/abroad, credit/macro/equity, etc.) after 9 to 12 months or they get promoted internally. If you pick up some Mandarin or Cantonese along the way, forget it you will be an eagle with razor talons competing for prey in a world where everyone else can't fly and is blind. A year in America in a silo within a silo will probably mean a relatively small bonus and the chance to keep climbing the ladder in your specific subsilo. So choose your silo wisely, to the extent you have a choice, as your first decision may be your last.

The American dream seems to now be manifesting itself in Asia. It is unfortunate that in order to have the best available options down the road in finance one will likely have to leave friends and family and venture to Asia. Unless said person chooses to be a "trade" professional or gets very lucky.

Yishen Kuik writes:

For decades, investment banking in Asia ex-Japan used to be a hire and fire business because of a very lumpy deal flow. China, and it's large growing capitalistic economy is a fundamental game changer.

However, the need to speak Mandarin fluently will become essential. There are few people at the top today who have the relationships, the experience and the language skills, hence the opening for Americans and Europeans to occupy the top spots. All junior people however, have the language skills, and in time they will acquire the experience and relationships. Within 8 years, all the associates working on Chinese deals today will be Managing Directors, and they will have the entire package.

40 years ago it was possible for a Frenchman to be the pre-eminent American investment banker. Today that notion is highly unlikely. Affinity is where the edge is.

Cantonese is not the language of business and has little value in the financial world even in Hong Kong. The people of Hong Kong, whose manufacturing was hollowed out by China long before Americans heard of the word outsourcing, are now undergoing the additional indignity of being culturally and linguistically hollowed out.

Jan

13

GaveKal’s Emerging Market Presentation, from Paolo Pezzutti

January 13, 2011 | Leave a Comment

This presentation of GaveKal's, which is about emerging markets, eventually derives conclusions exclusively from the analysis (very interesting) of China. It gives the perception (on purpose?) that China=Asia. It does not take into account specific local realities, but it may be correct because a bubble bursting in China would have effects all over Asia. Structural forces at work in China would influence the whole region (or better continent).

This presentation of GaveKal's, which is about emerging markets, eventually derives conclusions exclusively from the analysis (very interesting) of China. It gives the perception (on purpose?) that China=Asia. It does not take into account specific local realities, but it may be correct because a bubble bursting in China would have effects all over Asia. Structural forces at work in China would influence the whole region (or better continent).

These forces are pushing toward higher interests rates and currency valuations in Asia. Agricultural prices should also go up because of an expected increase in imports. Eventually, it poses to investors (for the next decade at least) the dilemma of Growth (emerging countries) vs Value (developed countries) on a global scale. The answer is: go for emerging countries. There may be difficult times ahead globally and also regionally (a bubble in Asia?), but that is in the long term where money is made. Being long emerging markets and short developed countries could be an option. Especially Europe appears pretty weak with PIIGS chronically below average growth level and paying higher interest on their debt. How long can they manage? This could be the plan of financial forces (seen as evil, aka speculators) (with a lot of politics involved).

Jan

13

Thought of the Day, from Dan Grossman

January 13, 2011 | 1 Comment

I haven't read the book, her WSJ article, or followed this at all. But are the Asian-American children's academic and music results a fair statistical test of their mothers' methods? How many Asian-American youngsters are there in the NFL or the NBA? That is, maybe their success in academics and music relates to some other than their maternal environment.

Jim Sogi writes:

Yao Ming

Ralph Vince writes:

If I were to believe the argument, then I would have to believe that black mothers raise their kids to be great defensive corners, and miserable placekickers (The socio-economic argument, that sports like football draw the poorer kids and hence the duskier kids by some reasoning, just knocked out of the ballpark).

Football is a sport where you see the minor physical differences under great magnification. That's not to say someone cannot be of primarily Asian descent and not be a great defensive corner (or placekicker). But the empirical data certainly seems to speak to an awful lot.

I refuse to disregard empirical data. (Just as I may believe in the notion of fiscal conservativism, but can clearly see empirical correlation between GDP growth and government deficit spending– even that clown Krugman [no defensive corner he], like a broken watch, right on occasion).

Dan Grossman responds:

But genes play a big role in whether you can demand that your child get an A in advanced calculus or make first seat in the violin section of the orchestra. With that in mind, let's contemplate the genes being fed into those Chua children who are doing so well.

Maternal grandfather: EE and computer sciences professor at Berkeley, known as the father of nonlinear circuit theory and cellular neural networks.

Mother: able to get into Harvard (a much better indicator of her IQ than the magna cum laude in economics that she got there); Executive Editor of the Law Review at Harvard Law School.

Father: Summa cum laude from Princeton and magna cum laude from Harvard Law School, now a chaired professor at Yale Law School.

Guess what. Amy Chua has really smart kids. They would be really smart if she had put them up for adoption at birth with the squishiest postmodern parents. They would not have turned out exactly the same under their softer tutelage, but they would probably be getting into Harvard and Princeton as well. Similarly, if Amy Chua had adopted two children at birth who turned out to have measured childhood IQs at the 20th percentile, she would have struggled to get them through high school, no matter how fiercely she battled for them.

Accepting both truths—parenting does matter, but genes constrain possibilities—seems peculiarly hard for some parents and almost every policy maker to accept.

Jan

13

Chinese Chess, from Don Chu

January 13, 2011 | Leave a Comment

A young Chinese girl reaps the reward of her hard work to become the new women's world chess champion, putting in the work and eating plenty of 'bitterness' along the way:

China Rises, and Checkmates from the NYT:

Ms. Hou is an astonishing phenomenon: at 16, she is the new women's world chess champion, the youngest person, male or female, ever to win a world championship. … Cynics sometimes suggest that China's rise as a world power is largely a matter of government manipulation of currency rates and trade rules, and there's no doubt that there's plenty of rigging or cheating going on in every sphere. But China has also done an extraordinarily good job of investing in its people and in spreading opportunity across the country. Moreover, perhaps as a legacy of Confucianism, its citizens have shown a passion for education and self-improvement — along with remarkable capacity for discipline and hard work, what the Chinese call "chi ku," or "eating bitterness." Ms. Hou dined on plenty of bitterness in working her way up to champion. She grew up in the boondocks, in a county town in Jiangsu Province, and her parents did not play chess. But they lavished attention on her and spoiled her, as parents of only children ("little emperors") routinely do in China.

She won by beating another lady compatriot in the final.

It does seem that Asian women are, relatively speaking, outdoing Asian men in the world of chess: see the article, "At Title Event, Asian Women Pursue World Domination"

(The only excuse East Asian men have here is that they are still pretty much preoccupied with Go/Weiqi; which is seeing quite a revival in interest in the last decade, mainly in the strong challenge faced by the erstwhile dominant Go/Weiqi/Baduk powerhouses Japan and South Korea, from a resurgence in strong young Chinese players.) But the young Ms. Hou's current FIDE ratings, does not even get her in the top 100. She has some ways to go yet…

Jan

13

The Cavs, from Ken Drees

January 13, 2011 | 1 Comment

Thoughts about the coach of the Cav's, Byron Scott. This guy is a loser. Cavs lose to Lakers 112 to 57. The Cavs are done, and so is Scott after this season. He is shepherding them into last place for the lottery–the Cavs are unwatchable.

Jan

13

Why Chinese Mothers Are Superior, shared by George Coyle

January 13, 2011 | Leave a Comment

I don't have kids, but this article on "Why Chinese Mothers Are Superior" seems to relate to some of what has gone around before about raising kids and Asian children generally being ahead of the curve vs their Western counterparts.

I don't have kids, but this article on "Why Chinese Mothers Are Superior" seems to relate to some of what has gone around before about raising kids and Asian children generally being ahead of the curve vs their Western counterparts.

Nigel Davies comments:

The Chinese authoress, Ching-ning Chu, described this tradition as '5,000 years of child abuse.

Steve Ellison writes:

Since the reaction to this article so far seems 100% negative, I will put in a good word for it. My (Korean immigrant) wife and I had a similar parenting philosophy, although not as extreme. Most American parents demand far too little of their children. I appreciate the author making the point that parents have a right to demand high standards and achievement.

My son attends a school for highly gifted students. Even among this population, some parents complain there is too much homework. By contrast, we hosted an exchange student from Korea in our home. This student while in Korea had gone to school as required from 8:00 am to 3:00 pm every day and then attended another school until 11:00 pm every night to get ahead in academics. This regimen is typical for children of families of means in Korea.

The author of the Journal article came to the US not from the People's Republic or a Chinese-majority jurisdiction, but from the Philippines, where there is a small Chinese minority that is far wealthier than the general population and is hated for it. The author's aunt was murdered by a mob during ethnic violence. The approach outlined in the article was probably necessary to survive in the Philippines.

Nigel Davies writes:

I see your point Steve, but to me the whole thing looked like an ill-tempered rant because the lady concerned attracted disapproval at the party she went to.

As a chess teacher I've taught youngsters from many different cultures. The ones I turn down flat are the pushy ones who have decided their kid will be a champion. The reason I refuse is simple - I've seen these kids burn themselves out as they try to perform well enough to be loved. On the other hand there are kids that genuinely developing excellence with full parental encouragement and support.

These two approaches may seem very similar but they're most definitely not; one comes with conditional love. And I think that it may be more valid to try and correlate the article's recommended approach with the kind of political regime that exists in China; brutality fosters brutes.

Laurel Kenner writes:

I am reading Battle Hymn of the Tiger Mother, the book excerpted in the WSJ article for which Mr. Coyle kindly posted a link. Aubrey is taking Mandarin from a disciplinarian Chinese native, and I said I'd be interested in her opinion. Her reaction to the article: She was furious. She had grown up under just such a mother, and it wasn't a happy memory. Her mother would say, "I would rather have given birth to a piece of roast pork than you" to shame her, and the recollection still stung, years later. We may admire the Chinese kids for their "A" report cards, but they in turn envy the American ability to think "out of the box," innovate and found big enterprises.

I like Ms. Chua's style, and the book certainly is thought-provoking. I agree that the best way to self-esteem is to master a skill.

However, the short biography she provides in the book provides an unwitting clue as to the drawbacks of the Chinese approach. At Harvard, she was unable to ask questions in class, as her instinct was to simply take notes on everything the professor said. When it came time for a job interview for a Yale professorship, she found herself tongue-tied and wasn't hired. (She did get the job seven years later, after writing a cutting-edge book on how ethnic conflicts doom democratic majority rule in the Third World.)

Charles Pennington writes:

This is a fascinating and valuable book, which I've halfway completed. It is a defense of her unfashionable parenting philosophy, and she is not afraid to describe how it works in real life, complete with many anecdotes that make herself look bad. I think adults end up appreciating the special efforts that their parents made to impart on them a special skill. Maybe by now even Andre Agassi can appreciate his father's unrelenting efforts to turn him into a great tennis player.

I value the book because it gives me a realistic picture of the trying times that my wife and I can expect when we harness and over-ride our children's impulses and push them in a better direction.

The article has generated thousands of written comments, many of them harshly negative, even vicious. Ms. Chua gets some extra points in my book for boldness and bravery.

Russ Sears writes:

Beyond talent, it take a combination of the three c's of developing and spotting genius are commitment, confidence and creativity. The trick is that non of these can be crammed down a child but nurtured and grown. Further, children will react differently to anyone method so the instructor/coach must tailor the methods to the child. Last, but also perhaps most importantly, each discipline, talent or endeavor each requires a different combination of these c's and a highly expert opinion of how when and where to apply them, in order to obtain greatness.

For example a high bar, can create drive in one kid, perfectionism in another and burnout (as Nigel suggest) and pattern of quitting in others. As the Chinese example shows simply demanding commitment leaves even the obedient fearful lacking in confidence and reliant on the instructor to guide them stifling creativity. Teaching a child to love a sport, hence commitment is a necessary groundwork, and a parent/ coaches first job, but not sufficient. The idea that you can out work everyone is a fatal flaw to many scholars athletes and business men. The greats are all highly committed and their love and understanding will always out perform those that simply are counting on toughness and commitment.

Confidence, however, is only in moderation or it become hubris. It too must be developed and work. Testosterone can give a nature edge. Steroid abuse on the other hand may give a physical edge, but also tends to develop overconfidence superman syndrome. This is why I believe most of the athletes that get caught started taking them after they already developed some level of greatness. However, if you are to thrive in times of great stress rather than choke you must have confidence. Enough confidence that you do not over think the process or the exam, but enough practice, talent and knowledge than your instincts are spot on. The opposite of confidence is of course anxiety or unnecessary fear. 1 in 8 American suffer from an anxiety disorders. This therefore would be a good place to start in understanding how behavioral psychology effects investors.

Creativity by itself generally need disciple of commitment and confidence to be applied right. When to make the exception to the rule? When to trust yourself rather than the authorities? What is the right question to ask? Answer these creative questions correctly and you are on your way to greatness. Creativity however, often is either completely ignored in recognizing genius. Or it is often thought to be the only thing that matters. Both views kill the budding geniuses.

Jeff Watson writes:

Reading all of this parental preparation makes me feel like I dropped the ball as a parent as I did very little except to minimize hangups, teach my son right from wrong and allow him to be the happiest kid I know with a million friends and several beautiful girlfriends.. His mother was instrumental in making him into a scholar and she didn't have to work at it very hard at guiding his inquisitive nature as there was genetically coded DNA ensuring his "Knack" for the classics. There was an expectation that he would always learn, do well, think critically, and we were not done with force, coercion,punishment, or any other psychological devices. I was there to teach him to be a man, to do sports, surfing, skimming, and skating, shooting, archery, golfing,, bandage his knees and elbows and tape up knees and shoulders. I was also his biggest cheerleader, proofreader, outline fixer, and science teacher, who also taught him to cook and bake like a chef and prepare BBQ like a Black Southerner from Memphis.. My son might not have Mandarin under his belt, but he has Latin, Greek, Spanish, French, Italian pretty well down, both conversational and written. The jury is still out as his grad school is looming and we don't know what will be his choice. I offered him a year off after school just to hang out and surf before he either resumes his career or schooling. I wish someone had given me a year long surf break at his age as I think I would have done better in all my business because I wouldn't have been uptight for a couple of years. Of course, the theories of Galton correspond with my family and the previous generations , and I expect them to continue into the future. Hopefully, the children of the list members can also improve their progeny by marrying well, creating the right circumstances, and not pushing the kids into overload as there's a delicate balance. Just being members of the list is indicative that your kids won't be hanging out in pool halls, OTB, Illegal Pokers and numbers games, and that's a very brilliant head start that 70% of the fellow New Yorker kids can't get.

Yishen Kuik writes:

Perhaps one notion that might be useful is the "casualty" rate.

When we say such-and-such a profession is a "rock star" business, we usually mean that the number of winners in that industry are few, most of the rest are struggling, and the winners take a massively disproportionate amount of the prizes in that industry. The "casualty" rate is very high. Being a musician or an artist is a rock star business, being a doctor is not.

In Singapore, parents push their kids and will go to great lengths to sacrifice for their education. In general, we are a law abiding, conscientious, well educated and pragmatic people. However we are not known for thinking big, taking risks or innovation. And while most Singaporeans are close to their extended families, dining with them once a week, it is unusual that parents enjoy close friendships with their children. The relationship is largely characterized by respect and filial piety.

Because of this system of strong family networks, strong interest in pushing children and demanding academics, not many Singaporeans fall through the cracks

- we are a low casualty rate society. Not very good at producing rock stars, but quite good at not producing bums. This is great for kids who need the discipline and guidance and would otherwise grow up to be bums, but one could argue limits the potential of those who could have been great.

This has worked well for our small country - a stable system and a non-striking, non-unionized, trouble free and educated labour force has proven to be a winning formula as a service providing small nation that supports business between larger nations. But clearly this is not a formula for a large industrialized country, which needs to depend on the innovation of the few to create sufficient large scale value. Perhaps a system that sacrifices the many in order to locate and promote the elite few is the natural solution for an innovation driven large economy? I do not know what the answer is.

Nonetheless, Singapore is a very young country and has only been wealthy since 1980. I would expect attitudes between parents and kids to shift in the next generation.

Alston Mabry comments:

Very nicely articulated, Yishen.

An interesting thread overall.

I heard the author of the book in question speak briefly on NKR today and heard that the subtitle of the book is:

This is a story about a mother, two daughters, and two dogs. This was

*supposed* to be a story of how Chinese parents are better at raising kids than Western ones. But instead, it's about a bitter clash of cultures, a fleeting taste of glory, and how I was humbled by a thirteen-year-old.

Jeff Watson adds:

I don't know, all these people drag out scientific ways to raise kids to be smart, to be champions. They push the kids pretty hard , aiming for Harvard, Yale, etc and one might expect some blow-back from that harsh regimen.. Fact is that parenting isn't an exact science and if you raise a responsible, happy, free from baggage, healthy, well spoken kid, you have 80% of the battle won.(I don't know what studies show but would suspect that well adjusted, happy kids probably do better in college than their non-adjusted peers) The schools previously mentioned like a story for admissions, and not the same story and school path and activities to get there that the great washed multitudes present them. So many in this world are competing through their children and I suspect that the outcome in this type of contest will not bode well for either child or parent especially if the child doesn't get into the first couple of choices..

Sometimes, a kid just needs to take an afternoon off, lie on his back and look up at the clouds and just imagine. Does a world of good in so many ways. If a kid is meant for an IVY school, he will get into an IVY school as there's always more than one way to skin a cat.

Jim Sogi opines:

Many modern children are horribly spoiled. It doesn't do them any good in the future. Their parent's are afraid of harming their delicate psyche's and end up with spoiled monsters that no one likes. You don't have to lay weird trips on them either, mostly that has to do with withholding love, or disapproval both of which create their own sick repercussions. A simple well defined set of expectations and rewards and time out or denial of reward is enough. Love must be unconditional. I see parents doing the absolutely wrong thing all the time, rewarding bad behavior and ignoring the good.

David Hillman writes:

I don't have children either, but I'm not certain having children is a prerequisite for recognizing common sense and good parenting. Is it that difficult to distinguish the difference between yelling at a child who's about to put his/her hand to a hot stove and yelling at a child skipping up the aisle at Walmart harming no one, i.e., just being a child? Or, what about a swat on the backside when a kid is being particularly rowdy and inattentive to commands to stop versus a backhand across the face to "put the fear of God in him/her"?

It was my great fortune to be born to parents who loved unconditionally and nurtured, yet they employed measured discipline and never spoiled. They told us "you can be anything you want to be and do anything you want to do if you apply yourself". The sky was the limit and we believed them. The only thing they absolutely insisted upon other than a "yes, ma'am" and a "no, sir", was that we were going to college come hell or high water, but what we did with our lives beyond that was our choice and they provided appropriate guidance. They led by example, not by threat of punishment and in the end produced a couple of reasonably well-balanced and self-satisfied [term used rather than 'successful' as the definition may vary from one to another] offspring.

Still, to this day, they occasionally lament their parental failings ["in retrospect, we should have…", "if we had it to do over again,……"]. While I, too, recognize some of their missteps privately, I tell them no instruction manual pops out of the womb with a kid, they were great parents, did the best anyone could, which was better than most, and I believe that to be true.

This discussion of parenting methods brings to mind a couple of items from long ago that provide contrast.

One, the clarinet lessons of my youth. Sister Mary Rasputin, a wizened, 4' tall 80 pounder taught me to play using the 'threat of physical abuse and eternal damnation' method. Her metronome was a 15" wooden ruler slapped rhythmically in the palm of her hand. She 'coaxed' exercises and pieces from my ebony Schmoeller & Mueller Bb licorice stick with red-faced, narrow-eyed, bared-tooth, shrill, 100db, spittle-laden complaints, insults, beratings, accusations and threats. Instead of motivating, however, I found intimidation worked quite the opposite with me. No matter how prepared, I dreaded the weekly 'lessons', hated the practice assignments and fell out of love with the clarinet. Eighth grade graduation, still a few years off, couldn't come soon enough. Yet, as it came and went, this instruction appeared fruitful as I wound up with 1st place medals from statewide competitions and was seated 2nd chair in the high school orchestra. But, I learned by intimidation and rote, didn't learn much about music theory until decades later, played mechanically, not with passion, and can't help but think I'd have been better off sitting in my room studying my Rubank Elementary Method and mimicking my Acker Bilk records.

Fast forward to interaction between two former mutual acquaintances. One was a very assertive sort who grew up in a middle-class family with a 'tough love' father, the other grew up in a somewhat disadvantaged but reasonably loving family. The former had had some business success, but even his own brother once told me "He's a great guy to be around, but I'd never do business with him." The latter had not made his mark at that point. He was ambitious, but more or less muddled through life looking for the 'big hit'. The former had material goods and proudly showed them off. The latter judged his own self-worth by comparing what luxuries he didn't have with what others had. The former often publically berated and ridiculed the latter in an effort to motivate him. The latter did not respond well. All the berating did was help him feel worse about himself than he did and perform poorly.

For one who is not a parent, it is still comforting and often poignant, and it gives me hope for future generations, when I see parents stopping in the grocery to quietly instruct a child on proper etiquette or behavior rather than employing a 'terrible swift sword' approach to discipline. And, I will frequently approach that parent and complement him/her on the obvious parenting skill. The reaction is always positive. I can't help but think that kid is going to be of more use to society than will one who's had good behavior pounded into them.

Yes, fear can be a strong motivator. We all know that and there are plenty of clear examples of success and heroics motivated by fear. In my own case, tho', I went to college and have done well because of it, but I haven't played my clarinet in years. A persistent nurturing and explanations of 'why' seems to have won out over terror in the long term. That was what worked for me, not a good skull cracking.

The point is there are many methods of parenting and of motivating and of instructing. I've had some parents say to me, "Sometimes you just have to say 'Because I'm the mom!', and I suppose that is so. I suppose also some kids need a 2×4 upside the head to get their attention. But not all methods work for all people. The trick seems to be knowing one's child or student [or employee or patient or spouse or recruit or client or you name it] and trying to recognize and employ the method or combination of methods that will be most fruitful. Not the easiest task and the stakes are often extremely high, especially in the case of child-rearing.

I always thought I'd have been a good parent. Maybe, maybe not. It didn't work out that way. I was either too selfish or not courageous enough to pull the trigger. But, I've compensated by becoming every kid's favorite uncle. And, since I've learned through observation the best kids are like the best dogs and like friends with boats…..you get to enjoy them, but they go home with someone else who has to maintain them, being the favorite uncle works for me.

Yet, I have great respect for those of you who have chosen to repopulate this planet with your 2.1 kids and thank those of you who take the time to know your kids and raise them well and give them the tools they need to help them grow into decent human beings. 'Cause what they become, how they behave, and what they do, will in some way impact me and all of us in some way, and that kinda makes them my kids, too.

George Zachar writes:

No amount of common sense, good intentions, or book research, prepares one for parenting.

Jim Sogi comments:

David's advice to patiently explain in detail the expected behavior is the proper method of parenting. The common wrong method is to say, "No, don't do that." It gives the child no clue as to the proper behavior. Set expectations in writing. For example: Wash dishes once per week, or no allowance. This is clear, since the consequence is obvious. The wrong way is to say, "You're lazy and no good, and I will withhold my love if you don't help around the house more." It is too vague, and the repercussions are not commensurate with the behavior. Yet it is the common tactic I see over and over.

Jan

12

Briefly Speaking, from Victor Niederhoffer

January 12, 2011 | 2 Comments

I found something useful and unbiased for the first time in a B news story. When the Fed comes into the market asking for offers on QE2 that their 3 30 yrs old traders are buying an average of 5 billion of day on, at 10:15 in the morning, the dealers all play musical notes on their computers, FED. How appropriate that this would be the first three notes of three blind mice.

Jan

12

Penny Stock Touts, from Ken Drees

January 12, 2011 | Leave a Comment

I just got two (I rarely get these anymore) penny stock touts. Both came in the mail today and were large multi page mailers.

ALME– the stock has gone up almost triple since December. The chart looks like it's saying step right up into this perfect buy spot.

The other HHWW looks like a heartbeat on a monitor– ready to do it again and then flatline. Anyone play against touts? i never mess with them.

Jan

12

The Encyclopedia of Exploration, from Dylan Distasio

January 12, 2011 | Leave a Comment

For those with more than a passing interest in the history of exploration, I would highly recommend checking out Howgego's four volume magnum opus the Encyclopedia of Exploration. For those unaquainted with him, he's a retired physics teacher who has spent the past 15+ years researching the history of travel and exploration. While no encyclopedia can be perfect, the amount of quality work put in by one man amazes. In the age of wikipedia, this collection demonstrates why there will always be a place for meticulous research.

For those with more than a passing interest in the history of exploration, I would highly recommend checking out Howgego's four volume magnum opus the Encyclopedia of Exploration. For those unaquainted with him, he's a retired physics teacher who has spent the past 15+ years researching the history of travel and exploration. While no encyclopedia can be perfect, the amount of quality work put in by one man amazes. In the age of wikipedia, this collection demonstrates why there will always be a place for meticulous research.

The collection is broken down into 4 volumes:

Part 1 covers up until 1800.

Part 2 covers 1800 to 1850.

Part 3 covers 1850 to 1940 (Oceans, Islands and Polar regions)

Part 4 covers 1850 to 1940 (Continental exploration)

The sheer scope is improbably hard to imagine, and the writing is very well done for an encylopedia. There are also tons of citations.

For those who just want to dip their toes into the waters, Howgego also has a very nice condensed volume called The Book of Exploration which highlights 150+ of his favorite explorers and includes maps, etc.

More info from the publisher can be found here.

Jan

12

Recognizing Genius, from Victor Niederhoffer

January 12, 2011 | 2 Comments

Would you agree with me that at least one area where genius is always recognized is sports. I can see one stroke usually from a player and tell if he's superb or bad. Certainly one stroke and a movement. Math and science geniuses also easy to spot. One would think that each of us, who usually know one field very well, could tell the genius in that field. I imagine Lack can tell a good driver from a minute or Messrs Sogi and Watson a good surfer? Agree?

Would you agree with me that at least one area where genius is always recognized is sports. I can see one stroke usually from a player and tell if he's superb or bad. Certainly one stroke and a movement. Math and science geniuses also easy to spot. One would think that each of us, who usually know one field very well, could tell the genius in that field. I imagine Lack can tell a good driver from a minute or Messrs Sogi and Watson a good surfer? Agree?

Jim Lackey writes:

I'd say it's the economy of motion. Genius pro vs. the weekend warrior– it's easy to spot. Yet it's not about being smooth or looking good, it's about maintaining track speed.

This old NYT article describes and has some good reporting on how hard at times it is to predict. I say there is no doubt about it… train the way you would race…perfect practice, and forget cross training:

Personal Best Running Efficiency: It's Good, but How Do You Get It?

"Still, there are a few tricks for novices, said Dr. Daniels. Most runners, he said, naturally fall into their most economical stride. But some bound along or, at the other extreme, take too many little steps. After studying hundreds of runners, Dr. Daniels discovered that taking 180 steps a minute made the most of energy expended.Dr. Coyle finds that the most economical cyclists have an abundance of a particular type of muscle fiber, so-called slow twitch. It is not known whether other types of muscle can convert to slow twitch with training. But, he said, it may be that after years of training, nerves are directed to allow more leg muscles to participate in pedaling. The result might be greater riding economy.

"You might wind up changing the way your neuromuscular system is wired," Dr. Coyle said. "It is a controversial area, but it makes sense."

George Coyle writes:

But how do we define genius? Is Lebron James a genius or a physical anomaly? Michael Phelps was supposedly born with joints which are very useful in swimming but does probable Darwinism make him a genius? Online dictionaries say genius is, "extraordinary intellect and talent". I would venture to guess many liberal arts "geniuses" could not easily figure a 15pct tip on a 125 bill and many a math/science pro can barely hold a social conversation. Some studies ascribe genius to practice but this is probably mainly useful for those a mile deep but an inch wide. What about those a mile wide but and inch deep? A universal definition is probably impossible, and in this instance measuring genius would require success to be recognized. Some Mensa members are homeless! I feel natural ability might be a better designation.

Steve Ellison comments:

I agree with the Chair that genius is recognized in sports. People's approach to sports is very results-oriented and commonsensical, in contrast to other fields that are heavily politicized. I often draw analogies to sports in debates about how school systems should handle gifted students.

Nobody would ever have suggested that Lebron James play in a league with math team geeks so that he could help the geeks get better at basketball at the expense of his own development. Yet an analogous strategy is standard practice in US schools because, after all, the gifted students will do just fine, anyway.

Pete Earle writes:

I would agree that genius can be recognized in the athletic franchise, but I believe that a realistic assessment of genius in boxing takes a long period of time and perhaps only becomes evident in retrospect. One certainly cannot tell from watching one punch, one round, or a single match whether a given fighter has truly superlative skills and qualities. Indeed, a term used often in describing both "Buster" Douglas and Hasim Rahman among others, is their ability to demonstrate "flashes of brilliance". This quality is exciting and raises the prospects for a given match to lend credibility to the description of boxing as the "theatre of the unexpected"…but it's not 'genius.'

In my experience, it takes a career - at the very least, a long stretch of fights against opponents of varying opposing talents and fortes - to assess the ultimate skill of a fighter. Boxers (usually, but not always) change their style of fighting and/or fight plan with each opponent, but also make changes with accumulated ring experience and to adjust to the phenomenon of aging; for that reason, and counterintuitively, one rarely finds pugilistic excellence in perfect records or knock-out preponderance among victories.

Philosophical issue: In boxing, a large part of ones' record depends upon savvy making of business decisions (e.g., Mayweather's refusal to put his place in history at risk - with a 41-0 record at present - by taking on Manny Pacquiao) which may include ducking some fighters and taking on overrated ones. Should we extend "genius", in the realm of sports, to the crafting of contexts/choosing of opponents itself, where applies?

Stefan Jovanovich writes:

Racquet sports remain a complete mystery to us Jovanovichs. The one time Eddy and I went to a tennis court when she was a young child she tried to swat the ball DOWN as if she had a lacrosse stick and was trying to scoop it. We decided to move on to the sports where your hands and feet touch the ball. In baseball talent is not so quickly and obviously apparent. Mike Piazza, who will probably hold the record for home runs by a catcher almost as long as Cy Young holds the one for wins by a pitcher (BTW, he was passed over by the 1st year elections to the baseball HOF), became a professional baseball player only because Tommy Lasorda was a family relative. Piazza was the 1,390th player picked in the 1988 draft; all of the scouting reports agreed that the kid didn't have a ghost of a chance.

Charles Pennington writes:

I remind the Chair of his thoughts from 2007 :

"The first three games of the first set, which Federer won, were fatal for Nadal, as was his inferior stroke production, and how this tired him out in the end. I predict that Nadal will drop out of the top ten within the next two years as his athleticism regresses with old age."

I also argued in September 2009 that Nadal would have a short shelf life on the basis of his extreme western grip.

It's not surprising that I could get it so wrong, but it should serve as a caution that the Chair, who could win most of his matches blindfolded, could miss the mark.

Phil McDonnell writes:

All propositions must be tested. My personal experience with testing was in baseball. Having been a college player I had seen many play at a high level. When it came time for tryouts each kid was given 5 grounders with throw back, 5 flies with throw back and 5 pitches to hit. That was all the coaches were allowed to see. Each of 4 years I was somehow able to draft the top or second best team in the league of 10 teams. The odds of that , at random would be something like 1 in 625.

Each year the team rosters were pretty independent because there was a strong tendency for other coaches to draft my top picks from the previous year. Of the roughly 48 players I coached 5 were subsequently drafted by the Majors for a total of over $5 million in bonus money. I suspect that is non random so I would argue the Chair's hypothesis is confirmed.

Stefan Jovanovich comments:

The great Dr. Phil keeps omitting the key statistic. How many of the bonus babies made it to the majors? Hell, in the age of bonus mania I was offered a signing bonus for a minor league contract because I had the good luck in prep school to catch a guy who could have made it to the show if he hadn't blown out his arm. I was a smart catcher but I was a 0 for 5 tool player who had as much chance of playing major league baseball as Rocky the Flying Squirrel.

Sam Marx comments:

Some thoughts on genius.

Thinking "outside the box", may be the result of one type of genius

but what if someone "thinks inside the box", perhaps by substantially

extending further that which is already known or combining 2 disciplines

to obtain a new discipline or to obtain substantial improvements in

existing disciplines. Isn't that a form of genius?

Compare Cole Porter and Irving Berlin, whom I consider genius

lyricists. Berlin used the simplest words, phrases and situations, ("All

Alone by the Telephone"). He "stayed within the box ", Porter used

rarely used words (fine fin and haddy) and varied original situations

("Did YOU Ever", In this Clan you're the forgotten man). Or how about

those lyricists who can write rhyming the last 2 words of each line.

In sports, what about Bobby Riggs, who stayed back and played a

conventional defensive game vs. a more original aggressive player like Jack Kramer?

T.K Marks comments:

Vic, I thought that given the racquet sports hypothesis you had suggested that it might be somewhat different for something like chess, for the possible reasons I mention below. So in pursuit of that I wrote Nigel and was informed that no, it's not. His last line was found particularly informative as it provided a window onto how a chess player on his level saw things.

Nigel, given Victor's hypothesis outlined above, in your many observations of chess players over the years have you ever witnessed a single move by somebody and were suddenly made to think by it that person thinks on a much more elevated plane than would be expected?…Or could be expected?…Just a truly eye-opening move that left you thinking, what in the world was that.

The reason that I ask is that in sports the person that makes the spectacular shot or play can not necessarily explain it afterwards as their body is basically in control at the time when they did it. But the rationale behind a spectacular chess move can be explained, so there would be something to learn from it.

He replied:

Well, we tend to explain things more in retrospect. For me it's more or less the same as Victor suggests– I know very quickly whether someone is any good and their moves don't come as a great surprise. In fact I often don't need to see their moves, just the position they've reached..

Jan

12

Unrecognized Genius, from Michael Ott

January 12, 2011 | 1 Comment

This is one of my all time favorite news stories.

This is one of my all time favorite news stories.

Relatedly, a friend of mine was at a karaoke bar in CA and a dirty blonde white guy was hogging the stage. He was terrible and people started booing. Then he sang a few Tom Petty songs and the crowd turned around. That's because it was Tom Petty.

This is another example , with Jewel, but staged.

Jim Sogi comments:

The question is not, "Do people recognize genius" here. What is being tested is "Do people, know, care about classical music?" Lets say they posted some brilliant computer code. Surely no one would recognize the genius therein. Let's say Bob Dylan stood with his guitar outside Alice Tully theatre. Most theater goers might ignore him and the screeching music, assuming they did not recognize his face.

Jan

12

Asia, from Victor Niederhoffer

January 12, 2011 | Leave a Comment

As always everyone is afraid to put a Galtonian take on the findings about Asia. It tends to break down the idea that has the world in its grip. That a proper intervention and social structure can create human achievement and happiness, a key aspect of interventionism.

Rocky Humbert responds: